Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CELGENE CORP /DE/ | tv483707_ex99-2.htm |

| 8-K - FORM 8-K - CELGENE CORP /DE/ | tv483707_8k.htm |

Exhibit 99.1

Celgene Announces Acquisition of Juno Therapeutics January 22, 2018 C HANGING THE C OURSE OF H UMAN H EALTH T HROUGH B OLD P URSUITS IN S CIENCE

Forward Looking Statements and Adjusted Financial Information Thi s presentatio n contain s forward - lookin g statements , whic h ar e generall y s tatement s tha t ar e not historica l facts . Forward - lookin g s tatement s ca n b e identifie d b y th e word s “ expects, ” “anticipates,” “believe s, ” “ intends ,” “esti m ate s, ” “p la n s ,” “will , ” “outlook , ” “targets” an d simila r ex pressions . F orward - lookin g statement s ar e base d o n m anagemen t ’ s curren t plans , estimates , assumption s a n d projections , and spea k onl y as o f th e dat e the y ar e m ade . W e underta ke n o obligatio n to updat e an y forward - looking statemen t in ligh t o f new i nformatio n o r futur e eve n ts , e xcep t as o therwis e require d b y la w . Forward - lookin g s tatement s i nvolv e inheren t r isk s an d unce r tainties , m os t of whic h ar e di f f icul t to predic t and ar e generall y beyon d ou r contro l . Actual result s o r outcome s m ay di f fe r m aterially from thos e im pl ied b y th e f orward - lookin g s tatement s a s a resul t o f th e i m pac t o f a nu m be r o f factors , man y o f which ar e discusse d in m or e detai l in ou r Annua l Repo r t on F orm 10 - K an d ou r othe r report s f iled wit h the Securities and Exchange Commission . T his presentatio n c ontain s adjuste d f inancia l measure s tha t w e beli e v e provid e in vestor s and managemen t wit h supplementa l informatio n relatin g to operatin g performanc e an d trend s t hat facilitate c o m parison s betwee n period s an d wit h respec t to projecte d infor m ation . Thes e adjusted measure s ar e no n - GAAP an d should b e considere d in additio n t o , bu t no t as a s ub stitute fo r , the informatio n prepare d in accordanc e wit h U . S . GAA P . W e t ypicall y exclud e certai n GAA P i tem s that managemen t d oe s no t believ e a f f e c t ou r basi c operation s an d tha t d o no t mee t th e GAA P definition o f unusua l o r non - recurrin g i tems . Othe r companie s ma y defin e t hes e m ea s ure s in di f feren t ways . Furthe r informatio n relevan t to th e i nterpretatio n o f a djuste d f inancia l m easur e s ma y be f oun d on our website at ww w . Celgene . com in the “Investor Relations” section .

Additional Information on the Tender Offer The tender offer described herein has not yet commenced. The description contained herein is for informational purposes only an d is not an offer to buy or the solicitation of an offer to sell any shares of Juno Therapeutics, Inc. (Juno). At the time the tende r offer is commenced, Celgene and its wholly owned subsidiary, Blue Magpie Corporation, intend to file with the U.S. Securities and Exch ang e Commission (the “SEC”) a Tender Offer Statement on Schedule TO containing an offer to purchase, a form of letter of transmitt al and other documents relating to the tender offer, and Juno intends to file a Solicitation/Recommendation Statement on Schedule 14 D - 9 with respect to the tender offer. Celgene, Blue Magpie Corporation and Juno intend to mail these documents to the stockholders of Juno. THESE DOCUMENTS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER AND JUNO STOCKHOLDERS ARE URGED TO READ THEM CAREFULLY WHEN THEY BECOME AVAILABLE. STOCKHOLDERS OF JUNO WILL BE ABLE TO OBTAIN A FREE COPY OF THESE DOCUMENTS (WHEN THEY BECOME AVAILABLE) AND OTHER DOCUMENTS FILED BY JUNO, CELGENE OR BLUE MA GPIE CORPORATION WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV . IN ADDITION, STOCKHOLDERS WILL BE ABLE TO OBTAIN A FREE COPY OF THESE DOCUMENTS (WHEN THEY BECOME AVAILABLE) FROM THE IN FORMATION AGENT NAMED IN THE OFFER TO PURCHASE OR FROM CELGENE.

Mark Alles Chief Executive Officer C HANGING THE C OURSE OF H UMAN H EALTH T HROUGH B OLD P URSUITS IN S CIENCE

Our Mission and Vision Celgene is building a preeminent global biopharmaceutical company focused on the discovery, development and commercialization of innovative therapies for patients with cancer, immune - inflammatory, and other unmet medical needs

2011 2012 2013 2014 2015 2016 2017 2018 Expected Near - Term Value Drivers Cellular Immunotherapy Is a Validated Approach and Has Vast Potential to Become a Standard Component of Cancer Care First CAR T Data Demonstrating Technical POC First CAR T Therapies Approved for R/R ALL and R/R DLBCL BCMA Clinically Demonstrated for R/R MM First BCMA CAR T Approval for R/R MM Expected in 2020 Clinical Validation in Additional Hematologic Malignancies CD19 Clinically Demonstrated for R/R ALL CD19 Clinically Demonstrated for R/R DLBCL Potential Application in Solid Tumors Next - Gen Constructs & Combination Approaches The Pace of Cellular Immunotherapy Innovation Is Accelerating 1 2 3 4

There Are Significant Advantages in Acquiring Juno Now x Near - term pipeline is complementary with our existing Hematology & Oncology portfolio x JCAR017 clinical data supports a potentially best - in - class profile providing an anchor therapy in NHL x JCARH125 adds to our campaign against BCMA, a key target in multiple myeloma x Solidifies Celgene’s long - term commitment to cellular immunotherapy x US tax reform enables improved visibility into after - tax cash flows and access to ex - US cash to fund transaction x Enables Celgene to immediately capitalize on future advances in cellular immunotherapy x Accelerates Juno’s pipeline development to capture the full potential of cellular immunotherapy x Captures 100% of global economics on all Juno cellular immunotherapy assets, including BCMA x Builds a global leadership position in NHL with JCAR017, which has an estimated global peak sales of ~$3B x 2020 targets: additive to revenue; no change to adj. EPS x Accelerates diversification with the potential to be a meaningful growth driver beyond 2020 Key Developments Driving Acquisition Strategic Rationale for Acquiring Juno

Celgene Will Be Well Positioned to Become a Preeminent Cellular Immunotherapy Company x Deep global Hematology & Oncology clinical and regulatory expertise x Global commercial reach x Complementary pipeline with potentially synergistic next - generation I/O assets x 15+ year history with GMP manufacturing of complex cellular therapies x Ability to fully develop cellular immunotherapy opportunity x Broad platform with CAR T and TCR x >100 scientists and relationships with leading immunotherapy research centers x Potentially best - in - class CAR T therapies with >8 targets addressing >10 indications x Lead asset, JCAR017, in pivotal trial for relapsed refractory DLBCL x Novel and scalable CAR T manufacturing platform A Leading Hematology & Oncology Company A Pioneer in Cellular Immunotherapy

Robert Hershberg, MD, PhD EVP, Head of Business Development C HANGING THE C OURSE OF H UMAN H EALTH T HROUGH B OLD P URSUITS IN S CIENCE

Juno’s Powerful Cellular Immunotherapy Platform, Established Relationships and Approach Drives the Emerging Pipeline CAR T Technology: recognizes proteins on the surface of cancer cells TCR Technology: recognizes intracellular tumor - specific proteins Cellular Immunotherapy Established Relationships with the Leading Cellular Immunotherapy Research Centers Juno’s Differentiated Approach Future State - of - the - Art Manufacturing Next generation Target turnaround time Generation 1 < 21 days Generation 2 14 - 18 days Generation 3 ~ 8 days Generation 4 3 - 6 days 1. Precise dose of CD4+ and CD8+ 2. Consistency and improvement in cell health 3. Control and optimization of phenotypes and in vitro function Potentially best - in - class safety and efficacy data Broad and Deep Pipeline

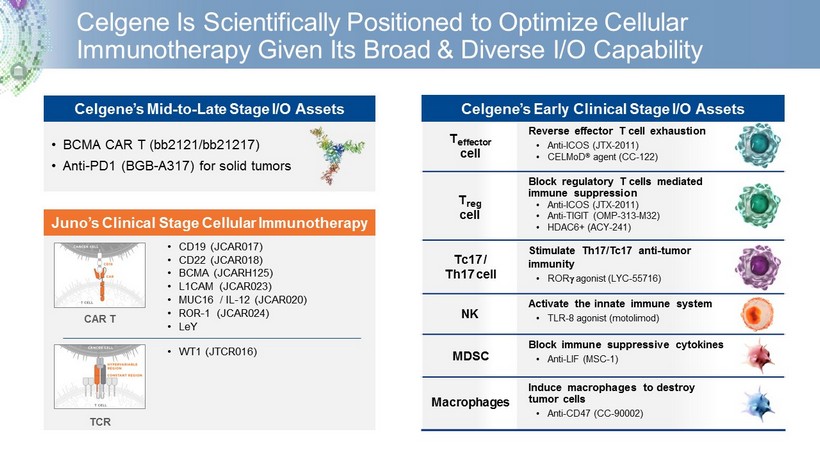

Celgene Is Scientifically Positioned to Optimize Cellular Immunotherapy Given Its Broad & Diverse I/O Capability • BCMA CAR T (bb2121/bb21217) • Anti - PD1 (BGB - A317) for solid tumors Celgene’s Mid - to - Late Stage I/O Assets CAR T TCR Juno’s Clinical Stage Cellular Immunotherapy • CD19 (JCAR017) • CD22 (JCAR018) • BCMA (JCARH125) • L1CAM (JCAR023) • MUC16 / IL - 12 (JCAR020) • ROR - 1 (JCAR024) • LeY • WT1 (JTCR016) Reverse effector T cell exhaustion • Anti - ICOS (JTX - 2011) • CELMoD ® agent (CC - 122) Block regulatory T cells mediated immune suppression • Anti - ICOS (JTX - 2011) • Anti - TIGIT (OMP - 313 - M32) • HDAC6+ (ACY - 241) Stimulate Th17/Tc17 anti - tumor immunity • ROR g agonist (LYC - 55716) Activate the i nnate immune system • TLR - 8 agonist (motolimod) Block immune suppressive cytokines • Anti - LIF (MSC - 1) Induce macrophages to destroy tumor cells • Anti - CD47 (CC - 90002) T reg cell T effector cell Tc17 / Th17 cell NK MDSC Macrophages Celgene’s Early Clinical Stage I/O Assets

Immune cell phenotyping by flow and mass cytometry Antibody profiling by protein and peptide microarray Gene expression profiling by RNA sequencing and microarray Immune cell metabolic profiling by metabolomics Cytokine, chemokine, soluble factors analysis by Mesoscale and Luminex TCR and Ig repertoire analysis by Next Generation Sequencing Celgene’s Translational Science Capabilities Enable Precise Hypothesis Testing in Clinical Studies ▪ Broad assay platform to survey immune response ▪ Integrated computational biology identifies biomarkers ▪ Translational insights drive rational combinations ▪ Gaps in portfolio can be filled by insight driven business development

JCARH125 Will Add to Our Campaign Against BCMA – A Key Target in Multiple Myeloma CAR T Cells TUMOR 3 . Antibody Drug Conjugate BCMA T Cells 2 . T Cell Engager Antibody BCMA 1. CAR T Therapy BCMA TCR Cytotoxic granules Cytotoxic granules Robust Multi - Modal Campaign Against BCMA T Cell Engager Antibody ▪ CC - 93269 – IND filed 2 1 2 3 1 CAR T Therapy ▪ bb2121* – pivotal trial initiated ▪ bb21217* – phase I trial initiated ▪ JCARH125 – IND filed 3 Antibody Drug Conjugate ▪ SUTRO* – IND planned in 2018 *partnered program

Nadim Ahmed President, Hematology & Oncology C HANGING THE C OURSE OF H UMAN H EALTH T HROUGH B OLD P URSUITS IN S CIENCE

0 0.5 1 1.5 2 2.5 3 3.5 LeY JCAR024 (ROR1) JCAR020 (MUC16/IL-12) JCAR023 (L1CAM) JTCR016 (WT1) JCARH125 (BCMA) JCAR018 (CD22) JCAR017 (CD19) NHL, CLL Pediatric ALL MM AML, NSCLC Pediatric Neuroblastoma Ovarian NSCLC, Breast Solid Tumors Phase I Preclinical Pivotal Market Ph I LEGEND Juno’s Pipeline Will Expand and Complement Celgene’s Near - and Long - term Opportunities in Hematology & Oncology Celgene has an exclusive option to license JTX - 2011 , navicixizumab, OMP - 313M32, FT - 1101 , AG - 881 and an option to acquire LYC - 55716 . REVLIMID ® MCL ISTODAX ® PTCL, CTCL REVLIMID ® NHL CC - 122 NHL, CLL JCAR017 NHL CC - 486 NHL Lymphoma & Leukemia 8 CC - 90002 NHL CC - 90010 NHL bb21217 RRMM REVLIMID ® NDMM, RRMM POMALYST ® RRMM THALOMID ® NDMM, RRMM CC - 220 RRMM bb2121 RRMM CC - 92480 RRMM Multiple Myeloma 7 Marizomib GBM CC - 486 NSCLC, mBC CC - 122 HCC CC - 90002 Solid Tumors CC - 90011 Solid Tumors ABRAXANE ® PanC, NSCLC, mBC AG - 881 Glioma Solid Tumors 14 OMP - 313M32 Solid Tumors navicixizumab Solid Tumors LYC - 55716 Solid Tumors JTX - 2011 Solid Tumors CC - 90010 Solid Tumors BGB - A317 Solid Tumors REVLIMID ® Del 5q MDS VIDAZA ® MDS, AML IDHIFA ® IDH2 RRAML CC - 486 MDS, AML Luspatercept MDS, Beta - thalassemia CC - 90002 AML Fedratinib MF CC - 90009 AML FT - 1101 MDS, AML Myeloid Disease 10 Luspatercept MF Juno’s Pipeline Celgene’s Hematology Oncology Pipeline

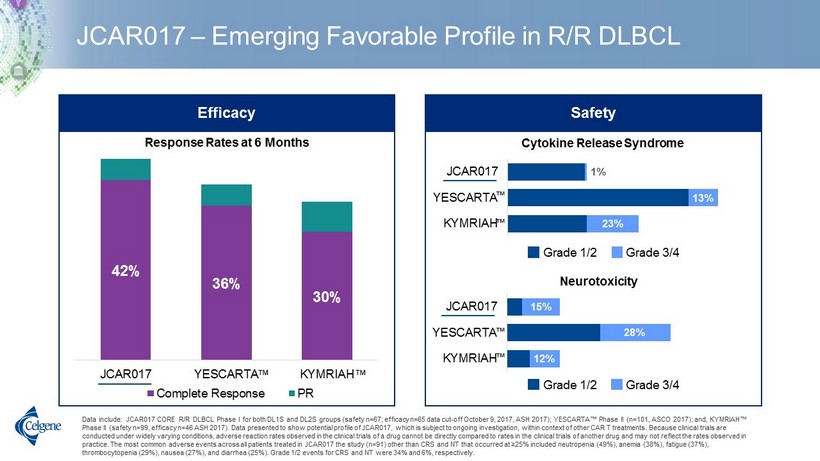

JCAR017 – Emerging Favorable Profile in R/R DLBCL Data include: JCAR017 CORE R/R DLBCL Phase I for both DL1S and DL2S groups (safety n=67; efficacy n=65 data cut - off October 9, 2017, ASH 2017); YESCARTA™ Phase II (n=101, ASCO 2017); and, KYMRIAH™ Phase II (safety n=99, efficacy n=46 ASH 2017). Data presented to show potential profile of JCAR017, which is subject to ongo ing investigation, within context of other CAR T treatments. Because clinical trials are conducted under widely varying conditions, adverse reaction rates observed in the clinical trials of a drug cannot be directl y c ompared to rates in the clinical trials of another drug and may not reflect the rates observed in practice. The most common adverse events across all patients treated in JCAR017 the study (n=91) other than CRS and NT that o ccu rred at ≥25% included neutropenia (49%), anemia (38%), fatigue (37%), thrombocytopenia (29%), nausea (27%), and diarrhea (25%). Grade 1/2 events for CRS and NT were 34% and 6%, respectively. 42% 36% 30% JCAR017 YESCARTA KYMRIAH Complete Response PR Response Rates at 6 Months Cytokine Release Syndrome 23% 13% 1% KYMRIAH YESCARTA JCAR017 Grade 1/2 Grade 3/4 Neurotoxicity 12% 28% 15% KYMRIAH YESCARTA JCAR017 Grade 1/2 Grade 3/4 Safety Efficacy Grade 1/2 Grade 3/4 Grade 1/2 Grade 3/4 ™ ™ ™ ™ ™ ™

Broad Clinical Development Plan in Place to Maximize JCAR017’s Clinical and Commercial Potential Phase I/II TRANSCEND (3 rd line with outpatient cohort) Initiate Phase II TRANSCEND WORLD Initiate Phase II PILOT (2 nd line non - transplant eligible) Initiate Phase III TRANSFORM (2 nd line transplant eligible) Phase II PLATFORM combination trial with durvalumab Phase I/II TRANSCEND - CLL (3 rd line) Initiate Phase I /II 2 nd line Initiate Phase II combo trial with ibrutinib 2018 2017 DLBCL CLL U.S. Approval Expected in 2019

JCAR017 Represents a Potential Foundational Therapy to Establish Global Leadership in Non - Hodgkin Lymphoma Note: REVLIMID ® is not approved for follicular or diffuse Large B - cell non - Hodgkin lymphoma CDx: companion diagnostic Diffuse Large B - cell Lymphoma Follicular Lymphoma Induction ABC UC GCB 1 st Relapse SCT Eligible SCT Ineligible Relapsed / Refractory 2 nd Relapse+ Double Refractory CC - 122 CC - 122 REVLIMID ® AUGMENT ™ CC - 122 CDx JCAR017 CC - 122 CDx REVLIMID ® ROBUST ® CC - 486 JCAR017 CD19 CAR T JCAR017 ▪ Potential best - in - class profile ▪ Pivotal program in DLBCL under way Epigenetics CC - 486 ▪ Combo with R - CHOP in DLBCL at ASH ‘17 ▪ Additional POC trial planned in 2018 Key Mechanisms Protein Homeostasis REVLIMID ® ▪ AUGMENT™ data in H1:18 ▪ ROBUST ® data in H2:18 CC - 122 ▪ Initiate pivotal program in 2018 Campaign Targeting High Unmet Need in NHL

Peter Kellogg Chief Financial Officer C HANGING THE C OURSE OF H UMAN H EALTH T HROUGH B OLD P URSUITS IN S CIENCE

Transaction Overview • All - cash consideration of $87 per share • Total transaction value of $9 billion, net of cash / marketable securities and Celgene ownership • Strong combined balance sheet • Resulting capital structure consistent with financial strategy and investment grade profile • Transaction expected to close in Q1:18 • Maintains financial flexibility for additional value creating transactions and share buyback • Sources of cash: mix of cash on hand and new debt • Plan to access debt capital markets • Adjusted EPS impact: approximately $0.50 in 2018 • Impact to 2020 targets: additive to net sales of $19B to $20B; no change to adj. EPS of $12.50+ • Potential growth driver beyond 2020: estimated global peak JCAR017 sales of ~$3 billion, promising capabilities and pipeline Consideration Financing Financial benefits Other

Scott Smith President & Chief Operating Officer C HANGING THE C OURSE OF H UMAN H EALTH T HROUGH B OLD P URSUITS IN S CIENCE

Delivering Industry - Leading Growth Through 2020… Late - stage Pipeline with Potential to Add Over $16B in Incremental Peak Revenue Through 2030 …And Positioned to Grow Beyond 2020 JCAR017 CC - 220 CC - 486 Luspatercept Marizomib CC - 122 bb2121 BGB - A317 Fedratinib Ozanimod Expected to Launch Ten Potential Blockbusters Adj. Diluted EPS Revenue ~19% CAGR 14.5% CAGR 2018 2019 2020 2021 2022 Note: CAGR calculation is from preliminary and unaudited 2017 measurements to the midpoint of the 2020 total revenue range $16 billion represents sum of individual potential peak sales for each illustrated product, which may not coincide. P eak sales for each product may not occur during illustrated timeframe. Graph is not to scale. $1B >$2B Current Estimate of Peak Sales Potential:

▪ Additive to 2020 revenue; no change to 2020 adjusted EPS ▪ Potentially best - in - class JCAR017 provides anchor position in NHL Building a Preeminent Cellular Immunotherapy Company Execute Delivering on 2020 Accelerate Positioning to Grow Beyond 2020 Expand Creating Sustainable Growth ▪ Accelerates diversification with meaningful growth drivers beyond 2020 ▪ JCARH125 will add to our campaign against BCMA ▪ Expands I/O Center of Excellence in Seattle, WA ▪ Optimally positioned to advance next - gen cellular immunotherapy