Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PARKER HANNIFIN CORP | exhibit9912qfy18.htm |

| 8-K - 8-K - PARKER HANNIFIN CORP | coverform8-k2qfy18.htm |

2nd Quarter Fiscal Year 2018

Earnings Release

Parker Hannifin Corporation

February 1, 2018

Exhibit 99.2

Forward-Looking Statements and

Non-GAAP Financial Measures

Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to

unforeseen uncertainties and risks. These statements may be identified from use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,”

“plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all

statements regarding future performance, earnings projections, events or developments. It is possible that the future performance and earnings projections of the company, including its individual

segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve

anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and

growth, innovation and global diversification initiatives. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance.

Among other factors which may affect future performance and earnings projections are: economic conditions within the company’s key markets, and the company’s ability to maintain and achieve

anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and

growth, innovation and global diversification initiatives. Additionally, the actual impact of the U.S. Tax Cuts and Jobs Act may affect future performance and earnings projections as the amounts

reflected in this period are preliminary estimates and exact amounts will not be determined until a later date, and there may be other judicial or regulatory interpretations of the U.S. Tax Cuts and

Jobs Act that may also affect these estimates and the actual impact on the company. A change in the economic conditions in individual markets may have a particularly volatile effect on segment

performance. Among other factors which may affect future performance of the company are, as applicable: changes in business relationships with and purchases by or from major customers,

suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates

for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of

acquisitions and similar transactions, including the integration of CLARCOR; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such

divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost

savings from such activities; ability to implement successfully capital allocation initiatives, including timing, price and execution of share repurchases; availability, limitations or cost increases of raw

materials, component products and/or commodities that cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits;

compliance costs associated with environmental laws and regulations; potential labor disruptions; threats associated with and efforts to combat terrorism and cyber-security risks; uncertainties

surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; competitive market conditions and resulting effects on sales and pricing; and global

economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest

rates and credit availability. The company makes these statements as of the date of this disclosure, and undertakes no obligation to update them unless otherwise required by law.

This presentation reconciles (a) sales amounts reported in accordance with U.S. GAAP to organic sales, which are sales amounts adjusted to remove the effects of acquisitions and the effects of

currency exchange rates, (b) cash flow from operating activities and cash flow from operating activities as a percent of sales in accordance with U.S. GAAP to cash flow from operating activities and

cash flow from operating activities as a percent of sales without the effect of discretionary pension plan contributions, (c) as reported and forecast segment operating income and operating margins

reported in accordance with U.S. GAAP to as reported and forecast segment operating income and operating margins without the effect of business realignment charges and CLARCOR costs to

achieve, (d) Below the Line Items reported in accordance with U.S. GAAP to Below the Line Items without the effect of the gain on sale and write-down of assets, net, and (e) Income tax in

accordance with U.S. GAAP to Income tax without the effect of U.S. Tax Reform one-time impact, net (f) as reported and forecast earnings per diluted share reported in accordance with U.S. GAAP

to as reported and forecast earnings per diluted share without the effect of business realignment charges, CLARCOR costs to achieve and a loss related to the sale of an investment. This

presentation also contains references to EBITDA and adjusted EBITDA. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA

before business realignment charges, CLARCOR costs to achieve, and a loss related to the sale of an investment. Although EBITDA and Adjusted EBITDA are not measures of performance

calculated in accordance with GAAP, we believe that it is useful to an investor in evaluating the results of this quarter versus one year ago. The effects of acquisitions, currency exchange rates,

discretionary pension plan contributions, business realignment charges, CLARCOR costs to achieve, gain on sale and write-down of assets, net and U.S. Tax Reform one-time impact, net are

removed to allow investors and the company to meaningfully evaluate changes in sales, and cash flow from operating activities as a percent of sales, segment operating income, operating margins,

Below the Line Items, Income Tax and earnings per diluted share on a comparable basis from period to period. Full year adjusted guidance removes business realignment charges, CLARCOR costs

to achieve, a gain on sale and write-down of assets, net and U.S. Tax Reform one-time impact, net.

Please visit www.PHstock.com for more information

2

Agenda

3

• Chairman & CEO Comments

• Results & Outlook

• Questions & Answers

Chairman and CEO Comments

4

Summary

Continued momentum for orders

Upside potential remains; Early days of New Win Strategy™

Second Quarter Results

Safety - 22% Reduction in recordable injuries

Second quarter sales record, up 26%; strongest organic growth since Q1FY12

Order rates increased 13%; margins continued to improve

$225 million net one-time charge for U.S. Tax Reform

Going Forward

Near-term capital deployment priorities

Updated EPS midpoint outlook to $7.58 As Reported, $9.85 Adjusted

Continue to drive the Win Strategy™ initiatives

Diluted Earnings Per Share

2nd Quarter FY2018

5

¹Adjusted for Business Realignment Charges, Clarcor Costs to Achieve,

U.S. Tax Reform one-time impact, net and the Gain on Sale and Write-

down of Assets, net

²Adjusted for Business Realignment Charges, Acquisition-related expenses

³Includes $.21 gain from sale of a product line

,

Influences on Adjusted Earnings Per Share

2nd Quarter FY2018 vs. 2nd Quarter FY2017

6

¹Adjusted for Business Realignment Charges, Acquisition-related expenses

²Includes $.21 gain from sale of a product line

³Adjusted for Business Realignment Charges, Clarcor Costs to Achieve,

U.S. Tax Reform one-time impact, net and the Gain on Sale and Write-down

of Assets, net

Sales & Segment Operating Margin

Total Parker

7

$ in millions 2nd Quarter

FY2018

%

Change FY2017

Sales

As Reported 3,371$ 26.2 % 2,671$

Acquisitions 356 13.3 %

Currency 90 3.4 %

Organic Sales 2,925$ 9.5 %

FY2018

% of

Sales FY2017

% of

Sales

S gment Operating Margin

As Reported 478$ 14.2 % 384$ 14.4 %

Business Realignment 13 8

CLARCOR Costs to Achieve 12

Adjusted 503$ 14.9 % 392$ 14.7 %

Sales & Segment Operating Margin

Diversified Industrial North America

8

$ in millions 2nd Quarter

FY2018

%

Change FY2017

Sales

As Reported 1,565$ 39.6 % 1,121$

Acquisitions 295 26.3 %

Currency 7 0.6 %

Organic Sales 1,263$ 12.7 %

FY2018

% of

Sales FY2017

% of

Sales

Segment Operating Margin

As Reported 226$ 14.4 % 184$ 16.4 %

Business Realignment 2 2

CLARCOR Costs to Achieve 9

Adjusted 237$ 15.1 % 186$ 16.6 %

Sales & Segment Operating Margin

Diversified Industrial International

9

$ in millions 2nd Quarter

FY2018

%

Change FY2017

Sales

As Reported 1,256$ 24.8 % 1,006$

Acquisitions 61 6.0 %

Currency 82 8.1 %

Organic Sales 1,113$ 10.7 %

FY2018

% of

Sales FY2017

% of

Sales

S gment Operating Margin

As Reported 165$ 13.1 % 128$ 12.7 %

Business Realignment 10 4

CLARCOR Costs to Achieve 3

Adjusted 178$ 14.2 % 132$ 13.1 %

Sales & Segment Operating Margin

Aerospace Systems

10

$ in millions 2nd Quarter

FY2018

%

Change FY2017

Sales

As Reported 550$ 1.1 % 544$

Acquisitions - - %

Currency 1 0.3 %

Organic Sales 549$ 0.8 %

FY2018

% of

Sales FY2017

% of

Sales

Segment Operating Margin

As Reported 87$ 15.9 % 73$ 13.3 %

Business Realignment 1 1

Adjusted 88$ 16.0 % 74$ 13.5 %

Order Rates

11

Excludes Acquisitions, Divestitures & Currency

3-month year-over-year comparisons of total dollars, except Aerospace Systems

Aerospace Systems is calculated using a 12-month rolling average

Dec 2017 Sep 2017 Dec 2016 Sep 2016

Total Parker 13 %+ 11 %+ 5 %+ 2 %+

Diversified Industrial North America 15 %+ 10 %+ 0% 4 %-

Diversified Industrial International 13 %+ 15 %+ 10 %+ 3 %+

Aerospace Systems 8 %+ 4 %+ 9 %+ 14 %+

Cash Flow from Operating Activities

FY2018 Q2 YTD

12

¹Adjusted for Discretionary Pension Plan Contribution

2nd Quarter Full Year

FY 2018 % of Sales FY 2017 % of Sales

As Reported Cash Flow From Operating Activities 460$ 6.8% 404$ 7.5%

Discretionary Pension Plan Contribution 220$

Adjusted Cash Flow From Operating Activities 460$ 6.8% 624$ 11.5%

Impact of U.S. Tax Reform

13

FY18

$225M net provisional charge

o $287M one-time charge for deemed repatriation of non-US earnings

o $62M benefit to adjust net deferred tax liabilities to new 21% federal rate

U.S. federal statutory tax rate of 28%

o Blend of: 35% rate (1H’18) and 21% rate (2H’18)

Favorable to Cash

Long Term Implications

Ongoing benefits

o Increased Net Income

o Improved mobility of international cash

Deemed repatriation payable over 8 years

Effective tax rate forecasted to be approximately 23%

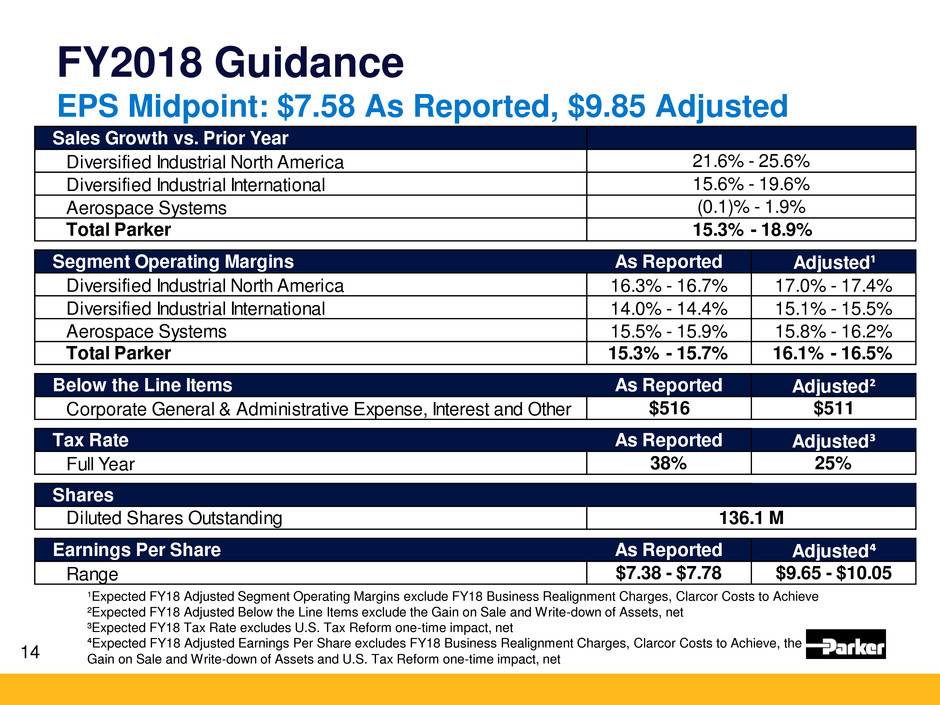

FY2018 Guidance

EPS Midpoint: $7.58 As Reported, $9.85 Adjusted

14

¹Expected FY18 Adjusted Segment Operating Margins exclude FY18 Business Realignment Charges, Clarcor Costs to Achieve

²Expected FY18 Adjusted Below the Line Items exclude the Gain on Sale and Write-down of Assets, net

³Expected FY18 Tax Rate excludes U.S. Tax Reform one-time impact, net

⁴Expected FY18 Adjusted Earnings Per Share excludes FY18 Business Realignment Charges, Clarcor Costs to Achieve, the

Gain on Sale and Write-down of Assets and U.S. Tax Reform one-time impact, net

Sales Growth vs. Prior Year

Diversified Industrial North America

Diversified Industrial International

Aerospace Systems

Total Parker

Segment Operating Margins As Reported Adjusted¹

Diversified Industrial North America 16.3% - 16.7% 17.0% - 17.4%

Diversified Industrial International 14.0% - 14.4% 15.1% - 15.5%

Aerospace Systems 15.5% - 15.9% 15.8% - 16.2%

Total Parker 15.3% - 15.7% 16.1% - 16.5%

Below the Line Items As Reported Adjusted²

Corporate General & Administrative Expense, Interest and Other $516 $511

Tax Rate As Reported Adjusted³

Full Year 38% 25%

Shares

Diluted Shares Outstanding

Earnings Per Share As Reported Adjusted⁴

Range $7.38 - $7.78 $9.65 - $10.05

136.1 M

21.6% - 25.6%

15.6% - 19.6%

(0.1)% - 1.9%

15.3% - 18.9%

FY2018 Guidance

Reconciliation to Prior Guidance

15

¹Adjusted for Business Realignment Charges, Clarcor Costs to Achieve,

U.S. Tax Reform one-time impact, net and the Gain on Sale and Write-

down of Assets, net

²Adjusted for Business Realignment Charges, Clarcor Costs to Achieve,

Loss related to sale of investment

16

Appendix

• Consolidated Statement of Income

• Adjusted Amounts Reconciliation

• Reconciliation of EPS

• Business Segment Information

• Reconciliation of Total Segment Operating Margin to Adjusted Total

Segment Operating Margin

• Reconciliation of EBITDA to Adjusted EBITDA

• Consolidated Balance Sheet

• Consolidated Statement of Cash Flows

• Reconciliation of Cash Flow from Operations to Adjusted Cash

Flow from Operations

• Reconciliation of Forecasted EPS

• Supplemental Sales Information – Global Technology Platforms

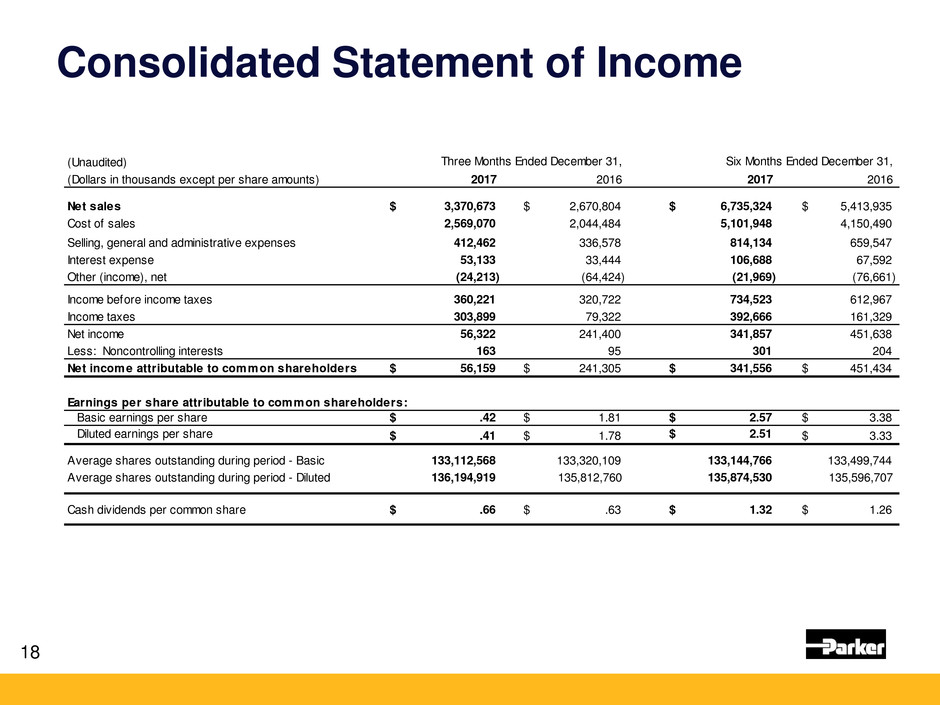

Consolidated Statement of Income

18

(Unaudited) Three Months Ended December 31, Six Months Ended December 31,

(Dollars in thousands except per share amounts) 2017 2016 2017 2016

Net sales 3,370,673$ 2,670,804$ 6,735,324$ 5,413,935$

Cost of sales 2,569,070 2,044,484 5,101,948 4,150,490

Selling, general and administrative expenses 412,462 336,578 814,134 659,547

Interest expense 53,133 33,444 106,688 67,592

Other (income), net (24,213) (64,424) (21,969) (76,661)

Income before income taxes 360,221 320,722 734,523 612,967

Income taxes 303,899 79,322 392,666 161,329

Net income 56,322 241,400 341,857 451,638

Less: Noncontrolling interests 163 95 301 204

Net income attributable to common shareholders 56,159$ 241,305$ 341,556$ 451,434$

Earnings per share attributable to common shareholders:

Basic earnings per share .42$ 1.81$ 2.57$ 3.38$

Diluted earnings per share .41$ 1.78$ 2.51$ 3.33$

Average shares outstanding during period - Basic 133,112,568 133,320,109 133,144,766 133,499,744

Average shares outstanding during period - Diluted 136,194,919 135,812,760 135,874,530 135,596,707

Cash dividends per common share .66$ .63$ 1.32$ 1.26$

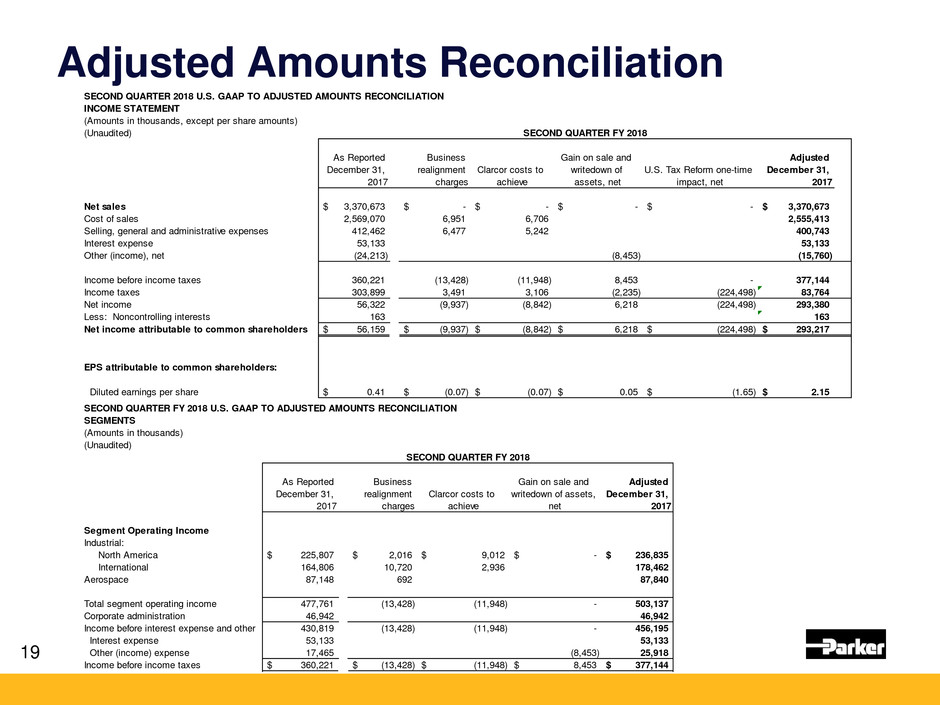

Adjusted Amounts Reconciliation

19

SECOND QUARTER FY 2018 U.S. GAAP TO ADJUSTED AMOUNTS RECONCILIATION

SEGMENTS

(Amounts in thousands)

(Unaudited)

As Reported

December 31,

2017

Business

realignment

charges

Clarcor costs to

achieve

Gain on sale and

writedown of assets,

net

Adjusted

December 31,

2017

Segment Operating Income

Industrial:

North America 225,807$ 2,016$ 9,012$ -$ 236,835$

International 164,806 10,720 2,936 178,462

Aerospace 87,148 692 87,840

Total segment operating income 477,761 (13,428) (11,948) - 503,137

Corporate administration 46,942 46,942

Income before interest expense and other 430,819 (13,428) (11,948) - 456,195

Interest expense 53,133 53,133

Other (income) expense 17,465 (8,453) 25,918

Income before income taxes 360,221$ (13,428)$ (11,948)$ 8,453$ 377,144$

SECOND QUARTER FY 2018

SECOND QUARTER 2018 U.S. GAAP TO ADJUSTED AMOUNTS RECONCILIATION

INCOME STATEMENT

(Amounts in thousands, except per share amounts)

(Unaudited)

As Reported

December 31,

2017

Business

realignment

charges

Clarcor costs to

achieve

Gain on sale and

writedown of

assets, net

U.S. Tax Reform one-time

impact, net

Adjusted

December 31,

2017

Net sales 3,370,673$ -$ -$ -$ -$ 3,370,673$

Cost of sales 2,569,070 6,951 6,706 2,555,413

elling, general and administrative expenses 412,462 6,477 5,242 400,743

Interest expense 53,133 53,133

Other (income), net (24,213) (8,453) (15,760)

Income before income taxes 360,221 (13,428) (11,948) 8,453 - 377,144

Income taxes 303,899 3,491 3,106 (2,235) (224,498) 83,764

Net income 56,322 (9,937) (8,842) 6,218 (224,498) 293,380

Less: Noncontrolling interests 163 163

Net income attributable to common shareholders 56,159$ (9,937)$ (8,842)$ 6,218$ (224,498)$ 293,217$

EPS attributable to common shareholders:

Diluted earnings per share 0.41$ (0.07)$ (0.07)$ 0.05$ (1.65)$ 2.15$

SECOND QUARTER FY 2018

Reconciliation of EPS

20

(Unaudited) Three Months Ended December 31, Six Months Ended December 31,

(Amounts in dollars) 2017 2016 2017 2016

Earnings per diluted share .41$ 1.78$ 2.51$ 3.33$

Adjustments:

Business realignment charges 0.07 0.04 0.12 0.10

Clarcor costs to achieve 0.07 - 0.10 -

Gain on sale and w ritedow n of assets, net (0.05) - 0.02 -

U.S. Tax Reform one-time impact, net 1.65 - 1.65 -

Acquisition-related expenses - 0.09 - 0.09

Adjusted earnings per diluted share 2.15$ 1.91$ 4.40$ 3.52$

Business Segment Information

21

(Unaudited) Three Months Ended December 31, Six Months Ended December 31,

(Dollars in thousands) 2017 2016 2017 2016

Net sales

Diversif ied Industrial:

North America 1,565,416$ 1,121,053$ 3,160,107$ 2,288,024$

International 1,255,569 1,005,968 2,494,343 2,020,891

Aerospace Systems 549,688 543,783 1,080,874 1,105,020

Total 3,370,673$ 2,670,804$ 6,735,324$ 5,413,935$

Segment operating income

Diversif ied Industrial:

North America 225,807$ 184,013$ 481,834$ 384,624$

Int rnatio al 164,806 127,517 356,597 264,713

Aerospace Systems 87,148 72,516 164,582 145,797

Total segment operating income 477,761 384,046 1,003,013 795,134

Corporate general and administrative expenses 46,942 43,926 88,292 74,960

Income before interest and other expense 430,819 340,120 914,721 720,174

Interest expense 53,133 33,444 106,688 67,592

Other expense (income) 17,465 (14,046) 73,510 39,615

Income before income taxes 360,221$ 320,722$ 734,523$ 612,967$

22

Reconciliation of Total Segment Operating

Margin to Adjusted Total Segment

Operating Margin

(Unaudited)

(Dollars in thousands)

Operating income Operating margin Operating income Operating margin

Total segment operating income 477,761$ 14.2% 384,046$ 14.4%

Adjustments:

Business realignment charges 13,428 7,897

Clarcor costs to achieve 11,948 -

Adjusted total segment operating income 503,137$ 14.9% 391,943$ 14.7%

Three months ended

December 31, 2017

Three months ended

December 31, 2016

23

Reconciliation of Total Segment Operating

Margin to Adjusted Total Segment

Operating Margin

(Unaudited)

Operating income Operating margin Operating income Operating margin

Total segment operating income 1,003,013$ 14.9% 795,134$ 14.7%

Adjustments:

Business realignment charges 21,654 18,642

Clarcor costs to achieve 17,748 -

Adjusted total segment operating income 1,042,415$ 15.5% 813,776$ 15.0%

December 31, 2017 December 31, 2016

Six months ended Six months ended

Reconciliation of EBITDA to Adjusted EBITDA

24

(Dollars in thousands)

(Unaudited)

Three Months Ended December 31,

2017 2016

Net sales 3,370,673$ 2,670,804$

Earnings before income taxes 360,221$ 320,722$

Depreciation and amortization 118,109 73,752

Interest expense 53,133 33,444

EBITDA 531,463 427,918

Adjustments:

Gain on sale and w ritedow n of assets, net (8,453) -

Business realignment charges 13,428 7,897

Clarcor costs to achieve 11,948 -

Acquisition-related expenses - 15,963

Gain on sale of a product line - (45,053)

Adjusted EBITDA 548,386$ 406,725$

EBITDA margin 15.8% 16.0%

Adjusted EBITDA margin 16.3% 15.2%

Consolidated Balance Sheet

25

(Unaudited) December 31, June 30, December 31,

(Dollars in thousands) 2017 2017 2016

Assets

Current assets:

Cash and cash equivalents 1,024,770$ 884,886$ 1,520,736$

Marketable securities and other investments 107,976 39,318 684,299

Trade accounts receivable, net 1,857,282 1,930,751 1,411,074

Non-trade and notes receivable 313,221 254,987 256,545

Inventories 1,780,262 1,549,494 1,241,593

Prepaid expenses 202,848 120,282 133,592

Total current assets 5,286,359 4,779,718 5,247,839

Plant and equipment, net 1,937,074 1,937,292 1,506,201

Deferred income taxes 36,668 36,057 482,136

Goodw ill 5,698,707 5,586,878 2,813,238

Intangible assets, net 2,174,104 2,307,484 849,692

Other assets 832,269 842,475 832,507

Total assets 15,965,181$ 15,489,904$ 11,731,613$

Liabilities and equity

Current liabilities:

Notes payable 1,248,212$ 1,008,465$ 581,487$

Accounts payable 1,229,336 1,300,496 997,189

Accrued liabilities 896,750 933,762 720,844

Accrued domestic and foreign taxes 163,405 153,137 125,954

Total current liabilities 3,537,703 3,395,860 2,425,474

Long-term debt 4,798,371 4,861,895 2,653,560

Pensions and other postretirement benefits 1,363,466 1,406,082 1,766,209

Deferred income taxes 137,196 221,790 50,809

Other liabilities 609,235 336,931 304,583

Shareholders' equity 5,513,401 5,261,649 4,527,709

Noncontrolling interests 5,809 5,697 3,269

Total liabilities and equity 15,965,181$ 15,489,904$ 11,731,613$

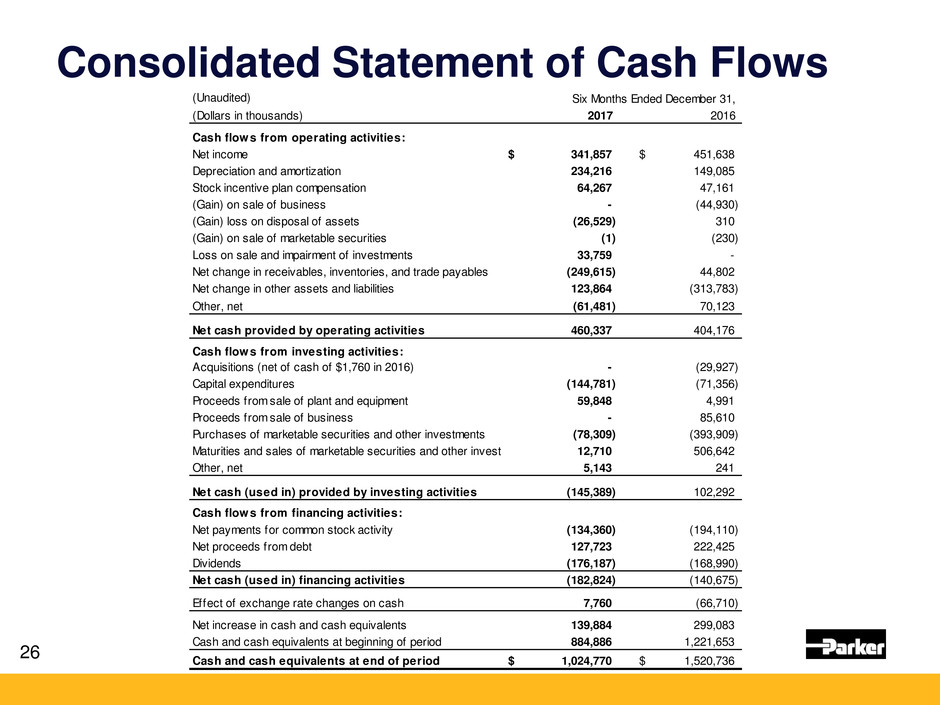

Consolidated Statement of Cash Flows

26

(Unaudited) Six Months Ended December 31,

(Dollars in thousands) 2017 2016

Cash flows from operating activities:

Net income 341,857$ 451,638$

Depreciation and amortization 234,216 149,085

Stock incentive plan compensation 64,267 47,161

(Gain) on sale of business - (44,930)

(Gain) loss on disposal of assets (26,529) 310

(Gain) on sale of marketable securities (1) (230)

Loss on sale and impairment of investments 33,759 -

Net change in receivables, inventories, and trade payables (249,615) 44,802

Net change in other assets and liabilities 123,864 (313,783)

Other, net (61,481) 70,123

Net cash provided by operating activities 460,337 404,176

Cash flows from investing activities:

Acquisitions (net of cash of $1,760 in 2016) - (29,927)

Capital expenditures (144,781) (71,356)

Proceeds from sale of plant and equipment 59,848 4,991

Proceeds from sale of business - 85,610

Purchases of marketable securities and other investments (78,309) (393,909)

Maturities and sales of marketable securities and other investments 12,710 506,642

Other, net 5,143 241

Net cash (used in) provided by investing activities (145,389) 102,292

Cash flows from financing activities:

Net payments for common stock activity (134,360) (194,110)

Net proceeds from debt 127,723 222,425

Divi ends (176,187) (168,990)

Net cash (used in) financing activities (182,824) (140,675)

Effect of exchange rate changes on cash 7,760 (66,710)

Net increase in cash and cash equivalents 139,884 299,083

Cash and cash equivalents at beginning of period 884,886 1,221,653

Cash and cash equivalents at end of period 1,024,770$ 1,520,736$

Reconciliation of Cash Flow from

Operations to Adjusted Cash Flow from

Operations

27

(Unaudited)

(Amounts in thousands)

Six Months Ended

December 31, 2017

Six Months Ended

December 31, 2016

Percent of sales Percent of sales

As reported cash flow from operations 460,337$ 6.8% 404,176$ 7.5%

Discretionary pension contribution - 220,000

Adjusted cash flow from operations 460,337$ 6.8% 624,176$ 11.5%

Reconciliation of Forecasted EPS

28

(Unaudited)

(Amounts in dollars)

Fiscal Year

2018

Forecasted earnings per diluted share $7.38 to $7.78

Adjustments:

Business realignment charges 0.32

Clarcor costs to achieve 0.28

Gain on sale and w ritedow n of assets, net 0.02

U.S. Tax Reform one-time impact, net 1.65

Adjusted forecasted earnings per diluted share $9.65 to $10.05

Supplemental Sales Information

Global Technology Platforms

29

(Unaudited)

(Dollars in thousands)

December 31,

2017

December 31,

2016

December 31,

2017

December 31,

2016

Net sales

Diversif ied Industrial:

Motion Systems 825,695$ 754,772$ 1,635,442$ $ 1,496,422

Flow and Process Control 997,837 783,864 1,993,184 1,608,178

Filtration and Engineered Materials 997,453 588,385 2,025,824 1,204,315

Aerospace Systems 549,688 543,783 1,080,874 1,105,020

Total 3,370,673$ 2,670,804$ 6,735,324$ 5,413,935$

Fiscal Year-to-DateThree Months Ending