Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VARIAN MEDICAL SYSTEMS INC | tv484424_8k.htm |

Exhibit 99.1

Dow Wilson President and Chief Executive Officer January 30, 2018 Acquisition of SIRTeX

This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing. 2 Forward - Looking Statements Except for historical information, this presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Statements concerning industry outlook, including growth drivers, future trends in cancer incidence and trends in cancer treatment needs, demand, innovation and growth opportunities ; Varian Medical Systems, Inc . ’s (”Varian” or the “company”) future orders, revenues, backlog or earnings growth ; future financial results ; any statements concerning Varian’s planned acquisition of Sirtex ; expected closing date ; Varian’s financing plans ; the company’s future orders, revenues, or earnings growth or other financial results ; and any statements using the terms “could”, “believe”, “expect”, “outlook”, “anticipate”, ”vision”, “estimate”, “future”, “horizon”, “aiming”, “driving”, “target” or similar statements are forward - looking statements that involve risks and uncertainties that could cause the company’s actual results to differ materially from those anticipated . Such risks and uncertainties include timing of regulatory approvals ; the availability of terms of debt financing ; the ability to integrate the Sirtex business ; global economic conditions and changes to trends for cancer treatment regionally ; the company’s ability to meet Food and Drug Administration (FDA) and other regulatory requirements for product clearances or to comply with FDA and other regulatory regulations or procedures, changes in the regulatory environment, including with respect to FDA requirements ; and the other risks listed from time to time in the company’s filings with the Securities and Exchange Commission, which by this reference are incorporated herein . The company assumes no obligation to update or revise the forward - looking statements in this presentation because of new information, future events, or otherwise . Reconciliations to GAAP financials can be found at http : //investors . varian . com/financialstatements and the appendix to this presentation . Medical Advice Disclaimer Varian as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual treatment res ult s may vary.

Deal summary • Builds on our foundation as a global leader in radiation medicine • Adds platform to enter fast - growing interventional oncology market • Extends our oncology customer base to accelerate revenue • Leverages our global operations, treatment planning, oncology practice management software, image guidance, and radiation safety capabilities • Financially attractive with accretive revenue growth, and on a non - GAAP basis, margins and earnings • Similar company cultures with deep commitment to beat cancer 3

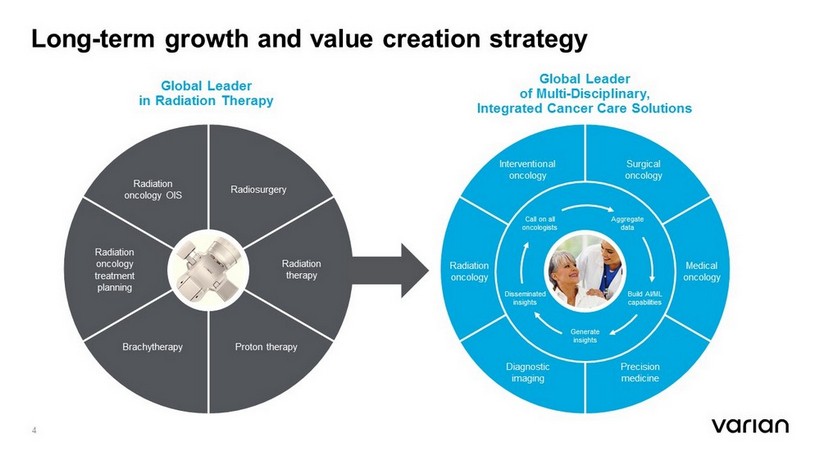

Long - term growth and value creation strategy 4 Global Leader in Radiation Therapy Radiation oncology OIS Radiosurgery Brachytherapy Radiation oncology treatment planning Proton therapy Radiation therapy Global Leader of Multi - Disciplinary, Integrated Cancer Care Solutions Interventional oncology Surgical oncology Diagnostic imaging Radiation oncology Precision medicine Medical oncology Generate insights Call on all oncologists Aggregate data Disseminated insights Build AI/ML capabilities

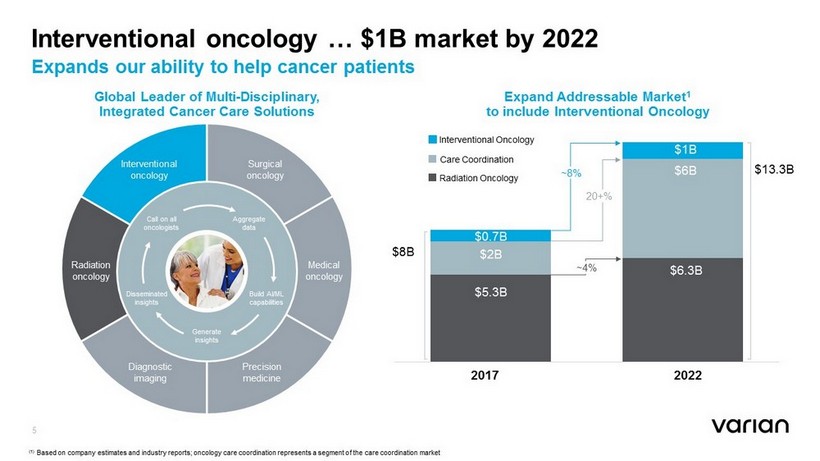

Interventional oncology … $1B market by 2022 Expands our ability to help cancer patients 5 Global Leader of Multi - Disciplinary, Integrated Cancer Care Solutions Interventional oncology Surgical oncology Diagnostic imaging Radiation oncology Precision medicine Medical oncology Generate insights Call on all oncologists Aggregate data Disseminated insights Build AI/ML capabilities Expand Addressable Market 1 to include Interventional Oncology $0.67B $5.3B $6B $6.3B 20+% $13.3B $8B Interventional Oncology Radiation Oncology 2017 2022 ~4% (1) Based on company estimates and industry reports; oncology care coordination represents a segment of the care coordination mar ke t $2B $1B $0.7B ~8% Care Coordination

SIRTeX Medical Limited: company overview ASX:SRX / HQ: Sydney, Australia 6 • Australian headquartered, global healthcare business • Listed on the ASX since 2000 (ASX:SRX); S&P / ASX 200 Index • Focus on Interventional Oncology Market – a rapidly growing subset of the cancer market that utilizes minimally invasive techniques to treat solid tumors • Main p roduct is SIR - Spheres ® Y - 90 resin microspheres − Tiny radioactive microspheres that provide high - dose radiation directly to the tumor while minimizing damage to normal healthy cells − Regulatory clearances in most major markets for the treatment of inoperable liver cancer • Approximately 80,000 doses of SIR - Spheres supplied to treat liver cancer patients in over 1,090 medical centers in over 40 countries 1 • Significant potential of technology – ~5% penetration of addressable market 1 (1) SIRTeX presentations

Deal rationale Acquire platform to build new interventional oncology business unit 7 • Adds global leader in radioembolization to our cancer care portfolio − Extends into adjacent market with proven technology, products, and services; enhances current position in cancer centers − Adds established and enduring liver cancer therapy • Advances Varian’s vision towards becoming a multi - modality oncology care company − Expands Varian’s addressable market by entering attractive Interventional Oncology market (~$1B by 2022, 8% CAGR) − Adds consumables business and sets foundation for new minimally invasive oncology platform • Opportunity for significant growth and cost synergies − Leverages Varian’s geographic footprint to enable new market entry − Global integration will drive efficiencies and yield strong financial returns

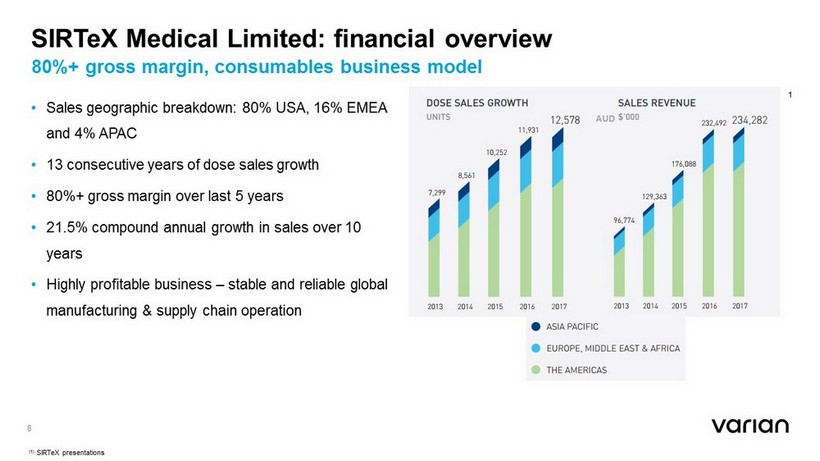

SIRTeX Medical Limited: financial overview 80%+ gross margin, consumables business model 8 • Sales geographic breakdown: 80% USA, 16% EMEA and 4% APAC • 13 consecutive years of dose sales growth • 80%+ gross margin over last 5 years • 21.5% compound annual growth in sales over 10 years • Highly profitable business – stable and reliable global manufacturing & supply chain operation AUD (1) SIRTeX presentations 1

Deal terms Incremental revenue growth, margins and earnings • Purchase price − A$28 / share (US$1,283M equity value) − Financed with a combination of cash and debt facilities • Financial impact − Accretive to non - GAAP earnings per share by 5 - 6% in the first full fiscal year after closing the transaction − Additional guidance to be provided as we near the close of the transaction • Process − Subject to customary closing conditions, SIRTeX shareholder, and regulatory approvals − Closing anticipated in late May 2018 9

Our promise 10 People powering victories Imagine a world without fear of cancer. We do, every day. We innovate new technologies for treating cancer and for connecting clinical teams to advance patient outcomes. Through ingenuity we inspire new victories and empower people in the fight against cancer. We are Varian.