Attached files

| file | filename |

|---|---|

| 8-K - 8-K NOVEMBER INVESTOR CONFERENCES - TCF FINANCIAL CORP | chfc8-knov2017investorconf.htm |

Creating a Premier Midwest

Community Bank

David T. Provost

Chief Executive Officer

Thomas C. Shafer

Vice Chairman, Chief Executive

Officer of Chemical Bank

Dennis Klaeser

Chief Financial Officer

November 2017 Conferences

This presentation and the accompanying presentation by management contains forward-looking statements that are based on management's beliefs, assumptions, current expectations,

estimates and projections about the financial services industry, the economy and Chemical Financial Corporation ("Chemical"). Words and phrases such as "anticipates," "believes,"

“focus,” "continue," "estimates," "expects," "forecasts," "future," "intends," "is likely," "opinion," "opportunity," "plans," "potential," "predicts," "probable," "projects," "should,"

"strategic," "trend," "will," and variations of such words and phrases or similar expressions are intended to identify such forward-looking statements. These statements include, among

others, statements related to loan pipeline and portfolio projections, expectations around future growth, including organic and acquisitive growth plans, and plans to hire additional

commercial lenders, bankers and other support staff, the impact of our restructuring efforts, including the expected pre-tax charges and annualized cost savings related to such efforts,

our focus on realizing operating and business synergies related to our merger with Talmer, and our focus, in 2018, on increasing our proportion of loans sold to enhance the run rate on

mortgage banking fee income. All statements referencing future time periods are forward-looking. Management's determination of the provision and allowance for loan losses; the

carrying value of acquired loans, goodwill and mortgage servicing rights; the fair value of investment securities (including whether any impairment on any investment security is

temporary or other-than-temporary and the amount of any impairment); and management's assumptions concerning pension and other postretirement benefit plans involve judgments

that are inherently forward-looking. There can be no assurance that future loan losses will be limited to the amounts estimated. All of the information concerning interest rate

sensitivity is forward-looking. The future effect of changes in the financial and credit markets and the national and regional economies on the banking industry, generally, and on

Chemical, specifically, are also inherently uncertain.

Forward-looking statements are based upon current beliefs and expectations and involve substantial risks and uncertainties that could cause actual results to differ materially from

those expressed or implied by such forward-looking statements. Accordingly, such statements are not guarantees of future performance and involve certain risks, uncertainties and

assumptions ("risk factors") that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ

from what may be expressed or forecasted in such forward-looking statements. Chemical undertakes no obligation to update, amend or clarify forward-looking statements, whether as

a result of new information, future events or otherwise. Risk factors including, without limitation:

• Chemical’s ability to attract and retain new commercial lenders and other bankers as well as key operations staff in light of competition for experienced employees in the banking

industry;

• Chemical’s ability to grow its deposits while reducing the number of physical branches that it operates;

• Negative reactions to the branch closures by Chemical Bank’s customers, employees and other counterparties;

• Economic conditions (both generally and in Chemical’s markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a

reduction in demand for credit and a decline in real estate values;

• A general decline in the real estate and lending markets, particularly in Chemical’s market areas, could negatively affect Chemical’s financial results;

• Increased cybersecurity risk, including potential network breaches, business disruptions, or financial losses;

• Restrictions or conditions imposed by Chemical’s or Chemical Bank’s regulators on Chemical’s or Chemical Bank’s operations may make it more difficult for Chemical to

achieve its goals;

• Legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect Chemical;

• Changes in the interest rate environment may reduce margins or the volumes or values of the loans Chemical makes or has acquired; and

• Economic, governmental, or other factors may prevent the projected population, residential, and commercial growth in the markets in which Chemical operates.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A of Chemical’s Annual Report on Form 10-K for the year ended December 31, 2016. These

and other factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a preceding forward-looking statement.

Forward-Looking Statements

2

Non-GAAP Financial Measures

This presentation and the accompanying presentation by management contain certain non-GAAP financial disclosures that are not in accordance with U.S. generally accepted

accounting principles ("GAAP"). Such non-GAAP financial measures include Chemical’s tangible shareholders' equity to tangible assets ratio, tangible book value per share,

presentation of net interest income and net interest margin on a fully taxable equivalent basis, operating expenses-core (which excludes merger and restructuring expenses and

impairment of income tax credits), operating expenses-efficiency ratio (which excludes merger and restructuring expenses, impairment of income tax credits and amortization of

intangibles), the adjusted efficiency ratio (which excludes significant items, impairment of income tax credits, amortization of intangibles, net interest income FTE adjustments, gains

from sale of investment securities and closed branch locations) and other information presented excluding significant items, including net income, diluted earnings per share, return on

average assets, return on average shareholders' equity and return on average tangible shareholders’ equity. Chemical uses non-GAAP financial measures to provide meaningful,

supplemental information regarding its operational results and to enhance investors’ overall understanding of Chemical’s financial performance. The limitations associated with non-

GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these

measures differently. These disclosures should not be considered an alternative to Chemical’s GAAP results. See the Appendix included with this presentation for a reconciliation of

the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Non-GAAP Financial Measures

2

Emphasize our strategy of

being the Premier Midwest

Community Bank

4

1

Demonstrated track record of

organic growth2

Strong performance metrics and

profitability should drive upside3

Realizing our ever greater potential

The largest banking company headquartered in Michigan

Scalable core strategies and disciplines

Proven organic growth initiatives

Leadership in EPS growth among peers (1)

Total Return out-performance (peers and indices) (1)

ROAA(2) 1.2%, ROAE(2) 8.6%, ROATCE(2)14.7%, low efficiency ratio

Delivering on projected merger benefits

Consistent EPS growth performance

Market share growth

Revenue enhancements

Concentrate on achieving cost savings and exploiting business synergy opportunities

Continue to build out and enhance risk management practices

(1) Source: SNL Geographic Intelligence

(2) ROAA, ROAE and ROATCE, excluding significant items, are non-GAAP financial measure. “Significant items” are defined as merger expenses, restructuring

expenses and the change in fair value of loan servicing rights. Please refer to slides 32 - 35 for a reconciliation of non-GAAP financial measures.

Overview

4

“Local” community bank

Strong belief in the community banking concept

23 identified centers of influence

Community-driven leadership, rapid local response

Emphasis on building relationships

We know our markets, what works, and what does not work

Strong credit culture

Diversification

In-depth knowledge of our customers and markets

Underwriting discipline

Low cost, stable, core funding – starts at relationship level

Expense management and control

Clean balance sheet, solid capital ratios and intense focus on effective capital deployment

Identify, hire, motivate and retain talented individuals to carry out our relationship strategies

Sustain long-term growth through combination of organic and acquisitive growth

Higher lending limits provide enhanced middle market lending growth opportunities

Opportunities for fee income growth from Wealth Management and Mortgage Banking synergies

Enhancing preparedness for future acquisitive growth opportunities in Michigan, Ohio, and Indiana

Scalable Core Strategies & Disciplines

Core Values

5

▪ Company-wide focus on efficient allocation of capital, enhancing

efficiency, improving customer service and driving revenue

growth

* 7.5 percent reduction in total employees in 3Q17

* 4Q17 planned consolidation of 25 branches, in addition to the 13 branches

consolidated in 3Q17

* Planned exiting of title insurance services and reducing resources allocated to auto

lending

* 3Q17 resulted in a pre-tax charge of $18.8 million as a result of retirement costs,

severance and charges associated with disposition of branch facilities

* Annualized cost savings expected to be about $20 million

▪ A portion of cost savings will be spent hiring commercial lenders,

other bankers and support staff with a goal of building market

share and further enhancing revenue growth

Restructuring Announced Sept. 12, 2017

6

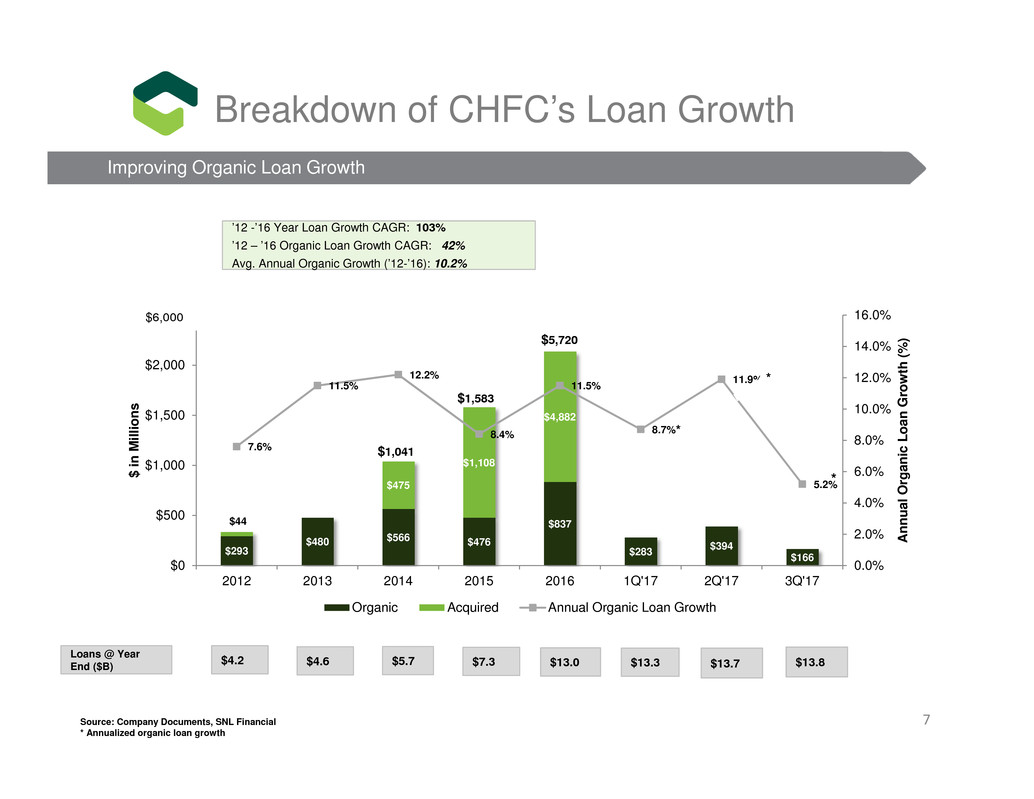

$293

$480 $566 $476

$837

$283 $394 $166

$44

$475

$1,108

$4,882

7.6%

11.5%

12.2%

8.4%

11.5%

8.7%

11.9%

5.2%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

$0

$500

$1,000

$1,500

$2,000

$2,500

2012 2013 2014 2015 2016 1Q'17 2Q'17 3Q'17

Annual

Organic

Loan

Gr

o

w

th

(

%

)

$

i

n

M

i

l

l

i

o

n

s

Organic Acquired Annual Organic Loan Growth

7

Breakdown of CHFC’s Loan Growth

Source: Company Documents, SNL Financial

* Annualized organic loan growth

$1,041

$1,583

$5,720

g g ( )

’12 -’16 Year Loan Growth CAGR: 103%

’12 – ’16 Organic Loan Growth CAGR: 42%

Av . Annual Or anic Growth ’12-’16 : 10.2%

Loans @ Year

End ($B) $4.2 $4.6 $5.7 $7.3 $13.0

Improving Organic Loan Growth

$13.3

*

$13.7

6,0

*

*

$13.8

8

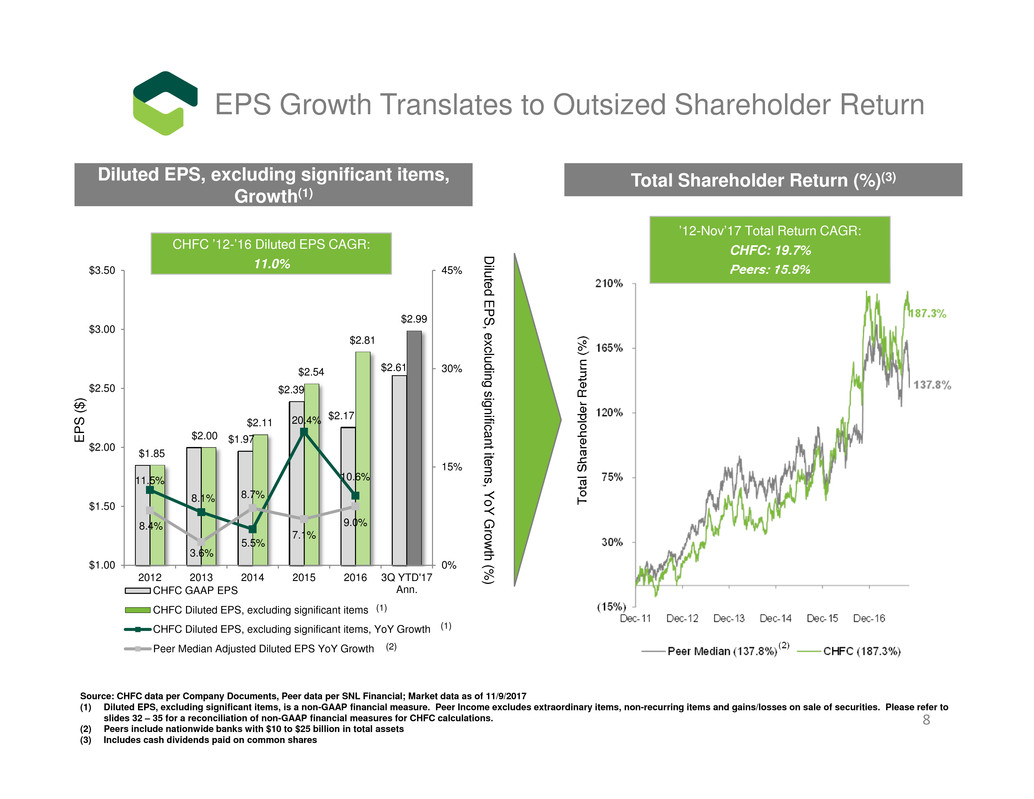

EPS Growth Translates to Outsized Shareholder Return

Source: CHFC data per Company Documents, Peer data per SNL Financial; Market data as of 11/9/2017

(1) Diluted EPS, excluding significant items, is a non-GAAP financial measure. Peer Income excludes extraordinary items, non-recurring items and gains/losses on sale of securities. Please refer to

slides 32 – 35 for a reconciliation of non-GAAP financial measures for CHFC calculations.

(2) Peers include nationwide banks with $10 to $25 billion in total assets

(3) Includes cash dividends paid on common shares

Diluted EPS, excluding significant items,

Growth(1)

Total Shareholder Return (%)(3)

(2)

E

P

S

(

$

)

D

iluted E

P

S

, excluding significant item

s, Y

oY

G

row

th (%

)

T

o

t

a

l

S

h

a

r

e

h

o

l

d

e

r

R

e

t

u

r

n

(

%

)

(2)

CHFC ’12-’16 Diluted EPS CAGR:

11.0%

(1)

(1)

’12-Nov’17 Total Return CAGR:

CHFC: 19.7%

Peers: 15.9%

$1.97

$2.39

$2.17

$2.61

$1.85

$2.00

$2.11

$2.54

$2.81

$2.99

11.5%

8.1%

5.5%

20.4%

10.6%

8.4%

3.6%

8.7%

7.1%

9.0%

0%

15%

30%

45%

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2012 2013 2014 2015 2016 3Q YTD'17

Ann.CHFC GAAP EPS

CHFC Diluted EPS, excluding significant items

CHFC Diluted EPS, excluding significant items, YoY Growth

Peer Median Adjusted Diluted EPS YoY Growth

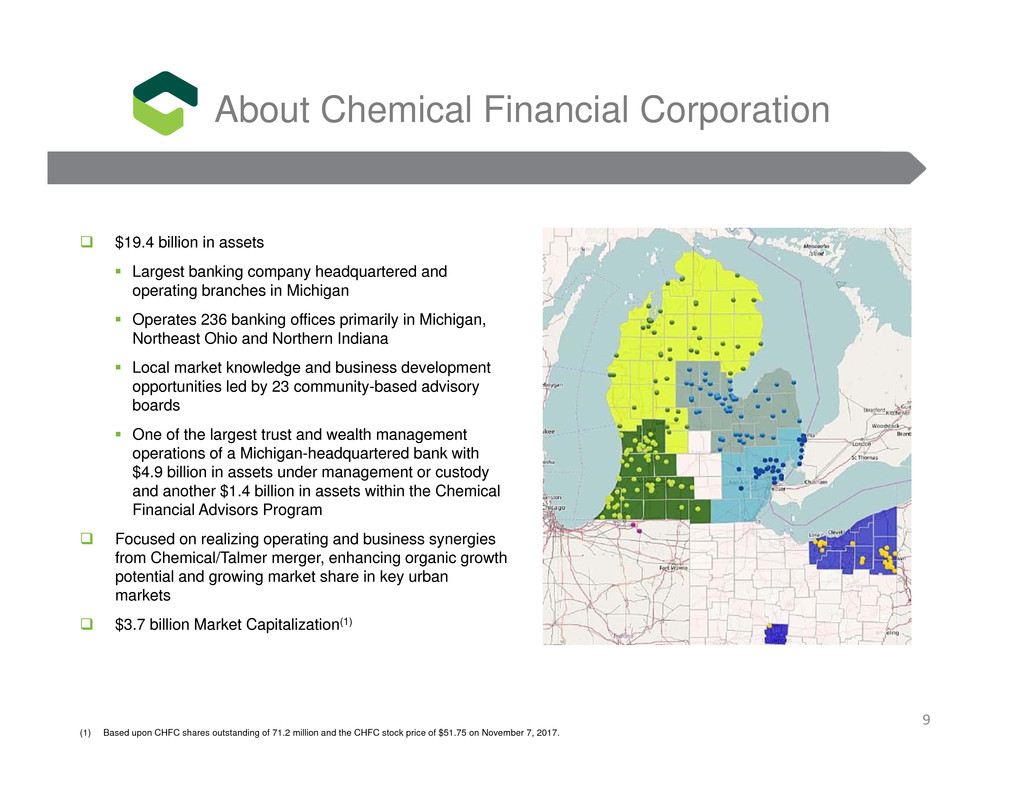

$19.4 billion in assets

Largest banking company headquartered and

operating branches in Michigan

Operates 236 banking offices primarily in Michigan,

Northeast Ohio and Northern Indiana

Local market knowledge and business development

opportunities led by 23 community-based advisory

boards

One of the largest trust and wealth management

operations of a Michigan-headquartered bank with

$4.9 billion in assets under management or custody

and another $1.4 billion in assets within the Chemical

Financial Advisors Program

Focused on realizing operating and business synergies

from Chemical/Talmer merger, enhancing organic growth

potential and growing market share in key urban

markets

$3.7 billion Market Capitalization(1)

(1) Based upon CHFC shares outstanding of 71.2 million and the CHFC stock price of $51.75 on November 7, 2017.

9

About Chemical Financial Corporation

62.7%

64.2%

65.3%

63.2%

67.2%

61.5%

60.8%

63.1%

61.6%

58.7%

54.4% 53.5%

59.5%

63.0%

61.2%

59.4%

57.5%

55.7%

50.0%

53.0%

56.0%

59.0%

62.0%

65.0%

68.0%

2012 2013 2014 2015 2016 YTD'17 Ann.

CHFC, GAAP CHFC, adjusted Peer Median

11.2%

11.4%

10.3%

12.8%

12.2%

12.8%

11.2%

11.4% 11.2%

13.7% 13.6%

14.7%

10.9%

11.8% 11.5% 11.5% 11.4%

13.0%

8.00%

10.00%

12.00%

14.00%

16.00%

2012 2013 2014 2015 2016 YTD'17 Ann.

CHFC CHFC, adjusted Peer Median

0.9% 1.0%

1.0%

1.0%

0.9%

1.0%

0.9% 0.9%

1.0%

1.1%

1.2% 1.2%

0.9%

1.1% 1.1% 1.1%

1.1%

1.1%

0.7%

0.8%

0.9%

1.0%

1.1%

1.2%

1.3%

2012 2013 2014 2015 2016 YTD'17 Ann.

CHFC, GAAP CHFC, adjusted Peer Median

10

ROAA(3)(%)

CHFC’s Performance Metrics

Source: SNL Financial and Company Documents; CHFC GAAP from SNL Financial

(1) CHFC Income excludes merger and acquisition expenses, restructuring expenses, loan servicing rights changes in fair value and gains on sales of branches. Peer income excludes extraordinary

items, non-recurring items and gains/losses on sale of securities. Please refer to slides 32 - 35 for a reconciliation of non-GAAP financial measures.

(2) Peers include nationwide banks with $10 to $25 billion in total assets; ratios are presented on an “adjusted” basis, see footnote 1.

(3) ROAA, ROATCE and the efficiency ratio, excluding significant items, are non-GAAP financial measures. Please refer to slides 32 – 35 for a reconciliation of non-GAAP financial measures.

ROATCE(3)(%)

Efficiency Ratio, non-GAAP(3)(%)

(2) (2)

(2)

Dividends per Share ($)

(1) (1)

$0.82

$0.87

$0.94

$1.00

$1.06

$1.10

$0.70

$0.80

$0.90

$1.00

$1.10

$1.20

2012 2013 2014 2015 2016 YTD'17 Ann.

(1)

11

Delivering on Projected Merger Benefits

Source: Company Documents

(1) Taken from presentation dated 2/1/2016; presentation filed with the SEC and was utilized by CHFC’s Senior Mgmt. team during analyst / institutional investor meetings to discuss the merger. CHFC

12/31/15 figures have been adjusted to reflect the current non-GAAP methodology utilized; the variance between the non-GAAP calculations are immaterial.

(2) Includes nationwide banks with total assets between $10 and $25 billion

(3) Denotes a non-GAAP financial measure. Refer to pages 32 – 35 for reconciliations of non-GAAP financial measures.

(4) Market data as of 1/29/2016

(5) Market Data as of 11/9/2017

(6) EPS estimates in the 12/31/2015 CHFC column were consensus “Street” estimates just prior to announcement of the merger; estimates in the Pro Forma CHFC / TLMR column were the pro forma

estimates provided by CHFC; estimates in the Today column are the current consensus “Street” estimates per Bloomberg

(7) Difference between Peer Median and Top Quartile multiples and CHFC Today, divided by CHFC Today. This is forward-looking, provided for information purposes only and not a guarantee of

performance.

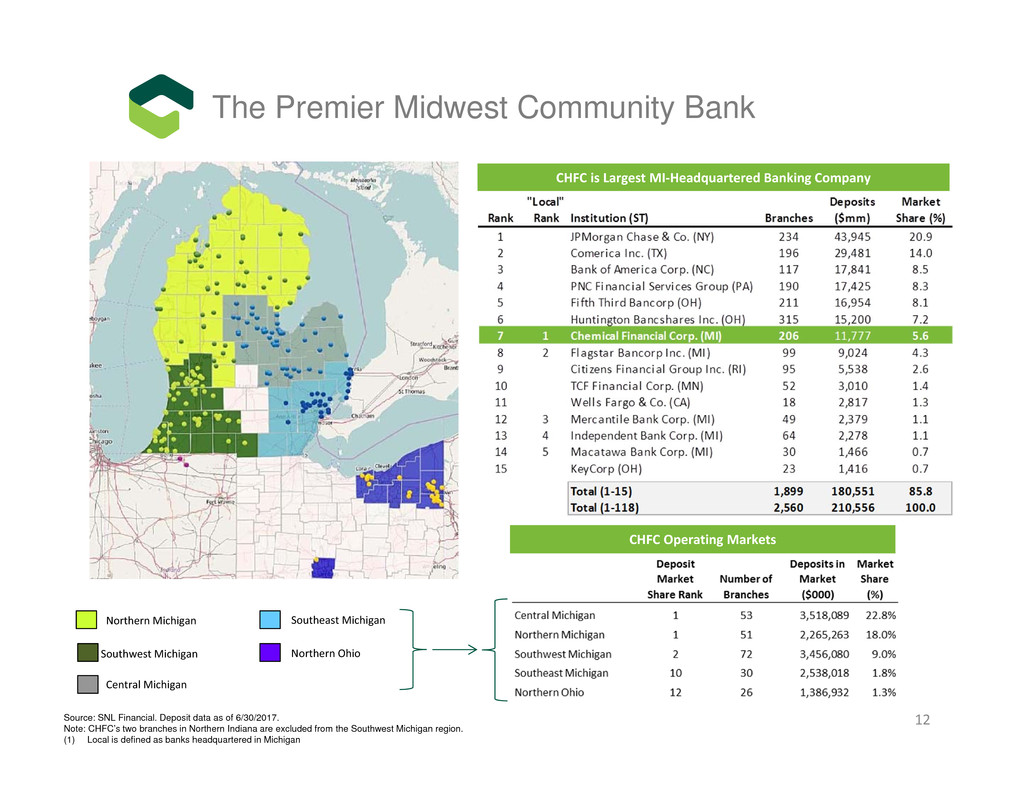

CHFC is Largest MI‐Headquartered Banking Company

CHFC Operating Markets

Source: SNL Financial. Deposit data as of 6/30/2017.

Note: CHFC’s two branches in Northern Indiana are excluded from the Southwest Michigan region.

(1) Local is defined as banks headquartered in Michigan

Northern Michigan Southeast Michigan

Southwest Michigan

Central Michigan

Northern Ohio

The Premier Midwest Community Bank

12

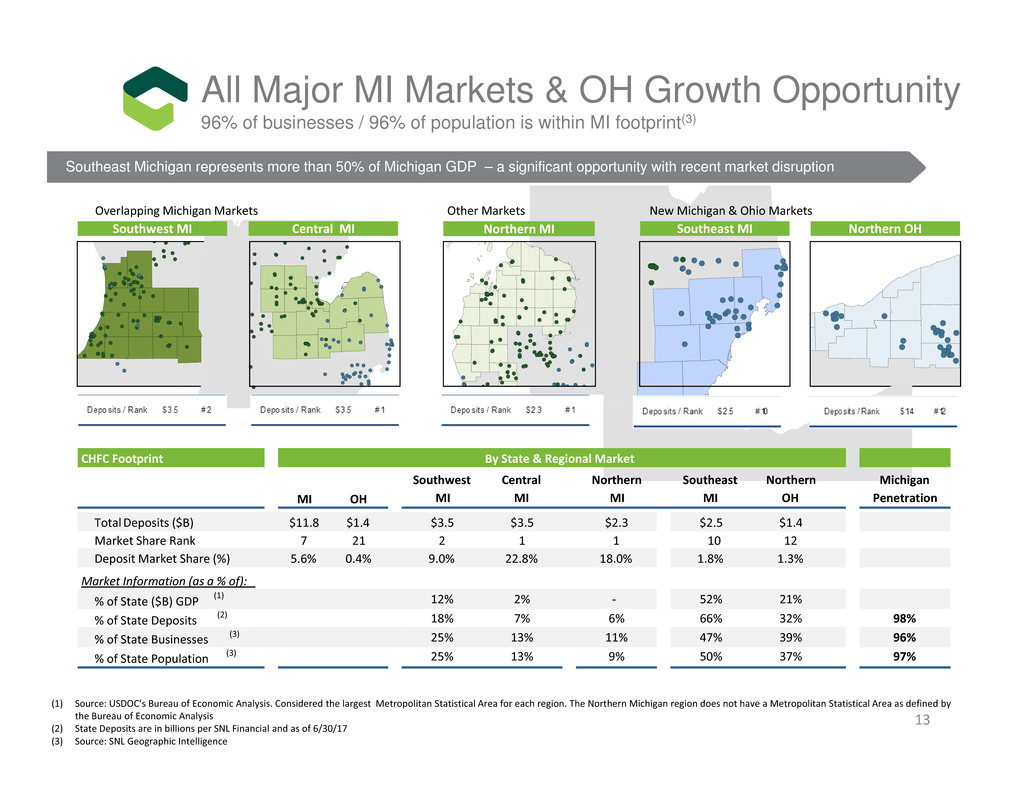

Overlapping Michigan Markets New Michigan & Ohio MarketsOther Markets

Southwest MI Central MI Southeast MI Northern OHNorthern MI

(1) Source: USDOC’s Bureau of Economic Analysis. Considered the largest Metropolitan Statistical Area for each region. The Northern Michigan region does not have a Metropolitan Statistical Area as defined by

the Bureau of Economic Analysis

(2) State Deposits are in billions per SNL Financial and as of 6/30/17

(3) Source: SNL Geographic Intelligence

All Major MI Markets & OH Growth Opportunity

96% of businesses / 96% of population is within MI footprint(3)

Southeast Michigan represents more than 50% of Michigan GDP – a significant opportunity with recent market disruption

CHFC Footprint By State & Regional Market

MI OH

Southwest

MI

Central

MI

Northern

MI

Southeast

MI

Northern

OH

Michigan

Penetration

TotalDeposits ($B) $11.8 $1.4 $3.5 $3.5 $2.3 $2.5 $1.4

Market Share Rank 7 21 2 1 1 10 12

Deposit Market Share (%) 5.6% 0.4% 9.0% 22.8% 18.0% 1.8% 1.3%

Market Information (as a % of):

% of State ($B) GDP (1) 12% 2% ‐ 52% 21%

% of State Deposits (2) 18% 7% 6% 66% 32% 98%

% of State Businesses (3) 25% 13% 11% 47% 39% 96%

% of State Population (3) 25% 13% 9% 50% 37% 97%

13

Increase in in-house lending limit and new Middle Market Loan Committee creates new

opportunities to further penetrate the middle-market space

Recruiting Efforts

3 key hires with deep C&I experience joining our SE MI and Grand Rapids Commercial teams will lift

referrals to Middle Market

5 C&I candidates in the talent pipeline

Opportunity (Companies $50 - $500 million in sales revenue):

West Michigan – 150 companies; present penetration <15

Southeast Michigan – 400 companies; present penetration <10

Ohio – 250 companies; present penetration <10

Portfolio Projections: $350 million at year-end 2017

Realizing our ever greater potential

14

October 2017

Southeast

Michigan Ohio

West

Michigan Other Total

Current Loans (#) 8 10 7 9 34

Current Loans ($) $61 million $123 million $53 million $86 million $323 million

New originations

next 30 days

$15 million $0 million $5 million $10 million $30 million

Through 9/30/2017, hired 36 mortgage loan officers (net 14), 3 producing sales managers (net minus

1) and 2 non-producing sales managers

Anticipate hiring 20 – 25 additional MLO’s in 2017 and 2018 (have added 5 MLO’s since 9/30/17, including

3 CRA lenders)

Opportunity & Focus: Grand Rapids, Southeast Michigan and Cleveland

Michigan Market Penetration:

4Q2016 (average): 2.05%

1Q2017 (average): 2.47%

2Q2017 (average): 4.30% (now ranked #3 in Michigan)

Origination Volume:

4Q2016: $490.5 million – 60% purchase / 40% refinance; 54% sale / 46% portfolio

1Q 2017: $313.3 million – 65% purchase / 35% refinance; 46% sale / 54% portfolio

2Q 2017: $463.2 million – 76% purchase / 24% refinance; 45% sale / 55% portfolio

3Q 2017: $482.5 million – 73% purchase / 27% refinance; 47% sale / 53% portfolio

YTD 2017: $1.26 billion – 72% purchase / 28% refinance; 46% sale / 54% portfolio

Key strategic focus in 2018 is to increase proportion of loans originated for sale in order to enhance

the run rate of mortgage banking fee income

Adjust the ARM index from CMT to LIBOR in order to sell ARM loans into the secondary market

Increase margin on portfolio products

Additional MLO training on conforming products

Realizing our ever greater potential

15

Opportunity, Enhancement, Growth (October 2016 through September 2017)

Emphasize our strategy of being the Premier Midwest Community Bank

Focus on what will build shareholder value

• Organic revenue growth and cost discipline

• Concentrate on achieving cost savings

• Expand our market presence and product lines where additional value

can be created

• Rationalization of branch locations

Closing Comments

16

Supplemental Information

David T. Provost

Chief Executive Officer

Thomas C. Shafer

Vice Chairman, Chief Executive

Office of Chemical Bank

Dennis Klaeser

Chief Financial Officer

Q3 2017 Highlights

Diluted earnings per share of $0.56, compared to $0.73 in the 2nd qtr. 2017 and $0.23 in the 3rd qtr. 2016

Diluted earnings per share, excluding significant items,(1)(2) of $0.79; up 5% from both 2nd qtr. 2017 and 3rd qtr.

2016

Return on average assets and return on average shareholders' equity of 0.86% and 6.1%, respectively, in 3rd qtr.

2017 (1.21% and 8.6%, respectively, excluding significant items(1)(2))

Return on average tangible shareholders' equity of 10.9% in 3rd qtr. 2017 (15.3%, excluding significant

items(1)(2))

Loan Growth

▪ $166 million in 3rd qtr. 2017 (quarterly organic loan growth: 12.3% commercial real estate construction,

4.0% consumer installment and 3.1% residential mortgage loans)

Asset quality ratios

▪ Nonperforming loans/total loans of 0.39% at September 30, 2017; increased from 0.37% at June 30,

2017, and from 0.32% at September 30, 2016

▪ Net loan charge-offs/average loans of 0.10%

(1)"Significant items" include merger and restructuring expenses and the change in fair value in loan servicing rights.

(2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

18

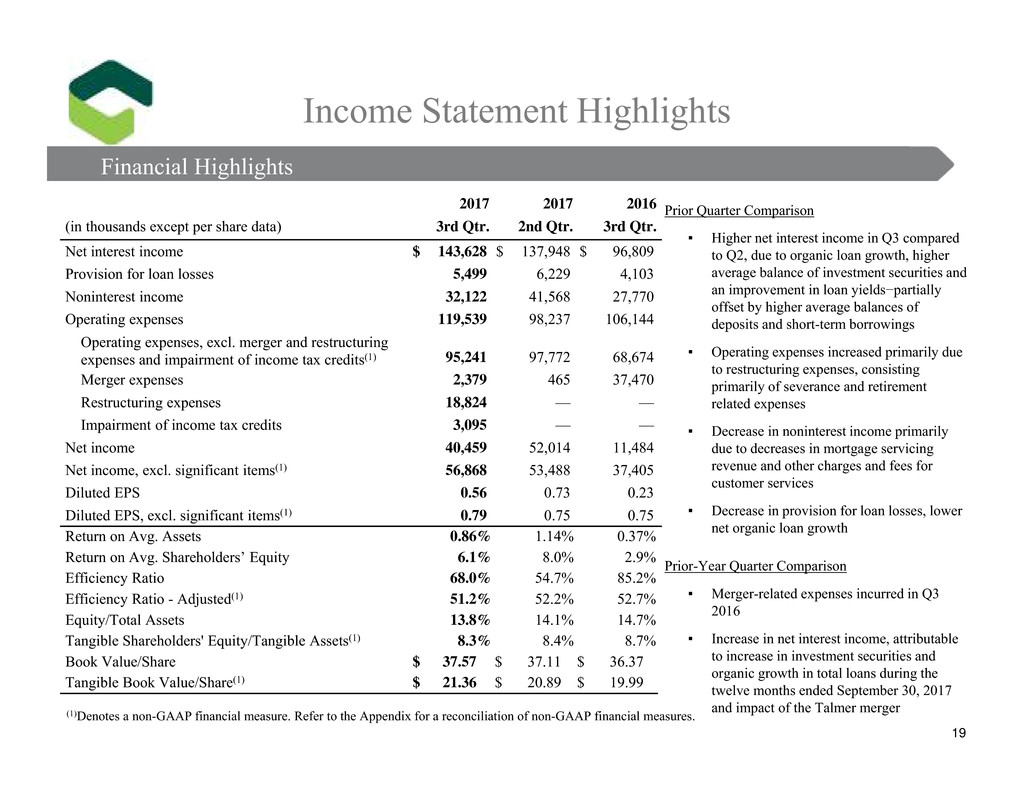

2017 2017 2016

(in thousands except per share data) 3rd Qtr. 2nd Qtr. 3rd Qtr.

Net interest income $ 143,628 $ 137,948 $ 96,809

Provision for loan losses 5,499 6,229 4,103

Noninterest income 32,122 41,568 27,770

Operating expenses 119,539 98,237 106,144

Operating expenses, excl. merger and restructuring

expenses and impairment of income tax credits(1) 95,241 97,772 68,674

Merger expenses 2,379 465 37,470

Restructuring expenses 18,824 — —

Impairment of income tax credits 3,095 — —

Net income 40,459 52,014 11,484

Net income, excl. significant items(1) 56,868 53,488 37,405

Diluted EPS 0.56 0.73 0.23

Diluted EPS, excl. significant items(1) 0.79 0.75 0.75

Return on Avg. Assets 0.86% 1.14% 0.37%

Return on Avg. Shareholders’ Equity 6.1% 8.0% 2.9%

Efficiency Ratio 68.0% 54.7% 85.2%

Efficiency Ratio - Adjusted(1) 51.2% 52.2% 52.7%

Equity/Total Assets 13.8% 14.1% 14.7%

Tangible Shareholders' Equity/Tangible Assets(1) 8.3% 8.4% 8.7%

Book Value/Share $ 37.57 $ 37.11 $ 36.37

Tangible Book Value/Share(1) $ 21.36 $ 20.89 $ 19.99

Prior Quarter Comparison

▪ Higher net interest income in Q3 compared

to Q2, due to organic loan growth, higher

average balance of investment securities and

an improvement in loan yields−partially

offset by higher average balances of

deposits and short-term borrowings

▪ Operating expenses increased primarily due

to restructuring expenses, consisting

primarily of severance and retirement

related expenses

▪ Decrease in noninterest income primarily

due to decreases in mortgage servicing

revenue and other charges and fees for

customer services

▪ Decrease in provision for loan losses, lower

net organic loan growth

Prior-Year Quarter Comparison

▪ Merger-related expenses incurred in Q3

2016

▪ Increase in net interest income, attributable

to increase in investment securities and

organic growth in total loans during the

twelve months ended September 30, 2017

and impact of the Talmer merger(1)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

Financial Highlights

Income Statement Highlights

19

Financial Highlights

2015 Total: $86.8(1); $92.3(2)(3) 2016 Total: $108.0(1); $140.4(2)(3) 2017

(1)Net Income

(2)Net Income, excluding significant items.

(3)Denotes a non-GAAP financial measure. Please refer to the Appendix for a reconciliation of non-GAAP financial measures.

$56.9(2)(3)

Net Income Trending Upward ($ Millions, except EPS data)

Net Income

$0.57(3)

Net Income Trending Upward ($ Millions, except EPS data)

2015 2016 2017

$53.5(2)(3)

20

$37.4(2)(3)

Significant items (after-tax)

Net Income

__ Diluted EPS, excluding significant items (non-GAAP) (3)

$0.79(3)

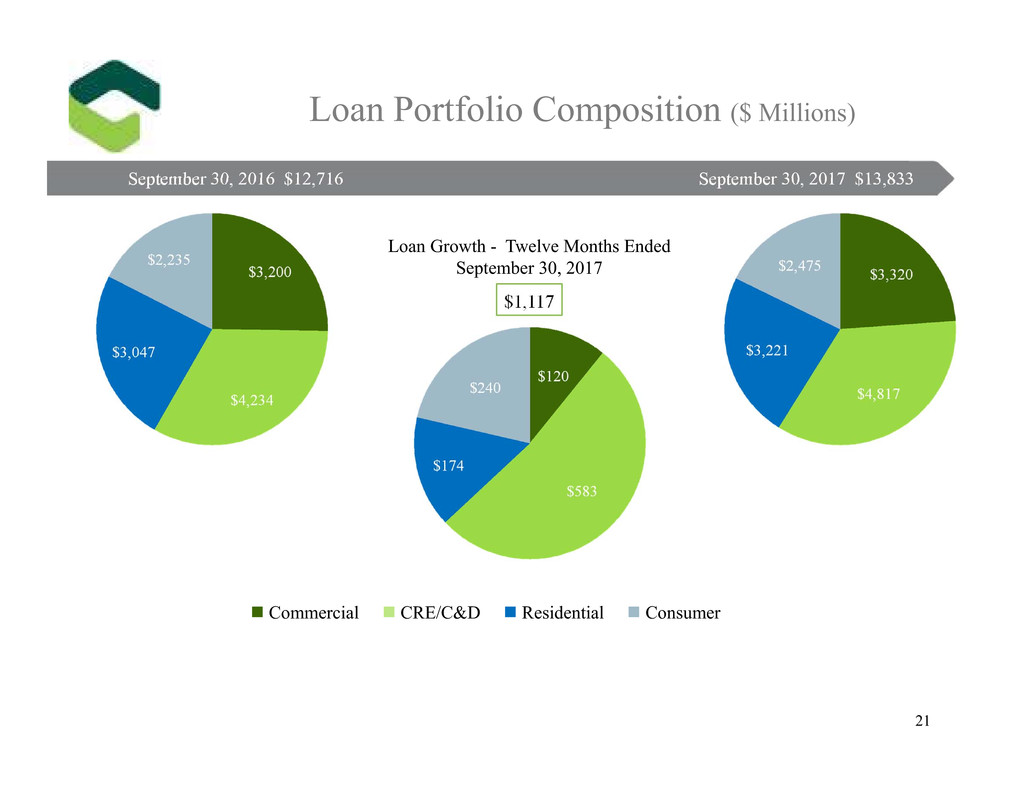

Loan Portfolio Composition ($ Millions)

$1,117

21

September 30, 2016 $12,716 September 30, 2017 $13,833

Total Loan Growth -

Commercial CRE/C&D Residential Consumer

Loan Growth - Twelve Months Ended

September 30, 2017

2015 - $476 2016 - $837 2017 - $843

$15

$224

$181

$280

$56

$843 $837

$96

$186

Quarterly Loan Growth Trends

Loan Growth* ($ Millions)

$275

*Excludes the impact of the $4.88 billion of loans acquired in the Talmer merger.

$283

22

Commercial

CRE/C&D

Residential

Consumer

Quarterly Loan Growth Trends

Loan Growth - 2016 Total* Loan Growth - 2017 YTD

$166

$394

Quarterly Loan Growth Trends

Q3 2017 Q2 2017 Q1 2017 2016 Total*

Originated Loan Portfolio

Commercial $ 71 $ 195 $ 88 $ 380

CRE/C&D 139 313 239 594

Residential 197 89 119 258

Consumer 89 103 56 418

Total Originated Loan Portfolio Growth $ 496 $ 700 $ 502 $ 1,650

Acquired Loan Portfolio

Commercial $ (111) $ (88) $ (52) $ (292)

CRE/C&D (92) (94) (64) (317)

Residential (102) (97) (72) (133)

Consumer (25) (27) (31) (71)

Total Acquired Loan Portfolio Run-off $ (330) $ (306) $ (219) $ (813)

Total Loan Portfolio

Commercial $ (40) $ 107 $ 36 $ 88

CRE/C&D 47 219 175 277

Residential 95 (8) 47 125

Consumer 64 76 25 347

Total Loan Portfolio Growth $ 166 $ 394 $ 283 $ 837

Loan Growth (Run-off) ($ Millions)

Loan Growth* – Originated v. Acquired

*Excludes the impact of the $4.88 billion of loans acquired in the Talmer merger. 23

Loan Growth (Run-off) ($ Millions)

(1)Comprised of $874 million of growth in customer deposits offset by a $342 million decrease in brokered deposits.

(2)Cost of deposits based on period averages.

Total Deposits – September 30, 2016

$13.3

Total Deposits – September 30, 2017

$13.8

Organic

$0.5, 4.0%(1)

Total Deposits ($ Billions)

Deposit Composition

(2)

2016 2017

24

Total Deposits ($ Billions)

Average Deposits ($ Millions) & Cost of Deposits(2) (%)

Noninterest-bearing Demand Deposits Interest-bearing Demand Deposits Savings Deposits Time Deposits Brokered Deposits

$(0.4)

$(0.3)

Average Cost of Funds Q3 2017 – 0.53% Average Cost of Funds Q2 2017 – 0.44%

$16.0 billion $16.6 billion

Average cost of wholesale

borrowings – 1.35%

Average cost of wholesale

borrowings – 1.14%

Funding Breakdown ($ Billions)

25

June 30, 2017 September 30, 2017

Deposits:

Time Deposits

Customer Repurchase

Agreements

Wholesale borrowings (at

September 30, 2017: brokered

deposits - $0.1 billion, short

and long term borrowings -

$2.3 billion)

Interest and

noninterest-

bearing, demand,

savings, money

market

ALL

NPLs

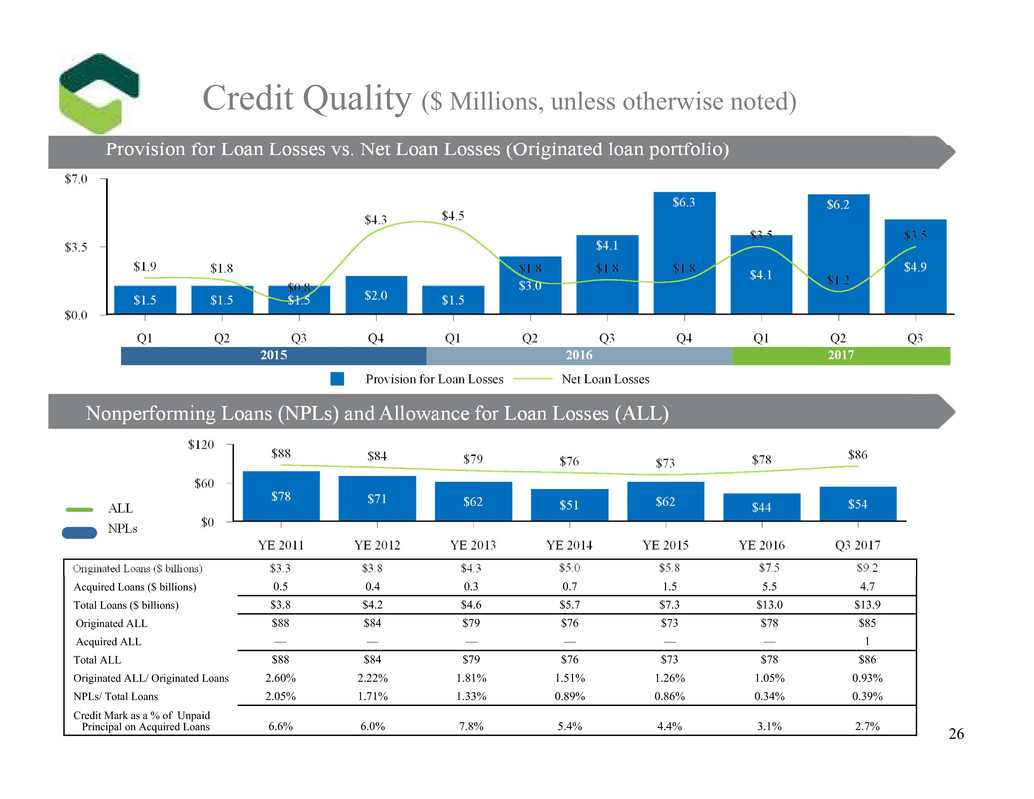

2015 2016 2017

Originated Loans ($ billions) $3.3 $3.8 $4.3 $5.0 $5.8 $7.5 $9.2

Acquired Loans ($ billions) 0.5 0.4 0.3 0.7 1.5 5.5 4.7

Total Loans ($ billions) $3.8 $4.2 $4.6 $5.7 $7.3 $13.0 $13.9

Originated ALL $88 $84 $79 $76 $73 $78 $85

Acquired ALL — — — — — — 1

Total ALL $88 $84 $79 $76 $73 $78 $86

Originated ALL/ Originated Loans 2.60% 2.22% 1.81% 1.51% 1.26% 1.05% 0.93%

NPLs/ Total Loans 2.05% 1.71% 1.33% 0.89% 0.86% 0.34% 0.39%

Credit Mark as a % of Unpaid

Principal on Acquired Loans 6.6% 6.0% 7.8% 5.4% 4.4% 3.1% 2.7%

Provision for Loan Losses vs. Net Loan Losses

Credit Quality ($ Millions, unless otherwise noted)

Provision for Loan Losses vs. Net Loan Losses (Originated loan portfolio)

Nonperforming Loans (NPLs) and Allowance for Loan Losses (ALL)

26

Net Interest Margin(1) and Loan Yields

Net Interest Margin(1)

Purchase Accounting Accretion on Loans

Loan Yields

Net Interest Income

(Quarterly Trend)

Net Interest Income, Net Interest Margin

and Loan Yields

(1)Computed on a fully taxable equivalent basis (non-GAAP) using a federal income tax rate of 35%. Please refer to the Appendix for a

reconciliation of non-GAAP financial measures.

27

Quarterly Tre

2016 2017

2016 2017

$20.9

$32.1*

Quarterly

Non-Interest Income

* Significant items: Changes in fair value in loan servicing rights were a $4.0 million detriment in Q3 2017, a $1.8 million detriment in

Q2 2017, a $0.5 million detriment in Q1 2017, a $6.3 million benefit in Q4 2016 and a $1.2 million detriment in Q3 2016. Q4 2016 also

included a $7.4 million gain on sales of branch offices.

$41.6*

$27.8*

$54.3*

28

Quarterly

2016 2017

$38.0*

$19.4

$68.6(1)

$106.1

$56.0(1)

$59.1

$96.3(1)

$114.3

Quarterly

Operating Expenses

$98.2

$100.0(1)

29

Quarterly

2016 2017

$104.2

$97.7(1)

$95.2(1)

$119.5

(1) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

$56.3(1)

$58.9

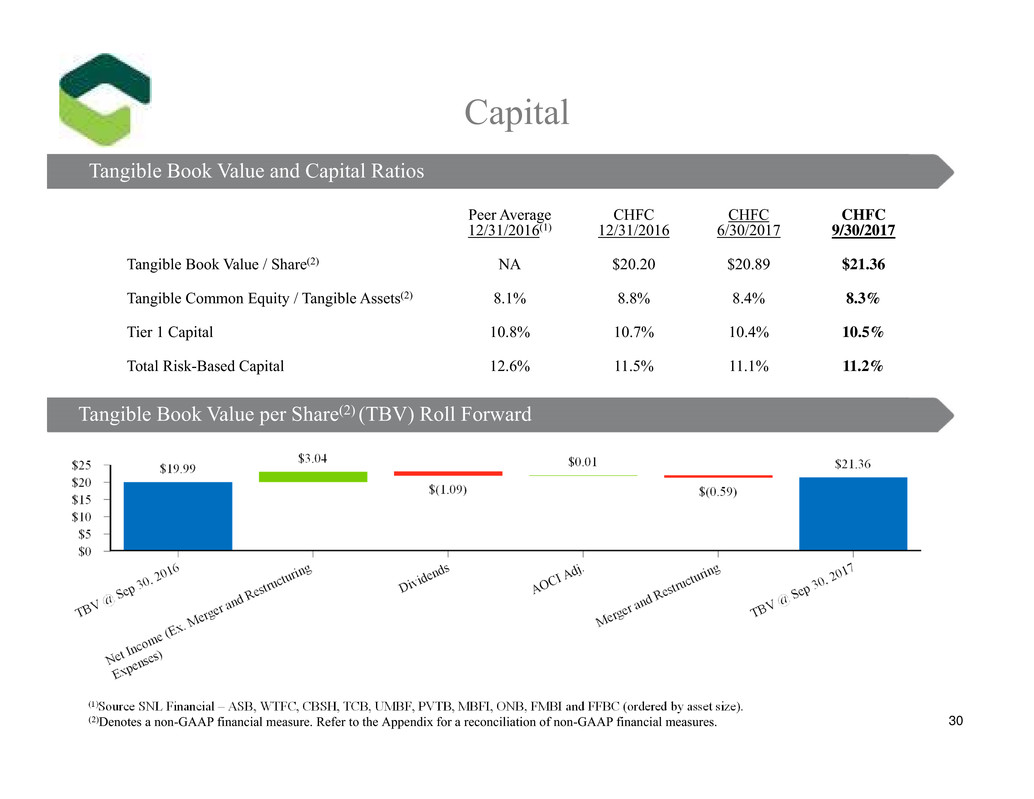

Peer Average

12/31/2016(1)

CHFC

12/31/2016

CHFC

6/30/2017

CHFC

9/30/2017

Tangible Book Value / Share(2) NA $20.20 $20.89 $21.36

Tangible Common Equity / Tangible Assets(2) 8.1% 8.8% 8.4% 8.3%

Tier 1 Capital 10.8% 10.7% 10.4% 10.5%

Total Risk-Based Capital 12.6% 11.5% 11.1% 11.2%

Capital

(1)Source SNL Financial – ASB, WTFC, CBSH, TCB, UMBF, PVTB, MBFI, ONB, FMBI and FFBC (ordered by asset size).

(2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

Tangible Book Value and Capital Ratios

Tangible Book Value per Share(2) (TBV) Roll Forward

30

Analyst

Consensus

Consistent growth and performance for shareholders through economic cycles

Merger creates the opportunity to strengthen the foundation for delivering

sustainable, strong EPS growth into the future

Consensus EPS Consensus Dividend

SNL Core EPS Common Dividend

31

Consistent EPS Growth Performance

Source: SNL Financial; analyst consensus estimates as of 11/9/2017

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

1.00

$

P

e

r

S

h

a

r

e

Performance & Expectations

Full Year

Q3 2017 Q2 2017 Q3 2016 2016 2015

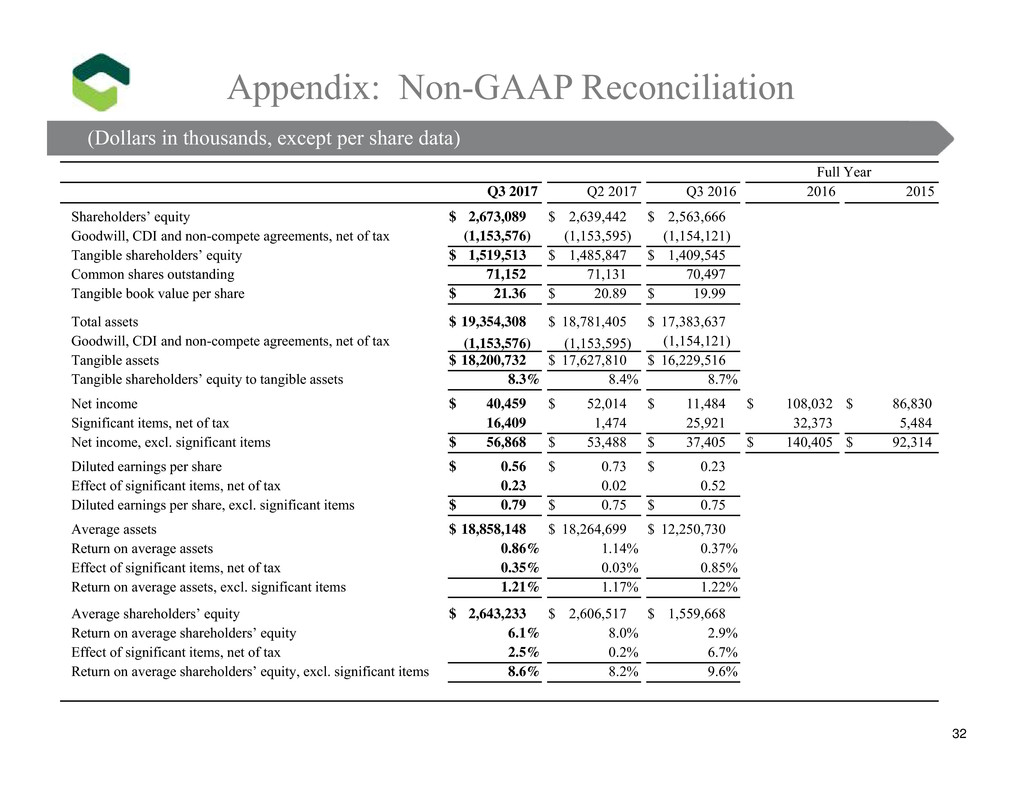

Shareholders’ equity $ 2,673,089 $ 2,639,442 $ 2,563,666

Goodwill, CDI and non-compete agreements, net of tax (1,153,576) (1,153,595) (1,154,121)

Tangible shareholders’ equity $ 1,519,513 $ 1,485,847 $ 1,409,545

Common shares outstanding 71,152 71,131 70,497

Tangible book value per share $ 21.36 $ 20.89 $ 19.99

Total assets $ 19,354,308 $ 18,781,405 $ 17,383,637

Goodwill, CDI and non-compete agreements, net of tax (1,153,576) (1,153,595) (1,154,121)

Tangible assets $ 18,200,732 $ 17,627,810 $ 16,229,516

Tangible shareholders’ equity to tangible assets 8.3% 8.4% 8.7%

Net income $ 40,459 $ 52,014 $ 11,484 $ 108,032 $ 86,830

Significant items, net of tax 16,409 1,474 25,921 32,373 5,484

Net income, excl. significant items $ 56,868 $ 53,488 $ 37,405 $ 140,405 $ 92,314

Diluted earnings per share $ 0.56 $ 0.73 $ 0.23

Effect of significant items, net of tax 0.23 0.02 0.52

Diluted earnings per share, excl. significant items $ 0.79 $ 0.75 $ 0.75

Average assets $ 18,858,148 $ 18,264,699 $ 12,250,730

Return on average assets 0.86% 1.14% 0.37%

Effect of significant items, net of tax 0.35% 0.03% 0.85%

Return on average assets, excl. significant items 1.21% 1.17% 1.22%

Average shareholders’ equity $ 2,643,233 $ 2,606,517 $ 1,559,668

Return on average shareholders’ equity 6.1% 8.0% 2.9%

Effect of significant items, net of tax 2.5% 0.2% 6.7%

Return on average shareholders’ equity, excl. significant items 8.6% 8.2% 9.6%

(Dollars in thousands, except per share data)

Appendix: Non-GAAP Reconciliation

32

lars in thousands, exce t per share data)

Q3 2017 Q2 2017 Q3 2016

Efficiency Ratio:

Total revenue – GAAP $ 175,750 $ 179,516 $ 124,579

Net interest income FTE adjustment 3,260 3,169 2,426

Significant items 4,040 1,725 935

Total revenue – Non-GAAP $ 183,050 $ 184,410 $ 127,940

Operating expenses – GAAP $ 119,539 $ 98,237 $ 106,144

Merger and restructuring expenses (21,203) (465) (37,470)

Impairment of income tax credits (3,095) — —

Operating expenses, core - Non-GAAP 95,241 97,772 68,674

Amortization of intangibles (1,526) (1,525) (1,292)

Operating expenses, efficiency ratio -excluding merger & restructuring

expenses, impairment of income tax credits and amortization of

intangibles - Non-GAAP $ 93,715 $ 96,247 $ 67,382

Efficiency ratio – GAAP 68.0% 54.7% 85.2%

Efficiency ratio – adjusted 51.2% 52.2% 52.7%

Net Interest Margin:

Net interest income – GAAP $ 143,628 $ 137,948 $ 96,809

Adjustments for tax equivalent interest:

Loans 824 814 777

Investment securities 2,436 2,355 1,649

Total taxable equivalent adjustments 3,260 3,169 2,426

Net interest income (on a tax equivalent basis) $ 146,888 $ 141,117 $ 99,235

Average interest-earning assets $ 16,815,240 $ 16,228,996 $ 11,058,143

Net interest margin – GAAP 3.40% 3.41% 3.49%

Net interest margin (on a tax-equivalent basis) 3.48% 3.48% 3.58%

(Dollars in thousands, except per share data)

Appendix: Non-GAAP Reconciliation

33

lars in thousands, exce t per share data)

YTD 9/30

2017

2016 2015 2014 2013 2012

Net income $140,077 $108,032 $86,830 $62,121 $56,808 $51,008

Significant items, net of tax 20,929 32,373 5,484 4,555 0 0

Net income, excluding significant items $161,006 $140,405 $92,314 $66,676 $56,808 $51,008

Diluted earnings per share $1.95 $2.17 $2.39 $1.97 $2.00 $1.85

Effect of significant items, net of tax 0.29 0.64 0.15 0.14 0.00 0.00

Diluted earnings per share, excluding significant

items

$2.24 $2.81 $2.54 $2.11 $2.00 $1.85

Diluted earnings per share, excluding significant

items (Annualized)(1)

$2.99

Average assets $18,204,024 $12,037,155 $8,481,228 $6,473,144 $5,964,592$5,442,079

Return on average assets(1) 1.03% 0.90% 1.02% 0.96% 0.95% 0.94%

Effect of significant items, net of tax 0.15% 0.27% 0.07% 0.07% 0.00% 0.00%

Return on average assets, excluding significant

items(1)

1.18% 1.17% 1.09% 1.03% 0.95% 0.94%

Efficiency Ratio:

Total revenue – GAAP $ 523,373 $ 503,431 $ 354,224 $ 275,646 $ 257,056 $242,229

Net interest income FTE adjustment 9,498 9,642 7,452 5,975 5,355 5,037

Significant items 6,194 (13,172) (779) 0 0 0

Total revenue – Non-GAAP $539,065 $499,901 $360,897 $281,621 $ 262,411 $247,266

Operating expenses – GAAP $321,972 $338,418 $223,894 $179,925 $ 164,948 $151,921

Merger, acquisition and restructuring expenses (25,835) (61,134) (7,804) (6,388) 0 0

Impairment of income tax credits (3,095) 0 0 0 0 0

Amortization of intangibles (4,564) (5,524) (4,389) (2,029) (1,909) (1,569)

Operating expenses – Non-GAAP $288,478 $271,760 $211,701 $171,508 $163,039 $150,352

Efficiency ratio – GAAP 61.5% 67.2% 63.2% 65.3% 64.2% 62.7%

Efficiency ratio – adjusted 53.5% 54.4% 58.7% 60.9% 62.1% 60.8%

34

Non-GAAP Reconciliation

(Dollars in thousands, except per share data)

(1) YTD 9/30/17 has been annualized for comparison.

35

YTD 9/30

2017

2016 2015 2014 2013 2012

Average Tangible Common

Equity

Average common equity $2,611,630 $ 1,546,721 $ 919,328 $ 754,211 $ 626,555 $ 587,451

Average goodwill, CDI and

noncompete agreements, net of

tax (1,154,243) (514,634) (245,894) (157,634) (127,363) (130,173)

Average tangible common equity $1,457,387 $ 1,032,087 $ 673,434 $ 596,577 $ 499,192 $ 457,278

Return on Average Tangible

Shareholders’ Equity

Net Income $140,077 $108,032 $86,830 $62,121 $56,808 $51,008

Net income, excluding significant

items $161,006 $140,405 $92,314 $66,676 $56,808 $51,008

Average tangible shareholders’

equity $1,457,387 $1,032,087 $ 673,434 $ 596,577 $ 499,192 $ 457,278

Return on average tangible

shareholders’ equity(1) 12.8% 12.2% 12.8% 10.3% 11.4% 11.2%

Return on average tangible

shareholders’ equity, excluding

significant items(1) 14.7% 13.6% 13.7% 11.2% 11.4% 11.2%

Non-GAAP Reconciliation

(Dollars in thousands)

(1) YTD 9/30/17 has been annualized for comparison.