Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CITIZENS FINANCIAL GROUP INC/RI | d485704d8k.htm |

Credit Suisse 19th Annual Financial Services Forum John F. Woods Chief Financial Officer February 14, 2018 Exhibit 99.1

Forward-looking statements and use of key performance metrics and non-GAAP financial measures This document contains forward-looking statements within the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: negative economic conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense; the rate of growth in the economy and employment levels, as well as general business and economic conditions; our ability to implement our strategic plan, including the cost savings and efficiency components, and achieve our indicative performance targets; our ability to remedy regulatory deficiencies and meet supervisory requirements and expectations; liabilities and business restrictions resulting from litigation and regulatory investigations; our capital and liquidity requirements (including under regulatory capital standards, such as the U.S. Basel III capital rules) and our ability to generate capital internally or raise capital on favorable terms; the effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber attacks; and management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the amount and timing of any future common stock dividends or share repurchases will depend on our financial condition, earnings, cash needs, regulatory constraints, capital requirements (including requirements of our subsidiaries), and any other factors that our board of directors deems relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends to holders of our common stock, or as to the amount of any such dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2016, filed with the United States Securities and Exchange Commission on February 24, 2017. Key Performance Metrics and Non-GAAP Financial Measures and Reconciliations Key Performance Metrics: Our management team uses key performance metrics (KPMs) to gauge our performance and progress over time in achieving our strategic and operational goals and also in comparing our performance against our peers. We have established the following financial targets, in addition to others, as KPMs, which are utilized by our management in measuring our progress against financial goals and as a tool in helping assess performance for compensation purposes. These KPMs can largely be found in our periodic reports which are filed with the Securities and Exchange Commission, and are supplemented from time to time with additional information in connection with our quarterly earnings releases. Our key performance metrics include: Return on average tangible common equity (ROTCE); Return on average total tangible assets (ROTA); Efficiency ratio; Operating leverage; and Common equity tier 1 capital ratio (U.S. Basel III Standardized fully phased-in basis). In establishing goals for these KPMs, we determined that they would be measured on a management-reporting basis, or an operating basis, which we refer to externally as “Adjusted”, “Underlying” or “Adjusted/Underlying” results. We believe that these “Adjusted”, “Underlying” or “Adjusted/Underlying” results provide the best representation of our financial progress toward these goals as they exclude items that our management does not consider indicative of our ongoing financial performance. KPMs that contain “Adjusted”, “Underlying” or “Adjusted/Underlying” results are considered non-GAAP financial measures. Non-GAAP Financial Measures: This document contains non-GAAP financial measures. The appendix presents reconciliations of our non-GAAP measures. These reconciliations exclude “Adjusted”, “Underlying” or “Adjusted/Underlying” items, which are included, where applicable, in the financial results presented in accordance with GAAP. “Adjusted”, “Underlying” or “Adjusted/Underlying” results, which are non-GAAP measures, exclude certain items, as applicable, that may occur in a reporting period which management does not consider indicative of on-going financial performance. The non-GAAP measures presented in the appendix include reconciliations to the most directly comparable GAAP measures and are: “noninterest income”, “total revenue”, “noninterest expense”, “pre-provision profit”, “total credit-related costs”, “income before income tax expense”, “income tax expense”, “effective income tax rate”, “net income”, “net income available to common stockholders”, “other income”, “salaries and employee benefits”, “outside services”, “amortization of software expense”, “other operating expense”, “net income per average common share”, “return on average common equity” and “return on average total assets”. We believe these non-GAAP measures provide useful information to investors because these are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe our “Adjusted”, “Underlying” or “Adjusted/Underlying” results in any period do not reflect our operational performance in that period and, accordingly, it is useful to consider our GAAP results and our “Adjusted”, “Underlying” or “Adjusted/Underlying” results together. We believe this presentation also increases comparability of period-to-period results. Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar measures used by other companies. We caution investors not to place undue reliance on such non-GAAP measures, but instead to consider them with the most directly comparable GAAP measure. Non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation, or as a substitute for our results as reported under GAAP.

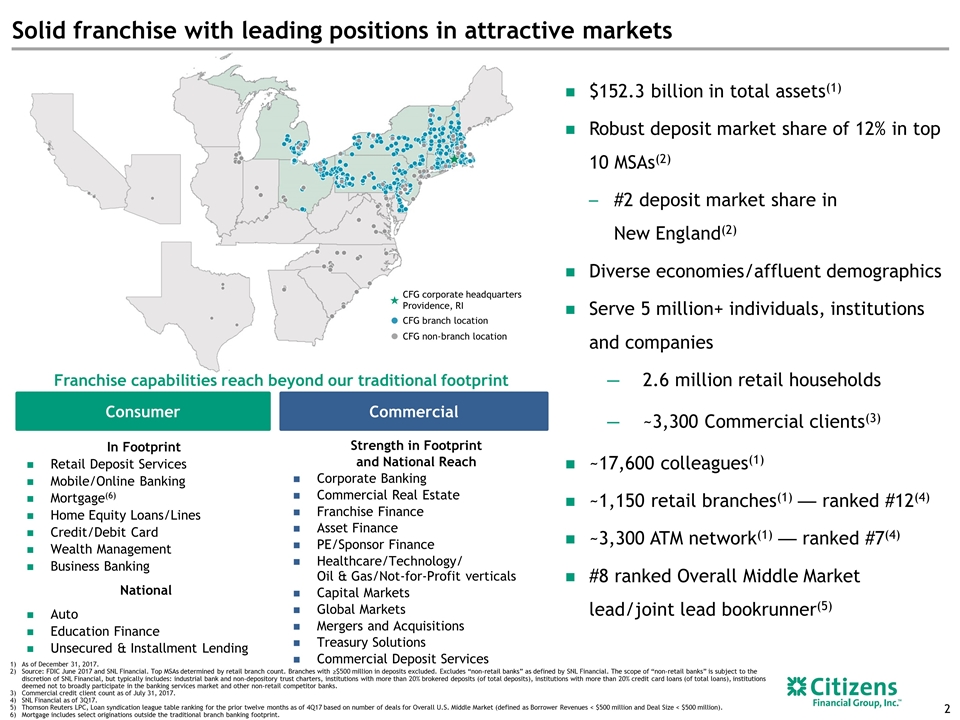

Solid franchise with leading positions in attractive markets $152.3 billion in total assets(1) Robust deposit market share of 12% in top 10 MSAs(2) #2 deposit market share in New England(2) Diverse economies/affluent demographics Serve 5 million+ individuals, institutions and companies 2.6 million retail households ~3,300 Commercial clients(3) ~17,600 colleagues(1) ~1,150 retail branches(1) — ranked #12(4) ~3,300 ATM network(1) — ranked #7(4) #8 ranked Overall Middle Market lead/joint lead bookrunner(5) Strength in Footprint and National Reach Corporate Banking Commercial Real Estate Franchise Finance Asset Finance PE/Sponsor Finance Healthcare/Technology/ Oil & Gas/Not-for-Profit verticals Capital Markets Global Markets Mergers and Acquisitions Treasury Solutions Commercial Deposit Services In Footprint Retail Deposit Services Mobile/Online Banking Mortgage(6) Home Equity Loans/Lines Credit/Debit Card Wealth Management Business Banking National Auto Education Finance Unsecured & Installment Lending Franchise capabilities reach beyond our traditional footprint As of December 31, 2017. Source: FDIC June 2017 and SNL Financial. Top MSAs determined by retail branch count. Branches with ≥$500 million in deposits excluded. Excludes “non-retail banks” as defined by SNL Financial. The scope of “non-retail banks” is subject to the discretion of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with more than 20% brokered deposits (of total deposits), institutions with more than 20% credit card loans (of total loans), institutions deemed not to broadly participate in the banking services market and other non-retail competitor banks. Commercial credit client count as of July 31, 2017. SNL Financial as of 3Q17. Thomson Reuters LPC, Loan syndication league table ranking for the prior twelve months as of 4Q17 based on number of deals for Overall U.S. Middle Market (defined as Borrower Revenues < $500 million and Deal Size < $500 million). Mortgage includes select originations outside the traditional branch banking footprint. CFG corporate headquarters Providence, RI CFG branch location CFG non-branch location Consumer Commercial

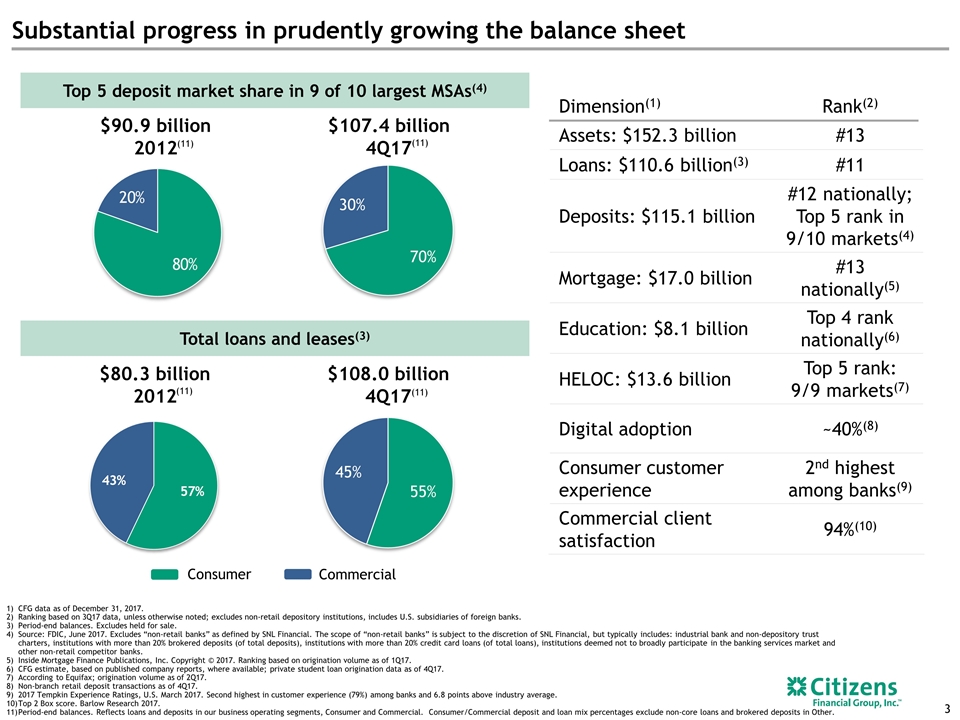

Consumer Substantial progress in prudently growing the balance sheet Dimension(1) Rank(2) Assets: $152.3 billion #13 Loans: $110.6 billion(3) #11 Deposits: $115.1 billion #12 nationally; Top 5 rank in 9/10 markets(4) Mortgage: $17.0 billion #13 nationally(5) Education: $8.1 billion Top 4 rank nationally(6) HELOC: $13.6 billion Top 5 rank: 9/9 markets(7) Digital adoption ~40%(8) Consumer customer experience 2nd highest among banks(9) Commercial client satisfaction 94%(10) CFG data as of December 31, 2017. Ranking based on 3Q17 data, unless otherwise noted; excludes non-retail depository institutions, includes U.S. subsidiaries of foreign banks. Period-end balances. Excludes held for sale. Source: FDIC, June 2017. Excludes “non-retail banks” as defined by SNL Financial. The scope of “non-retail banks” is subject to the discretion of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with more than 20% brokered deposits (of total deposits), institutions with more than 20% credit card loans (of total loans), institutions deemed not to broadly participate in the banking services market and other non-retail competitor banks. Inside Mortgage Finance Publications, Inc. Copyright © 2017. Ranking based on origination volume as of 1Q17. CFG estimate, based on published company reports, where available; private student loan origination data as of 4Q17. According to Equifax; origination volume as of 2Q17. Non-branch retail deposit transactions as of 4Q17. 2017 Tempkin Experience Ratings, U.S. March 2017. Second highest in customer experience (79%) among banks and 6.8 points above industry average. Top 2 Box score. Barlow Research 2017. Period-end balances. Reflects loans and deposits in our business operating segments, Consumer and Commercial. Consumer/Commercial deposit and loan mix percentages exclude non-core loans and brokered deposits in Other. Top 5 deposit market share in 9 of 10 largest MSAs(4) Total loans and leases(3) $90.9 billion 2012 $107.4 billion 4Q17 $108.0 billion 4Q17 $80.3 billion 2012 Commercial (11) (11) (11) (11)

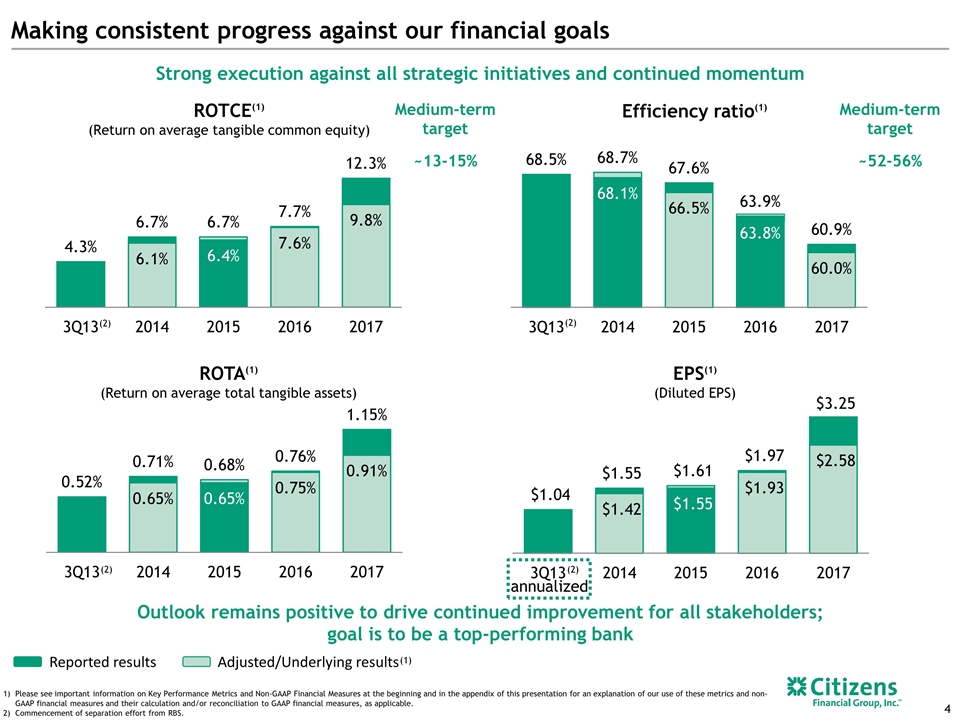

Efficiency ratio(1) ~52-56% Making consistent progress against our financial goals ROTCE(1) (Return on average tangible common equity) (2) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and in the appendix of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their calculation and/or reconciliation to GAAP financial measures, as applicable. Commencement of separation effort from RBS. Medium-term target Reported results Adjusted/Underlying results (1) (2) (2) ROTA(1) (Return on average total tangible assets) Medium-term target (2) EPS(1) (Diluted EPS) Strong execution against all strategic initiatives and continued momentum Outlook remains positive to drive continued improvement for all stakeholders; goal is to be a top-performing bank ~13-15% annualized

Further opportunities to improve returns: TOP Continuous improvement - TOP programs Self-fund investments through efficiency, expense discipline and mindset of continuous improvement Use new technologies to deliver more effective outcomes at lower costs TOP IV program targeting run-rate pre-tax benefit of ~$95 - $110 million by end of 2018 Targeting strong positive operating leverage to self-fund growth initiatives Efficiency Initiatives (selected examples) Organization Simplification: Focusing on spans and layers, centralization/centers of excellence, and role clarity Lean/Process Improvement: Redesigning end-to-end processes and leveraging automation to reduce costs and improve outcomes Vendor/Indirect Spend: Further vendor efficiencies and demand management (e.g., market data) Customer Journeys (revenue + efficiency): Simplifying and streamlining external customer-centric processes Revenue Initiatives (selected examples) New Channels: Using digital as a sales engine, building out direct to consumer mortgage, and leveraging call center to offer ‘service to solutions’ Expanding into Growth Areas: Next wave of corporate partnerships (Vivint, TBA) and expanding C&I lending in growth markets. Entered third-party strategic partnership to refer CRE clients for long-term permanent financing opportunities. Build-out Fee Income Capabilities: Scaling M&A advisory (Western Reserve), building our Commercial Securitization, and scaling MSR purchases

Further opportunities to improve returns: BSO Balance Sheet Optimization (“BSO”) Improve risk-adjusted returns and NIM while driving growth Enterprise-wide initiative with the same intensity and rigor as our TOP efficiency programs Recycle capital into more accretive growth and relationship categories given our improved return profile Reposition/optimize loan mix across categories to improve returns Reallocate capital within loan categories with a focus on deepening relationships Optimize deposit mix with a focus on lower-cost categories Positioned for continuing benefit from asset sensitive position as rates rise

Further opportunities to improve returns: Growth in fee income businesses Fee income Wealth Investments in FCs and sales, technology platforms and products with shift toward managed money SpeciFi™ robo-advisor launched 3Q17 Business Banking Fundation FinTech partnership to automate small business underwriting launched 4Q17 Mortgage Remix toward direct-to-consumer and conforming product Further leverage servicing platform Capital & Global Markets Broaden capabilities in DCM, M&A, CRE Leveraging FX options/currency swaps platform and capabilities launched early 2017 Treasury Solutions Replatforming cash management system Investments in trade finance, merchant services and commercial card Consumer Commercial Organic growth orientation, with potential for selective fee-based acquisitions

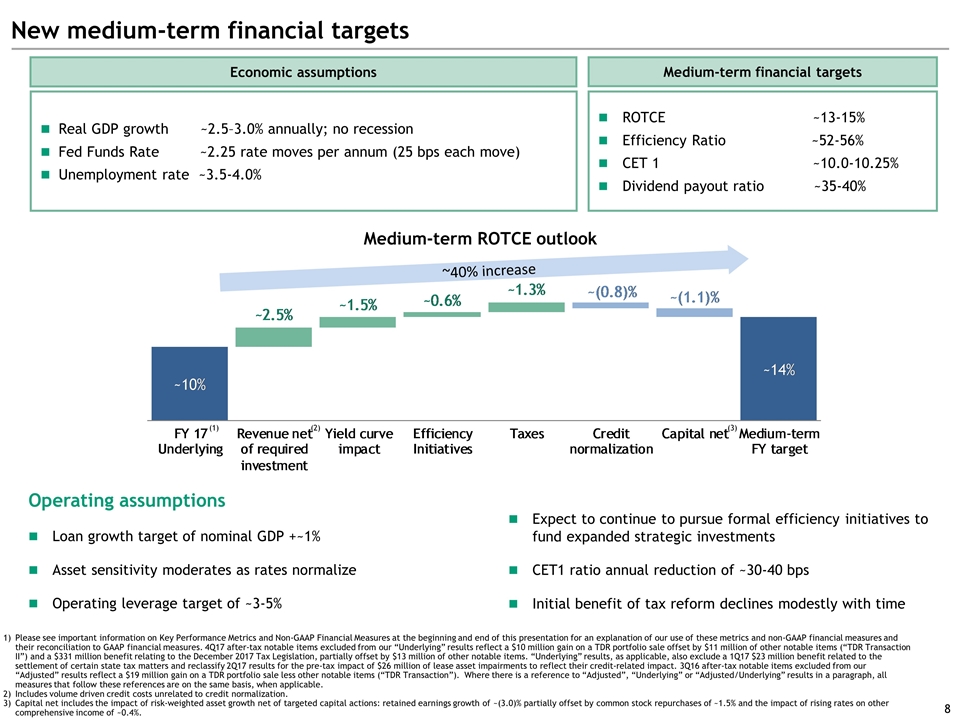

New medium-term financial targets ROTCE ~13-15% Efficiency Ratio ~52-56% CET 1 ~10.0-10.25% Dividend payout ratio ~35-40% Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures. 4Q17 after-tax notable items excluded from our “Underlying” results reflect a $10 million gain on a TDR portfolio sale offset by $11 million of other notable items (“TDR Transaction II”) and a $331 million benefit relating to the December 2017 Tax Legislation, partially offset by $13 million of other notable items. “Underlying” results, as applicable, also exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. 3Q16 after-tax notable items excluded from our “Adjusted” results reflect a $19 million gain on a TDR portfolio sale less other notable items (“TDR Transaction”). Where there is a reference to “Adjusted”, “Underlying” or “Adjusted/Underlying” results in a paragraph, all measures that follow these references are on the same basis, when applicable. Includes volume driven credit costs unrelated to credit normalization. Capital net includes the impact of risk-weighted asset growth net of targeted capital actions: retained earnings growth of ~(3.0)% partially offset by common stock repurchases of ~1.5% and the impact of rising rates on other comprehensive income of ~0.4%. Medium-term ROTCE outlook ~40% increase (3) Economic assumptions Medium-term financial targets Real GDP growth ~2.5–3.0% annually; no recession Fed Funds Rate ~2.25 rate moves per annum (25 bps each move) Unemployment rate ~3.5-4.0% Operating assumptions Loan growth target of nominal GDP +~1% Asset sensitivity moderates as rates normalize Operating leverage target of ~3-5% (1) Expect to continue to pursue formal efficiency initiatives to fund expanded strategic investments CET1 ratio annual reduction of ~30-40 bps Initial benefit of tax reform declines modestly with time (2)

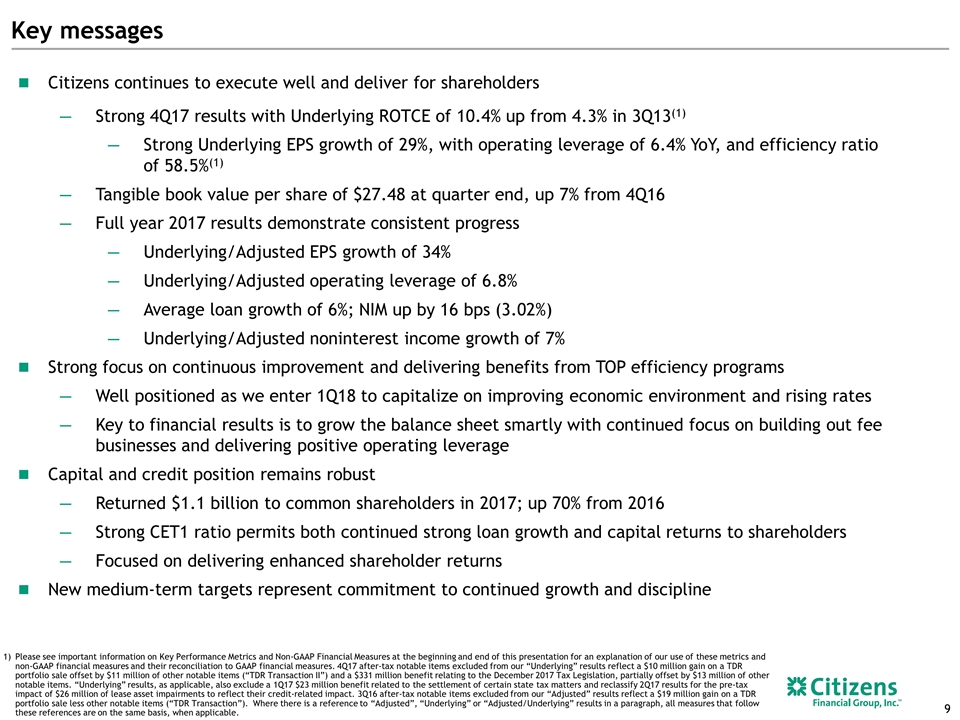

Key messages Citizens continues to execute well and deliver for shareholders Strong 4Q17 results with Underlying ROTCE of 10.4% up from 4.3% in 3Q13(1) Strong Underlying EPS growth of 29%, with operating leverage of 6.4% YoY, and efficiency ratio of 58.5%(1) Tangible book value per share of $27.48 at quarter end, up 7% from 4Q16 Full year 2017 results demonstrate consistent progress Underlying/Adjusted EPS growth of 34% Underlying/Adjusted operating leverage of 6.8% Average loan growth of 6%; NIM up by 16 bps (3.02%) Underlying/Adjusted noninterest income growth of 7% Strong focus on continuous improvement and delivering benefits from TOP efficiency programs Well positioned as we enter 1Q18 to capitalize on improving economic environment and rising rates Key to financial results is to grow the balance sheet smartly with continued focus on building out fee businesses and delivering positive operating leverage Capital and credit position remains robust Returned $1.1 billion to common shareholders in 2017; up 70% from 2016 Strong CET1 ratio permits both continued strong loan growth and capital returns to shareholders Focused on delivering enhanced shareholder returns New medium-term targets represent commitment to continued growth and discipline Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures. 4Q17 after-tax notable items excluded from our “Underlying” results reflect a $10 million gain on a TDR portfolio sale offset by $11 million of other notable items (“TDR Transaction II”) and a $331 million benefit relating to the December 2017 Tax Legislation, partially offset by $13 million of other notable items. “Underlying” results, as applicable, also exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. 3Q16 after-tax notable items excluded from our “Adjusted” results reflect a $19 million gain on a TDR portfolio sale less other notable items (“TDR Transaction”). Where there is a reference to “Adjusted”, “Underlying” or “Adjusted/Underlying” results in a paragraph, all measures that follow these references are on the same basis, when applicable.

Appendix

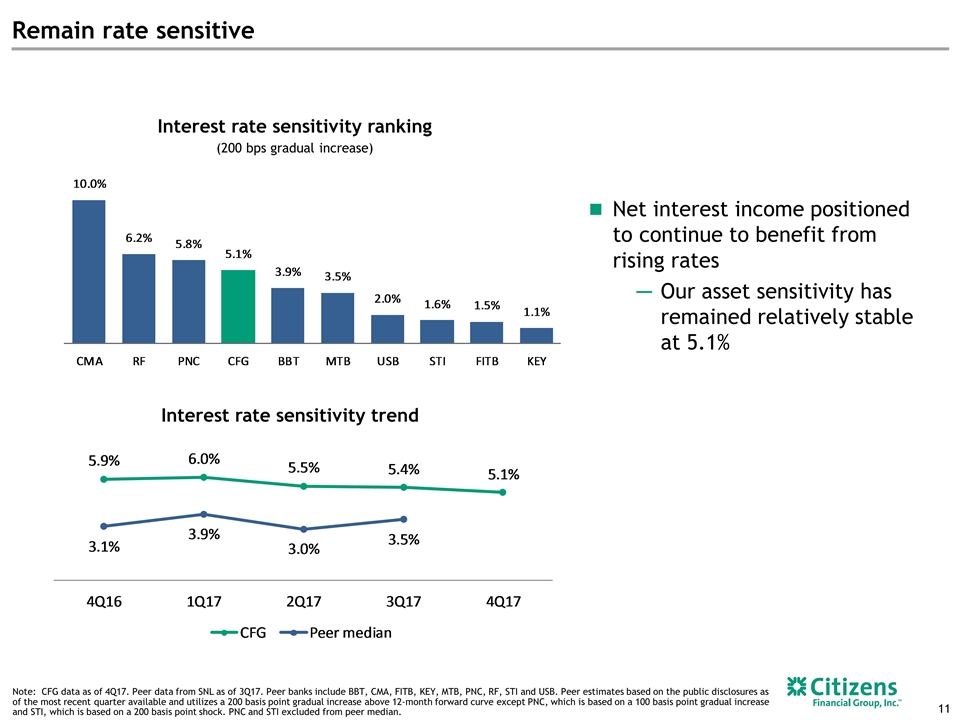

Remain rate sensitive Net interest income positioned to continue to benefit from rising rates Our asset sensitivity has remained relatively stable at 5.1% Interest rate sensitivity trend Interest rate sensitivity ranking (200 bps gradual increase) Note: CFG data as of 4Q17. Peer data from SNL as of 3Q17. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. Peer estimates based on the public disclosures as of the most recent quarter available and utilizes a 200 basis point gradual increase above 12-month forward curve except PNC, which is based on a 100 basis point gradual increase and STI, which is based on a 200 basis point shock. PNC and STI excluded from peer median.

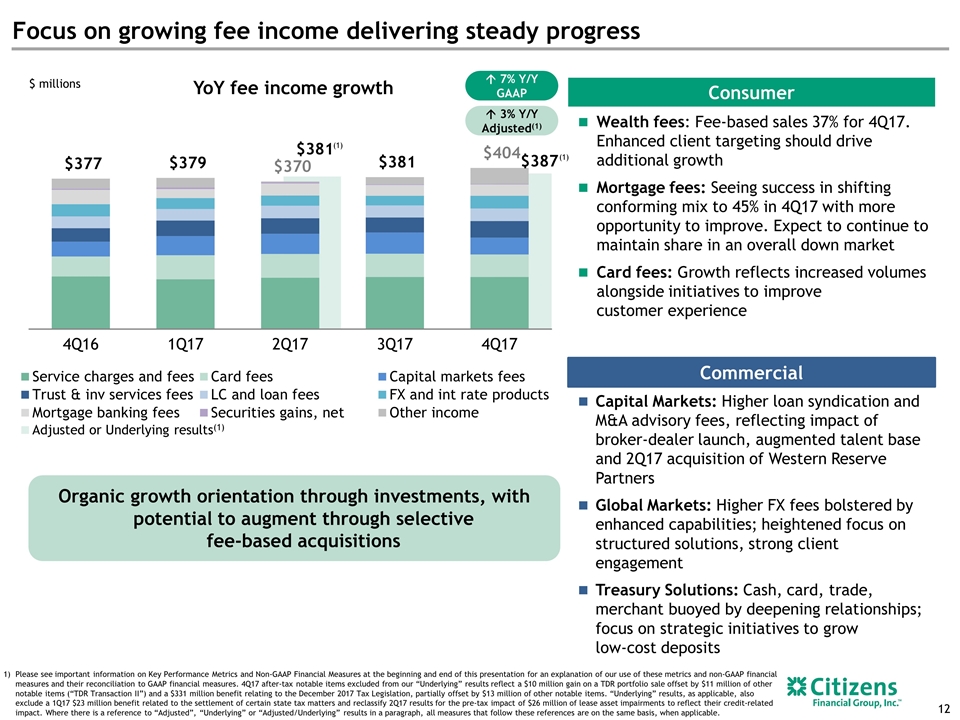

$381 (1) YoY fee income growth Focus on growing fee income delivering steady progress Wealth fees: Fee-based sales 37% for 4Q17. Enhanced client targeting should drive additional growth Mortgage fees: Seeing success in shifting conforming mix to 45% in 4Q17 with more opportunity to improve. Expect to continue to maintain share in an overall down market Card fees: Growth reflects increased volumes alongside initiatives to improve customer experience Consumer Commercial Capital Markets: Higher loan syndication and M&A advisory fees, reflecting impact of broker-dealer launch, augmented talent base and 2Q17 acquisition of Western Reserve Partners Global Markets: Higher FX fees bolstered by enhanced capabilities; heightened focus on structured solutions, strong client engagement Treasury Solutions: Cash, card, trade, merchant buoyed by deepening relationships; focus on strategic initiatives to grow low-cost deposits Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures. 4Q17 after-tax notable items excluded from our “Underlying” results reflect a $10 million gain on a TDR portfolio sale offset by $11 million of other notable items (“TDR Transaction II”) and a $331 million benefit relating to the December 2017 Tax Legislation, partially offset by $13 million of other notable items. “Underlying” results, as applicable, also exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. Where there is a reference to “Adjusted”, “Underlying” or “Adjusted/Underlying” results in a paragraph, all measures that follow these references are on the same basis, when applicable. Adjusted or Underlying results(1) $ millions Organic growth orientation through investments, with potential to augment through selective fee-based acquisitions á 3% Y/Y Adjusted(1) á 7% Y/Y GAAP $387 (1)

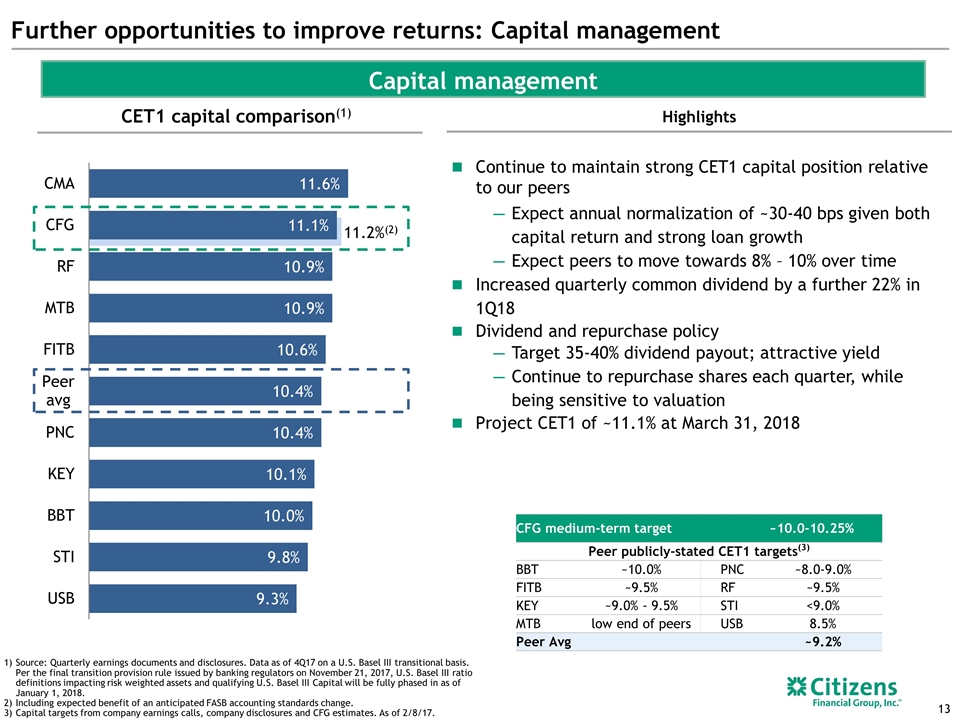

Source: Quarterly earnings documents and disclosures. Data as of 4Q17 on a U.S. Basel III transitional basis. Per the final transition provision rule issued by banking regulators on November 21, 2017, U.S. Basel III ratio definitions impacting risk weighted assets and qualifying U.S. Basel III Capital will be fully phased in as of January 1, 2018. Including expected benefit of an anticipated FASB accounting standards change. Capital targets from company earnings calls, company disclosures and CFG estimates. As of 2/8/17. Further opportunities to improve returns: Capital management Highlights Continue to maintain strong CET1 capital position relative to our peers Expect annual normalization of ~30-40 bps given both capital return and strong loan growth Expect peers to move towards 8% – 10% over time Increased quarterly common dividend by a further 22% in 1Q18 Dividend and repurchase policy Target 35-40% dividend payout; attractive yield Continue to repurchase shares each quarter, while being sensitive to valuation Project CET1 of ~11.1% at March 31, 2018 CFG medium-term target ~10.0-10.25% Peer publicly-stated CET1 targets(3) BBT ~10.0% PNC ~8.0-9.0% FITB ~9.5% RF ~9.5% KEY ~9.0% - 9.5% STI <9.0% MTB low end of peers USB 8.5% Peer Avg ~9.2% Capital management CET1 capital comparison(1) 11.2%(2)

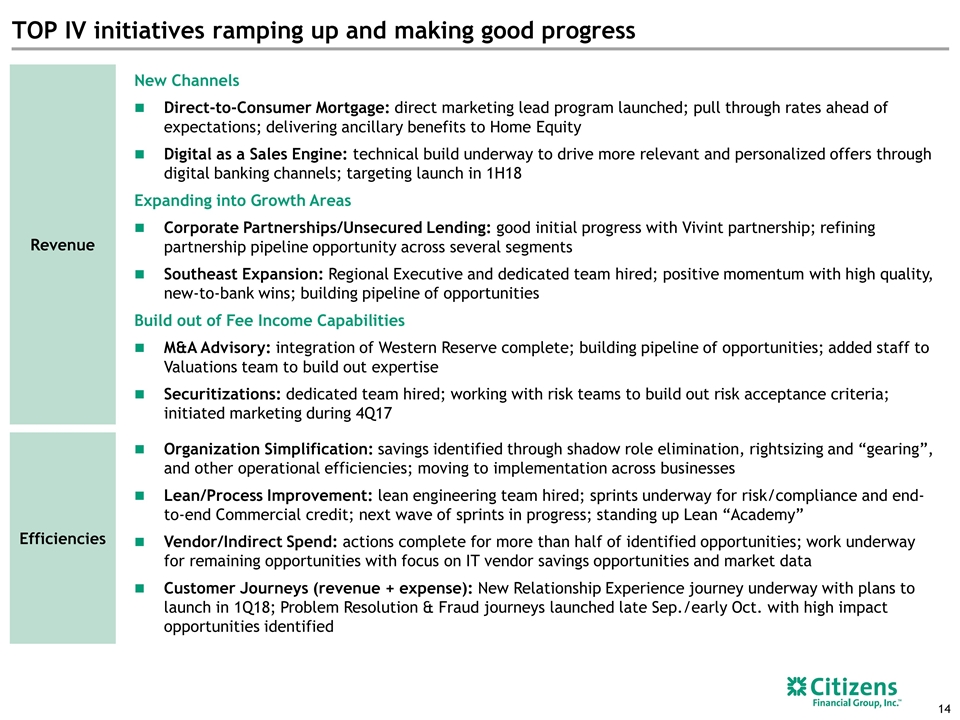

Organization Simplification: savings identified through shadow role elimination, rightsizing and “gearing”, and other operational efficiencies; moving to implementation across businesses Lean/Process Improvement: lean engineering team hired; sprints underway for risk/compliance and end-to-end Commercial credit; next wave of sprints in progress; standing up Lean “Academy” Vendor/Indirect Spend: actions complete for more than half of identified opportunities; work underway for remaining opportunities with focus on IT vendor savings opportunities and market data Customer Journeys (revenue + expense): New Relationship Experience journey underway with plans to launch in 1Q18; Problem Resolution & Fraud journeys launched late Sep./early Oct. with high impact opportunities identified TOP IV initiatives ramping up and making good progress New Channels Direct-to-Consumer Mortgage: direct marketing lead program launched; pull through rates ahead of expectations; delivering ancillary benefits to Home Equity Digital as a Sales Engine: technical build underway to drive more relevant and personalized offers through digital banking channels; targeting launch in 1H18 Expanding into Growth Areas Corporate Partnerships/Unsecured Lending: good initial progress with Vivint partnership; refining partnership pipeline opportunity across several segments Southeast Expansion: Regional Executive and dedicated team hired; positive momentum with high quality, new-to-bank wins; building pipeline of opportunities Build out of Fee Income Capabilities M&A Advisory: integration of Western Reserve complete; building pipeline of opportunities; added staff to Valuations team to build out expertise Securitizations: dedicated team hired; working with risk teams to build out risk acceptance criteria; initiated marketing during 4Q17 Revenue Efficiencies

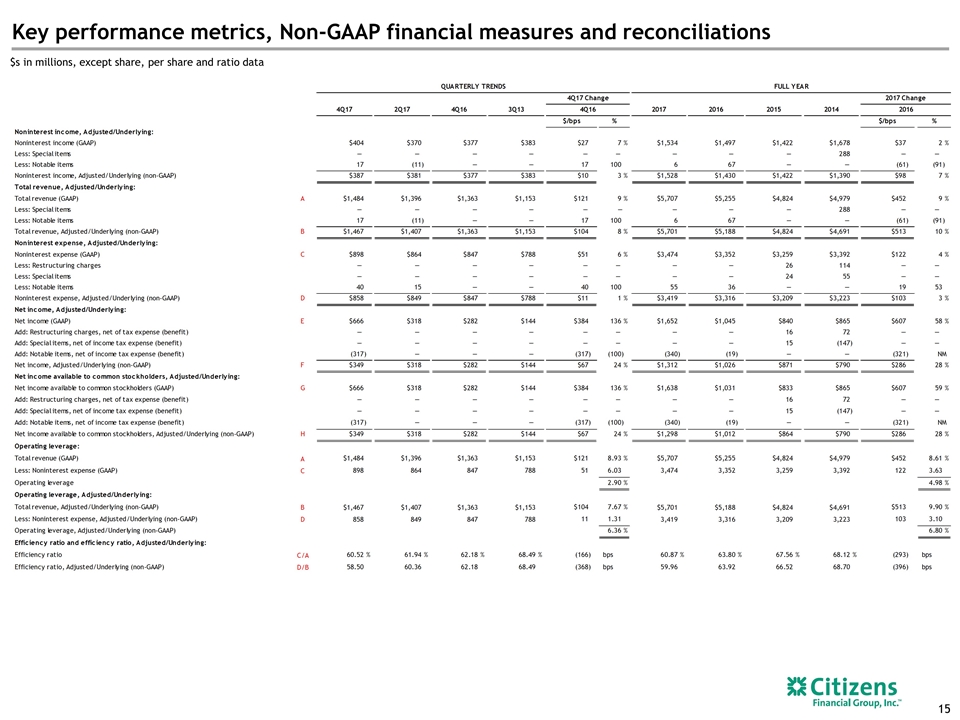

Key performance metrics, Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data

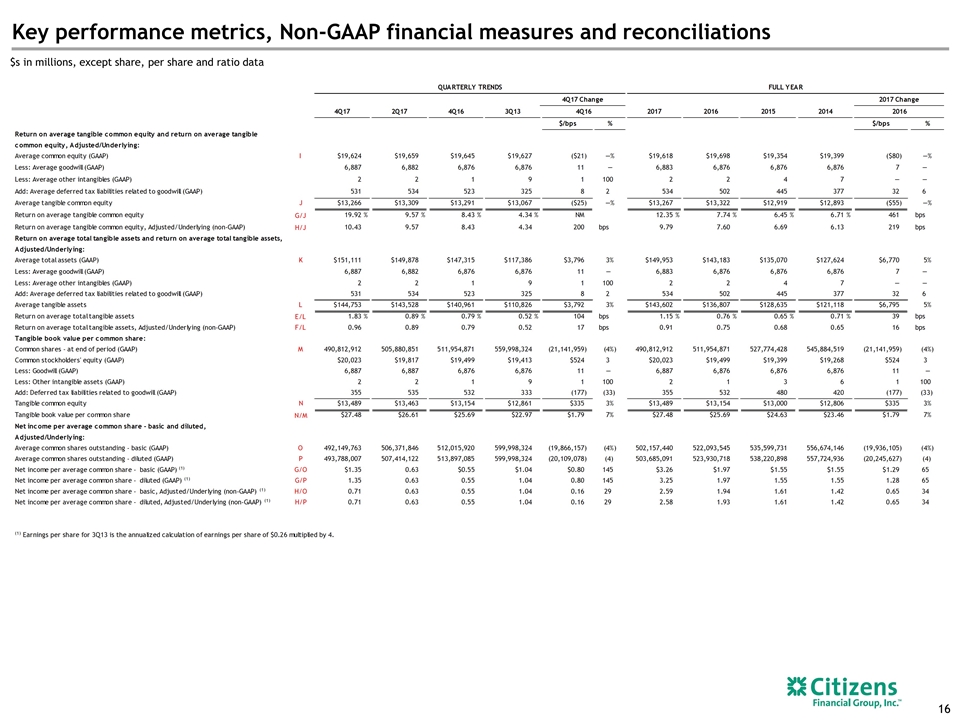

Key performance metrics, Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data