Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - VALVOLINE INC | exhibit32-certificationofs.htm |

| EX-31.2 - EXHIBIT 31.2 - VALVOLINE INC | exhibit312-certificationof.htm |

| EX-31.1 - EXHIBIT 31.1 - VALVOLINE INC | exhibit311-certificationof.htm |

| 10-Q - 10-Q - VALVOLINE INC | vvv1231201710q.htm |

EXHIBIT 10.1

FIRST AMENDMENT

Dated as of November 20, 2017

to the

TRANSFER AND ADMINISTRATION AGREEMENT

Dated as of November 29, 2016

This FIRST AMENDMENT (this “Amendment”) dated as of November 20, 2017 is entered into among VALVOLINE LLC, a Delaware limited liability company (“Valvoline” or “Master Servicer”), LEX CAPITAL LLC, a Delaware limited liability company (“SPV”), the Originators, the Investors, Letter of Credit Issuers, Managing Agents and Administrators party hereto, and PNC BANK, NATIONAL ASSOCIATION (“Agent” or “PNC”), as agent for the Investors.

RECITALS

WHEREAS, the parties hereto and PNC Capital Markets, LLC, have entered into that certain Transfer and Administration Agreement, dated as of November 29, 2016 (as amended, supplemented or otherwise modified through the date hereof, the “Agreement”);

WHEREAS, concurrently herewith, the parties hereto and PNC Capital Markets LLC are entering into that certain Amended and Restated Master Fee Letter, dated as of the date hereof (the “Fee Letter”); and

WHEREAS, the parties hereto desire to amend the Agreement as set forth herein.

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

SECTION 1. Definitions.

All capitalized terms not otherwise defined herein are used as defined in the Agreement.

SECTION 2. Amendment to the Agreement. The Agreement is hereby amended to incorporate the changes shown on the marked pages to the Agreement attached hereto as Exhibit A.

SECTION 3. Representations and Warranties. Each of Valvoline, each Originator and the SPV, as to itself, hereby represents and warrants to each of the other parties hereto as follows:

(a)after giving effect to this Amendment and the transactions contemplated hereby and thereby, no Termination Event or Potential Termination Event shall exist;

(b)the representations and warranties of such Person set forth in the Transaction Documents to which it is a party (as amended hereby) are true and correct as of the date hereof (except to the extent such representations and warranties relate solely to an earlier date and then as of such earlier date); and

(c) this Amendment constitutes the legal, valid and binding obligations of such Person enforceable against such Person in accordance with their respective terms, subject to the effect of any applicable bankruptcy, insolvency, reorganization, moratorium or similar law affecting creditors’

rights generally and to the effect of general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

SECTION 4. Pro Forma Master Servicer Report. On or prior to the date hereof, the Master Servicer shall deliver to the SPV, the Agent and each Managing Agent a pro forma Master Servicer Report as of October 31, 2017 setting forth the characteristics of the Receivables.

SECTION 5. Effectiveness. This Amendment shall become effective as of the date first above written upon receipt by the Agent of each of the following, each in form and substance satisfactory to the Agent:

(a)counterparts of this Amendment duly executed by each of the parties hereto;

(b)the pro forma Master Servicer Report described in Section 4 above;

(c)receipt by the Agent of counterparts of the Fee Letter duly executed by each of the parties thereto and confirmation that any fees owing thereunder have been paid in full;

(d)receipt by the Agent of a favorable opinion, in form and substance reasonably satisfactory to the Agent and each Managing Agent, of external counsel to Valvoline, the SPV and the Parent, as to certain general corporate, enforceability and no-conflict matters; and

(e)receipt by the Agent of such other agreements, documents, certificates, instruments and opinions as the Agent may reasonably request prior to the date hereof.

SECTION 6. Reference to the Effect on the Transaction Documents.

(a) On and after the effectiveness of this Amendment, each reference in the Agreement to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Agreement, and each reference in each of the other Transaction Documents to “the Transfer and Administration Agreement” or “the TAA,” “thereunder”, “thereof” or words of like import referring to the Agreement, shall mean and be a reference to the Agreement, as amended by this Amendment.

(b) The Agreement and each of the related documents, as specifically amended by this Amendment, is and shall continue to be in full force and effect and is hereby in all aspects ratified and confirmed. The covenants and other obligations of the SPV, Master Servicer, and each Originator (each in any capacity) shall continue under the Transaction Documents.

(c) The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of Agent, any of the Investors or any Indemnified Party under the Agreement or any other Transaction Document, nor constitute a waiver of any provision of the Agreement or any other Transaction Document.

SECTION 7. Counterparts. This Amendment may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same instrument. Delivery by facsimile or email of an executed signature page of this Amendment shall be effective as delivery of an executed counterpart hereof.

2

SECTION 8. Governing Law. This Amendment shall be governed by and construed in accordance with the internal laws of the State of New York (including Sections 5-1401-1 and 5-1401-2 of the General Obligations Law, but without regard to any other ConflictS of Law provisions thereof).

SECTION 9. Transaction Document. This Amendment shall be deemed to be a Transaction Document for all purposes of the Agreement and each other Transaction Document.

SECTION 10. Severability. If any one or more of the agreements, provisions or terms of this Amendment shall for any reason whatsoever be held invalid or unenforceable, then such agreements, provisions or terms shall be deemed severable from the remaining agreements, provisions and terms of this Amendment and shall in no way affect the validity or enforceability of the provisions of this Amendment or the Agreement.

SECTION 11. Section Headings. The various headings of this Amendment are included for convenience only and shall not affect the meaning or interpretation of this Amendment, the Agreement or any provision hereof or thereof.

SECTION 12. Ratification. After giving effect to this Amendment and each of the other agreements, documents and instruments contemplated in connection herewith, the Parent Undertaking, along with each of the provisions thereof, remains in full force and effect and is hereby ratified and reaffirmed by the Parent and each of the other parties hereto.

[Signature pages follow.]

3

IN WITNESS WHEREOF, the parties have executed this Amendment as of the date first written above.

VALVOLINE LLC | ||

By: | /s/ Lynn P. Freeman | |

Name: | Lynn P. Freeman | |

Title: | Vice President and Assistant Treasurer | |

[SIGNATURES CONTINUE ON THE FOLLOWING PAGE]

S- 1

First Amendment to the TAA

(Valvoline - LEX Capital LLC)

LEX CAPITAL LLC | ||

By: | /s/ Lynn P. Freeman | |

Name: | Lynn P. Freeman | |

Title: | President | |

[SIGNATURES CONTINUE ON THE FOLLOWING PAGE]

S- 2

First Amendment to the TAA

(Valvoline - LEX Capital LLC)

VALVOLINE INC. | ||

By: | /s/ Lynn P. Freeman | |

Name: | Lynn P. Freeman | |

Title: | Assistant Treasurer | |

[SIGNATURES CONTINUE ON THE FOLLOWING PAGE]

S- 3

First Amendment to the TAA

(Valvoline - LEX Capital LLC)

PNC BANK , NATIONAL ASSOCIATION, | ||

as the Agent, as a Managing Agent and as a Committed Investor for the PNC Investor Group | ||

By: | /s/ Eric Bruno | |

Name: | Eric Bruno | |

Title: | Senior Vice President | |

PNC BANK, NATIONAL ASSOCIATION, | ||

as a Letter of Credit Issuer | ||

By: | /s/ Eric Bruno | |

Name: | Eric Bruno | |

Title: | Senior Vice President | |

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

S- 4

First Amendment to the TAA

(Valvoline - LEX Capital LLC)

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., as a Managing Agent and Administrator for the MUFG Investor Group | |||

By: | /s/ Eric Williams | ||

Name: | Eric Williams | ||

Title: | Managing Director | ||

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., as a Committed Investor for the MUFG Investor Group | ||

LTD., as a Committed Investor for the MUFG Investor Group | ||

By: | /s/ Eric Williams | |

Name: | Eric Williams | |

Title: | Managing Director | |

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

S- 5

First Amendment to the TAA

(Valvoline - LEX Capital LLC)

GOTHAM FUNDING CORPORATION, | ||

as a Conduit Investor and an Uncommitted Investor for the MUFG Investor Group | ||

By: | /s/ David V. DeAngelis | |

Name: | David V. DeAngelis | |

Title: | Vice President | |

[SIGNATURES CONTINUE ON THE FOLLOWING PAGE]

S- 6

First Amendment to the TAA

(Valvoline - LEX Capital LLC)

EXHIBIT A

[Attached]

Exhibit A

CONFORMED COPY

Conformed through the Supplement to Schedule 1.1, dated December 19, 2016

Conformed through the First Amendment, dated November 20, 2017

TRANSFER AND ADMINISTRATION AGREEMENT

Dated as of November 29, 2016

by and among

LEX CAPITAL LLC,

VALVOLINE LLC,

and each other entity from time to time party hereto

as an Originator, as Originators,

VALVOLINE LLC,

as initial Master Servicer,

PNC BANK, NATIONAL ASSOCIATION,

as the Agent, a Letter of Credit Issuer, a Managing Agent and

a Committed Investor,

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH

as a Managing Agent, an Administrator and a Committed Investor,

GOTHAM FUNDING CORPORATION,

as a Conduit Investor and an Uncommitted Investor,

PNC CAPITAL MARKETS, LLC,

as Structuring Agent,

and

THE VARIOUS INVESTOR GROUPS, MANAGING AGENTS, LETTER OF CREDIT ISSUERS AND

ADMINISTRATORS FROM TIME TO TIME PARTIES HERETO

This Transfer and Administration Agreement (this “Agreement”), dated as of November 29, 2016, by and among:

(1) LEX Capital LLC, a Delaware limited liability company (the “SPV”);

(2) Valvoline LLC, a Delaware limited liability company (“Valvoline LLC”), and each other entity from time to time party hereto as an “Originator” pursuant to a joinder agreement substantially in the form of Exhibit E hereto (each, an “Originator” and collectively, the “Originators”);

(3) Valvoline LLC, as initial Master Servicer;

(4) PNC Bank, National Association (“PNC”), as the Agent, a Letter of Credit Issuer, a Managing Agent and a Committed Investor;

(5) The Bank of Tokyo-Mitsubishi UFJ, Ltd., NEW YORK BRANCH (“MUFG”), as a Managing Agent, an Administrator and a Committed Investor;

(6) Gotham Funding Corporation, a Delaware corporation (“Gotham”), as a Conduit Investor and an Uncommitted Investor;

(7) the various Investor Groups, Managing Agents, Letter of Credit Issuers and Administrators from time to time parties hereto; and

(8) PNC Capital Markets LLC, a Pennsylvania limited liability company, as the Structuring Agent.

ARTICLE I

DEFINITIONS

SECTION 1.1 Certain Defined Terms. As used in this Agreement, the following terms shall have the following meanings:

“Administrators” means the Gotham Administrator and any other Person that becomes a party to this Agreement as an “Administrator”.

“Adverse Claim” means a Lien on any Person’s assets or properties in favor of any other Person; provided that “Adverse Claim” shall not include any “precautionary” financing statement filed by any Person not evidencing any such Lien.

“Affected Assets” means, collectively, (a) the Receivables, (b) the Related Security, (c) with respect to any Receivable, all rights and remedies of the SPV under the First Tier Agreement, together with all financing statements filed by the SPV against the Originators in connection therewith, and (d) all proceeds of the foregoing.

“Affiliate” means, as to any Person, any other Person which, directly or indirectly, owns, is in control of, is controlled by, or is under common control with such Person, in each case

whether beneficially, or as a trustee, guardian or other fiduciary. A Person shall be deemed to control another Person if the controlling Person possesses, directly or indirectly, the power to direct or cause the direction of the management or policies of the other Person, whether through the ownership of voting securities or membership interests, by contract, or otherwise.

“Agent” means PNC, in its capacity as agent for the Secured Parties, and any successor thereto appointed pursuant to Article X.

“Agents” means, collectively, the Managing Agents and the Agent.

“Agent-Related Persons” means, with respect to any Managing Agent or the Agent, such Person together with its Affiliates, and the officers, directors, employees, agents and attorneys-in-fact of such Persons and their respective Affiliates.

“Aggregate Unpaid Balance” means, as of any date of determination, the sum of the Unpaid Balances of all Receivables which constitute Eligible Receivables as of such date of determination.

“Aggregate Unpaids” means, at any time, an amount equal to the sum of (a) the aggregate unpaid Yield accrued and to accrue through the end of all Rate Periods (or calendar month for Portions of Investment with daily Rate Periods) in existence at such time, (b) the Net Investment at such time and (c) all other amounts owed (whether or not then due and payable) hereunder and under the other Transaction Documents by the SPV and each Originator to the Agent, the Managing Agents, the Administrators, the Investors or the Indemnified Parties at such time.

“Agreement” is defined in the Preamble.

“Alternate Rate” is defined in Section 2.4.

“Anti-Corruption Laws” means all laws, rules, and regulations of any jurisdiction applicable to the SPV, the initial Master Servicer, any Originator or any of their respective Subsidiaries from time to time concerning or relating to bribery or corruption, including the Foreign Corrupt Practices Act of 1977, and any applicable law or regulation implementing the Organisation for Economic Co-operation and Development Convention on Combating Bribery of Foreign Public Officials in International Business Transactions.

“Anti-Terrorism Laws” has the meaning set forth in Section 4.1(bb).

“Applicable Special Designated Obligor Percentage” means initially (i) for Genuine Parts Company (d/b/a NAPA), 15.0%, (ii) for AutoZone, Inc., 15.0 20.0%, (iii) Advance Auto Parts, Inc., 10.0%, and (iv) for each other Special Designated Obligor, the applicable percentage designated in a written supplement to this Agreement signed by the Agent, each Managing Agent, the Master Servicer and the SPV, each in their sole discretion, by which such Special Designated Obligor is so designated, in each case, as such percentage is modified from time to time pursuant to the terms of this Agreement.

“Ashland Global” means Ashland Global Holdings Inc., a Delaware corporation.

2

“Closing Date” means November 29, 2016.

“Code” means the Internal Revenue Code of 1986, as amended, or any successor thereto.

“Collections” means, with respect to any Receivable, all cash collections and other cash proceeds of such Receivable, including (i) all scheduled interest and principal payments, and any applicable late fees, in any such case, received and collected on such Receivable, (ii) all proceeds received by virtue of the liquidation of such Receivable, net of expenses incurred in connection with such liquidation, (iii) all proceeds received (net of any such proceeds which are required by law to be paid to the applicable Obligor) under any damage, casualty or other insurance policy with respect to such Receivable, (iv) all cash proceeds of the Related Security related to or otherwise attributable to such Receivable, and (v) all Deemed Collections, Repurchase Price amounts and other payments received with respect to such Receivable, but, for the avoidance of doubt, excluding any Excluded Amounts.

“Commercial Paper” means the promissory notes issued or to be issued by a Conduit Investor (or its related commercial paper issuer if such Conduit Investor does not itself issue commercial paper) in the commercial paper market.

“Commitment” means, with respect to each Committed Investor, as the context requires, (a) the commitment of such Committed Investor to make Investments (including Investments funding the reimbursement of each Letter of Credit Issuer for draws on its Letters of Credit) and to pay Assignment Amounts in accordance herewith in an amount not to exceed the amount described in the following clause (b), and (b) the dollar amount set forth opposite such Committed Investor’s signature on the signature pages hereof under the heading “Commitment” (or, in the case of a Committed Investor which becomes a party hereto pursuant to an Assignment and Assumption Agreement, as set forth in such Assignment and Assumption Agreement), minus the dollar amount of any Commitment or portion thereof assigned by such Committed Investor pursuant to an Assignment and Assumption Agreement, plus the dollar amount of any increase to such Committed Investor’s Commitment consented to by such Committed Investor prior to the time of determination; provided that if the Facility Limit is reduced, the aggregate of the Commitments of all the Committed Investors shall be reduced in a like amount and the Commitment of each Committed Investor shall be reduced in proportion to such reduction.

“Commitment Fee” is defined in the Master Fee Letter.

“Commitment Termination Date” means November 27, 2017, 19, 2020, or such later date to which the Commitment Termination Date may be extended by the SPV, the Agent and the Committed Investors (in their sole discretion).

“Committed Investors” means (a) for the PNC Investor Group, the PNC Committed Investors, (b) for the MUFG Investor Group, the Gotham Committed Investors, and (c) for any other Investor Group, each of the Persons executing this Agreement in the capacity of a

6

(a) with respect to each Special Designated Obligor, if the aggregate Unpaid Balance of all Eligible Receivables relating to such Special Designated Obligor (together with its subsidiaries and Affiliates), exceeds the Applicable Special Designated Obligor Percentage of the Aggregate Unpaid Balance at such time;

(b) with respect to each Obligor other than a Special Designated Obligor, if the aggregate Unpaid Balance of all Eligible Receivables relating to such Obligor (and any other Obligor(s) aggregated with it for such purpose pursuant to the rules of construction set forth in the definitions of Group A, B and C Obligor below, respectively), exceeds the applicable percentage of the Aggregate Unpaid Balance specified below;

Group | Concentration Limit Percentage |

Group A Obligor | 20.0% |

Group B Obligor | 10.0% |

Group C Obligor | 6.67% |

Group D Obligor | if such Group D Obligor is the Largest Group D Obligor, 7.0%, otherwise, 5.0% |

(c) if the aggregate Unpaid Balance of all Extended Term Receivables 61-90 exceeds 50.0% of the Aggregate Unpaid Balance at such time;

(d) if the aggregate Unpaid Balance of all Extended Term Receivables 91-195 exceeds 35.0% of the Aggregate Unpaid Balance at such time;

(e) if the aggregate Unpaid Balance of all Eligible Extended Term Receivables 196-360 exceeds 3.5% of the Aggregate Unpaid Balance at such time;

(f) if the aggregate Unpaid Balance of all Eligible Receivables, the Obligors of which are Official Bodies, exceeds 1.0% of the Aggregate Unpaid Balance at such time;

(fg) if the aggregate Unpaid Balance of all Eligible Receivables, the Obligors of which are Eligible Foreign Obligors, exceeds 1.0% of the Aggregate Unpaid Balance at such time;

(gh) if the aggregate Unpaid Balance of all Eligible Receivables, the Obligors of which are Canadian Obligors, exceeds 3.0% of the Aggregate Unpaid Balance at such time; or

(hi) if the aggregate Unpaid Balance of all Eligible Receivables for which the related merchandise has been shipped, but has not yet been delivered, to the related Obligor exceeds 3.0% of the Aggregate Unpaid Balance at such time.

7

“Conduit Assignee” means, with respect to any Conduit Investor, any special purpose entity that finances its activities directly or indirectly through asset backed commercial paper and is administered by a Managing Agent or any of its Affiliates and designated by such Conduit Investor’s Managing Agent from time to time to accept an assignment from such Conduit Investor of all or a portion of the Net Investment.

“Conduit Investment Termination Date” means, with respect to any Conduit Investor, the date of the delivery by such Conduit Investor to the SPV of written notice that such Conduit Investor elects, in its sole discretion, to permanently cease to fund Investments hereunder.

“Conduit Investor” means Gotham and any other Person that shall become a party to this Agreement in the capacity as a “Conduit Investor” and any Conduit Assignee of any of the foregoing.

“Contract” means, in relation to any Receivable, any and all contracts, instruments, agreements, leases, invoices, notes, or other writings pursuant to which such Receivable arises or which evidence such Receivable or under which an Obligor becomes or is obligated to make payment in respect of such Receivable.

“CP Rate” is defined in Section 2.4.

“Credit and Collection Policy” means Valvoline LLC’s credit and collection policy or policies and practices relating to Receivables as in effect on the Closing Date and set forth in Exhibit B, as modified, from time to time, in compliance with Sections 6.1(a)(vii) and 6.2(c).

“CRR” means Regulation (EU) No. 575/2013 of the European Parliament and the Council of June 26, 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No. 648/2012, together with the related implementing technical standards and regulatory technical standards and any related regulatory guidance published by the European Banking Authority and adopted by the European Commission.

“Debtor Relief Laws” means the Bankruptcy Code of the United States, and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, or similar debtor relief laws of the United States or other applicable jurisdictions from time to time in effect and affecting the rights of creditors generally.

“Deemed Collections” means any Collections on any Receivable deemed to have been received pursuant to Sections 2.6.

“Deemed Financial Covenants” means any one of the “financial covenants” set forth in Section 7.11 of the Parent Credit Agreement (or any replacement or successor to such Section or any similar section or sections in any replacement senior credit agreement) as in effect immediately prior to the initial occurrence of (i) any Committed Investor and each of its Affiliates, if applicable, ceasing to be a party to the Parent Credit Agreement as a lender thereunder. or (ii) any amendment, restatement, waiver or supplement thereto to which any Managing Agent does not consent pursuant to Section 6.3.

8

withholding by presenting the obligation for payment in another member state of the European Union without any undue expense or hardship on the recipient and (i) any United States federal withholding Taxes imposed under FATCA.

“Extended Term Receivables 61-90” means all Eligible Receivables with maturities greater than 60 days but not more than 90 days.

“Extended Term Receivables 91-195” means all Eligible Receivables with maturities greater than 90 days but not more than 195 days.

“Extended Term Receivables 196-360” means all Eligible Receivables with maturities greater than 195 days but not more than 360 days.

“Facility Limit” means at any time the lesser of (i) $125,000,000 175,000,000 and (ii) the aggregate Commitments then in effect, as reduced in accordance with Section 2.16.

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with) and any current or future regulations or official interpretations thereof.

“Federal Funds Rate” is defined in Section 2.4.

“Fee Letter” means either the Master Fee Letter, any Upfront Fee Letter or any L/C Fee Letter, and “Fee Letters” means, collectively, the Master Fee Letter, all such Upfront Fee Letters and all such L/C Fee Letters.

“Final Payout Date” means the date, after the Termination Date, on which the Net Investment has been reduced to zero, all accrued Servicing Fees have been paid in full and all other Aggregate Unpaids have been paid in full in cash.

“Financial Covenant” means any one of the “financial covenants” set forth in Section 7.11 of the Parent Credit Agreement (or any replacement or successor to such Section or any similar section or sections in any replacement senior credit agreement) at such time.

“Financial Covenant Amendment” is defined in Section 6.3.

“Financial Covenant Grace Period” is defined in Section 7.5(f).

“First Tier Agreement” means the Sale Agreement, dated as of the Closing Date, among the Originators and the SPV.

“Foreign Currency Receivable” means a Foreign Receivable denominated in a currency other than Dollars.

“Foreign Receivable” means any Receivable, the Obligor of which is not a U.S. Obligor.

13

“L/C Fee Expectation” is defined in Section 2.17(g).

“L/C Fee Letter” means any confidential letter agreement among the SPV, Valvoline LLC and a Letter of Credit Issuer for the Letter of Credit Fees pursuant to Section 2.5(b).

“L/C Issuance Date” is defined in Section 2.17(b).

“L/C Request” means each request substantially in the form of Exhibit D.

“Largest Group D Obligor” means the Group D Obligor with the greatest aggregate Unpaid Balance of all Eligible Receivables relating to any Group D Obligor as of the most recent Month End Date.

“Law” means any law (including common law), constitution, statute, treaty, regulation, rule, ordinance, order, injunction, writ, decree, judgment or award of any Official Body.

“Letter of Credit” means a standby letter of credit substantially in the form of Exhibit I (as such form may be modified from time to time by a Letter of Credit Issuer in accordance with its standard business practices) issued by a Letter of Credit Issuer pursuant to Section 2.17 either as originally issued or as the same may, from time to time, be amended or otherwise modified or extended.

“Letter of Credit Application” means an application and agreement for a standby letter of credit by and between the SPV and a Letter of Credit Issuer in a form acceptable to such Letter of Credit Issuer (and customarily used by it in similar circumstances) and conformed to the terms of this Agreement, either as originally executed or as it may from time to time be supplemented, modified, amended, renewed, or extended; provided that, to the extent that the terms of such Letter of Credit Application are inconsistent with the terms of this Agreement, the terms of this Agreement shall control.

“Letter of Credit Fees” is defined in Section 2.5(b).

“Letter of Credit Issuer” means PNC, or any other Investor or Affiliate of PNC, or such other Investor so designated, and which accepts such designation, by the SPV, and which is approved by the Agent (such approval not to be unreasonably withheld, conditioned or delayed).

“Letter of Credit Liability” means the aggregate amount of the undrawn face amount of all outstanding Letters of Credit plus the amount drawn under Letters of Credit for which the Letter of Credit Issuers and the Investors, or any one or more of them, have not yet received payment or reimbursement (in the form of a conversion of such liability to Investments, or otherwise). For all purposes of this Agreement, if on any date of determination a Letter of Credit has expired by its terms but any amount may still be drawn thereunder by reason of the operation of Rule 3.14 of the ISP, such Letter of Credit shall be deemed to be “outstanding” in the amount so remaining available to be drawn.

“Letter of Credit Sublimit” means, at any time, an amount equal to the lesser of (i) $125,000,000 and (ii) the Facility Limit.

“Lien” means any mortgage, pledge, hypothecation, assignment, deposit arrangement, encumbrance, lien (statutory or other), charge, or preference, priority or other security interest or

19

“Sanctioned Person” means a Person that is, or is owned or controlled by Persons that are: (i) the subject of any Sanctions, or (ii) located, organized or resident in a Sanctioned Country.

“Sanctions” means any sanctions administered or enforced by the U.S. Department of Treasury’s Office of Foreign Assets Control, the U.S. Department of State, the United Nations Security Council, the European Union, Her Majesty’s Treasury, or other relevant sanctions authority.

“Secured Parties” means the Investors, the Letter of Credit Issuers, the Agent, each Managing Agent, each Administrator and the Program Support Providers.

“Separation Agreement” means that certain Separation Agreement by and between Ashland Global Holdings Inc. and Parent dated as of September 22, 2016, as amended from time to time.

“Servicing Fee” means the fees payable to the Master Servicer from Collections, in an amount equal to either (i) at any time when the Master Servicer is a Subsidiary of Parent, 1.0% per annum on the weighted daily average of the aggregate Unpaid Balances of the Receivables for the preceding calendar month, or (ii) at any time when the Master Servicer is not a Subsidiary of Parent, the amount determined upon the agreement of the Master Servicer, and the Agent, payable in arrears on each Settlement Date from Collections pursuant to, and subject to the priority of payments set forth in, Section 2.12. With respect to any Portion of Investment, the Servicing Fee allocable thereto shall be equal to the Servicing Fee determined as set forth above, times a fraction, the numerator of which is the amount of such Portion of Investment and the denominator of which is the Net Investment.

“Settlement Date” means (a) prior to the Termination Date, and starting in December 2017, the 15 20th day of each calendar month (or, if such day is not a Business Day, the immediately succeeding Business Day) or such other day as agreed upon in writing by the SPV and the Agent, after consultation with the Managing Agents, and (b) for any Portion of Investment on and after the Termination Date, each day selected from time to time by the Agent, after consultation with the Managing Agents (it being understood that the Agent may select such Settlement Date to occur as frequently as daily) or, in the absence of any such selection, the date which would be the Settlement Date for such Portion of Investment pursuant to clause (a) of this definition.

“Special Designated Obligor” means each of Genuine Parts Company, AutoZone, Inc., Advance Auto Parts, Inc. and any other Obligor approved as such in a written supplement to this Agreement signed by the Agent, each Managing Agent, the Master Servicer and the SPV; provided that such Special Designated Obligor status may be revoked by any Managing Agent upon ten (10) Business Day’s written notice to the SPV, at which time the affected Obligor shall be subject to the Concentration Limits as provided in clause (b) of the definition thereof. As of the Closing Date, Genuine Parts Company, AutoZone, Inc. and Advance Auto Parts, Inc. are the sole Special Designated Obligors.

“SPV” is defined in the Preamble.

26

Deemed Collection and such amount shall be applied by the Master Servicer as a Collection in accordance with Section 2.12.

(c) Repurchase Amounts. In the event the SPV at any time receives the payment in full of any Repurchase Price pursuant to Section 4.4 of the First Tier Agreement, the SPV shall immediately pay such amounts to the Master Servicer for application as a Collection in accordance with the terms and conditions hereof and, at all times prior to such payment, such amounts shall be held in trust by the SPV for the exclusive benefit of the Investors, the Managing Agents and the Agent.

SECTION 2.7 Payments and Computations, Etc. All amounts to be paid or deposited by the SPV or the Master Servicer hereunder shall be paid or deposited in accordance with the terms hereof no later than 12:00 noon on the day when due in immediately available funds without set-off or counterclaim; if such amounts are payable to the Agent or any Managing Agent (whether on behalf of any Investor or otherwise) they shall be paid or deposited in the account indicated under the heading “Payment Information” in Section 11.3, until otherwise notified by the Agent or any Managing Agent. The SPV shall, to the extent permitted by Law, pay to the Agent or the applicable Managing Agent, for the benefit of the Investors, upon demand, interest on all amounts not paid or deposited when due hereunder at the Default Rate. All computations of per annum fees hereunder shall be made on the basis of a year of 360 days for the actual number of days (including the first but excluding the last day) elapsed. Any computations made by the Agent or any Managing Agent of amounts payable by the SPV hereunder shall be binding upon the SPV absent manifest error.

SECTION 2.8 Reports. By Starting in December 2017, by no later than 4:00 p.m. on the fourth second Business Day prior to each Settlement Date, or if such day is not a Business Day then on the next succeeding Business Day (and, during the continuation of a Termination Event or a Potential Termination Event, within three (3) Business Days after a request from the Agent or any Managing Agent), the Master Servicer shall prepare and forward to the Agent and each Managing Agent a Master Servicer Report, certified by the Master Servicer. In addition to the foregoing, at such times as Parent’s unsecured debt has a public rating from S&P or Moody’s below “BB-” or “Ba3”, respectively, the Master Servicer shall be obligated to prepare and forward to the Agent and each Managing Agent a Weekly Master Servicer Report on every Thursday of each calendar week (or the next Business Day if such day is not a Business Day), certified by the Master Servicer. The reporting period covered by a Weekly Servicing Report shall be the period ending on (and including) the Friday preceding the applicable Reporting Date and beginning on (and including) the Saturday preceding such Friday.

SECTION 2.9 Accounts. Any Collections (other than Collections on Foreign Currency Receivables) received directly by the SPV, any of the Originators or the Master Servicer shall be sent promptly (but in any event within two (2) Business Days the SPV, the Master Servicer or any Originator becomes aware of the receipt of each such Collection) to a Blocked Account. If any Collections are received directly by Ashland LLC or any Affiliate thereof (including pursuant to the Separation Agreement), the SPV, the Originators and the Master Servicer shall promptly cause Ashland LLC or any Affiliate thereof to deliver such Collections to a Blocked Account following such receipt. With respect to the Receivables and any Collections thereon, the Originator and the Master Servicer shall enforce all obligations of Ashland LLC and its Affiliates

36

none or less than all the Commitments of the non-renewing Committed Investors are so assigned as provided above, then the Commitment Termination Date shall not be renewed.

SECTION 3.4 Replacement of Investor Group. Notwithstanding any other provision of the Transaction Documents and so long as no Termination Event exists and is continuing, if any Committed Investor and its Affiliates ceases to be a party to the Parent Credit Agreement as a lender thereunder and or fails to consent to the Financial Covenants, the SPV may, at its sole expense, upon written notice to the Managing Agent for such Committed Investor and the Agent, (i) remove such Committed Investor and its Investor Group as a party hereto or (ii) require such Committed Investor and its Investor Group to assign and delegate, without recourse (in accordance with and subject to the restrictions contained in, and consents required by, Section 11.8(b)), all of its interests, rights and obligations under this Agreement and the related Transaction Documents to a new or existing Committed Investor who agrees to assume such obligations, provided that:

(a) the Managing Agent for such Committed Investor shall, on behalf of its Investor Group, have received payment of an amount equal to the Aggregate Unpaids due and payable to its Investor Group hereunder and under the other Transaction Documents from the SPV in the case of a removal pursuant to clause (i) above or from the assignee and the SPV, as applicable, in the case of an assignment pursuant to clause (ii) above;

(b) in the case of an assignment pursuant to clause (ii) above, such assignment does not conflict with applicable law;

(c) a Committed Investor and its Investor Group shall not be required to be removed from this Agreement or make any such assignment or delegation if, prior thereto, as a result of a waiver or consent by such Committed Investor or otherwise, the circumstances entitling the SPV to require such removal or such assignment and delegation cease to apply;

(d) in the case of a removal pursuant to clause (i) above, the Maximum Commitment shall (x) be reduced by the corresponding amount of such Committed Investor’s Commitment and (y) if applicable, concurrently increased up to the amount of the removed Committed Investor’s Commitment by the Commitment of any existing Committed Investor that has, in its sole discretion, consented to increase its Commitment or new Committed Investor that has joined this Agreement by execution of a separate joinder agreement hereto, subject to the consent of the Managing Agents (in their sole discretion); provided that, such consent shall not be required if the SPV (with funds other than Collections (except for amounts returned to the SPV pursuant to Section 2.12(c)(vi)) has fully Cash Collateralized the Fronting Exposure with respect to such new Committed Investor and agrees that it will continue to do so in connection with each future Letter of Credit issuance hereunder; provided further that in no event shall the Maximum Commitment be reduced such that the Net Investment will exceed the Available Commitment; and

(e) such removal or assignment shall be made upon not less than ten (10) Business Days’ notice delivered by the SPV to the Managing Agent for such Committed Investor and the Agent. Any Investor required to assign pursuant to this Section 3.4 shall have no duty to procure an assignee.

50

to take, any other action under the First Tier Agreement that would reasonably be expected to result in a material adverse effect on the Agent, any Managing Agent or any Investor.

(i) Other Debt. Except as provided herein, the SPV shall not create, incur, assume or suffer to exist any Indebtedness whether current or funded, or any other expense, fee, obligation or liability other than (i) Indebtedness of the SPV representing fees, expenses and indemnities arising hereunder or under the First Tier Agreement for the purchase price of the Receivables and other Affected Assets under the First Tier Agreement, (ii) the Deferred Purchase Price payable in respect of the Receivables acquired pursuant to the First Tier Agreement and (iii) other outstanding Indebtedness, expenses, fees or obligations incurred in the ordinary course of its business each in an amount that does not exceed $13,000; provided that all reasonable legal and accounting expenses and fees incurred in connection with this Agreement shall be permitted.

(j) Payment to the Originators. The SPV shall not acquire any Receivable other than through, under, and pursuant to the terms of the First Tier Agreement, through the payment by the SPV either in cash, by increase of the capital contribution of the Originators pursuant to the First Tier Agreement, by increase in the Deferred Purchase Price or by the arrangement of Letters of Credit hereunder that support the obligations of one or more Originators (or, if applicable and permitted by the terms hereof, extending the expiration date of an existing Letter of Credit), in an amount equal to the unpaid purchase price for such Receivable as required by the terms of the First Tier Agreement.

(k) Restricted Payments. The SPV shall not (A) purchase or redeem any equity interest in the SPV, (B) prepay, purchase or redeem any Indebtedness, (C) lend or advance any funds or (D) repay any loans or advances to, for or from any of its Affiliates (the amounts described in clauses (A) through (D) being referred to as “Restricted Payments”), except that the SPV may (1) make Restricted Payments out of funds received pursuant to Section 2.2 and (2) may make other Restricted Payments (including the payment of dividends or distributions, and payments of the Deferred Purchase Price) if, after giving effect thereto, no Termination Event or Potential Termination Event shall have occurred and be continuing.

(l) Transaction Information. Unless requested by the Managing Agent for any Investor Group or unless required by Law, neither the SPV nor the Master Servicer shall provide Transaction Information to any NRSRO which to its knowledge relates to an initial credit rating of, or undertaking credit rating surveillance on, the Commercial Paper of such Managing Agent’s related Conduit Investor.

SECTION 6.3 Affirmative Covenant of Parent; Deemed Financial Covenants. If, at any time after the Closing Date November 20, 2017 and until the Final Payout Date, the Financial Covenants are amended or are otherwise varied from as set forth in the Parent Credit Agreement in effect on the Closing Date, November 20, 2017 are amended, restated, waived or supplemented, (i) Valvoline LLC shall provide copies of such changes or amendments to the Agent within three (3) Business Days following the effective date of any such changes or amendments to the Agent and each Managing Agent. So long as and (ii) such Financial Covenants for purposes of this clause shall be deemed to be also so amended, restated, waived or supplemented if (and only if) (a) each Committed Investor (or its Affiliates) is or an Affiliate, if applicable, is then a party to the Parent Credit Agreement as a lender thereunder and (b) each

68

Managing Agent consents in writing to such amendment, restatement, waiver or supplement. So long as each Managing Agent consents to such amendments, restatements, waivers and supplements, this Agreement shall not contain independent financial covenants (whether identical to those in the Parent Credit Agreement or otherwise). If (i) any Committed Investor (and its Affiliates) ceases to be a party to the Parent Credit Agreement as a lender thereunder (including due to termination or expiration of the Parent Credit Agreement without being replaced by a successor credit agreement) and such Committed Investor or (ii) any Managing Agent does not otherwise consent to the Financial Covenants, Deemed Financial Covenants shall become effective. If requested by any Investor or the Agent, the Master Servicer, the Originators and the SPV shall cooperate with the Investors to amend the provisions of this Agreement to evidence the Deemed Financial Covenants (a “Financial Covenant Amendment”); provided that in lieu of Deemed Financial Covenants becoming effective, the SPV may instead exercise its rights to remove or replace the applicable Committed Investor and its Investor Group under Section 3.4. Neither the agent nor any Investor shall require any fee to provide a waiver of any breach of a Financial Covenant or the document a Financial Covenant Amendment if such fee is in addition to the fees otherwise payable to such party as a lender under the Parent Credit Agreement (it being understood that the foregoing shall not apply to the reimbursement of the Agent for reasonable legal expenses to the extent otherwise payable under Section 9.5 hereof).

ARTICLE VII

ADMINISTRATION AND COLLECTIONS

SECTION 7.1 Appointment of Master Servicer.

(a) The servicing, administering and collection of the Receivables shall be conducted by the Person (the “Master Servicer”) so designated from time to time as Master Servicer in accordance with this Section 7.1. Each of the SPV, the Managing Agents and the Investors hereby appoints as its agent the Master Servicer, from time to time designated pursuant to this Section, to enforce its respective rights and interests in and under the Affected Assets. To the extent permitted by applicable law, each of the SPV and the Originators (to the extent not then acting as Master Servicer hereunder) hereby grants to any Master Servicer appointed hereunder an irrevocable power of attorney to take any and all steps in the SPV’s and/or such Originator’s name and on behalf of the SPV or such Originator as necessary or desirable, in the reasonable determination of the Master Servicer, to collect all amounts due under any and all Receivables, including endorsing the SPV’s and/or such Originator’s name on checks and other instruments representing Collections and enforcing such Receivables and the related Contracts and to take all such other actions set forth in this Article VII. Until the Agent gives notice to the existing Master Servicer (in accordance with this Section 7.1) of the designation of a new Master Servicer, the existing Master Servicer is hereby designated as, and hereby agrees to perform the duties and obligations of, the Master Servicer pursuant to the terms hereof. At any time following the occurrence and during the continuation of a Master Servicer Default, the Agent may upon the direction of the Managing Agents representing the Majority Investors, designate as Master Servicer any Person (including the Agent) to succeed the initial Master Servicer or any successor Master Servicer, on the condition in each case that any such Person so designated shall agree to perform the duties and obligations of the Master Servicer pursuant to the terms hereof.

69

payable or required to be prepaid (other than by a regularly scheduled payment) prior to its stated maturity; or

(d) there is entered against the Master Servicer or any Material Subsidiary thereof (i) one or more final judgments or orders for the payment of money in an aggregate amount (as to all such judgments and orders) exceeding $100,000,000 (to the extent not covered by independent third-party insurance as to which the insurer is rated at least “A” by A.M. Best Company, has been notified of the potential claim and does not dispute coverage), or (ii) any one or more non-monetary final judgments that have, or would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect and, in either case, (A) enforcement proceedings are commenced by any creditor upon such judgment or order, or (B) there is a period of ten (10) consecutive days during which a stay of enforcement of such judgment, by reason of a pending appeal or otherwise, is not in effect;

(e) any Event of Bankruptcy shall occur with respect to the Master Servicer or any of its Material Subsidiaries; or

(f) the Master Servicer breaches a breach of a Financial Covenant or a Deemed Financial Covenant, as applicable, shall occur; provided that, with respect to a breach of a Financial Covenant, (i) so long as Parent is in good faith pursuing a waiver under the Parent Credit Agreement, the breach of such Financial Covenant shall not constitute a Master Servicer Default until thirty (30) days after Parent receives notice or otherwise obtains knowledge of such breach (the “Financial Covenant Grace Period”) and (ii) to the extent any such breach of a Financial Covenant is cured by Parent or waived by the lenders under the Parent Credit Agreement within the Financial Covenant Grace Period, the related Master Servicer Default hereunder shall also be deemed waived automatically but only so long as such waiver is granted at a time when each Committed Investor (or its Affiliates) is then also a party to the Parent Credit Agreement and a majority of such Committed Investors (being those Committed Investors that hold Commitments aggregating in excess of 50% of the Facility Limit as of such date) have consented to such waiver under the Parent Credit Agreement (it being understood that the vote of Affiliates of a Committed Investor party to the Parent Credit Agreement shall be considered for purposes of determining consent).

SECTION 7.6 Servicing Fee. The Master Servicer shall be paid a Servicing Fee in accordance with 2.12 and subject to the priorities therein.

SECTION 7.7 Protection of Ownership Interest of the Investors. Each of the Originators and the SPV agrees that it shall, from time to time, at its expense, promptly execute and deliver all instruments and documents and take all actions as may be necessary or as the Agent may reasonably request in order to perfect or protect the Asset Interest or to enable the Agent, each Managing Agent or the Investors to exercise or enforce any of their respective rights hereunder. Without limiting the foregoing, each of the Originators and the SPV shall, upon the request of the Agent, any Managing Agent or any of the Investors, in order to accurately reflect the transactions evidenced by the Transaction Documents, (i) execute and file such financing or continuation statements or amendments thereto or assignments thereof (as otherwise permitted to be executed and filed pursuant hereto) as may be requested by the Agent, any Managing Agent or any of the Investors and (ii) mark its respective master data processing records and other documents with a

74

Commitment:

$75,000,000 105,000,000

PNC BANK , NATIONAL ASSOCIATION, | ||

as the Agent, as a Managing Agent and as a Committed Investor for the PNC Investor Group | ||

By: | ||

Name: | ||

Title: | ||

PNC BANK, NATIONAL ASSOCIATION, | ||

as a Letter of Credit Issuer | ||

By: | ||

Name: | ||

Title: | ||

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

S-3

PNC-Valvoline Transfer

and Administration Agreement

Commitment:

$50,000,000 70,000,000

THE BANK OF TOKYO-MITSUBISHI UFJ, | ||

LTD., NEW YORK BRANCH as a Managing | ||

Agent and Administrator for the MUFG Investor | ||

Group | ||

By: | ||

Name: | ||

Title: | ||

THE BANK OF TOKYO-MITSUBISHI UFJ, | ||

LTD., as a Committed Investor for the MUFG | ||

Investor Group | ||

By: | ||

Name: | ||

Title: | ||

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

S-4

PNC-Valvoline Transfer

PNC-Valvoline Transfer

and Administration Agreement

distributor (after giving effect to the credit and any delivery allowance) is less than the balance of the original Receivable from the distributor, such difference shall constitute Dilution); provided further that writeoffs or credits related to pricing adjustments shall not constitute Dilution so long as (a) such pricing adjustments are treated as sale reversals and (b) the applicable pricing adjustment is processed the same calendar month during which the related Receivable was generated.

“Dilution Horizon Ratio” means, for any Calculation Period, the ratio (expressed as a percentage) computed as of the most recent Month End Date by dividing (i) the aggregate initial Unpaid Balance of sales by the Originators giving rise to Receivables during (a) the calendar month ended on such Month End Date or, (b) with the approval of all Investors, the two calendar month period ended on such Month End Date by (ii) the Net Pool Balance as of such Month End Date.

“Dilution Ratio” means, for any Calculation Period, the ratio (expressed as a percentage) computed as of the most recent Month End Date of (a) the aggregate Dilution incurred during such period, divided by (b) the aggregate amount of sales by the Originators giving rise to Receivables in the month prior to the month of determination.

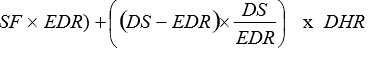

“Dilution Reserve Percentage” for any Calculation Period, a percentage equal to:

where:

SF = the Stress Factor;

EDR = the Expected Dilution Ratio;

DS = the Dilution Spike; and

DHR = the Dilution Horizon Ratio.

“Dilution Spike” means, as of any date of determination, the highest average Dilution Ratio for any three consecutive calendar months during the immediately preceding 12 calendar months.

“Expected Dilution Ratio” means, for any Calculation Period, the average of the Dilution Ratios for the 12 calendar months ending on the most recent Month End Date.

“Loss Horizon Ratio” means, for any Calculation Period, the quotient, expressed as a percentage, of (a) the aggregate initial Unpaid Balance of sales by the Originators giving rise to Receivables which arose during the period ending on the most recent Month End Date equal to six the sum of (i) two and one half (6.5) months, quarter (2.25) months plus (ii) the quotient of (x)

Schedule II- 2

the Weighted Average Remaining Credit Terms divided by (y) 30, divided by (b) the Net Pool Balance at the most recent Month End Date.

“Loss Reserve Ratio” means, for any Calculation Period, the product of (a) the Stress Factor, (b) the highest three-month average, during the twelve-month period ending on the most recent Month End Date, of the Default Ratio and (c) the Loss Horizon Ratio for such Calculation Period.

“Minimum Percentage” means, for any Calculation Period, the sum (expressed as a percentage) of (a) the Concentration Reserve Percentage, plus (b) the product of (i) the Expected Dilution Ratio and (ii) the Dilution Horizon Ratio.

“Month End Date” means the last day of each calendar month.

“Obligor Percentage” means, for any Calculation Period, for each Obligor, a fraction, expressed as a percentage and determined as of the most recent Month End Date, (a) the numerator of which is the aggregate Unpaid Balance of the Eligible Receivables of such Obligor less the amount (if any) then deducted from the Net Pool Balance pursuant to clause (b) of the definition thereof with respect to such Obligor due to the Concentration Limits and (b) the denominator of which is the Aggregate Unpaid Balance at such time.

“Required Reserves” at any time means the sum of (a) the Yield Reserve, plus (b) the Servicing Fee Reserve, plus (c) the greater of (i) the sum of the Loss Reserve Ratio and the Dilution Reserve Percentage and (ii) the Minimum Percentage, each as in effect at such time, multiplied by the Net Pool Balance on such date.

“Servicing Fee Reserve” means, at any time, an amount equal to the product of (a) the current Servicing Fee times, (b) the product of (i) a fraction, the numerator of which is the highest monthly Days Sales Outstanding during the last 12 calendar months and the denominator of which is 360 multiplied by (ii) the Net Pool Balance.

“Stress Factor” means 2.25.

“Yield Reserve” means, as of any date of determination, an amount equal to (a) the product of (i) 2 times (ii) the Days Sales Outstanding in effect on such date times (iii) the sum of the Offshore Rate in effect on such date (as determined by the Agent) plus 2%, divided by (b) 360, multiplied by (c) the Net Pool Balance on such date.

“Weighted Average Remaining Credit Terms” means, for any Calculation Period, the weighted average of remaining days until the due date for any Receivables outstanding as of such date.

Schedule II- 3

SCHEDULE 1.1

ELIGIBLE RECEIVABLES PAYMENT TERMS FOR CERTAIN OBLIGORS

Obligor | Payment Terms |

Advance Auto Parts, Inc. | Within (a) Prior to January 1, 2018, within 100 |

days of the original billing date and (b) on and | |

after January 1, 2018, within 110 days of the original billing date | |

AutoZone, Inc. | Within 120 days of the original billing date |

Genuine Parts Company d/b/a NAPA | Within 195 days of the original billing date |

Ozark Purchasing LLC | Within 360 days of the original billing date |

1.1-1

SCHEDULE 4.1(i)

Location of Certain Offices and Records

Principal Place of Business: SPV:

3475 Blazer Parkway 100 Valvoline Way, Suite 3001

Lexington, Kentucky 40509

Initial Master Servicer:

3499 Blazer Parkway

100 Valvoline Way

Lexington, Kentucky 40509

Chief Executive Office: SPV:

3475 Blazer Parkway 100 Valvoline Way, Suite 3001

Lexington, Kentucky 40509

Initial Master Servicer:

3499 Blazer Parkway

100 Valvoline Way

Lexington, Kentucky 40509

Location of Records: SPV:

3475 Blazer Parkway 100 Valvoline Way, Suite 3001

Lexington, Kentucky 40509

Initial Master Servicer:

3499 Blazer Parkway

100 Valvoline Way

Lexington, Kentucky 40509

4.1(i)- 1

SCHEDULE 11.3

Address and Payment Information

If to the Conduit Investor:

Gotham Funding Corporation

c/o The Bank of Tokyo-Mitsubishi UFJ, Ltd.

1221 Avenue of Americas

New York, NY 10020

Attention: Securitization Group - Eric Williams / Katherine

Connolly/Aditya Reddy

Telephone: (212) 792-4910 / (212) 782-4628 / (212) 782-6957

Email: securitization_reporting@us.mufg.jp

ewilliams@us.mufg.jp

areddy@us.mufg.jp

kconnolly@us.mufg.jp

If to the SPV:

LEX Capital LLC

3475 Blazer Parkway 100 Valvoline Way, Suite 3001

Lexington, Kentucky 40509

Attention: Lynn P. Freeman, President

Telephone: (859) 357-7556

Email: lpfreeman@valvoline.com

Payment Information:

Citibank, N.A.

Branch: Citibank New York

SWIFT: CITIUS33

ABA: 021000089

Address: 11 Wall Street, New York, NY 10043 (USA)

Account Number: 31021912

Account Name: LEX Capital LLC

If to the Originators:

[Originator Name]

c/o Valvoline LLC

3499 Blazer Parkway 100 Valvoline Way

Lexington, Kentucky 40509

Attention: Lynn P. Freeman

Telephone: (859) 357-7444

11.3- 1

Email: lpfreeman@valvoline.com

If to the Master Servicer:

Valvoline LLC

3499 Blazer Parkway 100 Valvoline Way

Lexington, Kentucky 40509

Attention: Lynn P. Freeman

Telephone: (859) 357-7444

Email: lpfreeman@valvoline.com

If to the Agent:

PNC Bank, National Association

300 Fifth Avenue, 11th Floor

Pittsburgh, PA 15222-2707

Attention: Robyn Reeher

Telephone: 412-768-3090

Email: robyn.reeher@pnc.com

If to the Gotham Administrator:

The Bank of Tokyo-Mitsubishi UFJ, Ltd.,

as Administrator

1221 Avenue of Americas

New York, NY 10020

Attention: MUFG Securitization Group / Eric Williams /Katherine

Connnolly

Telephone: (212) 792-4910 / (212) 782-4628/ (201) 413-8138

Email: securitization_reporting@us.mufg.jp

ewilliams@us.mufg.jp

kconnolly@us.mufg.jp

Payment Information:

Bank: The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York

Branch

ABA#: 026-009-632

Account: Gotham Funding Corporation

Account #: 310-035-147

Reference: Valvoline LEX Capital LLC)

If to the Managing Agent for the PNC Investor Group:

PNC Bank, National Association

300 Fifth Avenue, 11th Floor

Pittsburgh, PA 15222-2707

11.3- 2

Exhibit C

Form of Investment Request

LEX Capital LLC (the “SPV”), pursuant to Section 2.2(a) of the Transfer and Administration Agreement, dated as of November 29, 2016 (as amended, modified, or supplemented from time to time, the “Agreement”), among LEX Capital LLC, as transferor (in such capacity, the “SPV”), the Originators party thereto, Valvoline LLC, as master servicer (in such capacity, the “Master Servicer”), PNC Bank, National Association, as agent, and each of the Conduit Investors, Committed Investors, Managing Agents and Administrators from time to time parties thereto, hereby requests that the Investors effect an Investment from it pursuant to the following instructions:

Investment Date:[___________________________________]

Purchase Price:[ ___________________________________]2

PNC Bank, National Association: $[______] ([___]% of Purchase Price)

The Bank of Tokyo-Mitsubishi UFJ, Ltd.,

New York Branch : $[______] ([___]% of Purchase Price)

[Add appropriate level of detail for calculation of Purchase Price]

Account to be credited:

[bank name]

ABA No.[ _____________________________________]

Account No. [_________________________________]

Reference No.[ _______________________________]

Please credit the above-mentioned account on the Investment Date. Capitalized terms used herein and not otherwise defined herein have the meaning assigned to them in the Agreement.

The SPV hereby certifies as of the date hereof that the conditions precedent to such Investment set forth in Section 5.2 of the Agreement have been satisfied, and that all of the representations and warranties made in Section 4.1 of the Agreement are true and correct in all material respects (except those representations and warranties qualified by materiality or by reference to a material adverse effect, which are true and correct in all respects), with respect to on and as of the Investment Date, both before and after giving effect to the Investment (unless such representations or warranties specifically refer to a previous day, in which case, they shall be complete and correct in all material respects (or, with respect to such representations or warranties as are qualified by materiality or by reference to a material adverse effect, complete and correct in all respects) on and as of such previous day).

2 At least $1,000,000 and in integral multiples of $100,000. Please break-out applicable amounts and

percentages per Investor Group as provided below Purchase Price.

Exhibit C- 1

Exhibit D

Form of L/C Request

[DATE]

PNC Bank, National Association

[________________]

[________________]

Attention: [_______________]

Tel. No.: (____) ____-_____

Email: [_______________]

Ladies and Gentlemen:

This Request for Letter of Credit (this “Request for Letter of Credit”) is executed and delivered by LEX Capital LLC (the “SPV”) to PNC Bank, National Association (“PNC”), pursuant to Section 2.17 of that certain Transfer and Administration Agreement (as amended, modified, supplemented, or restated from time to time, the “Agreement”) dated as of November 29, 2016, entered into by and among the SPV, Valvoline LLC, as an Originator and as initial Master Servicer, and each other Originator from time to time party thereto, Gotham Funding Corporation, as a Conduit Investor and an Uncommitted Investors, PNC, as Agent, a Letter of Credit Issuer, a Managing Agent and a Committed Investor, The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, as a Managing Agent, an Administrator and a Committed Investor, and the various Investor Groups, Managing Agents, Letter of Credit Issuers and Administrators from time to time party thereto. Capitalized terms not defined herein shall have the meanings assigned to such terms in the Agreement. SPV has contemporaneously executed and delivered to the Agent for each of the Letter of Credit Issuers a Letter of Credit Application dated [DATE]. In the event of a conflict between the terms of the Agreement and said Letter of Credit Application, the terms of the Agreement will control.

1. | SPV hereby requests that [___________], as Letter of Credit Issuer, [issue][amend] a Letter of Credit as follows: |

For issuances: | |

Proposed Issuance Date: | |

Stated Amount: | $ |

Expiry Date: | |

Beneficiary Name and Address: | |

Exhibit D- 1

Exhibit E

Form of Originator Joinder Agreement

This JOINDER AGREEMENT (this “Joinder”) is made as of _______, 20__.

Reference is made to (i) that certain Transfer and Administration Agreement (as amended, modified, supplemented, or restated from time to time, the “Transfer and Adminisration Agreement”) dated as of November 29, 2016, entered into by and among the LEX Capital LLC (the “SPV”), Valvoline LLC, as an Originator and as initial Master Servicer, and each other Originator from time to time party thereto, Gotham Funding Corporation, as a Conduit Investor and an Uncommitted Investor, PNC Bank, National Association, as Agent, a Letter of Credit Issuer, a Managing Agent, and a Committed Investor, The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch as a Managing Agent, an Administrator and a Committed Investor, and the various Investor Groups, Managing Agents, Letter of Credit Issuers and Administrators from time to time party thereto; and (ii) the certain Sale Agreement (as amended, modified, supplemented, or restated from time to time, the “Sale Agreement”) dated as of November 29, 2016, entered into by and among the Originators and the SPV. Terms defined in the Transfer and Administration Agreement and the Sale Agreement are used herein with the same meaning.

The “New Originator[s]” referred to on Schedule 1 hereby agree as follows:

Each New Originator agrees to become an Originator and to be bound by the terms of the Transfer and Administration Agreement, the Sale Agreement and each of the other Transaction Documents.

Each New Originator: (a) confirms that it has received a copy of the Transfer and Administration Agreement, the Sale Agreement and the other Transaction Documents, and such other documents and information as it has deemed appropriate to make its own analysis and decision to enter into this Joinder; (b) agrees that it will perform in accordance with their terms all of the obligations that by the terms of the Transfer and Administration Agreement, the Sale Agreement and the other Transaction Documents are required to be performed by it as an Originator; and (c) represents and warrants to the SPV and the Secured Parties that each of the representations and warranties set forth in Sections 5.1 and 5.2 of the Sale Agreement as supplemented by Schedule 1 are true and correct with respect to itself as of the date hereof, except to the extent such representations or warranties relate to an earlier date, in which case such representations and warranties are true and correct as of such earlier date.

This Joinder shall be effective on the date (the “Effective Date”) that the Agent shall have received: (a) a fully executed copy of this Joinder; (b) such officer certificates and legal opinions as it may reasonably request; (c) UCC search results and filings, reasonably acceptable to the Agent; (d) its reasonable costs incurred in connection with this Joinder, including any applicable fees of its legal counsel; and (e) such other documentation or information as the Agent may request in its reasonable discretion.

Exhibit E- 1

ACCEPTED AND APPROVED:

VALVOLINE LLC, | ||

as Master Servicer | ||

By: | ||

Name: | ||

Title: | ||

PNC BANK, NATIONAL ASSOCIATION, | ||

as the Agent and as a Managing Agent | ||

By: | ||

Name: | ||

Title: | ||

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD, NEW YORK BRANCH | |||

as a Managing Agent | |||

By: | |||

Name: | |||

Title: | |||

Exhibit J

Form of Optional Reduction Notice

[DATE]

To: Managing Agents

Ladies and Gentlemen:

This Optional Reduction Notice (this “Optional Reduction Notice”) is executed and delivered by LEX Capital LLC (the “SPV”) to the Managing Agents pursuant to Section 2.13(b) of that certain Transfer and Administration Agreement (as amended, modified, supplemented, or restated from time to time, the “Agreement”) dated as of November 29, 2016, entered into by and among the SPV, Valvoline LLC, as an Originator and as initial Master Servicer, and each other Originator from time to time party thereto, Gotham Funding Corporation, as a Conduit Investor and an Uncommitted Investor, PNC Bank, National Association, as Agent, a Letter of Credit Issuer, a Managing Agent and a Committed Investor, The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, as a Managing Agent, an Administrator and a Committed Investor, and the various Investor Groups, Managing Agents, Letter of Credit Issuers and Administrators from time to time party thereto. Capitalized terms not defined herein shall have the meanings assigned to such terms in the Agreement.

The SPV hereby gives notice that it will reduce the Net Investment outstanding under the Agreement (the “Reduction”), and in connection therewith sets forth below the terms on which the Reduction is to be made:

1. Date of Reduction:3______________________________________

2. Amount of Reduction:4____________________________________

PNC Bank, National Association: $[______] ([___]% of Reduction)

The Bank of Tokyo-Mitsubishi UFJ, Ltd. $[______] ([___]% of Reduction)

REMAINDER OF PAGE INTENTIONALLY LEFT BLANK.

SIGNATURE PAGE(S) FOLLOW(S).

3Reductions require one (1) Business Day’s prior notice received by 3:00 p.m.

4Reduction shall be in the minimum amount of $1,000,000.

Exhibit J- 1