Attached files

Exhibit 10.59

AWARD AGREEMENT

This Award Agreement (this ‘Agreement’), is made as of this [•] day of [•], 2015, between Teva Pharmaceutical Industries Limited (the ‘Company’) and [•] (the ‘Participant’). Capitalized terms used and not otherwise defined herein shall have the meanings assigned thereto in the Company’s 2010 Long-Term Equity-Based Incentive Plan (the ‘Plan’).

Pursuant to the terms of the Plan, the Company grants to the Participant as of the Grant Date the number of Options and Restricted Share Units (RSUs) (Options and RSUs are collectively and individually referred to herein as ‘Awards’) set forth below, subject to the terms and conditions contained herein and in the appendices attached hereto, as well as the terms and conditions of the Plan, which are incorporated herein in their entirety.

| Total Fair Value of Award: | [•] | |

| Fair Value of each Option: | $[•] | |

| Fair Value of each RSU: | $[•] | |

| Options Granted: | [•] Representing approximately 50% of the Total Fair Value of Award divided by the Fair Value of each Option. Calculated as follows: the difference between the total fair value of the award and the total fair value of the number of RSUs granted is divided by the fair value of each Option, and the result is rounded up to the nearest whole number. | |

| RSUs Granted: | [•] Representing approximately 50% of the Total Fair Value of Award divided by the Fair Value of each RSU. Calculated as follows: 50% of the total fair value of the award is divided by the fair value of each RSU, and the result is rounded down to the nearest whole number. | |

| Grant Date: | [•] | |

| Vesting of 1st Fourth ( 1⁄4) of Grant: | First Anniversary of Grant Date | |

| Vesting of 2nd Fourth ( 1⁄4) of Grant: | Second Anniversary of Grant Date | |

| Vesting of 3rd Fourth ( 1⁄4) of Grant: | Third Anniversary of Grant Date | |

| Vesting of Grant Balance: | Fourth Anniversary of Grant Date | |

| Option Exercise Price: | USD [•], the NYSE closing price of Teva ADSs on the Grant Date | |

| Option Expiration Date: | Tenth Anniversary of the Grant Date. | |

1. Options.

(a)Grant of Options. As set forth above, the Company grants to the Participant, as of the Grant Date, Options in a number to be determined as set forth in the table above, to purchase up to, but not exceeding in the aggregate, an equal number of Shares. (b)No Obligation to Exercise Options. The grant and acceptance of the Options impose no obligation on the Participant to exercise them.

2. Restricted Share Units.

(a)Grant of Restricted Share Units. As set forth above, the Company grants to the Participant, as of the Grant DatefV, an Award of Restricted Share Units, in a number to be determined as set forth in the table above. (b)No Issuance at Grant. No Shares shall be issued or delivered to the Participant at the time the Restricted Share Units are granted.

3. Other Provisions.

(a) Vesting. Subject to the Participant; ‘, s continuous employment with the Company and its subsidiaries and affiliates through the applicable vesting dates, Awards shall vest and become exercisable (or settle, as the case may be), as set forth in the table above.

(b) No Rights as a Shareholder. The Participant shall have no rights as a shareholder with respect to any Shares covered by the Options or Restricted Share Units until the date of issuance of the underlying Shares.

(c) Termination of Employment.

(i) In the event of a Participant’s Termination with the Employer prior to the Expiration Date for any reason other than (A) the Participant’s death or Disability, (B) a Qualifying Retirement, or (C) by the Employer for Cause, (1) all vesting with respect to such Participant’s Options and Restricted Share Units shall cease, (2) all of such Participant’s unvested Options shall expire as of the date of such Termination, and (3) all of such Participant’s vested Options shall remain exercisable until the earlier of the Expiration Date and the date that is ninety (90) days after the date of such Termination.

(ii) In the event of a Participant’s Termination with the Employer prior to the Expiration Date by reason of such Participant’s death, Disability or Qualifying Retirement, (A) all of such Participant’s Options and Restricted Share Units shall continue to vest in accordance with their

2

original vesting schedule as if no such termination had occurred, and (B) Options shall remain exercisable until the Expiration Date. In the event of a Participant’s death, such Participant’s Options shall be exercisable by the person or persons to whom a Participant’s rights under the Options pass by will or the applicable laws of descent and distribution until the Expiration Date.

(iii) In the event of a Participant’s Termination with the Employer prior to the Expiration Date by the Employer for Cause, all of such Participant’s Options (whether or not vested) shall immediately expire and all Restricted Share Units shall be forfeited as of the date of such Termination.

(d) Withholding. The Company or the Participant’s employer, or a third party holding Awards on behalf of the Participant, shall have the right to make all payments or distributions pursuant to this Agreement to a Participant net of any applicable taxes, fees or other required deductions, such as but not limited to income taxes, social security premiums, and custody fees, trustee charges, fees for exercise and/or transfer of any Award or its underlying Share payable by the Participant or required to be paid or withheld as a result of the exercise of an Option, the settlement of a Restricted Share Unit, the delivery of a Share or its transfer, and any other event occurring pursuant to the Plan or this Agreement, that necessitates the withholding of income or employment taxes or any other required deductions or payments (hereinafter referred to as -Taxes-). The Company or the Participant’s employer, may withhold from wages or other amounts payable to a Participant such Taxes as may be required by law or otherwise payable by the Participant, or to otherwise require the Participant to pay such Taxes.

(e) Other Effective Documents; Other Agreements. The terms and provisions of the Plan are incorporated herein by reference and made a part hereof. In case of contradiction between the terms of this Agreement and/or its Appendices and/or the Plan, it is agreed that the terms of the Plan shall prevail over the terms of the Agreement and any appendix, and that the terms of any appendix shall prevail of the terms of the Agreement. The Participant agrees to (i) execute and become a party to the agreements set forth in any appendix attached hereto, and (ii) the terms of an Award administration framework agreement and its terms and conditions, as may be set forth in an appendix or as requested by the Employer in the future, and will also agree to such agreement in writing.

(f) Binding Effect. This Agreement shall be binding upon the heirs, executors, administrators, and successor of the parties hereto.

(g) Governing Law. This Agreement (including, for the avoidance of doubt, its appendices) shall be construed and interpreted in accordance with the local laws of country where the Participant is or was last employed by the Company or its Affiliate, as applicable, without giving effect to the principles of the conflicts of laws thereofe.

(h) Entire Agreement; Modification. This Agreement (together with the appendices attached hereto) and the Plan constitute the entire agreement between the parties relative to the subject matter hereof, and supersede all proposals, written or oral, and all other communications between the parties relating to the subject matter of this Agreement. This Agreement may be modified, amended, or rescinded only by a written agreement executed by both parties.

3

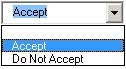

(i) Counterparts, Electronic Signature. This Agreement may be signed in counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. Signature of the Agreement, unless otherwise stipulated in any appendix, may be by electronic or digital means.

I acknowledge that I have read the Award Agreement above and I

4