Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - RMR GROUP INC. | rmr_093017xexhibit992.htm |

| EX-32.1 - EXHIBIT 32.1 - RMR GROUP INC. | rmr_093017xexhibitx321.htm |

| EX-31.2 - EXHIBIT 31.2 - RMR GROUP INC. | rmr_093017xexhibitx312.htm |

| EX-31.1 - EXHIBIT 31.1 - RMR GROUP INC. | rmr_093017xexhibitx311.htm |

| EX-23.1 - EXHIBIT 23.1 - RMR GROUP INC. | rmr_093017xexhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - RMR GROUP INC. | rmr_093017xexhibitx211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2017 | |

or | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-37616

THE RMR GROUP INC.

(Exact Name of Registrant as Specified in Its Charter)

Maryland (State of Organization) | 47-4122583 (IRS Employer Identification No.) |

Two Newton Place, 255 Washington Street, Suite 300, Newton, MA 02458-1634

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code 617-796-8230

Securities registered pursuant to Section 12(b) of the Act:

Title Of Each Class | Name Of Each Exchange On Which Registered |

Class A common stock, $0.001 par value per share | The Nasdaq Stock Market LLC |

(Nasdaq Capital Market) | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☐ | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting shares of Class A common stock, $0.001 par value, of the registrant held by non-affiliates was approximately $343.8 million based on the $49.50 closing price per common share on The Nasdaq Stock Market LLC, on March 31, 2017. For purposes of this calculation, an aggregate of 8,148,918 common shares of Class A common Stock, held directly by, or by affiliates of, the directors and the executive officers of the registrant have been included in the number of common shares held by affiliates.

As of December 11, 2017, there were 15,164,066 shares of Class A common stock, par value $0.001 per share, 1,000,000 shares of Class B-1 common stock, par value $0.001 per share and 15,000,000 shares of Class B-2 common stock, par value $0.001 per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for its 2018 annual meeting of shareholders are incorporated by reference in Part III of this Form 10- K.

WARNING CONCERNING FORWARD LOOKING STATEMENTS

THIS ANNUAL REPORT ON FORM 10-K CONTAINS FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. OUR FORWARD LOOKING STATEMENTS REFLECT OUR CURRENT VIEWS, INTENTS AND EXPECTATIONS WITH RESPECT TO, AMONG OTHER THINGS, OUR OPERATIONS AND FINANCIAL PERFORMANCE. OUR FORWARD LOOKING STATEMENTS CAN BE IDENTIFIED BY THE USE OF WORDS SUCH AS “OUTLOOK,” “BELIEVE,” “EXPECT,” “POTENTIAL,” “WILL,” “MAY,” “ESTIMATE,” “ANTICIPATE” AND DERIVATIVES OR NEGATIVES OF SUCH WORDS OR SIMILAR WORDS. SUCH FORWARD LOOKING STATEMENTS ARE SUBJECT TO VARIOUS RISKS AND UNCERTAINTIES. ACCORDINGLY, THERE ARE OR WILL BE FACTORS THAT COULD CAUSE ACTUAL OUTCOMES OR RESULTS TO DIFFER MATERIALLY FROM THOSE STATED OR IMPLIED IN THESE STATEMENTS. WE BELIEVE THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO THE FOLLOWING:

• | SUBSTANTIALLY ALL OF OUR REVENUES ARE DERIVED FROM SERVICES TO A LIMITED NUMBER OF CLIENT COMPANIES; |

• | OUR REVENUES MAY BE HIGHLY VARIABLE; |

• | CHANGING MARKET CONDITIONS, INCLUDING RISING INTEREST RATES THAT MAY ADVERSELY IMPACT OUR CLIENT COMPANIES AND OUR BUSINESS WITH THEM; |

• | POTENTIAL TERMINATIONS OF OUR MANAGEMENT AGREEMENTS WITH OUR CLIENT COMPANIES; |

• | OUR ABILITY TO EXPAND OUR BUSINESS DEPENDS UPON THE GROWTH AND PERFORMANCE OF OUR CLIENT COMPANIES AND OUR ABILITY TO OBTAIN OR CREATE NEW CLIENTS FOR OUR BUSINESS AND IS OFTEN DEPENDENT UPON CIRCUMSTANCES BEYOND OUR CONTROL; |

• | LITIGATION RISKS; |

• | ALLEGATIONS, EVEN IF UNTRUE, OF ANY CONFLICTS OF INTEREST ARISING FROM OUR MANAGEMENT ACTIVITIES; |

• | OUR ABILITY TO RETAIN THE SERVICES OF OUR FOUNDERS AND OTHER KEY PERSONNEL; |

• | RISKS ASSOCIATED WITH AND COSTS OF COMPLIANCE WITH LAWS AND REGULATIONS, INCLUDING SECURITIES REGULATIONS, EXCHANGE LISTING STANDARDS AND OTHER LAWS AND REGULATIONS AFFECTING PUBLIC COMPANIES; AND |

• | OTHER RISKS DESCRIBED UNDER “RISK FACTORS” BEGINNING ON PAGE 16. |

FOR EXAMPLE:

• | WE HAVE A LIMITED NUMBER OF CLIENT COMPANIES. WE HAVE LONG TERM CONTRACTS WITH OUR MANAGED EQUITY REITS (COLLECTIVELY, GOVERNMENT PROPERTIES INCOME TRUST, A MARYLAND REAL ESTATE INVESTMENT TRUST, INCLUDING ITS SUBSIDIARIES, OR GOV; HOSPITALITY PROPERTIES TRUST, A MARYLAND REAL ESTATE INVESTMENT TRUST, INCLUDING ITS SUBSIDIARIES, OR HPT; SELECT INCOME REIT, A MARYLAND REAL ESTATE INVESTMENT TRUST, INCLUDING ITS SUBSIDIARIES, OR SIR; AND SENIOR HOUSING PROPERTIES TRUST, A MARYLAND REAL ESTATE INVESTMENT TRUST, INCLUDING ITS SUBSIDIARIES, OR SNH); HOWEVER, THE OTHER CONTRACTS UNDER WHICH WE EARN OUR REVENUES ARE FOR SHORTER TERMS, AND THE LONG TERM CONTRACTS WITH OUR MANAGED EQUITY REITS MAY BE TERMINATED IN CERTAIN CIRCUMSTANCES. THE TERMINATION OR LOSS OF ANY OF OUR MANAGEMENT CONTRACTS MAY HAVE A MATERIAL ADVERSE IMPACT UPON OUR REVENUES, PROFITS, CASH FLOWS AND BUSINESS REPUTATION. |

• | OUR MANAGEMENT FEES FROM OUR MANAGED EQUITY REITS ARE CALCULATED BASED UPON THE LOWER OF EACH REIT’S COST OF ITS APPLICABLE ASSETS AND SUCH REIT’S MARKET CAPITALIZATION. OUR MANAGEMENT FEES FROM OUR MANAGED OPERATORS (COLLECTIVELY, FIVE STAR SENIOR LIVING INC., A MARYLAND CORPORATION, INCLUDING ITS SUBSIDIARIES, OR FIVE STAR; SONESTA INTERNATIONAL HOTELS CORPORATION, A MARYLAND CORPORATION, INCLUDING ITS SUBSIDIARIES, OR SONESTA; AND TRAVELCENTERS OF AMERICA LLC, A DELAWARE |

i

LIMITED LIABILITY COMPANY, INCLUDING ITS SUBSIDIARIES, OR TA) ARE CALCULATED BASED UPON CERTAIN REVENUES FROM EACH OPERATOR'S BUSINESS. ACCORDINGLY, OUR FUTURE REVENUES, INCOME AND CASH FLOWS WILL DECLINE IF THE BUSINESSES, ASSETS OR MARKET CAPITALIZATION OF OUR CLIENT COMPANIES DECLINE.

• | THE FACT THAT WE EARNED SIGNIFICANT INCENTIVE BUSINESS MANAGEMENT FEES FROM ONE OF OUR MANAGED EQUITY REITS FOR THE CALENDAR YEARS 2016 AND 2015, AND THAT WE ESTIMATE THAT WE WOULD HAVE EARNED AGGREGATE INCENTIVE BUSINESS MANAGEMENT FEES FROM THE MANAGED EQUITY REITS OF $63.6 MILLION AS OF SEPTEMBER 30, 2017, IF THAT DATE HAD BEEN THE END OF A MEASUREMENT PERIOD, MAY IMPLY THAT WE WILL EARN INCENTIVE BUSINESS MANAGEMENT FEES FOR THE CALENDAR YEAR 2017 OR IN FUTURE YEARS. THE INCENTIVE BUSINESS MANAGEMENT FEES THAT WE MAY EARN FROM OUR MANAGED EQUITY REITS ARE BASED UPON TOTAL RETURNS REALIZED BY THE REITS' SHAREHOLDERS COMPARED TO THE TOTAL SHAREHOLDERS RETURN OF CERTAIN IDENTIFIED INDICES. WE HAVE ONLY LIMITED CONTROL OVER THE TOTAL RETURNS REALIZED BY SHAREHOLDERS OF THE MANAGED EQUITY REITS AND EFFECTIVELY NO CONTROL OVER INDEXED TOTAL RETURNS. THERE CAN BE NO ASSURANCE THAT WE WILL EARN INCENTIVE BUSINESS MANAGEMENT FEES IN THE FUTURE. |

• | WE CURRENTLY INTEND TO PAY A REGULAR QUARTERLY DIVIDEND OF $0.25 PER CLASS A COMMON SHARE AND CLASS B-1 COMMON SHARE. OUR DIVIDENDS ARE DECLARED AND PAID AT THE DISCRETION OF OUR BOARD OF DIRECTORS. OUR BOARD MAY CONSIDER MANY FACTORS WHEN DECIDING WHETHER TO DECLARE AND PAY DIVIDENDS, INCLUDING OUR CURRENT AND PROJECTED EARNINGS, OUR CASH FLOWS AND ALTERNATIVE USES FOR ANY AVAILABLE CASH. OUR BOARD MAY DECIDE TO LOWER OR EVEN ELIMINATE OUR DIVIDENDS. THERE CAN BE NO ASSURANCE THAT WE WILL CONTINUE TO PAY ANY REGULAR DIVIDENDS OR WITH REGARD TO THE AMOUNT OF DIVIDENDS WE MAY PAY. |

• | WE WERE THE VICTIM OF A BUSINESS EMAIL COMPROMISE FRAUD WHICH RESULTED IN OUR CAUSING A PAYMENT TO BE MADE BY WIRE TRANSFER TO A FRAUDULENT BANK ACCOUNT. WE INCURRED A NET LOSS OF $590,000 AS A RESULT. ENHANCEMENTS HAVE BEEN MADE TO OUR CONTROLS RELATING TO THE ELECTRONIC PAYMENTS THAT WE BELIEVE WILL REDUCE OUR RISK OF BECOMING A VICTIM OF FUTURE FRAUDS RELATED TO OUR PAYMENTS, INCLUDING BY WIRE TRANSFERS. HOWEVER, CYBER-RELATED CRIMINAL ACTIVITIES CONTINUE TO EVOLVE AND INCREASE IN SOPHISTICATION, FREQUENCY AND SEVERITY. AS A RESULT, THE ENHANCEMENTS THAT HAVE BEEN MADE, AND ANY ADDITIONAL ENHANCEMENTS THAT MAY BE MADE IN THE FUTURE, TO OUR CONTROLS MAY NOT BE SUCCESSFUL IN AVOIDING OUR BECOMING A VICTIM OF CRIMES. |

• | WE EXPECT THAT THE BUSINESS MANAGEMENT FEES AND PROPERTY MANAGEMENT FEES WE EARN FROM GOV IN THE FUTURE MAY INCREASE AS A RESULT OF GOV'S ACQUISITION OF FIRST POTOMAC REALTY TRUST, OR FPO. HOWEVER, OUR ABILITY TO REALIZE INCREASED EARNINGS FROM GOV AS A RESULT OF ITS ACQUISITION OF FPO WILL DEPEND ON GOV’S ABILITY TO GROW AND MAINTAIN ITS MARKET CAPITALIZATION, BUSINESS AND SHAREHOLDER RETURNS AND ON OUR ABILITY TO PROVIDE SERVICES PROFITABLY. MOREOVER, DECLINES IN EARNINGS FROM OTHER CLIENTS OR FOR OTHER REASONS MAY EXCEED ANY ADDITIONAL EARNINGS WE MAY REALIZE AS A RESULT OF GOV’S ACQUISITION OF FPO. |

• | THE STATEMENT IN THIS REPORT THAT WE EXPECT OUR FEES FROM GOV MAY INCREASE AS A RESULT OF GOV'S ACQUISITION OF FPO MAY IMPLY THAT OUR EARNINGS WILL INCREASE. IN FACT, THE ADDED COSTS WHICH WE INCUR TO MANAGE AN ENLARGED GOV AS A RESULT OF GOV'S ACQUISITION OF FPO MAY EXCEED ANY INCREASE IN FEES WE RECEIVE AND, AS A RESULT, WE MAY NOT REALIZE ANY INCREASED EARNINGS OR WE MAY INCUR LOSSES. |

• | WE ARE CONSIDERING WAYS TO GROW OUR BUSINESS AND THE BUSINESS OF CERTAIN OF OUR CLIENT COMPANIES IN RESPONSE TO THE CHANGES THAT ARE OCCURRING IN THE METHODS AND LOCATIONS OF RETAIL SALES FROM STORES AND SHOPPING MALLS TO E-COMMERCE PLATFORMS. WE BELIEVE THAT THIS INDUSTRY CHANGE MAY REDUCE THE VALUE OF TRADITIONAL RETAIL PROPERTIES AND INCREASE THE VALUE OF INDUSTRIAL AND LOGISTICS PROPERTIES THAT WILL OVERWHELM CYCLICAL TRENDS. ANY ACTIONS WE MAY TAKE TO GROW OUR BUSINESS OR THE BUSINESS OF OUR CLIENT COMPANIES IN RESPONSE TO THESE CHANGES MAY NOT BE |

ii

SUCCESSFUL. IN ADDITION, ANY INVESTMENTS OR REPOSITIONING OF PROPERTIES WE OR OUR CLIENT COMPANIES MAY MAKE OR PURSUE MAY NOT INCREASE THE VALUE OF THE APPLICABLE PROPERTIES OR OFFSET THE DECLINE IN VALUE THOSE PROPERTIES MAY OTHERWISE EXPERIENCE.

THERE ARE OR WILL BE ADDITIONAL IMPORTANT FACTORS THAT COULD CAUSE BUSINESS OUTCOMES OR FINANCIAL RESULTS TO DIFFER MATERIALLY FROM THOSE STATED OR IMPLIED IN OUR FORWARD LOOKING STATEMENTS. FOR EXAMPLE, CHANGING MARKET CONDITIONS, INCLUDING RISING INTEREST RATES, MAY LOWER THE MARKET VALUE OF OUR MANAGED EQUITY REITS OR CAUSE THE REVENUES OF OUR MANAGED OPERATORS TO DECLINE AND, AS A RESULT, OUR REVENUES MAY DECLINE.

WE HAVE BASED OUR FORWARD LOOKING STATEMENTS ON OUR CURRENT EXPECTATIONS ABOUT FUTURE EVENTS THAT WE BELIEVE MAY AFFECT OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS. BECAUSE FORWARD LOOKING STATEMENTS ARE INHERENTLY SUBJECT TO RISKS AND UNCERTAINTIES, SOME OF WHICH CANNOT BE PREDICTED OR QUANTIFIED, OUR FORWARD LOOKING STATEMENTS SHOULD NOT BE RELIED ON AS PREDICTIONS OF FUTURE EVENTS. THE EVENTS AND CIRCUMSTANCES REFLECTED IN OUR FORWARD LOOKING STATEMENTS MAY NOT BE ACHIEVED OR OCCUR AND ACTUAL RESULTS COULD DIFFER MATERIALLY FROM THOSE PROJECTED OR IMPLIED IN OUR FORWARD LOOKING STATEMENTS. THE MATTERS DISCUSSED IN THIS WARNING SHOULD NOT BE CONSTRUED AS EXHAUSTIVE AND SHOULD BE READ IN CONJUNCTION WITH THE OTHER CAUTIONARY STATEMENTS THAT ARE INCLUDED IN THIS ANNUAL REPORT ON FORM 10-K. WE UNDERTAKE NO OBLIGATION TO UPDATE ANY FORWARD LOOKING STATEMENT, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE DEVELOPMENTS OR OTHERWISE, EXCEPT AS REQUIRED BY LAW.

iii

Table of Contents

Page | ||

iv

PART I

Item 1. Business

Our Company

The RMR Group Inc., or RMR Inc., owns a 51.9% economic interest in and is the managing member of The RMR Group LLC, or RMR LLC. Substantially all of the business of RMR Inc. is conducted by RMR LLC. RMR LLC was founded in 1986 to manage real estate related businesses. In this Annual Report on Form 10-K, unless otherwise indicated, "we", "us" and "our" refers to RMR Inc. and its direct and indirect subsidiaries, including RMR LLC. Our business primarily consists of providing management services to our Managed Equity REITs (four publicly traded real estate investment trusts, or REITs) and our Managed Operators (three real estate operating companies). Since its founding, RMR LLC has substantially grown the amount of real estate assets under management and the number of real estate businesses it manages. As of September 30, 2017, we had $28.5 billion of assets under management. For more information about our calculation of assets under management, see Item 6, Selected Financial Data, included in Part II of this Annual Report on Form 10-K. Our assets under management include more than 1,400 properties, which are primarily owned by our Managed Equity REITs.

As manager of the Managed Equity REITs, we are responsible for implementing investment strategies and managing day to day operations, subject to supervision and oversight by each Managed Equity REIT’s board of trustees. The Managed Equity REITs have no employees, and we provide the personnel and services necessary for each Managed Equity REIT to conduct its business. The Managed Equity REITs invest in diverse income producing properties as follows:

• | Government Properties Income Trust (Nasdaq: GOV), or GOV, primarily owns office properties leased to the U.S. government and state governments. As of September 30, 2017, GOV owned 74 properties (96 buildings) located in 31 states and the District of Columbia. |

• | Hospitality Properties Trust (Nasdaq: HPT), or HPT, primarily owns hotel and travel center properties. As of September 30, 2017, HPT owned 522 properties (323 hotels and 199 travel centers) located in 45 states, Puerto Rico and Canada. |

• | Select Income REIT (Nasdaq: SIR), or SIR, primarily owns properties that are leased to single tenants, including industrial and commercial lands on the island of Oahu, Hawaii. As of September 30, 2017, SIR owned 124 properties (366 buildings, leasable land parcels and easements) located in 36 states. |

• | Senior Housing Properties Trust (Nasdaq: SNH), or SNH, primarily owns independent and assisted living communities, continuing care retirement communities, nursing homes, wellness centers and properties leased to medical service providers, clinics, biotech laboratory tenants and other medical related businesses. As of September 30, 2017, SNH owned 435 properties (461 buildings) located in 42 states and the District of Columbia. |

We also provide management services to the Managed Operators that have diverse businesses as follows:

• | Five Star Senior Living Inc. (Nasdaq: FVE), or Five Star, is a national healthcare and senior living services company that operates senior living communities, including independent living, assisted living, continuing care and skilled nursing facilities, many of which are owned by SNH. As of September 30, 2017, Five Star operated 283 senior living communities located in 32 states. |

• | Sonesta International Hotels Corporation, or Sonesta, manages and franchises an international collection of hotels, resorts and cruise ships offering upscale and extended stay accommodations to travelers, including hotels in the United States owned by HPT. As of September 30, 2017, Sonesta’s business included 79 properties in seven countries. |

• | TravelCenters of America LLC (Nasdaq: TA), or TA, operates, leases and franchises a national chain of full service travel centers located along the U.S. Interstate Highway System, many of which are owned by HPT. TA also owns, operates and franchises convenience stores and standalone restaurants. As of September 30, 2017, TA’s business included 256 travel centers in 43 states and Canada, 233 gasoline / convenience stores in 11 states and 50 standalone restaurants in 14 states. |

RMR Advisors LLC, or RMR Advisors, a wholly owned subsidiary of RMR LLC, is an investment advisor registered with the Securities and Exchange Commission, or SEC, which provides investment advisory services to the RMR Real Estate Income Fund (NYSE MKT: RIF), or RIF, a closed end investment company focused on investing in real estate securities, including REITs and other dividend paying securities (excluding our Client Companies, as defined below). RMR Advisors has been managing investments in real estate securities since 2003.

1

On August 5, 2016, we acquired certain assets of Tremont Realty Capital LLC, or the Tremont business, which specializes in commercial real estate finance, principally providing capital to commercial real estate owners and developers and serving as advisor to a private fund that principally make commercial real estate debt investments. As part of this transaction, our wholly owned subsidiary, Tremont Realty Advisors LLC, or Tremont Advisors, an investment advisor registered with the SEC, was assigned the investment management contracts with investment advisory clients of the Tremont business. Tremont Advisors advises a private fund and other separately managed accounts that invest in commercial real estate debt, including secured mortgage debt and mezzanine financing opportunities. Tremont Advisors may also provide advice with respect to commercial real estate that may become owned by its clients.

Effective September 18, 2017, Tremont Advisors also provides advisory services for Tremont Mortgage Trust (Nasdaq: TRMT), or TRMT, a mortgage real estate investment trust created to focus primarily on originating and investing in first mortgage loans secured by middle market or transitional commercial real estate, or CRE. TRMT completed its initial public offering, or the TRMT IPO, on September 18, 2017. Concurrently with the closing of the TRMT IPO, Tremont Advisors purchased 600,000 common shares of TRMT at $20.00 per share, the initial public offering price in the TRMT IPO, pursuant to a private placement purchase agreement entered into by Tremont Advisors and TRMT on September 13, 2017. TRMT defines middle market CRE as commercial properties that have values up to $75 million and transitional CRE as commercial properties subject to redevelopment or repositioning activities that are expected to increase the value of the properties. Although TRMT's primary focus is originating and investing in floating rate first mortgage loans of less than $50 million, its target investments also include subordinated mortgages, mezzanine loans and preferred equity interests in entities that own middle market or transitional CRE.

In addition, we provide management services to certain other businesses, including Affiliates Insurance Company, or AIC, an Indiana insurance company, and ABP Trust, historically a Massachusetts business trust, and, as of January 20, 2016, a Maryland statutory trust, wholly owned by Barry M. Portnoy and Adam D. Portnoy, or collectively our Founders. We refer to the Managed Equity REITs, Managed Operators, RIF, AIC, ABP Trust, TRMT and the clients of the Tremont business as our Client Companies. We refer to the Managed Equity REITs and TRMT collectively as the Managed REITs.

Our Business Strategy

Our business strategy is to provide a full range of management services to our Client Companies and to increase the number of clients to which we provide services.

We believe that we have several strengths that distinguish our business:

• | Revenue Base. Our revenues are primarily from recurring fees earned under long term agreements with high credit quality companies. Our agreements with the Managed Equity REITs extend for 20 year terms. For the fiscal year ended September 30, 2017, 86.9% of our total revenue was from the Managed Equity REITs. In addition, the businesses of the Managed Operators are conducted in large part at properties under long term leases and management arrangements with the Managed Equity REITs. |

• | Cash Flow and Dividend. Our net income and Adjusted EBITDA for the fiscal year ended September 30, 2017 was $108.7 million and $107.2 million, respectively. We have no debt outstanding. Our current dividend rate of $0.25 per share per quarter ($1.00 per share per year) has been well covered by our earnings and cash flows. Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of net income to Adjusted EBITDA, see footnote (2) to “Selected Financial Data” beginning on page 32. |

• | Broad Real Estate Experience. We provide management services to a wide range of real estate assets and businesses that include healthcare facilities, senior living and other apartments, hotels, office buildings, industrial buildings, leased lands, travel centers, retail stores, and various specialized properties such as properties leased to government tenants and properties specially designed for medical and biotech research. The properties and businesses we managed as of September 30, 2017, are located throughout the United States in 48 states and Washington D.C., and in Puerto Rico and Canada. |

• | Growth. Since the founding of RMR LLC in 1986, we have substantially grown our real estate assets under management and the number and variety of real estate businesses we manage. As of September 30, 2017, we had $28.5 billion of assets under management, including more than 1,400 properties. The synergies among our clients may also facilitate their and our growth. We assist our clients in realizing investment opportunities by working together to make acquisitions and to complete certain development activities. We expect to use our operating cash flow and we may use our equity to fund our growth and diversify our operations. During the fiscal year 2017, we funded $8.9 million of |

2

transaction costs to assist TRMT with the TRMT IPO, and RIF with a rights offering that raised $45 million. In addition, during fiscal 2017, GOV agreed to acquire First Potomac Realty Trust, or FPO, for total consideration of approximately $1.4 billion. FPO is a Maryland REIT that owned 39 office properties (74 buildings) with 6,454,382 rentable square feet, including two properties owned by joint ventures in which GOV acquired FPO's 50% and 51% interests. GOV completed this acquisition in October 2017.

• | Quality and Depth of Management. Our highly qualified and experienced management team provides a broad base of deep expertise to our clients. Our senior management has worked together through several business cycles in which they acquired, financed, managed and disposed of real estate assets and started real estate businesses. As of September 30, 2017, we employed over 475 real estate professionals in more than 35 offices throughout the United States, and the companies we manage collectively had over $11 billion of annual revenues and over 53,000 employees. We have also assisted our clients to grow by successfully accessing the capital markets; since our founding in 1986, our clients have successfully completed over $34.0 billion of financing in over 160 capital raising transactions. |

• | Alignment of Interests. We believe our structure fosters strong alignment of interests between our principal executive officers and our shareholders because our principal executives, Barry M. Portnoy and Adam D. Portnoy, have a combined direct and indirect 51.9% economic interest in RMR LLC. |

We can provide no assurance that we will be able to implement our business strategy or achieve our desired growth. Our business and the businesses of our Client Companies are subject to a number of risks and uncertainties. See “Risk Factors” beginning on page 16.

Our Management Agreements with the Managed Equity REITs

RMR LLC is party to a business management agreement and a property management agreement with each Managed Equity REIT. The following is a summary of the terms of our business and property management agreements with the Managed Equity REITs. The summary does not purport to be complete and is subject to, and qualified in its entirety by, reference to the actual agreements, copies of which are filed or incorporated as exhibits to this Annual Report on Form 10-K.

Business Management Services

Each business management agreement requires RMR LLC to use its reasonable best efforts to present the Managed Equity REIT with a continuing and suitable real estate investment program consistent with the REIT’s real estate investment policies and objectives.

Subject to the overall management, direction and oversight of the Board of Trustees of each Managed Equity REIT, RMR LLC has the responsibility to:

• | provide research and economic and statistical data in connection with the Managed Equity REIT's real estate investments and recommend changes in the Managed Equity REIT's real estate investment policies when appropriate; |

• | investigate, evaluate and negotiate contracts for the investment in, or the acquisition or disposition of, real estate and related interests, financing and refinancing opportunities and make recommendations concerning specific real estate investments to the Board of Trustees of the Managed Equity REIT; |

• | investigate, evaluate, prosecute and negotiate any of the Managed Equity REIT’s claims in connection with its real estate investments or otherwise in connection with the conduct of the Managed Equity REIT’s business; |

• | administer bookkeeping and accounting functions as required for the Managed Equity REIT's business and operation, contract for audits and prepare or cause to be prepared reports and filings required by a governmental authority in connection with the conduct of the Managed Equity REIT's business, and otherwise advise and assist the Managed Equity REIT with its compliance with applicable legal and regulatory requirements; |

• | advise and assist in the preparation of all equity and debt offering documents and all registration statements, prospectuses or other documents filed by the Managed Equity REIT with the SEC or any state; |

• | retain counsel, consultants and other third party professionals on behalf of the Managed Equity REIT; |

• | provide internal audit services; |

3

• | advise and assist with the Managed Equity REIT's risk management and business oversight function; |

• | advise and assist the Managed Equity REIT with respect to the Managed Equity REIT's public relations, preparation of marketing materials, internet website and investor relations services; |

• | provide communication facilities for the Managed Equity REIT and its officers and trustees and provide meeting space as required; |

• | provide office space, equipment and experienced and qualified personnel necessary for the performance of the foregoing services; and |

• | to the extent not covered above, advise and assist the Managed Equity REIT in the review and negotiation of the Managed Equity REIT's contracts and agreements, coordination and supervision of all third party legal services and oversight for processing of claims by or against the Managed Equity REIT. |

Property Management Services

Under each property management agreement, RMR LLC is required to act as managing agent for each Managed Equity REIT’s properties and devote such time, attention and effort as may be appropriate to operate and manage the Managed Equity REIT’s properties in a diligent, orderly and efficient manner. Subject to the overall management and supervision of the Board of Trustees of each Managed Equity REIT, RMR LLC has the responsibility to:

• | seek tenants for the Managed Equity REIT's properties and negotiate leases; |

• | collect rents and other income from the Managed Equity REIT's properties; |

• | make contracts for, and supervise repairs and/or alterations on, the Managed Equity REIT's properties; |

• | for the Managed Equity REIT's account and at its expense, hire, supervise and discharge employees as required for the efficient operation and maintenance of the Managed Equity REIT's properties; |

• | obtain appropriate insurance for the Managed Equity REIT's properties and notify the Managed Equity REIT's insurance carriers with respect to casualties or injuries at the properties; |

• | procure supplies and other necessary materials; |

• | pay from rental receipts, other income derived from the Managed Equity REIT's properties or other monies made available by the Managed Equity REIT for such purpose, all costs incurred in the operation of the Managed Equity REIT's properties that are expenses of the Managed Equity REIT; |

• | establish reasonable rules and regulations for tenants of the Managed Equity REIT's properties; |

• | institute or defend, on the Managed Equity REIT's behalf and in the Managed Equity REIT's name, any and all legal actions or proceedings relating to the operation of the Managed Equity REIT's properties; |

• | maintain the books and records of the Managed Equity REIT reflecting the management and operation of the Managed Equity REIT's properties and prepare and deliver statements of expenses for tenants of the REIT's properties; |

• | aid, assist and cooperate with the Managed Equity REIT in matters relating to taxes and assessments and insurance loss adjustments; |

• | provide emergency services as may be required for the efficient management and operation of the Managed Equity REIT's properties; and |

• | arrange for day to day operations of the Managed Equity REIT's properties, including water, fuel, electricity, cleaning and other services. |

Term and Termination

The terms of the business and property management agreements with each Managed Equity REIT end on December 31, 2037, and automatically extend on December 31st of each year so that the terms thereafter end on the 20th anniversary of the date of the extension. A Managed Equity REIT has the right to terminate its management agreements with RMR LLC: (1) at

4

any time upon 60 days’ written notice for convenience, (2) immediately upon written notice for cause, as defined in the agreements, (3) on written notice given within 60 days after the end of any calendar year for a performance reason, as defined in the agreements, and (4) by written notice during the 12 months following a manager change of control, as defined in the agreements. RMR LLC has the right to terminate the management agreements for good reason, as defined in the agreements.

If a Managed Equity REIT terminates a management agreement for convenience, or if RMR LLC terminates a management agreement with a Managed Equity REIT for good reason, the Managed Equity REIT is obligated to pay RMR LLC a termination fee equal to the sum of the present values of the monthly future fees, as defined in the agreement, payable for the remaining term of the agreement, assuming it had not been terminated. If a Managed Equity REIT terminates a management agreement for a performance reason, as defined in the agreement, the Managed Equity REIT is obligated to pay RMR LLC the termination fee calculated as described above, but assuming a remaining term of ten years.

The management agreements provide for certain adjustments to the termination fees if a Managed Equity REIT merges with another REIT to which RMR LLC is providing management services or if the Managed Equity REIT spins off a subsidiary to which it contributed properties and to which RMR LLC is providing management services both at the time of the spin off and on the date of the expiration or termination of either of the management agreements.

A Managed Equity REIT is not required to pay any termination fee if it terminates its business or property management agreements for cause, or as a result of a manager change of control, in each case as defined in such agreements.

Business Management Fees and Expense Reimbursement

Each business management agreement between RMR LLC and a Managed Equity REIT provides for (i) an annual base management fee, payable monthly, and (ii) an annual incentive business management fee.

The annual base management fee generally is calculated as the lesser of:

• | the sum of (a) 0.5% of the historical cost of transferred real estate assets, if any, as defined in the applicable business management agreement, plus (b) 0.7% of the average invested capital (exclusive of the transferred real estate assets), as defined in the applicable business management agreement, up to $250.0 million, plus (c) 0.5% of the average invested capital exceeding $250.0 million; and |

• | the sum of (a) 0.7% of the average market capitalization, as defined in the applicable business management agreement, up to $250.0 million, plus (b) 0.5% of the average market capitalization exceeding $250.0 million. |

The base management fee is payable monthly in arrears, based on the Managed Equity REIT’s monthly financial statements and average market capitalization for the applicable month.

The annual incentive business management fee payable by each Managed Equity REIT to RMR LLC, if any, is calculated as follows:

• | The incentive business management fee is calculated as an amount equal to 12.0% of the product of (a) the equity market capitalization of the Managed Equity REIT, as defined in the applicable business management agreement, on the last trading day of the year immediately prior to the measurement period, and (b) the amount, expressed as a percentage, by which the Managed Equity REIT's total return per share realized by its common shareholders (i.e. share price appreciation plus dividends) or the "total return per share," exceeds the total shareholder return of a specified REIT index, the "benchmark return per share," for the relevant measurement period, with each of (a) and (b) subject to adjustments for common shares issued by the Managed Equity REIT during the measurement period. |

• | No incentive business management fee is payable by the Managed Equity REIT unless its total return per share during the measurement period is positive. |

• | The measurement period for an annual incentive business management fee is defined as the three year period ending on December 31 of the year for which such fee is being calculated, with shorter periods applicable in the calculation of incentive business management fees for calendar year 2015 (two years) and 2014 (one year). |

• | If the Managed Equity REIT's total return per share exceeds 12% per year in the measurement period, the benchmark return per share is adjusted to be the lesser of the total shareholder return of the specified REIT index for such measurement period and 12% per year, or the “adjusted benchmark return per share.” In instances where the adjusted |

5

benchmark return per share applies, the incentive fee will be reduced if the Managed Equity REIT’s total return per share is between 200 basis points and 500 basis points below the specified REIT index by a low return factor, as defined in the applicable business management agreement, and there will be no incentive business management fee paid if, in these instances, the Managed Equity REIT’s total return per share is more than 500 basis points below the specified REIT index.

• | The incentive management fee payable by the Managed Equity REIT is subject to a cap equal to the value of the number of its common shares which would, after issuance, represent (a) 1.5% of the number of its common shares outstanding on December 31 of the year for which such fee is being calculated multiplied by (b) the average closing price of its common shares during the 10 consecutive trading days having the highest average closing prices during the final 30 trading days of the relevant measurement period. |

• | Incentive fees paid by the Managed Equity REIT for any measurement period may be subject to certain "clawback" if the financial statements of the Managed Equity REIT for that measurement period are restated due to material non-compliance with any financial reporting requirements under the securities laws as a result of the bad faith, fraud, willful misconduct or gross negligence of RMR LLC and the amount of the incentive fee paid by the Managed Equity REIT was greater than the amount it would have paid based on the restated financial statements. |

If the business management agreement is terminated, the base business management fee and incentive business management fee due in respect of any partial period prior to the date of termination will be prorated as provided in the agreement.

Under each business management agreement: the Managed Equity REIT pays or reimburses RMR LLC for all of the expenses relating to the Managed Equity REIT’s activities, including the costs and expenses of investigating, acquiring, owning and disposing of its real estate (third party property diligence costs, appraisal, reporting, audit and legal fees), its costs of borrowing money, its costs of securities listing, transfer, registration and compliance with reporting requirements and its costs of third party professional services, including legal and accounting fees; and RMR LLC bears its general and administrative expenses relating to its performance of its obligations under the agreement, including expenses of its personnel, rent and other office expenses. Also, the allocable cost of internal audit services is reimbursed by each Managed Equity REIT to RMR LLC.

Property Management Fees and Expense Reimbursement

No property management fees are payable by a Managed Equity REIT to RMR LLC for any hotels, senior living communities or travel centers which are leased to, or managed by, a Managed Operator or another operating business such as a hotel management company or a senior living or healthcare services provider. For other properties, each property management agreement between RMR LLC and a Managed Equity REIT provides for (i) a management fee equal to 3.0% of the gross rents collected from tenants and (ii) a construction supervision fee equal to 5.0% of the cost of any construction, renovation or repair activities at the Managed Equity REIT’s properties, other than ordinary maintenance and repairs. Also, under each property management agreement, the Managed Equity REIT pays certain allocable expenses of RMR LLC in the performance of its duties, including wages for onsite property management personnel and allocated costs of centralized property management services.

Other Provisions

Under both the business and property management agreements, each Managed Equity REIT has agreed to indemnify RMR LLC, its members, officers, employees and affiliates against liabilities relating to acts or omissions of RMR LLC with respect to the provision of services by RMR LLC, except to the extent such provision was in bad faith or fraudulent, was willful misconduct or was grossly negligent. In addition, each management agreement provides that any disputes, as defined in those agreements, arising out of or relating to the agreement or the provision of services pursuant thereto, upon the demand of a party to the dispute, will be subject to mandatory arbitration in accordance with procedures provided in the agreement.

Our Management Agreements with the Managed Operators

RMR LLC provides services and earns fees pursuant to a business management agreement with each of the Managed Operators. Under these agreements, RMR LLC provides services to the Managed Operators relating to, or assists them with, among other things, their compliance with various laws and rules applicable to them, capital markets and financing activities, maintenance of their properties, selection of new business sites and evaluation of other business opportunities, accounting and financial reporting, internal audit, investor relations and general oversight of the company’s daily business activities, including legal and tax matters, human resources, insurance programs and management information systems.

6

Each Managed Operator pays RMR LLC a fee under its business management agreement in an amount equal to 0.6% of: (i) for Five Star, Five Star’s revenues from all sources reportable under U.S. generally accepted accounting principles, or GAAP, other than revenues reportable by Five Star with respect to properties for which Five Star provides management services, plus the gross revenues of properties managed by Five Star determined in accordance with GAAP; (ii) for Sonesta, Sonesta’s revenues from all sources reportable under GAAP, other than any revenues reportable by Sonesta with respect to hotels for which Sonesta provides management services, plus the revenues of hotels managed by Sonesta (except to the extent such managed hotel revenues are included in Sonesta’s gross revenues under GAAP); and (iii) for TA, the sum of TA’s gross fuel margin, determined as TA’s fuel sales revenues less its cost of fuel sales, plus TA’s total nonfuel revenues. In addition, the business management agreement with each Managed Operator provides that the compensation of senior executives of the Managed Operator, who are also employees or officers of RMR LLC, is the responsibility of the party to or on behalf of which the individual renders services. In the past, because at least 80.0% of each of these executives’ business time was devoted to services to the Managed Operator, 80.0% of these executives' total cash compensation was paid by the Managed Operator and the remainder was paid by RMR LLC.

The terms of the business management agreements with each Managed Operator end on December 31, 2017, and automatically extend for successive one year terms, unless RMR LLC or the applicable Managed Operator gives notice of non-renewal before the expiration of the applicable term. Also, a Managed Operator may terminate its business management agreement at any time (i) for Five Star and TA, on 60 days’ notice and RMR LLC may terminate such agreements at any time on 120 days’ notice and (ii) for Sonesta, on 30 days’ notice and RMR LLC may terminate its agreement with Sonesta on 30 days’ notice. If Five Star or TA terminates or elects not to renew its agreement, other than for cause as defined in each agreement, the Managed Operator is obligated to pay RMR LLC a termination fee equal to 2.875 times the sum of the annual base management fee and the annual internal audit services expense, which amounts are based on averages during the 24 consecutive calendar months prior to the date of notice of nonrenewal or termination.

Each Managed Operator has agreed to indemnify RMR LLC, its members, officers, employees and affiliates against liabilities relating to acts or omissions of RMR LLC with respect to the provision of services by RMR LLC, except to the extent such provision was in bad faith or was grossly negligent. In addition, each agreement provides that any disputes, as defined in those agreements, arising out of or relating to the agreement or the provision of services pursuant thereto, upon the demand of a party to the dispute, shall be subject to mandatory arbitration in accordance with procedures provided in the agreement.

Our Advisory Agreements, Our Management Agreement and Other Services to Advisory Clients

RMR Advisors is party to an investment advisory agreement with RIF. Pursuant to this agreement, RMR Advisors provides RIF with a continuous investment program, makes day to day investment decisions and generally manages the business affairs of RIF in accordance with its investment objectives and policies. RMR Advisors is compensated pursuant to its agreement with RIF at an annual rate of 0.85% of RIF’s average daily managed assets, as defined in the agreement. Average daily managed assets includes the net asset value attributable to RIF’s outstanding common shares, plus the liquidation preference of RIF’s outstanding preferred shares plus the principal amount of any borrowings, including from banks or evidenced by notes, commercial paper or other similar instruments issued by RIF.

RMR Advisors' agreement with RIF continues from year to year or for such longer term as may be approved by RIF’s board of trustees, as permitted by the Investment Company Act of 1940, as amended, or the Investment Company Act. So long as required by the Investment Company Act, the agreement is terminable by RIF on 60 days’ notice and automatically in the event of an assignment, as defined in the Investment Company Act.

Tremont Advisors is party to an investment advisory agreement with a private fund created for an institutional investor and, effective September 18, 2017, a management agreement with TRMT. Pursuant to these agreements, Tremont Advisors provides the private fund and TRMT with a continuous investment program, makes day to day investment decisions and generally manages the business affairs of the private fund and TRMT in accordance with the private fund's and TRMT's investment objectives and policies.

Tremont Advisors is compensated pursuant to its agreement with the private fund at an annual rate of 1.35% of the weighted average outstanding balance of all strategic investments, as defined in the agreement, of the private fund. Strategic investments include any direct or indirect participating or non-participating debt investment in certain real estate. Tremont Advisors' agreement with the private fund will terminate upon the removal or withdrawal of the private fund’s general partner; this agreement is also terminable by the private fund’s general partner at any time, or by Tremont Advisors in certain circumstances, on 90 days’ notice. Tremont Advisors is also party to loan servicing agreements with its separately managed account clients. Under such agreements, Tremont Advisors is compensated at an annual rate of 0.50% of the outstanding principal balance of the outstanding loans. In certain circumstances, Tremont Advisors is entitled to performance fees based on

7

exceeding certain performance targets. Performance fees are realized when a separately managed account client’s cumulative returns are in excess of a stated return. Tremont Advisors did not earn any such performance fees in the period subsequent to our acquisition of the Tremont business in August 2016 through September 30, 2017.

Tremont Advisors is compensated pursuant to its management agreement with TRMT at an annual rate of 1.5% of TRMT's equity, as defined in the agreement. Tremont Advisors may also earn an incentive fee under the management agreement beginning in the fourth quarter of calendar year 2018 equal to the difference between: (a) the product of (i) 20% and (ii) the difference between (A) TRMT’s core earnings, as defined in the agreement, for the most recent 12 month period (or such lesser number of completed calendar quarters, if applicable), including the calendar quarter (or part thereof) for which the calculation of the incentive fee is being made, and (B) the product of (1) TRMT’s equity in the most recent 12 month period (or such lesser number of completed calendar quarters, if applicable), including the calendar quarter (or part thereof) for which the calculation of the incentive fee is being made, and (2) 7% per year and (b) the sum of any incentive fees paid to Tremont Advisors with respect to the first three calendar quarters of the most recent 12 month period (or such lesser number of completed calendar quarters preceding the applicable period, if applicable). No incentive fee shall be payable with respect to any calendar quarter unless TRMT’s core earnings for the 12 most recently completed calendar quarters (or such lesser number of completed calendar quarters from the date of the completion of the TRMT IPO) in the aggregate is greater than zero. The incentive fee may not be less than zero.

The initial term of the management agreement with TRMT ends on December 31, 2020, and the agreement will automatically renew for successive one year terms beginning January 1, 2021 and each January 1 thereafter, unless it is sooner terminated upon written notice delivered no later than 180 days prior to a renewal date by the affirmative vote of at least two-thirds (2/3) of the independent trustees of TRMT based upon a determination that (a) Tremont Advisors’ performance is unsatisfactory and materially detrimental to TRMT or (b) the base management fee and incentive fee, taken as a whole, payable to Tremont Advisors under the management agreement are not fair to TRMT (provided that in the instance of (b), Tremont Advisors will be afforded the opportunity to renegotiate the base management fee and incentive fee prior to termination). The management agreement may be terminated by Tremont Advisors before each annual renewal upon written notice delivered to the board of trustees of TRMT no later than 180 days prior to an annual renewal date.

In the event the management agreement is terminated by TRMT without a cause event or by Tremont Advisors for a material breach, TRMT will be required to pay Tremont Advisors a termination fee equal to (a) three times the sum of (i) the average annual base management fee and (ii) the average annual incentive fee, in each case paid or payable to Tremont Advisors during the 24 month period immediately preceding the most recently completed calendar quarter prior to the date of termination or, if such termination occurs within 24 months of its initial commencement, the base management fee and the incentive fee will be annualized for such two year period based on such fees earned by Tremont Advisors during such period, plus (b) an amount equal to the initial organizational costs related to TRMT’s formation and the costs of the TRMT IPO and the concurrent private placement paid by Tremont Advisors. No termination fee will be payable if the management agreement is terminated by TRMT for a cause event or by Tremont Advisors without TRMT’s material breach.

Tremont Advisors, and not TRMT, will be responsible for the costs of Tremont Advisors’ employees who provide services to TRMT, including the cost of Tremont Advisors’ personnel who originate TRMT’s loans, unless any such payment or reimbursement is specifically approved by a majority of the independent trustees of TRMT, is a shared services cost or relates to awards made under any equity compensation plan adopted by TRMT from time to time. TRMT is required to pay or to reimburse Tremont Advisors and its affiliates for all other costs and expenses of TRMT’s operations, including but not limited to, the costs of rent, utilities, office furniture, equipment, machinery and other overhead type expenses, the costs of legal, accounting, auditing, tax planning and tax return preparation, consulting services, diligence costs related to TRMT’s investments, investor relations expenses and other professional services, and other costs and expenses not specifically required under the management agreement to be borne by Tremont Advisors. Some of these overhead, professional and other services will be provided by RMR LLC pursuant to a shared services agreement between Tremont Advisors and RMR LLC. In addition, TRMT will also pay its pro rata costs of any combined directors and officers liability or other insurance programs arranged by RMR LLC for public companies managed by RMR LLC or its affiliates and TRMT’s pro rata portion of internal audit costs incurred by RMR LLC on behalf of TRMT and other public companies to which RMR LLC or its affiliates provides management services. We currently expect that the amount of the RMR LLC shared services costs which Tremont Advisors will pay and TRMT will reimburse to be approximately $1.5 million during the first year of TRMT's operations.

The Tremont business may also act as transaction originators for its non-investment advisory clients for negotiated fees. For the fiscal year ended September 30, 2017, the Tremont business earned between 0.50% and 2.0% of the aggregate principal amounts of loans so originated.

Our Management Agreements with AIC and ABP Trust

8

RMR LLC provides business management services to AIC for a fee calculated as 3.0% of the total premiums paid for insurance arranged by AIC. RMR LLC also provides business and property management services to our controlling shareholder, ABP Trust, for which it receives, depending upon the services provided, a business management fee in an annual amount equal to 0.6% of ABP Trust’s revenues from all sources reportable under GAAP, a property management fee in an amount equal to 3.0% of rents collected from managed properties and a construction supervision fee in an amount equal to 5.0% of the cost of any construction, renovation or repair activities at the managed properties, other than ordinary maintenance and repairs.

Our Organizational Structure

(In this “Business—Our Organizational Structure” section, the words, “we,” “our” and “us” refer solely to RMR Inc.)

We were incorporated in Maryland on May 28, 2015 in contemplation of the transaction, described below, in which, among other things, the Managed Equity REITs acquired 15,000,000 shares of Class A Common Stock of RMR Inc., par value $0.001 per share, or Class A Common Shares. We refer to this transaction in this Annual Report on Form 10-K as the Up-C Transaction. For more information about the Up-C Transaction, please see Note 6, Related Person Transactions, to our Consolidated Financial Statements included in Part IV, Item 15 of this Annual Report on Form 10-K. We are a holding company; substantially all of our business is conducted by RMR LLC, we have no employees and the personnel and various services we require to operate are provided to us by RMR LLC.

We own a 51.9% economic interest in RMR LLC, a company founded in 1986 to manage real estate related businesses. Prior to the Up-C Transaction, RMR LLC was 100% owned by ABP Trust, which is wholly owned by our Founders. We are the sole managing member of RMR LLC and, in that capacity, we operate and control the business and affairs of RMR LLC.

9

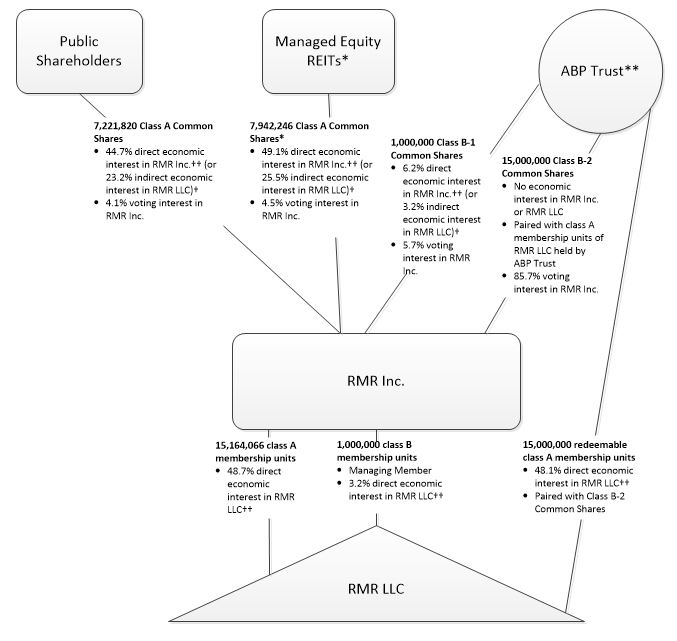

On December 14, 2015, the Managed Equity REITs completed the distribution of approximately half of the 15,000,000 Class A Common Shares they acquired in the Up-C Transaction to holders of their respective common shares. The diagram below depicts our organizational structure as of September 30, 2017.

* As of September 30, 2017, ABP Trust owned 761,781 common shares of GOV (0.8 % of outstanding), 1,672,783 common shares of HPT (1.0% of outstanding), 1,483,898 common shares of SIR (1.7% of outstanding) and 2,550,019 common shares of SNH (1.1% of outstanding).

** As of September 30, 2017, ABP Trust also owned 90,564 Class A Common Shares (0.6% of Class A Common Shares outstanding). In addition, as of September 30, 2017, Adam Portnoy and Barry Portnoy owned 30,938 and 40,883 Class A Common Shares, respectively (0.2% and 0.3% of Class A Common Shares outstanding, respectively).

†Indirect economic interests in RMR LLC means, (i) in respect of holders of Class A Common Shares, the economic interest of RMR Inc. in RMR LLC as the holder of an equivalent number of class A membership units of RMR LLC and (ii) in respect of holders of Class B-1 Common Shares, the economic interest of RMR Inc. in RMR LLC as the holder of an equivalent number of class B membership units of RMR LLC. Indirect economic interests in RMR LLC are the interests in RMR LLC owned by RMR Inc. and are subject to RMR Inc.'s liabilities including its liabilities to ABP Trust under the Tax Receivable Agreement.

††Direct economic interest means, (i) in respect of RMR Inc., the right of a holder of common stock of RMR Inc. to share in dividends or distributions made by RMR Inc. to holders of its common stock and, upon liquidation, dissolution or winding up of RMR Inc., to share in the assets of RMR Inc. after payments to creditors and (ii) in respect of RMR LLC, the right of a holder of a class A membership unit or class B membership unit of RMR LLC to share in distributions made by RMR LLC and, upon liquidation, dissolution or winding up of RMR LLC, to share in the assets of RMR LLC after payments to creditors.

10

The RMR LLC Operating Agreement

The operating agreement of RMR LLC, or the LLC Operating Agreement, governs the operations of RMR LLC and the rights and obligations of its members. The material terms of the LLC Operating Agreement are summarized below. The summary does not purport to be complete and is subject to, and qualified in its entirety by, reference to the actual agreement, a copy of which is incorporated by reference as an exhibit to this Annual Report on Form 10-K.

Governance

Through our status as the managing member of RMR LLC, we exercise control over RMR LLC and are responsible for all operational and administrative decisions of RMR LLC and the day to day management of RMR LLC’s business. No other members of RMR LLC, in their capacity as such, have any authority or right to control the management of RMR LLC or to bind it in connection with any matter, except that members of RMR LLC generally have voting rights in connection with (i) the transfer by us of our managing member interest in RMR LLC, (ii) the dissolution of RMR LLC and (iii) amendments to the LLC Operating Agreement. If RMR LLC proposes to engage in a material transaction, including a merger, consolidation or sale of substantially all of its assets, we, as the managing member of RMR LLC, have the power and authority to approve or prevent such a transaction; provided, however, that we may not transfer all or any portion of our interest in RMR LLC without the majority consent of the non-managing members of RMR LLC. Currently we and ABP Trust are the only members of RMR LLC.

Distributions by RMR LLC to its members

Pursuant to the LLC Operating Agreement, we determine when distributions will be made to the members of RMR LLC and the amount of any such distributions, except that RMR LLC is required by the LLC Operating Agreement to make certain pro rata distributions to each member of RMR LLC quarterly on the basis of the assumed tax liabilities of the members and in connection with a dissolution of RMR LLC.

Members of RMR LLC, including us, incur U.S. federal, state and local income taxes on their allocable share of any net taxable income of RMR LLC. Net profits and net losses of RMR LLC are generally allocated to its members pro rata in accordance with the percentage interest of the units they hold. In accordance with the LLC Operating Agreement, we cause RMR LLC to make cash distributions to its members for purposes of funding their tax obligations in respect of the income of RMR LLC that is allocated to them. Generally, these tax distributions are computed based on our estimate of the net taxable income of RMR LLC allocable to the member multiplied by an assumed tax rate equal to the highest effective marginal combined U.S. federal and state income tax rate prescribed for an individual or corporation (taking into account the nondeductibility of certain expenses and the character of our income). Additional amounts may be distributed by RMR LLC if needed to meet our tax obligations and our obligations pursuant to the tax receivable agreement, dated June 5, 2015, by and among RMR Inc., RMR LLC and ABP Trust, or the Tax Receivable Agreement.

We are not permitted to cause RMR LLC to make distributions that would render it insolvent. All distributions from RMR LLC are made to the members of RMR LLC pro rata in accordance with the percentage economic interest of the units they hold.

Coordination of RMR Inc. and RMR LLC

Under the LLC Operating Agreement, RMR LLC is permitted to issue additional units from time to time provided that they are substantially equivalent to additional equity securities issued from time to time by us. RMR LLC is generally restricted from issuing additional units to us unless (i) (A) the additional units are (x) class A membership units of RMR LLC, or Class A Units, issued in connection with an issuance of our Class A Common Shares, (y) class B membership units of RMR LLC, or Class B Units, issued in connection with an issuance of our class B-1 common stock of RMR Inc., par value $0.001 per share, or Class B-1 Common Shares, or (z) units issued in connection with an issuance of our equity securities where the units and equity securities being issued have substantially the same rights (other than voting rights), restrictions, limitations as to distributions, qualifications and terms and conditions of redemption, and (B) we contribute to RMR LLC the cash proceeds or other consideration we receive (less amounts for which we are permitted to be reimbursed under the LLC Operating Agreement), if any, in connection with the issuance or (ii) the additional units are issued upon the conversion, redemption or exchange of debt, units or other securities issued by RMR LLC.

At any time we issue any equity securities, we have agreed to contribute to RMR LLC the net proceeds, if any, we receive in connection with the issuance, less amounts (issuance costs, underwriting discounts, etc.) for which we are permitted to be reimbursed under the LLC Operating Agreement. In exchange for the contribution, RMR LLC has agreed to issue to us (i) in

11

the case of an issuance of Class A Common Shares, an equivalent number of Class A Units, (ii) in the case of an issuance of Class B-1 Common Shares, an equivalent number of Class B Units or (iii) in the case of an issuance of any other type of equity securities, an equivalent number of units of RMR LLC with substantially the same rights (other than voting rights), restrictions, limitations as to distributions, qualifications and terms and conditions of redemption.

Conversely, if we redeem or repurchase any of our equity securities, RMR LLC will, immediately prior to the redemption or repurchase, redeem or repurchase, upon the same terms and for the same price, an equal number of (i) in the case of a redemption or repurchase of Class A Common Shares, Class A Units held by us, (ii) in the case of a redemption or repurchase of Class B-1 Common Shares, Class B Units held by us or (iii) in the case of a redemption or repurchase of any other type of our equity securities, equity securities of RMR LLC held by us with substantially the same rights (other than voting rights), restrictions, limitations as to distributions, qualifications and terms and conditions of redemption, as the equity securities are redeemed or repurchased.

The LLC Operating Agreement restricts us and RMR LLC from subdividing or combining our or its outstanding equity securities without the other making an identical subdivision or combination, as the case may be, of its corresponding outstanding equity.

If, at any time, any of our equity securities are converted or exchanged into other equity securities, in whole or in part, then a number of the corresponding membership units of LLC held by us equal to the number of equity securities being so converted or exchanged shall automatically be converted or exchanged, as the case may be, into that same number of membership units of LLC that correspond to the number of equity securities issued in such conversion or exchange.

The Class A Units not held by us and our class B-2 common stock of RMR Inc., par value $0.001 per share, or Class B-2 Common Shares, constitute “paired interests.” If RMR LLC issues additional Class A Units to someone other than us, we have agreed to issue to that member an equivalent number of our Class B-2 Common Shares. Each Class B-2 Common Share entitles the holder to ten votes per share, and, accordingly, the issuance of additional Class B-2 Common Shares would have a significant dilutive effect on the voting power of the then current holders of our Class A Common Shares.

Redemption rights of holders of Class A Units

Holders of Class A Units, other than us, may cause RMR LLC to redeem their Class A Units for Class A Common Shares on a one for one basis. At our option, we may elect to pay cash in lieu of Class A Common Shares for some or all of such redeemed Class A Units; the amount of the alternative cash payment will be based on the market price of the Class A Common Shares as determined pursuant to the LLC Operating Agreement. For each Class A Unit redeemed, we will automatically redeem the corresponding Class B-2 Common Share, comprising the “paired interest” for no additional consideration.

Transfers of membership units of RMR LLC

Membership units of RMR LLC are generally subject to restrictions on transfer in accordance with the terms of the LLC Operating Agreement. Under the LLC Operating Agreement, we may not transfer any of our membership units of RMR LLC without the majority consent of the non-managing members of RMR LLC. Under the LLC Operating Agreement, Class A Units and Class B-2 Common Shares comprising “paired interests” may be transferred to a permitted transferee, including our Founders, qualified employees, the immediate family members of our Founders or qualified employees, any of their respective lineal descendants or any entity controlled by ABP Trust or an individual named above. In addition, Class A Units and Class B-2 Common Shares comprising “paired interests” may be transferred by the creation of certain security interests, by will or pursuant to the laws of descent and distribution or in any transfer approved in advance by our Board of Directors.

Indemnification and exculpation

Under the LLC Operating Agreement, RMR LLC has agreed to indemnify, to the maximum extent permitted by Maryland law, the current or former members of RMR LLC, executive officers or directors (or equivalent) of us or RMR LLC, and current or former executive officers or directors (or equivalent) of us or RMR LLC serving at our request as an executive officer or director (or equivalent) of another corporation, partnership, joint venture, limited liability company, trust or other entity, except in respect of a matter for which (i) there has been a final and non-appealable judgment entered by a court or arbitration panel of competent jurisdiction determining that, in respect of the matter, the indemnified person actually received an improper benefit or profit in money, property, or services or (ii) there has been a final, non-appealable judgment or adjudication adverse to the person entered by a court or arbitration panel of competent jurisdiction in a proceeding based on a finding in the proceeding, in respect of the matter, that the person’s action or failure to act, was the result of active and deliberate dishonesty and was material to the cause of action adjudicated in the proceeding.

12

Except as otherwise expressly provided in the LLC Operating Agreement or in any written agreement, the LLC Operating Agreement provides that we, our affiliates and executive officers, the tax matters partner of RMR LLC and the executive officers of RMR LLC will not be liable to RMR LLC or to any non-managing member of RMR LLC for any act or omission performed or omitted by or on behalf of (i) us, in our capacity as the sole managing member of RMR LLC, (ii) our affiliate, in its, his or her capacity as such, (iii) the tax matters partner, in its capacity as such, or (iv) an executive officer of RMR LLC, in his or her capacity as an officer of RMR LLC, except that the limitation of liability will not apply to limit the liability of a person in respect of a matter if (a) there has been a final, non-appealable judgment entered by a court or arbitration panel of competent jurisdiction determining that, in respect of the matter, the person actually received an improper benefit or profit in money, property, or services or (b) there has been a final, non-appealable judgment or adjudication adverse to the person entered by a court or arbitration panel of competent jurisdiction in a proceeding based on a finding in the proceeding, in respect of the matter, that the person’s action or failure to act, was the result of active and deliberate dishonesty and was material to the cause of action adjudicated in the proceeding.

Dissolution

RMR LLC may be dissolved only upon the occurrence of certain events specified in the LLC Operating Agreement, including the approval of the managing member of RMR LLC and the unanimous approval of the members of RMR LLC that then hold any units with voting rights.

Tax Receivable Agreement

Pursuant to the Up-C Transaction, we purchased Class A Units from ABP Trust. In the future, additional Class A Units may be redeemed by ABP Trust for our Class A Common Shares or cash. We expect that, as a result of both this initial purchase and any future redemptions of Class A Units for our Class A Common Shares or cash, the tax basis of the assets of RMR LLC attributable to our interests in RMR LLC will be increased. These increases in the tax basis of the assets of RMR LLC attributable to our interests in RMR LLC would not have been available to us but for this initial purchase and future redemptions of Class A Units for Class A Common Shares or cash. Such increases in tax basis are likely to increase (for tax purposes) depreciation and amortization deductions and therefore reduce the amount of income tax we would otherwise be required to pay in the future. These increases in tax basis may also decrease gain (or increase loss) on future dispositions of certain capital assets to the extent the increased tax basis is allocated to those capital assets. The United States Internal Revenue Service, or IRS, may challenge all or part of these tax basis increases, and a court might sustain such a challenge.

We and RMR LLC have entered into the Tax Receivable Agreement with ABP Trust, the material terms of which are summarized below. This summary of the Tax Receivable Agreement does not purport to be complete and is subject to, and qualified in its entirety by, reference to the actual agreement, a copy of which is incorporated by reference as an exhibit to this Annual Report on Form 10-K.

The Tax Receivable Agreement provides for the payment by us to ABP Trust of 85.0% of the amount of cash savings, if any, in U.S. federal, state and local income tax or franchise tax that we realize as a result of (a) the increases in tax basis attributable to our dealings with ABP Trust and (b) tax benefits related to imputed interest deemed to be paid by us as a result of this Tax Receivable Agreement. We expect to benefit from the remaining 15.0% of cash savings, if any, in income tax that we realize. For purposes of the Tax Receivable Agreement, cash savings in income tax will be computed by comparing our income tax liability to the amount of such taxes that we would have been required to pay had there been no increase to the tax basis of the tangible and intangible assets of RMR LLC as a result of our purchase of RMR LLC Class A Units and the future redemptions, if any, and had we not entered into the Tax Receivable Agreement. The term of the Tax Receivable Agreement commenced on June 5, 2015 and will continue until all such tax benefits have been utilized or expired, unless the Tax Receivable Agreement is terminated upon a change of control or upon certain breaches of the agreement that we fail to cure in accordance with the terms of the agreement.

ABP Trust will not reimburse us for any payments made under the Tax Receivable Agreement. As a result, in certain circumstances, we may make payments to ABP Trust under the Tax Receivable Agreement in excess of our cash tax savings. While the amount and timing of any payments under this agreement will vary depending upon a number of factors, including the timing of redemptions, the price of our Class A Common Shares at the time of the redemption, the extent to which such redemptions are taxable and the amount and timing of our income, we expect that, as a result of the size of the increases of the tangible and intangible assets of RMR LLC attributable to our interests in RMR LLC, during the expected term of the Tax Receivable Agreement, the payments that we may make to ABP Trust could be substantial. Payments made under the Tax Receivable Agreement are required to be made within 80 days of the filing of our tax returns. Because we generally expect to receive the tax savings prior to making the cash payments to the redeeming holders of Class A Units, we do not expect the cash payments to have a material impact on our liquidity.

13

The Tax Receivable Agreement provides that, upon certain changes of control and certain breaches of the agreement that we fail to cure in accordance with the terms of the agreement, our obligations with respect to exchangeable Class A Units will be accelerated. In those circumstances, our obligations under the Tax Receivable Agreement would be based on certain assumptions, including that we would have sufficient taxable income to fully utilize the deductions arising from the increased tax deductions and tax basis and other benefits described in the Tax Receivable Agreement, and that any Class A Units that have not been redeemed will be deemed redeemed for the market value of our Class A Common Shares at the time of the change of control or breach, as applicable. It is possible, in these circumstances, that the cash tax savings realized by us may be significantly less than the corresponding Tax Receivable Agreement payments.

Regulation

We and our Client Companies are subject to supervision and regulation by state, federal and non-U.S. governmental authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions upon the ways in which we and our Client Companies do business including various requirements for public disclosure of our and their activities.

The Managed Equity REITs have qualified and expect to continue to qualify, and TRMT expects to qualify, to be taxed as real estate investment trusts under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code. In addition, the Managed Equity REITs generally distribute, and TRMT is expected to generally distribute, 100.0% of their taxable income to avoid paying corporate federal income taxes; and as REITs, such companies must currently distribute, at a minimum, an amount equal to 90.0% of their taxable income. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT status, including share ownership tests and assets and gross income composition tests. If a Managed REIT fails to continue to qualify as a REIT under Sections 856 through 860 of the Code in any taxable year, it will be subject to federal income tax (including any applicable alternative minimum tax) on its taxable income at regular corporate tax rates. Even if a Managed REIT qualifies for taxation as a REIT, it may be subject to state and local income taxes and to federal income tax and excise tax on its undistributed income.

Certain of our Client Companies own or operate healthcare and senior living properties. These companies are subject to numerous federal, state and local laws and regulation that are subject to frequent and material changes (sometimes applied retroactively) resulting from legislation, adoption of rules and regulations and administrative and judicial interpretations of existing laws. Some of the revenues received by these companies are paid by governmental programs which are also subject to periodic and material changes.

Certain of our Client Companies own and operate hotels and some provide dining, food and beverage services, including the sale of alcoholic beverages. The operation of such properties is subject to numerous regulations by various governmental entities.

TA is also required to comply with federal and state regulations regarding the storage and sale of petroleum and natural gas products and franchising of petroleum retailers. In addition, as a result of TA’s involvement in gaming operations, TA and certain of its subsidiaries are subject to gaming regulations in Illinois, Louisiana, Montana and Nevada; and because HPT owns TA properties where gaming occurs, HPT is also subject to gaming regulations in some of those jurisdictions.