Attached files

| file | filename |

|---|---|

| 8-K - TAIWAN FUND INC | fp0029851_8k.htm |

Investment objective

The Fund’s investment objective is to seek long-term capital appreciation primarily through investments in equity securities listed in Taiwan.

| Fund facts | (as at 11/30/17) |

| Net asset value per share | $23.77 |

| Market price | $21.16 |

| Premium/discount | -10.98% |

| Total net assets | $194.53 m |

| Market cap | $173.17 m |

| Fund statistics | |

| Investment adviser (date of appointment) | JF International Management, Inc. (07/22/14) |

| Fund manager | Shumin Huang |

| Listed | NYSE |

| Launch date | 12/23/86 |

| Shares outstanding | 8,183,761 |

| Last dividend (Ex-dividend date) |

$2.6332 (December 26, 2014) |

| Benchmark | TAIEX Total Return Index |

| Fund codes | |

| Bloomberg | TWN |

| Sedol | 286987895 |

| CUSIP | 874036106 |

| ISIN | US8740361063 |

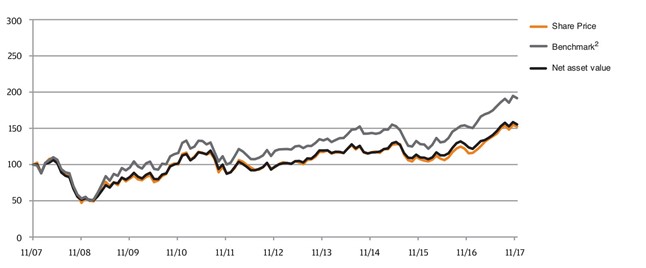

| 10 year performance data | (as at 11/30/17) |

| Cumulative Performance1 | (as at 11/30/17) | ||||||

| % | 1m | 3m | YTD2 | 1Y | 3Y | 5Y | 10Y |

| The Taiwan Fund, Inc. | -2.0 | -1.4 | 27.7 | 25.7 | 33.2 | 59.7 | 55.5 |

| Market Price | -1.4 | -1.0 | 31.4 | 31.9 | 30.3 | 58.1 | 52.6 |

| TSE Index | -1.6 | 0.4 | 22.6 | 21.4 | 18.6 | 35.0 | 32.3 |

| TAIEX Total Return Index3 | -1.6 | 0.5 | 27.4 | 26.2 | 33.4 | 61.1 | 91.6 |

| MSCI Taiwan Index | -3.3 | -0.6 | 26.0 | 24.4 | 29.0 | 58.7 | 67.5 |

| Rolling 12 month performance1 | (as at 11/30/17) | ||||

| % | 2017/2016 | 2016/2015 | 2015/2014 | 2014/2013 | 2013/2012 |

| The Taiwan Fund, Inc. | 25.7 | 12.6 | -5.9 | -2.3 | 22.7 |

| Market Price | 31.9 | 7.7 | -8.3 | -0.3 | 21.8 |

| TSE Index | 21.4 | 13.7 | -14.1 | 4.5 | 8.9 |

| TAIEX Total Return Index3 | 26.2 | 18.5 | -10.7 | 7.7 | 12.1 |

| MSCI Taiwan Index | 24.4 | 19.1 | -13.0 | 13.4 | 8.5 |

| Top 10 holdings | (as at 11/30/17) |

| Holding | Fund % |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 9.5% |

| Hon Hai Precision Industry Co., Ltd. | 7.5% |

| Largan Precision Co., Ltd. | 4.4% |

| MediaTek, Inc. | 3.7% |

| Cathay Financial Holding Co., Ltd. | 3.6% |

| CTBC Financial Holding Co., Ltd. | 2.7% |

| Airtac International Group | 2.6% |

| Ennoconn Corp. | 2.6% |

| Formosa Plastics Corp. | 2.5% |

| Nan Ya Plastics Corp. | 2.5% |

| 1 | In US Dollar terms |

| 2 | Calendar year to date |

| 3 | TAIEX Total Return Index (prior to January 1, 2003, TAIEX Index) |

| Sector breakdown | (as at 11/30/17) | ||

| Sector Allocation | Fund % | Benchmark | Deviation |

| Automobile | 0.0% | 1.3% | -1.3% |

| Biotechnology & Medical Care | 0.7% | 0.7% | 0.0% |

| Building Material & Construction | 0.0% | 1.3% | -1.3% |

| Cement | 1.2% | 0.9% | 0.3% |

| Chemical | 0.0% | 1.0% | -1.0% |

| Communications & Internet | 3.1% | 5.8% | -2.7% |

| Computer & Peripheral Equipment | 5.5% | 5.1% | 0.4% |

| Electric & Machinery | 7.2% | 2.1% | 5.1% |

| Electrical & Cable | 0.0% | 0.4% | -0.4% |

| Electronic Parts & Components | 5.6% | 4.8% | 0.8% |

| Electronic Products Distribution | 0.0% | 0.9% | -0.9% |

| Financial & Insurance | 11.1% | 12.7% | -1.6% |

| Foods | 2.0% | 2.0% | 0.0% |

| Glass & Ceramic | 0.0% | 0.2% | -0.2% |

| Information Service | 0.0% | 0.2% | -0.2% |

| Iron & Steel | 0.6% | 1.9% | -1.3% |

| Oil, Gas & Electricity | 2.3% | 3.4% | -1.1% |

| Optoelectronic | 6.3% | 4.8% | 1.5% |

| Other | 3.6% | 3.2% | 0.4% |

| Other Electronic | 13.5% | 7.7% | 5.8% |

| Paper & Pulp | 0.0% | 0.4% | -0.4% |

| Plastics | 6.5% | 6.2% | 0.3% |

| Rubber | 0.0% | 1.0% | -1.0% |

| Semiconductor | 23.6% | 26.9% | -3.3% |

| Shipping & Transportation | 1.2% | 1.6% | -0.4% |

| Textiles | 0.3% | 1.5% | -1.2% |

| Tourism | 1.5% | 0.5% | 1.0% |

| Trading & Consumers' Goods | 1.8% | 1.5% | 0.3% |

| Cash | 2.4% | 0.0% | 2.4% |

| OVERALL TOTAL | 100.0% | 100.0% | 0.0% |

Market review

After reaching a 27 year high, the TAIEX Total Return Index (TAIEX) decreased by 1.6% in November following profit-taking in the technology sector. The sell-off mirrored the correction that took place elsewhere in the world, particularly the United States and Asia. Semi-conductor and hardware names were the major underperformers with many hardware assemblers reporting disappointing margins due to slower production and higher material costs. In contrast, there was an increase in investor interest in financials on the expectation of rising interest rates.

Fund update

The Fund underperformed the TAIEX by 0.4% in November. Apple focused stocks such as Largan Precision Co., Ltd. and Hon Hai Precision Industry Co., Ltd. were the largest detractors from performance. The Fund's holdings in companies such as Bizlink Holding, Inc., Tripod Technology Corp. and Kingpak Technology, Inc. were also weak due to concerns around production problems at Tesla, Inc. and some investor profit-taking. Additionally, Macronix International retreated due to a downgrade from a broker based on weak demand for its flash memory product. The Fund consolidated its holdings in stocks involved in computer memory production and exited Macronix International given the increasing preference for dynamic random access memory (DRAM) due to better supply-demand dynamics. The Fund's structural underweight position in Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC) was the biggest contributor as the stock declined as part of the rotation out of technology stocks. Ennoconn Corp. rebounded after reporting improved third quarter operating profit. Holdings in Hiwin Technologies Corp. and Airtac International Group outperformed as orders and margins in automation businesses continued to beat expectations. Semi-conductor names, Win Semiconductors Corp. and Parade Technologies Ltd., also improved following better than expected results.

The Fund made no change to its core investment approach and remained focused on quality companies with strong growth profiles. The Fund continues to prefer consumer growth names with sustainable franchises, including those in the sportswear and automobile parts businesses. The Fund also favored its exposure to industrials. Additionally, the Fund remained overweight in technology companies in the Apple Inc. supply chain, and in the cloud, internet-of-things, gaming and semi-conductor sectors. The Fund remained underweight in telecommunications and basic materials.

Outlook

The shift out of the outperforming technology sectors into the previously underperforming non-technology sectors was expected after an almost year-long rally in Taiwan technology stocks and rising interest rates that are expected to benefit the financial sector. The consolidation experienced in November could continue into December. However, with earnings growth expected to be in the double digit range and with technology expected to generate stronger growth in 2018, the market outlook for the year ahead remains positive.

| Full portfolio holdings | (as at 11/30/17) | |

| Holding | Market Value USD |

Fund % |

| Semiconductor | 45,947,212 | 23.6 |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 18,430,219 | 9.5 |

| MediaTek, Inc. | 7,140,828 | 3.7 |

| Nanya Technology Corp. | 3,613,236 | 1.8 |

| Win Semiconductors Corp. | 2,528,506 | 1.3 |

| Parade Technologies Ltd. | 2,486,497 | 1.3 |

| ASPEED Technology, Inc. | 2,037,140 | 1.0 |

| Silergy Corp. | 1,759,952 | 0.9 |

| Advanced Semiconductor Engineering, Inc. | 1,672,180 | 0.9 |

| Realtek Semiconductor Corp. | 1,371,724 | 0.7 |

| Global Unichip Corp | 1,175,235 | 0.6 |

| Winbond Electronics Corp. | 1,144,229 | 0.6 |

| Macronix International | 952,126 | 0.5 |

| Powertech Technology, Inc. | 949,623 | 0.5 |

| Chipbond Technology Corp. | 685,717 | 0.3 |

| Other Electronic | 26,245,700 | 13.5 |

| Hon Hai Precision Industry Co., Ltd. | 14,527,102 | 7.5 |

| Catcher Technology Co., Ltd. | 2,713,743 | 1.4 |

| Voltronic Power Technology Corp. | 2,558,706 | 1.3 |

| Foxconn Technology Co., Ltd. | 1,924,145 | 1.0 |

| Bizlink Holding, Inc. | 1,671,234 | 0.9 |

| Kingpak Technology, Inc. | 1,579,716 | 0.8 |

| Chroma ATE, Inc. | 1,271,054 | 0.6 |

| Financial & Insurance | 21,610,292 | 11.1 |

| Cathay Financial Holding Co., Ltd. | 6,950,904 | 3.6 |

| CTBC Financial Holding Co., Ltd. | 5,337,735 | 2.7 |

| Yuanta Financial Holding Co., Ltd. | 3,794,069 | 1.9 |

| Fubon Financial Holding Co., Ltd. | 3,255,936 | 1.7 |

| E. Sun Financial Holding Co., Ltd. | 1,530,681 | 0.8 |

| China Life Insurance Co., Ltd. | 740,967 | 0.4 |

| Electric & Machinery | 14,067,992 | 7.2 |

| Airtac International Group | 5,093,560 | 2.6 |

| Hiwin Technologies Corp. | 4,472,339 | 2.3 |

| Global PMX Co., Ltd. | 2,223,445 | 1.1 |

| Hota Industrial Manufacturing Co., Ltd. | 1,870,700 | 1.0 |

| Macauto Industrial Co., Ltd. | 407,948 | 0.2 |

| Plastics | 12,687,538 | 6.5 |

| Formosa Plastics Corp. | 4,911,503 | 2.5 |

| Nan Ya Plastics Corp. | 4,899,860 | 2.5 |

| Formosa Chemicals & Fibre Corp. | 2,876,175 | 1.5 |

| Optoelectronic | 12,266,130 | 6.3 |

| Largan Precision Co., Ltd. | 8,568,381 | 4.4 |

| Epistar Corp. | 1,901,180 | 1.0 |

| E Ink Holdings, Inc. | 1,796,569 | 0.9 |

| Electronic Parts & Components | 10,953,749 | 5.6 |

| Delta Electronics, Inc. | 3,072,570 | 1.6 |

| Primax Electronics Ltd. | 2,623,325 | 1.3 |

| Tripod Technology Corp. | 2,421,924 | 1.2 |

| Compeq Manufacturing Co., Ltd. | 1,373,780 | 0.7 |

| Sinbon Electronics Co., Ltd. | 777,546 | 0.4 |

| Elite Material Co., Ltd. | 383,877 | 0.2 |

| King Slide Works Co., Ltd. | 300,727 | 0.2 |

Full portfolio holdings (cont'd)

| Holding | Market Value | Fund |

| USD | % | |

| Computer & Peripheral Equipment | 10,674,039 | 5.5 |

| Ennoconn Corp. | 5,002,838 | 2.6 |

| Acer, Inc. | 2,689,455 | 1.4 |

| Quanta Computer, Inc. | 1,966,343 | 1.0 |

| Mitac Holdings Corp. | 1,015,403 | 0.5 |

| Other | 6,950,123 | 3.6 |

| Chailease Holding Co., Ltd. | 3,590,918 | 1.9 |

| Nien Made Enterprise Co., Ltd. | 1,521,971 | 0.8 |

| Taiwan Paiho Ltd. | 1,252,117 | 0.6 |

| KMC Kuei Meng International, Inc. | 585,117 | 0.3 |

| Communications & Internet | 5,944,656 | 3.1 |

| Merry Electronics Co., Ltd. | 2,727,395 | 1.4 |

| Advanced Ceramic X Corp. | 1,654,431 | 0.9 |

| Accton Technology Corp | 1,070,881 | 0.6 |

| Visual Photonics Epitaxy Co., Ltd. | 252,794 | 0.1 |

| Wistron NeWeb Corp. | 239,155 | 0.1 |

| Oil, Gas & Electricity | 4,498,833 | 2.3 |

| Formosa Petrochemical Corp. | 4,498,833 | 2.3 |

| Foods | 3,882,219 | 2.0 |

| Uni-President Enterprises Corp. | 3,882,219 | 2.0 |

| Trading & Consumers' Goods | 3,577,923 | 1.8 |

| President Chain Store Corp. | 2,007,335 | 1.0 |

| Poya International Co., Ltd. | 1,570,588 | 0.8 |

| Tourism | 2,821,748 | 1.5 |

| Gourmet Master Co., Ltd. | 2,821,748 | 1.5 |

| Cement | 2,420,557 | 1.2 |

| Taiwan Cement Corp. | 2,420,557 | 1.2 |

| Shipping & Transportation | 2,239,581 | 1.2 |

| Evergreen Marine Corp. (Taiwan) Ltd. | 2,239,581 | 1.2 |

| Biotechnology & Medical Care | 1,392,278 | 0.7 |

| St. Shine Optical Co., Ltd. | 1,392,278 | 0.7 |

| Iron & Steel | 1,152,547 | 0.6 |

| China Steel Corp. | 1,152,547 | 0.6 |

| Textiles | 493,270 | 0.3 |

| Eclat Textile Co., Ltd. | 493,270 | 0.3 |

| Cash | 4,707,447 | 2.4 |

| Cash | 4,707,447 | 2.4 |

| Grand Total | 194,533,834 | 100.0 |

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express of implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

Important Information

This document is issued and approved by JF International Management, Inc. (“JFIMI”), as investment advisor of The Taiwan Fund, Inc. (the ‘'Fund''). JFIMI is an investment advisor registered with the US Securities and Exchange Commission. Certain information herein is believed to be reliable but has not been verified by JFIMI. JFIMI makes no representation or warranty and does not accept any responsibility in relation to such information or for opinion or conclusion which the reader may draw from this newsletter.

The Fund is classified as a diversified investment company under the US Investment Company Act of 1940 as amended. It meets the criteria of a closed end US fund and its shares are listed on the New York Stock Exchange. JFIMI has been appointed investment advisor to the Fund.

This newsletter does not constitute an offer of shares. Closed-end funds, unlike open-end funds, are not continuously offered. After the initial public offering, shares are bought and sold on the open market through a stock exchange. JFIMI, its ultimate and intermediate holding companies, subsidiaries, affiliates, clients, directors or staff may, at any time, have a position in the market referred to herein, and may buy or sell securities, currencies, or any other financial instruments in such markets. The information or opinion expressed in this newsletter should not be construed to be a recommendation to buy or sell any security, including the securities, commodities, currencies or financial instruments referred to herein.

Portfolio holdings are subject to change daily.

It should not be assumed that any of the securities transactions or holdings discussed here were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Investing in the Fund involves certain considerations in addition to the risks normally associated with making investments in securities. The value of the shares issued by the Fund, and the income from them, may go down as well as up and there can be no assurance that upon sale, or otherwise, investors will receive back the amount originally invested. There can be no assurance that you will receive comparable performance returns. Movements in foreign exchange rates may have a separate effect, unfavorable as well as favorable, on the gain or loss otherwise experienced on an investment. Past performance is not a guide to future returns. Accordingly, the Fund is only suitable for investment by investors who are able and willing to withstand the total loss of their investment. In particular, prospective investors should consider the following risks:

Discretionary investment is not risk-free. The past operating performance does not guarantee a minimum return for the discretionary investment fund. Apart from exercising the duty of care of a prudent adviser, JFIMI will not be responsible for the profit or loss of the discretionary investment fund, nor guarantee a minimum return.

| • | It should be noted that investment in the Fund is only suitable for sophisticated investors who are aware of the risk of investing in Taiwan and should be regarded as long term. Funds which invest in one country carry a higher degree of risk than those with portfolios diversified across a number of markets. |

| • | Investment in the securities of smaller and unquoted companies can involve greater risk than is customarily associated with investment in larger, more established, companies. In particular, smaller companies often have limited product lines, markets or financial resources and their management may be dependent on a smaller number of key individuals. In addition, the market for stock in smaller companies is often less liquid than that for stock in larger companies, bringing with it potential difficulties in acquiring, valuing and disposing of such stock. Proper information for determining their value, or the risks to which they are exposed, may not be available. |

| • | Investments within emerging markets such as Taiwan can be of higher risk. Many emerging markets, and the companies quoted on their stock exchanges, are exposed to the risks of political, social and religious instability, expropriation of assets or nationalization, rapid rates of inflation, high interest rates, currency depreciation and fluctuations and changes in taxation which may affect the Fund's income and the value of its investments. |

| • | The marketability of quoted shares may be limited due to foreign investment restrictions, wide dealing spreads, exchange controls, foreign ownership restrictions, the restricted opening of stock exchanges and a narrow range of investors. Trading volume may be lower than on more developed stock markets, and equities are less liquid. Volatility of prices can also be greater than in more developed stock markets. The infrastructure for clearing, settlement and registration on the primary and secondary markets may be undeveloped. Under certain circumstances, there may be delays in settling transactions in some of the markets. |

If you have any questions or comments about the Fund, please contact the Fund at the address or telephone number below or via the website www.thetaiwanfund.com

The Taiwan Fund, Inc.

c/o State Street Bank and Trust Company

P.O. Box 5049 One Lincoln Street

Boston MA 02206-5049

Tel: 877-217-9502