Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | rf2018-0212ir.htm |

Credit Suisse 19th

Annual Financial

Services Forum

February 13, 2018

Exhibit 99.1

ON TRACK TO MEET LONG-TERM FINANCIAL TARGETS

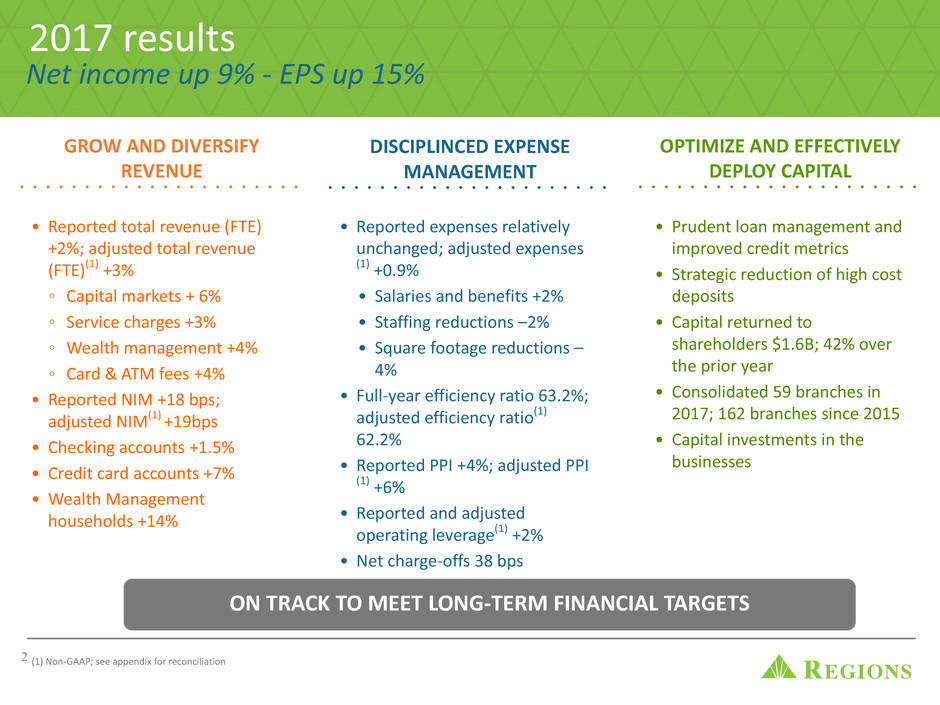

2017 results

Net income up 9% - EPS up 15%

GROW AND DIVERSIFY

REVENUE

DISCIPLINCED EXPENSE

MANAGEMENT

OPTIMIZE AND EFFECTIVELY

DEPLOY CAPITAL

• Reported total revenue (FTE)

+2%; adjusted total revenue

(FTE)(1) +3%

◦ Capital markets + 6%

◦ Service charges +3%

◦ Wealth management +4%

◦ Card & ATM fees +4%

• Reported NIM +18 bps;

adjusted NIM(1) +19bps

• Checking accounts +1.5%

• Credit card accounts +7%

• Wealth Management

households +14%

• Reported expenses relatively

unchanged; adjusted expenses

(1) +0.9%

• Salaries and benefits +2%

• Staffing reductions –2%

• Square footage reductions –

4%

• Full-year efficiency ratio 63.2%;

adjusted efficiency ratio(1)

62.2%

• Reported PPI +4%; adjusted PPI

(1) +6%

• Reported and adjusted

operating leverage(1) +2%

• Net charge-offs 38 bps

• Prudent loan management and

improved credit metrics

• Strategic reduction of high cost

deposits

• Capital returned to

shareholders $1.6B; 42% over

the prior year

• Consolidated 59 branches in

2017; 162 branches since 2015

• Capital investments in the

businesses

(1) Non-GAAP; see appendix for reconciliation2

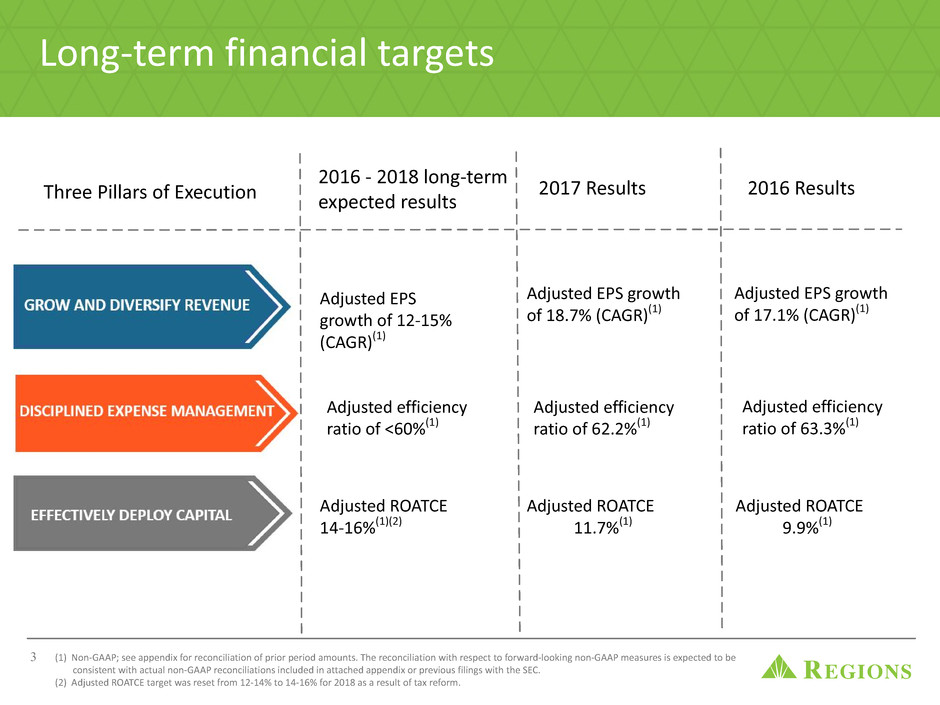

Long-term financial targets

3

Three Pillars of Execution

2016 - 2018 long-term

expected results

2017 Results 2016 Results

Adjusted efficiency

ratio of <60%(1)

Adjusted ROATCE

14-16%(1)(2)

Adjusted EPS

growth of 12-15%

(CAGR)(1)

Adjusted ROATCE

9.9%(1)

Adjusted efficiency

ratio of 63.3%(1)

Adjusted EPS growth

of 17.1% (CAGR)(1)

Adjusted ROATCE

11.7%(1)

Adjusted efficiency

ratio of 62.2%(1)

Adjusted EPS growth

of 18.7% (CAGR)(1)

(1) Non-GAAP; see appendix for reconciliation of prior period amounts. The reconciliation with respect to forward-looking non-GAAP measures is expected to be

consistent with actual non-GAAP reconciliations included in attached appendix or previous filings with the SEC.

(2) Adjusted ROATCE target was reset from 12-14% to 14-16% for 2018 as a result of tax reform.

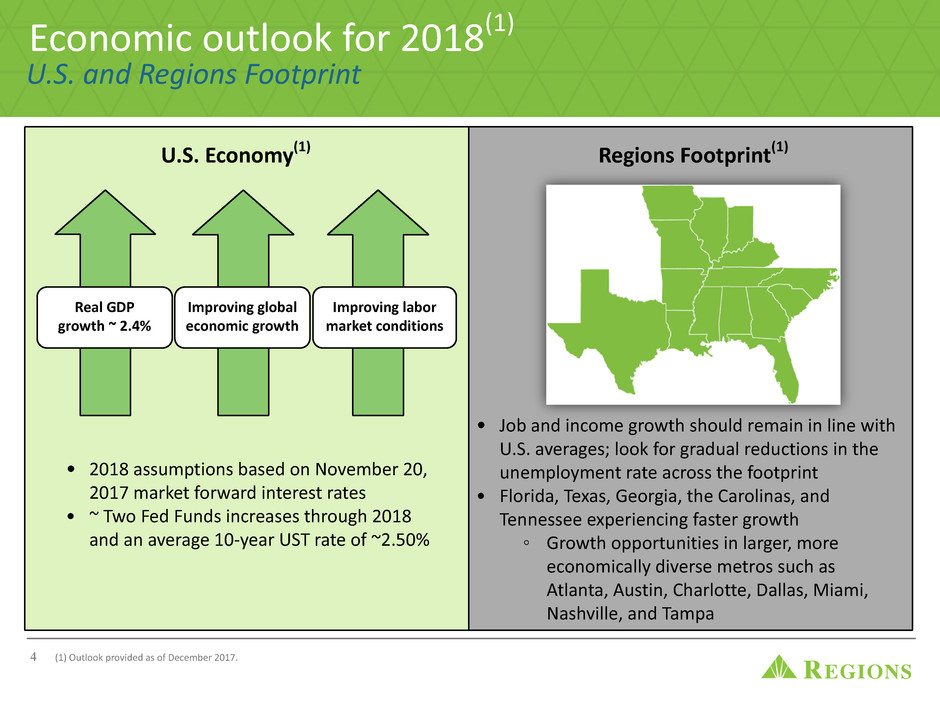

Economic outlook for 2018(1)

U.S. and Regions Footprint

Real GDP

growth ~ 2.4%

Improving global

economic growth

Improving labor

market conditions

• 2018 assumptions based on November 20,

2017 market forward interest rates

• ~ Two Fed Funds increases through 2018

and an average 10-year UST rate of ~2.50%

U.S. Economy(1) Regions Footprint(1)

• Job and income growth should remain in line with

U.S. averages; look for gradual reductions in the

unemployment rate across the footprint

• Florida, Texas, Georgia, the Carolinas, and

Tennessee experiencing faster growth

◦ Growth opportunities in larger, more

economically diverse metros such as

Atlanta, Austin, Charlotte, Dallas, Miami,

Nashville, and Tampa

4 (1) Outlook provided as of December 2017.

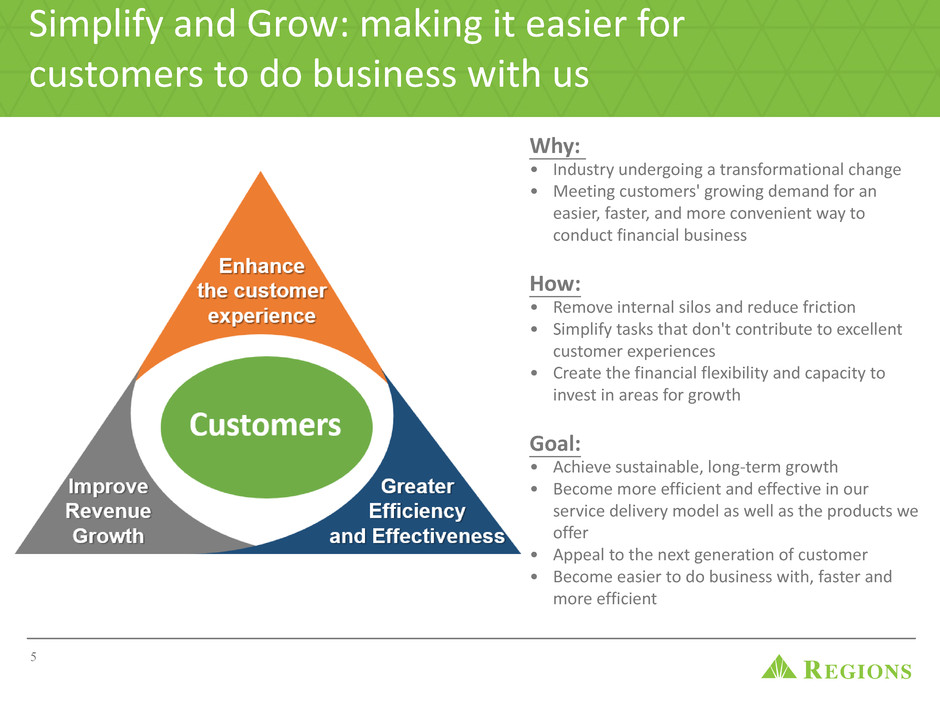

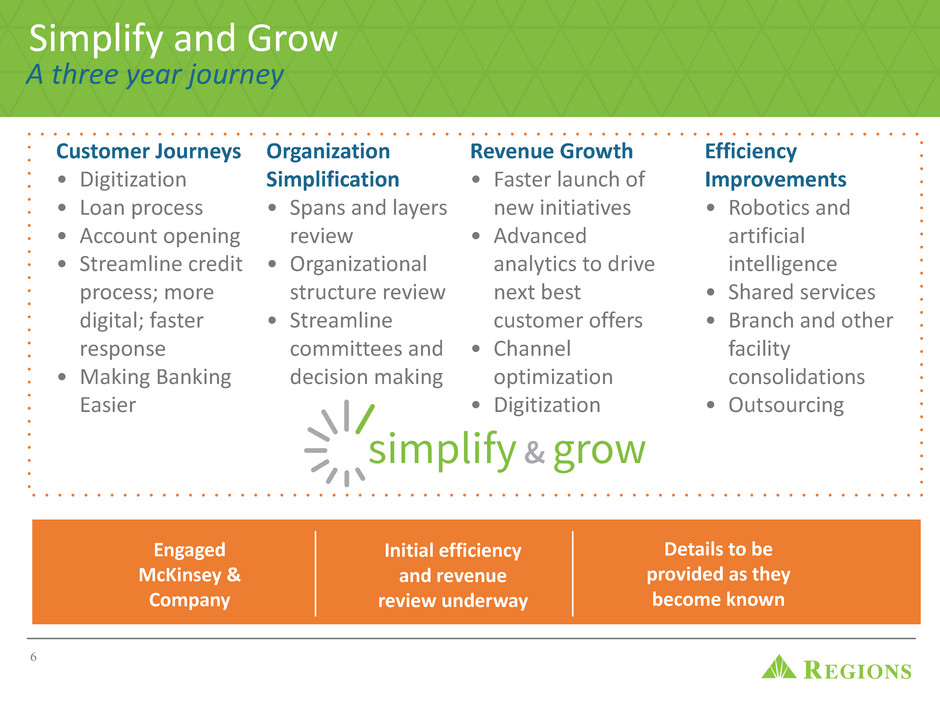

Simplify and Grow: making it easier for

customers to do business with us

Why:

• Industry undergoing a transformational change

• Meeting customers' growing demand for an

easier, faster, and more convenient way to

conduct financial business

How:

• Remove internal silos and reduce friction

• Simplify tasks that don't contribute to excellent

customer experiences

• Create the financial flexibility and capacity to

invest in areas for growth

Goal:

• Achieve sustainable, long-term growth

• Become more efficient and effective in our

service delivery model as well as the products we

offer

• Appeal to the next generation of customer

• Become easier to do business with, faster and

more efficient

5

Customer Journeys

• Digitization

• Loan process

• Account opening

• Streamline credit

process; more

digital; faster

response

• Making Banking

Easier

Revenue Growth

• Faster launch of

new initiatives

• Advanced

analytics to drive

next best

customer offers

• Channel

optimization

• Digitization

Organization

Simplification

• Spans and layers

review

• Organizational

structure review

• Streamline

committees and

decision making

Efficiency

Improvements

• Robotics and

artificial

intelligence

• Shared services

• Branch and other

facility

consolidations

• Outsourcing

Simplify and Grow

A three year journey

Engaged

McKinsey &

Company

Initial efficiency

and revenue

review underway

Details to be

provided as they

become known

6

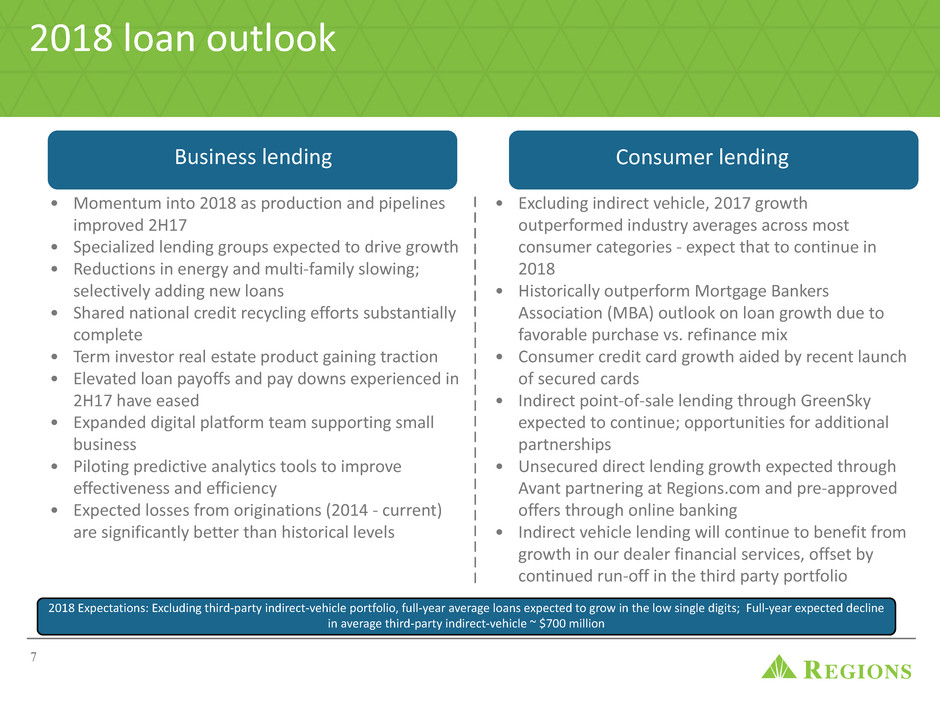

• Excluding indirect vehicle, 2017 growth

outperformed industry averages across most

consumer categories - expect that to continue in

2018

• Historically outperform Mortgage Bankers

Association (MBA) outlook on loan growth due to

favorable purchase vs. refinance mix

• Consumer credit card growth aided by recent launch

of secured cards

• Indirect point-of-sale lending through GreenSky

expected to continue; opportunities for additional

partnerships

• Unsecured direct lending growth expected through

Avant partnering at Regions.com and pre-approved

offers through online banking

• Indirect vehicle lending will continue to benefit from

growth in our dealer financial services, offset by

continued run-off in the third party portfolio

2018 loan outlook

• Momentum into 2018 as production and pipelines

improved 2H17

• Specialized lending groups expected to drive growth

• Reductions in energy and multi-family slowing;

selectively adding new loans

• Shared national credit recycling efforts substantially

complete

• Term investor real estate product gaining traction

• Elevated loan payoffs and pay downs experienced in

2H17 have eased

• Expanded digital platform team supporting small

business

• Piloting predictive analytics tools to improve

effectiveness and efficiency

• Expected losses from originations (2014 - current)

are significantly better than historical levels

Business lending Consumer lending

7

2018 Expectations: Excluding third-party indirect-vehicle portfolio, full-year average loans expected to grow in the low single digits; Full-year expected decline

in average third-party indirect-vehicle ~ $700 million

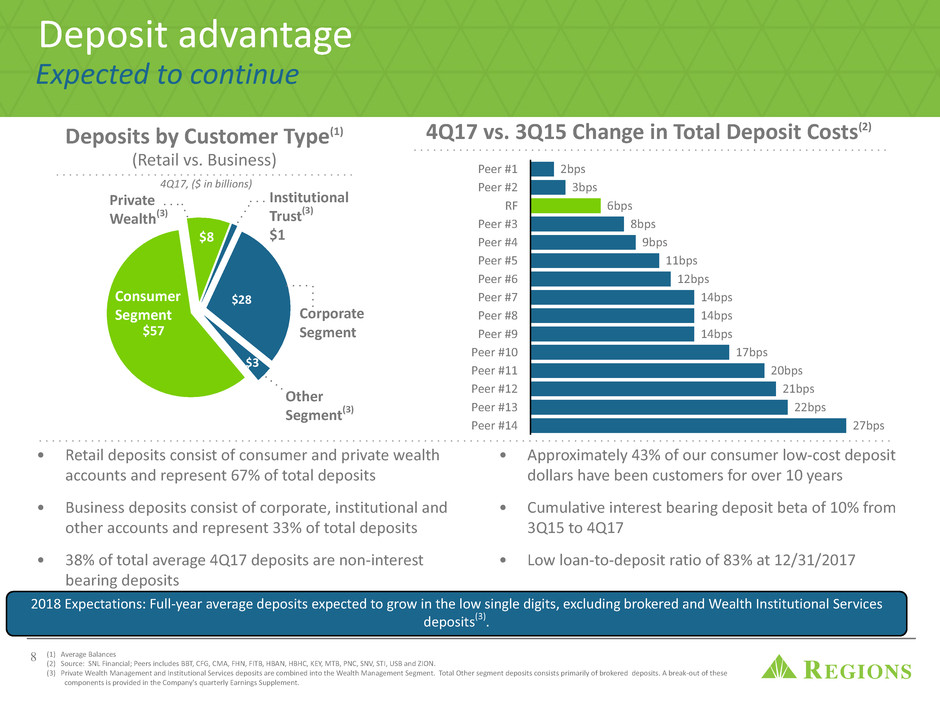

Peer #1

Peer #2

RF

Peer #3

Peer #4

Peer #5

Peer #6

Peer #7

Peer #8

Peer #9

Peer #10

Peer #11

Peer #12

Peer #13

Peer #14

2bps

3bps

6bps

8bps

9bps

11bps

12bps

14bps

14bps

14bps

17bps

20bps

21bps

22bps

27bps

$57

$8

$28

$3

4Q17 vs. 3Q15 Change in Total Deposit Costs(2)

Other

Segment(3)

Deposit advantage

Deposits by Customer Type(1)

(Retail vs. Business)

• Retail deposits consist of consumer and private wealth

accounts and represent 67% of total deposits

• Business deposits consist of corporate, institutional and

other accounts and represent 33% of total deposits

• 38% of total average 4Q17 deposits are non-interest

bearing deposits

• Approximately 43% of our consumer low-cost deposit

dollars have been customers for over 10 years

• Cumulative interest bearing deposit beta of 10% from

3Q15 to 4Q17

• Low loan-to-deposit ratio of 83% at 12/31/2017

Consumer

Segment

Private

Wealth(3)

Corporate

Segment

Institutional

Trust(3)

$1

(1) Average Balances

(2) Source: SNL Financial; Peers includes BBT, CFG, CMA, FHN, FITB, HBAN, HBHC, KEY, MTB, PNC, SNV, STI, USB and ZION.

(3) Private Wealth Management and Institutional Services deposits are combined into the Wealth Management Segment. Total Other segment deposits consists primarily of brokered deposits. A break-out of these

components is provided in the Company's quarterly Earnings Supplement.

4Q17, ($ in billions)

Expected to continue

2018 Expectations: Full-year average deposits expected to grow in the low single digits, excluding brokered and Wealth Institutional Services

deposits(3).

8

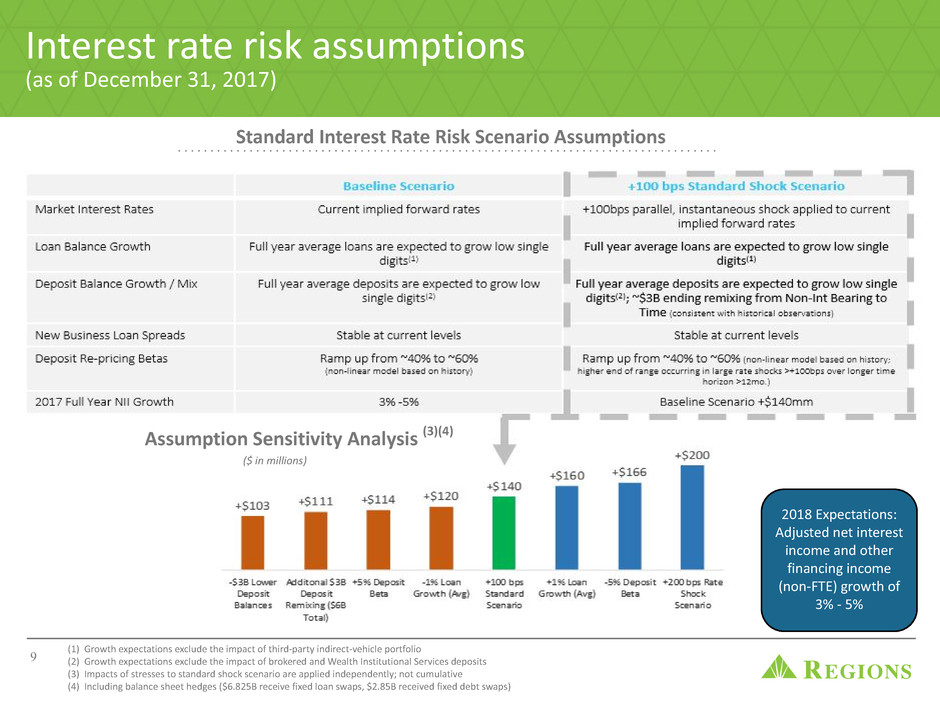

Assumption Sensitivity Analysis (3)(4)

($ in millions)

Standard Interest Rate Risk Scenario Assumptions

Interest rate risk assumptions

(as of December 31, 2017)

(1) Growth expectations exclude the impact of third-party indirect-vehicle portfolio

(2) Growth expectations exclude the impact of brokered and Wealth Institutional Services deposits

(3) Impacts of stresses to standard shock scenario are applied independently; not cumulative

(4) Including balance sheet hedges ($6.825B receive fixed loan swaps, $2.85B received fixed debt swaps)

9

2018 Expectations:

Adjusted net interest

income and other

financing income

(non-FTE) growth of

3% - 5%

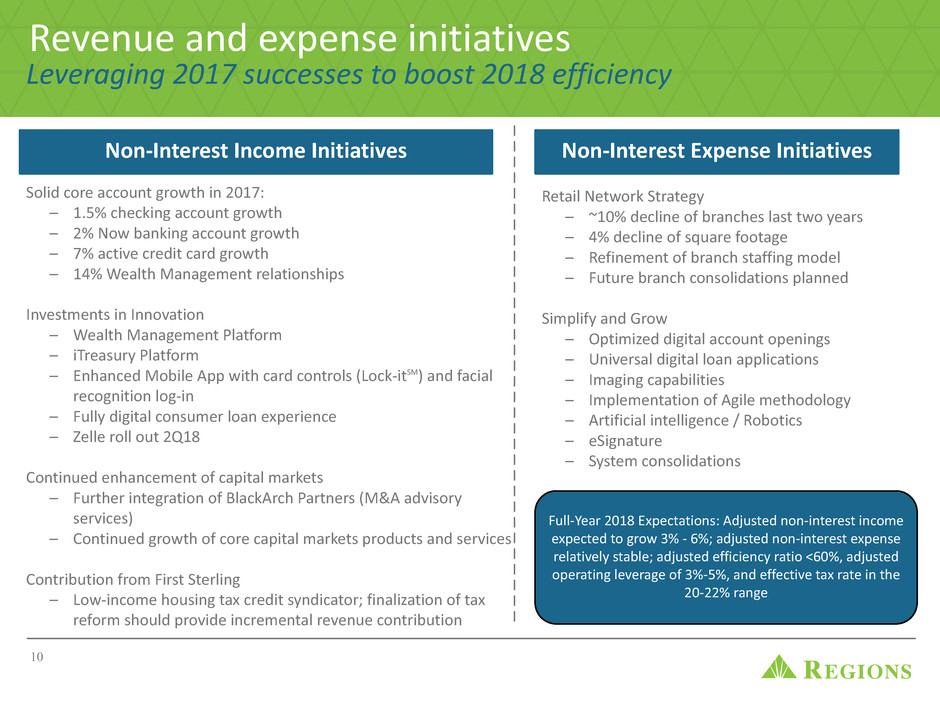

Retail Network Strategy

– ~10% decline of branches last two years

– 4% decline of square footage

– Refinement of branch staffing model

– Future branch consolidations planned

Simplify and Grow

– Optimized digital account openings

– Universal digital loan applications

– Imaging capabilities

– Implementation of Agile methodology

– Artificial intelligence / Robotics

– eSignature

– System consolidations

Solid core account growth in 2017:

– 1.5% checking account growth

– 2% Now banking account growth

– 7% active credit card growth

– 14% Wealth Management relationships

Investments in Innovation

– Wealth Management Platform

– iTreasury Platform

– Enhanced Mobile App with card controls (Lock-itSM) and facial

recognition log-in

– Fully digital consumer loan experience

– Zelle roll out 2Q18

Continued enhancement of capital markets

– Further integration of BlackArch Partners (M&A advisory

services)

– Continued growth of core capital markets products and services

Contribution from First Sterling

– Low-income housing tax credit syndicator; finalization of tax

reform should provide incremental revenue contribution

Revenue and expense initiatives

Leveraging 2017 successes to boost 2018 efficiency

Non-Interest Income Initiatives Non-Interest Expense Initiatives

Full-Year 2018 Expectations: Adjusted non-interest income

expected to grow 3% - 6%; adjusted non-interest expense

relatively stable; adjusted efficiency ratio <60%, adjusted

operating leverage of 3%-5%, and effective tax rate in the

20-22% range

10

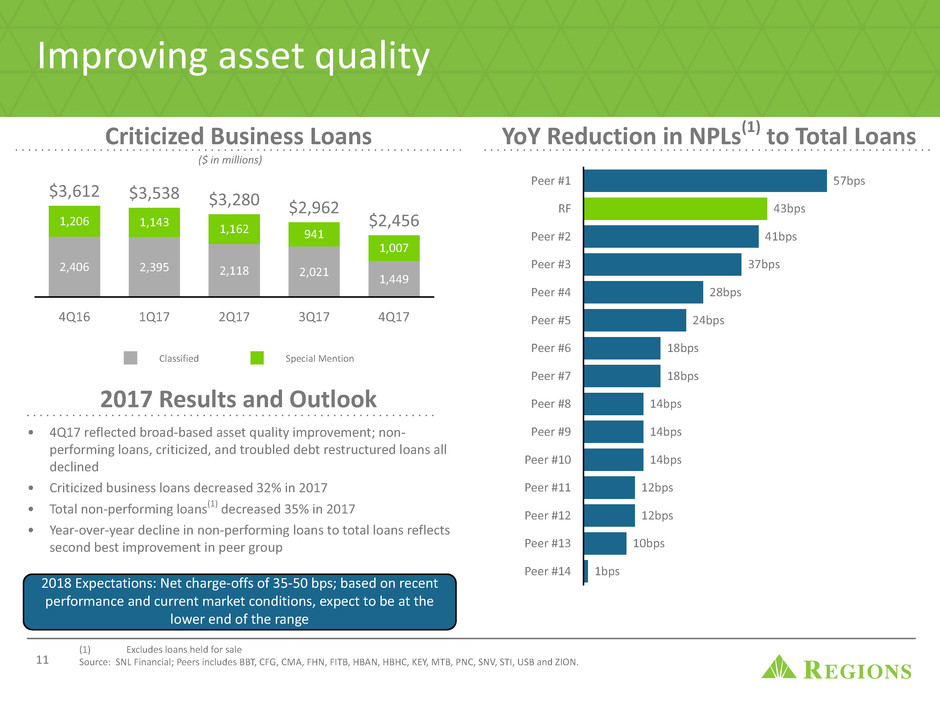

Criticized Business Loans

Classified Special Mention

4Q16 1Q17 2Q17 3Q17 4Q17

2,406 2,395 2,118 2,021 1,449

1,206

$3,612

1,143

$3,538

1,162

$3,280

941

$2,962

1,007

$2,456

Improving asset quality

• 4Q17 reflected broad-based asset quality improvement; non-

performing loans, criticized, and troubled debt restructured loans all

declined

• Criticized business loans decreased 32% in 2017

• Total non-performing loans(1) decreased 35% in 2017

• Year-over-year decline in non-performing loans to total loans reflects

second best improvement in peer group

($ in millions)

11

2017 Results and Outlook

(1) Excludes loans held for sale

Source: SNL Financial; Peers includes BBT, CFG, CMA, FHN, FITB, HBAN, HBHC, KEY, MTB, PNC, SNV, STI, USB and ZION.

2018 Expectations: Net charge-offs of 35-50 bps; based on recent

performance and current market conditions, expect to be at the

lower end of the range

YoY Reduction in NPLs(1) to Total Loans

Peer #1

RF

Peer #2

Peer #3

Peer #4

Peer #5

Peer #6

Peer #7

Peer #8

Peer #9

Peer #10

Peer #11

Peer #12

Peer #13

Peer #14

57bps

43bps

41bps

37bps

28bps

24bps

18bps

18bps

14bps

14bps

14bps

12bps

12bps

10bps

1bps

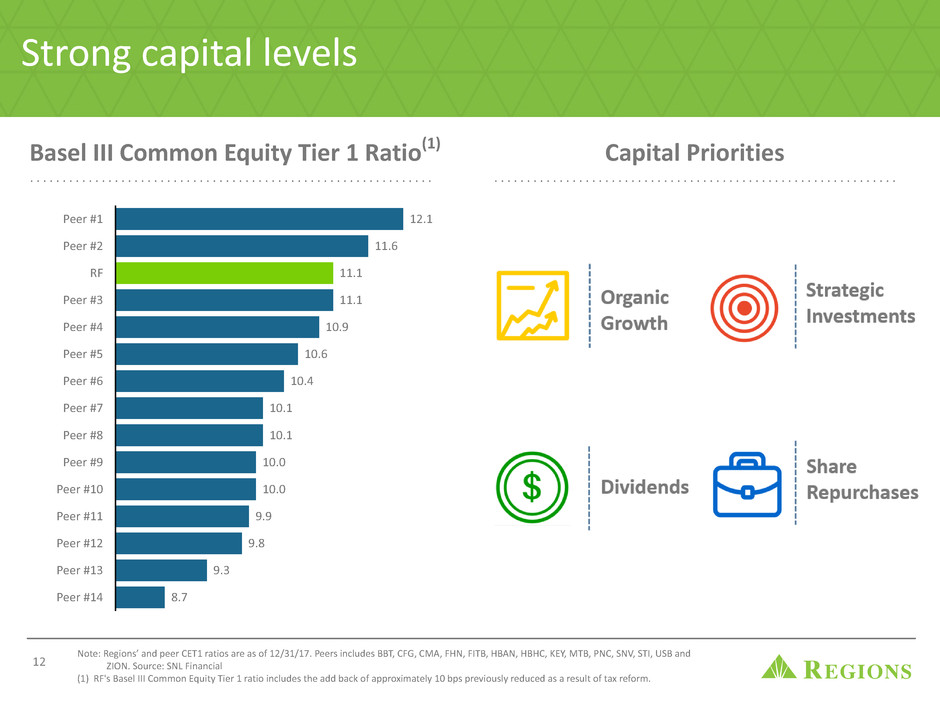

Strong capital levels

Note: Regions’ and peer CET1 ratios are as of 12/31/17. Peers includes BBT, CFG, CMA, FHN, FITB, HBAN, HBHC, KEY, MTB, PNC, SNV, STI, USB and

ZION. Source: SNL Financial

(1) RF's Basel III Common Equity Tier 1 ratio includes the add back of approximately 10 bps previously reduced as a result of tax reform.

12

Basel III Common Equity Tier 1 Ratio(1)

Peer #1

Peer #2

RF

Peer #3

Peer #4

Peer #5

Peer #6

Peer #7

Peer #8

Peer #9

Peer #10

Peer #11

Peer #12

Peer #13

Peer #14

12.1

11.6

11.1

11.1

10.9

10.6

10.4

10.1

10.1

10.0

10.0

9.9

9.8

9.3

8.7

Capital Priorities

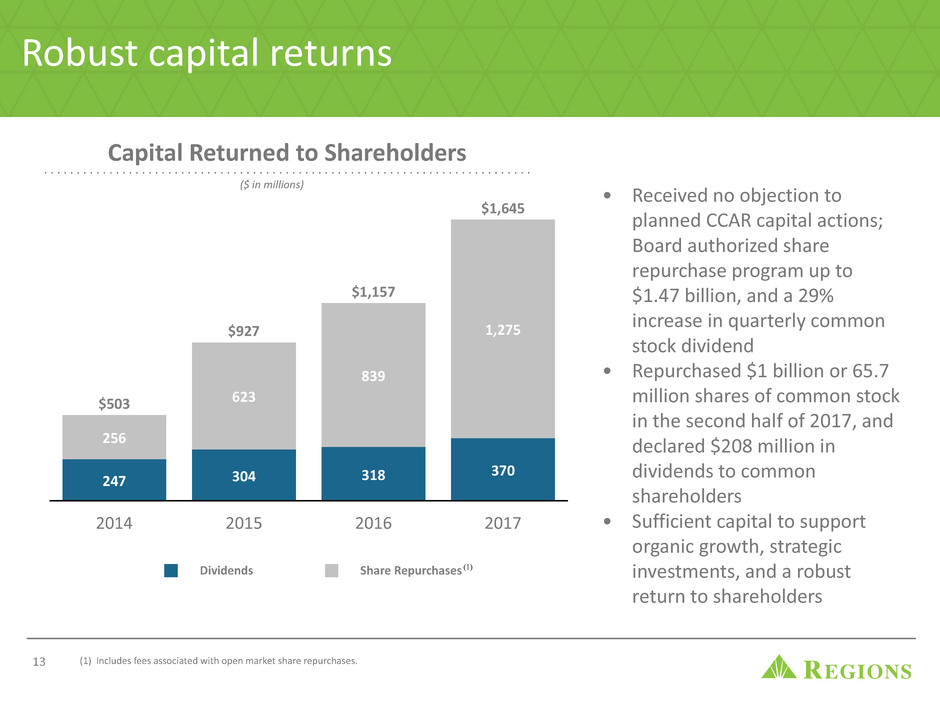

Capital Returned to Shareholders

Dividends Share Repurchases

2014 2015 2016 2017

247 304 318

370

256

$503 623

$927

839

$1,157

1,275

$1,645

Robust capital returns

(1) Includes fees associated with open market share repurchases.13

• Received no objection to

planned CCAR capital actions;

Board authorized share

repurchase program up to

$1.47 billion, and a 29%

increase in quarterly common

stock dividend

• Repurchased $1 billion or 65.7

million shares of common stock

in the second half of 2017, and

declared $208 million in

dividends to common

shareholders

• Sufficient capital to support

organic growth, strategic

investments, and a robust

return to shareholders

($ in millions)

(1)

Asset Sensitivity

Significant funding advantage

driven by low-cost deposit

base, accretive fixed-rate

reinvestments

Stable Asset Quality

Broad-based credit metric

improvements, ample reserves for

hurricane and energy losses

Capital Return

Capital sufficient for organic

growth, strategic opportunities,

robust shareholder returns

Efficiency Opportunities

Identify and execute additional

opportunities to increase revenues

and reduce expenses through our

Simplify and Grow initiative

4Q17 Deposit costs of 17 bps

Lowest NPLs in 10 years

$1.6B Returned to shareholders in 2017

Managing for long-term performance

Opportunities to drive growth and efficiencies

14

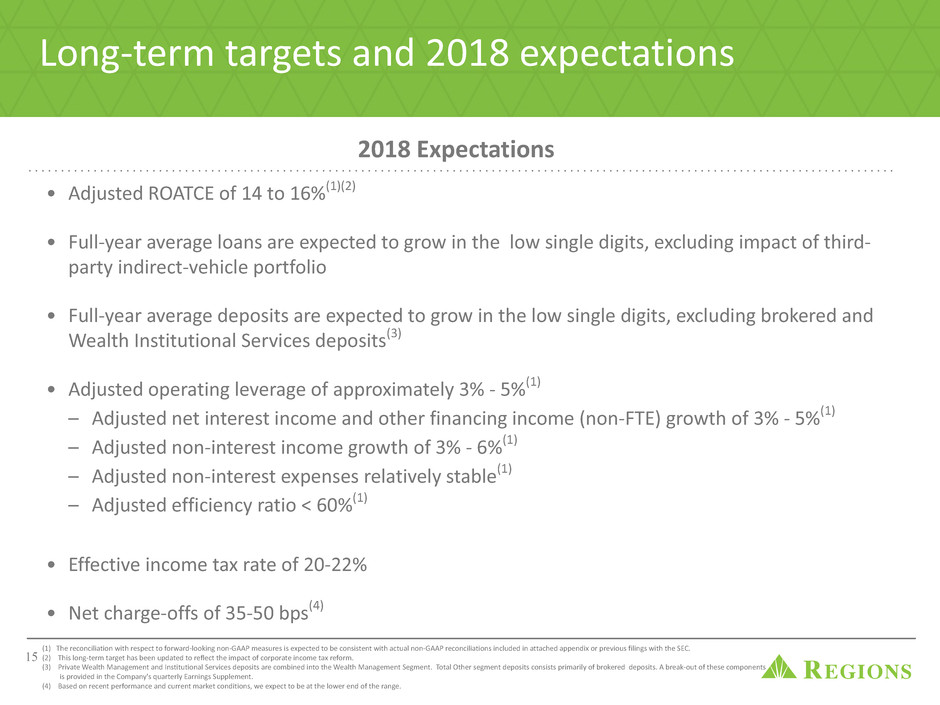

Long-term targets and 2018 expectations

• Adjusted ROATCE of 14 to 16%(1)(2)

• Full-year average loans are expected to grow in the low single digits, excluding impact of third-

party indirect-vehicle portfolio

• Full-year average deposits are expected to grow in the low single digits, excluding brokered and

Wealth Institutional Services deposits(3)

• Adjusted operating leverage of approximately 3% - 5%(1)

– Adjusted net interest income and other financing income (non-FTE) growth of 3% - 5%(1)

– Adjusted non-interest income growth of 3% - 6%(1)

– Adjusted non-interest expenses relatively stable(1)

– Adjusted efficiency ratio < 60%(1)

• Effective income tax rate of 20-22%

• Net charge-offs of 35-50 bps(4)

(1) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in attached appendix or previous filings with the SEC.

(2) This long-term target has been updated to reflect the impact of corporate income tax reform.

(3) Private Wealth Management and Institutional Services deposits are combined into the Wealth Management Segment. Total Other segment deposits consists primarily of brokered deposits. A break-out of these components

is provided in the Company's quarterly Earnings Supplement.

(4) Based on recent performance and current market conditions, we expect to be at the lower end of the range.

2018 Expectations

15

Appendix,

Non-GAAP and

Forward Looking

Statements

16

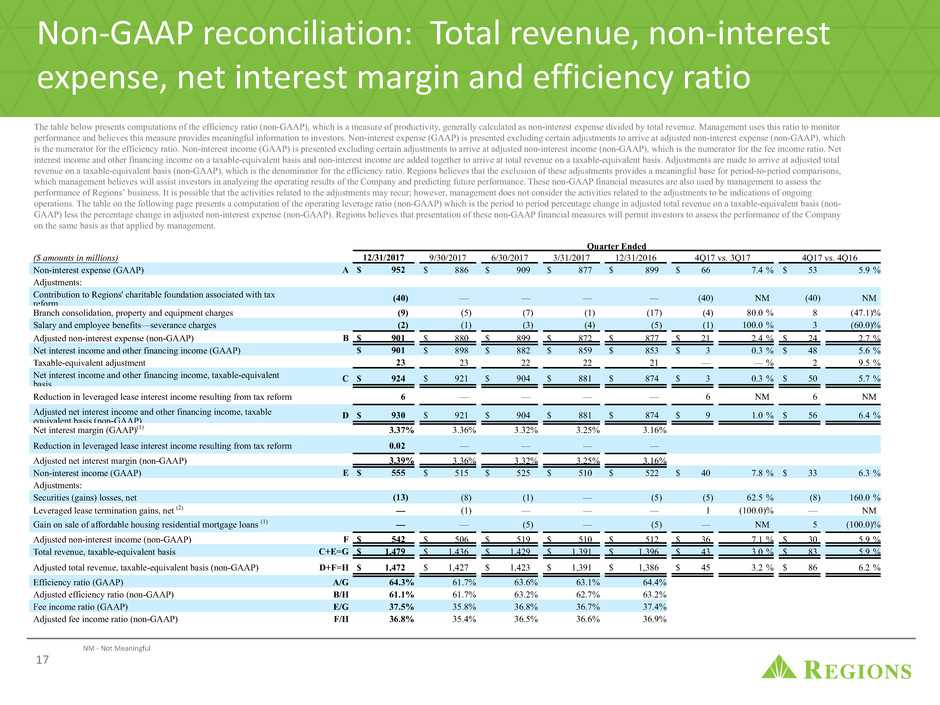

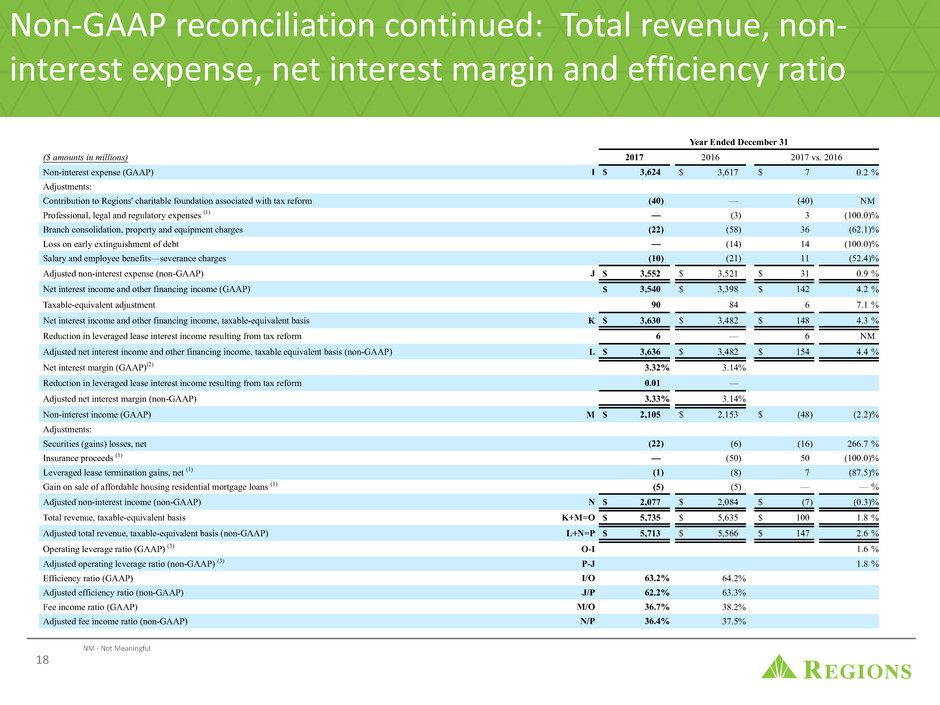

Non-GAAP reconciliation: Total revenue, non-interest

expense, net interest margin and efficiency ratio

NM - Not Meaningful

The table below presents computations of the efficiency ratio (non-GAAP), which is a measure of productivity, generally calculated as non-interest expense divided by total revenue. Management uses this ratio to monitor

performance and believes this measure provides meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which

is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Net

interest income and other financing income on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total

revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the efficiency ratio. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons,

which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the

performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing

operations. The table on the following page presents a computation of the operating leverage ratio (non-GAAP) which is the period to period percentage change in adjusted total revenue on a taxable-equivalent basis (non-

GAAP) less the percentage change in adjusted non-interest expense (non-GAAP). Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company

on the same basis as that applied by management.

17

Quarter Ended

($ amounts in millions) 12/31/2017 9/30/2017 6/30/2017 3/31/2017 12/31/2016 4Q17 vs. 3Q17 4Q17 vs. 4Q16

Non-interest expense (GAAP) A $ 952 $ 886 $ 909 $ 877 $ 899 $ 66 7.4 % $ 53 5.9 %

Adjustments:

Contribution to Regions' charitable foundation associated with tax

reform (40) — — — — (40) NM (40) NM

Branch consolidation, property and equipment charges (9) (5) (7) (1) (17) (4) 80.0 % 8 (47.1)%

Salary and employee benefits—severance charges (2) (1) (3) (4) (5) (1) 100.0 % 3 (60.0)%

Adjusted non-interest expense (non-GAAP) B $ 901 $ 880 $ 899 $ 872 $ 877 $ 21 2.4 % $ 24 2.7 %

Net interest income and other financing income (GAAP) $ 901 $ 898 $ 882 $ 859 $ 853 $ 3 0.3 % $ 48 5.6 %

Taxable-equivalent adjustment 23 23 22 22 21 — — % 2 9.5 %

Net interest income and other financing income, taxable-equivalent

basis C $ 924 $ 921 $ 904 $ 881 $ 874 $ 3 0.3 % $ 50 5.7 %

Reduction in leveraged lease interest income resulting from tax reform 6 — — — — 6 NM 6 NM

Adjusted net interest income and other financing income, taxable

equivalent basis (non-GAAP) D $ 930 $ 921 $ 904 $ 881 $ 874 $ 9 1.0 % $ 56 6.4 %

Net interest margin (GAAP)(1) 3.37% 3.36% 3.32% 3.25% 3.16%

Reduction in leveraged lease interest income resulting from tax reform 0.02 — — — —

Adjusted net interest margin (non-GAAP) 3.39% 3.36% 3.32% 3.25% 3.16%

Non-interest income (GAAP) E $ 555 $ 515 $ 525 $ 510 $ 522 $ 40 7.8 % $ 33 6.3 %

Adjustments:

Securities (gains) losses, net (13) (8) (1) — (5) (5) 62.5 % (8) 160.0 %

Leveraged lease termination gains, net (2) — (1) — — — 1 (100.0)% — NM

Gain on sale of affordable housing residential mortgage loans (1) — — (5) — (5) — NM 5 (100.0)%

Adjusted non-interest income (non-GAAP) F $ 542 $ 506 $ 519 $ 510 $ 512 $ 36 7.1 % $ 30 5.9 %

Total revenue, taxable-equivalent basis C+E=G $ 1,479 $ 1,436 $ 1,429 $ 1,391 $ 1,396 $ 43 3.0 % $ 83 5.9 %

Adjusted total revenue, taxable-equivalent basis (non-GAAP) D+F=H $ 1,472 $ 1,427 $ 1,423 $ 1,391 $ 1,386 $ 45 3.2 % $ 86 6.2 %

Efficiency ratio (GAAP) A/G 64.3% 61.7% 63.6% 63.1% 64.4%

Adjusted efficiency ratio (non-GAAP) B/H 61.1% 61.7% 63.2% 62.7% 63.2%

Fee income ratio (GAAP) E/G 37.5% 35.8% 36.8% 36.7% 37.4%

Adjusted fee income ratio (non-GAAP) F/H 36.8% 35.4% 36.5% 36.6% 36.9%

NM - Not Meaningful

18

Year Ended December 31

($ amounts in millions) 2017 2016 2017 vs. 2016

Non-interest expense (GAAP) I $ 3,624 $ 3,617 $ 7 0.2 %

Adjustments:

Contribution to Regions' charitable foundation associated with tax reform (40) — (40) NM

Professional, legal and regulatory expenses (1) — (3) 3 (100.0)%

Branch consolidation, property and equipment charges (22) (58) 36 (62.1)%

Loss on early extinguishment of debt — (14) 14 (100.0)%

Salary and employee benefits—severance charges (10) (21) 11 (52.4)%

Adjusted non-interest expense (non-GAAP) J $ 3,552 $ 3,521 $ 31 0.9 %

Net interest income and other financing income (GAAP) $ 3,540 $ 3,398 $ 142 4.2 %

Taxable-equivalent adjustment 90 84 6 7.1 %

Net interest income and other financing income, taxable-equivalent basis K $ 3,630 $ 3,482 $ 148 4.3 %

Reduction in leveraged lease interest income resulting from tax reform 6 — 6 NM

Adjusted net interest income and other financing income, taxable equivalent basis (non-GAAP) L $ 3,636 $ 3,482 $ 154 4.4 %

Net interest margin (GAAP)(2) 3.32% 3.14%

Reduction in leveraged lease interest income resulting from tax reform 0.01 —

Adjusted net interest margin (non-GAAP) 3.33% 3.14%

Non-interest income (GAAP) M $ 2,105 $ 2,153 $ (48) (2.2)%

Adjustments:

Securities (gains) losses, net (22) (6) (16) 266.7 %

Insurance proceeds (1) — (50) 50 (100.0)%

Leveraged lease termination gains, net (1) (1) (8) 7 (87.5)%

Gain on sale of affordable housing residential mortgage loans (1) (5) (5) — — %

Adjusted non-interest income (non-GAAP) N $ 2,077 $ 2,084 $ (7) (0.3)%

Total revenue, taxable-equivalent basis K+M=O $ 5,735 $ 5,635 $ 100 1.8 %

Adjusted total revenue, taxable-equivalent basis (non-GAAP) L+N=P $ 5,713 $ 5,566 $ 147 2.6 %

Operating leverage ratio (GAAP) (3) O-I 1.6 %

Adjusted operating leverage ratio (non-GAAP) (3) P-J 1.8 %

Efficiency ratio (GAAP) I/O 63.2% 64.2%

Adjusted efficiency ratio (non-GAAP) J/P 62.2% 63.3%

Fee income ratio (GAAP) M/O 36.7% 38.2%

Adjusted fee income ratio (non-GAAP) N/P 36.4% 37.5%

Non-GAAP reconciliation continued: Total revenue, non-

interest expense, net interest margin and efficiency ratio

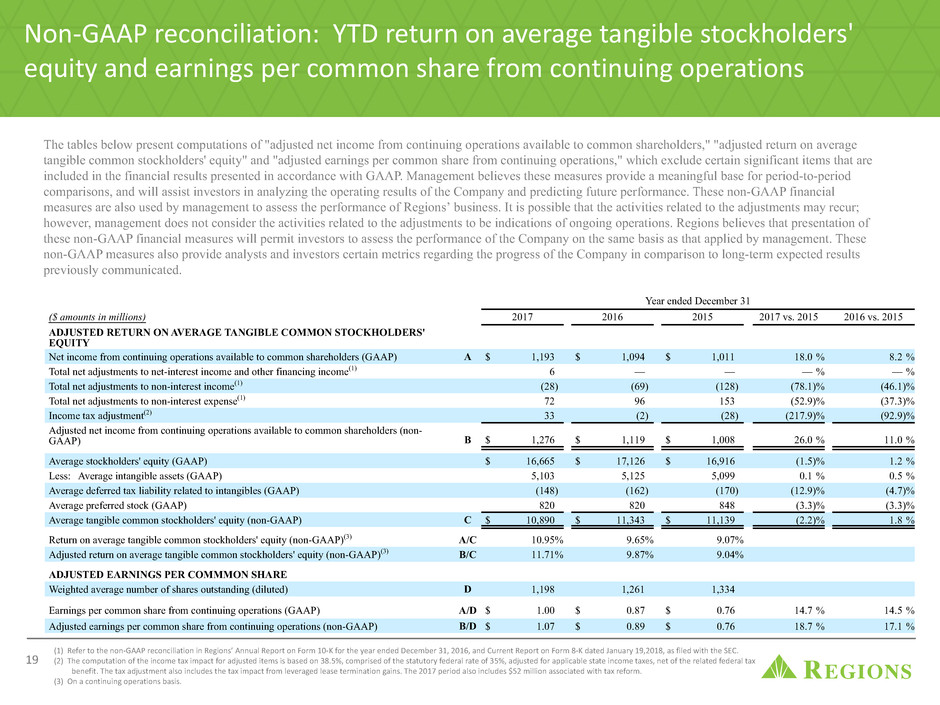

Non-GAAP reconciliation: YTD return on average tangible stockholders'

equity and earnings per common share from continuing operations

The tables below present computations of "adjusted net income from continuing operations available to common shareholders," "adjusted return on average

tangible common stockholders' equity" and "adjusted earnings per common share from continuing operations," which exclude certain significant items that are

included in the financial results presented in accordance with GAAP. Management believes these measures provide a meaningful base for period-to-period

comparisons, and will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial

measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur;

however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of

these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. These

non-GAAP measures also provide analysts and investors certain metrics regarding the progress of the Company in comparison to long-term expected results

previously communicated.

(1) Refer to the non-GAAP reconciliation in Regions’ Annual Report on Form 10-K for the year ended December 31, 2016, and Current Report on Form 8-K dated January 19,2018, as filed with the SEC.

(2) The computation of the income tax impact for adjusted items is based on 38.5%, comprised of the statutory federal rate of 35%, adjusted for applicable state income taxes, net of the related federal tax

benefit. The tax adjustment also includes the tax impact from leveraged lease termination gains. The 2017 period also includes $52 million associated with tax reform.

(3) On a continuing operations basis.

19

Year ended December 31

($ amounts in millions) 2017 2016 2015 2017 vs. 2015 2016 vs. 2015

ADJUSTED RETURN ON AVERAGE TANGIBLE COMMON STOCKHOLDERS'

EQUITY

Net income from continuing operations available to common shareholders (GAAP) A $ 1,193 $ 1,094 $ 1,011 18.0 % 8.2 %

Total net adjustments to net-interest income and other financing income(1) 6 — — — % — %

Total net adjustments to non-interest income(1) (28) (69) (128) (78.1)% (46.1)%

Total net adjustments to non-interest expense(1) 72 96 153 (52.9)% (37.3)%

Income tax adjustment(2) 33 (2) (28) (217.9)% (92.9)%

Adjusted net income from continuing operations available to common shareholders (non-

GAAP) B $ 1,276 $ 1,119 $ 1,008 26.0 % 11.0 %

Average stockholders' equity (GAAP) $ 16,665 $ 17,126 $ 16,916 (1.5)% 1.2 %

Less: Average intangible assets (GAAP) 5,103 5,125 5,099 0.1 % 0.5 %

Average deferred tax liability related to intangibles (GAAP) (148) (162) (170) (12.9)% (4.7)%

Average preferred stock (GAAP) 820 820 848 (3.3)% (3.3)%

Average tangible common stockholders' equity (non-GAAP) C $ 10,890 $ 11,343 $ 11,139 (2.2)% 1.8 %

Return on average tangible common stockholders' equity (non-GAAP)(3) A/C 10.95% 9.65% 9.07%

Adjusted return on average tangible common stockholders' equity (non-GAAP)(3) B/C 11.71% 9.87% 9.04%

ADJUSTED EARNINGS PER COMMMON SHARE

Weighted average number of shares outstanding (diluted) D 1,198 1,261 1,334

Earnings per common share from continuing operations (GAAP) A/D $ 1.00 $ 0.87 $ 0.76 14.7 % 14.5 %

Adjusted earnings per common share from continuing operations (non-GAAP) B/D $ 1.07 $ 0.89 $ 0.76 18.7 % 17.1 %

Forward-looking statements

20

Forward-Looking Statements

This release may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward-looking statements are not based

on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and

information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the

views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below:

• Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reductions of economic growth, which

may adversely affect our lending and other businesses and our financial results and conditions.

• Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings.

• The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict.

• Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity.

• Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting unit,

adverse consequences related to tax reform, or other factors.

• Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases.

• Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses.

• Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities.

• Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are.

• Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs.

• Our inability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner could have a negative impact on our revenue.

• The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries.

• Changes in laws and regulations affecting our businesses, such as the Dodd-Frank Act and other legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations

by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses.

• Our ability to obtain a regulatory non-objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current

or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us.

• Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such tests

and requirements.

• Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the LCR rule), including our ability to generate capital internally or raise capital on favorable terms, and if

we fail to meet requirements, our financial condition could be negatively impacted.

• The Basel III framework calls for additional risk-based capital surcharges for globally systemically important banks. Although we are not subject to such surcharges, it is possible that in the future we may become subject to similar surcharges.

• The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our

subsidiaries are a party, and which may adversely affect our results.

• Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business.

• Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives.

• The success of our marketing efforts in attracting and retaining customers.

• Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income.

• Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time.

• Fraud or misconduct by our customers, employees or business partners.

• Any inaccurate or incomplete information provided to us by our customers or counterparties.

• The risks and uncertainties related to our acquisition and integration of other companies.

• Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security

systems as a result of a cyber attack or similar act.

• The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts.

• The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses.

• The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business.

• Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices

such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries.

• Our inability to keep pace with technological changes could result in losing business to competitors.

• Our ability to identify and address cyber-security risks such as data security breaches, malware, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of and/or misuse or

misappropriation of confidential or proprietary information; disruption or damage to our systems; increased costs; losses; or adverse effects to our reputation.

• Our ability to realize our adjusted efficiency ratio target as part of our expense management initiatives.

• Significant disruption of, or loss of public confidence in, the Internet and services and devices used to access the Internet could affect the ability of our customers to access their accounts and conduct banking transactions.

• Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets.

• The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise

negatively affect our businesses.

• The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses; result in the disclosure of and/or misuse of confidential information or proprietary information; increase our costs;

negatively affect our reputation; and cause losses.

• Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders.

• Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect how we report our financial results.

• Other risks identified from time to time in reports that we file with the SEC.

• The effects of any damage to our reputation resulting from developments related to any of the items identified above.

The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10-

K for the year ended December 31, 2016, as filed with the SEC.

The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place

undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time.

Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Evelyn Mitchell at (205) 264-4551.

Forward-looking statements (continued)

21

®

22