Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Roadrunner Transportation Systems, Inc. | rrts-20180131xex991xpressr.htm |

| 8-K - 8-K - Roadrunner Transportation Systems, Inc. | rrts-20180131x8xkpressrele.htm |

Restatement Summary, 2016 Results &

2017 Business Trends

January 31, 2018

2

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which relate to future

events or performance. Forward-looking statements include, among others, statements regarding the anticipated

filing of Roadrunner’s future quarterly and annual reports, Roadrunner’s expected results for 2017, the positive

momentum and better environment for operational improvements in Roadrunner’s Truckload Logistics segment

and growth in Roadrunner’s LTL and Ascent Global Logistics segments during 2018 and the ability of

Roadrunner’s financing and capital to support its current business levels and organic growth over the next five

years. These statements are often, but not always, made through the use of words or phrases such as “may,”

“will,” “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “predict,”

“potential,” “opportunity,” and similar words or phrases or the negatives of these words or phrases. These forward-

looking statements are based on Roadrunner’s current assumptions, expectations and beliefs and are subject to

substantial risks, estimates, assumptions, uncertainties and changes in circumstances that may cause

Roadrunner’s actual results, performance or achievements, to differ materially from those expressed or implied in

any forward-looking statement. Such factors include, among others, risks related to the restatement of

Roadrunner’s previously issued financial statements, the remediation of Roadrunner’s identified material

weaknesses in its internal control over financial reporting, the litigation resulting from the restatement of

Roadrunner’s previously issued financial statements and the other risk factors contained in Roadrunner’s SEC

filings, including Roadrunner’s Annual Report on Form 10-K for the year ended December 31, 2016. Because the

risks, estimates, assumptions and uncertainties referred to above could cause actual results or outcomes to differ

materially from those expressed in any forward-looking statements, you should not place undue reliance on any

forward-looking statements. Any forward-looking statement speaks only as of the date hereof, and, except as

required by law, Roadrunner assumes no obligation and does not intend to update any forward-looking statement

to reflect events or circumstances after the date hereof.

Safe Harbor Statement

3

Topics for Today’s Call

1. Restatement Summary

2. 2016 Financial Results

3. 2017 Business Trends

4. Question & Answer Session

Restatement Summary

Background and Scope

• Internal investigation conducted by our Audit Committee and overseen by

independent outside counsel

• Reviews by company and outside consultants covered our operating companies and

corporate headquarters

• Includes reporting periods from 2011 to Q3 of 2016

Findings

• Material accounting errors impacting the financial statements and disclosures

• Deficiencies in the design and/or execution of internal controls that constituted

material weaknesses

4

Restatement Summary

Key Causes

• Increased size and complexity from acquisitions of 25 non-public companies

• Inconsistent accounting systems and policies and procedures

• Override of internal controls by prior management

Overstated Net Income by $66.5 million

• $15.2 in 2011 through 2013

• $19.3 in 2014

• $22.4 in 2015

• $9.6 in 2016 (through Q3)

Conclusion

• Over 80% of restatement occurred at five operating companies and corporate

Continuing to fully cooperate with DOJ and SEC investigations

5

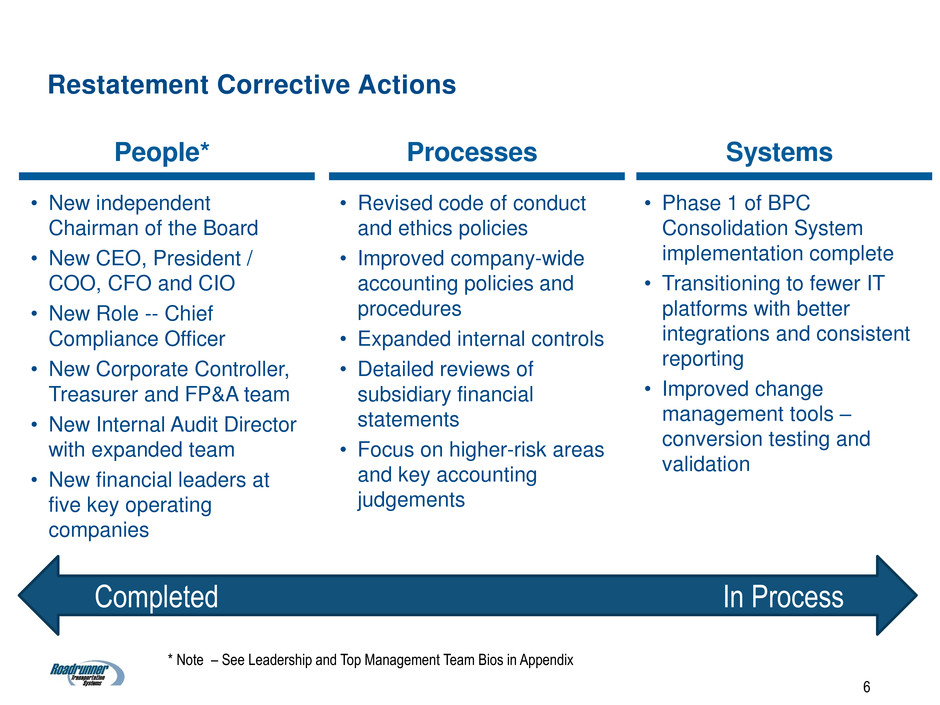

6

Restatement Corrective Actions

* Note – See Leadership and Top Management Team Bios in Appendix

• New independent

Chairman of the Board

• New CEO, President /

COO, CFO and CIO

• New Role -- Chief

Compliance Officer

• New Corporate Controller,

Treasurer and FP&A team

• New Internal Audit Director

with expanded team

• New financial leaders at

five key operating

companies

People*

• Revised code of conduct

and ethics policies

• Improved company-wide

accounting policies and

procedures

• Expanded internal controls

• Detailed reviews of

subsidiary financial

statements

• Focus on higher-risk areas

and key accounting

judgements

Processes Systems

• Phase 1 of BPC

Consolidation System

implementation complete

• Transitioning to fewer IT

platforms with better

integrations and consistent

reporting

• Improved change

management tools –

conversion testing and

validation

Completed In Process

Capital In Place to Support the Operational Turnaround

Raised more than $540 million in new financing

• Preferred stock investment* - recorded as debt for GAAP purposes

• No mandatory redemption payments until 2023

• Allows for deferred payment of dividends, if deferred earns interest until paid

• Asset-based lending (ABL) facility - supported by A/R and transportation equipment

• Covenant light requirements enables focus on operational improvements

Sold Unitrans for $95 million

• Non-core business unit

• Divestiture completed on September 15, 2017

• Reduced debt and provided additional liquidity

Current Status

• In compliance with ABL and preferred stock investment agreements

• Current available borrowing capacity under the ABL facility plus a standby

commitment for ~$50 million of additional preferred stock investment

7

* Note – See Preferred Stock Investment in Appendix

Summary of 2016 Results

Financial Summary

• Revenues: $2,033.2 million vs. $1,992.2 million in 2015

• Net loss, excluding impairment charges, of $35.6 million in 2016 vs. net income of

$25.6 million in 2015

• Adjusted EBITDA of $7.8 million in 2016 vs. $93.6 million in 2015

Declines in EBITDA

• Reduced profitability of Truckload Logistics segment ~ $48 million

– Cost increases primarily for insurance, equipment leasing, maintenance and payroll

– Deteriorating market conditions

– Lower truck productivity and network inefficiencies

– Negative revenue mix

• Reduced profitability of LTL segment ~ $21 million

– Revenue declines of $54 million caused significant negative operating leverage

• Reduced profitability in the Global Solutions (Ascent) segment ~ $3 million

– Due to lower revenue and yields in domestic and international freight management

• Higher-than-normal, non-allocated operating costs ~ $14 million

– Higher lease purchase guarantee reserves

– Increased legal and litigation settlement costs

8

2017 Business Trends

10

2017 Business Trends

• Difficult market conditions

in first three quarters,

particularly at Express

Ground, Intermodal and

Temp Control

• Improving rate environment

later in year benefiting

these businesses

Truckload Logistics

• Continuing investment

cycle focused on improving

customer experience

• Overall revenue stable with

improving trends later in

year

• Use of purchased power a

detriment as truckload rate

environment improves

LTL

Ascent Global

Logistics

• Continued top and bottom

line growth in these asset

free businesses

• Sale of Unitrans in

September of 2017 --$9.3

million of EBITDA in 2016

Overall

Revenue in line with 2016

Higher costs associated with upgrading finance, HR and IT talent

Approximately $30 million of restatement and refinancing costs

11

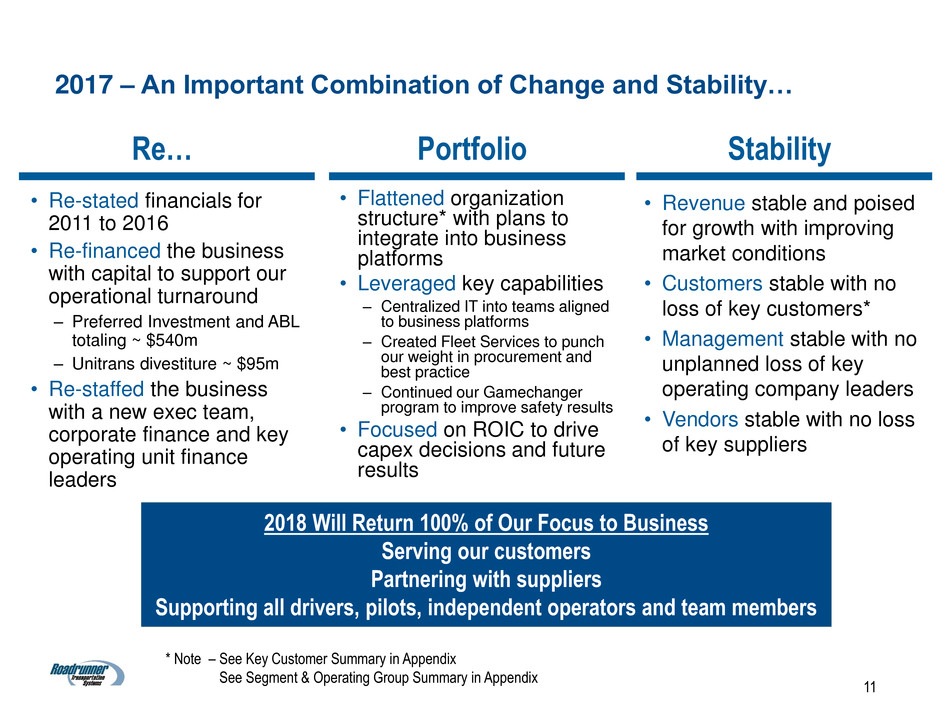

2017 – An Important Combination of Change and Stability…

• Re-stated financials for

2011 to 2016

• Re-financed the business

with capital to support our

operational turnaround

– Preferred Investment and ABL

totaling ~ $540m

– Unitrans divestiture ~ $95m

• Re-staffed the business

with a new exec team,

corporate finance and key

operating unit finance

leaders

Re…

• Flattened organization

structure* with plans to

integrate into business

platforms

• Leveraged key capabilities

– Centralized IT into teams aligned

to business platforms

– Created Fleet Services to punch

our weight in procurement and

best practice

– Continued our Gamechanger

program to improve safety results

• Focused on ROIC to drive

capex decisions and future

results

Portfolio Stability

• Revenue stable and poised

for growth with improving

market conditions

• Customers stable with no

loss of key customers*

• Management stable with no

unplanned loss of key

operating company leaders

• Vendors stable with no loss

of key suppliers

2018 Will Return 100% of Our Focus to Business

Serving our customers

Partnering with suppliers

Supporting all drivers, pilots, independent operators and team members

* Note – See Key Customer Summary in Appendix

See Segment & Operating Group Summary in Appendix

Future Communications

12

Topics for our Next Conference Call

• 2017 Results & Analysis

– 10-Qs through 9/30/17 by March

– Full Year 2017 as soon as possible thereafter

• Details surrounding 2018 plans and goals

– Don’t expect guidance

– What you can expect

• Guideposts for progress over the next few years

• CapEx guidelines for 2018 and future estimated annualized run rate

• Tax rate estimates

Other Communications

– Future announcements related to simplification and integration

Q&A

Appendix

New Executive Leadership Team

Chief Executive Officer

• Joined Roadrunner in early 2016 as

President and COO

• Previously served as CEO of RC2

Corp from 2003 to 2011 and at TOMY

International for two years after they

acquired RC2

• Deep experience in consumer

products, brand and channel

management, global sourcing and

logistics

• Strong track record of driving long-

term Sales and EBITDA Growth (11%

CAGR @ RC2)

• Extensive public company executive

management experience as CFO,

COO and CEO of acquisitive, levered

growth-oriented company

Curt Stoetling Curt Stoelting

President & COO

Mike Gettle

• Joined Roadrunner in 2016 as

Executive Vice President

• Previously served as Americas CEO

and Global CFO of market-research

firm TNS, a highly acquisitive $2 billion

division of multinational WPP plc

• Earlier was Global CFO of sister firm

Millward Brown; grew it from $200M to

$1B through 29 acquisitions to

become one of the most profitable and

respected global research firms

• Background in finance, operations,

and leadership of people-oriented,

data intensive, geographically

dispersed businesses

• Strong track record of success in both

high growth, acquisitive and

turnaround environments

EVP & CFO

Terry Rogers

• Joined Roadrunner in May 2017 with

extensive public company and private

equity experience at Ryerson

• Most recently CFO of an acquisitive

manufacturing company with over 40

distinct businesses and revenues in

excess of $2 billion

• Extensive background in financings,

treasury management, investor

relations, internal controls and

enterprise-wide financial planning and

reporting systems

15

Top Management Team

16

Key Management Positions

Scott Cousins, Chief Information Officer

• Joined Roadrunner in January 2017 as CIO

• Held previous CIO positions at food distributor KeHe and NCH Marketing

• Earlier served as Senior Vice President of Information Technology at IndyMac Bank and as Associate Partner at Accenture

Bob Milane, General Counsel and Chief Compliance Officer

• Joined Roadrunner in 2014 and recently served as EVP for Risk Management and GC (new role remains responsible for risk management)

• Previously served as Managing Director for Risk Management at FedEx Ground and Assistant VP of Risk Management for Canal Insurance

Craig Paulson, SVP of Human Resources

• Joined Roadrunner in October 2017

• Previously HR experience at Danaher, Eaton/Cooper Industries, Dover and Generac

• Has managed all function HR areas and partnered with business leaders on people deployment and development

Frank Hurst, President - Roadrunner Freight

• Joined Roadrunner in January 2017 with 21 years of management and transportation industry experience

• Previously business and sales leader at North America Corp., Vitrans Express and Fed Ex

Bill Goodgion, President - Ascent Global Logistics

• Joined Roadrunner in April 2015 as President of Roadrunner Ascent Global Logistics

• Previously spent 15 year at FedEx Trade Networks where he served as MD of Regional Operations and then MD of Global Distribution

17

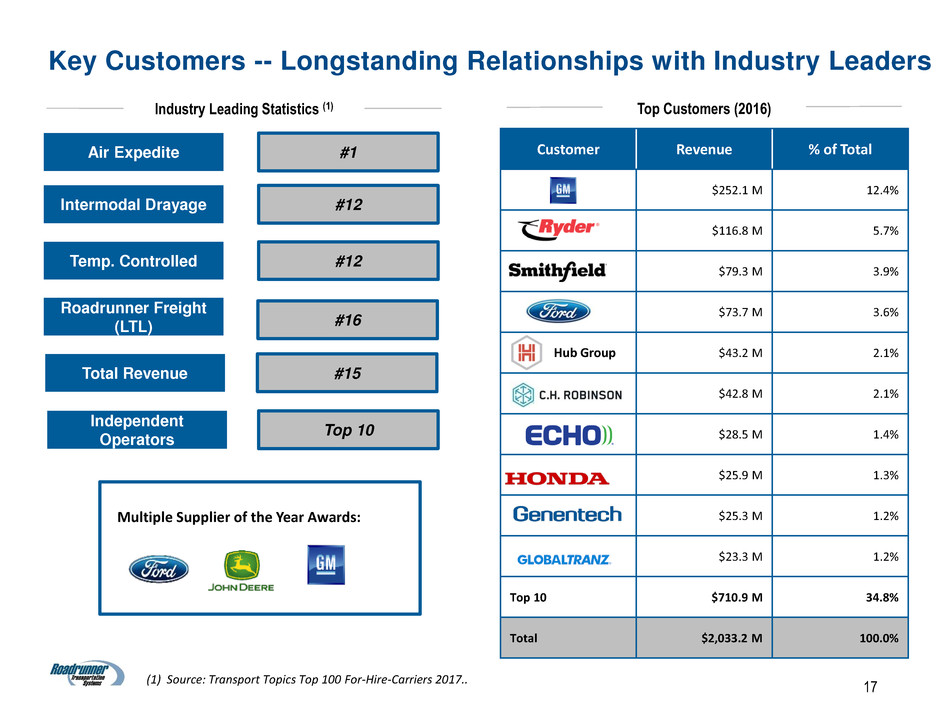

Top Customers (2016) Industry Leading Statistics (1)

Customer Revenue % of Total

$252.1 M 12.4%

(2) $116.8 M 5.7%

(2) $79.3 M 3.9%

( $73.7 M 3.6%

$43.2 M 2.1%

$42.8 M 2.1%

$28.5 M 1.4%

$25.9 M 1.3%

$25.3 M 1.2%

$23.3 M 1.2%

Top 10 $710.9 M 34.8%

Total $2,033.2 M 100.0%

Air Expedite

Intermodal Drayage

Temp. Controlled

Roadrunner Freight

(LTL)

Total Revenue

Independent

Operators

#1

#12

#12

#16

#15

Top 10

(1) Source: Transport Topics Top 100 For-Hire-Carriers 2017..

Key Customers -- Longstanding Relationships with Industry Leaders

Hub Group

Multiple Supplier of the Year Awards:

18

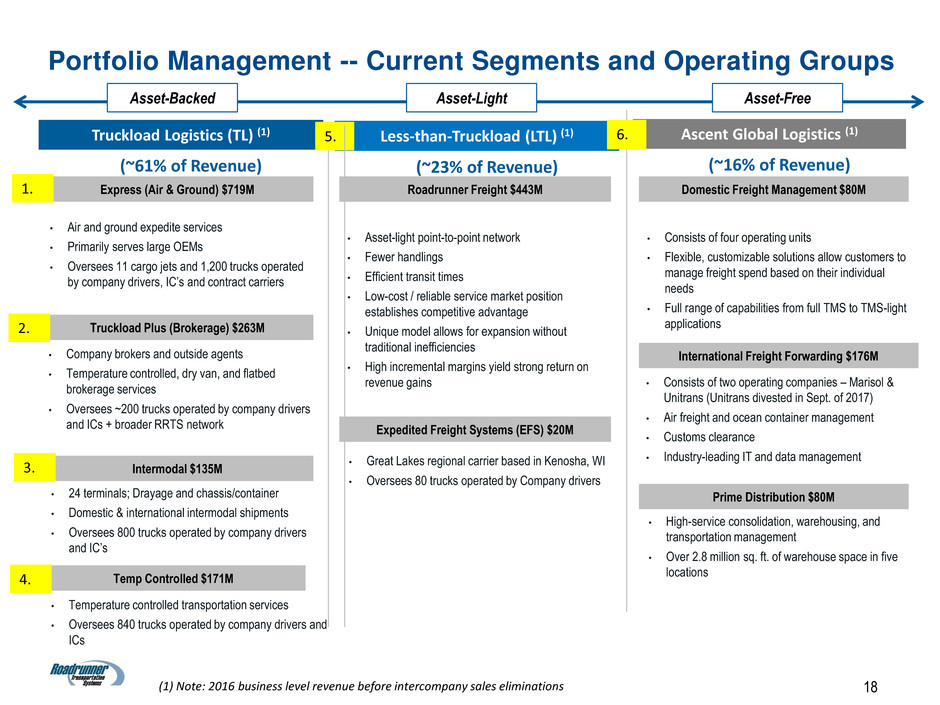

Truckload Logistics (TL) (1)

(~61% of Revenue)

2016 Revenue

Express (Air & Ground) $719M

• Air and ground expedite services

• Primarily serves large OEMs

• Oversees 11 cargo jets and 1,200 trucks operated

by company drivers, IC’s and contract carriers

Truckload Plus (Brokerage) $263M

• Company brokers and outside agents

• Temperature controlled, dry van, and flatbed

brokerage services

• Oversees ~200 trucks operated by company drivers

and ICs + broader RRTS network

Intermodal $135M

• 24 terminals; Drayage and chassis/container

• Domestic & international intermodal shipments

• Oversees 800 trucks operated by company drivers

and IC’s

Temp Controlled $171M

• Temperature controlled transportation services

• Oversees 840 trucks operated by company drivers and

ICs

Less-than-Truckload (LTL) (1)

(~23% of Revenue)

2016 Revenue

Roadrunner Freight $443M

• Asset-light point-to-point network

• Fewer handlings

• Efficient transit times

• Low-cost / reliable service market position

establishes competitive advantage

• Unique model allows for expansion without

traditional inefficiencies

• High incremental margins yield strong return on

revenue gains

Expedited Freight Systems (EFS) $20M

• Great Lakes regional carrier based in Kenosha, WI

• Oversees 80 trucks operated by Company drivers

Ascent Global Logistics (1)

(~16% of Revenue)

2016 Revenue

Domestic Freight Management $80M

• Consists of four operating units

• Flexible, customizable solutions allow customers to

manage freight spend based on their individual

needs

• Full range of capabilities from full TMS to TMS-light

applications

International Freight Forwarding $176M

• Consists of two operating companies – Marisol &

Unitrans (Unitrans divested in Sept. of 2017)

• Air freight and ocean container management

• Customs clearance

• Industry-leading IT and data management

Prime Distribution $80M

• High-service consolidation, warehousing, and

transportation management

• Over 2.8 million sq. ft. of warehouse space in five

locations

Portfolio Management -- Current Segments and Operating Groups

Asset-Backed Asset-Free

(1) Note: 2016 business level revenue before intercompany sales eliminations

1.

2.

3.

4.

5. 6.

Asset-Light

19

Preferred Investment Summary – treated as debt for GAAP purposes

• Elliott Management $540 million Preferred Investment provided a full refinancing of existing credit facility

• Over half of the Preferred Investment redeemed and retired with ABL Financing and Sale of Unitrans (see notes)

• Dividends payable quarterly in cash or deferred at company’s option; Deferred amounts earn additional interest

19

Preferred E Preferred B Preferred C Preferred D

Structure • Preferred equity

• Convertible to second lien

notes upon approval of ABL

lenders

• Preferred equity • Preferred equity • Preferred Equity valued at

4.01% of common equity

• Warrant Agreement for

380K shares (1% of

common equity)

Face Amount

Outstanding

$37.5M (2) $155MM $55MM 5% common equity economic

interest in company

Preferred Rate L + 5.25% + Additional Rate

(8.50%)

L + 3.00% + Additional Rate

(4.75 – 12.50%) based on

leverage

L + 3.00% + Additional Rate

(4.75 – 12.50%) based on

leverage

N/A

Redemption Term 6 years 8 years 8 years 8 years

Amortization None None None None

Financial

Covenants

None None None None

Redemption Rights 106.5 / 103.5 / Par NC 1 / 105 / 103 / Par 65% premium (subject to

stock price movement)

Subject to stock price

movement

Notes: 1) Series F preferred stock with a face value of $240.5M was redeemed on July 21, 2017 with proceeds from asset-based-lending financing

2) Series E preferred stock with a face value of $52.5M was redeemed on September 14, 2017 with proceeds from the sale of Unitrans.