Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ANGIODYNAMICS INC | an40915607-8k.htm |

Exhibit 99.1

J.P. Morgan Healthcare Conference – AngioDynamics Investor Presentation January 10, 2018

Forward-Looking Statement Notice Regarding Forward Looking StatementsThis release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements regarding AngioDynamics’ expected future financial position, results of operations, cash flows, business strategy, budgets, projected costs, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements that include the words such as “expects,” “reaffirms,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “optimistic,” or variations of such words and similar expressions, are forward-looking statements. These forward looking statements are not guarantees of future performance and are subject to risks and uncertainties. Investors are cautioned that actual events or results may differ from AngioDynamics’ expectations. Factors that may affect the actual results achieved by AngioDynamics include, without limitation, the ability of AngioDynamics to develop its existing and new products, technological advances and patents attained by competitors, infringement of AngioDynamics’ technology or assertions that AngioDynamics’ technology infringes the technology of third parties, the ability of AngioDynamics to effectively compete against competitors that have substantially greater resources, future actions by the FDA or other regulatory agencies, domestic and foreign health care reforms and government regulations, results of pending or future clinical trials, overall economic conditions, the results of on-going litigation, challenges with respect to third-party distributors or joint venture partners or collaborators, the results of sales efforts, the effects of product recalls and product liability claims, changes in key personnel, the ability of AngioDynamics to execute on strategic initiatives, the effects of economic, credit and capital market conditions, general market conditions, market acceptance, foreign currency exchange rate fluctuations, the effects on pricing from group purchasing organizations and competition, the ability of AngioDynamics to integrate purchased businesses, as well as the risk factors listed from time to time in AngioDynamics’ SEC filings, including but not limited to its Annual Report on Form 10-K for the year ended May 31, 2017 and its quarterly reports on Form 10-Q for the fiscal periods ended August 31, 2017 and November 30, 2017. AngioDynamics does not assume any obligation to publicly update or revise any forward-looking statements for any reason. In the United States, the NanoKnife System has received a 510(k) clearance by the Food and Drug Administration for use in the surgical ablation of soft tissue, and is similarly approved for commercialization in Canada, the European Union and Australia. The NanoKnife System has not been cleared for the treatment or therapy of a specific disease or condition. Notice Regarding Non-GAAP Financial MeasuresManagement uses non-GAAP measures to establish operational goals, and believes that non-GAAP measures may assist investors in analyzing the underlying trends in AngioDynamics’ business over time. Investors should consider these non-GAAP measures in addition to, not as a substitute for or as superior to, financial reporting measures prepared in accordance with GAAP. In this news release, AngioDynamics has reported adjusted EBITDAS (income before interest, taxes, depreciation and amortization and stock-based compensation); free cash flow and adjusted earnings per share. Management uses these measures in its internal analysis and review of operational performance. Management believes that these measures provide investors with useful information in comparing AngioDynamics’ performance over different periods. By using these non-GAAP measures, management believes that investors get a better picture of the performance of AngioDynamics’ underlying business. Management encourages investors to review AngioDynamics’ financial results prepared in accordance with GAAP to understand AngioDynamics’ performance taking into account all relevant factors, including those that may only occur from time to time but have a material impact on AngioDynamics’ financial results. Please see the tables that follow for a reconciliation of non-GAAP measures to measures prepared in accordance with GAAP.TrademarksAngioDynamics, the AngioDynamics logo, BioFlo, the BioFlo logo, NanoKnife, the NanoKnife logo, VenaCureEVLT, the VenaCureEVLT logo, AngioVac, the AngioVac logo, Solero, the Solero logo, Uni-Fuse, the Uni-Fuse logo, NAMIC, and the NAMIC logo are trademarks and/or registered trademarks of AngioDynamics, Inc., an affiliate or subsidiary. Endexo is a trademark and/or registered trademark of Interface Biologics. Habib is a trademark and/or registered trademark of Emcision. ASCLERA is a registered trademark of Chemische Fabrik Kreussler & Co., GmbH. All other marks are property of their respective owner.

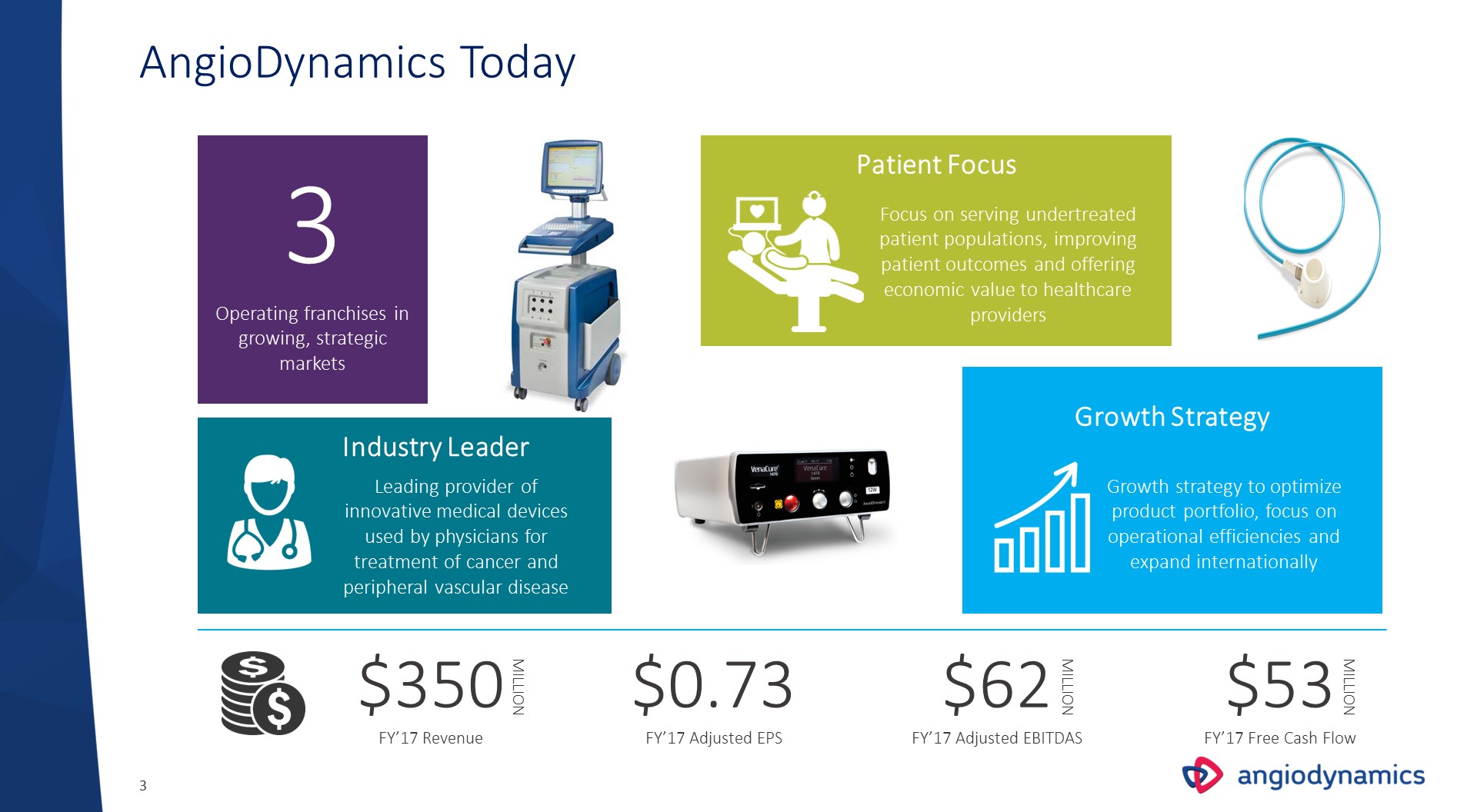

AngioDynamics Today 3 Focus on serving undertreated patient populations, improving patient outcomes and offering economic value to healthcare providers Operating franchises in growing, strategic markets Growth strategy to optimize product portfolio, focus on operational efficiencies and expand internationally $350FY’17 Revenue MILLION $62FY’17 Adjusted EBITDAS MILLION $53FY’17 Free Cash Flow Growth Strategy Patient Focus $0.73FY’17 Adjusted EPS MILLION Leading provider of innovative medical devices used by physicians for treatment of cancer and peripheral vascular disease Industry Leader

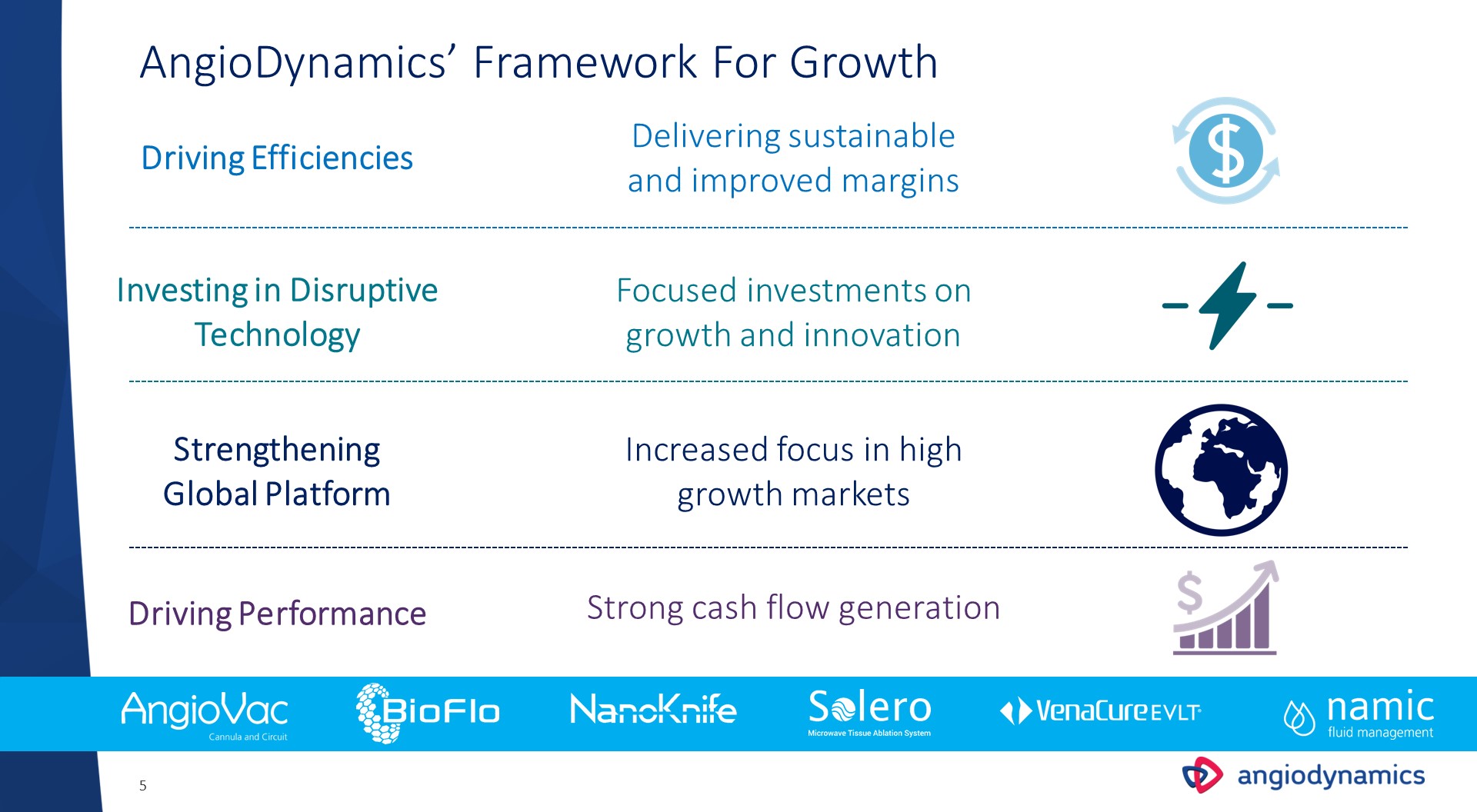

AngioDynamics’ Framework For Growth Driving Efficiencies Investing in Disruptive Technology Strengthening Global Platform Driving Performance Delivering sustainable and improved margins Focused investments on growth and innovation Increased focus in high growth markets Strong cash flow generation

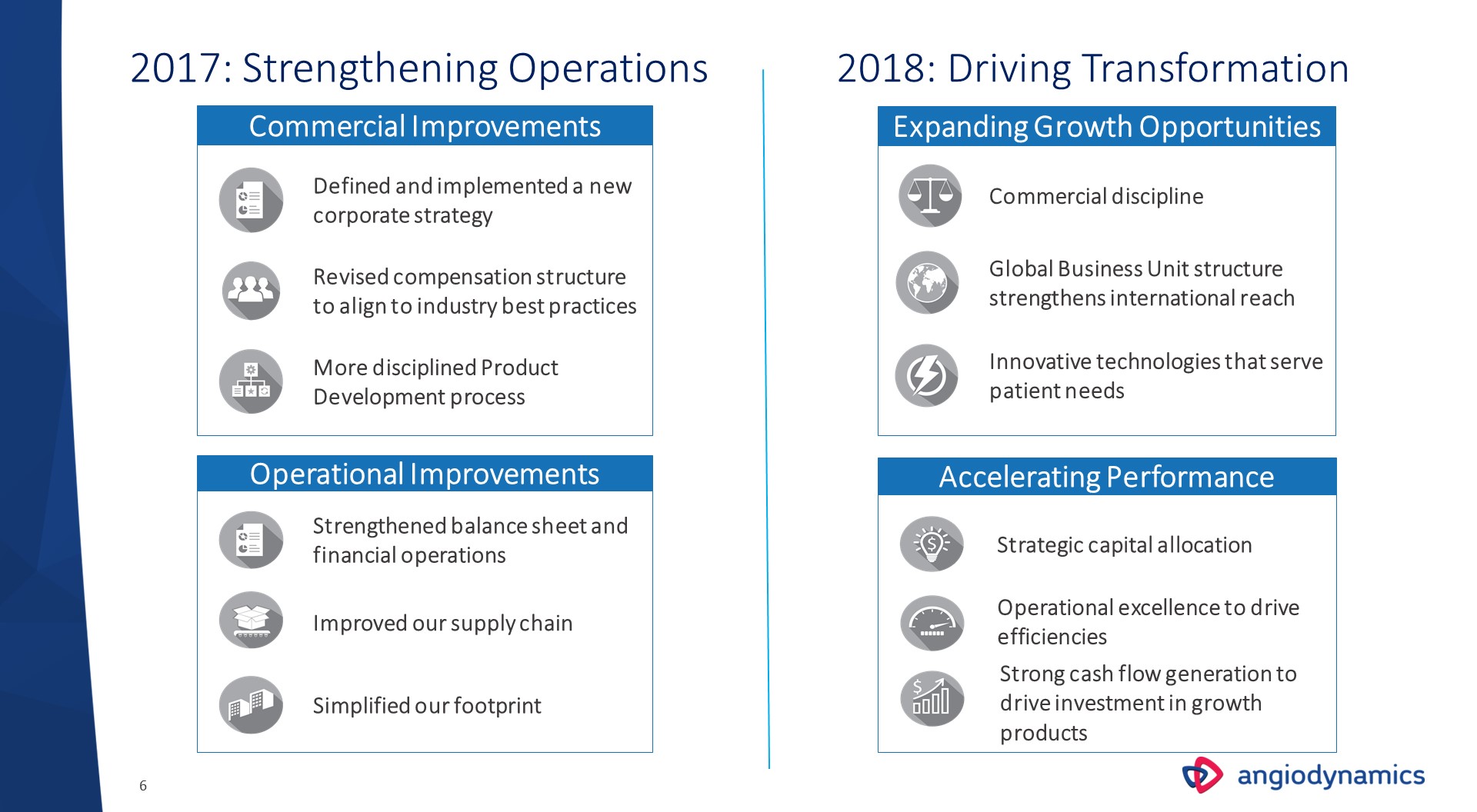

2017: Strengthening Operations More disciplined Product Development process Defined and implemented a new corporate strategy Commercial Improvements Revised compensation structure to align to industry best practices Operational Improvements Improved our supply chain Simplified our footprint Strengthened balance sheet and financial operations 2018: Driving Transformation Expanding Growth Opportunities Global Business Unit structure strengthens international reach Commercial discipline Innovative technologies that serve patient needs Accelerating Performance Strategic capital allocation Strong cash flow generation to drive investment in growth products Operational excellence to drive efficiencies

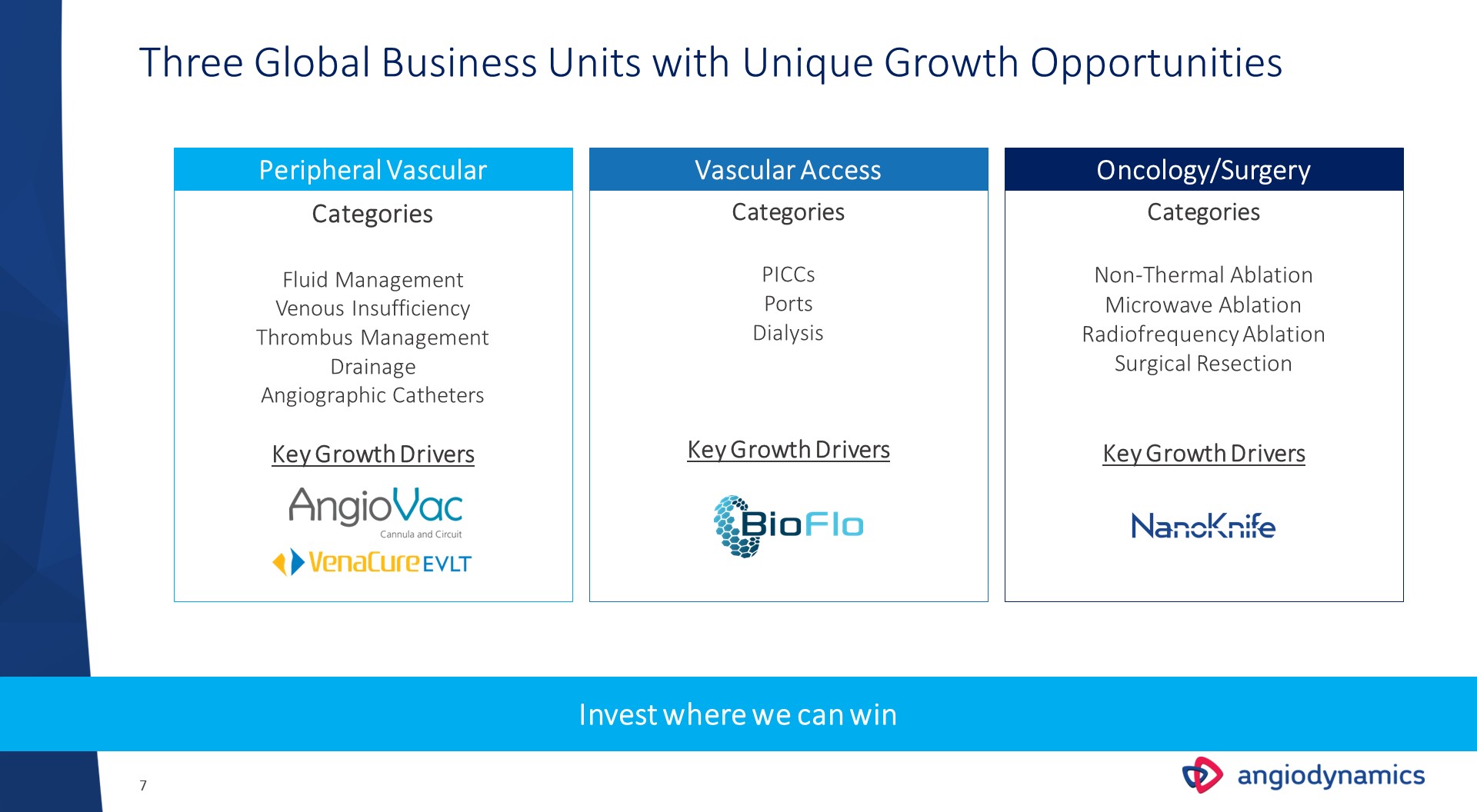

Three Global Business Units with Unique Growth Opportunities CategoriesFluid ManagementVenous InsufficiencyThrombus ManagementDrainageAngiographic CathetersKey Growth Drivers Peripheral Vascular Vascular Access Oncology/Surgery CategoriesPICCsPortsDialysisKey Growth Drivers CategoriesNon-Thermal AblationMicrowave AblationRadiofrequency AblationSurgical ResectionKey Growth Drivers Invest where we can win

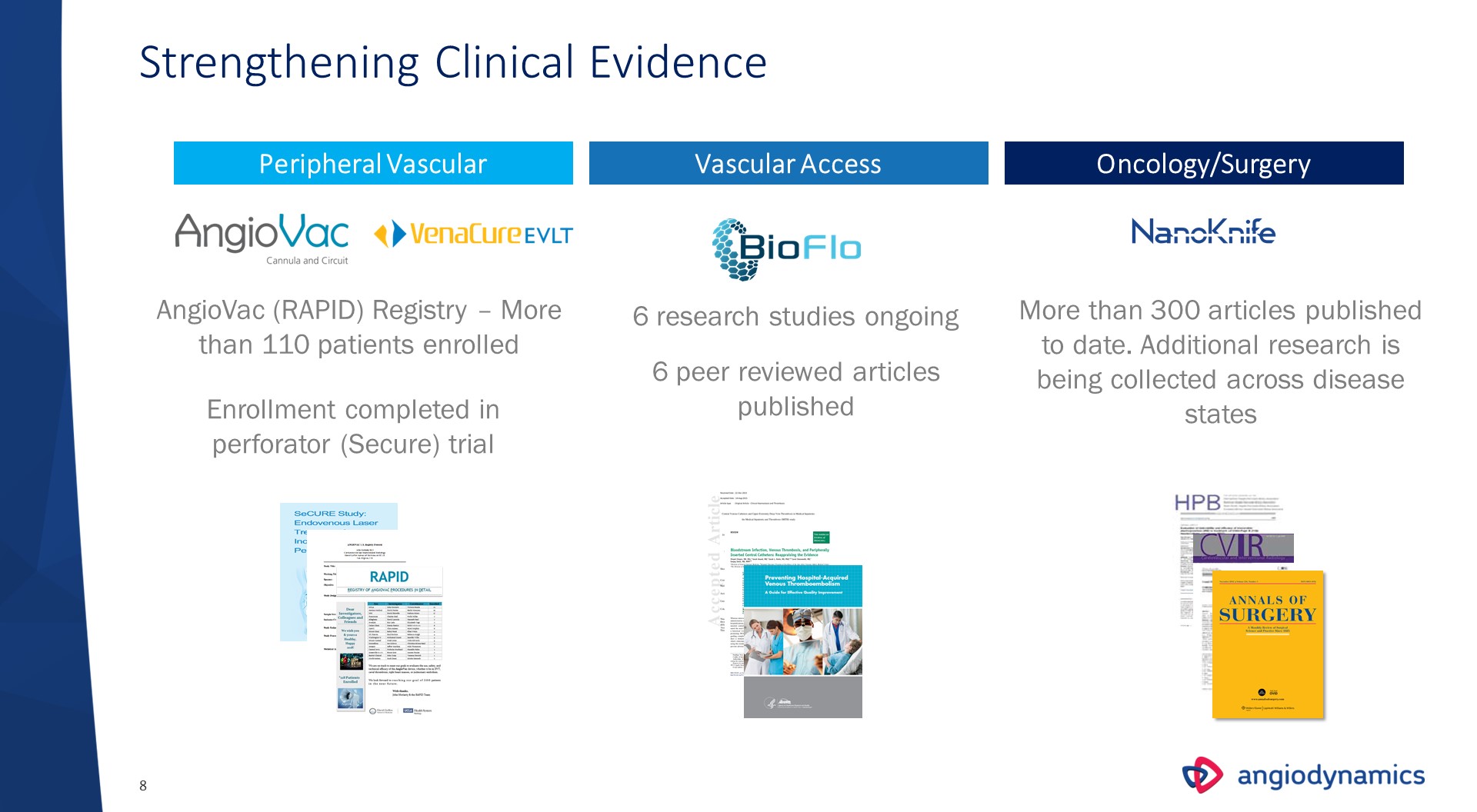

Strengthening Clinical Evidence Peripheral Vascular Vascular Access Oncology/Surgery More than 300 articles published to date. Additional research is being collected across disease states 6 research studies ongoing 6 peer reviewed articles published Enrollment completed in perforator (Secure) trial AngioVac (RAPID) Registry – More than 110 patients enrolled

Financial Update

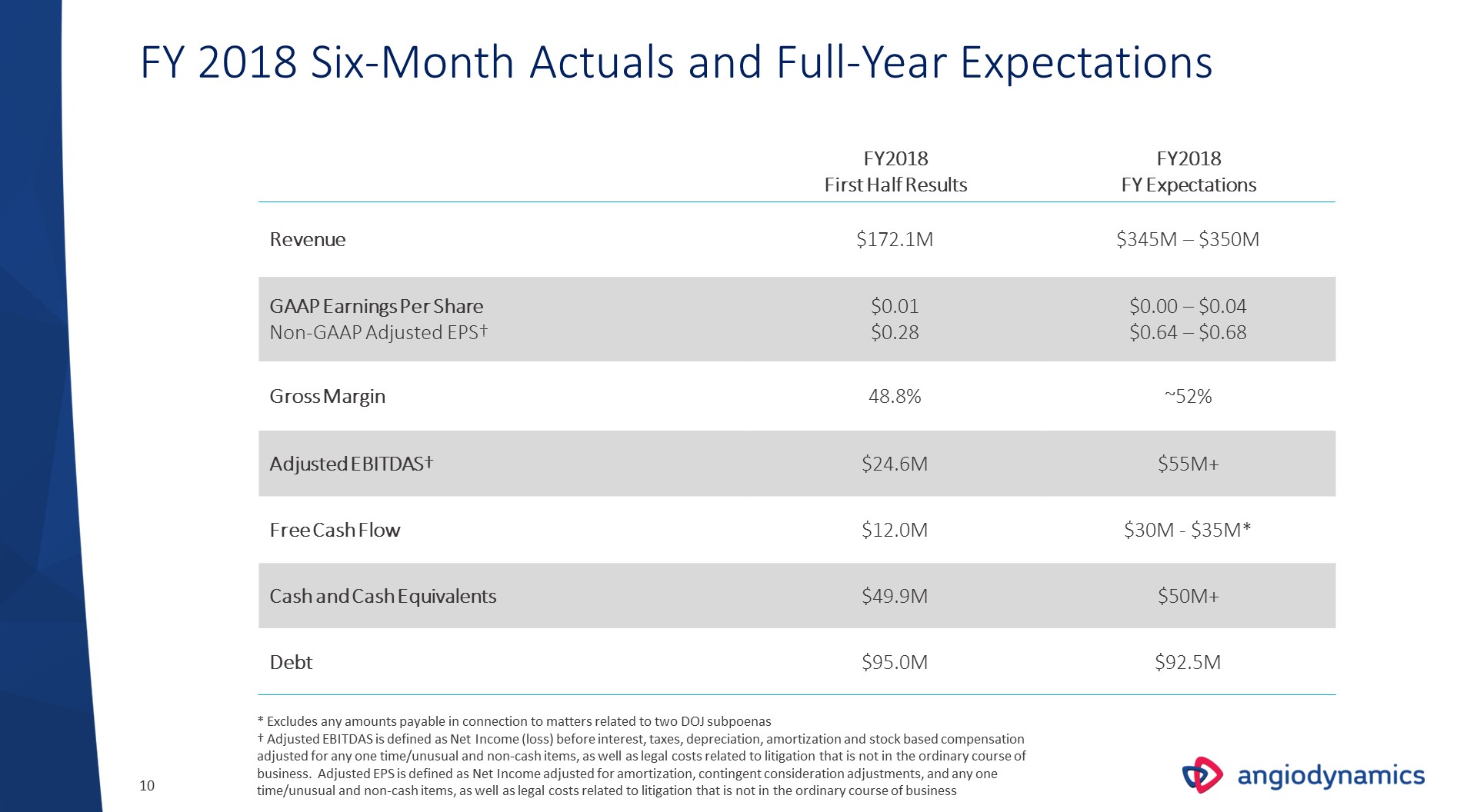

FY2018First Half Results FY2018FY Expectations Revenue $172.1M $345M – $350M GAAP Earnings Per ShareNon-GAAP Adjusted EPS† $0.01$0.28 $0.00 – $0.04$0.64 – $0.68 Gross Margin 48.8% ~52% Adjusted EBITDAS† $24.6M $55M+ Free Cash Flow $12.0M $30M - $35M* Cash and Cash Equivalents $49.9M $50M+ Debt $95.0M $92.5M FY 2018 Six-Month Actuals and Full-Year Expectations * Excludes any amounts payable in connection to matters related to two DOJ subpoenas† Adjusted EBITDAS is defined as Net Income (loss) before interest, taxes, depreciation, amortization and stock based compensation adjusted for any one time/unusual and non-cash items, as well as legal costs related to litigation that is not in the ordinary course of business. Adjusted EPS is defined as Net Income adjusted for amortization, contingent consideration adjustments, and any one time/unusual and non-cash items, as well as legal costs related to litigation that is not in the ordinary course of business

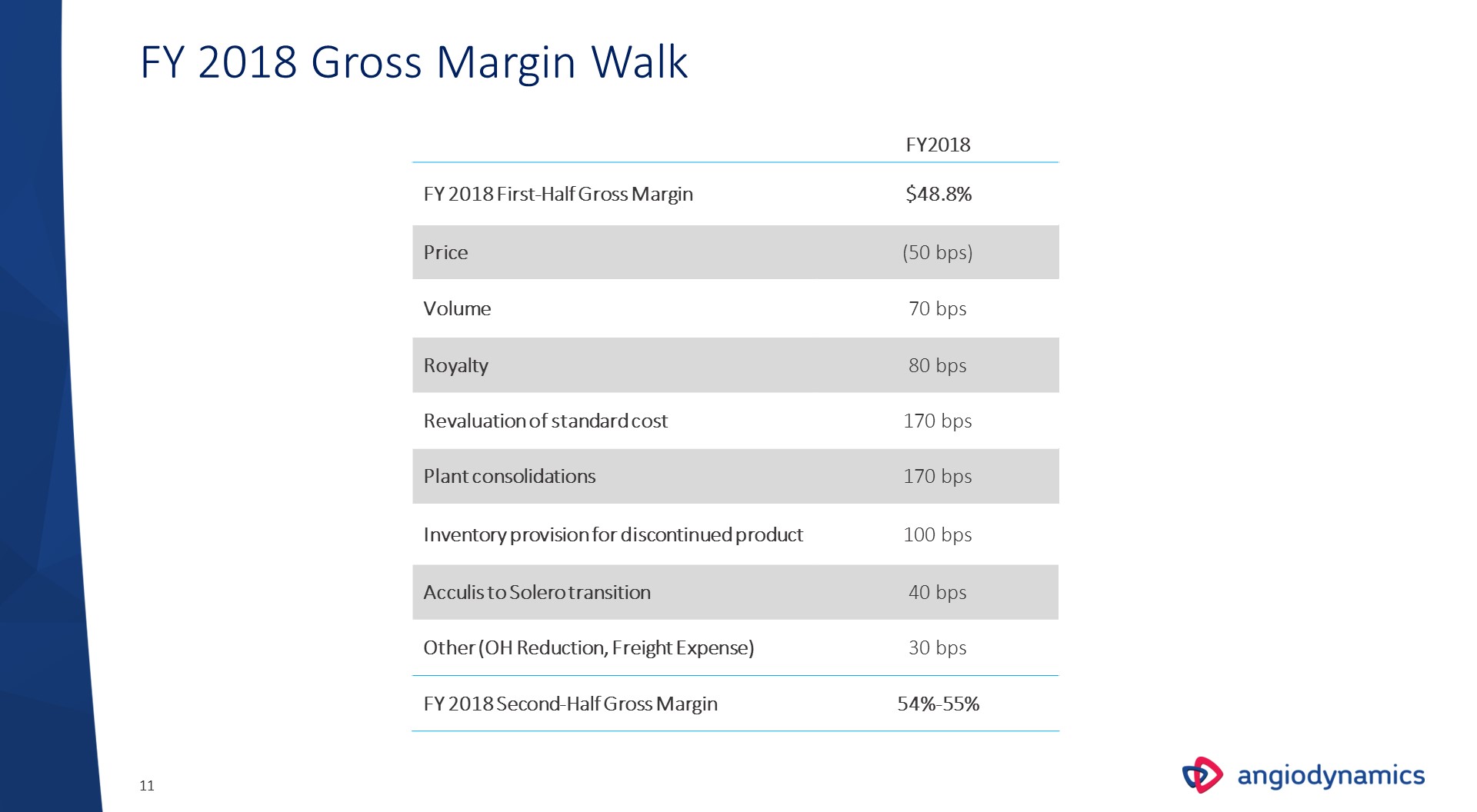

FY2018 FY 2018 First-Half Gross Margin $48.8% Price (50 bps) Volume 70 bps Royalty 80 bps Revaluation of standard cost 170 bps Plant consolidations 170 bps Inventory provision for discontinued product 100 bps Acculis to Solero transition 40 bps Other (OH Reduction, Freight Expense) 30 bps FY 2018 Second-Half Gross Margin 54%-55% FY 2018 Gross Margin Walk

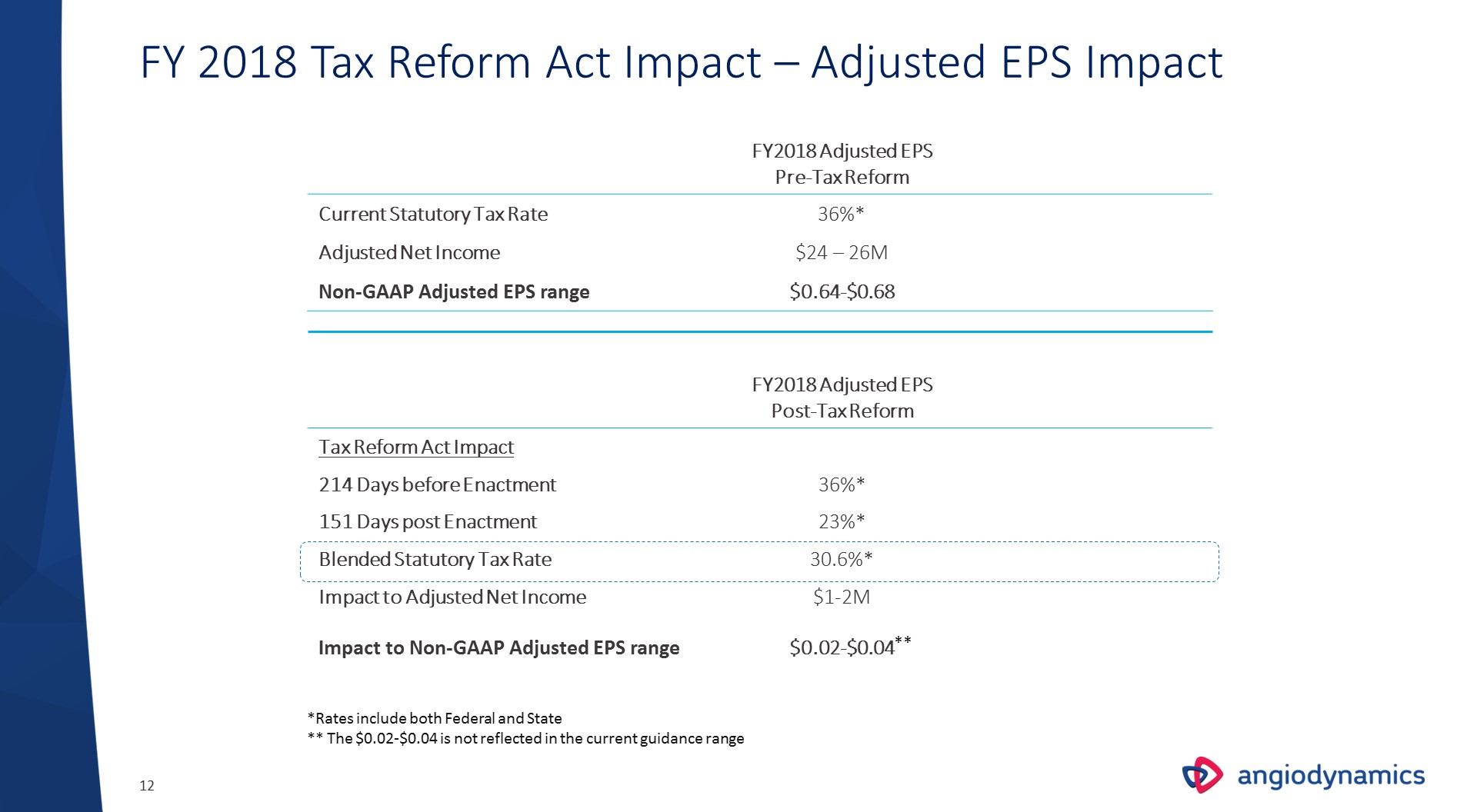

FY 2018 Tax Reform Act Impact – Adjusted EPS Impact FY2018 Adjusted EPS Pre-Tax Reform Current Statutory Tax Rate 36%* Adjusted Net Income $24 – 26M Non-GAAP Adjusted EPS range $0.64-$0.68 FY2018 Adjusted EPSPost-Tax Reform Tax Reform Act Impact 214 Days before Enactment 36%* 151 Days post Enactment 23%* Blended Statutory Tax Rate 30.6%* Impact to Adjusted Net Income $1-2M Impact to Non-GAAP Adjusted EPS range $0.02-$0.04 *Rates include both Federal and State** The $0.02-$0.04 is not reflected in the current guidance range **

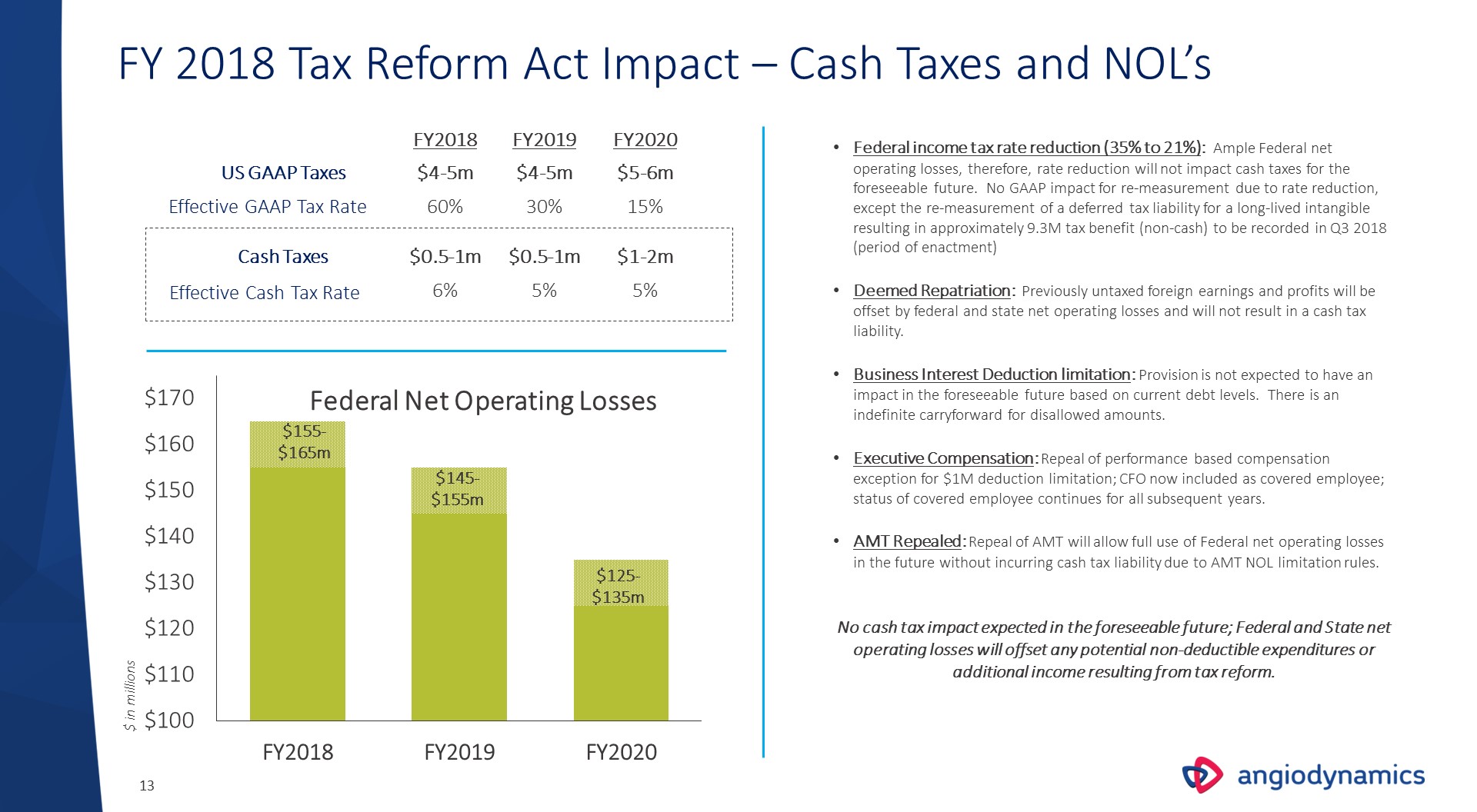

FY 2018 Tax Reform Act Impact – Cash Taxes and NOL’s $ in millions Federal Net Operating Losses $155-$165m US GAAP Taxes Effective GAAP Tax Rate Cash Taxes Effective Cash Tax Rate FY2018 FY2019 FY2020 Federal income tax rate reduction (35% to 21%): Ample Federal net operating losses, therefore, rate reduction will not impact cash taxes for the foreseeable future. No GAAP impact for re-measurement due to rate reduction, except the re-measurement of a deferred tax liability for a long-lived intangible resulting in approximately 9.3M tax benefit (non-cash) to be recorded in Q3 2018 (period of enactment)Deemed Repatriation: Previously untaxed foreign earnings and profits will be offset by federal and state net operating losses and will not result in a cash tax liability.Business Interest Deduction limitation: Provision is not expected to have an impact in the foreseeable future based on current debt levels. There is an indefinite carryforward for disallowed amounts.Executive Compensation: Repeal of performance based compensation exception for $1M deduction limitation; CFO now included as covered employee; status of covered employee continues for all subsequent years.AMT Repealed: Repeal of AMT will allow full use of Federal net operating losses in the future without incurring cash tax liability due to AMT NOL limitation rules.No cash tax impact expected in the foreseeable future; Federal and State net operating losses will offset any potential non-deductible expenditures or additional income resulting from tax reform. $4-5m $4-5m $5-6m 15% 30% 60% $0.5-1m $0.5-1m $1-2m 5% 5% 6% $145-$155m $125-$135m

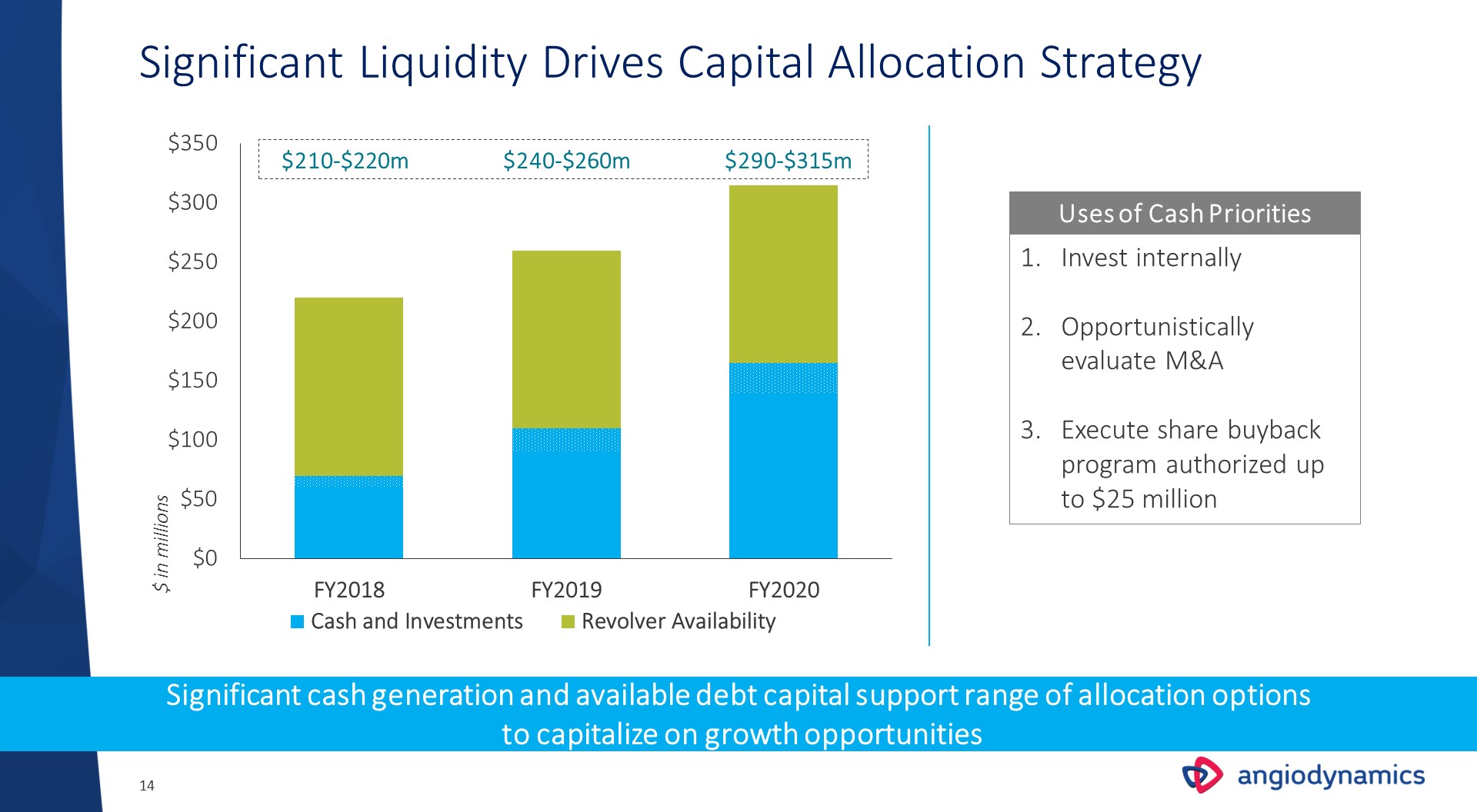

Significant Liquidity Drives Capital Allocation Strategy Uses of Cash Priorities Invest internallyOpportunistically evaluate M&AExecute share buyback program authorized up to $25 million Significant cash generation and available debt capital support range of allocation options to capitalize on growth opportunities $ in millions $240-$260m $290-$315m $210-$220m

Our Vision for AngioDynamics 3 1 2 Increase our value to each of our stakeholders Partner with providers and caregivers to deliver superior care to patients Be recognized as a consistent, high-performing MedTech company

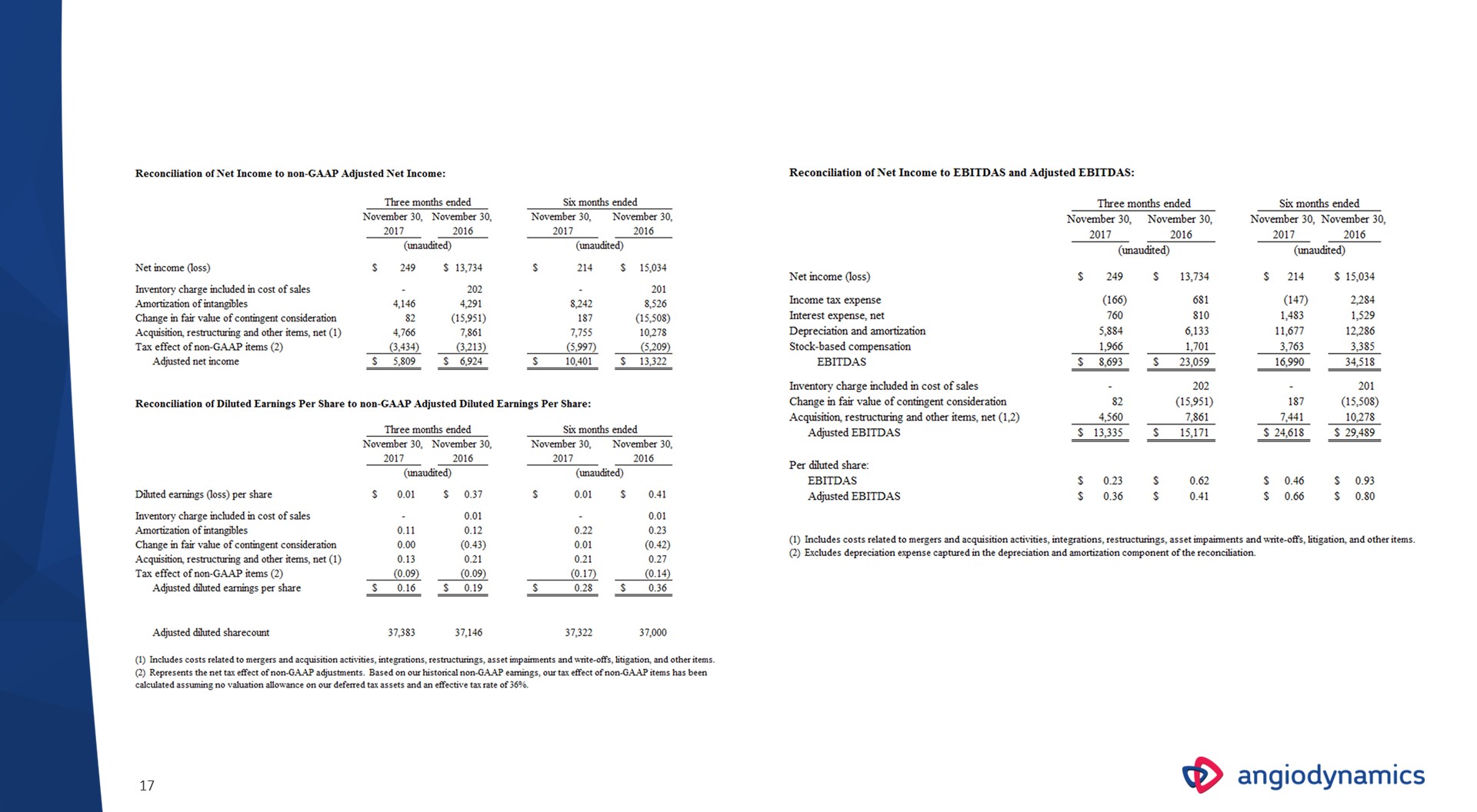

Reconciliation Tables