Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BILL BARRETT CORP | bbg-01222018x8k.htm |

Corporate Update

January 2018

NYSE: BBG www.billbarrettcorp.com 2

Forward-Looking & Other Cautionary Statements

• Please reference the appendix at the end of this

presentation for important disclosures on:

Forward-looking statements

Non-GAAP measures

Reserves

Transaction Highlights

Creates Leading DJ Basin Pure Play Focused on Rural, Oily Portion of Basin

Highlights

3

Leading Pure Play Asset Base

Fifth Creek Acreage

BBG Acreage

Chalk Bluffs

~5,700 net acres

353 gross locations

Hereford Field

~81,000 net acres

1,179 gross locations

Robust operating performance drives basin leading operating margins

~151,100 largely contiguous net acres primed for XRL development

Decades of drilling inventory – 2,865 gross undeveloped total locations with a

65% weighted average IRR at NYMEX strip(1)

Liquids-rich production base of ~24 MBoe/d (81% liquids, 64% oil)(2)

NE Wattenberg

~64,400 net acres

1,333 gross locations

Strong balance sheet to fund development and opportunistically pursue additional M&A

(1) NYMEX strip pricing as of 11/24/2017

(2) Includes 2 Mboe/d of production associated with Uinta Basin asset divestiture that closed December 29, 2017

• Strategic combination with Fifth Creek Energy (“Fifth Creek”)

materially expands DJ Basin footprint

~81,000 net acres in Hereford Field in rural northern Weld

County, Colorado

100% operated with high working interest

Proved reserves of 113 MMBoe (75% oil)

2.9 MBoe/d of Q3 2017 net production (72% oil)

• De-risked position offsetting prolific EOG Fairway Field with

strong, multi-bench results

>310 ft of stacked pay with 2 producing horizontal zones

Extensive well control (62 producing SRLs and 7 producing

XRLs) and extensive 3D seismic result in low risk

development

Seven XRLs completed in 2017 with avg. IP30 of 1,052 Boe/d

(84% oil) (two-stream basis)

• Contiguous acreage block provides decades of highly economic

Niobrara and Codell drilling inventory

1,179 gross drilling locations across primary targets of

Niobrara B and Codell; conducive to XRL development

Further upside from de-risking of additional Niobrara

benches and downspacing opportunities

>80% weighted average IRR at NYMEX strip(1)

• Existing infrastructure supports development

• Largely undeveloped nature allows BBG to immediately apply

established execution skillset and best-in-class cost structure

• Strong pro forma balance sheet underpinned by significant cash

position, significant liquidity and improved credit metrics

Exchanged $50 mm of 7% Notes for common stock and a

completed $116 mm common stock offering

Transaction Overview

4

• Unanimously approved by both boards

• BBG shareholder approval required

• Regulatory and other customary approvals

• Closing expected in late Q1 or early Q2 2018

• NGP locked up for 90 days post closing

Key Conditions

and Timing

• 100 mm shares to be issued to Fifth Creek

• Combined company initial equity value in excess of

$1.0 billion

• BBG Unsecured Notes will be left outstanding

Transaction Terms

• ~81,000 net acres in Weld County

• Q3 2017 net production of 2,898 Boe/d (72% oil)

• YE 2016 proved reserves of 113 MMBoe (75% oil)

• 1,179 gross undeveloped locations

• 3 wells being completed and 9 wells waiting on

completion

Key Asset

Information

• Attractive entry price with adjusted $/net acre of

~$6,900/acre (PDP valued at $30,000 Boe/d)

• Transaction is accretive to BBG NAV at current NYMEX

strip(1)

Valuation Metrics

• Scot Woodall will serve as CEO and President of the

combined company

• Current board will be increased by five Fifth Creek

nominated directors; Jim W. Mogg will continue to

serve as Chairman

Management and

Governance

Fifth Creek Offset Operators

Weld

(1) NYMEX strip pricing as of 11/24/2017.

Laramie

Strategic Rationale

5

• Applying BBG’s leading cost structure and operational momentum to the Fifth Creek asset base will drive

significantly enhanced economic returns to shareholders

• Transfer of on-going completions optimization & flow back strategy presents substantial upside to resource

potential and return profile

Delivers

Meaningful

Operating

Efficiencies

• Merger consistent with strategic focus on high-quality, low-risk oil-weighted properties in the DJ Basin

• Continues preference for rural, open space assets that allow for XRL development

• Dramatically increases scale with 70% increase in gross undeveloped drilling locations

• Provides drill-ready opportunity to drive long-term cash flow growth

• High-quality asset base to be led by BBG team with established execution track record and peer-leading

operating margins of $28.35 per Boe(1)

Strategic Fit

• Combined acreage position of 151,100 net acres

• 2,865 gross undeveloped locations (~95% XRL) across combined position

• Undeveloped inventory represents decades of operated drilling inventory

• Strong economics across the portfolio with a 65% weighted average IRR at NYMEX strip(2)

Creates Leading DJ

Basin Pure Play with

Robust Inventory

• Credit accretive transaction with pro forma BBG having modest leverage at close and improving metrics

going forward with substantially larger scale

• Significant liquidity to internally fund development program and 2018 anticipated capital plan

• Attractive debt maturity profile with nearest note maturity not until 2022

• Debt exchange and equity offering further strengthens capital structure

Strengthens

Balance Sheet

(1) Based on company filings and calculated for the third quarter 2017 results. Peers include: BCEI, PDCE, SRCI, XOG

(2) NYMEX strip pricing as of 11/24/2017

Successfully Increases Scale & Value

6

Q3 2017 Production (MBoe/d)

Net Location Count-Indicative

Economics NYMEX Strip Price Deck(3)

YE 2016 Proved Reserves (MMBoe)(1)DJ Basin Net Acres

Gross Undeveloped Locations

+112% +14% +206%

+70%

(1) Proved reserves at YE16 for Bill Barrett Corporation include 12 MMBoe associated with the Uinta Basin and Fifth Creek YE16 proved reserves are comprised of 97% PUD reserves (both reviewed by NSAI)

(2) Includes 2 Mboe/d of production associated with Uinta Basin asset divestiture that closed December 29, 2017

(3) NYMEX strip pricing as of 11/24/2017

(4) BBG XRL location base indicative well economics

(1) f

(2) d

(3) D

(1) d

(2) N

(3) I

(4) s

Pro Forma Capitalization

Improved Leverage & Ample Liquidity to Fund High-Return Development Plan

7

Overview of Announced Financings

• Uinta sale announced in November 2017 for proceeds

of $110 million, closed on December 29, 2017

• Raised $116 million of gross proceeds through sale of

common stock (including overallotment)

• Reduced long term debt by $50 million in a private

exchange of common stock for 7% Senior Notes due

2022

Pro Forma Financial Profile

• Undrawn BBG credit facility with borrowing base of

$300 million

No anticipated need to draw on revolver in 2018

Borrowing base was reaffirmed during Fall redetermination;

no impact from UOP sale

Expect to launch a new combined credit facility at or before

close with Fifth Creek reserves

• Strong liquidity at close to fund development

Uinta Basin divestiture

Equity raise pre funds majority of anticipated 2018/2019

activity

Pro Forma Capitalization (Excludes Fifth Creek Assumed Debt)

Note: Pro forma for BBG stand-along financing activities

Market Cap (1) ~$580 million

Enterprise Value (1) ~$890 million

1 Based on closing stock price as of January 19, 2018, pro forma for financing transactions, projected YE2017

net debt and excluding 100 mm shares to be issued to Fifth Creek at closing of acquisition

($ in millions) BBG @ 9/30/2017 Financings PF BBG @ 9/30/2017

Cash $156 $219 $375

RCF Borrowings - - -

Unsecured Debt 675 (50) 625

Lease Financing Obligation 2 - 2

Total Debt $677 ($50) $627

Net Debt $522 ($257) $252

Borrowing Base $300 $0 $300

Letters of Credit 26 - 26

Revolver Availability 274 - 274

Liquidity 430 219 649

NYSE: BBG www.billbarrettcorp.com 8

Credit Accretive Transaction

• Significant debt reduction accomplished

in challenging commodity price

environment

Completed April 2017 debt offering that

reduced gross debt by 6%

Completed December 2017 debt exchange

that reduced gross debt by 7%

• No near term debt maturities

Nearest note maturity not until 2022

• Improving leverage metrics

• Expect to achieve strategic objective of

<1.5x net debt to EBITDAX in 2019

Track Record of Debt Reduction

2.5 2.4

1.5–2.0

Net Debt / EBITDAX

1.5–2.0

1.0–1.5

Fifth Creek Acreage

Complementary Rural Position

9

Combined acreage position is rural in nature with no urban exposure or associated development complexities

Operate in

rural area of

DJ Basin

Favorable

Regulatory

Environment

Controllable and

efficient

development

Rural PositioningFavorable Development Setting

Less Dense

< 340k sq. mile

More Dense

> 3.8mm sq. mile

Population Density

Laramie

BBG Acreage

Source: U.S. Census Bureau; 2010 Census

Fifth Creek Acreage Position

10

Significant Well ControlHereford Field Meets All Key Geologic Criteria

Silo Field

Fairway

Field

Hereford

Field

DJ Geothermal Gradient Map

WYO

CO

• Hereford Field is where the horizontal Niobrara play

kicked off with the “Jake well” in 2009

• Fifth Creek position lies in favorable Thermal Maturity

fairway for the Niobrara/Codell petroleum system

• Optimal GOR with 78% crude oil

• HBP Acreage & Proven Production: 2009 to 2012

drilling included 58 Niobrara, 1 Codell and 1

Greenhorn horizontal well

• Early vintage Niobrara wells in Hereford Field have

outperformed similar vintage wells in the Fairway

Field area to the north

• Fifth Creek 2017 drilling program results are

comparable with EOG Fairway Results

Enhanced Maturity

& High Niobrara

Resistivity Fairway

*Only drilled horizontal wells shown

Jake

Well

Fifth Creek

Position

Source: COGCC and WOGCC

Primary Targets Consistent Across Acreage

11Source: COGCC and WOGCC

• Consistent geology from Colorado Hereford Field to Wyoming Fairway Field

• Continuity and consistency of primary targets across acreage position

Niobrara B bench thickness range = 100’ to 120’

Codell thickness range = 17’ to 23’

• BBG Talmadge core well on north edge of position: 317 ft of Niobrara & Codell core analyzed with

data tied to Petrophysical evaluation

Petrophysical analysis confirms pay and resource in place

• Seismic coverage: ~143 square miles of 3D covering majority of acreage block

W

E

BBC Talmadge

Core Well

Strong Well Results Validate Hereford Field Position

Initial Well Performance Ranks Among the Best in the DJ Basin

12

Legend

Operators

Fifth Creek Acreage

HRM

EOG

Fifth Creek

Niobrara well

Codell well

Critter Creek 278-1527H (Sep-2017)

IP30: 1,249 Boe/d | 73% Oil

Target: Niobrara | LL: 9,797’

20Jubilee 154-1034H (Aug-2014)

IP30: 1,032 Boe/d | 90% Oil

Target: Niobrara | LL: 9,838’

1

1 3

Jubilee 153-1034H (Aug-2014)

IP30: 710 Boe/d | 90% Oil

Target: Niobrara | LL: 9,051’

2

2

Jubilee 151-1034H (Aug-2014)

IP30: 792 Boe/d | 91% Oil

Target: Niobrara | LL: 9,837’

3

4

Bull Canyon 508-0607H (Dec-2014)

IP30: 1,004 Boe/d | 88% Oil

Target: Codell | LL: 8,503’

12

5

Windy 508-1806H (Nov-2014)

IP30: 1,133 Boe/d | 91% Oil

Target: Codell | LL: 9,132’

4

6

Windy 573-1720H (Jul-2015)

IP30: 1,086 Boe/d | 81% Oil

Target: Codell | LL: 8,468’

6

7

Jubilee 604-2425H (Mar-2016)

IP30: 1,062 Boe/d | 91% Oil

Target: Codell | LL: 9,006’

7

8

Jubilee 529-2227H (Sep-2014)

IP30: 1,109 Boe/d | 90% Oil

Target: Codell | LL: 8,651’

8

9 10

Jubilee 143-3601H (Oct-2017)

IP30: 1,075 Boe/d | 97% Oil

Target: Codell | LL: 8,900’

10

11

Jubilee 546-3601H(Oct-2017)

IP30: 1,080 Boe/d | 93% Oil

Target: Codell | LL: 9,500’

11

Jubilee 541-3502H (Apr-2016)

IP30: 1,080 Boe/d | 91% Oil

Target: Codell | LL: 9,039’

9

12

Windy 01-18H (Mar-2013)

IP30: 394 Boe/d | 90% Oil

Target: Niobrara | LL: 3,533’

5

13

Cushing 24-8H (Mar-2012)

IP30: 647 Boe/d | 95% Oil

Target: Niobrara | LL: 3,886’

13

14

Fox Creek 222-3422H (Mar-2017)

IP30: 1,089 Boe/d | 88% Oil

Target: Niobrara | LL: 9,100’

14

Fox Creek 504-2524H (Mar-2017)

IP30: 847 Boe/d | 88% Oil

Target: Codell | LL: 9,186’

15

16

15

Critter Creek 512-1510H (Sep-2017)

IP30: 1,086 Boe/d | 87% Oil

Target: Codell | LL: 10,129’

1618

Fox Creek 505-2501H (May-2017)

IP30: 1,017 Boe/d | 84% Oil

Target: Codell | LL: 9,954’

18

19

Critter Creek 562-1527H (Sep-2017)

IP30: 1,348 Boe/d | 83% Oil

Target: Codell | LL: 9,822’

19

20

Fox Creek 501-3403H (Jan-2017)

IP30: 730 Boe/d | 88% Oil

Target: Codell | LL: 8,902’

17

17

Note: IP30 rates show above calculated on two-stream basis

Laramie

Weld

Fifth Creek Undeveloped Well Economics

Deep Inventory of High Return Niobrara & Codell Locations

13(1) NYMEX strip pricing as of 11/24/2017

(2) WTI price required for a 10% pre-tax, pre-G&A IRR assuming a 20:1 oil to gas price ratio.

Fifth Creek XRL (9,500') Illustrative Economics

Niobrara Codell

2-Phase EUR (MBoe) 400 - 475 475 - 575

% Oil 78% 78%

D&C ($mm) $5.1 $5.1

IRR @ NYMEX Strip(1) 59% - 98% 56% - 86%

NPV10 @ NYMEX Strip ($mm) $3.0 - $4.7 $3.9 - $5.7

Payout (Months) 11 13

Breakeven Oil Price ($/Bbl)(2) $35 - $40 $30 - $40

Gross Proved Undeveloped Locations 739 440

Net Proved Undeveloped Locations 487 289

$8.25

$6.25

$4.75 $4.75

2014 2015 2016 2017

Efficiencies offset

cost of enhanced

completions

Implement Development Efficiencies

14

Hereford Field Development Plan

• Initiate full DSU development

• Drill 100% XRL wells (~9,500’ lateral

length)

Replicate cost efficiencies currently

being realized in NE Wattenberg

Achieve similar operational cycle times

• Optimize lateral spacing

Develop both Niobrara and Codell

formations

• Implement enhanced completions

1,500 – 2,000 pounds of sand per

lateral foot

Reduce frac stage spacing with 80-90

stages per lateral

Implement enhanced flowback process

BBG NE Wattenberg XRL D&C Cost ($mm)

BBG NE Wattenberg Combined Cycle Time (Days)

0

5

10

15

20

25

30

35

40

2014 2015 2016 2017

Drill Days Frac Days Drill Out Days

DJ Basin Infrastructure

15

• Addition of Saddlehorn / Grand Mesa oil pipeline in 2016 significantly increased takeaway capacity to ~650 MBbls/d(1)

DJ Basin oil production currently in excess of 350 MBbls/d(1)

Local refineries and rail provide additional outlets

• Current infrastructure provides multiple outlets out of the basin

• BBG benefits from having no firm marketing commitments and favorable API

gravity crude

Acreage position near all pipelines to provide optionality

• Q3 2017 differential averaged $2.06/Bbl

79% improvement in oil differentials since 2015

• Executed agreement for additional gas processing capacity

DJ Basin Infrastructure / NE Wattenburg

• No long-term crude contracts or minimum volume commitments

Current oil differential of $2.20/Bbl

• Gas gathering and processing with Summit Midstream (20 MMcf/d current capacity)

In November 2017, Summit announced an expansion of its Northern Weld County process complex with a new 60 MMcf/d

processing plant that is expected to be placed online by year-end 2018

Modest minimum volume commitments associated with Summit Midstream

Line pressures are contractually obligated at less than 50 psig

Fifth Creek Midstream Overview

Bill Barrett Midstream Overview

(1) COGCC and company estimates

Natural Gas

~20%

NGLs

~15%

Crude

~65%

Preliminary 2018 Outlook

16

2018E Production Mix

• Drilling and Completion Capital

Anticipate operating 3 rigs in 2018

2018E capital expenditures of $500 – $600 mm

Capital will be allocated to the highest return inventory

across the combined position

High degree of operational control and proximity of

acreage blocks provides ability to opportunistically

adjust capital deployment

• Production

Net sales production of 11 – 12 MMBoe (~65% oil)

• Actively manage hedge portfolio to support capital

program, protect future cash flow and reduce

commodity price risk

• Formal 2018 guidance anticipated to be issued

post the closing of the Fifth Creek transaction

• 2018 activity to be internally funded through a

combination of cash on hand and cash flow from

operations

Note: 2017 guidance reflects updated guidance as issued by BBG on 10/31/2017, the 2018 preliminary plans assumes full-year outlooks for each company, formal 2018 guidance is anticipated to be issued following the

closing of the transaction

Net Sales Production (MMBoe)

Value Proposition to BBG Shareholders

NYSE: BBG www.billbarrettcorp.com 17

• Combination creates leading DJ Basin pure-play with high-quality, oily, rural acreage that is

consistent with strategic focus

• Unique opportunity to add a large, undeveloped acreage position at an attractive cost that is highly

complementary to our legacy acreage

• Visibility into decades of development drilling – 70% increase to 2,865 gross undeveloped locations

with strong weighted average IRR of 65%

• Contiguous acreage position and operational control allows for returns-focused capital allocation

flexibility

• Ability to immediately transfer superior execution skills and operational expertise through

enhanced completion and flowback techniques to deliver peer-leading margins of $28.35 per boe

• Credit accretive transaction with pro forma BBG having modest leverage at close and improving

metrics going forward with substantially larger scale

• Balance sheet strength highlighted by improving leverage metrics, no near-term debt maturities

and strong liquidity to fund development

Appendix

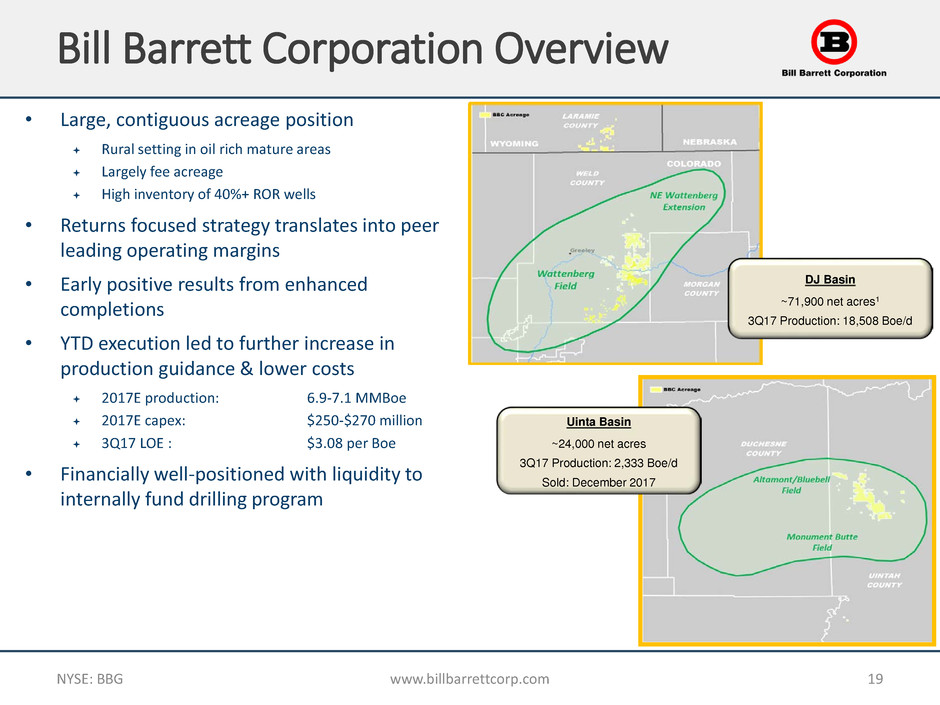

Bill Barrett Corporation Overview

NYSE: BBG www.billbarrettcorp.com 19

• Large, contiguous acreage position

Rural setting in oil rich mature areas

Largely fee acreage

High inventory of 40%+ ROR wells

• Returns focused strategy translates into peer

leading operating margins

• Early positive results from enhanced

completions

• YTD execution led to further increase in

production guidance & lower costs

2017E production: 6.9-7.1 MMBoe

2017E capex: $250-$270 million

3Q17 LOE : $3.08 per Boe

• Financially well-positioned with liquidity to

internally fund drilling program

DJ Basin

~71,900 net acres1

3Q17 Production: 18,508 Boe/d

Uinta Basin

~24,000 net acres

3Q17 Production: 2,333 Boe/d

Sold: December 2017

Key Messages

NYSE: BBG www.billbarrettcorp.com 20

• Demonstrated execution of focused operational and financial strategy

Delivering solid results with basin leading margins

Exceeding growth and cost targets that translates into second positive guidance revision

• NE Wattenberg located in rural setting that is favorable for oil development

~44% rate of return at wellhead assuming base assumptions

• Have the capital resources to facilitate growth strategy

Cash position of ~$300 million at December 31, 2017 plus $300 million undrawn credit facility

UOP asset sale cash proceeds of $110 million

Gross proceeds of $116 million associated with recent sale of stock

Anticipated 2018 capital program is pre-funded with no need to draw on revolver

• Delivering continued improvement across corporate structure in 3Q17

LOE of $3.08 per Boe, represents 15% q/q improvement

DJ Basin LOE of $2.52 per Boe, represents 18% q/q improvement

DJ Basin oil price differential narrowed to $2.06 per barrel

• Returns focused capital program underpins continued improvement in

leverage ratio

2017 activity expected to deliver 2018 production growth in excess of 30% on legacy assets

Expect year-end 2017 net debt to EBITDAX of ~2.0x, pro forma for UOP asset sale and equity offering

3Q17 Achievements

NYSE: BBG www.billbarrettcorp.com 21

Production of 1.92 MMBoe, 26% sequential growth

Exceeded guidance by 10% with oil volumes growing 33% sequentially

4Q17 production expected to grow ~10% sequentially

Corporate oil price differential narrowed to $2.12 per barrel

DJ Basin differential improves to a basin leading $2.06 per barrel

Benefit from having no long-term oil marketing agreements

Delivering continued cost improvement with LOE of $3.08 per Boe

DJ Basin LOE of $2.52 per Boe, represents 18% sequential improvement

D&C cycle times have improved 28% compared to 2016

37% improvement in number of frac stages completed per day

27% improvement in days required to mill frac plugs

Encouraging early results from enhanced completions in the DJ Basin

Commenced marketed sales process to divest Uinta Basin assets

Improved capital efficiency and program execution lead to guidance increase

2017 production guidance increased to 6.9-7.1 MMBoe; represents 21% pro forma growth over 2016

Positioned to generate greater than 30% growth in 2018 on legacy assets

Translates into improved leverage metrics as Uinta Basin asset sale pre funds 2018 capital program

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

2012 2013 2014 2015 2016 2017E 2018E

Demonstrated Ability to Grow Production

NYSE: BBG www.billbarrettcorp.com 22

• Track record of delivering consistent

growth despite lower activity levels in

challenging crude market environment

Met or exceeded guidance for 12 consecutive

quarters

Increased 4Q17 and 2017 production guidance

• Early adopters of recognizing economic

benefit of XRL development

• Seeing early positive results from

enhanced completions

Implementing greater sand volume (1,500

lbs/lateral foot), tighter frac stage spacing (120’

per stage) and enhanced flowback technique

• Drilling and completion cycle times

increased by 28% over 2016

Driven by significant improvement in stage

completions per day and amount of sand placed

per day

• Maintain two rig drilling program on NE

Wattenberg asset

1 2017 and 2018 estimated production sales volumes based on corporate operating guidance

DJ Basin

Net Sales Volumes (Mboe)1

+30%

NE Wattenberg Cross Section

NYSE: BBG www.billbarrettcorp.com 23

Resistivity

Highlight > 20 ohms

Clay Bound Water / Free Water

/ Hydrocarbon Volume

Resistivity

Highlight > 20 ohms

GR

0-300

Resistivity

Highlight > 20 ohms

N

io

br

ar

a

P

ay

S

ec

tio

n

A

Bench

B

Bench

C

Bench

A A’

Clay Bound Water / Free Water

/ Hydrocarbon Volume

Clay Bound Water / Free Water

/ Hydrocarbon Volume

GR

0-300

GR

0-300

• Detailed core analysis confirms reservoir and resource

quality is consistent

Over 920’ of core was analyzed from four distinct well locations

throughout acreage position

Strong average oil saturations (So) across acreage = 45%-57%

• Nine mineral petrophysical model calibrated from core

data for more accurate reservoir and resource

assessment

Calculated oil saturated pore volume (SoPhiH), an indicator of

resource in place, is consistent with range = 5.5’-8’

Net footage of resistivity greater than 20 Ohms, an indicator of overall

hydrocarbon charge, is also fairly consistent, with a range of 59’-79’

Avg So = 48%

SoPhiH = 5.5

Net feet > 20 Ohmms = 59’

Avg So = 45%

SoPhiH = 8

Net feet > 20 Ohmms = 79’

Avg So = 57%

SoPhiH = 7.5

Net feet > 20 Ohmms = 73’

A’

A

7

Current XRL Development

NYSE: BBG www.billbarrettcorp.com 24

BBG horizontal wells

XRL well activity

NE Wattenberg Focus Area

Section 5-61-20 (8 XRL wells)

Enhanced proppant (~1,500 lbs/lateral foot)

Frac stage spacing of ~120’ (82-stages)

Initial flowback in 4Q17

Section 4-62-29 and 4-62-32 (10 XRL wells

per DSU)

4-62-29 Initial flowback in 4Q17

4-62-32 Currently completing

Section 3-62-4 (10 XRL wells)

Currently completing

Section 5-61-27 (4 XRL wells)

Currently drilling

Section 4-62-28 (5 XRL wells)

Currently drilling

Planned development beneath reservoir

0

5

10

15

20

25

30

35

40

2014 2015 2016 2017

Drill Days Frac Days Drill Out Days

0

2

4

6

8

10

12

14

2014 2015 2016 2017

0

4

8

12

16

20

2014 2015 2016 2017

Significant Improvement in Cycle Times

NYSE: BBG www.billbarrettcorp.com 25

Drill Days Frac Days

Drill Out Days

0

3

6

9

2014 2015 2016 2017

Combined Cycle Time

$4.75 mm current XRL well cost

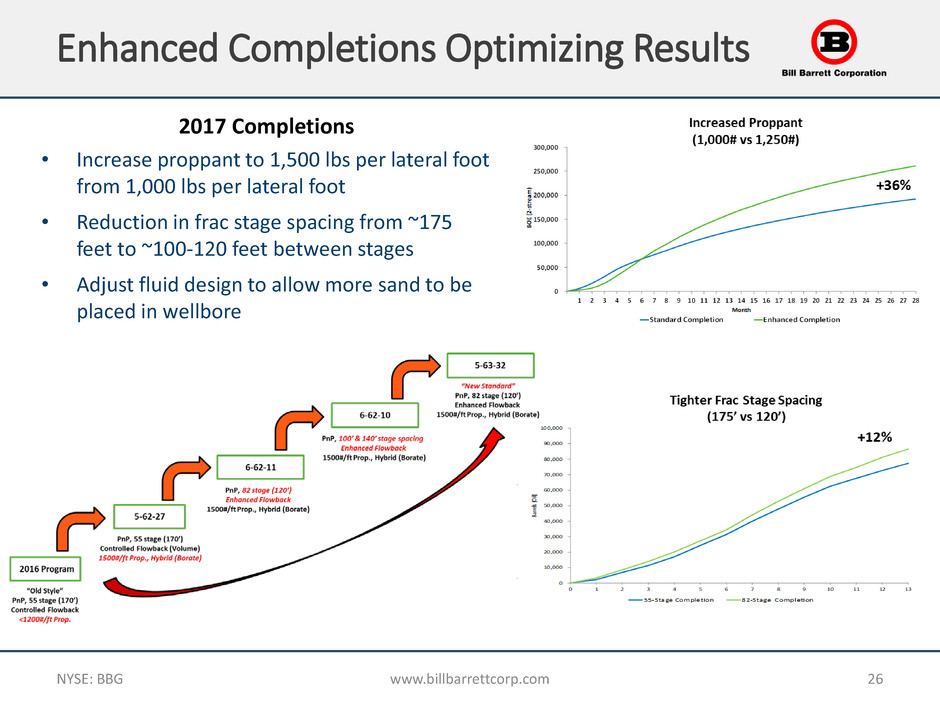

Enhanced Completions Optimizing Results

NYSE: BBG www.billbarrettcorp.com 26

2017 Completions

• Increase proppant to 1,500 lbs per lateral foot

from 1,000 lbs per lateral foot

• Reduction in frac stage spacing from ~175

feet to ~100-120 feet between stages

• Adjust fluid design to allow more sand to be

placed in wellbore

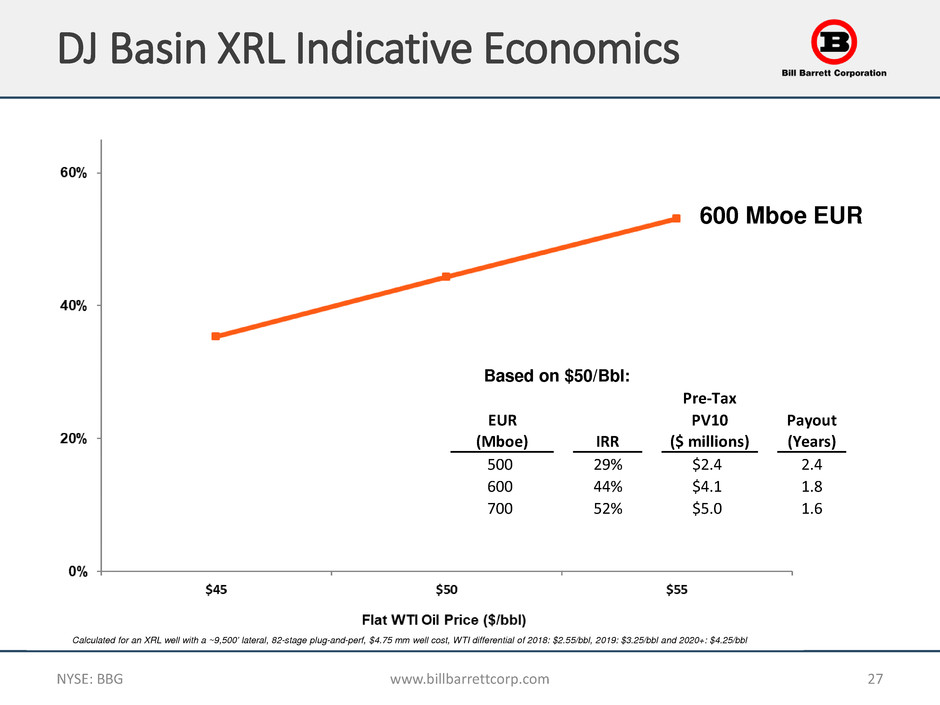

DJ Basin XRL Indicative Economics

NYSE: BBG www.billbarrettcorp.com 27

600 Mboe EUR

Calculated for an XRL well with a ~9,500’ lateral, 82-stage plug-and-perf, $4.75 mm well cost, WTI differential of 2018: $2.55/bbl, 2019: $3.25/bbl and 2020+: $4.25/bbl

Based on $50/Bbl:

Pre-Tax

EUR PV10 Payout

(Mboe) IRR ($ millions) (Years)

500 29% $2.4 2.4

600 44% $4.1 1.8

700 52% $5.0 1.6

Best in Class DJ Basin Operating Margins

NYSE: BBG www.billbarrettcorp.com 28

Source: Company filings and calculated for third quarter 2017 results

Peers include: BCEI, PDCE, SRCI, XOG

Generating 31% greater unhedged operating

margins compared to DJ Basin peers

0

3,000

6,000

9,000

12,000

1Q18 2Q18 3Q18 4Q18 2019

V

ol

um

es

(b

bl

/d

)

Legacy BBG Crude Oil Hedges

$52.99 $53.28

$53.09

$53.49

NYSE: BBG www.billbarrettcorp.com 29

Hedging Program Protects Cash Flow

• Actively manage hedge portfolio to support

capital program, protect future cash flow

and reduce commodity price risk

• Strategy is to hedge 50-70% of production on

a forward 12-month to 18-month basis

2018 – 9,563 Bbls/d of crude oil hedged at an

average WTI price of $53.12/Bbl

2019 – 4,496 Bbls/d of crude oil hedged at an

average WTI price of $53.49/Bbl

• Fifth Creek has a total of ~954,000 Bbls

swapped at $51.97/Bbl in 2018 and 2019

1 Hedge position as of January 19, 2018

$53.09

Legacy BBG Oil and Natural Gas Hedge Summary

NYSE: BBG www.billbarrettcorp.com 30

2018-2019 hedge position, as of January 19, 2018

Swaps

Period Oil Natural Gas

Volume

(Bbls/d)

WTI Price

($/Bbl)

Volume

(MMBtu/d)

NWPL Price

($MMBtu)

1Q18 9,250 $ 52.99 5,000 $ 2.68

2Q18 10,000 $ 53.28 5,000 $ 2.68

3Q18 9,500 $ 53.09 5,000 $ 2.68

4Q18 9,500 $ 53.09 5,000 $ 2.68

1Q19 5,000 $ 53.66

2Q19 5,000 $ 53.66

3Q19 4,000 $ 53.29

4Q19 4,000 $ 53.29

$23

$25

$27

$29

Initial Current

$

m

m

$28.5

$24.5

2017 Operating Guidance

NYSE: BBG www.billbarrettcorp.com 31

• Production sales volumes of 6.9-7.1 MMBoe

Represents 21% production growth at the mid-point compared to pro forma 2016 production

4Q17 production expected to approximate 2.0-2.2 MMBoe - ~10% sequential growth

2017 activity expected to deliver 2018 production growth in excess of 30% on legacy assets

• Capital expenditures of $250-$270 million

Assumes $4.75 mm XRL well cost reflecting enhanced completions

Capital program funded through cash flow and cash on hand

4Q17 capital expenditures are expected to total $80-$90 million

• Lease operating expense of $24-$25 million

Driven by positive well results, the timing of well completions and

greater operating efficiencies

Production Capital Expenditures Lease Operating Expense

Represents initial 2017 guidance and mid-point of current guidance range

6.0

6.2

6.4

6.6

6.8

7.0

Initial Current

M

M

B

oe

7.0

6.25

$250

$255

$260

$265

$270

Initial Current

$

m

m

$270

$260

Three and Nine month Financial Results

NYSE: BBG www.billbarrettcorp.com 32

1 Discretionary cash flow, adjusted net income (loss) and EBITDAX are non-GAAP (Generally Accepted Accounting Principles) measures. Please reference the reconciliations to GAAP financial statements on the following pages

Three Months Ended Nine Months Ended

September 30, September 30,

2017 2016 2017 2016

Net cash provided by operating activities ($ millions) $57.2 $67.4 $95.4 $116.2

Discretionary cash flow ($ millions)1 $34.8 $36.5 $79.4 $93.7

Net income (loss) ($ millions) ($28.8) ($26.2) ($60.4) ($121.0)

Per share, basic ($0.39) ($0.44) ($0.81) ($2.28)

Per share, dilutive ($0.39) ($0.44) ($0.81) ($2.28)

Adjusted net income (loss) ($ millions)1 ($5.9) ($6.2) ($30.3) ($26.6)

Per share, basic ($0.08) ($0.10) ($0.41) ($0.50)

Per share, dilutive ($0.08) ($0.10) ($0.41) ($0.50)

Weighted average shares outstanding, basic (in thousands) 74,886 58,852 74,743 53,082

Weighted average shares outstanding, diluted (in thousands) 74,886 58,852 74,743 53,082

EBITDAX ($ millions)1 $47.9 $49.8 $120.7 $136.6

Three Months Ended Nine Months Ended

September 30, September 30,

2017 2016 2017 2016

Production sales volumes (Mboe) 1,920 1,566 4,879 4,540

Daily production sales volumes (Boe/d) 20,870 17,022 17,872 16,569

Oil price differential (per barrel) $2.12 $3.02 $2.95 $4.44

DJ Basin oil price differential (per barrel) $2.06 $2.21 $2.48 $3.51

Average Costs (per Boe):

Lease operating expenses $3.08 $3.06 $3.54 $4.87

Gathering, transportation and processing $0.32 $0.30 $0.34 $0.41

Production tax $2.80 $2.45 $1.87 $1.55

Depreciation, depletion and amortization $22.52 $27.51 $24.81 $27.64

General and administrative expense $6.51 $5.86 $6.31 $6.95

Non-GAAP Reconciliation (Unaudited)

NYSE: BBG www.billbarrettcorp.com 33

EBITDAX Reconciliation

Three Months Ended Nine Months Ended

September 30, September 30,

2017 2016 2017 2016

(in thousands)

Net Income (Loss) ($28,842) ($26,186) ($60,404) ($121,101)

Adjustments to reconcile to EBITDAX:

Depreciation, depletion and amortization 41,732 43,083 119,409 125,491

Impairment, dry hole and abandonment expense 261 974 8,336 1,766

Exploration expense 18 16 48 64

Unrealized derivative (gain) loss 19,672 14,358 (2,592) 85,675

Incentive compensation and other non-cash charges 1,480 1,777 5,134 7,208

(Gain) loss on sale of properties — 1,914 (92) 1,206

(Gain) loss on extinguishment of debt — (29) 7,904 (8,726)

Interest and other income (332) (72) (1,030) (166)

Interest expense 13,926 13,991 44,014 45,160

Provision for (benefit from) income taxes — — — —

EBITDAX $47,915 $49,826 $120,727 $136,577

Discretionary cash flow and adjusted net income (loss) are non-GAAP measures. These measures are presented because management believes that they provide useful additional

information to investors for analysis of the Company's ability to internally generate funds for exploration, development and acquisitions as well as adjusting net income (loss) for certain

items to allow for a more consistent comparison from period to period. In addition, the Company believes that these measures are widely used by professional research analysts and others

in the valuation, comparison and investment recommendations of companies in the oil and gas exploration and production industry, and that many investors use the published research of

industry research analysts in making investment decisions.

These measures should not be considered in isolation or as a substitute for net income, income from operations, net cash provided by operating activities or other income, profitability, cash

flow or liquidity measures prepared in accordance with GAAP. The definition of these measures may vary among companies, and, therefore, the amounts presented may not be

comparable to similarly titled measures of other companies.

Non-GAAP Reconciliation (Unaudited)

NYSE: BBG www.billbarrettcorp.com 34

1 Adjusted (provision for) benefit from income taxes is calculated using the Company’s current effective tax rate prior to applying the valuation allowance against deferred tax assets

Discretionary Cash Flow Reconciliation

Three Months Ended Nine Months Ended

September 30, September 30,

2017 2016 2017 2016

(in thousands)

Net Cash Provided by (Used in) Operating Activities $57,184 $67,428 $95,383 $116,207

Adjustments to reconcile to discretionary cash flow:

Exploration expense 18 16 48 64

Changes in working capital (22,371) (30,964) (16,023) (22,613)

Discretionary Cash Flow 34,831 36,480 79,408 93,658

Adjusted Net Income (Loss) Reconciliation

Three Months Ended Nine Months Ended

September 30, September 30,

2017 2016 2017 2016

(in thousands, except per share amounts)

Net Income (Loss) ($28,842) ($26,186) ($60,404) ($121,101)

Provision for (Benefit from) income taxes — — — —

Income (Loss) before Income Taxes (28,842) (26,186) (60,404) (121,101)

Adjustments to Net Income (Loss):

Unrealized derivative (gain) loss 19,672 14,358 (2,592) 85,675

Impairment expense — — 8,010 183

(Gain) loss on sale of properties — 1,914 (92) 1,206

(Gain) loss on extinguishment of debt — (29) 7,904 (8,726)

One-time items:

(Income) expense related to properties sold (282) — (1,610) —

Adjusted Income (Loss) before Income Taxes (9,452) (9,943) (48,784) (42,763)

Adjusted (provision for) benefit from income taxes (1) 3,549 3,791 18,460 16,164

Adjusted Net Income (Loss) ($5,903) ($6,152) ($30,324) ($26,599)

Per share, diluted ($0.08) ($0.10) ($0.41) ($0.50)

Forward-Looking & Other Cautionary Statements

DISCLOSURE STATEMENTS:

Cautionary statement regarding forward-looking statements: Throughout this prospectus supplement and the accompanying base prospectus, including in the documents and information incorporated by reference

herein and therein, we make statements that may be deemed “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about the closing of the Merger, the timing of

such closing, the expected benefits of the Merger, the closing and effect of the debt exchange (as defined below) and our future strategy, plans, estimates, beliefs, timing and expected performance. All of these types of

statements, other than statements of historical fact included in or incorporated by reference into this prospectus supplement, are forward-looking statements. In some cases, you can identify forward-looking statements

by terminology such as “expect”, “seek”, “believe”, “upside”, “will”, “may”, “expect”, “anticipate”, “plan”, “will be dependent on”, “project”, “potential”, “intend”, “could”, “should”, “estimate”, “predict”, “pursue”,

“target”, “objective”, “continue”, the negative of such terms or other comparable terminology.

Forward-looking statements are dependent upon events, risks and uncertainties that may be outside our control. The term “outlook” may be used to indicate our current perspective on possible outcomes in periods

beyond the current fiscal year. Because statements of this type relate to events or conditions further in the future, they are subject to increased levels of uncertainty. Our actual results could differ materially from those

discussed in these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the following risks and uncertainties:

• risks and uncertainties relating to the Merger, including the possibility that the Merger does not close when expected or at all because conditions to closing are not satisfied on a timely basis or at all;

• potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Merger;

• timing of the Merger;

• the possibility that the anticipated benefits of the Merger are not realized when expected or at all, including as a result of the impact of, or problems arising from the integration of the two companies;

• the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events;

• diversion of management’s attention from ongoing business operations and opportunities;

• oil, natural gas liquids (“NGLs”) and natural gas price volatility, including regional price differentials;

• changes in operational and capital plans;

• costs, availability and timing of build-out of third party facilities for gathering, processing, refining and transportation; delays or other impediments to drilling and completing wells arising from political or judicial

developments at the local, state or federal level, including voter initiatives related to hydraulic fracturing; development drilling and testing results;

• the potential for production decline rates to be greater than expected;

• regulatory delays, including seasonal or other wildlife restrictions on federal lands;

• exploration risks such as drilling unsuccessful wells;

• higher than expected costs and expenses, including the availability and cost of services and material and our potential inability to achieve expected cost savings;

• unexpected future capital expenditures;

• economic and competitive conditions;

• debt and equity market conditions, including the availability and costs of financing to fund the Company’s operations;

• the ability to obtain industry partners to jointly explore certain prospects, and the willingness and ability of those partners to meet capital obligations when requested;

• declines in the values of our oil and gas properties resulting in impairments;

• changes in estimates of proved reserves;

• compliance with environmental and other regulations;

• derivative and hedging activities;

• risks associated with operating in one major geographic area;

• the success of the Company’s risk management activities;

• title to properties, including those to be acquired in the Merger;

• litigation, including litigation concerning the Merger;

• environmental liabilities ; and

• other uncertainties, as well as those factors discussed in this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2017, June 30, 2017 and September 30, 2017 under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” and in other documents incorporated by

reference in this prospectus supplement.

35

Forward-Looking & Other Cautionary Statements

The forward-looking statements contained in this prospectus supplement are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions

reflect our judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks

and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in

this prospectus supplement are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or that forward-looking events and circumstances will occur. Actual results

may differ materially from those anticipated or implied in the forward-looking statements due to many factors including those listed above and in the documents incorporated by reference herein. All forward-looking

statements contained in this prospectus supplement speak only as of the date of this prospectus supplement and all forward-looking statements incorporated by reference into this prospectus supplement speak only as

of the dates such statements were made. Readers should not place undue reliance on these forward-looking statements, which reflect management’s views only as of the date hereof. Other than as required under the

securities laws, we do not intend to, and do not undertake any obligation to, publicly update or revise any forward-looking statements as a result of changes in internal estimates or expectations, new information,

subsequent events or circumstances or otherwise. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

IMPORTANT ADDITIONAL INFORMATION

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, the Company and Fifth

Creek will cause New BBG to file with the SEC a registration statement on Form S-4, which will include a prospectus with respect to the shares of New BBG to be issued in the proposed transaction and a proxy statement

of the Company with respect to the obtaining of stockholder approval for the transaction. The Company and New BBG also plan to file other documents with the SEC regarding the proposed merger. After the registration

statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the stockholders of the Company. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE REGISTRATION

STATEMENT AND PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED MERGER THAT WILL BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors will be able to obtain free copies of the proxy

statement/prospectus and other documents containing important information about New BBG, the Company and Fifth Creek, once such documents are filed with the SEC, through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s internet website at www.billbarrettcorp.com under the tab “Investors” and then under

the tab “SEC Filings” or by contacting the Company’s Investor Relations Department at (303) 293-9100.

PARTICIPANTS IN THE SOLICITATION

New BBG, The Company, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors

and executive officers of the Company is set forth in the Company’s public filings with the SEC, including its definitive proxy statement filed with the SEC on April 6, 2017. Other information regarding the participants in

the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC. Free

copies of these documents can be obtained as described in the preceding paragraph.

36

Forward-Looking & Other Cautionary Statements

NYSE: BBG www.billbarrettcorp.com 37

Reserve Disclosure

The SEC generally permits oil and gas companies, in filings made with the SEC, to disclose proved reserves, which are reserve estimates that geological and engineering data

demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions and certain probable and possible

reserves that meet the SEC’s definitions for such terms. In this presentation, the Company uses the terms “estimated ultimate recovery”, “EUR” or other descriptions of potential

reserves or volumes of reserves, as well as aggregated proved, probable and possible (“3P”) reserves, which the SEC guidelines restrict from being included in filings with the SEC.

The estimates conform to Society of Petroleum Evaluation Engineers (SPEE) methodology. They are not prepared or reviewed by third party engineers. EURs refer to the Company’s

internal estimates of per-well hydrocarbon quantities that may be potentially recovered from a hypothetical and/or actual well completed in the area. Actual quantities that may be

ultimately recovered from the Company’s interests are unknown. Factors affecting ultimate recovery include the scope of the Company’s ongoing drilling program, which will be

directly affected by the availability of capital, drilling and production costs, availability and cost of drilling services and equipment, lease expirations, transportation constraints,

regulatory approvals and other factors, as well as actual drilling results, including geological and mechanical factors affecting recovery rates. Estimates of ultimate recovery from

reserves may change significantly as development of the Company’s core assets provide additional data. In addition, the Company’s production forecasts and expectations for future

periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which

may be affected by significant commodity price declines or drilling cost increases. The Company's EURs are provided in this presentation because management believes it is useful,

additional information that is widely used by the investment community in the valuation, comparison and analysis of companies.

ADDITIONAL INFORMATION:

Rate of return estimates do not reflect lease acquisition costs or corporate general and administrative expenses.

Initial and test results from a well do not necessarily reflect the well’s longer-term performance or the performance of other wells in the same area.

1099 Eighteenth Street, Suite 2300

Denver, CO 80202

303.293.9100

Website: www.billbarrettcorp.com

Investor Relations Contact:

Larry C. Busnardo

(303) 312-8514

lbusnardo@billbarrettcorp.com