Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Skyline Champion Corp | d531327d8k.htm |

Exhibit 99.1

This filing relates to the proposed share contribution and exchange transaction (the “Exchange”) between Skyline Corporation (“Skyline”) and Champion Enterprises Holdings, LLC (“Champion Holdings”) pursuant to the terms of a Share Contribution & Exchange Agreement dated as of January 5, 2018 (the “Exchange Agreement”) between Skyline and Champion Holdings. The Exchange Agreement is on file with the Securities and Exchange Commission (“SEC”) as Exhibit 2.1 to the Current Report on Form 8-K filed by Skyline on January 5, 2018.

Set forth below are slides from an investor presentation given on January 25, 2018 by Richard W. Florea, President and Chief Executive Officer of Skyline, Keith Anderson, Chief Executive Officer of Champion Home Builders, Inc., and Laurie Hough, Senior Vice President and Chief Financial Officer of Champion Holdings.

Additional Information for Shareholders

In connection with the proposed Exchange and certain matters to be approved by Skyline’s shareholders at a special meeting of shareholders relating to the Exchange (the “Company Shareholder Approval Matters”), Skyline will prepare a proxy statement to be filed with the SEC. When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of Skyline. The proxy statement will contain important information about the Company Shareholder Approval Matters and the proposed Exchange and related matters. SKYLINE’S SHAREHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED EXCHANGE (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY SHAREHOLDER APPROVAL MATTERS AND THE PROPOSED EXCHANGE. Skyline’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website at www.sec.gov. Skyline’s shareholders also will be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to Skyline Corporation, 2520 By-Pass Road, P.O. Box 743, Elkhart, Indiana 46514, Attention: Corporate Secretary, or by calling (574) 294-6521, or from Skyline’s website at www.skylinecorp.com under the tab “Investors – SEC Filings.” The information available through Skyline’s website is not and shall not be deemed part of this document or incorporated by reference into other filings Skyline makes with the SEC. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

This communication is not a solicitation of proxies in connection with the proposed Exchange. However, Skyline and its directors and officers may be deemed to be participants in the solicitation of proxies from Skyline’s shareholders with respect to the special meeting of shareholders that will be held to consider the Company Shareholder Approval Matters in connection with the Exchange. Information concerning the ownership of Skyline securities by Skyline’s directors and executive officers is included in their SEC filings on Forms 3, 4, and 5 and additional information about Skyline’s directors and executive officers and their ownership of Skyline’s common stock is set forth in the proxy statement for Skyline’s 2017 annual meeting of shareholders, as filed with the SEC on Schedule 14A on August 22, 2017. Shareholders may obtain additional information regarding the interests of Skyline and its directors and executive officers in the proposed Exchange, which may be different than those of Skyline’s shareholders generally, by reading the proxy statement and other relevant documents regarding the proposed Exchange, when filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Forward-Looking Statements

Except for historical information contained herein, this document expresses “forward-looking statements” which are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995, as amended. Such matters include forward-looking statements regarding the prospective effects and timing of the proposed Exchange. Generally, the words “believe,” “expect,” “intend,” “estimate,” “project,” “will,” and similar expressions indicate forward-looking statements. Those statements, including statements, projections, estimates, or assumptions concerning future events or performance, and other statements that are other than statements of historical fact, are subject to material risks and uncertainties. Skyline cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. Skyline may make other written or oral forward-looking statements from time to time. Readers are advised that various important factors could cause Skyline’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Such factors, among others, include, but are not limited to: potential failure to obtain shareholder approval of the Company Shareholder Approval Matters; potential failure to obtain regulatory approval for the Exchange or to satisfy other conditions to the consummation of the Exchange on the proposed terms and within the proposed timeframes; costs or difficulties relating to integration matters might be greater than expected; material adverse changes in Skyline’s operations or earnings; changes in laws, regulations, or accounting principles generally accepted in the United States; the effect of the recently enacted Tax Cuts and Jobs Act on Skyline and its subsidiaries; Skyline’s competitive position within the markets it serves; unforeseen downturns in the local, regional, or national economies or in the specific regions in which Skyline has market concentrations; and other risks discussed in Skyline’s filings with the SEC, including its Annual Report on Form 10-K, which filings are available from the SEC. Skyline undertakes no obligation to publicly update or revise any forward-looking statements except as required by law.

* * * * * * *

CoverPageAddedID logoRBCCM1 Capital Markets 0 Business Combination of Skyline Corporation and Champion Homes Creating the Nation’s Largest Publicly Traded Factory-Built Housing Company January 25, 2018 79 129 189 157 177 207 195 12 62 53 88 131 89 89 89 144 20 100

Disclaimer Forward-Looking Statements Statements in this presentation and discussions that follow regarding the proposed transaction between Skyline Corporation (“Skyline”) and Champion Enterprises Holdings, LLC (“Champion Homes” or “Champion”), the expected timing for completing the proposed transaction, the completion of the consolidation and upsize of the revolving credit facilities, and the potential benefits created by the proposed transaction are intended to be covered by the safe harbor for "forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by use of statements that include, but are not limited to, phrases such as "believe," "expect," "future," "anticipate," "intend," "plan," "foresee," "may," "should," "will," "estimates," "potential," "continue," or other similar words or phrases. Similarly, statements that describe objectives, plans, or goals also are forward-looking statements. Such forward-looking statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Skyline, Champion or Skyline Champion Corporation, the post-combination company. Skyline cautions that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Risks and uncertainties include, but are not limited to: the failure of the proposed transaction, or consolidation and upsize of the revolving credit facilities, to close; Skyline Champion Corporation’s inability to realize the expected benefits from the proposed transaction, general economic conditions; availability of wholesale and retail financing; the health of the U.S. housing market as a whole; federal, state, and local regulations pertaining to the manufactured housing industry; the cyclical nature of the manufactured housing industry; general or seasonal weather conditions affecting sales; potential impact of natural disasters on sales and raw material costs; potential periodic inventory adjustments by independent retailers; interest rate levels; the impact of inflation; the impact of high or rising fuel costs; the cost of labor and raw materials; competitive pressures on pricing and promotional costs; Skyline's relationships with its shareholders, customers, and other stakeholders; catastrophic events impacting insurance costs; the availability of insurance coverage for various risks to Skyline; market demographics; and management's ability to attract and retain executive officers and key personnel and other risks and uncertainties more fully described in Skyline’s Annual Report on Form 10-K for the year ended May 31, 2017, as filed with the SEC, as well as the other filings that Skyline makes with the SEC. Investors and stockholders are also urged to read the risk factors set forth in the proxy statement carefully when they are available. If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, the developments and future events concerning Skyline, Champion and Skyline Champion Corporation set forth in this presentation and any discussions that follow may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this document. We anticipate that subsequent events and developments will cause our expectations and beliefs to change. Skyline assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws. Additional Information for Shareholders In connection with the matters to be approved by Skyline’s shareholders pursuant to the proposed exchange transaction described in this presentation, Skyline will prepare a proxy statement to be filed with the SEC. When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of Skyline. Skyline’s shareholders are urged to read the proxy statement regarding the proposed exchange transaction because it will contain important information about the matters to be approved by Skyline’s shareholders in connection with the proposed exchange and important information about the proposed exchange transaction itself. Skyline’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website at www.sec.gov. Skyline’s shareholders also will be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to Skyline Corporation, 2520 By-PassRoad, P.O. Box 743, Elkhart, Indiana 46514, Attention: Corporate Secretary, or by calling (574) 294-6521, or from Skyline’s website at www.skylinecorp.com under the tab “Investors – SEC Filings.” This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. Certain Information Regarding Participants Skyline, Champion and their respective directors and certain of their officers may be deemed to be participants in the solicitation of proxies from Skyline’s shareholders with respect to the special meeting of shareholders that will be held to consider the matters to be approved by Skyline’s shareholders in connection with the exchange transaction. Information about Skyline’s directors and executive officers and their ownership of Skyline’s common stock is set forth in the proxy statement for Skyline’s 2017 annual meeting of shareholders, as filed with the SEC on Schedule 14A on August 22, 2017. Shareholders may obtain additional information regarding the interests of Skyline and its directors and executive officers, and the proposed Skyline Champion Corporation and its anticipated directors and executive officers, in the proposed Exchange, which may be different than those of Skyline’s shareholders generally, by reading the proxy statement and other relevant documents regarding the proposed Exchange, when filed with the SEC. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. We believe that the presentation of these financial measures enhances an investor’s understanding of Skyline and Champion’s financial performance. Non-GAAP measures should be read only in conjunction with consolidated financials prepared in accordance with GAAP. We believe that these financial measures are useful financial metrics to assess our operating performance from period to period by excluding certain items that we believe are not representative of our core business. These financial measures should not be considered as alternatives to net income (loss) or any other performance measures derived in accordance with GAAP as measures of operating performance or as measures of liquidity. Pursuant to the requirements of SEC Regulation G, Skyline has provided reconciliations within these slides, as necessary, of the non-GAAP financial measures to the most directly comparable GAAP financial measure. LTM Financial Presentation References throughout this presentation to Skyline’s last twelve month (“LTM”) financials refer to the twelve months ended December 3, 2017. References throughout this presentation to Champion’s LTM financials refer to the twelve months ended December 30, 2017.

Proven Leadership Keith Anderson Chief Executive Officer Appointed CEO of Champion Homes in January 2015 Mr. Anderson has served on Champion’s Board of Directors since 2013 Prior to Champion, he served as EVP and COO of Walter Investment and President and CEO of Green Tree Servicing Laurie Hough Chief Financial Officer & Senior Vice President Appointed Senior Vice President and CFO of Champion Homes in November 2016 Ms. Hough joined Champion in 2010 and was appointed VP and Controller in 2012; prior to that she held positions at Chrysler and PwC Licensed CPA and received her BS in Accounting from Oakland University Richard Florea President & Chief Executive Officer Mr. Florea has been President and CEO of Skyline since 2015 Prior to joining Skyline, Mr. Florea served as President and CEO of Truck Accessories Group Previously, Mr. Florea served as President and CEO of Dutchmen Manufacturing, a Thor Industries company

Champion Homes and Skyline: A Compelling Strategic Combination Attractive market dynamics with meaningful increase in industry shipments, strong demographic trends and financing availability Creates a leading factory-built housing player with #2 North American market position Results in an attractive geographic footprint to serve customers across North America Existing product offerings complemented by enhanced capabilities such as commercial modular construction and in-house logistics and retail businesses Proven ability to achieve operational improvements with meaningful future opportunities Significant synergies anticipated from combination of two businesses Strong pro forma balance sheet and significant financial flexibility provides ability to pursue attractive growth opportunities All-stock transaction allows shareholders to participate in value creation resulting from the transaction Strong Industry Backdrop Enhanced Platform Powerful Combination

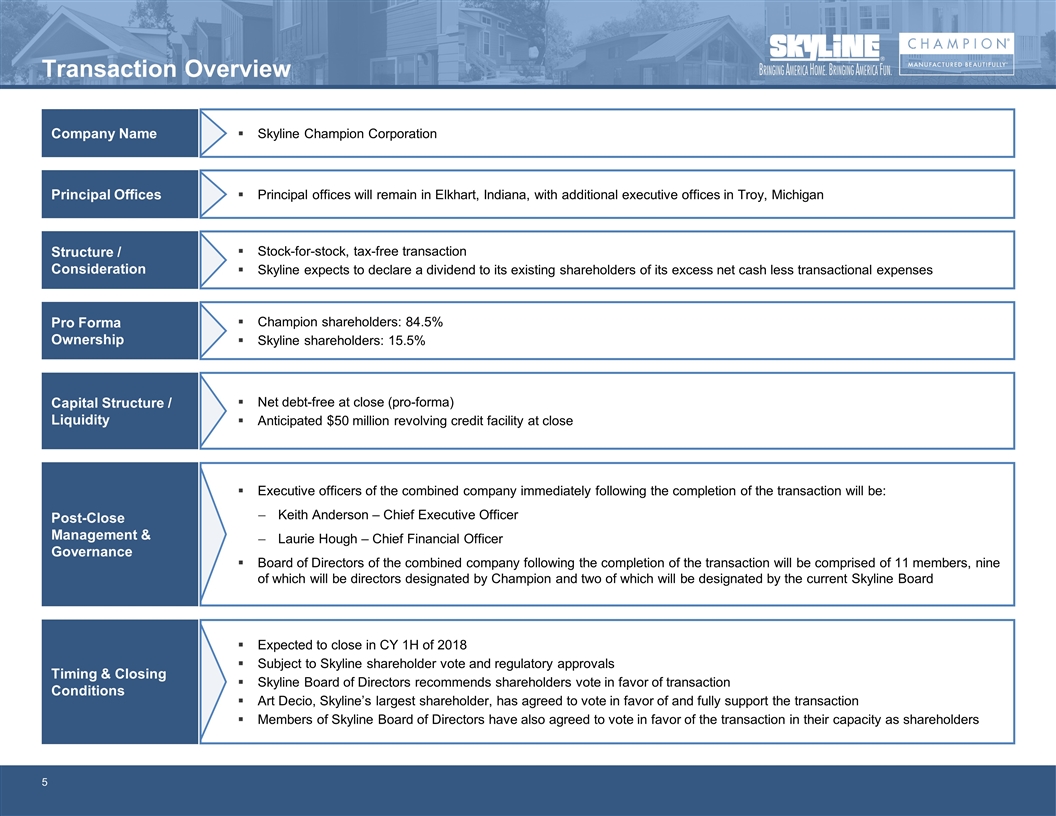

Structure / Consideration Stock-for-stock, tax-free transaction Skyline expects to declare a dividend to its existing shareholders of its excess net cash less transactional expenses Pro Forma Ownership Champion shareholders: 84.5% Skyline shareholders: 15.5% Post-Close Management & Governance Executive officers of the combined company immediately following the completion of the transaction will be: Keith Anderson – Chief Executive Officer Laurie Hough – Chief Financial Officer Board of Directors of the combined company following the completion of the transaction will be comprised of 11 members, nine of which will be directors designated by Champion and two of which will be designated by the current Skyline Board Capital Structure / Liquidity Net debt-free at close (pro-forma) Anticipated $50 million revolving credit facility at close Timing & Closing Conditions Expected to close in CY 1H of 2018 Subject to Skyline shareholder vote and regulatory approvals Skyline Board of Directors recommends shareholders vote in favor of transaction Art Decio, Skyline’s largest shareholder, has agreed to vote in favor of and fully support the transaction Members of Skyline Board of Directors have also agreed to vote in favor of the transaction in their capacity as shareholders Company Name Skyline Champion Corporation Principal Offices Principal offices will remain in Elkhart, Indiana, with additional executive offices in Troy, Michigan Transaction Overview

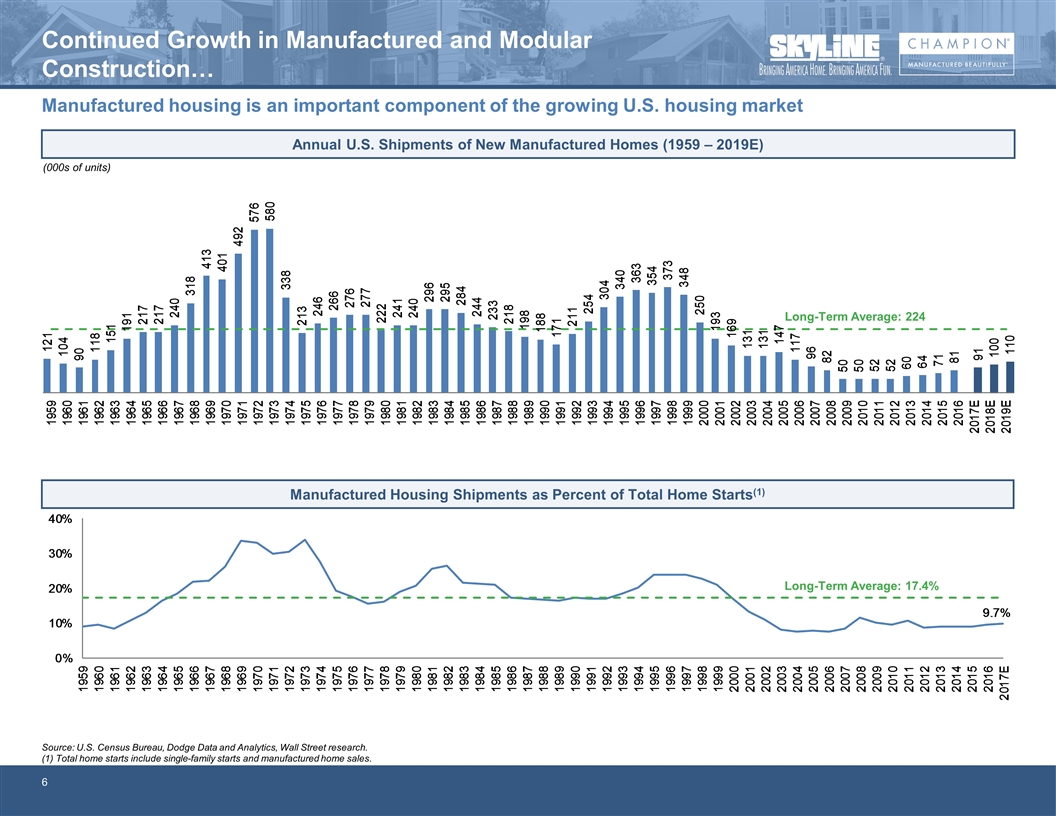

Continued Growth in Manufactured and Modular Construction… Manufactured Housing Shipments as Percent of Total Home Starts(1) Source: U.S. Census Bureau, Dodge Data and Analytics, Wall Street research. (1) Total home starts include single-family starts and manufactured home sales. (000s of units) Annual U.S. Shipments of New Manufactured Homes (1959 – 2019E) Long-Term Average: 224 Long-Term Average: 17.4% Manufactured housing is an important component of the growing U.S. housing market

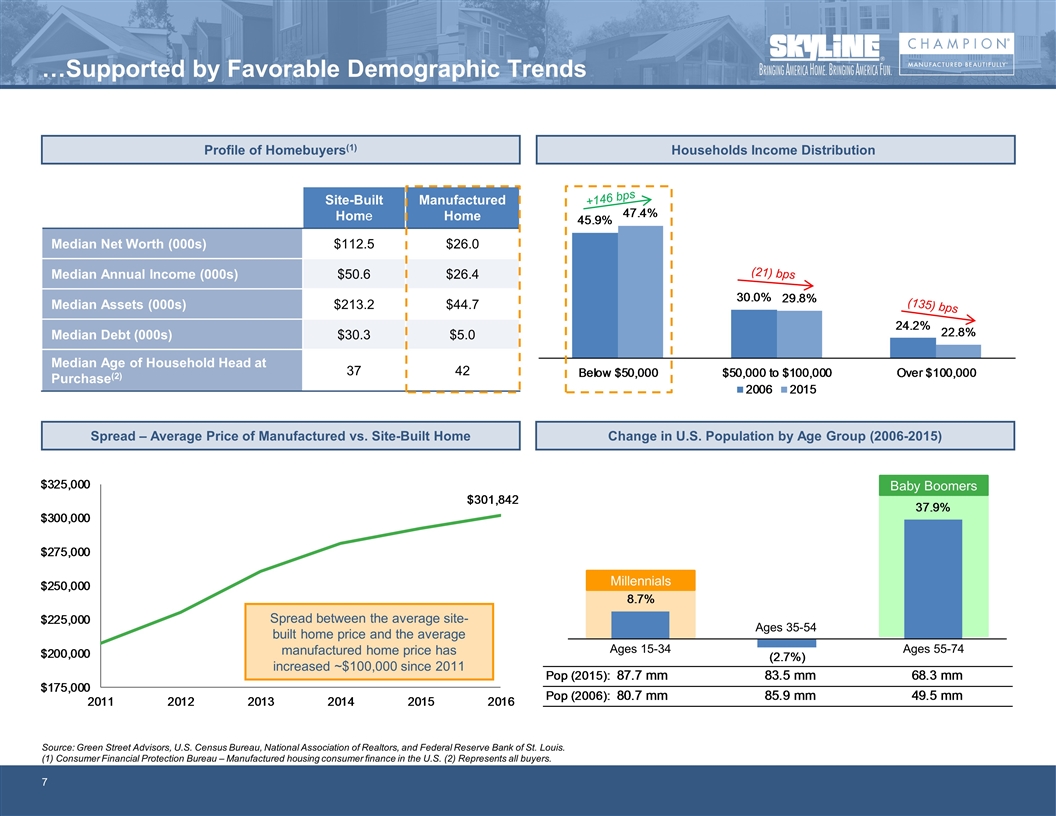

…Supported by Favorable Demographic Trends Source: Green Street Advisors, U.S. Census Bureau, National Association of Realtors, and Federal Reserve Bank of St. Louis. (1) Consumer Financial Protection Bureau – Manufactured housing consumer finance in the U.S. (2) Represents all buyers. Site-Built Home Manufactured Home Median Net Worth (000s) $112.5 $26.0 Median Annual Income (000s) $50.6 $26.4 Median Assets (000s) $213.2 $44.7 Median Debt (000s) $30.3 $5.0 Median Age of Household Head at Purchase(2) 37 42 +560 bps +39 bps (487) bps (73) bps (21) bps +146 bps (135) bps Profile of Homebuyers(1) Spread – Average Price of Manufactured vs. Site-Built Home Households Income Distribution Change in U.S. Population by Age Group (2006-2015) Ages 15-34 Ages 35-54 Ages 55-74 Spread between the average site-built home price and the average manufactured home price has increased ~$100,000 since 2011 Millennials Baby Boomers

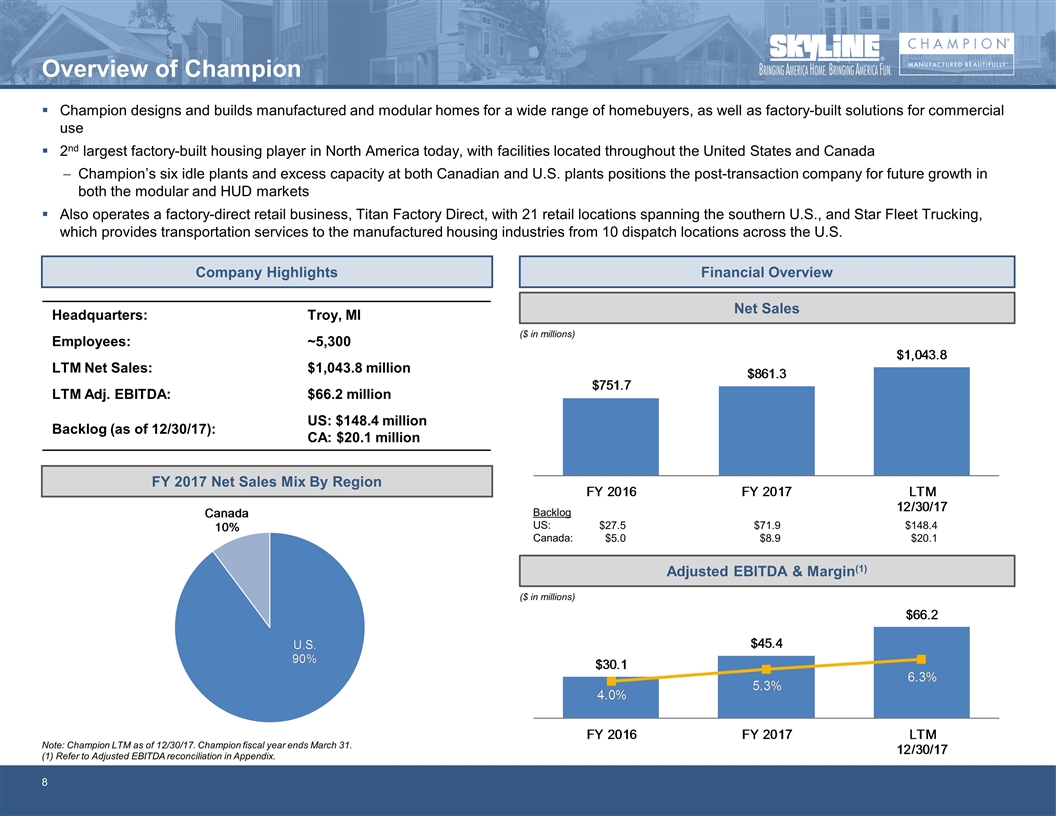

Overview of Champion Champion designs and builds manufactured and modular homes for a wide range of homebuyers, as well as factory-built solutions for commercial use 2nd largest factory-built housing player in North America today, with facilities located throughout the United States and Canada Champion’s six idle plants and excess capacity at both Canadian and U.S. plants positions the post-transaction company for future growth in both the modular and HUD markets Also operates a factory-direct retail business, Titan Factory Direct, with 21 retail locations spanning the southern U.S., and Star Fleet Trucking, which provides transportation services to the manufactured housing industries from 10 dispatch locations across the U.S. Company Highlights Financial Overview FY 2017 Net Sales Mix By Region Headquarters: Troy, MI Employees: ~5,300 LTM Net Sales: $1,043.8 million LTM Adj. EBITDA: $66.2 million Backlog (as of 12/30/17): US: $148.4 million CA: $20.1 million Note: Champion LTM as of 12/30/17. Champion fiscal year ends March 31. (1) Refer to Adjusted EBITDA reconciliation in Appendix. Net Sales ($ in millions) Adjusted EBITDA & Margin(1) ($ in millions) Backlog US: Canada: $27.5 $5.0 $71.9 $8.9 $148.4 $20.1

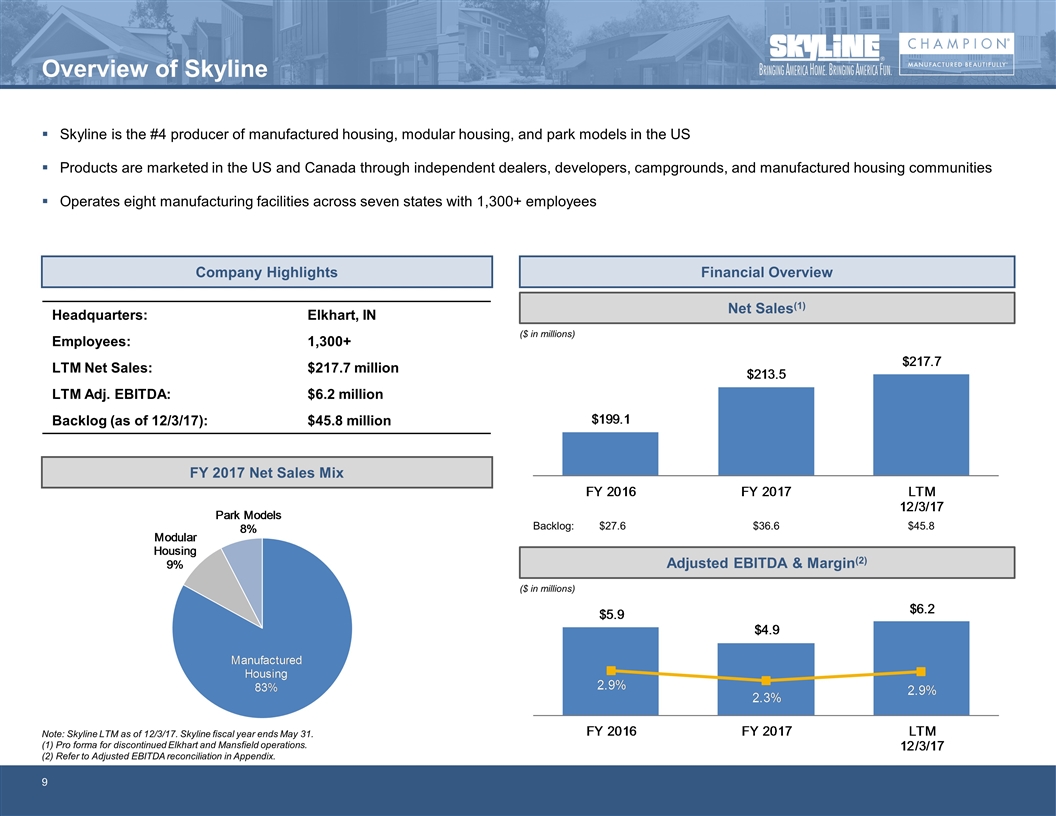

Overview of Skyline Financial Overview Note: Skyline LTM as of 12/3/17. Skyline fiscal year ends May 31. (1) Pro forma for discontinued Elkhart and Mansfield operations. (2) Refer to Adjusted EBITDA reconciliation in Appendix. Net Sales(1) ($ in millions) Adjusted EBITDA & Margin(2) ($ in millions) FY 2017 Net Sales Mix Company Highlights Headquarters: Elkhart, IN Employees: 1,300+ LTM Net Sales: $217.7 million LTM Adj. EBITDA: $6.2 million Backlog (as of 12/3/17): $45.8 million Skyline is the #4 producer of manufactured housing, modular housing, and park models in the US Products are marketed in the US and Canada through independent dealers, developers, campgrounds, and manufactured housing communities Operates eight manufacturing facilities across seven states with 1,300+ employees Backlog: $27.6 $36.6 $45.8

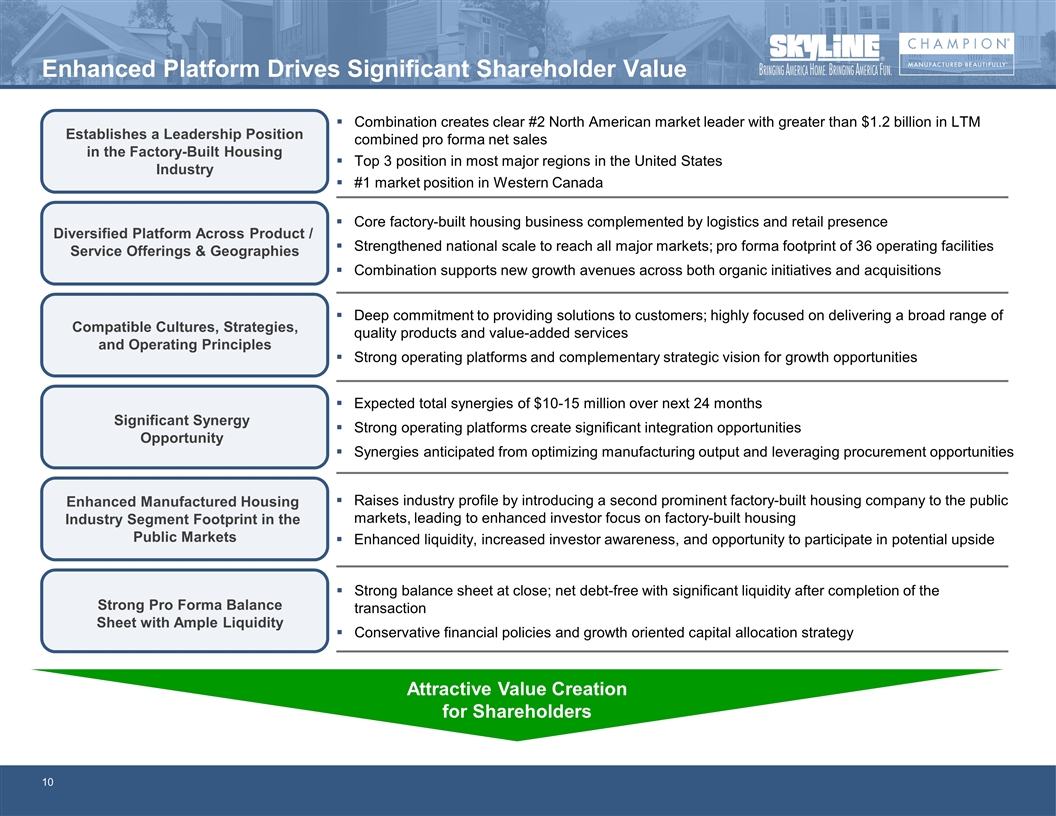

Enhanced Platform Drives Significant Shareholder Value Combination creates clear #2 North American market leader with greater than $1.2 billion in LTM combined pro forma net sales Top 3 position in most major regions in the United States #1 market position in Western Canada Establishes a Leadership Position in the Factory-Built Housing Industry Core factory-built housing business complemented by logistics and retail presence Strengthened national scale to reach all major markets; pro forma footprint of 36 operating facilities Combination supports new growth avenues across both organic initiatives and acquisitions Diversified Platform Across Product / Service Offerings & Geographies Deep commitment to providing solutions to customers; highly focused on delivering a broad range of quality products and value-added services Strong operating platforms and complementary strategic vision for growth opportunities Compatible Cultures, Strategies, and Operating Principles Expected total synergies of $10-15 million over next 24 months Strong operating platforms create significant integration opportunities Synergies anticipated from optimizing manufacturing output and leveraging procurement opportunities Significant Synergy Opportunity Strong balance sheet at close; net debt-free with significant liquidity after completion of the transaction Conservative financial policies and growth oriented capital allocation strategy Strong Pro Forma Balance Sheet with Ample Liquidity Attractive Value Creation for Shareholders Raises industry profile by introducing a second prominent factory-built housing company to the public markets, leading to enhanced investor focus on factory-built housing Enhanced liquidity, increased investor awareness, and opportunity to participate in potential upside Enhanced Manufactured Housing Industry Segment Footprint in the Public Markets

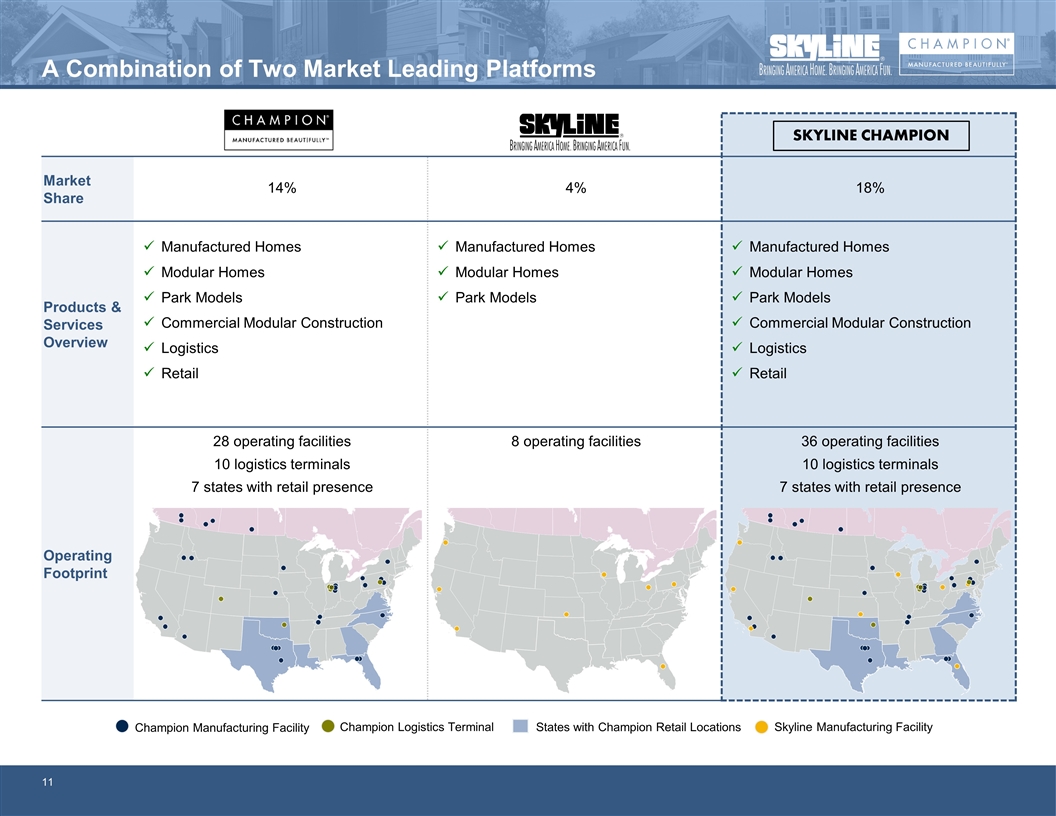

Market Share 14% 4% 18% Products & Services Overview Manufactured Homes Modular Homes Park Models Commercial Modular Construction Logistics Retail Manufactured Homes Modular Homes Park Models Manufactured Homes Modular Homes Park Models Commercial Modular Construction Logistics Retail Operating Footprint 28 operating facilities 10 logistics terminals 7 states with retail presence 8 operating facilities 36 operating facilities 10 logistics terminals 7 states with retail presence A Combination of Two Market Leading Platforms Champion Manufacturing Facility Skyline Manufacturing Facility States with Champion Retail Locations Champion Logistics Terminal SKYLINE CHAMPION

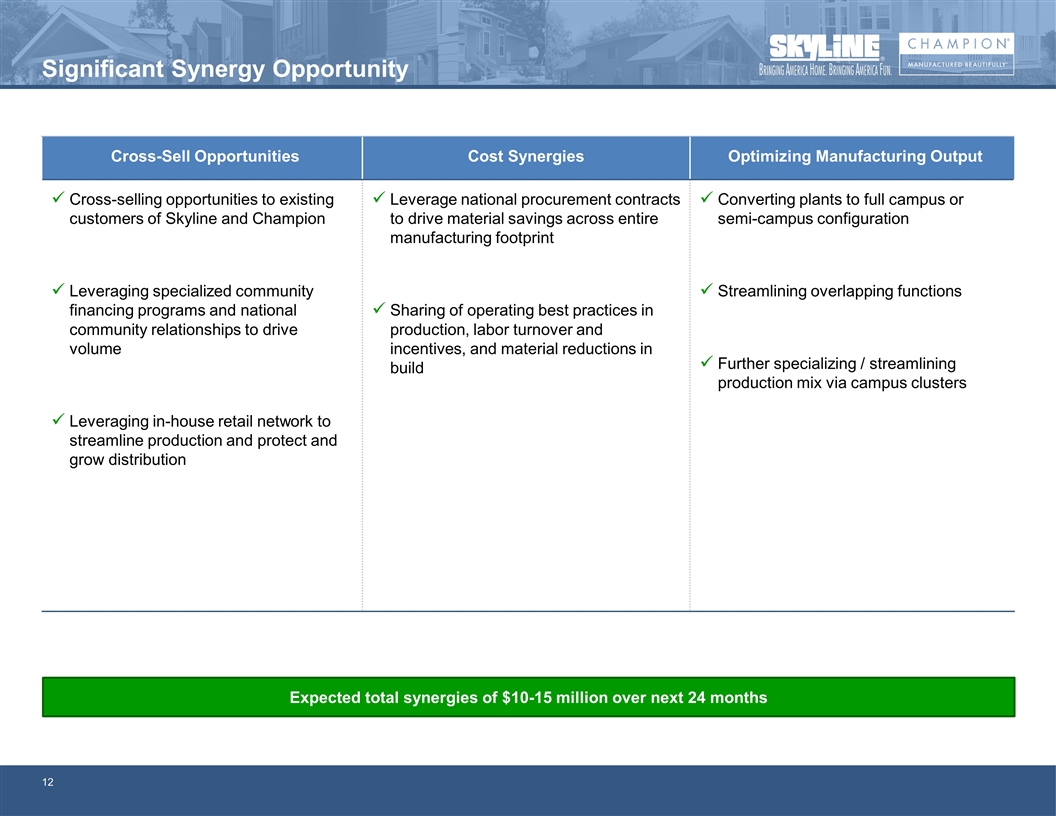

Significant Synergy Opportunity Expected total synergies of $10-15 million over next 24 months Cross-Sell Opportunities Cost Synergies Optimizing Manufacturing Output Cross-selling opportunities to existing customers of Skyline and Champion Leveraging specialized community financing programs and national community relationships to drive volume Leveraging in-house retail network to streamline production and protect and grow distribution Leverage national procurement contracts to drive material savings across entire manufacturing footprint Sharing of operating best practices in production, labor turnover and incentives, and material reductions in build Converting plants to full campus or semi-campus configuration Streamlining overlapping functions Further specializing / streamlining production mix via campus clusters

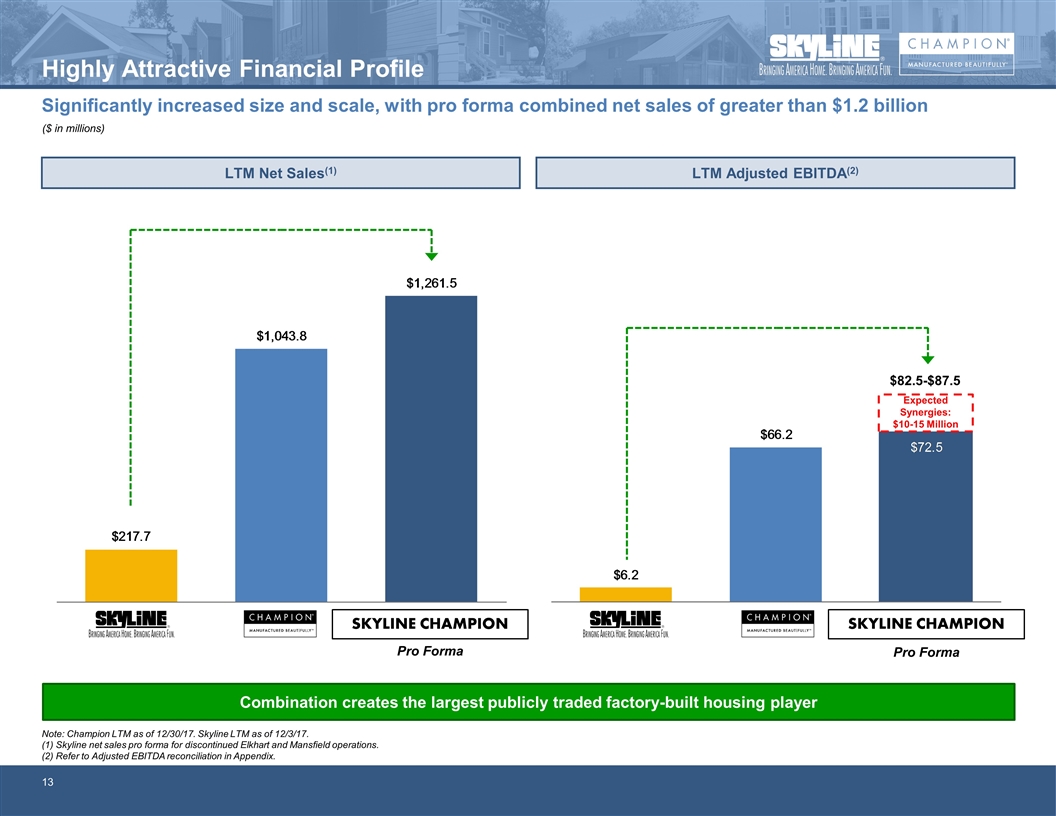

Significantly increased size and scale, with pro forma combined net sales of greater than $1.2 billion Highly Attractive Financial Profile ($ in millions) LTM Net Sales(1) LTM Adjusted EBITDA(2) Note: Champion LTM as of 12/30/17. Skyline LTM as of 12/3/17. (1) Skyline net sales pro forma for discontinued Elkhart and Mansfield operations. (2) Refer to Adjusted EBITDA reconciliation in Appendix. Combination creates the largest publicly traded factory-built housing player Expected Synergies: $10-15 Million Pro Forma Pro Forma $82.5-$87.5 SKYLINE CHAMPION SKYLINE CHAMPION

Appendix

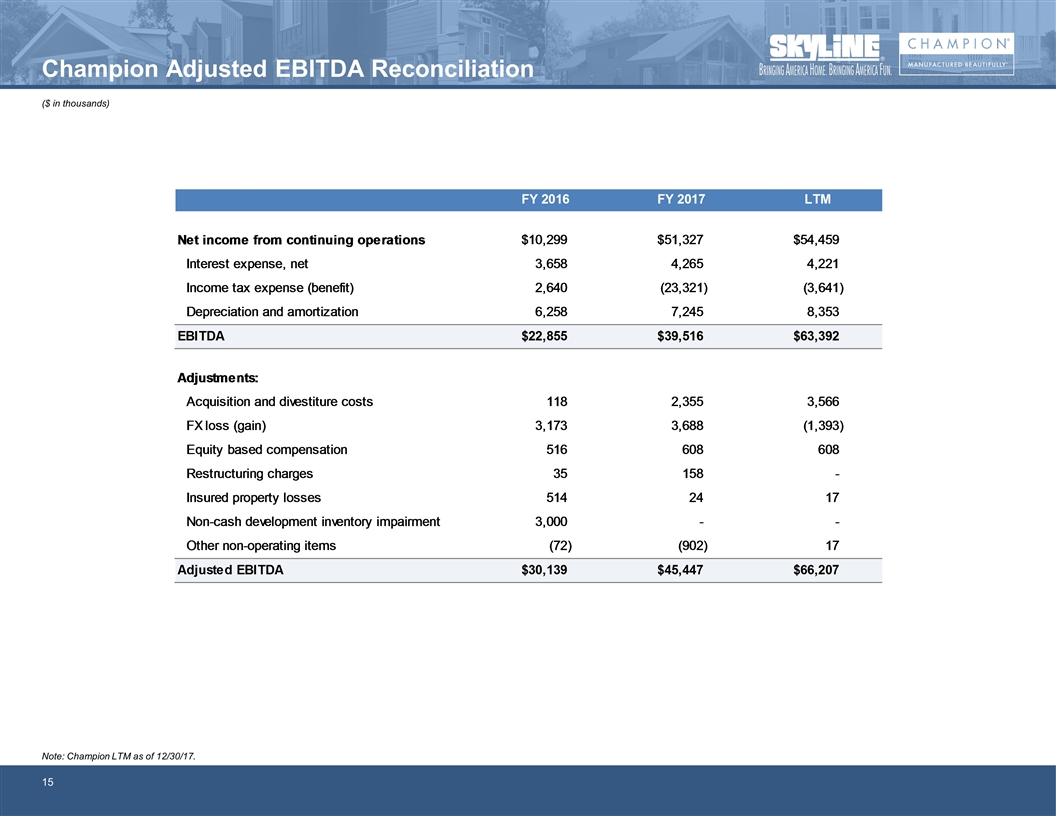

Champion Adjusted EBITDA Reconciliation ($ in thousands) Note: Champion LTM as of 12/30/17.

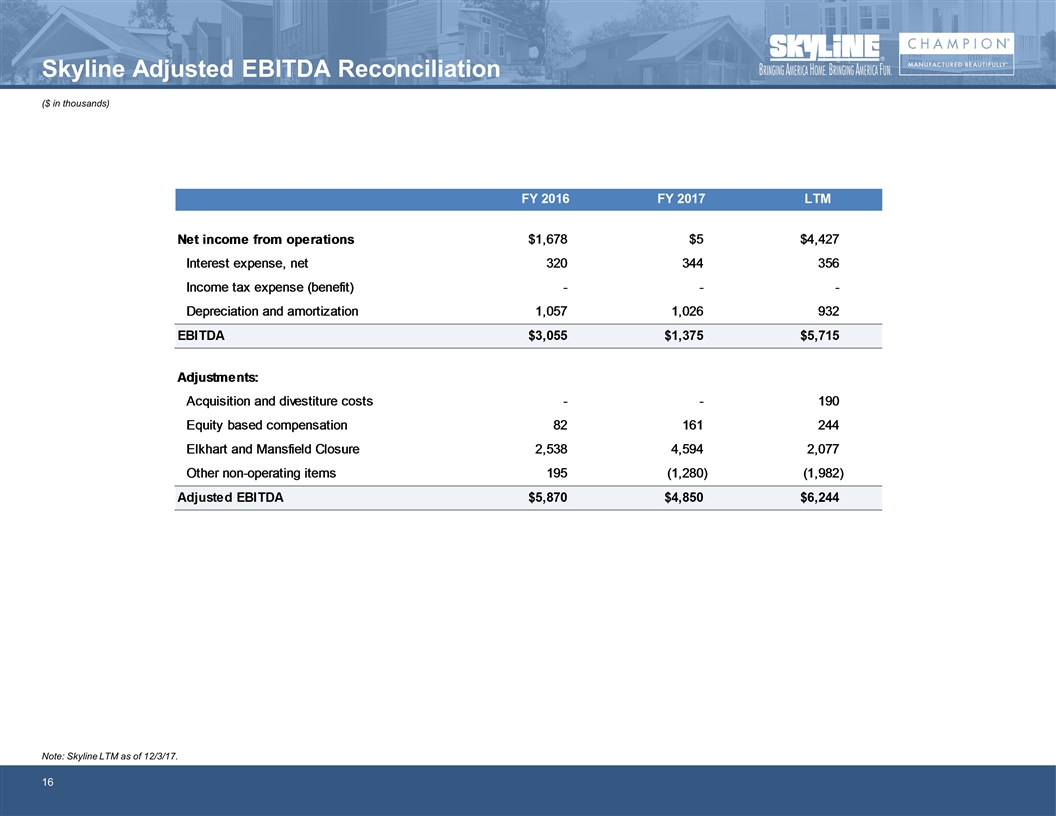

Skyline Adjusted EBITDA Reconciliation ($ in thousands) Note: Skyline LTM as of 12/3/17.