Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Bison Merger Sub I, LLC | fmsa-ex322_9.htm |

| EX-95.1 - EX-95.1 - Bison Merger Sub I, LLC | fmsa-ex951_6.htm |

| EX-32.1 - EX-32.1 - Bison Merger Sub I, LLC | fmsa-ex321_10.htm |

| EX-31.2 - EX-31.2 - Bison Merger Sub I, LLC | fmsa-ex312_7.htm |

| EX-31.1 - EX-31.1 - Bison Merger Sub I, LLC | fmsa-ex311_8.htm |

| 10-Q - 10-Q - Bison Merger Sub I, LLC | fmsa-10q_20170930.htm |

Exhibit 10.1

EXECUTION COPY

Sand Lease and Rights Agreement

This Sand Lease and Rights Agreement (this "Lease") is entered into effective this 18th day of July, 2017 (the “Effective Date”), by and between the ESTATE OF LARRY LEONARD FERNANDES, DECEASED (“Estate”), WILLIAM DOUGLAS FERNANDES, JR. (“Will Fernandes”), KAREN LEE FERNANDES STONE (“Karen Lee Fernandes Stone”), HALLIE ANN FERNANDES NESOM (“Hallie Ann Fernandes Nesom”), EDWARD STREET FERNANDES (“Ed Fernandes,” and together with the Estate, Karen Lee Fernandes Stone, Hallie Anne Fernandes Nesom and Will Fernandes, collectively referred to herein as the “Owner”) and FML SAND LLC, an Ohio limited liability company, its successors and assigns (“FML”).

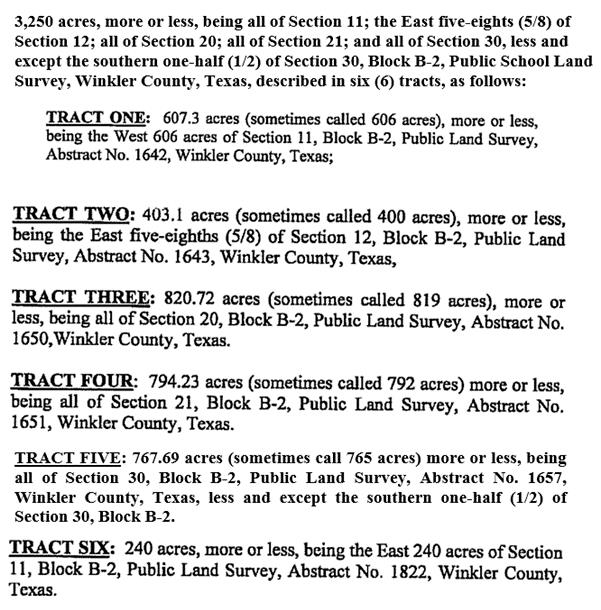

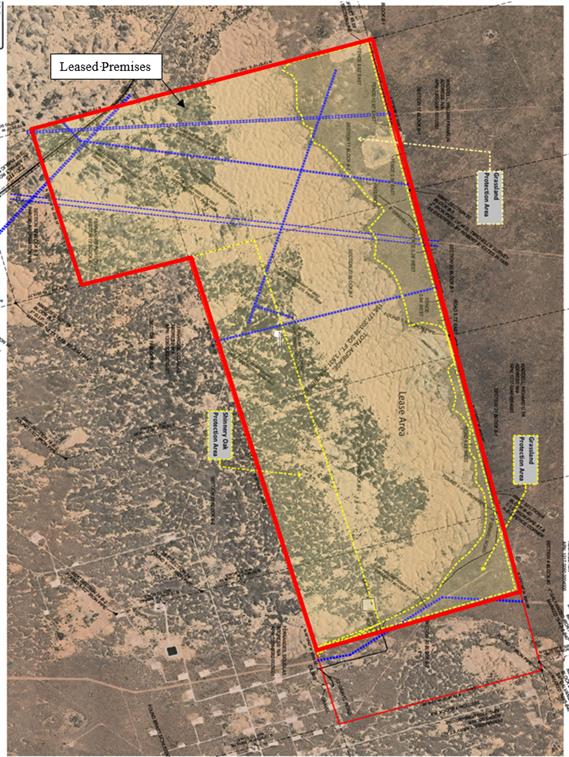

1.Grant of Lease and Exclusive Mineral Sand Rights. In consideration of the sum of Forty Million Dollars ($40,000,000.00) (the "Lease Fee"), the Product Royalties and Outside Sand Plant Royalty (all as defined below), to be paid to Owner in accordance with Section 5 herein below, and other good and valuable consideration as specified herein, Owner leases and grants to FML for the Term (as defined below) all of the surface mineral sand rights and all rights to associated natural aggregates, including the surface estate in and to Owner’s land consisting of approximately 3,250 acres of real property known as the Section 11, the East 400 acres of Section 12, Sections 20, 21 and 30, all in Block B-2, Public School Land Survey, Winkler County, Texas, less and except the southern ½ of Section 30, Block B-2, Public School Land Survey, Winkler County, Texas, as highlighted and noted on the map attached hereto as Exhibit A, more fully described on Exhibit B, attached hereto and incorporated herein by reference (the “Premises”), and the sole and exclusive right to prospect, mine and use with reasonable rights of access, ingress and egress for the mining, production, transportation, processing, drying, storage, blending, stockpiling, removing, sale and shipment of sand, sand reserves and sand products (the “Product”), from the Premises or any portion thereof, as limited by the Protection Areas as defined below and identified in Exhibit D, and to do, construct and place all things in, on, over, under and across the Premises, that in the judgment of FML, are reasonably necessary or appropriate for the same, including without limitation, temporary tanks, pipes, silos, telephone and electric lines, roads, buildings, crushers, equipment, machinery, drilling rigs, wash plants, warehouses and other equipment, dumps, stock and waste piles, processing plant or facility, wells, berms, dikes, mines, cells and ponds (the “Business Operations”). FML shall also have the right to conduct exploratory operations to confirm the existence of the Product and associated natural aggregates, and to do and perform all acts reasonably necessary in connection therewith. This grant and lease includes so much of the land, its surface and subsurface and ingress and egress rights to and from public roadways and highways and the surface and subsurface water rights, as hereinafter defined, as is necessary for FML’s Business Operations and uses as set forth in this Lease. As used herein, “surface and subsurface water rights” shall mean deep water wells drilled on the Premises by FML, with a depth of greater than 500 feet, and any reclaimed or recycled water from those deep wells which is located on the surface of the Premises. Without limiting the generality of this section, FML shall have the non-exclusive right during the Term to use soils, rocks and aggregates, or any part of such soils, rocks and aggregates found below the surface of the Premises, as are reasonably necessary for the purposes of constructing or installing, berms, dikes, cells, tailings ponds and retention ponds and for reclamation.

(a)In the event of a conflict with Owner’s use of the Premises, FML’s rights as granted and enumerated above shall prevail and take priority over the surface rights of Owner to the Premises as limited by the Protection Areas. Owner retains the right to control activities on the Protection Areas, insofar and only insofar as the activities of Owner, its licensees, lessees, or agents (“Owner’s Representatives”), do not unreasonably restrict FML’s rights granted hereunder. It is further understood that Owner retains the right

to continue its ranching operations on the then non-active mining areas of the Premises, insofar and only insofar as the activities of Owner, its licensees, lessees, or agents (“Owner’s Representatives”), do not unreasonably restrict FML’s rights granted hereunder and Owner and Owner’s Representatives comply with all MSHA rules and regulations, where applicable. Notwithstanding the forgoing, FML acknowledges and agrees that its rights granted herein are subject to those oil and gas leases and associated agreements set forth on Exhibit C attached hereto and incorporated herein by reference (collectively, the “OG Leases”). Owner and OWL SWD Development, LLC (“Owl”) have entered into that certain Lease for Saltwater Disposal on April, 13, 2017 as memorialized by that certain Memorandum of Lease for Saltwater Disposal, dated as of April 13, 2017 and recorded in the Winkler County, Texas records (the “Memorandum”), which lease is included in the OG Leases. FML further acknowledges and agrees that the rights granted herein are subject to existing pipeline rights of way of record in Winkler County, Texas, which affect the Premises. Owner and Owl shall amend the Memorandum in order to clarify that the right of first refusal set forth in the Memorandum only pertains to the right of first refusal involving salt water disposal operations with third parties on the property described in such Memorandum (the “Amended Memorandum”). Owner shall record the Amended Memorandum and provide FML with a copy of the recorded Amended Memorandum within forty (40) days of the Effective Date. Owner agrees that it shall not enter into any additional OG Leases, easements, agreements, leases or other arrangements associated with the Premises that will unreasonably impair or interfere with the operation or use of the Processing Facility (as defined below) or the Premises (excluding the Protection Areas). Additionally, in the event Owner receives any surface damage payments as provided for in any OG Lease, easements, agreements, leases or other arrangements associated with the Premises and FML’s Business Operations on the Premises are unreasonably impaired by such surface damage, Owner shall promptly remit such payments to FML to the extent of the impairment of FML’s Business Operations, but in no event shall Owner’s obligation to FML exceed the amount of the surface damage payment received by Owner. Owner shall advise and consult with FML in connection with the execution and location of any easements, pipelines, agreements or other arrangements associated with the Premises (excluding the Protection Areas) in order to not unreasonably impair or interfere with the operation or use of the Processing Facility or the Premises (excluding the Protection Areas).

(b)At FML’s expense, FML may develop and install roadways and access drives (“FML Roads”), for FML’s use on the Premises, excluding the Protection Areas, for accessing FML’s operations and the Product thereon, and may use, on a nonexclusive basis, all roads or rights-of-way now existing on the Premises in connection with the rights granted under this Lease, including access to Texas State Highway 115. Notwithstanding anything contained herein to the contrary and unless otherwise agreed to in writing by Owner, FML shall have no right to access, use or otherwise conduct mining operations on the highlighted areas noted as Grasslands Protection Area and Shinnery Oak Protection Area on Exhibit D attached hereto and incorporated by reference (collectively, the “Protection Areas”), unless otherwise agreed to in writing by Owner and FML. FML intends to start its mining activities on the West 600 acres of Section 11 and the East 400 acres of Section 12, Block B-2, Public School Land Survey, in connection with its Business Operations at the Premises.

2.Title.Owner represents and specially warrants to FML that: (i) Owner is the only person(s) or entity that has fee simple title to the Premises; (ii) Owner has good and marketable title to all the surface mineral sand rights conveyed hereunder on, over, across, upon, within and beneath the Premises; (iii) the Premises is free from all unrecorded liens, claims and encumbrances of any kind whatsoever; (iv) Owner has not entered into any other leases, options, licenses or other agreements that limit or conflict with the rights granted to FML hereunder, other than the OG Leases; (v) Owner has full right, power and authority to enter into this Lease; and (vi) the Premises is not designated as Mineral Classified Lands. Notwithstanding the foregoing, Owner’s representations and warranties of title are limited to claims made by parties claiming an interest in the Premises by, through or under Owner, but not otherwise. Owner shall execute any reasonable affidavits, agreements or other documents necessary for the issuance of leasehold title insurance policies to FML or its lender.

3.Term. Subject to the termination rights set forth herein, the term of this Lease will begin on the Effective Date (the “Commencement Date”) and continue for forty years (40) years ending at 11:59 p.m. on the day preceding the fortieth (40th) anniversary of the Commencement Date (the “Initial Term”). Each twelve (12) month period commencing on the first day of the Term or any anniversary of said day, shall be referred to hereinafter as a “Lease Year.” In the event FML sells less than 240,000 tons of Product from the Premises within a period of twenty-four (24) consecutive months after the Initial Sales Date and FML produces less than 20,000 tons of Product from the Premises within the last sixty (60) days of the twenty-four (24) consecutive month period after the Initial Sales Date (collectively, the “Termination Events”), then Owner shall provide FML with written notice and thirty (30) days to cure such Termination Events, and thereafter, failing to effectuate a cure and except as otherwise provided herein, Owner shall have the option, as their sole remedy therefore, to terminate this Lease, wherein this Lease shall terminate and be deemed null and void and the parties shall have no further obligations to each other hereunder. Notwithstanding anything contained herein to the contrary, if the Termination Events are due to Force Majeure (as defined below) or FML’s Business Operations are disturbed, impaired or impeded by the exercise of surface or mineral rights of parties associated with the Premises, FML rights shall continue under this Lease until such cure is obtained and Owner shall have no right to terminate this Lease. In the event that FML’s Business Operations are disturbed, impaired or impeded by the exercise of surface or mineral rights of parties associated with the Premises, then FML shall have the option to terminate this Lease, wherein this Lease shall terminate and be deemed null and void and the parties shall have no further obligations to each other hereunder, other than the obligation of FML to reclaim the Premises as provided in Section 10, hereof.

4.Surface Rights. During the Term, and in addition to all other rights granted herein, FML shall have the right to dig ditches, drill water wells, use surface water as defined herein, remove and deposit overburden, fines and tailings, construct settling areas, erect and maintain power lines, build processing, transloading plants and maintenance facilities, silos, and place equipment on any portion on, over, across the surface and/or below the surface of the Premises and construct, locate, install, maintain, repair, replace any of the forgoing, or any other activities or items on the Premises as are reasonably necessary for the convenience of the operation to be carried on by FML. FML shall construct an approximate 3,000,000 ton, per year, processing facility (the “Processing Facility”) on approximately forty (40) acres of land located on the East 400 acres of Section 12, Block B-2. FML shall be the owner of the Processing Facility and all machinery, equipment, tanks, buildings, crushers, pipelines, poles, lines and fixtures, and all other property constructed on or placed by FML or its employees, agents, representatives or invitees on, over, across or under the Premises during the Term (“FML’s Property”). FML shall not process Product in the Processing Facility that is mined off of the Premises from any location in Winkler County, Texas. FML’s Property shall remain the property of FML during the Term and FML shall have the right and the obligation upon termination of the Term, at any time and from time to time during the Term and for a reasonable period, not to exceed twelve (12) months, following the expiration or earlier termination of the Term to remove any and all of FML’s Property. FML shall have the right to operate and depreciate (for income tax purposes) FML’s Property. FML reserves the right to relocate any portion or all of FML’s Property and the Processing Facility at any time throughout the Term to any other area of the Premises that FML deems necessary or appropriate upon the prior consent of Owner, which consent shall not be unreasonably withheld, conditioned or delayed. The addition of any new processing facilities on the Premises by FML in order to increase sand processing or resin coating of sand on the Premises shall be mutually agreed upon by the parties and shall be memorialized by an amendment to the Lease. FML shall drill certain deep water closed-loop system wells (the “Water Wells”) at a depth of 500 ft.-800 ft. on the Premises. Upon the consent of FML, which consent shall not unreasonably be withheld or delayed, Owner shall have the right to utilize water from the Water Wells for livestock purposes, and connection to the Water Wells shall be at Owner’s expense. Upon the cessation of Business Operations on the Premises, the Water Wells shall be retained by Owner and FML shall have no further right, title or interest in such Water Wells. FML shall

take reasonable precautions and perform groundwater monitoring at the Premises to ensure that the shallow water table (ranging from 40ft to 100ft in depth), which is utilized by Owner for its agricultural operations on the Premises, is not disturbed or diminished by FML’s Business Operations on the Premises. FML shall maintain accurate records of its monitoring results of the shallow water table and agrees to allow Owner to inspect and copy the records upon reasonable notice.

5.Lease Fee Payment and Royalty.

(a) FML will pay Owner an initial lease fee in the amount of Twenty Million Dollars ($20,000,000.00) (the “Initial Fee”) upon the mutual execution of this Lease.

(b)FML will pay Owner a secondary lease fee in the amount of Ten Million Dollars ($10,000,000.00) (the “Secondary Fee”) upon the issuance to FML of the last of all required federal, state and local permits and any crossing permits in order for FML to conduct its Business Operations at the Premises (the “Permits”). FML shall make good faith efforts to expedite processing of the Permits after the Commencement Date and Owner shall join in the filing of any and all applications, submissions or other actions necessary for obtaining the Permits and shall reasonably cooperate with FML in obtaining same. Notwithstanding anything contained herein to the contrary, in the event that the Permits are not obtained by FML by the one (1) year anniversary of the Commencement Date, FML shall have the right upon written notice to Owner within one hundred and eighty (180) days from such period, to terminate this Lease, wherein this Lease shall terminate and be deemed null and void and the parties shall have no further obligations to each other, including, but not limited to, no payment by FML of the Secondary Fee, Third Fee or any Product Royalties. Owner shall retain the Initial Fee upon FML’s termination of the Lease as provided herein.

(c)Except as otherwise provided in 5(d) below, FML will pay Owner a third lease fee in the amount of Ten Million Dollars ($10,000,000.00) (the “Third Fee,” and together with the Initial Fee and Secondary Fee, collectively referred to herein as the “Lease Fee”) upon the earlier to occur of (the “Third Fee Payment Date”): (i) two (2) years from the Commencement Date or (ii) the date that FML makes its first commercial sale to a non-affiliated third party of sand mined and processed at the Premises (the “Initial Sales Date”).

(d) In the event that FML has not obtained reasonably satisfactory surface rights agreements executed by Boyd & McWilliams Energy Group, Inc. and its associated investors in connection with their interest in the OG Leases and any oil and gas leases, trade arrangements, conveyance, transfer or other agreements with Conoco Phillips (collectively, the “Surface Rights Agreements”) at the time of the payment of the Third Fee, the Third Fee shall be disbursed as follows: (i) FML shall pay Owner Six Million Dollars ($6,000,000.00); and (ii) Four Million Dollars ($4,000,000.00) (the “Escrow Funds”) shall be deposited into an escrow account with Stewart Title Company (the “Escrow Agent”). If FML has not received the Surface Rights Agreements within one (1) year after the Third Fee Payment Date (the “Escrow Payment Date”), then the Escrow Agent shall disburse Five Hundred Thousand Dollars ($500,000.00) to Owner and shall continue thereafter to disburse such amount to Owner on the annual anniversary of the Escrow Payment Date for a period of eight (8) years from the Escrow Payment Date. In the event FML receives the Surface Rights Agreements, the Escrow Agent shall promptly disburse any remaining Escrow Funds to Owner. In the event FML’s Processing Facility is disturbed, impaired or impeded by the exercise of surface or mineral rights of parties associated with the Premises, the Escrow Agent shall promptly disburse any remaining Escrow Funds to FML. For the purposes of this Section 5 (d), the words “disturbed, impaired or impeded” mean activities which amount to substantial interference with FML’s Business Operations at the Processing Facility and not minor temporary inconveniences to FML.

(e)FML will pay Owner a product royalty of One Dollar and Forty Cents ($1.40) per ton sold (the “First Year Product Royalty”) for all Product mined, processed and shipped from the Premises and delivered to or picked up by FML’s customers from the Initial Sales Date through the first anniversary of the Initial Sales Date (the “First Year Royalty Term”).

(f) FML will pay Owner a product royalty of One Dollar and Eighty Cents ($1.80) per ton sold (the “Second Year Product Royalty”) for all Product mined, processed and shipped from the Premises and delivered to or picked up by FML’s customers from the expiration of the First Year Royalty Term through the second anniversary of the Initial Sales Date (the “Second Year Royalty Term”).

(g)FML will pay Owner a product royalty of Two Dollars and Twenty Cents ($2.20) per ton sold (the “Third Year Product Royalty”) for all Product mined, processed and shipped from the Premises and delivered to or picked up by FML’s customers from the expiration of the Second Year Royalty Term through the third anniversary of the Initial Sales Date (the “Third Year Royalty Term”).

(h)FML will pay Owner a product royalty of Two Dollars and Sixty Cents ($2.60) per ton sold (the “Fourth Year Product Royalty”) for all Product mined, processed and shipped from the Premises and delivered to or picked up by FML’s customers from the expiration of the Third Year Royalty Term through the fourth anniversary of the Initial Sales Date (the “Fourth Year Royalty Term”).

(i)FML will pay Owner a product royalty of Three Dollars ($3.00) per ton sold (the “Remaining Term Product Royalty”) for all Product mined, processed and shipped from the Premises and delivered to or picked up by FML’s customers from the expiration of the Fourth Year Royalty Term until the expiration of the Term. The Remaining Term Product Royalty, the First Year Product Royalty, the Second Year Product Royalty, the Third Year Product Royalty and the Fourth Year Product Royalty are collectively referred to herein as the “Product Royalties.”

(j)FML will pay Owner an outside sand plant royalty of twenty-five percent (25%) of the then applicable Product Royalties amount per ton sold of all Product shipped to the Premises from any location outside of Winkler County, Texas, processed and sold from the Premises, if any (the “Outside Sand Plant Royalty”).

(k)The Product Royalties and Outside Sand Plant Royalty shall be a net payment to Owner and free of expense. The weight of Product delivered to FML’s customers will be computed using standard methods accepted in the industry for measurements of such kind and based upon FML’s weights and measures. Upon the Initial Sales Date, the Product Royalties and Outside Sand Plant Royalty, if any, as provided herein will be paid to Owner on a quarterly basis, within forty-five (45) days from the expiration of each quarter, and each payment shall be accompanied with a summary of the calculation of the payment. Owner and FML agree that the payment of the Product Royalties and Outside Sand Plant Royalty to Owner shall also be the consideration for FML’s right to use surface and/or subsurface water rights, as herein defined, consumed by FML at the Premises in connection with its Business Operations during the Term. FML shall maintain an accounting software report/export containing: (i) the Product Royalties and Outside Sand Plant Royalty; (ii) the ship date; (iii) tonnage of Product mined and shipped by FML from the Premises; (iv) tonnage of Product shipped to the Premises and sold by FML from the Premises; and (v) bill of ladings numbers associated with each shipment which shall be made available at the Premises upon Owner’s written request for inspection, audit and copying by Owner or its agents, at Owner’s expense, within ninety (90) days at the end of each Lease Year. Owner may perform an audit of those books and records during such ninety (90) day period at its own cost and expense; provided that if Owner does not perform such an audit within such time period, the records and Product Royalties and Outside Sand Plant Royalty paid for that applicable Lease Year shall be deemed approved by Owner and FML shall have no obligation to make any additional payment to Owner in connection with the Product Royalties or Outside

Sand Plant Royalty for that Lease Year. Notwithstanding anything to the contrary, if an audit performed by Owner reveals that FML has underpaid any applicable Product Royalties or Outside Sand Plant Royalty, then FML shall pay the underpaid amount to Owner within thirty (30) days of notice from Owner and copies of the audit results, and if the Product Royalties or Outside Sand Plant Royalty due Owner are underpaid by more than 3%, FML shall pay the reasonable expense incurred by Owner in performing the audit. If such an audit reveals that FML has overpaid any Product Royalty or Outside Sand Plant Royalty for that Lease Year, then FML may withhold the overpaid amount from future Product Royalties or Outside Sand Plant Royalty payments.

(l)The Lease Fee, Product Royalties and Outside Sand Plant Royalty shall be paid to the Owner, their heirs, successors and assigns as follows:

(i)Will Fernandes - 37.5%

(ii)Edward Fernandes - 37.5%

(iii)Estate of Larry Leonard Fernandes, deceased - 18.75%

(iv)Karen Lee Fernandes Stone – 3.125%

(v)Hallie Ann Fernandes Nesom - 3.125%

6.Taxes, Assessments and Fees.

(a)Except as herein provided, Owner shall pay the amounts due for all real estate taxes, ad valorem taxes, special assessments or any other tax or governmental charge, general and special, which is levied upon or solely attributed to the Premises (all such taxes hereinafter referred to as “Taxes”). FML shall pay all real estate taxes, ad valorem taxes, special assessments or any other tax or governmental charge, general or special, which is levied upon or solely attributable to improvements placed by FML on the Premises and any personal property owned by FML. FML and Owner shall equally pay for any increase in taxes or roll back taxes on the Premises which is due to a change in use classification, from “agricultural purposes” of any portion of the Premises, which reclassification is caused by FML’s use and Business Operations on the Premises. Except as provided herein, FML shall not be required to pay: (i) municipal, state or federal income taxes or gross receipts taxes assessed against Owner; (ii) municipal, state or federal capital levy, estate, succession, inheritance or transfer taxes of Owner; (iii) franchise taxes imposed upon any owner of the fee of the Premises; or (iv) the Taxes. Owner shall promptly provide FML with copies of all Tax bills.

(b)In the event that Owner fails to pay Taxes on a timely basis and such Taxes become delinquent then FML may, at its option, but without obligation, pay any portion or the entire amount of such delinquency to the taxing authority and deduct, on a dollar for dollar basis, any payment made by FML to the taxing authority from the payment of Product Royalties or Outside Sand Plant Royalty to Owner.

(c)In the event that FML fails to pay Taxes on a timely basis and such Taxes become delinquent, then Owner may, at its option, but without obligation, pay any portion or the entire amount of such delinquency to the taxing authority and, after ninety (90) days written notice (the “Cure Period”) and opportunity to cure is provided to FML, declare FML in default and terminate this Lease. Notwithstanding the forgoing, Owner shall provide FML’s lender (to the extent that Owner has the contact information for FML’s lender), with written notice of said default after the expiration of the Cure Period and afford such lender an additional thirty (30) days in which to cure such default if the lender elects to effectuate such cure.

7.Utilities. During the Term, FML shall pay for all governmental and utility company charges for gas and electricity used and consumed by FML on the Premises and shall indemnify and save Owner harmless from any and all charges connected therewith. Owner agrees from time to time upon request from

FML, to join with FML in the execution and delivery of utility easements and other necessary easements over the Premises.

8.Confidentiality. Unless legally required to do so or otherwise necessary for public reporting requirements, and except for the Memorandum of Lease (as defined below), both Owner and FML for themselves and for their agents, employees, representatives, successors and assigns, acknowledge and agree that the terms of this Lease are confidential, and any of the terms hereof shall not be disclosed to any persons (other than the parties attorneys, lenders, employee or in connection with any public disclosure required by applicable law) without the express written consent of FML. Owner acknowledges and agrees that FML shall publicly file a news release disclosing this Lease and also a copy of this Lease in connection with its public disclosure requirements. The parties hereto acknowledge and agree that monetary damages would be impossible to measure as a form of liquidated damages in the event of the breach of this Lease the parties agree that this restriction may be enforced by specific performance or other equitable relief in addition to all other remedies available at law. This provision shall survive any termination or breach of this Lease.

9.Inventory. In the event FML has extracted Product and stockpiled or stored it in silos or other storage containers on the Premises (the “Sand Inventory”), upon the expiration or earlier termination of the Term, FML will have the right at any time during the twelve (12) month period after such expiration or termination of the Term to remove the Sand Inventory and deliver or ship the Sand Inventory to customers or to otherwise dispose of the Excess Product. Notwithstanding anything contained herein to the contrary, the Product Royalties will be payable with respect to any Sand Inventory that is sold and delivered or shipped to customers following the end of the Term.

10.Mining Operations/Reclamation. During the Term, FML shall maintain industry standard protective barriers around open pits located at the Premises resulting from FML’s use of the Premises. FML will maintain all existing fences currently located on the Premises. FML shall not remove any existing large cottonwood trees on the mining areas of the Premises, as such trees are located in shallow water table areas; provided, however FML shall have the right to remove existing large cotton wood trees in connection with the construction of the Processing Facility. FML will perform all reclamation of the Premises as may be required by applicable local, state and federal laws and regulations, and as is reasonably required by Owner, including re-leveling and re-seeding affected areas. FML agrees to consult with Owner and keep Owner informed concerning reclamation activities, including consulting with Owner concerning grass varieties best suited for the area. FML will endeavor to complete reclamation on those areas of the Premises in an ongoing basis as such areas are mined and will complete total reclamation of the Premises within two (2) years following the cessation of Business Operations on the Premises. FML shall provide Owner with an ongoing reclamation plan prior to and during the period of mining on the Premises, and shall consult with Owner concerning the reclamation plan.

11.Indemnification.

(a)Owner does hereby agree to indemnify, defend and save FML harmless from and against all expenses, liabilities, obligations, damages, penalties, claims, accidents, costs, and/or liens, including reasonable attorney’s fees, paid, suffered or incurred for any injury or death to persons or damage to property whatsoever occurring on the Premises which is caused by Owner’s use or occupancy of the Premises or the condition of the Premises as of the Commencement Date or any acts or omissions of Owner or of any other person entering the Premises as an employee, agent, representative, lessee, operator, licensee or invitee of Owner, or for a material breach of a representation set forth herein, or any rights or claims of any lessees, operators, except for injuries or damage caused by the grossly negligent acts or intentional omissions of FML or its employees, agents, representatives, lessees, operators or invitees as a result of FML’s use of the Premises or resulting out of FML’s gross negligence or willful misconduct. Owner hereby

releases and waives all claims, obligations or liabilities of FML arising out of the loss of cattle or other livestock on the portions of the Premises other than the Prohibited Mining Area.

(b)FML does hereby agree to indemnify, defend and save Owner harmless from and against all expenses, liabilities, obligations, damages, penalties, claims, accidents, costs, and/or liens, including reasonable attorney’s fees, paid, suffered or incurred for any injury or death to persons or damage to property whatsoever occurring on the Premises which is caused by FML’s use or occupancy of the Premises or any acts or omissions of FML or of any other person entering the Premises as an employee, agent, representative, lessee, operator, licensee or invitee of FML, except for injuries or damage caused by the grossly negligent acts or intentional omissions of Owner or its employees, agents, representatives, lessees, operators, or invitees as a result of Owner’s use of the Premises or resulting out of Owner’s gross negligence or willful misconduct.

(c)The parties shall comply with all existing and future environmental regulations in conducting its activities on the Premises and each shall be responsible for any environmental clean-up made necessary by its activities and, further, shall defend, indemnify, and hold each other harmless from any losses, damages, claims, or suits arising from the other party’s failure to comply with all such environmental regulations. Owner warrants and represents to FML that: (i) neither Owner nor, to Owner’s knowledge, has any other person ever caused or permitted any hazardous substances or wastes to be disposed of on, under or at the Premises; and (ii) Owner has not received any claim, request for information, demand or notification that it is or may be a potentially responsible party in any action, proceeding or site clean-up commenced pursuant to any applicable environmental laws affecting the Premises.

12.Insurance.

(a)During any period in which FML is conducting operations at the Premises, FML shall obtain and maintain in full force and effect, at FML’s sole cost and expense, the following insurance coverage:

|

|

(i)commercial general liability covering FML’s use of the Premises, with bodily injury and property damage liability coverage with combined single limits of Two Million Dollars ($2,000,000). FML’s commercial general liability insurance policy shall name Owner, as an additional insured. |

|

|

(ii)property insurance commonly referred to as extended form casualty insurance covering FML’s Property in such amounts as FML, from time to time, deems commercially reasonable. |

(iii)workers’ compensation insurance as required by law.

Upon written request, FML will deliver to Owner certificates of insurance evidencing such coverage.

(b)Each of the parties hereto and all persons claiming through or under them agrees to and does hereby waive all rights of recovery and causes of action against the other and all persons claiming through or under such other party by way of subrogation or otherwise for any damage to the Premises or the contents thereof, as the case may be, caused by any of the perils covered by such fire and extended coverage (or broader coverage, if applicable) insurance policies (as now or hereafter constituted), regardless of whether any such damage or destruction may be due to the negligence of such other party or the parties claiming through or under such other party.

13.Notices. All reports, notices, requests, payments and other communications required or permitted by this Lease to be given to a party will be in writing and will be deemed to be duly given and received if delivered personally, sent by overnight private courier service, or if mailed by certified or registered mail, return receipt requested, addressed to the party concerned at its address as set forth below or at such other address as a party may specify by notice to the other, or, if sent by PDf electronic copy with evidence of delivery upon the date sent:

Communications concerning Owner shall be addressed to:

Will Fernandes

P.O. Box 56

Wink, Texas 79789

Edward Fernandes

P.O. Box 1522

Pecos, Texas 79772

The Estate of Larry Leonard Fernandes

Attention: Ms. Karen Stone, Independent Executrix

Karen Lee Fernandes Stone

P.O. Box 800

Kermit, Texas 79745

Hallie Ann Fernandes Nesom

P.O. Drawer 1131

Oakdale, LA 71463

With a copy to:

Atkins, Hollmann, Jones, Peacock, Lewis & Lyon, Inc.

3800 East 42nd Street, Suite 500

Odessa, Texas 79762

Attention: P. A. Lyon III

|

|

Communications concerning FML shall be addressed to:

|

|

c/o Fairmount Santrol Inc.

8834 Mayfield Road

Chesterland, Ohio 44026

Attention: David J. Crandall, Executive Vice President and General Counsel

|

|

With copy to:

Calfee, Halter & Griswold LLP

The Calfee Building

1405 East Sixth Street

Cleveland, Ohio 44114

Attention: Karla M. Rogers, Esq.

14.Recording. This Lease will not be recorded; however, the parties agree that a memorandum of lease describing the Premises, stating the term of this Lease and referring to this Lease, in substantially the same form as set forth on Exhibit E attached hereto and incorporated herein by reference (the “Memorandum of Lease”) will be recorded in the Winkler County, Texas official records.

15.Assignment and Subletting/Successors. FML has the right (a) to sublet any portion of the Premises with the prior written consent of Owner, which consent shall not unreasonably be withheld, conditioned or delayed by Owner; (b) to assign this Lease to any person or entity which FML controls, is controlled by or is under common control with, without the prior written consent of Owner; (c) to assign this Lease to any person or entity which acquires the stock or assets of FML or any portion thereof, without the prior written consent of Owner; or (d) to otherwise assign this Lease to any other party with the prior written consent of Owner, which consent will not be unreasonably withheld, conditioned or delayed. The terms, covenants and conditions contained in this Lease are binding upon and will inure to the benefit of Owner and FML and their respective successors and assigns. FML shall have the right to freely mortgage or provide a deed of trust of this Lease and the leasehold estate hereby created and the execution and delivery of a leasehold deed of trust shall not be deemed to constitute an assignment or transfer of this Lease.

16.Subordination; Estoppel Certificates; Attornment. Owner reserves the right to subordinate this Lease at any time to the lien of any mortgage or deed of trust now or hereinafter placed upon Owner’s interest in the Premises, or any portion of the land upon which the Premises are situated and to subordinate the same to all advances made or hereafter to be made upon the security thereof, provided that the holder of the lien executes a non-disturbance agreement with FML in a customary form reasonably approved by FML and such lien holder pursuant to which such holder agrees to recognize FML’s rights hereunder. If Owner has an existing mortgage on the Premises Owner will obtain a non-disturbance agreement from Owner’s lender at FML’s request. Within thirty (30) days after request by either party, the other party agrees to deliver from time to time a certificate certifying the terms of this Lease, the time periods through which fees have been paid, whether this Lease is in full force and effect, whether there are defenses or offsets thereto and such other statements as the first party may reasonably request. FML shall further, in the event of any foreclosure, attorn to the purchaser as a landlord under this Lease, subject to FML’s having received the non-disturbance agreement referred to above.

17.Noncompetition. Owner agrees that from the Commencement Date until the fifth (5th) anniversary of the Commencement Date (the “Noncompetion Period”), Owner shall be prohibited from engaging, directly or indirectly, in any type of Business Operation on the real property owned by Owner, as applicable, in Blocks B2 and B6, PSL Survey, Winkler County, Texas (the “Prohibited Property”). Notwithstanding the forgoing, Owner may grant ingress or egress easements or licenses to any party, including a competitor of FML, for use of roads on the Prohibited Property and such grant shall not be in violation of this Section hereof. Further, as to any mineral classified lands located in the Prohibited Property, Owner shall not be prohibited from performing its fiduciary responsibility to the State of Texas in the leasing of the minerals located on the mineral classified properties. During the Term, FML shall have a right of first refusal to lease (other than oil and gas leases) or purchase the Prohibited Property as provided herein (“ROFR”). Upon receipt of a bona-fide offer for the lease (other than oil and gas leases) or purchase of the Prohibited Property (the “Offer”), Owner shall provide written notice to FML of the Offer including all terms of the Offer (the “Offer Notice”). FML may elect to exercise the ROFR and purchase or lease the Prohibited Property on the same terms and conditions as those set forth in the Offer, and shall notify Owner of its election in writing within fifteen (15) business days of receiving the Offer Notice (the “Acceptance Notice”). If Owner receives an offer for the purchase or lease of the Prohibited Property which is not consummated, then FML’s right of first refusal shall be unaffected and remain applicable to subsequent offers.

18.FORCE MAJEURE. If either party is delayed or hindered in, or prevented from the performance required under this Lease by reason of earthquakes; landslides; strikes; lockouts; labor troubles; failure of power; riots; insurrection; war; terrorism; acts of God; federal, state or local regulations, laws, rules or requirements; customer directives; the listing of, or efforts to list, the Dunes Sagebrush Lizard as an endangered or threatened species; or other reason of the like nature not the fault of the party delayed in performance of its obligation (“Force Majeure”), such party is excused from such performance for the period of delay. The period for the performance of any such act will then be extended for the period of such delay. The party claiming Force Majeure shall take commercially reasonable steps to remove the Force Majeure event, and shall promptly notify the other party within a period of seven (7) days, excluding weekends and holidays, when it learns of the existence of a Force Majeure condition and will similarly notify the other party within a period of seven (7) days, excluding weekends and holidays, when a Force Majeure is terminated.

19.Authority. Each party to this Lease represents and warrants to the other that such party has full power, capacity and authority to enter into this Lease and that such party’s execution, delivery, and performance of this Lease has been fully authorized and approved, and that no further approvals or consents are required to bind such party.

20.Compliance with Laws. FML will comply with all applicable permits, laws, regulations, ordinances and rules regulating FML’s operations under this Lease.

21.Counterparts. This Lease may be executed in one or more counterparts each of which when so executed will be deemed to be an original and such counterparts together will constitute but one and the same instrument.

22.Severability. If any term or other provision of this Lease is held to be invalid, illegal or incapable of being enforced under any law or public policy, all other terms and provisions of this Lease will nevertheless remain in full force and effect for so long as the economic or legal substance of the transactions contemplated by this Lease are not affected in any manner materially adverse to either party. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the parties will negotiate in good faith to modify this Lease so as to effect the original intent of the parties as closely as possible in an acceptable manner in order that the transactions contemplated by this Lease are consummated as originally contemplated to the greatest extent possible.

23.Drafting. No provision of this Lease will be interpreted for or against any party on the basis that such party was the draftsman of such provision, both parties being deemed to have participated equally in the drafting this Lease, and no presumption or burden of proof will arise favoring or disfavoring any party by virtue of the authorship of this Lease.

24.Entire Agreement. This Lease constitutes the entire agreement and understanding of the parties with respect to the subject matter and supersedes all prior negotiations and representations. This Lease may not be amended or otherwise modified except in writing signed by the parties.

25.Further Assurances. In addition to the actions specifically mentioned in this Lease, upon the request of the other party, each of the parties will do whatever is reasonably necessary to effect the transactions contemplated in this Lease including, without limitation, executing any additional documents reasonably necessary to effect the of this Lease.

26.Governing Law. The validity, interpretation, construction and enforcement of this Lease will be governed by the laws of the State of Texas without giving effect to any principles of law governing choice of law. Venue for any legal action concerning this Lease shall be in Winkler County, Texas.

27.Exhibits. All exhibits referred to in this Lease are incorporated into this Lease in their entirety.

28.Brokers. The parties acknowledge that there are no brokers involved in this transaction. Each of Owner and FML agrees to indemnify the other party from and against all loss, cost, damage or expense arising out of any act of such party which gives rise to any claim of any broker or agent in connection with this transaction.

29.Quiet Enjoyment. Owner hereby covenants and agrees that if FML performs all of the covenants and agreements herein stipulated to be performed on FML’s part, FML will at all times during the continuance hereof have peaceable and quiet enjoyment and possession of the Premises without any hindrance from Owner or any person or persons lawfully claiming the Premises, save and except in the event of the taking of the Premises by public or quasi-public authority as provided for hereunder.

30.Condemnation. In the event the Premises or any part thereof are taken for public or quasi-public use or condemned under eminent domain, then if and when there is an actual taking of physical possession of the Premises or of any part thereof which renders the remainder unfit for use by FML as hereinafter defined, FML will have the right to terminate this Lease without any further liability (subject to the right to pursue takings award as provided below) including any liability to Owner for future Product Royalties or Lease Fee hereunder. The Premises will be deemed to be “unfit” for use by FML if the portion of the Premises remaining after such taking is less than sufficient to accommodate FML’s activities carried on in the Premises just prior to such taking. If FML elects to terminate this Lease as provided above, it will give written notice to Owner within thirty (30) days after the entry of a final court order authorizing the taking or appropriation or the date of settlement, as the case may be, and FML shall pursue its award from the condemning authority. In the event of a partial taking in excess of 5% of the Premises, a proportionate allowance will be made in the Lease Fee, if applicable, based on the portion of the Premises remaining as compared to the original Premises. FML shall have a right to pursue its separate takings remedies against the condemning authority without having any claim to Owner’s award.

Remaining Balance of Page Intentionally Left Blank

In Witness Whereof, this Lease has been executed as of the Effective Date.

OWNER:

By: /s/ William Douglas Fernandes, Jr.

William Douglas Fernandes, Jr.

By: /s/ Edward Street Fernandes

Edward Street Fernandes

By: /s/ Karen Lee Fernandes Stone

Karen Lee Fernandes Stone

By: /s/ Hallie Ann Fernandes Nesom

Hallie Ann Fernandes Nesom

ESTATE OF LARRY LEONARD FERNANDES, DECEASED

By: /s/ Karen Lee Fernandes Stone

Name: Karen Lee Fernandes Stone

Its: Independent Executrix

FML:

FML SAND LLC

By: /s/ David J. Crandall

Name: David J. Crandall

Its: Executive Vice President, General Counsel and Secretary

) SS:

Ector COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Karen Lee Fernandes Stone, Independent Executrix of the Estate of Larry Leonard Fernandes, Deceased, who acknowledged that she did sign the foregoing instrument and that the same is her free act and deed and as such independent executrix of the Estate of Larry Leonard Fernandes, Deceased.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at Odessa, Texas, this 17th day of July 2017.

/s/ Elizabeth A. Corrales

Notary Public

My Commission Expires: 06-24-2018

STATE OF TEXAS)

) SS:

Ector COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named William Douglas Fernandes, Jr., an individual, who acknowledged that he did sign the foregoing instrument and that the same is his free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at Odessa, Texas, this 17th day of July 2017.

/s/ Elizabeth A. Corrales

Notary Public

My Commission Expires: 06-24-2018

STATE OF TEXAS)

) SS:

Ector COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Karen Lee Fernandes Stone, an individual, who acknowledged that she did sign the foregoing instrument and that the same is her free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at Odessa, Texas, this 17th day of July 2017.

/s/ Elizabeth A. Corrales

Notary Public

My Commission Expires: 06-24-2018

STATE OF TEXAS)

) SS:

Ector COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Hallie Ann Fernandes Nesom, an individual, who acknowledged that she did sign the foregoing instrument and that the same is her free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at Odessa, Texas, this 17th day of July 2017.

/s/ Elizabeth A. Corrales

Notary Public

My Commission Expires: 06-24-2018

STATE OF TEXAS)

) SS:

Ector COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Edward Street Fernandes, an individual, who acknowledged that he did sign the foregoing instrument and that the same is his free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at Odessa, Texas, this 17th day of July 2017.

/s/ Elizabeth A. Corrales

Notary Public

My Commission Expires: 06-24-2018

) SS:

GEAUGA COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named, FML Sand LLC, a Ohio limited liability company, by David J. Crandall, its Executive Vice President, General Counsel and Secretary, who acknowledged that he did sign the foregoing instrument and that the same is his free act and deed as such officer and the free act and deed of such limited liability company.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at Geauga, Ohio, this 17th day of July 2017.

/s/ Jessica A. O’Reilly

Notary Public

My Commission Expires: 06-25-2022

This instrument prepared by

And when recorded returned to:

Calfee, Halter & Griswold LLP

Karla M. Rogers, Esq.

The Calfee Building

1405 East Sixth Street

Cleveland, Ohio 44114

Map of the Premises

EXHIBIT B

Description of the Premises

EXHIBIT C

Oil and Gas Leases

|

1. |

Oil and Gas Lease Agreement dated August 22, 2016, between Bank of America, N.A., Trustee of the R.T. and Mary Lee Waddell Trust f/b/o Richard C. Waddell and Boyd & McWilliams Energy Group, Inc. |

|

2. |

Oil and Gas Lease Agreement dated April 25, 2016, between Jo Ann Humphries, Trustee of the James M. Waddell, Jr. Trust and Boyd & McWilliams Energy Group, Inc. |

|

3. |

Oil and Gas Lease Agreement dated April 21, 2016, between First Financial Trust & Asset Management Company, NA., Agent for William Franklin Waddell, Lolisa Ann Waddell Laenger, James Stephen Waddell, and Mary Leanne Waddell South and Boyd & McWilliams Energy Group, Inc. |

|

4. |

Oil and Gas Lease Agreement dated April 25, 2016, between John Dennison and Boyd & McWilliams Energy Group, Inc. |

|

5. |

Oil and Gas Lease Agreement dated May 9, 2016, between Lynn Fernandes Fowler and Boyd & McWilliams Energy Group, Inc. |

|

6. |

Oil and Gas Lease Agreement dated May 10, 2016, between Larry L. Fernandes and Boyd & McWilliams Energy Group, Inc. |

|

7. |

Oil and Gas Lease Agreement dated May 27, 2016, between William Douglas Fernandes, Jr. and Boyd & McWilliams Energy Group, Inc. |

|

8. |

Oil and Gas Lease Agreement dated May 27, 2016, between Edward Street Fernandes and Boyd & McWilliams Energy Group, Inc. |

|

9. |

Oil and Gas Lease Agreement dated April 22, 2016, between Barbara Ann Brown Johnston and Boyd & McWilliams Energy Group, Inc. |

|

10. |

Oil and Gas Lease Agreement dated April 22, 2016, between Sara Genora Brown Watson and Boyd & McWilliams Energy Group, Inc. |

|

11. |

Oil and Gas Lease Agreement dated April 22, 2016, between Yates E. Brown and Boyd & McWilliams Energy Group, Inc. |

|

12. |

Oil and Gas Lease Agreement dated May 31, 2016, between Peggy Joyce Bowers Vanderford and Boyd & McWilliams Energy Group, Inc. |

|

13. |

Oil and Gas Lease Agreement dated April 25, 2016, between Mary Edith Waddell and Boyd & McWilliams Energy Group, Inc. |

|

14. |

Oil and Gas Lease Agreement dated April 25, 2016, between Highway 302, LLC and Boyd & McWilliams Energy Group, Inc. |

|

15. |

Oil and Gas Lease Agreement dated July 21, 2016, between Shelby H. Blades [sic], Jr., Elizabeth Lee Blaydes, Rod D. Blaydes, and Kenneth B. Blaydes and Boyd & McWilliams Energy Group, Inc. |

|

16. |

Oil and Gas Lease Agreement dated May 10, 2016, between Murray “Pap” Roark, Trustee of the Wilma Terry Finley Family Trust and Boyd & McWilliams Energy Group, Inc. |

|

17. |

Oil and Gas Lease Agreement dated March 28, 2016, between Robert Scogin and Orr Holdings, Ltd. |

|

18. |

Oil and Gas Lease Agreement dated April 25, 2016, between Sandhills-Waddell, Ltd. and Boyd & McWilliams Energy Group, Inc. |

|

19. |

Oil and Gas Lease Agreement dated April 25, 2016, between Mary Edith Waddell, Trustee of the Mary Lee Waddell Testamentary Trust and Boyd & McWilliams Energy Group, Inc. |

|

20. |

Oil and Gas Lease Agreement dated January 18, 2017, between Larry A. Godwin, Individually, and Boyd & McWilliams Energy Group, Inc. |

|

21. |

Oil and Gas Lease Agreement dated January 13, 2017, between Richard Ganem, Individually, and Boyd & McWilliams Energy Group, Inc. |

|

22. |

Oil and Gas Lease Agreement dated January 18, 2017, between Pangea Properties, Inc. and Boyd & McWilliams Energy Group, Inc. |

|

23. |

Oil and Gas Lease Agreement dated January 18, 2017, between Stephen P. Hanger, Individually, and Boyd & McWilliams Energy Group, Inc. |

|

24. |

Oil and Gas Lease Agreement dated December 9, 2016, between John R. Collins, Trustee of the J.R. Collins Trust UTA dated effective February 1, 1999 and Boyd & McWilliams Energy Group, Inc. |

|

25. |

Oil and Gas Lease Agreement dated January 18, 2017, between David L. Cherry, Individually, and Boyd & McWilliams Energy Group, Inc. |

|

Countryman; James P. Bewley, Successor Trustee; Ann K. Waddell Countryman, for life, with remainder to James M. Waddell, Jr., Robert Scogin and John P. Gammill, Trustee; Jennie D. Hamilton, Trustee and Ancillary Administratrix of the Estate of Mary Dilworth Hall; Ann E. Waddell Countryman, for life with remainder to Thomas C. Waddell, Beth Blaydes, Robert Scogin and John P. Gammell, Trustee; and First Republic Bank of Odessa, N.A., Trustee of the Richard C. Waddell Trust and Chevron U.S.A., Inc., as amended and as assigned to Whiting Oil and Gas Corporation. |

|

27. |

Oil and Gas Lease Agreement dated January 1, 2002, between Burlington Resources Oil & Gas Company LP and CQ Acquisition Partners I, L.P. (95.9596%) and EnerQuest Oil & Gas, Ltd. (4.0404%), as amended and as assigned to Whiting Oil and Gas Corporation. |

|

28. |

Lease for Saltwater Disposal dated April 13, 2017 between OWL SWD Development, LLC and Ed Fernandes, Will Fernandes and The Estate of Larry Leonard Fernandes, Deceased. |

Description of Protection Areas

EXHIBIT E

Memorandum of Lease

MEMORANDUM OF LEASE

This Memorandum of Lease (this “Memorandum”) is made and entered into as of July____, 2017 (the “Effective Date”), by and between the Estate of Larry Leonard Fernandes, Deceased, William Douglas Fernandes, Jr., Karen Lee Fernandes Stone, Hallie Ann Fernandes Nesom and Edward Street Fernandes (collectively, the “Owners”) and FML Sand LLC, an Ohio limited liability company (“FML”).

W I T N E S S E T H:

WHEREAS, Owners and FML have entered into a certain Sand Lease and Rights Agreement dated as of July____, 2017 (the “Lease”); and

WHEREAS, Owners and FML desire to have a memorandum of the Lease recorded in the real property records of Winkler County, Texas; and

WHEREAS, capitalized terms used but not otherwise defined herein shall have the respective meanings ascribed to such terms in the Lease.

NOW, THEREFORE, Owners and FML hereby state the following for recording:

1.The addresses for Owners and FML as set forth in the Lease are as follows:

For Owners:

Will Fernandes

P.O. Box 56

Wink, Texas 79789

Edward Fernandes

P.O. Box 1522

Pecos, Texas 79772

Estate of Larry Leonard Fernandes, Deceased

Attn: Ms. Karen Stone, Independent Executrix

and

Karen Lee Fernandes Stone

P.O. Box 800

Kermit, Texas 79745

Hallie Ann Fernandes Nesom

P.O. Drawer 1131

Oakdale, LA 71463

With Copy to:

Atkins, Hollmann, Jones, Peacock, Lewis & Lyon, Inc.

Attn: P.A. Lyon III

3800 East 42nd Street, Suite 500

Odessa, Texas 79762

For FML:

C/O Fairmount Santrol Inc.

8834 Mayfield Road

Chesterland, Ohio 44026

Attn: David J. Crandall, Executive Vice President and General Counsel

With Copy to:

Calfee, Halter and Griswold LLP

1405 East Sixth Street

Cleveland, Ohio 44114

Attn: Karla M. Rogers, Esq.

2.Pursuant to the terms of the Lease, Owners leases to FML all of the surface mineral sand rights and all rights to associated natural aggregates, including the surface estate in and to Owner’s land consisting of approximately 3,250 acres of real property located in Winkler County, TX, and known as the West 600 acres of Section 11, the East 400 acres of Section 12, Sections 20, 21 and Section 30, less and except the southern one-half (1/2) of Section 30, all in Block B-2, Public School Land Survey, Winkler County, Texas, more fully described on Exhibit A, attached hereto and incorporated herein by reference (the “Premises”).

3.The initial term of the Lease commenced on July ____, 2017 (the “Commencement Date”), and shall expire at 11:59 p.m. on the day immediately preceding the fortieth (40th) anniversary of the Commencement Date.

4.This Memorandum has been executed to evidence of record the Lease, and shall not be deemed to amend or supplement the Lease. In the event of any conflicts between the provisions of this Memorandum and the provisions of the Lease, the provisions of the Lease shall prevail. Third parties are hereby put on notice of the interest of FML in the Premises, the terms and conditions of which are more specifically set forth in the Lease.

5.In the event of termination of the Lease for any reason contained therein, or upon the expiration or earlier termination of the Lease, if applicable, this Memorandum shall be deemed terminated, null and void, of no further force and effect and removed of record.

6.This Memorandum may be executed in multiple counterparts, each of which shall be deemed an original and all of which shall constitute one agreement, and the signature of any party to any counterpart shall be deemed to be a signature to, and may be appended to, any other counterpart.

[Signature Pages to Follow]

IN WITNESS WHEREOF, this Memorandum has been executed as of the Effective Date.

|

OWNER: |

FML: |

|

ESTATE OF LARRY LEONARD FERNANDES, DECEASED

By: Name: Karen Lee Fernandes Stone Its: Independent Executrix

By: William Douglas Fernandes, Jr.

By: Karen Lee Fernandes Stone

By: Hallie Ann Fernandes Nesom

By: Edward Street Fernandes

|

FML Sand LLC, an Ohio limited liability company

By: Print Name: Title:

|

|

|

|

) SS:

COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Karen Lee Fernandes Stone, Independent Executrix of the Estate of Larry Leonard Fernandes, Deceased, who acknowledged that she did sign the foregoing instrument and that the same is her free act and deed and as such independent executrix of the Estate of Larry Leonard Fernandes, Deceased.

.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at _________, __________, this ____ day of July 2017.

Notary Public

My Commission Expires:

STATE OF )

) SS:

COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named William Douglas Fernandes, Jr., an individual, who acknowledged that he did sign the foregoing instrument and that the same is his free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at _________, __________, this ____ day of July, 2017.

Notary Public

My Commission Expires:

STATE OF )

) SS:

COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Karen Lee Fernandes Stone, an individual, who acknowledged that she did sign the foregoing instrument and that the same is her free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at _________, __________, this ____ day of July, 2017.

Notary Public

My Commission Expires:

STATE OF )

) SS:

COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Hallie Ann Fernandes Nesom, an individual, who acknowledged that she did sign the foregoing instrument and that the same is her free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at _________, __________, this ____ day of July 2017.

Notary Public

My Commission Expires:

STATE OF )

) SS:

COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named Edward Street Fernandes, an individual, who acknowledged that he did sign the foregoing instrument and that the same is his free act and deed.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at _________, __________, this ____ day of July 2017.

Notary Public

My Commission Expires:

) SS:

GEAUGA COUNTY)

Before me, a Notary Public in and for said County and State, personally appeared the above-named, FML Sand LLC, a Ohio limited liability company, by David Crandall, its Executive Vice President, General Counsel and Secretary, who acknowledged that he did sign the foregoing instrument and that the same is his free act and deed as such officer and the free act and deed of such limited liability company.

IN TESTIMONY WHEREOF, I have hereunto set my hand and official seal at Geauga, Ohio, this ____ day of July 2017.

Notary Public

My Commission Expires:

This instrument prepared by

And when recorded returned to:

Calfee, Halter & Griswold LLP

Karla M. Rogers, Esq.

The Calfee Building

1405 East Sixth Street

Cleveland, Ohio 44114-1607

EXHIBIT A

Legal Description