Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DECEMBER 2017 - Energy Recovery, Inc. | form8-kxregfd2017x1127doc.htm |

ERI INVESTOR PRESENTATION

(NASDAQ: ERII)

2017

This presentation contains forward-looking statements within the “Safe Harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements in this report include, but are not limited to, statements about our

expectations, objectives, anticipations, plans, hopes, beliefs, intentions, or strategies regarding the future. Forward-looking

statements that represent our current expectations about future events are based on assumptions and involve risks and

uncertainties. If the risks or uncertainties occur or the assumptions prove incorrect, then our results may differ materially from

those set forth or implied by the forward-looking statements. Our forward-looking statements are not guarantees of future

performance or events. Words such as “expects,” “anticipates,” “believes,” “estimates,” variations of such words, and similar

expressions are also intended to identify such forward-looking statements.

These forward-looking statements are subject to risks, uncertainties, and assumptions that are difficult to predict; therefore,

actual results may differ materially and adversely from those expressed in any forward-looking statements. You should not

place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of this

presentation. All forward-looking statements included in this presentation are subject to certain risks and uncertainties, which

could cause actual results to differ materially from those projected in the forward-looking statements, as disclosed from time to

time in our reports on Forms 10-K, 10-Q, and 8-K as well as in our Annual Reports to Stockholders and, if necessary, updated in

our quarterly reports on Form 10 Q or in other filings. We assume no obligation to update any such forward-looking

statements. It is important to note that our actual results could differ materially from the results set forth or implied by our

forward-looking statements.

FORWARD LOOKING STATEMENT

Page 2

ENERGY RECOVERY SNAPSHOT

Page 3

What We Do

An energy solutions provider and technology leader in

applying fluid dynamics and advanced materials science

Pressure Energy is our Arbitrage

Who We Are

Create markets to preserve or eliminate pumps that

are subject to and destroyed by hostile process fluids

Convert wasted pressure energy into a reusable asset

Core End-Markets

WATER OIL & GAS CHEMICALS

Page 4

VORTEQ COMMERCIALIZATION UPDATE

o VorTeq private testing deemed highly successful

Tested all 12 PXs individually up to 8.5 barrels per minute each at 9000 psi clean (no proppant)

Achieved long duration runs in excess of 60 bpm at 9000 psi clean

Pumped a total of 100,000 pounds of proppant throughout testing at up to 64 bpm

Culminated in a 33 minute continuous run at up to 2.4 pounds per gallon of sand and rates up

to 64 bpm, equating to 87,000 pounds of proppant delivery to simulated wellbore without

VorTeq system failure

Choke and dissipation system erosion precluded achievement of full pressure and run was

predominantly in a range of 6800 psi to 7200 psi;

Choke and dissipation system is to simulate well conditions as part of test apparatus, not

VorTeq system; enhanced design will be used at license partner facility test

o Continue to expect milestone success in 2017

Page 5

VORTEQ – A MATTER OF ENGINEERING NOT PHYSICS

o System excitation (vibration / shaking) at elevated flow rates was primary failure mode –

resulting in:

Axial bearing failure – increase in friction, cartridge rotation impeded

PX cartridge liftoff – PX not seated flush / correctly within housing, increase in friction, cartridge

rotation impeded

Radial bearing failure – sand enters radial channel, increase in friction, cartridge rotation impeded

Carbide fracture – cracks in carbide, increase in friction, cartridge rotation impeded

o Design enhancements to mitigate failure modes

New Missile Design – Caterpillar Kemper designed manifold: System excitation addressed via modal &

harmonic analysis on entire manifold

New Cartridge Design: Bearing failure addressed through hybrid bearing with optimized hydrostatic

and secondary hydrodynamic features

New Housing: Cartridge liftoff addressed mechanically and hydraulically (bolted-down and force-

balanced)

New Carbide Grade: addresses carbide fracture through use of grade with greater ductility

o Computational and Experiential Design Process

Over 17,500 man-hours consisting of 5 PhDs and multiple masters and bachelor degreed engineers

Engineering Disciplines employed – fluid dynamics, fluid-structural interaction, structural dynamics,

rotor dynamics, fracture mechanics, tribology

1992 - 2014 2015

Developed

Pressure

Exchanger

Technology

Established

Market

Leadership in

Desalination

Increased

shipments of

Energy Recovery

Devices

Worldwide

Invested in R&D

New Corporate

Strategy and

Management

Team

Revenues up

47% in 2015

Signed 15-year

license with

Schlumberger

Installed first

Energy Recovery

device in Saudi

Aramco production

portfolio

HISTORY OF ENERGY RECOVERY

Page 6

2016

Commenced

collaborative

VorTeq testing

with Schlumberger

Secured largest

purchase order in

company history

Record company

gross margins

2014-2016

revenue CAGR

of 34%

INVESTMENT HIGHLIGHTS

Page 7

Growth

Commercialize VorTeq technology

MTeq product introduction and commercialization

Alderley agreement to further penetrate Saudi Aramco & greater GCC

Expand water desalination segment’s total addressable market

Perpetual Innovation

Pressure exchanger technology, adaptable to other industries

Target-rich product development road map

World-class engineering talent – critical mass of PhD assets

Validation of New Corporate Strategy & Management Team

Signed 15 year exclusive licensing agreement with Schlumberger

Signed 10 year exclusive licensing agreement with Alderley in the GCC for IsoGen & IsoBoost

Corporate speed and agility – new product introductions on 12 month cycle

Financial Strength

Industry leading balance sheet (~$100MM in cash, no debt)

CORE TECHNOLOGY – THE PRESSURE EXCHANGER

Page 8

Sleeve

Rotor with ducts

(only moving part)

End covers

Desalination - Ceramic PX Energy Applications - Tungsten Carbide PX

Pressure Exchange Motion Snapshot

PRODUCT PORTFOLIO

Page 9

Hydraulic Fracturing: VorTeq

IsoGen Applications

Gas Processing

Pipelines

Ammonia

IsoBoost Applications

Gas Processing

Ammonia

Making Desalination

Affordable

18,000 Installations

on 7 continents

WATER CHEMICALS OIL & GAS

Pressure Exchanger

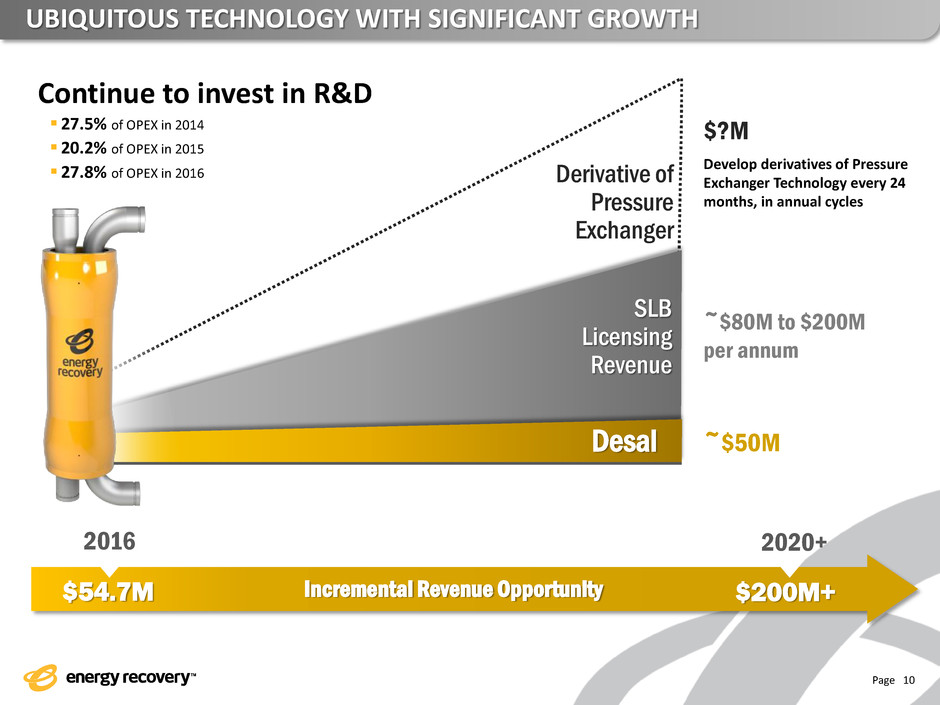

UBIQUITOUS TECHNOLOGY WITH SIGNIFICANT GROWTH

Page 10

$54.7M $200M+

2016 2020+

Incremental Revenue Opportunity

~$50M

~$80M to $200M

per annum

$?M

Desal

SLB

Licensing

Revenue

Derivative of

Pressure

Exchanger

Develop derivatives of Pressure

Exchanger Technology every 24

months, in annual cycles

Continue to invest in R&D

27.5% of OPEX in 2014

20.2% of OPEX in 2015

27.8% of OPEX in 2016

Page 11

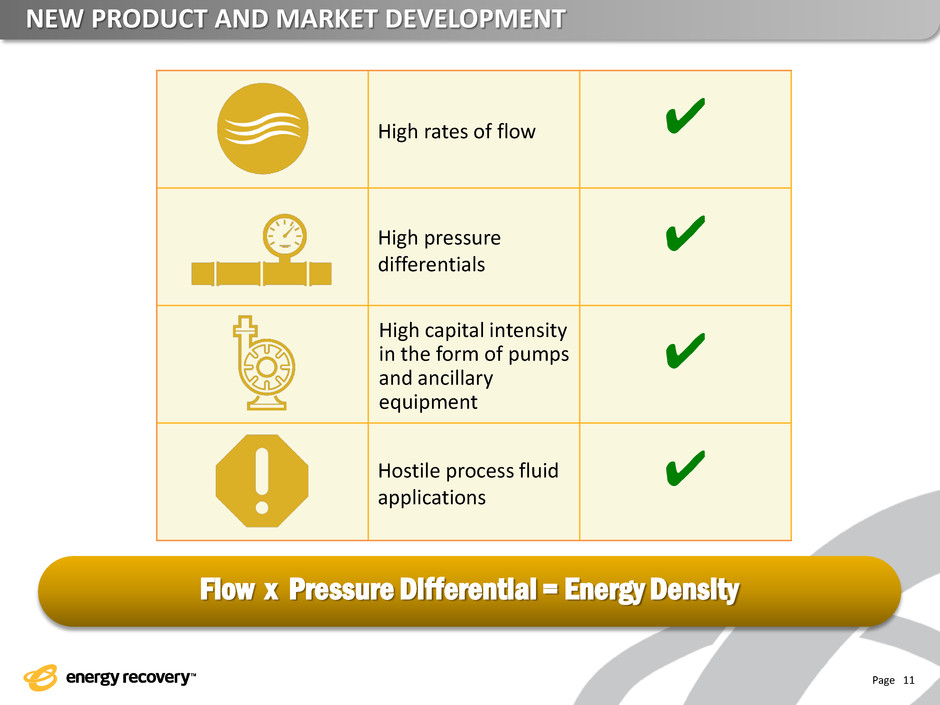

NEW PRODUCT AND MARKET DEVELOPMENT

Flow x Pressure Differential = Energy Density

High rates of flow

✔

High pressure

differentials

✔

High capital intensity

in the form of pumps

and ancillary

equipment

✔

Hostile process fluid

applications

✔

EFFICIENT FRONTIER OF PRODUCT OPTIONALITY

Page 12

Risk (technology, execution, capital)

R

et

u

rn

IsoBoost™ – 2016 secured PO totaling up to $11M

IsoGen™ – 2015, installed first ERD in Saudi

Aramco facility

VorTeq™ – 2015, exclusive licensing agreement with SLB

PX / VorTeq derivatives – target rich product

development road map

Cash Cow/

Funding

Mechanism

Early-stage Businesses / Real Options Desalination

$15 - $20M FCFE

Page 13

GO TO MARKET STRATEGY

Targeting 24 month development cycles, commencing every twelve months

1

Next

concept

cycle begins

Concept

cycle

begins

Proof

of

concept

Months

12 24

Concept

Size and

segment

market

Derive

value

proposition

Consummate

early adoption

partnership

Prototype

design and

manufacturing

Initiate

field trials

Consummate

long-term

strategic

partnership

Conclude

field trials

Manufacture

commercial

units

Generate

product

revenues

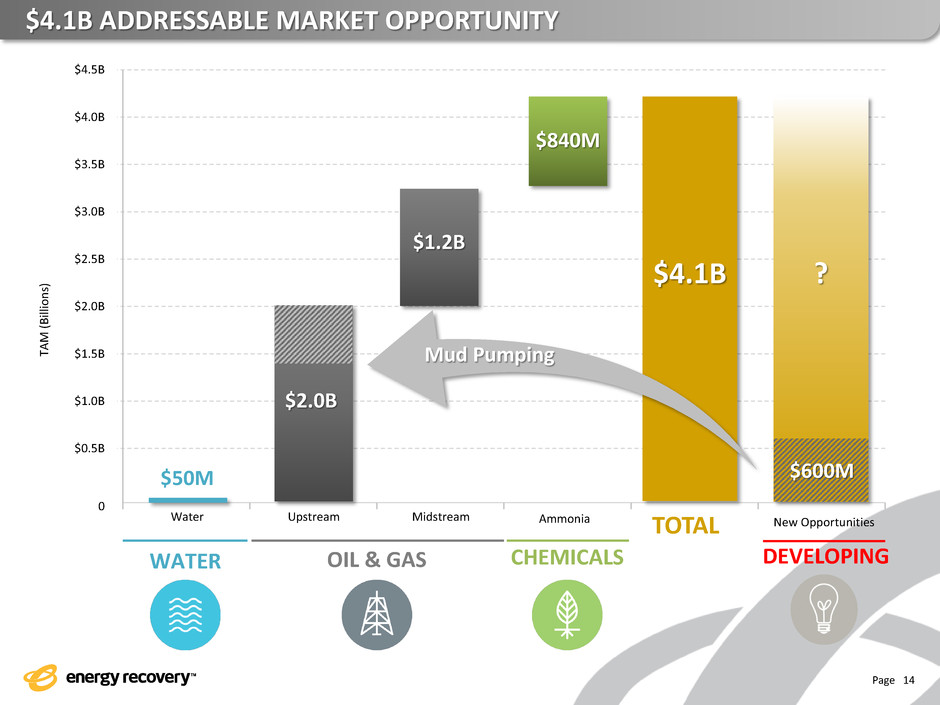

$4.1B ADDRESSABLE MARKET OPPORTUNITY

Page 14

WATER CHEMICALS OIL & GAS

$50M

$4.1B

TAM (Bi

llio

n

s)

$4.0B

$3.5B

$3.0B

$2.5B

$2.0B

$1.5B

$1.0B

$0.5B

0

Water Upstream Midstream New Opportunities Ammonia TOTAL

$2.0B

$1.2B

$840M

DEVELOPING

?

$600M

$4.5B

Mud Pumping

Click to edit Master text styles

− Second level

• Third level

Desalination

Page 15

The “PX Pressure Exchanger”

18,000 PX devices installed worldwide

25-year life with no maintenance

Dominant global market share

60%+ gross margins

Compelling short and long term market opportunity

Global water demand / supply gap

Expand product offering to increase total addressable market

Expand procurement vehicle options – Energy Services Agreements

DESALINATION – OUR FIRST DISRUPTIVE TECHNOLOGY

Page 16

Significant Cash Flow Funds Growth Initiatives

17 Page 17

Emerging Markets

Upstream Oil & Gas

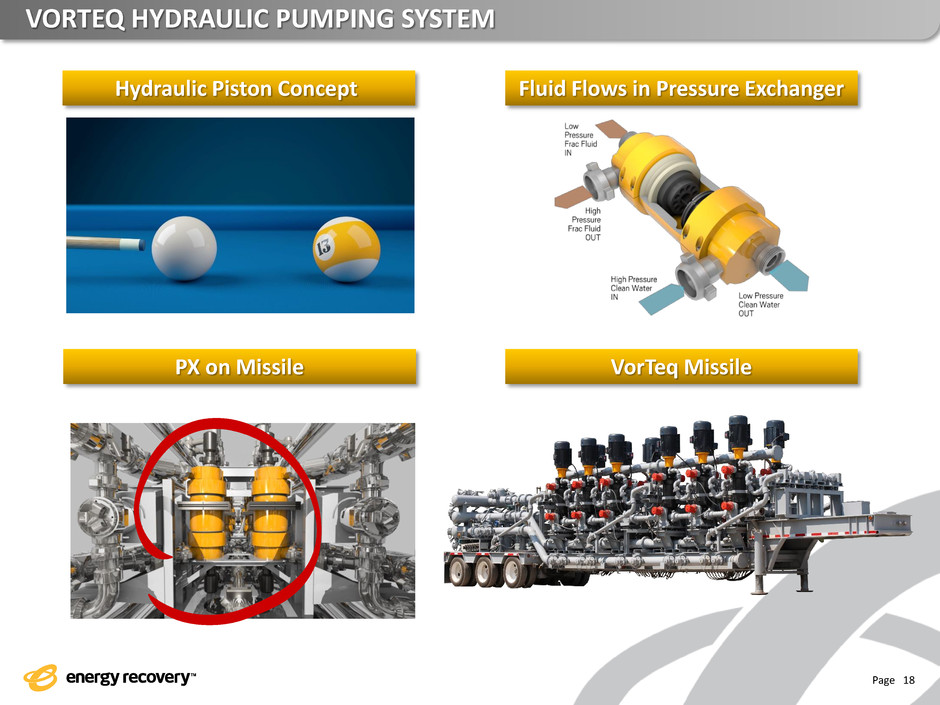

VORTEQ HYDRAULIC PUMPING SYSTEM

Page 18

Hydraulic Piston Concept

PX on Missile

Fluid Flows in Pressure Exchanger

VorTeq Missile

VORTEQ INTEGRATION

STRICTLY PRIVATE AND CONFIDENTIAL Page 19

Status Quo With VorTeq

IS VORTEQ DISRUPTIVE?

Page 20

Existing Pumping Model

with 15 to 20 PD Pumps

New Pumping Model with 3 to 4

Centrifugal Pumps

Centrifugal Pump Model

$8M to $12M p/yr p/fleet*

Reduced Maintenance:

$3M to $4M p/yr p/fleet*

Decreased Pump

Redundancy / Lower CAPEX:

$1M to $2M p/yr p/fleet*

With VorTeq Status Quo Centrifugal Pump Model

1

2

3

*ERI estimates

Page 21

SLB LICENSING AGREEMENT STRUCTURE

o Agreement provides exclusive rights to ERI’s VorTeq™ Hydraulic Pumping System for on-shore

hydraulic fracturing (Field of Use)

Commercializes the VorTeq™ technology with one of the industry’s most respected oil-field

services companies

o Highlights

Schlumberger paid an upfront $75M exclusivity fee (15 year revenue recognition)

Schlumberger will pay two separate $25M milestone payments (for a total of $50M) subject to

certain KPI’s (revenue recognition in period milestone achieved)

Milestone 1: Frac on test well at SLB Oklahoma facility

Milestone 2: Frac on E&P well

Path to commercialization and royalties

New manifold/missile design implemented and approved for field use

Upon commercialization, royalty rate of $1.5M per VorTeq per year

Royalty payments on a “take or pay” basis

MTEQ MUD PUMPING SYSTEM

Page 22

Status Quo With MTeq

MTEQ UNLOCKS VALUE FOR OPERATORS

Page 23

Drilling Configuration with MTeq & Centrifugal Pumps

Reduced Operating Cost

Reduced R&M

Increased pump life

Fewer pumps

Reduced Logistics

Lower load requirements

Less rig-up and rig-down

time

Increased Productivity

Reduction in planned and

unplanned rig downtime

Higher Reliability & Safety

Less risk of injury

Emerging Markets

Midstream & Chemicals

Page 24

OUR SOLUTION – GAS PROCESSING, AMMONIA, AND PIPELINES

Page 25

IsoBoost and IsoGen recover pressure energy and

increase reliability of pumping systems

Save millions of dollars in energy over life of plant

Improve reliability, availability, maintainability

Decrease carbon footprint

Licensing Agreement with Alderley plc

10 year exclusive license for IsoBoost ™ & IsoGen™ in

Gas Processing & Pipelines in the GCC, Iraq & Iran*

Agreement leverages ERI’s unique technology & Alderley’s distribution channel with GCC operators

The agreed royalty rates increase the product’s margin profile and mitigate execution risk

Subject to certain minimum sales requirements to maintain exclusivity

Helps Plants Save Energy, Reduce Maintenance,

And Run More Profitably

*To the extent international sanctions and laws permit

Status Quo With IsoBoost

OUR SOLUTION – GAS PROCESSING AND AMMONIA

SWEET GAS

CONTACTOR

SOUR GAS

RICH AMINE

LETDOWN

VALVE

HEAT

EXCHANGER

TO

REGENERATOR

HIGH

PRESSURE

PUMP

HIGH

PRESSURE

PUMP

HIGH

PRESSURE

PUMP

FROM

REGENERATOR

LEAN AMINE

SWEET GAS

LEAN AMINE

CONTACTOR

SOUR GAS

RICH AMINE HEAT EXCHANGER

TO

REGENERATOR

FROM

REGENERATOR

REDUCED SIZE

HIGH PRESSURE

PUMP

Page 26

Wasted Pressure Energy & High Pump CAPEX Reduced OPEX & Pump CAPEX

Status Quo With IsoGen

OUR SOLUTION - PIPELINES

Page 27

Vertical Pipelines Must Be Depressurized Pressure Generating Power

Strategic Imperatives

Short Term and Long Term Goals

Page 28

STRATEGIC IMPERATIVES

Page 29

Commercialize VorTeq

On schedule to achieve Milestone success in 2017

Deployment estimated to commence in 2018

Monetize Centrifugal Product Lines

Alderley relationship provides path for growth in GCC

Execute similar structure for monetization in other regions around the globe

Market Expansion

Enhance market position in water desalination

Increased sales into retrofit market have commenced

Product Innovation

Innovate and achieve proof of concept of new products that are derivatives of

Pressure Exchanger technology every 24 months, in annual cycles

MTeq introduction demonstrates success of strategy in 2017

THANK YOU