Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLUMBIA PROPERTY TRUST, INC. | cxp8-k201710presentation.htm |

183

248

248

80

277

$150,000

$170,000

$190,000

$210,000

$230,000

$250,000

$270,000

$290,000

3Q 17

Cash NOI

Annualized

Dispositions

333 Market St.

University Circle

(Remaining 22.5%)

Acquisitions

1800 M St 55%

Acquisitions

NYRT Assets

Uncommenced

Leases &

Free Rent

Burnoff

Lease Rent

Escalations

Lease

Expirations

Lease Up

Expired Space

Lease Up

Vacant Space

Pro Forma

Cash NOI

NOI Bridge - Cash Rents

Allianz JV

Contractual

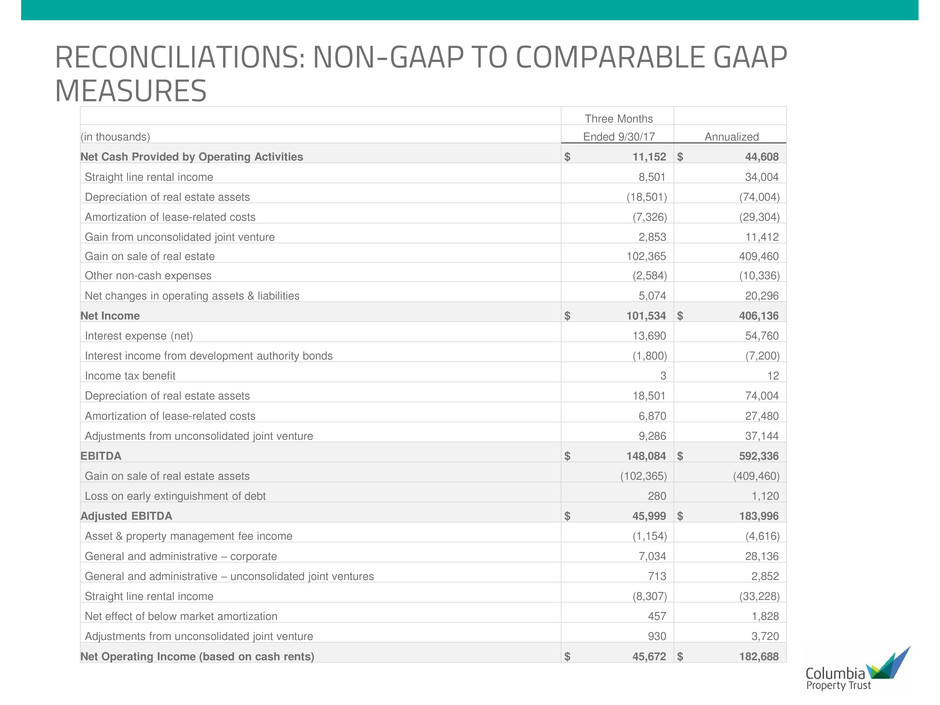

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

Three Months

(in thousands) Ended 9/30/17 Annualized

Net Cash Provided by Operating Activities $ 11,152 $ 44,608

Straight line rental income 8,501 34,004

Depreciation of real estate assets (18,501) (74,004)

Amortization of lease-related costs (7,326) (29,304)

Gain from unconsolidated joint venture 2,853 11,412

Gain on sale of real estate 102,365 409,460

Other non-cash expenses (2,584) (10,336)

Net changes in operating assets & liabilities 5,074 20,296

Net Income $ 101,534 $ 406,136

Interest expense (net) 13,690 54,760

Interest income from development authority bonds (1,800) (7,200)

Income tax benefit 3 12

Depreciation of real estate assets 18,501 74,004

Amortization of lease-related costs 6,870 27,480

Adjustments from unconsolidated joint venture 9,286 37,144

EBITDA $ 148,084 $ 592,336

Gain on sale of real estate assets (102,365) (409,460)

Loss on early extinguishment of debt 280 1,120

Adjusted EBITDA $ 45,999 $ 183,996

Asset & property management fee income (1,154) (4,616)

General and administrative – corporate 7,034 28,136

General and administrative – unconsolidated joint ventures 713 2,852

Straight line rental income (8,307) (33,228)

Net effect of below market amortization 457 1,828

Adjustments from unconsolidated joint venture 930 3,720

Net Operating Income (based on cash rents) $ 45,672 $ 182,688

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

(continued from prior page)

(in thousands) Three Months

Ended 9/30/17 Annualized

Net Operating Income (based on cash rents) $ 45,672 $ 182,688

Dispositions – 333 Market St. & University Circle, remaining 22.5% (Allianz JV) (2,994) (11,976)

Acquisitions – 1800 M Street, 55% (Allianz JV) 2,611 10,444

Acquisitions – NYRT Assets 6,028 24,112

Uncommenced Leases & Free Rent Burnoff 11,575 46,300

Lease Rent Escalations 1,150 4,600

Lease Expirations (1,955) (7,820)

Lease Up Expired Space 2,250 9,000

Lease Up Vacant Space 5,000 20,000

Net Operating Income (based on cash rents) – “Pro Forma” $ 69,337 $ 277,348