Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FORD MOTOR CO | sales8-kdated11x1x2017.htm |

| EX-99 - EXHIBIT 99 - FORD MOTOR CO | october2017salesfinalrelease.pdf |

§ Ford Motor Company’s U.S. sales increased 6.2

percent last month, with 200,436 vehicles sold

§ Retail performance was up 3.5 percent versus a

year ago, on sales of 148,105 vehicles

§ Fleet sales, as expected, increased 14.6 percent

due to order timing, with 52,331 vehicles sold

§ F-Series sales totaled 75,974 trucks for October, a

15.9 percent gain. Overall F-Series average

transaction prices increased $4,000 versus last

year, to $47,300, with strong new F-150 high series

demand and continued strong demand for high

series Super Duty

§ Ford brand SUV sales totaled 57,637 vehicles, a

gain of 4.6 percent overall and a 9.0 percent

increase at retail

§ Sales of Edge increased 36.9 percent, with overall

sales of 11,036 vehicles. Last month represents

Edge’s best October performance since its first year

of launch in 2007

§ Explorer performance was up 5.0 percent, with

sales totaling 16,914 vehicles. Explorer performed

even better at retail, posting a 13.1 percent gain

§ Focus sales increased 7.8 percent in October, the

fourth straight month of gains. Focus performance

models, Focus ST and RS, were up 42.3 percent

§ Lincoln SUV sales gained 13.1 percent; MKC, MKX

and Navigator sales all saw increases

###

About Ford Motor Company

Ford Motor Company is a global company based in Dearborn, Michigan. The

company designs, manufactures, markets and services a full line of Ford

cars, trucks, SUVs, electrified vehicles and Lincoln luxury vehicles, provides

financial services through Ford Motor Credit Company and is pursuing

leadership positions in electrification, autonomous vehicles and mobility

solutions. Ford employs approximately 203,000 people worldwide. For

more information regarding Ford, its products and Ford Motor Credit

Company, please visit www.corporate.ford.com.

*Average transaction pricing based on J.D. Power and Associates PIN data

O C T O B E R 2 0 17 S A L E S

October 2017 Sales

“F-Series produced another big sales

gain for us in October. Strong customer

demand for high series Super Duty

continues, and now we’re seeing the

same for the new 2018 F-150. With

sales up 15.9 percent, F-Series drove

our overall truck sales to an 11.4

percent gain for the month.”

– Mark LaNeve, Ford vice president,

U.S. Marketing, Sales and Service

Ford Posts 6.2 Percent October Sales Gain, Marks Best F-Series

Sales in 13 Years; Ford Brand SUV Sales Up 4.6 Percent, While

Strong Customer Demand Lifts Lincoln SUV Sales 13.1 Percent

Total Vehicle Retail Fleet Truck SUV Car

U.S. Sales 200,436 148,105 52,331 93,248 63,339 43,849

Versus

October 2016 6.2% 3.5% 14.6% 11.4% 5.3% -2.4%

H I G H L I G H T S

K E Y V E H I C L E S

F-Series sales of 75,974 pickups

saw their best October since 2004.

Continued strong customer demand

for high series Super Duty increased

its average transaction pricing to

$55,200 last month, a $1,600 gain

over year ago.

2018 Ford F-150

2018 Ford Explorer

Lincoln MKX

Ford just announced its new

Performance Pack Level 2 for the

2018 Mustang. This will be Ford’s

fastest Mustang GT ever, featuring

Michelin Pilot Sport Cup 2 tires. The

new Mustang just began arriving at

dealerships at the end of October.

Lincoln MKX saw sales up 17.8

percent, marking its best October

since it’s first year of launch in

2007. MKC was up 10.3 percent

and Navigator up 9.7 percent.

Overall Lincoln SUV sales increased

13.1 percent for October. This

momentum bodes well for the

launch of our all-new Lincoln

Navigator.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

www.twitter.com/Ford

Explorer retail sales climbed 13.1

percent in October. The strongest

retail increases came out of the

Central and Southeastern regions of

the country, with retail sales up 31.1

and 34.0 percent respectively.

2018 Ford Mustang

O C T O B E R 2 0 17 I N V E N T O R Y / F L E E T R E S U LT S

October 2017 Sales

C O N TA C T

Erich Merkle

313.806.4562

emerkle2@ford.com

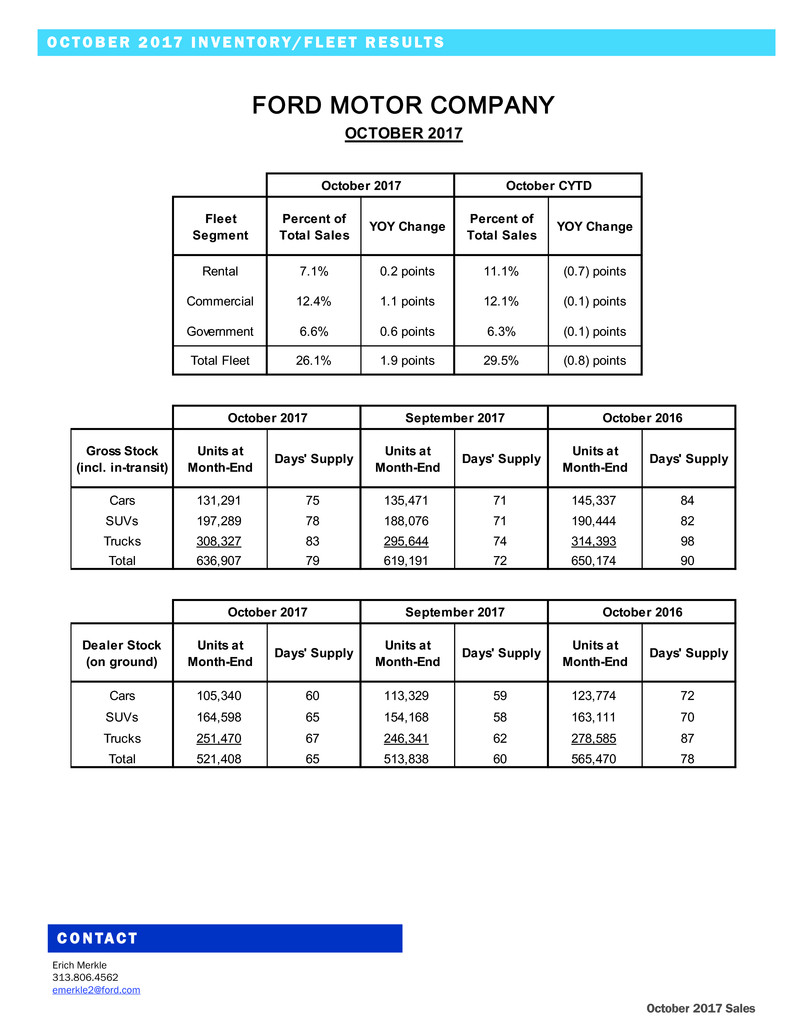

Fleet

Segment

Percent of

Total Sales

YOY Change Percent of

Total Sales

YOY Change

Rental 7.1% 0.2 points 11.1% (0.7) points

Commercial 12.4% 1.1 points 12.1% (0.1) points

Government 6.6% 0.6 points 6.3% (0.1) points

Total Fleet 26.1% 1.9 points 29.5% (0.8) points

Gross Stock

(incl. in-transit)

Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply

Cars 131,291 75 135,471 71 145,337 84

SUVs 197,289 78 188,076 71 190,444 82

Trucks 308,327 83 295,644 74 314,393 98

Total 636,907 79 619,191 72 650,174 90

Dealer Stock

(on ground)

Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply

Cars 105,340 60 113,329 59 123,774 72

SUVs 164,598 65 154,168 58 163,111 70

Trucks 251,470 67 246,341 62 278,585 87

Total 521,408 65 513,838 60 565,470 78

October 2017 September 2017 October 2016

??????????????????

OCTOBER 2017

October 2017 October CYTD

October 2017 September 2017 October 2016