Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - SAExploration Holdings, Inc. | d502503dex994.htm |

| EX-99.3 - EX-99.3 - SAExploration Holdings, Inc. | d502503dex993.htm |

| EX-99.2 - EX-99.2 - SAExploration Holdings, Inc. | d502503dex992.htm |

| EX-10.1 - EX-10.1 - SAExploration Holdings, Inc. | d502503dex101.htm |

| 8-K - 8-K - SAExploration Holdings, Inc. | d502503d8k.htm |

Exhibit 99.1

NASDAQ: SAEX DISCUSSION MATERIALS S T R I C T L Y P R I V I L E G E D & C O N F I D E N T I A L – S U B J E C T T O F R E 4 0 8

Safe Harbor This presentation includes certain “forward-looking statements” within the meaning of the U.S. federal securitieslawswith respect to theCompany,includingstatements regarding SAE’s financial condition,results of operationsand businessand SAE’s expectationsorbeliefsconcerningfutureperiodsandpossiblefutureevents. Thesestatements arebased on SAE’s currentexpectationsorbeliefsandaresubjecttouncertaintyand changes in circumstances. Actual results mayvarymaterially from those expressed orimplied bythestatements herein dueto changesin economic, business, competitiveand/or regulatory factors,and otherrisksand uncertainties affecting the operation of SAE’s business. These risks, uncertainties and contingencies include: fluctuations in the levels of exploration and development activity in the oil and gas industry; intense industry competition; a limited number of customers; the need to manage rapid growth; delays, reductions or cancellations of service contracts; operational disruptionsdueto seasonality, weatherorotherexternal factors; crewproductivity;the availabilityof capital resources; high levels ofindebtedness,substantial internationalbusiness exposing SAE to currency fluctuations and global factors, including economic, political and military uncertainties; the need to comply with diverse and complex laws and regulations; and other factors set forth in SAE’s filings with the Securities and Exchange Commission. The information set forth herein should be read in light of such risks. Except as required bylaw, SAEisnot underany obligation to,and expresslydisclaimsany obligation to,update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptionsorotherwise. NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 2

Executive Summary ï,¾ SAExplorationHoldings,Inc. (“SAE” orthe “Company”) continuestopositionitselfasthepremierseismicdataacquisition andlogisticalsupportservicesproviderdespitesignificantindustryheadwindsï,¾ While the previous restructuring consummated in 2016 provided much needed liquidity and some deleveraging, there remaindifficulties • Thebusinessenvironmentremainschallenging o Effectofweakcommodityprices o Overcapacityinthemarket o Reluctanceofcustomerstocontractforlongterm • OnelargeaccountreceivabledependentonpaymentoftaxcreditsfromtheStateofAlaskaremainsinprocess o WhileSAEbelievespaymentwillultimatelybereceived,timelineisuncertainï,¾ TheCompanyhasmaderecenteffortstorecapitalizeandrestructure • Amended$30milliontermloantoextendthematuritydate • Secureda newcreditfacilitywhichprovidesincremental liquidity andreplaces theWellsFargofacility maturingin November2017 NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 3

Business Highlights • Over 165 years of combined experience between SAE top management team Experienced Management Team with • Company has endured energy market cycles and management has ability to execute Exposure to Multiple Market Cycles amidst uncertainty • Clients Include: Long-Term Relationships with the Largest Energy Companies in the World First-Choice, Full-Service Logistics • Provide a variety of key services to clients in all relevant target markets Provider in Core Target Markets Significant Value in Underlying Collateral •Realization of tax credits has potential to greatly benefit SAE’s operating position including $68.3mm in Tax Credits from • While management believes it will monetize all the credits, timing is uncertain the State of Alaska NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 4

Operating Strategy ï,¾ Realigncapitalstructureforlong-termviability • Resetsabilitytosuccessfullycompetewithunleveredpeers • Providesneededflexibilitytomanageworkingcapitalswings,particularlyinarecoveryorgrowthphase • Createsattractivefinancialprofiletoaccompanyindustryleadingoperationalhistory • Enhancescashflowgenerationandreturntostakeholders ï,¾ Operateahighly-focusedbusinessmodelwithanemphasisonthefollowing: • Servingcustomersinexistingcoreareas • Protectmarketshareand pricinginmarketsSAEcontrols • Continue to bid onand take strategic contracts with majoroil companies in Alaska, South America, and Ocean-BottomMarine (“OBM”) marketsworldwide • AlaskaandColombiaexpectedtodrivenear-termactivitywithadditionalupsidefromBoliviaandOBM markets • Strengthen and exploit relationships with existing customers who may have opportunities or assets in other strategicregions • Limitexpansionarygrowthtocorecustomerswithprojectsthatofferabove-averagepricingcharacteristics • ExtendstrategicrelationshipwiththeKuukpiksinAlaskato2020orbeyond • WillsecuremostoftheNorth Slopemarketinfrontofnextexplorationcycle • Pursueconsolidationandotherstrategicinitiativesthatimprovecompetitivepositioningandcomplementstrategic focus NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 5

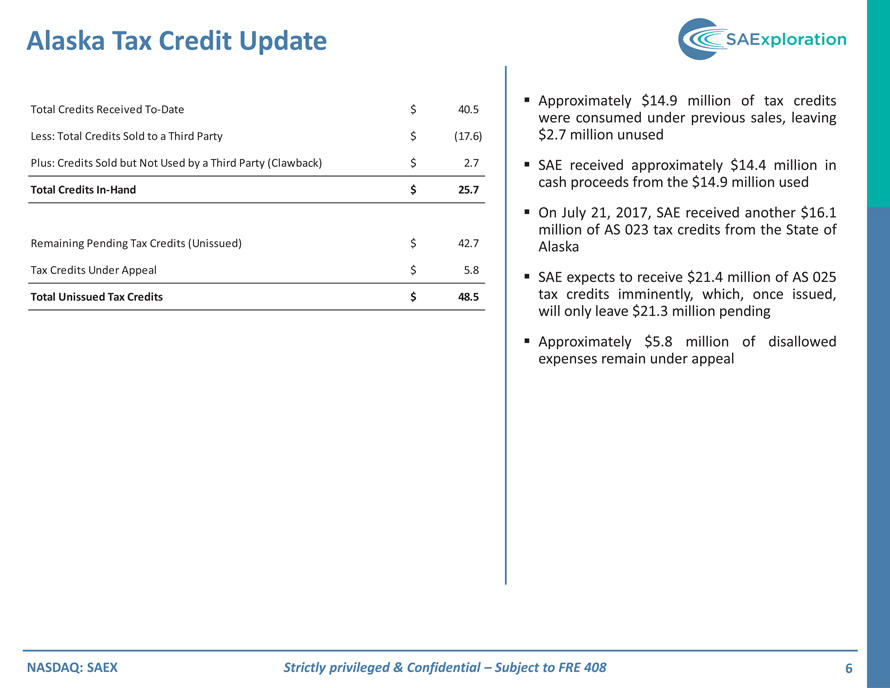

Alaska Tax Credit Update

Total Credits Received To-Date $ 40.5

Less: Total Credits Sold to a Third

Party $ (17.6)

Plus: Credits Sold but Not Used by a Third Party (Clawback) $ 2.7

Total Credits In-Hand $ 25.7

Remaining Pending Tax Credits (Unissued) $ 42.7

Tax Credits Under Appeal $ 5.8

Total Unissued Tax Credits $ 48.5

Approximately $14.9 million of tax credits were consumed under previous sales, leaving $2.7 million unused

SAE received approximately $14.4 million in cash proceeds from the $14.9 million used

On July

21, 2017, SAE received another $16.1 million of AS 023 tax credits from the State of Alaska

SAE expects to receive $21.4 million of AS 025 tax credits imminently,

which, once issued, will only leave $21.3 million pending

Approximately $5.8 million of disallowed expenses remain under appeal

NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 6

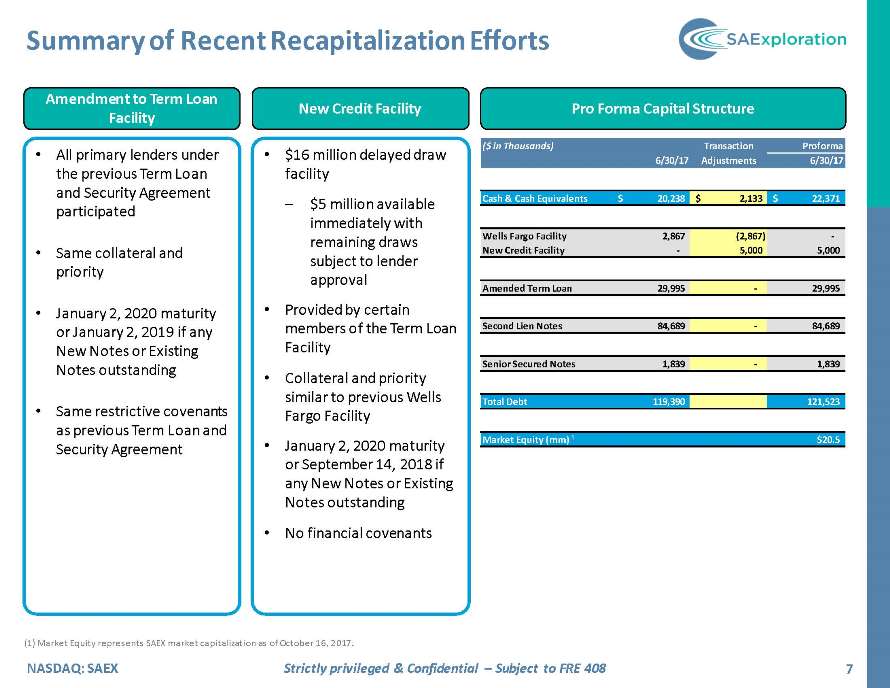

Summary of Recent Recapitalization Efforts Amendment to Term Loan New Credit Facility Pro Forma Capital Structure Facility ($ in Thousands) Transaction Proforma • All primary lenders under • $16 million delayed draw 6/30/17 Adjustments 6/30/17 the previous Term Loan facility and Security Agreement – $5 million available Cash & Cash Equivalents $20,238 $2,133 $22,371 participated immediately with remaining draws Wells Fargo Facility 2,867 (2,867)— • Same collateral and subject to lender New Credit Facility—5,000 5,000 priority approval Amended Term Loan 29,995—29,995 • January 2, 2020 maturity • Provided by certain or January 2, 2019 if any members of the Term Loan Second Lien Notes 84,689—84,689 New Notes or Existing Facility Notes outstanding Senior Secured Notes 1,839—1,839 • Collateral and priority • similar to previous Wells Total Debt 119,390 121,523 Same restrictive covenants Fargo Facility as previous Term Loan and Market Equity (mm) ¹ $20.5 Security Agreement • January 2, 2020 maturity or September 14, 2018 if any New Notes or Existing Notes outstanding • No financial covenants (1) Market Equity represents SAEX market capitalization as of October 16, 2017. NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 7

Appendix Strictly privileged & Confidential – Subject to FRE 408

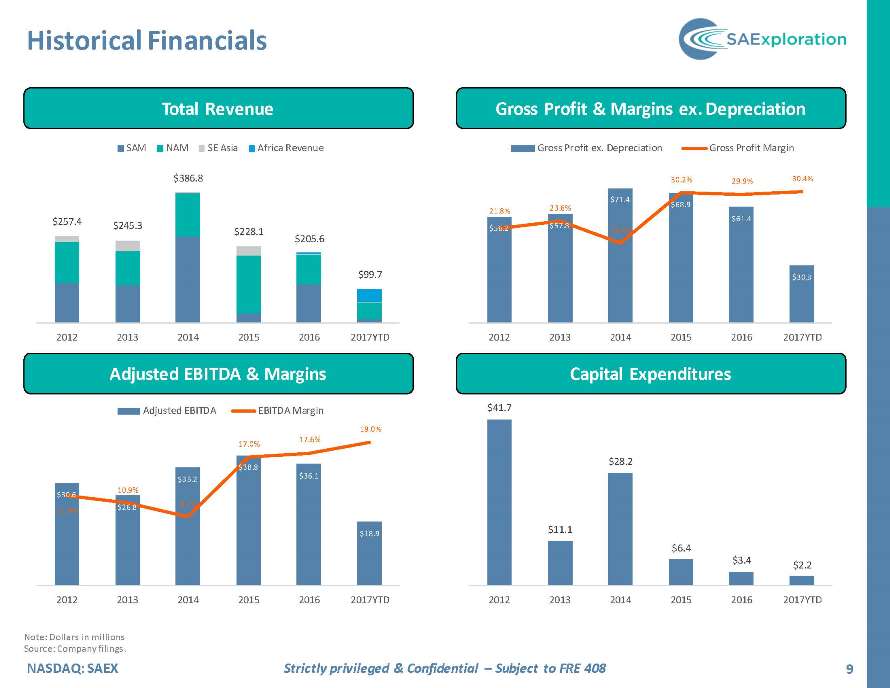

Historical Financials Total Revenue Gross Profit & Margins ex. Depreciation SAM NAM SE Asia Africa Revenue Gross Profit ex. Depreciation Gross Profit Margin $386.8 30.2% 29.9% 30.4% $71.4 $68.9 21.8% 23.6% $257.4 $61.4 $245.3 $56.2 $57.8 $228.1 18.5% $205.6 $99.7 $30.3 2012 2013 2014 2015 2016 2017YTD 2012 2013 2014 2015 2016 2017YTD Adjusted EBITDA & Margins Capital Expenditures Adjusted EBITDA EBITDA Margin $41.7 19.0% 17.6% 17.0% $28.2 $38.8 $36.1 $35.2 10.9% $30.6 9.1% $26.8 11.9% $11.1 $18.9 $6.4 $3.4 $2.2 2012 2013 2014 2015 2016 2017YTD 2012 2013 2014 2015 2016 2017YTD Note: Dollars in millions Source: Company filings. NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 9

Executive Management Years Experience Mr.HastingsjoinedSAEin2011afterhisinitialinvestmentintheCompanyin2008 Founded Fairweather Geophysical, which was the long-time leading provider of seismicservicesinAlaskabeforebeingacquiredbyVeritasDGCin2000 35+ Following the acquisition, Mr. Hastings retained his role as head of the Alaskan DivisionforVeritasandthenCGGVeritasfollowingitsacquisitionofVeritasDGC Mr.HastingswasinstrumentalinassistingSAEinsuccessfullyexpandingitsoperations Jeff Hastings into Alaska’s CookInletandNorthSlope,aswellasMalaysiaandAfrica Chairman and CEO Founded SAE in 2006 after establishing and maintaining Veritas DGC’s South Americanoperations,whereheranoperationsforover15years AftergrowingthecompanyintoColombia,PapuaNewGuineaandBolivia,Mr.Beatty 30+ spearheaded SAE’s expansion into Canada through its acquisition of Datum Exploration Begancareerinseismicfieldmanagementin1980withVeritasDGC Brian Beatty COO After earning his MBA in 2006, Mr. Whiteley assumed the role of Senior Vice President inchargeof alloperationsfor CGGVeritas’ LandAcquisitionbusinessinthe Americas 20+ JoinedSAEin2011asChiefOperatingOfficerandGeneralCounsel,latertransitioning totheroleofChiefFinancialOfficerandGeneralCounsel Since2011,Mr.Whiteleyhasledthe Company’s raiseofover$200millionindebtand Brent Whiteley equitycapital CFO and GC NASDAQ: SAEX Strictly privileged & Confidential – Subject to FRE 408 10