Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNIVERSAL TECHNICAL INSTITUTE INC | feb2018investorpresentatio.htm |

Investor Presentation

Kim McWaters, President & CEO

Bryce Peterson, CFO

February 8, 2018

2

This presentation may contain forward-looking

statements regarding events or future financial

performance. These statements are only

predictions and the actual events or results may

differ materially. For important factors that could

cause actual results to differ materially from

those contained in our forward-looking

statements, please refer to the Company’s filings

with the Securities and Exchange Commission.

Safe harbor

2

3

• 50+ years of training technicians

• 200,000+ graduates

• 30+ leading manufacturer partners

- BMW, Cummins, Ford, Harley-Davidson

• 86% graduate employment rate 1

• $324.3 million in revenue in fiscal 2017

• $93.3 million in cash & equivalents/investments 2

• NYSE: UTI

Nation’s leading provider of skilled

transportation technicians

1UTI employment rate for 2016 graduates who were employed within one year of graduation was 86%. See UTI’s 10-K for additional information. For 2016, we had

approximately 9,200 total graduates, of which approximately 8,600 were available for employment. Of those graduates available for employment, approximately 7,400 were

employed within one year of their graduation date, for a total of 86%.

2December 31, 2017

4

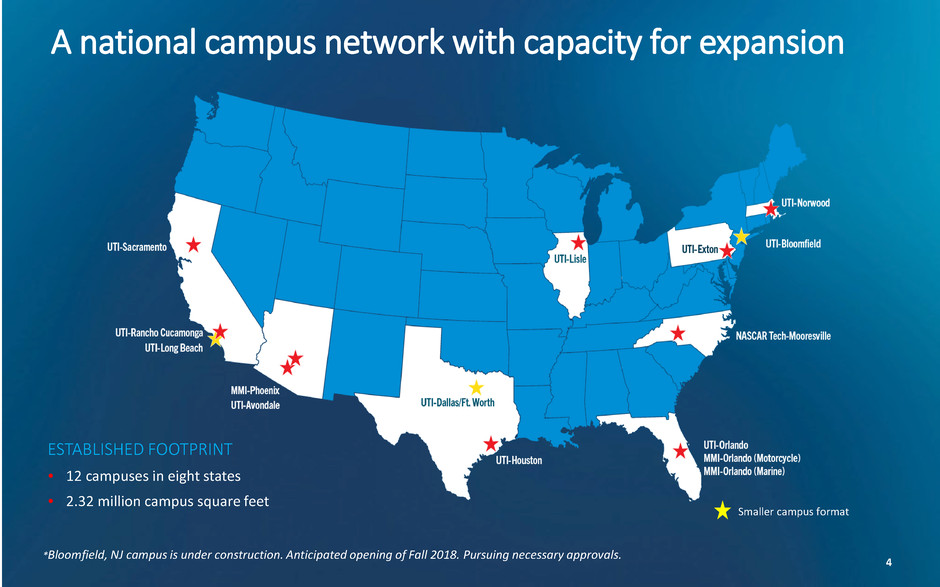

A national campus network with capacity for expansion

Smaller campus format

ESTABLISHED FOOTPRINT

• 12 campuses in eight states

• 2.32 million campus square feet

*Bloomfield, NJ campus is under construction. Anticipated opening of Fall 2018. Pursuing necessary approvals.

5

Impressive training facilities

Dallas/Fort Worth campus

6

State-of-the-industry vehicles and technology

Long Beach, Calif. campus

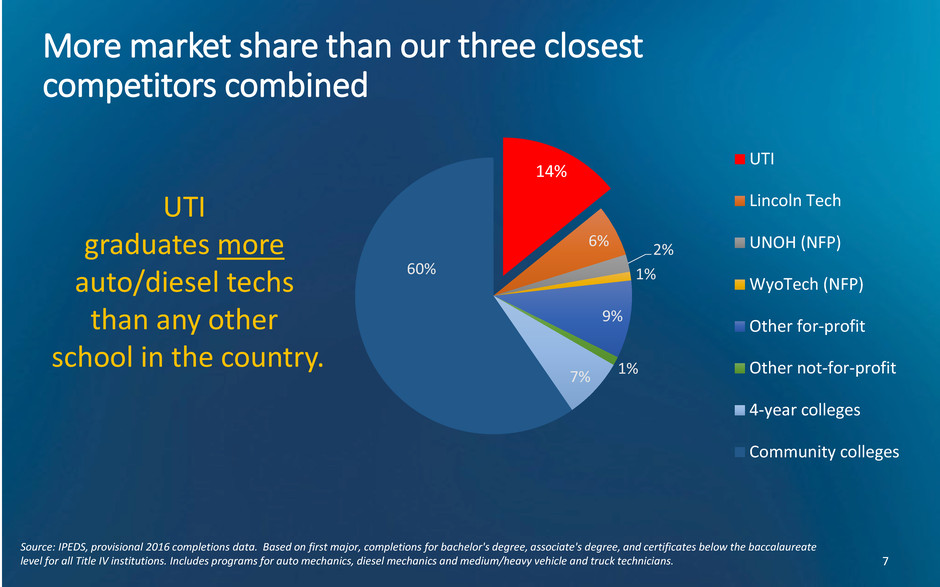

14%

6% 2%

1%

9%

1% 7%

60%

UTI

Lincoln Tech

UNOH (NFP)

WyoTech (NFP)

Other for-profit

Other not-for-profit

4-year colleges

Community colleges

7

Source: IPEDS, provisional 2016 completions data. Based on first major, completions for bachelor's degree, associate's degree, and certificates below the baccalaureate

level for all Title IV institutions. Includes programs for auto mechanics, diesel mechanics and medium/heavy vehicle and truck technicians.

More market share than our three closest

competitors combined

UTI

graduates more

auto/diesel techs

than any other

school in the country.

8

Partnerships with the world’s leading manufacturers

86%

graduate

employment rate*

*UTI employment rate for 2016 graduates who were employed within one year of graduation was 86%. See UTI’s 10-K for additional information. For 2016, we had

approximately 9,200 total graduates, of which approximately 8,600 were available for employment. Of those graduates available for employment, approximately

7,400 were employed within one year of their graduation date, for a total of 86%.

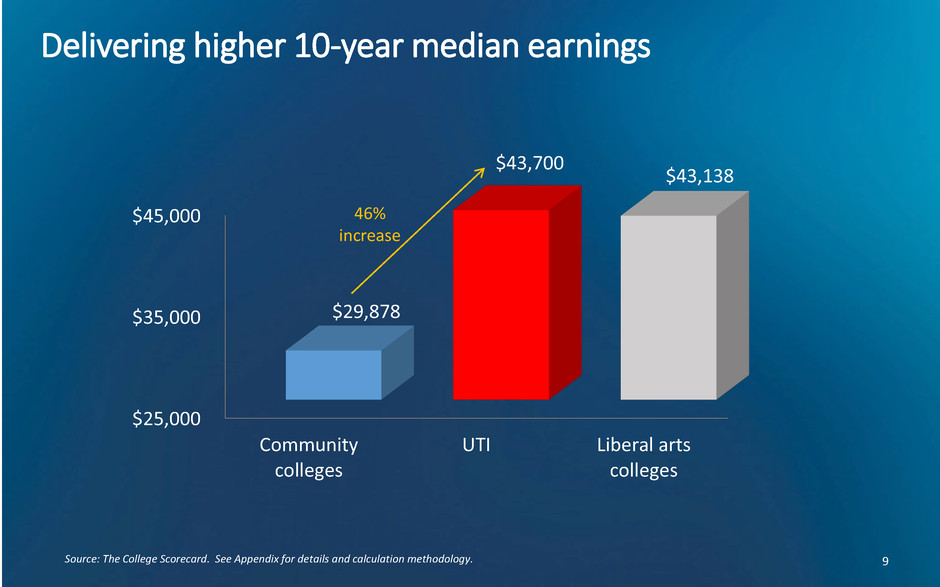

$25,000

$35,000

$45,000

Community

colleges

UTI Liberal arts

colleges

$29,878

$43,700

$43,138

Delivering higher 10-year median earnings

Source: The College Scorecard. See Appendix for details and calculation methodology.

46%

increase

9

10

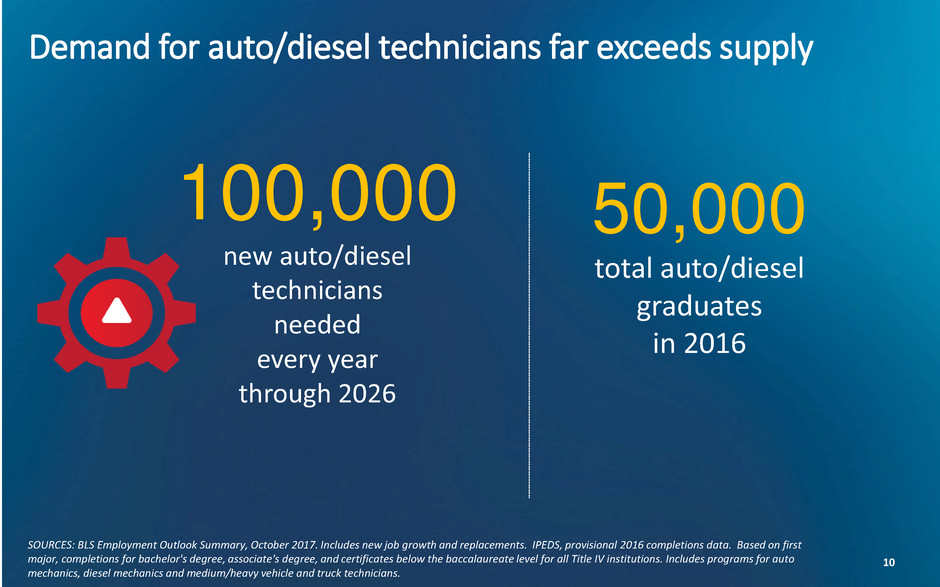

Demand for auto/diesel technicians far exceeds supply

100,000

new auto/diesel

technicians

needed

every year

through 2026

SOURCES: BLS Employment Outlook Summary, October 2017. Includes new job growth and replacements. IPEDS, provisional 2016 completions data. Based on first

major, completions for bachelor's degree, associate's degree, and certificates below the baccalaureate level for all Title IV institutions. Includes programs for auto

mechanics, diesel mechanics and medium/heavy vehicle and truck technicians.

50,000

total auto/diesel

graduates

in 2016

11

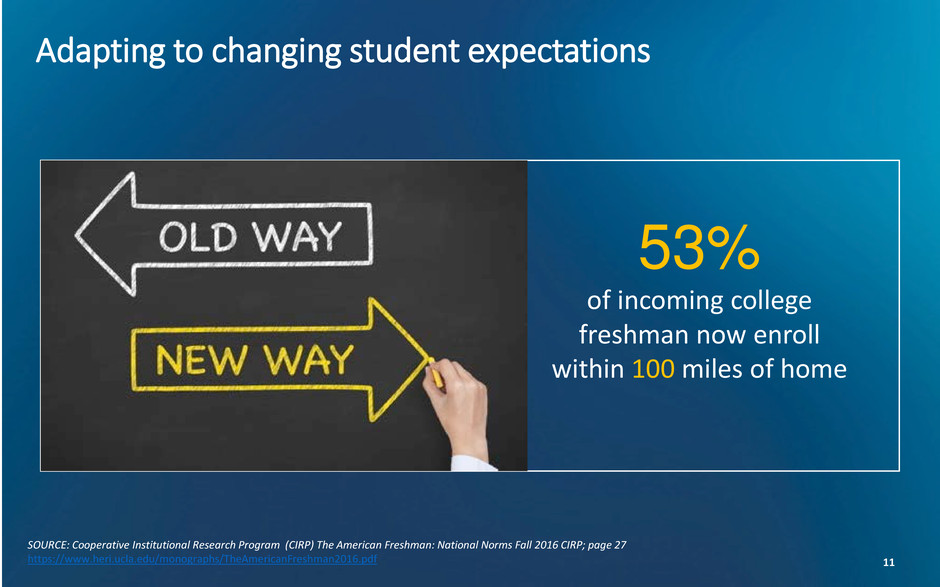

Adapting to changing student expectations

53%

of incoming college

freshman now enroll

within 100 miles of home

SOURCE: Cooperative Institutional Research Program (CIRP) The American Freshman: National Norms Fall 2016 CIRP; page 27

https://www.heri.ucla.edu/monographs/TheAmericanFreshman2016.pdf

12

Transitioning from destination to commuter campus model

DALLAS 2010

• 100-150K square feet, depending on program offerings

• Average student capacity of 750

• ~$10-$15 million capital investment

• Accretive to earnings in 18 months

• Cumulative cash flow breakeven by year 4

LONG BEACH 2015

13

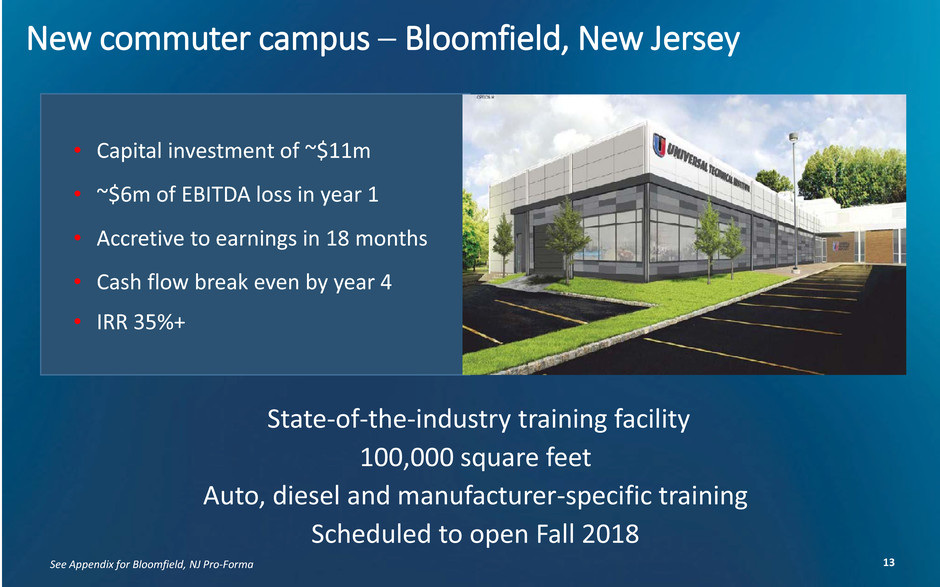

New commuter campus – Bloomfield, New Jersey

• Capital investment of ~$11m

• ~$6m of EBITDA loss in year 1

• Accretive to earnings in 18 months

• Cash flow break even by year 4

• IRR 35%+

See Appendix for Bloomfield, NJ Pro-Forma

State-of-the-industry training facility

100,000 square feet

Auto, diesel and manufacturer-specific training

Scheduled to open Fall 2018

14

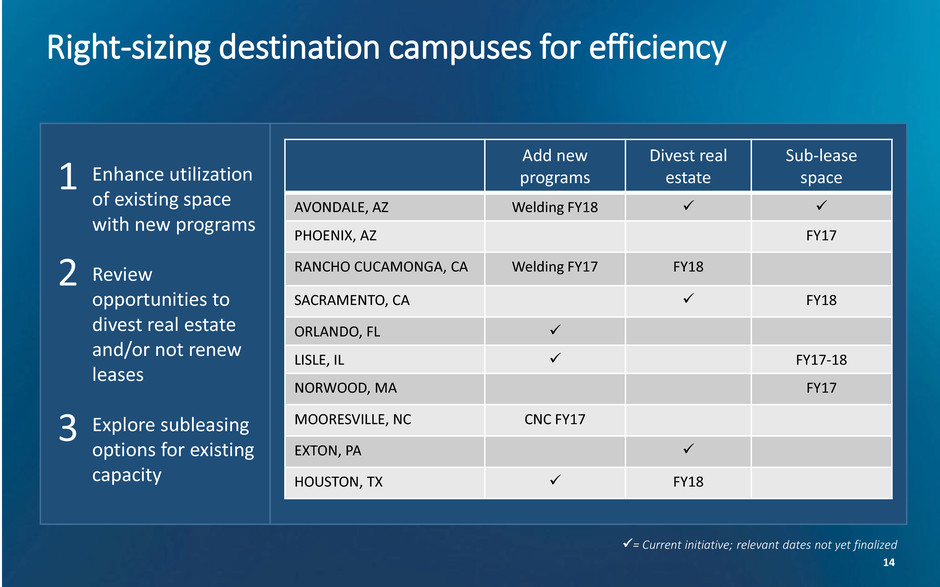

Enhance utilization

of existing space

with new programs

Review

opportunities to

divest real estate

and/or not renew

leases

Explore subleasing

options for existing

capacity

Right-sizing destination campuses for efficiency

= Current initiative; relevant dates not yet finalized

AVONDALE, AZ Welding FY18

PHOENIX, AZ FY17

RANCHO CUCAMONGA, CA Welding FY17 FY18

SACRAMENTO, CA FY18

ORLANDO, FL

LISLE, IL FY17-18

NORWOOD, MA FY17

MOORESVILLE, NC CNC FY17

EXTON, PA

HOUSTON, TX FY18

Add new

programs

Divest real

estate

Sub-lease

space 1

3

2

15

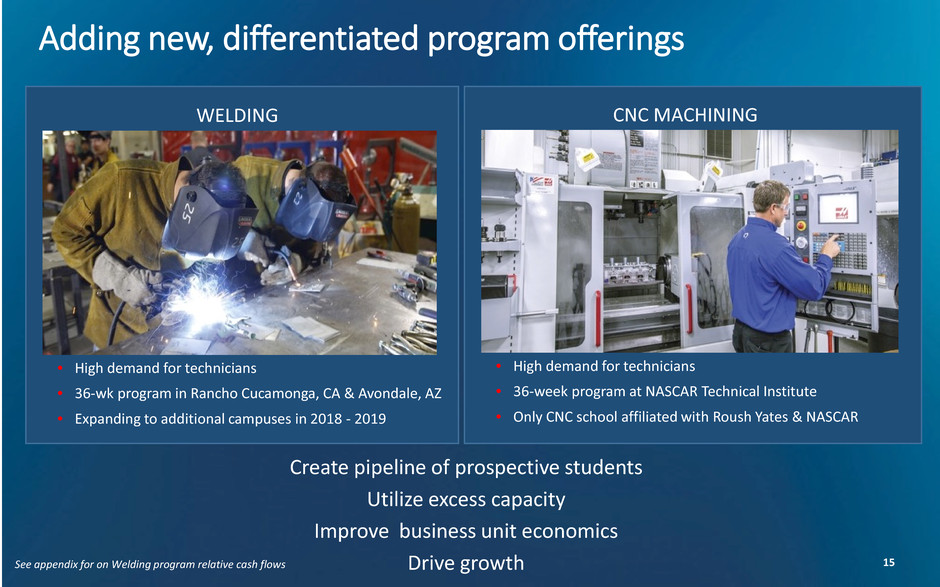

Adding new, differentiated program offerings

CNC MACHINING

• High demand for technicians

• 36-week program at NASCAR Technical Institute

• Only CNC school affiliated with Roush Yates & NASCAR

WELDING

• High demand for technicians

• 36-wk program in Rancho Cucamonga, CA & Avondale, AZ

• Expanding to additional campuses in 2018 - 2019

Create pipeline of prospective students

Utilize excess capacity

Improve business unit economics

Drive growth

See appendix for on Welding program relative cash flows

16

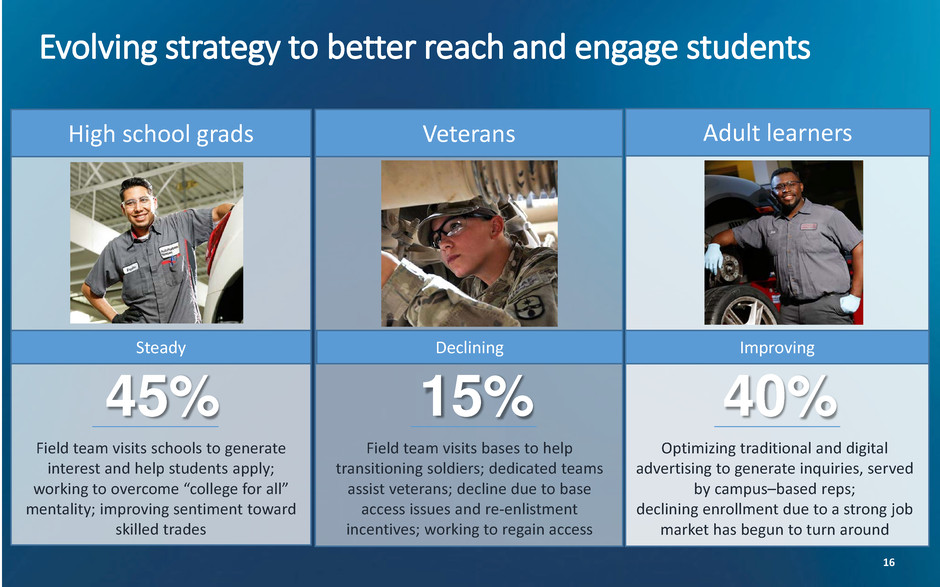

Evolving strategy to better reach and engage students

HIGH SCHOOL GRADS ADULT LEARNERS

Steady Declining Improving

45% 15% 40%

igh school grads Veterans dult learners

Field team visits schools to generate

interest and help students apply;

working to overcome “college for all”

mentality; improving sentiment toward

skilled trades

Field team visits bases to help

transitioning soldiers; dedicated teams

assist veterans; decline due to base

access issues and re-enlistment

incentives; working to regain access

Optimizing traditional and digital

advertising to generate inquiries, served

by campus–based reps;

declining enrollment due to a strong job

market has begun to turn around

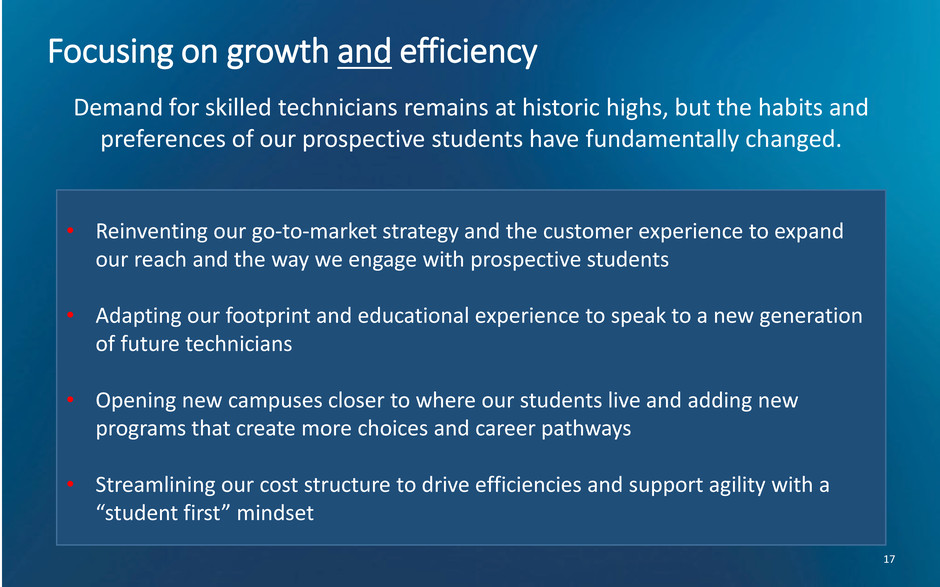

Focusing on growth and efficiency

17

Demand for skilled technicians remains at historic highs, but the habits and

preferences of our prospective students have fundamentally changed.

• Reinventing our go-to-market strategy and the customer experience to expand

our reach and the way we engage with prospective students

• Adapting our footprint and educational experience to speak to a new generation

of future technicians

• Opening new campuses closer to where our students live and adding new

programs that create more choices and career pathways

• Streamlining our cost structure to drive efficiencies and support agility with a

“student first” mindset

2016 – recapitalized our business to enable our future growth strategy

2017 – implemented our Financial Improvement Plan to drive cost efficiencies

2018 – investing to:

• open Bloomfield, New Jersey campus

• expand welding program to new locations

• re-tool marketing and student recruitment efforts

• drive cost efficiencies across the organization

• rationalize footprint to drive $3-4m in annualized savings in future years

Q1 2018 trends:

• positive student response to new campus and programs

• leading indicators suggest marketing optimizations are working

• new student starts and key financial metrics exceeding plan

Stabilizing the business and investing for growth

18

19

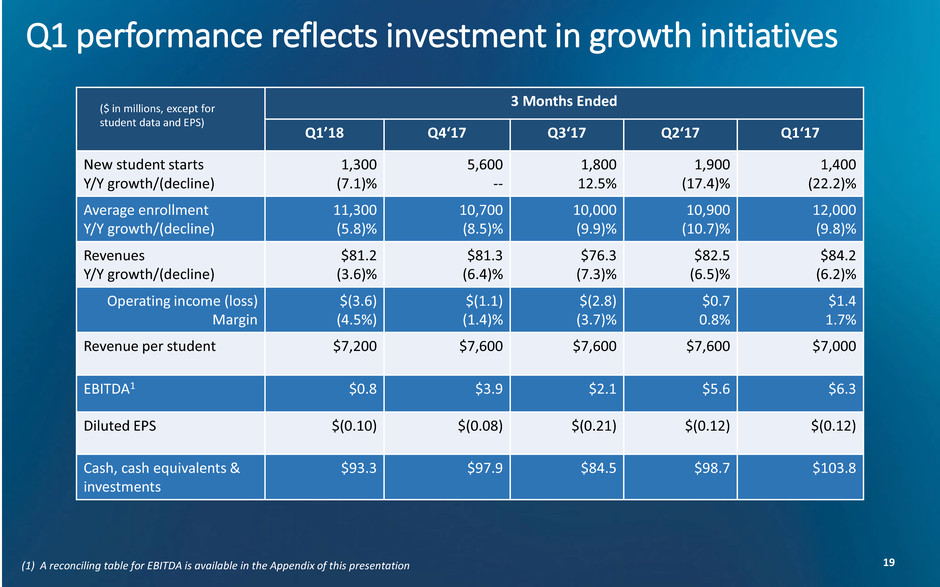

Q1 performance reflects investment in growth initiatives

(1) A reconciling table for EBITDA is available in the Appendix of this presentation

3 Months Ended

Q1’18 Q4‘17 Q3‘17 Q2‘17 Q1‘17

New student starts

Y/Y growth/(decline)

1,300

(7.1)%

5,600

--

1,800

12.5%

1,900

(17.4)%

1,400

(22.2)%

Average enrollment

Y/Y growth/(decline)

11,300

(5.8)%

10,700

(8.5)%

10,000

(9.9)%

10,900

(10.7)%

12,000

(9.8)%

Revenues

Y/Y growth/(decline)

$81.2

(3.6)%

$81.3

(6.4)%

$76.3

(7.3)%

$82.5

(6.5)%

$84.2

(6.2)%

Operating income (loss)

Margin

$(3.6)

(4.5%)

$(1.1)

(1.4)%

$(2.8)

(3.7)%

$0.7

0.8%

$1.4

1.7%

Revenue per student $7,200 $7,600 $7,600 $7,600 $7,000

EBITDA1 $0.8 $3.9 $2.1 $5.6 $6.3

Diluted EPS $(0.10) $(0.08) $(0.21) $(0.12) $(0.12)

Cash, cash equivalents &

investments

$93.3 $97.9 $84.5 $98.7 $103.8

($ in millions, except for

student data and EPS)

20

2018 financial outlook

• Start growth: low single digits; weighted toward back

of year

• Average population: down mid-single digits

• Revenue: $310 – $320 million

• Operating expenses: $340 – $345 million

• Operating loss: $20 – $25 million; negative EBITDA

due to revenue decline and investments in:

- New Jersey campus

- welding program(s)

- initiatives to drive start growth in 2018, 2019

• Capital expenditures: $24 million – $25 million

21

Strong and growing end-market demand

Strong student value proposition

Business is stabilizing; enrollment near inflection point

Why invest in UTI

Leader in transportation technician training

Industry partnerships that create competitive advantage

Investing in strengths to drive growth

Subsiding regulatory headwinds

Appendix

23

Management team – more than 140 combined years of

education experience

Kim McWaters

• Education

industry

experience:

business

strategy,

operations,

marketing and

admissions

President & CEO

Bryce Peterson

• Education

industry

experience:

finance,

accounting,

compliance,

and information

technology

EVP & CFO

• Education

industry

experience:

human capital

management

SVP People

Services

Rhonda Turner

EVP & General

Counsel

• Education

industry

experience:

governance,

regulatory/SEC

compliance,

corporate

development,

mergers and

acquisitions

Chad Freed

EVP Admissions

& Operations

• Education

industry

experience:

campus

operations

including

education and

admissions

Sherrell Smith

EVP & CMO

• Education

industry

experience:

marketing and

admissions

Piper Jameson

EVP & COO

• Education

industry

experience:

digital learning

technology,

product

development,

business

development

and sales

Jerome Grant

24

A highly qualified Board of Directors

Robert DeVincenzi

Non-Executive Chairman,

Universal Technical Institute;

Principal, Lupine Ventures;

Former President and CEO of

Redflex Holdings Ltd.

William J. Lennox, Jr.

Former Superintendent of

the United States Military

Academy at West Point;

President, Saint Leo

University

Conrad A. Conrad

Former Executive Vice

President and Chief

Financial Officer, The

Dial Corporation

Chris Shackelton

Managing Partner,

Coliseum Capital

Management

David Blaszkiewicz

President and Chief

Executive Officer,

Invest Detroit

Kenneth R. Trammell

Chief Financial Officer,

Tenneco Inc.

Former President,

Young and Rubicam

Advertising

Linda J. Srere Roger S. Penske

Chairman, Penske

Automotive Group,

Inc.

Kimberly McWaters

President and Chief Executive

Officer, Universal Technical

Institute

Roderick Paige

Former U.S.

Secretary of

Education; Interim

President, Jackson

State University

John C. White

Former Chairman, Universal

Technical Institute, Inc.;

Founder, Motorcycle

Mechanics Institute

25

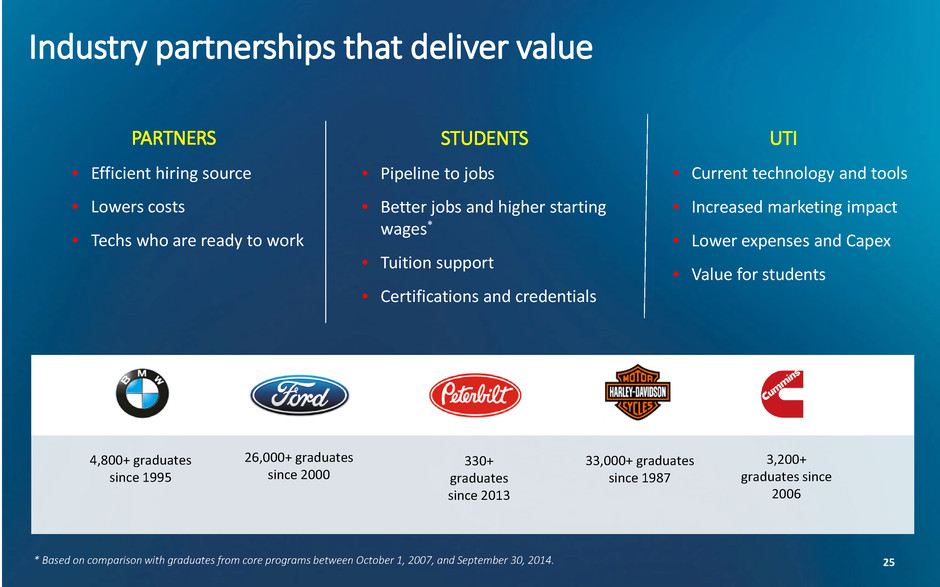

Industry partnerships that deliver value

* Based on comparison with graduates from core programs between October 1, 2007, and September 30, 2014.

PARTNERS

• Efficient hiring source

• Lowers costs

• Techs who are ready to work

UTI

• Current technology and tools

• Increased marketing impact

• Lower expenses and Capex

• Value for students

STUDENTS

• Pipeline to jobs

• Better jobs and higher starting

wages*

• Tuition support

• Certifications and credentials

4,800+ graduates

since 1995

33,000+ graduates

since 1987

330+

graduates

since 2013

26,000+ graduates

since 2000

3,200+

graduates since

2006

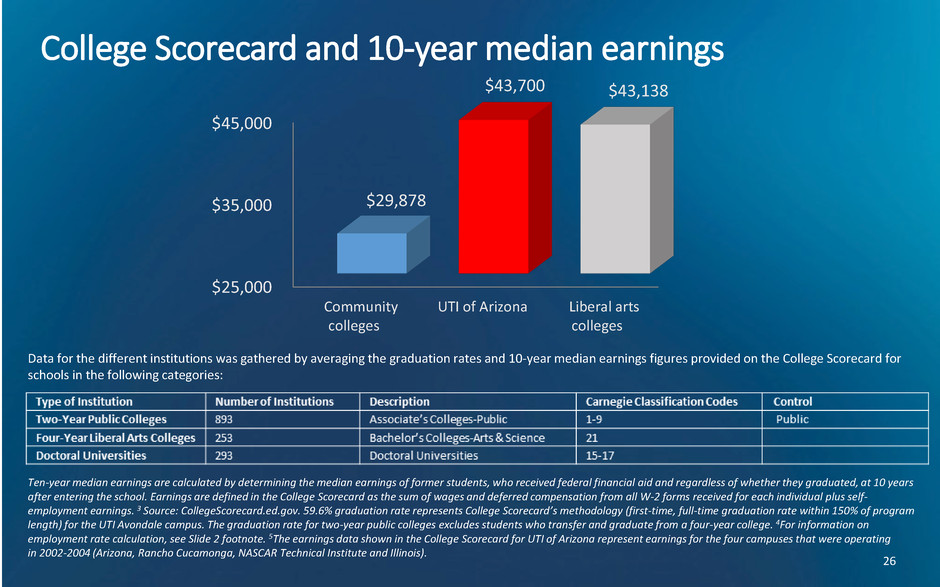

College Scorecard and 10-year median earnings

Data for the different institutions was gathered by averaging the graduation rates and 10-year median earnings figures provided on the College Scorecard for

schools in the following categories:

Ten-year median earnings are calculated by determining the median earnings of former students, who received federal financial aid and regardless of whether they graduated, at 10 years

after entering the school. Earnings are defined in the College Scorecard as the sum of wages and deferred compensation from all W-2 forms received for each individual plus self-

employment earnings. 3 Source: CollegeScorecard.ed.gov. 59.6% graduation rate represents College Scorecard’s methodology (first-time, full-time graduation rate within 150% of program

length) for the UTI Avondale campus. The graduation rate for two-year public colleges excludes students who transfer and graduate from a four-year college. 4For information on

employment rate calculation, see Slide 2 footnote. 5The earnings data shown in the College Scorecard for UTI of Arizona represent earnings for the four campuses that were operating

in 2002-2004 (Arizona, Rancho Cucamonga, NASCAR Technical Institute and Illinois).

$25,000

$35,000

$45,000

Community

colleges

UTI of Arizona Liberal arts

colleges

$29,878

$43,700 $43,138

26

27

200

250

300

350

400

450

500

550

600

650

UTI Competitor

0

200

400

600

800

1000

1200

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

-P

re

lim

UTI Competitor

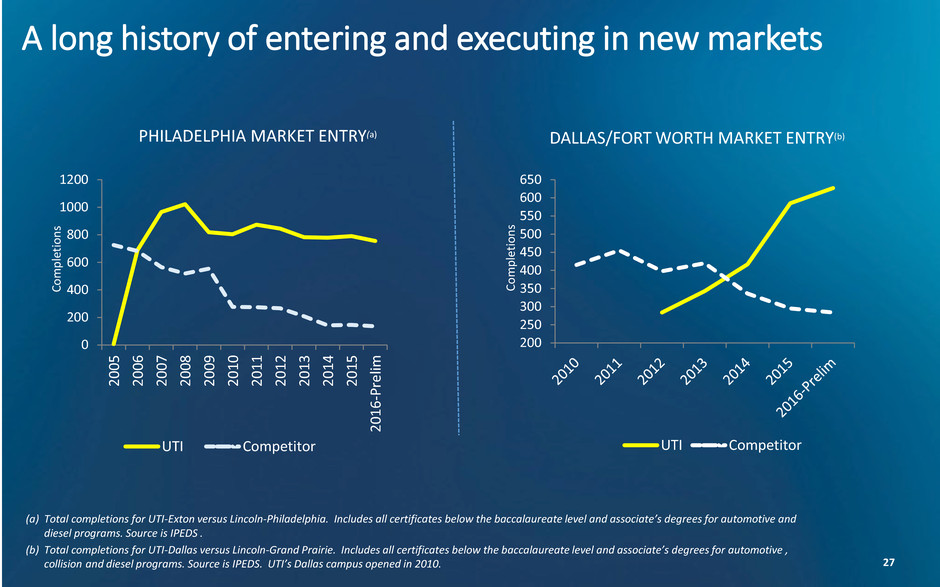

A long history of entering and executing in new markets

PHILADELPHIA MARKET ENTRY(a) DALLAS/FORT WORTH MARKET ENTRY(b)

(a) Total completions for UTI-Exton versus Lincoln-Philadelphia. Includes all certificates below the baccalaureate level and associate’s degrees for automotive and

diesel programs. Source is IPEDS .

(b) Total completions for UTI-Dallas versus Lincoln-Grand Prairie. Includes all certificates below the baccalaureate level and associate’s degrees for automotive ,

collision and diesel programs. Source is IPEDS. UTI’s Dallas campus opened in 2010.

Co

m

pl

et

io

ns

Co

m

pl

et

io

ns

28

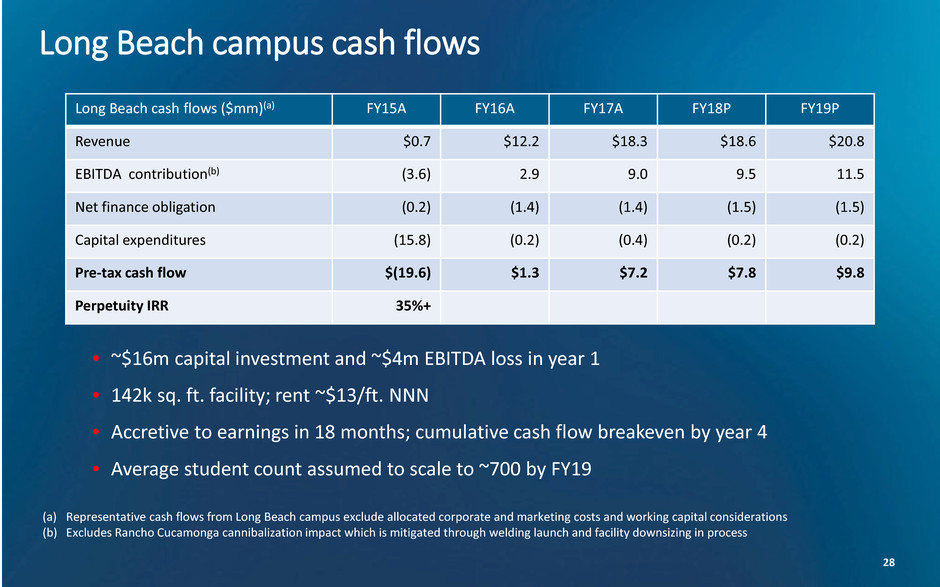

(a) Representative cash flows from Long Beach campus exclude allocated corporate and marketing costs and working capital considerations

(b) Excludes Rancho Cucamonga cannibalization impact which is mitigated through welding launch and facility downsizing in process

Long Beach campus cash flows

Long Beach cash flows ($mm)(a) FY15A FY16A FY17A FY18P FY19P

Revenue $0.7 $12.2 $18.3 $18.6 $20.8

EBITDA contribution(b) (3.6) 2.9 9.0 9.5 11.5

Net finance obligation (0.2) (1.4) (1.4) (1.5) (1.5)

Capital expenditures (15.8) (0.2) (0.4) (0.2) (0.2)

Pre-tax cash flow $(19.6) $1.3 $7.2 $7.8 $9.8

Perpetuity IRR 35%+

• ~$16m capital investment and ~$4m EBITDA loss in year 1

• 142k sq. ft. facility; rent ~$13/ft. NNN

• Accretive to earnings in 18 months; cumulative cash flow breakeven by year 4

• Average student count assumed to scale to ~700 by FY19

29

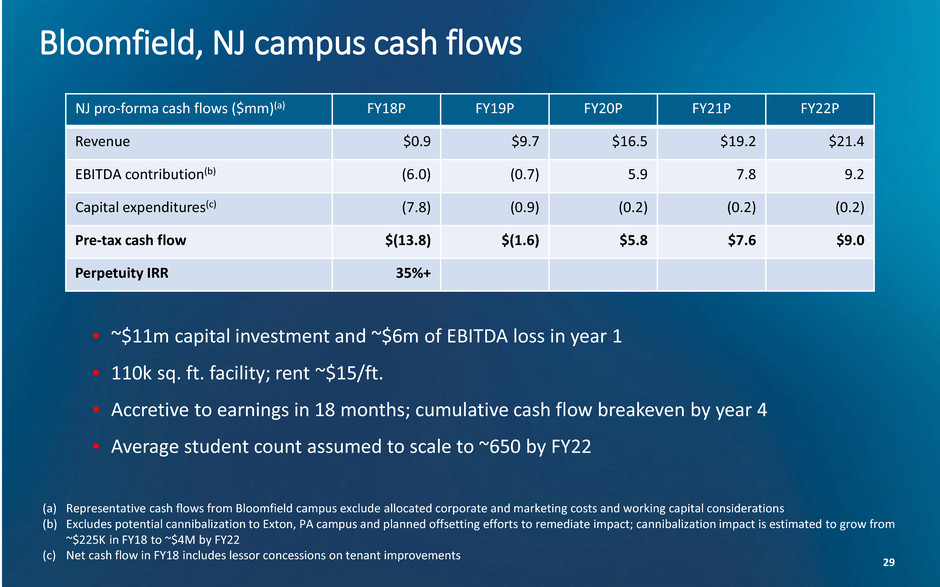

Bloomfield, NJ campus cash flows

• ~$11m capital investment and ~$6m of EBITDA loss in year 1

• 110k sq. ft. facility; rent ~$15/ft.

• Accretive to earnings in 18 months; cumulative cash flow breakeven by year 4

• Average student count assumed to scale to ~650 by FY22

NJ pro-forma cash flows ($mm)(a) FY18P FY19P FY20P FY21P FY22P

Revenue $0.9 $9.7 $16.5 $19.2 $21.4

EBITDA contribution(b) (6.0) (0.7) 5.9 7.8 9.2

Capital expenditures(c) (7.8) (0.9) (0.2) (0.2) (0.2)

Pre-tax cash flow $(13.8) $(1.6) $5.8 $7.6 $9.0

Perpetuity IRR 35%+

(a) Representative cash flows from Bloomfield campus exclude allocated corporate and marketing costs and working capital considerations

(b) Excludes potential cannibalization to Exton, PA campus and planned offsetting efforts to remediate impact; cannibalization impact is estimated to grow from

~$225K in FY18 to ~$4M by FY22

(c) Net cash flow in FY18 includes lessor concessions on tenant improvements

30

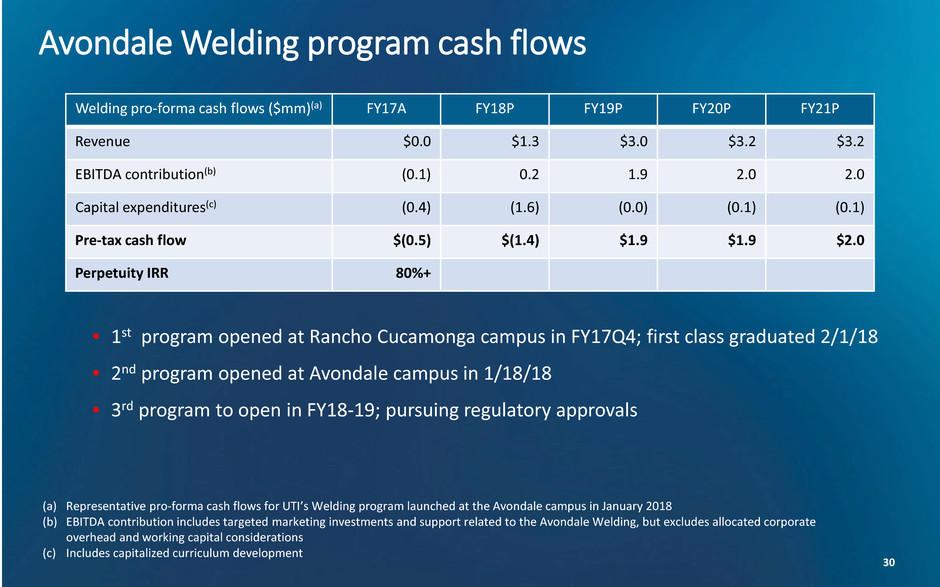

Avondale Welding program cash flows

(a) Representative pro-forma cash flows for UTI’s Welding program launched at the Avondale campus in January 2018

(b) EBITDA contribution includes targeted marketing investments and support related to the Avondale Welding, but excludes allocated corporate

overhead and working capital considerations

(c) Includes capitalized curriculum development

• 1st program opened at Rancho Cucamonga campus in FY17Q4; first class graduated 2/1/18

• 2nd program opened at Avondale campus in 1/18/18

• 3rd program to open in FY18-19; pursuing regulatory approvals

Welding pro-forma cash flows ($mm)(a) FY17A FY18P FY19P FY20P FY21P

Revenue $0.0 $1.3 $3.0 $3.2 $3.2

EBITDA contribution(b) (0.1) 0.2 1.9 2.0 2.0

Capital expenditures(c) (0.4) (1.6) (0.0) (0.1) (0.1)

Pre-tax cash flow $(0.5) $(1.4) $1.9 $1.9 $2.0

Perpetuity IRR 80%+

31

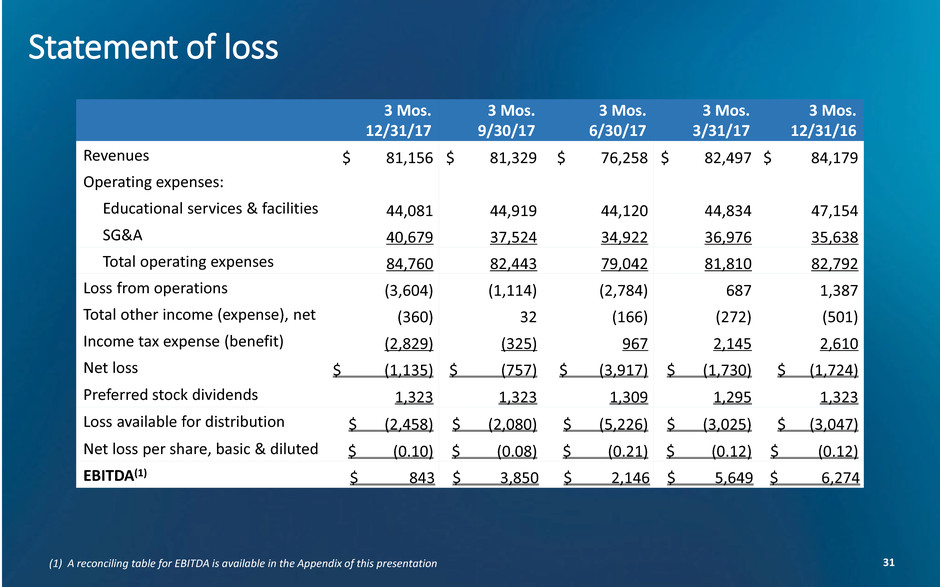

(1) A reconciling table for EBITDA is available in the Appendix of this presentation

Statement of loss

($ in thousands, except per share amounts) 3 Mos.

12/31/17

3 Mos.

9/30/17

3 Mos.

6/30/17

3 Mos.

3/31/17

3 Mos.

12/31/16

Revenues $ 81,156 $ 81,329 $ 76,258 $ 82,497 $ 84,179

Operating expenses:

Educational services & facilities 44,081 44,919 44,120 44,834 47,154

SG&A 40,679 37,524 34,922 36,976 35,638

Total operating expenses 84,760 82,443 79,042 81,810 82,792

Loss from operations (3,604) (1,114) (2,784) 687 1,387

Total other income (expense), net (360) 32 (166) (272) (501)

Income tax expense (benefit) (2,829) (325) 967 2,145 2,610

Net loss $ (1,135) $ (757) $ (3,917) $ (1,730) $ (1,724)

Preferred stock dividends 1,323 1,323 1,309 1,295 1,323

Loss available for distribution $ (2,458) $ (2,080) $ (5,226) $ (3,025) $ (3,047)

Net loss per share, basic & diluted $ (0.10) $ (0.08) $ (0.21) $ (0.12) $ (0.12)

EBITDA(1) $ 843 $ 3,850 $ 2,146 $ 5,649 $ 6,274

32

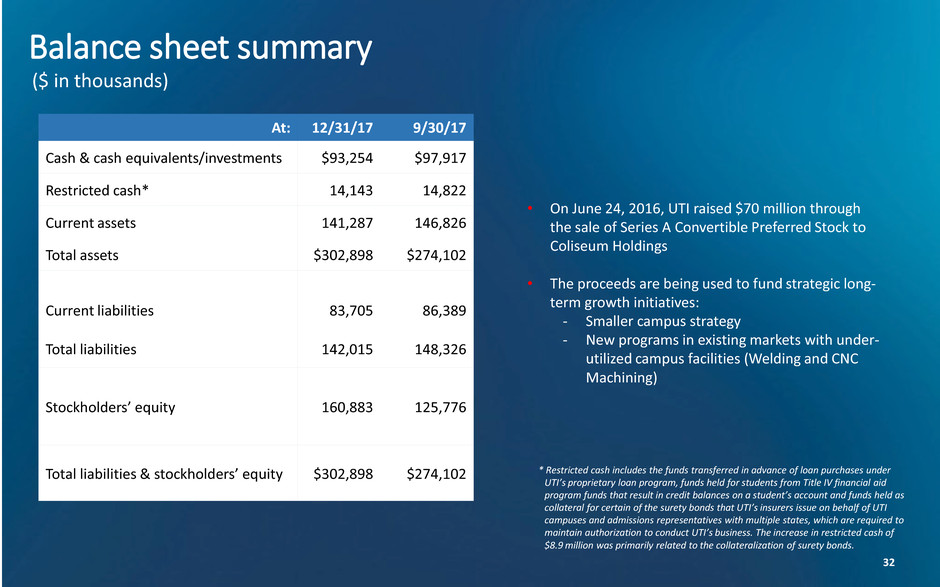

Balance sheet summary

($ in thousands)

• On June 24, 2016, UTI raised $70 million through

the sale of Series A Convertible Preferred Stock to

Coliseum Holdings

• The proceeds are being used to fund strategic long-

term growth initiatives:

- Smaller campus strategy

- New programs in existing markets with under-

utilized campus facilities (Welding and CNC

Machining)

* Restricted cash includes the funds transferred in advance of loan purchases under

UTI’s proprietary loan program, funds held for students from Title IV financial aid

program funds that result in credit balances on a student’s account and funds held as

collateral for certain of the surety bonds that UTI’s insurers issue on behalf of UTI

campuses and admissions representatives with multiple states, which are required to

maintain authorization to conduct UTI’s business. The increase in restricted cash of

$8.9 million was primarily related to the collateralization of surety bonds.

At: 12/31/17 9/30/17

Cash & cash equivalents/investments $93,254 $97,917

Restricted cash* 14,143 14,822

Current assets 141,287 146,826

Total assets $302,898 $274,102

Current liabilities 83,705 86,389

Total liabilities 142,015 148,326

Stockholders’ equity 160,883 125,776

Total liabilities & stockholders’ equity $302,898 $274,102

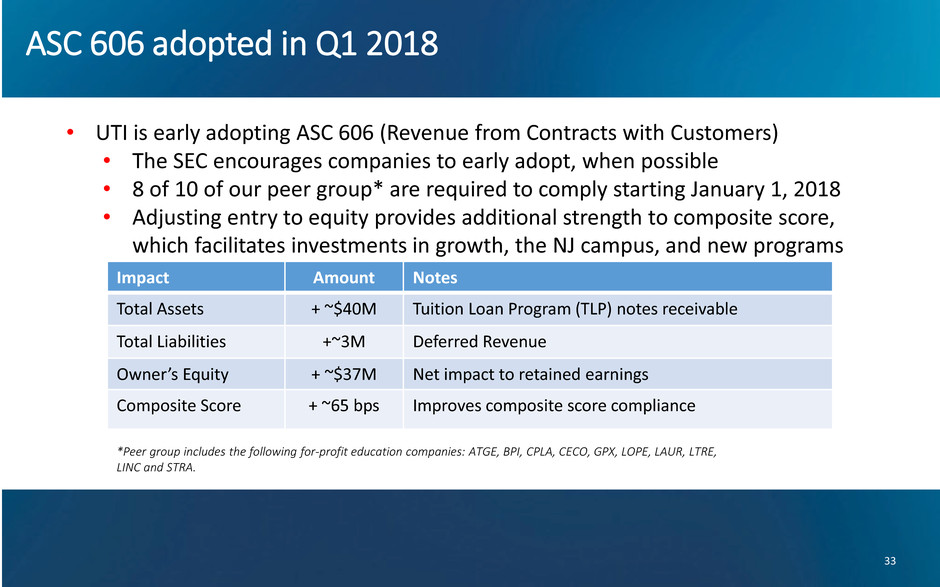

ASC 606 adopted in Q1 2018

33

• UTI is early adopting ASC 606 (Revenue from Contracts with Customers)

• The SEC encourages companies to early adopt, when possible

• 8 of 10 of our peer group* are required to comply starting January 1, 2018

• Adjusting entry to equity provides additional strength to composite score,

which facilitates investments in growth, the NJ campus, and new programs

Impact Amount Notes

Total Assets + ~$40M Tuition Loan Program (TLP) notes receivable

Total Liabilities +~3M Deferred Revenue

Owner’s Equity + ~$37M Net impact to retained earnings

Composite Score + ~65 bps Improves composite score compliance

*Peer group includes the following for-profit education companies: ATGE, BPI, CPLA, CECO, GPX, LOPE, LAUR, LTRE,

LINC and STRA.

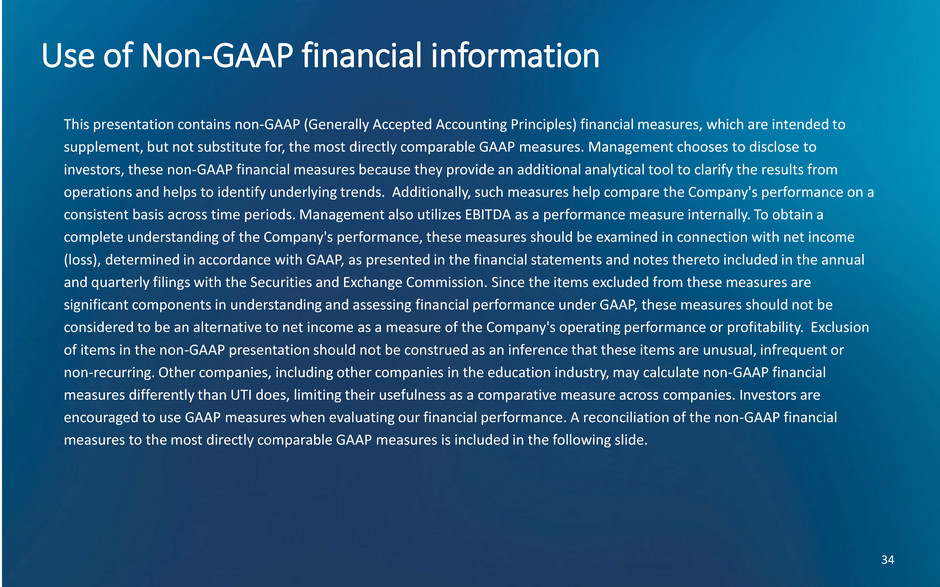

Use of Non-GAAP financial information

This presentation contains non-GAAP (Generally Accepted Accounting Principles) financial measures, which are intended to

supplement, but not substitute for, the most directly comparable GAAP measures. Management chooses to disclose to

investors, these non-GAAP financial measures because they provide an additional analytical tool to clarify the results from

operations and helps to identify underlying trends. Additionally, such measures help compare the Company's performance on a

consistent basis across time periods. Management also utilizes EBITDA as a performance measure internally. To obtain a

complete understanding of the Company's performance, these measures should be examined in connection with net income

(loss), determined in accordance with GAAP, as presented in the financial statements and notes thereto included in the annual

and quarterly filings with the Securities and Exchange Commission. Since the items excluded from these measures are

significant components in understanding and assessing financial performance under GAAP, these measures should not be

considered to be an alternative to net income as a measure of the Company's operating performance or profitability. Exclusion

of items in the non-GAAP presentation should not be construed as an inference that these items are unusual, infrequent or

non-recurring. Other companies, including other companies in the education industry, may calculate non-GAAP financial

measures differently than UTI does, limiting their usefulness as a comparative measure across companies. Investors are

encouraged to use GAAP measures when evaluating our financial performance. A reconciliation of the non-GAAP financial

measures to the most directly comparable GAAP measures is included in the following slide.

34

35

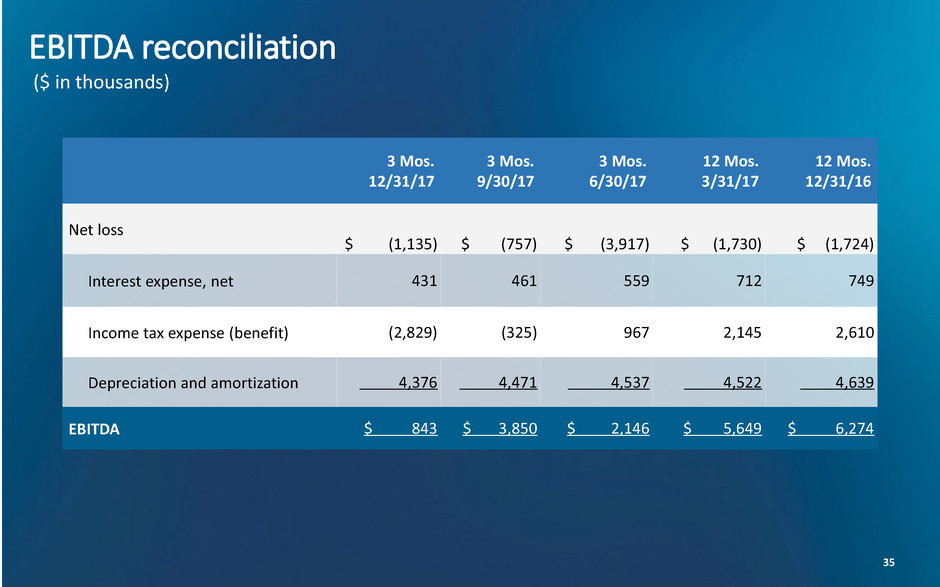

EBITDA reconciliation

($ in thousands)

3 Mos.

12/31/17

3 Mos.

9/30/17

3 Mos.

6/30/17

12 Mos.

3/31/17

12 Mos.

12/31/16

Net loss

$ (1,135) $ (757) $ (3,917) $ (1,730) $ (1,724)

Interest expense, net 431 461 559 712 749

Income tax expense (benefit) (2,829) (325) 967 2,145 2,610

Depreciation and amortization 4,376 4,471 4,537 4,522 4,639

EBITDA $ 843 $ 3,850 $ 2,146 $ 5,649 $ 6,274