Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HUNTINGTON BANCSHARES INC /MD/ | hban20170913_8-k.htm |

Huntington Bancshares Incorporated

Barclays Global Financial Services Conference

September 13, 2017

Welcome

©2017 Huntington Bancshares Incorporated. All rights reserved. (NASDAQ: HBAN)

Exhibit 99.1

Disclaimer

2

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals,

projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements

that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements.

Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar

expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking

statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause

actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political,

or industry conditions; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board;

volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and

services; success, impact, and timing of our business strategies, including market acceptance of any new products or services

implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews,

reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and

the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the possibility that the

anticipated benefits of the merger with FirstMerit Corporation are not realized when expected or at all, including as a result of the impact of,

or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the

areas where we do business; diversion of management’s attention from ongoing business operations and opportunities; potential adverse

reactions or changes to business or employee relationships, including those resulting from the completion of the merger with FirstMerit

Corporation; and other factors that may affect our future results. Additional factors that could cause results to differ materially from those

described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2016, and in its subsequent Quarterly

Reports on Form 10-Q, including for the quarter ended June 30, 2017, each of which is on file with the Securities and Exchange

Commission (the “SEC”) and available in the “Investor Relations” section of our website, http://www.huntington.com, under the heading

“Publications and Filings” and in other documents we file with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. We do not

assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-

looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As

forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such

statements.

Huntington Update

3

MI

WI

IL IN

PA

WV

KY

OH

4

(1) Total includes 11 Private Client Group Offices

Combined GDP of 8 state core footprint

represents 4th largest economy in world(2)

MSA Rank Branches Deposits Share

Columbus, OH 1 97 $20,453 32.1%

Cleveland, OH 2 153 8,976 14.0

Detroit, MI 6 121 6,542 5.4

Akron, OH 1 56 5,611 38.5

Indianapolis, IN 4 46 3,272 7.2

Cincinnati, OH 4 36 2,727 2.6

Pittsburgh, PA 8 38 2,689 2.3

Chicago, IL 16 39 2,581 0.7

Toledo, OH 1 33 2,474 24.7

Grand Rapids, MI 2 46 2,466 12.0

Top 10 Deposit MSAs

Huntington’s top 10 deposit MSAs represent

~75% of total deposits

Source: SNL Financial, FDIC deposit data as of June 30, 2016

Huntington Bancshares Overview

$101 Billion Asset Midwest financial services holding company

• Founded in 1866 in Columbus, Ohio

• Traditional regional bank with strategic focus on

small to medium-sized businesses, consumers,

and auto finance

(2) Source: 2016 International Monetary Fund and US Bureau of Economic Analysis

Branches 996(1)

ATMs 1,860

Ranked #1 in deposit share in 14% of

total footprint MSAs and top 3 in 42%

Ranked #1 in branch market share in

both Ohio (15%) and Michigan (14%)

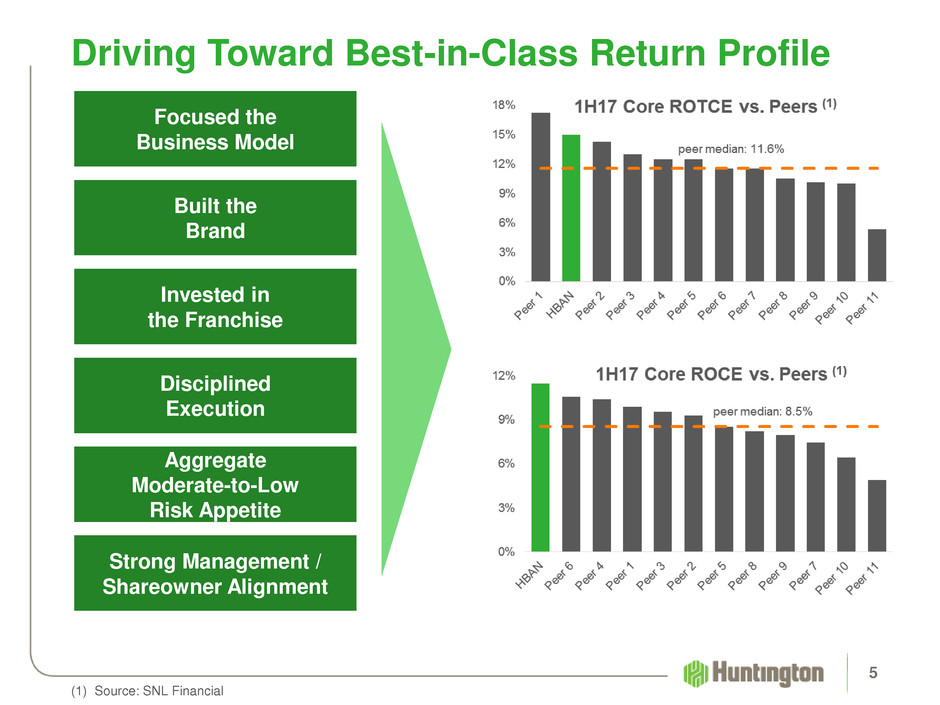

Driving Toward Best-in-Class Return Profile

5

Focused the

Business Model

Aggregate

Moderate-to-Low

Risk Appetite

Invested in

the Franchise

(1) Source: SNL Financial

Built the

Brand

Disciplined

Execution

Strong Management /

Shareowner Alignment

FirstMerit Acquisition Accelerated Achievement

of Our Long-Term Financial Goals

6

Long-Term

Financial

Goal

1H17

(GAAP)

1H17

Adjusted (1)

(Non-GAAP)

FY2017

Adjusted

(Non-GAAP)

Expectation

2018

Target

Revenue (FTE) Growth 4% - 6% +39% +38% +23%

Expense Growth

Positive

Operating

Leverage

+38% +29% +18%

Efficiency Ratio 56% - 59% 64% 59% 57%

NCO 35 - 55 bp 22 bp 22 bp 24 bp

ROTCE 13% - 15% 13% 15% 15%

(1) See reconciliation on slides 27 & 28

High Confidence in FirstMerit Deal Economics

On pace to meet or exceed originally announced cost savings and

revenue enhancements

7

$255+ MM

Cost Savings

✔ Implementation of all cost

savings complete

✔ Eliminated 42% of legacy

FirstMerit expense base

✔ Fully converted all operating

systems to HBAN systems

✔ Consolidated 24 operations

centers and corporate offices

✔ Consolidated 101 branches in

1Q17; 38 additional full-service

branches and 7 drive-through

only locations to be

consolidated in 3Q17

$100+ MM

Revenue Synergies

✔ Intense focus on revenue

initiatives execution

✔ Introduced full HBAN product

suite to FMER customer base

✔ Expanded SBA expertise to

Chicago / WI

✔ Expanded RV / Marine lending

to 17 new states

✔ Expanded Home Lending

business to Chicago / WI

Delivering FMER Economics

Cost savings remain on pace and revenue initiatives ramping

8

FMER integration nearly complete, as planned

o Systems conversions successfully completed

o Consumer deposit retention has outperformed

modeled assumptions with balances up 2%1

vs. 10% runoff assumption

Achieving ~$255 million annualized cost savings

target set at announcement

o All remaining cost savings were implemented

during 3Q17

Revenue enhancement initiatives implemented

across the bank

o Expected to augment both net interest income

and noninterest income

o All four revenue segments developed targeted

strategies and initiatives

o Remain on pace to deliver $100 million of total

revenue enhancements in 2018 with incremental

efficiency ratio of ~50%

(1) Consumer deposits from FMER customers and former FMER branches, June 30, 2017 vs. August 31, 2016

Adjusted Noninterest Expense

Intangible Amortization Expense

FDIC Temporary Surcharge

Incremental FMER Revenue Initiative-related Expense

Total Noninterest Expense

Total Noninterest Expense excluding Revenue Initiatives

($ millions)

($ millions)

FMER Revenue Enhancement Opportunities

Initiatives provide additional near-term and long-term upside

9

Home Lending Expansion

SBA Lending Expansion

• Expanded HBAN SBA lending expertise

into IL and WI markets & deepened

coverage in overlap markets

• SBA FY2017 YTD 1: #3 bank in dollars in

both IL and WI & #4 bank in number of

loans in both IL and WI

RV & Boat Expansion

OCR Improvement

• Expansion of legacy FMER 17 state

footprint to 34 states

• Annual loan production of ~$200 million

within two years

• Expansion into Chicago and WI markets

and deeper penetration in overlap markets

• Annual loan production of ~$900 million

within two years

• Cross-sell opportunities identified across

business and consumer client base:

– Capital Markets

– Treasury Management

– Private Banking

– Credit Card

(1) Source: SBA; rankings for first nine months of SBA 2017 fiscal year (September 30 year-end)

($ millions)

Common Equity Tier 1 (CET1) Ratio

2017 CCAR minimum (3)

2Q17 Actual

Total Risk-Based Capital Ratio

2017 CCAR minimum (3)

2Q17 Actual

Positioned for Strong Relative Performance

Through-the-Cycle

10

Commercial Consumer

2Q17 Average Balance Sheet MixPretax Pre-Provision Net Revenue (1)

Dodd-Frank Act Stress Test Results

(1) Non-GAAP financial metric; see Appendix slide 29; (2) Annualized; (3) projected minimum in the Federal

Reserve Severely Adverse Scenario

Cumulative Losses as a % of Average Total Loans in

Supervisory Severely Adverse Scenario

2015

4.2%

#1

2016

4.8%

#4

2017

4.6%

#4

Note: Ranking among 19 traditional commercial banks

% of

RWA

1.92% 1.86% 1.86% 1.75% 2.22% (2)

$ billions

Strong Capital Base

Auto Finance Update

11

Dealer

Relationships

Indirect Auto

• Consistently in the

business for 60 years

• Super-prime, average

FICO ~760

• Top 3 bank in J.D. Power

• Custom Score with

predictive modeling

• Strong market position

• Local Market execution

with tenured staff

• Used vehicle focus

Commercial

Relationships

• Local market execution

with tenured staff

• Top 2 bank in J.D. Power

last two years

• Innovative solutions,

Avg. cross-sell >6

• High credit quality,

no delinquencies

• Zero auto floorplan net

charge-offs in 10+ years

12

History & Deep Dealer Relationships Drive Value

Huntington is a business partner and solutions provider

Auto

Sales

Team

Full Product Suite to Meet Dealer Needs

Private Banking Investments & 401K Employee Banking

Floorplan Loans Deposits

Treasury Management InsuranceCapital Markets

Operating Loans CRE Loans

13

Value Proposition Drives Premium Pricing

Huntington’s unique value proposition for dealers

• Local sales and underwriting: 11 regional sales offices with tenured local sales and local

underwriting regularly calling on dealers - a strategy unique in the market. Underwriters directly

compensated based on credit performance by vintage.

• Consistency in the market: Well-established 60+ year commitment to auto finance business.

Expanded during the financial crisis, when other lenders pulled back or exited, demonstrating a

partnership approach. Well-defined, consistent credit execution (FICO, LTV, and Term).

• Industry-leading customer service: Differentiated customer service focus for borrowers enhances

dealer brand, as consumers associates loan with dealers.

• Speed of answer: 70% of applications decisioned in 3 seconds or less via credit engine.

Remaining 30% manually underwritten with credit engine recommendation. Recommended

decision rarely over ridden.

• Loan Design Pricing matrix: Unique capability to offer a matrix of loan options with every approval

decision, not just the specific terms requested. Simplifies and expedites the sales process for the

dealer and the consumer. Viewed by dealer as incredibly dealer-centric.

• Same-day funding: Over 70% of consumer loans are funded same day to dealer.

14

Value Proposition Drives Premium Pricing

Credit-adjusted indirect auto loan yields lead peers

Pricing:

• Credit-adjusted yield among the highest of our peers

• New origination credit-adjusted yield of 3.36% in 2Q17

Operational Efficiencies:

• Highly leverageable infrastructure

• Innovative and proprietary custom solutions

Sources: 2Q17 earnings releases *Includes direct and indirect auto loans

**Federal Reserve-regulated banks; differences in charge-off recognition for Chapter 7 and 11 bankruptcies

compared to OCC-regulated banks ***Originated Portfolio

Huntington Auto Finance

Significant presence in our markets and in our industry

15

11 strategically located regional offices

servicing our dealer partners in 23 states:

Ohio New Hampshire

Indiana Tennessee

Michigan Minnesota

West Virginia New Jersey

Pennsylvania Connecticut

Kentucky Iowa

Wisconsin North Dakota

Illinois South Dakota

Massachusetts Texas

Maine Kansas

Vermont Missouri

Rhode Island

Huntington is the 13th largest auto loan

lender and 7th largest auto loan bank

lender in the U.S.(1)

Huntington is the #1 auto loan lender in the

states of Ohio, Indiana, and Kentucky(1)

(1) Source: Experian data from 1/17 - 6/17

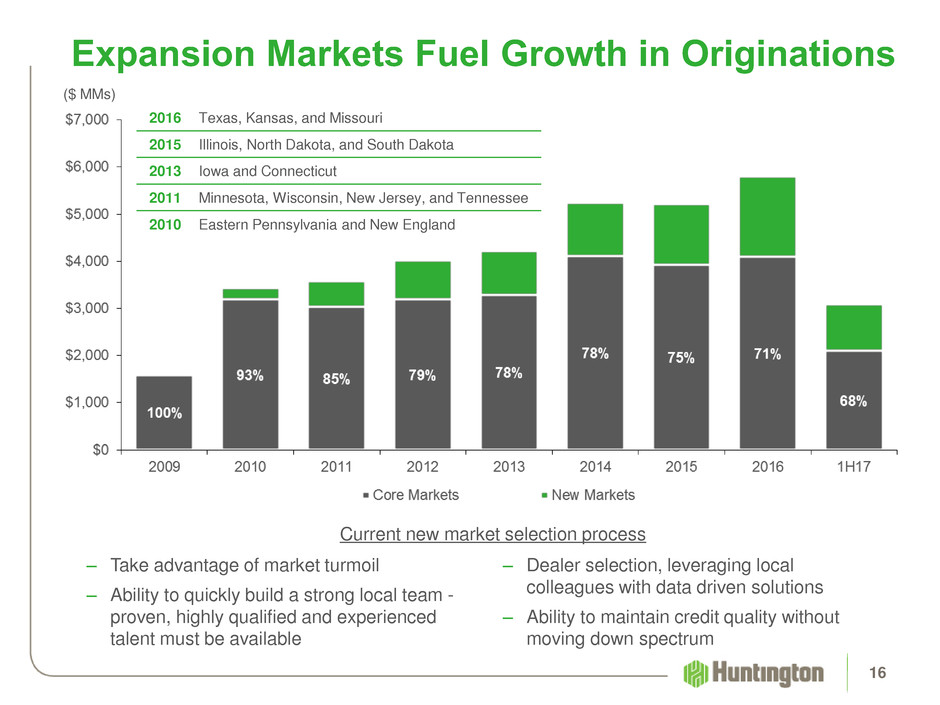

Expansion Markets Fuel Growth in Originations

16

($ MMs)

2016 Texas, Kansas, and Missouri

2015 Illinois, North Dakota, and South Dakota

2013 Iowa and Connecticut

2011 Minnesota, Wisconsin, New Jersey, and Tennessee

2010 Eastern Pennsylvania and New England

– Take advantage of market turmoil

– Ability to quickly build a strong local team -

proven, highly qualified and experienced

talent must be available

– Dealer selection, leveraging local

colleagues with data driven solutions

– Ability to maintain credit quality without

moving down spectrum

Current new market selection process

Loan Design Pricing matrix:

Enabled by a 1,000 point pricing matrix, our

proprietary loan design pricing sales tool provides the

dealer with 20 unique credit approvals on a single

application, making it easier for the dealer to discuss

a variety of options regarding amount and term.

17

Huntington’s Custom Auto Finance Scorecard

Best-in-class credit underwriting and risk pricing tool

• Huntington developed and implemented a proprietary (custom) scorecard in 2005

• Application information and credit bureau data are combined to generate a Custom Score

• Credit and price decisions driven by Custom Score

• Database used to create Custom Score contains information from the past 20+ years of Auto

loan performance

• Scorecard parameters further refined in December 2011 and January 2017

• Improved automated process results in faster decisions

• Dealer provided with Loan Design Pricing matrix

($MM) 1H17 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

Originations $3,081 $5,816 $5,207 $5,242 $4,220 $4,021 $3,575 $3,428 $1,586 $2,213 $1,911

% New Vehicles 45% 49% 48% 49% 46% 45% 52% 48% 37% 44% 47%

Avg. LTV 89% 89% 90% 89% 89% 88% 88% 88% 92% 95% 97%

Avg. FICO 765 765 764 764 760 758 760 768 763 752 743

Weighted Avg. Original

Term (months)

69 68 68 67 67 66 65 65 64 69 70

Avg. Custom Score 407 396 396 397 395 395 402 405 403 390 382

Annualized risk

expected loss

0.23% 0.25% 0.27% 0.26% 0.28% 0.27% 0.22% 0.37% 0.40% 0.60% 0.83%

Charge-off %

(annualized)(2)

0.36% 0.30% 0.23% 0.23% 0.19% 0.21% 0.26% 0.54% 1.51% 1.12% 0.65%

18

Automobile Loans: $11.6 Billion(1)

Loan originations from 2010 through 2017 demonstrate strong

characteristics and continued improvements from pre-2010

(1) End of Period

1

Credit scoring model most recently updated in January 2017

Began conscience migration to lower risk tolerance starting in 2008. Actual peak loss approximately

2x average risk expected loss from 2007-2008.

2016-2017 net charge-offs impacted by acquisition of FirstMerit, including purchase accounting

treatment of acquired portfolio (see Appendix slide 30)

1

(1) End of period (2) NCOs in 2008-2010 related to CRE loans; zero NCOs related to floorplan loans

19

C&I – Auto Dealer: $3.3 Billion(1)

A consistent approach for over 60 years: high touch, local

delivery, and dealer-centric

Outstandings

($MM) 1H17 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

Floorplan-domestic $ 1,826 $ 1,833 $ 1,390 $ 1,196 $ 1,141 $1,009 $ 781 $ 599 $ 388 $ 553 $ 432

Floorplan-foreign 760 755 686 636 620 525 388 457 283 408 351

Total floorplan 2,586 2,588 2,076 1,832 1,761 1,534 1,169 1,056 671 961 783

Other (includes owner

occupied CRE) 714 698 616 576 517 517 404 373 373 346 315

Total dealers $ 3,300 $ 3,286 $ 2,692 $ 2,408 $ 2,278 $2,051 $1,573 $1,429 $1,044 $1,307 $1,097

NALs (1) 0.00% 0.00% 0.00% 0.00% 0.00% 0.03% 0.05% 0.07% 0.00% 0.00% 0.00%

Net charge-offs

(recoveries) (2) 0.00% 0.00% -0.01% 0.00% -0.03% 0.00% 0.00% 0.05% 0.02% 0.05% 0.00%

• Our Auto Finance business is relationship focused on our customer: the dealer.

• Deep commercial lending relationships with over 300 franchised dealers.

• Ranked #1 or #2 bank in J.D. Power Dealer Satisfaction Survey for the past 2 years in

commercial floorplan in the U.S.

• Consistent low charge-offs due to strong risk culture driven by client selection and explicit

inventory tracking. 2008-2010 charge-offs related to CRE loans (no floorplan losses).

Closing Remarks

20

Strong economic outlook for Midwest footprint

Completed FirstMerit integration; implemented all cost savings ahead of original

schedule and building revenue opportunities

Focused on three areas with sustainable competitive advantages

o Consumer

o Small to Medium Enterprises (including Commercial Real Estate)

o Auto

Consistent core strategy since 2009

o Delivered on growth strategies with sustained investment

o Meaningful investment in people, technology, and brand – continuously improving

o Disciplined risk management – aggregate moderate-to-low risk profile

Driving core deposit and loan growth through disciplined execution and a

differentiated customer experience; maintaining 4%-6% 2017 loan growth outlook

Committed to consistent through-the-cycle shareholder returns

High level of colleague stock ownership ensures ongoing shareholder alignment

Important Messages

21

Appendix

22

2017 First Half Highlights

Continued focus on realizing FirstMerit deal economics and driving

top tier performance

23

Financial Highlights Y/Y

EPS $0.40 +3%

Net Interest Margin 3.31% +23 bp

Net Interest Income (FTE) $1,499 46%

Noninterest Income $638 24%

Total Revenue (FTE) $2,136 39%

Noninterest Expense $1,402 38%

Net Income $480 39%

Avg diluted shares 1,108.6 37%

Efficiency Ratio 64.3% -110 bp

NCOs / Avg Loans 0.22% +12 bp

EPS

+3% Y/Y

TBVPS

-8% Y/Y

ROA

0.97%

ROTCE

12.9%

Balance Sheet Y/Y

TBVPS $6.74 -8%

Avg Assets $100,232 39%

Avg Earning Assets $91,435 36%

Avg Loans and Leases $67,164 31%

Avg Deposits $76,248 38%

Avg Core Deposits $71,898 39%

Avg Tang. Common Equity $7,193 27%

TCE Ratio 7.41% -55 bp

CET1 Ratio 9.88% +8 bp

NPA Ratio 0.61% -32 bp

Note: $ in millions, except per share; results were impacted by significant items primarily related to

FirstMerit integration.

Huntington’s Peer Group

24

$ in millions

Total

Assets

Total

Deposits

Total

Loans

Market

Capitalization

Price /

Dividend

YieldConsensus

2017E

Consensus

2018E

Tangible

Book

PNC Financial Services Group, Inc. $372,190 $259,176 $218,034 $58,228 14.6x 13.1x 1.8x 2.5%

BB&T Corporation 221,192 156,968 143,645 35,532 14.0x 12.7x 2.1x 3.0%

SunTrust Banks, Inc. 207,223 159,873 144,268 25,134 13.0x 11.8x 1.6x 3.1%

Citizens Financial Group, Inc. 151,407 113,613 109,046 16,427 13.1x 11.8x 1.3x 2.2%

Fifth Third Bancorp 141,067 101,880 91,446 18,492 13.3x 12.3x 1.5x 2.2%

KeyCorp 135,824 102,821 86,503 18,075 12.0x 10.7x 1.6x 2.3%

Regions Financial Corporation 124,643 98,093 80,127 15,847 13.2x 11.7x 1.4x 2.7%

M&T Bank Corporation 120,897 93,541 88,532 21,889 15.7x 14.6x 2.1x 2.1%

Comerica Incorporated 71,447 56,781 49,408 11,385 13.9x 12.3x 1.6x 1.9%

Zions Bancorporation 65,446 52,378 43,683 8,418 15.1x 13.3x 1.4x 1.2%

CIT Group 50,479 30,925 29,032 5,916 16.7x 12.4x 0.9x 1.4%

Median $135,824 $101,880 $88,532 $18,075 13.9x 12.3x 1.6x 2.2%

Huntington Bancshares Incorporated $101,407 $75,933 $68,059 $13,429 12.6x 11.3x 1.9x 2.6%

Source: SNL, data as of 9/08/17

Footprint Economic Indicators

Leading indicators signal optimism for 2017

25

Sources: US Bureau of Labor Statistics; Federal Reserve Bank of Philadelphia; Haver Analytics

• 6 of 8 Huntington footprint states grew faster than the nation in the economic recovery that

began in July 2009.

• The Huntington footprint states account for 60.4% of all manufacturing employment growth

during the current economic recovery (July 2009 to July 2017, BLS.) According to the ISM

report on business in manufacturing, manufacturing should continue to be a strong area of

growth in the national economy in the second half of 2017. The regional manufacturing

economy will likely continue on an upward trend, as well.

• Unemployment rates in the Huntington footprint states have declined significantly during the

economic recovery. 5 Huntington footprint states were in the top 10 decreases in YOY

unemployment rates (July 2017 vs. July 2016).

July 2017 State Leading Indexes

(Expected Six-Month Change)

Less than -4.5%

-1.6% to -4.5%

0.0% to -1.5%

0.0% to +1.5%

+1.6% to +4.5%

More than +4.5%

Less than -1.0%

-0.6% to -1.0%

0.0% to -0.5%

0.0% to +0.5%

+0.6% to +1.0%

More than +1.0%

July 2017 State Coincident Indexes

(Three-Month Historical Change)

Unemployment Rates in Top Deposit MSAs

Our largest deposit markets compare favorably with U.S.

26

Sources: US Bureau of Labor Statistics; Federal Reserve Bank of Philadelphia; Haver Analytics

• According to the Philadelphia FRB coincident economic indicator, economic activity grew faster than the nation in 6 of 8 Huntington

footprint states during the economic recovery-to-date. Michigan, Ohio, Indiana, Illinois, Kentucky, and Wisconsin all exhibited stronger

growth than the nation since the Great Recession ended.

• In July 2017, unemployment rates were below the national average of 4.3% in Columbus, Detroit, Grand Rapids, Indianapolis,

Madison, and Milwaukee. Chicago and Cincinnati were within 0.2% of the national average.

• Solid housing markets provided home price growth in all 8 Huntington footprint states for 4 consecutive years through the first quarter

according to the FHFA Expanded Data Housing Price index. Affordability remains some of the best in the nation.

National

Unemployment

Rate (4.3%)

27

Reconciliation

Revenue, Noninterest Income, and Noninterest Expense Growth

($ in millions) GAAP Adjustment (1) Adjusted

1H17 Net interest income (FTE) $1,499 -- $1,499

1H17 Noninterest income $638 $2 (2) $636

1H17 Total Revenue $2,136 $2 (2) $2,134

1H16 Net interest income (FTE) $1,028 -- $1,028

1H16 Noninterest income $513 -- $513

1H16 Total revenue $1,541 -- $1,541

1H17 Total revenue growth 39% 38%

1H17 Noninterest expense $1,402 $124 (2) $1,278

1H16 Noninterest expense $1,015 $27 (2) $988

1H17 Noninterest expense growth 38% 29%

(1) Significant items related to FirstMerit acquisition related net expenses

(2) Pre-tax

28

Reconciliation

Efficiency Ratio and ROTCE

($ in millions) GAAP Adjustment (1) Adjusted

1H17:

Noninterest expense $1,402 $124 (2) $1,278

Amortization of intangibles $29 -- $29

Noninterest expense less amortization of intangibles A $1,373 $1,250

Total revenue (FTE) $2,136 $2 $2,134

Securities gains $0 -- $0

Total revenue (FTE) less securities gains B $2,136 $2,133

Efficiency ratio A / B 64% 59%

Net income applicable to common shares $442 $79 (3) $521

Less: Amortization of intangibles (net of deferred tax) $19 (3) -- $19 (3)

Net income applicable to common shares less amortization of intangibles C $461 $540

Average tangible common equity D $7,193 -- $7,193

Return on average tangible common equity (ROTCE): C / D * 2 13% 15%

(2) Pre-tax (3) After-tax

(1) Significant items related to FirstMerit acquisition related net expenses

29

Reconciliation

Pretax Pre-Provision Net Revenue (PPNR)

($ in millions) 1H17 2016 2015 2014 2013

Net interest income – FTE $1,499 $2,412 $1,983 $1,865 $1,732

Noninterest income 638 1,151 1,039 961 1,012

Total revenue 2,136 3,563 3,022 2,826 2,744

Less: significant items 2 1 3 1 0

Less: gain on securities 0 0 1 18 0

Total revenue – adjusted A 2,134 3,562 3,018 2,807 2,744

Noninterest expense 1,402 2,408 1,976 1,882 1,758

Add: provision for unfunded loans (13) 21 11 (2) 22

Less: significant items 124 239 58 65 (10)

Noninterest expense – adjusted B 1,266 2,191 1,929 1,815 1,791

Pretax pre-provision net revenue (PPNR) A - B $868 $1,372 $1,089 $1,011 $953

Risk-weighted assets (RWA) $78,366 $78,263 $58,420 $54,479 $49,690

PPNR as % of RWA 2.22% 1.75% 1.86% 1.86% 1.92%

2Q17 1Q17 4Q16

($MM) Originated Acquired Total Originated Acquired Total Originated Acquired Total

Average Auto Loans $10,205 $1,119 $11,324 $9,791 $1,272 $11,063 $9,416 $1,450 $10,866

% of Avg Auto Loans 90% 10% 100% 88% 12% 100% 87% 13% 100%

Reported Net Charge-offs

(NCOs)

$5.1 $3.2 $8.3 $8.6 $3.8 $12.4 $9.4 $3.8 $13.1

FMER-related Net

Recoveries in Noninterest

Income

-- (0.9) (0.9) -- (1.2) (1.2) -- (0.8) (0.8)

Adjusted Net Charge-offs 5.1 2.3 7.4 8.6 2.6 11.2 9.4 2.9 12.3

Reported NCOs as % of

Avg Loans

0.20% 1.14% 0.29% 0.36% 1.22% 0.45% 0.40% 1.03% 0.48%

Adjusted NCOs as % of

Avg Loans

0.20% 0.81% 0.26% 0.36% 0.83% 0.41% 0.40% 0.80% 0.45%

• The auto loan performance trends were impacted by the accounting for recoveries on loans acquired from FirstMerit.

• Accounting requires that all recoveries associated with loans charged off prior to the date of FirstMerit acquisition be

booked as noninterest income. This inflates the level of net charge-offs as the normal recovery stream is not

included.

Indirect Auto Charge-off Performance

Reconciliation – non GAAP

* * *

* Auto loans acquired in FirstMerit acquisition

30

Use of Non-GAAP Financial Measures

This document contains GAAP financial measures and non-GAAP financial measures where management believes it to be

helpful in understanding Huntington’s results of operations or financial position. Where non-GAAP financial measures are

used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can

be found in this document, the earnings press release, or the Form 8-K related to this document, all of which can be found

on the “Investor Relations” section of Huntington’s website at www.huntington.com.

Annualized Data

Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for

analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or

year-over-year amounts. For example, loan and deposit growth rates, as well as net charge-off percentages, are most often

expressed in terms of an annual rate like 8%. As such, a 2% growth rate for a quarter would represent an annualized 8%

growth rate.

Fully-Taxable Equivalent Interest Income and Net Interest Margin

Income from tax-exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this

income had been taxable at statutory rates. This adjustment puts all earning assets, most notably tax-exempt municipal

securities and certain lease assets, on a common basis that facilitates comparison of results to results of competitors.

Earnings per Share Equivalent Data

Significant income or expense items may be expressed on a per common share basis. This is done for analytical and

decision-making purposes to better discern underlying trends in total corporate earnings per share performance excluding

the impact of such items. Investors may also find this information helpful in their evaluation of the company’s financial

performance against published earnings per share mean estimate amounts, which typically exclude the impact of Significant

Items. Earnings per share equivalents are usually calculated by applying an effective tax rate to a pre-tax amount to derive

an after-tax amount, which is divided by the average shares outstanding during the respective reporting period. Occasionally,

when the item involves special tax treatment, the after-tax amount is disclosed separately, with this then being the amount

used to calculate the earnings per share equivalent.

Rounding

Please note that columns of data in this document may not add due to rounding.

Basis of Presentation

31

Do we

consolidate

this and

next slide?

Significant Items

From time to time, revenue, expenses, or taxes are impacted by items judged by Management to be outside of ordinary

banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually

large that their outsized impact is believed by Management at that time to be infrequent or short term in nature. We refer

to such items as “Significant Items”. Most often, these Significant Items result from factors originating outside the

company – e.g., regulatory actions/assessments, windfall gains, changes in accounting principles, one-time tax

assessments/refunds, litigation actions, etc. In other cases they may result from Management decisions associated with

significant corporate actions out of the ordinary course of business – e.g., merger/restructuring charges, recapitalization

actions, goodwill impairment, etc.

Even though certain revenue and expense items are naturally subject to more volatility than others due to changes in

market and economic environment conditions, as a general rule volatility alone does not define a Significant Item. For

example, changes in the provision for credit losses, gains/losses from investment activities, asset valuation write-downs,

etc., reflect ordinary banking activities and are, therefore, typically excluded from consideration as a Significant Item.

Management believes the disclosure of “Significant Items”, when appropriate, aids analysts/investors in better

understanding corporate performance and trends so that they can ascertain which of such items, if any, they may wish

to include/exclude from their analysis of the company’s performance - i.e., within the context of determining how that

performance differed from their expectations, as well as how, if at all, to adjust their estimates of future performance

accordingly. To this end, Management has adopted a practice of listing “Significant Items” in its external disclosure

documents (e.g., earnings press releases, quarterly performance discussions, investor presentations, Forms 10-Q and

10-K).

“Significant Items” for any particular period are not intended to be a complete list of items that may materially impact

current or future period performance. A number of items could materially impact these periods, including those

described in Huntington’s 2016 Annual Report on Form 10-K and other factors described from time to time in

Huntington’s other filings with the Securities and Exchange Commission.

Basis of Presentation

32