Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - VECTOR GROUP LTD | vectorgroupfactsheetnov2.htm |

| EX-99.2 - EXHIBIT 99.2 - VECTOR GROUP LTD | vgr-2017q3xex992sfdstockdiv.htm |

| EX-99.1 - EXHIBIT 99.1 - VECTOR GROUP LTD | vgr-2017q3xex991.htm |

| 8-K - 8-K - VECTOR GROUP LTD | vgr-2017q3x8kstockdiv.htm |

1

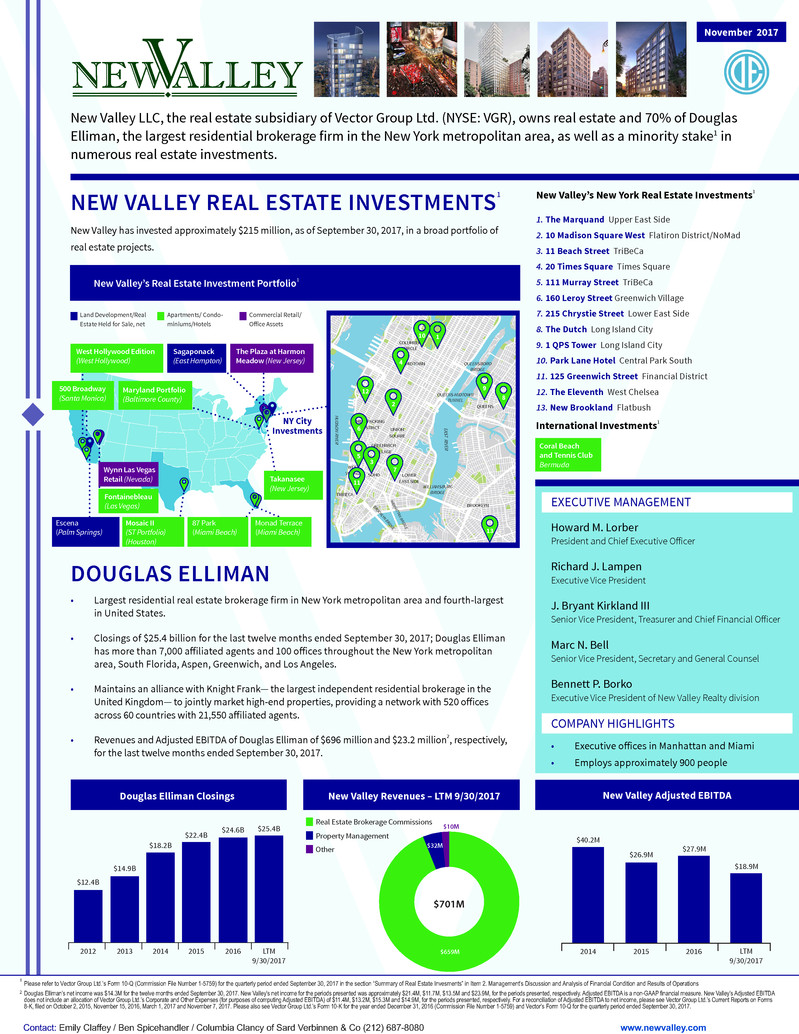

New Valley LLC, the real estate subsidiary of Vector Group Ltd. (NYSE: VGR), owns real estate and 70% of Douglas

Elliman, the largest residential brokerage firm in the New York metropolitan area, as well as a minority stake1 in

numerous real estate investments.

New Valley has invested approximately $215 million, as of September 30, 2017, in a broad portfolio of

real estate projects.

NEW VALLEY REAL ESTATE INVESTMENTS1

November 2017

DOUGLAS ELLIMAN

• Largest residential real estate brokerage firm in New York metropolitan area and fourth-largest

in United States.

• Closings of $25.4 billion for the last twelve months ended September 30, 2017; Douglas Elliman

has more than 7,000 affiliated agents and 100 offices throughout the New York metropolitan

area, South Florida, Aspen, Greenwich, and Los Angeles.

• Maintains an alliance with Knight Frank— the largest independent residential brokerage in the

United Kingdom— to jointly market high-end properties, providing a network with 520 offices

across 60 countries with 21,550 affiliated agents.

• Revenues and Adjusted EBITDA of Douglas Elliman of $696 million and $23.2 million2, respectively,

for the last twelve months ended September 30, 2017.

COMPANY HIGHLIGHTS

• Executive offices in Manhattan and Miami

• Employs approximately 900 people

Douglas Elliman’s net income was $14.3M for the twelve months ended September 30, 2017. New Valley’s net income for the periods presented was approximately $21.4M, $11.7M, $13.5M and $23.9M, for the periods presented, respectively. Adjusted EBITDA is a non-GAAP financial measure. New Valley’s Adjusted EBITDA

does not include an allocation of Vector Group Ltd.’s Corporate and Other Expenses (for purposes of computing Adjusted EBITDA) of $11.4M, $13.2M, $15.3M and $14.9M, for the periods presented, respectively. For a reconciliation of Adjusted EBITDA to net income, please see Vector Group Ltd.’s Current Reports on Forms

8-K, filed on October 2, 2015, November 15, 2016, March 1, 2017 and November 7, 2017. Please also see Vector Group Ltd.’s Form 10-K for the year ended December 31, 2016 (Commission File Number 1-5759) and Vector’s Form 10-Q for the quarterly period ended September 30, 2017.

2

LTM

9/30/2017

$18.9M

New Valley Adjusted EBITDA

Maryland Portfolio

(Baltimore County)

New Valley’s Real Estate Investment Portfolio1

New Valley’s New York Real Estate Investments1

1. The Marquand Upper East Side

2. 10 Madison Square West Flatiron District/NoMad

3. 11 Beach Street TriBeCa

4. 20 Times Square Times Square

5. 111 Murray Street TriBeCa

6. 160 Leroy Street Greenwich Village

7. 215 Chrystie Street Lower East Side

8. The Dutch Long Island City

9. 1 QPS Tower Long Island City

10. Park Lane Hotel Central Park South

11. 125 Greenwich Street Financial District

12. The Eleventh West Chelsea

13. New Brookland Flatbush

Coral Beach

and Tennis Club

Bermuda

International Investments1

Land Development/Real

Estate Held for Sale, net

Apartments/ Condo-

miniums/Hotels

Commercial Retail/

Office Assets

Monad Terrace

(Miami Beach)

www.newvalley.comContact: Emily Claffey / Ben Spicehandler / Columbia Clancy of Sard Verbinnen & Co (212) 687-8080

Escena

(Palm Springs)

Douglas Elliman Closings

LTM

9/30/2017

$25.4B

EXECUTIVE MANAGEMENT

Howard M. Lorber

President and Chief Executive Officer

Richard J. Lampen

Executive Vice President

J. Bryant Kirkland III

Senior Vice President, Treasurer and Chief Financial Officer

Marc N. Bell

Senior Vice President, Secretary and General Counsel

Bennett P. Borko

Executive Vice President of New Valley Realty division

NY City

Investments

New Valley Revenues – LTM 9/30/2017

Other

Real Estate Brokerage Commissions

Property Management

West Hollywood Edition

(West Hollywood)

The Plaza at Harmon

Meadow (New Jersey)

Sagaponack

(East Hampton)

87 Park

(Miami Beach)

Mosaic II

(ST Portfolio)

(Houston)

Takanasee

(New Jersey)

$701M

$659M

$32M

$10M

Wynn Las Vegas

Retail (Nevada)

Fontainebleau

(Las Vegas)

500 Broadway

(Santa Monica)

2012

$12.4B

2013

$14.9B

$18.2B

2014 2015

$22.4B

2016

$24.6B

2014

$40.2M

2015

$26.9M

2016

$27.9M

2

12

13

7

8

9

1

MEATPACKING

DISTRICT

MIDTOWN

QUEENS-MIDTOWN

TUNNEL

QUEENS

WILLIAMSBURG

BRIDGE

QUEENSBORO

BRIDGE

BROOK

LYN BRIDG

E

MANH

ATTAN BRIDG

E

HUDSON RIVE

R

EAST RIVE

R

COLUMBUS

CIRCLE

UNION

SQUARE

BROOKLYN

LOWER

EAST SIDE

GREENWICH

VILLAGE

WEST

VILLAGE SOHO

TRIBECA

6

5

3

11

4

10

Please refer to Vector Group Ltd.’s Form 10-Q (Commission File Number 1-5759) for the quarterly period ended September 30, 2017 in the section “Summary of Real Estate Invesments” in Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations