Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HEARTLAND FINANCIAL USA INC | ex991firstbanklubbockannou.htm |

| 8-K - 8-K - HEARTLAND FINANCIAL USA INC | form8-kfirstbanklubbockann.htm |

Lynn B. Fuller

Chairman and CEO

HTLF | www.htlf.com

Acquisition of FirstBank Lubbock Bancshares, Inc.

A FOUNDATION FOR FUTURE GROWTH

DECEMBER 13, 2017

2

The following presentation relates to the proposed acquisition (the “Acquisition”) of FirstBank Lubbock Bancshares, Inc. (“FBLB”) by Heartland Financial USA, Inc. (“Heartland”). As a result of the

acquisition, FBLB’s Texas bank subsidiary, FirstBank & Trust Company (“FirstBank & Trust”) will become a wholly owned subsidiary of Heartland. Certain statements contained in this presentation are

not statements of historical fact and are forward-looking statements. These forward-looking statements, which are based on certain assumptions and describe Heartland’s future plans, strategies

and expectations, can generally be identified by the use of the words “may”, “would”, “could”, “will”, “expect”, “anticipate”, “project”, “believe”, “intend”, “plan” and “estimate”, as well as similar expressions.

These forward-looking statements include statements related to our projected growth, the Acquisition, including statements related to the expected timing, completion and other effects of the

Acquisition, our anticipated future financial performance, and management’s long-term performance goals, as well as statements relating to the anticipated effects on results of operations and

financial condition from expected developments or events, or business and growth strategies, including projections of future amortization and accretion, the impact of the expiration of loss share

agreements, and anticipated internal growth.

These forward-looking statements involve significant risks and uncertainties that could cause our actual results to differ materially from those in such statements. Potential risks and uncertainties

include the following:

> the inability to obtain the requisite regulatory and shareholder approvals for the Acquisition and the inability to meet other closing terms and conditions;

> the reaction to the Acquisition by all of Heartland’s customers, employees and counter-parties, or difficulties related to the transition of services required by the Acquisition;

> general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a continued

deterioration in credit quality, a further reduction in demand for credit and a further decline in real estate values;

> our ability to raise additional capital may be impaired if market disruption and volatility occurs;

> costs or difficulties related to the integration of FirstBank & Trust or other banks we may acquire may be greater than expected;

> restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals;

> legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us;

> competitive pressures among depository and other financial institutions may increase significantly;

> changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or acquire;

> other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can;

> our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry;

> adverse changes may occur in the bond and equity markets;

> war or terrorist activities may cause deterioration in the economy or cause instability in credit markets;

> economic, governmental or other factors may prevent the projected residential and commercial growth in the markets in which we operate; and

> we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the Securities Exchange Commission ( the “SEC”)

For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

You should not place undue reliance on the forward-looking statements, which speak only as of the date of this presentation. All subsequent written and oral forward-looking statements

attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. We undertake no

obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Report on

form 10-K for the year ended December 31, 2016, for a description of some of the important risks of investing in Heartland common stock.

Cautionary Note Regarding Forward-Looking Statements

3

Additional Information about the Acquisition and Where to Find it

In connection with the proposed Acquisition, Heartland will file a registration statement on Form S-4 with the SEC to register shares of Heartland common stock that will be issued to FBLB share-

holders in connection with the Acquisition. The registration statement will include a proxy statement of FBLB and a prospectus of Heartland as well as other relevant documents concerning the

proposed Acquisition. The registration statement and the proxy statement/prospectus to be filed with the SEC relating to the proposed Acquisition will contain important information about Heart-

land, FirstBank & Trust, the proposed Acquisition and related matters. WE URGE HOLDERS OF FBLB COMMON STOCK TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS

WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE ACQUISITION OR INCORPORATED BY REFERENCE INTO THE REGISTRATION

STATEMENT AND PROXY STATEMENT/PROSPECTUS), BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Holders of FBLB common stock may also obtain free copies of these

documents and other documents filed with the SEC, at the SEC’s website at https://www.sec.gov. These holders may also obtain free copies of the documents filed with the SEC by Heartland at

its website at https://www.htlf.com (which website is not incorporated herein by reference) or by contacting Bryan R. McKeag, Executive Vice President and Chief Financial Officer of Heartland by

telephone at 563-589-1994. Holders of FBLB common stock may also obtain free copies of the information relating to FBLB at its website at www.firstbanklubbock.com (which website is not incor-

porated herein by reference) or by contacting Denise Thomas, Executive Vice President and Chief Financial Officer of FBLB, by telephone at 806-788-2804.

FBLB and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of FBLB in connection with the proposed Acquisi-

tion. Information regarding these persons who may, under the rules of the SEC, be considered participants in the solicitation of shareholder votes in connection with the proposed Acquisition

will be provided in the proxy statement/prospectus described above when it is filed with SEC.

4

Heartland to Lay a New Foundation for Growth in Texas and Leap Over

the $10 Billion Mark

» Significant expansion in the attractive Texas market through a proven high growth, high profitability market leader in West Texas

» Natural geographic extension from Heartland’s well established and growing New Mexico franchise

» Foundation for Texas expansion through organic growth and future acquisitions

» Unique opportunity to partner with FirstBank & Trust:

• Proven leadership: Barry Orr, highly regarded Texas banker and founder of FBLB

• Cultural fit established over two years of discussions

• Market leader: 3rd largest independent bank in service area

• FirstBank & Trust owns a mortgage company subsidiary with $400 million in annual originations and a $700

million servicing portfolio

• Experienced acquirer with three whole bank acquisitions in 10 years

• Highly profitable institution with a 20 year history of strong growth

» Low execution risk through minimal disruption of existing FirstBank & Trust operations:

• Retention of leadership: Barry Orr, Chairman and CEO, and Greg Garland, President, to lead Heartland’s efforts in Texas

• Preservation of bank charter, FirstBank & Trust and mortgage operations, PrimeWest Mortgage

• Conservative cost reductions of 25% of non-interest expenses

» Financially attractive to Heartland:

• Expected to be accretive to EPS in 2018 and ~6.5% accretive to EPS in 2019

• Tangible book value earn-back in ~3.6 years

• Internal Rate of Return in excess of 20%

» Projected to close in Q2 2018 after Heartland crosses the $10 Billion asset mark

5

Transaction Structure

STRUCTURE /

CONSIDERATION

PRICING

MULTIPLES1

MANAGEMENT

APPROVALS/

TIMING

(1) Based on HTLF’s closing price of $50.15 on December 11, 2017 and financials for FBLB as of 09/30/17

(2) This amount includes payments to FBLB stockholders and SARs holders but excludes the assumption of approximately

$9.3 Million in Trust Preferred Securities and the repayment of $4.5 million of indebtedness.

(3) The reported earnings of FBLB, a Chapter S corporation, have been tax effected at 35% for this calculation

• A total of approximately 3.35 million shares of Heartland common stock and $17.5 million in cash

resulting in an approximate 90%/10% common stock and cash mix. Of the $17.5 million of cash, approximately

$11.5 million will be paid out to the holders of FBLB stock appreciation rights (“SARs”)

• Both stock and cash consideration are subject to certain potential adjustments as set forth in the definitive

merger agreement

• Double trigger walk-away provision versus KBW Regional Bank Index (“KRX”)

• FBLB will be merged into Heartland

• FirstBank & Trust will continue to operate as a Texas state chartered bank , FDIC insured institution

and Heartland’s 11th bank subsidiary

• Aggregate Deal Value: ~ $185.6 million2

• Aggregate Deal Value/Tangible Book Value: ~ 2.22x

• Aggregate Deal Value/LTM Earnings: ~ 14.2x 3

• Core Deposit Premium: ~ 13.8%

• Barry Orr, Chairman and CEO of FBLB to retain his position and lead Heartland Texas operations

• Greg Garland, President, and existing management team of FirstBank & Trust to remain in place

• Anticipated closing in Q2 2018 / systems conversion in Q3 2018

• Closing subject to customary regulatory approvals and approval by FBLB shareholders

6

Natural Entry into West Texas from Growing Franchise in New Mexico

FirstBank & Trust

PrimeWest Mortgage Corp

Heartland Financial

Wichita Falls

Denton

Garland

Plano

Waxahachie

Clovis

7

Expansion into Attractive Texas Markets

Texas Economy: A Driver of U.S. Banking Growth and Future Heartland Expansion

» Contains four of the top ten fastest growing cities in the U.S.

» Projected to have 40 million residents by 2030

» In the past 10 years, Texas has added 732,000 jobs

» Home to more Fortune 1000 companies than any other state

» Texas has the 11th largest GDP in the world, if it were considered an independent country

» Favorable banking environment; over 400 commercial banks headquartered in the state,

creating opportunities for further acquisitions

Lubbock and Surrounding Area: A Broadly Diversified Economy Close to the Permian Basin

» Lubbock is known as the “Hub City” due to its geographically centralized and accessible location

along I-27 and four major U.S. highways:

• The population of the MSA is over 320,000

• Home to corporations including Covenant Health System and United Supermarkets

• Favorable unemployment rates coupled with projected median household income growth

through 2023 over 11%

• Ranks as one of the top 15 cities to start a business in 2017, according to CNBC

• Home to Texas Tech University, which currently enrolls over 37,000 students

» The “High Plains” region around Lubbock is the main cotton producing region of the United States:

• Texas’ cotton production ranks number one in the U.S. and accounts for 40% of U.S. production.

The High Plains region accounts for two thirds of the Texas crop

• Lubbock lies within 80 miles of the top eleven cotton producing counties in the country

Source: SNL Financial, US Bureau of Labor Statistics, US Census Bureau, Texas Tech University, Trade & Industry Development, Lubbock

Economic Development Alliance, Covenant Health Care Website, Wichita Falls Chamber of Commerce, Plains Cotton Growers, Inc.

8

FirstBank & Trust, A Franchise Built on Twenty Years of Organic Growth

and AcquisitionsFBLB ASSET GROWTH TIMELINE

$1 B ILL

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

1994

PRIMEWEST MORTGAGE ACQUIRED

1996

FIRSTBANK LUBBOCK BANCSHARES FORMED

WHITE DEER ACQUIRED

MOBILE HOME UNIT OPENS

1998

SOUTH OPENS

2003

MIDCITY OPENS

2007

TAHOKA AND WILSON ACQUIRED

2009

CENTRE OPENS

2014

SOUTH MOTOR BANK OPENS

SNYDER AQUIRED

2015

WEST OPENS

COLORADO CITY ACQUIRED

OPERATIONS CENTER OPENS

2004

FIRST ALLIANCE MORTGAGE ACQUIRED

$44

$175

$258

$374

$534

$583

$628

$739

$821

$875

A

SS

E

T

S

IN

M

IL

LI

O

N

S

2017

PREPARATION FOR

$1 BILLION

$930

($ in thousands) CAGR 2013 -

At or for the period ended December 31 2013 2014 2015 2016 09/30/17 Q3-2017

Total Assets $628,221 $739,907 $820,828 $868,227 $929,158 11.0%

Total Loans and Leases 465,122 540,463 568,684 632,863 680,346 10.7%

Total Deposits 515,598 635,026 696,227 774,022 824,233 13.3%

Tangible Common Equity 58,170 69,215 79,136 84,123 96,376 14.4%

ROAA (%)2 1.13 1.20 1.03 1.32 1.52

ROAE (%)2 12.16 13.12 10.94 13.08 15.02

Net Interest Margin (%) 4.12 3.96 3.95 4.06 4.20

Efficiency Ratio (%) 70.46 68.27 70.61 66.27 62.14

TCE/TA (%) 9.27 9.37 9.66 9.70 10.39

Total Risk Based Capital Ratio (%) 14.22 13.81 14.42 14.14 14.39

NPAs/Assets 1.55 1.96 0.79 0.94 0.84

Net Charge-offs/Avg Loans 0.26 0.38 0.26 0.11 0.07

Loan Loss Reserves/ Gross Loans 1.31 1.31 1.42 1.50 1.41

PrimeWest Mortgage Origination3 $392,000 $386,000 $432,000 $423,000 $289,459

Purchased Volume (%)3 74 81 76 74 83

Financial Highlights (FirstBank& Trust Level)(1)

(1) As per Regulatory Call reports and SNL Financial

(2) Tax Adjusted at 35%

(3) Data provided by FBLB. Mortgage originations for 2017 are for the nine months ended 09/30/17

AND

9

FirstBank & Trust, A Franchise Built on Twenty Years of Organic Growth

and Acquisitions

Combined Pro Forma Financial Impact of Recent Heartland Acquisitions

Estimated

GAAP EPS

Impact

Estimated

TBVPS Impact1

2018 (partial year of cost savings): ~1.2% ~1.7% ~3.0%

2019: ~2.7% ~6.5% ~9.3%

Initial TBVPS dilution: ~1.8% ~3.8% ~5.2%

TBVPS Earn back period: ~3.7 years ~3.6 years ~3.8 years

Deal value paid in the form of cash: ~$9.8 million ~$17.5 million ~$27.3 million

Recently Announced Expansion

Signature FBLB Pro Forma

For Both Deals

7.46% ~7.6%

9.48% ~9.2%

10.01% ~9.9%

11.84% ~11.6%

13.58% ~13.0%

HTLF Pro Forma2

1) Financial impact for Signature at estimated closing of 3/31/18 and for FBLB at estimated closing of 6/30/18

2) Pro forma financial impact includes the acquisitions of Signature and FBLB and calculated at the

estimated closing of the acquisition of FBLB on 6/30/18

Key Regulatory Capital Ratios

09/30/2017 06/30/2018

TCE/TA

Tier 1 Leverage Ratio

CET1 Risk-based Capital Ratio

Tier 1Total Risk-based Capital Ratio

Total Risk-based Capital

10

Transaction Analysis

• Comprehensive due diligence process

• In-depth review of credit files, underwriting methodology and policy

• Approximately 65% of total loans reviewed and 100% of NPAs

• Detailed review of expenses on a line item basis

• Estimated 2.15% credit mark of $14.6 million

• Loan rate mark of 0.25% or $1.7 million accreted over 3.0 years

• Projected 25% cost savings, 75% phased-in by year-end 2018 and 100% thereafter

• Pretax, one-time buyer and seller combined merger charges estimated at $10.3 million

• Core deposit intangibles of 1.50% amortized over 10 years using sum of years digits

• 10% mark down on OREO

• Trust preferred mark of 20% or $1.9 million amortized over 16 years

• No revenue enhancements modeled

11

Crossing the $10 Billion Threshold (Dodd-Frank)

DFAST (Dodd-Frank Stress Test Act)

As part of the Dodd-Frank financial reform legislation in 2010, financial institutions with total consolidated assets of more than $10

billion are required to conduct an annual stress test. Heartland is well underway in the preparation for the DFAST requirements. A gap

analysis has been prepared and project work is underway. The Audit and Compliance groups have been strengthened, and the Company

is preparing to invest in IT system requirements. Heartland’s expected reporting time-line is:

“As-of” date for first stress test December 31, 2019

First stress test reporting date July 31, 2020

First public disclosure October 15-31, 2020

Durbin Amendment

The Durbin amendment, passed as part of the Dodd-Frank Act, required the Federal Reserve to limit fees charged to retailers for debit

card processing. For financial institutions with total of $10 billion or more as of December 31st, the debit card fees are reduced begin-

ning on July 1st of the following year. Due to the acquisitions of Signature and FirstBank, Heartland expects to exceed the $10 billion

threshold on December 31, 2018. The effective date for the impact of the Durbin Amendment is expected to be July 1, 2019. Heartland’s

estimated reduction in debit card fees per year is:

• 2018 $0

• 2019 $2.5-$3 million pre-tax

• 2020 $6-$7 million pre-tax

These estimated reductions in debit card fees are included in the pro forma

merger impact provided throughout this investor presentation

12

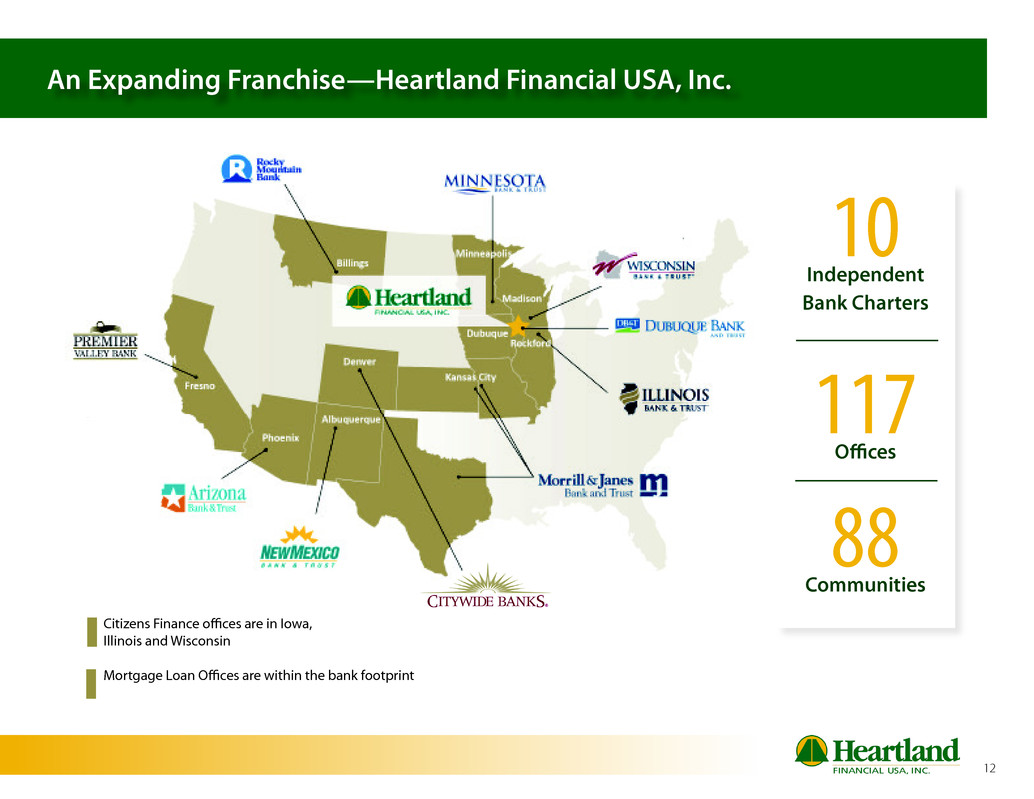

An Expanding Franchise—Heartland Financial USA, Inc.

10

Independent

Bank Charters

117

Offices

88

Communities

Citizens Finance offices are in Iowa,

Illinois and Wisconsin

Mortgage Loan Offices are within the bank footprint

13

A Compelling Opportunity for Heartland and its Stockholders

» Market expansion in high-growth Texas banking markets

» Natural move into West Texas from well established and growing New Mexico franchise

» High growth, high profitability franchise well positioned for further organic and acquisition growth

» Acquisition of a highly successful mortgage company, PrimeWest Mortgage

» Retention of local management, board representation and relationship management talent

» Strategically attractive with compelling financial metrics

» Expected low execution risk

» When completed, the Acquisition will be Heartland’s 14th acquisition since 2012; Heartland has a history of successful merger

execution and integration

» Transaction enhances Heartland’s long-term stockholder value

14

Appendix

15

HTLF is a Proven Acquirer and Integrator

$0.8 B Morrill

Bancshares, Inc.

Kansas

$ 0.2 B Founders

Bancorp

California

$0.1B

Freedom Bank

Illinois

$0.2B Community

Bancorporation

New Mexico

$0.1 B First Scottsdale Bank

Arizona

$0.7 B Premier Valley Bank

California

$0.7 B CIC Bancshares

Colorado

$1.4 B Citywide Banks

of Co

Citywide

$0.4 B Signature

Bancshares

Minnesota

$ 0.9 B FBLB

Texas

$0.5 B Community

Banc-Corp of

Sheboygan

Wisconsin

RECENT ACQUISITIONS (DATE OF ANNOUNCEMENT)

2013 2014 2015 2016 2017

16

Pro Forma Deposit Composition as of 9/30/17 (Bank Level)

HTLF FIRSTBANK PRO FORMA

Deposits ($M)

NIB Demand $97 28.6%

NOW & Other Trans. 24 7.2%

Savings & MMDA 161 47.5%

Retail CDs 47 13.8%

Jumbo CDs 10 2.9%

Total $339 100.0%

Source: Regulatory Call Reports

Deposits ($M)

NIB Demand $3,010 36.6%

NOW & Other Trans. 222 2.7%

Savings & MMDA 4,006 48.6%

Retail CDs 771 9.4%

Jumbo CDs 223 2.7%

Total $8,232 100.0%

Deposits ($M)

NIB Demand $3,288 35.0%

NOW & Other Trans. 250 2.7%

Savings & MMDA 4,539 48.3%

Retail CDs 1,003 10.7%

Jumbo CDs 317 3.4%

Total $9,395 100.0%

Deposits ($M)

NIB Demand $181 21.9%

NOW & Other Trans. 4 0.5%

Savings & MMDA 372 45.2%

Retail CDs 184 22.3%

Jumbo CDs 83 10.1%

Total $824 100.0%

SIGNATURE

NIB

Demand

36.6%

NOW &

Other

Trans.

2.7%

Savings &

MMDA

48.7%

Retail CDs

9.4%

Jumbo CDs

2.7%

NIB

Demand

28.5%

NOW &

Other

Trans.

7.2% Savings &

MMDA

47.5%

Retail CDs

13.8%

Jumbo CDs

2.9%

NIB

Demand

35.0%

NOW &

Other

Trans.

2.7%

Savings &

MMDA

48.3%

Retail CDs

10.7%

Jumbo CDs

3.4%

NIB

Demand

28.5%

NOW &

Other

Trans.

7.2%

Savings &

MMDA

47.5%

Retail CDs

13.8%

Jumbo CDs

2.9%

NIB

Demand

28.6%

NOW &

Other

Trans.

7.2% Savings &

MMDA

47.5%

Retail CDs

13.8%

Jumbo CDs

2.9%

Jumbo CDs

10.1% NIB

Demand

21.9%

NOW &

Other Trans.

0.5%

Savings &

MMDA

45.1%

Retail CDs

22.3%

45.2%

48.6%

17

Pro Forma Deposit Composition as of 9/30/17 (Bank Level) Pro Forma Loan Composition As of 9/30/17 (Bank Level)

HTLF FIRSTBANKSIGNATURE PRO FORMA

Loans ($M)

Residential RE $1,116 17.4%

Owner Occupied CRE 1,052 16.4%

Multi & Other CRE 1,167 18.2%

Const. & Land Construction 678 10.6%

C&I 1,284 20.1%

Ag Production & RE 515 8.0%

Cons. & Other Consumer 597 9.3%

Total $6,409 100.0%

Loans ($M)

Residential RE $72 21.8%

Owner Occupied CRE 45 13.5%

Multi & Other CRE 50 15.2%

Const. & Land Construction 9 2.6%

C&I 119 36.1%

Ag Production & RE 1 0.2%

Cons. & Other Consumerr 35 10.6%

Total $331 100.0%

Loans ($M)

Residential RE $136 20.1%

Owner Occupied CRE 74 10.9%

Multi & Other CRE 96 14.0%

Const. & Land Construction 138 20.3%

C&I 182 26.7%

Ag Production & RE 37 5.5%

Cons. & Other Consumer 17 2.5%

Total $680 100.0%

Loans ($M)

Residential RE $1,324 17.8%

Owner Occupied CRE 1,171 15.8%

Multi & Other CRE 1,313 17.7%

Const. & Land Construction 825 11.1%

C&I 1,585 21.4%

Ag Production & RE 553 7.5%

Cons. & Other Consumer 649 8.7%

Total $7,420 100.0%

Source: Regulatory Call Reports

Resi. RE

20.1%

Own. Oc.

CRE

10.9%

Multi. &

Other CRE

14.0% Const. &

Land

20.3%

C&I

26.7%

Ag.

5.5%

Cons. &

Other

2.5% Resi. RE

17.8%

Own. Oc.

CRE

15.8%

Multi. &

Other CRE

17.7%

Const. &

Land

11.1%

C&I

21.4%

Ag.

7.5%

Cons. &

Other

8.7%

Resi. RE

21.8%

Own. Oc.

CRE

13.5%

Multi. &

Other CRE

15.2%

Const. &

Land

2.6%

C&I

36.1%

Ag.

0.2%

Cons. &

Other

10.6% Resi. RE

17.4%

Own. Oc.

CRE

16.4%

Multi. &

Other CRE

18.2%

Const. &

Land

10.6%

C&I

20.1%

Ag.

8.0%

Cons. &

Other

9.3%

17.7%

18

Contact Information

BRUCE K. LEE

President

PHONE: (563) 587-4176

FAX: (563) 589-2011

TOLL-FREE: (888) 739-2100

blee@htlf.com

www.htlf.com

1398 CENTRAL AVENUE P.O. BOX 778 DUBUQUE, IA 52004-0778

LYNN B. FULLER

Chairman

PHONE: (563) 589-2105

FAX: (563) 589-2011

TOLL-FREE: (888) 739-2100

lfuller@htlf.com

www.htlf.com

1398 CENTRAL AVENUE P.O. BOX 778 DUBUQUE, IA 52004-0778

BRYAN R. McKEAG

Executive Vice President

Chief Financial Officer

PHONE: (563) 589-1994

CELL: (920) 284-0732

FAX: (563) 589-1951

TOLL-FREE: (888) 739-2100

bmckeag@htlf.com

www.htlf.com

1398 CENTRAL AVENUE DUBUQUE, IA 52001