Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - UNITED STATES CELLULAR CORP | usmexhibit32_2.htm |

| EX-32.1 - EX-32.1 - UNITED STATES CELLULAR CORP | usmexhibit32_1.htm |

| EX-31.2 - EX-31.2 - UNITED STATES CELLULAR CORP | usmexhibit31_2.htm |

| EX-31.1 - EX-31.1 - UNITED STATES CELLULAR CORP | usmexhibit31_1.htm |

| EX-12 - EX-12 - UNITED STATES CELLULAR CORP | usmexhibit12.htm |

| EX-10.7 - EX-10.7 - UNITED STATES CELLULAR CORP | usmexhibit10_7.htm |

| EX-10.6 - EX-10.6 - UNITED STATES CELLULAR CORP | usmexhibit10_6.htm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES |

|||||||||||||||||

|

SECURITIES AND EXCHANGE COMMISSION |

|||||||||||||||||

|

Washington, D.C. 20549 |

|||||||||||||||||

|

FORM 10-Q |

|||||||||||||||||

|

(Mark One) |

|||||||||||||||||

|

[x] |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||||||||||||||

|

For the quarterly period ended September 30, 2017 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||||||||||||||

|

For the transition period from to |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission file number 001-09712 |

|||||||||||||||||

|

|

|

(Exact name of Registrant as specified in its charter) |

|||||||||||||||||

|

Delaware |

|

|

62-1147325 |

||||||||||||||

|

(State or other jurisdiction of incorporation or organization) |

|

|

(IRS Employer Identification No.) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8410 West Bryn Mawr, Chicago, Illinois 60631 |

|||||||||||||||||

|

(Address of principal executive offices) (Zip code) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (773) 399-8900 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||||||||||||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

[x] |

[ ] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

[x] |

[ ] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

|||||||||||||||||

|

Large accelerated filer |

[ ] |

|

|

|

|

|

|

|

Accelerated filer |

[x] |

|||||||

|

Non-accelerated filer |

[ ] |

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

[ ] |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

[ ] |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

[ ] |

||||||||||||||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

[ ] |

[x] |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class |

|

|

Outstanding at September 30, 2017 |

||||||||||||||

|

Common Shares, $1 par value |

|

|

52,117,967 Shares |

||||||||||||||

|

Series A Common Shares, $1 par value |

|

|

33,005,877 Shares |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

United States Cellular Corporation |

||

|

|

|

|

|

Quarterly Report on Form 10-Q |

||

|

For the Period Ended September 30, 2017 |

||

|

|

|

|

|

Index |

Page No. |

|

|

|

|

|

|

|

Management Discussion and Analysis of Financial Condition and Results of Operations |

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

Supplemental Information Relating to Non-GAAP Financial Measures |

|

|

|

||

|

|

||

|

|

||

|

|

Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

United States Cellular Corporation Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The following discussion and analysis compares United States Cellular Corporation’s (U.S. Cellular) financial results for the three and nine months ended September 30, 2017, to the three and nine months ended September 30, 2016. It should be read in conjunction with U.S. Cellular’s interim consolidated financial statements and notes included herein, and with the description of U.S. Cellular’s business, its audited consolidated financial statements and Management's Discussion and Analysis (MD&A) of Financial Condition and Results of Operations included in U.S. Cellular’s Annual Report on Form 10-K (Form 10-K) for the year ended December 31, 2016. Certain numbers included herein are rounded to millions for ease of presentation; however, calculated amounts and percentages are determined using the unrounded numbers.

This report contains statements that are not based on historical facts, including the words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement for additional information.

U.S. Cellular uses certain “non-GAAP financial measures” and each such measure is identified in the MD&A. A discussion of the reason U.S. Cellular determines these metrics to be useful and a reconciliation of these measures to their most directly comparable measures determined in accordance with accounting principles generally accepted in the United States of America (GAAP) are included in the Supplemental Information Relating to Non-GAAP Financial Measures section within the MD&A of this Form 10-Q Report.

|

|

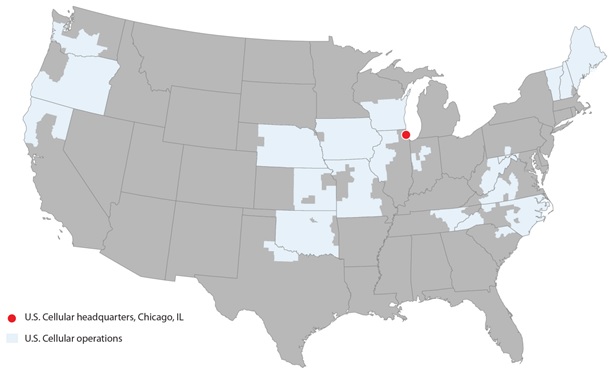

U.S. Cellular owns, operates, and invests in wireless markets throughout the United States. U.S. Cellular is an 83%-owned subsidiary of Telephone and Data Systems, Inc. (TDS). U.S. Cellular’s strategy is to attract and retain wireless customers through a value proposition comprised of a high-quality network, outstanding customer service, and competitive devices, plans, and pricing, all provided with a local focus.

|

OPERATIONS |

|

|

|

|

|

U.S. Cellular Mission and Strategy

U.S. Cellular’s mission is to provide exceptional wireless communication services which enhance consumers’ lives, increase the competitiveness of local businesses, and improve the efficiency of government operations in the mid-sized and rural markets served.

In 2017, U.S. Cellular continues to execute on its strategies to protect its current customer base, grow revenues by attracting new customers through economical offerings and identifying new revenue opportunities, and drive improvements in its overall cost structure. Strategic efforts include:

- U.S. Cellular continues to devote efforts to enhance its network capabilities. During the first half of 2017, U.S. Cellular commercially deployed VoLTE technology for the first time in one key market and will continue to build out VoLTE services over the next few years. The next commercial launch is expected to occur in several additional operating markets in early 2018. VoLTE technology allows customers to utilize a 4G LTE network for both voice and data services, and offers enhanced services such as high definition voice, video calling and simultaneous voice and data sessions. In addition, the deployment of VoLTE technology expands U.S. Cellular’s ability to offer roaming services to other carriers.

- U.S. Cellular continues to enhance its spectrum position and monetize non-strategic assets by participating in auctions and entering into agreements with third parties. During the nine months ended September 30, 2017, the FCC announced by way of public notice that U.S. Cellular was the winning bidder for 188 licenses for an aggregate purchase price of $329 million. In addition, U.S. Cellular closed on certain license exchange agreements and received $15 million of cash and recognized gains of $19 million. See Note 5 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information related to certain of these transactions.

- U.S. Cellular is focused on expanding its solutions available to business and government customers, including a growing suite of connected machine-to-machine solutions and software applications across various categories. U.S. Cellular will continue to enhance its advanced wireless services and connected solutions for consumer, business and government customers.

Net loss attributable to U.S. Cellular shareholders was $299 million and $261 million for the three and nine months ended September 30, 2017, respectively. Such net losses include a non-cash charge related to goodwill impairment of $370 million ($309 million, net of tax), which was recorded for the three months ended September 30, 2017. See Note 6 — Intangible Assets for a detailed discussion regarding the goodwill impairment. Refer to Supplemental Information to Non-GAAP Financial Measures within this MD&A for a reconciliation of the goodwill impairment, net of tax.

|

|

The following is a list of definitions of certain industry terms that are used throughout this document:

- 4G LTE – fourth generation Long-Term Evolution which is a wireless broadband technology.

- Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

- Auctions 1000, 1001, and 1002 – Auction 1000 is an FCC auction of 600 MHz spectrum licenses that started in 2016 and continued into 2017 involving: (1) a “reverse auction” in which broadcast television licensees submit bids to voluntarily relinquish spectrum usage rights in exchange for payments (referred to as Auction 1001); (2) a “repacking” of the broadcast television bands in order to free up certain broadcast spectrum for other uses; and (3) a “forward auction” of licenses for spectrum cleared through this process to be used for wireless communications (referred to as Auction 1002).

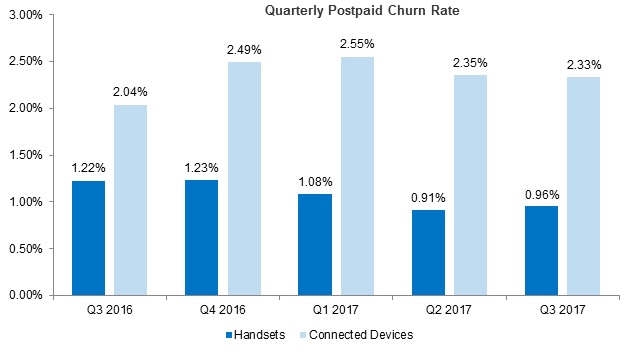

- Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

- Connections – individual lines of service associated with each device activated by a customer. This includes smartphones, feature phones, tablets, modems, hotspots, and machine-to-machine devices.

- Connected Devices – non-handset devices that connect directly to the U.S. Cellular network. Connected devices include products such as tablets, modems, and hotspots.

- EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document.

- FCC – Federal Communications Commission.

- Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

- Machine-to-Machine or M2M – technology that involves the transmission of data between networked devices, as well as the performance of actions by devices without human intervention. U.S. Cellular sells and supports M2M solutions to customers, provides connectivity for M2M solutions via the U.S. Cellular network, and has agreements with device manufacturers and software developers which offer M2M solutions.

- Net Additions – represents the total number of new connections added during the period, net of connections that were terminated during that period.

- OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document.

- Postpaid Average Billings per Account (Postpaid ABPA) – non-GAAP metric is calculated by dividing total postpaid service revenues plus equipment installment plan billings by the average number of postpaid accounts and by the number of months in the period.

- Postpaid Average Billings per User (Postpaid ABPU) – non-GAAP metric is calculated by dividing total postpaid service revenues plus equipment installment plan billings by the average number of postpaid connections and by the number of months in the period.

- Postpaid Average Revenue per Account (Postpaid ARPA) – metric is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

- Postpaid Average Revenue per User (Postpaid ARPU) – metric is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

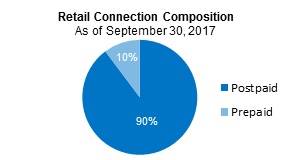

- Retail Connections – the sum of postpaid connections and prepaid connections.

- Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the FCC intended to promote universal access to telecommunications services in the United States.

- VoLTE – Voice over Long-Term Evolution is a technology specification that defines the standards and procedures for delivering voice communications and related services over 4G LTE networks.

|

|

|

|

|

|

|

|

Q3 |

Q3 |

YTD |

YTD |

|||||

|

|

|

|

|

|

2017 |

2016 |

2017 |

2016 |

|||||

|

|

Postpaid Activity and Churn |

|

|

|

|

||||||||

|

|

|

Gross Additions: |

|||||||||||

|

|

|

||||||||||||

|

|

|

|

|

Handsets |

|||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

Connected Devices |

|||||||||

|

|

|

|

|

||||||||||

|

As of September 30, |

|

|

Net Additions (Losses): |

||||||||||

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

Handsets |

||||||

|

|

|

|

|

|

|

|

|||||||

|

Retail Connections – End of Period |

|

|

|

|

Connected Devices |

||||||||

|

|

|

|

|

||||||||||

|

|

Postpaid |

|

|

|

Churn: |

1.16% |

1.34% |

1.19% |

1.27% |

||||

|

|

|

|

|

||||||||||

|

|

Prepaid |

|

|

|

|

|

Handsets |

0.96% |

1.22% |

0.98% |

1.17% |

||

|

|

|

|

|

|

|

||||||||

|

|

Total |

|

|

|

|

|

Connected Devices |

2.33% |

2.04% |

2.41% |

1.97% |

||

|

|

|

|

|

|

|

||||||||

The increase in postpaid net additions for the three months ended September 30, 2017, when compared to the same period last year, was driven mainly by higher handsets gross additions as well as lower handsets churn. These impacts were slightly offset by a decline in tablet gross additions and higher tablet churn which are included in the connected devices line above.

The decrease in postpaid net additions for the nine months ended September 30, 2017, when compared to the same period last year, was driven mainly by lower tablet gross additions and an increase in tablet churn, partially offset by an improvement in handsets net additions largely reflecting a decline in handsets churn.

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

||||||||

|

|

|

September 30, |

|

|

September 30, |

|||||||

|

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

||||

|

Average Revenue Per User (ARPU) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average Billings Per User (ABPU)1 |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

Average Revenue Per Account (ARPA) |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

Average Billings Per Account (ABPA)1 |

$ |

|

$ |

|

$ |

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Postpaid ABPU and Postpaid ABPA are non-GAAP financial measures. Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of these measures. |

|||||||||||

Postpaid ARPU and Postpaid ARPA decreased for the three and nine months ended September 30, 2017, due primarily to industry-wide price competition resulting in overall price reductions on plan offerings.

Equipment installment plans increase equipment sales revenue as customers pay for their wireless devices in installments at a total device price that is generally higher than the device price offered to customers in conjunction with alternative plans that are subject to a service contract. Equipment installment plans also have the impact of reducing service revenues as certain equipment installment plans provide for reduced monthly service charges. In order to show the trends in total service and equipment revenues received, U.S. Cellular has presented Postpaid ABPU and Postpaid ABPA, which are calculated as Postpaid ARPU and Postpaid ARPA plus average monthly equipment installment plan billings per connection and account, respectively.

Equipment installment plan billings increased for the three and nine months ended September 30, 2017, when compared to the same periods last year, mainly due to increased penetration of equipment installment plans. Postpaid ABPU and ABPA decreased for the three and nine months ended September 30, 2017, when compared to the same periods last year, as the increase in equipment installment plan billings was more than offset by the decline in Postpaid ARPU and ARPA discussed above. U.S. Cellular expects the penetration of equipment installment plans to continue to increase over time due to the fact that, effective in September 2016, all equipment sales to retail customers are made under installment plans.

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|||||||||||||

|

|

|

|

|

|

September 30, |

|

September 30, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

2017 vs. |

|

|

|

|

2017 vs. |

|||||

|

|

|

|

|

|

2017 |

|

2016 |

|

2016 |

|

2017 |

|

2016 |

|

2016 |

||||

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

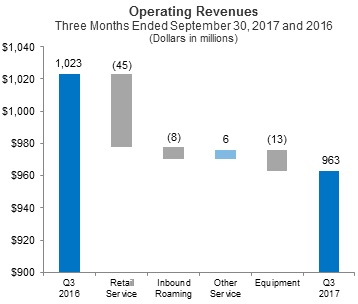

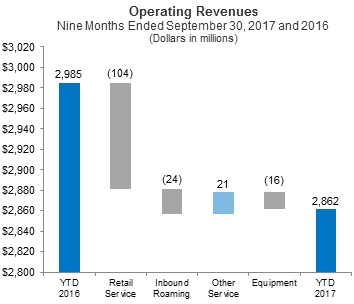

Retail service |

|

$ |

|

$ |

|

(7)% |

|

$ |

|

$ |

|

(5)% |

|||||||

|

Inbound roaming |

|

|

|

|

|

(17)% |

|

|

|

|

|

(20)% |

|||||||

|

Other1 |

|

|

|

|

|

12% |

|

|

|

|

|

13% |

|||||||

|

|

Service revenues1 |

|

|

|

|

|

(6)% |

|

|

|

|

|

(5)% |

||||||

|

Equipment sales |

|

|

|

|

|

(5)% |

|

|

|

|

|

(3)% |

|||||||

|

|

Total operating revenues1 |

|

|

|

|

|

(6)% |

|

|

|

|

|

(4)% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

System operations (excluding Depreciation, amortization and accretion reported below) |

|

|

|

|

|

(6)% |

|

|

|

|

|

(4)% |

|||||||

|

Cost of equipment sold |

|

|

|

|

|

(7)% |

|

|

|

|

|

(6)% |

|||||||

|

Selling, general and administrative |

|

|

|

|

|

(5)% |

|

|

|

|

|

(4)% |

|||||||

|

Depreciation, amortization and accretion |

|

|

|

|

|

(2)% |

|

|

|

|

|

– |

|||||||

|

Loss on impairment of goodwill |

|

|

|

|

|

N/M |

|

|

|

|

|

N/M |

|||||||

|

(Gain) loss on asset disposals, net |

|

|

|

|

|

(26)% |

|

|

|

|

|

(17)% |

|||||||

|

(Gain) loss on sale of business and other exit costs, net |

|

|

|

|

|

N/M |

|

|

|

|

|

>(100)% |

|||||||

|

(Gain) loss on license sales and exchanges, net |

|

|

|

|

|

100% |

|

|

|

|

|

(16)% |

|||||||

|

|

Total operating expenses |

|

|

|

|

|

32% |

|

|

|

|

|

8% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Operating income (loss)¹ |

|

$ |

|

$ |

|

>(100)% |

|

$ |

|

$ |

|

>(100)% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Net income (loss) |

|

$ |

|

$ |

|

>(100)% |

|

$ |

|

$ |

|

>(100)% |

|||||||

|

Adjusted OIBDA (Non-GAAP)1,2 |

|

$ |

|

$ |

|

(6)% |

|

$ |

|

$ |

|

– |

|||||||

|

Adjusted EBITDA (Non-GAAP)2 |

|

$ |

|

$ |

|

(6)% |

|

$ |

|

$ |

|

(1)% |

|||||||

|

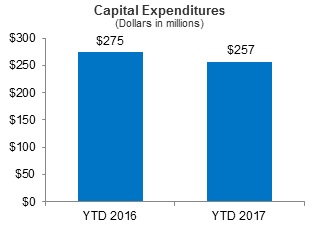

Capital expenditures |

|

$ |

|

$ |

|

8% |

|

$ |

|

$ |

|

(7)% |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/M - Percentage change not meaningful |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Equipment installment plan interest income is reflected as a component of Service revenues consistent with an accounting policy change effective January 1, 2017. All prior period numbers have been recast to conform to this accounting change. See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for additional details. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure. |

||||||||||||||||||

|

|