Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - AMERISOURCEBERGEN CORP | exhibit32-q12018.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERISOURCEBERGEN CORP | exhibit312-q12018.htm |

| EX-31.1 - EXHIBIT 31.1 - AMERISOURCEBERGEN CORP | exhibit311-q12018.htm |

| EX-10.3 - EXHIBIT 10.3 - AMERISOURCEBERGEN CORP | exhibit103.htm |

| EX-10.1 - EXHIBIT 10.1 - AMERISOURCEBERGEN CORP | exhibit101.htm |

| 10-Q - 10-Q - AMERISOURCEBERGEN CORP | a10-qxq12018.htm |

Exhibit 10.2

EXECUTION VERSION

TWELFTH AMENDMENT TO AMENDED AND RESTATED

RECEIVABLES PURCHASE AGREEMENT

THIS TWELFTH AMENDMENT TO AMENDED AND RESTATED RECEIVABLES

PURCHASE AGREEMENT, dated as of December 18, 2017 (this “Amendment”) is entered into

among AMERISOURCE RECEIVABLES FINANCIAL CORPORATION, a Delaware

corporation (in such capacity, the “Seller”), AMERISOURCEBERGEN DRUG

CORPORATION, a Delaware corporation, as the initial Servicer (in such capacity,

the “Servicer”), the PURCHASER AGENTS and PURCHASERS listed on the signature pages

hereto, and THE BANK OF TOKYO-MITSUBISHI UFJ, LTD. (“BTMU”), as administrator (in

such capacity, the “Administrator”).

R E C I T A L S

The Seller, Servicer, the Purchaser Groups, and the Administrator are parties to that

certain Amended and Restated Receivables Purchase Agreement, dated as of April 29, 2010

(as amended, supplemented or otherwise modified from time to time, the “Agreement”).

The parties hereto desire to amend the Agreement as hereinafter set forth.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, the parties agree as follows:

1. Certain Defined Terms. Capitalized terms used but not defined herein shall have

the meanings set forth for such terms in Exhibit I to the Agreement.

2. Amendments to the Agreement. As of the Effective Date (as defined below), the

Agreement is hereby amended as follows:

(a) The Agreement is hereby amended to incorporate the changes shown on the

marked pages of the Agreement attached hereto as Exhibit A.

(b) Each instance of the phrase “New York Branch” in the Agreement is hereby

deleted.

(c) The definition of “Credit Agreement” set forth in Exhibit I to the Agreement is

hereby replaced in its entirety with the following:

“Credit Agreement” shall mean the Credit Agreement, dated as of March 18,

2011, as amended and restated as of November 18, 2016, as amended by Amendment No.

1 thereto dated as of December 18, 2017, among AmerisourceBergen, the borrowing

subsidiaries party thereto, the lenders named therein, JPMorgan Chase Bank, N.A., as

administrative agent, and the other parties thereto (without giving effect to any other

amendment, waiver, termination, supplement or other modification thereof thereafter

unless consented to by the Required Purchaser Agents).

726149251 03128405

3. Representations and Warranties; Covenants. Each of the Seller and the Servicer

(on behalf of the Seller) hereby certifies, represents and warrants to the Administrator, each

Purchaser Agent and each Purchaser that on and as of the date hereof:

(a) each of its representations and warranties contained in Article V of the Agreement

is true and correct, in all material respects, as if made on and as of the Effective Date;

(b) no event has occurred and is continuing, or would result from this Amendment or

any of the transactions contemplated herein, that constitutes an Amortization Event or

Unmatured Amortization Event; and

(c) the Facility Termination Date for all Purchaser Groups has not occurred.

4. Effect of Amendment. Except as expressly amended and modified by this

Amendment, all provisions of the Agreement shall remain in full force and effect. After this

Amendment becomes effective, all references in the Agreement and each of the other

Transaction Documents to “this Agreement”, “hereof”, “herein”, or words of similar effect

referring to the Agreement shall be deemed to be references to the Agreement, as amended by

this Amendment. This Amendment shall not be deemed to expressly or impliedly waive, amend

or supplement any provision of the Agreement (or any related document or agreement) other

than as expressly set forth herein.

5. Effectiveness. This Amendment shall become effective on the date hereof

(the “Effective Date”) upon satisfaction of each of the following conditions:

(a) receipt by the Administrator and each Purchaser Agent of counterparts of (i) this

Amendment and (ii) that certain Second Amendment to Amended and Restated Performance

Undertaking, dated as of the date hereof, by and among the Seller, the Performance Guarantor,

the Administrator and each Purchaser Agent (the “Performance Undertaking Amendment”); and

(b) receipt by each Purchaser Agent of such other documents and instruments as a

Purchaser Agent may reasonably request, in form and substance satisfactory to such Purchaser

Agent.

6. Counterparts. This Amendment may be executed in any number of counterparts

and by different parties on separate counterparts, and each counterpart shall be deemed to be an

original, and all such counterparts shall together constitute but one and the same instrument.

Counterparts of this Amendment may be delivered by facsimile transmission or other electronic

transmission, and such counterparts shall be as effective as if original counterparts had been

physically delivered, and thereafter shall be binding on the parties hereto and their respective

successors and assigns.

7. Governing Law. This Amendment shall be governed by, and construed in

accordance with the law of the State of New York without regard to any otherwise applicable

principles of conflicts of law (other than Sections 5-1401 and 5-1402 of the New York General

Obligations Law).

726149251 03128405 2

8. Section Headings. The various headings of this Amendment are inserted for

convenience only and shall not affect the meaning or interpretation of this Amendment, the

Agreement or any other Transaction Document or any provision hereof or thereof.

9. Transaction Document. This Amendment shall constitute a Transaction

Document under the Agreement.

10. Severability. Each provision of this Amendment shall be severable from every

other provision of this Amendment for the purpose of determining the legal enforceability of any

provision hereof, and the unenforceability of one or more provisions of this Amendment in one

jurisdiction shall not have the effect of rendering such provision or provisions unenforceable in

any other jurisdiction.

11. Ratification. After giving effect to this Amendment, the Performance

Undertaking Amendment and the transactions contemplated hereby and thereby, all of the

provisions of the Performance Undertaking shall remain in full force and effect and the

Performance Guarantor hereby ratifies and affirms the Performance Undertaking and

acknowledges that the Performance Undertaking has continued and shall continue in full force

and effect in accordance with its terms.

[signature pages begin on next page]

726149251 03128405 3

IN WITNESS WHEREOF, the parties have caused this Amendment to be executed by

their respective officers thereunto duly authorized, as of the date first above written.

AMERISOURCE RECEIVABLES FINANCIAL

CORPORATION, as Seller

By: /s/ J.F. Quinn

Name: J.F. Quinn

Title: Vice President & Corporate Treasurer

AMERISOURCEBERGEN DRUG

CORPORATION, as initial Servicer

By: /s/ J.F. Quinn

Name: J.F. Quinn

Title: Vice President & Corporate Treasurer

Acknowledged and Agreed

AMERISOURCEBERGEN

CORPORATION

By: /s/ J.F. Quinn

Name: J.F. Quinn

Title: Vice President & Corporate

Treasurer

726149251 03128405 S-1 Twelfth Amendment to RPA

(ARFC)

THE BANK OF TOKYO-MITSUBISHI UFJ,

LTD.,

as Administrator

By: /s/ Luna Mills

Name: Luna Mills

Title: Managing Director

VICTORY RECEIVABLES CORPORATION,

as an Uncommitted Purchaser

By: /s/ David V. DeAngelis

Name: David V. DeAngelis

Title: Vice President

THE BANK OF TOKYO-MITSUBISHI UFJ,

LTD.,

as Purchaser Agent for

Victory Receivables Corporation

By: /s/ Luna Mills

Name: Luna Mills

Title: Managing Director

THE BANK OF TOKYO-MITSUBISHI UFJ,

LTD.,

as Related Committed Purchaser

for Victory Receivables Corporation

By: /s/ Luna Mills

Name: Luna Mills

Title: Managing Director

726149251 03128405 S-2 Twelfth Amendment to RPA

(ARFC)

WELLS FARGO BANK, NATIONAL

ASSOCIATION,

as an Uncommitted Purchaser

By: /s/ Eero Maki

Name: Eero Maki

Title: Managing Director

WELLS FARGO BANK, NATIONAL

ASSOCIATION,

as Purchaser Agent and

Related Committed Purchaser

for Wells Fargo Bank, National Association

By: /s/ Eero Maki

Name: Eero Maki

Title: Managing Director

726149251 03128405 S-3 Twelfth Amendment to RPA

(ARFC)

LIBERTY STREET FUNDING LLC,

as an Uncommitted Purchaser

By: /s/ Jill A. Russo

Name: Jill A. Russo

Title: Vice President

THE BANK OF NOVA SCOTIA,

as Purchaser Agent and

Related Committed Purchaser

for Liberty Street Funding LLC

By: /s/ Michelle C. Phillips

Name: Michelle C. Phillips

Title: Execution Head & Director

726149251 03128405 S-4 Twelfth Amendment to RPA

(ARFC)

PNC BANK, NATIONAL ASSOCIATION,

as a Purchaser Agent,

Uncommitted Purchaser and

Related Committed Purchaser

By: /s/ Eric Bruno

Name: Eric Bruno

Title: Senior Vice President

726149251 03128405 S-5 Twelfth Amendment to RPA

(ARFC)

MIZUHO BANK, LTD.,

as a Purchaser Agent,

Uncommitted Purchaser and

Related Committed Purchaser

By: /s/ Bertram H. Tang

Name: Bertram H. Tang

Title: Authorized Signatory

726149251 03128405 S-6 Twelfth Amendment to RPA

(ARFC)

EXHIBIT A

(ATTACHED)

726149251 03128405 Exhibit A-1 Twelfth Amendment to RPA

(ARFC)

CONFORMED COPY includes

First Amendment dated 4/28/11

Second Amendment dated 10/28/11

Third Amendment dated 11/16/12

Fourth Amendment dated 1/16/13

Fifth Amendment dated 6/28/13

Sixth Amendment dated 10/7/13

Seventh Amendment dated 7/17/14

Eighth Amendment dated 12/5/14

Omnibus Amendment dated 11/4/15

Tenth Amendment dated 6/21/16

Eleventh Amendment 11/18/16

Twelfth Amendment 12/18/17

AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT

DATED AS OF APRIL 29, 2010

AMONG

AMERISOURCE RECEIVABLES FINANCIAL CORPORATION, AS SELLER,

AMERISOURCEBERGEN DRUG CORPORATION, AS INITIAL SERVICER,

THE VARIOUS PURCHASERS GROUPS FROM TIME TO TIME PARTY HERETO

AND

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH, AS

ADMINISTRATOR

726249534 03128405

WORKING CAPITAL MANAGEMENT CO., LP,

as an Uncommitted Purchaser

By:______________________________________

Name:

Title:

Address for notice:

Working Capital Management Co., LP

c/o Mizuho Bank, Ltd.

1251 Avenue of the Americas

New York, NY 10020

Attention: Conduit Management Group

ADVANTAGE ASSET SECURITIZATION

CORP., as an Uncommitted Purchaser

By:______________________________________

Name:

Title:

Address for notice:

Advantage Asset Securitization Corp.

c/o Mizuho Bank

1251 Avenue of the Americas

New York, NY 10020

Attention: Conduit Management GroupMIZUHO

BANK, LTD., as Purchaser Agent, Uncommitted

Purchaser and Related Committed Purchaser for

Working Capital Management Co., LP and

Advantage Asset Securitization Corp.

By:______________________________________

Name:

Title:

Address for notice:

Mizuho Bank, Ltd.

1251 Avenue of the Americas

New York, NY 10020

Attention: Corporate Finance Division

Commitment: $345,000,000

726249534 03128405 S- 9 Amended and Restated

Receivables Purchase Agreement

(ARFC)

EXHIBIT I

DEFINITIONS

As used in this Agreement, the following terms shall have the following meanings

(such meanings to be equally applicable to both the singular and plural forms of the terms

defined):

“Accordion Confirmation” has the meaning set forth in Section 1.1(b)(vi).

“Accordion Group Commitment” means with respect to any Purchaser Group, the

aggregate amount of any increase in such Purchaser Group’s Group Commitment pursuant to

Section 1.1(b) consented to by the Purchaser Agent on behalf of the Purchasers in such Purchaser

Group.

“Accordion Invested Amount” means, with respect to any Purchaser and its related

Invested Amount, the portion, if any, of such Invested Amount being funded or maintained by

such Purchaser under its Purchaser Group’s Accordion Group Commitment.

“Accordion Period” has the meaning set forth in Section 1.1(b).

“Accordion Purchase Limit” means the aggregate of the amount of any increase to the

Purchase Limit pursuant to Section 1.1(b) consented to by the Increasing Purchaser Groups (and

as such amount may be decreased in connection with any Exiting Purchaser); provided, that the

Accordion Purchase Limit shall in no event exceed $250,000,000 without the consent of all

Purchaser Agents.

“Accordion Ratable Share” means, for each Purchaser Group (other than those

comprised of Exiting Purchasers), such Purchaser Group’s Accordion Group Commitment

divided by the aggregate Accordion Group Commitments of all Purchaser Groups (other than

those comprised of Exiting Purchasers).

“Account Disclosure Letter” means that certain letter from the Seller and the Servicer to

the Administrator and each Purchaser Agent, setting forth each Lock-Box and Collection

Account to which Collections are remitted.

“Adjusted Dilution Ratio” means, at any time, the rolling average of the Dilution Ratio

for the 12 Calculation Periods then most recently ended.

“Administrator” has the meaning set forth in the preamble to this Agreement.

“Advantage Asset” means Advantage Asset Securitization Corp., and its successors.

“Affiliate” shall mean, with respect to a Person, any other Person, which directly or

indirectly controls, is controlled by or is under common control with, such Person. The term

“control” means the possession, directly or indirectly, of the power to direct or cause the

direction of the management and policies of a Person, whether through the ownership of voting

securities, by contract or otherwise.

726249534 03128405 I- 1

“Independent Director” shall mean a member of the Board of Directors of Seller who is

not at such time, and has not been at any time during the preceding five (5) years: (A) a director,

officer, employee or affiliate of Performance Guarantor, any Originator or any of their respective

Subsidiaries or Affiliates (other than Seller), or (B) the beneficial owner (at the time of such

individual’s appointment as an Independent Director or at any time thereafter while serving as an

Independent Director) of any of the outstanding common shares of Seller, any Originator, or any

of their respective Subsidiaries or Affiliates, having general voting rights.

“Interest Period” means with respect to any Receivable Interest funded through a Bank

Rate Funding:

(a) the period commencing on the date of the initial funding of such

Receivable Interest through a Bank Rate Funding and including on, but excluding, the

Business Day immediately preceding the next following Settlement Date; and

(b) thereafter, each period commencing on, and including, the Business Day

immediately preceding a Settlement Date and ending on, but excluding, the Business Day

immediately preceding the next following Settlement Date.

“Internal Revenue Code” shall mean the Internal Revenue Code of 1986, as amended

from time to time and any successor thereto, and the regulations promulgated and rulings issued

thereunder.

“Invested Amount” of any Receivable Interest means, at any time, (A) the Purchase Price

of such Receivable Interest paid by the Purchasers, minus (B) the sum of the aggregate amount of

Collections and other payments received by the applicable Purchaser Agent which in each case

are applied to reduce such Invested Amount in accordance with the terms and conditions of this

Agreement; provided that such Invested Amount shall be restored (in accordance with Section

2.5) in the amount of any Collections or other payments so received and applied if at any time the

distribution of such Collections or payments are rescinded, returned or refunded for any reason.

“Invoice Payment Terms” means, with respect to any Receivable, the number of days

following the date of the related original invoice by which such Receivable is required to be paid

in full, as set forth in such original invoice.

“Law” shall mean any law (including common law), constitution, statute, treaty,

regulation, rule, ordinance, order, injunction, writ, decree or award of any Official Body.

“LIBO Rate” means, on any date of determination:

(a) in the case of Wells Fargo, Advantage AssetMizuho and PNC, the LIBOR

Market Index Rate;

(b) in the case of any Purchaser other than Wells Fargo, Advantage AssetMizuho

and PNC, a rate per annum (rounded upwards, if necessary, to the nearest 1/100th of 1%)

determined by dividing (x) the Daily Eurodollar Rate for such date of determination, by

(y) 1 minus the Reserve Percentage for such date of determination; and

726249534 03128405 I- 15

bridge loan agreement or other voluntary advance facility) of all or any portion of, or any

undivided interest in, a Receivable Interest.

“Liquidity Provider” means each bank or other financial institution that provides

liquidity support to any Conduit Purchaser pursuant to the terms of a Liquidity Agreement.

“Location” shall mean, with respect to the Seller, any Originator or the Servicer, the

place where the Seller, such Originator or the Servicer, as the case may be, is “located” (within

the meaning of Section 9-307, or any analogous provision, of the UCC, in effect in the

jurisdiction whose Law governs the perfection of the Administrator’s (for the benefit of the

Secured Parties) interests in any Purchased Assets).

“Lock-Box” means each locked postal box with respect to which a bank who has

executed a Collection Account Agreement has been granted exclusive access for the purpose of

retrieving and processing payments made on the Receivables and which is listed on Exhibit I to

the Account Disclosure Letter.

“Loss Reserve” means, for any Calculation Period, the product (expressed as a

percentage) of (a) 2.25, times (b) the highest three-month rolling average Default Ratio during

the 12 Calculation Periods ending on the immediately preceding Cut-Off Date, times (c) the

Default Horizon Ratio as of the immediately preceding Cut-Off Date.

“Mizuho” means Mizuho Bank, Ltd., and its successors.

“Moody’s” means Moody’s Investors Service, Inc.

“Multiemployer Plan” means a “multiemployer plan”, within the meaning of Section

4001 (a) (3) of ERISA, to which Performance Guarantor or any ERISA Affiliate makes, is

making, or is obligated to make contributions or, during the preceding three calendar years, has

made, or been obligated to make, contributions.

“Net Pool Balance” means, at any time, the aggregate Outstanding Balance of all

Eligible Receivables at such time reduced by (i) the aggregate amount by which the Outstanding

Balance of all Eligible Receivables of each Obligor and its Affiliates exceeds the Obligor

Concentration Limit for such Obligor, (ii) the Rebate Reserve, (iii) the Government Receivable

Excess and (iv) sales tax, excise tax or other similar tax or charge, arising with respect to such

Eligible Receivables in connection with their creation and satisfaction.

“Non-Accordion Purchase Limit” means the Purchase Limit without giving effect to any

increases or decreases pursuant to Section 1.1(b) of the Agreement.

“Obligor” shall mean, for any Receivable, each and every Person who purchased goods

or services on credit under a Contract and who is obligated to make payments to an Originator or

the Seller as assignee thereof pursuant to such Contract.

“Obligor Concentration Limit” means, at any time, in relation to the aggregate

Outstanding Balance of Eligible Receivables owed by any single Obligor and its Affiliates (if

any), the applicable concentration limit determined as follows for Obligors who have short term

726249534 03128405 I- 17

outstanding amount of Aggregate Invested Amount determined as of the date of the most recent

Settlement Report, without taking into account such proposed Incremental Purchase.

“Purchased Assets” means all of Seller’s right, title and interest, whether now owned and

existing or hereafter arising in and to all of the Receivables, the Related Security, the Collections

and all proceeds of the foregoing.

“Purchaser” means each Uncommitted Purchaser and/or each Related Committed

Purchaser, as applicable.

“Purchaser Agent” means each Person acting as agent on behalf of a Purchaser Group

and designated as a Purchaser Agent for such Purchaser Group on the signature pages to the

Agreement or any other Person who becomes a party to this Agreement as a Purchaser Agent

pursuant to an Assumption Agreement or a Transfer Supplement.

“Purchaser Group” means, for each Uncommitted Purchaser (or Purchaser Agent), such

Uncommitted Purchaser, its Related Committed Purchasers (if any) and its related Purchaser

Agent (and, to the extent applicable, its related Funding Sources and Indemnified Parties);

provided, however, that the Purchaser Group that includes Working Capital Management Co., LP

shall additionally include Advantage Asset and Advantage Asset shall not constitute a Purchaser

Group separate from the Working Capital Management Co., LP Purchaser Group.

“Purchasers’ Portion” means, on any date of determination, the sum of the percentages

represented by the Receivable Interests of the Purchasers (other than any Exiting Purchasers).

“Ratable Share” means, for each Purchaser Group (other than those comprised of

Exiting Purchasers), such Purchaser Group’s Group Commitments (excluding any Accordion

Group Commitment) divided by the aggregate Group Commitments (excluding any Accordion

Group Commitments) of all Purchaser Groups (other than those comprised of Exiting

Purchasers).

“Rating Agency Condition” means that each Conduit Purchaser has received written

notice from the rating agencies then rating its Commercial Paper that an amendment, a change or

a waiver will not result in a withdrawal or downgrade of the then current ratings of such

Commercial Paper; provided that, if the applicable Purchaser Agent notifies the Seller, the

Servicer and the Administrator that such Conduit Purchaser is not required to obtain such notice

prior to the effectiveness of such amendment, change or waiver, the “Rating Agency Condition”

with respect to such Conduit Purchaser shall mean the consent of such Purchaser Agent (which

consent shall only be withheld if such Purchaser Agent reasonably believes that such amendment,

change or waiver would result in a withdrawal or downgrade of the then current ratings of such

Commercial Paper).

“Rebate Reserve” means an amount equal to the accounting reserve for rebates on the

Receivables determined in the ordinary course of business in accordance with GAAP according

to policies consistently applied (and consistent with the Originators’ practices in effect on the

date hereof) and reported on the Settlement Report related to, or in anticipation of, rebates

affecting the Receivables.

726249534 03128405 I- 20

Purchaser Group’s Group Invested Amount shall exceed its Group Commitment, and (iii) the

aggregate of the Receivable Interests shall not exceed 100%.

2. The [Servicer, on behalf of the] Seller hereby requests that the Purchasers

make a Purchase on ___________, 20__ (the “Purchase Date”) as follows:

(a) Purchase Price: $_____________

(b) (X) Ratable Share1:

(i) Liberty Street Funding LLC’s

Purchaser Group: $_____________

(ii) PNC Bank, National Association’s

Purchaser Group: $_____________

(iii) Victory Receivables Corporation’s

Purchaser Group: $_____________

(iv) Wells Fargo Bank, National Association’s

Purchaser Group: $_____________

(v) Working Capital Management Co., LPMizuho Bank, Ltd.’s

Purchaser Group: $_____________

1 For Purchases based on the Ratable Share.

726249534 03128405 II- 2

(Y) Accordion Ratable Share2:

(i) Liberty Street Funding LLC’s Purchaser Group: $_____________

(ii) PNC Bank, National Association’s

Purchaser Group: $_____________

(iii) Victory Receivables Corporation’s

Purchaser Group: $_____________

(iv) Wells Fargo Bank, National Association’s

Purchaser Group: $_____________

(v) Working Capital Management Co., LPMizuho Bank, Ltd.’s

Purchaser Group: $_____________

3. Please disburse the proceeds of the Purchase as follows:

[Apply $________ to payment of Aggregate Unpaids due on the Purchase Date].

[Wire transfer $________ to the Facility Account.]

2 For Purchases based on the Accordion Ratable Share.

726249534 03128405 II- 3

(iv) Wells Fargo Bank, National Association’s

Purchaser Group: $_____________

(v) Working Capital Management Co., LPMizuho Bank, Ltd.’s

Purchaser Group: $_____________

(X) Accordion Ratable Share5:

(i) Liberty Street Funding LLC’s

Purchaser Group: $_____________

(ii) PNC Bank, National Association’s

Purchaser Group: $_____________

(iii) Victory Receivables Corporation’s

Purchaser Group: $_____________

(iv) Wells Fargo Bank, National Association’s

Purchaser Group: $_____________

(v) Working Capital Management Co., LPMizuho Bank, Ltd.’s

Purchaser Group: $_____________

5 For reductions based on the Accordion Ratable Share.

726249534 03128405 XI- 2

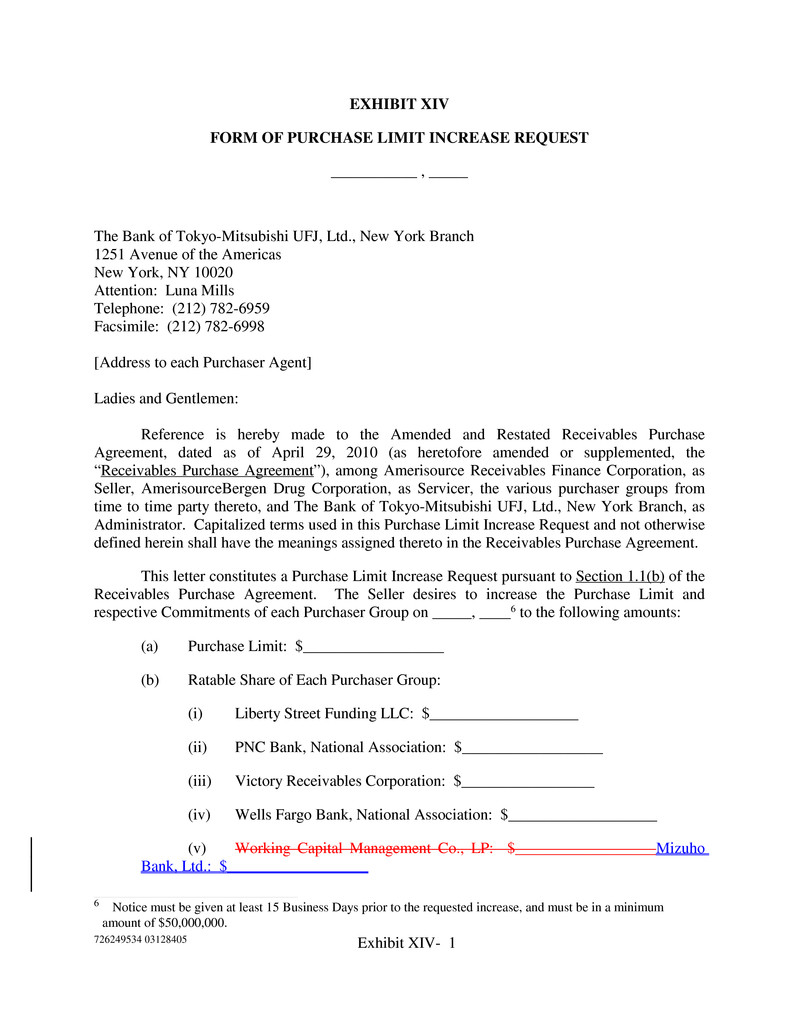

EXHIBIT XIV

FORM OF PURCHASE LIMIT INCREASE REQUEST

___________ , _____

The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch

1251 Avenue of the Americas

New York, NY 10020

Attention: Luna Mills

Telephone: (212) 782-6959

Facsimile: (212) 782-6998

[Address to each Purchaser Agent]

Ladies and Gentlemen:

Reference is hereby made to the Amended and Restated Receivables Purchase

Agreement, dated as of April 29, 2010 (as heretofore amended or supplemented, the

“Receivables Purchase Agreement”), among Amerisource Receivables Finance Corporation, as

Seller, AmerisourceBergen Drug Corporation, as Servicer, the various purchaser groups from

time to time party thereto, and The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, as

Administrator. Capitalized terms used in this Purchase Limit Increase Request and not otherwise

defined herein shall have the meanings assigned thereto in the Receivables Purchase Agreement.

This letter constitutes a Purchase Limit Increase Request pursuant to Section 1.1(b) of the

Receivables Purchase Agreement. The Seller desires to increase the Purchase Limit and

respective Commitments of each Purchaser Group on _____, ____6 to the following amounts:

(a) Purchase Limit: $__________________

(b) Ratable Share of Each Purchaser Group:

(i) Liberty Street Funding LLC: $___________________

(ii) PNC Bank, National Association: $__________________

(iii) Victory Receivables Corporation: $_________________

(iv) Wells Fargo Bank, National Association: $___________________

(v) Working Capital Management Co., LP: $__________________Mizuho

Bank, Ltd.: $__________________

6 Notice must be given at least 15 Business Days prior to the requested increase, and must be in a minimum

amount of $50,000,000.

726249534 03128405 Exhibit XIV- 1

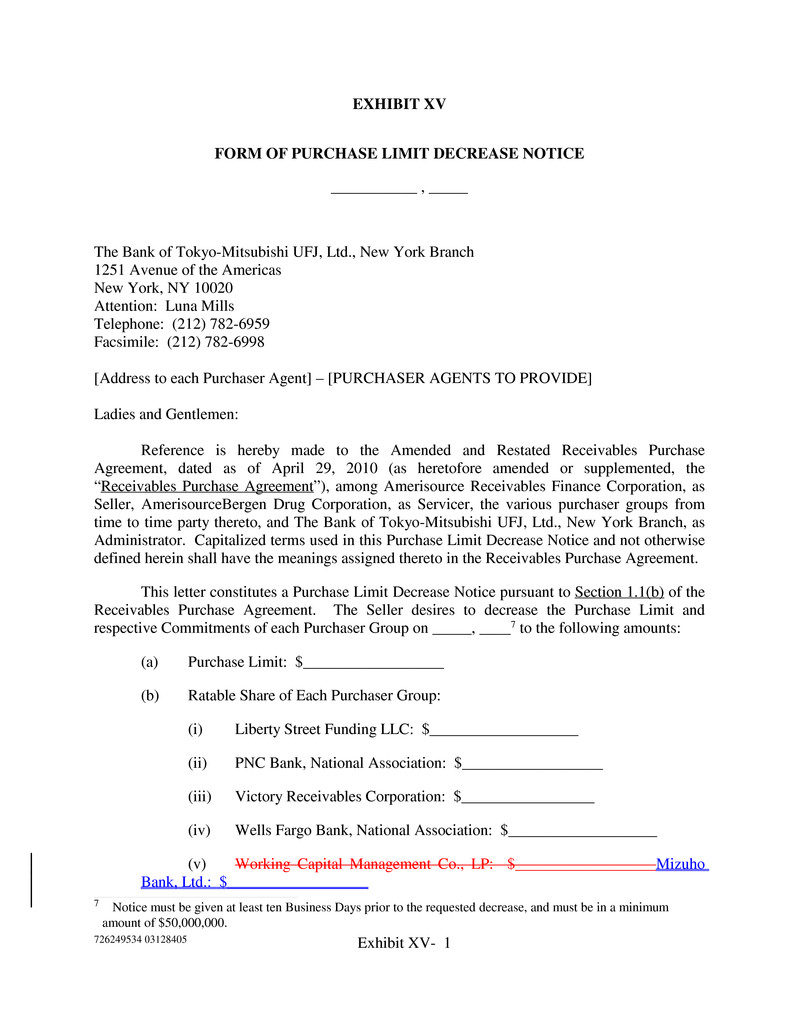

EXHIBIT XV

FORM OF PURCHASE LIMIT DECREASE NOTICE

___________ , _____

The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch

1251 Avenue of the Americas

New York, NY 10020

Attention: Luna Mills

Telephone: (212) 782-6959

Facsimile: (212) 782-6998

[Address to each Purchaser Agent] – [PURCHASER AGENTS TO PROVIDE]

Ladies and Gentlemen:

Reference is hereby made to the Amended and Restated Receivables Purchase

Agreement, dated as of April 29, 2010 (as heretofore amended or supplemented, the

“Receivables Purchase Agreement”), among Amerisource Receivables Finance Corporation, as

Seller, AmerisourceBergen Drug Corporation, as Servicer, the various purchaser groups from

time to time party thereto, and The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, as

Administrator. Capitalized terms used in this Purchase Limit Decrease Notice and not otherwise

defined herein shall have the meanings assigned thereto in the Receivables Purchase Agreement.

This letter constitutes a Purchase Limit Decrease Notice pursuant to Section 1.1(b) of the

Receivables Purchase Agreement. The Seller desires to decrease the Purchase Limit and

respective Commitments of each Purchaser Group on _____, ____7 to the following amounts:

(a) Purchase Limit: $__________________

(b) Ratable Share of Each Purchaser Group:

(i) Liberty Street Funding LLC: $___________________

(ii) PNC Bank, National Association: $__________________

(iii) Victory Receivables Corporation: $_________________

(iv) Wells Fargo Bank, National Association: $___________________

(v) Working Capital Management Co., LP: $__________________Mizuho

Bank, Ltd.: $__________________

7 Notice must be given at least ten Business Days prior to the requested decrease, and must be in a minimum

amount of $50,000,000.

726249534 03128405 Exhibit XV- 1

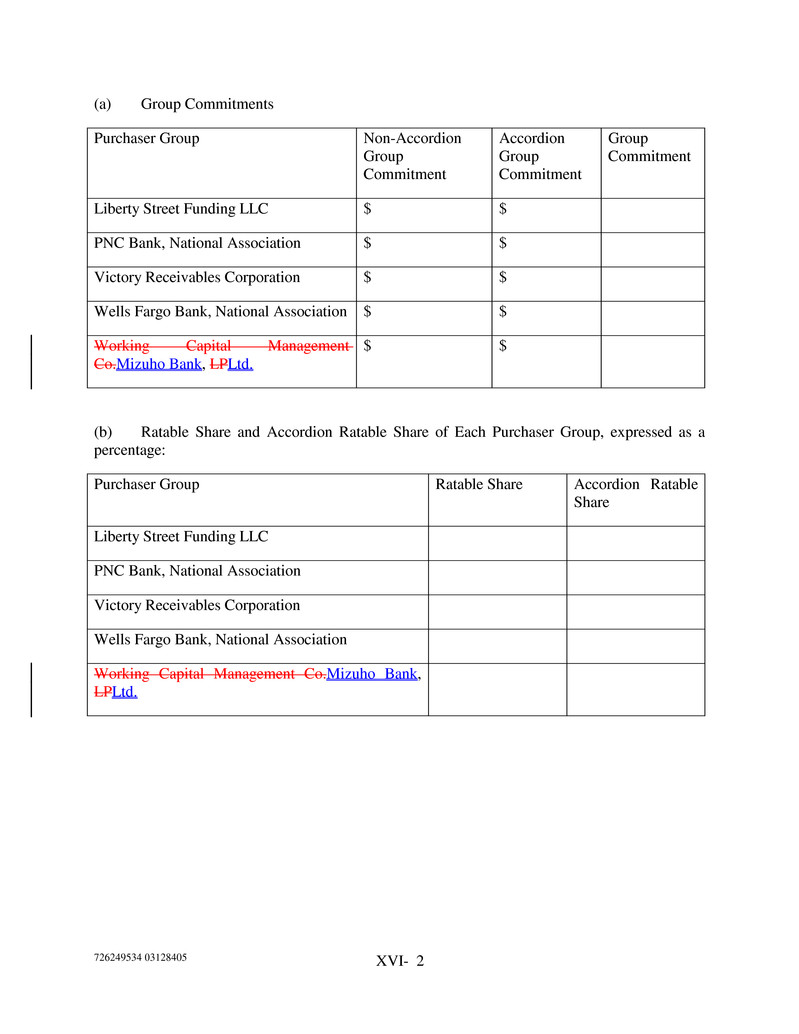

(a) Group Commitments

Purchaser Group Non-Accordion

Group

Commitment

Accordion

Group

Commitment

Group

Commitment

Liberty Street Funding LLC $ $

PNC Bank, National Association $ $

Victory Receivables Corporation $ $

Wells Fargo Bank, National Association $ $

Working Capital Management

Co.Mizuho Bank, LPLtd.

$ $

(b) Ratable Share and Accordion Ratable Share of Each Purchaser Group, expressed as a

percentage:

Purchaser Group Ratable Share Accordion Ratable

Share

Liberty Street Funding LLC

PNC Bank, National Association

Victory Receivables Corporation

Wells Fargo Bank, National Association

Working Capital Management Co.Mizuho Bank,

LPLtd.

726249534 03128405 XVI- 2