Attached files

| file | filename |

|---|---|

| 8-K - TRINITY CAPITAL CORP | form8k_20170922.htm |

1 Rights Offering of Common SharesOTCQX: TRIN Free Writing ProspectusFiled Pursuant to Rule 433Registration Statement No. 333-218952Dated September 22, 2017

2 Forward Looking Statements This presentation contains forward looking statements of the Company within the meaning of the Private Securities Litigation Reform Act of 1995, with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Actual results could differ materially from the results indicated in this presentation because of risks and uncertainties, known or unknown (many of which are beyond the Company’s control), including those described in Item 1A “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2016 and the Company’s Registration Statement on Form S-1, as amended (No. 333-218952), filed with the Securities and Exchange Commission on June 23, 2017. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. All subsequent written and oral forward-looking statements in this presentation attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update or revise any statement in light of new information or future events, except as required by law. The Company has filed a registration statement (including a prospectus) with the Securities and Exchange Commission for the offering mentioned in this communication. Before you invest, you should read the prospectus in that registration statement and the other documents that the Company has filed with the Securities and Exchange Commission for more complete information about the Company and the offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, Boenning & Scattergood, Inc., as our financial advisor for the offering, or Continental Stock Transfer & Trust Company, as our subscription agent in the offering, will arrange to send you a prospectus, if you request it by contacting the Company at (505) 662-5171, Boenning & Scattergood at (866) 326-8186 or trinityinfo@boenninginc.com attn: Michael Marting or Continental at (917) 262-2378.

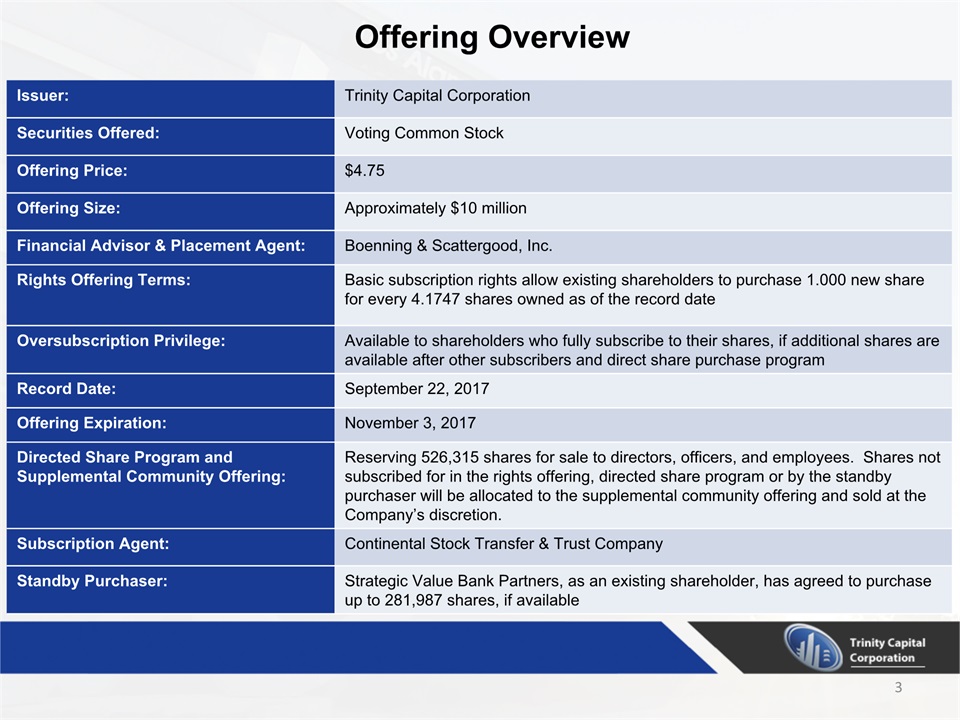

3 Issuer: Trinity Capital Corporation Securities Offered: Voting Common Stock Offering Price: $4.75 Offering Size: Approximately $10 million Financial Advisor & Placement Agent: Boenning & Scattergood, Inc. Rights Offering Terms: Basic subscription rights allow existing shareholders to purchase 1.000 new share for every 4.1747 shares owned as of the record date Oversubscription Privilege: Available to shareholders who fully subscribe to their shares, if additional shares are available after other subscribers and direct share purchase program Record Date: September 22, 2017 Offering Expiration: November 3, 2017 Directed Share Program and Supplemental Community Offering: Reserving 526,315 shares for sale to directors, officers, and employees. Shares not subscribed for in the rights offering, directed share program or by the standby purchaser will be allocated to the supplemental community offering and sold at the Company’s discretion. Subscription Agent: Continental Stock Transfer & Trust Company Standby Purchaser: Strategic Value Bank Partners, as an existing shareholder, has agreed to purchase up to 281,987 shares, if available Offering Overview

4 Process Overview Registered holders interested in participating in the offering should send a completed rights certificate and payment (other than by wire transfer) to:Continental Stock Transfer & Trust Company1 State Street Plaza - 30th FloorNew York, NY 10004A shareholder participating in the offering should submit payment for the full number of shares for which he or she is subscribing by any one of the following methods: Cashier’s check or personal check drawn upon a U.S. bank made payable to Continental Stock Transfer & Trust CompanyWire transfer of immediately available funds to the following account maintained by the subscription agent:Trinity Capital Corporation Escrow Accountc/o Continental Stock Transfer & Trust Company Account No.: 475-470656 ABA/Routing Number: 021.000.021Upon completion of the subscription period, the Company will determine the number of shares subscribed for in the rights offering and directed share program and determine whether to accept subscriptions from the supplemental community offering. The Company will credit the account of each rights holder with shares of voting common stock purchased pursuant to the exercise of the basic subscription right and the over-subscription privilege as soon as practicable after the rights offering has closed.Please consult the prospectus for further details on how to execute your subscription privileges. You may also contact Boenning & Scattergood, our financial advisor, at (866) 326-8186 or trinityinfo@boenninginc.com, Attn: Michael G. Marting.

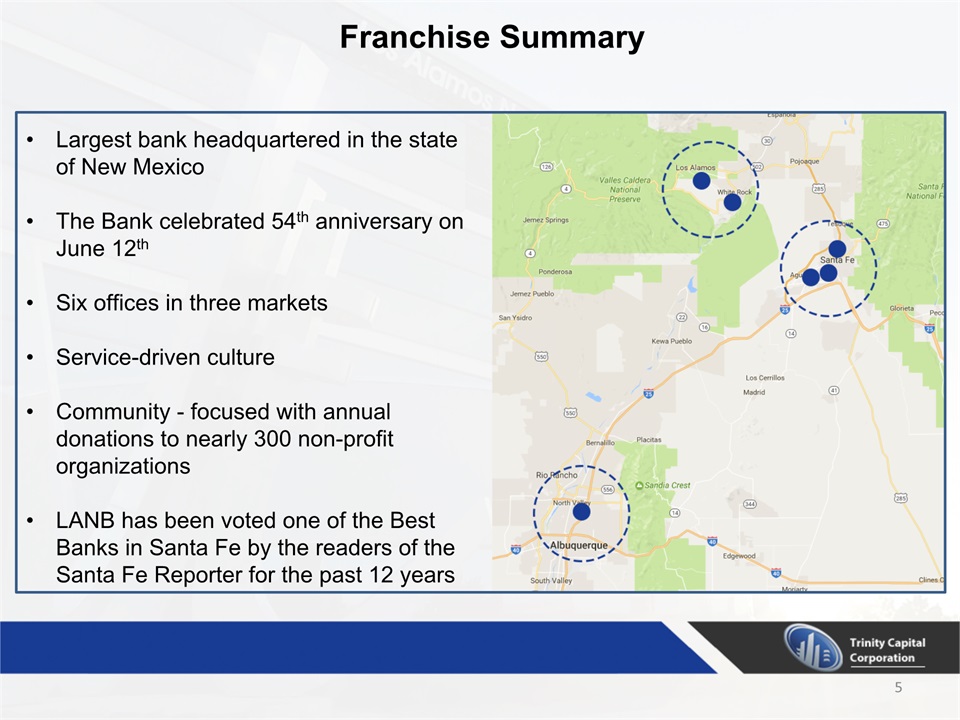

5 Largest bank headquartered in the state of New Mexico The Bank celebrated 54th anniversary on June 12thSix offices in three markets Service-driven cultureCommunity - focused with annual donations to nearly 300 non-profit organizationsLANB has been voted one of the Best Banks in Santa Fe by the readers of the Santa Fe Reporter for the past 12 years Franchise Summary

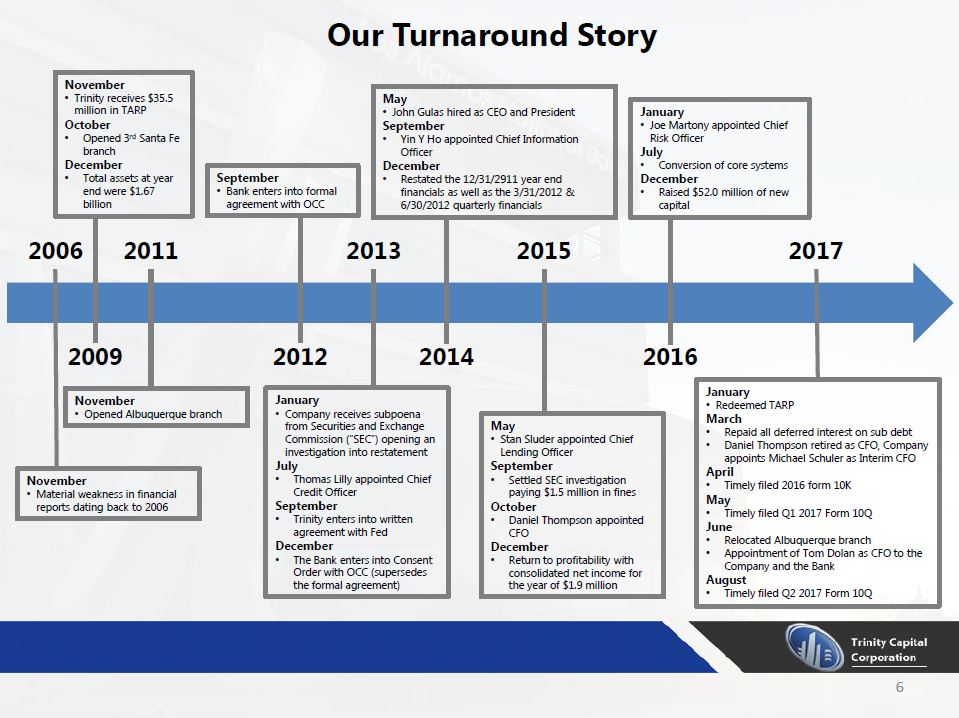

6 Our Turnaround Story 2006 NovemberMaterial weakness in financial reports dating back to 2006 NovemberTrinity receives $35.5 million in TARPOctoberOpened 3rd Santa Fe branchDecemberTotal assets at year end were $1.67 billion 2009 2011 NovemberOpened Albuquerque branch 2012 SeptemberBank enters into formal agreement with OCC 2013 JanuaryCompany receives subpoena from Securities and Exchange Commission (“SEC”) opening an investigation into restatementJulyThomas Lilly appointed Chief Credit OfficerSeptemberTrinity enters into written agreement with FedDecemberThe Bank enters into Consent Order with OCC (supersedes the formal agreement) 2014 MayJohn Gulas hired as CEO and PresidentSeptemberYin Y Ho appointed Chief Information OfficerDecemberRestated the 12/31/2911 year end financials as well as the 3/31/2012 & 6/30/2012 quarterly financials 2015 MayStan Sluder appointed Chief Lending OfficerSeptemberSettled SEC investigation paying $1.5 million in finesOctoberDaniel Thompson appointed CFODecemberReturn to profitability with consolidated net income for the year of $1.9 million 2016 JanuaryJoe Martony appointed Chief Risk OfficerJulyConversion of core systemsDecemberRaised $52.0 million of new capital 2017 JanuaryRedeemed TARPMarchRepaid all deferred interest on sub debtDaniel Thompson retired as CFO, Company appoints Michael Schuler as Interim CFOAprilTimely filed 2016 form 10KMayTimely filed Q1 2017 Form 10QJuneRelocated Albuquerque branchAppointment of Tom Dolan as CFO to the Company and the BankAugustTimely filed Q2 2017 Form 10Q

7 Continuing Recovery & Executing Business Plan Building Shareholder Value

8 Superior Service Culture WHYTo add value to the lives of our communities, customers and employees.HOWThrough excellent service that is designed to help customers identify and achieve financial goals.WHATProvide deposit and credit products and services that improve the lives of our customers by providing them improved access, information and ideas.

9 Investment Highlights

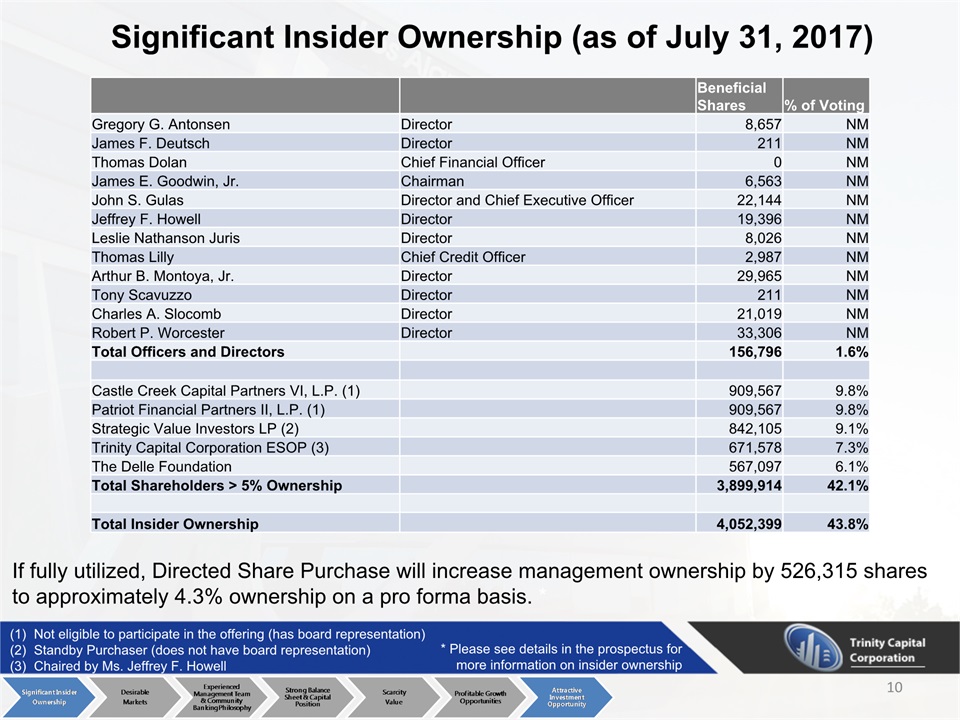

10 Significant Insider Ownership (as of July 31, 2017) Not eligible to participate in the offering (has board representation)Standby Purchaser (does not have board representation)Chaired by Ms. Jeffrey F. Howell If fully utilized, Directed Share Purchase will increase management ownership by 526,315 shares to approximately 4.3% ownership on a pro forma basis. * Beneficial Shares % of Voting Gregory G. Antonsen Director 8,657 NM James F. Deutsch Director 211 NM Thomas Dolan Chief Financial Officer 0 NM James E. Goodwin, Jr. Chairman 6,563 NM John S. Gulas Director and Chief Executive Officer 22,144 NM Jeffrey F. Howell Director 19,396 NM Leslie Nathanson Juris Director 8,026 NM Thomas Lilly Chief Credit Officer 2,987 NM Arthur B. Montoya, Jr. Director 29,965 NM Tony Scavuzzo Director 211 NM Charles A. Slocomb Director 21,019 NM Robert P. Worcester Director 33,306 NM Total Officers and Directors 156,796 1.6% Castle Creek Capital Partners VI, L.P. (1) 909,567 9.8% Patriot Financial Partners II, L.P. (1) 909,567 9.8% Strategic Value Investors LP (2) 842,105 9.1% Trinity Capital Corporation ESOP (3) 671,578 7.3% The Delle Foundation 567,097 6.1% Total Shareholders > 5% Ownership 3,899,914 42.1% Total Insider Ownership 4,052,399 43.8% * Please see details in the prospectus for more information on insider ownership

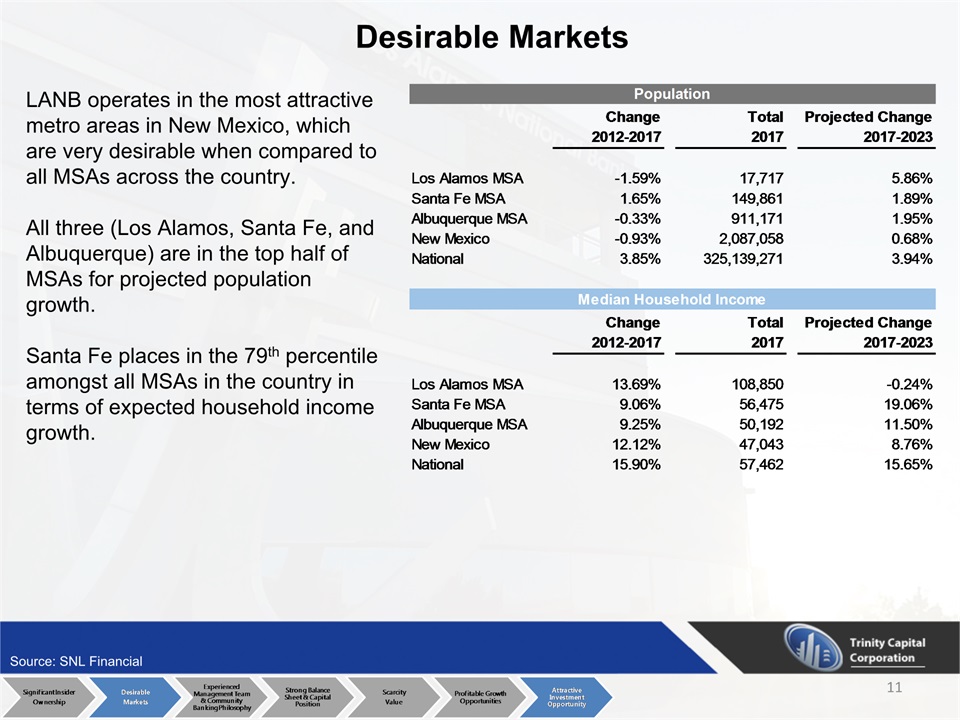

11 Desirable Markets Source: SNL Financial LANB operates in the most attractive metro areas in New Mexico, which are very desirable when compared to all MSAs across the country.All three (Los Alamos, Santa Fe, and Albuquerque) are in the top half of MSAs for projected population growth. Santa Fe places in the 79th percentile amongst all MSAs in the country in terms of expected household income growth.

12 Deposit Market Share Overview as of 6/30/2016 Source: FDIC

13 Community Banking Philosophy Source: SNL Financial Franchise value driven by dedication to making a difference in markets served.Customers benefit from local decision-making and individual service.Customer-centric approach builds long term relationships with desirable customers.Respected position in communities served encourages recruitment of talented and experienced management team.Seasoned community banking executive management team.Contribute to nearly 300 non-profit organizations annually.Employee giving campaign raised over $50,000 in aggregate for United Way of Northern New Mexico, Santa Fe Community Foundation and United Way of Central New Mexico in 2016.Winner of the 2016 St. Vincent’s Hospital Foundation and Albuquerque Journal’s Philanthropist of the Year Award. Employees have cumulatively volunteered approximately 1,000 hours of community service as of August 31, 2017

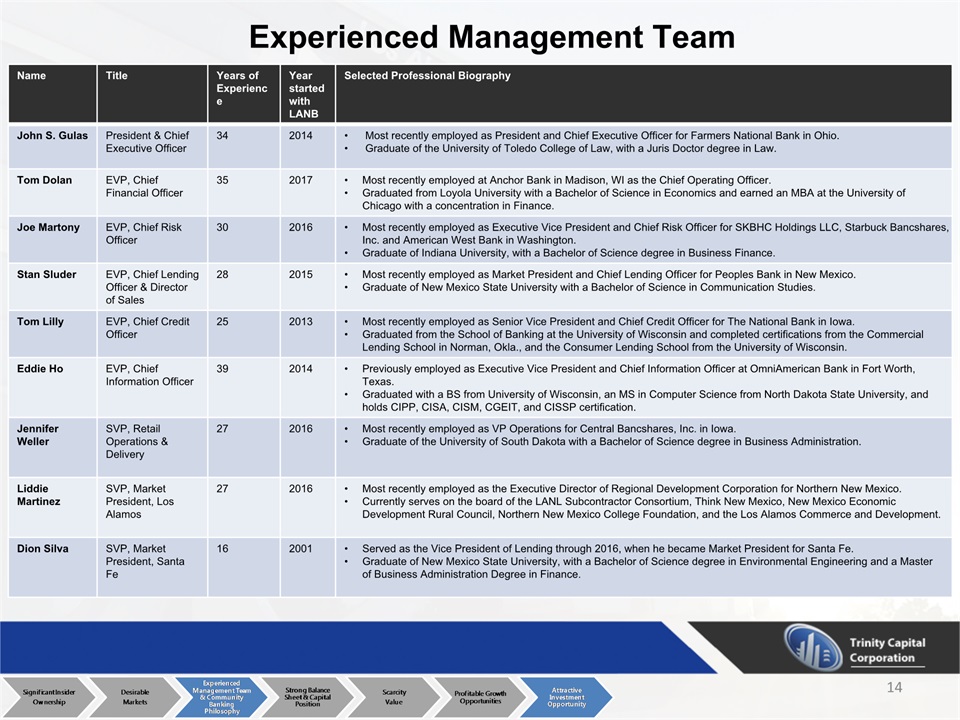

14 Experienced Management Team Name Title Years of Experience Year started with LANB Selected Professional Biography John S. Gulas President & Chief Executive Officer 34 2014 Most recently employed as President and Chief Executive Officer for Farmers National Bank in Ohio. Graduate of the University of Toledo College of Law, with a Juris Doctor degree in Law. Tom Dolan EVP, Chief Financial Officer 35 2017 Most recently employed at Anchor Bank in Madison, WI as the Chief Operating Officer.Graduated from Loyola University with a Bachelor of Science in Economics and earned an MBA at the University of Chicago with a concentration in Finance. Joe Martony EVP, Chief Risk Officer 30 2016 Most recently employed as Executive Vice President and Chief Risk Officer for SKBHC Holdings LLC, Starbuck Bancshares, Inc. and American West Bank in Washington. Graduate of Indiana University, with a Bachelor of Science degree in Business Finance. Stan Sluder EVP, Chief Lending Officer & Director of Sales 28 2015 Most recently employed as Market President and Chief Lending Officer for Peoples Bank in New Mexico. Graduate of New Mexico State University with a Bachelor of Science in Communication Studies. Tom Lilly EVP, Chief Credit Officer 25 2013 Most recently employed as Senior Vice President and Chief Credit Officer for The National Bank in Iowa.Graduated from the School of Banking at the University of Wisconsin and completed certifications from the Commercial Lending School in Norman, Okla., and the Consumer Lending School from the University of Wisconsin. Eddie Ho EVP, Chief Information Officer 39 2014 Previously employed as Executive Vice President and Chief Information Officer at OmniAmerican Bank in Fort Worth, Texas.Graduated with a BS from University of Wisconsin, an MS in Computer Science from North Dakota State University, and holds CIPP, CISA, CISM, CGEIT, and CISSP certification. Jennifer Weller SVP, Retail Operations & Delivery 27 2016 Most recently employed as VP Operations for Central Bancshares, Inc. in Iowa.Graduate of the University of South Dakota with a Bachelor of Science degree in Business Administration. Liddie Martinez SVP, Market President, Los Alamos 27 2016 Most recently employed as the Executive Director of Regional Development Corporation for Northern New Mexico. Currently serves on the board of the LANL Subcontractor Consortium, Think New Mexico, New Mexico Economic Development Rural Council, Northern New Mexico College Foundation, and the Los Alamos Commerce and Development. Dion Silva SVP, Market President, Santa Fe 16 2001 Served as the Vice President of Lending through 2016, when he became Market President for Santa Fe. Graduate of New Mexico State University, with a Bachelor of Science degree in Environmental Engineering and a Master of Business Administration Degree in Finance.

15 James E. Goodwin, Jr.New Chairman of the Board Member of the Boards of Directors of Trinity and the Bank since 2013. Former chair of the Audit Committee and serves as the audit committee financial expert, as defined under the SEC rules and regulations. Former Chair of the Board’s Asset/Liability Management Committee and is a member of the Board’s Compensation, and Loan and Strategic Planning Committees. Previously a Partner in the firm of PricewaterhouseCoopers LLP and served as a member of the firm’s U.S. Board of Partners and Principals. Member of the Board of Directors of The National Dance Institute of New Mexico. Member of the Audit Committee of the New Mexico State Investment Council. Experienced Management Team

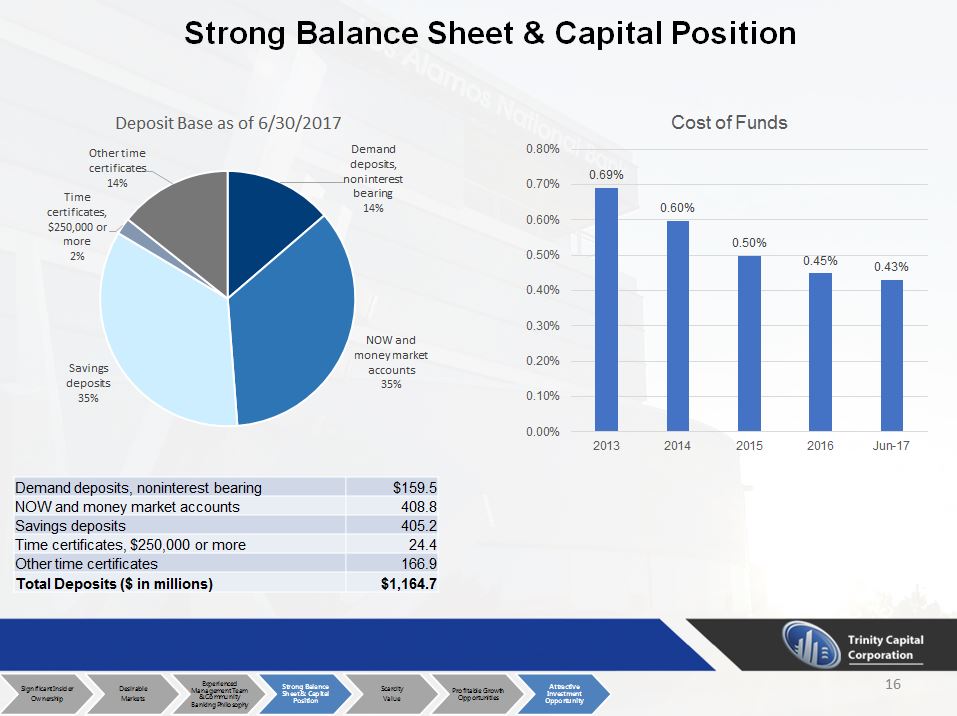

16 Strong Balance Sheet & Capital Position Demand deposits, noninterest bearing $159.5 NOW and money market accounts 408.8 Savings deposits 405.2 Time certificates, $250,000 or more 24.4 Other time certificates 166.9 Total Deposits ($ in millions) $1,164.7

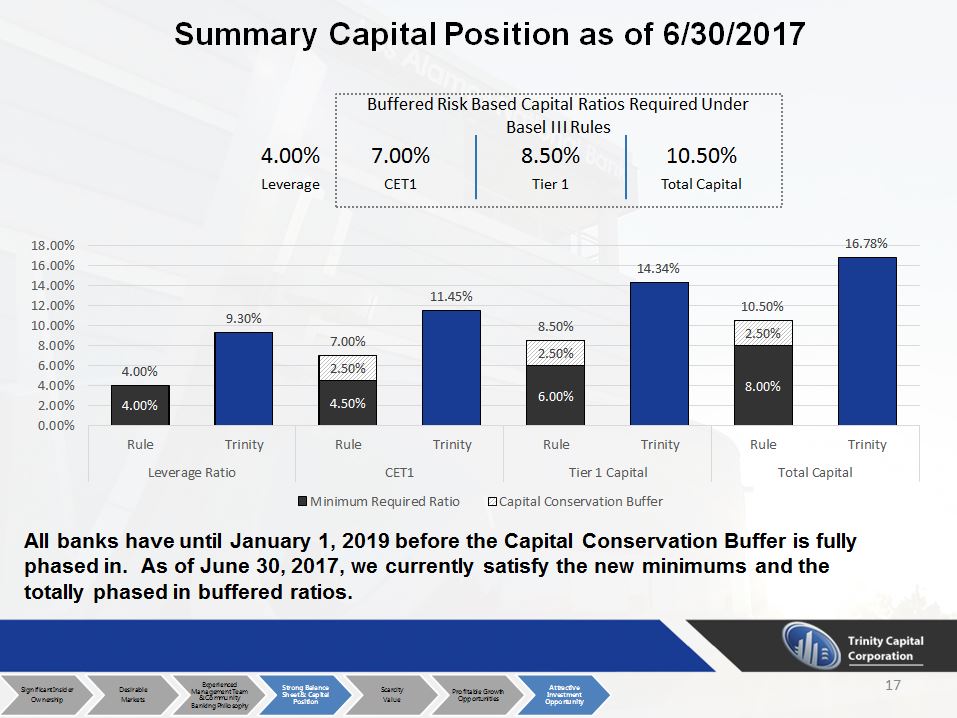

17 7.00% 4.00% 8.50% 10.50% CET1 Leverage Tier 1 Total Capital Summary Capital Position as of 6/30/2017 Buffered Risk Based Capital Ratios Required Under Basel III Rules All banks have until January 1, 2019 before the Capital Conservation Buffer is fully phased in. As of June 30, 2017, we currently satisfy the new minimums and the totally phased in buffered ratios.

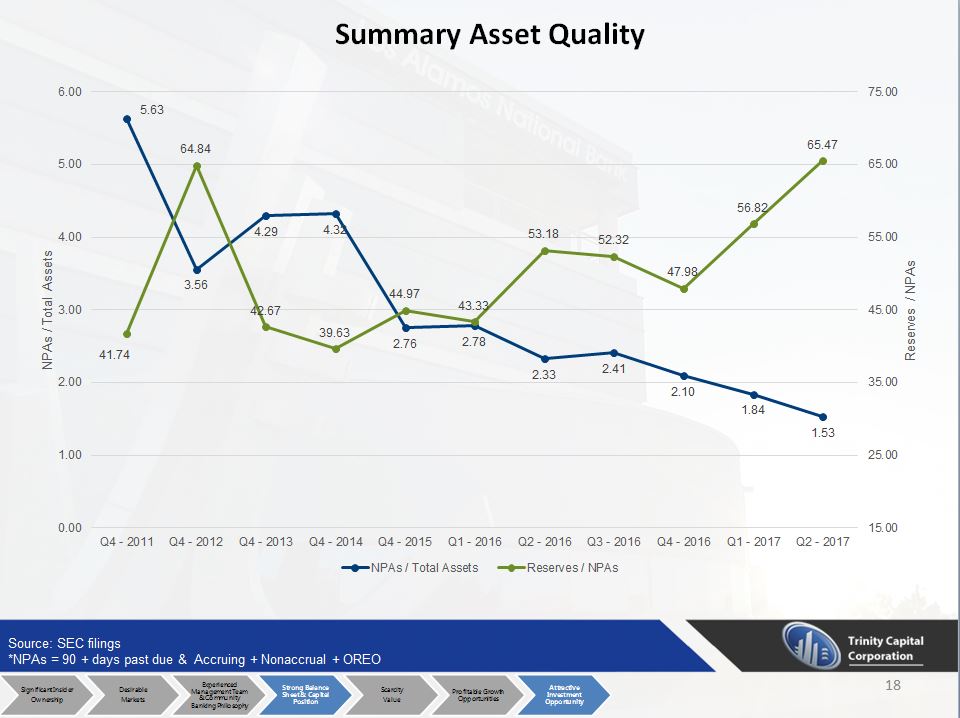

18 Summary Asset Quality Source: SEC filings*NPAs = 90 + days past due & Accruing + Nonaccrual + OREO

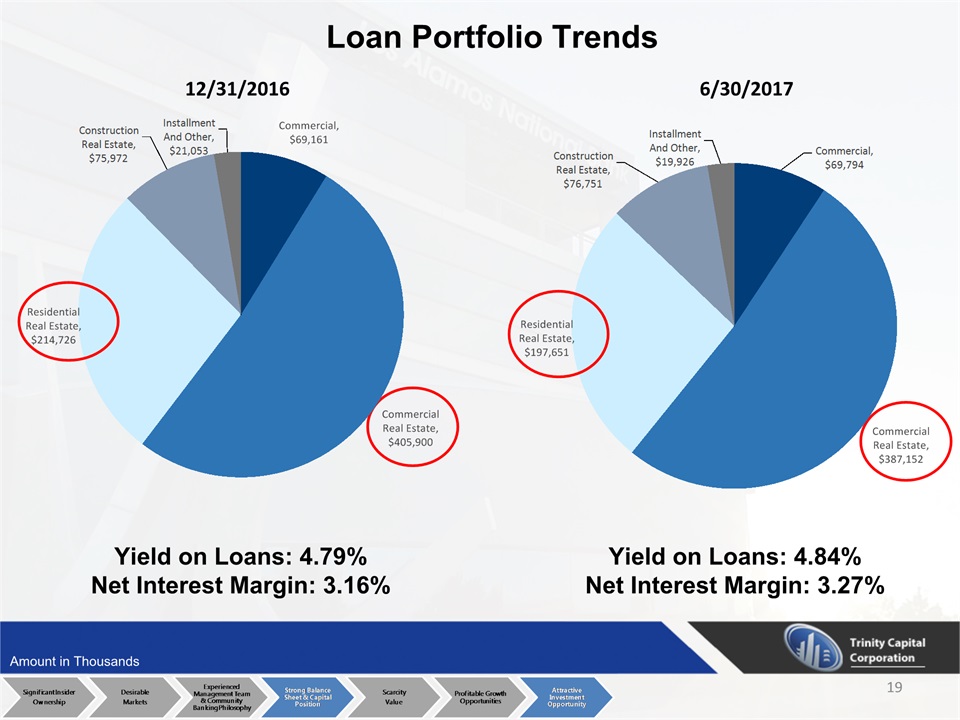

19 Loan Portfolio Trends Amount in Thousands 6/30/2017 Yield on Loans: 4.84%Net Interest Margin: 3.27% 12/31/2016 Yield on Loans: 4.79%Net Interest Margin: 3.16%

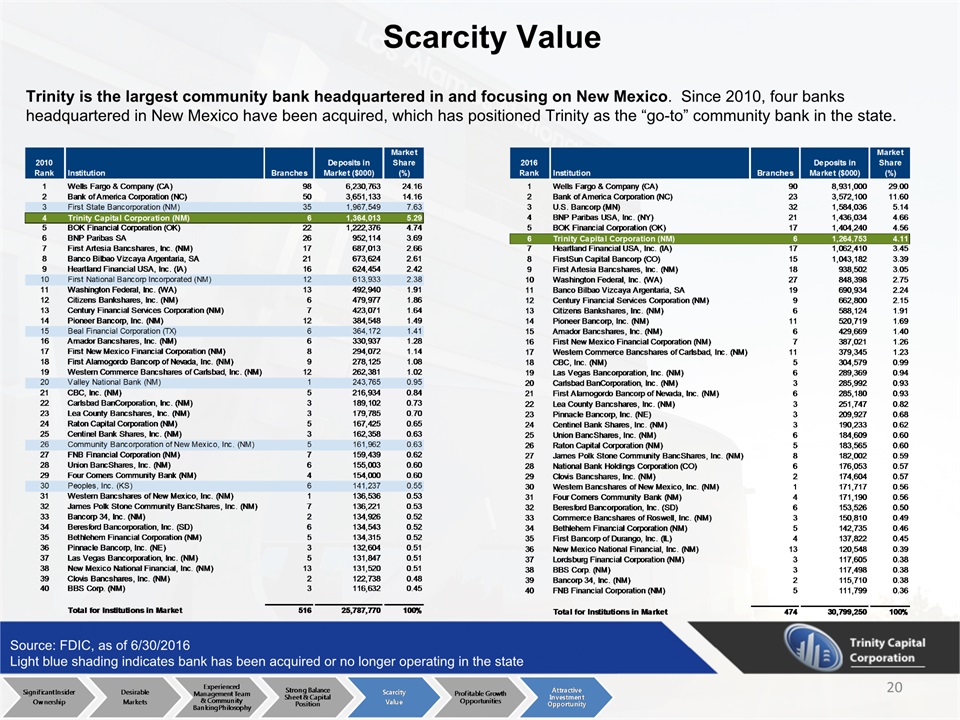

20 Scarcity Value Trinity is the largest community bank headquartered in and focusing on New Mexico. Since 2010, four banks headquartered in New Mexico have been acquired, which has positioned Trinity as the “go-to” community bank in the state. Source: FDIC, as of 6/30/2016Light blue shading indicates bank has been acquired or no longer operating in the state

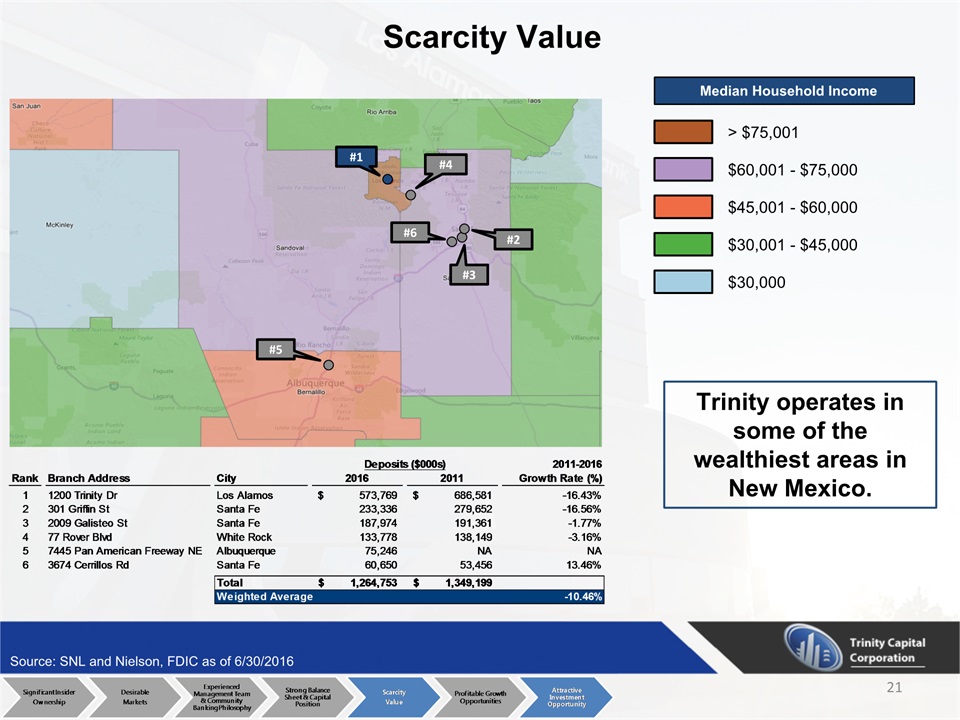

21 Scarcity Value Median Household Income #1 #4 #2 #3 #6 #5 Trinity operates in some of the wealthiest areas in New Mexico. Source: SNL and Nielson, FDIC as of 6/30/2016 > $75,001 $60,001 - $75,000 $45,001 - $60,000 $30,001 - $45,000 $30,000

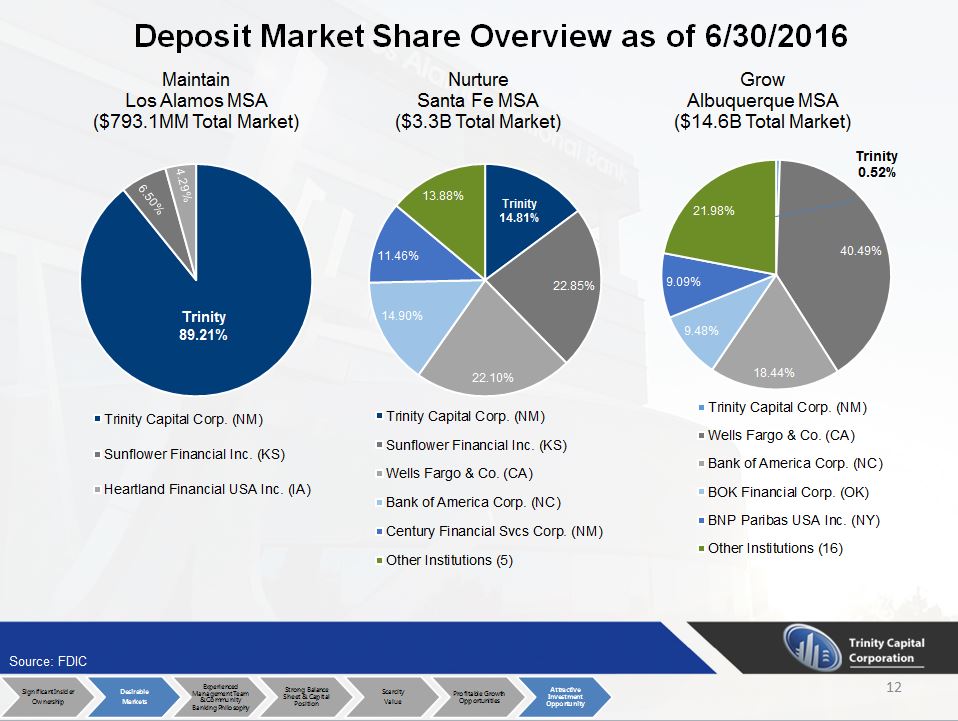

22 Scarcity Value LANB was founded in 1962 in Los Alamos, New Mexico, and added a second area branch in White Rock in 1971.Los Alamos is a genuinely unique market, with levels of stability and affluence that bely its relatively small population.The median household income in Los Alamos County was 88% higher than the national median as of 2016. As of 2014, 12.4% of households had over $1 million in assets, making Los Alamos the city with the highest concentration of millionaires in the U.S.The city is home to the famous Los Alamos National Laboratory, know best for coordinating the Manhattan Project. LANL’s budget is over $2.2 billion annually and it directly employs over 11,000 people.In 2016, 18.6% of residents over the age of 25 held a doctoral degree, compared to 1.3% for the United States overall.As of June 30, 2016, LANB dominated deposit market share in Los Alamos County with $707.5 million in deposits, or 89.8% of the $793.1 million of total deposits in the market. Santa Fe has a strong tourism sector, owing to its rich cultural history that dates back to the 15th century. It is the oldest state capital and its Palace of the Governors is the oldest continuously occupied public building in the United States.In part due to its proximity to Los Alamos, Santa Fe has become a hub for science and technology, and has spawned the Santa Fe Institute and the National Center for Genome Research. The presence of these institutions and Santa Fe’s established tourist industry has led Santa Fe to routinely host a variety of scientific conferences, meetings and summer schools.As of June 30, 2016, the Bank ranked third out of ten institutions in Santa Fe by deposit market share, with $482.0 million of deposits, or 16.6% of the $3.3 billion of total deposits in the market. Since 2000, the Santa Fe deposit market has increased by 179.4%, or 6.6% compounded annually through 2016. In 2016, the greater Santa Fe MSA had a population of approximately 150,000 with a projected population growth rate of 2.1% over the next five years. In 2006, Trinity entered the market with a branch in North Albuquerque and moved to its current location in June 2017 to be more accessible to customers. Albuquerque is the largest city in New Mexico, the fourth largest city on the Southwestern United States, and the 32nd most populous city in the United States. Sandia National Laboratories, located on the Kirkland Air Force Base, employs over 8,000 people towards the research and development of non-nuclear components of nuclear weapons and supporting technologies.The MSA is also the major manufacturing center of New Mexico, including Boeing, Intel, Eclipse Aerospace, SolAero Technologies and OSO BioPharmaceuticals Manufacturing.In 2016, the greater Albuquerque MSA boasted a population of approximately 908,000 with a projected population growth rate of 2.3% over the next five years.In Albuquerque, Trinity ranks 14th out of 21 institutions in the city by deposit market share, with $75.2 million of deposits, or 0.5% of the $14.6 billion of deposits in the market as of June 30, 2016. Los Alamos County Santa Fe MSA Albuquerque MSA Source: SNL Financial, Nielsen, Los Alamos National Laboratory, Kiplinger, Bureau of the Census, and Bureau of Economic Analysis

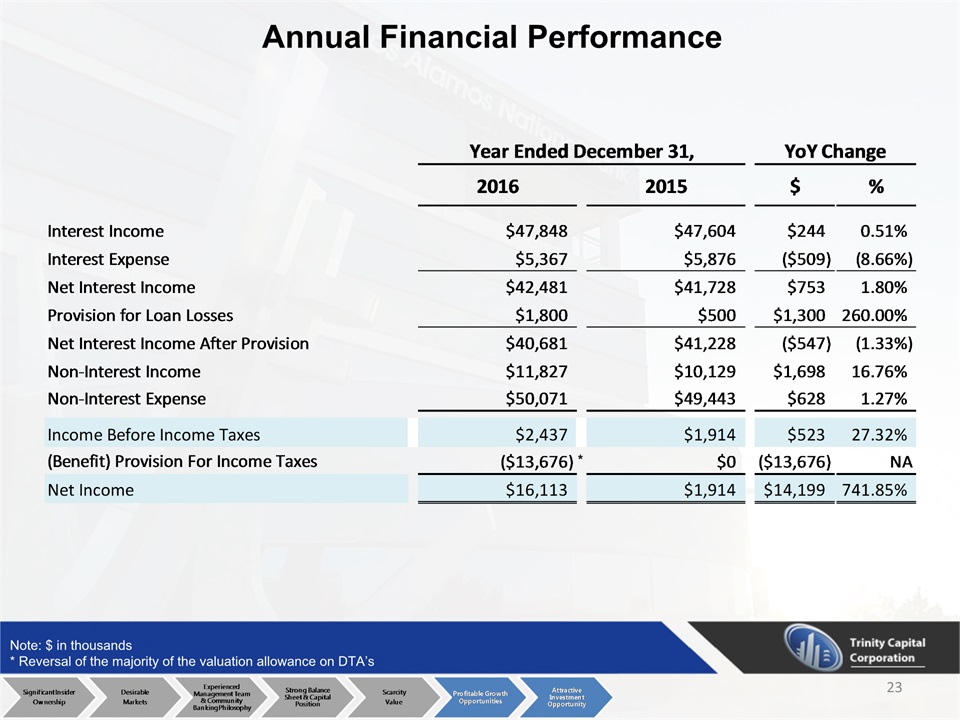

23 Annual Financial Performance * Note: $ in thousands* Reversal of the majority of the valuation allowance on DTA’s

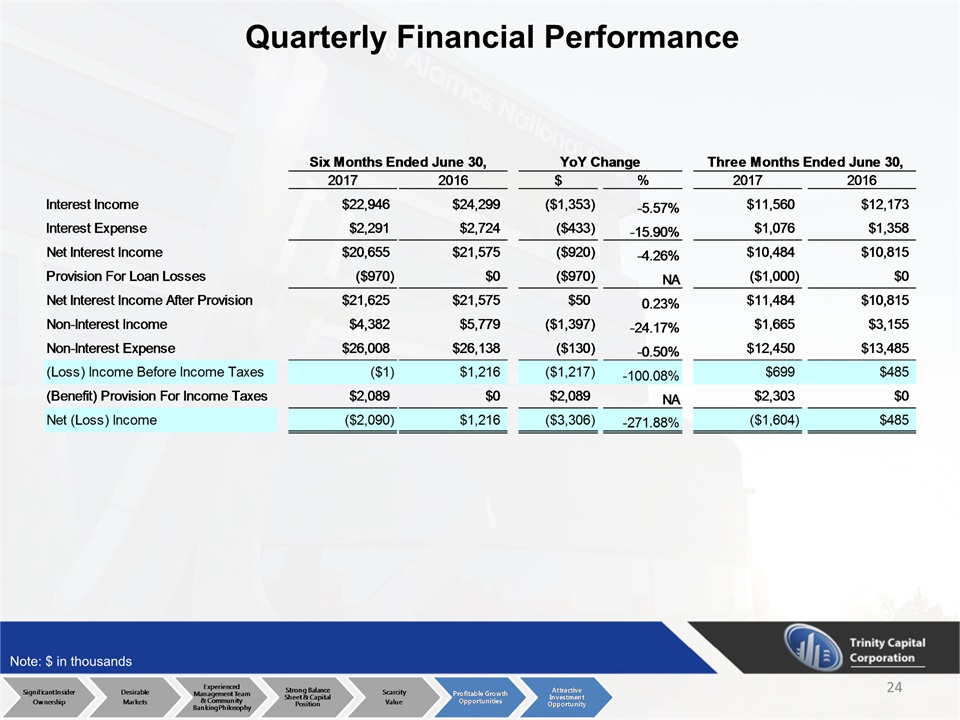

24 Quarterly Financial Performance Note: $ in thousands

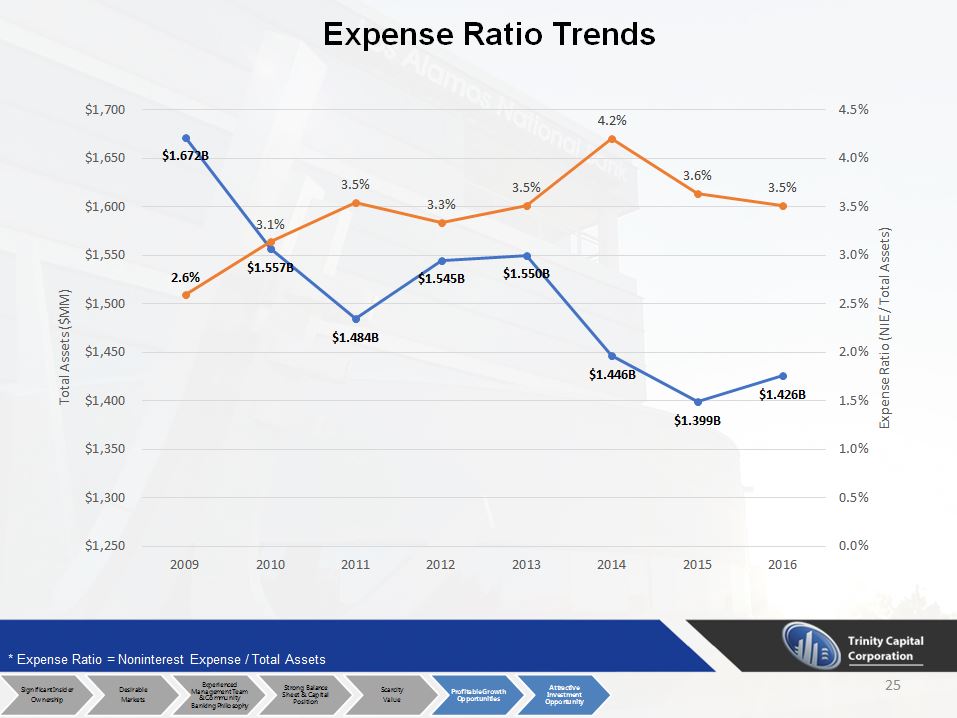

25 Expense Ratio Trends * Expense Ratio = Noninterest Expense / Total Assets

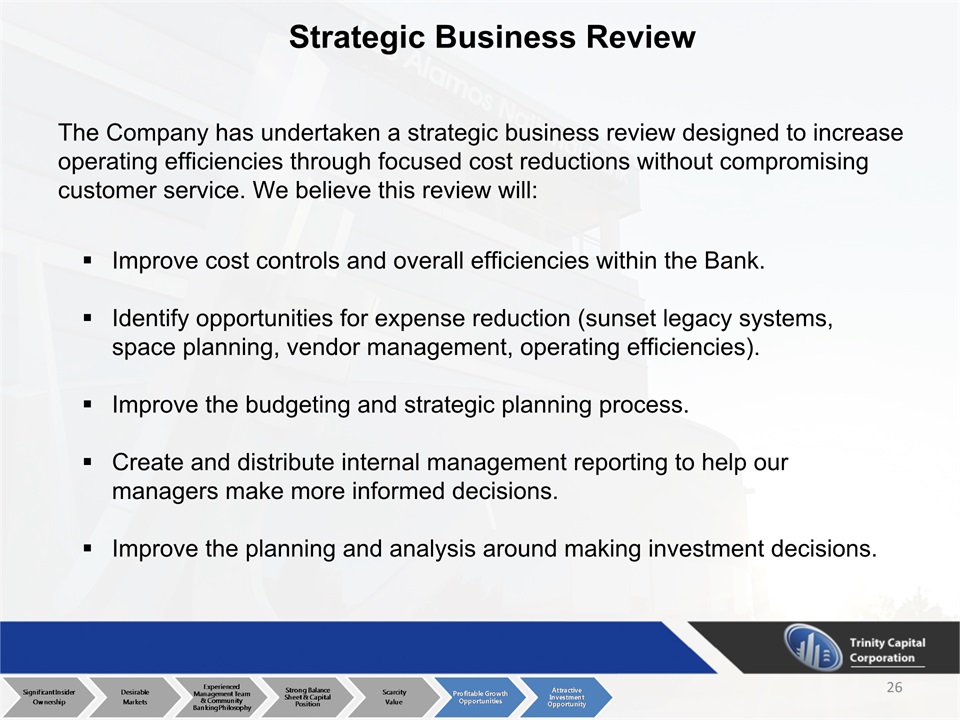

26 Strategic Business Review The Company has undertaken a strategic business review designed to increase operating efficiencies through focused cost reductions without compromising customer service. We believe this review will: Improve cost controls and overall efficiencies within the Bank.Identify opportunities for expense reduction (sunset legacy systems, space planning, vendor management, operating efficiencies).Improve the budgeting and strategic planning process.Create and distribute internal management reporting to help our managers make more informed decisions. Improve the planning and analysis around making investment decisions.

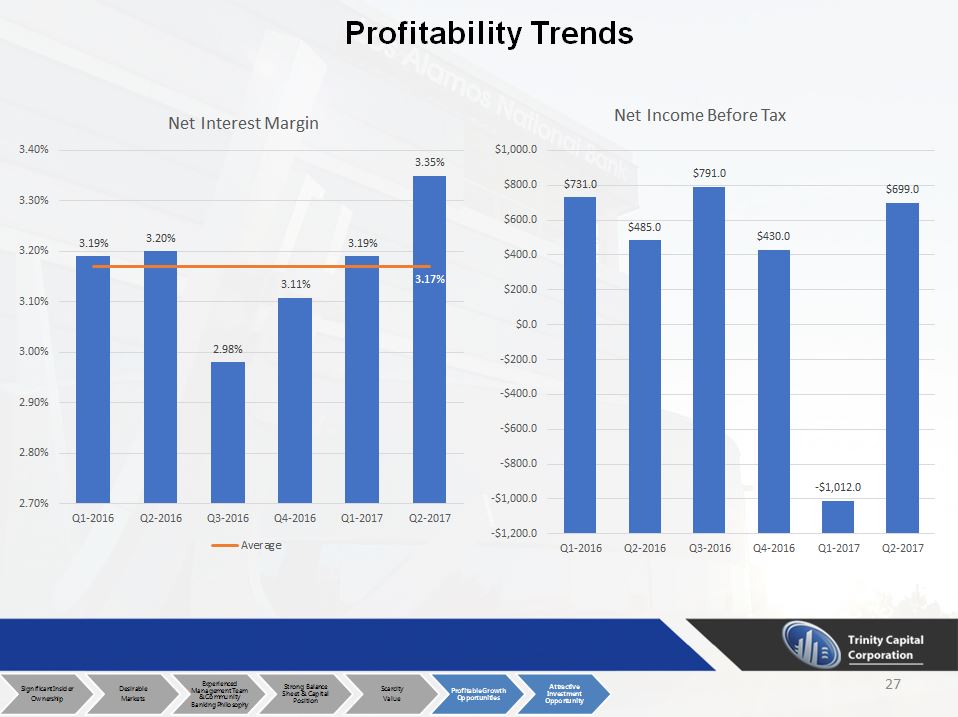

27 Profitability Trends

28 Investment Highlights

29 Contact Information Tom DooleySenior Vice PresidentW: (614) 408-1224tdooley@boenninginc.com Nick BickingSenior Vice President(614) 408-1223nbicking@boenninginc.com Michael C. VoinovichManaging DirectorW: (216) 378-1302M: (440) 804-6254mvoinovich@boenninginc.com Christopher M. ChapmanDirectorW: (216) 378-1297M: (216) 288-2924cchapman@boenninginc.com Please consult the offering document for further details on how to execute your subscription privileges. You may also contact representatives from Boenning & Scattergood, our financial advisor below or, at (866) 326-8186 or trinityinfo@boenninginc.com, Attn: Michael G. Marting John S. GulasChief Executive OfficerW: (505) 663-3990johnsg@lanb.com Thomas DolanChief Financial OfficerW: (505) 662-1045thomasd@lanb.com