Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HUNTINGTON INGALLS INDUSTRIES, INC. | q42017earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - HUNTINGTON INGALLS INDUSTRIES, INC. | hii2017q4earningsrelease.htm |

Q4 2017 Earnings Presentation

February 15, 2018

Mike Petters

President and Chief Executive Officer

Chris Kastner

Executive Vice President, Business Management and Chief Financial Officer

Exhibit 99.2

2

Forward-Looking Statements

Statements in this presentation, other than statements of historical fact, constitute

"forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements involve risks and uncertainties that

could cause our actual results to differ materially from those expressed in these

statements. Factors that may cause such differences include: changes in government

and customer priorities and requirements (including government budgetary constraints,

shifts in defense spending, and changes in customer short-range and long-range plans);

our ability to estimate our future contract costs and perform our contracts effectively;

changes in procurement processes and government regulations and our ability to

comply with such requirements; our ability to deliver our products and services at an

affordable life cycle cost and compete within our markets; natural and environmental

disasters and political instability; our ability to execute our strategic plan, including with

respect to share repurchases, dividends, capital expenditures, and strategic

acquisitions; adverse economic conditions in the United States and globally; changes in

key estimates and assumptions regarding our pension and retiree health care costs;

security threats, including cyber security threats, and related disruptions; and other risk

factors discussed in our filings with the U.S. Securities and Exchange Commission.

There may be other risks and uncertainties that we are unable to predict at this time or

that we currently do not expect to have a material adverse effect on our business, and

we undertake no obligation to update any forward-looking statements. You should not

place undue reliance on any forward-looking statements that we may make. This

presentation also contains non-GAAP financial measures and includes a GAAP

reconciliation of these financial measures. Non-GAAP financial measures should not be

construed as being more important than comparable GAAP measures.

3

HII’s Q4 & FY 2017 Highlights

Revenues were $2.0 billion in the quarter; ~$7.4 billion in 2017

Diluted EPS was $1.41 in the quarter; $10.46 in 2017

Adjusted Diluted EPS* was $3.11 in the quarter; $12.14 in 2017

Strong cash flow generation in the quarter and for the year

o Cash from operations was $434 million in the quarter; $814 million in 2017

o Free cash flow* was $301 million in the quarter; $453 million in 2017

Delivered/redelivered 6 ships to the U.S. Navy: aircraft carrier USS Gerald R. Ford (CVN 78), Virginia-class

submarine USS Washington (SSN 787), aircraft carrier USS Abraham Lincoln (CVN 72), amphibious transport

dock USS Portland (LPD 27), guided missile destroyer Ralph Johnson (DDG 114) and guided missile destroyer

USS Ramage (DDG 61)

$8.1 billion of new contract awards in 2017, bringing total backlog at Dec. 31, 2017 to $21.4 billion

*Non-GAAP measure. See appendix for definition and reconciliation.

4

HII’s Q4 2017 Consolidated Results

$1,922 $1,996

$—

$500

$1,000

$1,500

$2,000

$2,500

Q4 2016 Q4 2017

(in

m

illio

ns)

Revenues

$268

$227

$—

$50

$100

$150

$200

$250

$300

Q4 2016 Q4 2017

(in

m

illio

ns)

Operating Income

13.9%

11.4%

—%

3.0 %

6.0 %

9.0 %

12.0 %

15.0 %

Q4 2016 Q4 2017

Operating Margin$4.20

$1.41

$3.11

$—

$1.00

$2.00

$3.00

$4.00

$5.00

Q4 2016 Q4 2017

Diluted EPS

GAAP Adjusted*

*Non-GAAP measure. See appendix for definition and reconciliation.

5

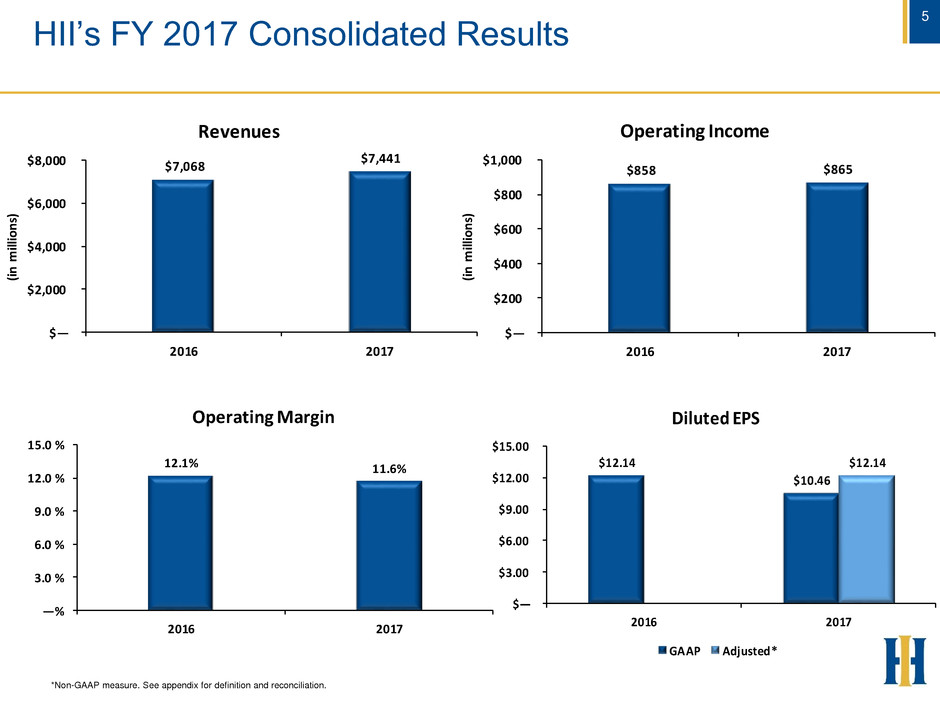

HII’s FY 2017 Consolidated Results

$7,068

$7,441

$—

$2,000

$4,000

$6,000

$8,000

2016 2017

(in

m

illion

s)

Revenues

$858 $865

$—

$200

$400

$600

$800

$1,000

2016 2017

(in

m

illio

ns)

Operating Income

12.1% 11.6%

—%

3.0 %

6.0 %

9.0 %

12.0 %

15.0 %

2016 2017

Operating Margin

$12.14

$10.46

$12.14

$—

$3.00

$6.00

$9.00

$12.00

$15.00

2016 2017

Diluted EPS

GAAP Adjusted*

*Non-GAAP measure. See appendix for definition and reconciliation.

6

$33

$115 $41

$288

$—

$50

$100

$150

$200

$250

$300

$350

$400

$450

Q4 2017 2017

(in

m

illi

on

s)

Shareholder Distributions

Dividends Share Repurchases

HII’s Q4 and 2017 Capital Deployment

*Non-GAAP measure. See appendix for definition and reconciliation.

** Includes $2 million of share repurchases not yet settled for cash as of December 31, 2017

Capital expenditures were 4.9% of revenues in 2017

Made cash contributions of $335 million to pension and postretirement benefits plans in 2017

o $294 million were discretionary contributions to our qualified pension plans

Distributed to shareholders $403 million of the free cash flow* generated in 2017

Total

$74

Total

$403

$434

$814

$133

$361

$301

$453

$—

$150

$300

$450

$600

$750

$900

Q4 2017 2017

(in

m

illi

on

s)

Cash Flow Generation

Cash from Operations CAPEX Free Cash Flow*

**

7

2018 Outlook

Non-Current State Income Taxes $8 - $12 million benefit*

Effective Tax Rate ~21%*

Interest Expense ~63 million*

Capital Expenditures 5 - 6% of Revenues*

* Estimated amounts.

8

2018-2019 Pension Outlook

12

($ in millions) 2017 (Actual) 20184 20194

Pension Discount Rate 4.47% 3.82% 3.82%

Expected Long-Term Return on Assets 7.25% 7.25% 7.25%

CAS Recoveries over/(under) Cash

Contributions1,2

$26 ($89) $307

FAS/CAS Adjustment1,3 $189 $369 $356

CAS1 $361 $460 $399

FAS Service Pension Expense1 ($156) ($166) ($160)

FAS other Pension (Expense)/Income1 ($16) $75 $117

Pension and Post-retirement Benefits

Cash Contribution2

$335 $549 $92

1 Includes pension & other postretirement benefits.

2 2018 projected cash contributions of $549 million include $514 million of discretionary pension contributions ($508 million qualified; $6

million non-qualified) and $35 million of post retirement benefits contributions. 2019 projected cash contributions of $92 million include $56

million of discretionary pension contributions ($49 million qualified; $7 million non-qualified) and $36 million of post retirement benefits

contributions.

3 Total Net FAS/CAS pension adjustment is presented as a single amount consistent with our historical presentation. Starting in 2018, in

accordance with ASU No. 2017-07, FAS service pension expense will be reflected in operating income and FAS other pension

(expense)/income will be reflected below operating income. CAS pension cost will continue to be recorded in operating income.

4 Projected and subject to change during 2018 and 2019

9

Appendix

10

Non-GAAP Measures Definitions

We make reference to “segment operating income (loss),” “segment operating margin,” “adjusted net earnings

(loss),” “adjusted diluted earnings per share,” and “free cash flow.”

We internally manage our operations by reference to “segment operating income (loss)” and “segment

operating margin,” which are not recognized measures under GAAP. When analyzing our operating

performance, investors should use segment operating income (loss) and segment operating margin in addition

to, and not as alternatives for, operating income and operating margin or any other performance measure

presented in accordance with GAAP. They are measures that we use to evaluate our core operating

performance. We believe that segment operating income (loss) and segment operating margin reflect an

additional way of viewing aspects of our operations that, when viewed with our GAAP results, provide a more

complete understanding of factors and trends affecting our business. We believe these measures are used by

investors and are a useful indicator to measure our performance. Because not all companies use identical

calculations, our presentation of segment operating income (loss) and segment operating margin may not be

comparable to similarly titled measures of other companies.

Adjusted net earnings (loss) and adjusted diluted earnings per share are not measures recognized under

GAAP. They should be considered supplemental to and not a substitute for financial information prepared in

accordance with GAAP. We believe these measures are useful to investors because they exclude items that do

not reflect our core operating performance. They may not be comparable to similarly titled measures of other

companies.

Free cash flow is not a measure recognized under GAAP. Free cash flow has limitations as an analytical tool

and should not be considered in isolation from, or as a substitute for, analysis of our results as reported under

GAAP. We believe free cash flow is an important measure for our investors because it provides them insight

into our current and period-to-period performance and our ability to generate cash from continuing operations.

We also use free cash flow as a key operating metric in assessing the performance of our business and as a

key performance measure in evaluating management performance and determining incentive compensation.

Free cash flow may not be comparable to similarly titled measures of other companies.

11

Non-GAAP Measures Definitions Cont’d

Segment operating income (loss) is defined as operating income (loss) for the relevant segment(s) before

the FAS/CAS Adjustment and non-current state income taxes.

Segment operating margin is defined as segment operating income (loss) as a percentage of sales and

service revenues.

Adjusted net earnings (loss) is defined as net earnings (loss) adjusted for the after-tax impact of the loss on

early extinguishment of debt in fourth quarter 2017 and for tax reform.

Adjusted diluted earnings per share is defined as adjusted net earnings (loss) divided by the weighted-

average diluted common shares outstanding.

Free cash flow is defined as net cash provided by (used in) operating activities less capital expenditures net of

related grant proceeds.

FAS/CAS Adjustment is defined as the difference between our pension and postretirement plan expense

under GAAP Financial Accounting Standards and the same expense under U.S. Cost Accounting Standards

(CAS). Our pension and postretirement plan expense is charged to our contracts under CAS and included in

segment operating income.

Non-current state income taxes are defined as deferred state income taxes, which reflect the change in

deferred state tax assets and liabilities and the tax expense or benefit associated with changes in state

uncertain tax positions in the relevant period. These amounts are recorded within operating income. Current

period state income tax expense is charged to contract costs and included in cost of sales and service

revenues in segment operating income.

We present financial measures adjusted for the FAS/CAS Adjustment and non-current state income taxes to

reflect the company’s performance based upon the pension costs and state tax expense charged to our

contracts under CAS. We use these adjusted measures as internal measures of operating performance and for

performance-based compensation decisions.

12

Non-GAAP Reconciliations – Segment Operating

Income (Loss) & Segment Operating Margin

($ in millions) 2017 2016 2017 2016

Ingalls revenues 638$ 641$ 2,420$ 2,389$

Newport News revenues 1,139 1,119 4,164 4,089

Technical Solutions revenues 242 186 952 691

Intersegment eliminations (23) (24) (95) (101)

Sales and Service Revenues 1,996 1,922 7,441 7,068

Segment Operating Income (Loss)

Ingalls 75 85 313 321

As a percentage of Ingalls revenues 11.8 % 13.3 % 12.9 % 13.4 %

Newport News 106 139 354 386

As a percentage of Newport News revenues 9.3 % 12.4 % 8.5 % 9.4 %

Technical Solutions 8 1 21 8

As a percentage of Technical Solutions revenues 3.3 % 0.5 % 2.2 % 1.2 %

Intersegment eliminations — — — —

Segment Operating Income (Loss) 189 225 688 715

As a percentage of Sales and Service revenues 9.5 % 11.7 % 9.2 % 10.1 %

Non-segment factors affecting operating income (loss):

FAS/CAS Adjustment 45 38 189 145

N n-current state income taxes (7) 5 (12) (2)

Operating Income 227 268 865 858

Interest expense (41) (18) (94) (74)

Other, net 1 1 1 —

Federal and foreign income taxes (123) (54) (293) (211)

Net Earnings 64$ 197$ 479$ 573$

Three Months Ended Year Ended

December 31 December 31

13

Non-GAAP Reconciliations – Adjusted Net Earnings &

Adjusted Diluted EPS

13

(in millions, except per share amounts) 2017 2016 2017 2016

Adjusted Net Earnings (Loss)

Net earnings (loss) 64$ 197$ 479$ 573$

After-tax adjustment for loss on early extinguishment of debt1 14 — 14 —

Tax reform adjustments:

Tax expense related to 2017 Tax Act2 56 — 56 —

Tax expense related to discretionary pension contributions3 7 — 7 —

Adjusted Net Earnings (Loss) 141$ 197$ 556$ 573$

Adjusted Diluted EPS

Diluted earnings (loss) per share 1.41$ 4.20$ 10.46$ 12.14$

After-tax adjustment for loss on early extinguishment of debt per share1 0.31 — 0.31 —

Tax reform adjustments:

Tax expense related to 2017 Tax Act per share2 1.23 — 1.22 —

Tax expense related to discretionary pension contributions per share 3 0.16 — 0.15 —

Adjusted Diluted EPS 3.11$ 4.20$ 12.14$ 12.14$

Three Months Ended Year Ended

December 31 December 31

14

Non-GAAP Reconciliations – Footnotes to the Reconciliation of

Adjusted Net Earnings and Adjusted Diluted Earnings per Share

14

(in millions, except per share amounts) 2017 2016 2017 2016

(1) Loss on early extinguishment of debt 22$ —$ 22$ —$

Tax effect at 35% statutory rate* 8 — 8 —

After-tax effect 14 — 14 —

Weighted-Average Diluted Shares Outstanding 45.4 46.9 45.8 47.2

Per share impact** 0.31$ —$ 0.31$ —$

(2) Tax expense related to 2017 Tax Act a 56$ —$ 56$ —$

Weighted-Average Diluted Shares Outstanding 45.4 46.9 45.8 47.2

Per share impact** 1.23$ —$ 1.22$ —$

(3) Tax expense related to discretionary pension contributions b 7$ —$ 7$ —$

Weighted-Average Diluted Shares Outstanding 45.4 46.9 45.8 47.2

P r share impact** 0.16$ —$ 0.15$ —$

**Amounts may not recalculate exactly due to rounding.

a Reflects the impact of the net deferred tax assets write down

b Reflects the additional income tax expense from the lower manufacturing deductions available as a result of our planned $214

million increased pre-tax discretionary pension contribution in 2018

Three Months Ended Year Ended

December 31 December 31

*The income tax impact is calculated using the tax rate in effect for the relevant non-GAAP adjustment.

15

Non-GAAP Reconciliation – Free Cash Flow

15

($ in millions) 2017 2016 2017 2016

Net cash provided by (used in) operating activities 434 345 814 822

Less capital expenditures:

Capital expenditure additions (154) (140) (382) (285)

Grant proceeds for capital expenditures 21 — 21 —

Free cash flow 301 205 453 537

Three Months Ended

December 31

Year Ended

December 31