Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BIOLIFE SOLUTIONS INC | tv485602_8k.htm |

Exhibit 99.1

© 2018 BIOLIFE SOLUTIONS, INC. NASDAQ: BLFS Investor Presentation Biopreservation Tools for Cells, Tissues and Organs

© 2018 BIOLIFE SOLUTIONS, INC. Safe Harbor Statement Except for historical information contained herein, this presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements include, but are not limited to, statements concerning the company's anticipated business and operations, guidance for financial results in 2018 , the potential utility of and market for its products and services, potential revenue growth and market expansion, regulatory approvals and/or commercial manufacturing of our customers' products, and potential customer revenue . All statements other than statements of historical fact are statements that could be deemed forward - looking statements . These statements are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward - looking statements, including among other things, uncertainty regarding market adoption of products ; uncertainty regarding third - party market projections ; market volatility ; competition ; litigation ; and those other factors described in our risk factors set forth in our filings with the Securities and Exchange Commission from time to time, including our Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q . We undertake no obligation to update the forward - looking statements contained herein or to reflect events or circumstances occurring after the date hereof, other than as may be required by applicable law . 2

© 2018 BIOLIFE SOLUTIONS, INC. Mission Become the leading provider of biopreservation tools for cells, tissues, and organs By supplying best - in - class tools for maintaining the health and function of biologic source material and finished products during manufacturing, storage and distribution WHAT WHY HOW To help our customers commercialize new biologic - based therapies 3

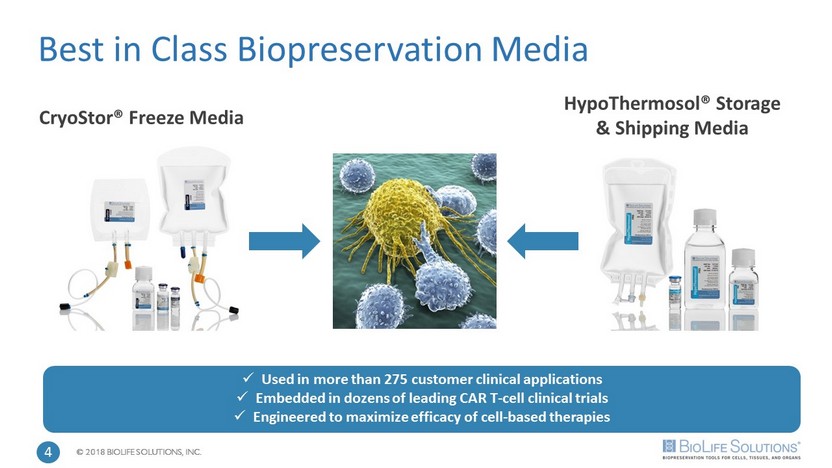

© 2018 BIOLIFE SOLUTIONS, INC. Best in Class Biopreservation Media CryoStor® Freeze Media x Used in more than 275 customer clinical applications x Embedded in dozens of leading CAR T - cell clinical trials x Engineered to maximize efficacy of cell - based therapies HypoThermosol® Storage & Shipping Media 4

© 2018 BIOLIFE SOLUTIONS, INC. Investment Thesis • Enabling cellular therapies; potential cures for cancer and other leading causes of death; by supplying embedded preservation technologies to keep cell - based therapies viable until patient administration • Proprietary IP and sticky customer relationships – sole source supplier; critical to customers’ manufacturing and distribution processes • No significant commercial competition • Embedded in >275 customer clinical applications • Each application represents $500K – $2M annual revenue if approved • Significant upside for next 5 – 10 years as customers obtain approvals • Growing revenue at a CAGR of 35% NASDAQ: BLFS 5

© 2018 BIOLIFE SOLUTIONS, INC. Strategic Revenue Markets and Channels BIOBANKING 11% OF 2017 Umbilical cord blood banks Adult stem cell banks Tissue banks Biorepositories Hair transplant physicians DRUG DISCOVERY Pharmaceutical companies Cell suppliers Toxicity testing labs Personalized medicine labs 12% OF 2017 REGENERATIVE MEDICINE Cell therapy companies Hospital - based stem cell transplant centers University - based clinical research labs Cell therapy CDMO, CRO 48% OF 2017 DISTRIBUTORS Worldwide distribution network Includes regenerative medicine, drug discovery and biobanking customers 29% OF 2017 6

© 2018 BIOLIFE SOLUTIONS, INC. Biopreservation Challenges Survival – How Long Viability – How Many Function – How Well Ex Vivo Time Viability Ex Vivo Time Survival Ex Vivo Time Function Cold storage is used to preserve biologic integrity and function by lowering metabolism . CAR T and other cell therapies MUST be preserved during manufacturing and shipping to maintain therapeutic potency Traditional methods and tools are not optimized and offer limited protection from preservation - induced stress, injury, and death. 7

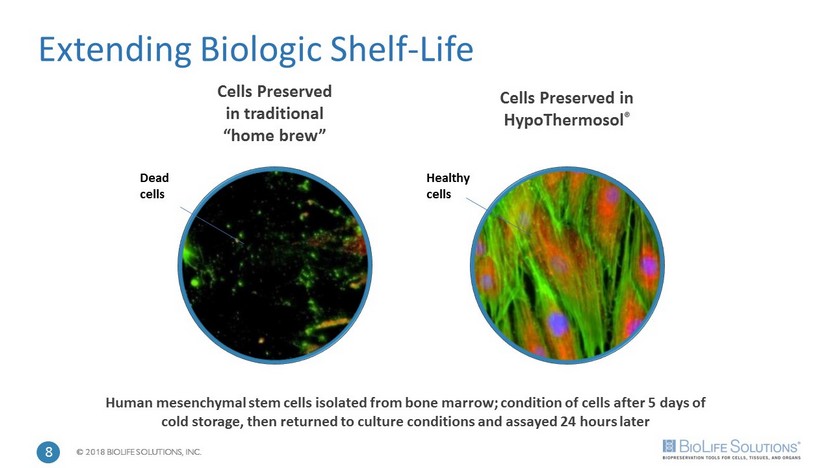

© 2018 BIOLIFE SOLUTIONS, INC. Cells Preserved in traditional “home brew” Human mesenchymal stem cells isolated from bone marrow; condition of cells after 5 days of cold storage, then returned to culture conditions and assayed 24 hours later Extending Biologic Shelf - Life Cells Preserved in HypoThermosol ® Dead cells Healthy cells 8

© 2018 BIOLIFE SOLUTIONS, INC. Biopreservation Yield: COGS and Efficacy Cost Cost Yield Yield LESS Required to Achieve Desired Therapeutic Effect Source Material Manufactured Cell Products LESS Required MORE Doses = 9

© 2018 BIOLIFE SOLUTIONS, INC. Serum - free, protein - free, animal - origin free; highest - quality ingredients; US FDA Master File CryoStor® Freeze Media Improved cell viability and functional recovery compared to commercial and home - brew alternatives in numerous cell types Formulated to mitigate molecular cell stress during freeze/thaw process in cord blood stem cells, T cells, others 10

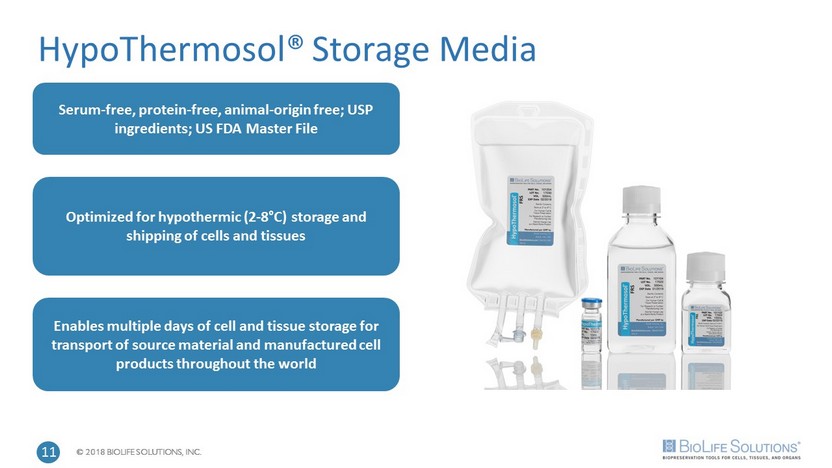

© 2018 BIOLIFE SOLUTIONS, INC. HypoThermosol® Storage Media Optimized for hypothermic (2 - 8 ° C) storage and shipping of cells and tissues Enables multiple days of cell and tissue storage for transport of source material and manufactured cell products throughout the world Serum - free, protein - free, animal - origin free; USP ingredients; US FDA Master File 11

© 2018 BIOLIFE SOLUTIONS, INC. Source Material Preservation Media Cell Factory Final Manufactured Product evo® CRYO LN2 Preservation Media Cell Therapy Manufacturing Workflow Biopreservation Media and Cold Chain Tools for Source Material and Final Dose Patient Temperature Controlled Container evo® CRYO LN2 Customer Engagement - Product Integration 12

© 2018 BIOLIFE SOLUTIONS, INC. Regenerative Medicine Market August 2017 $12B Gilead Acquisition of Kite August 2017 Novartis Kymriah™ CAR - T Cell Therapy Approved October 2017 Kite Yescarta™ CAR - T Cell Therapy Approved 13 Jan 2018 $ 9 B Celgene Acquisition of Juno $22B Invested in 2015 - 2017

© 2018 BIOLIFE SOLUTIONS, INC. Broad, High Value Customer Base DISTRIBUTORS CMO & CDMO CELL THERAPY MARKET 14

© 2018 BIOLIFE SOLUTIONS, INC. FDA – Customer Approval • Kite Pharma (Gilead) YESCARTA™ CAR T Cell Therapy • US FDA approval in October 2017 for adult patients with relapsed or refractory large B - Cell lymphoma after two or more lines of systemic therapy • Our CryoStor ® freeze media is embedded in each dose of Yescarta™ and all current and pending clinical trials in USA, China, Japan, EU 15

© 2018 BIOLIFE SOLUTIONS, INC. Customer Approval • Kolon Life Science – Invossa™ • Cell - mediated gene therapy for knee osteoarthritis shipped frozen • Each dose is frozen in our CryoStor® cell freeze media • Approved in Korea; estimated 5M patients • Worldwide patient population estimated at 150M 16

© 2018 BIOLIFE SOLUTIONS, INC. Financial Highlights 17

© 2018 BIOLIFE SOLUTIONS, INC. Executing for Growth 50% 52% 54% 56% 58% 60% 62% 64% 66% 68% 70% $0 $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 $14,000,000 $16,000,000 $18,000,000 $20,000,000 2015 2016 2017E 2018E 35% CAGR with Significant Operating Leverage Revenue Gross Margin % 18

© 2018 BIOLIFE SOLUTIONS, INC. Q3 2017 Financial Results (In Thousands) Q3 2017 Q3 2016 CHANGE % CHANGE Revenue* $ 2,963 $ 2,135 $ 828 39% COGS 1,095 921 174 19% Gross Margin % 63% 57% 6pts N/A OPEX 1,900 2,352 (452) (19%) Operating Loss (32) (1,138) (1,106) N/A Adjusted EBITDA 298 (567) 865 N/A Cash Provided/(Used) by Operating Activities 74 (884) 958 N/A Cash Balance** $ 2,831 $ $1,369 $ 1,462 N/A *Preliminary full year revenue of $11 million; up 34% over 2016 **Cash balance at 12/31/2017 was $6.7 million 19

© 2018 BIOLIFE SOLUTIONS, INC. $0 $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 FY2016 FY2017 Annual Revenue Growth Preliminary Q4 and FY 2017 Revenue $2,000,000 $2,200,000 $2,400,000 $2,600,000 $2,800,000 $3,000,000 $3,200,000 $3,400,000 Q4 16 Q3 17 Q4 17 Quarterly Revenue Growth 5% 39% 34% 20

© 2018 BIOLIFE SOLUTIONS, INC. 2018 Guidance Metric 2018 2018 change from 2017 Revenue $13.6M - $14.7M Up to 35% growth Gross Margin 62% - 64% Up to 400 bps OPEX $9 - $9.5M 12% - 18% increase GAAP Operating Profit Full year positive First time in Company history Adjusted EBITDA Significant increase Pending 10 - K Filing 21

© 2018 BIOLIFE SOLUTIONS, INC. Cap Table – 24.5mm Fully Diluted Shares ▪ 5.6mm @ $4.75 ▪ 550K @ $1.75 ▪ 3.9mm held by the same two long term shareholders ▪ Management and employee incentives ▪ 1.6mm vested ▪ $1.79 wt. avg exercise price ▪ Increasing institutional holders ▪ 46% held by two long term shareholders Shares – 14.0mm Directors & Officers Affiliates Other Warrants – 6.7mm Directors & Officers Affiliates Other Options/RSUs – 3.8mm Directors & Officers Affiliates Other 22

© 2018 BIOLIFE SOLUTIONS, INC. Experienced Executive Team Mike Rice – Chief Executive Officer BS Bus Admin; 10 years as BLFS CEO; chief visionary of BLFS market opportunities, branding, marketing strategies; 18 years medical device sales, sales management, marketing; patient monitoring, defibrillators, implantable CRM, hearing devices, LAN/WAN; 5 issued and 13 pending patents Aby J. Mathew, PhD – CTO, Senior Vice President BS Microbiology, PhD, Cell & Molecular Biology; co - developer of platform HypoThermosol® media; in demand industry thought leader in biopreservation of cells and tissues for clinical applications; catalyst responsible for driving regen med market to adopt BLFS clinical grade biopreservation media; 6 issued and 6 pending patents; numerous journal articles Roderick de Greef – Chief Financial Officer BA Economics, MBA; 25 years CFO experience for 5 public companies; Serves/served on 5 US public company boards; Raised >$200mm from US, EU and AP private and institutional investors; Structured, negotiated and closed $400mm of public company mergers and acquisition transactions in the US and Europe Karen Foster – Vice President, Operations BS Biological Sciences, MS Zoology, MBA; 25 year career in quality and manufacturing operations including 13 years VP Manufacturing Operations and Site Leader at ViaCord, 2 positions leading 80 member teams; certified Six Sigma Green Belt Jim Mathers – Vice President, Global Sales BA, Biology, MBA; 35 years sales and sales and marketing management; repeated achievement in driving early adoption of new medical device technologies for Stryker, MAKO Surgical, BrainLab, AccuRay, Cardiac Science, JNJ Todd Berard – Vice President, Marketing BS, Biochemistry, MBA; 16 years marketing including leadership of marcom, corporate branding, product marketing, and positioning for Verathon, Physio Control (MDT), tech startups 23

© 2018 BIOLIFE SOLUTIONS, INC. Investment Thesis • Enabling cellular therapies; potential cures for cancer and other leading causes of death; by supplying embedded preservation technologies to keep cell - based therapies viable until patient administration • Proprietary IP and sticky customer relationships – sole source supplier; critical to customers’ manufacturing and distribution processes • No significant commercial competition • Embedded in >275 customer clinical applications • Each application represents $500K – $2M annual revenue if approved • Significant upside for next 5 – 10 years as customers obtain approvals • Growing revenue at a CAGR of 35% NASDAQ: BLFS 24

© 2018 BIOLIFE SOLUTIONS, INC. NASDAQ: BLFS For additional questions or comments, please contact: Mike Rice | President and CEO mrice@BioLifeSolutions.com | (425) 686 - 6003 Roderick de Greef | CFO rdegreef@BioLifeSolutions.com | (425) 686 - 6002 www.biolifesolutions.com BioLife Solutions, Inc. 3303 Monte Villa Parkway, Suite 310 Bothell, WA 98021 25