Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Attis Industries Inc. | f8k102617_meridianwaste.htm |

Exhibit 99.1

Investor Presentation Meridian Waste Solutions October 2017 NASDAQ: MRDN

www.mwsinc.com This presentation contains certain forward - looking information about us that is intended to be covered by the safe harbor for “forward - looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward - looking statements are statements that are not historical facts. Words such as “guidance,” “expect,” “will,” “may,” “anticipate,” “plan,” “estimate, ” “ project,” “intend,” “should,” “can,” “likely,” “could,” “outlook” and similar expressions are intended to identify forward - looking stateme nts. These statements include statements about our plans, strategies and prospects. Forward - looking statements are not guarantees of performance. These statements are based upon the current beliefs and expectations of our management and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied or projected by, t he forward - looking information and statements. Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot assure you that the expectations will prove to be correct. Among the factors that could cau se actual results to differ materially from the expectations expressed in the forward - looking statements are: the impact on us of o ur substantial indebtedness, including on our ability to obtain financing on acceptable terms to finance our operations and grow th strategy and to operate within the limitations imposed by financing arrangements; general economic and market conditions, including inflation and changes in commodity pricing, fuel, interest rates, labor, risk, health insurance and other variable cos ts that generally are not within our control, and our exposure to credit and counterparty risk; whether our estimates and assumptions concerning our selected balance sheet accounts, income tax accounts, and property and equipment and labor, fuel rates and economic and inflationary trends, turn out to be correct or appropriate; competition and demand for services in the solid was te industry; the negative impact on our operations of union organizing campaigns, work stoppages or labor shortages; changes by the Financial Accounting Standards Board or other accounting regulatory bodies to generally accepted accounting principles or pol ici es; and acts of war, riots or terrorism, including the continuing war on terrorism, as well as actions taken or to be taken by th e U nited States or other governments as a result of further acts or threats of terrorism, and the impact of these acts on economic, fi nan cial and social conditions in the United States. Additionally, new risk factors emerge from time to time and it is not possible for us to predict all such risk factors, or to as sess the impact such risk factors might have on our business or the extent to which any factor or combination of factors may cause act ual results to differ materially from those contained in any forward - looking statements. You should not place undue reliance on any forward - looking statements on our website, which speak only as of the date they were placed on the website. Except to the exten t required by applicable law or regulation, we undertake no obligation to update or publish revised forward - looking statements to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events.

www.mwsinc.com NASDAQ: MRDN Our Mission 3 Meridian Waste Solutions, Inc. is a company defined by our commitments to servicing our customers with unwavering respect, fairness and care. We are focused on finding and implementing solutions to solid waste needs and challenges within the industry and for our customers.

www.mwsinc.com NASDAQ: MRDN Management Team Jeff S. Cosman, Chairman & Chief Executive Officer , has more than 10 years experience in the solid waste industry from local operations up to corporate accounting and finance with Republic Services (NYSE:RSG) and Browning Ferris Industries (NYSE: BFI). Mr. Cosman holds a B.B.A. in Managerial Finance and Banking & Finance, as well as a Bachelors of Accountancy from the University of Mississippi. Mr. Cosman was drafted by the New York Mets and played professional baseball in the minor leagues from 1993 - 1996. Mr. Cosman is the son of Jim Cosman, Sr., former President & COO of Republic Services. Jeff Cosman played an active role during the consolidation of Republic Services, specifically in the accounting consolidation, initial cultural integration and the reporting to Wall Street when they acquired 168 companies in 30 months, going from $500 Million in Revenue to over $2.1 Billion. Wally Hall, Director, President & Chief Operating Officer , Started his career with Browning Ferris Industries (NYSE: BFI ) and within 6 years oversaw 400 employees with annual revenue of $50 Million. In 2001, Mr. Hall was one of three founders of Advanced Disposal Services, Inc. (NYSE:ADSW), which is now the fourth largest solid waste company in the U.S. Starting with two trucks, Mr. Hall grew operations to over $1.3 Billion in annual revenue, 5300 employees, 91 collection/hauling facilities, 45 MSW and C&D Landfills, 71 Transfer Stations and 21 recycling facilities as Chief Operating Officer. At the time of Mr. Hall’s departure in 2014, Mr. Hall had successfully merged 3 (three) companies (Advanced Disposal, Veolia & Interstate Waste). Chris Diaz, Chief Financial Officer , was most recently responsible for ensuring accurate and timely completion of the month - end, quarter - end, and year - end closing process for Advanced Disposal Services, Inc . (NYSE : ADSW) while managing accounting policies, procedures and internal control within a SOX - compliant environment . His experience also includes performing due diligence and subsequent purchase accounting for numerous acquisitions . He has also held financial reporting and auditing positions with CSX Transportation and Skinner Nurseries, Inc . Mr . Diaz began his career as an auditor with the national accounting firm McGladrey & Pullen, LLP . 4

www.mwsinc.com NASDAQ: MRDN Investment Highlights » Large and fragmented waste collection and disposal market • Domestic TAM is ~$55B annually, with 30% of this or ~$17B managed by thousands of private small to mid - sized operators » Highly experienced management team • Executives come from leading waste management companies, including Waste Management (NYSE:WM) , Republic Services (NYSE:RSG) , Advanced Disposal Services (NYSE: ADSW) and Browning Ferris Industries (NYSE: BFI) - team has done over [200] acquisitions in the space » Vertically integrated service platform from collection to landfill • Operates over 200 trucks, 3 transfer stations and 3 MSW landfills • Serves over 105,000 residential customers and 8,000 commercial customers - growing organically and through attractive acquisitions » Growth platform with strong Adjusted EBITDA and long - term contracted revenues • Adjusted EBITDA in the mid - 20% range with substantial opportunities to expand • ~40 municipal contracts with terms of 3 - 6 years and 97% retention rate of its municipal contracts • 3 acquisitions completed to date, with long pipeline of accretive targets » Developing technologies to support growth and provide differentiation • Meridian Materials – initial patents enable use of low value pulp byproduct to create a lower cost plastic with up 70% greater strength used in the $80Bn siding and $5Bn decking markets • Mobile – enables municipalities to communicate with their residents and/or our customers and to bill via a mobile platform 5

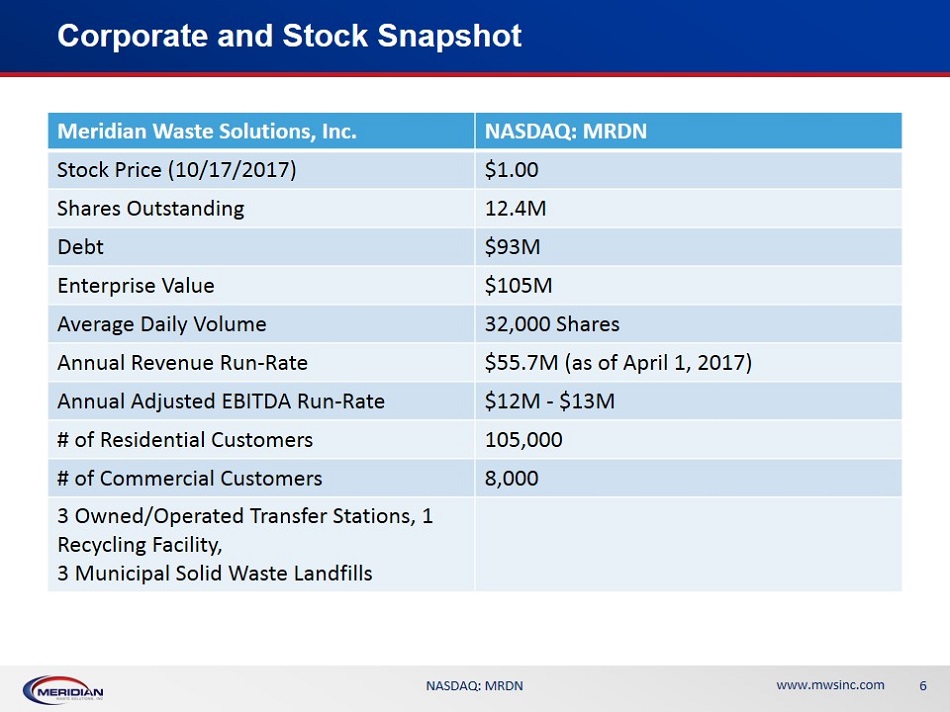

www.mwsinc.com NASDAQ: MRDN Corporate and Stock Snapshot 6 Meridian Waste Solutions, Inc. NASDAQ: MRDN Stock Price (10/17/2017 ) $ 1.00 Shares Outstanding 12.4M Debt $93M Enterprise Value $105M Average Daily Volume 32,000 Shares Annual Revenue Run - Rate $55.7M (as of April 1, 2017) Annual Adjusted EBITDA Run - Rate $ 12M - $ 13M # of Residential Customers 105,000 # of Commercial Customers 8,000 3 Owned/ Operated Transfer Stations, 1 Recycling Facility, 3 Municipal Solid Waste Landfills

www.mwsinc.com NASDAQ: MRDN Meridian Waste Operations » A vertically integrated provider of non - hazardous solid waste collection, transfer, recycling and disposal services. » Collection: Meridian operates approximately 200+ trucks with a an average age of 2010, based in St. Louis MO and Richmond, VA marketplaces, consisting of approximately 150 residential trucks and 40 commercial trucks, 10 industrial trucks and variou s other trucks. » Approximately 80% of the company’s 105,000 residential customers are municipal contract - based. » The company has roughly 40 municipal contracts with terms of 3 to 6 years and a 97% Retention Rate. » The Company has over 8,000 commercial customers and over 16,000 Roll Off Customer with 19% being Permanent and 81% being Temporary. » Transfer Stations: Meridian currently operates 3 transfer stations. » Landfill: Meridian currently owns 3 municipal solid waste landfills. Its Bowling Green, MO location has a 265 acre landfill with an expected 22,000,000 cubic yards (“cys”) currently in process of being permitted. Its Petersburg, VA location’s landfill an d transfer station has 1,500 tpd daily permit capacity. Its Lunenburg, VA landfill has 1,000 tpd daily permit capacity. » Recycling: Meridian offers recycling with their municipal contracts and subscription customers. The same residential trucks are utilized to service the recycling routes. 7 Overview Fiscal Year End December 2016 38% 21% 18% 23% Residential Municipal and Subscription Commercial Roll Off Landfill & Transfer Stations OUR FOOTPRINT: » 2016 data reflects the pro forma effect of the February 16, 2017 CFS acquisition St. Louis - 1 landfill - 2 transfer stations Richmond - 2 landfills - 1 transfer station Atlanta - Headquarters

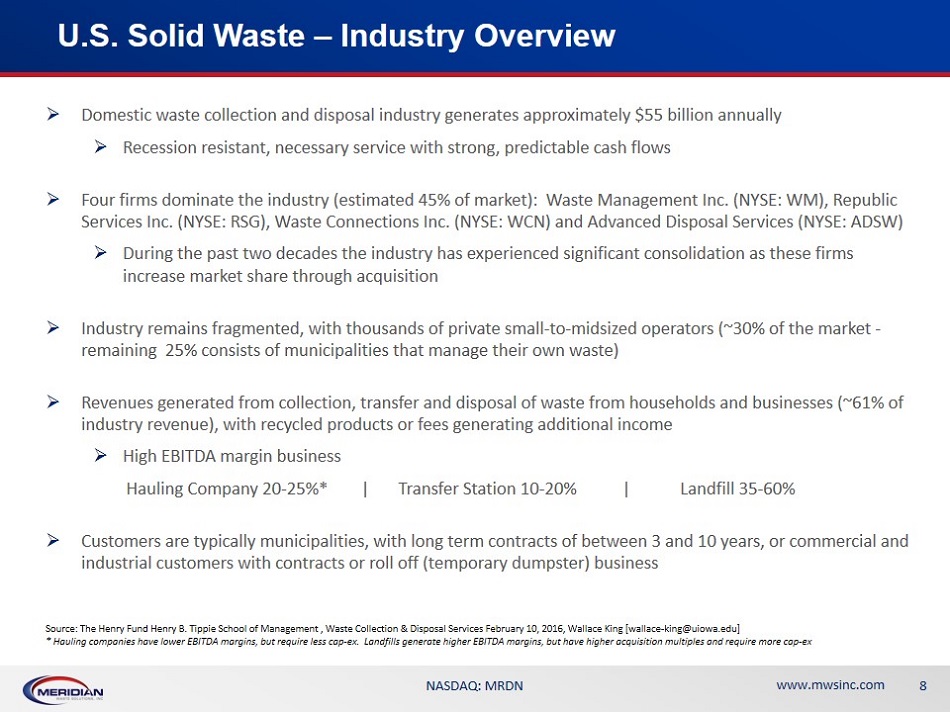

www.mwsinc.com NASDAQ: MRDN U.S. Solid Waste – Industry Overview » Domestic waste collection and disposal industry generates approximately $55 billion annually » Recession resistant, necessary service with strong, predictable cash flows » Four firms dominate the industry (estimated 45% of market): Waste Management Inc. (NYSE: WM), Republic Services Inc. (NYSE: RSG), Waste Connections Inc. (NYSE: WCN) and Advanced Disposal Services (NYSE: ADSW) » During the past two decades the industry has experienced significant consolidation as these firms increase market share through acquisition » Industry remains fragmented, with thousands of private small - to - midsized operators (~30% of the market - remaining 25% consists of municipalities that manage their own waste) » Revenues generated from collection, transfer and disposal of waste from households and businesses (~61% of industry revenue), with recycled products or fees generating additional income » High EBITDA margin business Hauling Company 20 - 25%* | Transfer Station 10 - 20% | Landfill 35 - 60% » Customers are typically municipalities, with long term contracts of between 3 and 10 years, or commercial and industrial customers with contracts or roll off (temporary dumpster) business 8 Source: The Henry Fund Henry B. Tippie School of Management , Waste Collection & Disposal Services February 10, 2016, Wallace King [wallace - king@uiowa.edu] * Hauling companies have lower EBITDA margins, but require less cap - ex. Landfills generate higher EBITDA margins, but have high er acquisition multiples and require more cap - ex

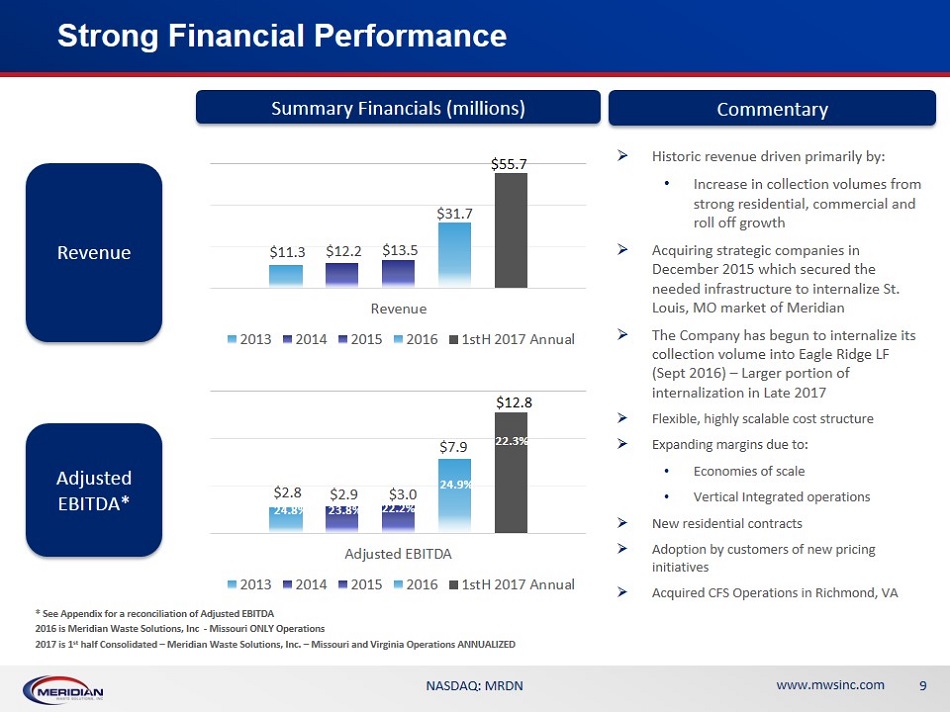

www.mwsinc.com NASDAQ: MRDN Strong Financial Performance 9 Summary Financials (millions) Revenue Adjusted EBITDA* * See Appendix for a reconciliation of Adjusted EBITDA 2016 is Meridian Waste Solutions, I nc - Missouri ONLY Operations 2017 is 1 st half Consolidated – Meridian Waste Solutions, Inc. – Missouri and Virginia Operations ANNUALIZED $11.3 $12.2 $13.5 $31.7 $55.7 Revenue 2013 2014 2015 2016 1stH 2017 Annual $2.8 $2.9 $3.0 $7.9 $12.8 Adjusted EBITDA 2013 2014 2015 2016 1stH 2017 Annual » Historic revenue driven primarily by : • Increase in collection volumes from strong residential, commercial and roll off growth » Acquiring strategic companies in December 2015 which secured the needed infrastructure to internalize St. Louis, MO market of Meridian » The Company has begun to internalize its collection volume into Eagle Ridge LF (Sept 2016) – Larger portion of internalization in Late 2017 » Flexible, highly scalable cost structure » Expanding margins due to: • Economies of scale • Vertical Integrated operations » New residential contracts » Adoption by customers of new pricing initiatives » Acquired CFS Operations in Richmond, VA Commentary 24.8% 23.8% 22.2% 24.9% 22.3%

www.mwsinc.com NASDAQ: MRDN Quarter over Quarter Growth 10 June 2015 - June 2017 $3.38 $3.78 $7.49 $8.01 $8.39 $7.81 $10.90 Revenue 9/30/15 12/31/15 3/31/16 6/30/16 9/30/16 12/31/16 3/31/17 6/30/17* ($ in millions) 26% 25% 30% 31% 29% 29% 36% Gross Profit % 9/30/15 12/31/15 3/31/16 6/30/16 9/30/16 12/31/16 3/31/17 6/30/17* $14.20 20% *2 nd Quarter was lowered by consolidation of CFS Group, Consolidation of 4 billing systems, conversion to robust G/L Package, impl em entation of 2 new municipal contracts in MO and the poor historical performance of CFS being a drain on Consolidated Meridian

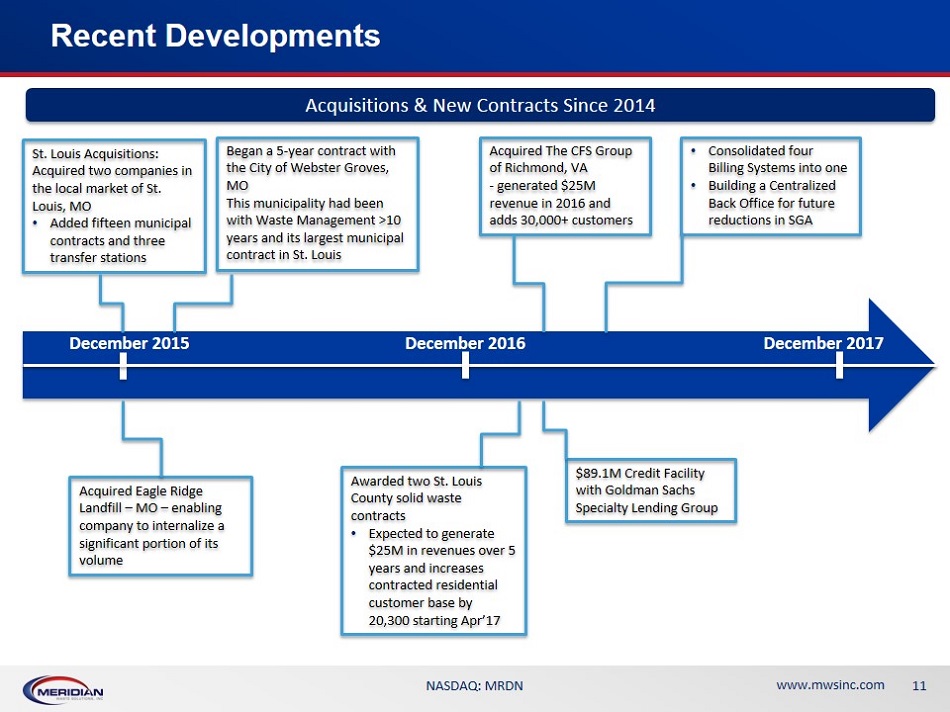

www.mwsinc.com NASDAQ: MRDN Recent Developments 11 St. Louis Acquisitions: Acquired two companies in the local market of St. Louis, MO • Added fifteen municipal contracts and three transfer stations Began a 5 - year contract with the City of Webster Groves, MO This municipality had been with Waste Management >10 years and its largest municipal contract in St. Louis Acquired Eagle Ridge Landfill – MO – enabling company to internalize a significant portion of its volume Awarded two St. Louis County solid waste contracts • Expected to generate $25M in revenues over 5 years and increases contracted residential customer base by 20,300 starting Apr’17 Acquired The CFS Group of Richmond, VA - generated $25M revenue in 2016 and adds 30,000+ customers $89.1M Credit Facility with Goldman Sachs Specialty Lending Group • Consolidated four Billing Systems into one • Building a Centralized Back Office for future reductions in SGA Acquisitions & New Contracts Since 2014 December 2015 December 2016 December 2017

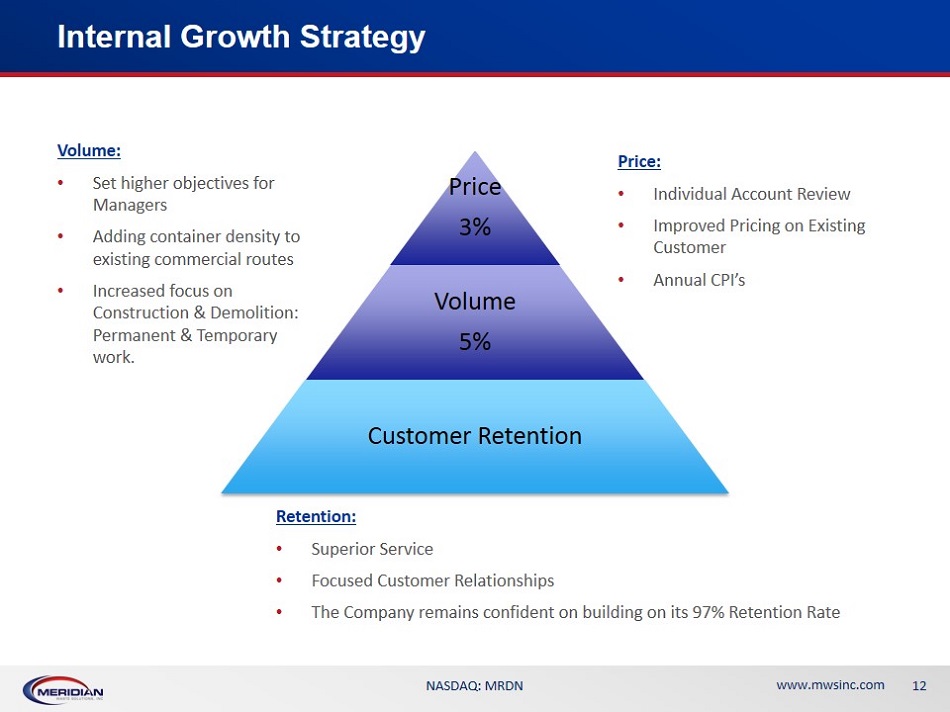

www.mwsinc.com NASDAQ: MRDN Internal Growth Strategy 12 Price 3% Volume 5% Customer Retention Price: • Individual Account Review • Improved Pricing on Existing Customer • Annual CPI’s Volume: • Set higher objectives for Managers • Adding container density to existing commercial routes • Increased focus on Construction & Demolition: Permanent & Temporary work. Retention: • Superior Service • Focused Customer Relationships • The Company remains confident on building on its 97% Retention Rate

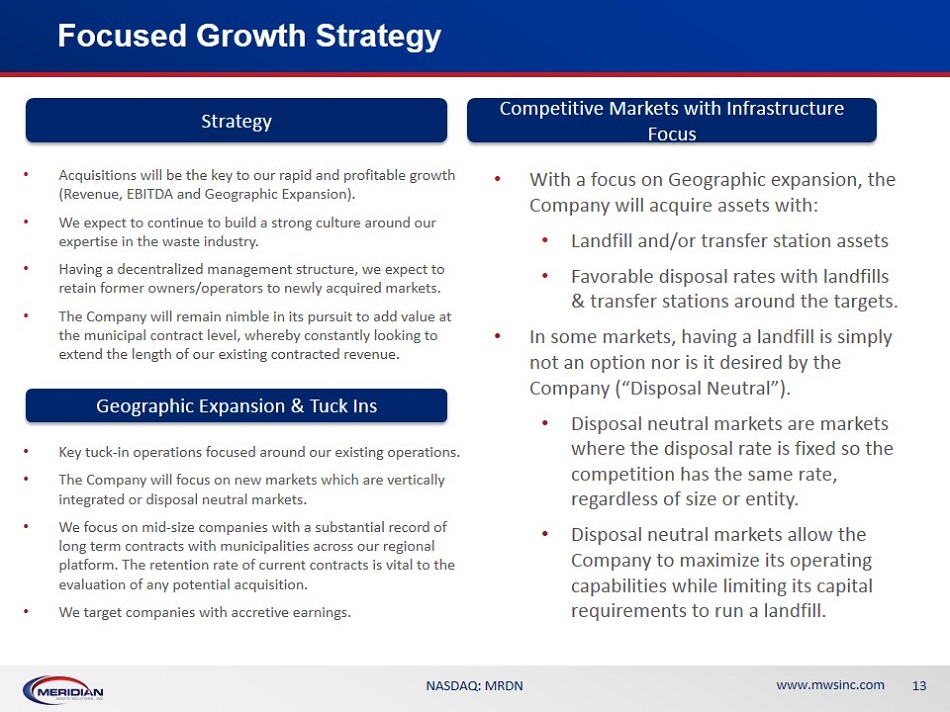

www.mwsinc.com NASDAQ: MRDN Focused Growth Strategy • Acquisitions will be the key to our rapid and profitable growth (Revenue, EBITDA and Geographic Expansion). • We expect to continue to build a strong culture around our expertise in the waste industry. • Having a decentralized management structure, we expect to retain former owners/operators to newly acquired markets. • The Company will remain nimble in its pursuit to add value at the municipal contract level, whereby constantly looking to extend the length of our existing contracted revenue. 13 Strategy Geographic Expansion & Tuck Ins • Key tuck - in operations focused around our existing operations. • The Company will focus on new markets which are vertically integrated or disposal neutral markets. • We focus on mid - size companies with a substantial record of long term contracts with municipalities across our regional platform. The retention rate of current contracts is vital to the evaluation of any potential acquisition. • We target companies with accretive earnings. • With a focus on Geographic expansion, the Company will acquire assets with: • Landfill and/or transfer station assets • Favorable disposal rates with landfills & transfer stations around the targets. • In some markets, having a landfill is simply not an option nor is it desired by the Company (“Disposal Neutral”). • Disposal neutral markets are markets where the disposal rate is fixed so the competition has the same rate, regardless of size or entity. • Disposal neutral markets allow the Company to maximize its operating capabilities while limiting its capital requirements to run a landfill. Competitive Markets with Infrastructure Focus

www.mwsinc.com NASDAQ: MRDN The Real Growth Story • The exit strategy for an owner with Meridian comes in three buckets: • Initial Cash + Initial Stock + Long Term Employment Agreement • The Company believe sellers are attracted to our mission that focuses on: • Local Management/Former Owners – long term employment agreements • Retaining Existing employees • Customer Focus • Growth (Tuck Ins & Corp Growth) 14 Why Acquisition Targets Would Sell to Meridian Versus WM, RSG, WCN, ADSW Maximize Growth Strategy for Investors • The Company believes the last growth strategy on the public markets was Waste Connections (WCN). • Private Equity remains the primary source of growth for smaller companies; reducing ”true growth strategies” exposure to public markets. • The Company believes a focused mid - sized company with an experienced management team who have executed both new market start - up and acquisition growth strategies will benefit value oriented growth investors.

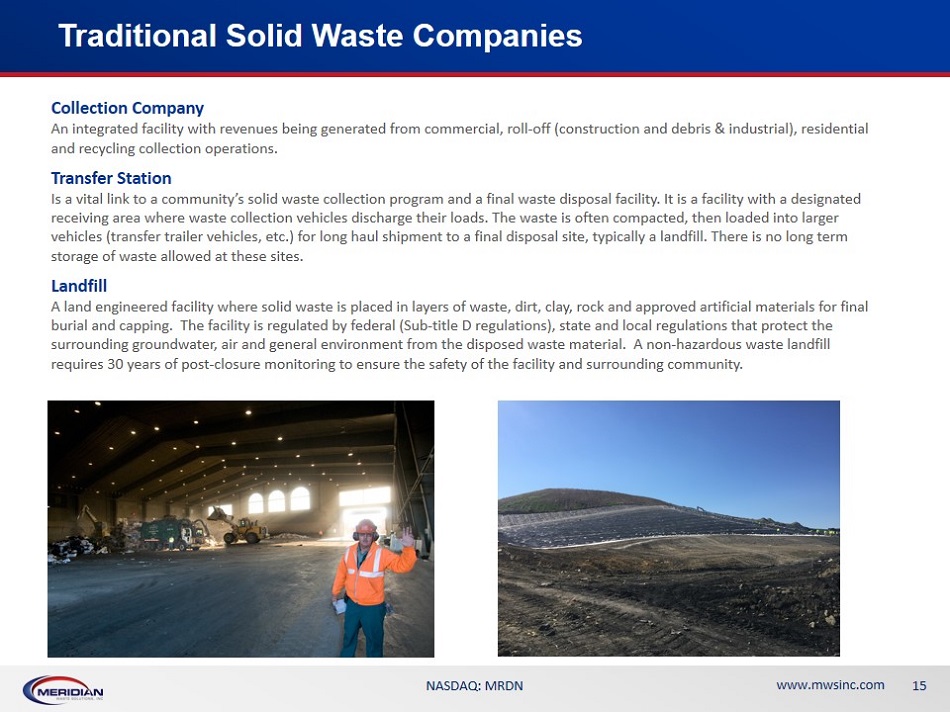

www.mwsinc.com NASDAQ: MRDN Traditional Solid Waste Companies Collection Company An integrated facility with revenues being generated from commercial, roll - off (construction and debris & industrial), residenti al and recycling collection operations. Transfer Station Is a vital link to a community’s solid waste collection program and a final waste disposal facility. It is a facility with a des ignated receiving area where waste collection vehicles discharge their loads. The waste is often compacted, then loaded into larger vehicles (transfer trailer vehicles, etc.) for long haul shipment to a final disposal site, typically a landfill. There is no lo ng term storage of waste allowed at these sites. Landfill A land engineered facility where solid waste is placed in layers of waste, dirt, clay, rock and approved artificial materials fo r final burial and capping. The facility is regulated by federal (Sub - title D regulations), state and local regulations that protect th e surrounding groundwater, air and general environment from the disposed waste material. A non - hazardous waste landfill requires 30 years of post - closure monitoring to ensure the safety of the facility and surrounding community. 15

www.mwsinc.com NASDAQ: MRDN Meridian Innovations, LLC • Enormous volumes of manufacturing residues are disposed of on a daily basis • These residues contain concentrated sources of otherwise valuable materials that could yield superior economic value should they be efficiently recovered and further processed • Meridian Innovations is investing in advanced byproduct recovery technologies to capitalize on these opportunities. • In addition, Meridian Innovations, plans to acquire certain downstream production assets that can further capitalize on the low cost, high performance materials it recovers • A technical development team of experts has been assembled who have a highly successful track record in technology development and commercialization • Over the past ten years, these technologists have invented and commercialized technologies that are currently generating more than $500 million per year in net income through the recovery of materials from otherwise low value industrial byproduct streams 16 Seeking to Capitalize on Value of Recovered Materials

www.mwsinc.com NASDAQ: MRDN Meridian Materials, LLC 17 Joint Venture with Advanced Lignin Bio - composites, LLC • Meridian Materials LLC was formed as a Joint Venture between Meridian Innovations and technology provider Advanced Lignin Biocomposites LLC. The company plans to recover Lignin from the byproduct streams of those businesses that process woody biomass (Pulp & Paper Producers and Cellulosic Biorefineries). Lignin is an essential component in all plants and if efficiently recovered and further processed can be used to produce a wide array of valuable materials such as: plastics, carbon fiber, adhesives and transportation fuels. • While we are not the first “green, plant based, materials company”, Advanced Lignin believes its technology portfolio will be the first to produce materials that perform as well or better than those produced from non - sustainable sources, such as petroleum, and to do so at a lower cost. • Current Value of Lignin = $60/ton, Our objective is to convert lignin into materials that displace: ABS Plastic = $2200/ton, PVC/PE/PP = $1200/ton, Carbon Fiber $20,000/ton, PF Adhesives = $1600/ton, Transportation Fuels = $500/ton • How much lignin is there? While there is about 230 Bn Tons of Crude Oil in the Ground being reduced daily, there is about 300 Bn Tons of Lignin, a rapidly renewable resource, sitting on the Earth’s surface right now.

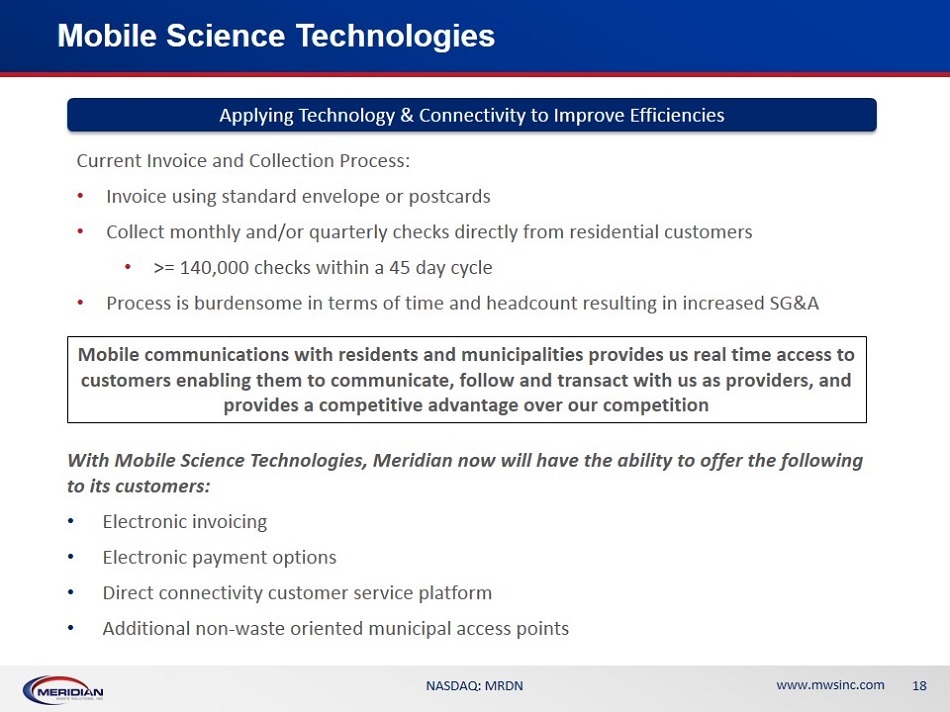

www.mwsinc.com NASDAQ: MRDN Mobile Science Technologies With Mobile Science Technologies, Meridian now will have the ability to offer the following to its customers: • Electronic invoicing • Electronic payment options • Direct connectivity customer service platform • Additional non - waste oriented municipal access points 18 Applying Technology & Connectivity to Improve Efficiencies Current Invoice and Collection Process: • Invoice using standard envelope or postcards • Collect monthly and/or quarterly checks directly from residential customers • >= 140,000 checks within a 45 day cycle • Process is burdensome in terms of time and headcount resulting in increased SG&A Mobile communications with residents and municipalities provides us real time access to customers enabling them to communicate, follow and transact with us as providers, and provides a competitive advantage over our competition

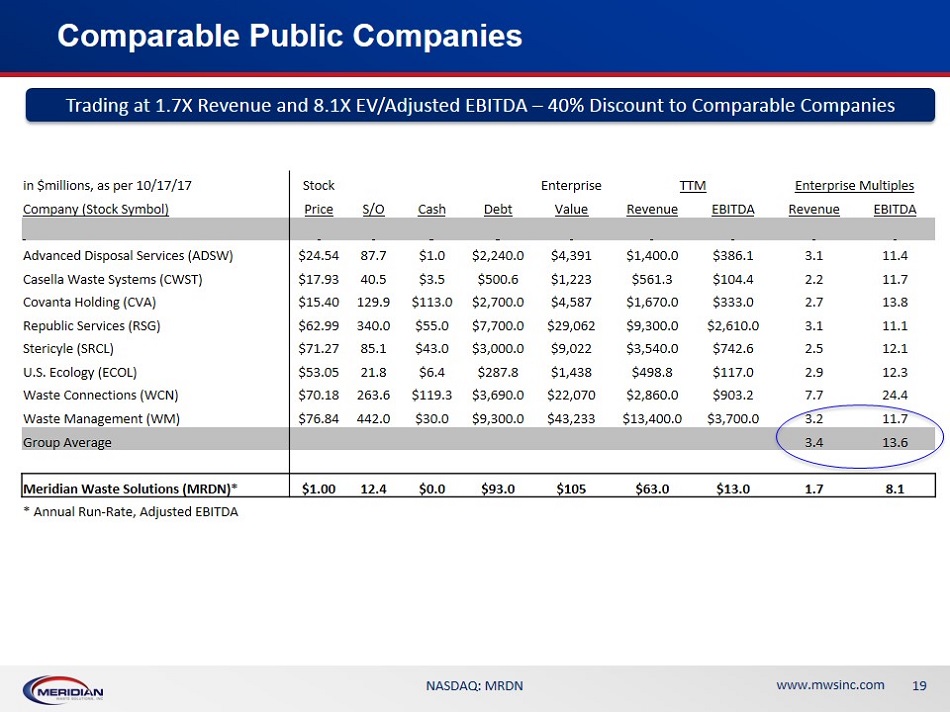

www.mwsinc.com NASDAQ: MRDN Comparable Public Companies 19 Trading at 1.7X Revenue and 8.1X EV/Adjusted EBITDA – 40% Discount to Comparable Companies in $millions, as per 10/17/17 Stock Enterprise TTM Enterprise Multiples Company (Stock Symbol) Price S/O Cash Debt Value Revenue EBITDA Revenue EBITDA Advanced Disposal Services (ADSW) $24.54 87.7 $1.0 $2,240.0 $4,391 $1,400.0 $386.1 3.1 11.4 Casella Waste Systems (CWST) $17.93 40.5 $3.5 $500.6 $1,223 $561.3 $104.4 2.2 11.7 Covanta Holding (CVA) $15.40 129.9 $113.0 $2,700.0 $4,587 $1,670.0 $333.0 2.7 13.8 Republic Services (RSG) $62.99 340.0 $55.0 $7,700.0 $29,062 $9,300.0 $2,610.0 3.1 11.1 Stericyle (SRCL) $71.27 85.1 $43.0 $3,000.0 $9,022 $3,540.0 $742.6 2.5 12.1 U.S. Ecology (ECOL) $53.05 21.8 $6.4 $287.8 $1,438 $498.8 $117.0 2.9 12.3 Waste Connections (WCN) $70.18 263.6 $119.3 $3,690.0 $22,070 $2,860.0 $903.2 7.7 24.4 Waste Management (WM) $76.84 442.0 $30.0 $9,300.0 $43,233 $13,400.0 $3,700.0 3.2 11.7 Group Average 3.4 13.6 Meridian Waste Solutions (MRDN)* $1.00 12.4 $0.0 $93.0 $105 $63.0 $13.0 1.7 8.1 * Annual Run - Rate, Adjusted EBITDA

www.mwsinc.com NASDAQ: MRDN Board of Directors Thomas J. Cowee, Director (Audit Committee Chair) , has 37 years of experience in the environmental industry, including 15 years as a Chief Financial Officer. After retiring at the end of 2012, Mr. Cowee began serving as a board director for companies an d i s currently serving as a director on; Enviro Group, LLC and STC Investors, LLC, both privately owned environmental companies, b oth since 2015. Enviro Group, LLC is a hazardous trucking and transfer company, and STC Investors, LLC is primarily a refinery se rvi ces and trucking company. Previously Mr. Cowee served as a director on the board of Rizzo Group, LLC, a privately owned solid waste collection, transfer and recycling business from 2014 to 2016, until sold. Mr. Cowee was Vice President and Chief Financial Offi cer of Progressive Waste Solutions Ltd, from 2005 to 2012. Progressive Waste Solutions Ltd (NYSE:BIN) , was a publicly traded solid waste collection, transfer, recycling and landfill business, with operations in the United States and Canada. Mr. Cowee joined I ESI Corporation in 1997 as its Chief Financial Officer and in 2000 was appointed Senior Vice President and Chief Financial Officer u ntil IESI Corporation was acquired by Progressive Waste Solutions Ltd in 2005. From 1995 to 1997, he was Assistant Corporate Controller of USA Waste Services, Inc., and from 1979 to 1995 he held various field accounting positions with Waste Management Inc. Mr. Cowee has a B.Sc. in accounting from The Ohio State University. Jackson Davis, Director (Nominating Committee Chair) , has more than 20 years experience in technology and technology leadership, previously holding roles with software development companies providing mobile infrastructure management and wholesale financing solutions. Mr. Davis holds a BSBA in Decision Science with concentration in Management Information Syste ms from East Carolina University and has extensive experience in guiding organizational business strategy to propel improvement and maximum impact, while focusing on cost - efficiency and productivity. He is currently Director of Financial and Business Services Applications for Cox Enterprises a leading communications, media, and automotive services company with revenues of $18 billio n. Joe Ardagna, Director (Compensation Committee Chair) , Brings 30 years of experience in the restaurant industry, starting as an hourly kitchen employee to owning and operating a 28 restaurant chain in Atlanta and the Carolinas doing approximately $ 90 million in yearly sales . Mr . Ardagna oversaw all aspects of the business including but not limited to finance, legal, compensation, site selection, design and development, licensing and brand development . Mr . Ardagna sold a majority of his interest to a private equity group in 2011 and currently sits on the Board of Directors with the Company . In 2013 , Mr . Ardagna started a new venture in the restaurant industry in Atlanta and currently oversees the operation of 4 pizza restaurants and the construction of a new store opening in February 2017 . He has an undergraduate degree from Bowdoin College in 1984 and serves on the Board of Trustees at the New Hampton School in New Hampshire . 20

Meridian Waste Solutions Investor Presentation Thank You! October 2017 Jeff Cosman, CEO ir@mwsinc.com One Glenlake Parkway NE, Suite 900, Atlanta, GA 30328 www.mwsinc.com NASDAQ: MRDN