Attached files

| CONSOLIDATED DEBT PURCHASE AGREEMENT |

THIS CONSOLIDATED DEBT PURCHASE AGREEMENT (the “Agreement”) is entered into effective as of the 30th day July, 2017 (the “Effective Date”), by and between JDF CAPITAL INC., having an address of 62 E. Main St., Freehold, New Jersey, 07728 (“Assignor”); and, BLUE CITI LLC, having an address of 1357 Ave. Ashford, San Juan, Puerto Rico, 00907 (“Assignee”). Assignor and Assignee are sometimes referred to collectively herein as the “Parties”, and each individually as a “Party”.

RECITALS

A. Assignee wishes to assume all of Assignor’s right, title, and interest in and to those twenty (20) certain promissory notes issued by Lithium Exploration Group, Inc., a Nevada corporation (the “Company”) in favor of Assignor in the total original principal amount of Two Million Nine Hundred Seventeen Thousand Six Hundred Five Dollars ($2,917,605), with a current outstanding principal balance of Two Million Seventy Eight Thousand Six Hundred Five Dollars ($2,078,605), referred to herein as the “Assigned Amount”.

B. The Assigned Amount is represented by those promissory notes of the Company attached hereto as Exhibit “A” (each, a “Note”, and collectively, the “Notes”).

C. The Assigned Amount represents the original principal under each of the Notes. The actual principal owed and outstanding under the Notes is less than the Assigned Amount.

D. Assignee is the holder of that certain Convertible Debenture dated 10 April 2015 in the original principal amount of Five Hundred Thirty Five Thousand Dollars ($535,000) issued by Thinspace Technology, Inc., a copy of which is attached hereto as Exhibit “B” (the “Thinspace Debenture”).

E. Assignor desires to assign to Assignee all of Assignors’ right, title, and interest in and to the Notes and any all amounts due thereunder (without limitation, principal, interest, default interest, penalties, and similar amounts, and each of them, based on the terms and conditions set out herein.

F. Assignee desires to acquire all of Assignors’ right, title, and interest in and to the Notes, and each of them, based on the terms and conditions set out herein, using a portion of the Thinspace Debenture as part of the consideration paid hereunder.

G. NOW, THEREFORE, in consideration of the promises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

1. Consideration. In consideration for the assignment of the Note, Assignee shall pay to Assignor the exact and total amount of Three Hundred Fifty Thousand Dollars ($350,000.00), which amount is referred to herein as the “Purchase Price”.

2. Payment. Payment of the Purchase Price shall be payable as follows:

a. One Hundred Thousand Dollars ($100,000) in the form of Assignee’s promissory note, attached hereto as Exhibit “C” (“Payment Note”), to be delivered at the Closing.

b. Two Hundred Fifty Thousand Dollars ($250,000) in the form of Assignee’s right, title, and interest in and to Two Hundred Fifty Thousand Dollars ($250,000) of the original principal balance and all accrued and unpaid interest thereon under the Thinspace Debenture (the “Assigned Portion”).

3. Closing and Assignment. Subject to and in accordance with the terms and conditions set forth in this Agreement, Assignor hereby grants, sells, assigns, and conveys to Assignee, without recourse, all of Assignor’s right, title, and interest in, to, and under each of the Notes. The closing of the transactions contemplated hereunder (the “Closing”) shall take place simultaneously with the delivery of the Purchase Price via delivery of the signed Payment Note and a fully executed version of this Agreement. The Closing shall occur no later than 5:00 P.M., New York time, on 31 July 2017, unless extended by the mutual written consent of the Parties.

1

4. Representations of Assignor. Assignor hereby represents and covenants to Assignee that:

a. Assignor has all requisite authority to execute and deliver this Agreement and any other document contemplated by this Agreement and to perform its obligations hereunder and to consummate the transactions hereunder. This Agreement has been duly executed and delivered by Assignor and constitutes the legal, valid, and binding obligations of Assignor, enforceable against Assignor in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles relating to enforceability (regardless of whether considered in a proceeding at law or in equity).

b. Upon Closing, Assignor shall retain no right, title, or interest in and to any of the Notes, and all outstanding principal, accrued and unpaid interest, and all other fees, penalties, amounts due on each of the Notes shall be collected by Assignee.

c. Each Note is free and clear of all liens, mortgages, pledges, security interests, encumbrances, or charges of any kind or description. Assignor has the sole and unrestricted right to sell and/or transfer the Notes. Assignor is conveying to Assignee all of its rights, title, and interests to each of the Notes, free and clear of all liens, mortgages, pledges, security interests, encumbrances, or charges of any kind or description. Upon transfer to Assignee by Assignor of the Notes, Assignee will have good and unencumbered title to each Note, free and clear of any and all liens or claims.

d. Assignor is an "accredited investor" within the meaning of Regulation D, Rule 501(a), promulgated by the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”).

e. Assignor represents and warrants that it has read the terms of the Thinspace Debenture and agrees to such terms.

f. Neither Assignor nor any of its officers and directors, if a legal entity, are now, or have been in the last 90-days, officers or directors of the Company, or beneficial holders of 10% or more of the equity securities of the Company, or in any way an affiliate of the Company, as such term is defined under the Securities Act.

5. Representations of Assignee. Assignee hereby represents and covenant to Assignor that:

a. Assignee has all requisite power and authority to execute and deliver this Agreement and any other document contemplated by this Agreement to be signed by Assignee and to perform its obligations hereunder and to consummate the transactions contemplated hereby.

b. Assignee understands that the shares to be issued upon conversion of the Notes have not been, and may not be, registered under the Securities Act by reason of a specific exemption from the registration provisions of the Securities Act, the availability of which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of Assignee’s representations as expressed herein or otherwise made pursuant hereto.

c. Assignee has substantial experience in evaluating and investing in securities of companies similar to the Company and acknowledges that it can protect its own interests. Assignee has such knowledge and experience in financial and business matters so it is capable of evaluating the merits and risks of its investment in the Company. Assignee is an “accredited investor” within the meaning of the Securities Act.

d. Assignee represents and warrants that it has read the terms of each of the Note and agrees to such terms, and further understands that the actual principal owed and outstanding under the Notes is less than the Assigned Amount.

2

e. Upon Closing, Assignee shall retain no right, title, or interest in and to the Assigned Portion under the Thinspace Debenture, and all outstanding principal, accrued and unpaid interest, and all other fees, penalties, amounts due on the Assigned Portion under the Thinspace Debenture shall be collected by Assignor.

f. The Thinspace Debenture is free and clear of all liens, mortgages, pledges, security interests, encumbrances, or charges of any kind or description. Assignee has the sole and unrestricted right to sell and/or transfer the Thinspace Debenture, and in particular the Assigned Portion. Assignee is conveying to Assignor all of its rights, title, and interests to the Assigned Portion under the Thinspace Debenture, free and clear of all liens, mortgages, pledges, security interests, encumbrances, or charges of any kind or description. Upon transfer to Assignor by Assignee of the Assigned Portion under the Thinspace Debenture, Assignor will have good and unencumbered title to the Assigned Portion under the Thinspace Debenture, free and clear of any and all liens or claims.

g. Assignee has not modified or amended the Thinspace Debenture or agreed to modify or amend the Thinspace Debenture, other than that certain Amendment No. 1 to Convertible Debenture dated 10 April 2015, executed on 14 May 2015, a copy of which is attached hereto as Exhibit “D”.

h. Assignee is not aware of any valid offset, defense, counterclaim, or right of rescission as to the Thinspace Debenture.

5. Additional Provisions.

a. This Agreement may be executed in any number of counterparts, all of which when taken together shall be considered one and the same agreement, it being understood that all Parties need not sign the same counterpart. In the event that any signature is delivered by Fax or by E-Mail, such signature shall create a valid and binding obligation of that Party (or on whose behalf such signature is executed) with the same force and effect as an original thereof. Any photographic, photocopy, or similar reproduction copy of this Agreement, with all signatures reproduced on one or more sets of signature pages, shall be considered for all purposes as if it were an executed counterpart of this Agreement.

b. This Agreement, and all references, documents, or instruments referred to herein, contains the entire agreement and understanding of the Parties in respect to the subject matter contained herein. The Parties have expressly not relied upon any promises, representations, warranties, agreements, covenants, or undertakings, other than those expressly set forth or referred to herein. This Agreement supersedes (i) any and all prior written or oral agreements, understandings, and negotiations between the Parties with respect to the subject matter contained herein; and, (ii) any course of performance and/or usage of the trade inconsistent with any of the terms hereof.

c. Each and every provision of this Agreement is severable and independent of any other term or provision of this Agreement. If any term or provision hereof is held void or invalid for any reason by a court of competent jurisdiction, such invalidity shall not affect the remainder of this Agreement.

d. This Agreement shall be governed by the laws of the State of Nevada, without giving effect to any choice or conflict of law provision or rule (whether of the State of Nevada or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Nevada. If any court action is necessary to enforce the terms and conditions of this Agreement, the Parties hereby agree that the Superior Court of California, County of Orange, shall be the sole jurisdiction and venue for the bringing of such action.

e. The Parties agree that irreparable damage would occur in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached. Accordingly, it is agreed that the Parties shall be entitled to seek an injunction or injunctions to prevent breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement, this being in addition to any other remedy to which they are entitled at law or in equity. The remedies of the Parties under this Agreement are cumulative and shall not exclude any other remedies to which any person may be lawfully entitled.

3

f. No failure by any Party to insist on the strict performance of any covenant, duty, agreement, or condition of this Agreement or to exercise any right or remedy on a breach shall constitute a waiver of any such breach or of any other covenant, duty, agreement, or condition.

g. In the event of any legal action (including arbitration) to enforce or interpret the provisions of this Agreement, the non-prevailing Party shall pay the reasonable attorneys’ fees and other costs and expenses including expert witness fees of the prevailing Party in such amount as the court shall determine. In addition, such non-prevailing Party shall pay reasonable attorneys’ fees incurred by the prevailing Party in enforcing, or on appeal from, a judgment in favor of the prevailing Party. The preceding sentence is intended by the Parties to be severable from the other provisions of this Agreement and to survive and not be merged into such judgment.

h. The facts recited in Article II, above, are hereby conclusively presumed to be true as between and affecting the Parties.

i. No Party may assign any right, benefit, or interest in this Agreement without the written consent of the other Party, which consent may not be unreasonably withheld. This Agreement will inure to the benefit of, and be binding upon, the Parties and their respective successors and assigns.

j. This Agreement is the result of negotiations by and between the Parties, and each Party has had the opportunity to be represented by independent legal counsel of its choice. This Agreement is the product of the work and efforts of all Parties, and shall be deemed to have been drafted by all Parties. In the event of a dispute, no Party shall be entitled to claim that any provision should be construed against any other Party by reason of the fact that it was drafted by one particular Party.

k. When a reference is made in this Agreement to an Article, Section, Subsection, Exhibit, or Schedule, such reference shall be to said item of this Agreement unless otherwise indicated. The Exhibits and Schedules identified in this Agreement are incorporated herein by reference and made a part hereof as if set out in full herein.

l. Each Party agrees (i) to furnish upon request to each other Party such further information; (ii) to execute and deliver to each other Party such other documents; and, (iii) to do such other acts and things, all as another Party may reasonably request for the purpose of carrying out the intent of this Agreement and the transactions envisioned hereunder. However, this provision shall not require that any additional representations or warranties be made and no Party shall be required to incur any material expense or potential exposure to legal liability pursuant to this section.

m. All notices, requests and demands hereunder shall be in writing and delivered by hand, by Electronic Transmission, by mail, or by recognized commercial over-night delivery service (such as Federal Express or UPS), and shall be deemed given (a) if by hand delivery, upon such delivery; (b) if by Electronic Transmission, upon telephone confirmation of receipt of same; (c) if by mail, forty-eight (48) hours after deposit in the United States mail, first class, registered or certified mail, postage prepaid; or, (d) if by recognized commercial over-night delivery service, upon such delivery.

1. Each Party hereby expressly consents to the use of Electronic Transmission for communications and notices under this Agreement. For purposes of this Agreement, “Electronic Transmission” means a communication (i) delivered by Fax or E-Mail when directed to the Fax number or E-Mail address, respectively, for that recipient on record with the sending Party; and, (ii) that creates a record that is capable of retention, retrieval, and review, and that may thereafter be rendered into clearly legible tangible form.

2. Any Party may alter the Fax number, E-Mail address, physical address, or postage address to which communications or copies are to be sent by giving notice of such change of address to the other Parties in accordance with the provisions of this section.

n. For purposes of this Agreement, (i) those words, names, or terms which are specifically defined herein shall have the meaning specifically ascribed to them; (ii) wherever from the context it appears appropriate, each term stated either in the singular or plural shall include the singular and plural; (iii) wherever from the context it appears appropriate, the masculine, feminine, or neuter gender, shall each include the others; (iv) the words “hereof”, “herein”, “hereunder”, and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole, and not to any particular provision of this Agreement; (v) all references to “Dollars” or “$” shall be construed as being United States Dollars; (vi) the term “including” is not limiting and means “including without limitation”; and, (vii) all references to all statutes, statutory provisions, regulations, or similar administrative provisions shall be construed as a reference to such statute, statutory provision, regulation, or similar administrative provision as in force at the date of this Agreement and as may be subsequently amended.

4

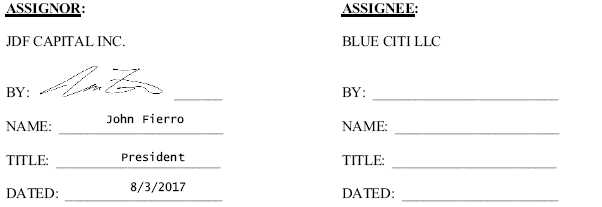

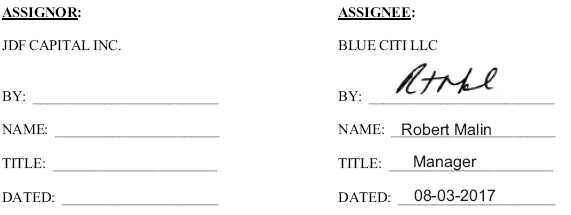

EXECUTION

IN WITNESS WHEREOF, this CONSOLIDATED DEBT PURCHASE AGREEMENT has been duly executed by the Parties. Each of the undersigned Parties hereby represents and warrants that it (i) has the requisite power and authority to enter into and carry out the terms and conditions of this Agreement, as well as all transactions contemplated hereunder; and, (ii) it is duly authorized and empowered to execute and deliver this Agreement.

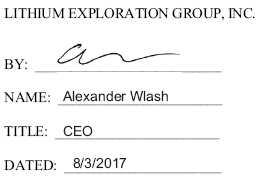

THE COMPANY HEREBY CONFIRMS THAT IT CONSENTS TO THE ASSIGNMENT OF THE NOTE AS PROVIDED FOR IN THE AGREEMENT. IT HEREAFTER RECOGNIZES ASSIGNEE AS THE TRUE, RIGHTFUL, AND LAWFUL “HOLDER” UNDER THE NOTE. THE PRINCIPAL AMOUNT, ACCRUED INTEREST, AND ALL FEES DUE ON THE NOTE REMAIN UNCHANGED AS A RESULT OF THE ASSIGNMENT. THE NON-AFFILIATE STATUS OF THE ASSIGNOR, ITS OFFICERS, AND DIRECTORS, AS SET FORTH HEREIN, IS CORRECT.

COMPANY:

LITHIUM EXPLORATION GROUP, INC.

BY: __________________________

NAME: _______________________

TITLE: _______________________

DATED: ______________________

5

each term stated either in the singular or plural shall include the singular and plural; (iii) wherever from the context it appears appropriate, the masculine, feminine, or neuter gender, shall each include the others; (iv) the words “hereof”, “herein”, “hereunder”, and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole, and not to any particular provision of this Agreement; (v) all references to “Dollars” or “$” shall be construed as being United States Dollars; (vi) the term “including” is not limiting and means “including without limitation”; and, (vii) all references to all statutes, statutory provisions, regulations, or similar administrative provisions shall be construed as a reference to such statute, statutory provision, regulation, or similar administrative provision as in force at the date of this Agreement and as may be subsequently amended.

EXECUTION

IN WITNESS WHEREOF, this CONSOLIDATED DEBT PURCHASE AGREEMENT has been duly executed by the Parties. Each of the undersigned Parties hereby represents and warrants that it (i) has the requisite power and authority to enter into and carry out the terms and conditions of this Agreement, as well as all transactions contemplated hereunder; and, (ii) it is duly authorized and empowered to execute and deliver this Agreement.

THE COMPANY HEREBY CONFIRMS THAT IT CONSENTS TO THE ASSIGNMENT OF THE NOTE AS PROVIDED FOR IN THE AGREEMENT. IT HEREAFTER RECOGNIZES ASSIGNEE AS THE TRUE, RIGHTFUL, AND LAWFUL “HOLDER” UNDER THE NOTE. THE PRINCIPAL AMOUNT, ACCRUED INTEREST, AND ALL FEES DUE ON THE NOTE REMAIN UNCHANGED AS A RESULT OF THE ASSIGNMENT. THE NON-AFFILIATE STATUS OF THE ASSIGNOR, ITS OFFICERS, AND DIRECTORS, AS SET FORTH HEREIN, IS CORRECT.

COMPANY:

5

EXHIBIT “A”

THE NOTES

6

EXHIBIT “B”

THINSPACE DEBENTURE

7

EXHIBIT “C”

PURCHASE NOTE

8