Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - Novelis Inc. | novelisq2fy18results.htm |

| 8-K - 8-K EARNINGS - Novelis Inc. | nvl-form8xkq2fy181.htm |

© 2017 Novelis

NOVELIS Q2 FISCAL 2018

EARNINGS CONFERENCE CALL

November 2, 2017

Steve Fisher

President and Chief Executive Officer

Devinder Ahuja

Senior Vice President and Chief Financial Officer

Exhibit 99.2

© 2017 Novelis

SAFE HARBOR STATEMENT

Forward-looking statements

Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward-

looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed

by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar

expressions. Examples of forward-looking statements in this presentation including statements concerning our expectation that we

will achieve record free cash flow this fiscal year. Novelis cautions that, by their nature, forward-looking statements involve risk and

uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not

intend, and we disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future

events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-

looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with

such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships

with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and

prices for, energy in the areas in which we maintain production facilities; our ability to access financing for future capital

requirements; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors

affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations,

breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory and political factors

within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum

rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in

general economic conditions including deterioration in the global economy, particularly sectors in which our customers operate;

cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our customers’

industries; changes in government regulations, particularly those affecting taxes, environmental, health or safety compliance;

changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing

agreements; the effect of taxes and changes in tax rates; and our ability to generate cash. The above list of factors is not

exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal

year ended March 31, 2017 are specifically incorporated by reference into this presentation.

2

© 2017 Novelis

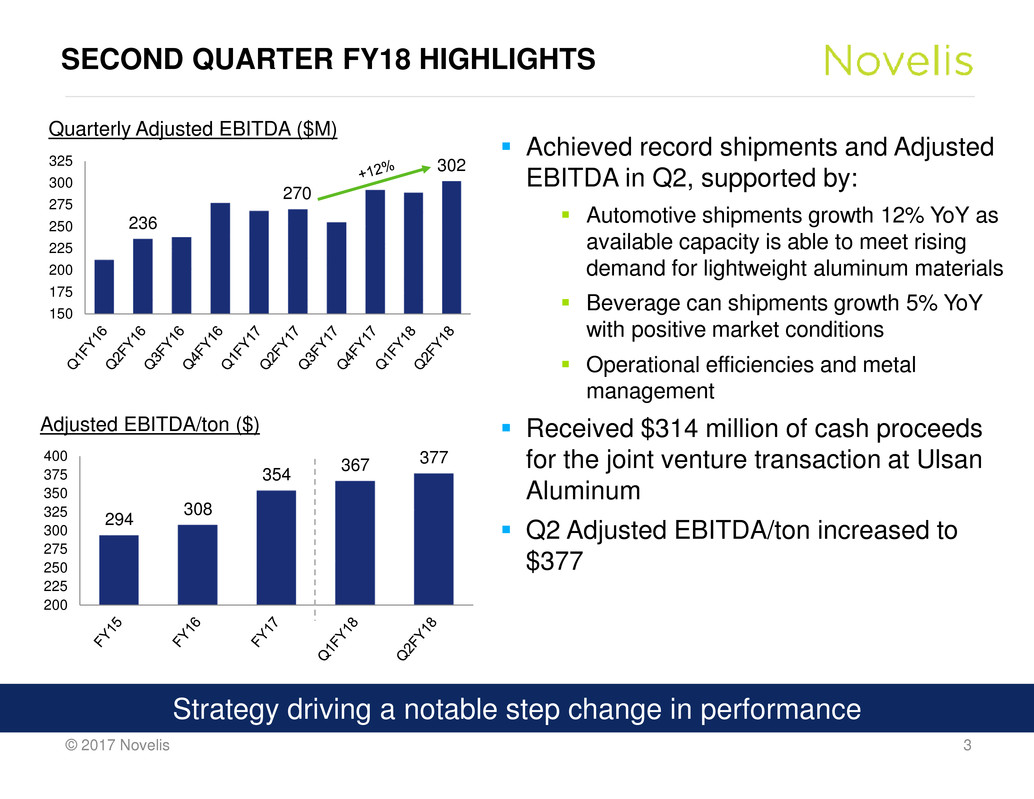

SECOND QUARTER FY18 HIGHLIGHTS

Achieved record shipments and Adjusted

EBITDA in Q2, supported by:

Automotive shipments growth 12% YoY as

available capacity is able to meet rising

demand for lightweight aluminum materials

Beverage can shipments growth 5% YoY

with positive market conditions

Operational efficiencies and metal

management

Received $314 million of cash proceeds

for the joint venture transaction at Ulsan

Aluminum

Q2 Adjusted EBITDA/ton increased to

$377

3

Quarterly Adjusted EBITDA ($M)

236

270

302

150

175

200

225

250

275

300

325

Adjusted EBITDA/ton ($)

294 308

354 367

377

200

225

250

275

300

325

350

375

400

Strategy driving a notable step change in performance

© 2017 Novelis

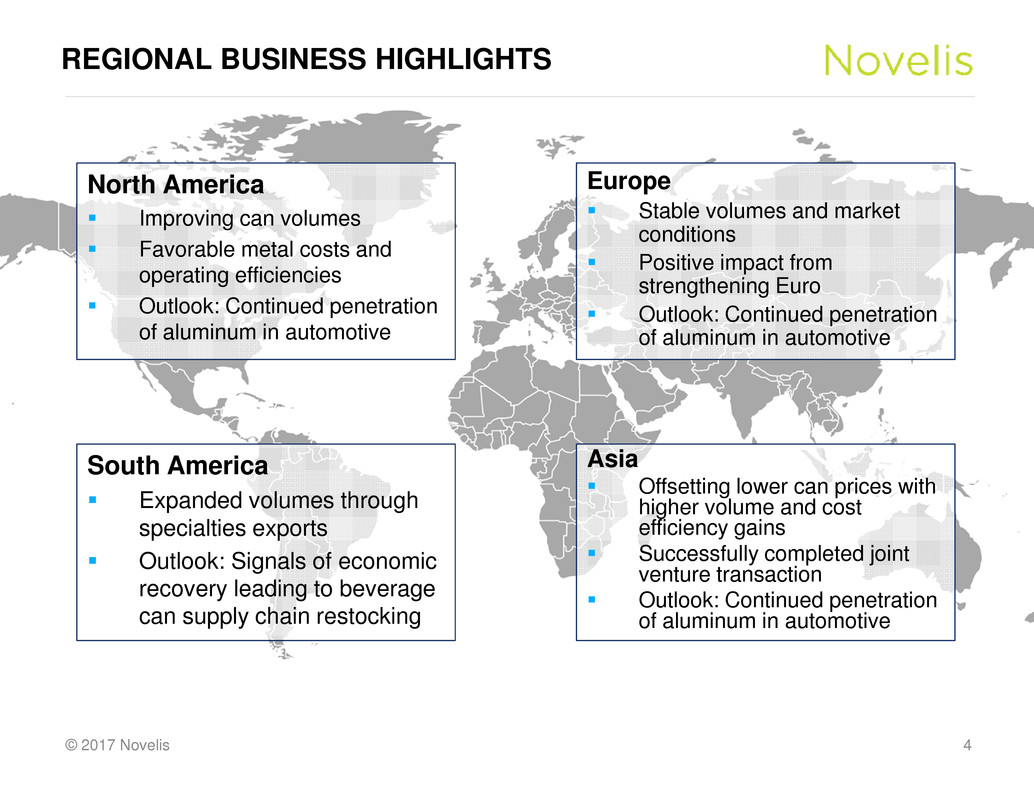

REGIONAL BUSINESS HIGHLIGHTS

South America

Expanded volumes through

specialties exports

Outlook: Signals of economic

recovery leading to beverage

can supply chain restocking

4

Europe

Stable volumes and market

conditions

Positive impact from

strengthening Euro

Outlook: Continued penetration

of aluminum in automotive

North America

Improving can volumes

Favorable metal costs and

operating efficiencies

Outlook: Continued penetration

of aluminum in automotive

Asia

Offsetting lower can prices with

higher volume and cost

efficiency gains

Successfully completed joint

venture transaction

Outlook: Continued penetration

of aluminum in automotive

© 2017 Novelis

FINANCIAL HIGHLIGHTS

© 2017 Novelis

Q2 FISCAL 2018 FINANCIAL HIGHLIGHTS

Net income of $307 million up from

negative $89 million in prior year

Excluding tax-effected special items*,

net income up 30% from $60 million to

$78 million

Adjusted EBITDA up 12% from $270

million to record $302 million

Sales up 18% to $2.8 billion

Total FRP Shipments up 4% to record

802 kilotonnes

Strong liquidity position at $1.6 billion

Reduced net leverage ratio to 3.5x

6

Q2FY18 vs Q2FY17

*Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss/gain on sale of business

TTM Adjusted EBITDA ($M)

1,137

750

800

850

900

950

1,000

1,050

1,100

1,150

1,200

Net Leverage ratio

TTM Adjusted EBITDA/net debt

3.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

© 2017 Novelis

Q2 ADJUSTED EBITDA BRIDGE

7

$ Millions

270

34

(4)

8

(6)

302

Q2FY17 Volume Price/Mix Operating Cost SG&A and Other Q2FY18

Bridge components adjusted to remove net impact of divested ALCOM business, reflected in SG&A & Other as ($1M).

Strong demand & production

led to increase in beverage

can and automotive volumes

Lower beverage can pricing mostly

offset by favorable product mix

mainly from higher automotive

Operational efficiencies and

favorable metal costs partly

offset by inflation

© 2017 Novelis

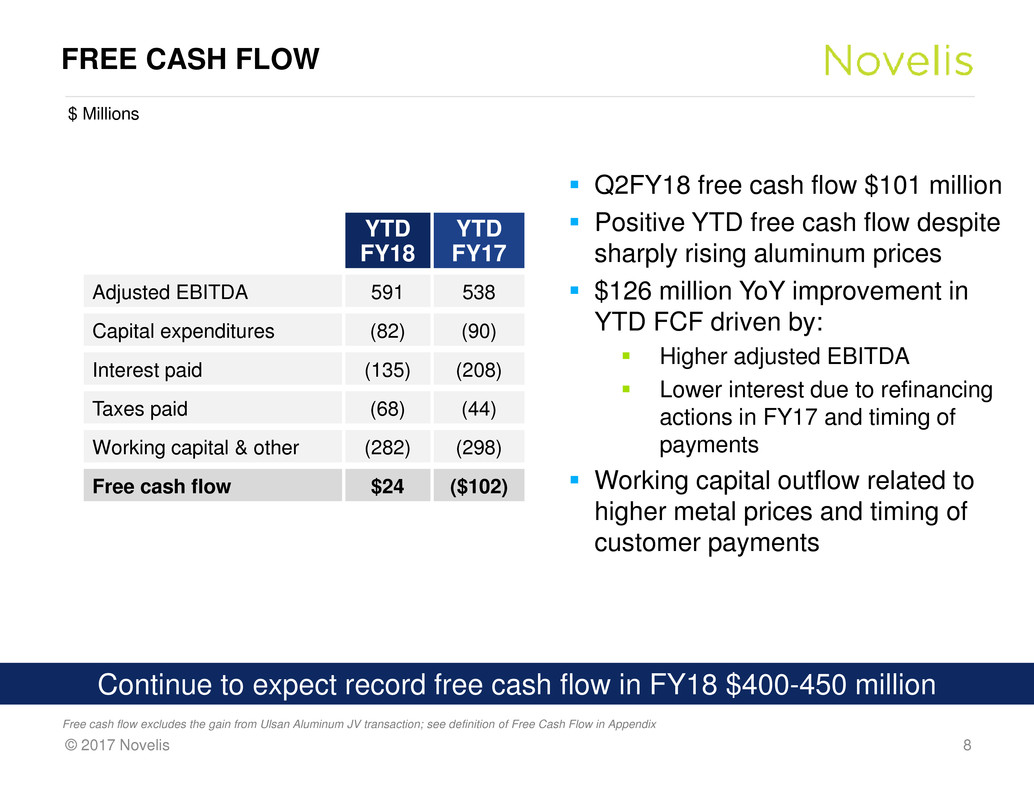

FREE CASH FLOW

8

YTD

FY18

YTD

FY17

Adjusted EBITDA 591 538

Capital expenditures (82) (90)

Interest paid (135) (208)

Taxes paid (68) (44)

Working capital & other (282) (298)

Free cash flow $24 ($102)

Q2FY18 free cash flow $101 million

Positive YTD free cash flow despite

sharply rising aluminum prices

$126 million YoY improvement in

YTD FCF driven by:

Higher adjusted EBITDA

Lower interest due to refinancing

actions in FY17 and timing of

payments

Working capital outflow related to

higher metal prices and timing of

customer payments

$ Millions

Free cash flow excludes the gain from Ulsan Aluminum JV transaction; see definition of Free Cash Flow in Appendix

Continue to expect record free cash flow in FY18 $400-450 million

© 2017 Novelis

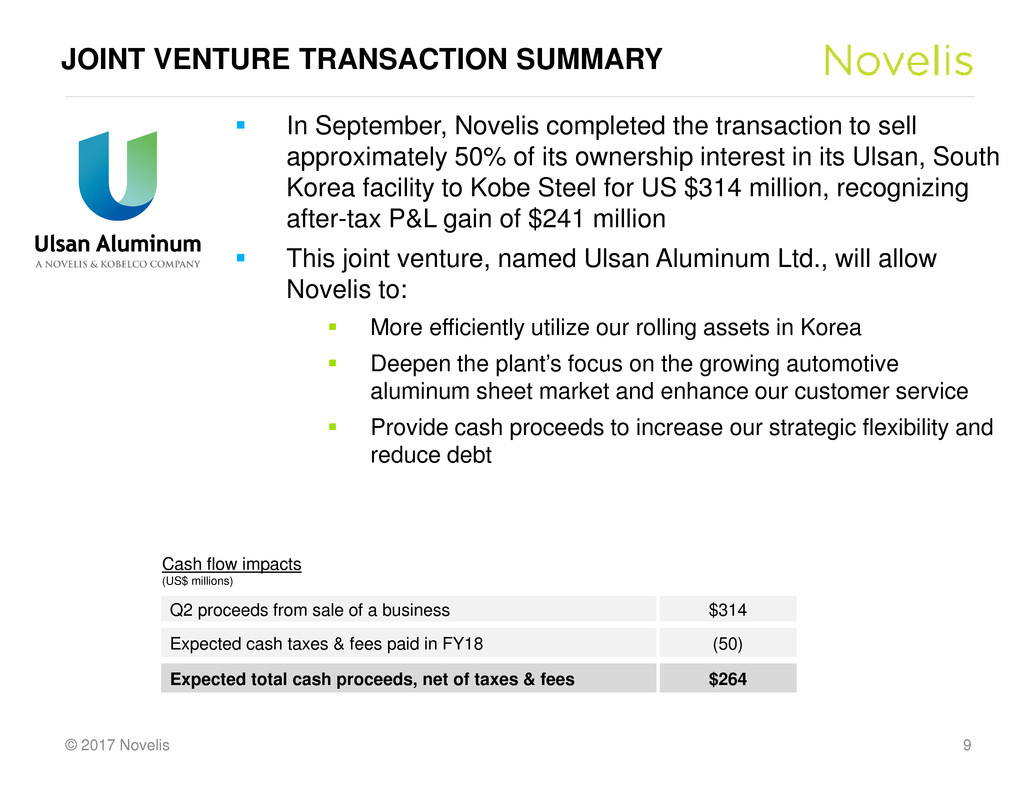

JOINT VENTURE TRANSACTION SUMMARY

9

In September, Novelis completed the transaction to sell

approximately 50% of its ownership interest in its Ulsan, South

Korea facility to Kobe Steel for US $314 million, recognizing

after-tax P&L gain of $241 million

This joint venture, named Ulsan Aluminum Ltd., will allow

Novelis to:

More efficiently utilize our rolling assets in Korea

Deepen the plant’s focus on the growing automotive

aluminum sheet market and enhance our customer service

Provide cash proceeds to increase our strategic flexibility and

reduce debt

Q2 proceeds from sale of a business $314

Expected cash taxes & fees paid in FY18 (50)

Expected total cash proceeds, net of taxes & fees $264

Cash flow impacts

(US$ millions)

© 2017 Novelis

OUTLOOK AND SUMMARY

© 2017 Novelis

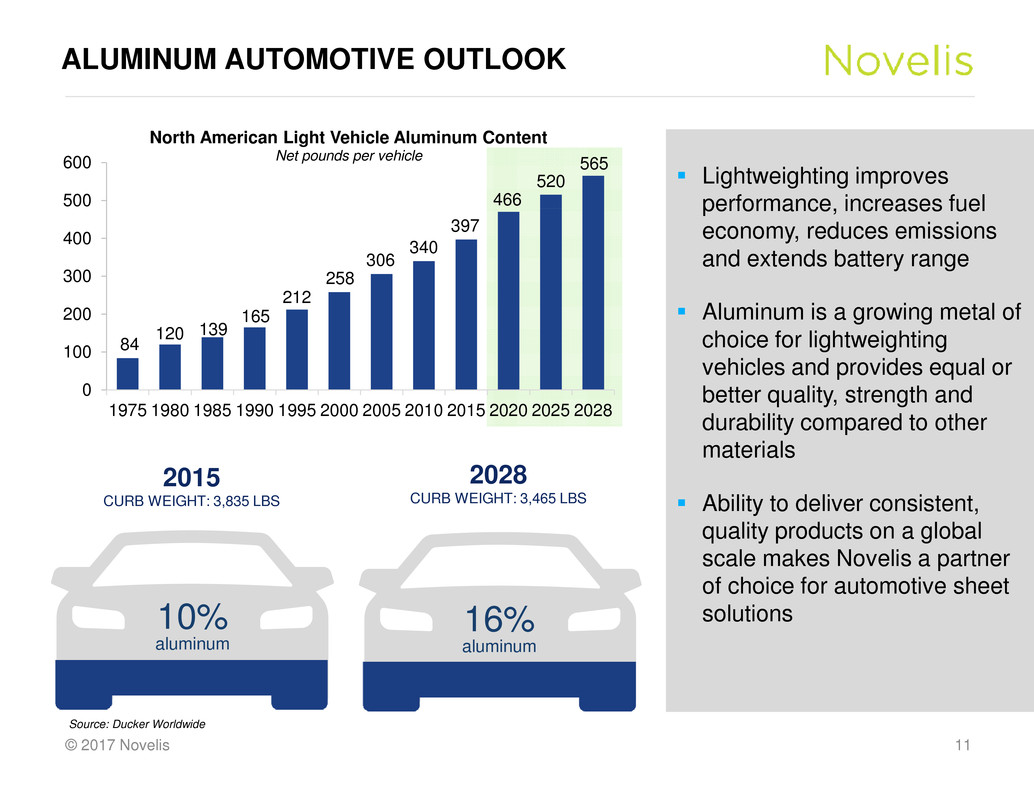

ALUMINUM AUTOMOTIVE OUTLOOK

11

Source: Ducker Worldwide

84 120

139

165

212

258

306

340

397

466

520

565

0

100

200

300

400

500

600

1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2028

North American Light Vehicle Aluminum Content

Net pounds per vehicle

2028

CURB WEIGHT: 3,465 LBS

16%

aluminum

2015

CURB WEIGHT: 3,835 LBS

10%

aluminum

Lightweighting improves

performance, increases fuel

economy, reduces emissions

and extends battery range

Aluminum is a growing metal of

choice for lightweighting

vehicles and provides equal or

better quality, strength and

durability compared to other

materials

Ability to deliver consistent,

quality products on a global

scale makes Novelis a partner

of choice for automotive sheet

solutions

© 2017 Novelis

SUMMARY

Record shipments and operating performance

drove record Q2 Adjusted EBITDA

Raise FY18 full year guidance for Adjusted

EBITDA to $1,150-$1,200 million

Previous guidance $1,100-$1,150 million

Maintain FY18 free cash flow guidance $400-

$450 million

Monitoring higher aluminum price pressure on

working capital

Solid cash flow and net leverage trending to 3x

by fiscal year end

Maintain positive outlook for automotive

aluminum sheet demand in near and long term;

reviewing organic growth options to meet

customer needs

12

© 2017 Novelis

THANK YOU

QUESTIONS?

THANK YOU AND QUESTIONS

© 2017 Novelis

APPENDIX

© 2017 Novelis

INCOME STATEMENT RECONCILIATION TO ADJUSTED

EBITDA

15

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Q2

FY18

Net income (loss) attributable to our common shareholder 24 (89) 63 47 45 101 307

- Noncontrolling interests - - 1 - 1 - -

- Interest, net 80 79 65 59 283 62 66

- Income tax provision 36 27 47 41 151 43 116

- Depreciation and amortization 89 90 88 93 360 90 91

EBITDA 229 107 264 240 840 296 576

- Unrealized loss (gain) on derivatives 7 (4) (21) 13 (5) (16) 18

- Realized gain on derivative instruments not included in segment

income (1) - (1) (3) (5) (1) -

- Proportional consolidation 8 8 4 8 28 8 8

- Loss on extinguishment of debt - 112 - 22 134 - -

- Restructuring and impairment, net 2 1 1 6 10 1 7

- Loss (gain) on sale of business - 27 - - 27 - (318)

- Loss (gain) on sale of fixed assets 4 2 (2) 2 6 1 1

- Gain on assets held for sale, net (1) (1) - - (2) - -

- Metal price lag (A) 13 14 4 - 31 1 5

- Others costs (income), net 7 4 6 4 21 (1) 5

Adjusted EBITDA 268 270 255 292 1,085 289 302

(A) Effective in the first quarter of fiscal 2018, management removed the impact of metal price lag from Adjusted EBITDA (Segment Income) in order to

provide more transparency and visibility for our stakeholders on the underlying performance of the business. On certain sales contracts, we experience

timing differences on the pass through of changing aluminum prices from our suppliers to our customers. Additional timing differences occur in the flow of

metal costs through moving average inventory cost values and cost of goods sold. This timing difference is referred to as metal price lag. The company will

continue to report metal price lag as a separate line item in Reconciliation from Net Income (loss) attributable to our common shareholder to Adjusted

EBITDA. Segment information for all prior periods presented has been updated to reflect this change.

© 2017 Novelis

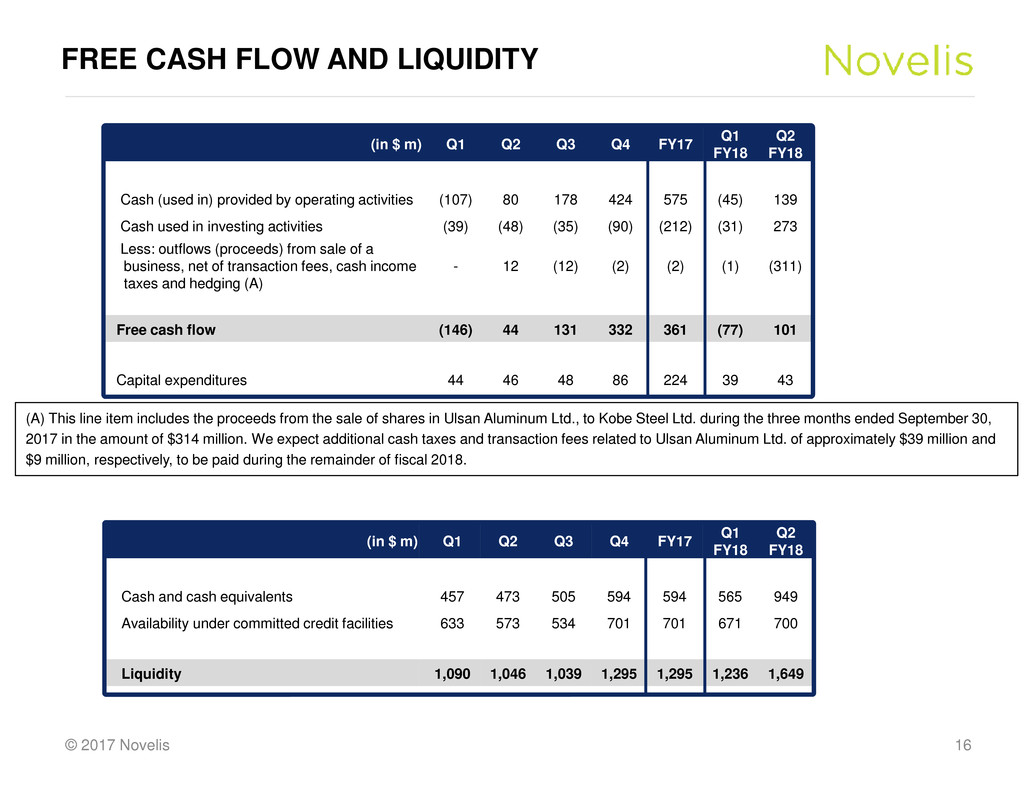

FREE CASH FLOW AND LIQUIDITY

16

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Q2

FY18

Cash (used in) provided by operating activities (107) 80 178 424 575 (45) 139

Cash used in investing activities (39) (48) (35) (90) (212) (31) 273

Less: outflows (proceeds) from sale of a

business, net of transaction fees, cash income

taxes and hedging (A)

- 12 (12) (2) (2) (1) (311)

Free cash flow (146) 44 131 332 361 (77) 101

Capital expenditures 44 46 48 86 224 39 43

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Q2

FY18

Cash and cash equivalents 457 473 505 594 594 565 949

Availability under committed credit facilities 633 573 534 701 701 671 700

Liquidity 1,090 1,046 1,039 1,295 1,295 1,236 1,649

(A) This line item includes the proceeds from the sale of shares in Ulsan Aluminum Ltd., to Kobe Steel Ltd. during the three months ended September 30,

2017 in the amount of $314 million. We expect additional cash taxes and transaction fees related to Ulsan Aluminum Ltd. of approximately $39 million and

$9 million, respectively, to be paid during the remainder of fiscal 2018.