Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - LAYNE CHRISTENSEN CO | d492445dex994.htm |

| EX-99.3 - EX-99.3 - LAYNE CHRISTENSEN CO | d492445dex993.htm |

| EX-99.2 - EX-99.2 - LAYNE CHRISTENSEN CO | d492445dex992.htm |

| EX-99.1 - EX-99.1 - LAYNE CHRISTENSEN CO | d492445dex991.htm |

| EX-2.1 - EX-2.1 - LAYNE CHRISTENSEN CO | d492445dex21.htm |

| 8-K - 8-K - LAYNE CHRISTENSEN CO | d492445d8k.htm |

GRANITE CONSTRUCTION TO ACQUIRE LAYNE CHRISTENSEN A PLATFORM FOR GROWTH FEBRUARY 2018 Exhibit 99.5

Forward Looking Statements All statements included or incorporated by reference in this communication, other than statements or characterizations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Granite’s current expectations, estimates and projections about its business and industry, management’s beliefs, and certain assumptions made by Granite and Layne, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. Examples of such forward-looking statements include, but are not limited to: (1) references to the anticipated benefits of the proposed transaction; (2) the expected future capabilities and served markets of the individual and/or combined companies; (3) projections of financial results, whether by specific market segment, or as a whole, and whether for each individual company or the combined company; (4) market expansion opportunities and segments that may benefit from sales growth as a result of changes in market share or existing markets; (5) the financing components of the proposed transaction; (6) potential credit scenarios, together with sources and uses of cash; and (7) the expected date of closing of the transaction. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those expressed in any forward-looking statement. Important risk factors that may cause such a difference in connection with the proposed transaction include, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals for the transaction from governmental authorities or the stockholders of Layne are not obtained; (2) litigation relating to the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operations of Granite or Layne; (5) the ability of Granite or Layne to retain and hire key personnel; (6) competitive responses to the proposed transaction and the impact of competitive products; (7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; (10) the terms and availability of the indebtedness planned to be incurred in connection with the transaction; and (11) legislative, regulatory and economic developments, including changing business conditions in the construction industry and overall economy as well as the financial performance and expectations of Granite and Layne’s existing and prospective customers. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that Granite will file with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. Investors and potential investors are urged not to place undue reliance on forward-looking statements in this document, which speak only as of this date. Neither Granite nor Layne undertakes any obligation to revise or update publicly any forward-looking statement to reflect future events or circumstances. Nothing contained herein constitutes or will be deemed to constitute a forecast, projection or estimate of the future financial performance of Granite, Layne, or the combined company, following the implementation of the proposed transaction or otherwise. In addition, actual results are subject to other risks and uncertainties that relate more broadly to Granite’s overall business, including those more fully described in Granite’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2016, and Layne’s overall business and financial condition, including those more fully described in Layne’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended January 31, 2017. No Offer or Solicitation This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Additional Information and Where to Find It In connection with the proposed transaction, Granite will file a registration statement on Form S-4, which will include a preliminary prospectus of Granite and a preliminary proxy statement of Layne (the “proxy statement/prospectus”), and each party will file other documents regarding the proposed transaction with the SEC. The registration statement has not yet become effective and the proxy statement/prospectus included therein is in preliminary form. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A definitive proxy statement/prospectus will be sent to Layne’s stockholders. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by. Granite on Granite’s Investor Relations website (investor.Granite.com) or by writing to Granite, Investor Relations, 585 West Beach Street, Watsonville, CA 95076 (for documents filed with the SEC by Granite), or by Layne on Layne’s Investor Relations website (investor.laynechristensen.com) or by writing to Layne Company, Investor Relations, 1800 Hughes Landing Boulevard, Suite 800, The Woodlands, TX 77380 (for documents filed with the SEC by Layne). Participants in the Solicitation Granite, Layne, and certain of their respective directors, executive officers, other members of management and employees and agents retained, may, under SEC rules, be deemed to be participants in the solicitation of proxies from Layne stockholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Layne stockholders in connection with the proposed transaction will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find more detailed information about Granite’s executive officers and directors in its definitive proxy statement filed with the SEC on April 25, 2017. You can find more detailed information about Layne’s executive officers and directors in its definitive proxy statement filed with the SEC on April 28, 2017. Additional information about Granite’s executive officers and directors and Layne’s executive officers and directors will be provided in the above-referenced Registration Statement on Form S-4 when it becomes available Safe Harbor

AGENDA TRANSACTION OVERVIEW COMPELLING STRATEGIC COMBINATION FINANCIAL BENEFITS CONCLUSION

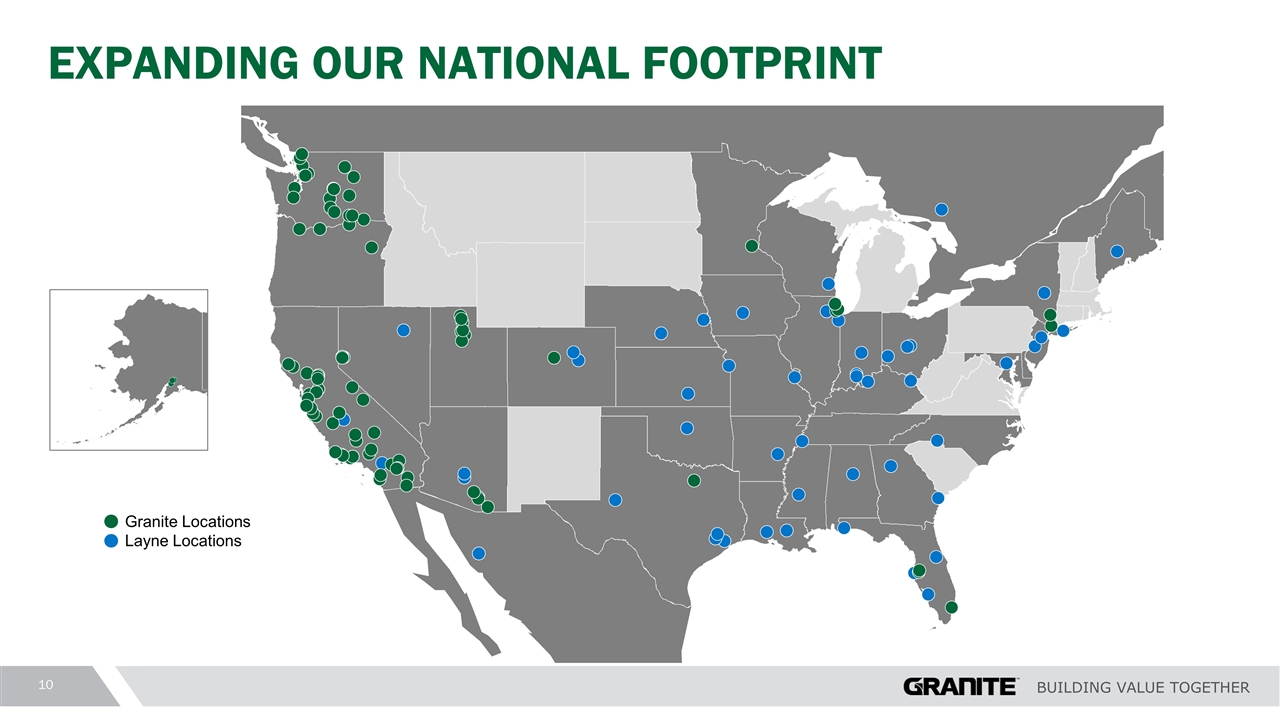

Delivering on the next logical step in Granite’s strategic plan and evolution Extends diversification efforts into growing water end market segments, leveraging prior investments Positions Granite as a national leader across both transportation and water infrastructure markets Poised to benefit from attractive macro dynamics of the water services industry Broadens portfolio to meet the needs of public and private water sector customers Expands national footprint, particularly in the Midwest Creates significant financial value, including cost savings and earnings accretion ESTABLISHING A PLATFORM FOR GROWTH

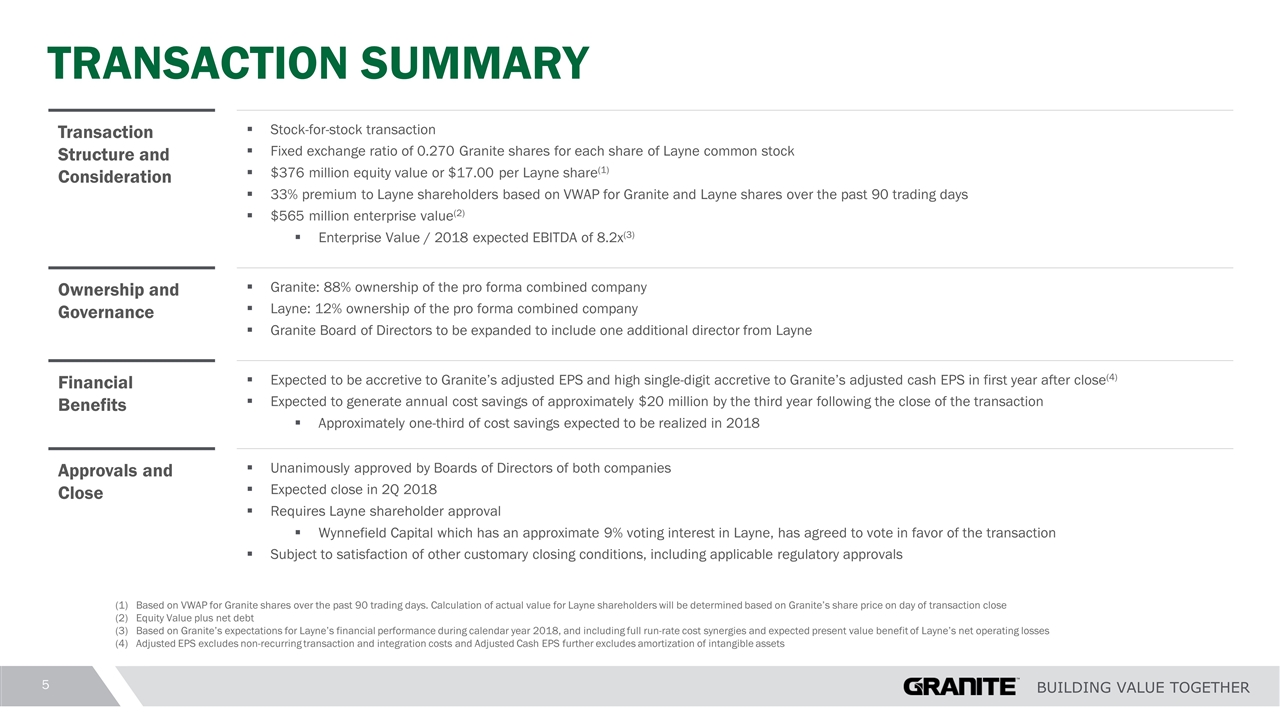

TRANSACTION SUMMARY (1) Based on VWAP for Granite shares over the past 90 trading days. Calculation of actual value for Layne shareholders will be determined based on Granite’s share price on day of transaction close (2) Equity Value plus net debt (3) Based on Granite’s expectations for Layne’s financial performance during calendar year 2018, and including full run-rate cost synergies and expected present value benefit of Layne’s net operating losses (4) Adjusted EPS excludes non-recurring transaction and integration costs and Adjusted Cash EPS further excludes amortization of intangible assets Transaction Structure and Consideration Stock-for-stock transaction Fixed exchange ratio of 0.270 Granite shares for each share of Layne common stock $376 million equity value or $17.00 per Layne share(1) 33% premium to Layne shareholders based on VWAP for Granite and Layne shares over the past 90 trading days $565 million enterprise value(2) Enterprise Value / 2018 expected EBITDA of 8.2x(3) Ownership and Governance Granite: 88% ownership of the pro forma combined company Layne: 12% ownership of the pro forma combined company Granite Board of Directors to be expanded to include one additional director from Layne Financial Benefits Expected to be accretive to Granite’s adjusted EPS and high single-digit accretive to Granite’s adjusted cash EPS in first year after close(4) Expected to generate annual cost savings of approximately $20 million by the third year following the close of the transaction Approximately one-third of cost savings expected to be realized in 2018 Approvals and Close Unanimously approved by Boards of Directors of both companies Expected close in 2Q 2018 Requires Layne shareholder approval Wynnefield Capital which has an approximate 9% voting interest in Layne, has agreed to vote in favor of the transaction Subject to satisfaction of other customary closing conditions, including applicable regulatory approvals

Increased demand for large water infrastructure programs due to population growth and scarcity of water supply U.S. municipal utility sector forecasted capital expenditures of $532 billion through 2025(5) >50% expected to be related to water and wastewater distribution networks Chronic underinvestment in U.S. municipal water and wastewater network requires significant rehabilitation Network of >1.6 million miles of pipes Average age of installed pipe has lengthened by 20+ years (to average age of 45 years) Pipes now nearing the end of their useful life ATTRACTIVE U.S. WATER SERVICE INDUSTRY DYNAMICS (5) U.S. Municipal Water Infrastructure: Utility Strategies & CAPEX Forecasts, 2016 – 2025, Bluefield Research

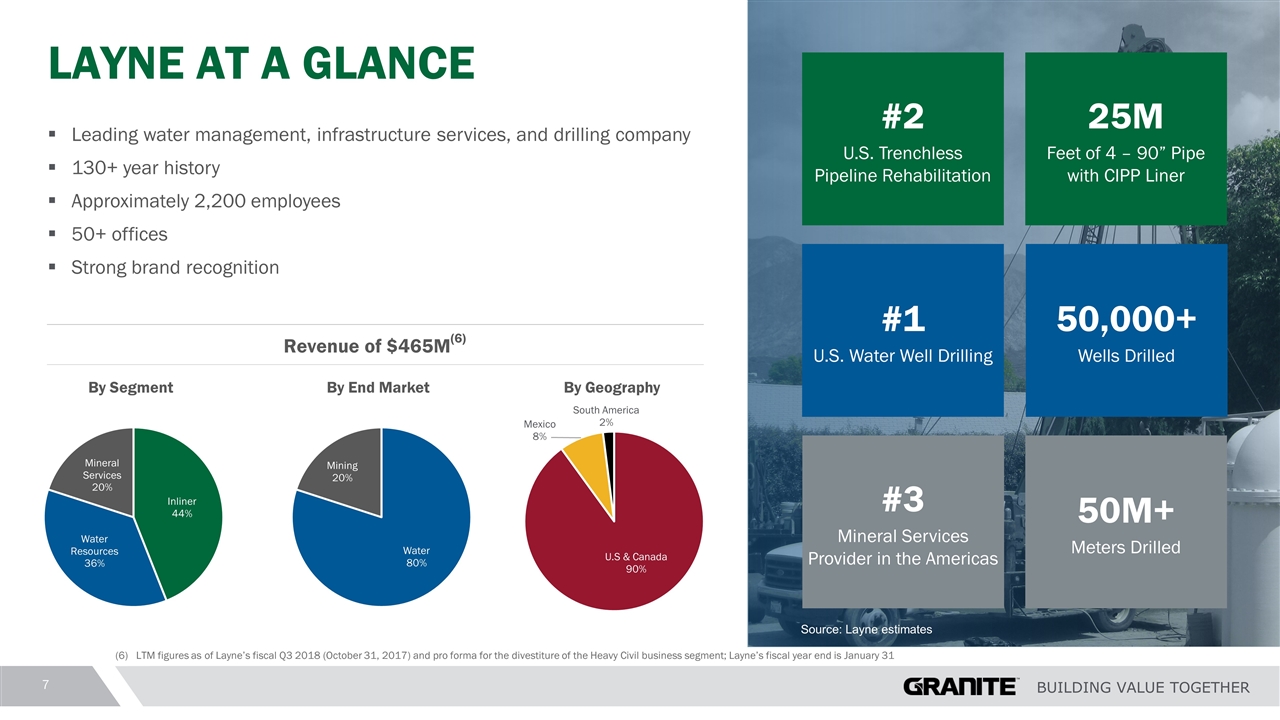

LAYNE AT A GLANCE Leading water management, infrastructure services, and drilling company 130+ year history Approximately 2,200 employees 50+ offices Strong brand recognition #1 U.S. Water Well Drilling #2 U.S. Trenchless Pipeline Rehabilitation #3 Mineral Services Provider in the Americas 50,000+ Wells Drilled 25M Feet of 4 – 90” Pipe with CIPP Liner 50M+ Meters Drilled (6) LTM figures as of Layne’s fiscal Q3 2018 (October 31, 2017) and pro forma for the divestiture of the Heavy Civil business segment; Layne’s fiscal year end is January 31 Revenue of $465M(6) Source: Layne estimates

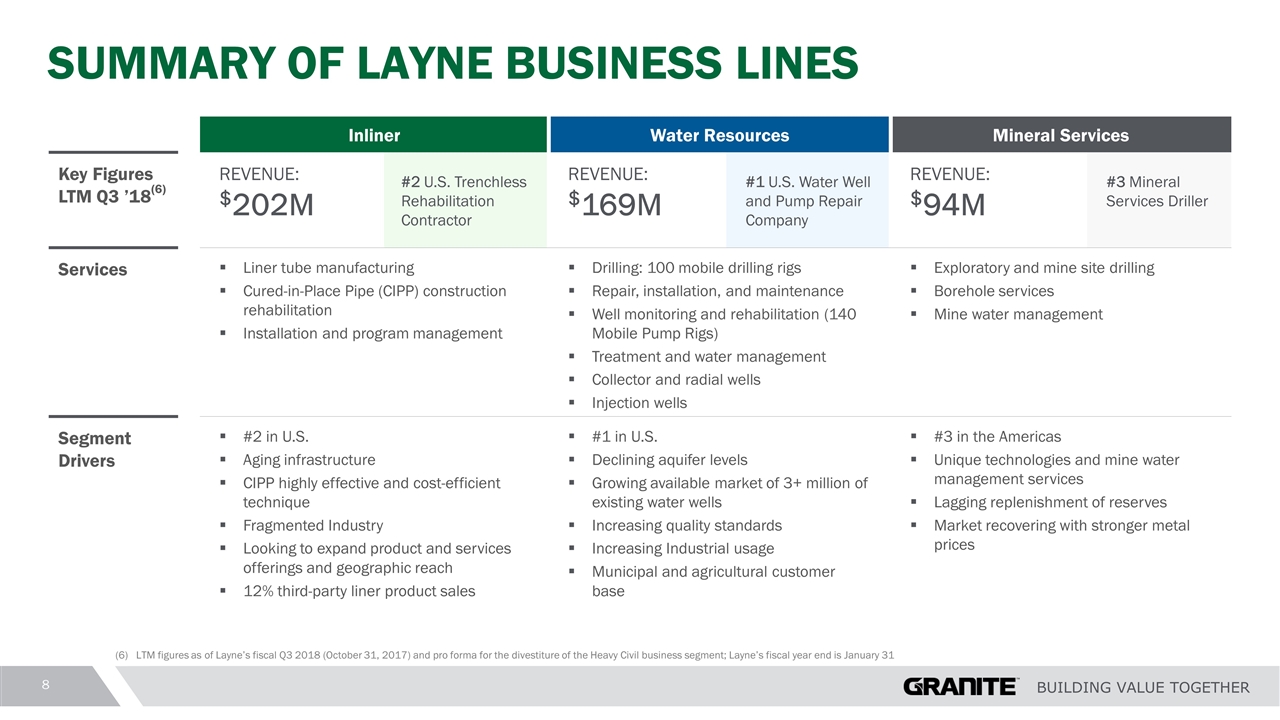

SUMMARY OF LAYNE BUSINESS LINES Inliner Water Resources Mineral Services Key Figures LTM Q3 ’18(6) REVENUE: $202M #2 U.S. Trenchless Rehabilitation Contractor REVENUE: $169M #1 U.S. Water Well and Pump Repair Company REVENUE: $94M #3 Mineral Services Driller Services Liner tube manufacturing Cured-in-Place Pipe (CIPP) construction rehabilitation Installation and program management Drilling: 100 mobile drilling rigs Repair, installation, and maintenance Well monitoring and rehabilitation (140 Mobile Pump Rigs) Treatment and water management Collector and radial wells Injection wells Exploratory and mine site drilling Borehole services Mine water management Segment Drivers #2 in U.S. Aging infrastructure CIPP highly effective and cost-efficient technique Fragmented Industry Looking to expand product and services offerings and geographic reach 12% third-party liner product sales #1 in U.S. Declining aquifer levels Growing available market of 3+ million of existing water wells Increasing quality standards Increasing Industrial usage Municipal and agricultural customer base #3 in the Americas Unique technologies and mine water management services Lagging replenishment of reserves Market recovering with stronger metal prices (6) LTM figures as of Layne’s fiscal Q3 2018 (October 31, 2017) and pro forma for the divestiture of the Heavy Civil business segment; Layne’s fiscal year end is January 31

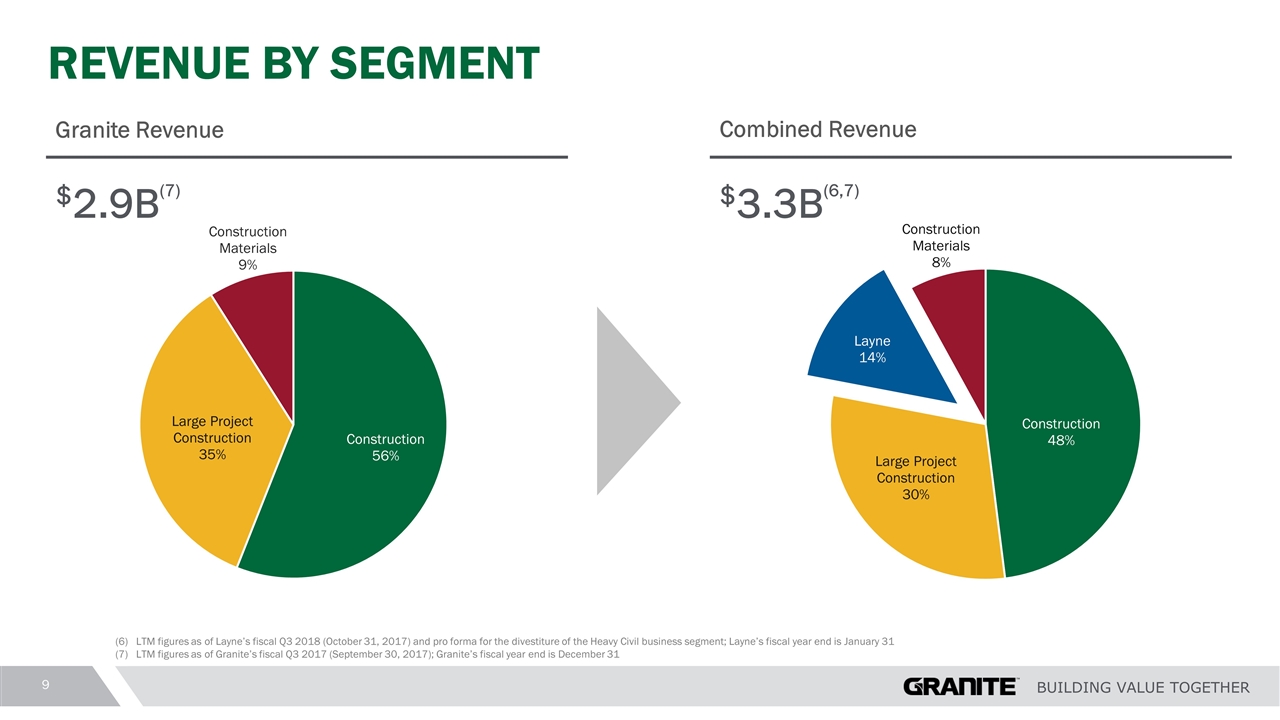

$3.3B(6,7) $2.9B(7) REVENUE BY SEGMENT (6) LTM figures as of Layne’s fiscal Q3 2018 (October 31, 2017) and pro forma for the divestiture of the Heavy Civil business segment; Layne’s fiscal year end is January 31 (7) LTM figures as of Granite’s fiscal Q3 2017 (September 30, 2017); Granite’s fiscal year end is December 31 Granite Revenue Combined Revenue

EXPANDING OUR NATIONAL FOOTPRINT Granite Locations Layne Locations

Expanded opportunities for employees as part of larger, stronger, and more diversified company Partnership unites two similar cultures and complementary organizations with proud history of leadership in their respective end markets Emphasizes core values focused on ethics, safety, sustainability, and commitment to community SIMILAR CULTURES AND CORE VALUES YEARS IN A ROW

SUBSTANTIAL FINANCIAL BENEFITS Significant Cost Savings Expected annual run-rate synergies of approximately $20 million by the third year following closing Approximately one-third realized in 2018 Approximately $11 million in one-time costs to achieve cost synergies Accretive to Earnings Expected to be accretive to Granite’s adjusted EPS and high single-digit accretive to Granite’s adjusted cash EPS in first year after close(4) Strong Balance Sheet and Financing Granite expects to assume outstanding Layne convertible debt with principal value of $170 million and honor the terms and existing maturity date provisions of the indentures Not expected to trigger any change of control provisions under Layne’s indentures $100 million par value 8.00% notes expected to convert at maturity $70 million par value 4.25% notes expected to be refinanced Cash flow generation expected to return Granite to current leverage levels by the end of 2018; Debt-to-EBITDA of less than 1.5x(8) Approximately $70 million of cash utilized will be funded through combination of excess balance sheet cash and existing Granite revolver Maintain investment grade credit profile following close of transaction Tax Net Operating Losses Additional value from NPV of NOLs of approximately $20 million(9) (4) Adjusted EPS excludes non-recurring transaction and integration costs and Adjusted Cash EPS further excludes amortization of intangible assets (8) Assumes conversion of Layne’s 8.00% convertible notes post-closing (9) NPV of NOLs based on projected NOL balance with utilization limited per Section 382 of the IRS Code

Potential for Meaningful Revenue Growth Opportunities Vertical integration via Inliner & Underground businesses in addition to continued geographic expansion Increased self-performance capabilities for combined company Cross-selling Layne’s Mineral Services expertise to Granite’s industrial and mining clients Approximately $20M Annual Run-Rate Cost Synergies Significant cost synergies achievable within first year after close Full run-rate synergies realized by third year Synergy opportunities include: Co-locate offices; Optimize operations; Align organizational structures; Consolidate / migrate systems; and Implement best practices across organizations and several functional areas VALUE CREATION THROUGH SYNGERGY REALIZATION

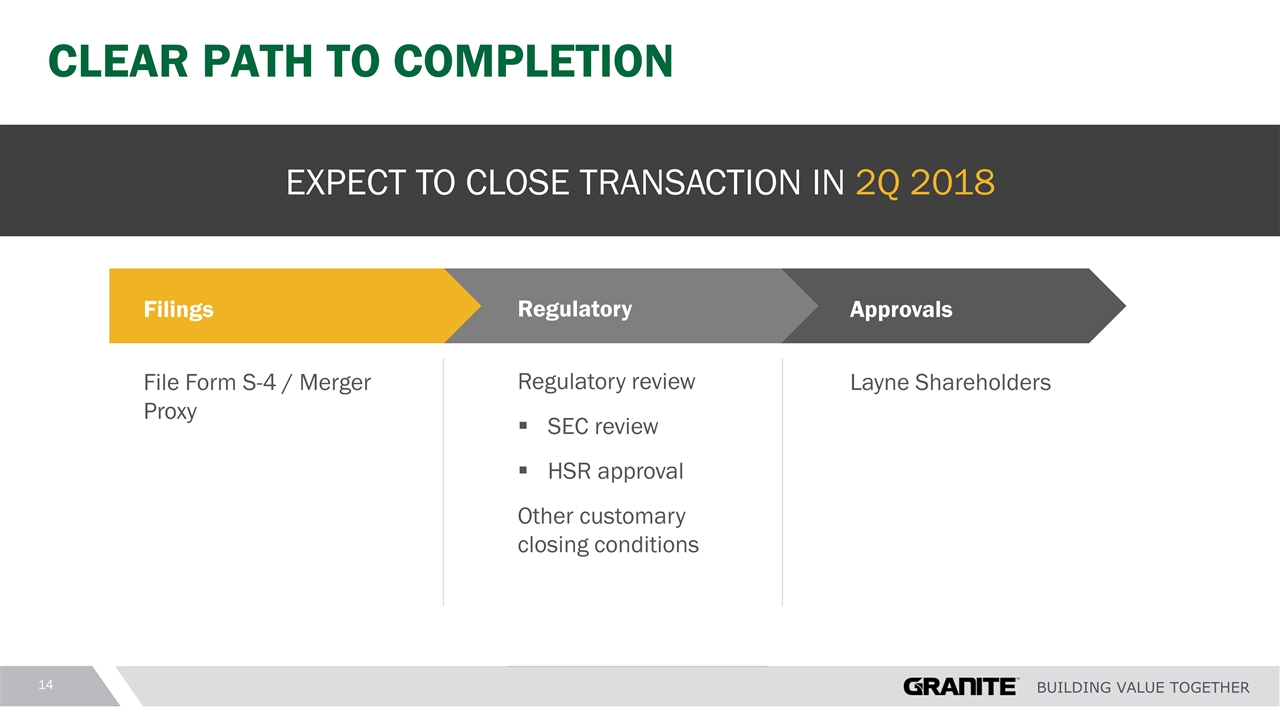

Regulatory Regulatory review SEC review HSR approval Other customary closing conditions CLEAR PATH TO COMPLETION Approvals Layne Shareholders Filings File Form S-4 / Merger Proxy EXPECT TO CLOSE TRANSACTION IN 2Q 2018

Delivering on the next logical step in Granite’s strategic plan and evolution Extends diversification efforts into growing water end market segments, leveraging prior investments Positions Granite as a national leader across both transportation and water infrastructure markets Poised to benefit from attractive macro dynamics of the water services industry Broadens portfolio to meet the needs of public and private water sector customers Expands national footprint, particularly in the Midwest Creates significant financial value, including cost savings and earnings accretion ESTABLISHING A PLATFORM FOR GROWTH