Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sucampo Pharmaceuticals, Inc. | f8k_092617.htm |

Exhibit 99.1

Sucampo Pharmaceuticals, Inc. Emerging Specialized Disease Company Cantor Fitzgerald Global Healthcare Conference September 26, 2017

Forward Looking Statement This presentation contains "forward - looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and involve risks and uncertainties, which may cause results to dif fer materially from those set forth in the statements. The forward - looking statements may include statements regarding product development, and othe r statements that are not historical facts. The following factors, among others, could cause actual results to differ from those set forth in t he forward - looking statements: the impact of pharmaceutical industry regulation and health care legislation; Sucampo's ability to accurately predict future mar ket conditions; dependence on the effectiveness of Sucampo's patents and other protections for innovative products; the effects of competitiv e p roducts on Sucampo’s products; and the exposure to litigation and/or regulatory actions. No forward - looking statement can be guaranteed and actual results may differ materially from those projected. Sucampo undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events, or otherwise. Forward - look ing statements in this presentation should be evaluated together with the many uncertainties that affect Sucampo's business, particularly those ment ion ed in the risk factors and cautionary statements in Sucampo's most recent Form 10 - K as filed with the Securities and Exchange Commission on March 8, 20 17, as amended, as well as its filings with the Securities and Exchange Commission on Forms 8 - K and 10 - Q since the filing of the Form 1 0 - K, all of which Sucampo incorporates by reference. 2

Non - GAAP Metrics This presentation contains three financial metrics ( Adjusted Net Income, EBITDA, Adjusted EBITDA, and free cash flow ) that are considered “non - GAAP” financial metrics under applicable Securities and Exchange Commission rules and regulations. These non - GAAP financial metrics should be considered supplemental to and not a substitute for financial information prepared in accordance with generally acc ept ed accounting principles. The company’s definition of these non - GAAP metrics may differ from similarly titled metrics used by others. Adjusted Net Income adjusts for specified items that can be highly variable or difficult to predict, and various non - cash items, which includes amortization of acquired intangibles, inventory step - up adjustment, R&D intangible asset impairment, one - time severance payments, restructuring costs, acquisition rel ated expenses, amortization of debt financing costs, debt extinguishment, R&D license option expense, foreign currency translations and the tax impact of these adjustments. EBITDA reflects net income excluding the impact of provision for income taxes, interest expense, interest incom e, depreciation, R&D intangible asset impairment, amortization of acquired intangibles and inventory step up adjustment. Adjusted EBITDA reflects EB ITDA and adjusts for specified items that can be highly variable or difficult to predict, and various non - cash items, which includes share based comp ensation expense, restructuring costs, one time severance payments, acquisition related expenses, debt extinguishment, R&D license option, and for eign currency translations. Free cash flow reflects net cash provided by operating activities less expenditures made for property and equi pme nt. The company views these non - GAAP financial metrics as a means to facilitate management’s financial and operational decision - making, includin g evaluation of the company’s historical operating results and comparison to competitors’ operating results. These non - GAAP financial metrics reflec t an additional way of viewing aspects of the company’s operations that, when viewed with GAAP results may provide a more complete understanding of factors and trends affecting the company’s business. The determination of the amounts that are excluded from these non - GAAP financial metrics is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts. Because non - GAAP financial metrics exclude the effe ct of items that will increase or decrease the company’s reported results of operations, management strongly encourages investors to review th e c ompany’s consolidated financial statements and publicly - filed reports in their entirety. 3

Investment Highlights 4 • Global biopharmaceutical company focused on specialty areas with high unmet medical needs • Late stage pipeline with 3 phase 3 programs with data readouts over next 12 - 24 months • VTS - 270 for Niemann - Pick Disease Type C1 (NPC) from recent acquisition of Vtesse Inc. • CPP - 1X/ sul combo in Familial Adenomatous Polyposis (FAP) • Life - cycle management programs for lubiprostone • Two marketed and outlicensed products in gastroenterology and ophthalmology providing >$200 million in annual revenue and significant operating cash flow to fund pipeline and operations and limit downside risk • AMITIZA for constipation • RESCULA in ophthalmology • Focused business development strategy focused on capital efficient, highly specialized diseases to bolster growth and diversify • Deep management team with proven ability to transform the company, create value, and commercialize products

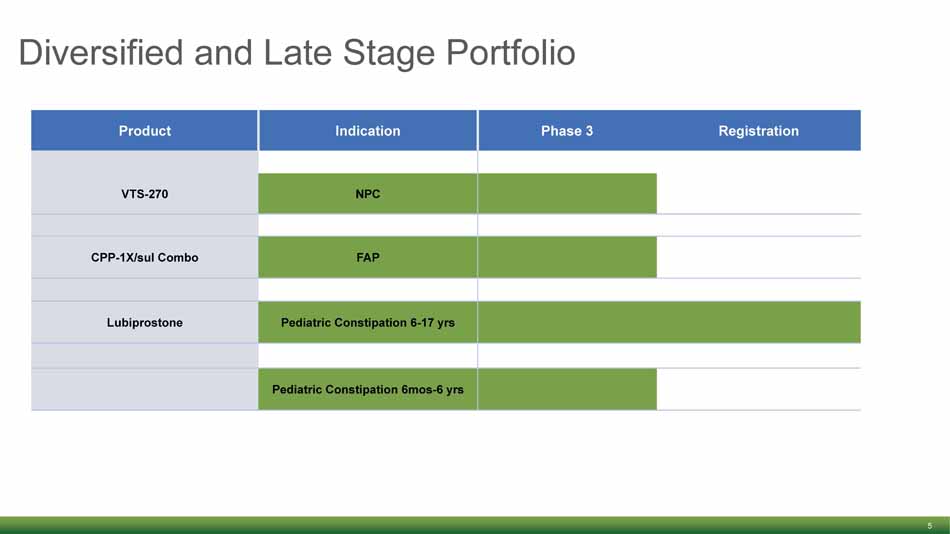

Diversified and Late Stage Portfolio 5 Product Indication Phase 3 Registration VTS - 270 NPC CPP - 1X/ sul Combo FAP Lubiprostone Pediatric Constipation 6 - 17 yrs Pediatric Constipation 6mos - 6 yrs

NPC - 1: Ultra - Rare, Fatal Pediatric Disease with Urgent Patient Need • NPC - 1 is an ultra - rare, progressive and fatal disease caused by defects in lipid transformation within the cell • Diagnosis of NPC - 1 most common outside infantile ages • Progressive and irreversible neurological manifestations • Estimated 2,000 - 3,000 cases globally • Under - and mis - diagnosed • NPC - 1 results in early death • Currently no approved treatments for the disease in the U.S. • VTS - 270 has breakthrough therapy designation in the U.S. • Highly motivated and involved patients, families and physicians with strong commitment to development 6

VTS - 270 for Treatment of NPC - 1 • VTS - 270 is a highly - purified mixture of 2 - hydroxypropyl - ß - cyclodextrins with a specific compositional fingerprint that targets cholesterol and sphingolipid storage • Initially evaluated by consortium of academic labs led by NIH in collaboration with parent and patient advocacy groups • In preclinical studies, VTS - 270 had a profound effect on depleting intracellular cholesterol stores and lysosomal accumulation • In multiple preclinical animal models of NPC - 1, VTS - 270 has also shown results in preventing dysfunctions such as ataxia and profoundly impacting survival On - going formulation studies may culminate in new intellectual property for VTS - 270 7

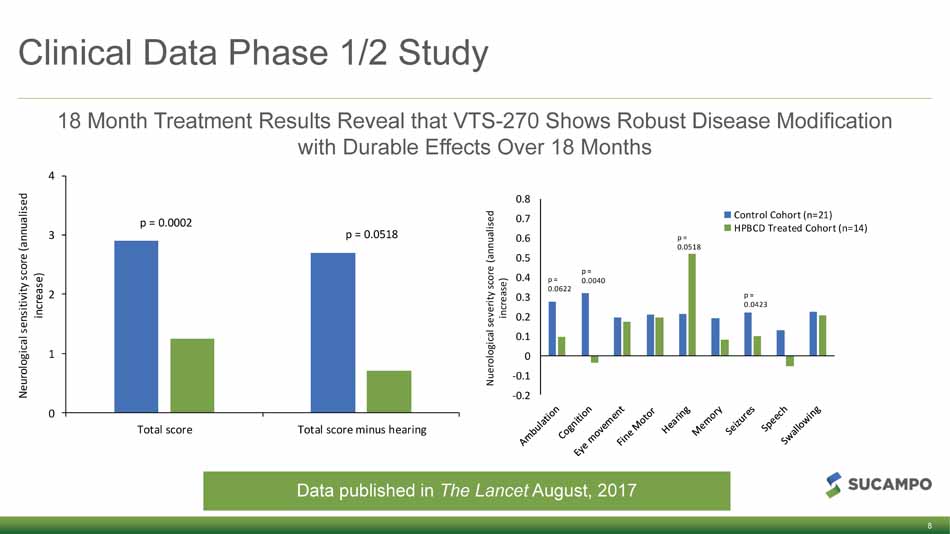

Clinical Data Phase 1/2 Study 18 Month Treatment Results Reveal that VTS - 270 Shows Robust Disease Modification with Durable Effects Over 18 Months 8 -0.2 -0.1 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Nuerological severity score (annualised increase) Control Cohort (n=21) HPBCD Treated Cohort (n=14) p = 0.0622 p = 0.0040 p = 0.0518 p = 0.0423 0 1 2 3 4 Total score Total score minus hearing Neurological sensitivity score (annualised increase) p = 0.0002 p = 0.0518 Data published in The Lancet August, 2017

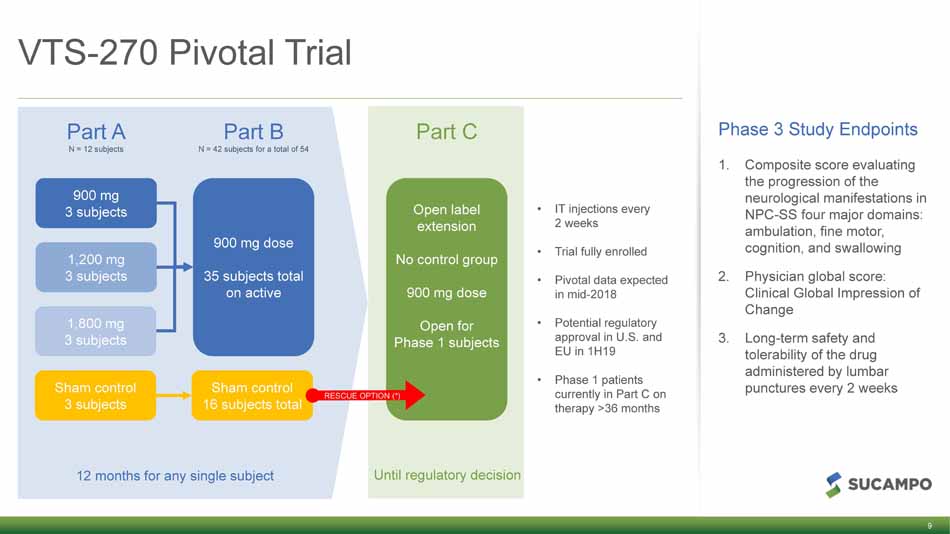

Until regulatory decision VTS - 270 Pivotal Trial • IT injections every 2 weeks • Trial fully enrolled • Pivotal data expected in mid - 2018 • Potential regulatory approval in U.S. and EU in 1H19 • Phase 1 patients currently in Part C on therapy >36 months Phase 3 Study Endpoints 1. Composite score evaluating the progression of the neurological manifestations in NPC - SS four major domains: ambulation, fine motor, cognition, and swallowing 2. Physician global score: Clinical Global Impression of Change 3. Long - term safety and tolerability of the drug administered by lumbar punctures every 2 weeks 12 months for any single subject Part A N = 12 subjects Part B N = 42 subjects for a total of 54 Part C Sham control 3 subjects 1,800 mg 3 subjects 1,200 mg 3 subjects 900 mg 3 subjects 900 mg dose 35 subjects total on active Sham control 16 subjects total Open label extension No control group 900 mg dose Open for Phase 1 subjects RESCUE OPTION (*) 9

Familial Adenomatous Polyposis (F.A.P.) 10 • Significant opportunity • Orphan indication in U.S. for familial adenomatous polyposis (FAP) • ~30K cases currently • No approved treatment options and dire patient need • 100% risk of colon cancer • Progressive removal of colon/rectum • Incremental opportunity of ~$200M – $400M • Additional opportunity in sporadic colon adenoma therapy (CAT)

CPP - 1X/Sul Combination 11 • Exclusive option with Cancer Prevention Pharma for N. America • Strong scientific rationale • CPP - 1X decreases polyamine synthesis by blocking Ornithine Decarboxylase (ODC1) • Sul (sulindac) increases polyamine catabolism and export by up - regulating transport genes (PPAR γ and SAT) • Phase 2 proof of concept data in sporadic colon adenoma/FAP • No statistically significant serious adverse events in Phase 2/3 “Meyskens” trial with 375 patients and three years of daily dosing of CPP - 1X/sul • Sulindac approved for arthritis and used extensively for many years • Defined regulatory pathway • Granted Fast Track status by FDA

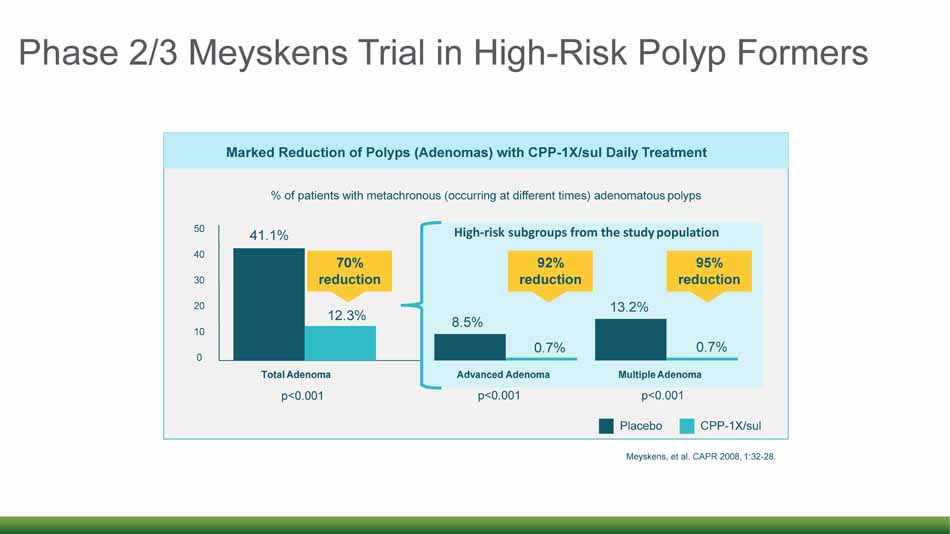

Phase 2/3 Meyskens Trial in High - Risk Polyp Formers 12 P lac e bo CPP - 1X/sul Marked Reduction of Polyps (Adenomas) with CPP - 1X/sul Daily Treatment % of patients with metachronous (occurring at different times) adenomatous polyps 0 10 20 30 40 50 41.1% 12.3% 70% reduction p<0.001 8.5% 0.7% Advanced Adenoma 0.7% 13.2% 92% reduction 95% reduction Multiple Adenoma High - risk subgroups from the study population p<0.001 Total Adenoma p<0.001 Meyskens, et al. CAPR 2008, 1:32 - 28.

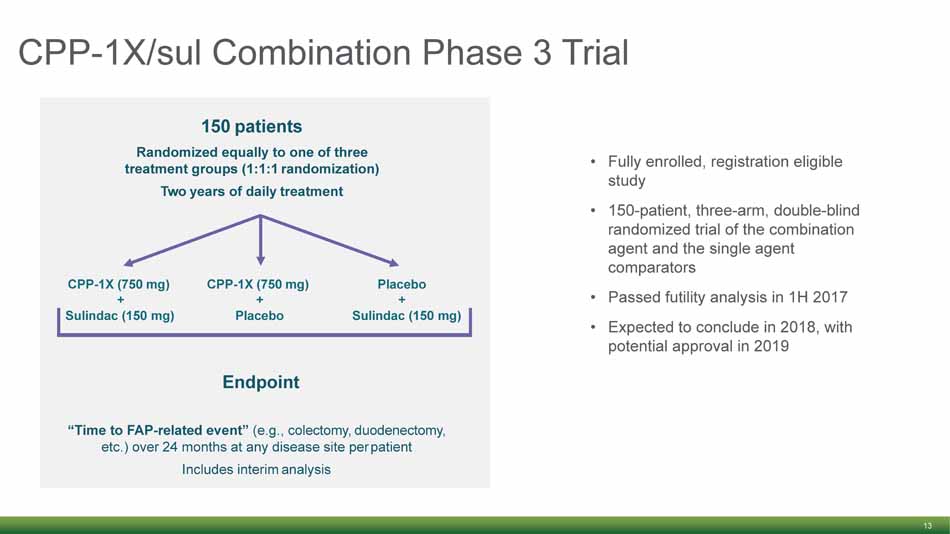

CPP - 1X/ sul Combination Phase 3 Trial 13 • Fully enrolled, registration eligible study • 150 - patient, three - arm, double - blind randomized trial of the combination agent and the single agent comparators • Passed futility analysis in 1H 2017 • Expected to conclude in 2018, with potential approval in 2019 “Time to FAP - related event” (e.g., colectomy, duodenectomy, etc.) over 24 months at any disease site per patient Includes interim analysis 150 patients Randomized equally to one of three treatment groups (1:1:1 randomization) Two years of daily treatment CPP - 1X (750 mg) + CPP - 1X (750 mg) + Placebo + Sulindac (150 mg) Placebo Sulindac (150 mg) Endpoint

Marketed Products Licensed to Pharma Partners 14 Product Partner Region AMITIZA Takeda North America and ROW Mylan Japan Harbin Gloria China RESCULA Santen Japan

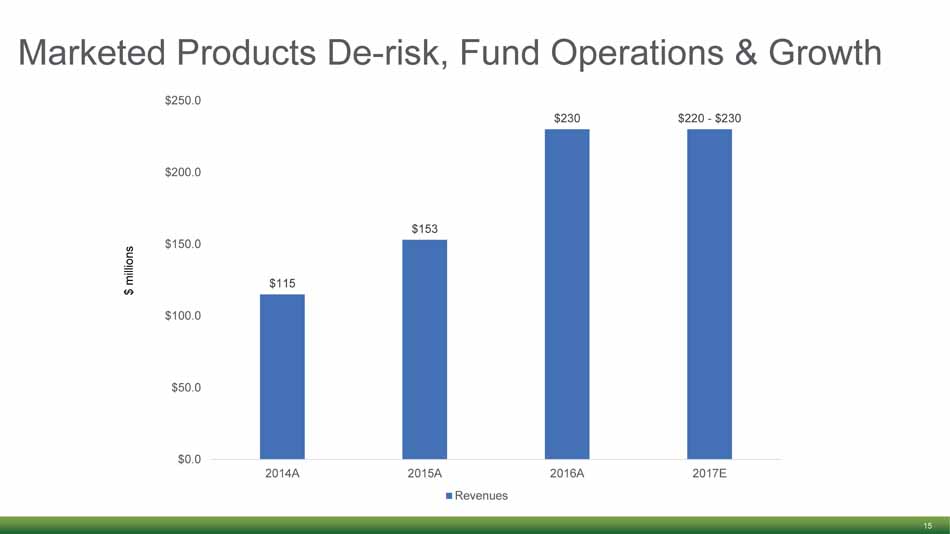

Marketed Products De - risk, Fund Operations & Growth 15 $115 $153 $230 $220 - $230 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2014A 2015A 2016A 2017E Revenues $ millions

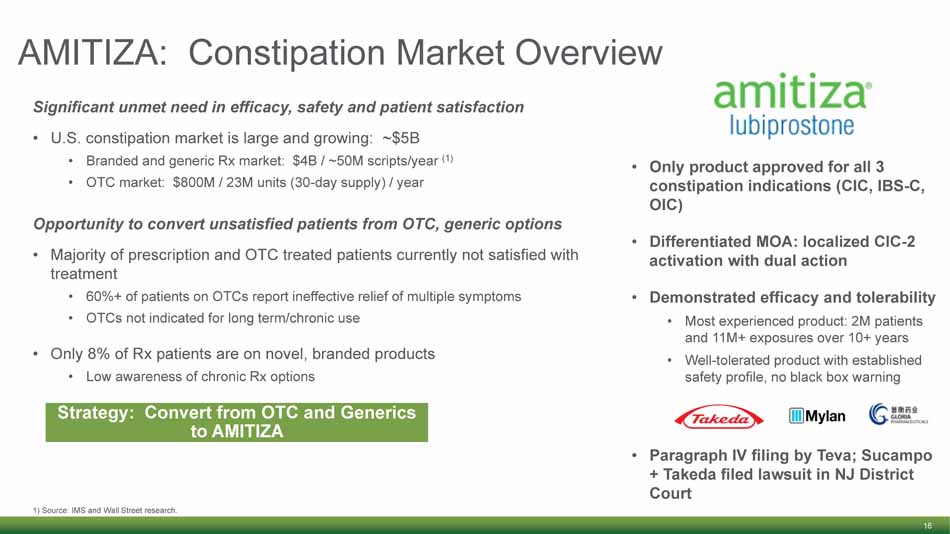

AMITIZA: Constipation Market Overview 16 Significant unmet need in efficacy, safety and patient satisfaction • U.S. constipation market is large and growing: ~$5B • Branded and generic Rx market: $4B / ~50M scripts/year (1) • OTC market: $800M / 23M units (30 - day supply) / year Opportunity to convert unsatisfied patients from OTC, generic options • Majority of prescription and OTC treated patients currently not satisfied with treatment • 60%+ of patients on OTCs report ineffective relief of multiple symptoms • OTCs not indicated for long term/chronic use • Only 8% of Rx patients are on novel, branded products • Low awareness of chronic Rx options 1) Source: IMS and Wall Street research. Strategy: Convert from OTC and Generics to AMITIZA • Only product approved for all 3 constipation indications (CIC, IBS - C, OIC) • Differentiated MOA: localized ClC - 2 activation with dual action • Demonstrated efficacy and tolerability • Most experienced product: 2M patients and 11M+ exposures over 10+ years • Well - tolerated product with established safety profile, no black box warning • Paragraph IV filing by Teva; Sucampo + Takeda filed lawsuit in NJ District Court

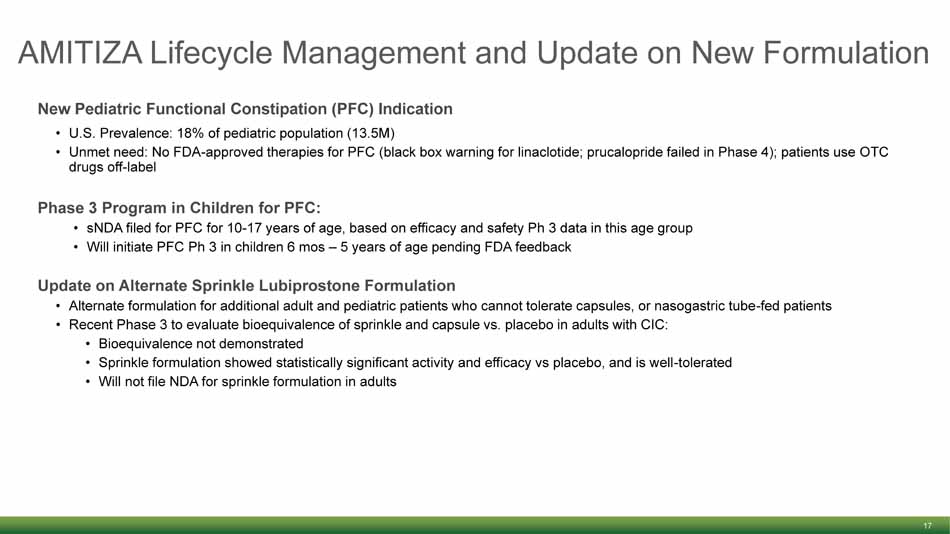

17 New Pediatric Functional Constipation (PFC) Indication • U.S. Prevalence: 18% of pediatric population (13.5M) • Unmet need: No FDA - approved therapies for PFC (black box warning for linaclotide; prucalopride failed in Phase 4); patients use OTC drugs off - label Phase 3 Program in Children for PFC: • sNDA filed for PFC for 10 - 17 years of age, based on efficacy and safety Ph 3 data in this age group • Will initiate PFC Ph 3 in children 6 mos – 5 years of age pending FDA feedback Update on Alternate Sprinkle Lubiprostone Formulation • Alternate formulation for additional adult and pediatric patients who cannot tolerate capsules, or nasogastric tube - fed patients • Recent Phase 3 to evaluate bioequivalence of sprinkle and capsule vs. placebo in adults with CIC: • Bioequivalence not demonstrated • Sprinkle formulation showed statistically significant activity and efficacy vs placebo, and is well - tolerated • Will not file NDA for sprinkle formulation in adults AMITIZA Lifecycle Management and Update on New Formulation

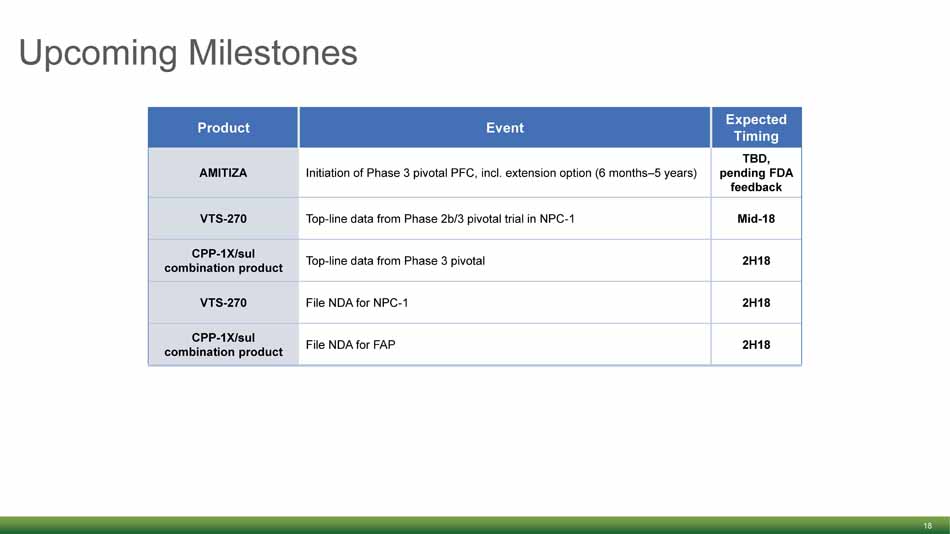

Upcoming Milestones 18 Product Event Expected Timing AMITIZA Initiation of Phase 3 pivotal PFC, incl. extension option (6 months – 5 years) TBD, pending FDA feedback VTS - 270 Top - line data from Phase 2b/3 pivotal trial in NPC - 1 Mid - 18 CPP - 1X/ sul combination product Top - line data from Phase 3 pivotal 2H18 VTS - 270 File NDA for NPC - 1 2H18 CPP - 1X/ sul combination product File NDA for FAP 2H18

Business Development Strategy 19 Highly Specialized Disease Areas Late Clinical Stage Capital Efficient Orphan/rare Focus

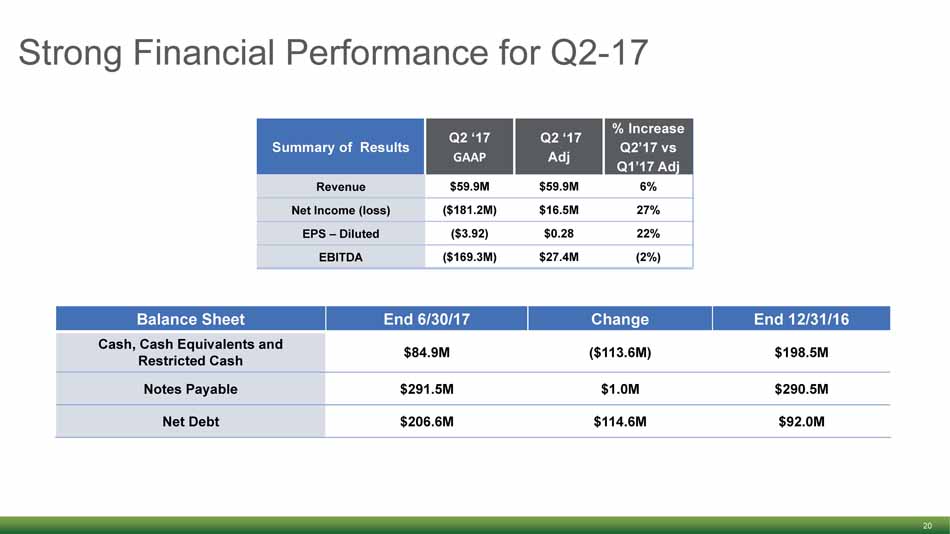

Strong Financial Performance for Q2 - 17 20 Summary of Results Q2 ‘17 GAAP Q2 ‘17 Adj % Increase Q2’17 vs Q1’17 Adj Revenue $59.9M $59.9M 6% Net Income (loss) ($181.2M) $16.5M 27% EPS – Diluted ($3.92) $0.28 22% EBITDA ($169.3M) $27.4M (2%) Balance Sheet End 6/30/17 Change End 12/31/16 Cash, Cash Equivalents and Restricted Cash $84.9M ($113.6M) $198.5M Notes Payable $291.5M $1.0M $290.5M Net Debt $206.6M $114.6M $92.0M

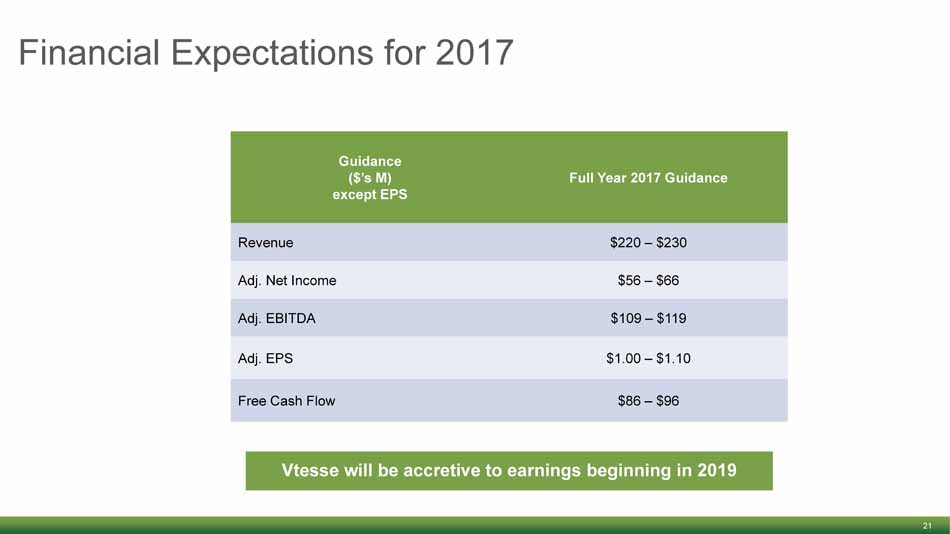

Financial Expectations for 2017 21 Guidance ($’s M) except EPS Full Year 2017 Guidance Revenue $220 – $230 Adj. Net Income $56 – $66 Adj. EBITDA $109 – $119 Adj. EPS $1.00 – $1.10 Free Cash Flow $86 – $96 Vtesse will be accretive to earnings beginning in 2019

Investment Highlights 22 • Global biopharmaceutical company focused on specialty areas with high unmet medical needs • Late stage pipeline with 3 phase 3 programs with data readouts over next 12 - 24 months • VTS - 270 for Niemann - Pick Disease Type C1 (NPC) from recent acquisition of Vtesse, Inc. • CPP - 1X/ sul Combo in Familial Adenomatous Polyposis (FAP) • Life - cycle management programs for lubiprostone • Two marketed and outlicensed products in gastroenterology and ophthalmology providing >$200 million in annual revenue and significant operating cash flow to fund pipeline and operations and limit downside risk • AMITIZA for constipation • RESCULA • Focused business development strategy focused on capital efficient, highly specialized diseases to bolster growth and diversify • Deep management team with proven ability to transform the company, create value, and commercialize products