Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RGC RESOURCES INC | a8kinvestorpresentation-20.htm |

RGC Resources, Inc. | NASDAQ: RGCO

Investor Presentation

December 2017

1

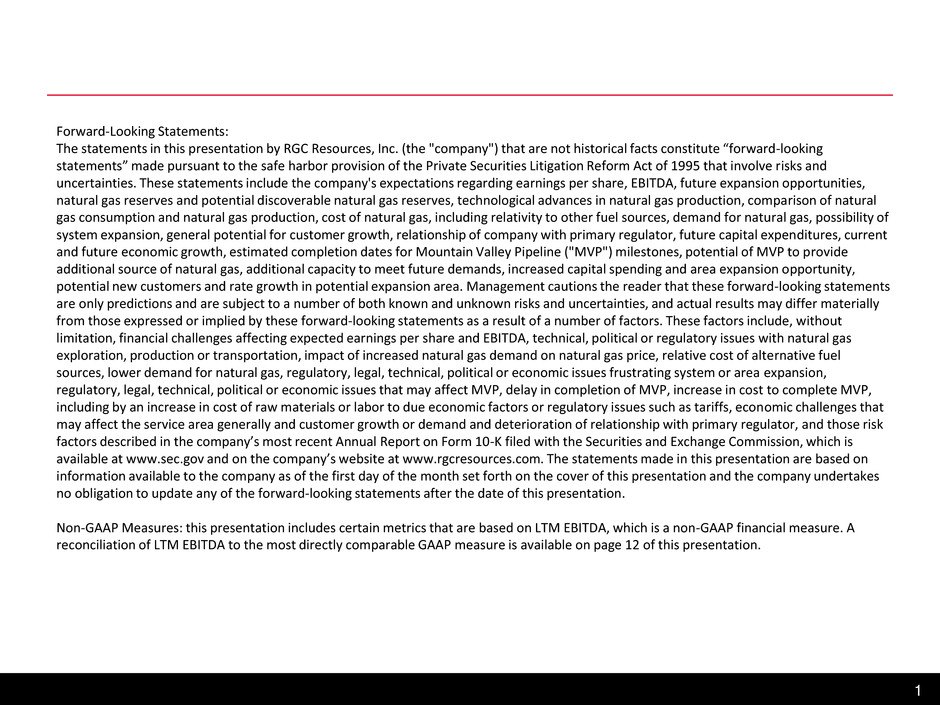

Forward-Looking Statements:

The statements in this presentation by RGC Resources, Inc. (the "company") that are not historical facts constitute “forward-looking

statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and

uncertainties. These statements include the company's expectations regarding earnings per share, EBITDA, future expansion opportunities,

natural gas reserves and potential discoverable natural gas reserves, technological advances in natural gas production, comparison of natural

gas consumption and natural gas production, cost of natural gas, including relativity to other fuel sources, demand for natural gas, possibility of

system expansion, general potential for customer growth, relationship of company with primary regulator, future capital expenditures, current

and future economic growth, estimated completion dates for Mountain Valley Pipeline ("MVP") milestones, potential of MVP to provide

additional source of natural gas, additional capacity to meet future demands, increased capital spending and area expansion opportunity,

potential new customers and rate growth in potential expansion area. Management cautions the reader that these forward-looking statements

are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results may differ materially

from those expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without

limitation, financial challenges affecting expected earnings per share and EBITDA, technical, political or regulatory issues with natural gas

exploration, production or transportation, impact of increased natural gas demand on natural gas price, relative cost of alternative fuel

sources, lower demand for natural gas, regulatory, legal, technical, political or economic issues frustrating system or area expansion,

regulatory, legal, technical, political or economic issues that may affect MVP, delay in completion of MVP, increase in cost to complete MVP,

including by an increase in cost of raw materials or labor to due economic factors or regulatory issues such as tariffs, economic challenges that

may affect the service area generally and customer growth or demand and deterioration of relationship with primary regulator, and those risk

factors described in the company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which is

available at www.sec.gov and on the company’s website at www.rgcresources.com. The statements made in this presentation are based on

information available to the company as of the first day of the month set forth on the cover of this presentation and the company undertakes

no obligation to update any of the forward-looking statements after the date of this presentation.

Non-GAAP Measures: this presentation includes certain metrics that are based on LTM EBITDA, which is a non-GAAP financial measure. A

reconciliation of LTM EBITDA to the most directly comparable GAAP measure is available on page 12 of this presentation.

2

Key Investment Highlights

Demonstrated Track

Record of Delivering

Shareholder Value

Total shareholder return of 317% since 2007, compared with 125% for the S&P 500

Recently announced $0.62 per share annual dividend, a 6.9% increase over 2017’s level

7% increase in earnings for the 12 month period ended Sept 30, 2017, attributable to:

Improved utility margins associated with infrastructure replacement programs

Customer growth

Midstream investment through Mountain Valley Pipeline (MVP)

Significant Growth

Potential

Attractive cost recovery mechanisms and opportunities for rate base growth

Service territory centered in the largest metropolitan area in western Virginia

Additional growth opportunities from investment in MVP, including service territory

expansion

Highly Stable Business

Model

Very constructive relationships with VA State Corporation Commission (SCC)

73 years of consecutive dividend payments, 14 years of consecutive dividend increases

$21 million availability on Prudential shelf agreement supports debt capital needs

Registered equity shelf filing in August 2017 authorizing issuance of up to $50 million of

common stock

Experienced

Management Team

30 average years of experience

CEO is member of the AGA Board of Directors

Numerous leadership positions within industry organizations

Attractive

Fundamental Backdrop

The U.S. has become a global powerhouse in natural gas production

Natural gas enjoys a significant structural cost advantage to other fuel sources

Significant infrastructure and modernization programs underway

Virginia’s regulatory climate makes it amongst the best ranked states for business1

1 Forbes “Best States For Business 2017” as of November 28, 2017

Overview of RGC Resources and Roanoke Gas

Business Description

Local distribution company (LDC) located in Roanoke, VA,

founded in 1883, that transports natural gas to residential

and commercial/industrial end users

Publicly listed on Nasdaq in 1994

98% earnings FYE 2017 from Roanoke Gas– regulated

natural gas utility

60,338 customers in Virginia

‒ 60% industrial/commercial/other by volume

‒ 40% residential

110 full time employees

RGC Midstream – Est. $35 million investment committed to

Mountain Valley Pipeline – FERC regulated interstate

pipeline

Public Market Overview ($mm)

Organizational Chart & Trading Statistics Service Territory

Sources: Company filings as of 9/30/17. Bloomberg market data as of 12/1/17.

Notes: Total debt pro forma for $8mm 3.58% 2027 Sr. Notes issued October 2, 2017. Proceeds used to pay down line of credit. ‘18E EBITDA = $20.8mm represents company

provided estimate.

Current service territory

Future expansion

opportunity

RGC

Resources, Inc.

Roanoke Gas

Company

RGC Midstream,

LLC

Shares o/s (mm) 7.2

% insider owned 8.3%

Float (mm) 6.3

% short interest 2.2%

3

($mm, except where noted) 9/30/17

Share price (as of 12/1/17) $26.87

Fully diluted shares outstanding 7.3

Market cap $197.4

Plus: debt 61.6

Less: cash (0.7)

Enterprise value $258.3

% of 52-week high 84%

% off 52-week low 65%

Credit metrics

Total debt / 2018E EBITDA 3.0x

Total debt / book cap 51%

Total liquidity (cash and avail. RLOC) $39.6

Guidance

2018E EPS $0.92

2019E EPS $1.00

$20.7 $20.3

$18.0 $18.4

$18.9 $18.4

$0

$5

$10

$15

$20

$25

2017A 2018E 2019E 2020E 2021E 2022E

$ mi

llio

n

s

Utility Maintenance Customer Growth SAVE Rider & Station Replacement

Infrastructure riders Weather normalization Purchased gas adjustment System expansion

4

Stable Regulation Environment for Gas Utility Segment

Established, productive relationships with VA SCC

9.75% authorized ROE

100% cast iron and bare steel pipe replaced

System technology and mapping initiative

Roanoke Gas Capital Expenditure Plan (Exclusive of Midstream)

Forecast period (FYE)

SAVE Rider & Station Replacement $47.1 50%

Customer Growth $24.2 26%

Utility Maintenance $22.8 24%

Total $94.1 100%

Forecast totals through 2022

Infrastructure Replacement Rider - SAVE

Approved through 2021

First Generation Plastic: $38mm

3 interconnect stations: $3mm

Coated steel tubing: $6mm

St

ab

le

b

u

si

n

ess

m

o

d

el

5

RGC’s Service Area is Enjoying an Uptick in Economic Growth

Home to over 300,000 people and an economic hub for more than one million people throughout western Virginia

Ranked in the Top 100 Best Places for Business and Careers and Top 15 Most Affordable Places for Doing Business by Forbes.com

High concentration of higher education institutions, with 25 colleges and universities within a 60-mile radius

More than 70 trucking lines serve the region with local, state, and interstate freight service, considered a foreign trade zone

A

tt

rac

ti

ve

e

co

n

o

mic

b

ac

kd

ro

p

Focus on innovation: Virginia Tech and Carilion recently broke ground on their $90 million

research hub in Roanoke The Roanoke Times – 10.21.17

Recently converted operations from 66%

coal to 100% natural gas

Steel Dynamics to invest $28 million at the Roanoke

Bar Division The Roanoke Times – 2.2.17

Ballast Point’s industrial-scale brewery for its East Coast operations is up

and brewing in Roanoke, Va The Roanoke Times – 8.9.17

Humm Kombucha will build a $10 million production and

packaging facility in Roanoke The Roanoke Times – 10.31.17

AEP Transmission will invest $12.7 million to relocate to and expand

in downtown Roanoke The Roanoke Times – 11.14.17

Altec Industries announces $30 million expansion to increase its existing plant

by 65,000 square feet The Roanoke Times – 10.24.17

6

Mountain Valley Pipeline (MVP) – Project Overview & Timeline

RGCO is a 1% owner of the planned $3.5bn MVP

300 mile, 42” underground natural gas pipeline spanning from

northwestern West Virginia to southern Virginia

Will provide two billion cubic feet (2Bcf) of natural gas per day to

New York, Mid- and South- Atlantic markets

Secured firm commitments for the full capacity of the project

under 20-year contracts

The pipeline will deliver a third source of gas with two interconnects

MVP creates expansion opportunities into Franklin County

Milestone Estimated Completion

FERC approval Issued October 13, 2017

Construction begins Early 2018

Targeted in-service date End 2018

Project Partners (% ownership)

MVP Overview

45.5%

BBB-

10%

A

12.5%

A-

1%

31%

A-

G

ro

w

th

p

o

te

n

tia

l

$5

$25

$4

$0

$10

$20

$30

2017A 2018E 2019E

($

m

m

)

MVP capital expenditures

7

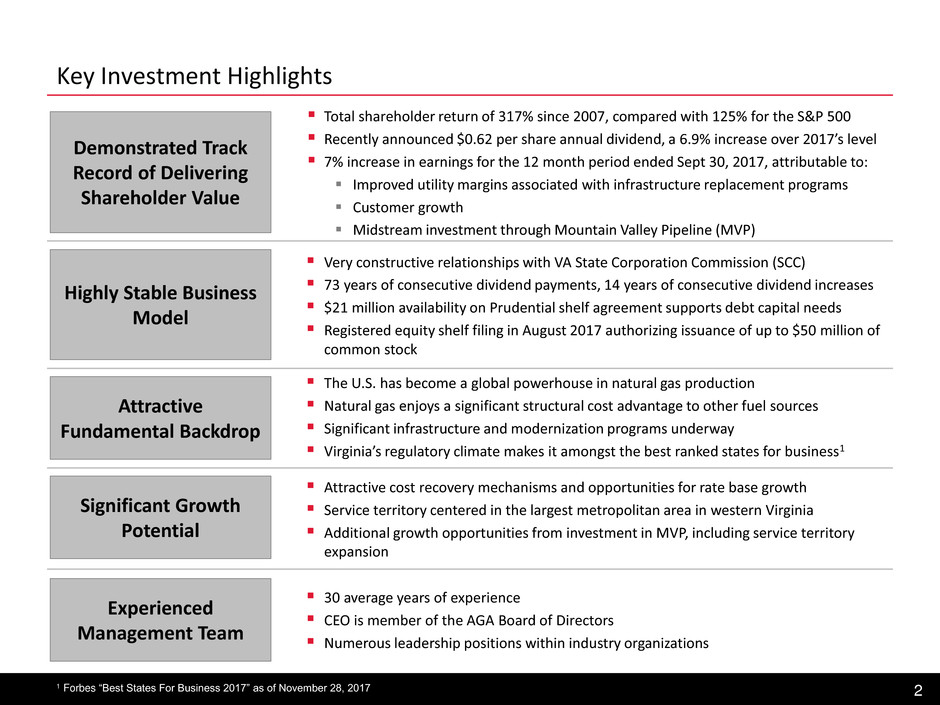

Franklin County Expansion

Estimated $4.8mm annual EBITDA contribution

from the MVP and Franklin County Expansion

Note: Roanoke Gas is in the process of completing its application for the Certificate of Public Convenience and Necessity with the Virginia SCC for exclusive natural gas

distribution rights in the remaining uncertified portions of Franklin County. New customers are included in the estimated $4.8mm annual EBITDA contribution. G

ro

w

th

p

o

te

n

tia

l

The Summit View Business Park is a 500 acre industrial park that is currently under development in Franklin County, along the

proposed path of the Mountain Valley Pipeline

RGC will build an interconnect and create a distribution system for the park and nearby town of Rocky Mount, which is

currently unserved by natural gas

Potential to add 1,500 new customers - Rocky Mount, VA

Rate base growth of $10 million

Summit View

Business Park

City of Roanoke

Summit View Business Park Proximity to Roanoke

Rocky Mount

MVP

8

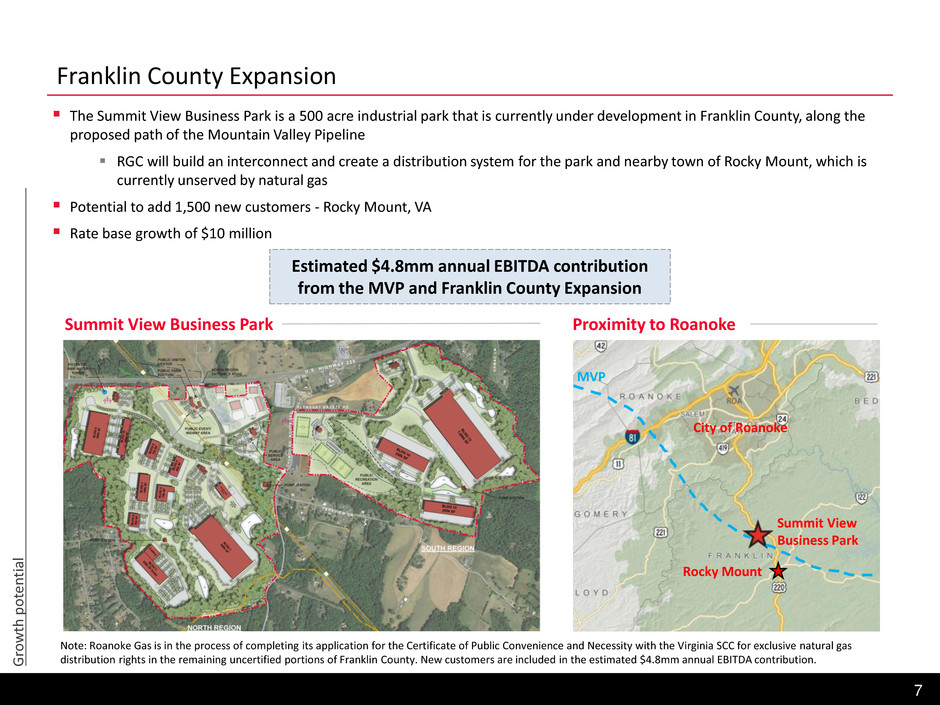

Financial Highlights

Diluted EPS Customer Growth

ROE Net Plant Growth ($000’s)

Sources: Bloomberg, SNL. Company filings.

Notes: Income statement data is TTM as of 9/30. Net plant growth = sum of last four quarters capex on utility plant without allowance for funds used during

construction (AFUDC). Customer count represents the rolling 12 month averages at 9/30/14, 9/30/15, 9/30/16, and 9/30/17. Fi

n

an

cial

p

ro

fil

e

$0.67

$0.72

$0.81

$0.86

$0.49

$0.51

$0.54

$0.58

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

2014 2015 2016 2017

Dividends/Share

58,993

59,536

59,988

60,338

58,500

59,000

59,500

60,000

60,500

FY 2014 FY 2015 FY 2016 Current

9.3%

9.7%

10.7% 10.8%

7.0%

8.0%

9.0%

10.0%

11.0%

2014 2015 2016 2017

$14,715

$13,780

$17,946

$20,750

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

$22,000

2014 2015 2016 2017

11.0% 10.8% 9.6% 9.7%

7.7%

3.5%

0.0%

5.0%

10.0%

15.0%

NJR RGCO UTL CPK NWN SJI

6.6% 6.5% 6.4%

5.8%

1.4%

0.5%

0.0%

2.0%

4.0%

6.0%

8.0%

NJR RGCO CPK SJI UTL NWN

9.1%

2.3%

(1.2%) (1.2%)

(3.0%)

(6.7%) (10.0%)

(5.0%)

0.0%

5.0%

10.0%

RGCO UTL NWN NJR CPK SJI

9

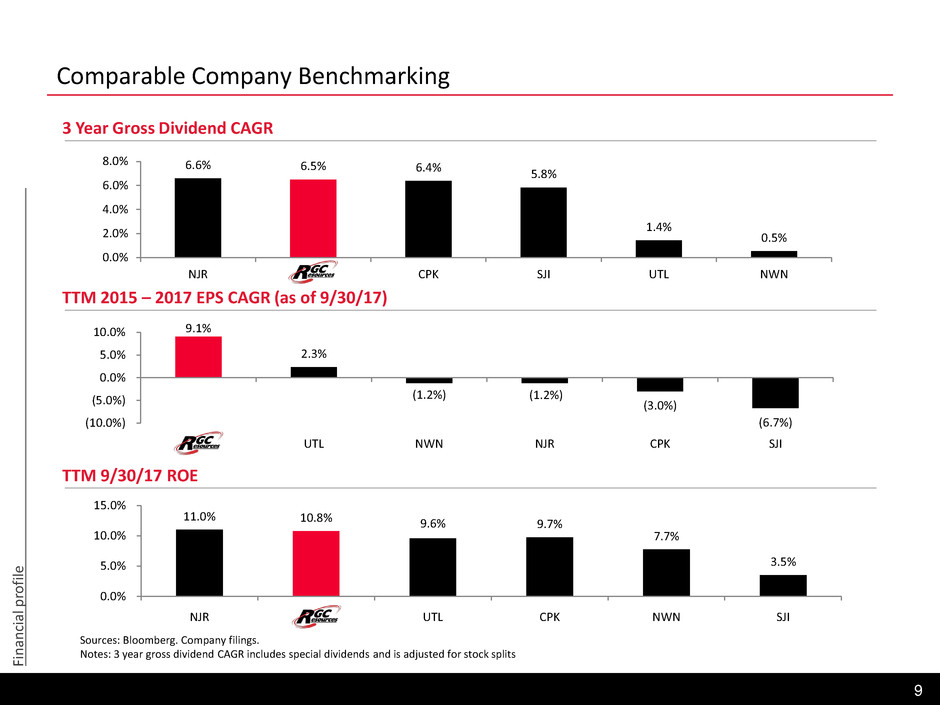

Comparable Company Benchmarking

3 Year Gross Dividend CAGR

Sources: Bloomberg. Company filings.

Notes: 3 year gross dividend CAGR includes special dividends and is adjusted for stock splits

TTM 2015 – 2017 EPS CAGR (as of 9/30/17)

TTM 9/30/17 ROE

Fi

n

an

cial

p

ro

fil

e

47.3% 47.9% 49.1% 50.5%

53.6%

60.4%

0.0%

20.0%

40.0%

60.0%

80.0%

CPK NWN SJI RGCO NJR UTL

3.2x 3.4x 3.5x

4.0x

5.2x

6.0x

0.0x

2.0x

4.0x

6.0x

8.0x

CPK RGCO NWN UTL NJR SJI

0

10,000

20,000

30,000

$

0

0

0

10

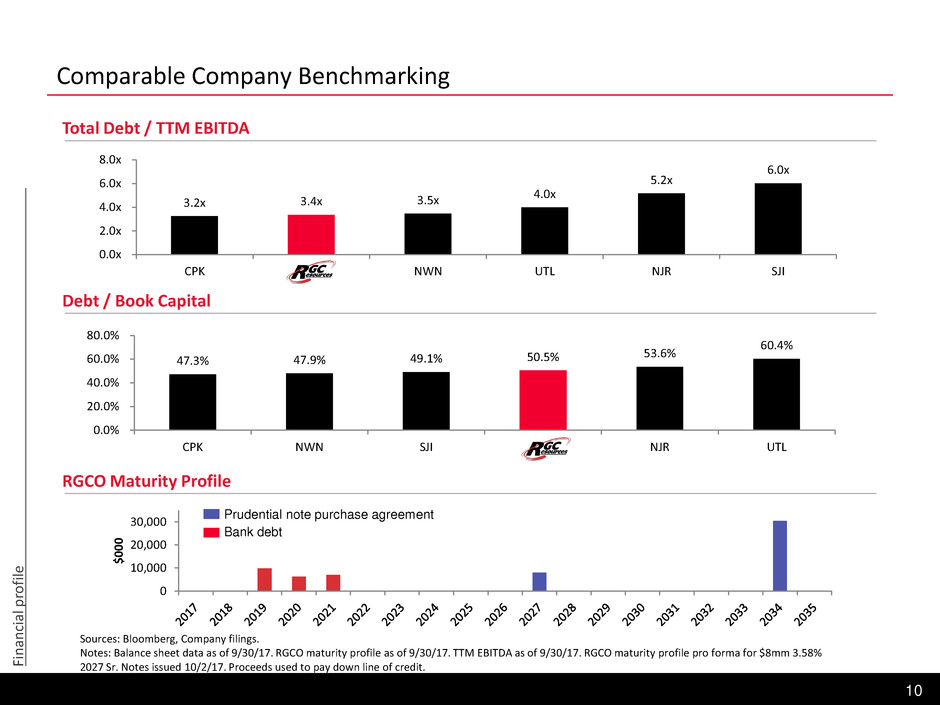

Comparable Company Benchmarking

Total Debt / TTM EBITDA

Debt / Book Capital

RGCO Maturity Profile

Sources: Bloomberg, Company filings.

Notes: Balance sheet data as of 9/30/17. RGCO maturity profile as of 9/30/17. TTM EBITDA as of 9/30/17. RGCO maturity profile pro forma for $8mm 3.58%

2027 Sr. Notes issued 10/2/17. Proceeds used to pay down line of credit.

Prudential note purchase agreement

Bank debt

Fi

n

an

cial

p

ro

fil

e

$0.40

$0.45

$0.50

$0.55

$0.60

$0.65

$0.70

$7.00

$9.00

$11.00

$13.00

$15.00

$17.00

$19.00

$21.00

$23.00

$25.00

$27.00

$29.00

$31.00

D

ivi

d

en

d

s

p

er

s

h

ar

e

($

)

Sh

are

p

rice

($

)

Share price Dividends/share

11

RGC Resources has Delivered Significant Shareholder Value

Source: Bloomberg data as of 12/1/17.

Note: Total returns include total dividends paid over the time period

RGCO total returns

6mo 9%

1yr 67%

3yr 106%

5yr 169%

10yr 317%

6/23/17: Added to

the Russell 3000

D

em

o

n

st

ra

te

d

t

rac

k

re

co

rd

11/27/17: Announced

6.9% dividend increase

12

EBITDA Reconciliation

EBITDA represents net income (loss) before interest expense, provision for income taxes, depreciation and amortization. EBITDA does not represent net income, as that

term is defined under GAAP, and should not be considered as an alternative to net income (loss) as an indicator of our operating performance.

Additionally, EBITDA and is not intended to be a measures of free cash flow available for management or discretionary use as such measures do not consider certain

cash requirements such as capital expenditures, tax payments and debt service requirements. EBITDA as presented herein is not necessarily comparable to similarly

titled measures.

Reconciliation of Net Income to EBITDA - Audited

Quarter ended

LTM 9/30/17 6/30/17 3/31/17 12/31/16

Net income $6,232,865 $159,886 $615,562 $3,225,199 $2,232,218

Add: Provision for income taxes 3,805,390 112,210 343,233 1,977,583 1,372,364

Add: Interest expense 1,917,254 516,953 472,300 469,480 458,521

Add: Depreciation and amortization expense 6,256,737 1,463,467 1,591,090 1,596,090 1,606,090

EBITDA $18,212,246 $2,252,516 $3,022,185 $7,268,352 $5,669,193

N

o

te

s

13