Attached files

| file | filename |

|---|---|

| EX-32.B - EXHIBIT 32.B - CAMPBELL SOUP CO | cpb-10292017x10xqxexb32b.htm |

| EX-32.A - EXHIBIT 32.A - CAMPBELL SOUP CO | cpb-10292017x10xqxexb32a.htm |

| EX-31.B - EXHIBIT 31.B - CAMPBELL SOUP CO | cpb-10292017x10xqxexb31b.htm |

| EX-31.A - EXHIBIT 31.A - CAMPBELL SOUP CO | cpb-10292017x10xqxexb31a.htm |

| EX-10.B - EXHIBIT 10.B - CAMPBELL SOUP CO | cpb-10292017x10xqxexb10b.htm |

| 10-Q - 10-Q - CAMPBELL SOUP CO | cpb-10292017x10xq.htm |

Executive Compensation Program

F’18

EXHIBIT 10(a)

Executive Compensation Program

Important LegaL InformatIon

Notice to participants in the Campbell Soup Company (the “Company”) 2015 Long-Term Incentive Plan (the “Plan”).

This brochure constitutes part of a prospectus covering securities that have been registered under the

Securities Act of 1933. The Long-Term Incentive (LTI) Program, which is a program provided under the Plan,

gives participants the opportunity to receive awards including performance restricted stock units based on

Total Shareowner Return (TSR) ranking compared with TSRs of the companies in the S&P Packaged Foods

Group (PSUs), time-lapse restricted stock units (RSUs), performance restricted stock units based on Earnings

Per Share (EPS) goals (EPS Units) and stock options (collectively, the “awards”). Participation in the Plan is

covered by a Registration Statement on Form S-8 (the “Registration Statement”), filed with the SEC pursuant

to the Securities Act of 1933. The maximum number of shares of Company common stock that may be granted

pursuant to awards under the Plan is 13 million.

The Compensation and Organization Committee of the Board of Directors of the Company (the “Committee”)

interprets and administers the LTI Program. Committee members are appointed by the Board of Directors of

the Company for a term of one year. Its decisions are final and conclusive with respect to interpretation of the

Plan and any awards. All awards are subject to the terms and conditions of the Plan and to such other terms

and conditions as the Committee deems appropriate, including the terms, restrictions, and provisions of this

brochure, and any agreement or statement related to each award.

All tax-related information in this brochure relates only to current U.S. tax laws. Tax information and related

administrative provisions may vary for participants outside the U.S. The Plan is not subject to provision of ERISA.

The Company expects to continue the Plan until its termination date of November 18, 2025, but reserves the

right to change or end the Plan at any time. If the Company does make a change or ends the Plan, you will be

notified. No such change or termination shall alter or impair any outstanding awards without the consent of the

participant. No award will be made after the plan’s termination date, but awards made prior to the termination

date may extend beyond that date.

The Company will provide without charge to each participant, upon request, a copy of any documents

incorporated by reference in the Registration Statement and such documents are incorporated by reference

herein. A request for information about the Plan, it’s administrators and any documents incorporated by

reference, should be directed to:

Corporate Secretary

Campbell Soup Company

One Campbell Place

Camden, NJ 08103-1799

(856) 342-4800

September 2017

This brochure reflects the terms and conditions applicable to the F’18 grant made in October 2017. If any information in the

brochure conflicts with the Plan or any applicable award agreement, the terms of the Plan and/or applicable award agreement

will control.

Executive Compensation Program

Creating Shareholder Value 2

LTI Eligibility 2

Determining Your Grant 2

Grant Vesting and Mix 2

Grant Acknowledgment 3

Performance Restricted Stock Units 4

Dividend Equivalents 5

Selling Your Stock - Restrictions 6

Taxation 7

Incentive Compensation Clawback Policy 8

If You Leave Campbell 9

Change in Control 12

Key Terms 13

Additional Legal Terms 14

Stock Plan Contact Information 15

Contents

F’18 LONG-TERM INCENTIVE Program | 1

Executive Compensation Program

CreatIng sHareHoLder VaLUe

The Campbell Soup Company Long-Term Incentive (LTI) Program is designed to recognize your performance

and potential as well as reward you for our success in creating shareholder value. The LTI Program also provides

you with an opportunity to increase your ownership in the Company.

LtI eLIgIBILItY

You are eligible to participate in the LTI Program if, on August 1 prior to the grant date, you are a regular salaried

employee, Level E* or above, of the Company or its participating subsidiaries, and you are regularly scheduled

to work at least 20 hours(1) per week.

determInIng YoUr grant

Each job level has a competitive LTI target range. In the U.S., the target ranges are expressed as a percentage

of base salary. For participants outside the U.S., the target range for each job level is based on a U.S. dollar

range that is driven by competitive market data. To determine your grant, your manager will make a LTI

recommendation based on an assessment of your contribution during the fiscal year and your future potential.

grant VestIng and mIX

Depending on your level in the organization, F’18 LTI grants are comprised of stock options, performance-based

restricted stock units (PSUs) and time-lapse restricted stock units (RSUs). The actual mix of units in your LTI

grant is shown below:

F’18 LONG-TERM INCENTIVE Program | 2

Level A(2) Level B Level E*

50%

25%

25%

35%

65%

50%

50%

30%

70%

Stock Options

RSU (Time-Lapse)

PSU (Relative TSR)

( 1) May vary by country

(2) LTI grants to Executive Officers consist of 50% PSUs, 25% stock options and 25% Earnings Per Share (EPS) units. Stock

Options will vest one-third per year over three years on each September 30. EPS units will vest one-third per year over

three years on each September 30 if the Company EPS performance goal is met for the first fiscal year of the grant.

Level C & D

* Beginning with the F’19 (October 2018) grant, all Level E’s are eligible for LTI, however only up to 50% will receive grants

in a given year.

Executive Compensation Program

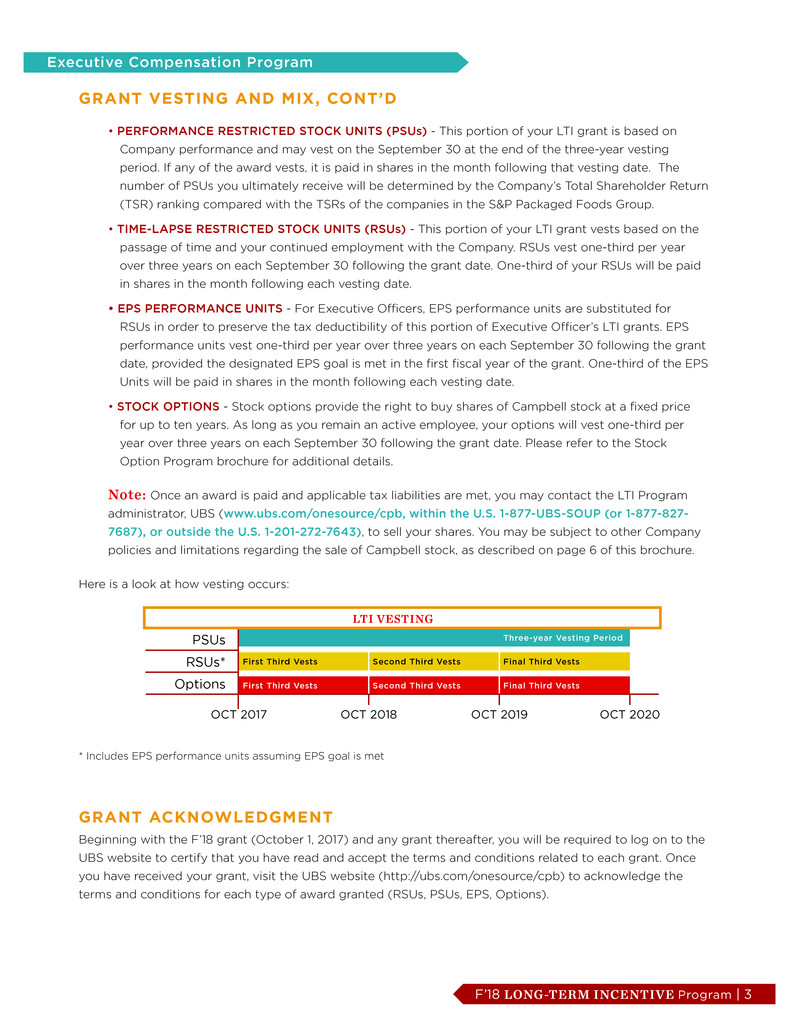

grant VestIng and mIX, Cont’d

• PERFORMANCE RESTRICTED STOCK UNITS (PSUs) - This portion of your LTI grant is based on

Company performance and may vest on the September 30 at the end of the three-year vesting

period. If any of the award vests, it is paid in shares in the month following that vesting date. The

number of PSUs you ultimately receive will be determined by the Company’s Total Shareholder Return

(TSR) ranking compared with the TSRs of the companies in the S&P Packaged Foods Group.

• TIME-LAPSE RESTRICTED STOCK UNITS (RSUs) - This portion of your LTI grant vests based on the

passage of time and your continued employment with the Company. RSUs vest one-third per year

over three years on each September 30 following the grant date. One-third of your RSUs will be paid

in shares in the month following each vesting date.

• EPS PErformancE UnitS - For Executive Officers, EPS performance units are substituted for

RSUs in order to preserve the tax deductibility of this portion of Executive Officer’s LTI grants. EPS

performance units vest one-third per year over three years on each September 30 following the grant

date, provided the designated EPS goal is met in the first fiscal year of the grant. One-third of the EPS

Units will be paid in shares in the month following each vesting date.

• STOCK OPTIONS - Stock options provide the right to buy shares of Campbell stock at a fixed price

for up to ten years. As long as you remain an active employee, your options will vest one-third per

year over three years on each September 30 following the grant date. Please refer to the Stock

Option Program brochure for additional details.

Note: Once an award is paid and applicable tax liabilities are met, you may contact the LTI Program

administrator, UBS (www.ubs.com/onesource/cpb, within the U.S. 1-877-UBS-SOUP (or 1-877-827-

7687), or outside the U.S. 1-201-272-7643), to sell your shares. You may be subject to other Company

policies and limitations regarding the sale of Campbell stock, as described on page 6 of this brochure.

Here is a look at how vesting occurs:

grant aCKnoWLedgment

Beginning with the F’18 grant (October 1, 2017) and any grant thereafter, you will be required to log on to the

UBS website to certify that you have read and accept the terms and conditions related to each grant. Once

you have received your grant, visit the UBS website (http://ubs.com/onesource/cpb) to acknowledge the

terms and conditions for each type of award granted (RSUs, PSUs, EPS, Options).

F’18 LONG-TERM INCENTIVE Program | 3

PSUs

RSUs*

Options

OCT 2017 OCT 2018 OCT 2019

LTI VESTING

OCT 2020

Three-year Vesting Period

Final Third Vests

Final Third Vests

Second Third Vests

Second Third Vests

First Third Vests

First Third Vests

* Includes EPS performance units assuming EPS goal is met

Executive Compensation Program

performanCe restrICted stoCK UnIts (psUs)

PSU Award

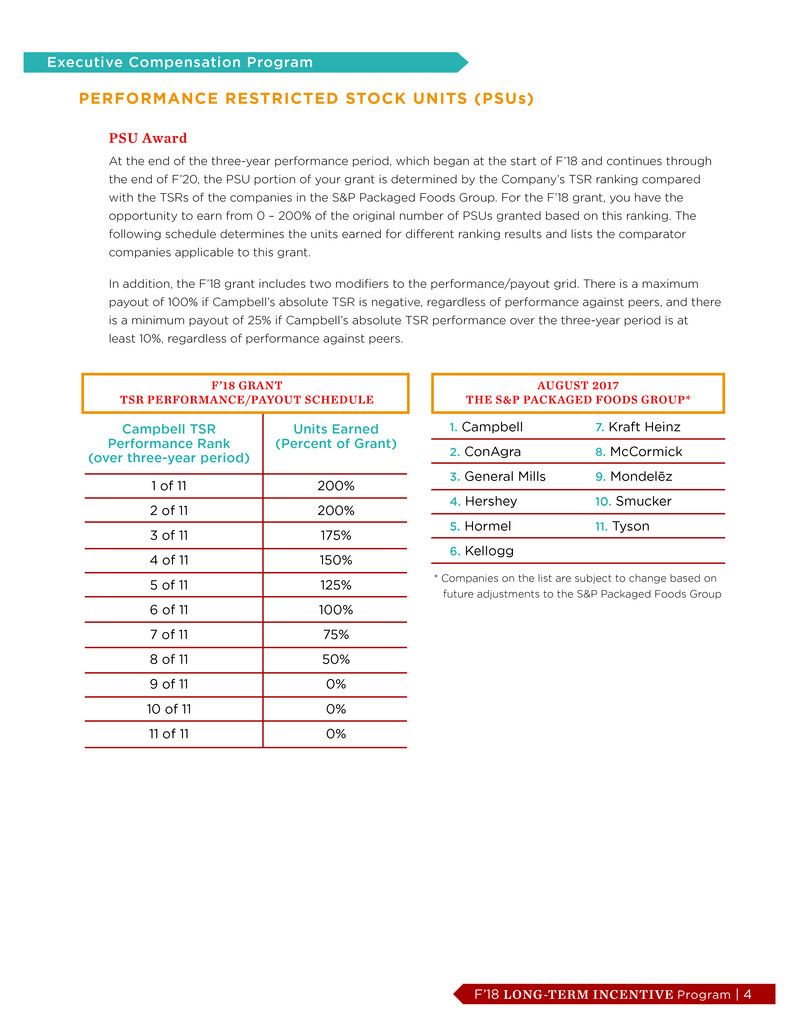

At the end of the three-year performance period, which began at the start of F’18 and continues through

the end of F’20, the PSU portion of your grant is determined by the Company’s TSR ranking compared

with the TSRs of the companies in the S&P Packaged Foods Group. For the F’18 grant, you have the

opportunity to earn from 0 – 200% of the original number of PSUs granted based on this ranking. The

following schedule determines the units earned for different ranking results and lists the comparator

companies applicable to this grant.

In addition, the F’18 grant includes two modifiers to the performance/payout grid. There is a maximum

payout of 100% if Campbell’s absolute TSR is negative, regardless of performance against peers, and there

is a minimum payout of 25% if Campbell’s absolute TSR performance over the three-year period is at

least 10%, regardless of performance against peers.

F’18 LONG-TERM INCENTIVE Program | 4

1 of 11

2 of 11

3 of 11

4 of 11

5 of 11

6 of 11

7 of 11

8 of 11

9 of 11

10 of 11

11 of 11

Campbell TSR

Performance Rank

(over three-year period)

200%

200%

175%

150%

125%

100%

75%

50%

0%

0%

0%

Units Earned

(Percent of Grant)

F’18 GRANT

TSR PERFORMANCE/PAYOUT SCHEDULE

1. Campbell

2. ConAgra

3. General Mills

4. Hershey

5. Hormel

6. Kellogg

7. Kraft Heinz

8. McCormick

9. Mondelēz

10. Smucker

11. Tyson

* Companies on the list are subject to change based on

future adjustments to the S&P Packaged Foods Group

AUGUST 2017

THE S&P PACKAGED FOODS GROUP*

Executive Compensation Program

performanCe restrICted stoCK UnIts (psUs), Cont’d

Understanding TSR

TSR is the return on the stock, taking into account the change in the stock price over a given time period,

and assuming dividends are reinvested. Campbell performance over the three-year performance period will

be compared to that of our peer companies. TSR will be measured “point-to-point,” with the starting and

ending points based on the average 20-trading day closing stock prices at the end of Campbell’s fiscal years.

What happens if there is a change to the companies included in the S&P Packaged

Foods Group?

If a company is added to the S&P Packaged Foods Group in the first year of a three-year performance

period, the peer group will be adjusted effective as of the date of the change. The new company’s TSR

will be calculated using the average 20-day closing stock price for the 20 trading days immediately

following its addition to the group. If there is an addition to the S&P Packaged Foods Group in the

second or third fiscal year of the three-year performance period, no adjustment will be made to the

peer group during that performance period.

If a company is deleted from the peer group in the first year of a three-year performance period, it

will be deleted from the group retroactive to the beginning of the performance period. If a company

is deleted in the second or third year of a three-year performance period and continues to be traded

publicly as an independent entity, it will continue to be included in the group for the applicable

performance period(s). If such a company does not continue to be traded as an independent entity,

it will be deleted from the peer group retroactive to the beginning of the performance period. The TSR

results of the deleted company will have no effect on the measurement of the full three-year results.

F’18 LONG-TERM INCENTIVE Program | 5

dIVIdend eQUIVaLents

Dividend equivalents are accumulated during the respective vesting periods for PSUs, RSUs and EPS units and

paid in cash in a lump sum in the month after the underlying units vest.

Dividend equivalents are based on the actual number of units that vest.

With limited exceptions as outlined on pages 9, 10 and 11, if you leave before a PSU, RSU and EPS unit vesting

date, you will forfeit accumulated dividend equivalents.

Outside the U.S., the payment of dividend equivalents, if any, will be governed by local tax law.

Dividend equivalents cannot be reinvested automatically.

Executive Compensation Program

seLLIng YoUr stoCK - restrICtIons

Upon vesting, stock units are paid in shares. Once you own shares of Campbell stock, you may sell them like any

other shares you own. However, as an employee of the Company, you may be subject to special restrictions on

when you may sell your Campbell stock.

Specifically, if you have information that is considered “material” and has not yet been released to the public,

you may not buy or sell Campbell stock. Information is considered material if there is a likelihood that a

reasonable investor would consider that information important in deciding whether to buy, sell or hold Campbell

stock. Some examples of possible material information include any of the following unannounced to the public:

• Earning estimates

• Significant acquisitions or divestitures

• Significant new products

• Significant changes in operations

• Dividend increases or decreases

• Extraordinary management changes

If you buy or sell Campbell stock when you have this kind of information, you could be subject to civil and

criminal penalties under U.S. Federal securities laws.

In addition, certain employees who regularly receive confidential information about the Company can only buy

or sell Campbell stock during “trading windows.” The Legal Department notifies employees who are subject to

this limitation, and these employees must receive approval from the Legal Department in order to sell shares.

Also, you are subject to additional selling restrictions if you are covered by the Executive Stock Ownership

Program and have not yet met the ownership requirements. Please refer to the Executive Stock Ownership

Program brochure for more details.

Executive Officers may also be subject to restrictions under Securities and Exchange Commission Rule 144.

If you have any questions about the appropriateness of selling your Campbell stock, please consult the

Legal Department.

F’18 LONG-TERM INCENTIVE Program | 6

Executive Compensation Program

taXatIon

Based on current law, this section provides a general description of expected U.S. federal income tax effects on

PSUs, RSUs and EPS units. Please note that this section does not address Social Security, state, local and foreign

taxes, and any other tax consequences that could apply to you based on your circumstances. In addition, the

Company is not guaranteeing any particular tax results related to your award. The Company will withhold taxes

and report income amounts to the IRS and other taxing authorities as required by applicable law.

Due to the complexity of the tax rules applicable to these awards, please consult your personal tax advisor

before making any decisions about your awards.

Within the United States

For participants subject to United States taxation (U.S. citizens, including those on expatriate assignments

to other countries, “green card” holders, and any others treated as U.S. tax residents), current federal tax

law results in the following tax treatment:

• Units are not subject to income taxation at the time they are granted

• When grants are paid in shares, the fair market value of the shares is taxable as ordinary income

• Dividend equivalents on units are taxable as ordinary income when they are received

In order to meet any federal, state or local tax withholding obligations with respect to an award under the

LTI Program, you may elect to have the Company, subject to procedures established by the Company:

• Withhold all or a portion of an LTI award;

• Withhold from your paycheck; or

• You may write a personal check to cover the withholding

If you are or become eligible for retirement during the applicable vesting period, the Company may be

required to collect FICA taxes from you prior to vesting in the units or receipt of shares.

If a portion of your award is included in income under Internal Revenue Code section 409A, that portion

will be distributed to you immediately.

As required under applicable laws, the Company reports plan payments and other plan-related information

to the appropriate governmental agencies.

Outside the United States

To the extent the Company is required to withhold foreign taxes in connection with your PSU’s, RSU’s, EPS

units and stock options, the Company may require you to make arrangements as the Company deems

necessary for the payment of such taxes required to be withheld. You may contact your local tax or

financial advisor for information on the tax treatment of your award and dividend equivalent payments.

F’18 LONG-TERM INCENTIVE Program | 7

Executive Compensation Program

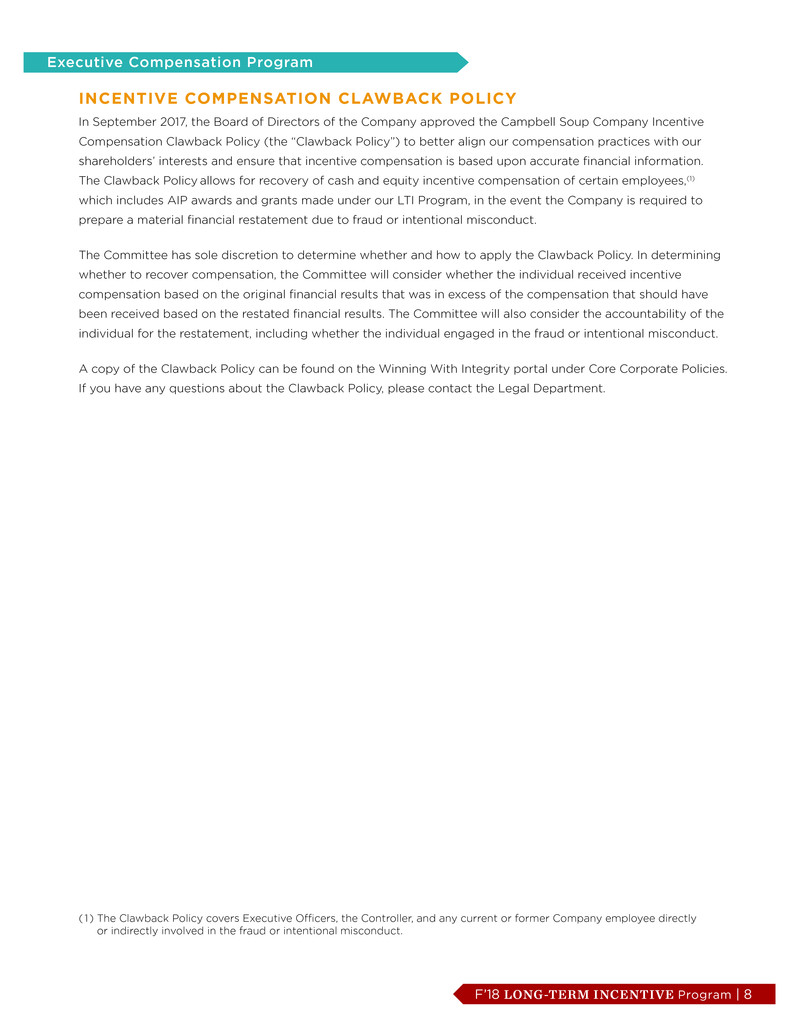

InCentIVe CompensatIon CLaWBaCK poLICY

In September 2017, the Board of Directors of the Company approved the Campbell Soup Company Incentive

Compensation Clawback Policy (the “Clawback Policy”) to better align our compensation practices with our

shareholders’ interests and ensure that incentive compensation is based upon accurate financial information.

The Clawback Policy allows for recovery of cash and equity incentive compensation of certain employees,(1)

which includes AIP awards and grants made under our LTI Program, in the event the Company is required to

prepare a material financial restatement due to fraud or intentional misconduct.

The Committee has sole discretion to determine whether and how to apply the Clawback Policy. In determining

whether to recover compensation, the Committee will consider whether the individual received incentive

compensation based on the original financial results that was in excess of the compensation that should have

been received based on the restated financial results. The Committee will also consider the accountability of the

individual for the restatement, including whether the individual engaged in the fraud or intentional misconduct.

A copy of the Clawback Policy can be found on the Winning With Integrity portal under Core Corporate Policies.

If you have any questions about the Clawback Policy, please contact the Legal Department.

F’18 LONG-TERM INCENTIVE Program | 8

( 1) The Clawback Policy covers Executive Officers, the Controller, and any current or former Company employee directly

or indirectly involved in the fraud or intentional misconduct.

Executive Compensation Program

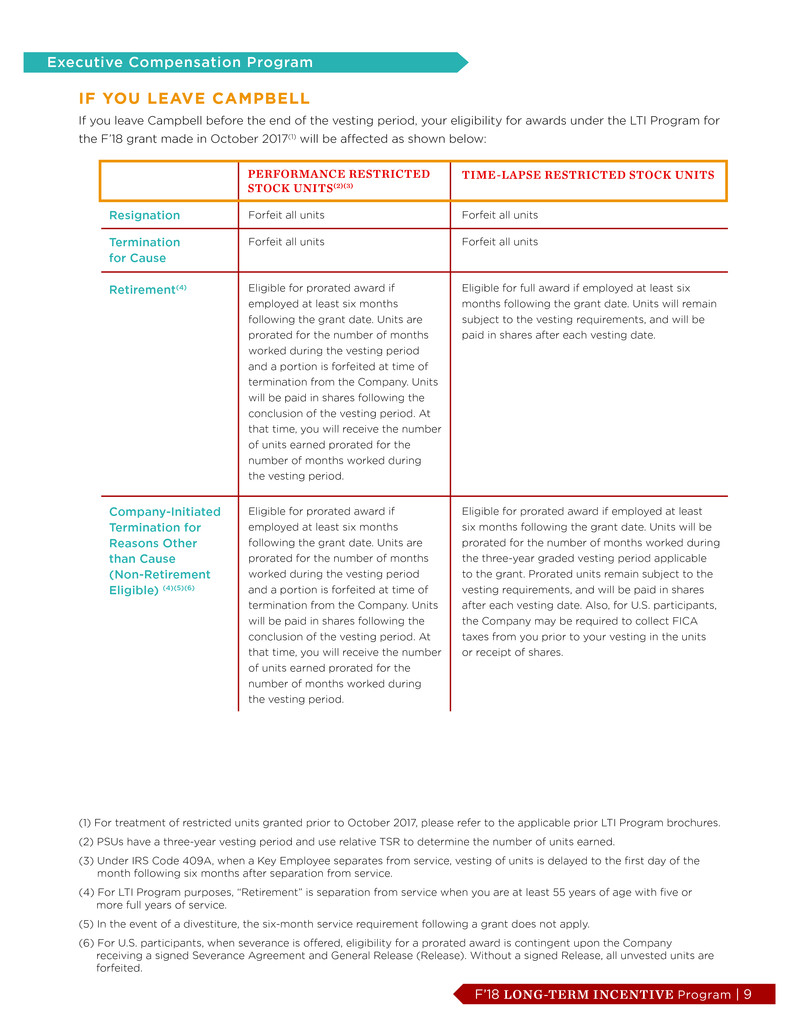

If YoU LeaVe CampBeLL

PERFORMANCE RESTRICTED

STOCK UNITS(2)(3)

TIME-LAPSE RESTRICTED STOCK UNITS

Resignation Forfeit all units

If you leave Campbell before the end of the vesting period, your eligibility for awards under the LTI Program for

the F’18 grant made in October 2017(1) will be affected as shown below:

Retirement(4)

Company-Initiated

Termination for

Reasons Other

than Cause

(Non-Retirement

Eligible) (4)(5)(6)

Termination

for Cause

F’18 LONG-TERM INCENTIVE Program | 9

Forfeit all units

Forfeit all units Forfeit all units

Eligible for prorated award if

employed at least six months

following the grant date. Units are

prorated for the number of months

worked during the vesting period

and a portion is forfeited at time of

termination from the Company. Units

will be paid in shares following the

conclusion of the vesting period. At

that time, you will receive the number

of units earned prorated for the

number of months worked during

the vesting period.

Eligible for full award if employed at least six

months following the grant date. Units will remain

subject to the vesting requirements, and will be

paid in shares after each vesting date.

Eligible for prorated award if

employed at least six months

following the grant date. Units are

prorated for the number of months

worked during the vesting period

and a portion is forfeited at time of

termination from the Company. Units

will be paid in shares following the

conclusion of the vesting period. At

that time, you will receive the number

of units earned prorated for the

number of months worked during

the vesting period.

Eligible for prorated award if employed at least

six months following the grant date. Units will be

prorated for the number of months worked during

the three-year graded vesting period applicable

to the grant. Prorated units remain subject to the

vesting requirements, and will be paid in shares

after each vesting date. Also, for U.S. participants,

the Company may be required to collect FICA

taxes from you prior to your vesting in the units

or receipt of shares.

(1) For treatment of restricted units granted prior to October 2017, please refer to the applicable prior LTI Program brochures.

(2) PSUs have a three-year vesting period and use relative TSR to determine the number of units earned.

(3) Under IRS Code 409A, when a Key Employee separates from service, vesting of units is delayed to the first day of the

month following six months after separation from service.

(4) For LTI Program purposes, “Retirement” is separation from service when you are at least 55 years of age with five or

more full years of service.

(5) In the event of a divestiture, the six-month service requirement following a grant does not apply.

(6) For U.S. participants, when severance is offered, eligibility for a prorated award is contingent upon the Company

receiving a signed Severance Agreement and General Release (Release). Without a signed Release, all unvested units are

forfeited.

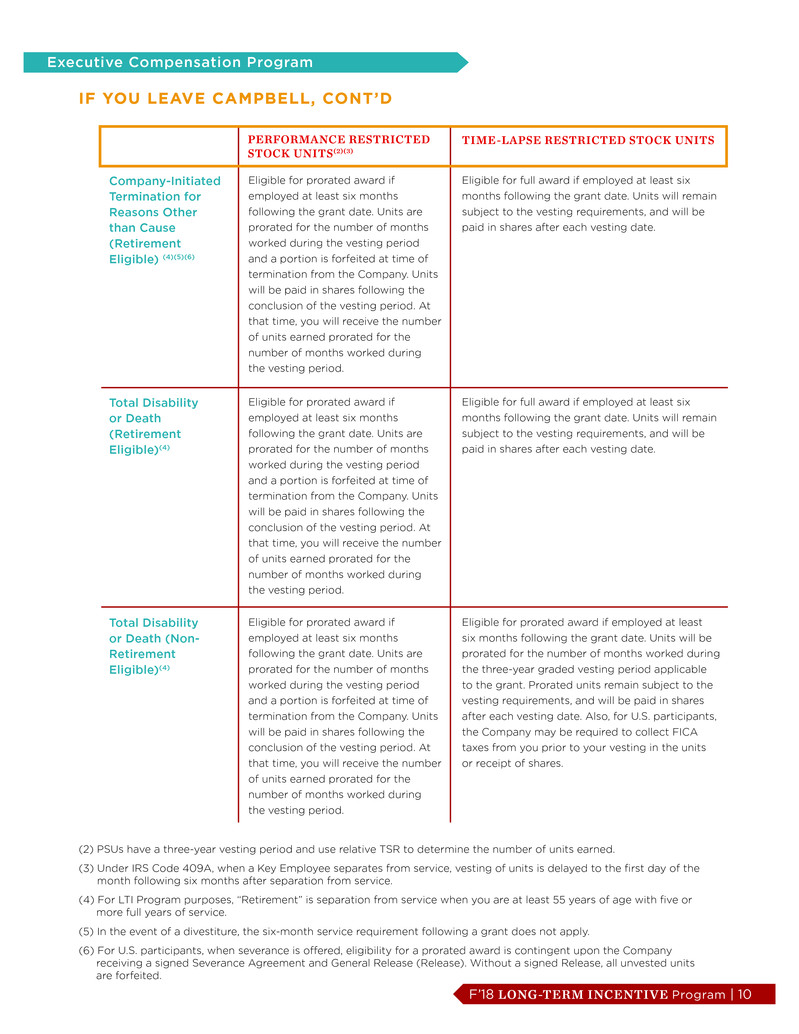

Executive Compensation Program

If YoU LeaVe CampBeLL

PERFORMANCE RESTRICTED

STOCK UNITS(2)(3)

TIME-LAPSE RESTRICTED STOCK UNITS

Eligible for prorated award if

employed at least six months

following the grant date. Units are

prorated for the number of months

worked during the vesting period

and a portion is forfeited at time of

termination from the Company. Units

will be paid in shares following the

conclusion of the vesting period. At

that time, you will receive the number

of units earned prorated for the

number of months worked during

the vesting period.

, Cont’d

Total Disability

or Death (Non-

Retirement

Eligible)(4)

Total Disability

or Death

(Retirement

Eligible)(4)

F’18 LONG-TERM INCENTIVE Program | 10

Eligible for full award if employed at least six

months following the grant date. Units will remain

subject to the vesting requirements, and will be

paid in shares after each vesting date.

(2) PSUs have a three-year vesting period and use relative TSR to determine the number of units earned.

(3) Under IRS Code 409A, when a Key Employee separates from service, vesting of units is delayed to the first day of the

month following six months after separation from service.

(4) For LTI Program purposes, “Retirement” is separation from service when you are at least 55 years of age with five or

more full years of service.

(5) In the event of a divestiture, the six-month service requirement following a grant does not apply.

(6) For U.S. participants, when severance is offered, eligibility for a prorated award is contingent upon the Company

receiving a signed Severance Agreement and General Release (Release). Without a signed Release, all unvested units

are forfeited.

Company-Initiated

Termination for

Reasons Other

than Cause

(Retirement

Eligible) (4)(5)(6)

Eligible for prorated award if

employed at least six months

following the grant date. Units are

prorated for the number of months

worked during the vesting period

and a portion is forfeited at time of

termination from the Company. Units

will be paid in shares following the

conclusion of the vesting period. At

that time, you will receive the number

of units earned prorated for the

number of months worked during

the vesting period.

Eligible for full award if employed at least six

months following the grant date. Units will remain

subject to the vesting requirements, and will be

paid in shares after each vesting date.

Eligible for prorated award if

employed at least six months

following the grant date. Units are

prorated for the number of months

worked during the vesting period

and a portion is forfeited at time of

termination from the Company. Units

will be paid in shares following the

conclusion of the vesting period. At

that time, you will receive the number

of units earned prorated for the

number of months worked during

the vesting period.

Eligible for prorated award if employed at least

six months following the grant date. Units will be

prorated for the number of months worked during

the three-year graded vesting period applicable

to the grant. Prorated units remain subject to the

vesting requirements, and will be paid in shares

after each vesting date. Also, for U.S. participants,

the Company may be required to collect FICA

taxes from you prior to your vesting in the units

or receipt of shares.

Executive Compensation Program

F’18 LONG-TERM INCENTIVE Program | 11

(1) For treatment of restricted units granted prior to October 2017, please refer to the F’17 and prior LTI Program brochures.

(2) For LTI Program purposes, “Retirement” is separation from service when you are at least 55 years of age with five or

more full years of service.

(3) In the event of a divestiture, the six-month service requirement following a grant does not apply.

(4) For U.S. participants, when severance is offered, eligibility for a prorated award is contingent upon the Company

receiving a signed Severance and General Release (Release). Without a signed Release, all unvested units are forfeited.

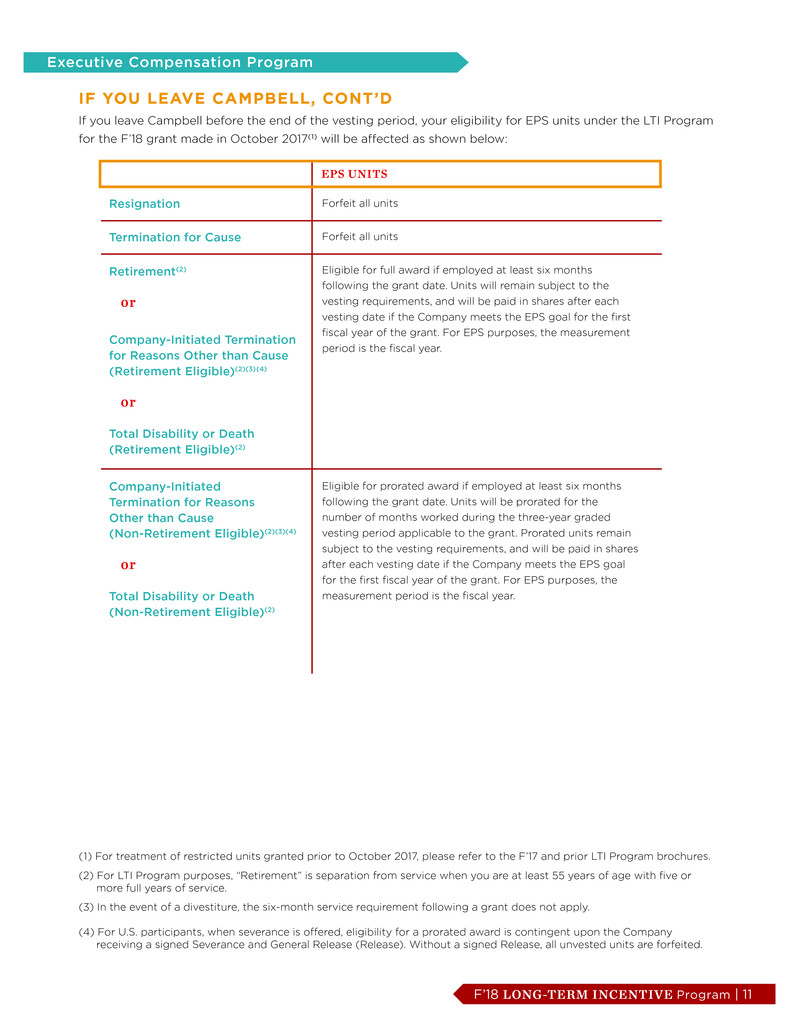

If YoU LeaVe CampBeLL, Cont’d

If you leave Campbell before the end of the vesting period, your eligibility for EPS units under the LTI Program

for the F’18 grant made in October 2017(1) will be affected as shown below:

EPS UNITS

Resignation Forfeit all units

Retirement(2)

or

Company-Initiated

Termination for Reasons

Other than Cause

(Non-Retirement Eligible)(2)(3)(4)

or

Total Disability or Death

(Non-Retirement Eligible)(2)

Termination for Cause Forfeit all units

Eligible for full award if employed at least six months

following the grant date. Units will remain subject to the

vesting requirements, and will be paid in shares after each

vesting date if the Company meets the EPS goal for the first

fiscal year of the grant. For EPS purposes, the measurement

period is the fiscal year.

Eligible for prorated award if employed at least six months

following the grant date. Units will be prorated for the

number of months worked during the three-year graded

vesting period applicable to the grant. Prorated units remain

subject to the vesting requirements, and will be paid in shares

after each vesting date if the Company meets the EPS goal

for the first fiscal year of the grant. For EPS purposes, the

measurement period is the fiscal year.

Company-Initiated Termination

for Reasons Other than Cause

(Retirement Eligible)(2)(3)(4)

or

Total Disability or Death

(Retirement Eligible)(2)

Executive Compensation Program

F’18 LONG-TERM INCENTIVE Program | 12

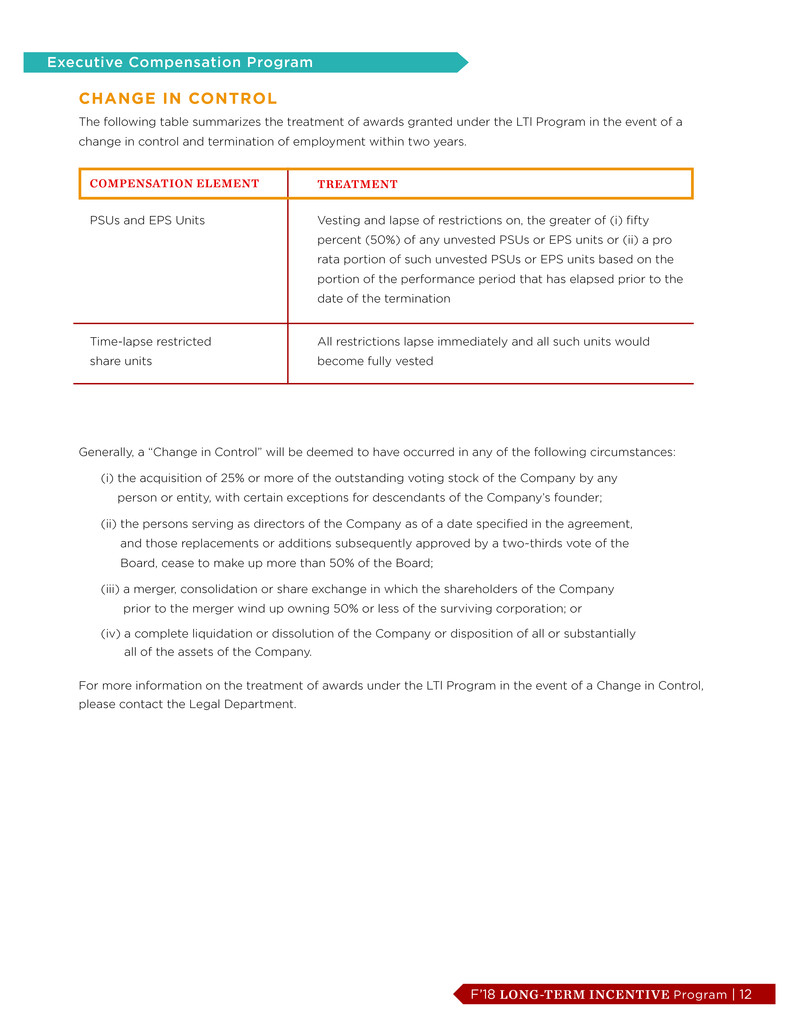

CHange In ControL

The following table summarizes the treatment of awards granted under the LTl Program in the event of a

change in control and termination of employment within two years.

Generally, a “Change in Control” will be deemed to have occurred in any of the following circumstances:

(i) the acquisition of 25% or more of the outstanding voting stock of the Company by any

person or entity, with certain exceptions for descendants of the Company’s founder;

(ii) the persons serving as directors of the Company as of a date specified in the agreement,

and those replacements or additions subsequently approved by a two~thirds vote of the

Board, cease to make up more than 50% of the Board;

(iii) a merger, consolidation or share exchange in which the shareholders of the Company

prior to the merger wind up owning 50% or less of the surviving corporation; or

(iv) a complete liquidation or dissolution of the Company or disposition of all or substantially

all of the assets of the Company.

For more information on the treatment of awards under the LTl Program in the event of a Change in Control,

please contact the Legal Department.

All restrictions lapse immediately and all such units would

become fully vested

Vesting and lapse of restrictions on, the greater of (i) fifty

percent (50%) of any unvested PSUs or EPS units or (ii) a pro

rata portion of such unvested PSUs or EPS units based on the

portion of the performance period that has elapsed prior to the

date of the termination

PSUs and EPS Units

Time-lapse restricted

share units

COMPENSATION ELEMENT TREATMENT

Executive Compensation Program

F’18 LONG-TERM INCENTIVE Program | 13

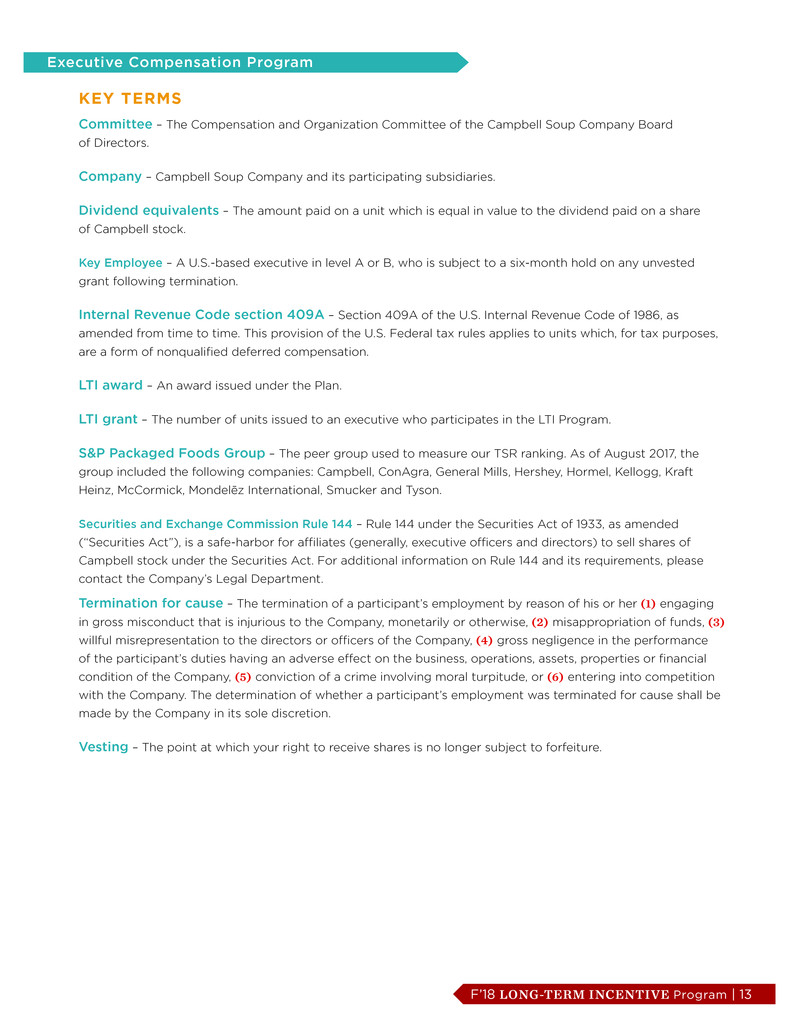

KeY terms

Committee – The Compensation and Organization Committee of the Campbell Soup Company Board

of Directors.

Company – Campbell Soup Company and its participating subsidiaries.

Dividend equivalents – The amount paid on a unit which is equal in value to the dividend paid on a share

of Campbell stock.

Key Employee – A U.S.-based executive in level A or B, who is subject to a six-month hold on any unvested

grant following termination.

Internal Revenue Code section 409A – Section 409A of the U.S. Internal Revenue Code of 1986, as

amended from time to time. This provision of the U.S. Federal tax rules applies to units which, for tax purposes,

are a form of nonqualified deferred compensation.

LTI award – An award issued under the Plan.

LTI grant – The number of units issued to an executive who participates in the LTI Program.

S&P Packaged Foods Group – The peer group used to measure our TSR ranking. As of August 2017, the

group included the following companies: Campbell, ConAgra, General Mills, Hershey, Hormel, Kellogg, Kraft

Heinz, McCormick, Mondelēz International, Smucker and Tyson.

Securities and Exchange Commission Rule 144 – Rule 144 under the Securities Act of 1933, as amended

(“Securities Act”), is a safe-harbor for affiliates (generally, executive officers and directors) to sell shares of

Campbell stock under the Securities Act. For additional information on Rule 144 and its requirements, please

contact the Company’s Legal Department.

Termination for cause – The termination of a participant’s employment by reason of his or her (1) engaging

in gross misconduct that is injurious to the Company, monetarily or otherwise, (2) misappropriation of funds, (3)

willful misrepresentation to the directors or officers of the Company, (4) gross negligence in the performance

of the participant’s duties having an adverse effect on the business, operations, assets, properties or financial

condition of the Company, (5) conviction of a crime involving moral turpitude, or (6) entering into competition

with the Company. The determination of whether a participant’s employment was terminated for cause shall be

made by the Company in its sole discretion.

Vesting – The point at which your right to receive shares is no longer subject to forfeiture.

Executive Compensation Program

F’18 LONG-TERM INCENTIVE Program | 14

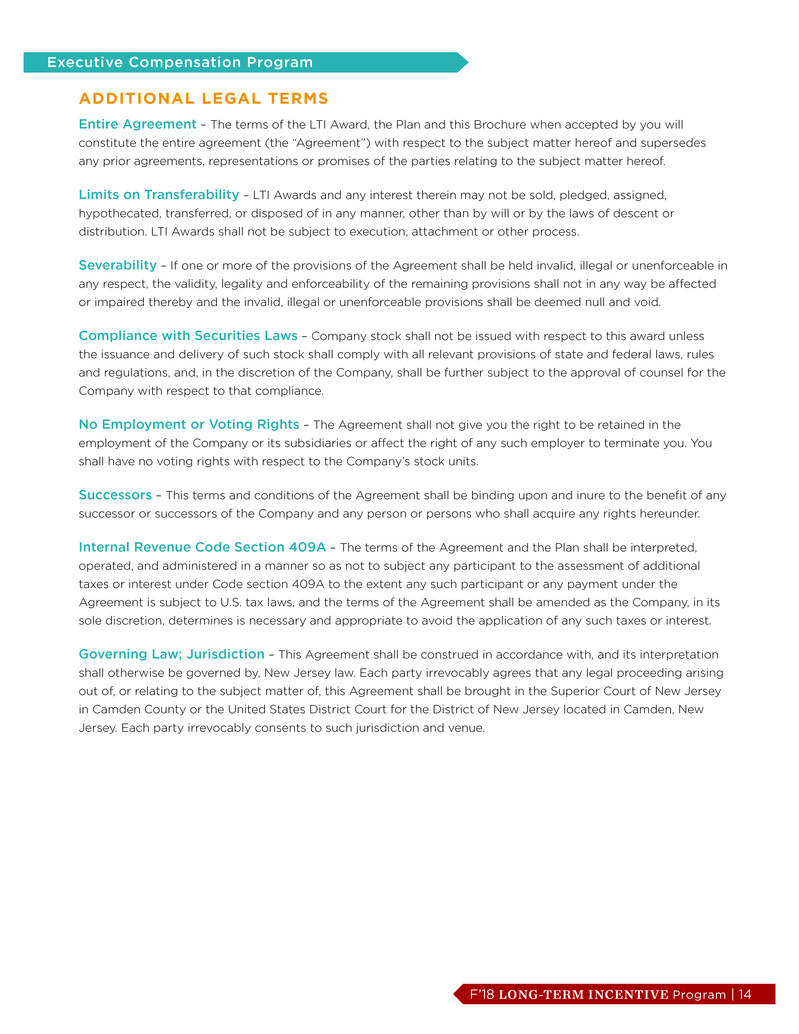

addItIonaL LegaL terms

Entire Agreement – The terms of the LTI Award, the Plan and this Brochure when accepted by you will

constitute the entire agreement (the “Agreement”) with respect to the subject matter hereof and supersedes

any prior agreements, representations or promises of the parties relating to the subject matter hereof.

Limits on Transferability – LTI Awards and any interest therein may not be sold, pledged, assigned,

hypothecated, transferred, or disposed of in any manner, other than by will or by the laws of descent or

distribution. LTI Awards shall not be subject to execution, attachment or other process.

Severability – If one or more of the provisions of the Agreement shall be held invalid, illegal or unenforceable in

any respect, the validity, legality and enforceability of the remaining provisions shall not in any way be affected

or impaired thereby and the invalid, illegal or unenforceable provisions shall be deemed null and void.

Compliance with Securities Laws – Company stock shall not be issued with respect to this award unless

the issuance and delivery of such stock shall comply with all relevant provisions of state and federal laws, rules

and regulations, and, in the discretion of the Company, shall be further subject to the approval of counsel for the

Company with respect to that compliance.

No Employment or Voting Rights – The Agreement shall not give you the right to be retained in the

employment of the Company or its subsidiaries or affect the right of any such employer to terminate you. You

shall have no voting rights with respect to the Company’s stock units.

Successors – This terms and conditions of the Agreement shall be binding upon and inure to the benefit of any

successor or successors of the Company and any person or persons who shall acquire any rights hereunder.

Internal Revenue Code Section 409A – The terms of the Agreement and the Plan shall be interpreted,

operated, and administered in a manner so as not to subject any participant to the assessment of additional

taxes or interest under Code section 409A to the extent any such participant or any payment under the

Agreement is subject to U.S. tax laws, and the terms of the Agreement shall be amended as the Company, in its

sole discretion, determines is necessary and appropriate to avoid the application of any such taxes or interest.

Governing Law; Jurisdiction – This Agreement shall be construed in accordance with, and its interpretation

shall otherwise be governed by, New Jersey law. Each party irrevocably agrees that any legal proceeding arising

out of, or relating to the subject matter of, this Agreement shall be brought in the Superior Court of New Jersey

in Camden County or the United States District Court for the District of New Jersey located in Camden, New

Jersey. Each party irrevocably consents to such jurisdiction and venue.

Executive Compensation Program

F’18 LONG-TERM INCENTIVE Program | 15

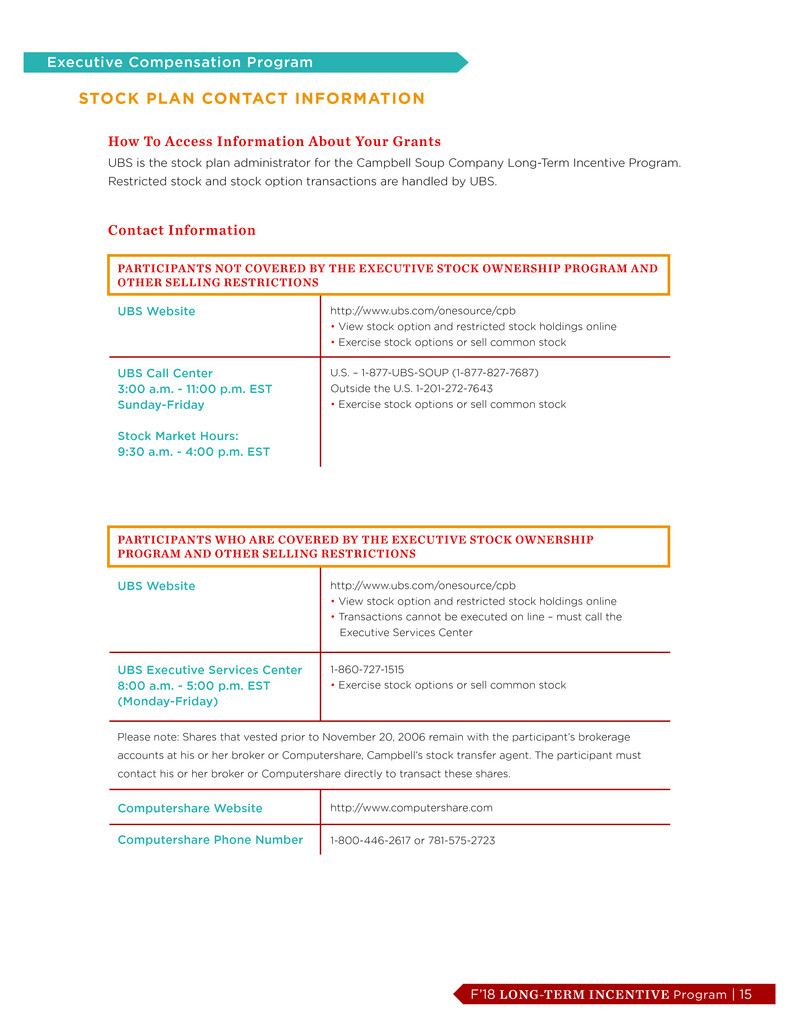

stoCK pLan ContaCt InformatIon

How To Access Information About Your Grants

UBS is the stock plan administrator for the Campbell Soup Company Long-Term Incentive Program.

Restricted stock and stock option transactions are handled by UBS.

Contact Information

PARTICIPANTS NOT COVERED BY THE EXECUTIVE STOCK OWNERSHIP PROGRAM AND

OTHER SELLING RESTRICTIONS

UBS Website http://www.ubs.com/onesource/cpb

• View stock option and restricted stock holdings online

• Exercise stock options or sell common stock

UBS Call Center

3:00 a.m. - 11:00 p.m. EST

Sunday-Friday

Stock Market Hours:

9:30 a.m. - 4:00 p.m. EST

U.S. – 1-877-UBS-SOUP (1-877-827-7687)

Outside the U.S. 1-201-272-7643

• Exercise stock options or sell common stock

UBS Executive Services Center

8:00 a.m. - 5:00 p.m. EST

(Monday-Friday)

Computershare Website

Computershare Phone Number

http://www.ubs.com/onesource/cpb

• View stock option and restricted stock holdings online

• Transactions cannot be executed on line – must call the

Executive Services Center

1-860-727-1515

• Exercise stock options or sell common stock

http://www.computershare.com

1-800-446-2617 or 781-575-2723

UBS Website

PARTICIPANTS WHO ARE COVERED BY THE EXECUTIVE STOCK OWNERSHIP

PROGRAM AND OTHER SELLING RESTRICTIONS

Please note: Shares that vested prior to November 20, 2006 remain with the participant’s brokerage

accounts at his or her broker or Computershare, Campbell’s stock transfer agent. The participant must

contact his or her broker or Computershare directly to transact these shares.