Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Aleris Corp | a8kinvestorpresentationnov.htm |

Aleris Restricted & Confidential

Bank of America / Merrill Lynch

2017 Leveraged Finance Conference November 29, 2017

2

IMPORTANT INFORMATION

This information is current only as of its date and may have changed. We undertake no obligation to update this information in light of new information, future events or otherwise. This information

contains certain forecasts and other forward looking information concerning our business, prospects, financial condition and results of operations, and we are not making any representation or warranty

that this information is accurate or complete. See “Forward-Looking Information” below.

BASIS OF PRESENTATION

We are a direct wholly owned subsidiary of Aleris Corporation. Aleris Corporation currently conducts its business and operations through us and our consolidated subsidiaries. As used in this

presentation, unless otherwise specified or the context otherwise requires, “Aleris,” “we,” “our,” “us,” “ and the “Company” refer to Aleris International, Inc. and its consolidated subsidiaries.

Notwithstanding the foregoing, with respect to the historical financial information and other data presented in this presentation, unless otherwise specified or the context requires, “Aleris,” “we,” “our,”

“us,” and the “Company’ refer to Aleris Corporation. We completed the sale of our recycling and specification alloys and extrusions businesses in the first quarter of 2015. We have reported these

businesses as discontinued operations for all periods presented, and reclassified the results of operations of these businesses as discontinued operations. Except as otherwise indicated, the discussion

of the Company’s business and financial information throughout this presentation refers to the Company’s continuing operations and the financial position and results of operations of its continuing

operations.

FORWARD-LOOKING INFORMATION

Certain statements contained in this presentation are “forward-looking statements” within the meaning of the federal securities laws. Statements under headings with “Outlook” in the title and statements

about our beliefs and expectations and statements containing the words “may,” “could,” “would,” “should,” “will,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “look forward to,”

“intend” and similar expressions intended to connote future events and circumstances constitute forward-looking statements. Forward-looking statements include statements about future costs and

prices of commodities, production volumes, industry trends, anticipated cost savings, anticipated benefits from new products, facilities, acquisitions or divestitures, projected results of operations,

achievement of production efficiencies, capacity expansions, future prices and demand for our products and estimated cash flows and sufficiency of cash flows to fund capital expenditures. Forward-

looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in or implied by any forward-looking statement.

Important factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, the following: (1) our ability to successfully implement our business

strategy; (2) the success of past and future acquisitions or divestitures; (3) the cyclical nature of the aluminum industry, material adverse changes in the aluminum industry or our end-uses, such as

global and regional supply and demand conditions for aluminum and aluminum products, and changes in our customers’ industries; (4) increases in the cost, or limited availability, of raw materials and

energy; (5) our ability to enter into effective metal, energy and other commodity derivatives or arrangements with customers to manage effectively our exposure to commodity price fluctuations and

changes in the pricing of metals, especially London Metal Exchange-based aluminum prices; (6) our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our

debt obligations; (7) competitor pricing activity, competition of aluminum with alternative materials and the general impact of competition in the industry end-uses we serve; (8) our ability to retain the

services of certain members of our management; (9) the loss of order volumes from any of our largest customers; (10) our ability to fulfill our substantial capital investment requirements; (11) our ability

to retain customers, a substantial number of whom do not have long-term contractual arrangements with us; (12) risks of investing in and conducting operations on a global basis, including political,

social, economic, currency and regulatory factors; (13) variability in general economic conditions on a global or regional basis; (14) current environmental liabilities and the cost of compliance with and

liabilities under health and safety laws; (15) labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; (16) our internal controls over financial reporting and our disclosure controls and

procedures may not prevent all possible errors that could occur; (17) our levels of indebtedness and debt service obligations, including changes in our credit ratings, material increases in our cost of

borrowing or the failure of financial institutions to fulfill their commitments to us under committed facilities; (18) our ability to access credit or capital markets; (19) the possibility that we may incur

additional indebtedness in the future; (20) limitations on operating our business as a result of covenant restrictions under our indebtedness, and our ability to pay amounts due under the Senior Notes;

and (21) other factors discussed in our filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” contained therein. Investors, potential investors and other

readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. We undertake no

obligation to publicly update or revise any forward-looking statements, whether in response to new information, futures events or otherwise, except as otherwise required by law.

NON-GAAP INFORMATION

The non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, commercial margin, and variations thereof) are not measures of financial

performance calculated in accordance with U.S. GAAP and should not be considered as alternatives to net income and loss attributable to Aleris Corporation or any other performance measure derived

in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Non-GAAP measures have limitations as analytical tools and should be considered in

addition to, not in isolation or as a substitute for, or as superior to, our measures of financial performance prepared in accordance with GAAP. Management believes that certain non-GAAP financial

measures may provide investors with additional meaningful comparisons between current results and results in prior periods. Management uses non-GAAP financial measures as performance metrics

and believes these measures provide additional information commonly used by the holders of our senior debt securities and parties to the 2015 ABL Facility with respect to the ongoing performance of

our underlying business activities, as well as our ability to meet our future debt service, capital expenditure and working capital needs. We calculate our non-GAAP financial measures by eliminating the

impact of a number of items we do not consider indicative of our ongoing operating performance, and certain other items. You are encouraged to evaluate each adjustment and the reasons we consider

it appropriate for supplemental analysis. See “Appendix.”

INDUSTRY INFORMATION

Information regarding market and industry statistics contained in this presentation is based on information from third party sources as well as estimates prepared by us using certain assumptions and our

knowledge of these industries. Our estimates, in particular as they relate to our general expectations concerning the aluminum industry, involve risks and uncertainties and are subject to changes based

on various factors, including those discussed under “Risk Factors” in our filings with the Securities and Exchange Commission.

WEBSITE POSTING

We use our investor website (investor.aleris.com) as a channel of distribution of Company information. The information we post through this channel may be deemed material. Accordingly, investors

should monitor this channel, in addition to following our press releases, Securities and Exchange Commission ("SEC") filings, and public conference calls and webcasts. The content of our website is

not, however, a part of this presentation.

Forward-Looking and Other Information

3

Metal price pass through business model; limited commodity exposure

Aleris Well-Positioned in Aluminum Value Chain

Processor

4

Aleris Overview

1Revenue includes intra-entity revenue of $34 million and adjusted EBITDA excludes corporate expense of $37 million

Overview

Global leader in Aerospace and Automotive aluminum rolled

products with a presence on three continents and leading North

American Continuous Cast (Building & Construction (“B&C”)

and Truck Trailer) business

Key investments driving strategic transformation complete

− Duffel wide auto sheet ramp-up complete; process

improvements driving throughput increase

− Lewisport running CALP I and commissioning CALP II –

commercial shipments commencing; planned outage tied to

widening of hot mill, approximately $30M of EBITDA impact

− Zhenjiang Aerospace presence established; mix and

portfolio upgrade well underway

− Nichols acquisition and integration resulted in industry-

leading continuous cast capabilities and flexibility

Significant, recent multi-year contract wins with global,

blue-chip customers supports mix shift (Airbus, Bombardier)

Robust research and development (R&D) platform and

technology portfolio

Approximately 5,400 employees and 13 manufacturing facilities

in North America, Europe and Asia

Financial performance gaining momentum

LTM 9/30/17 Revenues1

LTM 9/30/17 Adjusted EBITDA1

($M)

($M)

$1,447

51%

$112

4%

$1,251

45%

Europe

North America

Asia Pacific

Total: $2,810

$135

56%

$95

39%

$12

5%

Asia Pacific

Europe

North America

Total: $2431

5

Investment Highlights

Support from healthy long-term industry fundamentals

Key investments in place and largely complete

Well-positioned for growth with transformation strategy

Blue-chip customer base with contracts that underpin growth

6

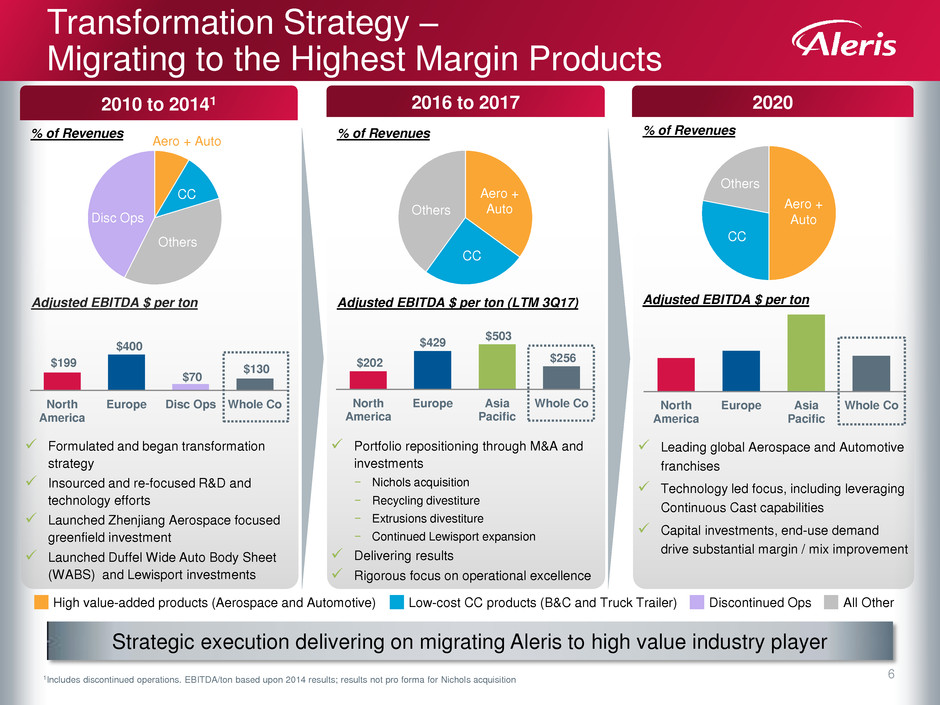

Strategic execution delivering on migrating Aleris to high value industry player

Transformation Strategy –

Migrating to the Highest Margin Products

2020

% of Revenues

Leading global Aerospace and Automotive

franchises

Technology led focus, including leveraging

Continuous Cast capabilities

Capital investments, end-use demand

drive substantial margin / mix improvement

North

America

Europe Asia

Pacific

Whole Co

Adjusted EBITDA $ per ton Adjusted EBITDA $ per ton

Formulated and began transformation

strategy

Insourced and re-focused R&D and

technology efforts

Launched Zhenjiang Aerospace focused

greenfield investment

Launched Duffel Wide Auto Body Sheet

(WABS) and Lewisport investments

2010 to 20141

% of Revenues

$199

$400

$70

$130

North

America

Europe Disc Ops Whole Co

2016 to 2017

% of Revenues

Portfolio repositioning through M&A and

investments

− Nichols acquisition

− Recycling divestiture

− Extrusions divestiture

− Continued Lewisport expansion

Delivering results

Rigorous focus on operational excellence

$202

$429

$503

$256

North

America

Europe Asia

Pacific

Whole Co

Adjusted EBITDA $ per ton (LTM 3Q17)

High value-added products (Aerospace and Automotive) All Other Low-cost CC products (B&C and Truck Trailer) Discontinued Ops

Aero + Auto

Aero +

Auto Aero +

Auto

CC

CC

CC Others

Others

Others

Disc Ops

1Includes discontinued operations. EBITDA/ton based upon 2014 results; results not pro forma for Nichols acquisition

7

Aleris’ Recent Investments Have Resulted in a

Realignment of the Business’ Commercial Strategy

Aerospace

Global platform – Germany / China

Leading position in aerospace plate and

sheet

State-of-the-art rolling mill in Zhenjiang was

1st plate mill in China with Western OEM

aerospace qualifications

Long-term sector trends; 8-year backlog

Significant customer momentum - heavily

contractual business (multi-year fixed term

contracts)

Significant volume captured

under new LTAs

Zhenjiang, China

Voerde, Germany (Casthouse)

Koblenz, Germany

World-class aerospace plate facilities

in Koblenz and China

Leading network and cost position

Leading positions in North America

B&C

Truck Trailer

Advanced scrap processing capabilities

Niche-focused light gauge business

Leading coating capabilities

Continuous Cast

Long standing customer relationships and

continued end use demand drives

forecasted continuous cast shipments

Lincolnshire, IL

Uhrichsville, OH Davenport, IA1

Ashville, OH Clayton, NJ

Buckhannon, WV

Richmond, VA

Largest, most flexible CC network serving

North America

1Two facilities located in Davenport, IA

Automotive

Global Platform – Belgium / Germany / U.S.

Leading position in EU ABS; U.S. poised to

ramp up

Strong shift by automotive OEMs to aluminum

sheet

Customer requirements becoming more

precise (e.g. design, formability)

Significant North America volume and margin

secured through 2025

Significant volume under LTAs

Lewisport, KY

Duffel, Belgium

Detroit, MI (R&D)

With the completion of Lewisport, Aleris

offers a global supply of ABS with the

potential for additional capacity in China

8

Recent investments target high growth, high margin and high cash flow end uses

Key Investments Driving

Strategic Transformation

% CAPEX

SPENT

LTM EBITDA AS

% OF EXPECTED

RUN-RATE

STRATEGIC

FOCUS

KEY

INVESTMENTS

NICHOLS

ACQUISITION

$110 million

ACQUIRED

Complementary asset

base; similar technologies

Significant synergies

captured and exceeding

expectations

Well-timed to benefit from

continued housing

strengths

Leading cost position

Significant value stream

from scrap utilization

Increased focus on

product development

CONTINUOUS CAST

DUFFEL

WABS

$85 million

COMPLETED

Technology leader in

Europe with 15-year

presence

Widest ABS capabilities in

Europe

Working with long-

standing global OEM

customers

“Overshoot” program

driving further throughput

AUTOMOTIVE

CHINA

$350 million

COMPLETED

Capturing Aerospace

growth and shift in

demand to Asia

Built to exacting, state-of-

art standards

Western OEM Aerospace

qualifications in place

Adjusted EBITDA

ramping

Adding 5-axis machining

capability

AEROSPACE

LEWISPORT

ABS

$425 million

NEARLY COMPLETE

Massive product mix

upgrades

Leveraging global leading

ABS capabilities

Significant customer

commitments / contracts

back investment

Significant ABS readiness

spend nearly complete

Commercial shipments

underway

220 kT CALP ABS

installed capacity

AUTOMOTIVE

9

Long-term relationships and contracts with global blue-chip customers

Long-Term Relationships with Blue-Chip,

Contracted Customer Base

NORTH

AMERICA

EUROPE

& APAC

Selected Customers

Regional

Brazing Coil and Sheet Specialty Coil and Sheet

Commercial Plate and

Distribution

B&C Truck Trailer Distribution and Consumer

Global

Automotive Aerospace

10

49 69 113

172 237

290 322 357

404

455

549

663

833

877

940 966

1,023

1,174

368

403

443

479

512

566

614

660

714

872

1,021

1,219

1,484

1,626

1,796

1,902

2,040

2,292

2016 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E

Shortage of CALP ABS supply expected over the medium term

ABS – Global Transformation Opportunity

Projected CALP Supply and Demand in North America Global ABS Industry Demand

(Metric tons in thousands) (Metric tons in thousands)

Source: CRU, Ducker International / Aluminum Association, IHS Automotive, McKinsey, Company analysis and customer data

1Capacity includes Aleris investment in 2 CALP lines in North America

Europe North America China

Potential Capacity

Tightness

403

543

671

788

836

890 890 890 890

1,174

20 6 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E

Capacity Demand

95% 76% 95% 92% 87% 95% 101% 99% 89%

% of Demand Satisfied 1

11

Lewisport Outage Update:

Complex Outage Completed

Scalper First Wide Coil Reversing Mill

Widened the scalper

Widened the hot mill

Upgraded pre-heating equipment

Upgraded hot mill controls

ABS spec-ready

Improved reliability and uptime

Over 4,000 individual projects successfully completed during ~60-day outage

Approximately $30M Adjusted EBITDA impact from Lewisport outage in 2017

12

First commercial ABS coil recently shipped, focused on additional customer qualifications and contracts

Wide Cold Mill: Provisional acceptance complete

CALP I: Provisional acceptance complete; moved into production mode

CALP II: Commissioning well underway

Three of four alloys approved by primary OEM; fourth currently in aging process

North America ABS Project Update

2014 2015 2016 2017E

$13 $153 $185 $72

AUTOMOTIVE BODY SHEET (ABS) PROJECT CAPEX ($M)

3Q17

$16

CALP I CALP II Wide Cold Mill

Automotive expansion on target to hit critical milestones

13

Approximately 50% of the 2017E – 2036E

growth will be driven by Asia Pacific

Aircraft Backlogs and Deliveries

Driving Growth

Aircraft Backlog1,2

(units)

(units)

Global Fleet Projections by Region3

OVER 34,000 NEW COMMERCIAL AIRCRAFT TO BE BUILT OVER THE NEXT 20 YEARS

Aircraft Deliveries1

1Airbus and Boeing Equity Research Reports, 2017; Company Websites

2Backlog defined as Net Orders (Gross Orders – Conversions/Cancellations) – Deliveries

3Airbus Global Market Forecast 2017-2036

3,887

12,150 12,582 12,528 12,350

2005 2014 2015 2016 Sep-17

Boeing Airbus

894 858

979 972 1,011

1,189

1,274

1,352 1,397

1,436

1,569

1,693

1,860 1,901

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017E2018E2019E2020E

Boeing Airbus

17E-20E

CAGR: 7%

6,456

17,749 4,697

7,997

5,216

7,286

1,249

3,322

1,411

2,882

831

1,702

640

1,592

20,500

42,530

2017E 2036E

Africa

CIS

Latin America

Middle East

North America

Europe

Asia-Pacific

4% CAGR

5% CAGR

14

5,609

8,281

-

2,000

4,000

6,000

8,000

10,000

2010 2011 2012 2013 2014 2015 2016

Housing Starts Household Formation

Demographics support continued housing growth

Healthy B&C Fundamentals

Source: Zelman Associates Macro Housing Forecasts (July 2017), Moody’s Analytic Forecast

1Cumulative 2010-2016 data; updated annually (last update 1/9/2017)

2Weighted index of data from the Zelman Building Products Survey, shifts in business days, Home Depot and Lowe’s Results, Hardware Co-Ops, BEA Structural Home Improvements and Home Improvement Research Institute

U.S. Total Housing Starts U.S. Total Single-Family Housing Starts

Cumulative Household Formation vs. Housing Starts1

(thousands) (thousands)

(thousands)

375 462 462

529 578 635

710 780

160

155 187

185

203

215

235

250

535

617 649

714

781

850

945

1,030

2012A 2013A 2014A 2015A 2016A 2017E 2018E 2019E

Production Single-Family Starts Contractor/Owner Built Starts

U.S. Home Improvement Index2

4.4%

6.2% 5.9% 6.0% 5.8%

5.3%

4.9% 4.7%

2012A 2013A 2014A 2015A 2016A 2017E 2018E 2019E

780

924

1,004

1,112 1,173

1,250 1,320 1,360

2 12A 2013A 2014A 2015A 2016A 2017E 2018E 2019E

Household formation has outgrown the

new housing starts over the past 6

years, which has created a shortage in

supply

15

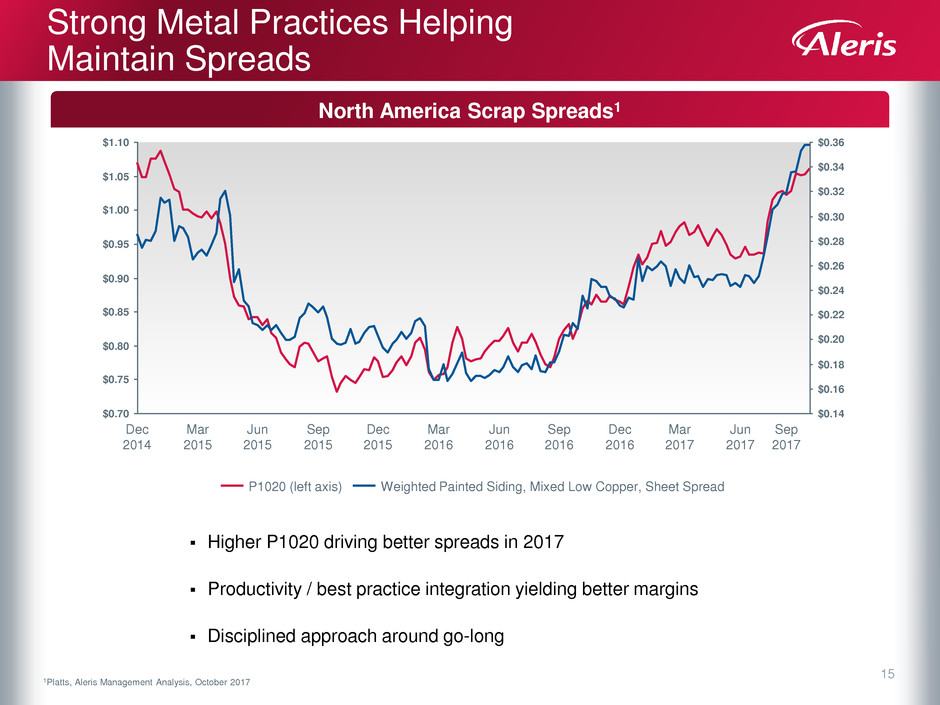

Strong Metal Practices Helping

Maintain Spreads

$0.95

$0.16

$0.24

$0.26

$1.10

$0.85

$0.14

$0.22

$1.00

$0.90

$0.70

$0.20

$0.18

$0.80

$0.75

$1.05

$0.36

$0.34

$0.30

$0.32

$0.28

Dec

2016

Sep

2017

Jun

2017

Mar

2016

Dec

2015

Sep

2016

Jun

2016

Mar

2017

Sep

2015

Jun

2015

Dec

2014

Mar

2015

P1020 (left axis) Weighted Painted Siding, Mixed Low Copper, Sheet Spread

North America Scrap Spreads1

Higher P1020 driving better spreads in 2017

Productivity / best practice integration yielding better margins

Disciplined approach around go-long

1Platts, Aleris Management Analysis, October 2017

16

FX and short-term volume headwinds creating temporary challenges

2017 YTD EBITDA Performance

3Q17 YTD vs. 3Q16 YTD Adj. EBITDA Bridge ($M)

$162 $164

$11

$12

200

80

120

160

Metal

Spreads

Volume/Mix Price 3Q16 YTD

($2)

Base Inflation Productivity Currency/

Translation/

Other

3Q17 YTD

($7)

Commodity

Inflation

($17) $0 $5

2016 2017 2016 2017

Shipments (kT) 426 418 214 199

Adj. EBITDA ($M) $109 $118 $53 $46

Adj. EBITDA/Ton $256 $282 $249 $229

1H 3Q

17

Transformation Driving Improving

Performance

LTM Adjusted EBITDA1,3,4 Volume1,2,3,4

(Metric tons in thousands) ($M)

452

372

482 493 486 471

396

299

301

314 327

316

23

2015

829

25

822

22

806

LTM

3Q17

2016 2014 2013

794

673

13

848

5

2007

North America2 Europe Asia Pacific

1Excludes discontinued operations

2Segment volumes include intercompany shipments

3Not pro forma for Nichols volumes in 2007, 2013 and 2014

42014 results not pro forma for Nichols acquisition

$206

$145

3Q17 1Q17

+43%

4Q16 2Q17 1Q15 2Q16 4Q15 1Q16 3Q16 3Q15 2Q15 3Q14 4Q14

18

Investments for growth mostly in place, expect to return to positive free cash flow in 2018

CapEx1 Investments Ramping Down

$82

$96 $88

$74

$201

$276

$157

$14

$107

2017E

$1251

2018E 2015

$10

2013

$7

$358

2016

$121

$230 - $2402

$65 - $75

$8

$298

$188

2014

$11

Other Growth North America ABS Project & Other Upgrades Maintenance

($M)

1Excludes discontinued operations CapEx of $50M, $43M, $15M in 2013-2015

2Guidance does not include capitalized interest

19

Capital Structure and Liquidity

9/30/2017

Cash and Restricted Cash1 $76

ABL 245

7.875% Senior Notes due 20202 440

9.500% Senior Notes due 20213 800

Zhenjiang Term Loan due 2024 167

Zhenjiang Revolver due 2021 7

Other 10

Net Debt4 $1,593

LTM 9/30/17 Adjusted EBITDA $206

Net Debt / Adj. EBITDA 7.7x

Net Recourse Debt5 / Adj. EBITDA 6.9x

1Includes $4 million of restricted cash for payoff of China Loan Facility

2Amounts exclude discount and deferred issuance costs

3Amounts exclude net premiums and deferred issuance costs

4Excludes $45 million of exchangeable notes

5Excludes China Loan Facilities

6Includes $60M cash payment and $20M letter of credit relief

Pro Forma Liquidity Summary – 9/30/2017 Capital Structure Highlights

Debt Maturity Profile – 9/30/2017 Capital Structure

No material near term amortization requirements

No restrictive cash dominion covenants unless liquidity drops

substantially

Amount

Cash and Restricted Cash1 $76

Availability under ABL Facility 206

Primary OEM Capacity Reservation Fees6 80

Pro Forma Liquidity $361

($M)

($M)

$800

$440

$245

$5 $7

$18

$27

$36 $36 $38

$7

Q4 2017 2018E 2019E 2020E 2021E 2022E 2023E 2024E

9.500% Senior Notes 7.875% Senior Notes

ABL Zhenjiang Term Loan

Zhenjiang Revolver

Aleris Restricted & Confidential

Appendix

21

Historical Financial Performance

Shipments and Revenues1,*

Adjusted EBITDA* Adjusted EBITDA – Capex2,*

Commercial Margin*

*2013 and 2014 results not pro forma for Nichols acquisition

1Excludes slab and billet sales from Voerde and Koblenz cast houses of 14 kT in 2013

2Excludes discontinued operations CapEx of $50M, $43M, $15M in 2013-2015

($M) ($M)

(metric tons in thousands; $B) ($M)

$2.5 $2.9 $2.9 $2.7 Revenues:

$233 $222 $271 $247 per ton1:

% of Revs

% of CM

7%

16%

6%

15%

8%

18%

8%

17%

Capex

Maintenance

Growth

Total

$82

106

$188

$96

25

$121

$88

210

$298

$74

284

$358

$2.8

806829822794

673

2016 2015 2014 2013 LTM 9/30/17

Shipments:

$1,192 $1,193 $1,204

$1,167

$1,052

LTM 9/30/17 2016 2013 2014 2015

$256

$206 $205

$223

$176

$157

2014 2013 2015 LTM 9/30/17 2016

7%

17%

$(75)

$(153)

$55

$(31)

$144 $131 $135

$80 $75

2014 2015 2013 2016 LTM

9/30/17

$(31)

EBITDA - Maintenance Capex EBITDA - Total Capex

$62

175

$237

22

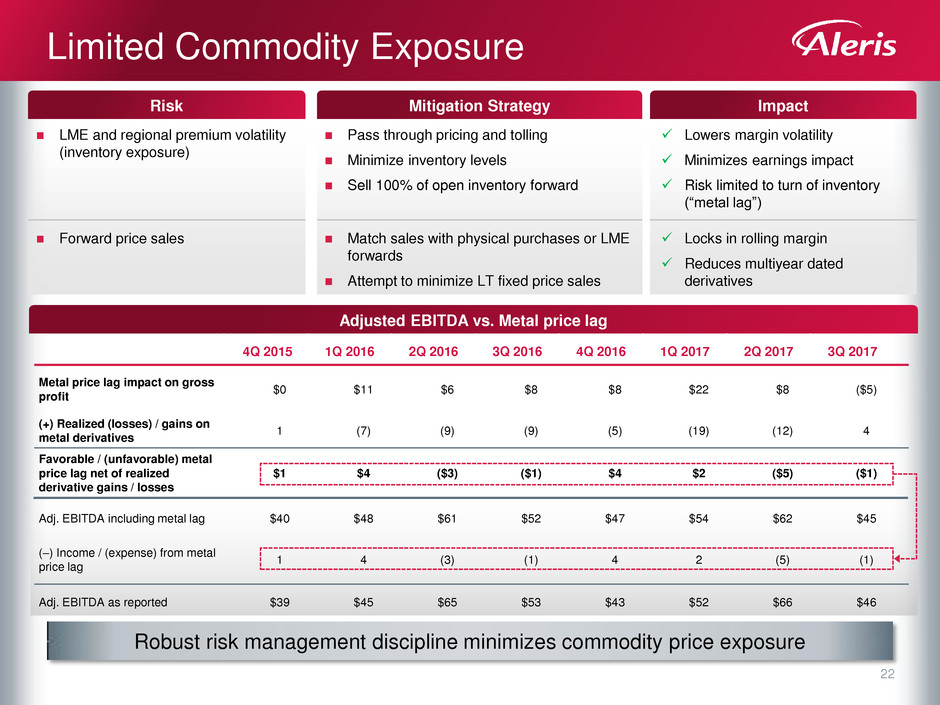

Robust risk management discipline minimizes commodity price exposure

Limited Commodity Exposure

Pass through pricing and tolling

Minimize inventory levels

Sell 100% of open inventory forward

LME and regional premium volatility

(inventory exposure)

Risk Impact Mitigation Strategy

Lowers margin volatility

Minimizes earnings impact

Risk limited to turn of inventory

(“metal lag”)

Match sales with physical purchases or LME

forwards

Attempt to minimize LT fixed price sales

Forward price sales Locks in rolling margin

Reduces multiyear dated

derivatives

Adjusted EBITDA vs. Metal price lag

Adj. EBITDA including metal lag $40 $48 $61 $52 $47 $54 $62 $45

(–) Income / (expense) from metal

price lag

1 4 (3) (1) 4 2 (5) (1)

Adj. EBITDA as reported $39 $45 $65 $53 $43 $52 $66 $46

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

Metal price lag impact on gross

profit

$0 $11 $6 $8 $8 $22 $8 ($5)

(+) Realized (losses) / gains on

metal derivatives

1 (7) (9) (9) (5) (19) (12) 4

Favorable / (unfavorable) metal

price lag net of realized

derivative gains / losses

$1 $4 ($3) ($1) $4 $2 ($5) ($1)

23

LTM Adjusted EBITDA Reconciliation

($M)

2015 2016 2017 2015 2016 2017 2014 2015 2016 2017 2013 2014 2015 2016 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

Adjusted EBITDA of continuing operations 188.1$ 212.3$ 212.4$ 208.9$ 216.5$ 214.2$ Adjusted EBITDA of continuing operations 144.7$ 222.0$ 201.6$ 206.4$ 156.9$ 176.5$ 222.8$ 205.1$ 203.8$ 196.7$ 180.1$ 156.9$ 152.0$ 133.5$ 144.7$ 176.5$ 188.1$ 208.9$ 222.0$ 222.8$ 212.3$ 216.5$ 201.6$ 205.1$ 212.4$ 214.2$ 206.4$

Unrealized (losses) gains on derivative financial instruments of continuing operations (4.5) (1.3) 1.9 10.8 (10.9) 21.4 Unrealized (losses) gains on derivative financial instruments of continuing operations 7.2 (24.2) 19.2 (6.2) 2.2 5.4 (30.1) 19.0 11.4 11.6 10.9 2.2 (17.8) (10.4) 7.2 5.4 (4.5) 10.8 (24.2) (30.1) (1.3) (10.9) 19.2 19.0 1.9 21.4 (6.2)

Impact of recording inventory at fair value through purchase accounting (8.0) - - (5.0) - - Impact of recording inventory at fair value through purchase accounting (5.5) (2.5) - - - (8.1) - - - - - - - (3.0) (5.5) (8.1) (8.0) (5.0) (2.5) - - - - - - - -

Restructuring charges (5.3) (8.3) (1.0) (9.7) (4.0) (1.2) Restructuring charges (1.2) (10.1) (3.3) (1.8) (5.0) (2.8) (10.3) (1.5) (5.9) (12.8) (12.8) (5.0) (7.8) (1.2) (1.2) (2.8) (5.3) (9.7) (10.1) (10.3) (8.3) (4.0) (3.3) (1.5) (1.0) (1.2) (1.8)

Unallocated currency exchange (losses) gains on debt 21.8 (8.7) (0.7) 19.7 (7.4) (1.4) Unallocated currency exchange (losses) gains on debt 6.0 7.8 (3.0) (2.8) (2.1) 12.0 1.0 (0.6) (1.2) 2.2 0.4 (2.1) (1.9) (2.3) 6.0 12.0 21.8 19.7 7.8 1.0 (8.7) (7.4) (3.0) (0.6) (0.7) (1.4) (2.8)

Stock-based compensation expense (12.4) (3.8) (5.9) (11.0) (2.9) (4.6) Stock-based compensation expense (14.1) (6.7) (6.2) (3.2) (14.3) (13.8) (4.8) (7.0) (11.6) (11.5) (14.5) (14.3) (15.8) (17.1) (14.1) (13.8) (12.4) (11.0) (6.7) (4.8) (3.8) (2.9) (6.2) (7.0) (5.9) (4.6) (3.2)

Start-up costs (19.6) (23.5) (54.1) (16.5) (29.6) (59.5) Start-up costs (23.8) (19.8) (36.9) (68.2) (35.6) (24.5) (21.1) (46.0) (37.2) (43.0) (41.7) (35.6) (32.9) (28.0) (23.8) (24.5) (19.6) (16.5) (19.8) (21.1) (23.5) (29.6) (36.9) (46.0) (54.1) (59.5) (68.2)

Favorable (unfavorable) metal price lag 27.7 (20.4) 1.6 (5.4) (1.8) - Favorable (unfavorable) metal price lag 30.4 (11.0) 0.7 0.2 22.3 33.7 (18.6) 3.2 15.7 18.9 20.8 22.3 28.9 33.6 30.4 33.7 27.7 (5.4) (11.0) (18.6) (20.4) (1.8) 0.7 3.2 1.6 - 0.2

Loss on extinguisment of debt - - (12.6) - (12.6) - Loss on extinguisment of debt - - (12.6) - - - - (12.6) - - - - - - - - - - - - - (12.6) (12.6) (12.6) (12.6) - -

Other (28.7) (11.7) (5.0) (29.6) (2.5) (8.8) Other (14.4) (29.8) (3.3) (6.6) (6.6) (24.4) (16.1) (4.5) (2.2) (4.4) (5.0) (6.6) (9.8) (13.2) (14.4) (24.4) (28.7) (29.6) (29.8) (16.1) (11.7) (2.5) (3.3) (4.5) (5.0) (8.8) (6.6)

EBITDA 159.1 134.6 136.6 162.2 144.8 160.1 EBITDA 129.3 125.7 156.2 117.8 117.8 154.0 122.8 155.1 172.8 157.7 138.2 117.8 94.9 91.9 129.3 154.0 159.1 162.2 125.7 122.8 134.6 144.8 156.2 155.1 136.6 160.1 117.8

Interest expense, net (107.9) (85.6) (91.5) (105.5) (82.2) (101.7) Interest expense, net (106.4) (101.8) (77.8) (114.5) (97.4) (107.4) (94.1) (82.5) (50.1) (74.6) (90.1) (97.4) (102.7) (105.1) (106.4) (107.4) (107.9) (105.5) (101.8) (94.1) (85.6) (82.2) (77.8) (82.5) (91.5) (101.7) (114.5)

Benefit from income taxes 132.2 11.8 (41.9) 145.2 (10.3) (45.3) Benefit from income taxes 12.8 142.9 (23.6) (34.6) 3.1 129.5 22.7 (40.0) (11.9) (14.3) (9.3) 3.1 6.7 8.8 12.8 129.5 132.2 145.2 142.9 22.7 11.8 (10.3) (23.6) (40.0) (41.9) (45.3) (34.6)

Depreciation and amortization from continuing operations (134.7) (113.6) (104.3) (134.2) (111.3) (103.7) Depreciation and amortization from continuing operations (115.4) (128.3) (109.8) (108.0) (98.7) (123.2) (123.8) (104.9) (52.0) (79.8) (89.4) (98.7) (104.6) (106.0) (115.4) (123.2) (134.7) (134.2) (128.3) (123.8) (113.6) (111.3) (109.8) (104.9) (104.3) (103.7) (108.0)

Income from discontinued operations, net of tax 161.3 (10.1) (3.3) 141.2 1.7 (3.3) Income from discontinued operations, net of tax 42.0 118.6 1.5 1.3 38.1 34.2 121.1 (3.3) 26.7 36.1 35.6 38.1 40.1 39.0 42.0 34.2 161.3 141.2 118.6 121.1 (10.1) 1.7 1.5 (3.3) (3.3) (3.3) 1.3

Net (loss) income attributable to Aleris Corporation 210.0 (62.9) (104.4) 208.9 (57.3) (93.9) Net (loss) income attributable to Aleris Corporation (37.7) 157.1 (53.5) (138.0) (37.1) 87.1 48.7 (75.6) 85.5 25.1 (15.0) (37.1) (65.6) (71.4) (37.7) 87.1 210.0 208.9 157.1 48.7 (62.9) (57.3) (53.5) (75.6) (104.4) (93.9) (138.0)

Net income (loss) from discontinued operations attributable to noncontrolling interest 0.8 - - 0.4 - - Net income (loss) from discontinued operations attributable to noncontrolling interest 1.1 0.2 - - 1.0 0.9 0.1 - 0.5 0.7 1.2 1.0 0.9 1.1 1.1 0.9 0.8 0.4 0.2 0.1 - - - - - - -

Net (loss) income 210.8$ (62.9)$ (104.4)$ 209.3$ (57.3)$ (93.9)$ Net (loss) income (36.6)$ 157.3$ (53.5)$ (138.0)$ (36.1)$ 88.0$ 48.8$ (75.6)$ 86.0$ 25.8$ (13.8)$ (36.1)$ (64.7)$ (70.3)$ (36.6)$ 88.0$ 210.8$ 209.3$ 157.3$ 48.8$ (62.9)$ (57.3)$ (53.5)$ (75.6)$ (104.4)$ (93.9)$ (138.0)$

TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE

For the last twelve months ended

March 31,

For the last twelve months ended

June 30,

For the last twelve months ended

September 30,

For the last twelve months ended

December 31, LTM ending LTM ending LTM ending LTM ending LTM ending

2015 2016 2017 2015 2016 2017 2014 2015 2016 2017 2013 2014 2015 2016 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

Adjusted EBITDA of continuing operations 188.1$ 212.3$ 212.4$ 208.9$ 216.5$ 214.2$ Adjusted EBITDA of continuing operations 144.7$ 222.0$ 201.6$ 206.4$ 156.9$ 176.5$ 222.8$ 205.1$ 203.8$ 196.7$ 180.1$ 156.9$ 152.0$ 133.5$ 144.7$ 176.5$ 188.1$ 208.9$ 222.0$ 222.8$ 212.3$ 216.5$ 201.6$ 205.1$ 212.4$ 214.2$ 206.4$

Unrealized (losses) gains on derivative financial instruments of continuing operations (4.5) (1.3) 1.9 10.8 (10.9) 21.4 Unrealized (losses) gains on derivative financial instruments of continuing operations 7.2 (24.2) 19.2 (6.2) 2.2 5.4 (30.1) 19.0 11.4 11.6 10.9 2.2 (17.8) (10.4) 7.2 5.4 (4.5) 10.8 (24.2) (30.1) (1.3) (10.9) 19.2 19.0 1.9 21.4 (6.2)

Impact of recording inventory at fair value through purchase accounting (8.0) - - (5.0) - - Impact of recording inventory at fair value through purchase accounting (5.5) (2.5) - - - (8.1) - - - - - - - (3.0) (5.5) (8.1) (8.0) (5.0) (2.5) - - - - - - - -

Restructuring charges (5.3) (8.3) (1.0) (9.7) (4.0) (1.2) Restructuring charges (1.2) (10.1) (3.3) (1.8) (5.0) (2.8) (10.3) (1.5) (5.9) (12.8) (12.8) (5.0) (7.8) (1.2) (1.2) (2.8) (5.3) (9.7) (10.1) (10.3) (8.3) (4.0) (3.3) (1.5) (1.0) (1.2) (1.8)

Unallocated currency exchange (losses) gains on debt 21.8 (8.7) (0.7) 19.7 (7.4) (1.4) Unallocated currency exchange (losses) gains on debt 6.0 7.8 (3.0) (2.8) (2.1) 12.0 1.0 (0.6) (1.2) 2.2 0.4 (2.1) (1.9) (2.3) 6.0 12.0 21.8 19.7 7.8 1.0 (8.7) (7.4) (3.0) (0.6) (0.7) (1.4) (2.8)

Stock-based compensation expense (12.4) (3.8) (5.9) (11.0) (2.9) (4.6) Stock-based compensation expense (14.1) (6.7) (6.2) (3.2) (14.3) (13.8) (4.8) (7.0) (11.6) (11.5) (14.5) (14.3) (15.8) (17.1) (14.1) (13.8) (12.4) (11.0) (6.7) (4.8) (3.8) (2.9) (6.2) (7.0) (5.9) (4.6) (3.2)

Start-up costs (19.6) (23.5) (54.1) (16.5) (29.6) (59.5) Start-up costs (23.8) (1 .8) (36.9) (68.2) (35.6) (24.5) (21.1) (46.0) (37. ) (43.0) (41.7) (35.6) (32.9) (28.0) (23.8) (24.5) (19.6) (16.5) (19.8) (21.1) (23.5) (29.6) (36.9) (46.0) (54.1) (59.5) (68.2)

Favorable (unfavorable) metal price lag 27.7 (20.4) 1.6 (5.4) (1.8) - Favorable (unfavorable) metal price lag 30.4 (11.0) 0.7 0.2 22.3 33.7 (18.6) 3.2 15.7 18.9 20.8 22.3 28.9 33.6 30.4 33.7 27.7 (5.4) (11.0) (18.6) (20.4) (1.8) 0.7 3.2 1.6 - 0.2

Loss on extinguisment of debt - - (12.6) - (12.6) - Loss on extinguisment of debt - - (12.6) - - - - (12.6) - - - - - - - - - - - - - (12.6) (12.6) (12.6) (12.6) - -

Other (28.7) (11.7) (5.0) (29.6) (2.5) (8.8) Other (14.4) (29.8) (3.3) (6.6) (6.6) (24.4) (16.1) (4.5) (2.2) (4.4) (5.0) (6.6) (9.8) (13.2) (14.4) 24.4) (28.7) (29.6) (29.8) (16.1) (11.7) (2.5) (3.3) (4.5) (5.0) (8.8) (6.6)

EBITDA 159.1 134.6 136.6 162.2 144.8 160.1 EBITDA 129.3 125.7 156.2 117.8 117.8 154.0 122.8 155.1 172.8 157.7 138.2 117.8 94.9 91.9 29.3 154.0 159.1 162.2 125.7 122.8 134.6 144.8 156.2 155.1 136.6 160.1 117.8

Int rest expense, net (107.9) (85.6) (91.5) (105.5) (82.2) (101.7) Interest expense, net (106.4) (101.8) (77.8) (114.5) (97.4) (107.4) (94.1) (82.5) (50.1) (74.6) (90.1) (97.4) (102.7) 105.1) 10 .4) (107.4) (107.9) (105.5) (101.8) (94.1) (85.6) (82.2) (77.8) (82.5) (91.5) (101.7) (114.5)

Benefit from income taxes 132.2 11.8 (41.9) 145.2 (10.3) (45.3) Benefit from income taxes 12.8 142.9 (23.6) (34.6) 3.1 129.5 22.7 (40.0) (11.9) (14.3) (9.3) 3.1 6.7 8.8 12.8 129.5 132.2 145.2 142.9 22.7 11.8 (10.3) (23.6) (40.0) (41.9) (45.3) (34.6)

Dep eciation and amortization from ontinuing operations (134.7) (113.6) (104.3) (134.2) (111.3) (103.7) Depreciation and amortization from continuing operations (115.4) (128.3) (109.8) (108.0) (98.7) (123.2) (123.8) (104.9) (52.0) (79.8) (89.4) (98.7) (104.6) ( 0 .0) (115.4) (123.2) (134.7) (134.2) (128.3) (123.8) (113.6) (111.3) (109.8) (104.9) (104.3) (103.7) (108.0)

Income from disconti ued operations, net of tax 161.3 (10.1) (3.3) 141.2 1.7 (3.3) Income from discontinued operations, net of tax 42.0 118.6 1.5 1.3 38.1 34.2 121.1 (3.3) 26.7 36.1 35.6 38.1 40.1 39.0 42.0 34.2 161.3 141.2 118.6 121.1 (10.1) 1.7 1.5 (3.3) (3.3) (3.3) 1.3

Net (loss) income attributable to Aleris Corporation 210.0 (62.9) (104.4) 208.9 (57.3) (93.9) Net (loss) income attributable to Aleris Corporation (37.7) 157.1 (53.5) (138.0) (37.1) 87.1 48.7 (75.6) 85.5 25. (15.0) (37.1) 65.6) (71.4) (37.7) 87.1 210.0 208.9 157.1 48.7 (62.9) (57.3) (53.5) (75.6) (104.4) (93.9) (138.0)

Net income (loss) from discontinued operations attributable to noncontrolling interest 0.8 - - 0.4 - - Net income (loss) from discontinued operations attributable to noncontrolling interest 1.1 0.2 - - 1.0 0.9 0.1 - 0.5 0.7 1.2 1.0 0.9 1.1 .1 0.9 0.8 0.4 0.2 0.1 - - - - - - -

N t (loss) incom 210.8$ (62.9)$ (104.4)$ 209.3$ (57.3)$ (93.9)$ Net (loss) income (36.6)$ 157.3$ (53.5)$ (138.0)$ (36.1)$ 88.0$ 48.8$ (75.6)$ 86.0$ 25.$ (13.8)$ (36.1)$ (64.7)$ (70.3)$ (36.6)$ 88.0$ 210.8$ 209.3$ 157.3$ 48.8$ (62.9)$ (57.3)$ (53.5)$ (75.6)$ (104.4)$ (93.9)$ (138.0)$

TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE TRUE

For the last twelve months ended

March 31,

For the last twelve months ended

June 30,

For the last twelve months ended

September 30,

For the last twelve months ended

December 31, LTM ending LTM ending LTM ending LTM ending LTM ending

24

LTM Adjusted EBITDA Reconciliation by Segment

($M)

2014 2017 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

North America

Segment Income 94.6$ 91.5$ 114.9$ 112.8$ 104.0$ 81.8$ 85.3$ 75.0$ 79.9$ 94.6$ 99.7$ 101.9$ 111.9$ 107.9$ 100.1$ 103.1$ 84.8$ 86.1$

Impact of recording inventory at fair value through purchase accounting 8.1 - - - - - - 3.0 5.5 8.1 8.0 5.0 2.5 - - - - -

(Favorable) unfavorable metal price lag (6.8) 3.8 (5.5) (6.1) (6.7) (5.6) (9.3) (10.1) (6.8) (6.8) (6.3) 6.1 1.8 1.1 1.0 (7.9) (5.6) (4.7)

Segment Adjusted EBITDA 96.0$ 95.3$ 109.5$ 106.8$ 97.5$ 76.2$ 76.1$ 68.0$ 78.6$ 96.0$ 101.4$ 113.0$ 116.2$ 109.1$ 101.0$ 95.1$ 79.1$ 81.4$

Europe

Segment Income 147.6$ 137.3$ 142.1$ 138.8$ 133.3$ 132.1$ 131.7$ 126.7$ 127.7$ 147.6$ 150.9$ 139.5$ 136.5$ 131.8$ 123.3$ 140.5$ 146.1$ 149.4$

Impact of recording inventory at fair value through purchase accounting - - (0.6) (0.4) (0.2) (0.1) - - - - - - - - - - - -

(Favorable) unfavorable metal price lag (26.9) (1.7) (10.2) (12.9) (14.3) (16.6) (19.8) (23.6) (23.6) (26.9) (21.4) (0.7) 9.2 17.4 19.5 9.8 5.0 1.9

Segment Adjusted EBITDA 120.7$ 135.6$ 131.1$ 125.3$ 118.6$ 115.3$ 111.9$ 103.2$ 104.3$ 120.7$ 129.6$ 138.9$ 145.7$ 149.3$ 142.8$ 150.3$ 151.0$ 151.3$

Asia Pacific

Segment (Loss) Income -$ 14.6$ (0.3)$ (0.3)$ (0.3)$ (0.2)$ -$ -$ -$ -$ (1.9)$ (1.8)$ (1.2)$ -$ 2.9$ 5.3$ 7.5$ 10.8$

(Favorable) unfavorable metal price lag - (2.2) - - - - - - - - - - - - - - - (0.4)

Segment Adjusted EBITDA -$ 12.4$ (0.3)$ (0.3)$ (0.3)$ (0.2)$ -$ -$ -$ -$ (1.9)$ (1.8)$ (1.2)$ -$ 2.9$ 5.3$ 7.5$ 10.4$

For the last twelve months

ended September 30,

For the last twelve months

ended December 31,

25

LTM Commercial Margin Reconciliation

($M)

For the last twelve months

ended September 30,

2013 2014 2015 2016 2017 1Q17 2Q17 3Q17 4Q17 Q1 Q2 Q3 Q4

Aleris Corp

Revenues 2,520.8$ 2,882.4$ 2,917.8$ 2,663.9$ 2,776.3$ Revenues 2,675.6$ 2,746.9$ 2,776.3$ 674.2$ 776.2$ 712.8$

Hedged cost of metal (1,446.4) (1,682.1) (1,732.1) (1,467.6) (1,584.4) Hedged cost of Metal (1,480.4) (1,541.3) (1,584.4) (378.1) (455.4) (425.2)

Unfavorable (favorable) metal price lag (22.3) (33.7) 18.6 (3.2) (0.2) Unfavorable (favorable) metal price lag (1.6) - (0.2) (2.1) 4.7 1.0

Commercial Margin 1,052.1$ 1,166.6$ 1,204.3$ 1,193.1$ 1,191.7$ Commercial Margin 1,193.6$ 1,205.6$ 1,191.7$ 294.0$ 325.5$ 288.6$

2017LTM ending

For the last twelve months ended

December 31,

26

2014 Discontinued Operations EBITDA Reconciliations

($M)

Total Aleris Cont. Ops. Disc. Ops.

Adjusted EBITDA 265.5$ 176.5$ 89.0$

Unrealized (losses) gains on derivative financial instruments of continuing operations 6.5 5.4 1.1

Impact of recording inventory at fair value through purchase accounting (8.1) (8.1) -

Restructuring charges and impairments (8.6) (2.8) (5.8)

Unallocated currency exchange (losses) gains on debt 11.4 12.0 (0.6)

Stock-based compensation expense (13.8) (13.8) -

Start-up costs (24.5) (24.5) -

Favorable (unfavorable) metal price lag 37.2 33.7 3.5

Loss on extinguisment of debt - - -

Other (40.4) (24.4) (16.0)

EBITDA 225.2 154.0 71.2

Interest expense, net (108.1) (107.4) (0.7)

Benefit from (provision for) income taxes 127.6 129.5 (1.9)

Depreciation and amortization (157.6) (123.2) (34.4)

Income from discontinued operations, net of tax - 34.2 (34.2)

Net (loss) income attributable to Aleris Corporation 87.1 87.1 -

Net income (loss) from discontinued operations attributable to noncontrolling interest 0.9 0.9 -

Net (loss) income 88.0$ 88.0$ -$

For the year ended December 31, 2014