Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Intercontinental Exchange, Inc. | ice2017930ex311.htm |

| EX-32.2 - EXHIBIT 32.2 - Intercontinental Exchange, Inc. | ice2017930ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Intercontinental Exchange, Inc. | ice2017930ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Intercontinental Exchange, Inc. | ice2017930ex312.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One) | |

þ | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2017 | |

Or | |

¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to | |

Commission File Number 001-36198

INTERCONTINENTAL EXCHANGE, INC.

(Exact name of registrant as specified in its charter)

Delaware | 46-2286804 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) |

5660 New Northside Drive, Atlanta, Georgia | 30328 (Zip Code) |

(Address of principal executive offices) | |

(770) 857-4700

Registrant’s telephone number, including area code

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ |

(Do not check if a smaller company) | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of October 31, 2017, the number of shares of the registrant’s Common Stock outstanding was 585,026,176 shares.

INTERCONTINENTAL EXCHANGE, INC.

Form 10-Q

Quarterly Period Ended September 30, 2017

TABLE OF CONTENTS

PART I. | Financial Statements | |

Item 1 | ||

Consolidated Balance Sheets as of September 30, 2017 and December 31, 2016 | ||

Consolidated Statements of Income for the nine and three months ended September 30, 2017 and 2016 | ||

Consolidated Statements of Comprehensive Income for the nine and three months ended September 30, 2017 and 2016 | ||

Consolidated Statements of Changes in Equity, Accumulated Other Comprehensive Loss and Redeemable Non-Controlling Interest for the nine months ended September 30, 2017 and for the year ended December 31, 2016 | ||

Consolidated Statements of Cash Flows for the nine months ended September 30, 2017 and 2016 | ||

Item 2 | ||

Item 3 | ||

Item 4 | ||

PART II. | Other Information | |

Item 1 | ||

Item 1A | ||

Item 2 | ||

Item 3 | ||

Item 4 | ||

Item 5 | ||

Item 6 | ||

PART I. Financial Statements

Item 1. Consolidated Financial Statements (Unaudited)

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Balance Sheets

(In millions, except per share amounts)

(Unaudited)

As of | As of | ||||||

September 30, 2017 | December 31, 2016 | ||||||

Assets: | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 419 | $ | 407 | |||

Short-term investments | 16 | 23 | |||||

Short-term restricted cash and investments | 762 | 679 | |||||

Customer accounts receivable, net of allowance for doubtful accounts of $7 at both September 30, 2017 and December 31, 2016 | 897 | 777 | |||||

Margin deposits and guaranty funds | 52,401 | 55,150 | |||||

Prepaid expenses and other current assets | 744 | 97 | |||||

Total current assets | 55,239 | 57,133 | |||||

Property and equipment, net | 1,192 | 1,129 | |||||

Other non-current assets: | |||||||

Goodwill | 12,016 | 12,291 | |||||

Other intangible assets, net | 10,056 | 10,420 | |||||

Long-term restricted cash and investments | 264 | 264 | |||||

Long-term investments | — | 432 | |||||

Other non-current assets | 351 | 334 | |||||

Total other non-current assets | 22,687 | 23,741 | |||||

Total assets | $ | 79,118 | $ | 82,003 | |||

Liabilities and Equity: | |||||||

Current liabilities: | |||||||

Accounts payable and accrued liabilities | $ | 427 | $ | 388 | |||

Section 31 fees payable | 32 | 131 | |||||

Accrued salaries and benefits | 184 | 230 | |||||

Deferred revenue | 228 | 114 | |||||

Short-term debt | 1,197 | 2,493 | |||||

Margin deposits and guaranty funds | 52,401 | 55,150 | |||||

Other current liabilities | 131 | 111 | |||||

Total current liabilities | 54,600 | 58,617 | |||||

Non-current liabilities: | |||||||

Non-current deferred tax liability, net | 2,989 | 2,958 | |||||

Long-term debt | 4,865 | 3,871 | |||||

Accrued employee benefits | 264 | 430 | |||||

Other non-current liabilities | 381 | 337 | |||||

Total non-current liabilities | 8,499 | 7,596 | |||||

Total liabilities | 63,099 | 66,213 | |||||

Commitments and contingencies | |||||||

Redeemable non-controlling interest | — | 36 | |||||

2

Equity: | |||||||

Intercontinental Exchange, Inc. shareholders’ equity: | |||||||

Preferred stock, $0.01 par value; 100 shares authorized; no shares issued or outstanding at September 30, 2017 and December 31, 2016 | — | — | |||||

Common stock, $0.01 par value; 1,500 shares authorized; 600 and 596 shares issued at September 30, 2017 and December 31, 2016, respectively, and 586 and 595 shares outstanding at September 30, 2017 and December 31, 2016, respectively | 6 | 6 | |||||

Treasury stock, at cost; 14 and 1 shares at September 30, 2017 and December 31, 2016, respectively | (833 | ) | (40 | ) | |||

Additional paid-in capital | 11,423 | 11,306 | |||||

Retained earnings | 5,718 | 4,789 | |||||

Accumulated other comprehensive loss | (322 | ) | (344 | ) | |||

Total Intercontinental Exchange, Inc. shareholders’ equity | 15,992 | 15,717 | |||||

Non-controlling interest in consolidated subsidiaries | 27 | 37 | |||||

Total equity | 16,019 | 15,754 | |||||

Total liabilities and equity | $ | 79,118 | $ | 82,003 | |||

See accompanying notes.

3

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Income

(In millions, except per share amounts)

(Unaudited)

Nine Months Ended September 30, | Three Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Revenues: | |||||||||||||||

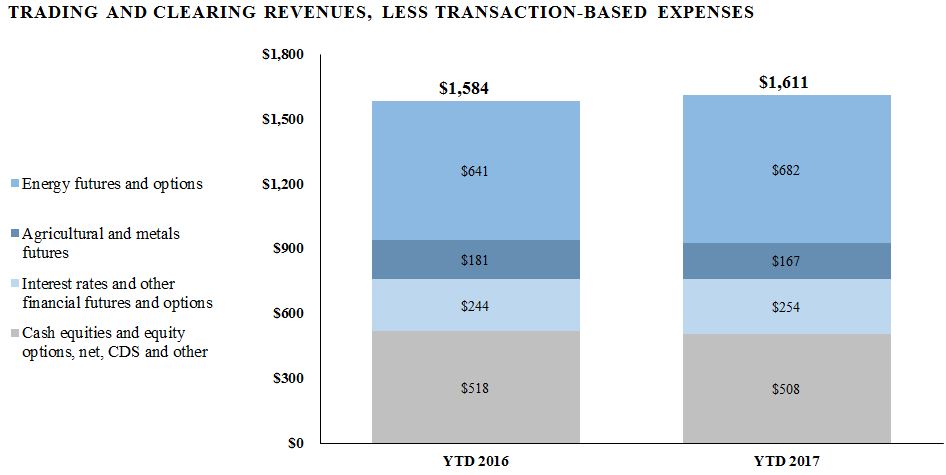

Transaction and clearing, net | $ | 2,373 | $ | 2,566 | $ | 758 | $ | 777 | |||||||

Data services | 1,559 | 1,463 | 518 | 489 | |||||||||||

Listings | 315 | 314 | 102 | 106 | |||||||||||

Other revenues | 148 | 131 | 54 | 44 | |||||||||||

Total revenues | 4,395 | 4,474 | 1,432 | 1,416 | |||||||||||

Transaction-based expenses: | |||||||||||||||

Section 31 fees | 275 | 290 | 92 | 94 | |||||||||||

Cash liquidity payments, routing and clearing | 635 | 823 | 197 | 244 | |||||||||||

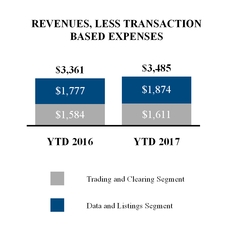

Total revenues, less transaction-based expenses | 3,485 | 3,361 | 1,143 | 1,078 | |||||||||||

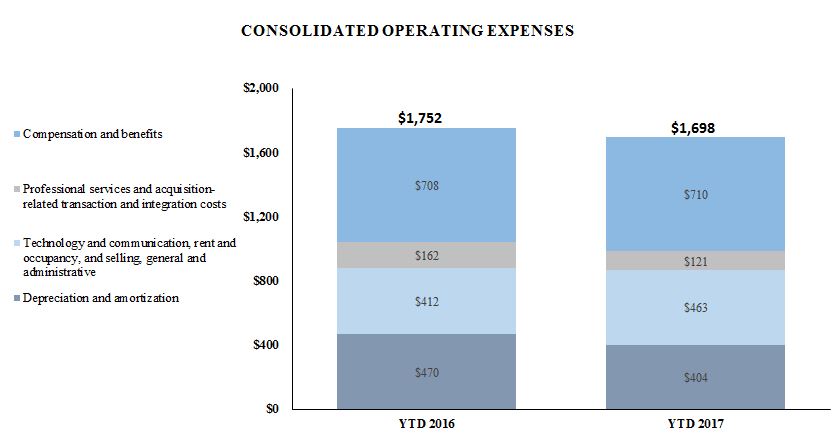

Operating expenses: | |||||||||||||||

Compensation and benefits | 710 | 708 | 231 | 236 | |||||||||||

Professional services | 94 | 101 | 30 | 32 | |||||||||||

Acquisition-related transaction and integration costs | 27 | 61 | 4 | 14 | |||||||||||

Technology and communication | 294 | 277 | 99 | 93 | |||||||||||

Rent and occupancy | 52 | 52 | 17 | 17 | |||||||||||

Selling, general and administrative | 117 | 83 | 38 | 31 | |||||||||||

Depreciation and amortization | 404 | 470 | 128 | 181 | |||||||||||

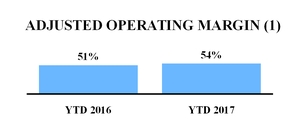

Total operating expenses | 1,698 | 1,752 | 547 | 604 | |||||||||||

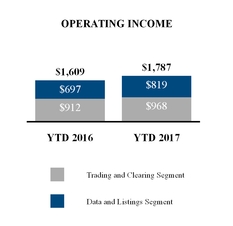

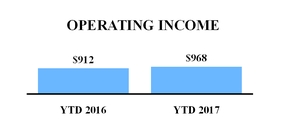

Operating income | 1,787 | 1,609 | 596 | 474 | |||||||||||

Other income (expense): | |||||||||||||||

Interest expense | (137 | ) | (134 | ) | (47 | ) | (44 | ) | |||||||

Other income, net | 198 | 24 | 11 | 13 | |||||||||||

Other income (expense), net | 61 | (110 | ) | (36 | ) | (31 | ) | ||||||||

Income before income tax expense | 1,848 | 1,499 | 560 | 443 | |||||||||||

Income tax expense | 537 | 409 | 185 | 93 | |||||||||||

Net income | $ | 1,311 | $ | 1,090 | $ | 375 | $ | 350 | |||||||

Net income attributable to non-controlling interest | (22 | ) | (20 | ) | (6 | ) | (6 | ) | |||||||

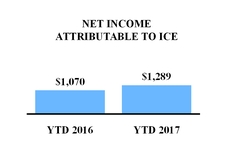

Net income attributable to Intercontinental Exchange, Inc. | $ | 1,289 | $ | 1,070 | $ | 369 | $ | 344 | |||||||

Earnings per share attributable to Intercontinental Exchange, Inc. common shareholders: | |||||||||||||||

Basic | $ | 2.18 | $ | 1.80 | $ | 0.63 | $ | 0.58 | |||||||

Diluted | $ | 2.17 | $ | 1.79 | $ | 0.62 | $ | 0.57 | |||||||

Weighted average common shares outstanding: | |||||||||||||||

Basic | 591 | 595 | 588 | 596 | |||||||||||

Diluted | 595 | 599 | 592 | 600 | |||||||||||

Dividend per share | $ | 0.60 | $ | 0.51 | $ | 0.20 | $ | 0.17 | |||||||

See accompanying notes.

4

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In millions)

(Unaudited)

Nine Months Ended September 30, | Three Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Net income | $ | 1,311 | $ | 1,090 | $ | 375 | $ | 350 | |||||||

Other comprehensive income (loss): | |||||||||||||||

Foreign currency translation adjustments, net of tax (expense) benefit of ($11) and $1 for the nine months ended September 30, 2017 and 2016, respectively, and ($4) for the three months ended September 30, 2017 | 130 | (245 | ) | 45 | (46 | ) | |||||||||

Change in fair value of available-for-sale securities | 68 | 117 | — | (12 | ) | ||||||||||

Reclassification of realized gain on available-for-sale investment to other income | (176 | ) | — | — | — | ||||||||||

Other comprehensive income (loss) | 22 | (128 | ) | 45 | (58 | ) | |||||||||

Comprehensive income | $ | 1,333 | $ | 962 | $ | 420 | $ | 292 | |||||||

Comprehensive income attributable to non-controlling interest | (22 | ) | (20 | ) | (6 | ) | (6 | ) | |||||||

Comprehensive income attributable to Intercontinental Exchange, Inc. | $ | 1,311 | $ | 942 | $ | 414 | $ | 286 | |||||||

See accompanying notes.

5

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Changes in Equity, Accumulated Other Comprehensive Loss

and Redeemable Non-Controlling Interest

(In millions)

(Unaudited)

Intercontinental Exchange, Inc. Shareholders' Equity | Non- Controlling Interest in Consolidated Subsidiaries | Total Equity | Redeemable Non-Controlling Interest | ||||||||||||||||||||||||||||||||||

Common Stock | Treasury Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | |||||||||||||||||||||||||||||||||

Shares | Value | Shares | Value | ||||||||||||||||||||||||||||||||||

Balance, as of December 31, 2015 | 628 | $ | 6 | (34 | ) | $ | (1,448 | ) | $ | 12,290 | $ | 4,148 | $ | (188 | ) | $ | 32 | $ | 14,840 | $ | 35 | ||||||||||||||||

Other comprehensive loss | — | — | — | — | — | — | (156 | ) | — | (156 | ) | — | |||||||||||||||||||||||||

Exercise of common stock options | 1 | — | — | — | 22 | — | — | — | 22 | — | |||||||||||||||||||||||||||

Treasury shares retired in connection with stock split | (35 | ) | — | 35 | 1,512 | (1,142 | ) | (370 | ) | — | — | — | — | ||||||||||||||||||||||||

Repurchases of common stock | — | — | (1 | ) | (50 | ) | — | — | — | — | (50 | ) | — | ||||||||||||||||||||||||

Payments relating to treasury shares | — | — | (1 | ) | (54 | ) | — | — | — | — | (54 | ) | — | ||||||||||||||||||||||||

Stock-based compensation | — | — | — | — | 136 | — | — | — | 136 | — | |||||||||||||||||||||||||||

Issuance of restricted stock | 2 | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Adjustment to redemption value | — | — | — | — | — | (2 | ) | — | — | (2 | ) | 1 | |||||||||||||||||||||||||

Distributions of profits | — | — | — | — | — | — | — | (19 | ) | (19 | ) | (3 | ) | ||||||||||||||||||||||||

Dividends paid to shareholders | — | — | — | — | — | (409 | ) | — | — | (409 | ) | — | |||||||||||||||||||||||||

Net income attributable to non-controlling interest | — | — | — | — | — | (27 | ) | — | 24 | (3 | ) | 3 | |||||||||||||||||||||||||

Net income | — | — | — | — | — | 1,449 | — | — | 1,449 | — | |||||||||||||||||||||||||||

Balance, as of December 31, 2016 | 596 | 6 | (1 | ) | (40 | ) | 11,306 | 4,789 | (344 | ) | 37 | 15,754 | 36 | ||||||||||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | 22 | — | 22 | — | |||||||||||||||||||||||||||

Exercise of common stock options | — | — | — | — | 11 | — | — | — | 11 | — | |||||||||||||||||||||||||||

Repurchases of common stock | — | — | (11 | ) | (709 | ) | — | — | — | — | (709 | ) | — | ||||||||||||||||||||||||

Payments relating to treasury shares | — | — | (2 | ) | (85 | ) | — | — | — | — | (85 | ) | — | ||||||||||||||||||||||||

Stock-based compensation | — | — | — | — | 116 | — | — | — | 116 | — | |||||||||||||||||||||||||||

Issuance of restricted stock | 4 | — | — | 1 | (1 | ) | — | — | — | — | — | ||||||||||||||||||||||||||

Acquisition of non-controlling interest | — | — | — | — | (9 | ) | — | — | (5 | ) | (14 | ) | — | ||||||||||||||||||||||||

Acquisition of redeemable non-controlling interest | — | — | — | — | — | (2 | ) | — | — | (2 | ) | (37 | ) | ||||||||||||||||||||||||

Distributions of profits | — | — | — | — | — | — | — | (26 | ) | (26 | ) | — | |||||||||||||||||||||||||

Dividends paid to shareholders | — | — | — | — | — | (358 | ) | — | — | (358 | ) | — | |||||||||||||||||||||||||

Net income attributable to non-controlling interest | — | — | — | — | — | (22 | ) | — | 21 | (1 | ) | 1 | |||||||||||||||||||||||||

Net income | — | — | — | — | — | 1,311 | — | — | 1,311 | — | |||||||||||||||||||||||||||

Balance, as of September 30, 2017 | 600 | $ | 6 | (14 | ) | $ | (833 | ) | $ | 11,423 | $ | 5,718 | $ | (322 | ) | $ | 27 | $ | 16,019 | $ | — | ||||||||||||||||

As of | As of | ||||||

September 30, 2017 | December 31, 2016 | ||||||

Accumulated other comprehensive loss was as follows: | |||||||

Foreign currency translation adjustments | $ | (215 | ) | $ | (345 | ) | |

Fair value of available-for-sale securities | — | 108 | |||||

Comprehensive income from equity method investment | 2 | 2 | |||||

Employee benefit plans adjustments | (109 | ) | (109 | ) | |||

Accumulated other comprehensive loss | $ | (322 | ) | $ | (344 | ) | |

See accompanying notes.

6

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In millions)

(Unaudited)

Nine Months Ended September 30, | |||||||

2017 | 2016 | ||||||

Operating activities: | |||||||

Net income | $ | 1,311 | $ | 1,090 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 404 | 470 | |||||

Stock-based compensation | 102 | 90 | |||||

Deferred taxes | 58 | 20 | |||||

Cetip realized investment gain, net | (114 | ) | — | ||||

Other | (13 | ) | 2 | ||||

Changes in assets and liabilities: | |||||||

Customer accounts receivable | (153 | ) | (88 | ) | |||

Other current and non-current assets | (29 | ) | (8 | ) | |||

Section 31 fees payable | (99 | ) | (83 | ) | |||

Deferred revenue | 133 | 144 | |||||

Other current and non-current liabilities | (190 | ) | (129 | ) | |||

Total adjustments | 99 | 418 | |||||

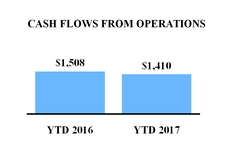

Net cash provided by operating activities | 1,410 | 1,508 | |||||

Investing activities: | |||||||

Capital expenditures | (136 | ) | (166 | ) | |||

Capitalized software development costs | (104 | ) | (88 | ) | |||

Cash received for divestitures (net of cash paid for acquisitions) | 9 | — | |||||

Proceeds from sale of Cetip, net | 438 | — | |||||

Decrease (increase) in restricted cash and investments | (80 | ) | 18 | ||||

Other | — | (70 | ) | ||||

Net cash provided by (used in) investing activities | 127 | (306 | ) | ||||

Financing activities: | |||||||

Repayments of commercial paper, net | (445 | ) | (1,006 | ) | |||

Proceeds from debt facilities, net | 985 | — | |||||

Repayments of debt facilities | (850 | ) | — | ||||

Repurchases of common stock | (709 | ) | — | ||||

Dividends to shareholders | (358 | ) | (307 | ) | |||

Payments relating to treasury shares received for restricted stock tax payments and stock option exercises | (85 | ) | (51 | ) | |||

Acquisition of non-controlling interest and redeemable non-controlling interest | (55 | ) | — | ||||

Other | (17 | ) | (2 | ) | |||

Net cash used in financing activities | (1,534 | ) | (1,366 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | 9 | (5 | ) | ||||

Net increase (decrease) in cash and cash equivalents | 12 | (169 | ) | ||||

Cash and cash equivalents, beginning of period | 407 | 627 | |||||

Cash and cash equivalents, end of period | $ | 419 | $ | 458 | |||

Supplemental cash flow disclosure: | |||||||

Cash paid for income taxes | $ | 511 | $ | 362 | |||

Cash paid for interest | $ | 99 | $ | 92 | |||

See accompanying notes.

7

Intercontinental Exchange, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1. | Description of Business |

We are a leading global operator of regulated exchanges, clearing houses and listings venues, and a provider of data services for commodity and financial markets. We operate regulated marketplaces for listing, trading and clearing a broad array of derivatives contracts and securities across major asset classes, including energy and agricultural commodities, interest rates, equities, equity derivatives, exchange traded funds, credit derivatives, bonds and currencies. We offer end-to-end market data services to support the trading, investment and risk management needs of customers across virtually all asset classes.

Our exchanges include futures exchanges in the United States, or U.S., United Kingdom, or U.K., European Union, or EU, Canada and Singapore, and cash equities, equity options and bond exchanges in the U.S. We also operate over-the-counter, or OTC, markets for physical energy and credit default swaps, or CDS, trade execution. To serve global derivatives markets, we operate central counterparty clearing houses in the U.S., U.K., EU, Canada and Singapore (Note 9). We offer a range of data services for global financial and commodity markets, including pricing and reference data, exchange data, analytics, feeds, desktop and connectivity solutions. Through our markets, clearing houses, listings and market data services, we provide end-to-end solutions for our customers through liquid markets, benchmark products, access to capital markets, and related services to support their ability to manage risk and raise capital.

2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared by us in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, pursuant to the rules and regulations of the Securities and Exchange Commission, or SEC, regarding interim financial reporting. Accordingly, the unaudited consolidated financial statements do not include all of the information and footnotes required by U.S. GAAP for complete financial statements and should be read in conjunction with our audited consolidated financial statements and related notes thereto for the year ended December 31, 2016. The accompanying unaudited consolidated financial statements reflect all adjustments that are, in our opinion, necessary for a fair presentation of results for the interim periods presented. These adjustments are of a normal recurring nature.

Preparing financial statements requires us to make certain estimates and assumptions that affect the amounts that are reported in the consolidated financial statements and accompanying disclosures. Although these estimates are based on our best knowledge of current events and actions that we may undertake in the future, actual results may be different from these estimates. The results of operations for the nine and three months ended September 30, 2017 are not necessarily indicative of the results to be expected for any future period or the full fiscal year.

The accompanying unaudited consolidated financial statements include the accounts of us and our wholly-owned and controlled subsidiaries. All intercompany balances and transactions between us and our wholly-owned and controlled subsidiaries have been eliminated in the consolidation. For those consolidated subsidiaries in which our ownership is less than 100% and for which we have control over the assets and liabilities and the management of the entity, the outside stockholders’ interests are shown as non-controlling interests. In instances where outside stockholders’ hold an option to require us to repurchase the outside stockholders’ interest, these interests are shown as redeemable non-controlling interests (Note 3).

Held for Sale

We classify long-lived assets or disposal groups as held for sale in the period in which all of the following criteria are met: management commits to a plan to sell; the long-lived asset or disposal group is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such long-lived assets or disposal groups; an active program to locate a buyer and other actions required to complete the plan to sell have been initiated; the sale is probable within one year; the asset or disposal group is being actively marketed for sale at a price that is reasonable in relation to its current fair value; and it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn. Long-lived assets and disposal groups classified as held for sale are measured at the lower of their carrying amount or fair value less costs to sell. Any loss resulting from this measurement is recognized in the period in which the held for sale criteria are met. Conversely, gains are not recognized until the date of sale. The fair value of a long-lived asset less any costs to sell is assessed each reporting period it remains classified as held for sale, and any change in fair value is reported as an adjustment to the carrying value of the asset, except that increases in fair value are limited to prior decreases recorded. Upon being classified as held for sale, depreciation and amortization is ceased. See Note 10 for information regarding our classification of Trayport as held for sale as of September 30, 2017.

New and Recently Adopted Accounting Pronouncements

8

The Financial Accounting Standards Board, or FASB, has issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606), or ASU 606. ASU 606 provides guidance outlining a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers that supersedes most current revenue recognition guidance. This guidance requires us to recognize revenue when we transfer promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. We are required to adopt ASU 606 at the beginning of our first quarter of fiscal 2018. The new guidance requires enhanced disclosures, including revenue recognition policies to identify performance obligations to customers and significant judgments in measurement and recognition. The new guidance may be applied retrospectively to each prior period presented or retrospectively with the cumulative effect recognized as of the date of adoption. We will apply the guidance retrospectively to each prior period presented when adopted, and provide the relevant disclosures in the first interim and annual periods in which we adopt the guidance. Based on our preliminary assessment, we expect that the adoption may accelerate the timing of recognition of a portion of original listing fees related to our New York Stock Exchange, or NYSE, businesses, which are currently deferred over an estimated customer life of nine years. We do not expect the adoption of this guidance to have a material impact on our consolidated financial statements within any accounting period presented. We are continuing our assessment, which may identify other impacts of the adoption of ASU 606.

The FASB has issued Accounting Standards Update No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, or ASU 2016-01. ASU 2016-01 provides updated guidance for the recognition, measurement, presentation, and disclosure of certain financial assets and liabilities, including the requirement that equity investments (except those accounted for under the equity method of accounting or those that result in consolidation of the investee) are to be measured at fair value with changes in fair value recognized in net income. We are required to adopt ASU 2016-01 at the beginning of our first quarter of fiscal 2018. On October 24, 2017, we made an investment in Euroclear plc, or Euroclear (Note 3), which will be impacted by our adoption of ASU 2016-01. Euroclear does not currently have a readily determinable fair market value as it is not a publicly listed company. Therefore, in accordance with and upon adoption of ASU 2016-01, we would only adjust the fair value of our investment in Euroclear if there is an observable price change in an orderly Euroclear transaction and any change in the fair value will be recognized in net income.

The FASB has issued Accounting Standards Update No. 2016-02, Leases, or ASU 2016-02. ASU 2016-02 requires an entity to recognize both assets and liabilities arising from financing and operating leases, along with additional qualitative and quantitative disclosures. A lessee should recognize in its balance sheet a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. ASU 2016-02 is required to be adopted at the beginning of our first quarter of fiscal 2019, with early adoption permitted. We will not adopt ASU 2016-02 early, but we are currently evaluating this guidance to determine the potential impact on our consolidated financial statements.

The FASB has issued Accounting Standards Update No. 2016-18, Statement of Cash Flows: Restricted Cash, or ASU 2016-18, that will require entities to show the changes in the total of cash, cash equivalents, restricted cash and restricted cash equivalents in the statement of cash flows. As a result, entities will no longer present transfers between cash and cash equivalents and restricted cash and restricted cash equivalents in the statement of cash flows. When cash, cash equivalents, restricted cash and restricted cash equivalents are presented in more than one line item on the balance sheet, the new guidance requires a reconciliation of the totals in the statement of cash flows to the related captions in the balance sheet. This reconciliation can be presented either on the face of the statement of cash flows or in the notes to the financial statements. Entities will also have to disclose the nature of their restricted cash and restricted cash equivalent balances. We are required to adopt ASU 2016-18 at the beginning of our first quarter of fiscal 2018, with early adoption permitted. We will be required to apply the guidance retrospectively when adopted, and provide the relevant disclosures in the first interim and annual periods in which we adopt the guidance. We will not adopt ASU 2016-18 early, but do expect to be impacted by the new presentation and disclosure requirements required by ASU 2016-18 due to our restricted and unrestricted cash balances.

The FASB has issued Accounting Standards Update No. 2017-07, Compensation-Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, or ASU 2017-07. The amendments in this update require that an employer disaggregate the service cost component from the other components of net benefit cost. The amendments also provide explicit guidance on how to present the service cost component in the same line item as other related compensation costs, and the other components of net benefit cost in the income statement outside of operating income. The guidance only allows the service cost component of net benefit cost to be eligible for capitalization. We are required to adopt ASU 2017-07 at the beginning of our first quarter of fiscal 2018, with early adoption permitted. We will be required to apply the guidance retrospectively when adopted, and provide the relevant disclosures in the first interim and annual periods in which we adopt the guidance. We will not adopt ASU 2017-07 early and we do not expect the adoption of this guidance to have a material impact on our consolidated financial statements within any accounting period presented.

9

3. | Acquisitions, Investments and Divestitures |

Pending Acquisition of Virtu BondPoint

On October 24, 2017, we entered into a definitive agreement to acquire 100% of Virtu BondPoint from Virtu Financial, Inc. for $400 million in cash. The transaction is expected to close in the first quarter of 2018, and the closing is subject to applicable regulatory reviews and approvals. Virtu BondPoint is a leading provider of electronic fixed income trading solutions for the buy-side and sell-side offering access to centralized liquidity and automated trade execution services through its alternative trading system, or ATS, linking more than 500 financial services firms.

Investment in Euroclear

On October 24, 2017, we acquired a 4.7% stake in Euroclear for €275 million ($326 million) in cash. Euroclear is a leading provider of post-trade services, including settlement, central securities depositories and related services for cross-border transactions across asset classes.

Acquisition of Global Research Division’s Index Business from Bank of America Merrill Lynch, or BofAML

On October 20, 2017, we acquired BofAML's Global Research division’s index business. BofAML indices are the second largest group of fixed income indices as measured by assets under management, or AUM, globally. The AUM benchmarked against our combined fixed income indices is nearly $1 trillion, and the indices have been re-branded as the ICE BofAML indices.

Purchase of Minority Interests

For consolidated subsidiaries in which our ownership is less than 100% and for which we have control over the assets, liabilities and management of the entity, the outside stockholders’ interests are shown as non-controlling interest in our consolidated financial statements. As of December 31, 2016, non-controlling interest included those related to the operating results of our CDS clearing subsidiaries in which non-ICE limited partners held a 42.5% net profit sharing interest; ICE Endex in which Gasunie held a 21% ownership interest; and ICE Clear Netherlands in which ABN AMRO Clearing Bank N.V. held a 25% ownership interest. For both ICE Endex and ICE Clear Netherlands, in addition to the non-controlling interest reported in the consolidated statements of income, we reported redeemable non-controlling interest in the consolidated balance sheets which represents the minority interest redemption fair value for each company.

During June 2017, we purchased both Gasunie’s 21% minority ownership interest in ICE Endex and ABN AMRO Clearing Bank N.V.’s 25% minority ownership interest in ICE Clear Netherlands. Subsequent to these acquisitions, we own 100% of ICE Endex and ICE Clear Netherlands and will no longer include any non-controlling interest amounts for ICE Endex and ICE Clear Netherlands in our consolidated financial statements. During April 2017, we purchased 3.2% of the net profit sharing interest in our CDS clearing subsidiaries from a non-ICE limited partner and the remaining non-ICE limited partners hold a 39.3% net profit sharing interest as of September 30, 2017.

NYSE Governance Services Divestiture

On June 1, 2017, we sold NYSE Governance Services to Marlin Heritage, L.P. NYSE Governance Services provides governance and compliance analytics and education solutions for organizations and their boards of directors through dynamic learning solutions. We recognized a net loss of $6 million on the sale of NYSE Governance Services, which was recorded as amortization expense within our data and listings segment in the accompanying consolidated statements of income for the nine months ended September 30, 2017.

TMX Atrium Acquisition

On May 1, 2017, we acquired 100% of TMX Atrium, a global extranet and wireless services business, from TMX Group. TMX Atrium provides low-latency access to markets and market data across 12 countries, more than 30 major trading venues, and ultra-low latency wireless connectivity to access markets and market data in the Toronto, New Jersey and Chicago metro areas. The wireless assets consist of microwave and millimeter networks that transport market data and provide private bandwidth. TMX Atrium is now part of ICE Data Services and is being integrated with our connectivity services.

Interactive Data Managed Solutions (IDMS) Divestiture

On March 31, 2017, we sold Interactive Data Managed Solutions, or IDMS, a unit of Interactive Data, to FactSet. IDMS is a managed solutions and portal provider for the global wealth management industry. There was no gain or loss recognized on the sale of IDMS.

10

National Stock Exchange Acquisition

On January 31, 2017, we acquired 100% of National Stock Exchange, Inc., now named NYSE National. The acquisition gives the NYSE Group a fourth U.S. exchange license. NYSE National is distinct from NYSE Group’s three listings exchanges because NYSE National will only be a trading venue and will not be a listings market. NYSE Group’s three listings exchanges, NYSE, NYSE American (NYSE American was formerly known as NYSE MKT) and NYSE Arca, have unique market models designed for corporate and exchange traded fund, or ETF, issuers. After closing the transaction, NYSE National ceased operations on February 1, 2017. We will engage with NYSE National members, buy-side participants and retail brokerage firms before finalizing operational plans for NYSE National’s re-launch, which is expected to occur in 2018.

4. | Goodwill and Other Intangible Assets |

The following is a summary of the activity in the goodwill balance for the nine months ended September 30, 2017 (in millions):

Goodwill balance at December 31, 2016 | $ | 12,291 | |

Acquisitions (divestitures), net | 1 | ||

Foreign currency translation | 57 | ||

Reclassification to held for sale | (331 | ) | |

Other activity, net | (2 | ) | |

Goodwill balance at September 30, 2017 | $ | 12,016 | |

The following is a summary of the activity in the other intangible assets balance for the nine months ended September 30, 2017 (in millions):

Other intangible assets balance at December 31, 2016 | $ | 10,420 | |

Acquisitions (divestitures), net | 5 | ||

Foreign currency translation | 60 | ||

Reclassification to held for sale | (214 | ) | |

Other activity, net | (9 | ) | |

Amortization of other intangible assets | (206 | ) | |

Other intangible assets balance at September 30, 2017 | $ | 10,056 | |

We completed the acquisitions of TMX Atrium and NYSE National and sold NYSE Governance Services and IDMS during the nine months ended September 30, 2017 (Note 3). We reclassified the net assets of Trayport, including the related goodwill and other intangible assets, and they are being recorded as held for sale as of September 30, 2017 (Note 10). The foreign currency translation adjustments in the tables above result from a portion of our goodwill and other intangible assets being held at our U.K., EU and Canadian subsidiaries, some of whose functional currencies are not the U.S. dollar. The changes in other activity, net in the tables above primarily relate to adjustments to the fair value of the net tangible and identifiable intangible assets and liabilities relating to the acquisitions, with a corresponding adjustment to goodwill.

In August 2016, we sold certain of Creditex’s U.S. voice brokerage operations to Tullett Prebon. During the third quarter of 2016, we discontinued Creditex’s U.K. voice brokerage operations. We continue to operate Creditex’s electronically traded markets and systems, post-trade connectivity platforms and intellectual property. Based on an analysis of these factors, it was determined that the carrying value of the Creditex customer relationship intangible asset was not fully recoverable and an impairment of the asset was recorded in September 2016 for $33 million based on a discounted cash flow calculation. The impairment was recorded as amortization expense within our trading and clearing segment in the accompanying consolidated statements of income for the nine and three months ended September 30, 2016.

Other than the Creditex customer relationship intangible asset impairment discussed above, we did not recognize any impairment losses on goodwill or other intangible assets during the nine and three months ended September 30, 2017 and 2016.

5. | Deferred Revenue |

Deferred revenue represents cash received that is yet to be recognized as revenue. Total deferred revenue was $366 million as of September 30, 2017, including $228 million in current deferred revenue and $138 million in non-current deferred revenue. The

11

changes in our deferred revenue during the nine months ended September 30, 2017 are as follows (in millions):

Annual Listings Revenue | Original Listings Revenues | Other Listings Revenues | Data Services and Other Revenues | Total | |||||||||||||||

Deferred revenue balance at December 31, 2016 | $ | — | $ | 66 | $ | 83 | $ | 88 | $ | 237 | |||||||||

Additions | 367 | 17 | 49 | 345 | 778 | ||||||||||||||

Amortization | (276 | ) | (8 | ) | (31 | ) | (324 | ) | (639 | ) | |||||||||

Less NYSE Governance Services, IDMS and Trayport (Notes 3 and 10) | — | — | — | (10 | ) | (10 | ) | ||||||||||||

Deferred revenue balance at September 30, 2017 | $ | 91 | $ | 75 | $ | 101 | $ | 99 | $ | 366 | |||||||||

6. | Debt |

Our total debt, including short-term and long-term debt, consisted of the following as of September 30, 2017 and December 31, 2016 (in millions):

As of September 30, 2017 | As of December 31, 2016 | ||||||

Debt: | |||||||

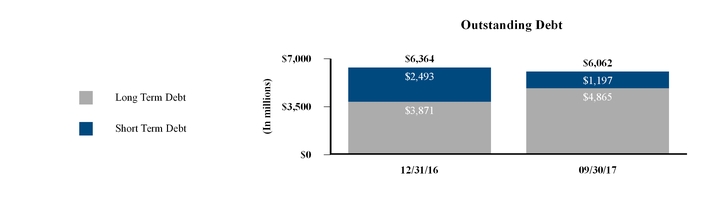

Commercial Paper | $ | 1,197 | $ | 1,642 | |||

NYSE Notes (2.00% senior unsecured notes due October 5, 2017) | — | 851 | |||||

Short-term debt | 1,197 | 2,493 | |||||

2018 Senior Notes (2.50% senior unsecured notes due October 15, 2018) | 599 | 598 | |||||

2020 Senior Notes (2.75% senior unsecured notes due December 1, 2020) | 1,243 | 1,242 | |||||

2022 Senior Notes (2.35% senior unsecured notes due September 15, 2022) | 495 | — | |||||

2023 Senior Notes (4.00% senior unsecured notes due October 15, 2023) | 791 | 790 | |||||

2025 Senior Notes (3.75% senior unsecured notes due December 1, 2025) | 1,242 | 1,241 | |||||

2027 Senior Notes (3.10% senior unsecured notes due September 15, 2027) | 495 | — | |||||

Long-term debt | 4,865 | 3,871 | |||||

Total debt | $ | 6,062 | $ | 6,364 | |||

Amended Credit Facility

We had previously entered into a $3.4 billion senior unsecured revolving credit facility, or the Credit Facility, which was scheduled to end on November 13, 2020. On August 18, 2017, we agreed with the lenders, amongst other items, to extend the maturity date to August 18, 2022, herein referred to as the Amended Credit Facility. The Amended Credit Facility includes an option for us to propose an increase in the aggregate amount available for borrowing by up to $975 million, subject to the consent of the lenders funding the increase and certain other conditions. The commitments available under the Amended Credit Facility are scheduled to reduce to $3.2 billion on November 13, 2020.

Other amendments within the Amended Credit Facility include, but are not limited to, (i) eliminating the step-up in the commitment fee ratings-based grid that was scheduled to take effect in April 2019, (ii) removing ICE Europe Parent Limited as a party to the credit agreement, (iii) removing the guaranty by ICE in respect of ICE Europe Parent Limited, (iv) increasing the maximum leverage ratio to 3.50:1.00, and (v) up to two times, increasing the maximum leverage ratio from 3.50:1.00 to 4.00:1.00 for a period of one year following a material acquisition.

No amounts were outstanding under the Amended Credit Facility as of September 30, 2017. We incurred debt issuance costs of $5 million relating to the Amended Credit Facility and they are presented in the accompanying consolidated balance sheet as other non-current assets and will be amortized over the life of the Amended Credit Facility.

Of the $3.4 billion that is currently available for borrowing under the Amended Credit Facility, $1.2 billion is required to back-stop the amount outstanding under our Commercial Paper Program as of September 30, 2017. The amount required to back-stop the amounts outstanding under the Commercial Paper Program will fluctuate as we increase or decrease our commercial paper borrowings. The remaining $2.2 billion available under the Amended Credit Facility as of September 30, 2017 is available to us to use for working capital and general corporate purposes including, but not limited to, acting as a back-stop to future increases in the amounts outstanding under the Commercial Paper Program.

12

Senior Notes

On August 17, 2017, we issued $1.0 billion in aggregate senior notes, including $500 million principal amount of 2.35% senior unsecured fixed rate notes due September 2022, or the 2022 Senior Notes, and $500 million principal amount of 3.10% senior unsecured fixed rate notes due September 2027, or the 2027 Senior Notes. We used the majority of the net proceeds from the 2022 Senior Notes and 2027 Senior Notes offering to fund the redemption of the NYSE Notes.

We incurred debt issuance costs of $8 million relating to the issuance of the 2022 Senior Notes and the 2027 Senior Notes and they are presented in the accompanying consolidated balance sheet as a deduction from the carrying amount of the related debt liability and will be amortized over the life of the 2022 Senior Notes and the 2027 Senior Notes. The 2022 Senior Notes and 2027 Senior Notes contain affirmative and negative covenants, including, but not limited to, certain redemption rights, limitations on liens and indebtedness and limitations on certain mergers, sales, dispositions and lease-back transactions.

Commercial Paper Program

We have entered into a U.S. dollar commercial paper program, or the Commercial Paper Program. Our Commercial Paper Program is currently backed by the borrowing capacity available under the Amended Credit Facility, equal to the amount of the commercial paper that is issued and outstanding at any given point in time. The effective interest rate of commercial paper issuances does not materially differ from short term interest rates (such as USD LIBOR). The fluctuation of these rates due to market conditions may impact our interest expense.

Commercial paper notes of $1.2 billion with original maturities ranging from 2 to 75 days were outstanding as of September 30, 2017 under our Commercial Paper Program. As of September 30, 2017, the weighted average interest rate on the $1.2 billion outstanding under our Commercial Paper Program was 1.23% per annum, with a weighted average maturity of 29 days. We repaid $445 million of the amounts outstanding under the Commercial Paper Program during the nine months ended September 30, 2017 primarily using net cash proceeds received from the sale of our investment in Cetip (Note 11) and cash flows from operations.

NYSE Notes

The $850 million, 2.00% senior unsecured fixed rate NYSE Notes were due in October 2017. We paid off the NYSE Notes in September 2017 using the majority of the proceeds from the 2022 Senior Notes and 2027 Senior Notes offering.

We previously provided condensed consolidating financial statements for Intercontinental Exchange, Inc., or ICE (Parent), NYSE Holdings LLC and the subsidiary non-guarantors in a footnote to our consolidated financial statements. However, in connection with the NYSE Notes being paid off in September 2017, all guarantees between ICE and NYSE Holdings LLC were terminated and we are no longer required to include a condensed consolidating financial statements footnote in our quarterly and annual filings.

7. | Equity |

We currently sponsor employee and director stock option and restricted stock plans. Stock options and restricted stock are granted at the discretion of the compensation committee of the board of directors. All stock options and restricted stock awards are granted at an exercise price equal to the fair value of the common stock on the date of grant. The grant date fair value is based on the closing stock price on the date of grant. The fair value of the stock options and restricted stock on the date of grant is recognized as expense over the vesting period, net of estimated forfeitures. The non-cash compensation expenses recognized in our consolidated statements of income for stock options and restricted stock were $102 million and $90 million for the nine months ended September 30, 2017 and 2016, respectively, and $34 million and $30 million for the three months ended September 30, 2017 and 2016, respectively.

Stock Option Plans

The following is a summary of stock options for the nine months ended September 30, 2017:

Number of Options | Weighted Average Exercise Price per Option | |||||

Outstanding at December 31, 2016 | 3,878,705 | $ | 36.05 | |||

Granted | 730,913 | 57.34 | ||||

Exercised | (429,435 | ) | 26.38 | |||

Outstanding at September 30, 2017 | 4,180,183 | 40.77 | ||||

Details of stock options outstanding as of September 30, 2017 are as follows:

13

Number of Options | Weighted Average Exercise Price | Weighted Average Remaining Contractual Life (Years) | Aggregate Intrinsic Value (In millions) | |||||||||

Vested or expected to vest | 4,180,183 | $ | 40.77 | 6.7 | $ | 117 | ||||||

Exercisable | 3,022,120 | $ | 35.72 | 5.9 | $ | 100 | ||||||

The total intrinsic value of stock options exercised during the nine months ended September 30, 2017 and 2016 were $15 million and $15 million, respectively, and $8 million and $5 million for the three months ended September 30, 2017 and 2016, respectively. As of September 30, 2017, there were $10 million in total unrecognized compensation costs related to stock options. These costs are expected to be recognized over a weighted average period of 1.8 years as the stock options vest.

We use the Black-Scholes option pricing model for purposes of valuing stock option awards. During the nine months ended September 30, 2017 and 2016, we used the weighted-average assumptions in the table below to compute the value of all options for shares of common stock granted to employees:

Nine Months Ended September 30, | |||||||

Assumptions: | 2017 | 2016 | |||||

Risk-free interest rate | 1.84 | % | 1.51 | % | |||

Expected life in years | 5.0 | 5.0 | |||||

Expected volatility | 21 | % | 24 | % | |||

Expected dividend yield | 1.40 | % | 1.36 | % | |||

Estimated weighted-average fair value of options granted per share | $ | 10.50 | $ | 9.88 | |||

The risk-free interest rate is based on the zero-coupon U.S. Treasury yield curve in effect at the time of grant. The expected life computation is derived from historical exercise patterns and anticipated future patterns. Expected volatilities are based on historical volatility of our stock.

Restricted Stock Plans

In January 2017, we reserved a maximum of 1,534,218 restricted shares for potential issuance as performance-based restricted shares to certain of our employees. The number of shares that will ultimately be granted under this award will be based on our actual financial performance as compared to financial performance targets set by our board of directors and compensation committee for the year ending December 31, 2017, as well as our 2017 total shareholder return as compared to that of the S&P 500 Index. The maximum compensation expense to be recognized under these performance-based restricted shares is $85 million if the maximum financial performance target is met and all 1,534,218 shares vest. The compensation expense to be recognized under these performance-based restricted shares will be $42 million if the target financial performance is met, which would result in 767,109 shares vesting. We will recognize expense on an accelerated basis over the three-year vesting period based on our quarterly assessment of the probable 2017 actual financial performance as compared to the 2017 financial performance targets. As of September 30, 2017, we determined that it is probable that the financial performance level will be at target for 2017. Based on this assessment, we recorded non-cash compensation expense of $18 million and $6 million for the nine and three months ended September 30, 2017, respectively, related to these shares and the remaining $24 million in non-cash compensation expense will be recorded on an accelerated basis over the remaining vesting period, including $6 million of which will be recorded during the fourth quarter of 2017.

The following is a summary of the non-vested restricted shares for the nine months ended September 30, 2017:

Number of Restricted Stock Shares | Weighted Average Grant-Date Fair Value per Share | ||||

Non-vested at December 31, 2016 | 6,435,871 | $ | 45.33 | ||

Granted | 3,186,709 | 57.28 | |||

Vested | (3,412,678) | 44.59 | |||

Forfeited | (370,008) | 51.65 | |||

Non-vested at September 30, 2017 | 5,839,894 | 52.47 | |||

Restricted stock shares granted in the table above include both time-based and performance-based grants. Performance-based shares have been presented to reflect the actual shares to be issued based on the achievement of past performance targets. Non-vested performance-based restricted shares granted are presented in the table above at the target number of restricted shares that would vest if the performance targets are met. As of September 30, 2017, there were $171 million in total unrecognized compensation costs related to the time-based restricted stock and the performance-based restricted stock. These costs are expected to be recognized over a

14

weighted-average period of 1.6 years as the restricted stock vests. These unrecognized compensation costs assume that a target performance level will be met on the performance-based restricted shares granted in January 2017. During the nine months ended September 30, 2017 and 2016, the total fair value of restricted stock vested under all restricted stock plans was $199 million and $120 million, respectively.

Stock Repurchase Program

In August 2016, our board of directors approved an aggregate of $1.0 billion for future repurchases of our common stock with no fixed expiration date, subject to applicable laws and regulations. The shares repurchased are held in treasury stock. As of September 30, 2017, the remaining board authorization permits repurchases of up to $241 million of our common stock. In September 2017, our board of directors approved an aggregate of $1.2 billion for future repurchases of our common stock with no fixed expiration date that becomes effective as of January 1, 2018. We expect funding for any share repurchases to come from our operating cash flow or borrowings under our debt facilities or commercial paper program. Repurchases may be made from time to time on the open market, through established trading plans, in privately-negotiated transactions or otherwise, in accordance with all applicable securities laws, rules and regulations. We have entered into a Rule 10b5-1 trading plan, as authorized by our board of directors, to govern some or all of the repurchases of our shares of common stock. We may discontinue the stock repurchases at any time and may amend or terminate the Rule 10b5-1 trading plan at any time. The approval of our board of directors for the share repurchases does not obligate us to acquire any particular amount of our common stock. In addition, our board of directors may increase or decrease the amount of capacity we have for repurchases from time to time.

During the nine months ended September 30, 2017, we repurchased 11,469,042 shares of our outstanding common stock at a cost of $709 million, excluding shares withheld upon vesting of equity awards. These repurchases were completed on the open market and under our 10b5-1 trading plan. The timing and extent of future repurchases that are not made pursuant to a Rule 10b5-1 trading plan will be at our discretion and will depend upon many conditions. Our management periodically reviews whether or not to be active in repurchasing our stock. In making a determination regarding any stock repurchases, we consider multiple factors. The factors may include: overall stock market conditions, our common stock price movements, the remaining amount authorized for repurchases by our board of directors, the potential impact of a stock repurchase program on our corporate debt ratings, our expected free cash flow and working capital needs, our current and future planned strategic growth initiatives, and other potential uses of our cash and capital resources.

Dividends

During the nine months ended September 30, 2017 and 2016, we paid cash dividends per share of $0.60 and $0.51, respectively, for an aggregate payout of $358 million and $307 million, respectively. The declaration of dividends is subject to the discretion of our board of directors, and may be affected by various factors, including our future earnings, financial condition, capital requirements, levels of indebtedness, credit ratings and other considerations our board of directors deem relevant. Our board of directors has adopted a quarterly dividend declaration policy providing that the declaration of any dividends will be determined quarterly by the board or audit committee of the board of directors taking into account such factors as our evolving business model, prevailing business conditions and our financial results and capital requirements, without a predetermined annual net income payout ratio.

8. | Income Taxes |

Our effective tax rate was 29% and 27% for the nine months ended September 30, 2017 and 2016, respectively, and 33% and 21% for the three months ended September 30, 2017 and 2016, respectively. The effective tax rates for the nine and three months ended September 30, 2017 and 2016 were lower than the federal statutory rate primarily due to favorable foreign income tax rate differentials, deferred tax benefits as a result of a U.K. income tax rate reduction enacted in the third quarter of 2016, and tax benefits associated with a divestiture in the second quarter of 2017, partially offset by state income taxes including additional tax expense from an Illinois corporate income tax rate increase enacted in the third quarter of 2017. Favorable foreign income tax rate differentials result primarily from lower income tax rates in the U.K. and various other lower tax jurisdictions as compared to the income tax rates in the U.S.

The effective tax rate for the three months ended September 30, 2017 is higher than the effective tax rate for the comparable period in 2016 primarily because of deferred tax benefits from a U.K. corporate income tax reduction in the third quarter of 2016 and additional tax expense as a result of an Illinois corporate income tax rate increase enacted in the third quarter of 2017. The same U.K. and Illinois factors affect the effective tax rate comparison for the nine months ended September 30, 2017 and 2016. Additionally, the nine month effective tax rate difference is impacted by tax benefits associated with a divestiture during the second quarter of 2017, partially offset by an income tax expense increase due to a relatively higher U.S. mix of income.

Our non-U.S. subsidiaries had $4.3 billion in cumulative undistributed earnings as of September 30, 2017. This amount represents the post-income tax earnings under U.S. GAAP adjusted for previously taxed income. The earnings from our non-U.S. subsidiaries are considered to be indefinitely reinvested. Accordingly, no provision for U.S. federal and state income taxes has been made in the accompanying consolidated financial statements. Further, a determination of the unrecognized deferred tax liability is not

15

practicable. Any future distribution by way of dividend of these non-U.S. earnings may subject us to both U.S. federal and state income taxes, as adjusted for non-U.S. tax credits, and withholding taxes payable to various non-U.S. countries.

9. | Clearing Organizations |

We operate regulated central counterparty clearing houses for the settlement and clearance of derivative contracts. The clearing houses include ICE Clear Europe, ICE Clear Credit, ICE Clear US, ICE Clear Canada, ICE Clear Netherlands and ICE Clear Singapore (referred to herein collectively as the “ICE Clearing Houses”).

• | ICE Clear Europe performs the clearing and settlement for all futures and options contracts traded through ICE Futures Europe and ICE Endex, for energy futures and options contracts trading through ICE Futures U.S., and for CDS contracts submitted for clearing in Europe. |

• | ICE Clear Credit performs the clearing and settlement for CDS contracts submitted for clearing in North America. |

• | ICE Clear US performs the clearing and settlement of agricultural, metals, currencies and financial futures and options contracts traded through ICE Futures U.S. |

• | ICE Clear Canada performs the clearing and settlement for all futures and options contracts traded through ICE Futures Canada. |

• | ICE Clear Netherlands offers clearing for equity options. |

• | ICE Clear Singapore performs the clearing and settlement for all futures and options contracts traded through ICE Futures Singapore. |

Each of the ICE Clearing Houses requires all clearing members to maintain cash on deposit or pledge certain assets, which may include government obligations, non-government obligations or gold to guarantee performance of the clearing members’ open positions. Such amounts in total are known as “original margin”. The ICE Clearing Houses may make intraday original margin calls in circumstances where market conditions require additional protection. The daily profits and losses from and to the ICE Clearing Houses due to the marking-to-market of open contracts are known as “variation margin”. The ICE Clearing Houses mark all outstanding contracts to market, and therefore pay and collect variation margin, at least once daily, and in some cases multiple times throughout the day. Marking-to-market allows the ICE Clearing Houses to identify any clearing members that may be unable to satisfy the financial obligations resulting from changes in the prices of their open contracts before those financial obligations become exceptionally large and jeopardize the ability of the ICE Clearing Houses to ensure financial performance of clearing members’ open positions.

Each of the ICE Clearing Houses requires that each clearing member make deposits into a fund known as a “guaranty fund”, which is maintained by the relevant ICE Clearing House. These amounts serve to secure the obligations of a clearing member to the ICE Clearing House to which it has made the guaranty fund deposit and may be used to cover losses sustained by the respective ICE Clearing House in the event of a default of a clearing member.

The ICE Clearing Houses seek to reduce their exposure through a risk management program that includes initial and ongoing financial standards for clearing member admission and continued membership, original and variation margin requirements, and mandatory deposits to the guaranty fund. The amounts that the clearing members are required to maintain in the original margin and guaranty fund accounts are determined by standardized parameters established by the risk management departments and reviewed by the risk committees and the boards of directors of each of the ICE Clearing Houses and may fluctuate over time. As of September 30, 2017 and December 31, 2016, the ICE Clearing Houses have received or have been pledged $91.6 billion and $95.7 billion, respectively, in cash and non-cash collateral in original margin and guaranty fund deposits to cover price movements of underlying contracts for both periods. The ICE Clearing Houses also have powers of assessment that provide the ability to collect additional funds from their clearing members to cover a defaulting member’s remaining obligations up to the limits established under the respective rules of each ICE Clearing House.

Should a particular clearing member fail to deposit original margin, or fail to make a variation margin payment, when and as required, the relevant ICE Clearing House may liquidate or hedge the clearing member’s open positions and use the clearing member’s original margin and guaranty fund deposits to make up any amount owed. In the event that those deposits are not sufficient to pay the amount owed in full, the ICE Clearing Houses may utilize the respective guaranty fund deposits of their respective clearing members on a pro-rata basis for that purpose.

We have contributed cash of $150 million, $50 million and $50 million to the guaranty funds of ICE Clear Europe, ICE Clear Credit and ICE Clear US, respectively, as of September 30, 2017, and such amounts are at risk and could be used in the event of a clearing member default where the amount of the defaulting clearing member’s original margin and guaranty fund deposits are insufficient. We have also contributed $4 million in cash in total to the guaranty funds of ICE Clear Canada, ICE Clear Netherlands and ICE Clear Singapore. The $254 million combined contributions to the guaranty funds as of September 30, 2017 and December 31, 2016 are included in long-term restricted cash in the accompanying consolidated balance sheets.

16

As of September 30, 2017, our cash margin deposits and guaranty fund were as follows for the ICE Clearing Houses (in millions):

ICE Clear Europe | ICE Clear Credit | ICE Clear US | Other ICE Clearing Houses | Total | |||||||||||||||

Original margin | $ | 20,686 | $ | 21,911 | $ | 4,004 | $ | 103 | $ | 46,704 | |||||||||

Guaranty fund | 3,025 | 2,345 | 305 | 22 | 5,697 | ||||||||||||||

Total | $ | 23,711 | $ | 24,256 | $ | 4,309 | $ | 125 | $ | 52,401 | |||||||||

As of December 31, 2016, our cash margin deposits and guaranty fund were as follows for the ICE Clearing Houses (in millions):

ICE Clear Europe | ICE Clear Credit | ICE Clear US | Other ICE Clearing Houses | Total | |||||||||||||||

Original margin | $ | 27,046 | $ | 16,833 | $ | 6,184 | $ | 107 | $ | 50,170 | |||||||||

Guaranty fund | 2,444 | 2,135 | 316 | 85 | 4,980 | ||||||||||||||

Total | $ | 29,490 | $ | 18,968 | $ | 6,500 | $ | 192 | $ | 55,150 | |||||||||

We have recorded these cash deposits in the accompanying consolidated balance sheets as current assets with corresponding current liabilities to the clearing members of the relevant ICE Clearing House. All cash and securities are available only to meet the financial obligations of that clearing member to the relevant ICE Clearing House. ICE Clear Europe, ICE Clear Credit, ICE Clear US, ICE Clear Canada, ICE Clear Netherlands and ICE Clear Singapore are separate legal entities and are not subject to the liabilities of the other ICE Clearing Houses or the obligations of the members of the other ICE Clearing Houses. The amount of these cash deposits may fluctuate due to the types of margin collateral choices available to clearing members and the change in the amount of deposits required. As a result, these assets and corresponding liabilities may vary significantly over time.

Of the cash held by the ICE Clearing Houses, as of September 30, 2017, $28.3 billion is secured in reverse repurchase agreements with primarily overnight maturities or direct investment in government securities. ICE Clear Credit, a systemically important financial market utility as designated by the Financial Stability Oversight Council, held $19.7 billion of its U.S. dollar cash in the guaranty fund and in original margin in cash accounts at the Federal Reserve Bank of Chicago as of September 30, 2017. During the quarter ended September 30, 2017, ICE Clear Europe established a Euro denominated account at the De Nederlandsche Bank, or DNB, the central bank of the Netherlands. This account provides the flexibility for ICE Clear Europe to place Euro denominated cash margin securely at a national bank, in particular during periods when liquidity in the Euro repo markets may temporarily become contracted, such as over a quarter or year end. As of September 30, 2017, ICE Clear Europe held $1.5 billion at DNB. The remaining cash deposits at the ICE Clearing Houses are held in demand deposit accounts at large, highly rated financial institutions and directly in U.S. Treasury securities with original maturities of less than 12 months. The carrying value of these securities approximates their fair value due to the short-term nature of the instruments and repurchase agreements.

In addition to the cash deposits for original margin and the guaranty fund, the ICE Clearing Houses have also received other assets from clearing members, which include government obligations, and may include other non-cash collateral such as certain agency and corporate debt or gold to mitigate credit risk. These assets are not reflected in the accompanying consolidated balance sheets as the risks and rewards of these assets remain with the clearing members unless the ICE Clearing Houses have sold or re-pledged the assets or in the event of a clearing member default, where the clearing member is no longer entitled to redeem the assets. Any income, gain or loss accrues to the clearing member. For certain non-cash deposits, the ICE Clearing Houses may impose discount or “haircut” rates to ensure adequate collateral levels to account for fluctuations in the market value of these deposits. As of September 30, 2017 and December 31, 2016, the assets pledged by the clearing members as original margin and guaranty fund deposits for each of the ICE Clearing Houses are detailed below (in millions):

As of September 30, 2017 | As of December 31, 2016 | ||||||||||||||||||||||||||||||

ICE Clear Europe | ICE Clear Credit | ICE Clear US | Other ICE Clearing Houses | ICE Clear Europe | ICE Clear Credit | ICE Clear US | Other ICE Clearing Houses | ||||||||||||||||||||||||

Original margin: | |||||||||||||||||||||||||||||||

Government securities at face value | $ | 24,611 | $ | 4,339 | $ | 9,738 | $ | 24 | $ | 22,961 | $ | 6,013 | $ | 10,542 | $ | 37 | |||||||||||||||

Other | — | — | — | — | — | — | — | 368 | |||||||||||||||||||||||

Total | $ | 24,611 | $ | 4,339 | $ | 9,738 | $ | 24 | $ | 22,961 | $ | 6,013 | $ | 10,542 | $ | 405 | |||||||||||||||

Guaranty fund: | |||||||||||||||||||||||||||||||

Government securities at face value | $ | 305 | $ | 42 | $ | 160 | $ | 2 | $ | 217 | $ | 178 | $ | 147 | $ | 40 | |||||||||||||||

17

10. | Held for Sale |

On December 11, 2015, we acquired 100% of Trayport in a stock transaction. The total purchase price was $620 million, comprised of 12.6 million shares of our common stock. Trayport is a software company that licenses its technology to serve exchanges, OTC brokers and traders to facilitate electronic and hybrid trade execution primarily in the energy markets.

The U.K. Competition and Markets Authority, or the CMA, undertook a review of our acquisition of Trayport under the merger control laws of the U.K. In October 2016, the CMA issued its findings and ordered a divestment of Trayport to remedy what the CMA determined to be a substantial lessening of competition. In November 2016, we filed an appeal with the Competition Appeal Tribunal, or the CAT, to challenge the CMA’s decision. In March 2017, the CAT upheld the CMA decision that we should divest Trayport. Following the CAT’s judgment, we asked for leave to appeal the CAT’s decision at the U.K. Court of Appeals. In May 2017, the U.K. Court of Appeals denied our request for leave to appeal. We are obligated to sell Trayport by January 2018.

The functional currency of Trayport is the pound sterling, as this is the currency in which Trayport operates. The $620 million in Trayport net assets were recorded on our December 11, 2015 opening balance sheet at a pound sterling/U.S. dollar exchange rate of 1.5218 (£407 million). Because our consolidated financial statements are presented in U.S. dollars, we must translate the Trayport net assets into U.S. dollars at the exchange rates in effect at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against the pound sterling will affect the value of the Trayport balance sheet, with gains or losses included in the cumulative translation adjustment account, a component of equity. As a result of the decrease in the pounds sterling/U.S. dollar exchange rate to 1.3398 as of September 30, 2017, the portion of our equity attributable to the Trayport net assets in accumulated other comprehensive loss from foreign currency translation was $74 million as of September 30, 2017.

As of June 30, 2017, we classified Trayport as held for sale and ceased depreciation and amortization of the property and equipment and other intangible assets (Note 2). As of September 30, 2017, the adjusted carrying value of Trayport’s net assets is $609 million, which is equal to the $535 million carrying value plus the $74 million in accumulated other comprehensive loss from foreign currency translation.

On October 27, 2017, we entered into a definitive agreement to sell Trayport to TMX Group for £550 million ($722 million based on the pounds sterling/U.S. dollar exchange rate of 1.3129 as of October 27, 2017). The proceeds of such sale will include a combination of cash and our acquisitions of Natural Gas Exchange, Inc., or NGX, and Shorcan Energy Brokers Inc., or Shorcan Energy, both wholly-owned subsidiaries of TMX Group. NGX, headquartered in Calgary, provides electronic trading, central counterparty clearing and data services to the North American natural gas, electricity and oil markets. Shorcan Energy offers brokerage services for the North American crude oil markets. If regulatory approval for the acquisitions of NGX and Shorcan Energy is not received within the required time to complete the sale of Trayport, then the sale of Trayport will proceed for cash consideration in the amount of £550 million and we would have one year from the signing date to close on the acquisitions of NGX and Shorcan Energy for cash consideration payable to TMX Group. We will recognize a gain on the closing of this transaction, equal to the gross proceeds received from TMX Group, less the adjusted carrying value and the costs to sell Trayport.

Trayport is included in our data and listings segment. The total assets held for sale as of September 30, 2017 were $595 million and were reclassified and are included in “prepaid expenses and other current assets” in our accompanying consolidated balance sheet and the total liabilities held for sale as of September 30, 2017 were $60 million and were reclassified and are included in “other current liabilities” in our accompanying consolidated balance sheet. The carrying amounts of the major classes of assets and liabilities of Trayport are as follows as of September 30, 2017 (in millions):

18

Assets held for sale: | |||

Cash and cash equivalents | $ | 5 | |

Goodwill | 341 | ||

Other intangibles, net | 220 | ||

Other current and non-current assets | 29 | ||

Total assets held for sale (included in prepaid expenses and other current assets) | $ | 595 | |

Liabilities held for sale: | |||

Deferred tax liabilities, net | $ | 39 | |

Other current and non-current liabilities | 21 | ||

Total liabilities held for sale (included in other current liabilities) | $ | 60 | |

Accumulated other comprehensive loss from foreign currency translation classified as held for sale in equity | $ | 74 | |

11. | Fair Value Measurements |

Our financial instruments consist primarily of cash and cash equivalents, short-term and long-term restricted cash and investments, short-term and long-term investments, customer accounts receivable, margin deposits and guaranty funds, cost and equity method investments, short-term and long-term debt and certain other short-term assets and liabilities. The fair value of our financial instruments are measured based on a three-level hierarchy:

• | Level 1 inputs — quoted prices for identical assets or liabilities in active markets. |

• | Level 2 inputs — observable inputs other than Level 1 inputs such as quoted prices for similar assets and liabilities in active markets or inputs other than quoted prices that are directly observable. |

• | Level 3 inputs — unobservable inputs supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

We use Level 1 inputs to determine fair value. The Level 1 assets consist of U.S. Treasury securities, equity and other securities listed in active markets, and investments in publicly traded mutual funds held for the purpose of providing future payments of the supplemental executive retirement and the supplemental executive savings plans.

Financial assets and liabilities recorded in the accompanying consolidated balance sheets as of September 30, 2017 and December 31, 2016 are classified in their entirety based on the lowest level of input that is significant to the asset or liability’s fair value measurement. Financial instruments measured at fair value on a recurring basis as of September 30, 2017 and December 31, 2016 are as follows (in millions):

As of September 30, 2017 | As of December 31, 2016 | ||||||||||||||||||||||

Level 1 | Level 2 and 3 | Total | Level 1 | Level 2 and 3 | Total | ||||||||||||||||||

Assets at fair value: | |||||||||||||||||||||||

Long-term investment in equity securities | $ | — | $ | — | $ | — | $ | 432 | $ | — | $ | 432 | |||||||||||

U.S. Treasury securities | 734 | — | 734 | 500 | — | 500 | |||||||||||||||||

Mutual Funds | 16 | — | 16 | 23 | — | 23 | |||||||||||||||||

Total assets at fair value | $ | 750 | $ | — | $ | 750 | $ | 955 | $ | — | $ | 955 | |||||||||||

As of September 30, 2017, the fair value of our $495 million 2027 Senior Notes was $498 million, the fair value of our $1.24 billion 2025 Senior Notes was $1.32 billion, the fair value of our $791 million 2023 Senior Notes was $851 million, the fair value of our $495 million 2022 Senior Notes was $499 million, the fair value of our $1.24 billion 2020 Senior Notes was $1.28 billion, and the fair value of our $599 million 2018 Senior Notes was $604 million. The fair values of these fixed rate notes were estimated using quoted market prices for these instruments. The fair value of our commercial paper approximates the carrying value since the rates of interest on this short-term debt approximate market rates as of September 30, 2017. All other financial instruments are determined to approximate carrying value due to the short period of time to their maturities.

Until March 29, 2017, we held a 12% ownership interest in Cetip, S.A., or Cetip, which we classified as an available-for-sale long-term investment. Cetip was recorded at its fair value using its quoted market price. Changes in the fair value of available-for-sale securities are reflected in accumulated other comprehensive income, and include the effects of both stock price and foreign currency

19

translation fluctuations. The unrealized holding gains and losses are excluded from earnings and reported in other comprehensive income until realized. Realized gains and losses, and declines in value deemed to be other-than-temporary, are recognized in earnings.