Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GARTNER INC | it-09302017x8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - GARTNER INC | it-09302017xex991.htm |

0 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Third Quarter 2017 Results

November 2, 2017

1 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Statements contained in this presentation regarding the growth and prospects of the business, the Company’s projected 2017 financial results, long-

term objectives and all other statements in this presentation other than recitation of historical facts are forward looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). Such forward looking statements involve known and unknown risks, uncertainties and other

factors; consequently, actual results may differ materially from those expressed or implied thereby.

Factors that could cause actual results to differ materially include, but are not limited to, the ability to achieve and effectively manage growth,

including the ability to integrate the CEB acquisition, other acquisitions and consummate acquisitions in the future; the ability to pay Gartner’s debt

obligations, which have increased substantially with the CEB acquisition; the ability to maintain and expand Gartner’s products and services; the

ability to expand or retain Gartner’s customer base; the ability to grow or sustain revenue from individual customers; the ability to attract and retain a

professional staff of research analysts and consultants upon whom Gartner is dependent; the ability to achieve continued customer renewals and

achieve new contract value, backlog and deferred revenue growth in light of competitive pressures; the ability to carry out Gartner’s strategic

initiatives and manage associated costs; the ability to successfully compete with existing competitors and potential new competitors; the ability to

enforce and protect our intellectual property rights; additional risks associated with international operations including foreign currency fluctuations;

the impact of restructuring and other charges on Gartner’s businesses and operations; general economic conditions; risks associated with the credit

worthiness and budget cuts of governments and agencies; and other risks listed from time to time in Gartner’s reports filed with the Securities and

Exchange Commission, including Gartner’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

The Company’s SEC filings can be found on Gartner’s website at investor.gartner.com and on the SEC’s website at www.sec.gov. Forward looking

statements included herein speak only as of November 2, 2017 and the Company disclaims any obligation to revise or update such statements to

reflect events or circumstances after this date or to reflect the occurrence of unanticipated events or circumstances.

In this presentation, we include “Combined” numbers that, for periods prior to our acquisition of CEB (unless expressly noted otherwise), reflect

numerical addition of the results of Gartner and CEB for each line item and do not include all the adjustments required with respect to the

presentation of pro forma financial information under GAAP and the rules and regulations of the SEC. Accordingly, these “Combined” numbers are

non-GAAP, but are provided because Gartner believes they are useful in comparing performance of Gartner following the CEB acquisition with

performance of Gartner and CEB independently prior to Gartner’s acquisition of CEB. These Combined numbers should be read together with the

historical financial statements of Gartner and CEB included in their respective quarterly reports on Form 10-Q and annual reports on Form 10-K, and

the pro forma financial statements included in Exhibit 99.1 to Gartner’s Current Report on Form 8-K filed with the SEC on April 6, 2017 and footnote

2 to Gartner’s Current Report on Form 10-Q for the period ended September 30, 2017.

References in this presentation to "Traditional Gartner" operating results and business measurements refer to Gartner excluding CEB.

Disclaimer & Explanatory Note

2 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Third Quarter 2017: Highlights

Traditional Gartner Total FX Neutral CV

Growth of 15%

y/y improvements in both client and wallet

retention metrics with strong productivity growth

Adjusted EBITDA of $149M

Combined Free Cash Flow Conversion

Rate of 139%

on a comparable basis

Adjusted Earnings Per Share of $0.65

above the high end of guidance range

Total Combined Adjusted Revenue

Growth of 11%

15% y/y FX neutral growth for traditional

Gartner business

Combined Free Cash Flow Growth of 14%

3 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

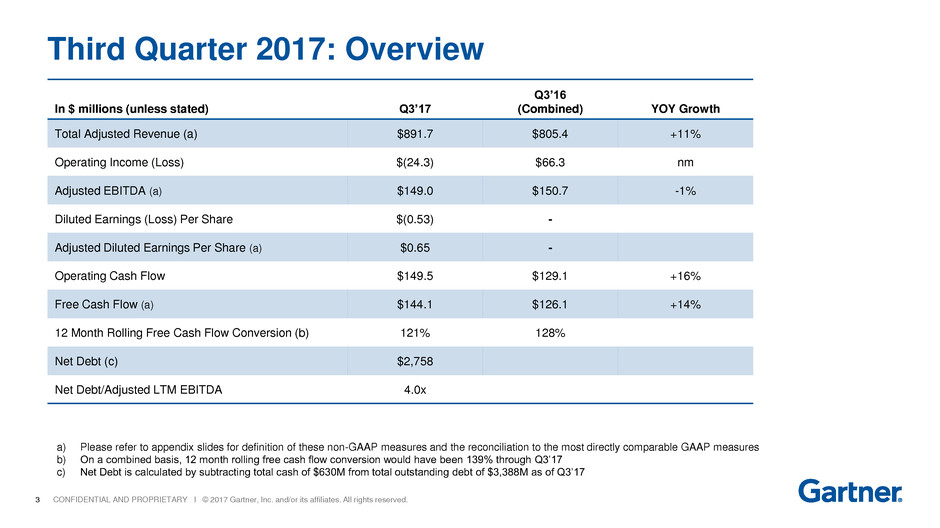

In $ millions (unless stated) Q3’17

Q3’16

(Combined) YOY Growth

Total Adjusted Revenue (a) $891.7 $805.4 +11%

Operating Income (Loss) $(24.3) $66.3 nm

Adjusted EBITDA (a) $149.0 $150.7 -1%

Diluted Earnings (Loss) Per Share $(0.53) -

Adjusted Diluted Earnings Per Share (a) $0.65 -

Operating Cash Flow $149.5 $129.1 +16%

Free Cash Flow (a) $144.1 $126.1 +14%

12 Month Rolling Free Cash Flow Conversion (b) 121% 128%

Net Debt (c) $2,758

Net Debt/Adjusted LTM EBITDA 4.0x

Third Quarter 2017: Overview

a) Please refer to appendix slides for definition of these non-GAAP measures and the reconciliation to the most directly comparable GAAP measures

b) On a combined basis, 12 month rolling free cash flow conversion would have been 139% through Q3’17

c) Net Debt is calculated by subtracting total cash of $630M from total outstanding debt of $3,388M as of Q3’17

4 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

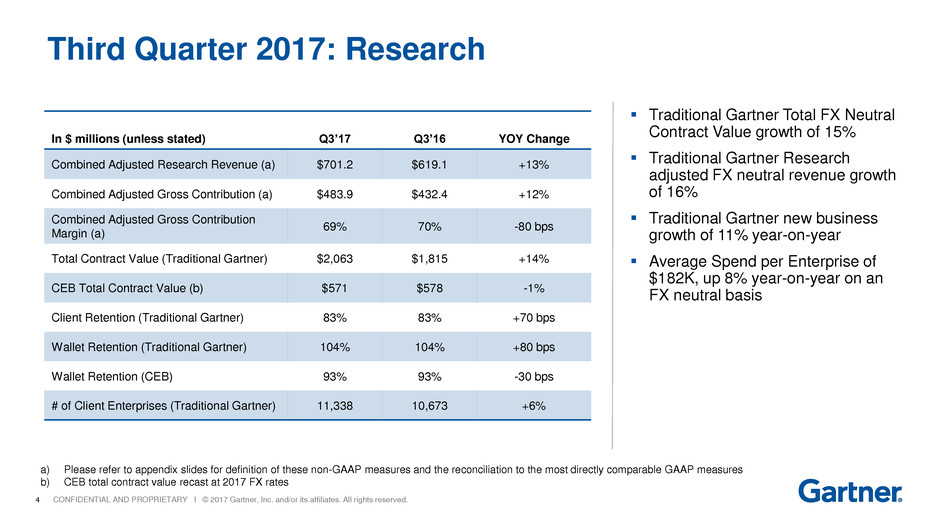

In $ millions (unless stated) Q3’17 Q3’16 YOY Change

Combined Adjusted Research Revenue (a) $701.2 $619.1 +13%

Combined Adjusted Gross Contribution (a) $483.9 $432.4 +12%

Combined Adjusted Gross Contribution

Margin (a)

69% 70% -80 bps

Total Contract Value (Traditional Gartner) $2,063 $1,815 +14%

CEB Total Contract Value (b) $571 $578 -1%

Client Retention (Traditional Gartner) 83% 83% +70 bps

Wallet Retention (Traditional Gartner) 104% 104% +80 bps

Wallet Retention (CEB) 93% 93% -30 bps

# of Client Enterprises (Traditional Gartner) 11,338 10,673 +6%

Third Quarter 2017: Research

Traditional Gartner Total FX Neutral

Contract Value growth of 15%

Traditional Gartner Research

adjusted FX neutral revenue growth

of 16%

Traditional Gartner new business

growth of 11% year-on-year

Average Spend per Enterprise of

$182K, up 8% year-on-year on an

FX neutral basis

a) Please refer to appendix slides for definition of these non-GAAP measures and the reconciliation to the most directly comparable GAAP measures

b) CEB total contract value recast at 2017 FX rates

5 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

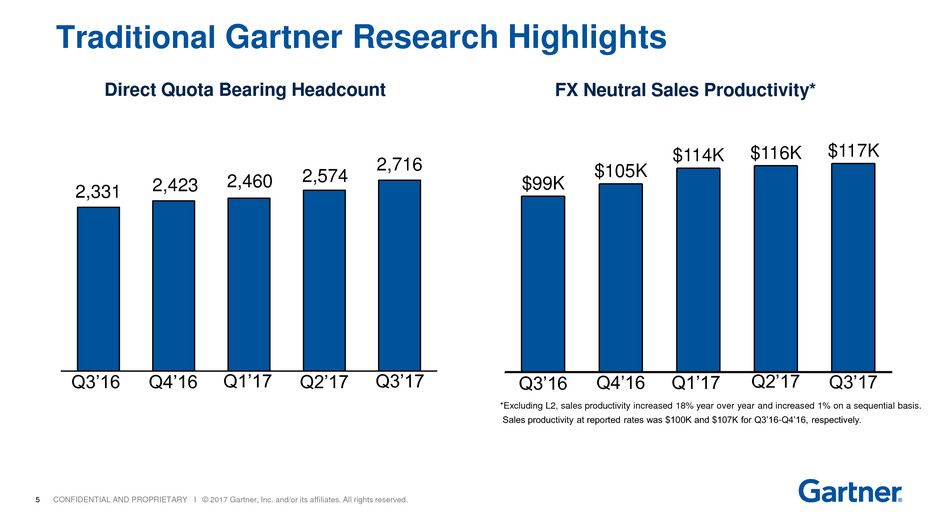

Traditional Gartner Research Highlights

Direct Quota Bearing Headcount FX Neutral Sales Productivity*

*Excluding L2, sales productivity increased 18% year over year and increased 1% on a sequential basis.

Sales productivity at reported rates was $100K and $107K for Q3’16-Q4’16, respectively.

Q3’17Q3’16 Q4’16 Q2’17Q1’17

2,331 2,423

2,460 2,574

2,716

Q2’17Q1’17 Q3’17Q4’16Q3’16

$116K$114K

$105K

$99K

$117K

6 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

In $ millions (unless stated) Q3'17

Q3'16

(Combined) YOY Growth

Adjusted Events Revenue (a) $45.1 $36.2 +25%

Adjusted Gross Contribution (a) $16.2 $12.8 +27%

Adjusted Contribution Margin (a) 36% 35% +40 bps

Number of Events (b) 17 16 -

Events Attendees 10,640 8,198 +30%

Third Quarter 2017: Events

a) Please refer to appendix slides for definition of these non-GAAP measures and the reconciliation to the most directly comparable GAAP measures

b) Includes Traditional Gartner and CEB destination events

On a same-events basis, Traditional

Gartner Event business adjusted

revenues increased 18% and 15%

year-on-year in Q3 2017 on a

reported and FX neutral basis,

respectively

Traditional Gartner Events held 16

events in Q3 2017, with 21% year-

on-year increase in same event

attendees

CEB held one destination event in

Q3 2017 (ReimagineHR)

7 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

In $ millions (unless stated) Q3'17

Q3'16

(Combined) YOY Change

Adjusted Consulting Revenue (a) $72.1 $73.7 -2%

Adjusted Gross Contribution (a) $16.2 $18.2 -11%

Adjusted Contribution Margin (a) 22% 25% -230 bps

Quarterly Utilization Rate 61% 63% -150 bps

Billable Headcount 682 630 +8%

Avg. Annualized Rev. per Billable Headcount

($ Thousands)

$355 $368 -4%

Third Quarter 2017: Consulting

134128125123115

Q2’17Q1'17Q4'16Q3'16

+17%

Q3’17

9191898990

Q2’17Q1’17Q4’16Q3’16 Q3’17

+2%

Managing Partners Consulting Backlog* ($M)

* No longer includes backlog associated with Strategic Advisory Services (SAS)

Continued investment in Managing

Partners, up 17% compared to

Q3 2016

Backlog increased by 3% year-on-

year on an FX-neutral basis in Q3

2017

Backlog represents approximately

4 months of forward coverage, in

line with operational target

a) Please refer to appendix slides for definition of these non-GAAP measures and the reconciliation to the most directly comparable GAAP measures

8 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

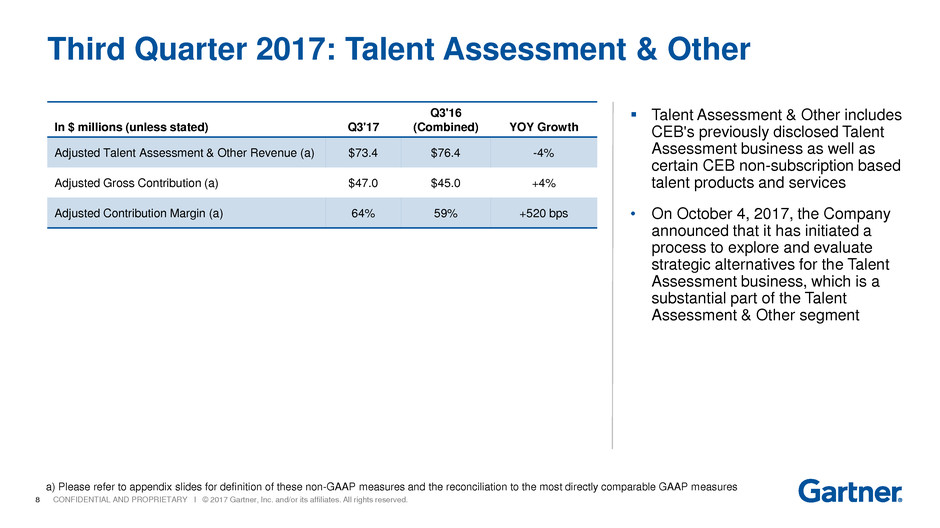

In $ millions (unless stated) Q3'17

Q3'16

(Combined) YOY Growth

Adjusted Talent Assessment & Other Revenue (a) $73.4 $76.4 -4%

Adjusted Gross Contribution (a) $47.0 $45.0 +4%

Adjusted Contribution Margin (a) 64% 59% +520 bps

Third Quarter 2017: Talent Assessment & Other

Talent Assessment & Other includes

CEB's previously disclosed Talent

Assessment business as well as

certain CEB non-subscription based

talent products and services

• On October 4, 2017, the Company

announced that it has initiated a

process to explore and evaluate

strategic alternatives for the Talent

Assessment business, which is a

substantial part of the Talent

Assessment & Other segment

a) Please refer to appendix slides for definition of these non-GAAP measures and the reconciliation to the most directly comparable GAAP measures

9 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Third Quarter 2017: Adjusted Earnings Per Share(a)

In $ thousands, except per share amounts

Three Months Ended

September 30, 2017

Net Income (Loss) $(48,180)

Acquisition adjustments, net of tax effect:

Amortization of acquired intangibles (b) $51,130

Amortization of pre-acquisition deferred revenues (c) $63,655

Acquisition and integration charges and other nonrecurring items (d) (e) $31,282

Tax impact of adjustments (f) $(38,371)

Adjusted net income $59,516

Adjusted diluted earnings per share (g): $0.65

Weighted average shares outstanding:

Diluted (in millions) 92.0

a) Adjusted earnings per share represents GAAP diluted earnings per share adjusted for the per share impact of certain items directly-related to acquisitions and other items

b) Consists of non-cash amortization charges from acquired intangibles

c) Consists of the amortization of non-cash fair value adjustments on pre-acquisition deferred revenues. The majority of the pre-acquisition deferred revenue is recognized ratably over the remaining period of the underlying revenue

contract.

d) Consists of incremental and directly-related charges related to acquisitions and other non-recurring items

e) Includes the amortization and write-off of deferred financing fees for both the three and nine months ended September 30, 2017 which is recorded in Interest expense, net in the Consolidated Statement of Operations and in the

Adjusted EPS table presented above

f) The effective tax rate was 26% for the three months ended September 30, 2017

g) The adjusted diluted EPS is calculated based on 92.0 million shares for the three months ended September 30, 2017

10 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

In $ millions Q3'17

Q3'16

(Combined) YOY Change

Adjusted EBITDA $149.0 $150.7 -1%

Operating Cash Flow $149.5 $129.1 +16%

- Capital Expenditures $(34.0) $(16.0)

+ Cash Acquisition and

Integration Payments

$28.5 $13.0

= Free Cash Flow $144.1 $126.1 +14%

Free Cash Flow Conversion* 121% 128%

Third Quarter 2017: Cash Flow Highlights

*On a combined basis, 12 month rolling free cash flow conversion would have been 139% through Q3’17

On a comparable basis, Q3 2017

operating cash flow growth was 16%

year-on-year, driven by the strong

performance of traditional Gartner

research in Q3 2017

On a comparable basis, free cash

flow increased by 14% year-on-year

driven by higher operating cash flow

Our business model continues to

convert Free Cash Flow well in

excess of Adjusted Net Income

11 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

$745 $703 $1,658

$3,468 $3,388

$(466) $(474)

$(1,228)

$(589) $(630)

3Q16 4Q16 1Q17 2Q17 3Q17

Total Debt Cash

Net Debt ($M)

0.7x

0.5x

0.9x

4.1x 4.0x

3Q16 4Q16 1Q17 2Q17 3Q17

Net Debt* / EBITDA Ratio

Third Quarter 2017: Balance Sheet and Capital Structure

$279 $229

$430

*Q3’17 Net Debt Leverage Ratio calculated using LTM of Adjusted EBITDA of $692.7M

Revolver capacity was $534M as of the end of Q3’17

65% of gross debt has fixed interest rates

$2,758$2,879

12 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Fiscal Year 2017

Outlook

13 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Updated 2017 Guidance

In $ millions, except per share amounts Updated 2017 Guidance Range*

Research revenue $2,455 - $2,480

Consulting revenue $320 - $335

Events revenue $323 - $338

Talent Assessment & Other $159 - $174

Total Revenue (GAAP) $3,257 - $3,327

Deferred Revenue Fair Value Adjustment $203 - $203

Total Adjusted Revenue $3,460 - $3,530

Operating Income $14 - $39

Adjusted EBITDA $685 - $710

Diluted Earnings (Loss) Per Share (GAAP) $(0.85) - $(0.65)

Adjusted Diluted Earnings Per Share $3.39 - $3.50

Fully Diluted Number of Shares 89.9 - 90.5

Operating Cash Flow $335 - $345

Acquisition and Integration Payments $115 - $125

Capital Expenditures $(115) - $(125)

Free Cash Flow $335 - $345

*2017 guidance is based on 12 months of traditional Gartner results plus 9 months of CEB results

14 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

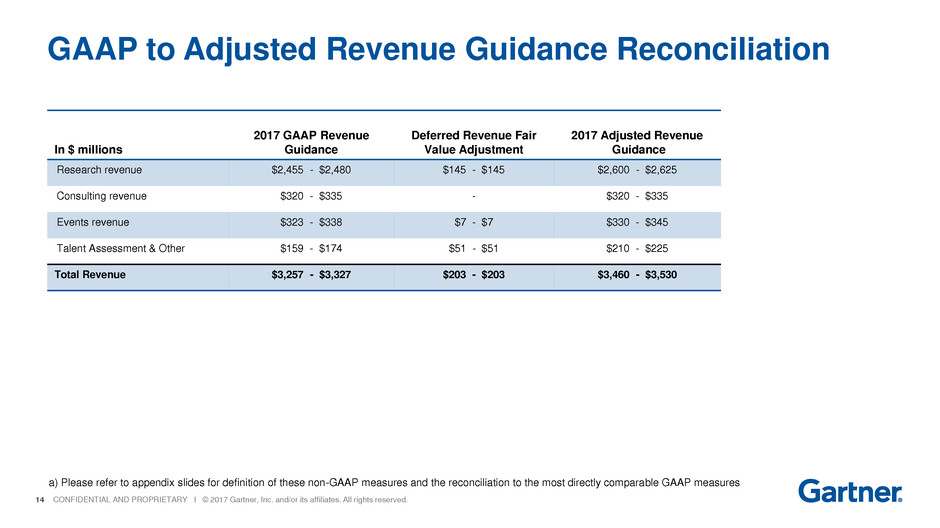

GAAP to Adjusted Revenue Guidance Reconciliation

In $ millions

2017 GAAP Revenue

Guidance

Deferred Revenue Fair

Value Adjustment

2017 Adjusted Revenue

Guidance

Research revenue $2,455 - $2,480 $145 - $145 $2,600 - $2,625

Consulting revenue $320 - $335 - $320 - $335

Events revenue $323 - $338 $7 - $7 $330 - $345

Talent Assessment & Other $159 - $174 $51 - $51 $210 - $225

Total Revenue $3,257 - $3,327 $203 - $203 $3,460 - $3,530

a) Please refer to appendix slides for definition of these non-GAAP measures and the reconciliation to the most directly comparable GAAP measures

15 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

$0.31

$(1.59)

$0.94

$1.49

Reconciliation of 2017 Adjusted to GAAP EPS Outlook

~$(1.29)

~$(1.38)

~$(1.53)

$3.39 – $3.50

**Adjusting items calculated at the midpoint of guidance range

Amortization of

Pre-Acquisition

Deferred Revenue

Adjusted EPS

Guidance

Range

Amortization

of Acquired

Intangibles Acquisition and

Integration and Other

Non-Recurring Items

$(0.85) – $(0.65)

GAAP EPS

Guidance Range

16 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Appendix

17 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

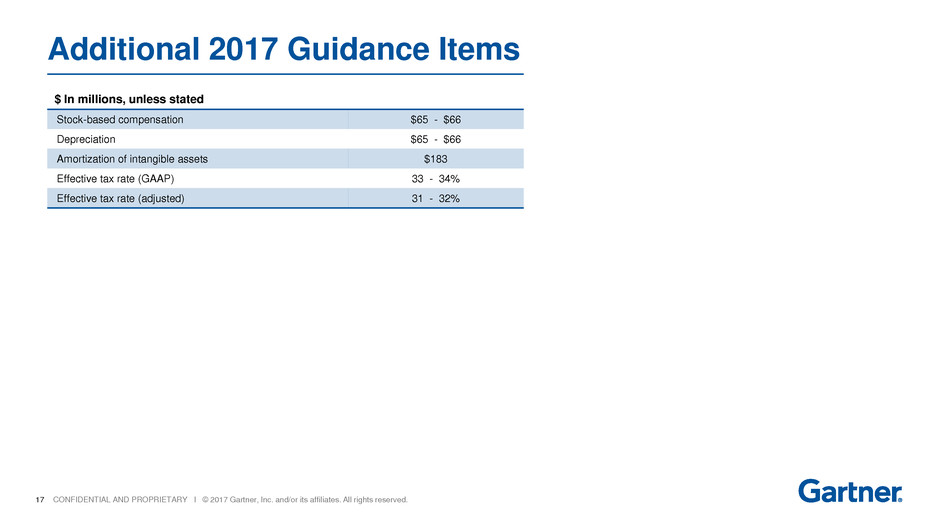

Additional 2017 Guidance Items

$ In millions, unless stated

Stock-based compensation $65 - $66

Depreciation $65 - $66

Amortization of intangible assets $183

Effective tax rate (GAAP) 33 - 34%

Effective tax rate (adjusted) 31 - 32%

18 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Operating Income (Loss) to Adjusted EBITDA(a)

Reconciliation

In $ thousands

Q3’17

Q3’16

(Combined)(g)

Operating income (Loss) $(24,349) $66,288

Normalizing adjustments:

Stock-based compensation expense (b) $13,198 $14,413

Depreciation, accretion, and amortization (c) $68,960 $40,676

Amortization of pre-acquisition deferred revenues (d) $63,655 $1,535

Acquisition and integration charges and other nonrecurring items (e) $27,523 $17,396

Other charges (f) $10,368

Adjusted EBITDA $148,987 $150,676

a) Adjusted EBITDA is based on GAAP operating income adjusted for certain normalizing adjustments

b) Consists of charges for stock-based compensation awards

c) Includes depreciation expense, accretion on excess facilities accruals, and amortization of intangibles. The depreciation and amortization amounts do not include any fair value adjustments as a result of the acquisition

d) Consists of the amortization of non-cash fair value adjustments on pre-acquisition deferred revenues. The majority of the pre-acquisition deferred revenue is recognized ratably over the remaining period of the underlying revenue contract

e) Consists of incremental and directly-related charges related to acquisitions and other non-recurring items

f) Primarily consists of restructuring costs, real estate and business transformation costs, equity investment losses and non-operating foreign currency impact related to the acquired CEB business

g) Please refer to Exhibit 99.2 filed with Form 8-K on August 8, 2017 for a breakdown of the combined amounts into the Traditional Gartner and CEB components

19 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

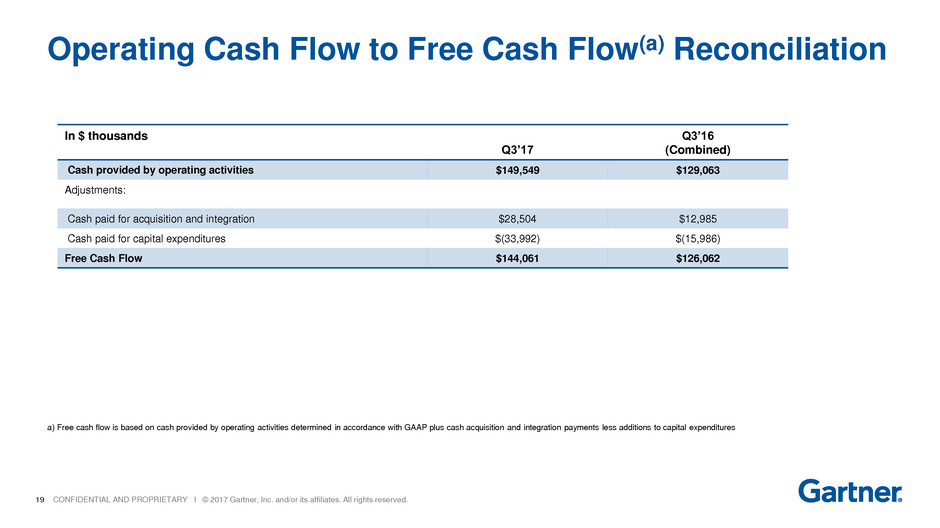

Operating Cash Flow to Free Cash Flow(a) Reconciliation

In $ thousands

Q3’17

Q3’16

(Combined)

Cash provided by operating activities $149,549 $129,063

Adjustments:

Cash paid for acquisition and integration $28,504 $12,985

Cash paid for capital expenditures $(33,992) $(15,986)

Free Cash Flow $144,061 $126,062

a) Free cash flow is based on cash provided by operating activities determined in accordance with GAAP plus cash acquisition and integration payments less additions to capital expenditures

20 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Adjusted Segments

Three Months Ended

September 30, 2016

Combined(a)

In $ thousands GAAP Revenue

Deferred

Revenue Fair

Value

Adjustment

Adjusted

Revenue Direct Expense

Adjusted Gross

Contribution

Adjusted

Contribution

Margin

Adjusted

EBITDA

Research $653,443 $47,725 $701,168 $217,221 $483,947 69%

Consulting $72,117 $0 $72,117 $55,929 $16,188 22%

Events $44,953 $147 $45,100 $28,942 $16,158 36%

Talent Assessment &

Other

$57,572 $15,783 $73,355 $26,357 $46,997 64%

TOTAL $828,085 $63,655 $891,740 $328,449 $563,290 63% $148,987

Three Months Ended

September 30, 2017

As Reported

a) Please refer to Exhibit 99.2 filed with Form 8-K on August 8, 2017 for a breakdown of the combined amounts into the Traditional Gartner and CEB components

In $ thousands GAAP Revenue

Deferred

Revenue Fair

Value

Adjustment

Adjusted

Revenue Direct Expense

Adjusted Gross

Contribution

Adjusted

Contribution

Margin

Adjusted

EBITDA

Research $618,636 $429 $619,065 $186,660 $432,405 70%

Consulting $73,707 $0 $73,707 $55,492 $18,215 25%

Events $35,119 $1,106 $36,225 $23,392 $12,833 35%

Talent Assessment &

Other $76,441 $0 $76,441 $31,449 $44,992 59%

TOTAL $803,903 $1,535 $805,438 $296,993 $508,445 63% $150,676

21 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Definitions

Adjusted Revenue: Represents GAAP revenue plus non-cash fair value adjustments on pre-acquisition deferred revenues. The majority

of the pre-acquisition deferred revenue is recognized ratably over the remaining period of the underlying revenue contract.

Adjusted EBITDA: Represents GAAP operating (loss) income excluding stock-based compensation expense; depreciation,

amortization, and accretion on obligations related to excess facilities; amortization of pre-acquisition deferred revenues; acquisition and

integration charges; and other non-recurring items.

Adjusted Net Income: Represents GAAP net (loss) income adjusted for the impact of certain items directly related to acquisitions and

other non-recurring items. These adjustments include the amortization of identifiable intangibles from acquisitions; incremental and

directly-related acquisition and integration charges related to the achievement of certain performance targets and employment

conditions, as well as legal, consulting, severance, and other costs; fair value adjustments on pre-acquisition deferred revenues; and

other non-recurring items.

Adjusted EPS: Represents Adjusted Net Income divided by the number of Non-GAAP diluted shares.

Free Cash Flow: Represents cash provided by operating activities determined in accordance with GAAP plus cash acquisition and

integration payments less payments for capital expenditures.

Adjusted Gross Contribution: Adjusted Revenue less Direct Expenses.

Adjusted Gross Margin: Adjusted Gross Contribution divided by Adjusted Revenue.

22 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.