Attached files

| file | filename |

|---|---|

| EX-32.2 - TRAQIQ, INC. | ex32-2.htm |

| EX-32.1 - TRAQIQ, INC. | ex32-1.htm |

| EX-31.2 - TRAQIQ, INC. | ex31-2.htm |

| EX-31.1 - TRAQIQ, INC. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

Commission File Number: 000-55785

TRAQIQ, INC.

(Exact Name of Registrant as Specified in Its Charter)

| California | 30-0580318 | |

| (State

or Other Jurisdiction of Incorporation or Organization) |

(I.R.S.

Employer Identification No.) | |

| 14205 SE 36th Street, Suite 100, Bellevue, WA | 98006 | |

| (Address of Principal Executive Office) | (Zip Code) |

(425) 818-0560

(Registrant’s Telephone Number, Including Area Code)

Thunderclap Entertainment, Inc.

201 Santa Monica Blvd., Suite 300

Santa Monica, CA 90401-2224

Former FYE – September 30, 2017

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| (Do not check if a smaller reporting company) | |||

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ X ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of November 13, 2017, there were 6,824,490 shares of the registrant’s common stock, $0.0001 par value, outstanding.

TRAQIQ, INC.

INDEX

| Page | ||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 20 |

| Item 4. | Controls and Procedures | 20 |

| PART II - OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 20 |

| Item 1A. | Risk Factors | 20 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 20 |

| Item 3. | Defaults Upon Senior Securities | 20 |

| Item 4. | Mine Safety Disclosures | 20 |

| Item 5. | Other Information | 20 |

| Item 6. | Exhibits | 21 |

| Signatures | 22 | |

| 2 |

FORWARD-LOOKING STATEMENTS

Except for any historical information contained herein, the matters discussed in this quarterly report on Form 10-Q contain certain “forward-looking statements’’ within the meaning of the federal securities laws. This includes statements regarding our future financial position, economic performance, results of operations, business strategy, budgets, projected costs, plans and objectives of management for future operations, and the information referred to under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

These forward-looking statements generally can be identified by the use of forward-looking terminology, such as “may,’’ “will,’’ “expect,’’ “intend,’’ “estimate,’’ “anticipate,’’ “believe,’’ “continue’’ or similar terminology, although not all forward-looking statements contain these words. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Although we believe that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. Important factors that may cause actual results to differ from projections include, for example:

| ● | the success or failure of management’s efforts to implement our business plan; | |

| ● | our ability to fund our operating expenses; | |

| ● | our ability to compete with other companies that have a similar business plan; | |

| ● | the effect of changing economic conditions impacting our plan of operation; and | |

| ● | our ability to meet the other risks as may be described in future filings with the Securities and Exchange Commission (the “SEC”). |

Unless otherwise required by law, we also disclaim any obligation to update our view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made in this quarterly report on Form 10-Q.

When considering these forward-looking statements, you should keep in mind the cautionary statements in this quarterly report on Form 10-Q and in our other filings with the SEC. We cannot assure you that the forward-looking statements in this quarterly report on Form 10-Q will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may prove to be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time-frame, or at all.

| 3 |

| 4 |

TraqIQ, Inc.

(formerly Thunderclap Entertainment, Inc.)

Condensed Consolidated Balance Sheets

| As of | As of | |||||||

| September 30, 2017 | December 31, 2016 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 4,999 | $ | 5,942 | ||||

| Accounts receivable, net | 2,898 | - | ||||||

| Prepaid expenses and other current assets | 18,918 | 3,668 | ||||||

| Total Current Assets | 26,815 | 9,610 | ||||||

| Property and equipment, net | 278 | - | ||||||

| TOTAL ASSETS | $ | 27,093 | $ | 9,610 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| LIABILITIES | ||||||||

| Current Liabilities: | ||||||||

| Note payable - bank | $ | - | $ | 75,000 | ||||

| Current portion of long term debt - related parties | 589,582 | 249,298 | ||||||

| Current portion of long term debt | - | 11,866 | ||||||

| Short term debt | 18,152 | - | ||||||

| Convertible debt - related parties, net of discounts | 74,924 | - | ||||||

| Accounts payable and accrued expenses | 228,153 | 106,657 | ||||||

| Total Current Liabilities | 910,811 | 442,821 | ||||||

| Long term debt, net of current portion | 45,000 | - | ||||||

| Total Liabilities | 955,811 | 442,821 | ||||||

| STOCKHOLDERS' DEFICIT | ||||||||

| Preferred stock, $0.0001 par value, 10,000,000 shares authorized: | ||||||||

|

Series A Convertible Preferred stock, $0.0001 par value, 50,000 shares and 0 shares authorized, issued and outstanding, as of September 30, 2017 and December 31, 2016 | 5 | - | ||||||

| Common stock, $0.0001 par value, 300,000,000 shares authorized, 6,824,490 and 824,490 shares issued and outstanding, as of September 30, 2017 and December 31, 2016 | 682 | 82 | ||||||

| Additional paid in capital | 14,403 | 4,408 | ||||||

| Accumulated deficit | (943,808 | ) | (437,701 | ) | ||||

| Total Stockholders' Deficit | (928,718 | ) | (433,211 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 27,093 | $ | 9,610 | ||||

See accompanying notes to condensed consolidated unaudited financial statements.

| 5 |

TraqIQ, Inc.

(formerly Thunderclap Entertainment, Inc.)

Condensed Consolidated Statements of Operations

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| REVENUE, NET | $ | 18,259 | $ | 46,132 | $ | 18,759 | $ | 192,430 | ||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Salaries and salary related costs | 38,455 | - | 38,455 | 20,782 | ||||||||||||

| Professional fees | 17,950 | 21,052 | 37,200 | 109,148 | ||||||||||||

| Rent expense | - | 10,540 | 15,713 | 26,042 | ||||||||||||

| General and administrative expense | 1,378 | 40,038 | 10,405 | 42,611 | ||||||||||||

| Total operating expenses | 57,783 | 71,629 | 101,773 | 198,583 | ||||||||||||

| NET LOSS BEFORE OTHER INCOME (EXPENSES) | (39,524 | ) | (25,497 | ) | (83,014 | ) | (6,153 | ) | ||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||

| Gain on sale of fixed assets | - | 4,379 | - | 4,379 | ||||||||||||

| Rental income | - | - | 11,685 | 18,000 | ||||||||||||

| Interest expense | (29,555 | ) | (2,861 | ) | (52,324 | ) | (21,296 | ) | ||||||||

| Total other income (expense) | (29,555 | ) | 1,518 | (40,639 | ) | 1,083 | ||||||||||

| NET LOSS BEFORE PROVISION FOR INCOME TAXES | (69,079 | ) | (23,980 | ) | (123,653 | ) | (5,070 | ) | ||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| NET LOSS | $ | (69,079 | ) | $ | (23,980 | ) | $ | (123,653 | ) | $ | (5,070 | ) | ||||

| Net Loss per share - Basic and Diluted | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.08 | ) | $ | (0.01 | ) | ||||

| Weighted Average Shares Outstanding | 5,585,360 | 824,490 | 2,428,886 | 824,490 | ||||||||||||

See accompanying notes to condensed consolidated unaudited financial statements.

| 6 |

TraqIQ, Inc.

(formerly Thunderclap Entertainment, Inc.)

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2017 | 2016 | |||||||

| CASH FLOW FROM OPERATING ACTIVITES | ||||||||

| Net loss | $ | (123,653 | ) | $ | (5,070 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Depreciation | 1,629 | 852 | ||||||

| Amortization of debt discounts | 6,897 | - | ||||||

| Gain on sale of property | - | (4,379 | ) | |||||

| Changes in assets and liabilities | ||||||||

| Decrease in accounts receivable | 1,443 | 26,326 | ||||||

| Decrease in prepaid expenses | 8,476 | - | ||||||

| Decrease in deferred revenue | - | (15,000 | ) | |||||

| Increase (decrease) in accounts payable and accrued expenses | 37,183 | (17,790 | ) | |||||

| Net cash used in operating activities | (68,025 | ) | (15,061 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Cash from reverse merger | 558 | - | ||||||

| Proceeds from sale of property | - | 5,945 | ||||||

| Net cash provided by investing activities | 558 | 5,945 | ||||||

| CASH FLOWS FROM FINANCING ACTIVITES | ||||||||

| Repayment of line of credit | (75,000 | ) | - | |||||

| Advances to related party - note receivable | (18,109 | ) | - | |||||

| Proceeds from long term debt - related parties | 178,951 | 73,464 | ||||||

| Repayment of long term debt - related parties | (79,744 | ) | - | |||||

| Proceeds from sale of preferred stock to related party | 10,000 | - | ||||||

| Proceeds from long term debt | 45,000 | - | ||||||

| Repayments of long term debt | (12,683 | ) | (53,150 | ) | ||||

| Net cash provided by financing activities | 66,524 | 20,314 | ||||||

| NET (DECREASE) INCREASE (DECREASE) IN CASH | (943 | ) | 11,198 | |||||

| CASH - BEGINNING OF PERIOD | 5,942 | 7,068 | ||||||

| CASH - END OF PERIOD | $ | 4,999 | $ | 18,266 | ||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||

| Interest paid in cash | $ | 1,421 | $ | 22,958 | ||||

| Income taxes paid in cash | $ | - | $ | - | ||||

| SCHEDULE OF NONCASH INVESTING AND FINANCING ACTIVITIES: | ||||||||

| Assets acquired and (liabilities assumed) in reverse merger and acquisition of Omni: | ||||||||

| Cash | $ | 558 | $ | - | ||||

| Accounts receivable | 4,341 | - | ||||||

| Prepaid expenses | 23,726 | - | ||||||

| Property and equipment | 1,907 | - | ||||||

| Stockholder advances | (306,421 | ) | - | |||||

| Short term financing obligations | (18,969 | ) | - | |||||

| Accounts payable | (86,996 | ) | - | |||||

| $ | (381,854 | ) | $ | - | ||||

See accompanying notes to condensed consolidated financial statements.

| 7 |

TraqIQ, Inc.

(Formerly Thunderclap Entertainment, Inc.)

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 1 – ORGANIZATION AND NATURE OF OPERATIONS

TraqIQ, Inc. (along with its wholly owned subsidiaries, referred to herein as the “Company”) was incorporated in the State of California on September 9, 2009 as Thunderclap Entertainment, Inc. On July 14, 2017, Thunderclap Entertainment, Inc. changed its name to TraqIQ, Inc. On July 19, 2017, the Company entered into a Share Exchange Agreement (“share Exchange”) with the stockholders of OmniM2M, Inc. (“OmniM2M”) and Ci2i Services, Inc. (“Ci2i”) whereby the stockholders of Omni and Ci2i agreed to exchange all of their respective shares, representing 100% ownership in OmniM2M and Ci2i in exchange for 3,000,000 shares of the Company’s common stock, respectively. The Share Exchange was accounted for as a reverse merger whereas Ci2i is considered the accounting acquirer and TraqIQ,Inc. is considered the accounting acquiree. Accordingly, the condensed consolidated financial statements included the accounts of Ci2i for all periods presented and the accounts of TraqIQ, Inc. and Omni, which was acquired by the Company on July 19,2017 since the date of acquisition. For accounting purposes, the acquisition of Omni is recorded at historical cost in accordance with Accounting Standard Codification (“ASC”) 805-50-25-2 as this is considered an acquisition of entities under common control as the management of the Company and Omni control the activities of the respective companies. Prior to the merger with Ci2i and acquisition of Omni, the Company was considered a shell company under Rule 12b-2 of the Exchange Act.

Ci2i is an innovative and growth-oriented services company founded in 1998 that develops and deploys intelligent technologies and products in order to meet the demand for sustainable, integrated solutions to contemporary business needs. Ci2i is a consulting services company that provides marketing and technical services to its clients. These services are delivered both on a Project and a Time & Materials basis. The primary focus has been in the Analytics and Intelligence segments. The Company typically does not own any IP, as all the work is done on behalf of the clients. The Company does most of its business with Microsoft and is looking to diversify into other segments and customers.

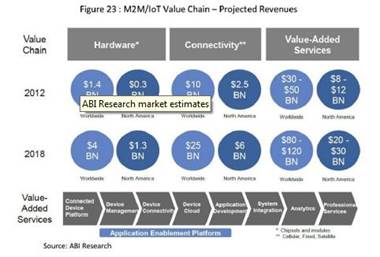

OmniM2M was formed in 2014 and is an innovative and growth-oriented company that develops and deploys “Internet of Things” (IoT) and “Mobile to Mobile” (M2M) products in order to meet the demand for sustainable, integrated solutions to contemporary business needs.

NOTE 2 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the regulations of the United States Securities and Exchange Commission. The condensed consolidated financial statements and accompanying notes are the representations of the Company’s management, who are responsible for their integrity and objectivity. These condensed consolidated financial statements should be read in conjunction with a reading of the Company’s consolidated financial statements and notes thereto included in Form 8-K/A filed with the SEC on August 3, 2017. Interim results of operations for the three and nine months ended September 30, 2017 are not necessarily indicative of future results for the full year.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. These estimates include, but are not limited to, management’s estimate of provisions required for non-collectible accounts receivable, depreciative lives of our assets, determination of technological feasibility, and valuation allowances of our deferred tax assets. Actual results could differ from those estimates.

| 8 |

Cash

Cash and cash equivalents include cash on hand and on deposit at banking institutions as well as all highly liquid short-term investments with original maturities of 90 days or less. The Company has no cash equivalents as of September 30, 2017.

Accounts Receivable and Concentration of Credit Risk

The Company considers accounts receivable, net of allowance for returns and doubtful accounts, to be fully collectible. The allowance is based on management’s estimate of the overall collectability of accounts receivable, considering historical losses and economic conditions. Based on these same factors, individual accounts are charged off against the allowance when management determines those individual accounts are uncollectible. Credit extended to customers is generally uncollateralized. Past-due status is based on contractual terms. Management has determined that no allowance is required for the outstanding accounts receivable as of September 30, 2017.

Property and Equipment and Long-Lived Assets

Property and equipment is stated at cost. Depreciation on property and equipment is computed using the straight-line method over the estimated useful lives of the assets, which range from three to seven years.

FASB Codification Topic 360 “Property, Plant and Equipment” (ASC 360), requires that long-lived assets and certain identifiable intangibles held and used by an entity be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The application of ASC 360 has not materially affected the Company’s reported earnings, financial condition or cash flows.

Intangible assets with definite useful lives are stated at cost less accumulated amortization. Omni has had and currently does have computer software development underway, however, has determined that the costs associated with this development, currently do not meet the requirements for capitalization under ASC 985-20-25. Omni will continue to monitor the development of such software in relationship to the requirements under the ASC in the future to determine if capitalization is warranted.

The Company will assess the impairment of identifiable intangibles whenever events or changes in circumstances indicate that the carrying value may not be recoverable at the time they do have intangible assets. Factors the Company considers to be important which could trigger an impairment review include the following:

1.Significant underperformance relative to expected historical or projected future operating results;

2.Significant changes in the manner of use of the acquired assets or the strategy for the overall business; and

3.Significant negative industry or economic trends.

When the Company determines that the carrying value of intangibles may not be recoverable based upon the existence of one or more of the above indicators of impairment and the carrying value of the asset cannot be recovered from projected undiscounted cash flows, the Company records an impairment charge. The Company will measure any impairment based on a projected discounted cash flow method using a discount rate determined by management to be commensurate with the risk inherent in the current business model. Significant management judgment is required in determining whether an indicator of impairment exists and in projecting cash flows.

Software Costs

Omni accounts for software development costs in accordance with ASC 985.730, Software Research and Development, and ASC 985-20, Costs of Software to be Sold, Leased or Marketed. ASC 985-20 requires that costs related to the development of Omni’s products be capitalized as an asset when incurred subsequent to the point at which technological feasibility of the enhancement is established. ASC 985-20 specifies that “technological feasibility” can only be established by the completion of a “detailed program design” or if no such design is prepared, upon the completion of a “working model” of the software. Omni’s development process does not include a detailed program design. Management believes that such a design could be produced in the early stages of development but would entail significant wasted expense and delay. Consequently, ASC 985-20 requires that development costs be recorded as an expense until the completion of a “working model”. In Omni’s case, the completion of a working model does not occur until shortly before the time when the software is ready for sale.

| 9 |

Revenue Recognition

Revenue primarily consists of the sale of consulting services. Revenue is recognized when the following criteria have been met:

Evidence of an arrangement exists. The Company considers a customer purchase order, service agreement, contract, or equivalent document to be evidence of an arrangement.

Delivery has occurred. Delivery is considered to have occurred when Ci2i consultants have delivered the items detailed in the PO or contract.

The fee is fixed or determinable. The Company considers the fee to be fixed or determinable if the fee is not subject to refund or adjustment and payment terms are standard, which is generally 30-60 days.

Collection is deemed reasonably assured. Collection is deemed reasonably assured if it is expected that the customer will be able to pay amounts under the arrangement as payments become due. If it is determined that collection is not reasonably assured, then revenue is deferred and recognized upon cash collection, or is reversed and not recognized at all.

For Ci2i, revenue is measured upon completion based on achieving milestones detailed in the agreements with its customers. Costs of providing services, including services accounted for in accordance with ASC 605-35, are expensed as incurred. If it is determined that either services or milestones were not fully completed, or are for a monthly fee for a period of time, revenue is deferred over the life of that agreement and amortized into current year revenue ratably over the life of the agreement.

Omni for its software revenue will recognize revenues in accordance with ASC 985-605, Software Revenue Recognition.

Revenue from software license agreements is recognized when persuasive evidence of an agreement exists, delivery of the software has occurred, the fee is fixed or determinable, and collectability is probable. In software arrangements that include more than one element, Omni allocates the total arrangement fee among the elements based on the relative fair value of each of the elements.

Omni enters into arrangements that can include various combinations of software, services, and hardware. Where elements are delivered over different periods of time, and when allowed under U.S. GAAP, revenue is allocated to the respective elements based on their relative selling prices at the inception of the arrangement, and revenue is recognized as each element is delivered. Omni uses a hierarchy to determine the fair value to be used for allocating revenue to elements: (i) vendor-specific objective evidence of fair value (“VSOE”), (ii) third-party evidence, and (iii) best estimate of selling price (“ESP”). For software elements, Omni follows the industry specific software guidance which only allows for the use of VSOE in establishing fair value. Generally, VSOE is the price charged when the deliverable is sold separately or the price established by management for a product that is not yet sold if it is probable that the price will not change before introduction into the marketplace.

ESPs are established as best estimates of what the selling prices would be if the deliverables were sold regularly on a stand-alone basis. The process for determining ESPs requires judgment and considers multiple factors that may vary over time depending upon the unique facts and circumstances related to each deliverable.

When the arrangement with a customer includes significant production, modification, or customization of the software, Omni recognizes the related revenue using the percentage-of-completion method in accordance with the accounting guidance and certain production-type contracts contained in ASC 605-35, Construction-Type and Production-Type Contracts. Omni uses the percentage of completion method provided all of the following conditions exist:

| ● | the contract includes provisions that clearly specify the enforceable rights regarding goods or services to be provided and received by the parties, the consideration to be exchanged and the manner and terms of settlement; | |

| ● | the customer can be expected to satisfy its obligations under the contract; | |

| ● | Omni can be expected to perform its contractual obligations; and | |

| ● | reliable estimates of progress towards completion can be made. |

| 10 |

Omni measures completion based on achieving milestones detailed in the agreements with the customers. Costs of providing services, including services accounted for in accordance with ASC 605-35, are expensed as incurred.

Uncertain Tax Positions

The Company follows ASC 740-10, “Accounting for Uncertainty in Income Taxes”. This requires recognition and measurement of uncertain income tax positions using a “more-likely-than-not” approach. Management evaluates their tax positions on an annual basis.

The Company files income tax returns in the U.S. federal tax jurisdiction and various state tax jurisdictions. The federal and state income tax returns of the Company are subject to examination by the IRS and state taxing authorities, generally for three years after they were filed.

Fair Value of Financial Instruments

ASC 825, “Financial Instruments,” requires the Company to disclose estimated fair values for its financial instruments. Fair value estimates, methods, and assumptions are set forth below for the Company’s financial instruments: The carrying amount of cash, accounts receivable, prepaid and other current assets, accounts payable and accrued expenses, stockholder advances, short term financing and convertible debt approximate fair value because of the short-term maturity of those instruments. The Company does not utilize derivative instruments.

Recoverability of Long-Lived Assets

The Company reviews recoverability of long-lived assets on a periodic basis whenever events and changes in circumstances have occurred which may indicate a possible impairment. The assessment for potential impairment is based primarily on the Company’s ability to recover the carrying value of its long-lived assets from expected future cash flows from its operations on an undiscounted basis. If such assets are determined to be impaired, the impairment recognized is the amount by which the carrying value of the assets exceeds the fair value of the assets. Fixed assets to be disposed of by sale will be carried at the lower of the then current carrying value or fair value less estimated costs to sell.

Earnings (Loss) Per Share of Common Stock

Basic net income (loss) per common share is computed using the weighted average number of common shares outstanding. Diluted earnings per share (EPS) include additional dilution from common stock equivalents, such as convertible notes, preferred stock, stock issuable pursuant to the exercise of stock options and warrants. Common stock equivalents are not included in the computation of diluted earnings per share when the Company reports a loss because to do so would be anti-dilutive for periods presented. An uncertain number of shares underlying convertible debt have been excluded from the computation of loss per share because their impact was anti-dilutive.

Related Party Transactions

Parties are considered to be related to the Company if the parties directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Company. Related parties also include principal stockholders of the Company, its management, members of the immediate families of principal stockholders of the Company and its management and other parties with which the Company may deal where one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. The Company discloses all related party transactions. All transactions shall be recorded at fair value of the goods or services exchanged. Property purchased from a related party is recorded at the cost to the related party and any payment to or on behalf of the related party in excess of the cost is reflected as compensation or distribution to related parties depending on the transaction.

Recently Issued Accounting Standards

In August 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standard Update (ASU) No. 2016-15, “Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments”. The amendments in this update provided guidance on eight specific cash flow issues. This update is to provide specific guidance on each of the eight issues, thereby reducing the diversity in practice in how certain transactions are classified in the statement of cash flows. ASU 2016-15 is effective for fiscal years and interim periods beginning after December 31, 2017. Early adoption is permitted. The Company is assessing the impact, if any, of implementing this guidance on its consolidated financial position, results of operations and liquidity.

| 11 |

In February 2016, the FASB issued ASU No. 2016-02, “Leases (Topic 842)”. ASU 2016-02 changes the accounting for leased assets, principally by requiring balance sheet recognition of assets under lease arrangements. It is effective for annual reporting periods, and interim periods within those years, beginning after December 15, 2018. The Company is currently in the process of evaluating the impact of the adoption of ASU 2016-02 on its consolidated financial statements.

In May 2014, August 2015 and May 2016, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers”, ASU 2015-14, “Revenue from Contracts with Customers, Deferral of the Effective Date”, and ASU 2016-12, “Revenue from Contracts with Customers, Narrow-Scope Improvements and Practical Expedients”, respectively, which implement ASC Topic 606. ASC Topic 606 outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance under US GAAP, including industry-specific guidance. It also requires entities to disclose both quantitative and qualitative information that enable financial statements users to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The amendments in these ASUs are effective for annual periods beginning after December 15, 2017, and interim periods therein. Early adoption is permitted for annual periods beginning after December 15, 2016. These ASUs may be applied retrospectively with a cumulative adjustment to retained earnings in the year of adoption. The Company s assessing the impact, if any, of implementing this guidance on its consolidated financial position, results of operations and liquidity.

In January 2017, the FASB issued ASU 2017-04 Intangibles – Goodwill and Other (Topic 350), Simplifying the Test for Goodwill Impairment. The amendments in this update are required for public business entities that have goodwill reported in their financial statements and have not elected the private company alternative for the subsequent measurement of goodwill. The update is intended to simplify the annual or interim goodwill impairment test. A public business entity that is a U.S. SEC filer must adopt the amendments in this update for its annual or interim goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The Company s assessing the impact, if any, of implementing this guidance on its consolidated financial position, results of operations and liquidity.

In January 2017, the FASB issued ASU 2017-01 Business Combinations (Topic 805), Clarifying the Definition of a Business. The amendments in this update are required for public business entities that have goodwill reported in their financial statements and have not elected the private company alternative for the subsequent measurement of goodwill. The update is intended to clarify the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The definition of a business affects many areas of accounting including acquisitions, disposals, goodwill, and consolidation. Public business entities must apply the amendments in this update to annual periods beginning after December 15, 2017. Early application is permitted under certain conditions. The Company s assessing the impact, if any, of implementing this guidance on its consolidated financial position, results of operations and liquidity.

There were other updates recently issued, most of which represent technical corrections to the accounting literature or application to specific industries or transactions that are not expected to have a material impact on the Company’s financial position, results of operations or cash flows.

Going Concern

The Company has an accumulated deficit of $943,808 and a working capital deficit of $902,105 as of September 30, 2017. As a result of these factors, Management has determined that there is substantial doubt about the Company ability to continue as a going concern.

These consolidated financial statements of the Company have been prepared assuming that the Company will continue as a going concern, which contemplates, among other things, the realization of assets and the satisfaction of liabilities in the normal course of business over a reasonable period of time. The consolidated financial statements of the Company do not include any adjustments that may result from the outcome of the uncertainties.

| 12 |

The Company plans to raise additional capital to carry out its business plan. The Company’s ability to raise additional capital through future equity and debt securities issuances is unknown. Obtaining additional financing, the successful development of the Company’s contemplated plan of operations, ultimately, to profitable operations are necessary for the Company to continue operations.

NOTE 2: PROPERTY AND EQUIPMENT

Property and equipment consisted of the following as of September 30, 2017 and December 31, 2016:

| 2017 | 2016 | |||||||

| Furniture and fixtures | $ | 2,784 | $ | - | ||||

| Office equipment | 15,186 | 11,926 | ||||||

| M2M equipment | 14,126 | - | ||||||

| Subtotal | 32,096 | - | ||||||

| Accumulated Depreciation | (31,818 | ) | (11,926 | ) | ||||

| Net | $ | 278 | $ | - | ||||

Depreciation expense for the nine months ended September 30, 2017 and 2016 was $1,629 and $852, respectively. There was no impairment on these assets for this period. The Company sold $5,945 of fully depreciated property and equipment in 2016. The Company recorded a gain on the sale of the property and equipment of $4,379.

NOTE 3: NOTE PAYABLE - BANK

The Company had a $75,000 Line of Credit at a 4.5% interest with Wells Fargo bank. The line of credit was secured by the Company’s assets and was personally guaranteed by the company’s CEO. The balance of the line of credit was repaid during the nine months ended September 30, 2017 and no amounts remain outstanding.

NOTE 4: LONG-TERM DEBT RELATED PARTIES

The following is a summary of long-term debt - related parties as of September 30, 2017 and December 31, 2016:

| 2017 | 2016 | |||||||||

| Promissory note - CEO. | (a) | $ | 557,582 | $ | 226,707 | |||||

| Amounts due to OmniM2M. These advances eliminate in consolidation for 2017 as a result of the reverse merger. |

(b) | - | 12,591 | |||||||

| Note payable - shareholder. | (c) | 32,000 | 10,000 | |||||||

| $ | 589,582 | $ | 249,298 | |||||||

| (a) | This is a loan from the CEO entered into January 1, 2015, and is unsecured. The loan bears interest at 15% annually (1.25% monthly). Interest expense on this loan for the nine months ended September 30, 2017 and 2016 was $48,077 and $15,890 , respectively. Accrued interest on this loan at September 30, 2017 is $ 174,108 |

| (b) | This is an unsecured note (advance) from OmniM2M. These funds are used to pay for the employee benefits of OmniM2M. There is no interest charged on this amount, and the companies have common shareholders and management. |

| (c) | Note payable to Satinder Thiara entered into December 13, 2016, at interest rate of 15% annually (1.25% monthly). This is an unsecured loan. Interest expense on this loan for the nine months ended September 30, 2017 was $2,365. Accrued interest on this loan at September 30, 2017 is $4,565. Satinder Thiara is a shareholder of the Company. |

The entire balance is reflected as a current liability as the amounts are due on demand.

| 13 |

NOTE 5: LONG-TERM DEBT

The following is a summary of long-term debt as of September 30, 2017 and December 31, 2016:

| 2017 | 2016 | |||||||||||

| Promissory notes - Kabbage | (a) | $ | - | $ | 11,866 | |||||||

| Notes payable - Swarn Singh | (b) | 45,000 | - | |||||||||

| Total | 45,000 | 11,866 | ||||||||||

| Current portion | - | 11,866 | ||||||||||

| Total - net of current portion | $ | 45,000 | $ | - | ||||||||

| (a) | Multiple monthly loan agreements with Kabbage. Each of these loans has a six-month duration with interest and fees spread over the 6 months. | |

| (b) | Note payable to Swarn Singh entered into January 2017 ($25,000) and February 2017 ($20,000), at interest rate of 15% annually (1.25% monthly). This is an unsecured loan. Interest expense on this loan for the nine months ended September 30, 2017 was $4,813. Accrued interest on this loan at September 30, 2017 is $4,813. Both notes are due December 31, 2018. |

NOTE 6: CONVERTIBLE DEBT – RELATED PARTIES

In connection with the reverse merger in July 2017, the Company and two stockholders, who had provided related party advances to the Company, agreed to exchange their related party advances for 6% Convertible Promissory Notes due on January 15, 2018 (the “Notes”) in the amount of $68,077. The Notes bear simple interest at 6% unless the Company defaults, which increases the interest rate to 10%. The Holders, at their option, can elect to convert the principal plus any accrued interest, into shares of the Company’s common stock at a conversion rate equal to eighty percent (80%) of the average closing share price as quoted on the OTC Markets for the five (5) trading days prior to the date of conversion> Because the Notes are convertible into a variable number of shares of common stock based on a fixed dollar amount, in accordance with ASC Topic 480, the notes are recorded at the fair value of the shares issuable upon conversion. The excess of the fair value of shares issuable over the face value of the Notes is recorded as a discount to the noted to be amortized in to interest expense over the term of the note. The following summarizes the carrying value of convertible debt as of September 30, 2017:

| Face value of the notes | $ | 68,027 | ||

| Excess of the fair value of shares issuable over the face value of the Notes | 17,007 | |||

| Unamortized discount | (10,110 | ) | ||

| $ | 74,924 |

NOTE 7: STOCKHOLDERS’ DEFICIT

On July 14, 2017, the “Company”) amended its Articles of Incorporation to increase its authorized common stock from 50,000,000 , no par value to 300,000,000, $0.0001 par value, change its 10,000,000 $0.0001 par value preferred stock to 10,000,000, $0.0001 par value preferred stock; and (iii) reverse split all outstanding shares of common stock (“Pre-Reverse Split Stock”) such that each twenty (20) shares of Pre-Reverse Split Stock shall be combined and reclassified into one (1) validly issued, fully paid and non-assessable share of the Company’s Common Stock, par value $0.0001 per share. Share amounts for all periods presented have been retroactively adjusted to reflect the reverse split in accordance with SAB Topic 14C. The Company had 824,250 shares issued and outstanding post-split and prior to the reverse merger with Ci2i on July 19, 2017.

| 14 |

Series A Convertible Preferred Stock

On July 19, 2017, the Company approved the issuance of 50,000 shares of its Series A Convertible Preferred Stock to its CEO and, on August 1 2017, the Company sold and issued the 50,000 shares of its Series A Convertible Preferred Stock to its CEO at a price of $0.20 per share for $10,000.

Each outstanding share of Series A Convertible Preferred Stock is convertible into the number of shares of the Company’s common stock (the “Common Stock”) determined by dividing the Stated Value by the Conversion Price as defined below, at the option of any Series A Convertible Preferred Stock shareholder in whole or in part, at any time commencing no earlier than six (6) months after the issuance date; provided that any conversion under this section must be made during the ten (10) day period immediately following the date on which the corporation files with the Securities and Exchange Commission any periodic report on form 10-Q, 10-K or the equivalent form; provided further that, any conversion under this Section IV: (a) shall be for a minimum Stated Value of $500.00 of Series A Convertible Preferred Stock.

The Conversion Price for each share of Series A Convertible Preferred Stock in effect on any Conversion Date shall be (i) eighty five percent (85%) of the average closing bid price of the Common Stock over the twenty (20) trading days immediately preceding the date of conversion, (ii) but no less than par value of the Common Stock. For purposes of determining the closing bid price on any day, reference shall be to the closing bid price for a share of Common Stock on such date on the OTC Markets, as reported on Bloomberg, L.P. (or similar organization or agency succeeding to its functions of reporting prices) (the “Per Share Market Value”).

Common Stock

On July 19, 2017, the Company issued 3,000,000 shares of common stock to the former shareholders of Ci2i pursuant to the Share Exchange Agreement. The acquisition of Ci2i was considered a reverse merger with Ci2i the accounting acquiror.

In addition, on July 19, 2017, the Company acquired Omni. For accounting purposes, the acquisition of Omni is recorded at historical cost in accordance with ASC 805-50-25-2 as this is considered an acquisition of entities under common control as the management of the Company and Omni control the activities of the respective companies. The Company issued 3,000,000 shares to the former shareholders of Omni in this acquisition.

The common stock was recorded at the historical basis of the net liabilities assumed as a result of the Share Exchange Agreement. As a result, the net liabilities assumed totaled $379,654 and was charged to accumulated deficit.

As of September 30, 2017, the Company has 6,824,250 shares issued and outstanding.

nOTE 8: CONCENTRATIONS

During the nine months ended September 30, 2017 and 2016, the Company had two major customers comprising 83% and 100% of sales, respectively. A major customer is defined as a customer that represents 10% or greater of total sales. Accounts receivable for these customers totaled $2,898 as of September 30, 2017, of which 83% of this balance was due from one customer. The Company does not believe that the risk associated with these customers will have an adverse effect on the business.

NOTE 9: PROVISION FOR INCOME TAXES

The provision (benefit) for income taxes for the nine months ended September 30, 2017 and the year ended December 31, 2016 differs from the amount which would be expected as a result of applying the statutory tax rates to the losses before income taxes due primarily to the valuation allowance to fully reserve net deferred tax assets.

Realization of deferred tax assets is dependent upon sufficient future taxable income during the period that deductible temporary differences and carry-forwards are expected to be available to reduce taxable income. As the achievement of required future taxable income is uncertain, the Company recorded a valuation allowance.

| 15 |

| As of | As of | |||||||

| September 30, 2017 | December 31, 2016 | |||||||

| Deferred tax assets: | ||||||||

| Net operating loss before non-deductible items | $ | (561,354 | ) | $ | (437,701 | ) | ||

| Tax rate | 34 | % | 34 | % | ||||

| Total deferred tax assets | 190,860 | 148,818 | ||||||

| Less: Valuation allowance | (190,860 | ) | (148,818 | ) | ||||

| Net deferred tax assets | $ | - | $ | - | ||||

As of September 30, 2017, the Company has a net operating loss carry forward of $561,354 expiring through 2037. The Company has provided a valuation allowance against the full amount of the deferred tax asset due to management’s uncertainty about its realization. Furthermore, the net operating loss carry forward may be subject to further limitation pursuant to Section 382 of the Internal Revenue Code. The valuation allowance was increased by $42,042 in 2017.

nOTE 10: SUBSEQUENT EVENTS

Subsequent events were evaluated through the date the consolidated financial statements were issued.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following presentation of management’s discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements, the accompanying notes thereto and other financial information appearing elsewhere in this quarterly report on Form 10-Q. This section and other parts of this quarterly report on Form 10-Q contain forward-looking statements that involve risks and uncertainties. See “Forward-Looking Statements.”

TraqIQ, Inc. (“TRAQIQ”, or the “Company”) comprised the business activities of two subsidiary companies: Ci2i Services, Inc. (“CI2I”) and OmniM2M, Inc. (“OmniM2M”).

OmniM2M, Inc.

The Industrial Internet of Things (“IIoT”) is about the transformation of any physical object into a digital data solution. Once you attach a sensor to it, a physical object (whether a tiny one like a pill that goes through your body, or a very large one like a plane or building) starts functioning a lot like any other digital solution – it emits data about its usage, location and state; it can be tracked, controlled, personalized and upgraded remotely; and, when coupled with all the progress in Big Data and artificial intelligence, the digital solution can become intelligent, predictive, collaborative and in some cases semi-autonomous.

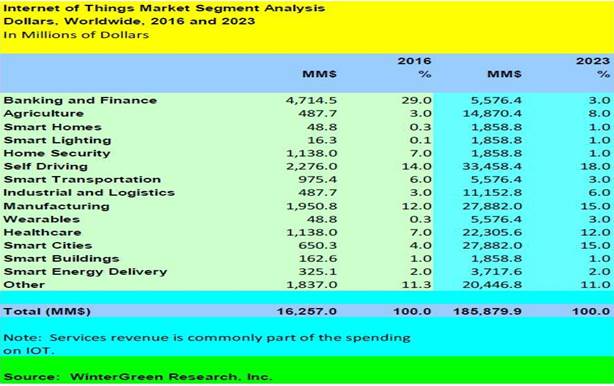

According to Gartner Group, there will be over 21 billion “things” connected to the internet by 2020, or in other words, 3 things per each human being on earth. The Gartner Group reported that the market size for services is expected to be $235 billion in 2016, with the majority coming from business services. Wintergreen Research (2016) more conservatively estimates the commercial IIoT market at $16.3B in 2016 and reaching $185.9B by 2020.

| 16 |

OmniM2M is focused on the IIoT, thereby helping commercial customers increase their return on investment in their facilities.

Applications such as video surveillance, smart meters, digital health monitors and a host of other services are creating new requirements and opportunities for new IIoT devices and solutions.

OmniM2M provides bundled solutions of hardware, software, connectivity, applications and analytics to address targeted problems in refrigeration, pest control and tank monitoring. OMNIM2M’s unique solutions can be deployed rapidly and provides considerable Return on Investment (ROI) benefits immediately by saving up to 25% of an employee’s time or meeting of corporate compliance goals). OmniM2M has deployed solutions that are currently being used by several customers with positive results.

OmniM2M Refrigeration Solution

The OmniM2M Refrigeration Solution includes a piece of hardware (the size is about that of a smart phone) that is deployed in the refrigeration units. It has a cellular connection to the OmniM2M software in the cloud. The solution tracks the temperature and alerts the user via email and/or text if there is a change in the temperature. When the health inspector performs its assessment, the customer can simply print or email the data using the Omni reporting feature solution. In addition to monitoring food, the OmniM2M solutions can potentially prevent food poisoning outbreaks by safely monitoring food and equipment to their optimum temperatures.

Customer Pain Points

The typical refrigeration customer (restaurant/meat distributor/catering) frequently has issues with its equipment breaking down, meeting compliance requirements and ensuring product freshness. Aging equipment typically results in significant financial losses when the asset fails. The typical restaurant has a regulatory requirement to log the temperature in its refrigeration units four (4) times per day. This data is compiled manually by employees who check each unit and log the temperature. Since it’s a manual process, there is generally no monitoring performed outside of business hours. Assets tend to fail outside of normal hours when employees are not on location and the issue or failure is not detected.

| 17 |

The Solution

The OmniM2M Refrigeration Solution includes a piece of hardware (the size is about that of a smart phone) that is deployed in the refrigeration units. It has a cellular connection to the OmniM2M software in the cloud. The solution tracks the temperature and alerts the user via email and/or text if there is a change in the temperature. When the health inspector performs its assessment, the customer can simply print or email the data using the Omni reporting feature solution. In addition to monitoring food, the OmniM2M solutions can potentially prevent food poisoning outbreaks by safely monitoring food and equipment to their optimum temperatures.

OmniM2M Pest Control Solution

By installing a small sensor on the pest trap, the OmniM2M Pest Control Solution notifies a control technician when a pest has been caught in a trap. This notification enables the user to check the trap when it has caught the targeted vermin. Our OmniM2M Pest Control Solution also complies with state and federal laws by sending daily status reports of the active traps.

This solution results in a saving of up to 2 hours of employee time per day and reduces driving time on average, by approximately 50 miles per day.

OmniM2M Tank Monitoring Solution

By installing a small sensor in any large tank (that holds liquids), the OmniM2M Tank Monitoring Solution notifies the user electronically when the tank needs to be refilled. This solution saves considerable expense of unplanned truck rolls for refilling the tanks.

By installing a small sensor in any large tank (that holds liquids), the OmniM2M system notifies the user electronically when the tank needs to be refilled. This solution saves considerable expense of unplanned truck rolls for refilling the tanks.

Ci2i Services, Inc.

CI2I was formed about over 15 years ago and has most recently been providing IT consulting solutions, predominantly in the business intelligence and data analytics arenas. The company has been a vendor to Microsoft for over 10 years, and has done work with many Microsoft product and business groups, including Microsoft Azure and Microsoft Media planning. CI2I has worked closely with customers including bConnections, where a wide variety of analytics solutions were built.

CI2I’s cloud solutions and analytics services comprise software development, program management, project management, and business analytics services.

In 2014, CI2I was invited into the Microsoft Supplier Program (MSP), which was designed to make it convenient for Microsoft business managers to identify and work with a pre-qualified group of suppliers. Over 80% of Microsoft’s annual spend is with MSP suppliers and MSP suppliers account for only 10% of Microsoft’s total active supplier population. In order to qualify for MSP, companies must also be nominated and be a part of the Approved Supplier List.

In 2015, CI2I was invited into Microsoft’s Contractor Hub program, an external staffing program designed to help Microsoft employees identify the right resources for all of their time & materials contractor needs. As a result of participating in Microsoft’s Contract Hub program, CI2I will increase its visibility with many new Microsoft Business Groups who can use CI2I’s time & material based resources, thereby further accelerating CI2I’s revenue growth.

Ci2i made it to the fastest growing list at Inc magazine – multiple times from 2006-2009. This includes being ranked 398 on the US Inc 500 list.

| 18 |

The Competitive Environment

The IIoT marketplace is very fragmented marketplace comprised of a few dozen Fortune 50 companies offering development platforms and networking infrastructure; about 100 Fortune 1000 companies offering a range of products, services and solutions across multiple industry segments; and at least 100 smaller start-up companies and publicly traded companies that offer a small number of products, services and solutions in targeted industry segments.

We believe that OmniM2M will succeed by focusing on a small number of industry segments – such as Transportation, Energy (Oil & Gas), and Resource Management – and by offering data analytics and systems integration services that complement the sale of IIoT devices to enterprise customers.

Results of Operations

Three Months Ended September 30, 2017 compared to Three Months Ended September 30, 2016

Revenues: Revenues decreased by $27,873, or 60%, from $46,132 for the three months ended September 30, 2016 to $18,259 for the three months ended September 30, 2017. The Company was still active in staffing projects last year – revenues in the new business areas is still minimal.

Salaries and salary related costs: Salaries and salary related costs increased by $38,455 from $0 for the three months ended September 30, 2016 to $38,455 for the three months ended September 30, 2017 due to the company investing in product development.

Professional fees: Professional fees decreased by $3,102, or 15%, from $21,052 for the three months ended September 30, 2016 to $17,950 for the three months ended September 30, 2017 due to one-time payments made to investment bankers.

Rent expense: Rent expense decreased by $10,540, or 100% from $10,540 for the three months ended September 30, 2016 to $0 for the three months ended September 30, 2017 due to the Company not renewing the office lease in Bellevue.

General and administrative: General and administrative expenses decreased by $38,660, or 97% from $40,038 for the three months ended September 30, 2016 to $1,378 for the three months ended September 30, 2017 due to tight control on expenses during the transition to an analytics company.

Interest expense: Interest expense increased by $26,694, or 933% from $2,861 for the three months ended September 30, 2016 to $29,555for the three months ended September 30, 2017 due to payments on loans taken to invest in product development.

| 19 |

Nine Months Ended September 30, 2017 compared to Nine Months Ended September 30, 2016

Revenues: Revenues decreased by $173,671, or 90%, from $192,430 for the nine months ended September 30, 2016 to $18,759 for the nine months ended September 30, 2017. The Company was still active in staffing projects last year – revenues in the new business areas is still minimal.

Salaries and salary related expenses: Salaries and salary related expenses increased by $17,673, or 85%, from $20,782 for the nine months ended September 30, 2016 to $38,455 for the nine months ended September 30, 2017 due to due to the Company investing in product development.

Professional fees: Professional fees decreased by $71,948, or 66%, from $109,148 for the nine months ended September 30, 2016 to $37,200 for the nine months ended September 30, 2017 due to due to one-time payments made for evaluating and soliciting incoming investments.

Rent expense: Rent expense decreased by $10,329, or 40% from $26,042 for the nine months ended September 30, 2016 to $15,713 for the nine months ended September 30, 2017 due to due to the Company not renewing the office lease in Bellevue.

General and administrative: General and administrative expenses decreased by $32,206, or 76% from $42,611 for the nine months ended September 30, 2016 to $10,405 for the nine months ended September 30, 2017 due to tight control on expenses during the transition to an analytics company

Interest expense: Interest expense increased by $31,028, or 146% from $21,296 for the nine months ended September 30, 2016 to $52,324 for the nine months ended September 30, 2017 due to payments on loans taken to invest in product development.

Continuing Operations, Liquidity and Capital Resources

As of September 30, 2017, we had a working capital deficit of $902,105. We intend to seek additional financing for our working capital, in the form of equity or debt, to provide us with the necessary capital to accomplish our plan of operation. There can be no assurance that we will be successful in our efforts to raise additional capital.

During the nine months ended September 30, 2017, we used $68,025 in operations, consisting of our loss from operations, offset by no cash expenses for depreciation and amortization of debt discounts of $8,526, and changes in our current assets and liabilities of $47,102. During the nine months ended September 30, 2016, we used $15,061 in operations, consisting of our loss from operations, offset by no cash expense for depreciation of $852 and changes in our current assets and liabilities of $6,464.

During the nine months ended September 30, 2017, we used $15,051 in investing activities, consisting of advances to a related party of $18,109, offset by cash received from the share exchange of $3,058. During the nine months ended September 30, 2016, we generated $5,945 from investing activities as a result of the sale of furniture.

During the nine months ended September 30, 2017, we generated $84,633 of cash from financing activities, consisting of $197,060 of advances from stockholders, $45,000 from other third-parties, $10,000 from the sale of preferred shares to an officer of the Company, offset by repayments of a line of credit of $75,000, notes to related parties of $79,744 and to other third parties of $12,683.

Off-Balance Sheet Arrangements

As of September 30, 2017, we did not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. The term “off-balance sheet arrangement” generally means any transaction, agreement or other contractual arrangement to which an entity unconsolidated with us is a party, under which we have any obligation arising under a guarantee contract, derivative instrument or variable interest or a retained or contingent interest in assets transferred to such entity or similar arrangement that serves as credit, liquidity or market risk support for such assets.

| 20 |

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Not required for smaller reporting companies.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our management, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, has reviewed and evaluated the effectiveness of the Company’s disclosure controls and procedures as of September 30, 2017. Based on such review and evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of September 30, 2017, the disclosure controls and procedures were not effective to ensure that information required to be disclosed by the Company in the reports that it files or submits under the Exchange Act (a) is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and (b) is accumulated and communicated to the Company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

There were no changes in the Company’s internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rule 13a-15 or 15d-15 of the Exchange Act that occurred during the fiscal quarter ended September 30, 2017 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

We are not a party to any material litigation, nor, to the knowledge of management, is any litigation threatened against us that may materially affect us.

None.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

(a) Not applicable.

(b) During the quarter ended September 30, 2017, there have not been any material changes to the procedures by which security holders may recommend nominees to the Board of Directors.

| 21 |

| Exhibit

Number |

Description of Exhibit | |

| 31.1 | Certification of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2 | Certification of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1 | Certification of the Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2 | Certification of the Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 101.INS | XBRL Instance | |

| 101.SCH | XBRL Taxonomy Extension Schema | |

| 101.CAL | XBRL Taxonomy Extension Calculation | |

| 101.DEF | XBRL Taxonomy Extension Definition | |

| 101.LAB | XBRL Taxonomy Extension Labels | |

| 101.PRE | XBRL Taxonomy Extension Presentation |

| 22 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| TraqIQ, Inc. | ||

| Date: November 13, 2017 | By: | /s/ Ajay Sikka |

| Ajay Sikka | ||

| Chief Executive Officer and Chief Financial Officer (principal executive officer, principal accounting officer and principal financial officer) | ||

| 23 |