Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Orexigen Therapeutics, Inc. | d516242d8k.htm |

Progress Report I January 2018 Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements about Orexigen Therapeutics, Inc. and its Contrave® product. Words such as “believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,” “should,” “intends,” “potential,” “suggests,” “assuming,” “designed” and similar expressions are intended to identify forward‐looking statements. These statements are based on the Company‘s current beliefs and expectations. These forward‐looking statements include statements regarding: the potential success of marketing and commercialization efforts for Contrave in the United States; the potential for Contrave and MysimbaTM to achieve commercial success globally, including through potential partnership arrangements outside the United States, and the potential timing of related launch plans and regulatory filings; the Company’s future financial and sales projections, including its sales growth projections through 2018; and the status of various strategic plans and initiatives. The inclusion of financial modeling, forward‐looking statements and potential financing and transaction plans and terms should not be regarded as a representation by Orexigen that any of its plans will be achieved. Actual results may differ materially from those expressed or implied in this presentation due to the risk and uncertainties inherent in the Orexigen business, including, without limitation: the potential that the marketing and commercialization of Contrave/Mysimba will not be successful; the Company’s ability to obtain and maintain partnerships and the ability of it or its partners to maintain marketing authorization globally; the Company’s ability to adequately inform consumers about Contrave; the Company‘s ability to successfully commercialize Contrave with a specialty sales force in the United States; the capabilities and performance of various third parties on which it relies for a number of activities related to the manufacture, development and commercialization of Contrave/Mysimba; the estimates of the capacity of manufacturing and the Company’s ability to secure additional manufacturing capabilities; the Company’s ability to successfully complete the post-marketing requirement studies for Contrave; the therapeutic and commercial value of Contrave/Mysimba; competition in the global obesity market, particularly from existing therapies; the Company’s failure to successfully acquire, develop and market additional product candidates or approved products; the Company’s ability to obtain and maintain global intellectual property protection for Contrave and Mysimba; the potential for an appeals court to determine in our patent litigation matter with Actavis that one or more of the Company’s patents is not valid or that Actavis' proposed generic product is not infringing each of the patents at issue; other legal or regulatory proceedings against Orexigen, as well as potential reputational harm, as a result of misleading public claims about Orexigen; the Company’s ability to maintain sufficient capital to fund its operations for the foreseeable future; the Company’s ability to satisfy covenants in the indentures for its outstanding indebtedness, including one requirement that the Company generate consolidated net product sales of least $100 million for fiscal year 2017; the Company’s ability to satisfy the applicable listing standards of the NASDAQ Global Market; and other risks described in Orexigen’s filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward‐looking statements, which speak only as of the date hereof, and Orexigen undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Further information regarding these and other risks is included under the heading "Risk Factors" in Orexigen's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 14, 2017 and its other reports, which are available from the SEC's website (www.sec.gov) and on Orexigen's website (www.orexigen.com) under the heading "Investors." All forward‐looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

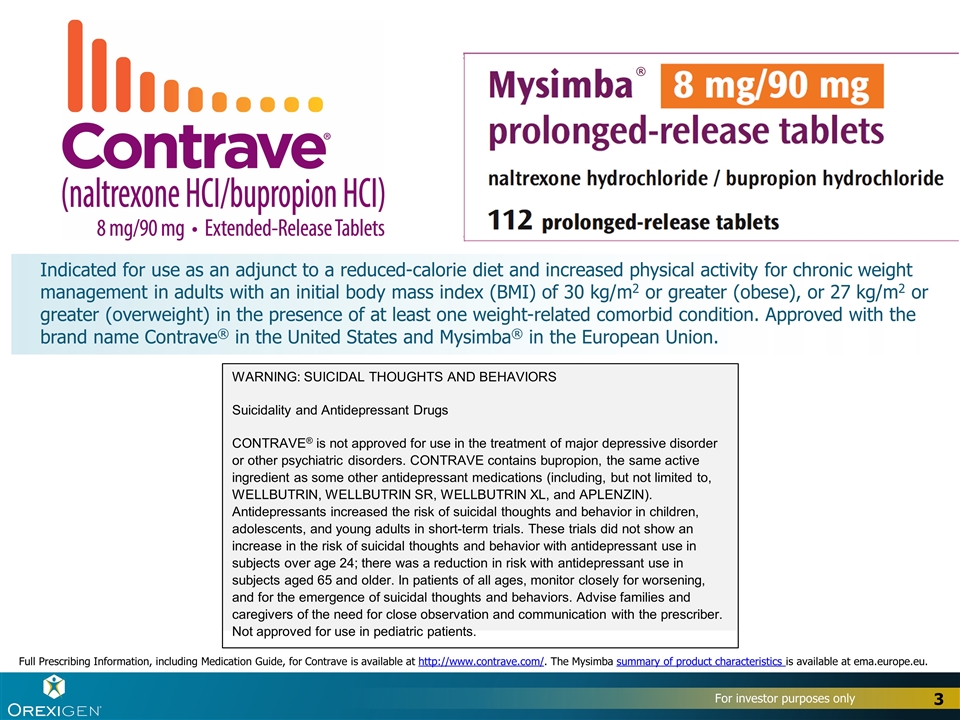

Indicated for use as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management in adults with an initial body mass index (BMI) of 30 kg/m2 or greater (obese), or 27 kg/m2 or greater (overweight) in the presence of at least one weight-related comorbid condition. Approved with the brand name Contrave® in the United States and Mysimba® in the European Union. WARNING: SUICIDAL THOUGHTS AND BEHAVIORS Suicidality and Antidepressant Drugs CONTRAVE® is not approved for use in the treatment of major depressive disorder or other psychiatric disorders. CONTRAVE contains bupropion, the same active ingredient as some other antidepressant medications (including, but not limited to, WELLBUTRIN, WELLBUTRIN SR, WELLBUTRIN XL, and APLENZIN). Antidepressants increased the risk of suicidal thoughts and behavior in children, adolescents, and young adults in short-term trials. These trials did not show an increase in the risk of suicidal thoughts and behavior with antidepressant use in subjects over age 24; there was a reduction in risk with antidepressant use in subjects aged 65 and older. In patients of all ages, monitor closely for worsening, and for the emergence of suicidal thoughts and behaviors. Advise families and caregivers of the need for close observation and communication with the prescriber. Not approved for use in pediatric patients. Full Prescribing Information, including Medication Guide, for Contrave is available at http://www.contrave.com/. The Mysimba summary of product characteristics is available at ema.europe.eu. ®

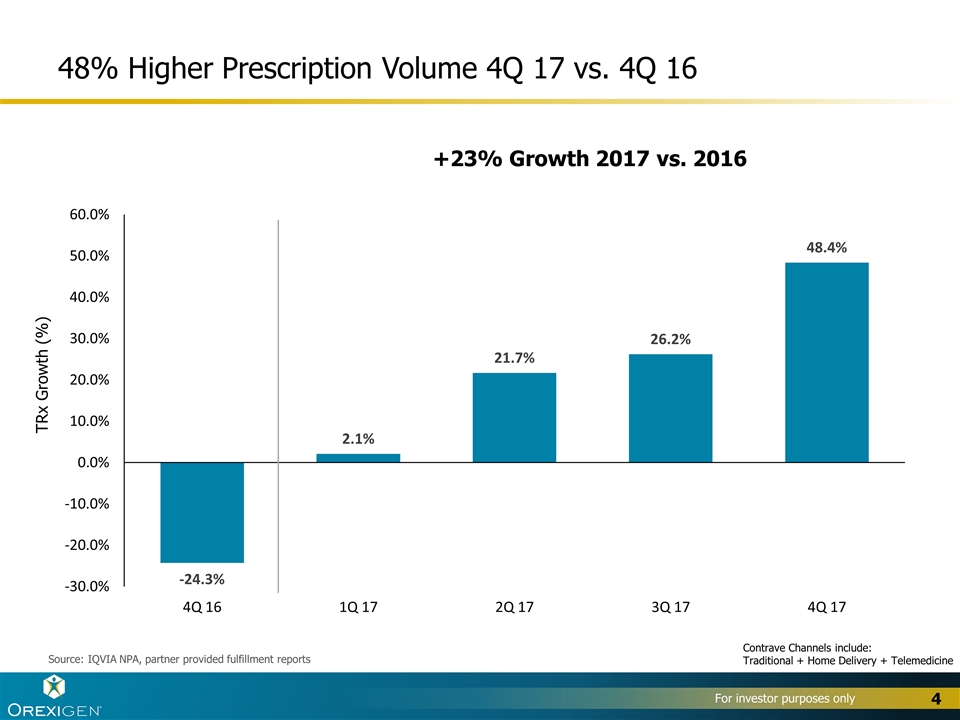

48% Higher Prescription Volume 4Q 17 vs. 4Q 16 TRx Growth (%) +23% Growth 2017 vs. 2016 Source: IQVIA NPA, partner provided fulfillment reports Contrave Channels include: Traditional + Home Delivery + Telemedicine

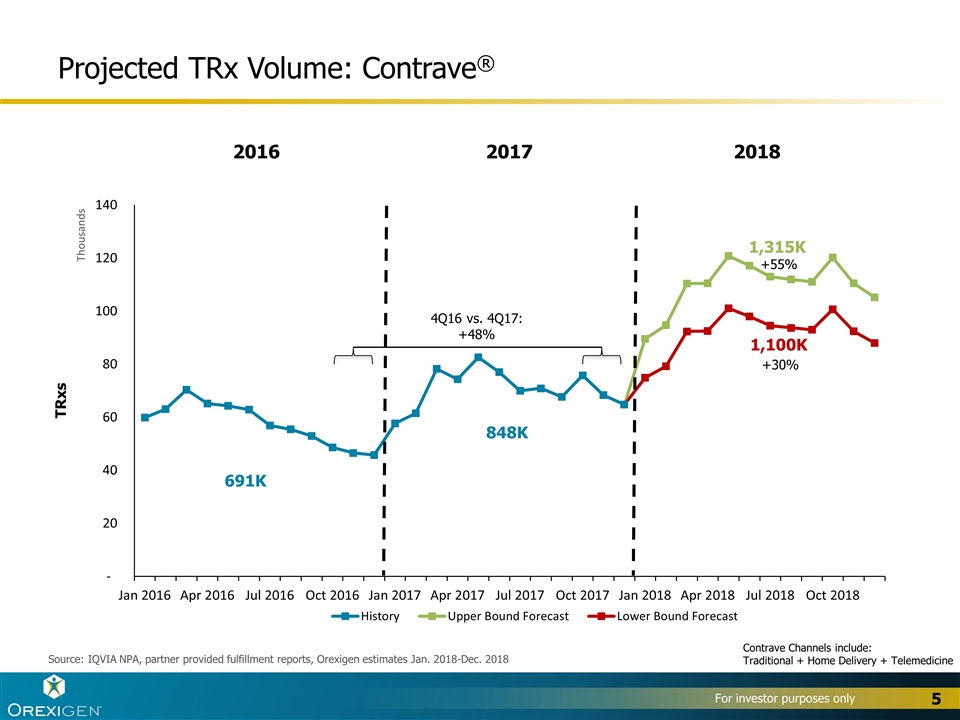

Projected TRx Volume: Contrave® TRxs 2016 2017 2018 Source: IQVIA NPA, partner provided fulfillment reports, Orexigen estimates Jan. 2018-Dec. 2018 1,315K 1,100K 691K 848K 4Q16 vs. 4Q17: +48% +30% +55% Contrave Channels include: Traditional + Home Delivery + Telemedicine

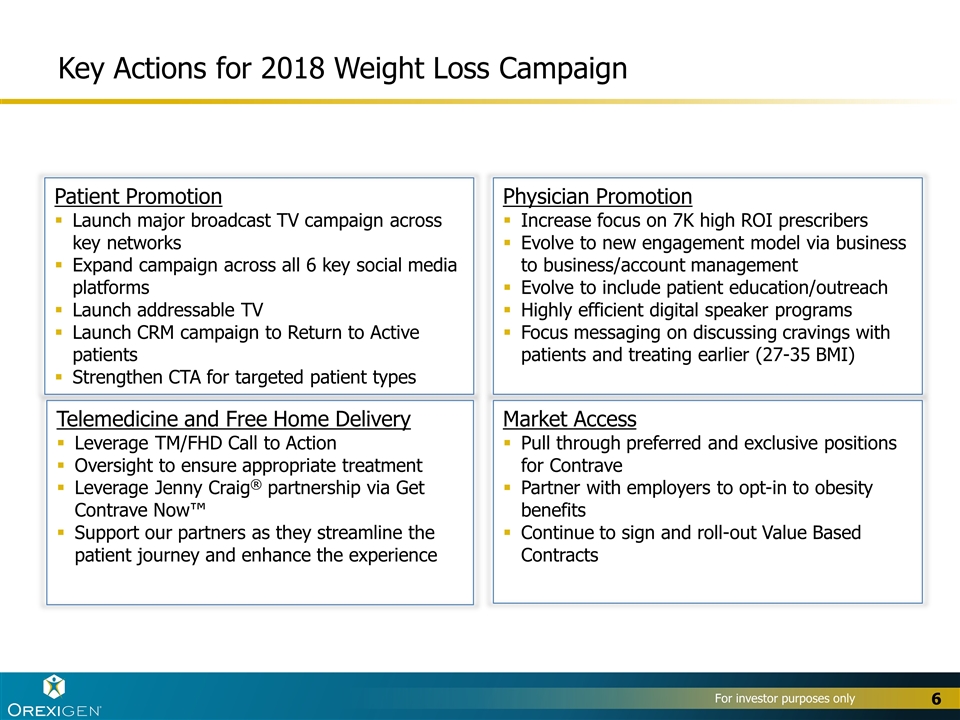

Key Actions for 2018 Weight Loss Campaign Physician Promotion Increase focus on 7K high ROI prescribers Evolve to new engagement model via business to business/account management Evolve to include patient education/outreach Highly efficient digital speaker programs Focus messaging on discussing cravings with patients and treating earlier (27-35 BMI) Patient Promotion Launch major broadcast TV campaign across key networks Expand campaign across all 6 key social media platforms Launch addressable TV Launch CRM campaign to Return to Active patients Strengthen CTA for targeted patient types Market Access Pull through preferred and exclusive positions for Contrave Partner with employers to opt-in to obesity benefits Continue to sign and roll-out Value Based Contracts Telemedicine and Free Home Delivery Leverage TM/FHD Call to Action Oversight to ensure appropriate treatment Leverage Jenny Craig® partnership via Get Contrave Now™ Support our partners as they streamline the patient journey and enhance the experience

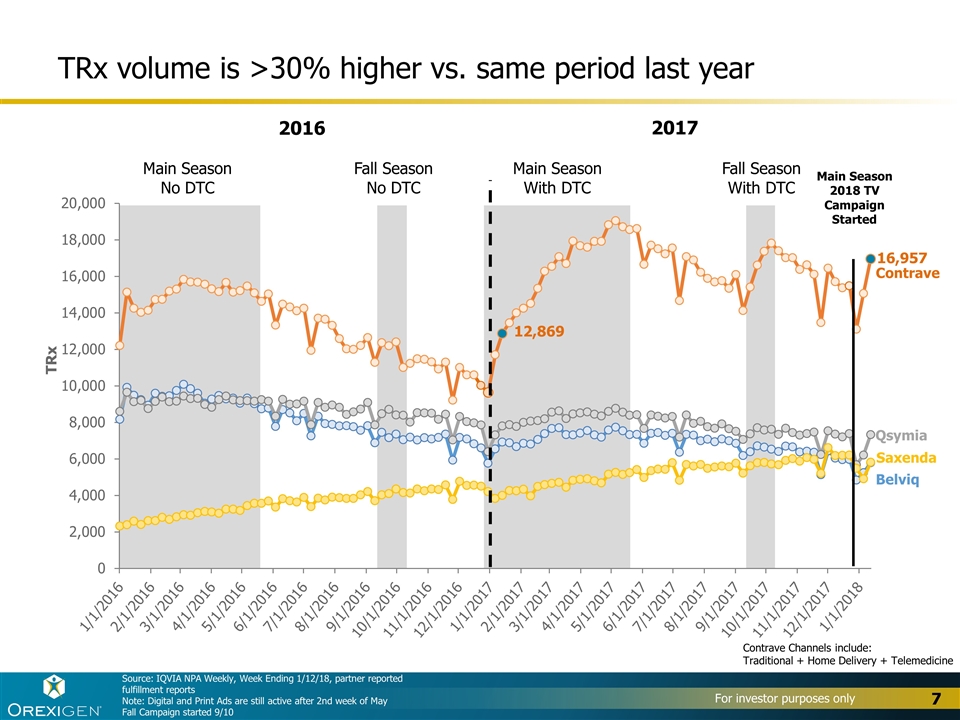

Main Season No DTC Fall Season No DTC Main Season With DTC Fall Season With DTC TRx volume is >30% higher vs. same period last year Source: IQVIA NPA Weekly, Week Ending 1/12/18, partner reported fulfillment reports Note: Digital and Print Ads are still active after 2nd week of May Fall Campaign started 9/10 2016 2017 Contrave Channels include: Traditional + Home Delivery + Telemedicine Main Season 2018 TV Campaign Started Contrave Belviq Qsymia Saxenda

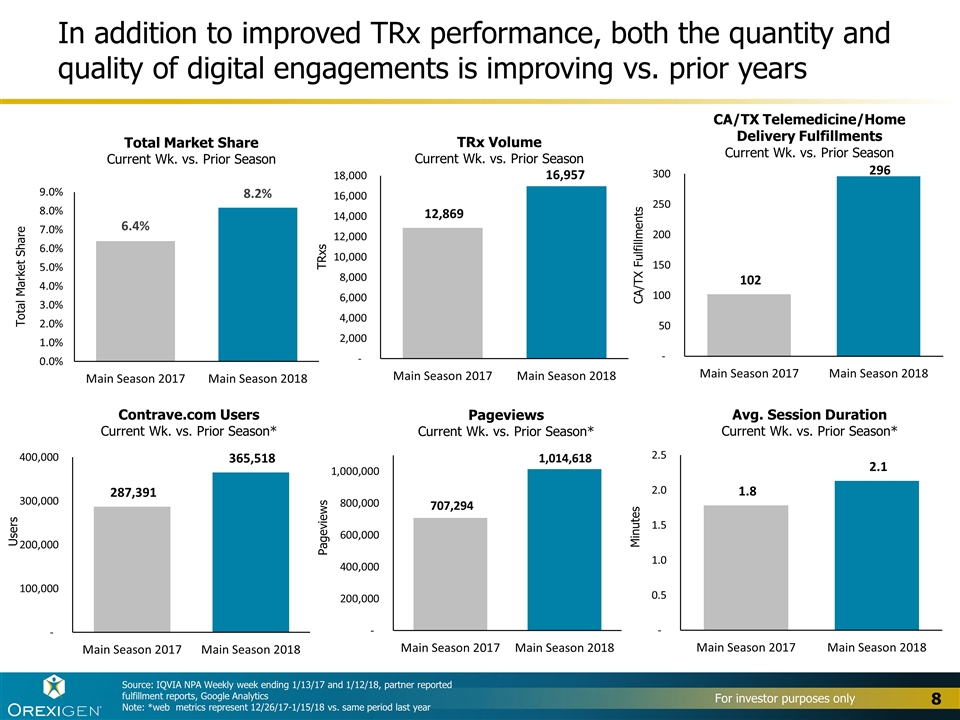

In addition to improved TRx performance, both the quantity and quality of digital engagements is improving vs. prior years Total Market Share Current Wk. vs. Prior Season CA/TX Fulfillments CA/TX Telemedicine/Home Delivery Fulfillments Current Wk. vs. Prior Season Total Market Share Avg. Session Duration Current Wk. vs. Prior Season* Minutes TRxs TRx Volume Current Wk. vs. Prior Season Pageviews Current Wk. vs. Prior Season* Pageviews Source: IQVIA NPA Weekly week ending 1/13/17 and 1/12/18, partner reported fulfillment reports, Google Analytics Note: *web metrics represent 12/26/17-1/15/18 vs. same period last year Users Contrave.com Users Current Wk. vs. Prior Season*

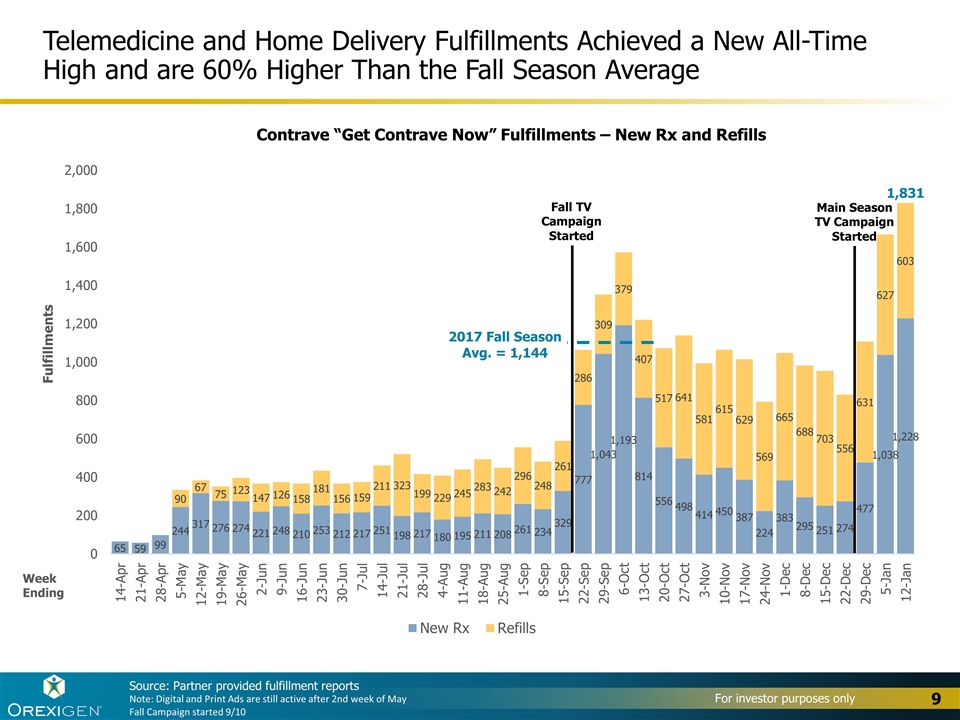

Source: Partner provided fulfillment reports Note: Digital and Print Ads are still active after 2nd week of May Fall Campaign started 9/10 Telemedicine and Home Delivery Fulfillments Achieved a New All-Time High and are 60% Higher Than the Fall Season Average Week Ending Fall TV Campaign Started Contrave “Get Contrave Now” Fulfillments – New Rx and Refills Main Season TV Campaign Started 2017 Fall Season Avg. = 1,144 1,831

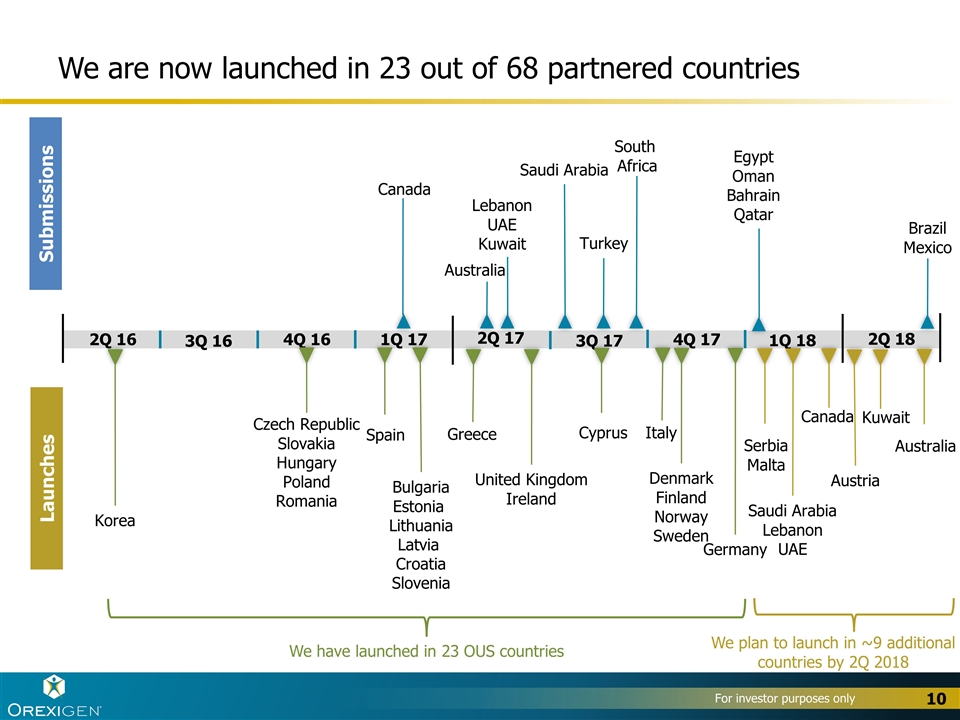

Submissions Launches 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 Saudi Arabia Lebanon UAE Canada Serbia Malta South Africa Saudi Arabia Australia Canada Lebanon UAE Kuwait Greece United Kingdom Ireland Spain Bulgaria Estonia Lithuania Latvia Croatia Slovenia Korea Czech Republic Slovakia Hungary Poland Romania Turkey We have launched in 23 OUS countries We plan to launch in ~9 additional countries by 2Q 2018 2Q 18 Italy Denmark Finland Norway Sweden We are now launched in 23 out of 68 partnered countries Germany Cyprus Kuwait Austria Australia Egypt Oman Bahrain Qatar Brazil Mexico

Evolving Commercial Focus in 2018

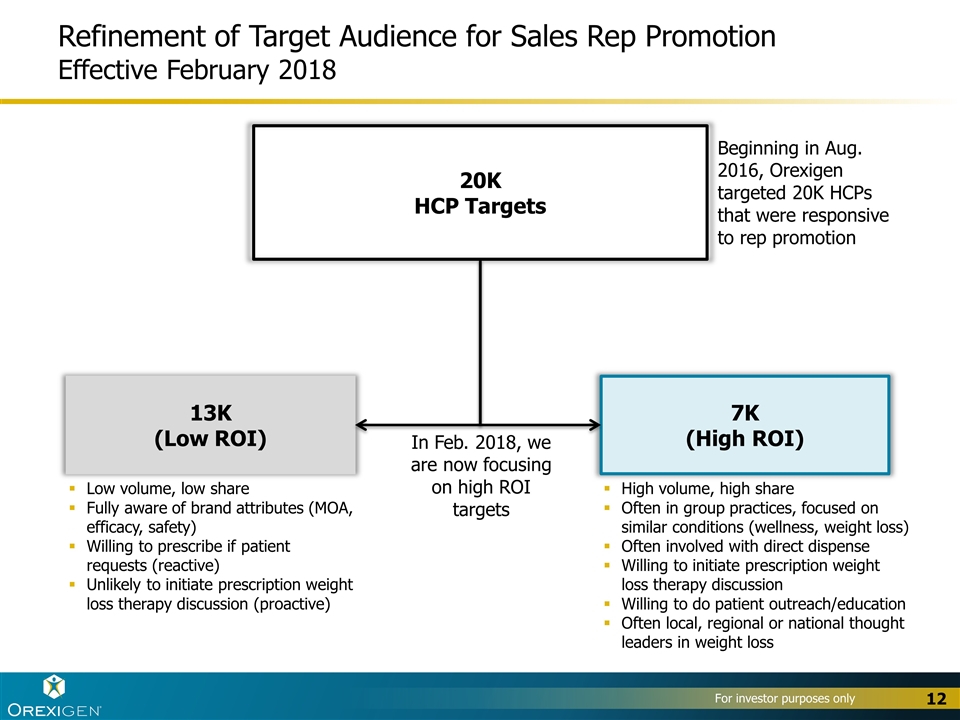

Refinement of Target Audience for Sales Rep Promotion Effective February 2018 20K HCP Targets Beginning in Aug. 2016, Orexigen targeted 20K HCPs that were responsive to rep promotion 13K (Low ROI) Low volume, low share Fully aware of brand attributes (MOA, efficacy, safety) Willing to prescribe if patient requests (reactive) Unlikely to initiate prescription weight loss therapy discussion (proactive) 7K (High ROI) High volume, high share Often in group practices, focused on similar conditions (wellness, weight loss) Often involved with direct dispense Willing to initiate prescription weight loss therapy discussion Willing to do patient outreach/education Often local, regional or national thought leaders in weight loss In Feb. 2018, we are now focusing on high ROI targets

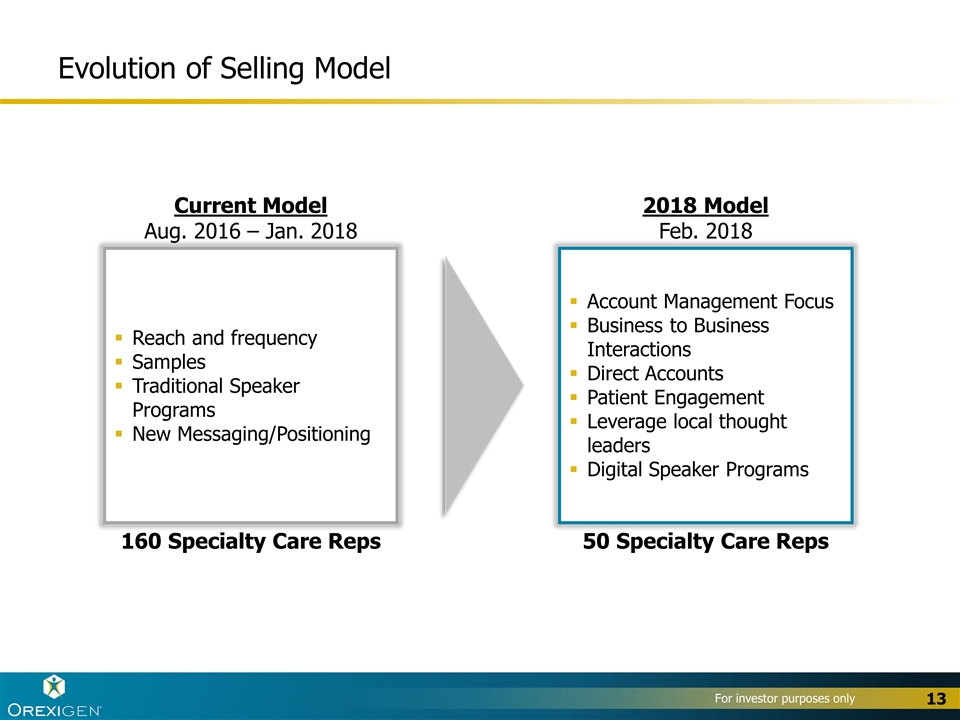

Evolution of Selling Model 2018 Model Feb. 2018 Reach and frequency Samples Traditional Speaker Programs New Messaging/Positioning Account Management Focus Business to Business Interactions Direct Accounts Patient Engagement Leverage local thought leaders Digital Speaker Programs Current Model Aug. 2016 – Jan. 2018 160 Specialty Care Reps 50 Specialty Care Reps

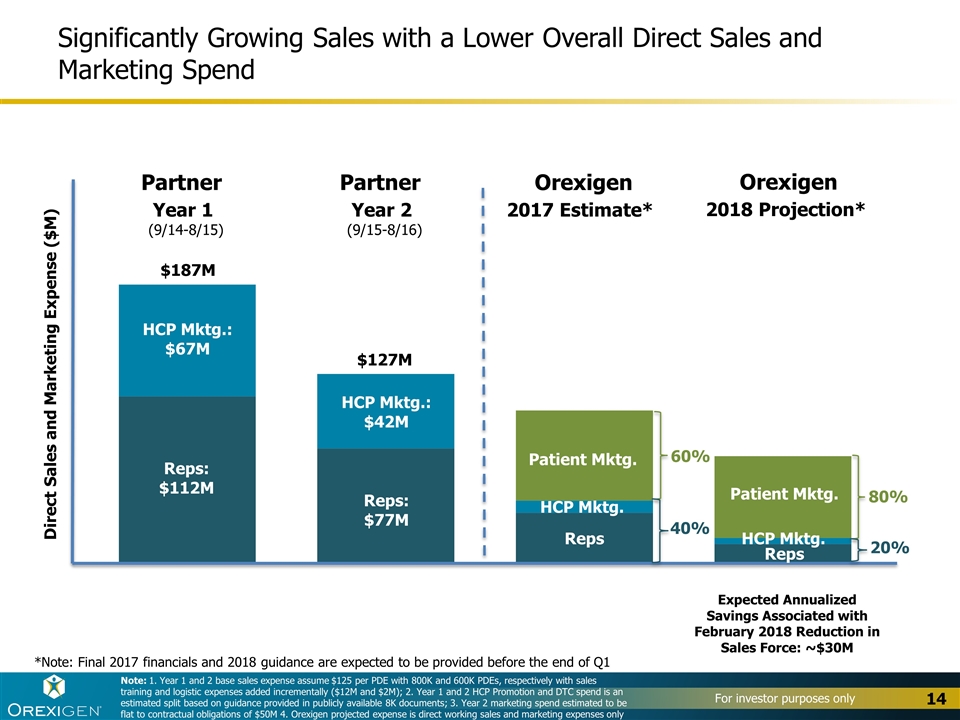

Significantly Growing Sales with a Lower Overall Direct Sales and Marketing Spend $187M $127M Reps: $112M Reps: $77M Reps HCP Mktg. HCP Mktg.: $67M HCP Mktg.: $42M Patient Mktg. Note: 1. Year 1 and 2 base sales expense assume $125 per PDE with 800K and 600K PDEs, respectively with sales training and logistic expenses added incrementally ($12M and $2M); 2. Year 1 and 2 HCP Promotion and DTC spend is an estimated split based on guidance provided in publicly available 8K documents; 3. Year 2 marketing spend estimated to be flat to contractual obligations of $50M 4. Orexigen projected expense is direct working sales and marketing expenses only Partner Orexigen Direct Sales and Marketing Expense ($M) Year 1 (9/14-8/15) Partner Year 2 (9/15-8/16) 2017 Estimate* Reps HCP Mktg. Patient Mktg. 60% 40% 80% 20% Orexigen 2018 Projection* Expected Annualized Savings Associated with February 2018 Reduction in Sales Force: ~$30M *Note: Final 2017 financials and 2018 guidance are expected to be provided before the end of Q1

Execute 2018 commercial plan in the United States to continue to drive Contrave prescription and revenue growth Support partners’ advancement of launches and regulatory filings in countries outside the United States Continue positive dialog with regulators regarding completion of post-marketing requirements in a cost-efficient manner Work with noteholders and investors to restructure debt and address near-term liquidity needs Advance ongoing discussions related to strategic transactions 2018 Strategic Objectives

Backup

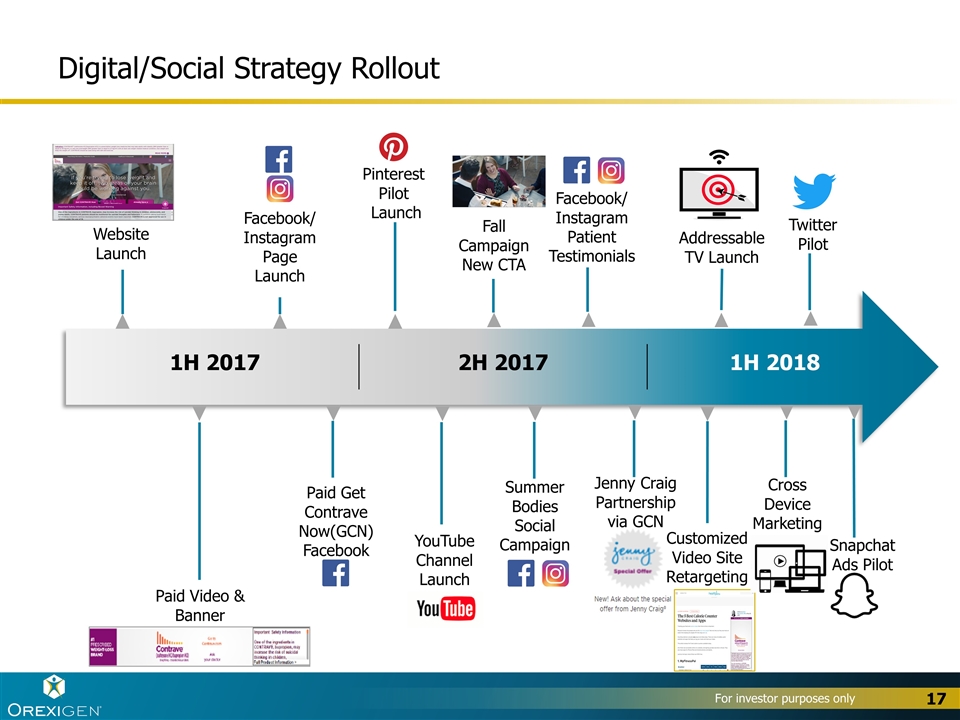

1H 2017 2H 2017 1H 2018 Paid Video & Banner Pinterest Pilot Launch Website Launch Facebook/ Instagram Page Launch Paid Get Contrave Now(GCN) Facebook Digital/Social Strategy Rollout Fall Campaign New CTA Summer Bodies Social Campaign Cross Device Marketing Twitter Pilot Customized Video Site Retargeting Addressable TV Launch YouTube Channel Launch Facebook/ Instagram Patient Testimonials Snapchat Ads Pilot Jenny Craig Partnership via GCN