Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - DuPont de Nemours, Inc. | exhibit991enrschedules3q17.htm |

| 8-K - 8-K - DuPont de Nemours, Inc. | enr8-k3q17.htm |

DowDuPont

3Q17 Earnings Conference Call

November 2, 2017

Safe Harbor Statement

Regulation G

This presentation includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures include the Company's pro forma consolidated

results and pro forma earnings per share on an adjusted basis, which excludes the after-tax impact of pro forma significant items and the after-tax impact of pro forma amortization

expense associated with DuPont's intangible assets. Management uses these measures internally for planning, forecasting and evaluating the performance of the Company's

segments, including allocating resources. DowDuPont's management believes that these non-GAAP measures best reflect the ongoing performance of the Company during the periods

presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful

comparison of year-over-year results. These non-GAAP measures supplement the Company's U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP

measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Reconciliations of non-GAAP

measures to GAAP are provided in the financial schedules attached to the earnings news release and the Investor Relations section of the Company’s website. DowDuPont does not

provide forward-looking GAAP financial measures or a reconciliation of forward-looking non-GAAP financial measures to the most comparable GAAP financial measures on a forward-

looking basis because the Company is unable to predict with reasonable certainty the ultimate outcome of pending litigation, unusual gains and losses, foreign currency exchange gains

or losses, potential future asset impairments and purchase accounting fair value adjustments, as well as discrete taxable events, without unreasonable effort. These items are

uncertain, depend on various factors, and could have a material impact on GAAP results for the guidance period.

Cautionary Statement about Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and

financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives

of these words.

On December 11, 2015, The Dow Chemical Company (“Dow”) and E. I. du Pont de Nemours and Company (“DuPont”) announced entry into an Agreement and Plan of Merger, as

amended on March 31, 2017, (the “Merger Agreement”) under which the companies would combine in an all-stock merger of equals transaction (the “Merger Transaction”). Effective

August 31, 2017, the Merger Transaction was completed and each of Dow and DuPont became subsidiaries of DowDuPont Inc. (“DowDuPont”). For more information, please see each

of DowDuPont’s, Dow’s and DuPont’s latest annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K, as the case may be, and the joint proxy statement/prospectus included

in the registration statement on Form S-4 filed by DowDuPont with the SEC on March 1, 2016 (File No. 333-209869), as last amended on June 7, 2016, and declared effective by the

SEC on June 9, 2016 (the “Registration Statement”) in connection with the Merger Transaction.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, including the intended separation of DowDuPont’s agriculture, materials science

and specialty products businesses in one or more tax efficient transactions on anticipated terms (the “Intended Business Separations”). Forward-looking statements are not guarantees

of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and

uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause DowDuPont’s, Dow’s or DuPont’s actual results to differ materially from

those projected in any such forward-looking statements include, but are not limited to: (i) successful integration of the respective agriculture, materials science and specialty products

businesses of Dow and DuPont, including anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, productivity actions, economic

performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined operations;

(ii) impact of the divestitures required as a condition to consummation of the Merger Transaction as well as other conditional commitments; (iii) achievement of the anticipated synergies

by DowDuPont’s agriculture, materials science and specialty products businesses; (iv) risks associated with the Intended Business Separations, including those that may result from the

comprehensive portfolio review undertaken by the DowDuPont board, changes and timing, including a number of conditions which could delay, prevent or otherwise adversely affect

the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances related to the Intended Business Separations, disruptions in the

financial markets or other potential barriers; (v) the risk that disruptions from the Intended Business Separations will harm DowDuPont’s business (either directly or as conducted by and

through Dow or DuPont), including current plans and operations; (vi) the ability to retain and hire key personnel; (vii) potential adverse reactions or changes to business relationships

resulting from the completion of the merger or the Intended Business Separations; (viii) uncertainty as to the long-term value of DowDuPont common stock; (ix) continued availability of

capital and financing and rating agency actions; (x) legislative, regulatory and economic developments; (xi) potential business uncertainty, including changes to existing business

relationships, during the pendency of the Intended Business Separations that could affect the company’s financial performance and (xii) unpredictability and severity of catastrophic

events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors.

2©2017 DowDuPont. All rights reserved.

Safe Harbor Statement, continued

Forward-Looking Statements, continued

These risks, as well as other risks associated with the merger and the Intended Business Separations, are more fully discussed in (1) the Registration Statement and (2) the current,

quarterly and annual reports filed with the SEC by DowDuPont and to the extent incorporated by reference into the Registration Statement, by Dow and DuPont. While the list of factors

presented here is, and the list of factors presented in the Registration Statement are, considered representative, no such list should be considered to be a complete statement of all

potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in

results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to

third parties and similar risks, any of which could have a material adverse effect on DowDuPont’s, Dow’s or DuPont’s consolidated financial condition, results of operations, credit rating or

liquidity. None of DowDuPont, Dow or DuPont assumes any obligation to publicly provide revisions or updates to any forward-looking statements whether as a result of new information,

future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

The Dow Diamond, DuPont Oval logo, DuPont™ and all products, unless otherwise noted, denoted with ™, ℠or ® are trademarks or registered trademarks of The Dow Chemical

Company, E. I. du Pont de Nemours and Company or their affiliates.

Supplemental unaudited pro forma information for DowDuPont is presented to illustrate the estimated effects of the Merger, assuming that the Merger had been consummated on January

1, 2016. For the third quarter of 2017, activity prior to August 31, 2017 (the “Merger Date”) was prepared on a pro forma basis and activity after the Merger Date was prepared on a

combined U.S. GAAP basis. The unaudited pro forma information was prepared in accordance with Article 11 of Regulation S-X. Pro forma adjustments have been made for (1) the

preliminary purchase accounting impact, (2) accounting policy alignment, (3) eliminate the effect of events that are directly attributable to the Merger Agreement (e.g., one-time transaction

costs), (4) eliminate the impact of transactions between Dow and DuPont, and (5) eliminate the effect of consummated or probable and identifiable divestitures agreed to with certain

regulatory agencies as a condition of approval for the Merger. Events that are not expected to have a continuing impact on the combined results (e.g., inventory step-up costs) are

excluded. The unaudited pro forma information does not reflect restructuring or integration activities or other costs following the Merger that may be incurred to achieve cost or growth

synergies of DowDuPont. The unaudited pro forma financial information provides shareholders with summary financial information and historical data that is on a basis consistent with how

DowDuPont reports current financial information.

3©2017 DowDuPont. All rights reserved.

Highlights

4©2017 DowDuPont. All rights reserved.

• Delivered solid 3Q17 pro forma results

– Sales increased 8%

– Volume growth of 4%

– Operating EBITDA up 7%

– Adjusted EPS increased 10%

• Closed the merger on August 31st

• Realigned the portfolio

– Shifted >$8B in sales, ~$2.4B in EBITDA to Specialty Products

– Aligned businesses along end-markets to increase competitiveness,

accelerate growth

• Progressed two of the three remedy transactions

Divestiture of Dow’s ethylene acrylic acid copolymer assets (closed Sept. 1)

Sale of certain DuPont crop protection assets to FMC, acquisition of most

of FMC health and nutrition business (Nov. 1)

– Divestiture of select portion of Dow AgroSciences' corn seed business in

Brazil on track to close in 4Q17

Strategic Drivers

5©2017 DowDuPont. All rights reserved.

• Closed transaction on Aug. 31

• New reporting structure

complete

• Pro formas delivered on Oct. 26,

incorporating business

realignments

• Re-mapping stand-and-spin

timing, evaluating multiple

scenarios and risk mitigation

plans

Stand and Spin

• Advancing playbook to deliver

$1B in growth synergies

• Early examples:

• Ag pipeline to deliver 10 new

seed products and 11 new CP

products over next 5 years

• Combination of Dow Pharma &

Food, DuPont Health & Nutrition

and acquired FMC business

creates one of the broadest

offerings to serve industry

• High performance packaging

solutions from integration of

DuPont’s ethylene copolymers

portfolio

Growth Synergies

• Remain committed to total $3B

of cost synergies

• New division targets:

• Agriculture: $1.0B (no change)

• Materials Science: $1.2B

• Specialty Products: $0.8B

• 70% run rate by end of Year 1;

100% run rate by end of Year 2

• Expect $500MM run rate by end

of 4Q17

• Broader cost synergy program

and actions announced today

Cost Synergies

3Q 2017 Financial Highlights

Financial Performance Snapshot 3Q16 3Q17 B/(W)

Pro Forma Net Sales ($MM) 16,991 18,285 +1,294

Pro Forma Operating EBITDA ($MM) 3,022 3,221 +199

Pro Forma Adjusted EPS ($/share) $0.50 $0.55 +$0.05

6©2017 DowDuPont. All rights reserved.

3Q 2017 Pro Forma Adjusted EPS Variance Highlights

• Volume growth from consumer-led demand

in key end-markets

• Pricing gains and currency tailwinds more

than offset higher feedstock costs

• Higher equity earnings led by Kuwait JVs

• Lower pension/OPEB costs

• Lost production and repair costs from impact

of hurricanes

• Challenging Ag market conditions,

particularly in Brazil

• Continued start-up spending on USGC

growth projects

$0.30

$1.08

3

Q

1

6

V

o

l

u

m

e

g

r

o

w

t

h

M

a

r

g

i

n

g

r

o

w

t

h

f

r

o

m

p

r

i

c

e

g

a

i

n

s

&

c

u

r

r

e

n

c

y

E

q

u

i

t

y

E

a

r

n

i

n

g

s

P

e

n

s

i

o

n

/

O

P

E

B

N

e

t

I

n

t

e

r

e

s

t

e

x

p

e

n

s

e

S

t

a

r

t

-

u

p

e

x

p

e

n

s

e

s

W

e

a

k

n

e

s

s

i

n

A

g

m

a

r

k

e

t

s

H

u

r

r

i

c

a

n

e

i

m

p

a

c

t

3

Q

1

7

$0.50

$0.55

Agriculture: 3Q 2017 Pro Forma Highlights

Pro Forma 3Q16 3Q17

Net Sales ($MM) 1,998 1,911

Op. EBITDA ($MM) (172) (239)

Op. EBITDA Margin (8.6)% (12.5)%

YoY Sales change: Vol (5)%, Local Price (4)%

Currency +2%, Port./Other +3%

Agriculture

Innovation

FY17 Pro Forma Outlook

• Crop Protection sales declined 6 percent due to high inventory levels,

particularly in Brazil, pressuring both volume and price; Crop Protection

volumes increased in North America

• Seed sales declined 11 percent excluding portfolio benefits; volume was

pressured by a delayed start to the summer season in Brazil and an expected

reduction in corn area

• Operating EBITDA¹ loss increased by $67MM due to lower price and volume,

partially offset by lower product costs and pension/OPEB benefit

• Continued penetration of new products, including ArylexTM herbicide, Leptra®

corn hybrids, Vessarya® fungicide and IsoclastTM insecticide

• Robust pipeline poised to launch 10 new seed products and 11 new crop

protection products over the next 5 years

• Sales expected to increase low-single-digits percent due to new product

introductions resulting in price and volume gains

• Operating EBITDA expected to increase 11-12 percent, driven by seed price

gains, volume growth and new product launches

7

©2017 DowDuPont. All rights reserved.

1Results for Agriculture for the third quarter of 2017 includes $13MM of EBITDA from a select portion of Dow AgroSciences’ corn seed remedy in Brazil for the month of September, in accordance with US GAAP. The results of this business

prior to the Merger were excluded from the pro forma results, in accordance with SEC regulations.

1 Canola-LL, SSX Pro, Sunflower Clearfield Plus, RSS, ProPound, Plenish,

Intacta, Leptra

2 Pyraxalt, Q8U80 Nematicide, Viovan, Aminocyclopyrachlor, XDE-659

Materials Science: 3Q 2017 Pro Forma Highlights

Performance Materials & Coatings

Industrial Intermediates & Infrastructure

Packaging & Specialty Plastics

Pro Forma 3Q16 3Q17

Net Sales ($MM) 2,046 2,219

Op. EBITDA ($MM) 345 487

Op. EBITDA Margin 16.9% 21.9%

Pro Forma 3Q16 3Q17

Net Sales ($MM) 2,770 3,226

Op. EBITDA ($MM) 401 676

Op. EBITDA Margin 14.5% 21.0%

Pro Forma 3Q16 3Q17

Net Sales ($MM) 5,070 5,490

Op. EBITDA ($MM) 1,386 1,147

Op. EBITDA Margin 27.3% 20.9%

YoY Sales change: Vol +6%, Local Price +1%

Currency +1%, Port./Other –

YoY Sales change: Vol +1%, Local Price +6%

Currency +1%, Port./Other –

YoY Sales change: Vol +3%, Local Price +12%

Currency +1%, Port./Other –

• Consumer Solutions delivered sales growth in all businesses, led by volume gains in

most geographies and price/volume management in silicone intermediate products

• Coatings & Perf. Monomers achieved higher sales as price increases in all regions

more than offset a modest decline in volume due to actions to shed lower margin

business

• Polyurethanes reported strong demand and price increases in downstream, higher-

margin systems applications and increased MDI sales

• Industrial Solutions delivered sales gains in consumer-driven market segments of

electronics processing and food and pharmaceutical applications

• Consumer-led demand drove sales growth in Asia Pacific and EMEA, enabled by ramp

up in Sadara volumes; Americas volume impacted by hurricane-related disruptions

• Operating EBITDA declined as sales growth was more than offset by higher feedstock

costs, hurricane impact, commissioning & start-up costs on USGC projects; marketing

of additional Sadara volumes slightly impacted unit margins

8©2017 DowDuPont. All rights reserved.

Specialty Products: 3Q 2017 Pro Forma Highlights

Electronics & Imaging Pro Forma 3Q16 3Q17

Net Sales ($MM) 1,138 1,198

Op. EBITDA ($MM) 341 382

Op. EBITDA Margin 30.0% 31.9%

Nutrition & Biosciences

Transportation & Advanced Polymers

Safety & Construction

• Broad-based volume growth across key end-markets, led by double-digit gains

in semiconductor, consumer electronics, industrial, PV and display end-markets

• Operating EBITDA improved on volume growth, mix enrichment and lower

pension/OPEB costs

Pro Forma 3Q16 3Q17

Net Sales ($MM) 1,469 1,473

Op. EBITDA ($MM) 321 315

Op. EBITDA Margin 21.9% 21.4%

Pro Forma 3Q16 3Q17

Net Sales ($MM) 1,187 1,299

Op. EBITDA ($MM) 303 325

Op. EBITDA Margin 25.5% 25.0%

Pro Forma 3Q16 3Q17

Net Sales ($MM) 1,238 1,310

Op. EBITDA ($MM) 282 351

Op. EBITDA Margin 22.8% 26.8%

YoY Sales change: Vol +6%, Local Price –

Currency –, Port./Other –

YoY Sales change: Vol +13%, Local Price (2)%

Currency – , Port./Other (6)%

YoY Sales change: Vol –, Local Price –

Currency +1%, Port./Other (1)%

YoY Sales change: Vol +5%, Local Price +3%

Currency +1%, Port./Other –

• Sales rose 9% on volume and local price gains

• Operating EBITDA increased 7% on volume and pricing gains and lower

pension/OPEB costs, partly offset by higher raw material costs

• Sales increased 6% on volume gains with increases in every region

• Operating EBITDA grew 24% due to volume growth, one-time gains, lower

pension/OPEB costs and better plant performance, despite higher raw

materials

• Sales gains in microbial control solutions, probiotics and biomaterials more than

offset declines in protein solutions, systems and texturants, and a negative

impact from portfolio

• Operating EBITDA declined as sales gains in microbial and probiotics was more

than offset by declines in protein solutions, systems and texturants

9©2017 DowDuPont. All rights reserved.

10

©2017 DowDuPont. All rights reserved.

4Q17 Modeling Guidance

4

Q

1

7

Corporate Segment Operating EBITDA ($200) – ($230)MM Operational Tax Rate(excl. EGL, DuPont Amort. & Sig. Items) 24-26%

D&A (includes the DuPont Amortization expense

below)

$1,380 – $1,410MM

(includes step-up D&A)

DuPont Non-operating pension

/OPEB2 (included in Op. EBITDA)

~$90 – $110MM credit in

4Q17

DuPont Amortization expense

(this is added back while calculating Adj. EPS)

~$270MM pre-tax

Taxed at ~32%

Net Interest Expense

(net of Interest Income, which is reported in

Sundry Income/Expense line)

$300 – 325MM

Net Income attributable to non-controlling

Interests (reduced from net income) ~$30MM Share Count ~2,350MM

Segment Outlook 4Q17 vs. 4Q16 Net Sales Op. EBITDA

(incl. Equity Earnings)

Agriculture Up ~10% ~$225MM

Performance Materials & Coatings Up high-single-digits percent Up mid-teens percent

Industrial Intermediates & Infrastructure Up high-teens percent Up 10-11%

Packaging & Specialty Plastics Up ~10% Up low-single-digits percent

Electronics & Imaging Down mid-single-digits percent Up low-single-digits percent

Nutrition & Biosciences Up high-single-digits percent Up 10-11%

Transportation & Advanced Polymers Up mid-single-digits percent Up mid-teens percent

Safety & Construction Up mid-single-digits percent Up low-twenties percent

Net Sales: $19.0 - $19.5B >7% vs. 4Q161 Op. EBITDA: 11-13% vs. 4Q161

1 All 4Q16 numbers are on a pro forma basis

2 The 4Q17 estimate for non-operating pension/OPEB costs does not include any potential settlements or curtailments that could occur during the remainder of the year

Note: Operating EBITDA estimates exclude approximately $1B related to a restructuring charge, which will be treated as a significant item

Refer to slide 14 in Appendix for additional commentary on segment outlook

Outlook

11©2017 DowDuPont. All rights reserved.

• Robust demand conditions remain in consumer-driven end-markets, such as

packaging, consumer electronics and transportation

• Ag fundamentals remain soft

– Full-year DowDuPont Ag results expected to increase YoY on self-help actions and

innovation-led growth

• Packaging fundamentals remain healthy globally

– Demand outlook enhanced by improving global GDP growth prospects

– Sustainable urbanization continues to drive demand in the developing world; tighter

environmental regulations could drive further upside

– Recent U.S. supply interruptions highlight tight supply/demand fundamentals

– Measured pace of capacity adds reduces duration and severity of supply/demand imbalance

Market Outlook

• Global economic expansion on continued strength in U.S. and with notable

improvements in Europe

– Consumer-driven strength an increasingly common theme globally

• Select headwinds remain, including geopolitical uncertainties and elevated

emerging market debt levels

Macro Outlook

Disciplined Focus on Financial, Strategic and

Operational Results

12©2017 DowDuPont. All rights reserved.

Deliver operating and financial plan

• Continued focus on volume and earnings growth

• Ongoing productivity and manufacturing excellence

Achieve synergy targets

• Finalize detailed plans to achieve cost synergies & mitigate dis-synergies

• Achieve 70% run rate in 12 months and 100% run rate in 24 months

• Advance growth synergies playbook

Stand and spin the intended companies

• Complete carve-out activities based on realignments

• Separate each intended company as soon as possible

• Remain committed to our original timeline; assessing options to accelerate

1

2

3

14©2017 DowDuPont. All rights reserved.

4Q17 Segment Expectations

1 4Q16 on a pro forma basis

2 Hemlock Semiconductor

Segments Key Sales and Operating EBITDA Outlook Drivers (4Q17 vs. 4Q161)

Packaging & Specialty

Plastics

Sales growth on pricing gains, higher Sadara PE volumes and start-up of U.S. Gulf Coast growth projects. Op. EBITDA up

modestly as higher prices and ramp-up of the new TX-9 and ELITE™ units through the quarter are mostly offset by higher

feedstock costs, start-up costs (~$50MM in 4Q17), spending and volume impact of higher turnaround activity as well as a

residual hurricane impact into 4Q17 (~$40MM).

Industrial Intermediates

& Infrastructure

Sales and Op. EBITDA growth on pricing momentum and volume gains supported by tight supply-demand fundamentals.

4Q17 results impacted by lower equity earnings (down ~$40-60MM) driven by major turnaround in Equate JV. Isocyanates

markets remain tight but supply improves as industry recovers from turnarounds and outages. Polyol margins under

pressure from higher feedstock costs.

Perf. Materials &

Coatings

Sales up on pricing gains. Op. EBITDA expected to grow on improved volume/mix and pricing, which more than offset

headwinds from higher raw material costs. 4Q17 HSC2 pre-tax equity earnings expected to be $100-$120MM.

Safety & Construction Expect continued demand from oil & gas and broader industrial markets. Raw materials costs projected to be higher year-

on-year. Benefit from expected lower pension/OPEB costs.

Transportation &

Advanced Polymers

Modest price increases announced to mitigate pressure from higher raw material costs. Volumes expected to remain

positive, with industry auto builds expected to be up slightly vs. last year. Tailwind from expected lower pension/OPEB costs.

Nutrition & Biosciences

Sales up on continued growth in microbial control solutions, probiotics, biomaterials and bioactives, partially offset by

continued declines in protein solutions. Op. EBITDA growth on mix enrichment and lower pension/OPEB costs, partially

offset by the absence of a prior year $27MM gain on asset sale. Portfolio benefit in Nov and Dec from acquisition of FMC’s

Health & Nutrition business.

Electronics & Imaging

Sales expected to be down vs. the year-ago period as continued growth in semiconductors, consumer electronics and

displays will be more than offset by the negative impact of portfolio (sale of stake in a non-core JV in 2Q17) and declines in

photovoltaics volumes due to Hurricane Maria-driven supply disruption in Puerto Rico. Op. EBITDA expected to be up on mix

enrichment, productivity gains and lower pension/OPEB costs.

Agriculture

Ag segment sales growth driven by increased fungicide volumes and the continued penetration of Leptra® corn hybrids.

Benefits from lower pension/OPEB costs and the inclusion of the Brazil corn seed remedy (until the expected close of

transaction in 4Q17) will be partially offset by continued price pressure within the crop protection business.

Refer in conjunction with Slide 10

3Q16 3Q17

-60%

-50%

-40%

-30%

-20%

-10%

0%

-250

-200

-150

-100

-50

0

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

15

©2017 DowDuPont. All rights reserved.

3Q Pro Forma Operating EBITDA

3Q17 Pro Forma Sales

• Ag markets continue to be challenging driven by lower expected corn

planted area, elevated crop protection inventory levels, and weak farm

economics. 3Q operating EBITDA¹ loss increased by $67MM as lower

sales were partially offset by lower product costs and benefits from

currency and portfolio

• FY17 Outlook: Sales expected to increase low-single-digits percent

due to new product introductions resulting in price and volume gains.

Op. EBITDA expected to increase 11-12 percent driven by top line price

gains and volume growth

Crop Protection

• 3Q sales down as high industry inventory levels, driven by Brazil, and

competitive markets resulted in volume and price declines

• FY17 Outlook: Driving full year new product volume gains with

Vessarya® fungicide, ArylexTM herbicide, Isoclast® herbicide, and novel

Seed Treatment solutions

Seed

• 3Q sales down as portfolio and currency benefits were more than offset

by lower volume and pricing

• Quarterly volume declines driven by a delayed start to the summer

season in Brazil and South Africa and expected lower planted corn area

also in Brazil. Quarterly price declines driven by higher replant in the

U.S. due to wet conditions during planting

• FY17 Outlook: Driving full year volume and seed price gains from

increased penetration of Leptra® corn hybrids, Enlist® cotton, and A-

series® soybeans

Seed Crop Protection

North America Asia Pacific

Europe Latin America

Pro Forma Sales down 4% vs 3Q16

Vol -5%, Local Price -4%, Currency 2%, Port./Other 3%

-172

-239

Agriculture

1. Results for Agriculture for the third quarter of 2017 includes $13MM of EBITDA from a select portion of Dow AgroSciences’ corn seed remedy in Brazil for the month of

September, in accordance with US GAAP. The results of this business prior to the Merger were excluded from the pro forma results, in accordance with SEC regulations.

Performance Materials & Coatings

16©2017 DowDuPont. All rights reserved.

3Q16 3Q17

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

0

50

100

150

200

250

300

350

400

450

500

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

3Q Pro Forma Operating EBITDA

3Q17 Pro Forma Sales

3,928

Coatings & Performance Monomers

Consumer Solutions

Coatings & Performance Monomers

Consumer Solutions

North America Asia Pacific

EMEA Latin America

Pro Forma Sales 8% vs 3Q16

Vol 1%, Local Price 6%, Currency 1%

• Higher prices in all geographic areas

• Modest decline in volume related to

hurricane-related lost sales and actions to

shed lower margin business

• Op. EBITDA growth as price gains more than

offset modest volume decline and higher raw

material costs

• Robust sales growth in all businesses led by

volume growth in silicones and price/volume

management in upstream silicone

intermediate products

• Op. EBITDA growth on continued silicones

cost synergy capture, increased pricing and

solid consumer demand

345

487

Ind. Intermediates & Infrastructure

17©2017 DowDuPont. All rights reserved.

3Q16 3Q17

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

0

100

200

300

400

500

600

700

800

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

3Q Pro Forma Operating EBITDA

3Q17 Pro Forma Sales

3,928

Constr. Chem. Energy Sol.

Ind. Sol. PU & CAV

North America Asia Pacific

EMEA Latin America

Pro Forma Sales up 16% vs 3Q16

Vol 3%, Local Price 12%, Currency 1%

Construction Chemicals

• Demand growth in acrylics-based and methyl cellulosics products

• Modest decline in pro forma op. EBITDA due to raw materials

cost increases that were partially offset by volume and price

increases

Polyurethanes & CAV

• Robust demand for PU systems; tight MDI and caustic

fundamentals continued

• Op. EBITDA rose on price gains and broad-based volume growth

Energy Solutions

• Sales declined due to decreased project activity in oil & gas

• Pro forma op. EBITDA improved due to scale down of solar

operations that was partially offset by decreased project activity

in oil & gas

Industrial Solutions

• Strong sales gains led by glycol ethers, ethylene glycol and

oxo alcohols in consumer-led market segments of electronics

processing, crop defense and food & pharma

• Pro forma op. EBITDA improved on pricing momentum,

higher equity earnings and volume growth

401

676

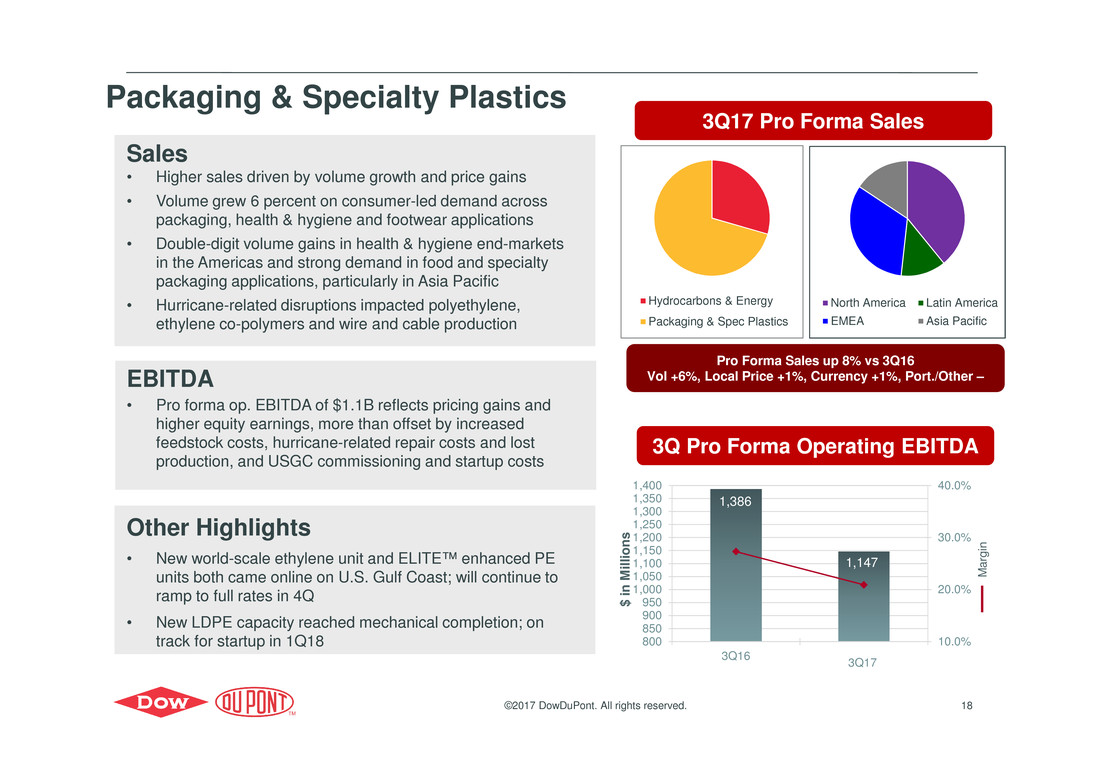

Sales

• Higher sales driven by volume growth and price gains

• Volume grew 6 percent on consumer-led demand across

packaging, health & hygiene and footwear applications

• Double-digit volume gains in health & hygiene end-markets

in the Americas and strong demand in food and specialty

packaging applications, particularly in Asia Pacific

• Hurricane-related disruptions impacted polyethylene,

ethylene co-polymers and wire and cable production

• Pro forma op. EBITDA of $1.1B reflects pricing gains and

higher equity earnings, more than offset by increased

feedstock costs, hurricane-related repair costs and lost

production, and USGC commissioning and startup costs

Other Highlights

• New world-scale ethylene unit and ELITE™ enhanced PE

units both came online on U.S. Gulf Coast; will continue to

ramp to full rates in 4Q

• New LDPE capacity reached mechanical completion; on

track for startup in 1Q18

Packaging & Specialty Plastics

18©2017 DowDuPont. All rights reserved.

3Q16 3Q17

10.0%

20.0%

30.0%

40.0%

800

850

900

950

1,000

1,050

1,100

1,150

1,200

1,250

1,300

1,350

1,400

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

3Q Pro Forma Operating EBITDA

3Q17 Pro Forma Sales

3,928

Hydrocarbons & Energy

Packaging & Spec Plastics

EBITDA

North America Latin America

EMEA Asia Pacific

Pro Forma Sales up 8% vs 3Q16

Vol +6%, Local Price +1%, Currency +1%, Port./Other –

1,386

1,147

Electronics & Imaging

19©2017 DowDuPont. All rights reserved.

3Q16 3Q17

10.0%

20.0%

30.0%

40.0%

300

310

320

330

340

350

360

370

380

390

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

3Q Pro Forma Operating EBITDA

3Q17 Pro Forma Sales

Sales

• 13 percent volume growth across key end-markets and

almost all geographic areas, primarily Asia Pacific

• Double-digit gains in semiconductor, consumer electronics,

industrial, photovoltaics and display end-markets

• Growth in semiconductor as strong demand for memory and

logic segments drove component manufacturing across

mobile devices, automotive and consumer electronics

• Local price declined 2 percent on pressure in Solamet® paste

and advanced printing applications

• 6 percent negative impact from portfolio changes (Display

Films and Authentication)

Operating EBITDA

• Op. EBITDA increased 12 percent on broad-based volume

growth, mix enrichment and lower pension/OPEB costs

more than offset lower local price and a negative impact

from portfolio

• Op. EBITDA margins expanded by about 190 basis points

North America Asia Pacific

Europe Latin America

Pro Forma Sales 5% vs 3Q16

Vol 13%, Local Price (2)%, Currency – , Port./Other (6)%

341

382

Nutrition & Biosciences

20©2017 DowDuPont. All rights reserved.

3Q16 3Q17

10.0%

20.0%

30.0%

40.0%

250

260

270

280

290

300

310

320

330

340

350

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

3Q Pro Forma Operating EBITDA

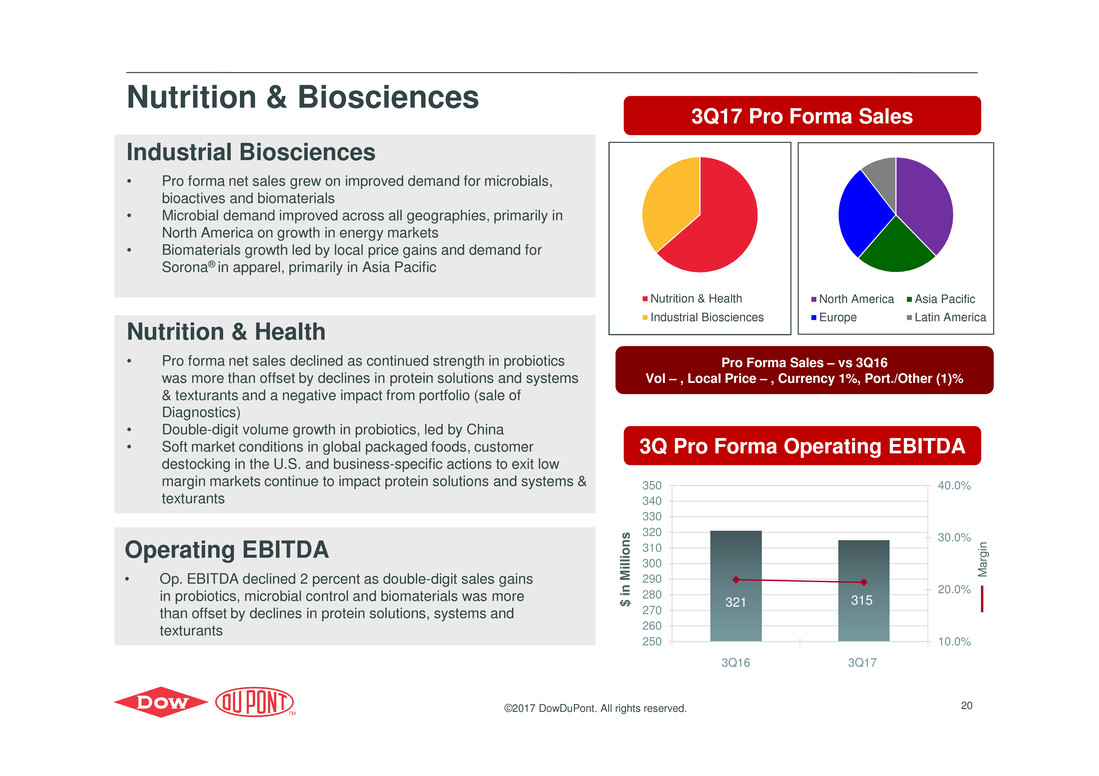

3Q17 Pro Forma Sales

Pro Forma Sales – vs 3Q16

Vol – , Local Price – , Currency 1%, Port./Other (1)%

Nutrition & Health

Industrial Biosciences

North America Asia Pacific

Europe Latin America

321 315

Industrial Biosciences

• Pro forma net sales grew on improved demand for microbials,

bioactives and biomaterials

• Microbial demand improved across all geographies, primarily in

North America on growth in energy markets

• Biomaterials growth led by local price gains and demand for

Sorona® in apparel, primarily in Asia Pacific

Operating EBITDA

• Op. EBITDA declined 2 percent as double-digit sales gains

in probiotics, microbial control and biomaterials was more

than offset by declines in protein solutions, systems and

texturants

Nutrition & Health

• Pro forma net sales declined as continued strength in probiotics

was more than offset by declines in protein solutions and systems

& texturants and a negative impact from portfolio (sale of

Diagnostics)

• Double-digit volume growth in probiotics, led by China

• Soft market conditions in global packaged foods, customer

destocking in the U.S. and business-specific actions to exit low

margin markets continue to impact protein solutions and systems &

texturants

Transportation & Adv. Polymers

21©2017 DowDuPont. All rights reserved.

3Q16 3Q17

10.0%

20.0%

30.0%

40.0%

200

250

300

350

400

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

3Q Pro Forma Operating EBITDA

3Q17 Pro Forma Sales

3,928

Sales

• Pro forma sales increased 9 percent to $1.3

billion due to volume and local price gains

• Strong demand from the automotive market,

particularly in Asia Pacific, Latin America and

EMEA; growth outpaced auto industry overall,

led by polymers and parts, including Kalrez®

and Vespel® as well as structural adhesives

and MolyKote® lubricants

• Price gains in nearly all regions

• Pro forma op. EBITDA increased 7 percent to

$325 million on volume and pricing gains and

lower pension/OPEB costs, partly offset by

higher raw material costs

Operating EBITDA

North America Asia Pacific

Europe Latin America

Pro Forma Sales 9% vs. 3Q16

Vol 5%, Local Price 3%, Currency 1%, Port./Other –

303 325

Safety & Construction

22©2017 DowDuPont. All rights reserved.

3Q Pro Forma Operating EBITDA

3Q17 Pro Forma Sales

3,928

Sales

• Pro forma sales of $1.3 billion increased 6 percent

due to volume gains of 6 percent with increases in

every region

• Oil & gas markets drove a double-digit gain in

Nomex® thermal garments and mid-single-digit gain

in Kevlar ® high-strength materials

• Tyvek ® protective material up mid-single digits due

to demand in graphics and building envelopes

• Double-digit growth in filtration from gains in

industrial markets in reverse osmosis and

ultrafiltration membranes and recent capacity

increases

Operating EBITDA

• Pro forma operating EBITDA of $351 million grew

24 percent due to volume growth, one-time gains of

$30 million, lower pension/OPEB costs and

improved plant performance, partly offset by higher

raw material costs

North America Asia Pacific

Europe Latin America

Sales 6% vs. 3Q16

Vol 6%, Local Price – , Currency – , Port./Other –

3Q16 3Q17

10.0%

20.0%

30.0%

40.0%

200

250

300

350

400

M

a

r

g

i

n

$

i

n

M

i

l

l

i

o

n

s

282

351