Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Ultragenyx Pharmaceutical Inc. | d458520dex991.htm |

| 8-K - FORM 8-K - Ultragenyx Pharmaceutical Inc. | d458520d8k.htm |

Proposal for Ultragenyx to Acquire Dimension Therapeutics September 18, 2017 Exhibit 99.2

Forward Looking Statements / Additional Information Except for the historical information contained herein, the matters set forth in this communication, including statements of anticipated changes in the business environment in which Ultragenyx operates and in Ultragenyx’s future prospects or results, statements relating to Ultragenyx’s intentions, plans, hopes, beliefs, anticipations, expectations or predictions of its future, or statements relating to Ultragenyx’s offer and the potential benefits of a transaction with Dimension Therapeutics, Inc. (“Dimension”), are forward-looking statements. Such forward-looking statements involve substantial risks and uncertainties that could cause our clinical development programs, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the uncertainties inherent in the clinical drug development process, such as the regulatory approval process, the timing of our regulatory filings and other matters that could affect sufficiency of existing cash, cash equivalents and short-term investments to fund operations and the availability or commercial potential of our drug candidates. There is no assurance that the potential transaction will be consummated, and it is important to note that actual results could differ materially from those projected in such forward-looking statements. Ultragenyx undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Ultragenyx in general, see Ultragenyx's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on July 28, 2017, and its subsequent periodic reports filed with the SEC. The tender offer referred to in this communication (an “Offer”) has not yet commenced. Accordingly, this communication is for informational purposes only and does not constitute an offer to purchase or a solicitation of an offer to sell any shares of Dimension common stock or any other securities. On the commencement date of any Offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related materials, will be filed with the SEC by Ultragenyx and a wholly owned subsidiary. The offer to purchase shares of Dimension common stock will only be made pursuant to the offer to purchase, letter of transmittal and related materials filed with the SEC by Ultragenyx as part of its Schedule TO. Investors and security holders are urged to read both the tender offer statement and any solicitation/recommendation statement filed by Dimension regarding the Offer, as they may be amended from time to time, when they become available, because they will contain important information about the Offer, including its terms and conditions, and should be read carefully before any decision is made with respect to the Offer. Investors and security holders may obtain free copies of these statements (when available) and other materials filed with the SEC at the website maintained by the SEC at www.sec.gov, or by directing requests for such materials to the information agent for the Offer, which will be named in the tender offer statement.

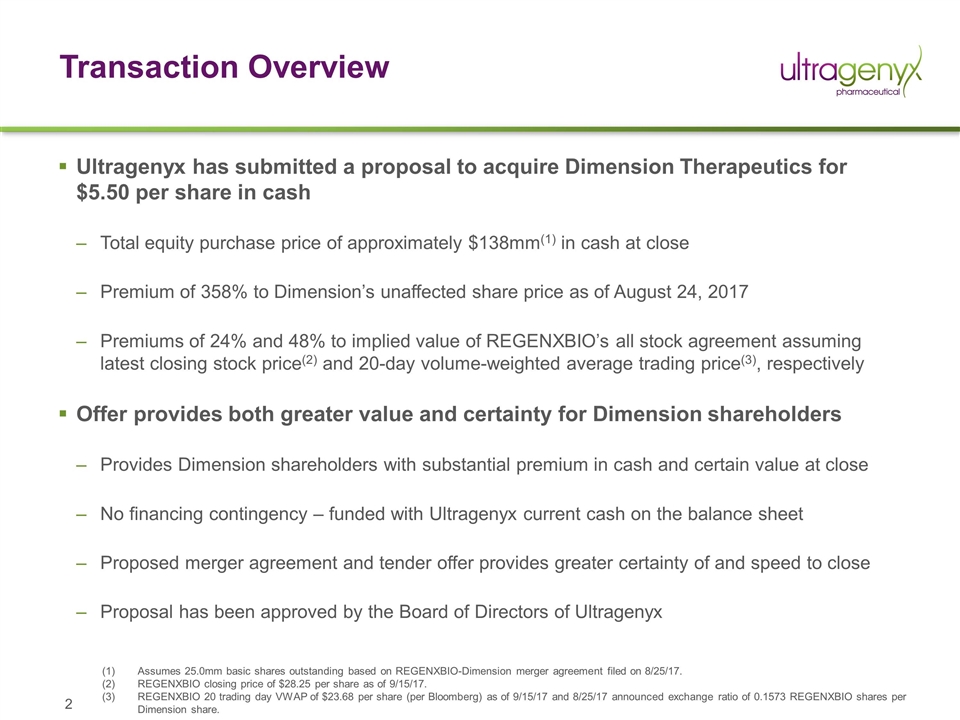

Transaction Overview Ultragenyx has submitted a proposal to acquire Dimension Therapeutics for $5.50 per share in cash Total equity purchase price of approximately $138mm(1) in cash at close Premium of 358% to Dimension’s unaffected share price as of August 24, 2017 Premiums of 24% and 48% to implied value of REGENXBIO’s all stock agreement assuming latest closing stock price(2) and 20-day volume-weighted average trading price(3), respectively Offer provides both greater value and certainty for Dimension shareholders Provides Dimension shareholders with substantial premium in cash and certain value at close No financing contingency – funded with Ultragenyx current cash on the balance sheet Proposed merger agreement and tender offer provides greater certainty of and speed to close Proposal has been approved by the Board of Directors of Ultragenyx Assumes 25.0mm basic shares outstanding based on REGENXBIO-Dimension merger agreement filed on 8/25/17. REGENXBIO closing price of $28.25 per share as of 9/15/17. REGENXBIO 20 trading day VWAP of $23.68 per share (per Bloomberg) as of 9/15/17 and 8/25/17 announced exchange ratio of 0.1573 REGENXBIO shares per Dimension share.

Our Strategy Transforming good science into great medicine for rare genetic diseases HOW HAVE WE DONE IT? CLEAR BIOLOGY RAPID DEVELOPMENT GLOBAL VISION NEW MODALITIES HOW DO WE CONTINUE DOING IT?

Ultragenyx – Dimension Strong Strategic Fit 5 things we look for in an opportunity: Rare and ultra-rare disease Genetic disease with clear biology Potential for meaningful clinical benefit Translating existing science to clinic rapidly Global rights to key assets Satisfies all of these criteria

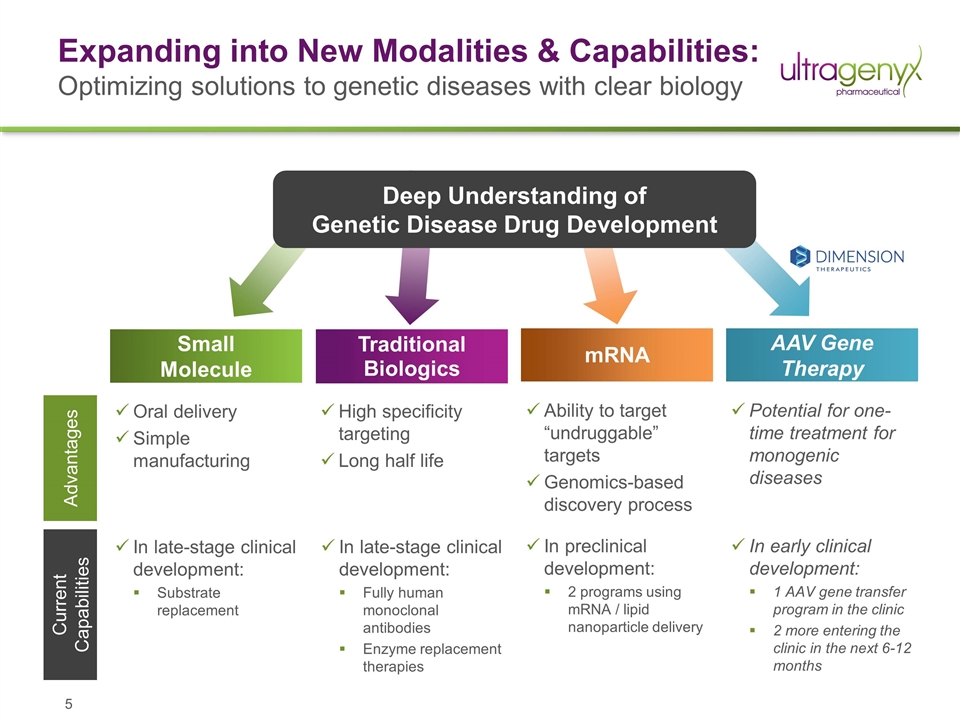

Expanding into New Modalities & Capabilities: Optimizing solutions to genetic diseases with clear biology In late-stage clinical development: Fully human monoclonal antibodies Enzyme replacement therapies Traditional Biologics Small Molecule AAV Gene Therapy Oral delivery Simple manufacturing mRNA Advantages Current Capabilities In late-stage clinical development: Substrate replacement In preclinical development: 2 programs using mRNA / lipid nanoparticle delivery In early clinical development: 1 AAV gene transfer program in the clinic 2 more entering the clinic in the next 6-12 months High specificity targeting Long half life Ability to target “undruggable” targets Genomics-based discovery process Potential for one-time treatment for monogenic diseases Deep Understanding of Genetic Disease Drug Development

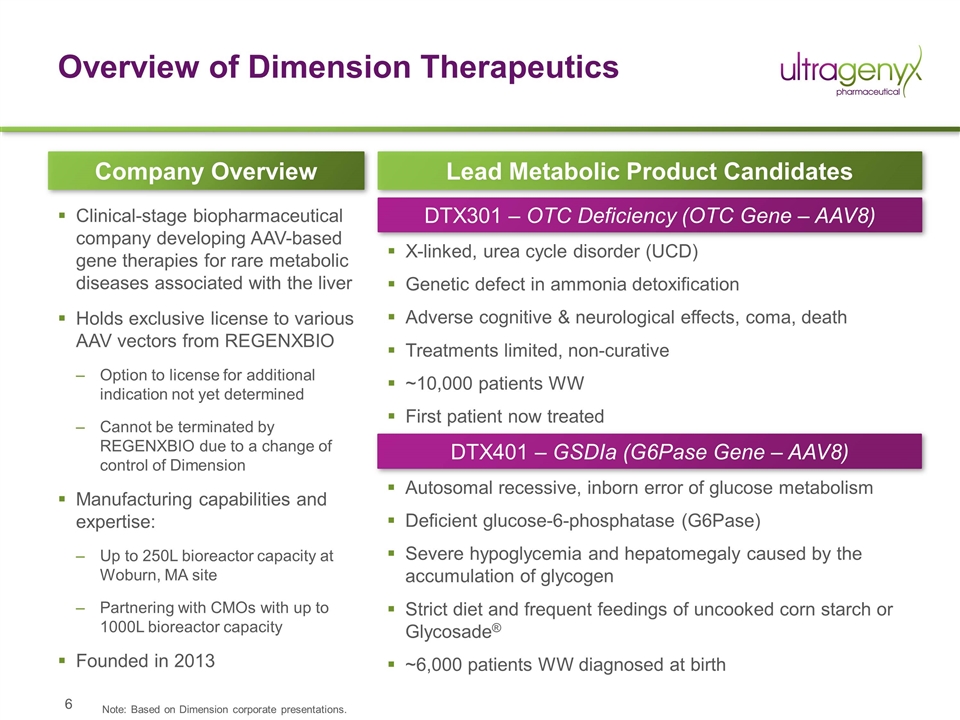

Overview of Dimension Therapeutics Clinical-stage biopharmaceutical company developing AAV-based gene therapies for rare metabolic diseases associated with the liver Holds exclusive license to various AAV vectors from REGENXBIO Option to license for additional indication not yet determined Cannot be terminated by REGENXBIO due to a change of control of Dimension Manufacturing capabilities and expertise: Up to 250L bioreactor capacity at Woburn, MA site Partnering with CMOs with up to 1000L bioreactor capacity Founded in 2013 Company Overview Lead Metabolic Product Candidates DTX301 – OTC Deficiency (OTC Gene – AAV8) DTX401 – GSDIa (G6Pase Gene – AAV8) X-linked, urea cycle disorder (UCD) Genetic defect in ammonia detoxification Adverse cognitive & neurological effects, coma, death Treatments limited, non-curative ~10,000 patients WW First patient now treated Autosomal recessive, inborn error of glucose metabolism Deficient glucose-6-phosphatase (G6Pase) Severe hypoglycemia and hepatomegaly caused by the accumulation of glycogen Strict diet and frequent feedings of uncooked corn starch or Glycosade® ~6,000 patients WW diagnosed at birth Note: Based on Dimension corporate presentations.

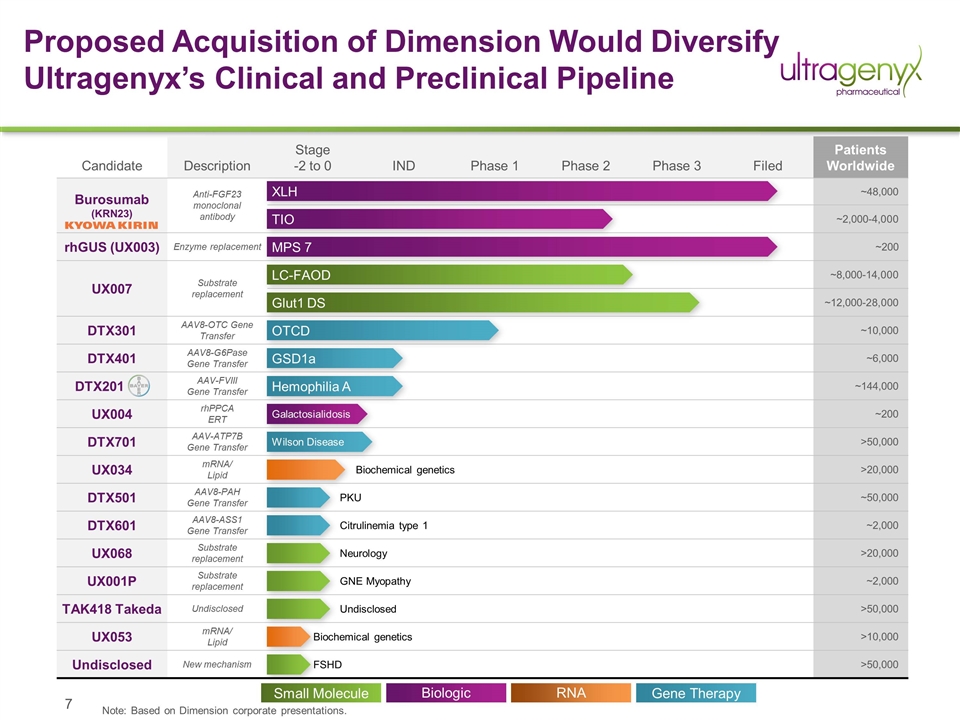

Proposed Acquisition of Dimension Would Diversify Ultragenyx’s Clinical and Preclinical Pipeline Candidate Description Stage -2 to 0 IND Phase 1 Phase 2 Phase 3 Filed Patients Worldwide Burosumab (KRN23) Anti-FGF23 monoclonal antibody ~48,000 ~2,000-4,000 rhGUS (UX003) Enzyme replacement ~200 UX007 Substrate replacement ~8,000-14,000 ~12,000-28,000 DTX301 AAV8-OTC Gene Transfer ~10,000 DTX401 AAV8-G6Pase Gene Transfer ~6,000 DTX201 AAV-FVIII Gene Transfer ~144,000 UX004 rhPPCA ERT ~200 DTX701 AAV-ATP7B Gene Transfer >50,000 UX034 mRNA/ Lipid >20,000 DTX501 AAV8-PAH Gene Transfer ~50,000 DTX601 AAV8-ASS1 Gene Transfer ~2,000 UX068 Substrate replacement >20,000 UX001P Substrate replacement ~2,000 TAK418 Takeda Undisclosed >50,000 UX053 mRNA/ Lipid >10,000 Undisclosed New mechanism >50,000 XLH TIO MPS 7 LC-FAOD Glut1 DS OTCD GSD1a Hemophilia A Galactosialidosis Wilson Disease PKU Citrulinemia type 1 Biochemical genetics Neurology GNE Myopathy Undisclosed Biochemical genetics FSHD Note: Based on Dimension corporate presentations. Biologic Small Molecule Gene Therapy RNA

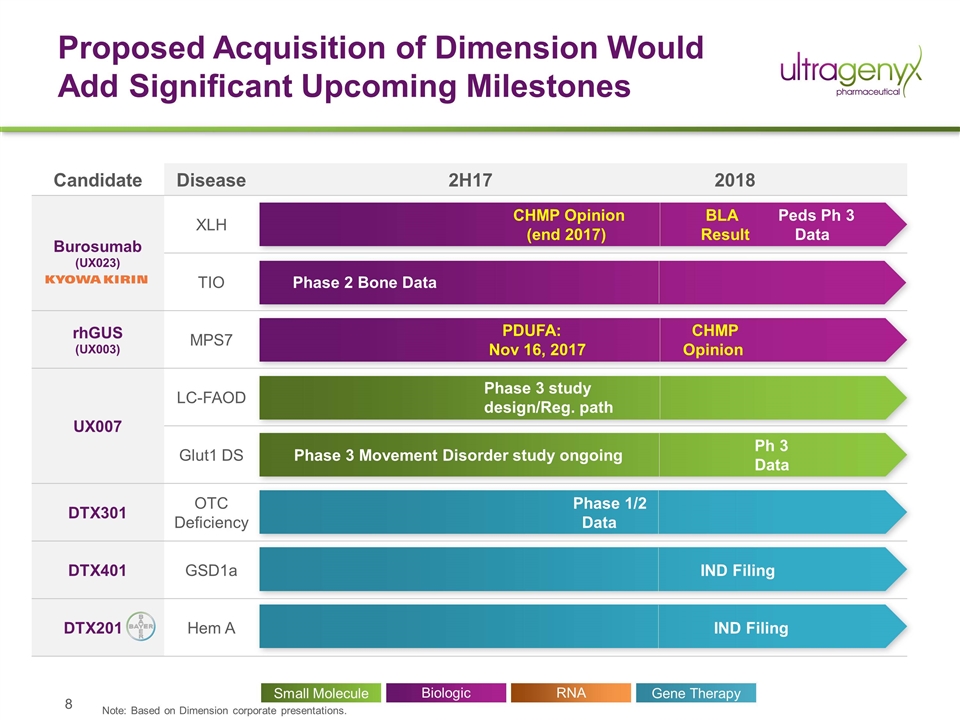

Candidate Disease 2H17 2018 Burosumab (UX023) XLH CHMP Opinion (end 2017) BLA Peds Ph 3 Result Data TIO Phase 2 Bone Data rhGUS (UX003) MPS7 PDUFA: Nov 16, 2017 CHMP Opinion UX007 LC-FAOD Phase 3 study design/Reg. path Glut1 DS Phase 3 Movement Disorder study ongoing Ph 3 Data DTX301 OTC Deficiency Phase 1/2 Data DTX401 GSD1a IND Filing DTX201 Hem A IND Filing Proposed Acquisition of Dimension Would Add Significant Upcoming Milestones Biologic Small Molecule Gene Therapy RNA Note: Based on Dimension corporate presentations.

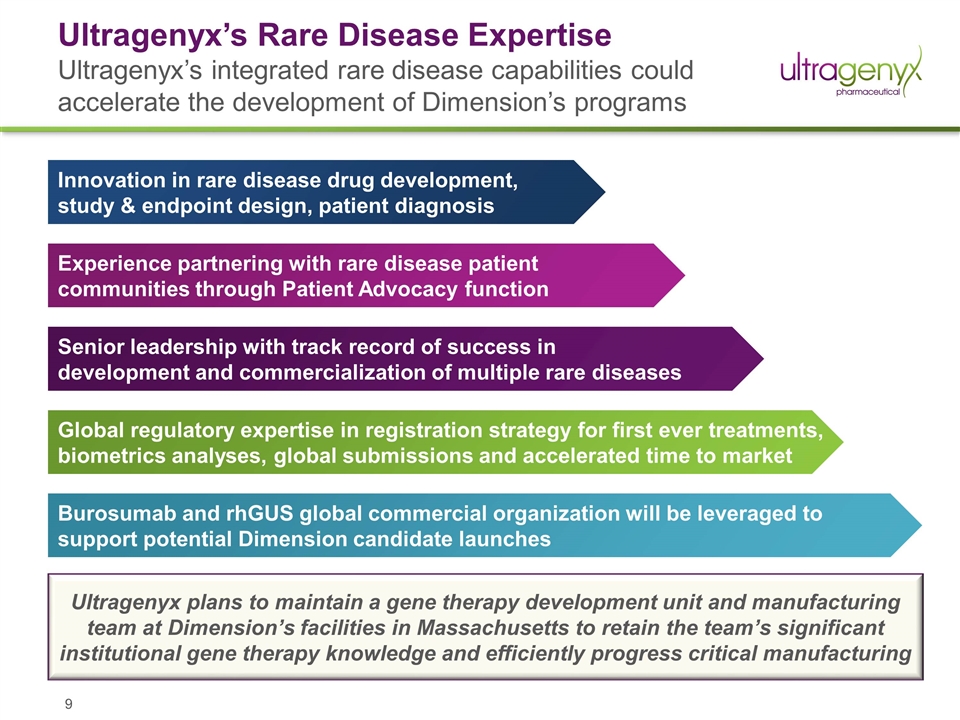

Ultragenyx’s Rare Disease Expertise Ultragenyx’s integrated rare disease capabilities could accelerate the development of Dimension’s programs Burosumab and rhGUS global commercial organization will be leveraged to support potential Dimension candidate launches Global regulatory expertise in registration strategy for first ever treatments, biometrics analyses, global submissions and accelerated time to market Senior leadership with track record of success in development and commercialization of multiple rare diseases Experience partnering with rare disease patient communities through Patient Advocacy function Innovation in rare disease drug development, study & endpoint design, patient diagnosis Ultragenyx plans to maintain a gene therapy development unit and manufacturing team at Dimension’s facilities in Massachusetts to retain the team’s significant institutional gene therapy knowledge and efficiently progress critical manufacturing

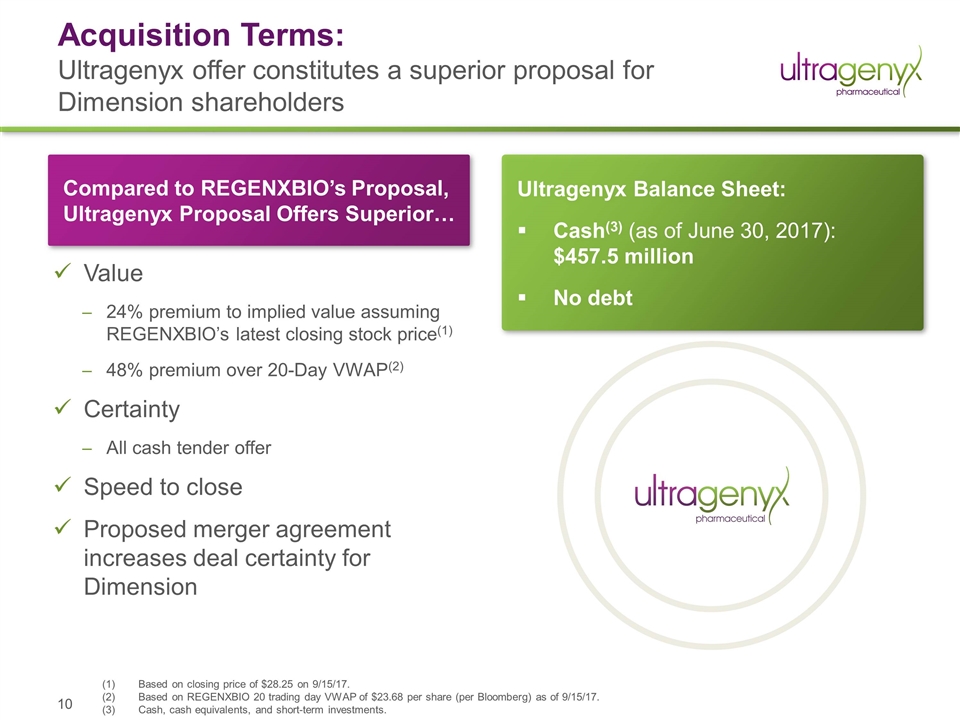

Ultragenyx Balance Sheet: Cash(3) (as of June 30, 2017): $457.5 million No debt Acquisition Terms: Ultragenyx offer constitutes a superior proposal for Dimension shareholders Value 24% premium to implied value assuming REGENXBIO’s latest closing stock price(1) 48% premium over 20-Day VWAP(2) Certainty All cash tender offer Speed to close Proposed merger agreement increases deal certainty for Dimension (1) Based on closing price of $28.25 on 9/15/17. Based on REGENXBIO 20 trading day VWAP of $23.68 per share (per Bloomberg) as of 9/15/17. Cash, cash equivalents, and short-term investments. Compared to REGENXBIO’s Proposal, Ultragenyx Proposal Offers Superior…

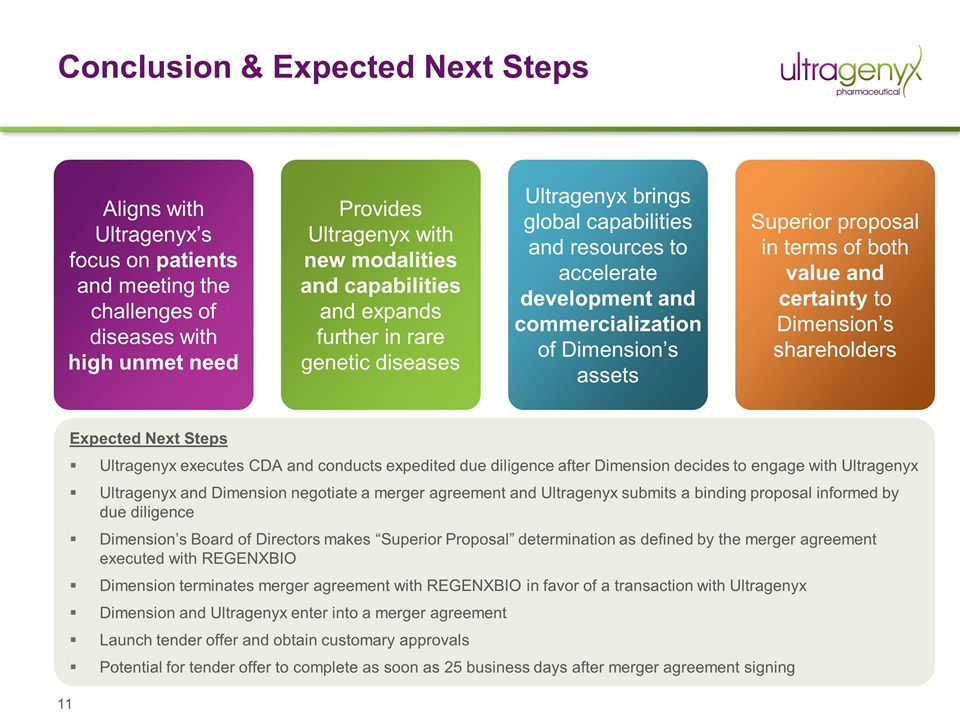

Conclusion & Expected Next Steps Aligns with Ultragenyx’s focus on patients and meeting the challenges of diseases with high unmet need Provides Ultragenyx with new modalities and capabilities and expands further in rare genetic diseases Ultragenyx brings global capabilities and resources to accelerate development and commercialization of Dimension’s assets Superior proposal in terms of both value and certainty to Dimension’s shareholders Expected Next Steps Ultragenyx executes CDA and conducts expedited due diligence after Dimension decides to engage with Ultragenyx Ultragenyx and Dimension negotiate a merger agreement and Ultragenyx submits a binding proposal informed by due diligence Dimension’s Board of Directors makes “Superior Proposal” determination as defined by the merger agreement executed with REGENXBIO Dimension terminates merger agreement with REGENXBIO in favor of a transaction with Ultragenyx Dimension and Ultragenyx enter into a merger agreement Launch tender offer and obtain customary approvals Potential for tender offer to complete as soon as 25 business days after merger agreement signing

Appendix

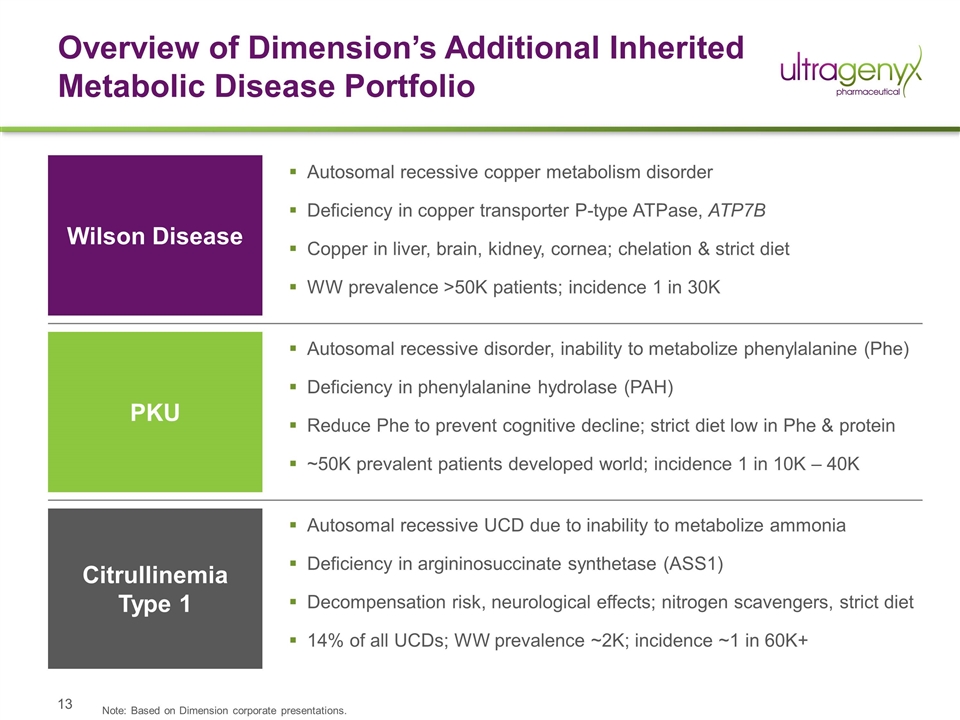

Overview of Dimension’s Additional Inherited Metabolic Disease Portfolio Autosomal recessive copper metabolism disorder Deficiency in copper transporter P-type ATPase, ATP7B Copper in liver, brain, kidney, cornea; chelation & strict diet WW prevalence >50K patients; incidence 1 in 30K Wilson Disease PKU Citrullinemia Type 1 Autosomal recessive disorder, inability to metabolize phenylalanine (Phe) Deficiency in phenylalanine hydrolase (PAH) Reduce Phe to prevent cognitive decline; strict diet low in Phe & protein ~50K prevalent patients developed world; incidence 1 in 10K – 40K Autosomal recessive UCD due to inability to metabolize ammonia Deficiency in argininosuccinate synthetase (ASS1) Decompensation risk, neurological effects; nitrogen scavengers, strict diet 14% of all UCDs; WW prevalence ~2K; incidence ~1 in 60K+ Note: Based on Dimension corporate presentations.

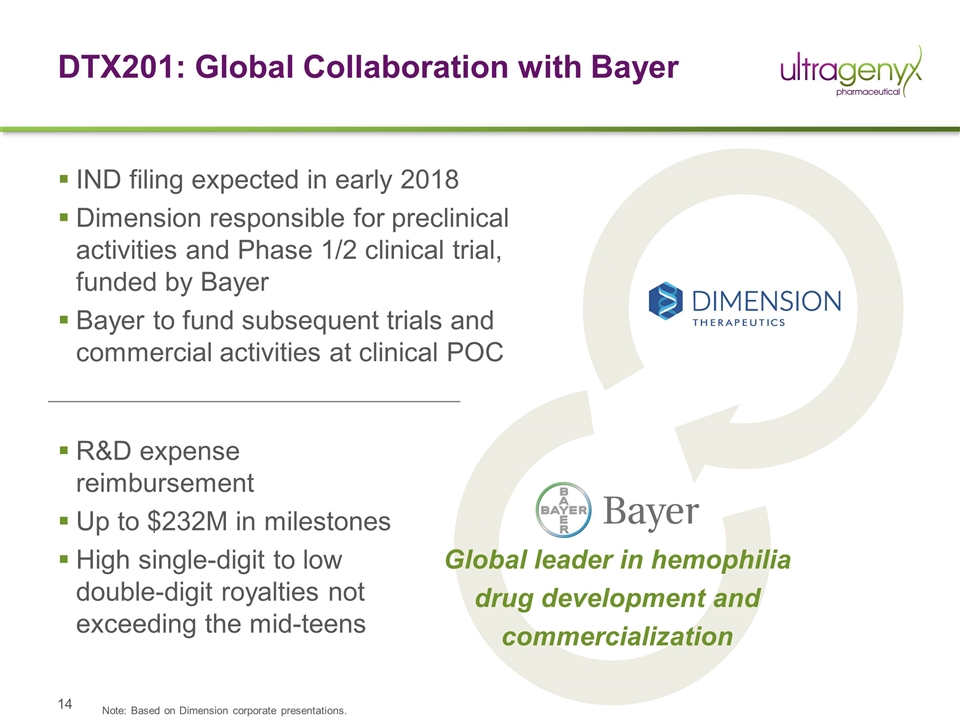

DTX201: Global Collaboration with Bayer R&D expense reimbursement Up to $232M in milestones High single-digit to low double-digit royalties not exceeding the mid-teens IND filing expected in early 2018 Dimension responsible for preclinical activities and Phase 1/2 clinical trial, funded by Bayer Bayer to fund subsequent trials and commercial activities at clinical POC Global leader in hemophilia drug development and commercialization Note: Based on Dimension corporate presentations.