Attached files

| file | filename |

|---|---|

| EX-99.3 - UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS - China Teletech Holding Inc | f8k111317a1ex99-3_chinatele.htm |

| EX-99.2 - UNAUDITED FINANCIAL STATEMENTS - China Teletech Holding Inc | f8k111317a1ex99-2_chinatele.htm |

| EX-99.1 - AUDITED FINANCIAL STATEMENTS - China Teletech Holding Inc | f8k111317a1ex99-1_chinatele.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - China Teletech Holding Inc | f8k111317a1ex21-1_chinatele.htm |

| EX-2.1 - SHARE EXCHANGE AGREEMENT DATED AS OF NOVEMBER 15, 2016 BY AND AMONG THE COMPANY, - China Teletech Holding Inc | f8k111317a1ex2-1_chinatele.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K/A

(Amendment No.1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 13, 2017

CHINA TELETECH HOLDING, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Florida | 333-130937 | 59-3565377 | ||

| (State

or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

Liwan District, No.145 Enzhou Big Lane, B2 Fuli Square, 8th Zhongshan Road, Unit 505, 5/F, Guangzhou, Guangdong, China |

| (Address, including zip code, of principal executive offices) |

Registrant’s telephone number, including area code (850) 521-1000

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This amendment amends the Current Report on Form 8-K filed on November 13, 2017 (the “Current Report”), to include a signed audit report in Exhibit 99.1 and update the risk factor section. This amendment does not amend or otherwise affect the other disclosures in the Current Report.

| Item 1.01 | Entry into a Material Definitive Agreement. |

On November 15, 2016, China Teletech Holding Inc., a Florida corporation (“China Teletech”), Liaoning Kuncheng Education Investment Co. Ltd., a company organized under the laws of the People’s Republic of China (“Kuncheng”), and Kunyuan Yang, the 94.9% shareholder of Kuncheng (the “Mr. Yang”) entered into a share exchange agreement (the “Kuncheng Share Exchange Agreement”), pursuant to which China Teletech would acquire 51% of the issued and outstanding equity securities of Kuncheng (the “Kuncheng Share Exchange”) upon closing of the transactions underlying the Kuncheng Share Exchange.

For a description of the Kuncheng Share Exchange Agreement and the Kuncheng Share Exchange, please refer to Item 2.01 herein below. The descriptions of the Kuncheng Share Exchange Agreement are qualified in their entirety by reference to the complete text of the Kuncheng Share Exchange Agreement, which is attached hereto as Exhibit 2.1, and are incorporated by reference herein. You are urged to read the entire Kuncheng Share Exchange Agreement and the other exhibits attached hereto.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

OVERVIEW

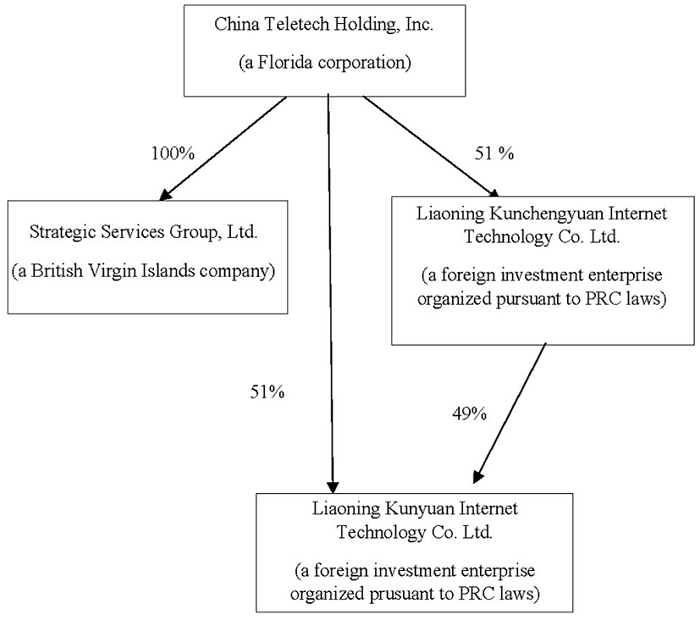

As used in this report, unless otherwise indicated, the terms “we” and “us” refer to China Teletech Holding Inc., a Florida corporation (“China Teletech”), its wholly-owned subsidiary Strategic Services Group Ltd., a British Virgin Islands company (“SSGL”), 51%-owned subsidiary Liaoning Kunchengyuan Internet Technology Co. Ltd. (formerly known as Liaoning Kuncheng Education Investment Co. Ltd.) (“Kuncheng”), and 51%-owned subsidiary Liaoning Kunyuan Internet Technology Co. Ltd (“Kunyuan”). As of the date of this report, each of Kuncheng and Kunyuan is a foreign investment limited liability entity (“FIE”) organized pursuant to PRC laws.

As of the date of this report, 51% of Kuncheng is held by China Teletech, 43.9% held by Mr. Yang, and the remaining 5.1% held by Zefeng Sun. As of the date of this Report, China Teletech is a 51% owner of Kunyuan upon closing of the Kuncheng Share Exchange, and Kuncheng a 49% holder.

HISTORY

We were incorporated as Avalon Development Enterprises, Inc. on March 29, 1999, under the laws of the State of Florida. From inception until January 2007, we engaged in the business of acquiring commercial property which later expanded to include building cleaning, maintenance services, and equipment leasing as supporting ancillary services and sources of revenue. On January 10, 2007, the Company, Global Telecom Holdings, Ltd., a British Virgin Islands company (“GTHL”), and the shareholders of GTHL, entered into a share exchange agreement, pursuant to which the Company issued 39,817,500 restricted shares of its common stock, par value $0.001 per share (the “Common Stock”) to the shareholders of GTHL in exchange for all of the issued and outstanding capital stock of GTHL. Following the transaction on March 27, 2007, GTHL became our wholly-owned subsidiary and we changed our name to Guangzhou Global Telecom Holdings, Inc. and succeeded to the business of GTHL.

| 2 |

In 2007, we established four subsidiaries; namely, Zhengzhou Global Telecom Equipment Limited (“ZGTE”), Macau Global Telecom Company Limited (“MGT”), Huantong Telecom Hongkong Holding Limited (“HTHKH”), and Huantong Telecom Singapore Company PTE Limited (“HTS”) with capital of RMB 500,000, Macau Dollar 300,000, Hong Kong Dollar 100 and Singapore Dollar 200,000, respectively. Simultaneously, we established a subsidiary; namely, Guangzhou Huantong Telecom Technology and Consultant Services, Ltd (“GHTTCS”) with capital of RMB 8,155,730. Pursuant to stock purchase agreements dated April 9, 2008 and July 29, 2008 (the “Stock Purchase Agreements”), respectively, the Company acquired 50% of the issued and outstanding shares of Beijing Lihe Jiahua Technology and Trading Company Ltd (“BLJ”) and 51% of the issued and outstanding shares of Guangzhou Renwoxing Telecom Co., Ltd. (“GRT”), a limited liability company incorporated in China from the respective shareholders of BLJ and GRT (the “Shareholders”). Pursuant to the terms of the Stock Purchase Agreements, the Shareholders agreed to sell and transfer the proportion of the shares to the Company for a purchase consideration of US$300,000 and US$291,833 respectively.

In 2009 and 2010, the Company disposed of CHTTCS, ZGTE, MGT and BLJ due to their loss in operations. HTHKH and HTS were not able to commence operations since its inception, so the Company deregistered them in 2010.

Acquisition of China Teletech Limited

On March 30, 2012, the Company completed a share exchange transaction with China Teletech Limited, a British Virgin Islands corporation (“CTL”), by entering into a share exchange agreement dated March 30, 2012 with CTL and the former shareholders of CTL.

CTL is a British Virgin Islands Company, incorporated on January 30, 2008 under the British Virgin Islands Business Act 2004. Its primary business operations were concluded through two wholly owned subsidiaries located in China, namely, (a) Shenzhen Rongxin Investment Co., Ltd. (“Shenzhen Rongxin”) and (b) Guangzhou Rongxin Science and Technology Limited (“Guangzhou Rongxin”).

Pursuant to the share exchange agreement dated March 30, 2012, we acquired all the outstanding capital stock of CTL from the former shareholders of CTL in exchange for the issuance of 40,000,000 shares of our Common Stock. The shares issued to the former shareholders of CTL constituted approximately 68.34% of our issued and outstanding shares of Common Stock immediately upon the commutation of the share exchange transaction. As a result of the share exchange, CTL became our wholly owned subsidiary and Dong Liu and Yuan Zhao, the former shareholders of CTL, became our principal shareholders.

In connection with the share exchange, Yankuan Li resigned as our Chief Financial Officer, Secretary and Chairman of the Board of Directors, effective as of March 30, 2012. At the same time, Dong Liu, Yuan Zhao, Yau Kwong Lee and Kwok Ming Wai Andrew were appointed as our directors. Ms. Yankuan Li remained President, Chief Executive Officer and a director of the Company.

Sale of the Company’s Wholly-Owned Subsidiary, Guangzhou Global Telecommunication Company Limited

On June 30, 2012, we entered into a sales and purchase agreement with Mr. Zhu Sui Hui (“Mr. Hui”) pursuant to which we sold all the capital stock of Guangzhou Global Telecommunication Company Limited (“GGT”), our wholly-owned subsidiary, to Mr. Hui for RMB 5,000, or approximately $800 (the “GGT Spin-Off”). Both parties agreed to unconditionally waive the current accounts payable or receivable balances between the Company (and its subsidiaries) and GGT. Before the GGT Spin-Off, GGT was engaged in the trading and distribution of cellular phones and accessories, prepaid calling cards, and rechargeable store-value cards.

Disposition of the Company’s variable interest entity, Shenzhen Rongxin Investment Co., Ltd.

On September 30, 2012, CTL entered into an agreement with a related party of us, Liu Yong, brother of Mr. Liu Dong, the Company’s former Chairman, to dispose of the variable interest entity Shenzhen Rongxin Investment Co., Ltd for a cash consideration of US$1,579.

Sale of the Company’s Subsidiary, GRT

On June 30, 2013, the Company’s subsidiary, GTHL, entered into an agreement with an independent third party to spin off its 51% owned subsidiary GRT for a cash consideration of US$3,232.

| 3 |

Deregistration of the Company’s Wholly-Owned Subsidiaries, Guangzhou Rongxin Science and Technology Limited

On December 30, 2013, the Company had its subsidiary, Guangzhou Rongxin deregistered due to ceased operations.

Following the deregistration of Guangzhou Rongxin, the Company became a shell company with no operations until the Company entered into the Jinke Share Exchange Agreement (defined below) with Jinke (defined below).

Sale of the Company’s Wholly-Owned Subsidiaries Global Telecom Holdings Limited and China Teletech Limited

On January 1, 2015, the Company entered into an agreement with an independent third party to dispose of GTHL and CTL for a cash consideration of US$2,000.

Share Exchange with Jinke

On January 28, 2015, the Company entered into a share exchange agreement (the “Jinke Share Exchange Agreement”) with Shenzhen Jinke Energy Development Co., Ltd., a company organized under the laws of the People’s Republic of China (“Jinke”), and Guangyuan Liu, the holder of 97% of the equity interest of Jinke (the “Mr. Liu”), pursuant to which the Company acquired 51% of the issued and outstanding equity securities of Jinke (the “Jinke Share Exchange”). In connection with the Jinke Share Exchange, Mr. Guangyuan Liu was appointed a director of the Company.

Pursuant to the Jinke Share Exchange Agreement, the Company agreed to issue an aggregate of 20,000,000 shares of its Common Stock to Mr. Liu in exchange for 51% of the issued and outstanding securities of Jinke. Of the 20,000,000 shares to be issued by the Company, 16,000,000 were issued on October 6, 2014 (“Jinke Issued Shares”) and delivered to Mr. Liu and his designee prior to closing and 4,000,000 were to be issued and delivered at closing. The Jinke Share Exchange closed on January 28, 2015. The remaining 4,000,000 shares were never issued to Mr. Liu.

Incorporation of Strategic Services Group Limited

On November 8, 2016, SSGL was incorporated in the British Virgin Islands as a wholly owned subsidiary of the Company. SSGL is an investment holding company with no business operation since its incorporation.

Rescission Agreement with Jinke

On November 15, 2016, the Company, Jinke and the Jinke Shareholder entered into a certain mutual rescission agreement (the “Rescission Agreement”), whereby the parties agreed to rescind the Jinke Exchange Agreement and unwind the Jinke Share Exchange as if it had never occurred, for a consideration of 10,000,000 newly issued restricted shares (the “Rescission Shares”) of the Common Stock to be issued to Mr. Liu upon closing of the transactions contemplated in the Rescission Agreement. Pursuant to the Rescission Agreement, Mr. Liu would return and surrender the Jinke Issued Shares and the Company would issue the Rescission Shares to Mr. Liu. Mr. Liu also resigned as a director pursuant to the Rescission Agreement, effective as of November 15, 2016. As of the date of this Report, Mr. Liu has not returned and surrendered the Jinke Issued Shares and the Company has not issued the Rescission Shares.

Kuncheng Share Exchange Agreement with Kuncheng

On November 15, 2016, the Company, Kuncheng and Mr. Yang, the principal shareholder of Kuncheng, entered into the Kuncheng Share Exchange Agreement pursuant to which the Company agreed to purchase 51% of the equity ownership in Kuncheng, for a purchase price of an aggregate of 30,000,000 shares of Common Stock issued to Mr. Yang (the “Kuncheng Share Exchange”).

In connection with the Kuncheng Share Exchange, Kuncheng shall appoint additional members to the Board of Directors of the Company (the “Board”) including Mr. Yang, upon Closing (defined below). As of the date of this report, Mr. Yang was appointed a director of the Board.

As of the date of this report, the Company and Mr. Yang completed the closing of the Kuncheng Share Exchange and the Company has completed the registration of the transfer of Kuncheng’s ownership with the relevant PRC governmental authorities (the “Closing”). 10,000,000 additional shares were issued and delivered upon closing of the Kuncheng Share Exchange, and the remaining 20,000,000 shares were issued at the Closing.

Registration of Kunyuan

On April 19, 2017, Liaoning Kunyuan Internet Technology Co. Ltd. (“Kunyuan”) was registered under the laws of the People’s Republic of China as a JV. Effective June 2, 2017, Kunyuan changed its registration to become an FIE. As of the date of this report, Kuncheng holds 49% and China Teletech holds 51% of the ownership in Kunyuan. As of the date of this report, Kunyuan has no significant business activities or operations.

| 4 |

The corporate structure of China Teletech subsequent to the closing of the Kunyuan Share Exchange is illustrated as follows:

The address of our principal executive offices and corporate offices is Liwan District, No.145 Enzhou Big Lane, B2 Fuli Square, 8th Zhongshan Road, Unit 505, 5/F, Guangzhou, Guangdong, China. Our telephone number is 00852-6873-3117.

PRINCIPAL TERMS OF THE KUNCHENG SHARE EXCHANGE AGREEMENT

On November 15, 2016, China Teletech, Kuncheng and Mr. Yang entered into the Kuncheng Share Exchange Agreement pursuant to which China Teletech agreed to issue an aggregate of 30,000,000 shares of its Common Stock, to Mr. Yang in exchange for 51% of the issued and outstanding securities of Kuncheng. Prior to the Kuncheng Share Exchange, Mr. Yang was a 94.9% shareholder of Kuncheng. At the closing of the Kuncheng Share Exchange, Mr. Yang is now a 43.9% shareholder of Kuncheng.

Both China Teletech and Kuncheng believed that the acquisition transaction is in the best interest of their respective shareholders. China Teletech believed that the acquisition would enhance the value of the Company through the acquisition of a majority equity interest in Kuncheng’s viable business, and Kuncheng believed that such transaction would afford Kuncheng access to the U.S. capital market and other possible financial resources. Prior to the execution of the Kuncheng Share Exchange Agreement, no material relationship had existed between China Teletech and its affiliates, on the one hand, and Kuncheng and its affiliates, on the other.

| 5 |

10,000,000 shares of Common Stock were issued and delivered on January 3, 2017, prior to the closing of the Kuncheng Share Exchange. The Kuncheng Share Exchange closed on the date of this Report, and the remaining 20,000,000 shares of Common Stock were issued to Mr. Yang. Because the Company is a non-PRC shareholder of Kuncheng, it must take steps to register its foreign ownership. As of May 26, 2017, Kuncheng has obtained approval from the relevant PRC governmental authorities including but not limited to, (1) changing the registration of ownership of Kuncheng to reflect the transfer of the 51% equity interest to China Teletech, and (2) changing Kuncheng’s registration from a PRC entity to an FIE.

In connection with the Kuncheng Share Exchange, Mr. Yang was appointed a director of the Board, effective as of the closing of the Kuncheng Share Exchange.

BUSINESS

Prior to entering into the Kuncheng Share Exchange with Kuncheng and Mr. Yang, we were a shell company with no operations. As of the date of this report which is the closing of the transactions underlying the Kuncheng Acquisition, we are a holding company with substantially all of our operations located in the PRC through our 51% equity ownership of Kuncheng. Through Kuncheng, we are now an education service company that provides education investment, education management and operation of education institutions, and international education programs.

Established in March 30, 2016, Kuncheng is a limited liability company primarily focused on investing in education programs and operating and managing education institutions.

Kuncheng entered into a certain Project Transfer Agreement on April 20, 2016 (the “Project Transfer Agreement”) with Shenyang Aidesi Education School, d/b/a Shenyang International A-Level Center (the “Center”) to acquire the right of operating and managing the Center for a consideration of RMB 3,485,250 (approximately US$ 535,000). The Center is a private, non-corporation entity registered/organized under the laws of the People’s Republic of China, and was established in May 2011. The consideration was fully paid by Kuncheng, to Gu Wei and Yang Weida, who control the Center and are referred to as “sponsors” of the Center according to PRC laws and regulations. The Center has a registered capital of RMB 500,000, of which 30% was previously paid in by Gu Wei, and 70% by Yang Weida. Kuncheng is not a “sponsor” to the Center. Following the Project Transfer Agreement, Gu Wei and Yang Weida continue to be the Center’s sponsors and no change of ownership or control of the Center is registered with the competent PRC government bureaus and/or agencies. After acquiring the right to manage and operate the Center, Kuncheng’s main operation currently is focused on operating and managing the Center, and the revenue mainly comes from the tuition and boarding income of the Center’s International A-level program and the tutoring program. The Center does not currently have a valid private school operating permit and its permit has expired since March 2016. The Center is in the process of obtaining a valid private school operating permit from the relevant local education bureau. We are operating the Center and may also be subject to relevant penalties. For risks related to operating the Center without a valid private school operating permit, see detailed discussion in the Risk Factors - Risks Related To Our Business - The private school operating permit of the Center that we operate and manage, is currently expired and we may be deemed operating a school illegally and may be subject to administrative penalties.

Following the transfer of the right to operate and manage the Center’s programs (“Project Transfer”), Kuncheng has been operating the Center’s International A-level program and the tutoring program. Teachers employed by the Center prior to the Project Transfer by Kuncheng are now employed by Kuncheng.

| 6 |

Our Program

Currently, our primary programs are International A-Level preparation program, and English tutoring program. Students who are accepted into our International A-Level Exam preparation program and later have completed our International A-Level Exam preparation courses plan to take the A-level Testing administered by Edexcel. Students who are not accepted into our International A-Level Exam preparation program will have the opportunity to take part in our tutoring program until we deem them ready to begin our International A-Level Exam preparation courses.

Our teachers are primarily licensed teachers, with either an English language undergraduate degree, a relevant degree to the subject matter they are teaching, or a teaching undergraduate degree. We employ both A-level course teachers and language tutors.

A-level and International A-level

The A Level (Advanced Level) is a subject-based qualification conferred as part of the General Certificate of Education, as well as a school leaving qualification offered by the educational bodies in the United Kingdom and the educational authorities of British Crown dependencies to students completing secondary or pre-university education. Obtaining A Level or equivalent qualifications is generally required for university entrance.

International A-level testing is similar to that offered by the educational bodies in the United Kingdom and the educational authorities of British Crown dependencies, but instead are offered outside of the UK and British Crown dependencies and mainly administered globally by Cambridge International Examiners and Edexcel. International A-level testing is recognized for university entrance.

Students can take A-level courses at any age. They mainly involve studying the theory of a subject combined with some investigative work, and are usually studied full-time over two years.

Edexcel International A-level Testing

Edexcel, now known as Pearson - London Examinations, is a multinational education and examination body owned by Pearson. Pearson Edexcel, the only privately owned examination board in the UK, is part of Pearson PLC, and regulates school examinations under the British Curriculum and offers qualifications for schools on the international and regional scale. Edexcel is the UK’s largest awarding organization offering academic and vocational qualifications in schools, colleges and work places in the UK and abroad, and also recognized internationally. Edexcel International A-level qualifications are only available outside of the UK, the Channel Islands and the Isle of Man.

Edexcel offers a variety of academic qualifications including GCSEs and A levels, as well as some vocational qualifications, including NVQs and Functional Skills. Edexcel A Level is one of the most respected qualifications in the world leading to university study. It is the most widely studied qualification by UK students aged 16-18 and the most referenced qualification by top-ranked UK institutions for progression onto university education and accepted by the world’s leading research universities. Edexcel A Level is recognized by many universities including the top 100 universities in the Times Higher Education World University Rankings universities, such as Massachusetts Institute of Technology (MIT), California Institute of Technology (Caltech), John Hopkins University and the University of Toronto. Available in over 40 subjects, Edexcel A-level curriculum give students the chance to develop intellectually as they explore the different subjects. Our Center uses preparation materials and teacher support of Edexcel A-level and our students take the qualification tests at Edescel International A-level testing centers.

| 7 |

Shenyang University Cooperation Agreement

Effective November 30, 2016, the Foreign Language Education Center of Shenyang University, a comprehensive university first established in 1906, and Liaoning Boqiao Study Abroad Co. Ltd. (“Boqiao”) entered into a certain Cooperation Agreement with Boqiao to establish and co-operate the Center (the “University Cooperation Agreement”). Boqiao is an affiliated party of Gu Wei, the Center’s sponsor, of whom Boqiao and the Center are under common control. Pursuant to the University Cooperation Agreement, the Foreign Language Education Center of Shenyang University provides the classrooms for the Center, for an annual fee.

We currently operate out of the Foreign Language School of Shenyang University, where we sublease our office and ten classrooms from Boqiao. For detailed information regarding the sublease, refer to Business – Properties below.

A-Level Preparation Courses

We provide test preparation courses for Edexcel International A-level testing to Chinese students who aspire to study in overseas and international universities via the Center. Our International A-level program was designed to specifically address the needs of these students in terms of both language and academics. The preparation courses we offer are basic mathematics, economics, biology, accounting, art and design, chemistry, physics and others. Currently our Center is located in Shenyang, the capital of Liaoning Province, and we mainly serve the three provinces in Northeast China, Heilongjiang, Liaoning, and Jilin.

To qualify for enrollment in our A-level Program, students are tested in three subjects, English, Mathematics, Science and are required to attend an interview conducted in English. Qualified students may immediately enroll in our A-level Program on a full-time basis. Those who do not qualified can elect to take tutoring classes until they qualify for our A-level program. Full-time students do not enroll in other high school diploma programs or PRC high schools. We do not offer PRC high school diplomas or any high school diploma equivalents to students in our A-level Program.

Annual tuition for full-time students enrolled in our A-level program is currently RMB 92,000, and subject to future changes. Students with outstanding performance in the enrollment qualification may receive a RMB 20,000 scholarship. The Center also provides boarding to students with such needs.

As of the date of this report, there are approximately 25 students enrolled in our A-level program for the school year of 2016-2017. The number of students have enrolled in our A-level program has increased steadily in the last six school years, 8 in 2011, 11 in 2012, 15 in 2013, 18 in 2014, and 22 in 2015.

Of those students who have completed their A-level preparation courses, taken the tests, and applied for universities abroad, 32 students have received offers from UK universities, 16 from US universities, 18 from Canadian universities, and 35 from Australian universities.

We recommend our application preparation business partners to our students in the A-level program with applying to universities abroad, and do not provide application preparation services to our students.

Tutoring

We also provide English language tutoring and subject tutoring to students who do not immediately qualify for enrollment in our A-level program, and preparation for IELTS, TOEFL and English testing taking courses. Upon successfully completing English language tutoring and/or subject tutoring, a student will be qualified to enroll in our A-level preparation courses. Currently, approximately 10 students are enrolled in our tutoring program.

| 8 |

Marketing

We selectively employ a variety of marketing methods to enhance the brand recognition of our programs. Currently, most of our student enrollments came from word-of-mouth and recruitment from our business partners who specialize in searching for and placing students who wish to study abroad for their higher education degrees. We plan to continue to take measures to increase word-of-mouth referrals which have been key to bringing in new students and building our brand. In addition, we also advertise in print and broadcast media, social media such as wechat.

Industry

China’s Private Education Market

Driven by rapid economic growth, urbanization and higher per capita disposable income of urban households, China has experienced significant growth in the private education market. According to the Frost & Sullivan Report, China’s private education market reached RMB 1,057.7 billion (US$163.3 billion) in 2015, and is expected to further grow at a CAGR of 15.4% to RMB 2,161.8 billion (US$333.7 billion) in 2020.

China’s A-Level Education Market

The Chinese Ministry of Education reports that 523,700 Chinese students went abroad to study in 2015, representing a 13.9% increase over 2014 levels but marks the second consecutive year – after 11.1% growth in 2014 – of growth levels below the 19.1% average annual growth over the past four decades. The percentage of students heading abroad for an undergraduate degree has also been increasing in recent years. In 2016, the percentage of Chinese students heading abroad for an undergraduate degree is 27.7%, according to Qide Education.

More and more Chinese students are considering pursuing an undergraduate degree abroad in recent years. Consequently, the students’ demand for preparation courses with respect to entrance to undergraduate programs abroad has rapidly and steadily increased. There are a number of international testing courses for entrance to undergraduate programs globally, with A-level, International Baccalaureate, and Advanced Placement being the three major ones. The number of schools that offer A-level courses, increasing at a consistent double digit rate in the last few years, and so have testing centers. As of September 2016, China has 318 registered A Level testing centers, including 169 testing centers authorized by Cambridge International Examiners and 149 testing centers authorized by Edexcel of Pearson. A Level is currently the most popular international courses for Chinese students, since the schools in China that offer A-Level, IB or AP, about half of these schools offer A Level courses.

In 2016, the total number of students from mainland China who enrolled in the Cambridge A-Level related courses (including AS, A-Level, and IGCSE) is 71, 651, which is a 15% increase over 2015, far exceeding the global growth rate of 10%. Out of the 71,651 students, approximately 31,000 students took Cambridge A-Level courses, which is an 11% increase over 2015.

China’s English Education Market

There are more opportunities for people in China to use English in their daily lives and significant and increasing demand among the Chinese population for improving their general English proficiency, owing to continued globalization, improvements in the standard of living and increasing demand from Chinese consumers for overseas services and products. According to the Frost & Sullivan Report, as of December 31, 2015, the population of K-12 students, college students and working adults in China reached 180.2 million, 26.3 million and 774.5 million, respectively, and the frequency of overseas travelling of residents in China reached 133.6 million times during 2015. All of these groups have potentially significant demand for English education. However, primarily due to the exam-driven curriculum design, China’s compulsory education system is unable to adequately enhance individuals’ English proficiency and address the large potential English education demand.

According to the Report, people value quality of teachers, lesson format and brand reputation as the top considerations when selecting English education providers. In particular, the majority of the participants prefer small group or one-on-one lesson over large group lesson formats for English education.

China’s English education market in terms of gross billings grew from RMB79.5 billion (US$12.3 billion) in 2010 to RMB153.4 billion (US$23.7 billion) in 2015, representing a CAGR of 14.0%, and is expected to further increase to RMB445.8 billion (US$68.8 billion) in 2020, representing a CAGR of 23.8% from 2015.

Competition

The private education especially foreign testing preparation sector in China is rapidly evolving, highly fragmented and competitive, and we expect competition in this sector to persist and intensify. We face intense competition in the A-level and English language programs we offer and the geographic market in which we operate. For example, we face regional competition for our A Level Training Program from several local competitors such as Dalian Lingying International School, Shenyang Foreign Language School, and Shenyang Peinuo Education, that focus on offering A-Levels courses to high school aged students in Northeastern region, including several local international schools.

| 9 |

We do not currently offer classes online but the increasing use of the internet and advances in internet- and computer-related technologies, such as web video conferencing and online testing simulators, are eliminating geographic and cost-entry barriers to providing private educational services. As a result, many of our international competitors that offer online test preparation and training courses may be able to more effectively penetrate the China market. Many of these international competitors have strong education brands, and students and parents in China may be attracted to the offerings of our international competitors based in the country that the student wishes to study in or in which the selected language is widely spoken. In addition, many smaller companies are able to use the Internet to quickly and cost-effectively offer their programs, services and products to a large number of students with less capital expenditure than previously required.

Growth Strategy

In addition to organic growth via enhanced student experience and maintaining our high reaching standard while enrolling more students, we intend to focus on expanding our operation by strategic acquisition of schools such as PRC high schools. Our goals are:

| 1. | Acquire up to four schools from 2017-2018, in Liaoning, Jilin and Helongjian; |

| 2. | Acquire up to 6 schools from 2019-2020, in Liaoning, Jilin and Helongjian |

| 3. | Acquire up to 9 schools in 2021-2022, in in Liaoning, Jilin and Helongjian and certain regions in Beijing, Tianjin, Hebei, Shanxi and Inner Mongolia. |

Intellectual Property

The Center’s Chinese name is 爱得思, which is the Chinese name used by Pearson’s Edexcel in the PRC market. The Center had chosen when the Center registered in 2011, and before Pearson acquired Edexcel. After Pearson acquired Edexcel, Pearson had approached the Center to suggest it change its legal entity name, but has not taken any legal actions as of the date of this report. The management believes that the risk of Pearson bringing a trademark infringement case against the Center is de minimus. Additionally, the Center is in the process of changing its registered corporate name.

Seasonality

Our industry is typically affected by seasonality, primarily due to the period of the delivery of education services in each school year. Each school year is comprised of two semesters. The first semester starts in the third quarter and the second semester starts in the first quarter. We have experienced higher gross revenue growth in the third quarter of the calendar year since our inception in March 2016, but due to our limited operating history, the seasonal trends that we have experienced in the past may not be indicative of our future operating results. Our financial condition and results of operations for future periods may continue to fluctuate. As a result, the trading price of our common stock may fluctuate from time to time due to seasonality.

PRC Government Regulations

We require a number of approvals, licenses and certificates in order to operate our business. Our principal approvals, licenses and certificates are set forth below.

The Center is required to have a private education institution license for offering non-degree education to students. The Center’s private education permit expired in March 2016, and the Center are in the process of obtaining the private school operating permit. As of the date of this report, the relevant local education bureau, Shenyang Education Bureau has not issued any warning, administrative penalty or other measures against the Center. For risks related to operating the Center without a valid private school operating permit, see detailed discussion in the Risk Factors - Risks Related To Our Business - The private school operating permit of the Center we operate and manage, is currently expired and we may be deemed operating a school illegally and may be subject to administrative penalties.

Regulations on Private Education

The principal laws and regulations governing private education in China consist of the Education Law of the PRC, the Law for Promoting Private Education (2003) and the Implementation Rules for the Law for Promoting Private Education (2004), and the Regulations on Chinese-Foreign Cooperation in Operating Schools. Below is a summary of the relevant provisions of these regulations.

Education Law of the PRC

On March 18, 1995, the National People’s Congress enacted the Education Law of the PRC. The Education Law sets forth provisions relating to the fundamental education system of the PRC, including a system of preschool, primary, secondary (including middle and high schools) and higher education and a system of awarding certificates or diplomas. The Education Law stipulates that the government formulates plans for the development of education, and establishes and operates schools and other institutions of education. Under the Education Law, enterprises, social organizations and individuals are encouraged to operate schools and other types of educational organizations in accordance with PRC laws and regulations. Meanwhile, no organization or individual may establish or operate a school or any other institution of education for profit-making purposes. However, private schools may be operated for “reasonable returns,” as described in more detail below.

| 10 |

The Law for Promoting Private Education (2003) and the Implementation Rules for the Law for Promoting Private Education (2004)

The Law for Promoting Private Education (2003) became effective on September 1, 2003. The Implementation Rules for the Law for Promoting Private Education (2004) became effective on April 1, 2004. Under these regulations, “private schools” are defined as schools established by non-governmental organizations or individuals using non-government funds.

According to PRC laws and regulations, entities and individuals who establish private schools are commonly referred to as “sponsors” instead of “owners” or “shareholders.” The economic substance of “sponsorship” with respect of private schools is substantially similar to that of ownership with regard to legal, regulatory and tax matters. The main differences between sponsorship and equity ownership can be found in the specific provisions of the laws and regulations applicable to sponsors and owners, as follows:

| ● | Right to receive a return on investment. Either sponsors or owners shall have the right to receive a return on investment. However, the portion of after-tax profits that can be distributed by a company to its owner is different from that distributed by a school to its sponsor. Under the PRC Company Law, a company is required to allocate 10% of its after-tax profits to statutory reserve funds, while under the Law for Promoting Private Education and the Implementation Rules for the Law for Promoting Private Education, a school that requires reasonable returns is required to allocate no less than 25% of its annual net profit or annual increased net assets to its development fund as well as make allocation for mandatory expenses as required by applicable laws and regulations. | |

| ● | Right to the distribution of residual properties upon termination and liquidation. Under the PRC Company Law, properties that remain upon termination and liquidation of a company after payment of relevant fees and compensations are to be distributed to its owners. With respect to a school, the Law for Promoting Private Education provides that such distribution be made in accordance with other relevant laws and regulations. However, since there have been no other relevant laws and regulations addressing the distribution of residual properties upon termination and liquidation of a private school, such distribution shall be made to the sponsors after payment of relevant fees and compensations since the sponsors bear the investment benefits and risks. |

Despite the above differences between sponsorship and ownership, the sponsor of a private school has effective control over such private school under the Law for Promoting Private Education through controlling the executive council or board of directors of such school, which is the decision-making body of the school. Through the school’s decision-making body, the sponsor exercises a broad range of powers, including (i) the appointment and dismissal of the school principal, (ii) the amendment of articles of association of the school and formulation of rules and regulations of the school, (iii) the adoption of development plans and approval of annual work plans, (iv) raising funds for school operations and adoption of budgets and final accounts, (v) making decisions on the size and compensation of the staff, (vi) making decisions on the division, merger or termination of the school, and (vii) making decisions on other important matters of the school. In addition, through controlling the decision-making body, the sponsor also has the power to use and manage the properties of the school in accordance with relevant laws and regulations.

In addition, under the Law for Promoting Private Education (2003), private schools providing certifications or diplomas, pre-school education, other culture education (including K-12 education) and self-study aids are subject to approval by the education authorities, while private schools engaging in occupational training are subject to approval by the authorities in charge of labor and social welfare.

A duly approved private school will be granted a private school operating permit, and shall be registered with the Ministry of Civil Affairs or its local bureaus as a privately run non-enterprise institution. In addition, schools and their learning centers must make filings with the MOE and the Ministry of Civil Affairs or their local bureaus.

Under the above regulations, private schools have the same status as public schools, though private schools are prohibited from providing military, police, political and other kinds of education that are of a special nature. Government-run schools that provide compulsory education are not permitted to be converted into private schools. In addition, operation of a private school is highly regulated. For example, the items and amounts of fees charged by a private school providing certifications or diplomas shall be approved by the governmental pricing authority and be publicly disclosed.

| 11 |

Private schools are divided into three categories: private schools established with donated funds; private schools that require reasonable returns and private schools that do not require reasonable returns. While private education is treated as a public welfare undertaking under the regulations, in the case of private schools choosing to require “reasonable returns,” sponsors of these schools may choose to require “reasonable returns” from the annual net balance of the school after deduction of costs, donations received, government subsidies, if any, the reserved development fund and other expenses required by the regulations.

The election to establish a private school requiring reasonable returns shall be provided in the articles of association of the school. The percentage of the school’s annual net balance that can be distributed as a reasonable return shall be determined by the school’s board of directors, taking into consideration the following factors: (i) items and criteria for the school’s fees, (ii) the ratio of the school’s expenses used for educational activities and improving the educational conditions to the total fees collected; and (iii) the admission standards and educational quality. Such information and the decision to distribute reasonable returns is also required to be filed with the approval authorities within 15 days from the decision made by the board. However, none of the current PRC laws and regulations provides a formula or guidelines for determining “reasonable returns.” In addition, none of the current PRC laws and regulations sets forth different requirements or restrictions on a private school’s ability to operate its education business based on such school’s status as a school that requires reasonable returns or a school that does not require reasonable returns.

At the end of each fiscal year, every private school is required to allocate a certain amount to its development fund for the construction or maintenance of the schools or procurement or upgrade of educational equipment. In the case of a private school that requires reasonable returns, this amount shall be no less than 25% of the annual net income of the school, while in the case of a private school that does not require reasonable returns, this amount shall be not less than 25% of the annual increase in the net assets of the school, if any. Under the Implementation Rules for the Law for Promoting Private Education in 2004, or the 2004 Implementing Rules, private schools, whether requiring reasonable returns or not, may enjoy preferential tax treatment. The 2004 Implementing Rules provide that the relevant authorities under the State Council may introduce preferential tax treatments and related policies applicable to private schools requiring reasonable returns. To date, however, no separate policies, regulations or rules have been introduced by the authorities in this regard.

As of the date of this report, the Center’s private school operating permit has expired in March 2016 and the Center is in the process of obtaining its private school operating permit with the local bureau of education as required by PRC regulations. Kuncheng has the right to operate and manage the Center, including directly receiving the revenue generated by tuition and board fees, but does not and will not be the sponsor of the Center.

Regulations on Chinese-foreign cooperation in operating schools

Chinese-foreign cooperation in operating schools or training programs is specifically governed by the Regulations on Operating Chinese-foreign Schools, promulgated by the State Council in 2003 and the Implementing Rules for the Regulations on Operating Chinese-foreign Schools, or the Implementing Rules, which were issued by the MOE in 2004.

The regulations on Operating Chinese-foreign Schools and its Implementing Rules encourage substantive cooperation between overseas educational organizations with relevant qualifications and experience in providing high-quality education and Chinese educational organizations to jointly operate various types of schools in the PRC, with such cooperation in the areas of higher education and occupational education being encouraged. Chinese-foreign cooperative schools are not permitted, however, to engage in compulsory education and military, police, political and other kinds of education that are of a special nature in the PRC.

Permits for Chinese-foreign Cooperation in Operating Schools can be obtained from education authorities or from the authorities that regulate labor and social welfare in the PRC.

| 12 |

Foreign investment in educational service industry

Under the Foreign Investment Industries Guidance Catalog (2015), or Foreign Investment Catalog, which was amended and promulgated by the National Development and Reform Commission, or NDRC, and the MOFCOM in March 2015 and became effective on April 10, 2015, foreign investment is encouraged in non-academic vocational training institutions. Preschool education, senior high school education and higher education in grades 10 to 12 are in a restricted industry, meaning foreign educational organizations with relevant qualifications and experience and Chinese educational organizations are only allow to operate senior high schools in cooperative ways in the PRC. Any foreign investment in higher education and senior high school education has to take the form of a cooperative joint venture. Foreign investment is banned from compulsory education, which means grades 1 to 9. Foreign investment is allowed in after-school tutoring services and training services which do not grant certificates or diplomas.

Employment Laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, and social insurance, housing funds and other welfare. These include local labor laws and regulations, which may require substantial resources for compliance.

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract. The National Labor Contract Law has enhanced rights for the nation’s workers, including permitting open-ended labor contracts and severance payments. The legislation requires employers to provide written contracts to their workers, restricts the use of temporary labor and makes it harder for employers to lay off employees. It also requires that employees with fixed-term contracts be entitled to an indefinite-term contract after a fixed-term contract is renewed once or the employee has worked for the employer for a consecutive ten-year period.

We are required by PRC laws and regulations to pay various statutory employee benefits, including pensions, housing funds, medical insurance, work-related injury insurance, unemployment insurance and maternity insurance to designated governmental agencies for the benefit of our employees. Except for housing funds, we are in compliance with payment of all other employment related insurance on behalf of our employees.

Tax

Pursuant to the Provisional Regulation of China on Value Added Tax and their implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay VAT at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to a portion of or all the refund of VAT that it has already paid or borne.

The Center has deregistered its Taxpayer Identification Number with Shenyang Huanggu District effective as of September 2016, after which Kuncheng has been remitting taxes for the operation of our A-level program.

Foreign Currency Exchange

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations promulgated by the State Council, as amended on August 5, 2008, or the Foreign Exchange Regulations. Under the Foreign Exchange Regulations, the Renminbi is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of China, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission.

| 13 |

Dividend Distributions

Under applicable PRC regulations, enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, enterprises in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year as its statutory general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

Kuncheng has never declared or paid any dividends on our common stock. We intend to retain any future earnings for use in the operation and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock to our stockholders for the foreseeable future.

Properties

Our corporate office is located at Liwan District, No.145 Enzhou Big Lane, B2 Fuli Square, 8th Zhongshan Road, Unit 505, 5/F, Guangzhou, Guangdong, China. This office is free of charge as provided by Ms. Yankuan Li, our President and Chief Executive Officer.

We currently sublease properties, covering ten classrooms and one room used for office, at Foreign Language Education Center of Shenyang University, from Boqiao, for approximately RMB 30,000 (approximately US$4,353). The sublease terminates on November 30, 2017, the same date as the termination of the University Cooperation Agreement, upon which we plan on entering into a separate lease agreement directly with Foreign Language Education Center of Shenyang University, for the same properties. We may not be able to sublease or lease the same properties after the sublease termination on November 30, 2017, in which case we will search for other suitable facilities. For detailed discussion related to such risk, refer to Risk Factors – We currently sublease our classrooms from Boqiao, and may not be able to enter into a lease or sublease agreement for similar terms upon expiration of the sublease agreement.

We believe that our current facilities are adequate and suitable for our operations.

Employees

As of the date of this report, we had 25 employees, of which 19 are full time and 6 are part time. None of our employees are covered by a collective bargaining agreement. We have not experienced any work stoppages and we consider our relations with our employees to be good.

Legal Proceedings

On October 9, 2014, Dong Liu, the Chairman of the Board of Directors of the Company, commenced an action individually and on behalf of the Company, against Yankuan Li, the Company’s President, Chief Executive Officer and director, Jiewen Li, Yuan Zhao, a director of the Company, and Jane Yu, the Company’s Chief Financial Officer and Secretary. In this action, Dong Liu v. Yankuan Li et al., New York County Supreme Court, Index No. 653084/2014, Dong Liu asserted claims sounding in fraud, civil conspiracy to commit fraud, breach of fiduciary duty and unjust enrichment.

Mr. Liu never served the complaint on the individual defendants. Instead, on November 3, 2014, Dong Liu, by order to show cause, moved for a temporary restraining order and preliminary injunction to enjoin the Company from proceeding with a merger with Jinke, granting Dong Liu unfettered access to the Company’s books and records and permitting him to serve the individual defendants by a method other than those permitted by the New York State Civil Practice and Laws or the Hague Convention on Service Abroad of Judicial and Extrajudicial Documents in Civil and Commercial Matters. On November 6, 2014, the New York Supreme Court denied the temporary restraining order and set up a briefing schedule to determine the preliminary injunction.

On February 18, 2015, the court issued a decision denying Dong Liu’s motion for a preliminary injunction and granting the defendants’ motion by dismissing the complaint without prejudice. Since that time, plaintiff has made no effort to re-plead the case or challenge the ruling. Under New York court rules, plaintiff’s time to re-argue the motion or serve notice to appeal has expired.

Except as described above, Kuncheng is not involved in any material legal proceedings outside of the ordinary course of its business.

| 14 |

RISK FACTORS

In addition to the other information contained and referred to in this report, you should consider carefully the following factors when evaluating our business. Any of these risks, or the occurrence of any of the events described in these risk factors, could cause our actual future results, performance or achievements to be materially different from or could materially adversely affect our business, financial condition or results of operations. In addition, other risks or uncertainties not presently known to us or that we currently do not deem material could arise, any of which could also materially adversely affect us.

RISKS RELATED TO OUR BUSINESS

RISK FACTORS

An investment in our common stocks involves significant risks. You should carefully consider all of the information in this report, including the risks and uncertainties described below, before making an investment in our common stocks. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our common stocks could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We have a limited operating history with our current business model, which makes it difficult to predict our future prospects and financial performance.

We have a short operating history with our current business model, since Kuncheng was established in March 2016. Our business has generated limited gross revenues, and may not produce significant gross revenues in the near term, or at all, which may harm our ability to obtain additional financing and may require us to reduce or discontinue our operations. If we do generate significant gross billings and revenues in the future, we expect it will be largely from tuition revenues, and our enrollment student body is relatively small and at its development stage. You must consider our business and prospects in light of the risks and difficulties we may encounter as an early-stage operating company in a new and rapidly evolving industry. We may not be able to successfully address these risks and difficulties, which could significantly harm our business, operating results and financial condition.

If we are not able to continue to attract students to enroll in our A-level program and our English language courses, and attract students to take their A-level testing at our Center, our business and prospects will be materially and adversely affected.

The success of our business largely depends on the number of students enrolled in our current schools and in any new schools we may establish or acquire in the future, as well as on the amount of tuition our students and parents are willing to pay. Our ability to continue to attract students to enroll in our A-level program and our English language courses, and attract students to take their A-level testing at our Center, are critical to the continued success and growth of our business. This in turn will depend on several factors, including our ability to effectively market our Center to a broader base of prospective students, continue to develop, adapt or enhance our existing programs to respond to market changes and student demands, expand our geographic reach, and manage our growth while maintain consistent and high teaching quality and support services to meet the evolving demands of our existing or prospective students and respond to the increasing competition in the market. We must also respond effectively to competitive pressures. If we are unable to continue to attract students to while maintaining consistent and high teaching quality, our gross revenue and net revenues may decline, which may have a material adverse effect on our business, financial condition and results of operations. The success of our business largely depends on the number of students enrolled in our current schools and in any new schools we may establish or acquire in the future, as well as on the amount of tuition our students and parents are willing to pay. Therefore, our ability to continue to attract students to enroll in our schools is critical to the continued success and growth of our business.

| 15 |

If fewer Chinese students choose to study abroad, especially in the United States, Canada and the United Kingdom, demand for our international program may decline.

One of the principal drivers of the growth of our international program is the increasing number of Chinese students who choose to study abroad, especially in the United States, Canada and the United Kingdom, reflecting the growing demand for higher education in overseas countries by Chinese students. As such, any restrictive changes in immigration policy, terrorist attacks, geopolitical uncertainties and any international conflicts involving these countries could increase the difficulty for Chinese students to obtain student visas to study overseas, or decrease the appeal of studying in such countries to Chinese students. Any significant change in admission standards adopted by overseas educational institutions could also affect the demand for overseas education by Chinese students. If overseas education institutions significantly reduce their reliance on or acceptance of admission and assessment tests, such as TOEFL, IELTS or the Scholastic Assessment Test, or the SAT, the difficulty for Chinese students to meet the new admission standards could significantly increase, which could in turn negatively affect the demand for overseas education by Chinese students. Additionally, Chinese students may also become less attracted to studying abroad due to other reasons, such as improving domestic educational or employment opportunities associated with increased economic development in China. These factors could cause declines in the demand for our international program, which may adversely affect our revenue and profitability.

We face significant competition and we may fail to compete effectively.

The test preparation education sector in China is rapidly evolving, highly fragmented and competitive, and we expect competition in this sector to persist and intensify. See “Business—Competition” for more information relating to the competitive landscape of the industry in which we compete. Competition could result in loss of market share and revenue, lower profit margins and limitations on our future growth. Some of our competitors have much longer operating history and experience than we do, and/or are bigger in student enrollment and/or capital resources. These competitors may devote greater resources, financial or otherwise, than we can to student recruitment, campus development and brand promotion and respond more quickly than we can to changes in student demands and market needs. Our student enrollment and retention may decrease due to intense competition. We may be required to reduce tuition and other fees or increase spending in response to competition in order to attract or retain students or pursue new market opportunities. As a result, our revenue, profit and profit margin may decrease. We cannot assure you that we will be able to compete successfully against current or future competitors. If we are unable to maintain our competitive position or otherwise fail to respond to competitive pressures effectively, we may lose market share and our business, financial condition and results of operations may be materially and adversely affected.

We may not be able to manage our business expansion and strategic acquisitions effectively.

We plan to continue to expand our presence through organic growth and strategic acquisitions. In particular, to support our continued growth and to strengthen our market share in the region in which we currently operate, we need to establish or acquire new schools. We also need to establish or acquire new schools in other regions to expand geographically. Expansion has resulted, and will continue to result, in substantial demands on our management and on our operational, technological and other resources. To manage our expected growth, we will be required to expand our existing managerial, operational, technological and financial systems. We also need to expand, train, manage and retain our growing employee base. Significant financial resources may also be needed to support our planned growth. We cannot assure you that our current and planned managerial, operational, technological and financial systems will be adequate to support our future operations, or that we will be able to effectively and efficiently manage the growth of our operations or recruit and retain qualified personnel. There is no assurance that we will obtain financial resources at commercial terms that are acceptable to us on a timely basis, or at all, to support our planned growth. Any failure to effectively and efficiently manage our expansion may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse effect on our financial condition and results of operations.

| 16 |

In addition, as a core part of our growth strategy, we intend to pursue selective strategic acquisitions and maximize synergies through integration of acquired entities. Our strategic acquisitions involve substantial risks and uncertainties, including:

| ● | our ability to identify and acquire targets in a cost-effective manner; | |

| ● | our ability to obtain approval from relevant government authorities for the acquisitions and to comply with applicable rules and regulations for acquisitions, including those relating to the transfer of school properties and facilities relating to the acquisitions; | |

| ● | our ability to obtain financing to support our acquisitions; | |

| ● | our ability to generate sufficient revenue to offset the costs and expenses of acquisitions, including the possibility of failure to achieve the intended revenue and other benefits expected from the acquisitions; | |

| ● | potential ongoing financial obligations in connection with the acquisitions, including any expenses in connection with impairment of goodwill recognized in connection with the acquisitions and potential unforeseen or hidden liabilities of any acquired entity, such as litigation claims or tax liabilities; | |

| ● | the diversion of resources and management attention from our existing businesses; and | |

| ● | potential loss of, or harm to, employee or customer relationships as a result of ownership changes in the acquired entities. |

If any one or more of these risks or uncertainties materializes or if any of the strategic objectives we contemplate are not achieved, our strategic acquisitions may not be beneficial to us and may have a material adverse effect on our business, financial condition and results of operations.

| 17 |

We may not be able to successfully integrate businesses that we acquire, which may cause us to lose anticipated benefits from such acquisitions and to incur significant additional expenses.

One of our growth strategies is to grow by acquisitions of additional schools. It is challenging to integrate business operations and management philosophies of acquired schools. The benefits of our future acquisitions depend in significant part on our ability to integrate management, operations, technology and personnel. The integration of acquired schools is a complex, time-consuming and expensive process that, without proper planning and implementation, could significantly disrupt our business and operations. The main challenges involved in integrating acquired entities include the following:

| ● | consolidating service offerings; | |

| ● | retaining qualified education professionals of any acquired entity; | |

| ● | consolidating and integrating corporate information technology and administrative infrastructure; | |

| ● | ensuring and demonstrating to our students and their parents that the acquisitions will not result in any adverse changes to our brand image, reputation, service quality or standards; | |

| ● | preserving strategic, marketing or other important relationships of any acquired entity and resolving potential conflicts that may arise with our key relationships; and | |

| ● | minimizing the diversion of our management’s attention from ongoing business concerns. |

We may not successfully integrate our operations and the operations of schools we acquire in a timely manner, or at all, and we may not realize the anticipated benefits or synergies of the acquisitions to the extent, or in the timeframe, we anticipated, which may have a material adverse effect on our business, financial condition and results of operations.

| 18 |

If we are not able to continue to engage, train and retain qualified teachers, we may not be able to maintain consistent teaching quality on our platform, and our business, financial conditions and operating results may be materially and adversely affected.

Our teachers are critical to the learning experience of our students and our reputation. We seek to engage highly qualified teachers with strong English and teaching skills. We must provide competitive pay and other benefits, such as flexibility in lesson scheduling to attract and retain them. We must also provide ongoing training to our teachers to ensure that they stay abreast of changes in course materials, student demands and other changes and trends necessary to teach effectively. Furthermore, as we continue to develop new course contents and lesson formats, we may need to engage additional teachers with appropriate skill sets or backgrounds to deliver instructions effectively. We cannot guarantee that we will be able to effectively engage and train such teachers quickly, or at all. Further, given other potential more attractive opportunities for our quality teachers, over time some of them may choose to leave our platform. For teachers who advanced to a rating of between three and five stars in the first quarter of 2015, approximately 63% of them were still with us and opened teaching slots on our platform in the first quarter of 2016. We have not experienced major difficulties in engaging, training or retaining qualified teachers in the past, however, we may not always be able to engage, train and retain enough qualified teachers to keep pace with our growth while maintaining consistent education quality. We may also face significant competition in engaging qualified teachers from our competitors or from other opportunities that are perceived as more desirable. A shortage of qualified teachers, a decrease in the quality of our teachers’ performance, whether actual or perceived, or a significant increase in the cost to engage or retain qualified teachers would have a material adverse effect on our business and financial conditions and results of operations.

The private school operating permit of the Center that we operate and manage is currently expired and we may be deemed operating a school illegally and may be subject to administrative penalties.

Operating a private school in the PRC requires the school to be duly approved and be granted a private school operating permit, and shall register the private school with the Ministry of Civil Affairs or its local bureaus as a privately run non-enterprise institution. In addition, schools and their learning centers must make filings with the MOE and the Ministry of Civil Affairs or their local bureaus. The Center which we operate and manage, had obtained the private school operating permit but the permit expired in March 2016. The Center is in the process of reinstating the private school operating permit for our Center but there is no guarantee that we will be granted such a permit. Although there are no specific regulations that specifically state the consequences of operating a private school without duly approval from the relevant PRC government bureaus and without a valid operating permit, the Center’s lack of valid operating permit may cause us to be deemed as operating a private school illegally by the relevant PRC government bureaus, and consequently may be required to cease operation of the Center and may also face administrative penalties. All the foregoing will result in a negative impact on our financial conditions and operating results.

The Center deregistered its taxpayer identification number at Shenyang Huanggu District, and was approved in September 2016.

The Center does not currently have a valid taxpayer identification number. Kuncheng has been operating the International A-level program and has remitted all relevant taxes and filed for relevant tax returns have been remitted and filed for tax return since the Center deregistered its taxpayer identification number. In the event that the local tax authorities deem that taxes should have been remitted by the Center itself and not by Kuncheng, then there may be negative regulatory consequences such as administrative penalties and fines, which would negatively impact our results of operations and financial results.

| 19 |

If former and/or current students demand tuition refund, our results of operation will be negatively impacted.

Students have previously demanded tuition refund for various reasons including a previous scholarship program at the Center failed. We are not certain if such former students or current students would demand tuition refunds from us in the future. If they so demand tuition refunds, our reputation and results of operation will be negatively impacted.

We face significant competition, and if we fail to compete effectively, we may lose our market share or fail to gain additional market share, which would adversely impact our business and financial conditions and operating results.

The study aboard testing preparation and English language education market in China is fragmented, rapidly evolving and highly competitive. We face competition in study aboard testing preparation and English language education and other specialized areas of English education, from existing online and offline education companies. In the future, we may also face competition from new entrants into the English education market.

Some of our competitors may be able to devote more resources than we can to the development and promotion of their education programs and respond more quickly than we can to changes in student demands, market trends or new technologies. In addition, some of our competitors may be able to respond more quickly to changes in student preferences or engage in price-cutting strategies. We cannot assure you that we will be able to compete successfully against current or future competitors. If we are unable to maintain our competitive position or otherwise respond to competitive pressure effectively, we may lose market share or be forced to reduce our fees for course packages, either of which would adversely impact our results of operations and financial condition.

If we fail to successfully execute our growth strategies, our business and prospects may be materially and adversely affected.

Our growth strategies include further enhancing our brand image to grow our student base and increase student enrollments, increasing our market penetration amongst study aboard testing preparation and English language students, expanding our course offerings, enhancing our teaching methods, improving the learning experience of our students, and advancing our technology. We may not succeed in executing these growth strategies due to a number of factors, including the following:

| ● | we may fail to further promote our programs; | |

| ● | we may not be successful in effectively delivering and promoting our group lessons with English tutors; | |

| ● | we may not be able to engage, train and retain a sufficient number of qualified teachers and other key personnel; | |

| ● | we may not be able to identify suitable targets for acquisitions and partnership. |

If we fail to successfully execute our growth strategies, we may not be able to maintain our growth rate and our business and prospects may be materially and adversely affected as a result.

| 20 |

Higher labor costs, inflation and implementation of stricter labor laws in the may adversely affect our business, financial conditions and results of operations.