Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NextPlay Technologies Inc. | mkgi-8k_020818.htm |

| EX-99.1 - PRESS RELEASE DATED FEBRUARY 12, 2018 - NextPlay Technologies Inc. | ex99-1.htm |

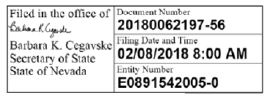

Exhibit 3.1

|

BARBARA K. CEGAVSKE

Secretary of State 202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708 Website: www.nvsos.gov |

|

Certificate of Amendment

(PURSUANT TO NRS 78.385 AND 78.390)

| USE BLACK INK ONLY — DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 — After Issuance of Stock)

1. Name of corporation:

Monaker Group, Inc. [E0891542005-0]

2. The articles have been amended as follows: (provide article numbers, if available)

Section 1. Capital Stock is deleted and replaced in its entirety with the attached (which shall have no effect on any previously designated series of preferred stock).

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise a least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: 54

4. Effective date of filing: 02/12/2018 (optional) |

| X /s/ Bill Kerby |

Signature of Officer

| * | If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof. |

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

| Nevada Secretary of State Amend Profit-After | ||

| This form must be accompanied by appropriate fees. | Revised: 1-5-15 |

Section 1. Capital Stock is deleted and replaced in its entirety with the following (which shall have no effect on any previously designated series of preferred stock):

“Section 1. Capital Stock

The aggregate number of shares that the Corporation will have authority to issue is Six Hundred Million (600,000,000) of which Five Hundred Million (500,000,000) shares will be common stock, with a par value of $0.00001 per share, and One Hundred Million (100,000,000) shares will be preferred stock, with a par value of $0.00001 per share.

The Preferred Stock may be divided into and issued in series. The Board of Directors of the Corporation is authorized to divide the authorized shares of Preferred Stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the shares of all other series and classes. The Board of Directors of the Corporation is authorized, within any limitations prescribed by law and this Article, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of Preferred Stock including but not limited to the following:

a.

The rate of dividend, the time of payment of dividends, whether dividends are cumulative, and the date from which any dividends shall accrue;

b.

Whether shares may be redeemed, and, if so, the redemption price and the terms and conditions of redemption;

c.

The amount payable upon shares in the event of voluntary or involuntary liquidation;

d.

Sinking fund or other provisions, if any, for the redemption or purchase of shares;

e.

The terms and conditions on which shares may be converted, if the shares of any series are issued with the privilege of conversion;

f.

Voting powers, if any, provided that if any of the Preferred Stock or series thereof shall have voting rights, such Preferred Stock or series shall vote only on a share for share basis with the Common Stock on any matter, including but not limited to the election of directors, for which such Preferred Stock or series has such rights; and,

g.

Subject to the foregoing, such other terms, qualifications, privileges, limitations, options, restrictions, and special or relative rights and preferences, if any, of shares or such series as the Board of Directors of the Corporation may, at the time so acting, lawfully fix and determine under the laws of the State of Nevada.

The Corporation shall not declare, pay or set apart for payment any dividend or other distribution (unless payable solely in shares of Common Stock or other class of stock junior to the Preferred Stock as to dividends or upon liquidation) in respect of Common Stock, or other class of stock junior the Preferred Stock, nor shall it redeem, purchase or otherwise acquire for consideration shares of any of the foregoing, unless dividends, if any, payable to holders of Preferred Stock for the current period (and in the case of cumulative dividends, if any, payable to holder of Preferred Stock for the current period and in the case of cumulative dividends, if any, for all past periods) have been paid, are being paid or have been set aside for payments, in accordance with the terms of the Preferred Stock, as fixed by the Board of Directors.

In the event of the liquidation of the Corporation, holders of Preferred Stock shall be entitled to received, before any payment or distribution on the Common Stock or any other class of stock junior to the Preferred Stock upon liquidation, a distribution per share in the amount of the liquidation preference, if any, fixed or determined in accordance with the terms of such Preferred Stock plus, if so provided in such terms, an amount per share equal to accumulated and unpaid dividends in respect of such Preferred Stock (whether or not earned or declared) to the date of such distribution. Neither the sale, lease or exchange of all or substantially all of the property and assets of the Corporation, nor any consolidation or merger of the Corporation, shall be deemed to be a liquidation for the purposes of this Article.

Reverse Stock Split of Outstanding Common Stock

Effective as of the effective date set forth under “Effective date and time of filing” on this Certificate of Amendment to Articles of Incorporation (or in the absence of such date, on the date such Amendment to the Articles of Incorporation is filed with the Secretary of State of Nevada)(the “Effective Time”), every Two and a half (2.5) shares of the Corporation’s common stock (but not any shares of Preferred Stock), issued and outstanding immediately prior to the Effective Time, or held in treasury prior to the Effective Time (collectively the “Old Capital Stock”), shall be automatically reclassified and combined into One (1) share of common stock (the “Reverse Stock Split”). Any stock certificate that, immediately prior to the Effective Time, represented shares of Old Capital Stock will, from and after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent the number of shares as equals the quotient obtained by dividing the number of shares of Old Capital Stock represented by such certificate immediately prior to the Effective Time by Two and a half (2.5), subject to any adjustments for fractional shares as set forth below; provided, however, that each person holding of record a stock certificate or certificates that represented shares of Old Capital Stock shall receive, upon surrender of such certificate or certificates, a new certificate or certificates evidencing and representing the number of shares of capital stock to which such person is entitled under the foregoing reclassification. No fractional shares of capital stock shall be issued as a result of the Reverse Stock Split. In lieu of any fractional share of capital stock to which a stockholder would otherwise be entitled, the Corporation shall issue that number of shares of capital stock as rounded up to the nearest whole share. The Reverse Stock Split shall have no effect on the number of authorized shares of capital stock or the par value thereof as set forth above in Section 1.”