Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | fanniemae201710kpressrelea.htm |

| 8-K - 8-K - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | fanniemae20178k.htm |

2017 Credit Supplement

February 14, 2018

© 2018 Fannie Mae. Trademarks of Fannie Mae.

Exhibit 99.2

§

This presentation includes information about Fannie Mae, including information contained in

Fannie Mae’s Annual Report on Form 10-K for the year ended December 31, 2017, the “2017

Form 10-K.” Some of the terms used in these materials are defined and discussed more fuly

in the 2017 Form 10-K. These materials should be reviewed together with the 2017 Form

10-K, copies of which are available through the “SEC Filings” page in the

“About Us/Investor Relations” section of Fannie Mae’s website at www.fanniemae.com.

Some of the information in this presentation is based upon information that we received

from third-party sources such as selers and servicers of mortgage loans. Although we

generaly consider this information reliable, we do not independently verify al reported

information.

Due to rounding, amounts reported in this presentation may not add to totals indicated (or

100%).

Unless otherwise indicated data labeled as “2017” is as of December 31, 2017 or for the ful

year of 2017.

§

§

§

© 2018 Fannie Mae. Trademarks of Fannie Mae.

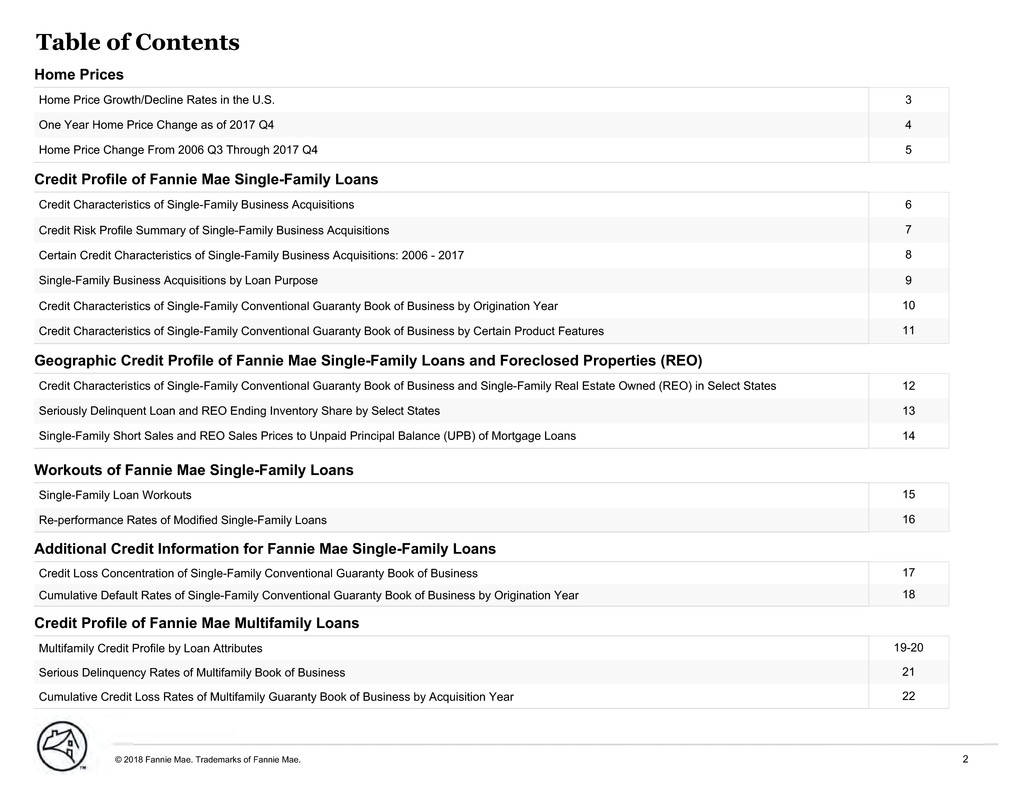

Table of Contents

Home Price Growth/Decline Rates in the U.S.

One Year Home Price Change as of 2017 Q4

Home Price Change From 2006 Q3 Through 2017 Q4 5

4

3

Home Prices

Credit Characteristics of Single-Family Business Acquisitions

Credit Risk Profile Summary of Single-Family Business Acquisitions

Certain Credit Characteristics of Single-Family Business Acquisitions: 2006 - 2017

Single-Family Business Acquisitions by Loan Purpose

Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Origination Year

Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Certain Product Features 11

10

9

8

7

6

Credit Profile of Fannie Mae Single-Family Loans

Credit Characteristics of Single-Family Conventional Guaranty Book of Business and Single-Family Real Estate Owned (REO) in Select States

Seriously Delinquent Loan and REO Ending Inventory Share by Select States

Single-Family Short Sales and REO Sales Prices to Unpaid Principal Balance (UPB) of Mortgage Loans 14

13

12

Geographic Credit Profile of Fannie Mae Single-Family Loans and Foreclosed Properties (REO)

Single-Family Loan Workouts

Re-performance Rates of Modified Single-Family Loans 16

15

Workouts of Fannie Mae Single-Family Loans

Credit Loss Concentration of Single-Family Conventional Guaranty Book of Business

Cumulative Default Rates of Single-Family Conventional Guaranty Book of Business by Origination Year 18

17

Additional Credit Information for Fannie Mae Single-Family Loans

Multifamily Credit Profile by Loan Atributes

Serious Delinquency Rates of Multifamily Book of Business

Cumulative Credit Loss Rates of Multifamily Guaranty Book of Business by Acquisition Year 22

21

19-20

Credit Profile of Fannie Mae Multifamily Loans

© 2018 Fannie Mae. Trademarks of Fannie Mae. 2

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-10.0%

-5.0%

0.0%

5.0%

10.0%

-3.7%

-9.0%

-4.8% -4.2%

-3.5%

2.6%

4.0%

7.6%

4.2% 4.6%

5.7% 5.6%

Fannie Mae Home Price Index

Based on our home price index, we estimate that home prices on a national basis increased by 5.6% in 2017, folowing increases of 5.7% in 2016, 4.6% in 2015

and 4.2% in 2014. Our home price estimates are based on preliminary data and are subject to change as additional data becomes available.

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

1.7% -5.4% -12.0% -3.8% -4.1% -3.9% 6.5% 10.7% 4.5% 5.2% 5.4% 5.7%

S&P/Case-Shiler Index

Home Price Growth/Decline Rates in the U.S.

Note: Estimate based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of December 2017. Including subsequent data may lead to materialy diferent results.

* Year-to-date as of Q3 2017. As comparison, Fannie Mae's index for the same period is 5.4%.

*

© 2018 Fannie Mae. Trademarks of Fannie Mae. 3

One Year Home Price Change as of 2017 Q4⁽¹⁾

NC

5.3%

2.6%

FL

5.9%

5.7%

CA

7.0%

19.5%

WA

11.1%

3.6%

UT

10.0%

1.3%

ID

11.1%

0.6%

NV

11.9%

1.1% KS3.6%

0.5%

LA

2.4%

0.9%

MO

4.5%

1.3%

MS

1.7%

0.4%

ND

1.7%

0.2%

NM

3.8%

0.5%

NY

4.8%

5.1%

OK

2.7%

0.7%

PA

4.0%

3.0%

TX

4.5%

6.2%

VA

3.3%

3.5%

WV

1.8%

0.2%

WY

4.4%

0.2%

AZ

6.5%

2.5% AL

4.4%

1.0%

GA

6.4%

2.7%

IN

5.1%

1.2%

KY

6.2%

0.6%

ME

6.2%

0.3%

MI

7.9%

2.3%

MN

7.3%

2.1%

MT

6.2%

0.3%

NE

6.8%

0.5% OH

5.3%

2.0%

OR

7.7%

1.8%

SC

5.6%

1.2%

SD

6.9%

0.2%

TN

7.4%

1.3%AR3.6%

0.5%

WI

6.3%

1.8%

IA

4.1%

0.7%

IL

4.4%

3.7%CO8.8%

3.0%

State: FL

Growth Rate: 5.9%

UPB %⁽²⁾: 5.7%

United States: 5.6%

(1) Source: Fannie Mae. Home price estimates are based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of December 2017. UPB estimates are based on

data available through the end of December 2017. Including subsequent data may lead to materialy diferent results.

(2) “UPB %” refers to unpaid principal balance of loans on properties in the applicable state as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie

Mae has access to loan-level information.

AK

2.2%

0.2%

Growth

Rate UPB %

CT

DC

DE

MA

MD

NH

NJ

RI

VT 0.1%

0.3%

3.7%

0.5%

2.7%

2.9%

0.4%

0.4%

1.2%

5.7%

7.8%

3.4%

7.2%

3.3%

6.6%

1.0%

8.9%

1.4%

HI

2.8%

0.7% State Growth Rate

0% to 5%

5% to 10%

10% and Above

© 2018 Fannie Mae. Trademarks of Fannie Mae. 4

(2)

TN

19.5%

1.3%

SC

7.3%

1.2%

NC

9.2%

2.6%AZ-17.7%

2.5%

FL

-18.1%

5.7%

NV

-20.3%

1.1%

CA

-5.1%

19.5%

ID

10.4%

0.6%

IN

14.5%

1.2%KS

17.1%

0.5% KY16.3%

0.6%

LA

18.1%

0.9%

MT

23.9%

0.3%

ND

53.8%

0.2%

NE

23.8%

0.5%

OK

17.8%

0.7%

OR

16.5%

1.8%

SD

31.8%

0.2%

TX

35.9%

6.2%

UT

26.6%

1.3%

WA

19.2%

3.6%

WY

18.9%

0.2%

CO

41.3%

3.0%

IA

18.6%

0.7%

IL

-9.4%

3.7%

VA

-6.0%

3.5%

NM

-1.5%

0.5% AL

3.5%

1.0%

GA

2.5%

2.7%

MI

1.3%

2.3%

MN

4.1%

2.1%

MS

2.5%

0.4%

OH

4.1%

2.0%

AR

8.5%

0.5%

ME

5.2%

0.3%

MO

7.2%

1.3%

NY

5.1%

5.1%

PA

7.8%

3.0%

WV

6.6%

0.2%

WI

6.2%

1.8%

State: FL

Growth Rate: -18.1%

UPB %⁽²⁾: 5.7%

United States: 4.1%

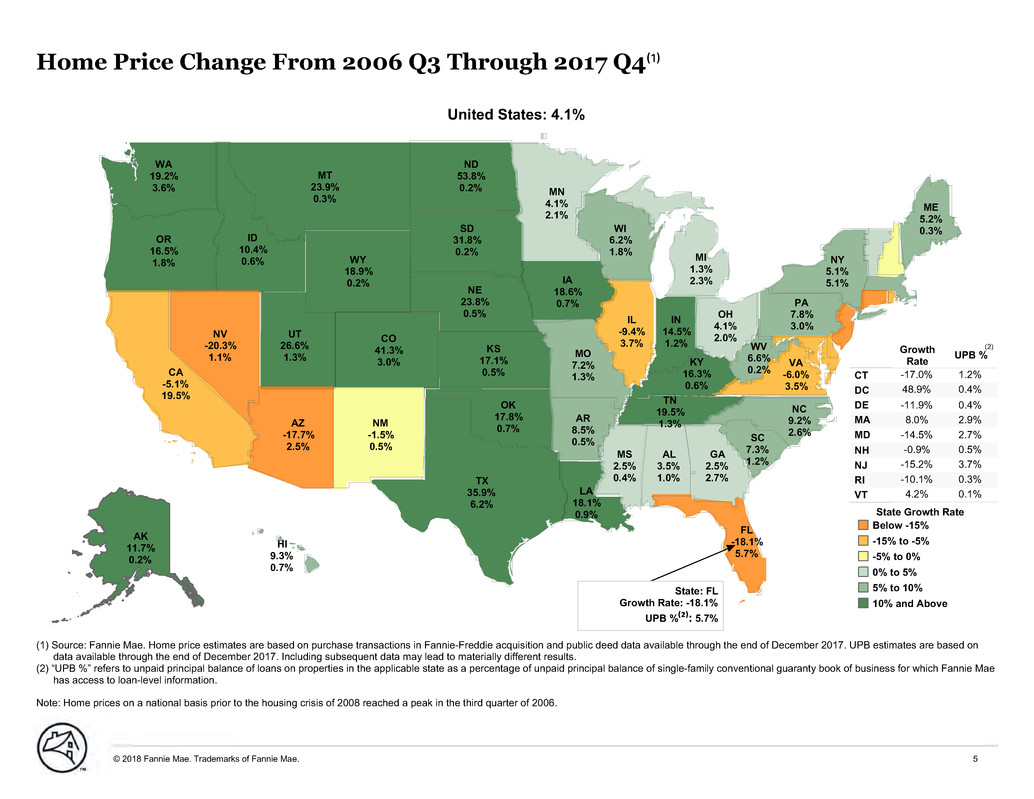

Home Price Change From 2006 Q3 Through 2017 Q4⁽¹⁾

(1) Source: Fannie Mae. Home price estimates are based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of December 2017. UPB estimates are based on

data available through the end of December 2017. Including subsequent data may lead to materialy diferent results.

(2) “UPB %” refers to unpaid principal balance of loans on properties in the applicable state as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie Mae

has access to loan-level information.

Note: Home prices on a national basis prior to the housing crisis of 2008 reached a peak in the third quarter of 2006.

AK

11.7%

0.2%

HI

9.3%

0.7%

Growth

Rate UPB %

CT

DC

DE

MA

MD

NH

NJ

RI

VT 0.1%

0.3%

3.7%

0.5%

2.7%

2.9%

0.4%

0.4%

1.2%

4.2%

-10.1%

-15.2%

-0.9%

-14.5%

8.0%

-11.9%

48.9%

-17.0%

State Growth Rate

Below -15%

-15% to -5%

-5% to 0%

0% to 5%

5% to 10%

10% and Above

(2)

© 2018 Fannie Mae. Trademarks of Fannie Mae. 5

Ful Year 2017

Single-Family

Acquisitions

Excl.

Refi Plus

Q4 2017

Single-Family

Acquisitions

Excl.

Refi Plus

Q3 2017

Single-Family

Acquisitions

Excl.

Refi Plus

Q2 2017

Single-Family

Acquisitions

Excl.

Refi Plus

Q1 2017

Single-Family

Acquisitions

Excl.

Refi Plus

Ful Year 2016

Single-Family

Acquisitions

Excl.

Refi Plus

Unpaid Principal Balance (UPB) ($B)

Weighted Average Origination Note Rate 4.12%

$487.7

4.12%

$501.8

4.09%

$125.2

4.09%

$127.9

4.13%

$131.5

4.13%

$134.2

4.25%

$117.6

4.26%

$121.2

4.00%

$113.4

4.00%

$118.5

3.73%

$558.9

3.74%

$581.0

<= 60%

60.01% to 70%

70.01% to 80%

80.01% to 90%

90.01% to 100%

> 100%

Weighted Average Origination LTV Ratio 75.6%

0.0%

18.1%

12.3%

39.3%

12.8%

17.4%

75.4%

0.2%

17.8%

12.3%

38.8%

12.9%

17.9%

75.8%

0.0%

18.5%

12.3%

39.1%

13.2%

16.9%

75.7%

0.1%

18.2%

12.3%

38.7%

13.2%

17.4%

76.6%

0.0%

19.7%

12.9%

39.6%

12.0%

15.8%

76.5%

0.1%

19.5%

12.9%

39.2%

12.0%

16.2%

76.3%

0.0%

19.2%

12.7%

39.9%

12.0%

16.2%

76.1%

0.2%

18.8%

12.7%

39.3%

12.1%

16.8%

73.3%

0.0%

14.8%

11.1%

38.6%

14.4%

21.1%

73.2%

0.3%

14.5%

11.1%

37.8%

14.5%

21.7%

73.6%

0.0%

14.8%

11.5%

38.8%

14.5%

20.4%

73.6%

0.4%

14.6%

11.6%

38.1%

14.5%

20.7%

Origination Loan-to-Value (LTV) Ratio

< 620

620 to < 660

660 to < 700

700 to < 740

>=740

Weighted Average FICO Credit Score 746

59.3%

22.6%

13.0%

5.1%

0.0%

745

58.6%

22.6%

13.2%

5.3%

0.3%

744

57.8%

23.1%

13.5%

5.5%

0.0%

743

57.3%

23.1%

13.7%

5.7%

0.2%

746

59.7%

22.5%

12.9%

5.0%

0.0%

745

59.2%

22.4%

13.0%

5.1%

0.2%

746

59.5%

22.6%

12.8%

5.0%

0.0%

745

58.7%

22.6%

13.1%

5.2%

0.3%

747

60.4%

22.2%

12.7%

4.7%

0.0%

746

59.4%

22.1%

13.0%

5.0%

0.4%

752

64.9%

20.4%

10.9%

3.8%

0.0%

750

63.9%

20.4%

11.3%

4.1%

0.3%

FICO Credit Scores

Credit Characteristics of Single-Family Business Acquisitions⁽¹⁾

Fixed-rate

Adjustable-rate

Alt-A

Interest Only

Investor

Condo/Co-op

Refinance 42.6%

9.8%

6.6%

0.0%

0.0%

2.6%

97.4%

44.2%

9.8%

6.9%

0.0%

0.3%

2.6%

97.4%

44.7%

9.7%

6.3%

0.0%

0.0%

1.9%

98.1%

45.9%

9.7%

6.5%

0.0%

0.2%

1.9%

98.1%

36.1%

9.6%

6.1%

0.0%

0.0%

3.0%

97.0%

37.4%

9.6%

6.4%

0.0%

0.2%

3.0%

97.0%

37.1%

9.9%

6.7%

0.0%

0.0%

3.4%

96.6%

39.0%

10.0%

7.0%

0.0%

0.3%

3.4%

96.6%

53.4%

9.9%

7.3%

0.0%

0.0%

2.2%

97.8%

55.4%

9.8%

7.7%

0.0%

0.3%

2.1%

97.9%

54.0%

9.6%

5.6%

0.0%

0.0%

1.6%

98.4%

55.7%

9.6%

6.0%

0.0%

0.3%

1.5%

98.5%

Certain Characteristics

Purchase

Cash-out refinance

Other refinance 20.5%

22.1%

57.4%

22.7%

21.5%

55.8%

20.7%

24.0%

55.3%

22.4%

23.5%

54.1%

16.3%

19.8%

63.9%

17.9%

19.5%

62.6%

16.9%

20.2%

62.9%

19.4%

19.6%

61.0%

28.7%

24.7%

46.6%

31.8%

23.6%

44.6%

33.9%

20.1%

46.0%

36.4%

19.3%

44.3%

Loan Purpose

Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization transactions.

Single-family business acquisitions for the applicable period excluding loans acquired under our Refi Plus initiative, which includes the Home Afordable Refinance Program ® (“HARP ®”). Our Refi Plus initiative provides expanded refinance

opportunities for eligible Fannie Mae borowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan.

Newly originated Alt-A loans for the applicable periods consist of the refinance of existing loans under our Refi Plus initiative. For a description of our Alt-A loan classification criteria, refer to Fannie Mae's 2017 Form 10-K.

(1)

(2)

(3)

(4)

Single-Family Acquisitions

6.0%

7.3%

20.3%

Single-Family Acquisitions

6.8%

7.6%

18.9%

Single-Family Acquisitions

California

Texas

Florida 6.1%

7.2%

19.5%

Single-Family Acquisitions

5.1%

6.9%

22.9%

Single-Family Acquisitions

6.1%

7.0%

18.4%

Single-Family Acquisitions

5.5%

7.1%

20.4%

Acquisition Period

(4)

Top 3 Geographic Concentrations

© 2018 Fannie Mae. Trademarks of Fannie Mae. 6

(3)

(2) (2) (2) (2) (2) (2)

®

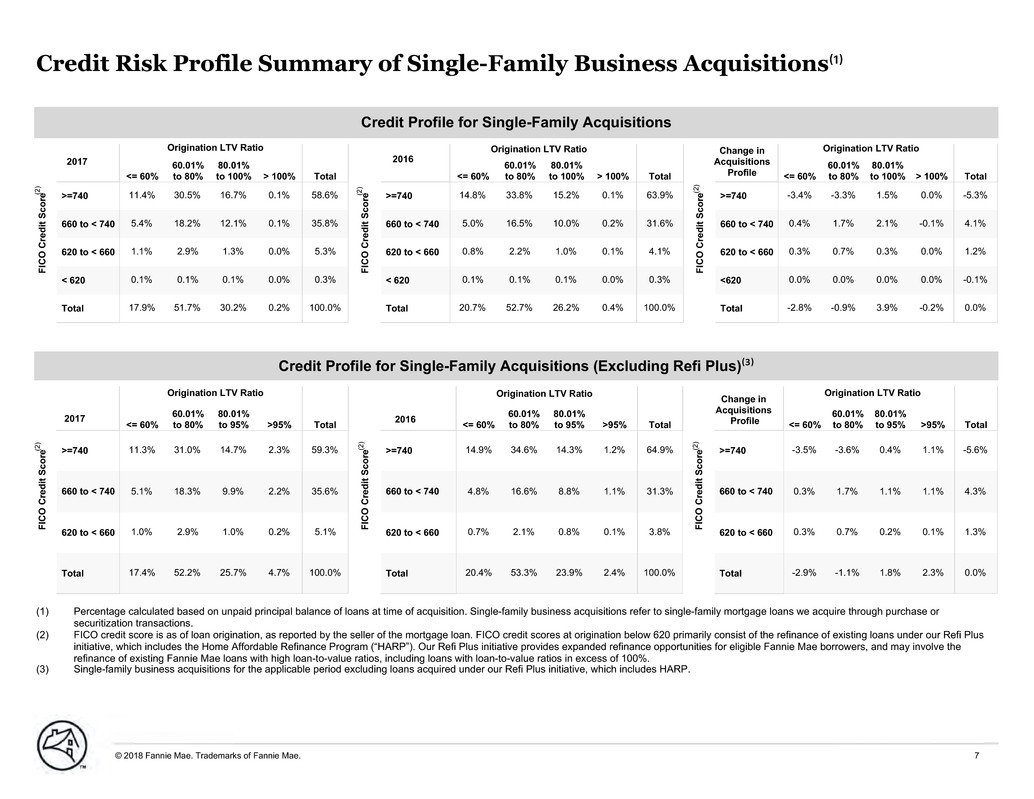

Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or

securitization transactions.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan. FICO credit scores at origination below 620 primarily consist of the refinance of existing loans under our Refi Plus

initiative, which includes the Home Afordable Refinance Program (“HARP”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae borowers, and may involve the

refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%.

Single-family business acquisitions for the applicable period excluding loans acquired under our Refi Plus initiative, which includes HARP.

<= 60%

60.01%

to 80%

80.01%

to 100% > 100% Total

>=740

660 to < 740

620 to < 660

< 620

Total 100.0%

0.3%

5.3%

35.8%

58.6%

0.2%

0.0%

0.0%

0.1%

0.1%

30.2%

0.1%

1.3%

12.1%

16.7%

51.7%

0.1%

2.9%

18.2%

30.5%

17.9%

0.1%

1.1%

5.4%

11.4%

<= 60%

60.01%

to 80%

80.01%

to 100% > 100% Total

>=740

660 to < 740

620 to < 660

< 620

Total 100.0%

0.3%

4.1%

31.6%

63.9%

0.4%

0.0%

0.1%

0.2%

0.1%

26.2%

0.1%

1.0%

10.0%

15.2%

52.7%

0.1%

2.2%

16.5%

33.8%

20.7%

0.1%

0.8%

5.0%

14.8%

<= 60%

60.01%

to 80%

80.01%

to 95% >95% Total

>=740

660 to < 740

620 to < 660

Total 100.0%

5.1%

35.6%

59.3%

4.7%

0.2%

2.2%

2.3%

25.7%

1.0%

9.9%

14.7%

52.2%

2.9%

18.3%

31.0%

17.4%

1.0%

5.1%

11.3%

<= 60%

60.01%

to 80%

80.01%

to 95% >95% Total

>=740

660 to < 740

620 to < 660

Total 100.0%

3.8%

31.3%

64.9%

2.4%

0.1%

1.1%

1.2%

23.9%

0.8%

8.8%

14.3%

53.3%

2.1%

16.6%

34.6%

20.4%

0.7%

4.8%

14.9%

Credit Profile for Single-Family Acquisitions (Excluding Refi Plus)⁽³⁾

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

(1)

(2)

(3)

<= 60%

60.01%

to 80%

80.01%

to 95% >95% Total

>=740

660 to < 740

620 to < 660

Total 0.0%

1.3%

4.3%

-5.6%

2.3%

0.1%

1.1%

1.1%

1.8%

0.2%

1.1%

0.4%

-1.1%

0.7%

1.7%

-3.6%

-2.9%

0.3%

0.3%

-3.5%

<= 60%

60.01%

to 80%

80.01%

to 100% > 100% Total

>=740

660 to < 740

620 to < 660

<620

Total 0.0%

-0.1%

1.2%

4.1%

-5.3%

-0.2%

0.0%

0.0%

-0.1%

0.0%

3.9%

0.0%

0.3%

2.1%

1.5%

-0.9%

0.0%

0.7%

1.7%

-3.3%

-2.8%

0.0%

0.3%

0.4%

-3.4%

Credit Profile for Single-Family Acquisitions

Credit Risk Profile Summary of Single-Family Business Acquisitions⁽¹⁾

2017

2017 2016

2016

Change in

Acquisitions

Profile

Change in

Acquisitions

Profile

Origination LTV Ratio Origination LTV Ratio Origination LTV Ratio

Origination LTV Ratio Origination LTV Ratio Origination LTV Ratio

© 2018 Fannie Mae. Trademarks of Fannie Mae. 7

(2)

(2)

(2) (2)

(2) (2

)

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

40%

60%

80%

100%

Or

igin

ati

on

LT

V R

ati

o

0%

5%

10%

15%

20%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

Origination Loan-to-Value (OLTV) Ratio⁽²⁾

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

660

680

700

720

740

760

780

FIC

O

Cr

ed

it S

co

re

0%

5%

10%

15%

20%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

FICO Credit Score⁽²⁾

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0%

20%

40%

60%

80%

100%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

Share of Single-Family Business Acquisitions:

Fixed-rate Product

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0%

20%

40%

60%

80%

100%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

Share of Single-Family Business Acquisitions:

Loan Purpose - Purchase

Product Feature⁽²⁾

Weighted Average Origination LTV Ratio Origination LTV > 90% Weighted Average FICO Credit Score FICO Credit Score < 620

Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization

transactions.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan. Loans acquired after 2009 with FICO credit scores at origination below 620 primarily consist of the refinance of existing

loans under our Refi Plus initiative, which includes HARP.

Certain Credit Characteristics of Single-Family Business Acquisitions: 2006 - 2017⁽¹⁾

(1)

(2)

.

© 2018 Fannie Mae. Trademarks of Fannie Mae. 8

2010 2011 2012 2013 2014 2015 2016 2017

0%

20%

40%

60%

80%

100%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

1%1%2%

2%3%4%6%14%16%10%10%

6%

9%9%14%14%

41%

52%48%36%

48%

55%52%54%

56%

44%45%52%

30%21%24%23%

HARP Refi Plus Acquisitions (Excluding HARP) Refinance Acquisitions (Excluding Refi Plus) Purchase Acquisitions

2010

HARP

Refi Plus

(Excl.

HARP)

2011

HARP

Refi Plus

(Excl.

HARP)

2012

HARP

Refi Plus

(Excl.

HARP)

2013

HARP

Refi Plus

(Excl.

HARP)

2014

HARP

Refi Plus

(Excl.

HARP)

2015

HARP

Refi Plus

(Excl.

HARP)

2016

HARP

Refi Plus

(Excl.

HARP)

2017

HARP

Refi Plus

(Excl.

HARP)

Unpaid Principal Balance (UPB) ($B)

Weighted Average Origination Note Rate 4.68%

$80.5

5.00%

$59.0

4.44%

$81.2

4.78%

$55.6

3.89%

$73.8

4.14%

$129.9

3.80%

$64.4

4.04%

$99.5

4.39%

$23.5

4.62%

$21.5

4.08%

$19.2

4.23%

$11.2

3.89%

$14.7

4.05%

$7.4

4.13%

$10.1

4.28%

$4.0

Credit Characteristics of Single-Family Business Acquisitions Under the Refi Plus Initiative⁽¹⁾

Our Refi Plus initiative, which started in April 2009, includes the Home Afordable Refinance Program (“HARP”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae

borowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan.

<=80%

80.01% to 105%

105.01% to 125%

>125%

Weighted Average Origination LTV Ratio 62.3%

0.0%

0.0%

0.0%

100.0%

92.2%

0.0%

5.6%

94.4%

0.0%

60.2%

0.0%

0.0%

0.0%

100.0%

94.3%

0.0%

11.9%

88.1%

0.0%

61.1%

0.0%

0.0%

0.0%

100.0%

111.0%

20.7%

22.1%

57.2%

0.0%

60.2%

0.0%

0.0%

0.0%

100.0%

109.8%

20.1%

21.5%

58.4%

0.0%

61.3%

0.0%

0.0%

0.0%

100.0%

101.5%

9.9%

16.9%

73.3%

0.0%

60.4%

0.0%

0.0%

0.0%

100.0%

98.4%

7.0%

15.0%

78.0%

0.0%

60.0%

0.0%

0.0%

0.0%

100.0%

96.9%

5.4%

13.5%

81.1%

0.0%

58.6%

0.0%

0.0%

0.0%

100.0%

96.0%

4.7%

12.4%

82.8%

0.0%

Origination LTV Ratio

< 620

620 to < 660

660 to < 740

>=740

Weighted Average FICO Credit Score 760

72.3%

23.9%

2.4%

1.4%

746

61.2%

33.1%

3.6%

2.0%

758

70.0%

25.6%

2.8%

1.7%

746

61.5%

32.6%

3.8%

2.1%

753

66.9%

26.0%

4.2%

2.9%

738

56.6%

33.8%

6.0%

3.7%

737

55.8%

31.9%

6.9%

5.3%

722

45.1%

38.7%

9.5%

6.7%

717

43.0%

36.5%

11.2%

9.3%

704

33.9%

41.0%

14.5%

10.6%

722

46.3%

34.4%

10.5%

8.8%

706

34.8%

41.1%

14.6%

9.5%

717

41.6%

37.5%

11.6%

9.2%

703

30.8%

44.9%

15.3%

9.1%

711

37.6%

40.1%

12.5%

9.8%

702

29.8%

46.2%

15.2%

8.8%

FICO Credit Scores

(1)

(2)

Single-Family Business Acquisitions by Loan Purpose

Acquisition Year

© 2018 Fannie Mae. Trademarks of Fannie Mae. 9

(2)

Acquisitions

Overal Book

Origination Year

2017 2016 2015 2014 2013 2012 2011 2010 2009

2008 &

Earlier

Unpaid Principal Balance (UPB) ($B)

Share of Single-Family Conventional Guaranty Book

Average Unpaid Principal Balance

Serious Delinquency Rate

Weighted Average Origination LTV Ratio

Origination LTV Ratio > 90%

Weighted Average Mark-to-Market LTV Ratio

Mark-to-Market LTV Ratio > 100% and <= 125%

Mark-to-Market LTV Ratio > 125%

Weighted Average FICO Credit Score

FICO < 620

Interest Only

Negative Amortizing

Fixed-rate

Primary Residence

Condo/Co-op

Credit Enhanced

Cumulative Default Rate

40.5%

9.3%

88.5%

95.2%

0.1%

1.2%

1.7%

745

0.2%

0.8%

58.1%

16.7%

75.0%

1.24%

$166,643

100.0%

$2,858.9

15.3%

9.1%

89.5%

71.0%

1.0%

10.9%

9.6%

698

1.4%

4.3%

57.7%

14.5%

75.3%

4.85%

$98,374

9.7%

$277.5

0.9%

3.2%

8.6%

90.6%

97.4%

0.0%

1.1%

1.0%

751

0.0%

0.1%

46.6%

6.2%

69.4%

1.07%

$131,428

2.8%

$80.6

0.7%

4.2%

8.1%

89.1%

96.9%

0.0%

0.9%

0.8%

756

0.0%

0.1%

44.8%

9.9%

71.0%

0.66%

$133,401

4.1%

$117.2

0.4%

6.5%

8.3%

86.9%

96.5%

0.0%

0.5%

0.8%

757

0.0%

0.1%

43.2%

12.1%

71.1%

0.57%

$134,278

5.0%

$143.9

0.4%

22.8%

8.7%

88.6%

98.3%

0.0%

0.2%

1.1%

759

0.2%

0.8%

47.0%

18.8%

76.4%

0.44%

$166,455

14.4%

$411.6

0.4%

46.0%

9.9%

86.0%

98.1%

0.0%

0.2%

1.9%

750

0.3%

1.0%

51.8%

20.5%

76.8%

0.62%

$164,031

12.5%

$357.8

0.2%

60.3%

9.7%

85.7%

96.2%

0.0%

0.0%

1.5%

743

0.1%

0.5%

58.8%

19.8%

76.9%

0.84%

$167,657

6.8%

$195.7

0.1%

64.8%

9.6%

88.0%

97.8%

0.0%

0.0%

0.7%

748

0.0%

0.2%

61.4%

16.7%

75.1%

0.57%

$196,783

11.6%

$331.7

0.0%

63.6%

9.5%

90.4%

98.8%

0.0%

0.0%

0.3%

751

0.0%

0.1%

65.5%

15.5%

73.7%

0.40%

$220,287

18.1%

$518.0

0.0%

41.7%

9.7%

88.9%

97.4%

0.0%

0.0%

0.3%

744

0.0%

0.2%

73.4%

18.7%

75.9%

0.21%

$222,105

14.9%

$424.9

Excludes non-Fannie Mae securities held in portfolio and those Alt-A and subprime wraps for which Fannie Mae does not have loan-level information. Fannie Mae had access to detailed loan-level information

for approximately 99% of its single-family conventional guaranty book of business as of December 31, 2017.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan. Loans acquired after 2009 with FICO credit scores at origination below 620 primarily consist of the refinance of existing

loans under our Refi Plus initiative, which includes HARP.

Percentage of loans in our single-family conventional guaranty book of business, measured by unpaid principal balance, included in an agreement used to reduce credit risk by requiring colateral, leters of

credit, mortgage insurance, corporate guarantees, inclusion in a credit risk transfer transaction reference pool, or other agreement that provides for our compensation to some degree in the event of a financial

loss relating to the loan. Because we include loans in reference pools for our Connecticut Avenue Securities™ and Credit Insurance Risk Transfer™ credit risk transfer transactions on a lagged basis (typicaly

about six months to one year after we initialy acquire the loans), we expect the percentage of our 2017 single-family loan acquisitions with credit enhancement wil increase in the future.

Defaults include loan foreclosures, short sales, sales to third parties at the time of foreclosure and deeds-in-lieu of foreclosure. Cumulative Default Rate is the total number of single-family conventional loans in

the guaranty book of business originated in the identified year that have defaulted, divided by the total number of single-family conventional loans in the guaranty book of business originated in the identified

year. For 2008 and earlier cumulative default rates, refer to slide 18.

(1)

(2)

(3)

(4)

.

Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Origination Year

(1)

(1)

(3)

(4)

As of December 31, 2017

© 2018 Fannie Mae. Trademarks of Fannie Mae. 10

(2)

(2)

n/a n/a

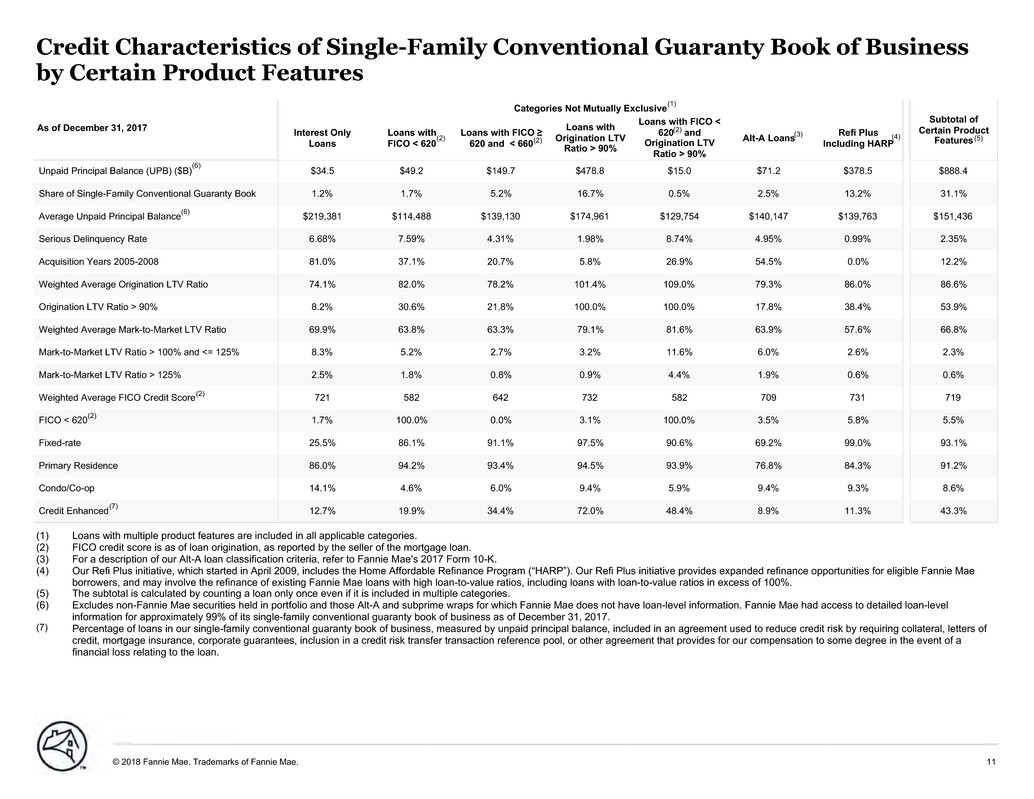

Categories Not Mutualy Exclusive

Interest Only

Loans

Loans with

FICO < 620

Loans with FICO ≥

620 and < 660

Loans with

Origination LTV

Ratio > 90%

Loans with FICO <

620 and

Origination LTV

Ratio > 90%

Alt-A Loans Refi PlusIncluding HARP

Unpaid Principal Balance (UPB) ($B)

Share of Single-Family Conventional Guaranty Book

Average Unpaid Principal Balance

Serious Delinquency Rate

Acquisition Years 2005-2008

Weighted Average Origination LTV Ratio

Origination LTV Ratio > 90%

Weighted Average Mark-to-Market LTV Ratio

Mark-to-Market LTV Ratio > 100% and <= 125%

Mark-to-Market LTV Ratio > 125%

Weighted Average FICO Credit Score

FICO < 620

Fixed-rate

Primary Residence

Condo/Co-op

Credit Enhanced 11.3%

9.3%

84.3%

99.0%

5.8%

731

0.6%

2.6%

57.6%

38.4%

86.0%

0.0%

0.99%

$139,763

13.2%

$378.5

8.9%

9.4%

76.8%

69.2%

3.5%

709

1.9%

6.0%

63.9%

17.8%

79.3%

54.5%

4.95%

$140,147

2.5%

$71.2

48.4%

5.9%

93.9%

90.6%

100.0%

582

4.4%

11.6%

81.6%

100.0%

109.0%

26.9%

8.74%

$129,754

0.5%

$15.0

72.0%

9.4%

94.5%

97.5%

3.1%

732

0.9%

3.2%

79.1%

100.0%

101.4%

5.8%

1.98%

$174,961

16.7%

$478.8

34.4%

6.0%

93.4%

91.1%

0.0%

642

0.8%

2.7%

63.3%

21.8%

78.2%

20.7%

4.31%

$139,130

5.2%

$149.7

19.9%

4.6%

94.2%

86.1%

100.0%

582

1.8%

5.2%

63.8%

30.6%

82.0%

37.1%

7.59%

$114,488

1.7%

$49.2

12.7%

14.1%

86.0%

25.5%

1.7%

721

2.5%

8.3%

69.9%

8.2%

74.1%

81.0%

6.68%

$219,381

1.2%

$34.5

Loans with multiple product features are included in al applicable categories.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan.

For a description of our Alt-A loan classification criteria, refer to Fannie Mae's 2017 Form 10-K.

Our Refi Plus initiative, which started in April 2009, includes the Home Afordable Refinance Program (“HARP”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae

borowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%.

The subtotal is calculated by counting a loan only once even if it is included in multiple categories.

Excludes non-Fannie Mae securities held in portfolio and those Alt-A and subprime wraps for which Fannie Mae does not have loan-level information. Fannie Mae had access to detailed loan-level

information for approximately 99% of its single-family conventional guaranty book of business as of December 31, 2017.

Percentage of loans in our single-family conventional guaranty book of business, measured by unpaid principal balance, included in an agreement used to reduce credit risk by requiring colateral, leters of

credit, mortgage insurance, corporate guarantees, inclusion in a credit risk transfer transaction reference pool, or other agreement that provides for our compensation to some degree in the event of a

financial loss relating to the loan.

Subtotal of

Certain Product

Features

43.3%

8.6%

91.2%

93.1%

5.5%

719

0.6%

2.3%

66.8%

53.9%

86.6%

12.2%

2.35%

$151,436

31.1%

$888.4

Credit Characteristics of Single-Family Conventional Guaranty Book of Business

by Certain Product Features

(1)

(2)

(3)

(4)

(5)

(6)

(7).

As of December 31, 2017

© 2018 Fannie Mae. Trademarks of Fannie Mae. 11

(6)

(2)

(2)

(6)

(2)

(2) (3) (4)

(7)

(2) (5)

(1)

Midwest

Northeast

Southeast

Southwest

West 12.0%

7.3%

24.3%

38.0%

18.4%

905

637

823

1,467

591

2,203

2,929

6,933

8,076

6,170

802

1,307

2,927

2,540

2,324

535

1,050

1,894

1,957

1,762

0.49%

0.99%

1.74%

2.11%

0.92%

8.4%

15.2%

33.6%

28.7%

14.1%

0.4%

0.4%

1.6%

1.6%

1.1%

51.4%

59.9%

62.0%

58.6%

62.4%

28.0%

17.3%

22.1%

17.8%

14.7%

$801.4

$495.8

$633.1

$508.6

$419.9

Regions

Based on the unpaid principal balance (UPB) of the single-family conventional guaranty book of business as of December 31, 2017. Excludes non-Fannie Mae securities held in portfolio and those Alt-A and

subprime wraps for which Fannie Mae does not have loan-level information. Fannie Mae had access to detailed loan-level information for approximately 99% of its single-family conventional guaranty book of

business as of December 31, 2017.

“Seriously delinquent loans” refers to single-family conventional loans that are 90 days or more past due or in the foreclosure process. “Seriously delinquent loan share” refers to the percentage of our

single-family seriously delinquent loan population in the applicable state or region. “Serious delinquency rate” refers to the number of single-family conventional loans that were seriously delinquent in the

applicable state or region, divided by the number of loans in our single-family conventional guaranty book of business in that state or region.

Measured from the borowers’ last paid instalment on their mortgages to when the related properties were added to our REO inventory for foreclosures completed in 2017. Home Equity Conversion

Mortgages (HECMs) insured by Department of Housing and Urban Development (HUD) are excluded from this calculation.

Expressed as a percentage of the single-family credit losses for the time periods noted. Credit losses consist of (a) charge-ofs net of recoveries and (b) foreclosed property expense (income). Percentages

exclude the impact of recoveries that have not been alocated to specific loans. For more information on credit losses, refer to Fannie Mae’s 2017 Form 10-K.

Select states represent the top ten states in UPB of the single-family conventional guaranty book of business as of December 31, 2017.

For information on which states are included in each region, refer to the single-family mortgage credit risk management discussion in Fannie Mae’s 2017 Form 10-K.

Credit Characteristics of Single-Family Conventional Guaranty Book of Business

and Single-Family Real Estate Owned (REO) in Select States

SF Conventional Guaranty Book of Business

as of December 31, 2017

Seriously Delinquent Loans

as of December 31, 2017 Real Estate Owned (REO) Credit Loss

(1)

(2)

(3)

(4)

(5)

(6)

Al States 100.0%91226,3119,9007,1981.24%100.0%1.0%58.1%100.0%$2,858.9

Unpaid Principal

Balance (UPB)

($B)

Share of

Single-Family

Conventional

Guaranty Book

Weighted

Average

Mark-to-Market

LTV Ratio

Mark-to-Market

LTV >100%

Seriously

Delinquent Loan

Share

Serious

Delinquency

Rate

Q4 2017

Acquisitions

(# of properties)

Q4 2017

Dispositions

(# of properties)

REO Ending

Inventory

as of 12/31/17

Average Days to

Foreclosure

% of 2017 Credit

Losses

California

Texas

Florida

New York

Ilinois

New Jersey

Washington

Virginia

Pennsylvania

Colorado 0.1%

4.5%

1.9%

0.6%

13.7%

9.4%

11.5%

10.4%

0.9%

8.3%

665

836

530

1,139

1,877

736

1,948

1,334

629

626

71

1,164

724

342

2,714

1,872

1,661

1,870

596

900

29

507

250

126

879

639

497

1,118

199

372

29

365

214

62

678

542

364

393

179

297

0.26%

1.39%

0.65%

0.49%

2.15%

1.24%

2.02%

3.71%

1.46%

0.42%

0.5%

4.0%

1.6%

1.2%

5.4%

4.3%

7.2%

19.2%

8.2%

4.6%

0.0%

1.0%

0.9%

0.1%

3.2%

2.8%

1.4%

3.3%

0.0%

0.4%

54.8%

62.5%

62.1%

53.4%

62.1%

64.0%

53.4%

62.1%

59.0%

49.4%

3.0%

3.0%

3.5%

3.6%

3.7%

3.7%

5.1%

5.7%

6.2%

19.5%

$84.9

$85.1

$99.0

$103.6

$105.0

$106.8

$145.7

$161.7

$178.3

$557.2

Select States

Total

© 2018 Fannie Mae. Trademarks of Fannie Mae. 12

(3) (4)(5)

(6)

(2)

(1) (2)

Based on states with the largest volume of seriously delinquent loans in our single-family conventional guaranty book of business as of December 31, 2017.

“Seriously delinquent loan share” refers to the percentage of our single-family seriously delinquent loan population in the applicable state.

Share of REO ending inventory calculated as the number of properties in the single-family REO ending inventory for the state divided by the total number of single-family properties in the REO ending inventory

for the specified time period.

2015

Q3

2015

Q4

2016

Q1

2016

Q2

2016

Q3

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

0K

40K

80K

120K

160K

200K

240K

280K

320K

360K

SD

Q

Vo

lum

e

0%

5%

10%

15%

20%

25%

212K

19.2%

8.2%

12.5%

7.2%

5.4%

4.6%

3.1%

10.6%

10.1%

5.2%

Seriously Delinquent Loan Share by Select States⁽²⁾

California

Florida

New Jersey

New York

Texas

SDQ Volume

2015

Q3

2015

Q4

2016

Q1

2016

Q2

2016

Q3

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

0K

10K

20K

30K

40K

50K

60K

70K

80K

90K

100K

RE

O

En

din

g I

nv

en

tor

y

0%

5%

10%

15%

20%

25%

26K

1.8% 2.3%

4.3% 6.3%

6.8%

10.3%

18.0%

7.1%

3.9%

3.4%

REO Ending Inventory Share by Select States⁽³⁾

California

Florida

New Jersey

New York

Texas

REO Ending Inventory

(1)

(2)

(3)

.

Seriously Delinquent Loan and REO Ending Inventory Share by Select States⁽¹⁾

© 2018 Fannie Mae. Trademarks of Fannie Mae. 13

Single-Family Short Sales and REO Sales Prices to Unpaid Principal Balance

(UPB) of Mortgage Loans

2015

Q3

2015

Q4

2016

Q1

2016

Q2

2016

Q3

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

60%

70%

80%

90%

72.4% 72.6% 73.1%

75.0% 73.9% 73.6% 74.1%

75.8% 75.5%75.2%

79.3% 79.9%

81.9% 80.9% 80.3% 80.9%

83.0% 82.7%82.3%

79.7%

REO⁽¹⁾ Direct Sale Dispositions: Sales Prices to UPB⁽²⁾

Net Sales Prices to UPB Trends for Top 10 States⁽²⁾⁽³⁾

REO Gross Sales/UPB REO Net Sales/UPB

2015

Q3

2015

Q4

2016

Q1

2016

Q2

2016

Q3

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

60%

70%

80%

90%

73.8% 73.5% 73.3% 74.6% 73.7% 74.1%74.1%

75.8%75.5%75.3%

82.0% 81.7% 83.2% 82.4% 82.5%82.7%

84.5%

82.4%

84.3%84.2%

Short Sales: Sales Prices to UPB⁽²⁾

Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Florida

New Jersey

Ilinois

Ohio

New York

Pennsylvania

Michigan

California

Maryland

Georgia 83.8%

71.8%

88.3%

70.1%

69.6%

71.8%

57.3%

63.5%

64.3%

82.7%

83.2%

70.4%

89.4%

69.6%

68.8%

71.3%

63.3%

64.9%

64.1%

83.1%

80.8%

67.7%

87.7%

68.0%

66.6%

70.3%

60.0%

62.5%

65.2%

81.7%

79.9%

70.4%

88.3%

62.4%

60.6%

68.3%

58.6%

64.7%

63.9%

80.5%

79.1%

70.4%

87.2%

60.9%

64.9%

66.9%

58.1%

63.3%

63.0%

79.7%

Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Florida

New Jersey

Ilinois

New York

California

Maryland

Nevada

Virginia

Connecticut

Pennsylvania 71.6%

72.5%

77.1%

76.1%

73.7%

82.3%

81.1%

70.5%

65.0%

77.2%

71.7%

74.2%

76.7%

75.6%

72.9%

83.7%

76.0%

70.6%

68.0%

76.0%

74.3%

71.5%

80.3%

76.2%

72.7%

84.1%

73.1%

70.2%

64.0%

77.5%

72.5%

65.4%

79.5%

70.7%

70.0%

81.9%

74.7%

70.6%

62.5%

74.3%

73.7%

69.9%

78.2%

73.3%

73.0%

81.4%

74.8%

69.1%

65.1%

73.4%

Short Sales Gross Sales/UPB Short Sales Net Sales/UPB

Includes REO properties that have been sold to a third party (excluding properties that have been repurchased by the seler/servicer, acquired by a mortgage insurance company, or redeemed by a borower).

Sales Prices to UPB are calculated as the sum of sales proceeds received divided by the aggregate unpaid principal balance (UPB) of the related loans. Gross sales price represents the contract sale price. Net

sales price represents the contract sale price less charges/credits paid by or due to the seler or other parties at closing.

The states shown had the greatest volume of properties sold in 2017 in each respective category.

(1)

(2)

(3)

REO Net Sales

Prices to UPB

Short Sales

Net Sales

Prices to UPB

© 2018 Fannie Mae. Trademarks of Fannie Mae. 14

Foreclosure Alternatives⁽²⁾

Consists of (a) modifications, which do not include trial modifications, loans to certain borowers who have received bankruptcy relief that are accounted for as troubled debt restructurings, or repayment plans

or forbearances that have been initiated but not completed and (b) repayment plans and forbearances completed.

Consists of (a) short sales, in which the borower, working with the servicer and Fannie Mae, sels the home prior to foreclosure for less than the amount owed to pay of the loan, accrued interest and other

expenses from the sale proceeds and (b) deeds-in-lieu of foreclosure, which involve the borower’s voluntarily signing over title to the property.

2015

Q3

2015

Q4

2016

Q1

2016

Q2

2016

Q3

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

0K

2K

4K

6K

8K

10K

12K

14K

16K

18K

20K

22K

24K

# o

f L

oa

ns

0K

2K2K2K2K2K

3K3K3K3K

4K 1K

1K1K1K

1K2K2K

2K

2K

6K

5K 5K 4K 4K 4K 3K 3K

2K 2K

Short Sales

Deeds-in-Lieu

2015

Q3

2015

Q4

2016

Q1

2016

Q2

2016

Q3

2016

Q4

2017

Q1

2017

Q2

2017

Q3

2017

Q4

0K

2K

4K

6K

8K

10K

12K

14K

16K

18K

20K

22K

24K

# o

f L

oa

ns

22K

20K

22K

20K

17K

21K21K21K

19K

22K

1K

1K

2K

2K

2K

2K2K1K

1K

1K

24K

20K

22K

23K 22K

19K

22K

23K

21K

23K

Modifications

Repayment Plans and Forbearances Completed

(1)

(2)

Home Retention Solutions⁽¹⁾

Single-Family Loan Workouts

© 2018 Fannie Mae. Trademarks of Fannie Mae. 15

Modifications reflect permanent modifications which does not include loans curently in trial modifications.

Defined as total number of completed modifications for the time periods noted.

2015 Q1 2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3

Modifications 19,92721,53919,92817,32520,80221,27820,89919,09922,19926,21426,700

Re-performance Rates of Modified Single-Family Loans⁽¹⁾

(1)

(2)

2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3

3 Months Post Modification

6 Months Post Modification

9 Months Post Modification

12 Months Post Modification

15 Months Post Modification

18 Months Post Modification

21 Months Post Modification

24 Months Post Modification

70%

65%

75%

64%

70%

79%

63%

66%

71%

77%

62%

65%

67%

69%

75%

62%

64%

66%

67%

68%

77%

63%

65%

65%

66%

65%

70%

79%

65%

65%

65%

64%

64%

67%

72%

78%

65%

65%

63%

62%

64%

67%

69%

76%

68%

65%

64%

64%

67%

67%

69%

77%

67%

65%

65%

66%

67%

68%

72%

79%

% Current or Paid Of

© 2018 Fannie Mae. Trademarks of Fannie Mae. 16

n/a

n/a n/a

n/a n/a n/a

n/a n/a n/a n/a

n/a n/a n/a n/a n/a

n/a n/a n/a n/a n/a n/a

n/a n/a n/a n/a n/a n/a n/a

(2)

Based on the unpaid principal balance (UPB) of the single-family conventional guaranty book of business as of December 31 for the time periods noted.

Based on single-family credit losses for the year ended December 31 for the time periods noted. Expressed as a percentage of single-family credit losses for the time periods noted. Credit losses consist of (a) charge-ofs net

of recoveries and (b) foreclosed property expense (income). Percentages exclude the impact of recoveries that have not been alocated to specific loans. Negative values are the result of recoveries on previously recognized

credit losses. For more information on credit losses, refer to Fannie Mae’s 2017 Form 10-K.

Loans with multiple product features are included in al applicable categories. Categories are not mutualy exclusive.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan.

Newly originated Alt-A loans acquired after 2008 consist of the refinance of existing loans under our Refi Plus Initiative. For a description of our Alt-A loan classification creteria, refer to Fannie Mae's 2017 Form 10-K.

For a description of our subprime loan classification criteria, refer to Fannie Mae’s 2017 Form 10-K.

Select states represent the top ten states with the highest percentage of single-family credit losses for the year ended December 31, 2017.

Credit Loss Concentration of Single-Family Conventional Guaranty Book of Business

(1)

(2)

(3)

(4)

(5)

(6)

(7)

New Jersey

New York

Florida

Ilinois

California

Maryland

Pennsylvania

Ohio

Connecticut

Nevada

Al Other States 50.6%

1.0%

1.4%

2.2%

3.1%

2.8%

19.0%

4.2%

6.0%

5.6%

4.0%

50.8%

1.0%

1.4%

2.1%

3.1%

2.8%

19.6%

4.1%

5.7%

5.6%

4.0%

51.0%

1.0%

1.3%

2.1%

3.0%

2.7%

19.6%

4.1%

5.6%

5.5%

4.0%

51.4%

1.0%

1.3%

2.0%

3.0%

2.7%

19.7%

4.0%

5.6%

5.4%

3.9%

51.9%

1.0%

1.3%

2.0%

3.0%

2.7%

19.6%

3.9%

5.6%

5.2%

3.8%

52.4%

1.1%

1.2%

2.0%

3.0%

2.7%

19.5%

3.7%

5.7%

5.1%

3.7%

35.4%

4.8%

0.9%

3.3%

1.6%

1.8%

18.4%

9.6%

21.4%

0.9%

2.0%

32.1%

3.8%

1.4%

4.1%

3.0%

3.1%

5.1%

12.9%

28.9%

1.9%

3.7%

26.7%

1.4%

2.8%

4.2%

4.2%

5.9%

-0.8%

10.9%

32.6%

4.8%

7.2%

18.6%

1.8%

2.3%

2.2%

3.4%

3.8%

1.4%

7.8%

20.8%

16.4%

21.6%

29.5%

1.2%

2.7%

4.3%

5.0%

3.9%

2.1%

8.7%

7.9%

18.3%

16.5%

28.9%

2.2%

2.8%

3.6%

4.5%

4.7%

8.3%

9.4%

10.4%

11.5%

13.7%

Select State

% of Single-Family Conventional Guaranty Book of Business

2017 2016 2015 2014 2013 2012

% of Single-Family Credit Losses

2017 2016 2015 2014 2013 2012

Negative Amortizing

Interest Only

FICO < 620

FICO 620 to < 660

Origination LTV Ratio > 90%

FICO < 620 and Origination LTV Ratio > 90%

Alt-A

Subprime

Refi Plus including HARP 16.5%

0.2%

5.6%

0.7%

12.8%

6.0%

2.9%

3.7%

0.3%

19.5%

0.1%

4.7%

0.7%

15.1%

5.5%

2.6%

2.9%

0.2%

19.1%

0.1%

4.2%

0.7%

15.9%

5.5%

2.5%

2.5%

0.2%

17.6%

0.1%

3.7%

0.7%

16.3%

5.5%

2.3%

2.1%

0.1%

15.4%

0.1%

3.1%

0.6%

16.4%

5.3%

2.0%

1.7%

0.1%

13.2%

0.1%

2.5%

0.5%

16.7%

5.2%

1.7%

1.2%

0.1%

3.5%

1.1%

23.7%

2.3%

16.8%

14.2%

7.8%

21.8%

0.5%

7.4%

-0.2%

26.0%

2.0%

20.8%

15.7%

7.0%

18.7%

0.8%

10.4%

1.3%

17.4%

2.9%

15.3%

17.6%

12.1%

10.2%

0.9%

7.8%

1.6%

29.3%

2.7%

16.4%

18.3%

11.1%

18.0%

1.2%

14.0%

1.3%

24.9%

3.9%

21.9%

21.3%

14.5%

12.2%

0.3%

15.9%

1.6%

21.9%

4.0%

23.9%

19.5%

13.5%

15.7%

0.2%

2009 - 2017

2005 - 2008

2004 & Prior 13.1%

21.7%

65.3%

9.1%

14.7%

76.2%

7.3%

12.2%

80.5%

5.8%

10.1%

84.1%

4.5%

8.1%

87.4%

3.5%

6.2%

90.3%

13.1%

81.8%

5.1%

12.4%

77.6%

10.0%

12.0%

74.7%

13.3%

12.1%

77.6%

10.3%

16.4%

64.7%

19.0%

12.2%

64.8%

23.1%

Vintage

Certain Product Features⁽³⁾

© 2018 Fannie Mae. Trademarks of Fannie Mae. 17

(4)

(4)

(4)

(5)

(6)

(1) (2)

(7)

Note: Defaults include loan foreclosures, short sales, sales to third parties at the time of foreclosure and deeds-in-lieu of foreclosure. Cumulative Default Rate is the total number of single-family conventional loans in

the guaranty book of business originated in the identified year that have defaulted, divided by the total number of single-family conventional loans in the guaranty book of business originated in the identified year.

* As of December 31, 2017, cumulative default rate on the loans originated from 2012 to 2017 was less than 1.2%.

Data as of December 31, 2017 is not necessarily indicative of the ultimate performance of the loans and performance is likely to change, perhaps materialy, in future periods.

Yr

1-Q

1

Yr

1-Q

2

Yr

1-Q

3

Yr

1-Q

4

Yr

2-Q

1

Yr

2-Q

2

Yr

2-Q

3

Yr

2-Q

4

Yr

3-Q

1

Yr

3-Q

2

Yr

3-Q

3

Yr

3-Q

4

Yr

4-Q

1

Yr

4-Q

2

Yr

4-Q

3

Yr

4-Q

4

Yr

5-Q

1

Yr

5-Q

2

Yr

5-Q

3

Yr

5-Q

4

Yr

6-Q

1

Yr

6-Q

2

Yr

6-Q

3

Yr

6-Q

4

Yr

7-Q

1

Yr

7-Q

2

Yr

7-Q

3

Yr

7-Q

4

Yr

8-Q

1

Yr

8-Q

2

Yr

8-Q

3

Yr

8-Q

4

Yr

9-Q

1

Yr

9-Q

2

Yr

9-Q

3

Yr

9-Q

4

Yr

10

-Q

1

Yr

10

-Q

2

Yr

10

-Q

3

Yr

10

-Q

4

Yr

11

-Q

1

Yr

11

-Q

2

Yr

11

-Q

3

Yr

11

-Q

4

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

Cu

mu

lat

ive

De

fau

lt R

ate

2007

2006

2005

2004

2003

2002

2017* 2016* 2015* 2014* 2013* 2012* 2011 2010 2009

2008

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012*

2013*

2014*

2015*

2016*

2017*

Cumulative Default Rates of Single-Family Conventional Guaranty Book of Business by Origination Year

Time Since Beginning of Origination Year

© 2018 Fannie Mae. Trademarks of Fannie Mae. 18

Loan Count UPB ($B)

% of Multifamily

Guaranty Book of

Business

% DUS Loans % SeriouslyDelinquent

2017 Multifamily

Credit Losses ($M)

2016 Multifamily

Credit Losses ($M)

2015 Multifamily

Credit Losses ($M)

Total Multifamily Guaranty Book of Business ($56)($4)($20)0.11%97.4%100%$277.328,184

Loans maturing in 2018

Loans maturing in 2019

Loans maturing in 2020

Loans maturing in 2021

Loans maturing in 2022

Other maturities ($56)

$1

$2

($1)

($2)

$0

($15)

$2

$1

$5

$0

$4

($7)

$0

($1)

($5)

($1)

($7)

0.07%

0.18%

0.31%

0.07%

0.34%

0.18%

98%

97%

97%

97%

98%

94%

75%

8%

6%

5%

5%

2%

$207.0

$22.8

$16.4

$13.5

$12.9

$4.6

17,867

3,154

2,262

2,172

1,715

1,014

Maturity Dates

Less than or equal to 70%

Greater than 70% and less than or equal to 80%

Greater than 80% $2

($34)

($24)

$0

$3

($7)

($2)

$0

($18)

0.21%

0.11%

0.10%

92%

99%

96%

2%

44%

55%

$4.2

$121.4

$151.7

945

9,960

17,279

Origination LTV Ratio

Less than or equal to $750K

Greater than $750K and less than or equal to $3M

Greater than $3M and less than or equal to $5M

Greater than $5M and less than or equal to $25M

Greater than $25M ($15)

($60)

$9

$9

$1

$0

($15)

$6

$5

$0

($2)

($22)

$1

$3

$0

0.07%

0.12%

0.20%

0.29%

0.34%

98%

99%

93%

85%

25%

51%

39%

5%

4%

0%

$142.1

$108.4

$13.6

$12.2

$1.0

2,786

9,794

3,743

7,763

4,098

Loan Size Distribution

(1)

(2)

(3)

(4)

(5)

(6)

Represents the percentage of loans for a given category (row) comprised of DUS loans, measured by unpaid principal balance.

Multifamily loans are classified as seriously delinquent when payment is 60 days or more past due.

Dolar amount of multifamily credit-related losses/(gains) for the applicable period and category. Total credit losses for each period may not tie to sum of al categories due to rounding.

Weighted average origination loan-to-value ratio is 67% as of December 31, 2017.

Under the Delegated Underwriting and Servicing, or DUS, program, Fannie Mae acquires individual, newly originated mortgages from specialy approved DUS lenders using DUS underwriting standards and/or DUS loan documents. Because

DUS lenders generaly share the risk of loss with Fannie Mae, they are able to originate, underwrite, close and service most loans without our pre-review.

Multifamily loans with an original unpaid balance of up to $3 milion nationwide or up to $5 milion in high cost markets.

DUS - Smal Balance Loans

DUS - Non Smal Balance Loans

Total ($54)

($57)

$3

($3)

($6)

$2

($19)

($25)

$5

0.11%

0.10%

0.24%

100%

100%

100%

97%

93%

5%

$270.0

$257.4

$12.6

22,598

15,793

6,805

Delegated Underwriting and Servicing (DUS) Loans

Non-DUS - Smal Balance Loans

Non-DUS - Non Smal Balance Loans

Total ($2)

($5)

$2

($1)

($2)

$1

($1)

$0

$0

0.08%

0.00%

0.18%

0%

0%

0%

3%

1%

1%

$7.2

$3.9

$3.3

5,586

262

5,324

Non-Delegated Underwriting and Servicing (Non-DUS) Loans

Lender Risk-Sharing

No Recourse to the Lender ($32)

($24)

($14)

$10

($14)

($6)

0.02%

0.11%

68%

98%

4%

96%

$10.1

$267.2

1,763

26,421

Lender Risk-Sharing

Fixed

Variable ($22)

($34)

$2

($6)

$0

($20)

0.09%

0.11%

97%

98%

18%

82%

$51.1

$226.2

5,964

22,220

Interest Rate Type

Multifamily Credit Profile by Loan Attributes

As of December 31, 2017

© 2018 Fannie Mae. Trademarks of Fannie Mae. 19

(1)®

(4)

(5)

(6)

(6)

(2) (3) (3) (3)

19

UPB ($B)

% of Multifamily

Guaranty Book of

Business

% DUS Loans % SeriouslyDelinquent

2017 Multifamily

Credit Losses ($M)

2016 Multifamily

Credit Losses ($M)

2015 Multifamily

Credit Losses ($M)

Total Multifamily Guaranty Book of Business ($56)($4)($20)0.11%97%100%$277.3

Multifamily Credit Profile by Loan Attributes (cont.)

California

Texas

New York

Florida

Washington $1

($3)

$1

($6)

$0

$0

$0

$0

($5)

$0

$0

$0

($1)

($3)

$0

0.00%

0.00%

0.01%

0.50%

0.00%

99%

98%

85%

100%

97%

4%

7%

9%

12%

20%

$10.6

$20.6

$24.1

$33.9

$54.6

Select States

Privately Owned with Subsidy ($4)$2($1)0.21%95%12%$33.3

Targeted Afordable Segment

DUS: Bank (Direct or Guaranteed Entity)

DUS: Non-Bank Financial Institution

Non-DUS: Bank (Direct or Guaranteed Entity)

Non-DUS: Non-Bank Financial Institution

Non-DUS: Public Agency/Non Profit $0

$0

$0

($13)

($44)

$0

($2)

$0

($5)

$3

$0

$0

$0

($4)

($16)

0.00%

0.00%

0.11%

0.12%

0.07%

3%

1%

0%

100%

97%

0%

0%

1%

66%

33%

$0.2

$0.2

$3.2

$181.8

$91.9

DUS & Non-DUS Lenders/Servicers

Represents the percentage of loans for a given category (row) comprised of DUS loans, measured by unpaid principal balance.

Multifamily loans are classified as seriously delinquent when payment is 60 days or more past due.

Dolar amount of multifamily credit-related losses/(gains) for the applicable period and category. Total credit losses for each period wil not tie to sum of al categories due to rounding.

The Multifamily Afordable Business Channel focuses on financing properties that are under an agreement that provides long-term afordability, such as properties with rent subsidies or income restrictions.

See htps:/www.fanniemae.com/multifamily/products for definitions.

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007

Prior to 2007 ($24)

($17)

($20)

$4

($1)

$2

$0

$0

$0

$0

$0

$0

($7)

($3)

($1)

$0

$3

$0

$2

$0

$0

$0

$0

$0

$2

($14)

($5)

$0

($5)

($1)

$0

$0

$2

$0

$1

$0

0.15%

0.63%

0.07%

0.06%

0.00%

0.38%

0.30%

0.11%

0.15%

0.09%

0.02%

0.04%

95%

69%

93%

97%

95%

96%

97%

98%

99%

99%

99%

97%

4%

1%

2%

3%

3%

5%

8%

8%

9%

14%

19%

24%

$12.4

$2.8

$4.9

$8.9

$9.0

$13.3

$22.2

$21.4

$24.1

$37.8

$53.4

$67.0

By Acquisition Year

Midwest

Northeast

Southeast

Southwest

West ($31)

($11)

($19)

$4

$1

($7)

($7)

$6

$1

$3

$0

($18)

$2

($1)

($2)

0.00%

0.30%

0.06%

0.13%

0.02%

97%

99%

99%

90%

99%

27%

23%

26%

15%

9%

$75.3

$63.7

$72.2

$41.2

$24.9

Regions

Conventional/Co-op

Seniors Housing

Manufactured Housing

Student Housing ($7)

$0

$7

($56)

($5)

$0

$2

($1)

$1

$0

($1)

($20)

0.00%

0.00%

0.00%

0.12%

100%

100%

98%

97%

4%

3%

5%

88%

$9.8

$9.5

$14.8

$243.1

Asset Class

(1)

(2)

(3)

(4)

(5)

As of December 31, 2017

© 2018 Fannie Mae. Trademarks of Fannie Mae. 20

(1) (2) (3) (3) (3)

(4)

(5)

19

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

Se

rio

us

De

linq

ue

nc

y R

ate

0.09%

0.44%

0.55%

0.34%

0.15%

0.08%0.08%

1.36%

1.20%

0.24%

0.30%

0.71%

0.18%

0.21%

0.56%

0.24% 0.21%

0.63%

0.50%

0.11%0.10%

0.59%

0.07%

0.07% 0.06% 0.05%

0.05%

0.92%

0.08%0.04%

0.39%

Multifamily Total Serious Delinquency Rate DUS Serious Delinquency Rate Non-DUS Serious Delinquency Rate

Serious Delinquency⁽¹⁾ Rates of Multifamily Book of Business

Multifamily loans are classified as seriously delinquent when payment is 60 days or more past due. Serious delinquency rate represents the year-end percentage of unpaid principal balance that is seriously

delinquent as of December 31 for the time periods noted.

Under the Delegated Underwriting and Servicing, or DUS, program, Fannie Mae acquires individual, newly originated mortgages from specialy approved DUS lenders using DUS underwriting standards

and/or DUS loan documents. Because DUS lenders generaly share the risk of loss with Fannie Mae, they are able to originate, underwrite, close and service most loans without our pre-review.

(1)

(2)

.

© 2018 Fannie Mae. Trademarks of Fannie Mae. 21

(2)

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

20

40

60

UP

B (

$B

)

$19

$33

$19 $24 $22

$46

$34

$19 $17

$24

$33 $29 $29

$42

$55

$67

DUS/Non-DUS Acquisition Unpaid Principal Balance ($B)⁽²⁾

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0.0%

0.5%

1.0%

1.5%

2.0%

Cr

ed

it L

os

s R

ate

0.2%

0.0%

0.1% 0.2%

0.0%

0.1%

0.4%

0.0%

0.3%

0.5%

0.0%

0.4%

0.9%

0.2%

0.7%

1.2%

0.9%

1.1%

0.8%

1.4%

0.9%

0.3%

0.1%

0.2%

0.1%0.0%0.1% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

DUS/Non-DUS Cumulative Credit Loss Rates through December 31, 2017⁽¹⁾

DUS Credit Loss Rate Non-DUS Credit Loss Rate Multifamily Total Credit Loss Rate

Cumulative Credit Loss Rates of Multifamily Guaranty Book of Business by

Acquisition Year

DUS Non-DUS

* Year-to-date through December 31, 2017. Acquisition Year

Cumulative credit loss rate is the cumulative credit losses (gains) through December 31, 2017 on the multifamily loans that were acquired in the applicable period, as a percentage of the total acquired unpaid

principal balance of multifamily loans in the applicable period.

Acquisition unpaid principal balance represents the total Multifamily volume acquired through purchase or securitization transactions for the applicable period.

(1)

(2)

© 2018 Fannie Mae. Trademarks of Fannie Mae. 22