Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - FRANKLIN RESOURCES INC | exhibit991q4fy17.htm |

| 8-K - FORM 8-K - FRANKLIN RESOURCES INC | form8kq4fy17.htm |

• The fiscal year ended on a positive note as strong sales momentum

and lower redemptions resulted in four consecutive quarters of

improved net outflows, driven by international retail flows that were

positive for the third consecutive quarter.

• The number of our four- and five- star funds in the U.S. has tripled

since last year led by U.S. equity and tax-free fixed income

products.

• During the year we made significant progress with a number of our

key broker dealer partners, gaining placement of several flagship

products, some for the first time, on a number of recommended

lists and platforms.

• Fiscal year financial results remained strong. For the year, the

company generated operating income of $2.3 billion, an operating

margin of 35.4%, and net income was $1.7 billion.

• The company continued its track record of shareholder friendly

capital management, returning over $1.2 billion during the fiscal

year through dividends and repurchases, which represents 71% of

net income. Diluted average shares outstanding declined by about

4% on a net basis.

• We continued to build out our global ETF platform and expanded

our product line in the quarter to include options for European

clients, bringing the total active and smart beta ETFs to 21

globally.

FRANKLIN RESOURCES, INC.

Executive Quarterly Earnings Commentary

Preliminary Fourth Quarter and Fiscal Year Results

October 26, 2017

Highlights

Investment

Performance

2

Assets Under

Management and

Flows

3-4

Flows by Investment

Objective

5-7

Financial Results 8

Operating Revenues

and Expenses

9-10

Other Income and

Taxes

10

Capital Management 11-12

Appendix 13

Greg Johnson

Chairman of the Board

Chief Executive Officer

Kenneth A. Lewis

Executive Vice President

Chief Financial Officer

Conference Call Details:

Johnson and Lewis will lead a live teleconference today at 11:00

a.m. Eastern Time to answer questions of a material

nature. Access to the teleconference will be available via

investors.franklinresources.com or by dialing (877) 407-8293 in the

U.S. and Canada or (201) 689-8349 internationally. A replay of the

teleconference can also be accessed by calling (877) 660-6853 in

the U.S. and Canada or (201) 612-7415 internationally using access

code 13671688, after 2:00 p.m. Eastern Time on October 26, 2017

through November 26, 2017.

Analysts and investors are encouraged to review the Company’s

recent filings with the U.S. Securities and Exchange Commission

and to contact Investor Relations at (650) 312-4091 before the live

teleconference for any clarifications or questions related to the

earnings release or written commentary.

Contents Page(s)

Exhibit 99.2

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

Investment Performance

Long-term relative investment performance rankings of our U.S. and cross-border mutual funds, as of September

30th, were generally consistent with what was reported last quarter.

Importantly, the investment performance of our largest ten mutual funds remains strong with relative performance

that exceeds that of the aggregate weighted average shown above. Performance of our Global Macro group

remains particularly strong, with top quartile performance over most time periods.

Franklin Income fund, which accounts for 17% of long-term total assets, continued to pressure three- and five-year

performance, however, the fund was just on the cusp of the second quartile (51st percentile) for the five-year period.

Additionally, if near term outperformance of the fund continues, we are likely to see improvement in the fund’s three-

year track record as past periods of underperformance begin to roll off next quarter.

Short-term relative investment performance for the one-year period was a bit lower, due mostly to a few global

equity funds which tend to underperform in bull markets due to their value approach.

2

Percentage of Total Long-Term Assets ($496 billion) in the Top Two Peer Group Quartiles1

1. The peer group rankings are sourced from either Lipper, a Thomson Reuters Company or Morningstar, as the case may be, and are based on an

absolute ranking of returns as of September 30, 2017. Lipper rankings for Franklin Templeton U.S.-registered long-term mutual funds are based

on Class A shares and do not include sales charges. Franklin Templeton U.S.-registered long-term funds are compared against a universe of all

share classes. Performance rankings for other share classes may differ. Morningstar rankings for Franklin Templeton cross-border long-term

mutual funds are based on primary share classes and do not include sales charges. Performance rankings for other share classes may differ.

Results may have been different if these or other factors had been considered. The figures in the table are based on data available from Lipper as

of October 6, 2017 and Morningstar as of October 9, 2017 and are subject to revision.

© 2017 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2)

may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are

responsible for any damages or losses arising from any use of this information.

Performance quoted above represents past performance, which cannot predict or guarantee future results. All investments involve risks,

including loss of principal.

Greg Johnson, Chairman and CEO

3-Year 5-Year 10-Year

Equity & Multi-Asset/Balanced- $292 billion

Fixed Income - $204 billion

1-Year

75%

58% 42% 50% 78%

57% 37% 43%

59% 49% 59% 82%

Assets Under Management and Flows

The change in assets under management was

attributable to net market change and improving flow

trends. Total long-term sales were up 10% for the

fiscal year and 21% from the same quarter a year

ago. Redemptions similarly improved, down 9% for

the full year and 16% from same quarter a year ago.

3

Simple Monthly Average vs. End of Period

(in US$ billions, for the three months ended)

736

723

732 742

749

733

720

740 743

753

9/16 12/16 3/17 6/17 9/17

Average AUM Ending AUM

Greg Johnson, Chairman and CEO

Net Market Change and Other

(In US$ billions, for the three months ended)

Long-Term Flows

(In US$ billions, for the three months ended)

22.7 24.5

30.5 29.8 27.5

(44.6) (46.7) (44.5)

(41.1) (37.4)

(17.7)

(14.4) (11.0) (7.3)

(5.9)

9/16 12/16 3/17 6/17 9/17

18.9

1.1

31.0

10.1

16.3

9/16 12/16 3/17 6/17 9/17

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

Assets under management ended the year at

$753 billion, 3% above the prior year, and

average assets for the quarter continue to trend

upward at $749 billion.

Long-Term

Sales

Long-Term

Redemptions

Net Flows1

1. Net flows are defined as long-term sales less long-term redemptions plus long-term net exchanges and long-term reinvested distributions.

The improvement in flows was most pronounced in

the international institutional channel, where the

combination of a 44% decline in redemptions and a

notable improvement in sales led to nearly breakeven

flows. In fact, sales in this channel were at the highest

level in nearly two years.

Our U.S. institutional business continues to face

headwinds as Templeton Global Equity, which has

historically been a big driver of sales in this channel,

has not seen as strong of a demand.

The decline in redemptions was also evident in the

retail channel this quarter, with retail product

redemptions at the lowest levels since the

third quarter of 2010.

Internationally, the retail business sustained recent

momentum and generated positive net inflows for the

third consecutive quarter. Sales and redemptions both

declined slightly, and flows were essentially flat, as

demand from a number of sales regions in this

channel continued.

We had particular success in the Asia Pacific region,

as sustained performance improvements in core

strategies, additional share class offerings, and strong

promotion of our brand in Asia resulted in improved

flows.

There has also been a pickup in the number of funds

approved on platforms across many of the global

financial institutions that we partner with, and we are

4 1. Graphs do not include high net-worth client flows.

Long-Term Flows: International1

(In US$ billions, for the three months ended)

Long-Term Flows: United States1

(In US$ billions, for the three months ended)

Greg Johnson, Chairman and CEO

Retail Long-Term

Sales

Retail Long-Term

Redemptions

Institutional

Long-Term Sales

Institutional Long-Term

Redemptions

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

actively working to get more key funds approved on

their recommended lists, with a focus on Franklin K2,

Templeton Global Macro, and Templeton Emerging

Markets products.

In the U.S., however, slower sales more than offset

the improvement in redemptions.

Uncertainty around the implementation of the

Department of Labor’s Fiduciary Rule continues to

weigh on sales. Additionally, U.S. retail sales were at a

thirteen year low in September and we suspect

hurricanes Harvey and Irma were a factor as we did

see significant declines coming from Florida, Houston

and other southeast territories.

Flows in the insurance channel continue to stabilize,

with redemptions at the lowest level in nearly a

decade and some positive sales momentum with our

first win in the rapidly growing fixed index annuity

market this quarter.

10.3 10.9

12.4 11.6

9.6

2.0 2.1 2.9 2.5 2.0

(20.9)

(25.9)

(20.7)

(17.1) (16.0)

(5.6) (5.2) (5.8) (5.6) (5.9)

9/16 12/16 3/17 6/17 9/17

7.7 8.5

12.0 12.5 12.4

2.5 2.1 2.9 2.4 3.2

(11.5) (11.8) (11.6) (11.3) (11.2)

(6.2)

(3.3)

(6.0) (6.3)

(3.5)

9/16 12/16 3/17 6/17 9/17

Retail Long-Term

Sales

Retail Long-Term

Redemptions

Institutional

Long-Term Sales

Institutional Long-Term

Redemptions

Flows by Investment Objective

5

1. Sales and redemptions as a percentage of beginning assets under management are annualized.

2. Net flows are defined as long-term sales less long-term redemptions plus long-term net exchanges and long-term reinvested distributions.

Global/ International Equity

Net Flows2 Long-Term

Sales

Long-Term

Redemptions

(in US$ billions, for the three months ended)

Looking now at flows by investment objective,

global equity outflows across the firm improved

again this quarter, as institutional redemptions from

international clients declined and we saw increased

demand for certain emerging markets equity

products from our retail clients, but this was offset

by lower sales into Mutual Global Discovery and

Templeton Foreign funds due to their value

investment approach.

4.9 5.9

6.9 6.5

5.4

(13.2)

(10.7)

(13.8) (12.9)

(11.0)

(7.7)

(2.9)

(6.7) (6.2) (5.0)

9/16 12/16 3/17 6/17 9/17

Global / International Fixed Income

(in US$ billions, for the three months ended)

6.3 6.1

9.0

11.2 11.9

(14.5) (14.2)

(11.6)

(9.5) (9.0)

(7.5) (7.5)

(2.0)

2.6

3.8

9/16 12/16 3/17 6/17 9/17

% of Beg. AUM1

Prior 4

Quarters Avg

Current

Quarter

Sales 12% 10%

Redemptions 25% 21%

% of Beg.

AUM1

Prior 4

Quarters Avg

Current

Quarter

Sales 21% 30%

Redemptions 31% 23%

Net Flows2 Long-Term

Sales

Long-Term

Redemptions

Greg Johnson, Chairman and CEO

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

Global international fixed income net inflows continue

to gain traction and were $3.8 billion this quarter, due

to both higher sales and lower redemptions. The

Templeton Emerging Markets bond fund continues to

be the main driver of flows here but net flows improved

again across many funds within the category, including

the flagship U.S. Templeton Global Bond and cross-

border Templeton Global Total Return funds, which

were both in positive territory this quarter.

We anticipate a portfolio allocation change by a key

distributor to occur this month, which is expected to

result in a redemption of about $850 million from

Templeton Global Bond.

6

Multi-Asset/Balanced

(In US$ billions, for the three months ended)

2.8

4.0 4.2 4.6 4.0

(5.0)

(6.7)

(6.0)

(6.8) (6.2)

(1.1) (1.2) (0.5) (0.6) (1.1)

9/16 12/16 3/17 6/17 9/17

U.S. Equity

(in US$ billions, for the three months ended)

3.5 3.7

4.3

3.6 3.1

(6.4)

(7.5)

(6.4) (5.9)

(5.6)

(2.1)

(0.5)

(1.9) (1.9) (1.8)

9/16 12/16 3/17 6/17 9/17

U.S. equity outflows were essentially flat for the

third consecutive quarter at about $2 billion as a

decline in redemptions was offset by a similar decline

in sales. However, there has been strong demand for

some of the largest funds in the category with

excellent relative performance, notably Franklin

Growth and Franklin Dynatech funds, which broke

sales records this fiscal year.

Net Flows2 Long-Term

Sales

Long-Term

Redemptions

% of Beg.

AUM1

Prior 4

Quarters Avg

Current

Quarter

Sales 15% 12%

Redemptions 25% 21%

% of Beg.

AUM1

Prior 4

Quarters Avg

Current

Quarter

Sales 11% 11%

Redemptions 18% 18%

Net Flows2 Long-Term

Sales

Long-Term

Redemptions

Multi-asset/balanced outflows increased and were

about $1 billion this quarter. Franklin Income fund

was the main driver as the fund was downgraded to

three stars by Morningstar last quarter, where it

remained through the fourth quarter. While sales

were down, redemptions in the fund were

essentially flat. Cross-border Franklin K2 Alternative

Strategies fund continued to see strong demand

and generated net inflows for the quarter.

Greg Johnson, Chairman and CEO

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

1. Sales and redemptions as a percentage of beginning assets under management are annualized.

2. Net flows are defined as long-term sales less long-term redemptions plus long-term net exchanges and long-term reinvested distributions.

7

Taxable U.S. Fixed Income

(In US$ millions for the three months ended)

2.6 2.6

4.2

2.2

1.5

(3.4)

(3.9) (3.9)

(3.1) (3.4)

(0.4)

(0.8)

0.5

(0.5)

(1.7)

9/16 12/16 3/17 6/17 9/17

Taxable U.S fixed income was one of the areas that

did not experience an improvement in flows this

quarter, due to lower demand for floating rate

strategies.

Redemptions from high yield also weighed on flows,

but we’ve seen a strong rebound in performance of

many of our high yield strategies, as commodities

have rebounded, which hopefully bodes well for

future flows.

Net Flows2 Long-Term

Sales

Long-Term

Redemptions

% of Beg.

AUM1

Prior 4

Quarters Avg

Current

Quarter

Sales 22% 12%

Redemptions 27% 26%

Tax-Free Fixed Income

(In US$ billions, for the three months ended)

2.6 2.2 1.9 1.7 1.6

(2.1)

(3.7)

(2.8) (2.9)

(2.2)

1.1

(1.5)

(0.4)

(0.7)

(0.1)

9/16 12/16 3/17 6/17 9/17

Tax-free fixed income net flows nearly broke even

this quarter, due primarily to lower redemptions, as

sales were essentially flat. Franklin High Yield Tax-

Free Income fund saw the most improvement with a

significant drop in redemptions this quarter and

several intermediate term funds also had improved

flows.

Our funds’ investments in Puerto Rico have drawn

some press attention lately, but our municipal bond

team’s exposure to the region is relatively immaterial,

only representing roughly 2% of total municipal bond

assets.

% of Beg.

AUM1

Prior 4

Quarters Avg

Current

Quarter

Sales 11% 9%

Redemptions 16% 12%

Net Flows2 Long-Term

Sales

Long-Term

Redemptions

Greg Johnson, Chairman and CEO

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

1. Sales and redemptions as a percentage of beginning assets under management are annualized.

2. Net flows are defined as long-term sales less long-term redemptions plus long-term net exchanges and long-term reinvested distributions.

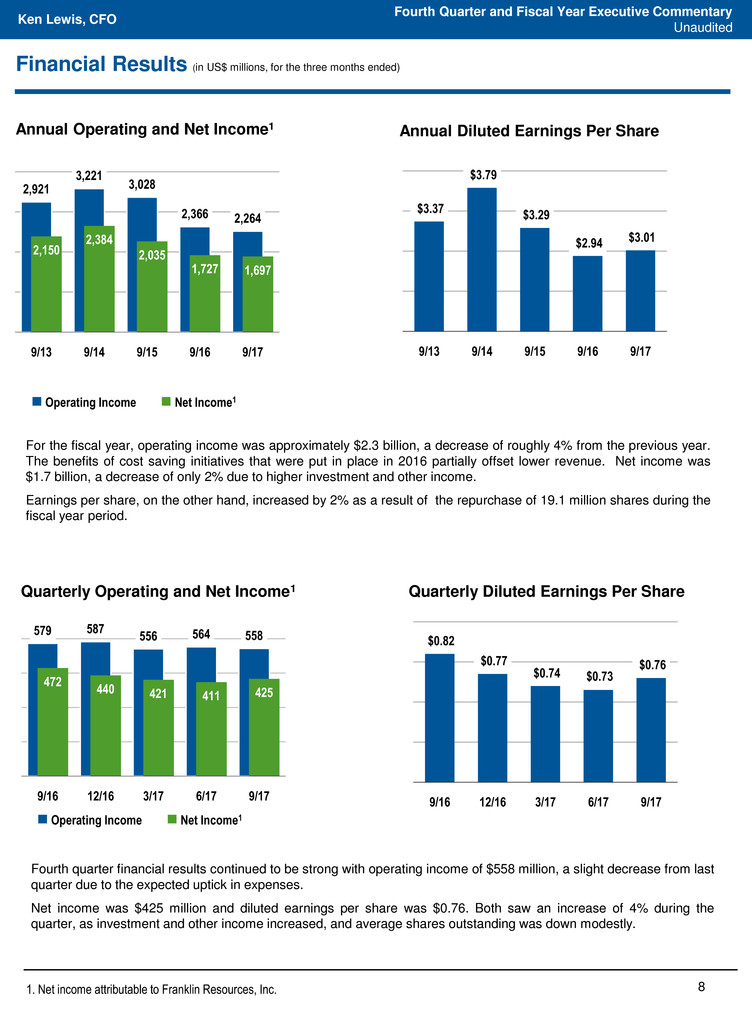

Financial Results

For the fiscal year, operating income was approximately $2.3 billion, a decrease of roughly 4% from the previous year.

The benefits of cost saving initiatives that were put in place in 2016 partially offset lower revenue. Net income was

$1.7 billion, a decrease of only 2% due to higher investment and other income.

Earnings per share, on the other hand, increased by 2% as a result of the repurchase of 19.1 million shares during the

fiscal year period.

8

(in US$ millions, for the three months ended)

$0.82

$0.77

$0.74 $0.73

$0.76

9/16 12/16 3/17 6/17 9/17

Quarterly Diluted Earnings Per Share

579 587 556 564 558

472

440 421 411 425

9/16 12/16 3/17 6/17 9/17

Quarterly Operating and Net Income1

Operating Income Net Income1

Fourth quarter financial results continued to be strong with operating income of $558 million, a slight decrease from last

quarter due to the expected uptick in expenses.

Net income was $425 million and diluted earnings per share was $0.76. Both saw an increase of 4% during the

quarter, as investment and other income increased, and average shares outstanding was down modestly.

1. Net income attributable to Franklin Resources, Inc.

Ken Lewis, CFO

Annual Operating and Net Income1 Annual Diluted Earnings Per Share

2,921

3,221

3,028

2,366 2,264

2,150

2,384

2,035

1,727 1,697

9/13 9/14 9/15 9/16 9/17

$3.37

$3.79

$3.29

$2.94 $3.01

9/13 9/14 9/15 9/16 9/17

Operating Income Net Income1

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

9

Total revenues for the quarter were $1.6 billion, essentially flat compared with the previous and year ago quarters.

Investment management fees increased 1% this quarter, due to higher average assets under management and the

additional day in the quarter. This was partially offset by lower performance fees, which were $1.3 million.

Sales and distribution fees decreased 3%, despite higher average assets under management, due to a slowing of

commissionable sales, particularly in the U.S. As summarized in the appendix, asset-based fees increased 2% and

were more than offset by the 18% decrease in sales based fees.

Shareholder servicing fees were down marginally, and other revenue was $29 million, with the increase almost

entirely attributable to dividend and interest income from consolidated sponsored investment products.

Ken Lewis, CFO

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

Sep-17 Jun-17

Sep-17 vs.

Jun-17

Mar-17 Dec-16 Sep-16

Sep-17 vs.

Sep-16

Sales, distribution and marketing $ 534.9 $ 541.2 (1%) $ 534.8 $ 520.0 $ 536.2 (0%)

Compensation and benefits 336.1 342.7 (2%) 343.4 311.5 317.2 6%

Information systems and

technology

60.0 54.1 11% 54.0 51.7 56.0 7%

Occupancy 33.0 30.2 9% 29.0 29.1 37.3 (12%)

General, administrative and other 95.2 81.5 17% 83.9 61.6 85.7 11%

Total Operating Expenses $ 1,059.2 $ 1,049.7 1% $ 1,045.1 $ 973.9 $ 1,032.4 3%

Sep-17 Jun-17

Sep-17 vs.

Jun-17

Mar-17 Dec-16 Sep-16

Sep-17 vs.

Sep-16

Investment management fees $ 1,109.8 $ 1,097.0 1% $ 1,089.2 $ 1,063.2 $ 1,096.3 1%

Sales and distribution fees 421.8 433.3 (3%) 431.2 419.3 440.8 (4%)

Shareholder servicing fees 56.0 56.7 (1%) 56.4 56.6 58.4 (4%)

Other 29.3 26.9 9% 23.8 21.7 16.3 80%

Total Operating Revenues $ 1,616.9 $ 1,613.9 0% $ 1,600.6 $ 1,560.8 $ 1,611.8 0%

Operating Revenues and Expenses

(in US$ millions, for the three months ended)

Sales, distribution and marketing expense was $535 million, down slightly over the prior quarter due mostly to a

decline in commissionable sales that outpaced the decline in total long-term retail sales. This was partially offset by

the impact of higher non-US assets and a longer quarter on the asset based component.

As expected, compensation and benefits expense was $336 million this quarter, a decrease of about 2% due

mostly to lower variable compensation.

Information systems and technology expense increased 11% and was $60 million this quarter. As a reminder, we

typically see fourth quarter seasonal increases in this line.

General, administrative and other expense was $95 million this quarter due mostly to a number of seasonally

higher expenses that impact this line item, but this was a little higher than expected due to some one-time items in

the quarter.

In the current fiscal year, we are planning to execute on a number of strategic initiatives to further enhance our

investment performance and global distribution capabilities, introduce some new products and services to the

marketplace (including expanding our ETF footprint in US, Europe and Canada) and maintain the infrastructure

needed to support these investments. We will be measured in our approach and may make additional investments

to capture momentum where we see success.

Our thoughts today are that these initiatives could lead to an increase in year over year operating expense,

excluding sales, distribution and marketing expense, of about 3-5%. It is difficult to be more precise as the

expenses are likely to be phased in over the year. Due to seasonality, it is reasonable to expect expenses to

decline next quarter.

10

Other Income and Taxes

Ken Lewis, CFO

30.5

19.5

0.1 0.7

(12.7)

(3.0)

65.6

100.7

([VALUE])

57.9

Dividend and

interest

income

Equity

method

investments

Available-for-

sale

investments

Trading

investments

Interest

expense

Foreign

exchange

and other

Consolidated

sponsored

investment

products

(SIPs)

Total

other

income

Noncontrolling

interests2

Other income,

net of

noncontrolling

interests

Other Income

(In US$ millions, for the three months ended)

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

Operating Margin (%) vs. Average AUM

(in US$ billions for the fiscal year ended)

Fiscal Year

Operating Income

(in US$ millions)

2,068 2,099 1,203 1,959 2,660 2,515 2,921 3,221 3,028 2,366 2,264

Average AUM:

2.4% CAGR

Operating

Income1:

0.9% CAGR

Average AUM ━Operating Margin

582 605

442

571

694 706

808

888 870

749 737

33.3%

34.8%

28.7%

33.5%

37.3%

35.4%

36.6% 37.9% 38.1%

35.7% 35.4%

9/07 9/08 9/09 9/10 9/11 9/12 9/13 9/14 9/15 9/16 9/17

1. CAGR is the compound average annual growth rate over the trailing 10-year period.

2. Reflects the portion of noncontrolling interests, attributable to third-party investors, related to consolidated SIPs included in Other

income

Other income, net of noncontrolling interests, was $58 million this quarter. Higher dividend and interest income

combined with lower unrealized foreign exchange losses drove the increase from the prior quarter.

The fiscal year tax rate of 29.8% was lower than expected, due mostly to an increase in net income attributable to

noncontrolling interests this quarter, and a shift in the earnings mix towards lower tax jurisdictions.

Profitability remains strong with an operating margin of 35.4% for the fiscal year. However, a decline in revenues

driven by lower average assets under management slightly outpaced the overall decline in expenses which caused

some modest contraction from the prior year.

11

1. U.S. asset managers include AB, AMG, APAM, APO, ARES, BLK, BX, CG, CLMS, CNS, EV, FIG, FII, GBL, IVZ, KKR, LM, MN, OAK, OMAM, OZM,

PZN, TROW, VRTS, WDR and WETF. Source: Thomson Reuters and company reports.

BEN U.S. Asset Managers Average (ex-BEN)2

Change in Ending Shares Outstanding

U.S. Asset

Managers (ex-

BEN)2: 1.9%

Compound

Annual Dilution

BEN: 2.7%

Compound

Annual Accretion

Capital Management

Ken Lewis, CFO

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

9/12 3/13 9/13 3/14 9/14 3/15 9/15 3/16 9/16 3/17 9/17

168 175 167

262

256

327 337

404

500

218

190

151

178

129

179

137

265

105

23

98 99

$0

$10

$20

$30

$40

$50

$60

9/173/179/163/169/153/159/143/149/133/139/12

Special Cash

Dividends per

Share Declared:

Dec-14: $0.50

Nov-12: $1.00

Share Repurchases (US$ millions) vs. Average BEN Price

BEN Average Price for the Period Special Cash Dividend Declared Share Repurchase Amount

During the quarter, we repurchased an additional 3.9 million shares, bringing total repurchases for the full fiscal year

to 19.1 million shares; far exceeding total issuance and decreasing shares outstanding by 2.7%.

12

1. The chart above illustrates the amount of share repurchases and dividends over the trailing 12 months, for the period ended. Dividend payout is

calculated as dividend amount declared divided by net income attributable to Franklin Resources, Inc. for the trailing 12-month period.

Repurchase payout is calculated as stock repurchase amount divided by net income attributable to Franklin Resources, Inc. for the trailing 12-

month period.

Trailing 12 Months Share Repurchases and Dividends1

(US$ millions and percentage of net income)

Dividends Share Repurchases

Ken Lewis, CFO

24% 25% 24% 25% 26%

77%

69%

57%

49% 45%

1,745

1,608

1,444

1,300

1,220

9/16 12/16 3/17 6/17 9/17

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

Cumulatively in fiscal year 2017, we returned approximately $770 million to shareholders via repurchases and

$450 million through the regular quarterly dividend of $0.20 per share. This combined for a total payout ratio of

71% of total net income for the full year.

In September, $300 million of outstanding debt was repaid at maturity, decreasing total debt outstanding to about

$1 billion.

We are currently optimistic that U.S. tax reform will be implemented, and this factored into our decision to not

refinance this maturity.

Sep-17

Equity $ 317.0

Multi Asset/Balanced 143.3

Fixed Income 286.6

Cash Management 6.3

Total $ 753.2

Sep-17

United States $ 501.0

Europe, the Middle East

and Africa

108.7

Asia-Pacific 92.9

Canada 32.4

Latin America 18.2

Total $ 753.2

67%

15%

12%

4%

2%

42%

19%

38%

1%

13 1. Net Cash and investments consist of Franklin Resources, Inc. cash and investments (including only direct investments in consolidated

SIPs), net of debt and deposits.

Net Cash and Investments1 (US$ billions)

Appendix

U.S. Net Cash and Investments Non-U.S. Net Cash and Investments

Ken Lewis, CFO

Investment Objective

(U.S.$ billions)

Sales Region

(US$ billions)

Mix of Ending Assets Under Management

(as of September 30, 2017)

0.8

1.8 1.7 1.2 1.3

6.5

7.4 7.9 8.5

9.1

7.3

9.2 9.6

9.7

10.4

FYE-9/13 FYE-9/14 FYE-9/15 FYE-9/16 FYE-9/17

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

14

Appendix (continued)

Sales and Distribution Summary

(in US$ millions, for the three months ended)

Consolidated SIPs Related Adjustments

(in US$ millions, for the three and nine months ended)

This table summarizes the

impact of consolidated

SIPs on the Company’s

reported U.S. GAAP

financial results.

Ken Lewis, CFO

Sep-17 Jun-17 Change % Change

Asset-based fees $ 339.9 $ 334.7 5.2 2%

Asset-based expenses (441.5) (432.9) (8.6) 2%

Asset-based fees, net $ (101.6) $ (98.2) $ (3.4) 3%

Sales-based fees 79.0 96.4 (17.4) (18%)

Contingent sales charges 2.9 2.2 0.7 32%

Sales-based expenses (74.3) (89.8) 15.5 (17%)

Sales-based fees, net $ 7.6 $ 8.8 $ (1.2) (14%)

Amortization of deferred sales commissions (19.1) (18.5) (0.6) 3%

Sales and Distribution Fees, Net $ (113.1) $ (107.9) $ (5.2) 5%

FY

Sep-17 Sep-17

Operating Revenues $ 16.9 $ 56.6

Operating Expenses 7.6 22.5

Operating Income 9.3 34.1

Investment Income (24.8) (55.6)

Interest Expense (0.7) (3.0)

Consolidated SIPs 65.6 118.2

Other Income 40.1 59.6

Net Income 49.4 93.7

Less: net income attributable to

noncontrolling interests

48.6 88.8

Net Income Attributable to Franklin

Resources, Inc.

$ 0.8 $ 4.9

Fourth Quarter and Fiscal Year Executive Commentary

Unaudited

The financial results in this commentary are preliminary. Statements in this commentary regarding Franklin Resources,

Inc. (“Franklin”) and its subsidiaries, which are not historical facts, are "forward-looking statements" within the meaning of

the U.S. Private Securities Litigation Reform Act of 1995. When used in this commentary, words or phrases generally

written in the future tense and/or preceded by words such as “will,” “may,” “could,” “expect,” “believe,” “anticipate,”

“intend,” “plan,” “seek,” “estimate”, “preliminary” or other similar words are forward-looking statements. Forward-looking

statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are

listed below, that could cause actual results and outcomes to differ materially from any future results or outcomes

expressed or implied by such forward-looking statements. While forward-looking statements are our best prediction at

the time that they are made, you should not rely on them and are cautioned against doing so. Forward-looking

statements are based on our current expectations and assumptions regarding our business, the economy and other

future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict. They are neither statements of historical fact nor

guarantees or assurances of future performance.

These and other risks, uncertainties and other important factors are described in more detail in Franklin’s recent filings

with the U.S. Securities and Exchange Commission, including, without limitation, in Risk Factors and Management’s

Discussion and Analysis of Financial Condition and Results of Operations in Franklin’s Annual Report on Form 10-K for

the fiscal year ended September 30, 2016 and Franklin’s subsequent Quarterly Reports on Form 10-Q:

• Volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may

significantly affect our results of operations and may put pressure on our financial results.

• The amount and mix of our assets under management (“AUM”) are subject to significant fluctuations.

• We are subject to extensive, complex, overlapping and frequently changing rules, regulations, policies and legal

interpretations.

• Global regulatory and legislative actions and reforms have made the regulatory environment in which we operate

more costly and future actions and reforms could adversely impact our financial condition and results of operations.

• Failure to comply with the laws, rules or regulations in any of the jurisdictions in which we operate could result in

substantial harm to our reputation and results of operations.

• Changes in tax laws or exposure to additional income tax liabilities could have a material impact on our financial

condition, results of operations and liquidity.

• Any significant limitation, failure or security breach of our information and cyber security infrastructure, software

applications, technology or other systems that are critical to our operations could disrupt our business and harm our

operations and reputation.

• Our business operations are complex and a failure to properly perform operational tasks or the misrepresentation of

our products and services, or the termination of investment management agreements representing a significant

portion of our AUM, could have an adverse effect on our revenues and income.

• We face risks, and corresponding potential costs and expenses, associated with conducting operations and growing

our business in numerous countries.

• We depend on key personnel and our financial performance could be negatively affected by the loss of their services.

• Strong competition from numerous and sometimes larger companies with competing offerings and products could

limit or reduce sales of our products, potentially resulting in a decline in our market share, revenues and income.

• Changes in the third-party distribution and sales channels on which we depend could reduce our income and hinder

our growth.

• Our increasing focus on international markets as a source of investments and sales of investment products subjects

us to increased exchange rate and market-specific political, economic or other risks that may adversely impact our

revenues and income generated overseas.

• Harm to our reputation or poor investment performance of our products could reduce the level of our AUM or affect

our sales, and negatively impact our revenues and income.

• Our future results are dependent upon maintaining an appropriate level of expenses, which is subject to fluctuation.

• Our ability to successfully manage and grow our business can be impeded by systems and other technological

limitations.

• Our inability to successfully recover should we experience a disaster or other business continuity problem could

cause material financial loss, loss of human capital, regulatory actions, reputational harm, or legal liability.

• Regulatory and governmental examinations and/or investigations, litigation and the legal risks associated with our

business, could adversely impact our AUM, increase costs and negatively impact our profitability and/or our future

financial results.

15

Forward-Looking Statements

16

Investor Relations Contacts

Brian Sevilla

+1 (650) 312-3326

Forward-Looking Statements (continued)

• Our ability to meet cash needs depends upon certain factors, including the market value of our assets, operating

cash flows and our perceived creditworthiness.

• We are dependent on the earnings of our subsidiaries.

Any forward-looking statement made by us in this commentary speaks only as of the date on which it is made. Factors

or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to

predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of

new information, future developments or otherwise, except as may be required by law.

The information in this commentary is provided solely in connection with this commentary, and is not directed

toward existing or potential investment advisory clients or fund shareholders.