Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DATED 11.8.2017 - TRIUMPH GROUP INC | form8-kq2fy2018earningsrel.htm |

| EX-99.1 - EXHIBIT 99.1 - EARNINGS RELEASE DATED 11.7.2017 - TRIUMPH GROUP INC | exhibit991q2fy2018.htm |

Daniel J. Crowley, President and Chief Executive Officer

James F. McCabe Jr., Senior Vice President and Chief Financial Officer

Second Quarter FY’18 Earnings Conference Call

November 8, 2017

2Triumph Group — Second Quarter FY'18

Forward Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “believe”, “expect”, “plan”,

“intend”, “project”, “may”, “will”, “should”, “could”, or similar words suggesting future outcomes or outlooks. These forward-looking

statements include, but are not limited to, statements of expectations of or assumptions about strategic actions, objectives, expectations,

intentions, aerospace market conditions, aircraft production rates, financial and operational performance, revenue and earnings growth

and profitability and earnings results. These statements are based on the current projections, expectations and beliefs of Triumph’s

management. These forward looking statements involve known and unknown risks, uncertainties and other factors which could cause

actual results to differ materially from any expected future results, performance or achievements, including, but not limited to, competitive

and cyclical factors relating to the aerospace industry, dependence on some of Triumph’s business from key customers, requirements of

capital, uncertainties relating to the integration of acquired businesses, general economic conditions affecting Triumph’s business

segments, product liabilities in excess of insurance, technological developments, limited availability of raw materials or skilled personnel,

changes in governmental regulation and oversight and international hostilities and terrorism. Further information regarding the important

factors that could cause actual results, performance or achievements to differ from those expressed in any forward looking statements can

be found in Triumph’s reports filed with the SEC, including in the risk factors described in Triumph’s Annual Report on Form 10-K for the

fiscal year ended March 31, 2017.

3Triumph Group — Second Quarter FY'18

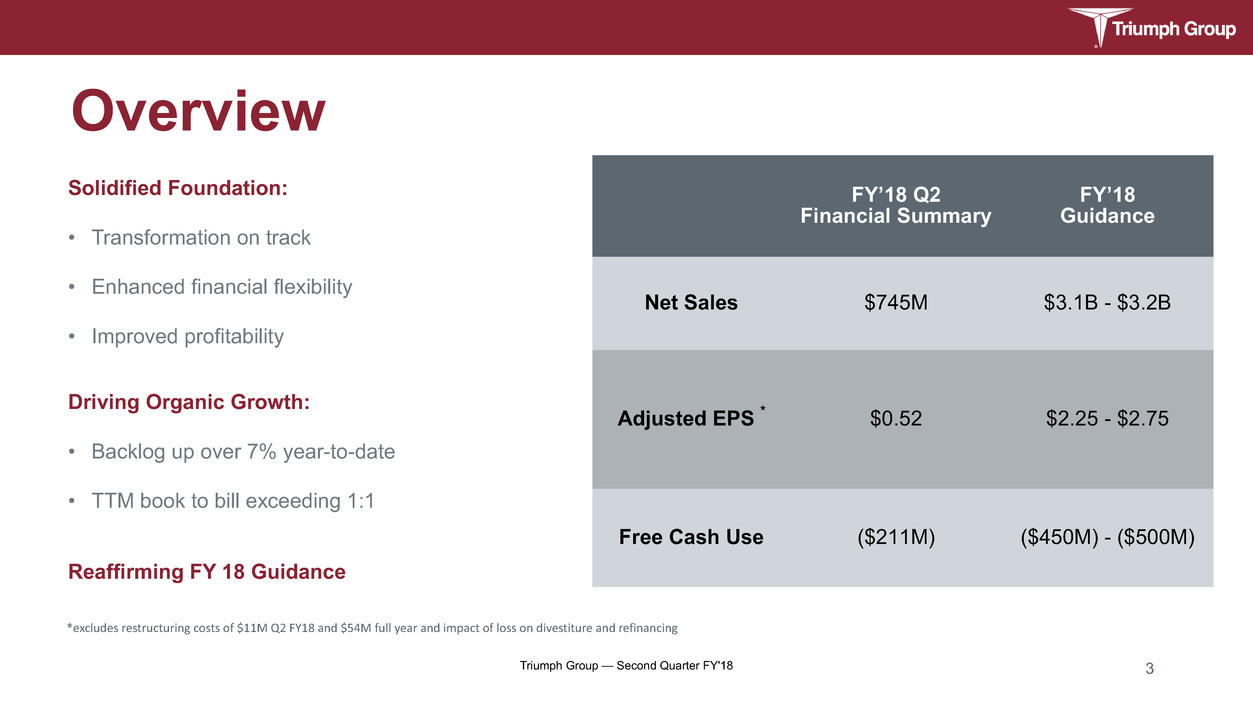

Overview

Solidified Foundation:

• Transformation on track

• Enhanced financial flexibility

• Improved profitability

Driving Organic Growth:

• Backlog up over 7% year-to-date

• TTM book to bill exceeding 1:1

Reaffirming FY 18 Guidance

FY’18 Q2

Financial Summary

FY’18

Guidance

Net Sales $745M $3.1B - $3.2B

Adjusted EPS * $0.52 $2.25 - $2.75

Free Cash Use ($211M) ($450M) - ($500M)

*excludes restructuring costs of $11M Q2 FY18 and $54M full year and impact of loss on divestiture and refinancing

4Triumph Group — Second Quarter FY'18

Transformation Progress

Enabling Increased Efficiency

• Completed 822 continuous improvement events YTD

• $43M in cost reduction YTD towards $96M goal

• Two additional facility closures announced in Q2

• 3rd divestiture successfully completed in Q2

• Reduced footprint by 1.3M sq. ft. to date

• Closed Bombardier Global 7000 negotiations in Q2

• Improved working capital managementFY 17 FY 18 FY 19

Cost Reduction Run Rate

200

150

100

50

0

$

M

illi

on

s

Supply Chain Efficiency Consolidations Headcount

Period Ending

Cost reductions on track, enhancing competiveness and financial performance

5Triumph Group — Second Quarter FY'18

Driving Organic Growth

Competitive Wins Customer BU

A320 V2500 Support AA / VA TPS

CFM56 Int. Gear Box GE TIS

Follow-on Business Customer BU

V-22 Sponson & Fuse Comp's Boeing TPC

ECS Ducting & Floor Panels Boeing TPC

C5 MLG Rotary Actuators DLA TIS

Partnership Customer BU

T-X Trainer Fuselage and Systems Boeing TAS

$12B Pipeline (50% Military) …..7% YTD backlog growth to $4.3B

Integrated Systems Aerospace Structures Precision Components

Backlog Trend

5,000

4,000

3,000

2,000

1,000

0

$

M

ill

io

ns

FY 2016 FY 2017 Q1 FY18 Q2 FY18

Military Pipeline

8,000

6,000

4,000

2,000

0

$

M

ill

io

ns

2018 JOP Q1 Q2

+7%

+41%

6Triumph Group — Second Quarter FY'18

Market Trends

Military

• Military budget outlook $632B (+OSC)

• Triumph opportunities on multiple platforms:

- T-X, B21, MQ-25, T-38/F15 SLEPS, Light Attack

• CH-53K ramp up adds nearer term growth

Commercial

• Commercial aviation remains long term growth industry

- 41,000+ new airplanes in next 20 years

- 11 year production backlog at current production rates

- Triumph benefiting from narrow-body rate increases

• Increasing long-range business jet outlook

• Higher efficiency engine development programs

• eCommerce shipments driving aircraft sales and MRO

• A/C deliveries & MRO center of mass shifting to Asia

• Vertical integration, off-shoring, IP ownership

• M&A accelerating

Healthy market, growing demand, increasing opportunities.

FY18 Budge

t

$ Billion

s

7Triumph Group — Second Quarter FY'18

Consolidated Quarterly Results

• Organic sales decrease was 12%

• Net sales decrease due to:

◦ Boeing and Gulfstream program

completions and rate reductions

◦ Timing of deliveries on certain

programs

◦ Partially offset by increased

production on 767/Tanker & Global

Hawk/Triton

• Adjusted operating income excludes:

◦ $20M loss on divestiture

◦ $11M restructuring costs

• Adjusted operating income and margin

improved sequentially

($ in millions) FY’18 Q2 FY’17 Q2 Variance %

Net Sales $745 $875 (15)%

Operating Income 19 70 (73)%

Operating Margin 3% 8%

Adjusted Operating

Income 51 89 (43)%

Adjusted Operating Margin 7% 10%

Revenue & Earnings ramp through 2H FY'18

8Triumph Group — Second Quarter FY'18

Integrated Systems

Highlights

• Selected as sole source supplier of aftermarket spare

rotary actuators on the C-5 Galaxy

• Non-core divestiture yielded $65M in proceeds

• Opened new facility in Windsor, CT to consolidate

three locations

• YTD Book to bill of 1.3:1

Year Over Year Comparison

Net Sales ($ in M)

300

250

200

150

100

50

0

$

M

illi

on

s

FY'18 Q2 FY'17 Q2

$234 $245

Operating Margin (%)

25

20

15

10

5

0

%

FY'18 Q2 FY'17 Q2

18% 19%

Financial

• Net sales change included:

◦ Growth in CH47, 737 and 787, offset by:

▪ Divestitures ($6M)

▪ Rate reductions on A380 and 777 and timing

of deliveries on other programs

• Operating margin included $1M in restructuring costs

• Excluding restructuring costs, operating margin was 19%

Triumph Integrated Systems' spare main landing gear rotary actuators will be used on the C-5 Galaxy, one of the

largest aircraft in the world.

9Triumph Group — Second Quarter FY'18

Product Support

Highlights

• Returned to organic growth following short-term

customer deferrals

• Awarded contract extension with OEM Thrust

Reverser support on key programs

• Secured two deals with operators in the U.S. and Asia

to provide MRO support for V2500-A5 Nacelles

• Hosted meeting in China attended by over 50 airline

representatives from various Asian operators

Year Over Year Comparison

Net Sales ($ in M)

100

80

60

40

20

0

$

M

illi

on

s

FY'18 Q2 FY'17 Q2

$68

$86

Operating Margin (%)

30

25

20

15

10

5

0

%

FY'18 Q2 FY'17 Q2

16% 17%

Financial

• Organic sales increased 9% due primarily to increased

demand of accessory components

◦ Sales in FY17 included $23M from divested

businesses

• Operating margin improved sequentially by 370 basis

points

Triumph Product Support is contracted to provide MRO support

for V2500-A5 Nacelles.

10Triumph Group — Second Quarter FY'18

Precision Components

Highlights

• Awarded contract extension on ducting and floor panels on

Boeing commercial programs

• Composites obtained green rating with all external customers

for quality and delivery performance

• Interiors earned green rating from Boeing on their annual

Production Readiness for all Boeing programs

• YTD Book to bill of 1.1:1, including two significant awards at

our Fabrications operating company

Year Over Year Comparison

Net Sales ($ in M)

300

250

200

150

100

50

0

$

M

illi

on

s

FY'18 Q2 FY'17 Q2

$229

$259

Operating Margin (%)

6

5

4

3

2

1

0

-1

-2

%

FY'18 Q2 FY'17 Q2

(1)%

5%

Financial

• Net sales and operating margin decreased primarily due

to decreased production rates and pricing on 777 as well

as pricing on 787

• Operating results impacted by restructuring costs of $4M

and related inefficiencies

Triumph Precision Components floor panels and ducting will be utilized on Boeing’s 737

(legacy and MAX), 747, 767, 777 (legacy) and 787 airplanes

11Triumph Group — Second Quarter FY'18

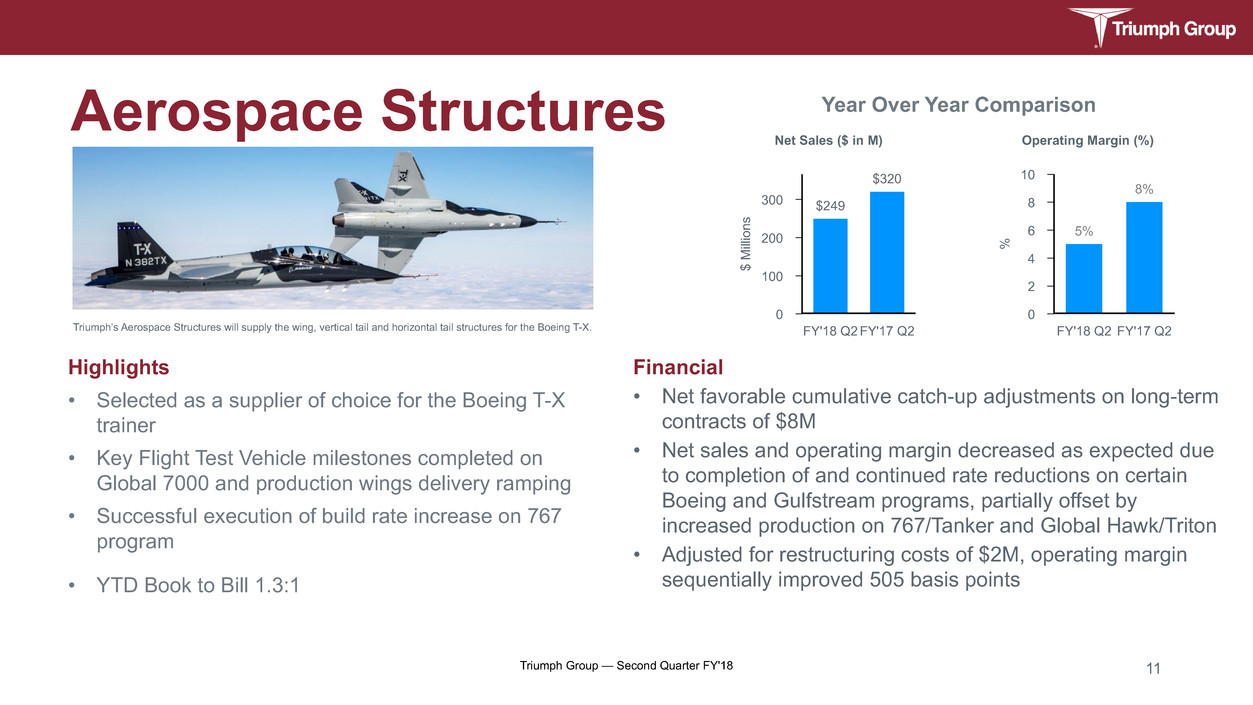

Aerospace Structures

Highlights

• Selected as a supplier of choice for the Boeing T-X

trainer

• Key Flight Test Vehicle milestones completed on

Global 7000 and production wings delivery ramping

• Successful execution of build rate increase on 767

program

• YTD Book to Bill 1.3:1

Year Over Year Comparison

Net Sales ($ in M)

300

200

100

0

$

M

illi

on

s

FY'18 Q2 FY'17 Q2

$249

$320

Operating Margin (%)

10

8

6

4

2

0

%

FY'18 Q2 FY'17 Q2

5%

8%

Financial

• Net favorable cumulative catch-up adjustments on long-term

contracts of $8M

• Net sales and operating margin decreased as expected due

to completion of and continued rate reductions on certain

Boeing and Gulfstream programs, partially offset by

increased production on 767/Tanker and Global Hawk/Triton

• Adjusted for restructuring costs of $2M, operating margin

sequentially improved 505 basis points

Triumph’s Aerospace Structures will supply the wing, vertical tail and horizontal tail structures for the Boeing T-X.

12

Free Cash Flow Walk - FY'18 Q2

Q2 Cash Drivers

• Development programs used $33M

• Restructuring used $10M

• Net working capital usage of $221M

includes:

◦ Reduction of customer advances

◦ Build of production inventory

◦ Reduced vendor financing

• Peak cash usage through Q3,

recovering in Q4

Consolidated ($ in millions) FY’18 Q2 FY’18 YTD

Net Income $ (5) $ (7)

Non-cash items:

Depreciation & Amortization 41 80

Interest Expense & Other 25 46

Amortization of Acquired Contracts (28) (57)

Loss on divestiture 20 20

Pension Income (15) (30)

OPEB Income (3) (6)

Income Tax Benefit (1) (2)

Cash uses:

Working Capital Usage (221) (300)

Interest Payments (8) (32)

Capital Expenditures (11) (23)

OPEB Payments (3) (6)

Tax Payments (2) (5)

Free Cash Use $ (211) $ (322)

On track to achieve guidance

13Triumph Group — Second Quarter FY'18

Capitalization, Leverage & Liquidity

• Completed $500M bond offering

• Amended and extended Securitization Facility

• Cash and Availability ~ $680M

• Senior Secured Leverage Ratio ~ 1.1x

• Interest Coverage Ratio ~ 3.5x

($ in millions) FY’18 Q2

Cash $ (34)

$800M Revolving Credit Facility 117

$125M Receivable Securitization Facility 89

Capital Leases 61

2013 Senior Notes Due 2021 375

2014 Senior Notes Due 2022 300

2017 Senior Notes Due 2025 500

Other Debt 8

Net Debt $ 1,416

Enhanced Financial Strength & Liquidity

14Triumph Group — Second Quarter FY'18

FY'18 Guidance

Net Sales $3.1B - $3.2B

Adjusted EPS * $2.25 - $2.75

Free Cash Use ($450M) - ($500M)

Effective Tax Rate ^ ~ 6%

Capital Expenditures $80M - $90M$50M - $60M

*excludes restructuring costs of $54M for FY'18

^ Potential opportunity to lower through release of valuation allowance and use of deferred tax benefits from prior divestitures. Expect third quarter effective tax rate of approximately 15%

Expect stronger 2nd half results, with Q4 better than Q3

15Triumph Group — Second Quarter FY'18

Concluding Remarks

• Operational performance stabilizing as CI culture takes hold – transformation setting foundation for future

• Enhanced backlog profitability through renegotiated contracts

• New wins increasing backlog - positions Triumph for sales growth in FY'19

• Disciplined portfolio and balance sheet actions strengthening margins and financial flexibility

16Triumph Group — Second Quarter FY'18

Our Vision

We aspire to be the premier design,

manufacturing and support company

whose comprehensive capabilities,

integrated processes and innovative

employees advance the safety and

prosperity of the world.

Our Mission

As One Team, we partner with our

customers to triumph over the

hardest aerospace, defense and

industrial challenges, enabling us to

deliver value to our shareholders.

Our Values

Integrity

Continuous Improvement

Teamwork

Innovation

Act with Velocity

17Triumph Group — Second Quarter FY'18

Appendix

18

Top Programs

Integrated Systems Aerospace Structures Precision Components

Boeing 777

Boeing 787

Airbus A350

Boeing 737

Boeing 767, Tanker

Boeing V-22

Boeing F-15

Bell Helicopter AH1

Bombardier C Series

NG Global Hawk

Represents 73% of

Precision Components backlog

Gulfstream

Boeing 767, Tanker

Bombardier Global

Airbus A330, A340

Boeing 747

Boeing V-22

Boeing 777

NG Global Hawk

Bell Helicopter 525

Embraer E2

Represents 97% of

Aerospace Structures backlog

Airbus A320, A321

Boeing 737

Boeing 787

Boeing V-22

Boeing AH-64

Boeing CH-47

Lockheed Martin C-130

Sikorsky UH60

Lockheed Martin F-35

Boeing 777

Represents 58% of

Integrated Systems backlog

19

Supplemental Data

Pension/OPEB Analysis ($ in millions) FY’17 FY’18

Pension Expense (Income) ≈ ($67) ≈ ($60)

Cash Pension Contribution ≈ $2 ≈ $0

OPEB Expense (Income) ≈ ($14) ≈ ($11)

Cash OPEB Contribution ≈ $17 ≈ $16

Restructuring ($ in millions) Remaining Estimate FY’18 E FY’19 +

Transformation Related —

Cash Based Costs $72 $52 $20

Transformation Related —

Non-Cash Based Costs 3 2 1

Total $75 $54 $21

20

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures

Adjusted income from continuing operations, before income taxes, adjusted income from continuing operations and adjusted income from continuing operations

per diluted share, before non-recurring costs has been provided for consistency and comparability. These measures should not be considered in isolation or as

alternatives to income from continuing operations before income taxes, income from continuing operations and income from continuing operations per diluted

share presented in accordance with GAAP. The following tables reconcile income from continuing operations before income taxes, income from continuing

operations, and income from continuing operations per diluted share, before non-recurring costs.

Three Months Ended

September 30, 2017

Pre-Tax After-Tax Diluted EPS

Loss from Continuing Operations - GAAP $ (6,527) $ (5,378) $ (0.11)

Adjustments:

Loss on divestiture 20,371 20,371 0.41

Refinancing costs 1,986 1,589 0.03

Restructuring costs (non-cash) 1,295 1,036 0.02

Restructuring costs (cash) 10,101 8,081 0.16

Adjusted Income from Continuing Operations - Non-GAAP $ 27,226 $ 25,699 $ 0.52 *

* Difference due to rounding

Non-GAAP

Disclosure

Six Months Ended

September 30, 2017

Pre-Tax After-Tax Diluted EPS

Loss from Continuing Operations - GAAP $ (9,136) $ (7,309) $ (0.15)

Adjustments:

Loss on divestiture 20,371 20,371 0.41

Refinancing costs 1,986 1,589 0.03

Restructuring costs (non-cash) 2,156 1,725 0.03

Restructuring costs (cash) 27,602 22,082 0.45

Adjusted Income from Continuing Operations - Non-GAAP $ 42,979 $ 38,458 $ 0.78 *

* Difference due to rounding

21

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Adjusted income from continuing operations, before income taxes, adjusted income from continuing operations and adjusted income from continuing operations

per diluted share, before non-recurring costs has been provided for consistency and comparability. These measures should not be considered in isolation or as

alternatives to income from continuing operations before income taxes, income from continuing operations and income from continuing operations per diluted

share presented in accordance with GAAP. The following tables reconcile income from continuing operations before income taxes, income from continuing

operations, and income from continuing operations per diluted share, before non-recurring costs.

Non-GAAP

Disclosure

Six Months Ended

September 30, 2016

Pre-Tax After-Tax Diluted EPS

Income from Continuing Operations - GAAP $ 81,189 $ 54,541 $ 1.10

Adjustments:

Triumph Precision Components - Strike related costs 15,701 10,834 0.22

Triumph Precision Components - Inventory write-down 6,089 4,201 0.08

Triumph Aerospace Structures - UAS program 14,200 9,798 0.20

Loss on divestiture 4,774 4,774 0.10

Restructuring costs (non-cash) 7,231 4,989 0.10

Restructuring costs (cash) 17,113 11,808 0.24

Adjusted Income from Continuing Operations - Non-GAAP $ 146,297 $ 100,945 $ 2.04 *

* Difference due to rounding

Three Months Ended

September 30, 2016

Pre-Tax After-Tax Diluted EPS

Income from Continuing Operations - GAAP $ 52,590 $ 34,807 $ 0.70

Adjustments:

Loss on divestiture 4,774 4,774 0.10

Restructuring costs (non-cash) 3,740 2,581 0.05

Restructuring costs (cash) 10,462 7,219 0.15

Adjusted Income from Continuing Operations - Non-GAAP $ 71,566 $ 49,381 $ 1.00 *

* Difference due to rounding

22

(Continued)

FINANCIAL DATA (UNAUDITED)

TRIUMPH GROUP, INC. AND SUBSIDIARIES

(dollars in thousands)

Non-GAAP Financial Measures Disclosures (continued)

Cash provided by operations has been provided for consistency and comparability. We also use free cash flow available for debt reduction as a key factor in

planning for and consideration of strategic acquisitions, stock repurchases and the repayment of debt. This measure should not be considered in isolation, as a

measure of residual cash flow available for discretionary purposes, or as an alternative to operating results presented in accordance with GAAP. The following

table reconciles cash provided by operations to free cash flow available for debt reduction.

We use "Net Debt to Capital" as a measure of financial leverage. The following table sets forth the computation of Net Debt to Capital:

Three Months Ended Six Months Ended

June 30, 2017 September 30, 2017

September 30,

2017

Cash flow from operations $ (99,048) $ (200,017) $ (299,065)

Less:

Capital expenditures (12,085) (10,690) (22,775)

Free cash flow $ (111,133) $ (210,707) $ (321,840)

September 30, March 31,

2017 2017

Calculation of Net Debt

Current portion $ 22,883 $ 160,630

Long-term debt 1,409,130 1,035,670

Total debt 1,432,013 1,196,300

Plus: Deferred debt issuance costs 18,638 11,752

Less: Cash (33,669) (69,633)

Net debt $ 1,416,982 $ 1,138,419

Calculation of Capital

Net debt $ 1,416,982 $ 1,138,419

Stockholders' equity 855,845 846,473

Total capital $ 2,272,827 $ 1,984,892

Percent of net debt to capital 62.3% 57.4%

Non-GAAP

Disclosure