Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Nexeo Solutions, Inc. | a09302017ex231.htm |

| EX-32.1 - EXHIBIT 32.1 - Nexeo Solutions, Inc. | a09302017ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Nexeo Solutions, Inc. | a09302017ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Nexeo Solutions, Inc. | a09302017ex311.htm |

| EX-21.1 - EXHIBIT 21.1 - Nexeo Solutions, Inc. | a09302017ex211.htm |

| EX-12.1 - EXHIBIT 12.1 - Nexeo Solutions, Inc. | a09302017ex121.htm |

| EX-10.12 - EXHIBIT 10.12 - Nexeo Solutions, Inc. | a09302017ex1012.htm |

| EX-10.7 - EXHIBIT 10.7 - Nexeo Solutions, Inc. | a09302017ex107.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

(Mark One)

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2017

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36477

NEXEO SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 46-5188282 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3 Waterway Square Place, Suite 1000 The Woodlands, Texas | 77380 | |

(Address of principal executive offices) | (Zip Code) | |

(281) 297-0700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Units, each consisting of one share of Common Stock, | NASDAQ Capital Market | |

$0.0001 par value, and one Warrant to purchase Common Stock | ||

Common Stock, $0.0001 par value | NASDAQ Capital Market | |

Warrants to purchase Common Stock | NASDAQ Capital Market | |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this Chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 299.405 of this Chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer x | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |

Emerging growth company o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of Nexeo Solutions, Inc. was $294,545,118 as of March 31, 2017, using the definition of beneficial ownership contained in Rule 13d-3 promulgated pursuant to the Securities Exchange Act of 1934, as amended, and excluding shares held by directors and executive officers. As of December 5, 2017, there were 89,753,662 shares of the Company's common stock issued and 89,741,309 shares outstanding, par value $0.0001 per share.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the definitive proxy statement relating to the 2018 Annual Meeting of Stockholders of Nexeo Solutions, Inc., which will be filed with the Securities and Exchange Commission within 120 days of September 30, 2017, are incorporated by reference in Item 10, Item 11, Item 12, Item 13 and Item 14 of Part III of this Form 10-K.

TABLE OF CONTENTS

i

GLOSSARY

The following terms and abbreviations appearing in the text of this Annual Report on Form 10-K have the meanings indicated below.

2016 LTIP | The Nexeo Solutions, Inc. 2016 Long Term Incentive Plan |

ABL Borrowers | Holdings, Sub Holding and Solutions together with Nexeo Solutions Canada Corporation |

ABL Facility | The asset-based credit facility pursuant to that certain asset-based credit agreement by and among the ABL Borrowers, Bank of America, N.A., as administrative agent and the lenders party thereto and the other parties thereto |

ADA Purchase Agreement | The Ashland Distribution Acquisition purchase agreement |

Archway Acquisition | The acquisition by the Predecessor of 100% of the outstanding shares of capital stock of Archway Sales, Inc. and substantially all of the assets of JACAAB, a related business of Archway Sales, Inc., that closed on April 1, 2014 |

ASC | The FASB Accounting Standards Codification |

Ashland | Ashland Inc. and its subsidiaries |

ASU | Accounting Standards Update issued by the FASB |

Blocker | TPG Accolade Delaware, L.P. |

Blocker Merger | The merger of Blocker Merger Sub into Blocker on June 9, 2016, immediately following the Company Merger, with Blocker continuing as the surviving entity |

Blocker Merger Sub | Neon Acquisition Company LLC, which was a wholly-owned subsidiary of WLRH at the time of the Blocker Merger |

Business Combination | The business combination between WLRH and Holdings pursuant to the Merger Agreement, which was consummated on the Closing Date |

CAA | U.S. Federal Clean Air Act |

CAD | Canadian dollar |

Canadian Tranche | Canadian tranche of the ABL Facility |

CERCLA | U.S. Comprehensive Environmental Response, Compensation and Liability Act |

CFATS | U.S. Chemical-Facility Anti-Terrorism Standards |

Closing Date | June 9, 2016 |

Company / Successor / Nexeo | Nexeo Solutions, Inc. (f/k/a WL Ross Holding Corp.) and its consolidated subsidiaries |

Company Merger | The merger of Company Merger Sub with and into Holdings consummated on June 9, 2016, with Holdings continuing as the surviving entity |

Company Merger Sub | Neon Holding Company LLC, which was a wholly-owned subsidiary of WLRH at the time of the Company Merger |

Company's 2018 Proxy Statement | The Company's proxy statement relating to its 2018 Annual Meeting of Stockholders |

Credit Facilities | The ABL Facility and the Term Loan Facility, collectively |

CWA | U.S. Clean Water Act |

Deferred Cash Consideration | The deferred payment to be made in cash to the Selling Equityholders pursuant to the Merger Agreement, where such deferred cash payments will generally be in an amount equal to the Company’s prevailing stock price at the time that the Company pays such deferred cash payments multiplied by the number of Excess Shares or as otherwise set forth in the Merger Agreement |

DHS | U.S. Department of Homeland Security |

Director Founder Shares | The 30,000 original Founders Shares transferred to the Company’s prior independent directors |

Distribution Business | The global distribution business purchased by the Predecessor from Ashland |

DTSC | California Department of Toxic Substances Control |

EBITDA | Earnings before interest, tax, depreciation and amortization |

EMEA | Europe, Middle East and Africa |

EPA | U. S. Environmental Protection Agency |

EPCRA | U.S. Emergency Planning and Community Right-To-Know Act |

ii

EPS | Earnings or loss per share |

ERP | Enterprise resource planning |

Excess Shares | The 5,178,642 shares of Company common stock used to calculate the Deferred Cash Consideration payable to the Selling Equityholders pursuant to the Merger Agreement |

Exchange Act | U.S. Securities Exchange Act of 1934, as amended |

FASB | Financial Accounting Standards Board |

FCPA | U.S. Foreign Corrupt Practices Act |

FHMTL | U.S. Federal Hazardous Material Transportation Law |

FILO Tranche | $30.0 million tranche within the ABL Facility for non-Canadian foreign subsidiaries to issue loans and letters of credit |

FPA | First Pacific Advisors, LLC |

Founder Shares | The 12,506,250 shares of Company common stock issued to the Sponsor at the time of the IPO |

GDP | Gross domestic product |

Holdings | Nexeo Solutions Holdings, LLC |

HMR | U.S. Hazardous Materials Regulations |

IPO | The initial public offering of WLRH, consummated on June 11, 2014 |

Merger Agreement | Agreement and Plan of Merger, as amended, by and among WLRH, Blocker Merger Sub, Company Merger Sub, Holdings, Blocker, and New Holdco dated as of March 21, 2016 |

Mergers | The Company Merger and the Blocker Merger, collectively |

Montgomery Lease | The Company’s leased facility in Montgomery, Illinois commencing in the first fiscal quarter of 2017 |

NASDAQ | NASDAQ Stock Market |

New Holdco | Nexeo Holdco, LLC |

Nexeo Plaschem | Nexeo Plaschem (Shanghai) Co., Ltd., a wholly-owned subsidiary of the Company |

NLRB | U.S. National Labor Relations Board |

Notes | 8.375% Senior Subordinated Notes of the Predecessor due 2018 |

OSH Act | U.S. Occupational Safety and Health Act of 1970 |

OSHA | U.S. Occupational Safety and Health Administration which administers the OSH Act |

Other Retained Remediation Liabilities | Under the ADA Purchase Agreement, Ashland agreed to retain environmental remediation liabilities unknown at the closing of the Ashland Distribution Acquisition related to the Distribution Business for which Ashland receives notice prior to the fifth anniversary of the closing of the ADA Purchase Agreement |

Performance-Based Units | Units within the Predecessor Equity Plan that vest in accordance with a performance-based schedule |

Peso | Mexican peso |

Predecessor | Holdings and its subsidiaries for the periods prior to the Closing Date |

Predecessor ABL Facility | Holdings asset-based credit facility which was terminated in connection with the Business Combination |

Predecessor Credit Facilities | Predecessor ABL Facility and Predecessor Term Loan Facility, collectively |

Predecessor Equity Plan | Predecessor restricted equity plan |

Predecessor Term Loan Facility | Holdings’ senior secured term loan credit facility which was terminated in connection with the Business Combination |

PSLRA | U.S. Private Securities Litigation Reform Act of 1995 |

PSU | Performance share unit issued under the 2016 LTIP |

RCRA | U.S. Resource Conservation and Recovery Act |

Retained Remediation Liabilities | Under the ADA Purchase Agreement, collectively, the Retained Specified Remediation Liabilities and the Other Retained Remediation Liabilities |

Retained Specified Remediation Liabilities | Under the ADA Purchase Agreement, Ashland agreed to retain all known environmental remediation liabilities as of the date of closing of the ADA Purchase Agreement |

RMB | Chinese renminbi |

iii

RSU | Restricted stock unit issued under the 2016 LTIP |

Ryder | Ryder Truck Rental, Inc. |

Ryder Lease | Lease Agreement entered into by and between the Predecessor and Ryder in May 2015 for certain transportation equipment with payments of approximately $35.0 million over seven year term. |

SAFE | People’s Republic of China State Administration of Foreign Exchange |

SEC | U.S. Securities and Exchange Commission |

Secured Net Leverage Ratio | The ratio of Consolidated Total Indebtedness divided by EBITDA (terms as defined in the Term Loan Facility agreement) |

Securities Act | U.S. Securities Act of 1933, as amended |

Selling Equityholders | The holders of equity interests in Holdings (other than Blocker) and the holders of equity interests in Blocker, in each case, as of the time immediately prior to the Business Combination |

Solutions | Nexeo Solutions, LLC |

Sponsor | WL Ross Sponsor LLC, the sponsor entity of WLRH prior to the Business Combination. |

Sub Holding | Nexeo Solutions Sub Holding Corp. |

Term Loan Facility | Term loan credit facility pursuant to that certain credit agreement by and among Holdings, Solutions, Sub Holding, Bank of America, N.A., as administrative and collateral agent, the other agents party thereto and the lenders party thereto |

Time-Based Units | Units within the Predecessor’s Equity Plan |

TLB Amendment No. 1 | The amendment to the Term Loan Facility dated March 22, 2017 |

TPG | TPG Capital, L.P. together with its affiliates, including TPG Accolade |

TPG Accolade | TPG Accolade, L.P. |

TPG Restricted Stock Grants | Restricted stock agreements entered into between TPG and certain of the Company’s officers and employees |

TRA | The Tax Receivable Agreement entered into in connection with the Business Combination, by and between the Company and the Selling Equityholders, dated as of June 9, 2016 |

TSCA | U.S. Toxic Substances Control Act |

U.K. | The United Kingdom |

Ultra Chem Acquisition | The April 3, 2017 acquisition of the equity interests of the Mexico City, Mexico based chemicals distribution business of the Ultra Chem Group pursuant to the Ultra Chem Stock Purchase Agreement |

Ultra Chem Closing Date | April 3, 2017 |

Ultra Chem Group | The Mexico City, Mexico based chemicals distribution business of Ultra Chem, S. de R.L. de C.V. and its related entities |

Ultra Chem Stock Purchase Agreement | The Stock Purchase Agreement dated March 9, 2017 related to the purchase of the equity interests of Ultra Chem Group |

U.S. | United States of America |

USD | U.S. Dollar |

U.S. GAAP | U.S. Generally accepted accounting principles |

U.S. Tranche | U.S. Tranche of the ABL Facility |

WLRH | WL Ross Holding Corp. |

iv

Unless the context otherwise requires, the financial information presented in this Annual Report on Form 10-K (this "Form 10-K") is the financial information of the Company on a consolidated basis together with its subsidiaries.

The terms "the Company," "us," "our" and "we" and similar terms in this Annual Report on Form 10-K refer to Nexeo Solutions, Inc. and its consolidated subsidiaries.

TRADEMARKS AND TRADE NAMES

We own or have rights to various trademarks, service marks, and trade names that we use in connection with the operation of our business. This Form 10-K may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Third party trademarks, services marks, trade names or products used or displayed in this Form 10-K belong to the holders and are not intended to, and do not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this Form 10-K may appear without the ®, TM or SM symbols, but omission of these references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our right or the right of the applicable licensor to these trademarks, service marks and trade names.

v

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information and statements contained in this Annual Report on Form 10-K are forward-looking statements within the meaning of the PSLRA codified in Section 27A of the Securities Act, and Section 21E of the Exchange Act, as amended. This statement is included for purposes of complying with the safe harbor provisions of the PSLRA. Forward-looking statements include statements regarding our expectations, beliefs, intentions, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are other than statements of historical facts. These statements may be identified, without limitation, by the use of forward-looking terminology such as "anticipate," "assume," "believe," "estimate," "expect," "intend," "plan," "project," "may," "will," "could," "would" and similar expressions. Certain forward-looking statements are included in this Annual Report on Form 10-K, principally in the sections captioned "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations."

These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Unless otherwise indicated or the context otherwise requires, comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our and our Predecessor’s historical experience and our present expectations or projections.

Our future results will depend upon various other risks and uncertainties, including those described in "Item 1A. Risk Factors." Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We undertake no obligation to update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement.

vi

PART I

Item 1. Business

Company Overview

We are a global chemicals distributor in North America and Asia and a global plastics distributor in North America, EMEA and Asia. In connection with the distribution of chemicals products, we provide value-added services such as custom blending, packaging and re-packaging, private-label manufacturing and product testing in the form of chemical analysis, product performance analysis and product development. We also provide on-site and off-site environmental services, including waste collection, recovery, disposal services and recycling in North America, primarily the U.S., through our Environmental Services line of business. During fiscal year 2017, we distributed over 24,000 products in more than 80 countries for approximately 1,400 suppliers to approximately 28,100 customers.

We have long-standing relationships with major chemicals and plastics producers and suppliers, a strong geographic presence and supply chain network and a balanced customer base that benefits from the service and distribution value we provide. The products we distribute are used in various end markets and customer segments within a broad cross section of manufacturing industries, including the household, industrial and institutional, lubricants, performance coatings (including architectural coatings, adhesives, sealants and elastomers), automotive, healthcare, personal care, oil and gas and construction end markets.

Our diverse array of product offerings allows us to provide many of our customers with a one-stop-shop resource for their chemicals and plastics needs. For customers with multiple locations, our centralized business model helps ensure consistency of product offerings and a single point of contact. Our services and broad product offerings allow for product customization, cost savings to customers on transaction and transportation costs and reliance on a single supplier to source all of a customer's diverse product requirements.

We believe we provide a compelling value proposition to suppliers as a single bulk buyer of their products and acting as an extension of their sales force by representing their brands and providing technical support to customers. Our deep understanding of key end markets presents suppliers with additional market reach and penetration opportunities, while our operating platform supports supplier visibility into the marketing and distribution of their products. We also believe we provide value to suppliers by distributing to larger customers through dedicated strategic accounts sales and marketing programs designed to solidify key relationships through enhanced customer service, efficient delivery and specialized value-added solutions. In addition to the value-added services mentioned above, we also provide dedicated stocking programs, vendor-managed inventory, quarterly customer demand forecasting, technical support and supply chain services.

We have an experienced management team with deep knowledge of the industry. We continue to implement strategies and invest to build upon our strengths by creating industry-leading marketing capabilities, including our focus on specific end markets, sales force effectiveness tools, market-based pricing and geographic expansion.

We distribute our product portfolio through a global supply chain consisting of approximately 180 owned, leased or third party warehouses, rail terminals and tank terminals with a private fleet of approximately 1,100 units, including tractors and trailers, primarily in North America. We currently employ approximately 2,640 employees globally. At September 30, 2017, we had approximately 500 sales professionals in North America, EMEA and Asia, including technical support, field managers and strategic account managers who assist our customers in the selection and application of commodity and specialty products for their end products and processes.

1

Company History

We were formed as a Delaware corporation on March 24, 2014, under the name WL Ross Holding Corp., as a special purpose acquisition company for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. We completed our IPO in June 2014, raising approximately $500.0 million in cash proceeds. We neither engaged in any operations nor generated any revenue prior to the Business Combination.

We acquired the business of Nexeo Solutions Holdings, LLC on June 9, 2016 through the Business Combination. In connection with the closing of the Business Combination, we changed our name from "WL Ross Holding Corp." to "Nexeo Solutions, Inc." and changed our ticker symbol for our common stock on NASDAQ from "WLRH" to "NXEO".

See Note 3 to our consolidated financial statements for further discussion on the Business Combination.

Industry Overview

The global market for industrial materials encompasses the products we offer. This market contains both products distributed directly to customers by suppliers and indirectly by distribution channel partners. Indirect distribution channel partners, like us, serve as intermediaries between suppliers and customers representing an additional step in the distribution supply chain. Suppliers leverage their distribution partners to administer the complexity of servicing the small and mid-size customer base while providing needed technical product expertise. The total available market of distribution is driven by macroeconomic factors, as well as suppliers’ decisions to either serve markets or customers directly or use a distribution partner. By creating and executing superior distribution services and related capabilities, we hope to influence the decision of suppliers to increase the magnitude of business being served by us as a distribution partner in the global market.

The chemicals and plastics materials distribution industry is characterized by increasingly complex regulatory, environmental and safety landscapes, the need for market intelligence that requires time and effort to develop and, in some cases, significant capital investments for transportation and storage infrastructure. Adding to the complexity of this business environment is the increasing demand by end customers for individualized solutions. These solutions are generally comprised of essential products and value-added services including blending, packaging and other special handling and special logistics requirements such as 24/7 delivery. We believe our ability to serve these complex needs as a result of our capabilities and scale will encourage suppliers to further leverage distributors like us.

2

Company Operations

Business Strategy

We strive to become a brand extension partner for key suppliers, provide best-in-class service, and align our sales force expertise with our customers' needs. Our value proposition focuses on supplier needs and direct customer activities. We have established four main strategies that drive our formula for success.

Go-To-Market Strategy. We aspire to use our technical capabilities, expertise and experience to commercially align with supplier strategies to operate as a brand extension while leveraging tools and systems to drive long-term loyalty through trust and transparency. Our sales force drives our customer-focused growth by utilizing technical expertise. The customer's journey is enhanced with a customized interface tailored for each customer's individual needs.

Profitability Growth & Margin Expansion. We seek to form strategic partnerships by leveraging foundational capabilities to demonstrate value propositions. We plan to optimize our portfolio by eliminating low profit business, expanding specialty product mix and executing ongoing productivity initiatives. To supplement growth, we plan to pursue accretive bolt-on acquisitions of product lines and businesses complementary to our current offerings.

Operational Excellence. We are committed to continued operational excellence by broadening our value-added service capabilities and delivering best-in-class service through a culture of continuous improvement. We focus on pricing strategies to optimize profit and efficient cash utilization through fully integrated purchasing and global enterprise cash management. Our commitment to high quality service is demonstrated by dedicated customer service representatives, Company-owned warehouses, a private fleet having an on-time delivery percentage of 99.1% and sophisticated inventory management practices.

Driving Scale & Fostering Innovation. We benefit from data-driven decision making and focus on scalable, long-term growth drivers. We continuously drive synergies by leveraging our centralized platform.

Competitive Strengths

We operate in a competitive industry and strive to differentiate ourselves from our competition by providing true end-to-end solutions, which requires using the right combination of integrated services that have the capacity and sophistication to serve larger customers while maintaining enough versatility to serve smaller customers. We believe our strengths include the following:

• | Centralized, scalable technology platform that allows us to efficiently manage the inherent complexity of our business and supports value creation by unlocking scale and scope efficiencies from both organic growth and strategic acquisitions; |

• | Exceptional distribution network with strategically located facilities optimizing route density; and |

• | Extensive product knowledge and end market expertise allowing us to act as an extension of our suppliers while providing application-based, value-added services to our customers. |

Segment Overview

We operate through three lines of business, or operating segments: Chemicals, Plastics and Environmental Services. Our lines of business market to different sets of customers operating in an array of different industries, with various end markets and customer segments within those industries. For segment presentation and disclosure purposes, our Chemicals and Plastics lines of business constitute separate reportable segments, while our Environmental Services line of business, which does not meet the materiality threshold for separate disclosure, is included in an "Other" category.

Chemicals. Our Chemicals line of business distributes specialty and industrial chemicals, additives and solvents to industrial users via railcars, barges and bulk tanker trucks and as packaged goods in trucks. Our chemicals products are distributed in more than 50 countries worldwide, primarily in North America and Asia. In connection with the distribution of chemicals products, we provide value-added services such as custom blending, packaging and re-packaging, private-label manufacturing and product testing in the form of chemical analysis, product performance analysis and product development. While our Chemicals line of business serves multiple end markets, the key end markets within the industrial space are household, industrial and institutional, performance coatings (including architectural coatings, adhesives, sealants and elastomers), lubricants, oil and gas and personal care.

3

Plastics. Our Plastics line of business distributes a broad product line consisting of commodity polymer products and prime engineering resins to plastics processors engaged in blow molding, extrusion, injection molding and rotation molding via railcars, bulk trucks, truckload boxes and mixed truckloads, or less-than-truckload quantities. We distribute plastics products in more than 50 countries worldwide, primarily in North America, EMEA and Asia. Our Plastics line of business serves a broad cross section of industrial segments with a current focus on the automotive and healthcare end markets.

Environmental Services. Our Environmental Services line of business, in connection with certain waste disposal service companies, provides customers with comprehensive on-site and off-site hazardous and non-hazardous waste collection, recovery, disposal services or recycling in North America, primarily in the U.S. These environmental services are offered through our network of distribution facilities used as transfer facilities and through a staff of dedicated on-site waste professionals. Our Environmental Services line of business serves multiple end markets such as aerospace and defense, automotive, chemical manufacturing, industrial manufacturing and oil and gas.

The table below provides a summary by line of business of the approximate number of customers served and key product offerings as of September 30, 2017:

Chemicals | Plastics | Environmental Services | |||

Approximate Customers: 14,200(1) | Approximate Customers: 11,700(1) | Approximate Customers: 2,200(1) | |||

Key Products | ž Alcohols ž Blends ž Esters ž Glycols ž Hydrocarbons ž Ketones ž Resins ž Silicones ž Surfactants | ž Engineered Thermoplastics ž Polyolefins (including Polypropylene) ž Specialty Thermoplastics ž Styrenics | ž On-Site Services ž Non-Hazardous and Hazardous Waste Disposal ž Non-Hazardous Waste Treatment/Recycling | ||

(1) Customer duplication between lines of business is immaterial | |||||

In each of the past three fiscal years, polypropylene was the only product that accounted for over 10.0% of our consolidated net revenue. During the fiscal years ended September 30, 2017 and 2016, polypropylene accounted for 15.5% and 17.6%, respectively, of total consolidated net revenue. For the period from October 1, 2015 through June 8, 2016 and the fiscal year ended September 30, 2015, polypropylene accounted for 17.7% and 14.4%, respectively, of the Predecessor total consolidated net revenue.

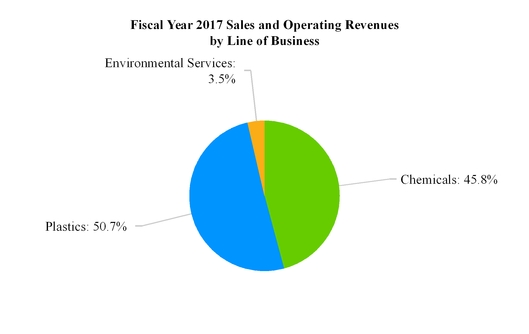

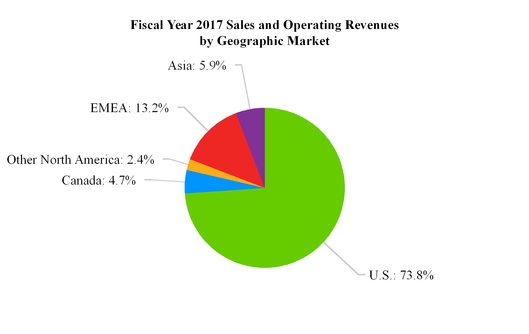

The charts below provide a summary of the proportional revenue contributions from our lines of business and our primary geographic markets during the fiscal year ended September 30, 2017, based on the jurisdiction of the subsidiary entity receiving revenue credit for the sale. It was not practical to provide a summary of the revenue contributions of our primary geographic markets based on external customer location. The substantial majority of our sales to customers in the geographic markets described below are made by entities located within the applicable geographic market.

4

Our lines of business generally leverage the same infrastructure, distribution networks, information technology and operational processes, but are differentiated by the products they distribute, their geographic footprints and their distinct customer and supplier relationships. See Note 16 to our consolidated financial statements for additional financial information with respect to our reportable segments.

5

Supplier Relationships

We source chemicals and plastics from a wide array of suppliers, including many leading global chemicals and plastics producers. We generally purchase and take possession of these products and then resell and deliver them to our customers. While our top ten suppliers generally fulfill approximately 50% of total product procured by value on an annual basis, we source products from approximately 1,400 suppliers. Two suppliers accounted for 12.1% and 9.9%, respectively, of consolidated purchases during the fiscal year ended September 30, 2017, and 11.9% and 10.4%, respectively, for the fiscal year ended September 30, 2016. Two suppliers accounted for 12.0% and 9.8%, respectively, for the period from October 1, 2015 through June 8, 2016 for the Predecessor consolidated purchases. During the fiscal year ended September 30, 2015 one of these suppliers accounted for 11.9% of the Predecessor consolidated purchases. Although this supplier serves both our Plastics and Chemicals lines of business, they primarily serve the Plastics line of business.

We maintain multiple sourcing options for most key products that we distribute to help ensure supply continuity and competitive pricing for our customers. We believe the depth of our supplier base ensures that we are able to satisfy the needs of all of our customers in all of our key geographic regions.

Our Chemicals and Plastics lines of business generally source products from distinct sets of suppliers.

• | Chemicals. We source chemicals from many suppliers, including several of the largest global chemical companies such as BASF, DowDuPont, Dow Corning, Eastman Chemical, LyondellBasell and Methanex. Our ten largest suppliers generally account for approximately 50% by value of the chemical products procured on an annual basis. |

• | Plastics. Our plastics suppliers include several of the largest global chemical companies and plastics producers, such as BASF, Borealis, ExxonMobil Chemical Co., LyondellBasell and SABIC. Our ten largest suppliers generally account for approximately 80% by value of the plastics products procured on an annual basis. |

In developing our supplier relationships, we evaluate prospective suppliers to determine the value they offer to the supply chain. We focus on suppliers that manufacture products utilized within the end markets we serve and provide opportunities that maintain healthy demand. Our key suppliers must also demonstrate a proven track record of reliability and commitment to invest in their businesses, as well as product price leadership.

We believe we provide value to suppliers in numerous ways, including the following:

• | We serve as an aggregator of customer demand, enabling us to act as a single bulk buyer of our suppliers’ products; |

• | We act as an extension of suppliers’ sales force by representing their brands and providing technical support to customers, particularly those that are small and mid-sized, as well as larger customers through our strategic accounts program; |

• | We develop compelling value propositions in various end markets by providing core commodity products, core specialty products and value-added services to target certain customer segments we believe can generate sustainable and profitable revenue growth; |

• | We provide quarterly customer demand forecasting and visibility into the marketing and distribution of the suppliers’ products; and |

• | We have leading pricing technology to capture maximum value for our suppliers' brands in the marketplace. |

Product Line Management and Purchasing

Our supplier relationships are managed by separate product management teams within our Chemicals and Plastics lines of business. These teams focus on developing and maintaining supplier relationships, monitoring existing product lines and trends, and analyzing potential new products. Product management teams work in close coordination with our sales and marketing teams, allowing them to quickly and effectively identify customer buying and demand trends.

Our purchasing department is generally responsible for executing purchase orders to suppliers through our ERP system. For the majority of our operations, this system provides a centralized control platform throughout the entire supply chain, enabling the purchasing department to optimize procurement decisions. See "—Proprietary Operating Systems" below.

6

Contracts

Our supply agreements allow flexibility, to help ensure product availability and our ability to set the specific terms of any purchase in accordance with prevailing market conditions. The agreements include commonly expected general terms and conditions such as volume expectations, pricing, price change mechanisms and guidelines for conflict resolution. Many of the agreements with key suppliers also provide for rebates upon achievement of specified volume purchase levels. Purchase prices are generally market-based and fluctuate in accordance with the costs of the relevant raw materials. We do not usually enter into contracts that are non-terminable, are "take or pay" or have other similar requirements.

Global Distribution Channels

We are organized around the philosophy that key operating processes, such as demand forecasting, purchasing and supplier selection, can be optimized for cost and efficiency when concentrated in a centralized business model. Accordingly, we operate our distribution network under a "hub-and-spoke" model by processing large volumes of inventory at our main regional hubs and shipping them to smaller local warehouses on a demand-driven basis from where they are delivered to customers. Products are transported to smaller customers in mixed truckloads or less-than-truckload quantities.

Facilities

Our facilities are strategically placed to optimize route density in an effort to balance high-quality customer service with execution costs. In North America, we operate several "hub-and-spoke" models as described above. We believe this model is beneficial, as it enables us to efficiently aggregate customer demand, and allows us to match a large number of suppliers and customers at a lower cost. This system also supports economies of scale, which is a key driver of our profitability, as the aggregation of inventory at the "hubs" reduces inventory procurement costs and permits fleet optimization and efficient route planning through shipment consolidation and frequent deliveries to the "spokes." During fiscal year 2017, these facilities served approximately 21,300 customers.

In EMEA, our international plastics business operates through 25 third party operated warehouses and eight sales offices. These warehouses are located across EMEA, and during fiscal year 2017 they served approximately 4,700 customers.

In Asia, our international chemicals and plastics businesses operate through 17 third party operated warehouses and eight sales offices. These warehouses are located in China and served approximately 1,900 customers during fiscal year 2017.

The following table lists each of the active distribution facilities we own or lease and does not include third party operated facilities. We classify a facility as a "bulk facility" if it is engaged in delivering goods in bulk to our customers.

Distribution Facilities as of September 30, 2017

North American Facilities | Facility Type | Owned/Leased | Line(s) of Business | |||

Birmingham, Alabama | Bulk/Warehouse | Owned | All | |||

Mobile, Alabama | Bulk/Warehouse | Owned | All | |||

Edmonton, Alberta | Bulk/Warehouse | Owned | All | |||

Chandler, Arizona | Bulk/Warehouse | Owned | All | |||

Richmond, British Columbia | Warehouse | Leased | All | |||

Carson, California (1) | Bulk/Warehouse | Leased | All | |||

Fairfield, California | Bulk/Warehouse | Owned/Leased | All | |||

Denver, Colorado | Bulk/Warehouse | Owned | All | |||

Miami, Florida | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Tampa, Florida | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Doraville, Georgia | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Cropa, Guatemala | Warehouse | Leased | Chemicals | |||

Montgomery, Illinois | Bulk/Warehouse | Leased | Chemicals and Plastics | |||

Willow Springs, Illinois | Bulk/Warehouse | Owned | All | |||

Kansas City, Kansas | Bulk/Warehouse | Owned | All | |||

Kansas City, Kansas | Bulk/Warehouse | Leased | Plastics | |||

7

Baton Rouge, Louisiana | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Baton Rouge, Louisiana | Warehouse | Owned | Chemicals and Plastics | |||

Winnipeg, Manitoba | Warehouse | Owned | All | |||

Tewksbury, Massachusetts | Warehouse | Owned | Chemicals and Plastics | |||

Guadalajara, Mexico | Warehouse | Leased | Chemicals | |||

Merida, Mexico | Warehouse | Leased | Chemicals | |||

Nuevo Leon, Mexico | Warehouse | Leased | Chemicals | |||

Tepotzotlán, Mexico | Warehouse | Leased | Chemicals and Plastics | |||

Tepotzotlán, Mexico | Warehouse | Leased | Chemicals | |||

Querétaro, Mexico | Warehouse | Leased | Chemicals | |||

Lansing, Michigan | Bulk/Warehouse | Owned | All | |||

Warren, Michigan | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Saint Paul, Minnesota | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Shakopee, Minnesota | Bulk/Warehouse | Owned | All | |||

St. Louis, Missouri | Bulk/Warehouse | Owned | All | |||

St. Louis, Missouri | Warehouse | Leased | Chemicals and Plastics | |||

Carteret, New Jersey | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Charlotte, North Carolina | Bulk/Warehouse | Owned | All | |||

Binghamton, New York | Warehouse | Owned | Plastics and Environmental Services | |||

Tonawanda, New York | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Columbus, Ohio | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Dayton, Ohio | Warehouse | Owned | Plastics and Environmental Services | |||

Evendale, Ohio | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Grove City, Ohio | Bulk/Warehouse | Owned | Plastics | |||

Twinsburg, Ohio | Bulk/Warehouse | Owned | Chemicals | |||

Twinsburg, Ohio | Warehouse | Leased | Chemicals and Plastics | |||

Tulsa, Oklahoma | Warehouse | Owned | Chemicals and Plastics | |||

Mississauga, Ontario | Bulk/Warehouse | Leased | All | |||

Morrisville, Pennsylvania | Bulk/Warehouse | Owned | All | |||

Catano, Puerto Rico | Warehouse | Owned | All | |||

Anderson, South Carolina | Bulk/Warehouse | Owned | Plastics | |||

Columbia, South Carolina | Bulk/Warehouse | Owned | All | |||

Knoxville, Tennessee | Bulk/Warehouse | Owned | All | |||

Memphis, Tennessee | Bulk/Warehouse | Owned | All | |||

Nashville, Tennessee | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Conroe, Texas | Bulk/Warehouse | Owned | Chemicals and Plastics | |||

Garland, Texas | Bulk/Warehouse | Owned | All | |||

Houston, Texas | Bulk/Warehouse | Owned | All | |||

Midland, Texas | Bulk/Warehouse | Owned | All | |||

Clearfield, Utah | Bulk/Warehouse | Leased | All | |||

(1) During fiscal year 2018, we plan to acquire the land currently being leased.

Our principal executive offices are located in The Woodlands, Texas. We believe that our facilities are adequate for our current operations.

8

Private Fleet

Transportation of products to and from customers and suppliers is a fundamental component of our business. During fiscal year 2017, our North American distribution service relied on our private fleet of trucks, tankers and trailers for 66% of volume delivered from our warehouses to our customers. We relied on common carriers for the remainder of our deliveries.

At September 30, 2017, our private fleet consisted of approximately 1,100 owned and leased units that carry solid, bulk and liquid materials.

Private Fleet Characteristics as of September 30, 2017

Vehicle Type | Number of Vehicles | Average Age (years) | Average Transport Capacity (lbs.) | ||||||

Tractors | 353 | 3 | 45,000 | ||||||

Bulk Liquid Tankers | 336 | 18 | 42,000 | ||||||

Van Trailers | 350 | 11 | 45,000 | ||||||

Straight Trucks | 10 | 5 | 6,500 | ||||||

Dry Bulk Trailers | 13 | 11 | 45,000 | ||||||

In addition, we currently lease approximately 400 railcars, which are primarily used for supplier shipments to our locations, stock transfers between our locations and occasional shipments to customers.

Our private fleet characteristics change constantly based on our market needs. We believe that we maintain an advantage over many of our competitors with our private fleet enterprise wide on-time delivery percentage of 99.1%. Our private fleet permits us to meet our customers’ demand and reduces their inventory risk through "just-in-time" delivery. Moreover, our ability to service our customers is less encumbered by the commercial transportation market providing reliability of service to customers, especially during periods of undersupply.

Direct Supply

In certain circumstances, we deliver full truckloads or large quantities of commodity products directly from a supplier to a customer, primarily via common carrier, and provide sourcing and supply chain support in connection with the delivery. Although the products move directly from supplier to customer, we remain the sole point of contact for both the customer and the supplier and generally take ownership of the products while in transit, bearing the risk of loss during transportation. Direct supply sales accounted for 15.9% of sales for the fiscal year ended September 30, 2017.

Sales and Marketing

For the fiscal year ended September 30, 2017, we served approximately 28,100 customers from a broad range of end markets resulting in approximately 480,000 orders for over 24,000 products. We have developed a sales and marketing organization with a broad scope of sales coverage to ensure we can service a diverse customer base.

As of September 30, 2017, our sales team consisted of approximately 500 sales professionals situated throughout North America, EMEA and Asia, including customer-facing personnel, such as technical support and corporate account managers, located in local markets. There are approximately 390 sales professionals based in North America, while approximately 60 sales professionals are based in EMEA and 50 sales professionals are based in Asia.

Our sales force compensation and incentive structure is designed to ensure alignment between the goals of the sales representatives and those of our overall business. All sales representatives earn a fixed base salary and variable rewards based on performance. We believe sales force compensation alignment is a key driver for the success of our business.

9

Customer Pricing Processes

We use data-driven pricing strategies, which enable our product managers to determine product pricing through the use of systems and tools that provide insight on relative market pricing across a number of factors including end markets, geography, packaging type and volume. Product managers, whose main responsibility is to cultivate and build supplier relationships, also develop a broad understanding of suppliers’ product offerings and the market’s needs. We have empowered these managers to make pricing decisions, working closely with our sales team to structure pricing for an optimal balance of price and volume to maximize profitability. The following is a description of our customers by line of business:

• | Chemicals. Our Chemicals customer base ranges from some of the largest global companies to smaller regional, private companies. Generally, no single Chemicals customer accounts for more than 5.0% of Chemicals sales, annually, while the five largest customers by value represent less than 10.0% of Chemicals sales on an annual basis. |

• | Plastics. Our Plastics customer base is diverse and serves a variety of end markets. Generally, no single Plastics customer accounts for more than 5.0% of Plastics sales, annually, while the five largest customers by value represent less than 5.0% of Plastics sales on an annual basis. |

• | Environmental Services. Our Environmental Services line of business includes customers who generate hazardous and non-hazardous waste in North America. One Environmental Services customer accounts for more than 5.0% but less than 10.0% of Environmental Services sales, annually, while the five largest customers generally account for less than 25.0% of Environmental Services sales on an annual basis. |

Contracts

Our customer contracts for the sale of chemicals and plastics products are generally framework agreements that do not contain an obligation to buy or sell. We use the agreements to define the general terms and conditions of sale and set volume expectations, pricing and price change mechanisms. The final terms of sale for each purchase are negotiated at the time of sale unless otherwise established by the terms of the contract. Consistent with industry standards, we may offer volume-based incentives to large customers if the customer purchases a specified volume with us over a specified time period. Our customer contracts for the provision of environmental services are generally framework agreements pursuant to which we provide environmental services from time to time, with fees agreed at the time the service is provided. These contracts are generally terminable by either party with or without cause upon 30 days’ notice. Additionally, our on-site environmental services contracts are typically term-based arrangements, with fee structures negotiated at the time of execution.

Value-Added Services

In addition to our products, we provide a range of value-added services, including mixing and blending to specific customer requirements, lab testing and analysis, formulating, repackaging from large to small quantities, vendor inventory management and technical support. We continue to seek opportunities to profitably expand our value-added services to differentiate our value proposition and create competitive advantages.

Three key services we offer are repackaging, custom blending and lab services. Our hub facilities handle large quantities of materials, usually receiving shipments by railcar or tank truck. Bulk deliveries are often repackaged into smaller containers, such as gaylords, totes and drums, which are in turn delivered to customers by truck. Our custom blending capabilities include buying in bulk from our large base of suppliers, lab testing for product customization and blending of numerous products to meet customer specifications. Our labs provide product testing services to our customers in the form of chemical analysis and product performance analysis. We employ a team of scientists and experienced formulation experts to help customers with product development, failure analysis and other technical support in a broad range of chemical and product applications.

10

Proprietary Operating Systems

We have developed a highly scalable technology platform with a centralized system and robust data analytics. These highly sophisticated systems enhance operational flexibility and facilitate the volume of customer orders, global sourcing, customer relations, distribution-related logistics, regulatory compliance, risk management controls and financial reporting. The operating platform consists of our transportation management system, pricing system, digital marketing, customer portal and ERP system. Our ERP system is used across the Company, with the exception of our subsidiary in China and the operations recently acquired in the Ultra Chem Acquisition, which will be integrated into our ERP system during fiscal year 2018. The advanced data gathering and analysis capabilities of our ERP system, and the efficiencies it provides, enable us to operate flexibly and create significant advantages across the supply chain. Our ERP system also provides advanced volume forecasting, enabling us to forecast rolling weekly volumes, anticipate demand shift fluctuations and quickly respond to rapidly changing customer needs. This capability helps our suppliers by providing reliable and accurate demand forecasts that result in improved efficiency, flexibility and faster execution. These daily forecasts also translate into better pricing as they allow for optimization of production schedules. We believe that continuous automation implementation drives operational excellence and productivity.

Seasonality

Seasonal changes may affect our business and results of operations. We serve a large number of customers in a broad range of end markets and our business trends follow the seasonality patterns exhibited by these end markets and customers. For example, we generally tend to realize lower sales across all of our lines of business in the fourth calendar quarter of each year (which is our first fiscal quarter) because industrial production tends to be seasonally lower during that period. Our business may also be affected by our suppliers’ decisions regarding seasonal capacity and production.

Competition

The chemicals and plastics distribution markets in which we operate are highly fragmented. The primary competitive factors affecting each of our lines of business are the diversity and quality of the product portfolio, service offerings, reliability of services and supply, technical support and price and delivery capabilities. In addition, producers represent another source of competition, as many elect to distribute products through direct sales as opposed to indirect distributors. For some of the markets in which we operate, if large chemical producers elect to limit or consolidate their outsourcing of distribution, partner with other distributors, or distribute their products directly to end-user customers, competition would increase. Additionally, competition could increase from producers reducing their level of distribution outsourcing to maintain profit margin during periods of poor macroeconomic factors and pricing weakness, particularly for commodity products that require nominal service complexity to the end-user customer. We believe that our reputation, our broad range of product offerings and our speed and responsiveness, coupled with our valued-added services and the breadth of our distribution network, allow us to compete effectively and achieve scale benefits.

Chemicals

Our principal Chemicals distribution competitors include Azelis, Brenntag AG, Helm, ICC Chemicals, IMCD and Univar Inc. Additionally, our Chemicals line of business competes with many regional and local companies throughout North America as well as a number of smaller companies in certain niche markets.

Plastics

Our primary Plastics distribution competitors in North America are Channel Prime Alliance, Entec Polymers, M. Holland Company and PolyOne Distribution. Our primary Plastics competitors in EMEA are A. Schulman, Albis, Biesterfeld, Distrupol and two divisions of Ravago: Resinex and Ultrapolymers. Our primary Plastics competitors in Asia are KDF, Nagase and Sinochem.

Environmental Services

The primary competitors of our Environmental Services line of business are Clean Harbors, Univar Inc. and Veolia.

11

Employees

At September 30, 2017, we had approximately 2,640 employees worldwide, with approximately 2,070 employees in the U.S., 100 employees in Canada, 180 employees in EMEA, 130 employees in Asia, and 160 employees in Latin America. In the U.S., approximately 140 of our employees are represented by unions in six locations representing seven bargaining units, five of which are affiliated with the International Brotherhood of Teamsters and two of which are affiliated with the United Steelworkers.

Regulatory Matters

We are subject to extensive regulation by federal, state and local governments and similar international agencies relating to the sale and distribution of our products. These regulations govern the use, labeling, packaging, transportation, storage and distribution of chemicals and hazardous substances. We are also subject to domestic and international import, export and customs regulations, and statutes and regulations relating to government contracting. In addition, we are subject to extensive environmental laws and other regulations concerning, among other things, emissions to the air, discharges to land, and water and the generation, handling, storage, transportation and disposal of non-hazardous and hazardous waste in various federal, state, local and foreign jurisdictions, including EMEA and Asia. We are also subject to other federal, state, local and foreign laws and regulations regarding health and safety matters. Below is a summary of certain of these regulations.

Environmental

We operate in a number of domestic and foreign jurisdictions and are subject to various types of governmental regulation relating to the protection of the environment. Such regulation comes in the form of federal, state, local and foreign laws and regulations concerning such issues as the handling, storage and transportation of chemicals, release of pollutants into the air, soil and water, disposal of hazardous and non-hazardous wastes, remediation of contaminated sites, protection of workers from exposure to hazardous substances and the public disclosure of information regarding environmental hazards. Some aspects of our businesses also require us to maintain various environmental permits and licenses. We believe that we are in substantial compliance with all applicable environmental laws, regulations and permits; however, environmental compliance costs in the form of compliance with regulations, remediation obligations, capital improvements, operating expenses and/or limitations on operations can be substantial.

Many of the environmental laws and regulations affecting our operations relate to the prevention and remediation of previous impacts to air, soil or water resulting from the release of regulated materials. Past operations at some of our facilities have resulted in the contamination of soil and groundwater, some of which require remediation. Under the ADA Purchase Agreement, Ashland retained liability for known remediation obligations related to its ownership and operation of the Distribution Business before the closing date of the Ashland Distribution Acquisition and all other environmental remediation liabilities arising prior to the closing date of the Ashland Distribution Acquisition for which Ashland received notice, other than for the Retained Remediation Liabilities. Subsequent to the closing date of the Ashland Distribution Acquisition, we assumed responsibility for all newly reported contamination and are required to indemnify Ashland should Ashland incur any expense related to such newly reported contamination. We may also discover new or previously unknown contamination for which we may not be indemnified by Ashland. In those cases, and in situations where Ashland does not fulfill its indemnification obligations to us, we may be responsible for substantial remediation costs at or associated with our facilities or with the Distribution Business. See also Item 3, "Legal Proceedings".

Comprehensive Environmental Response, Compensation, and Liability Act

In the U.S., CERCLA and analogous state laws regulate the remediation of certain contaminated sites and establish liability for the release of hazardous substances and related damages to natural resources from such sites. Under CERCLA, potentially responsible parties (including waste generators, waste transporters, and parties arranging for waste disposal) are subject to strict and, in certain circumstances, joint and several liability, for the cost of remediating contaminated sites. Our Chemicals and Environmental Services lines of business conduct waste disposal activities and handle products which could subject us to CERCLA liability.

In addition, we currently indemnify some of our Environmental Services customers for liabilities related to waste disposal activities that such customers may incur under certain environmental laws, including CERCLA.

12

Resource Conservation and Recovery Act

RCRA and analogous state laws regulate the generation, transportation, treatment, storage and disposal of hazardous waste. RCRA also establishes the regulatory framework for the management of certain non-hazardous wastes. RCRA requires owners and operators of hazardous waste treatment, storage and disposal facilities to obtain a RCRA permit. These permits may include both remedial actions and operational conditions. RCRA requires owners and operators of regulated facilities to investigate and remediate hazardous waste releases and to demonstrate compliance with financial assurance requirements. The financial assurance requirements are designed to ensure that adequate financial resources exist to respond to any releases of hazardous wastes at a permitted site and to perform any necessary corrective action and permanent site closure activities. Several of our facilities are subject to RCRA permits and some are undergoing corrective action to address previous releases of regulated materials as required under their permits. While we were required to assume responsibility for corrective action at a few sites in connection with the transfer of the business from Ashland to the Predecessor, Ashland agreed to continue to perform certain known ongoing corrective actions at these sites until they are completed and to indemnify the Predecessor for any costs necessary to complete these actions. However, we retain responsibility for any RCRA violations resulting from our own operations.

Clean Air Act

CAA and analogous state laws establish a variety of programs designed to regulate the discharge of pollutants into the air. Under these laws, permits may be required before construction can commence on any new or modified source that has the potential to emit a significant amount of any regulated pollutant, such as nitrogen oxides and volatile organic compounds. Additionally, we may be required to register with state environmental agencies, monitor and report emissions, and install new or improved emission control equipment in certain situations, including for existing sources of air emissions. Furthermore, CAA may require that we obtain federal operating permits for any major sources of air pollution, which incorporate applicable pollution control requirements and require reporting and certification obligations. CAA also requires owners and operators of facilities that produce, handle, process, distribute, or store threshold quantities of chemicals to implement and update detailed risk management plans, which must be filed with and approved by the EPA. We could be required to incur additional expenditures to comply with CAA, including costs to install and operate emissions control equipment at our facilities.

Clean Water Act

The EPA regulates discharges of pollutants into waters of the U.S. through the CWA. Pursuant to the CWA, the EPA establishes wastewater standards and water quality standards for contaminants discharged into surface waters such as streams, rivers and lakes. The discharge of any regulated pollutant from point sources (such as pipes and manmade ditches) into the waters of the U.S. is prohibited without a state or federally issued discharge permit. Several of our facilities are currently subject to and must comply with CWA permit limitations on the discharge of industrial wastewater and storm water.

Toxic Substances Control Act

The TSCA authorizes the EPA to require chemical manufacturers, importers, and exporters to comply with reporting, record keeping, testing, and other requirements relating to chemical substances or mixtures. The TSCA is primarily designed to ensure that certain chemicals do not pose an unreasonable risk to human health or the environment. The TSCA Chemical Substances Inventory, which is maintained by the EPA, lists approximately 85,000 covered chemical substances. Before a chemical substance can enter interstate commerce (either through manufacture or importation), the EPA must review and approve the substance’s pre-manufacture notice. As part of that review process, the EPA may identify conditions—up to and including a ban on production—limiting the use of a chemical substance before it enters commerce. The TSCA also requires the testing of chemicals by manufacturers, importers and processors and requires those importing or exporting chemicals to comply with certification reporting and recordkeeping requirements. The TSCA also requires that any chemical distributor having information reasonably suggesting a substantial risk of injury to health or the environment notify the EPA immediately. The TSCA reform legislation enacted in June 2016 expanded the EPA's authority to review and regulate new and existing chemicals. In addition, when we import chemicals into the U.S. or export chemicals out of the U.S., we must comply with the TSCA’s import certification and export notice requirements. We must also comply with the TSCA’s various recordkeeping requirements.

13

Emergency Planning and Community Right-To-Know Act

The EPCRA requires facilities manufacturing, processing, or storing designated hazardous chemicals to report certain information about their products to state and local officials and fire departments. These reporting obligations are intended to assist state and local governments in developing emergency response plans in the case of a chemical release and to provide information to the public regarding the type and amount of toxic or hazardous chemicals stored at a particular facility. In addition, facilities releasing toxic chemicals into the environment above certain thresholds must report such releases to the EPA as part of the facilities’ "Toxics Release Inventory." Because many of our chemical distribution facilities handle hazardous chemicals, we are subject to the reporting requirements under the EPCRA.

Chemical Facility Anti-Terrorism Standards

DHS regulates the security of certain high-risk chemicals facilities through CFATS. CFATS utilizes a Chemical Security Assessment Tool to identify those chemical facilities potentially deemed "high risk." The first step is user registration, followed by the completion of a top-screen evaluation. The top-screen evaluation analyzes whether a facility stores regulated chemicals above specified thresholds. If it does, the facility must complete a Security Vulnerability Assessment, which examines the likelihood that a threat against a facility will be successful. From there, the facility must develop a Site Security Plan to respond to any identified security vulnerabilities. The Site Security Plan must address such matters as access control, personnel credentialing, recordkeeping, employee training, emergency response, testing of security equipment, reporting of security incidents and suspicious activity, and deterring, detecting and delaying potential attacks. DHS must review and approve or deny all Security Vulnerability Assessments and Site Security Plans. CFATS also requires regulated facilities to keep detailed security records and allow DHS the right to enter, inspect, and audit the property, equipment, operations and records of such facilities. Our facilities handle a number of chemical substances subject to CFATS security requirements, and thus, some of our facilities must comply with its site security requirements. Other legislative and regulatory initiatives designed to minimize the vulnerability of chemical storage and transportation assets could result in increased regulation of our industry, potentially imposing additional limitations on our operations and causing us to incur higher operating and compliance costs.

Regulation of the Transportation of Hazardous Materials

The transportation of hazardous materials is a significant part of our business and is regulated by the Department of Transportation under the FHMTL and its implementing regulations, the HMR. The HMR regulate the handling of hazardous materials, hazardous wastes, hazardous substances, and marine pollutants, and establish rules applicable to myriad aspects of the transportation process, including employee training, incident notification, labeling and placarding of shipments, shipment preparation, carriage of hazardous materials, emergency response and the development of safety and security plans. Several Department of Transportation agencies, including the Pipeline and Hazardous Materials Safety Administration, the Federal Aviation Administration, the Federal Railroad Administration, the Federal Motor Carrier Safety Administration and the U.S. Coast Guard share responsibility for enforcing the FHMTL.

Certain international standards and regulations also govern the transportation of hazardous materials shipments within, to, and from the U.S. Such regulations include the International Civil Aviation Organization’s 132 Technical Instructions for the Safe Transport of Dangerous Goods by Air, the International Maritime Dangerous Goods Code, Transport Canada’s Transportation of Dangerous Goods Regulations and the International Atomic Energy Agency Regulations for the Safe Transport of Radioactive Materials. These standards and regulations prescribe, among other things, requirements for packaging, maximum weight and handling of hazardous materials. U.S. agencies have sought to harmonize their rules with international standards and regulations, but when hazardous materials are transported to, from, and within the U.S. in accordance with one or more of these international standards or regulations, U.S. HMR requirements must still be followed.

The majority of our logistics services, including transport of hazardous materials, involve highway transportation. The Transportation Security Administration requires any driver seeking to obtain, renew, or transfer a hazardous materials endorsement on a state-issued commercial driver’s license to undergo a security threat assessment. Additionally, under the Transportation Worker Identification Credential program, workers, including truckers, requiring unescorted access to maritime facilities must be issued tamper-resistant biometric credentials to access such facilities.

14

Like environmental regulations, the regulations governing the transportation of hazardous materials are often subject to modification. For example, the Pipeline and Hazardous Materials Safety Administration recently amended the HMR to remove the packing group II designation for certain organic peroxides, self-reactive substances and explosives and revised the requirements for the packaging of nitric acid and for the testing of pressure relief devices on cargo tanks. Hazardous Materials: Miscellaneous Amendments (RRR), 81 Fed. Reg. 35,484 (June 2, 2016). Portions of the rulemaking are subject to pending administrative appeals with the agency. In addition, the Federal Railroad Administration has strengthened regulations regarding security and control over railcars that transport certain classes of flammable, combustible, or explosive liquids and gases. Compliance with new regulations on the transportation of hazardous materials could adversely affect our business by raising our compliance and operational costs.

Occupational Safety and Health Regulations

We are subject to the OSH Act, which addresses safety and health in workplace environments. In addition to the OSH Act, we are subject to applicable state occupational safety and health regulations as well as the safety and health rules of applicable jurisdictions outside of the U.S, such as the Workplace Hazardous Materials Information System in Canada.

The OSH Act is administered by OSHA, which has established maximum workplace chemical exposure levels. Manufacturers and distributors of chemicals must employ a hazard communication program utilizing labels and other forms of warnings, as well as safety data sheets, setting forth safety and hazardous materials information to employees and customers. OSHA’s Hazard Communication Standard covers both physical hazards (such as flammability or the potential for explosions) and health hazards. Employers are required to provide a certain level of training to ensure that relevant employees are equipped to properly handle chemicals. OSHA has modified its Hazard Communication Standard to make it consistent with the United Nation’s Globally Harmonized System of Classification and Labeling of Chemicals. The new standards include more specific requirements for hazard classification, as well as standardized label components that provide consistent information and definitions for hazardous chemicals and a standard approach to conveying information on safety data sheets. Our Chemicals line of business has already completed its transition to the revised Hazard Communication Standard.

For our Chemicals and Plastics lines of business in Canada, we are in the process of transitioning to Health Canada's Globally Harmonized System - aligned Hazardous Products Regulations standard. In Canada, a phase-in period is currently underway, culminating in December 2018, during which companies can choose to comply with either the existing or the revised Hazardous Products Regulations, and we expect to complete this transition within the deadline.

Both the U.S. and Canada Hazard Communication Standards remain subject to periodic updates and revisions, and those changes, as well as other regulatory initiatives in occupational health and safety, could result in increased operation and compliance costs.

Product Control

We operate in a number of domestic and foreign jurisdictions and are subject to various types of governmental regulation relating to use, labeling, packaging, storage and distribution of chemicals and hazardous substances. Statutes and regulations governing the import, export and control of our products are enforced by government agencies such as the U.S. Customs and Border Protection, the Drug Enforcement Administration, the Department of Homeland Security, the Department of Commerce, the Department of Transportation, the Food and Drug Administration, the Department of Agriculture and similar international agencies.

We believe that we are in compliance in all material respects with federal, state and local regulations relating to the sale, distribution, import and export of our products. We have automated systems, processes and procedures in place to support compliance with these regulations, and because we have these automated systems, processes and procedures in place, we believe we conduct our global business in compliance in all material respects with applicable statutes and regulations as promulgated in the countries into which we sell our products. Although we believe we are in compliance in all material respects with such laws and regulations, any non-compliance could result in substantial fines or otherwise restrict our ability to conduct our business.

Intellectual Property

We are not substantially dependent upon patents, trademarks or licenses.

15

Insurance

Our operations are subject to significant hazards and risks inherent in the transportation, storage and disposal of chemicals and other potentially hazardous materials. We seek to mitigate these risks with effective industry-specific risk management techniques that include continuing and improving upon current loss prevention, claims management and training programs as well as a comprehensive insurance program. We have insurance coverage at levels that we consider adequate for our worldwide facilities and activities. Our insurance policies cover, among others, the following categories of risk: property damage and business interruption; marine cargo throughput, product and general liability; environmental liability; directors’ and officers’ liability and fraud and crime/theft.

Available Information