Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - C&J Energy Services, Inc. | d481611dex991.htm |

| EX-2.1 - EX-2.1 - C&J Energy Services, Inc. | d481611dex21.htm |

| 8-K - FORM 8-K - C&J Energy Services, Inc. | d481611d8k.htm |

1 Acquisition of O-Tex Pumping October 25, 2017 Exhibit 99.2

Important Disclaimer This presentation (and any oral statements made regarding the subjects of this presentation) contains certain statements and information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact, that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “once,” “intend,” “plan,” “estimate,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “potential,” “would,” “may,” “probable,” “likely,” and similar expressions that convey the uncertainty of future events or outcomes, and the negative thereof, are intended to identify forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation specifically include statements regarding the expected timetable for completing the proposed transaction; benefits and synergies of the proposed transaction; costs and other anticipated financial impacts of the proposed transaction; the combined company’s plans and objectives; future opportunities for the combined company and services; future financial performance and operating results; and any other statements regarding C&J’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. These forward-looking statements are based on management’s current expectations and beliefs, forecasts for our existing operations, experience, expectations and perception of historical trends, current conditions, anticipated future developments and their effect on us, and other factors believed to be appropriate. Although management believes that the expectations and assumptions reflected in these forward-looking statements are reasonable as and when made, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all). Moreover, our forward-looking statements are subject to significant risks, contingencies and uncertainties, many of which are beyond our control, which may cause actual results to differ materially from our historical results. These risks, contingencies and uncertainties include, but are not limited to: the timing to consummate the proposed transaction; the risk that conditions to closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of C&J and O-Tex; the effects of the business combination of C&J and O-Tex, including the combined company’s future financial condition, results of operations, strategy and plans; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; expected synergies and other benefits from the proposed transaction and the ability of C&J to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements and investigations; actions by third parties, including governmental agencies; volatility in customer spending and in oil and natural gas prices, which could adversely affect demand for C&J’s and O-Tex’s services and their associated effect on rates, utilization, margins and planned capital expenditures; global economic conditions; excess availability of cementing services equipment, including as a result of low commodity prices, reactivation or construction; liabilities from operations; decline in, and ability to realize, backlog; equipment specialization and new technologies; adverse industry conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages, delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; legal proceedings; ability to effectively identify and enter new markets; governmental regulation; and ability to retain management and field personnel. For additional information regarding known material factors that could cause our actual results to differ from our present expectations, please see our filings with the U.S. Securities and Exchange Commission, including our Current Reports on Form 8-K that we file from time to time, Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by law. All information in this presentation is as of October 25, 2017 unless otherwise indicated.

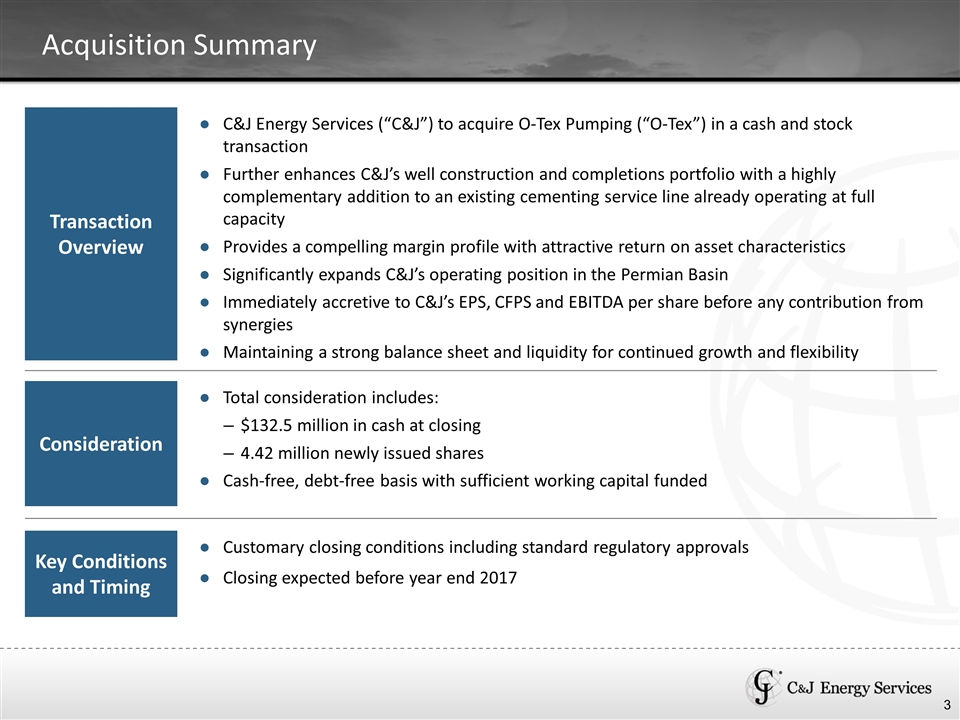

Acquisition Summary Consideration Total consideration includes: $132.5 million in cash at closing 4.42 million newly issued shares Cash-free, debt-free basis with sufficient working capital funded Key Conditions and Timing Customary closing conditions including standard regulatory approvals Closing expected before year end 2017 Transaction Overview C&J Energy Services (“C&J”) to acquire O-Tex Pumping (“O-Tex”) in a cash and stock transaction Further enhances C&J’s well construction and completions portfolio with a highly complementary addition to an existing cementing service line already operating at full capacity Provides a compelling margin profile with attractive return on asset characteristics Significantly expands C&J’s operating position in the Permian Basin Immediately accretive to C&J’s EPS, CFPS and EBITDA per share before any contribution from synergies Maintaining a strong balance sheet and liquidity for continued growth and flexibility

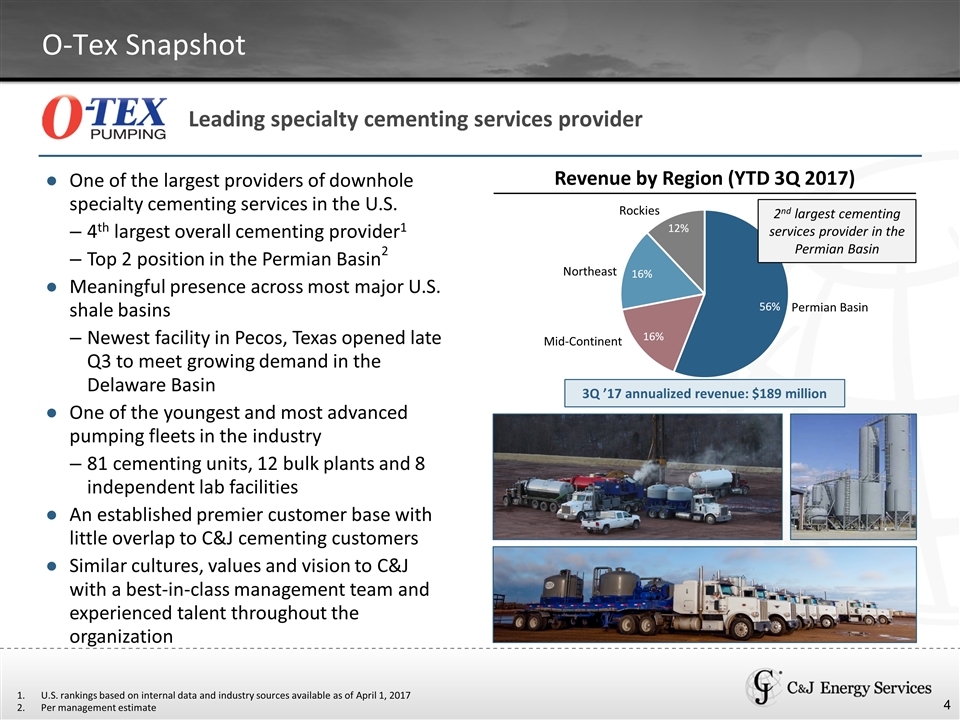

O-Tex Snapshot One of the largest providers of downhole specialty cementing services in the U.S. 4th largest overall cementing provider1 Top 2 position in the Permian Basin2 Meaningful presence across most major U.S. shale basins Newest facility in Pecos, Texas opened late Q3 to meet growing demand in the Delaware Basin One of the youngest and most advanced pumping fleets in the industry 81 cementing units, 12 bulk plants and 8 independent lab facilities An established premier customer base with little overlap to C&J cementing customers Similar cultures, values and vision to C&J with a best-in-class management team and experienced talent throughout the organization Leading specialty cementing services provider Revenue by Region (YTD 3Q 2017) U.S. rankings based on internal data and industry sources available as of April 1, 2017 Per management estimate Permian Basin Mid-Continent Northeast Rockies 2nd largest cementing services provider in the Permian Basin 3Q ’17 annualized revenue: $189 million

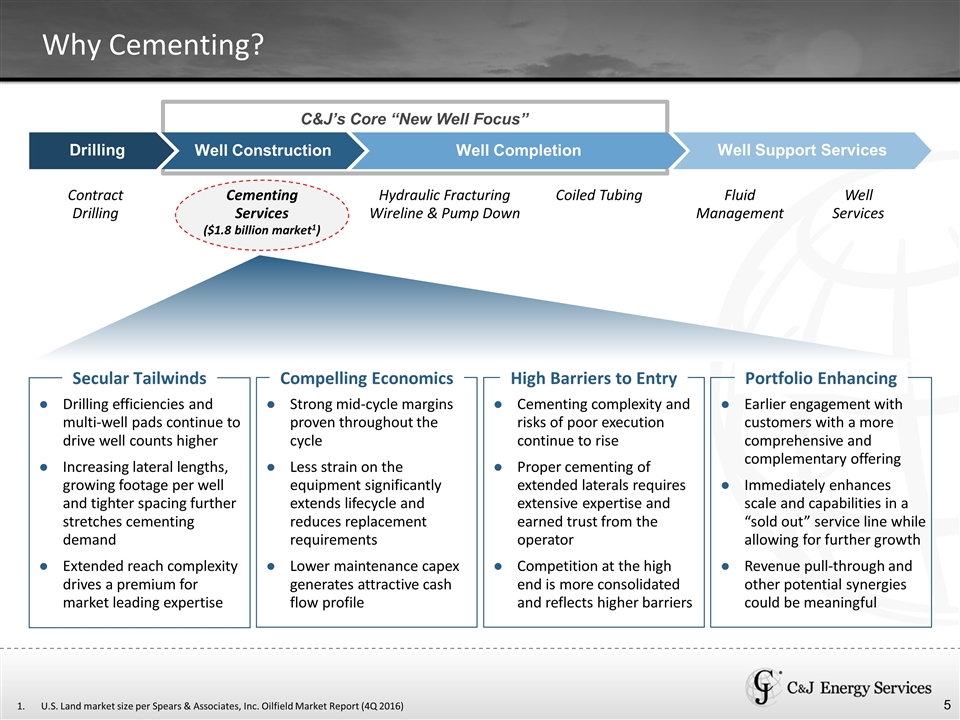

Drilling C&J’s Core “New Well Focus” Why Cementing? Well Completion Well Support Services Contract Drilling Cementing Services ($1.8 billion market1) Hydraulic Fracturing Wireline & Pump Down Coiled Tubing Fluid Management Well Services U.S. Land market size per Spears & Associates, Inc. Oilfield Market Report (4Q 2016) Secular Tailwinds Compelling Economics High Barriers to Entry Portfolio Enhancing Drilling efficiencies and multi-well pads continue to drive well counts higher Increasing lateral lengths, growing footage per well and tighter spacing further stretches cementing demand Extended reach complexity drives a premium for market leading expertise Strong mid-cycle margins proven throughout the cycle Less strain on the equipment significantly extends lifecycle and reduces replacement requirements Lower maintenance capex generates attractive cash flow profile Cementing complexity and risks of poor execution continue to rise Proper cementing of extended laterals requires extensive expertise and earned trust from the operator Competition at the high end is more consolidated and reflects higher barriers Earlier engagement with customers with a more comprehensive and complementary offering Immediately enhances scale and capabilities in a “sold out” service line while allowing for further growth Revenue pull-through and other potential synergies could be meaningful Drilling Drilling Well Construction

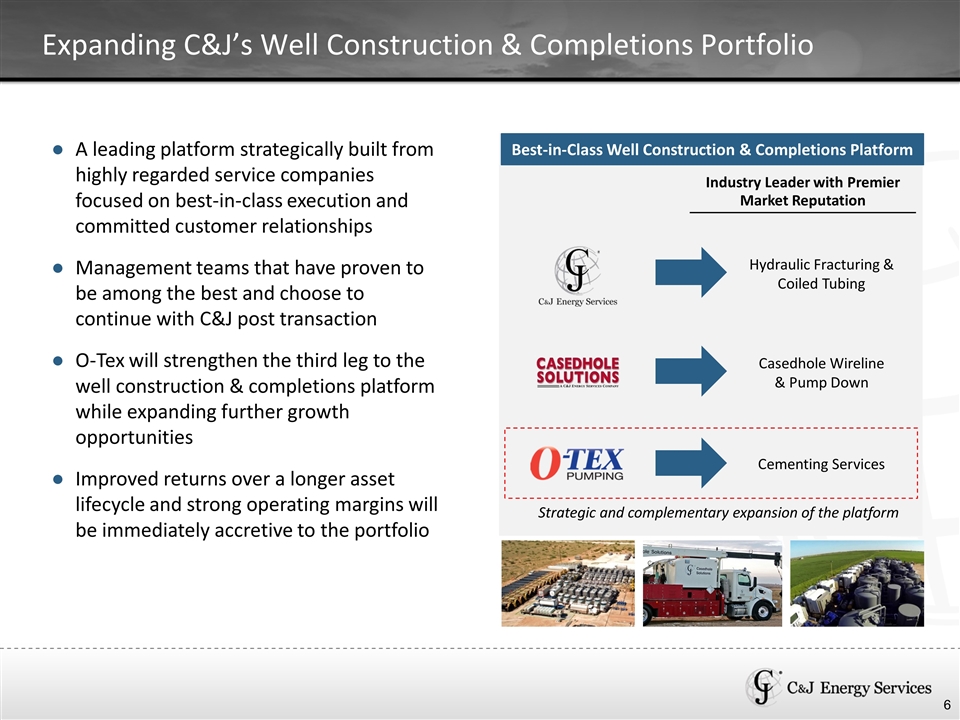

Expanding C&J’s Well Construction & Completions Portfolio A leading platform strategically built from highly regarded service companies focused on best-in-class execution and committed customer relationships Management teams that have proven to be among the best and choose to continue with C&J post transaction O-Tex will strengthen the third leg to the well construction & completions platform while expanding further growth opportunities Improved returns over a longer asset lifecycle and strong operating margins will be immediately accretive to the portfolio Hydraulic Fracturing & Coiled Tubing Industry Leader with Premier Market Reputation Best-in-Class Well Construction & Completions Platform Casedhole Wireline & Pump Down Cementing Services Strategic and complementary expansion of the platform

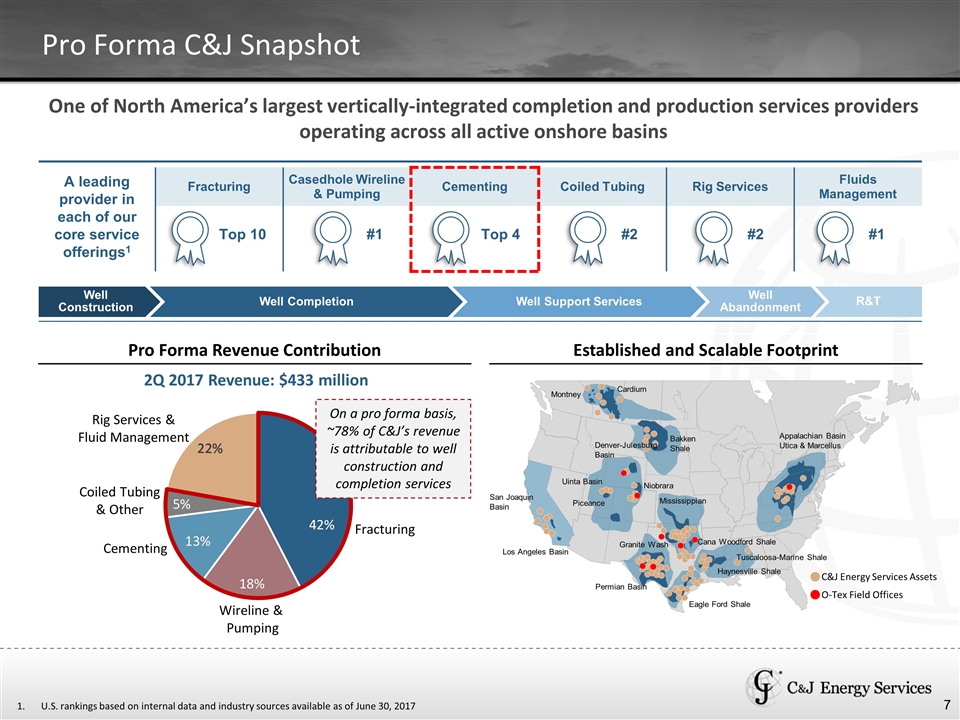

A leading provider in each of our core service offerings1 Fracturing Casedhole Wireline & Pumping Cementing Coiled Tubing Rig Services Fluids Management Pro Forma C&J Snapshot One of North America’s largest vertically-integrated completion and production services providers operating across all active onshore basins Well Construction Well Completion Well Support Services Well Abandonment 2Q 2017 Revenue: $433 million R&T Top 10 #1 #2 #2 #1 Top 4 Pro Forma Revenue Contribution Fracturing Wireline & Pumping Cementing Coiled Tubing & Other Rig Services & Fluid Management On a pro forma basis, ~78% of C&J’s revenue is attributable to well construction and completion services Tuscaloosa-Marine Shale Haynesville Shale Eagle Ford Shale Cana Woodford Shale Permian Basin Granite Wash Mississippian Niobrara Los Angeles Basin San Joaquin Basin Piceance Uinta Basin Denver-Julesburg Basin Bakken Shale Cardium Montney Appalachian Basin Utica & Marcellus C&J Energy Services Assets O-Tex Field Offices Established and Scalable Footprint U.S. rankings based on internal data and industry sources available as of June 30, 2017

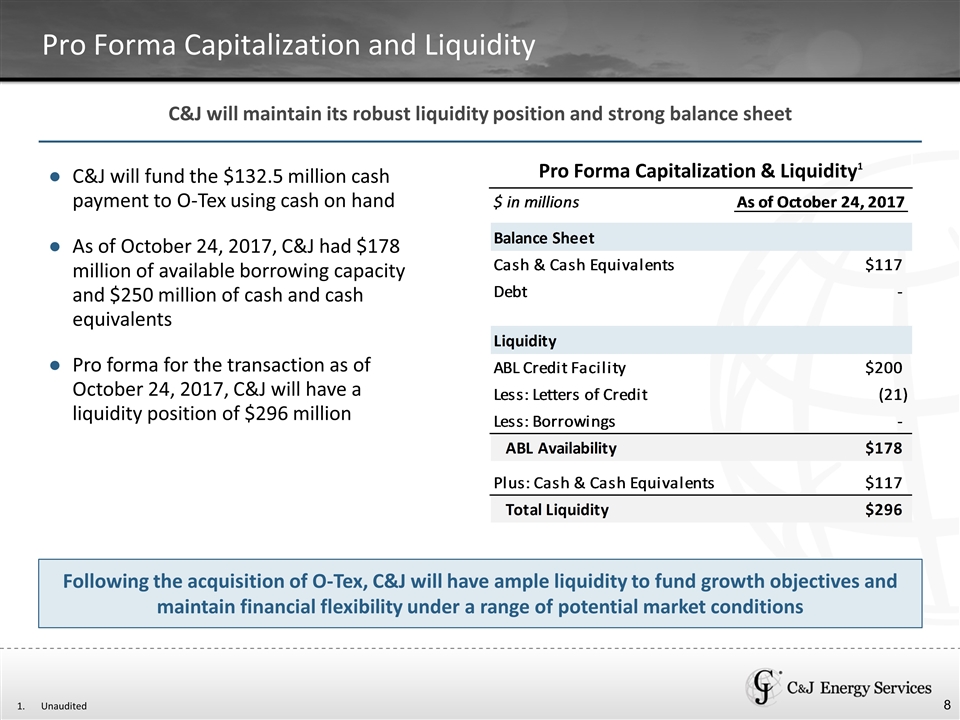

Pro Forma Capitalization and Liquidity C&J will maintain its robust liquidity position and strong balance sheet C&J will fund the $132.5 million cash payment to O-Tex using cash on hand As of October 24, 2017, C&J had $178 million of available borrowing capacity and $250 million of cash and cash equivalents Pro forma for the transaction as of October 24, 2017, C&J will have a liquidity position of $296 million Pro Forma Capitalization & Liquidity1 Following the acquisition of O-Tex, C&J will have ample liquidity to fund growth objectives and maintain financial flexibility under a range of potential market conditions Unaudited