Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PILGRIMS PRIDE CORP | d434097dex991.htm |

| EX-10.2 - EX-10.2 - PILGRIMS PRIDE CORP | d434097dex102.htm |

| EX-10.1 - EX-10.1 - PILGRIMS PRIDE CORP | d434097dex101.htm |

| EX-3.1 - EX-3.1 - PILGRIMS PRIDE CORP | d434097dex31.htm |

| EX-2.1 - EX-2.1 - PILGRIMS PRIDE CORP | d434097dex21.htm |

| 8-K - 8-K - PILGRIMS PRIDE CORP | d434097d8k.htm |

Pilgrim’s Acquires Moy Park September 11, 2017 Pilgrim’s Pride Corporation (NASDAQ: PPC) Exhibit 99.2

Cautionary Notes and Forward-Looking Statements Statements contained in this presentation that share our intentions, beliefs, expectations or predictions for the future, denoted by the words “anticipate,” “believe,” “estimate,” “should,” “expect,” “project,” “plan,” “imply,” “intend,” “foresee” and similar expressions, are forward-looking statements that reflect our current views about future events and are subject to risks, uncertainties and assumptions. Such risks, uncertainties and assumptions include the following matters affecting the chicken industry generally, including fluctuations in the commodity prices of feed ingredients and chicken; actions and decisions of our creditors; our ability to obtain and maintain commercially reasonable terms with vendors and service providers; our ability to maintain contracts that are critical to our operations; our ability to retain management and other key individuals; certain of our reorganization and exit or disposal activities, including selling assets, idling facilities, reducing production and reducing workforce, resulted in reduced capacities and sales volumes and may have a disproportionate impact on our income relative to the cost savings; risk that the amounts of cash from operations together with amounts available under our exit credit facility will not be sufficient to fund our operations; management of our cash resources, particularly in light of our substantial leverage; restrictions imposed by, and as a result of, our substantial leverage; additional outbreaks of avian influenza or other diseases, either in our own flocks or elsewhere, affecting our ability to conduct our operations and/or demand for our poultry products; contamination of our products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; changes in laws or regulations affecting our operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause our costs of business to increase, cause us to change the way in which we do business or otherwise disrupt our operations; competitive factors and pricing pressures or the loss of one or more of our largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels; and the impact of uncertainties of litigation as well as other risks described herein and under “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”). Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations. This presentation may include information that may be considered non-GAAP financial information as contemplated by SEC Regulation G, Rule 100, including EBITDA, Adjusted EBITDA, LTM EBITDA, Net Debt, Free Cash Flow, Adjusted EBITDA Margin and others. Accordingly, we have provided tables in the accompanying appendix and in our previous filings with the SEC that reconcile these measures to their corresponding GAAP-based measures and explain why these measures are useful to investors, which can be obtained from the Consolidated Statements of Income provided with our previous filings with the SEC. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements. 1

Presenters Fabio Sandri Chief Financial Officer, Pilgrim’s Pride Janet McCollum Chief Executive Officer, Moy Park Bill Lovette Chief Executive Officer, Pilgrim’s Pride 2

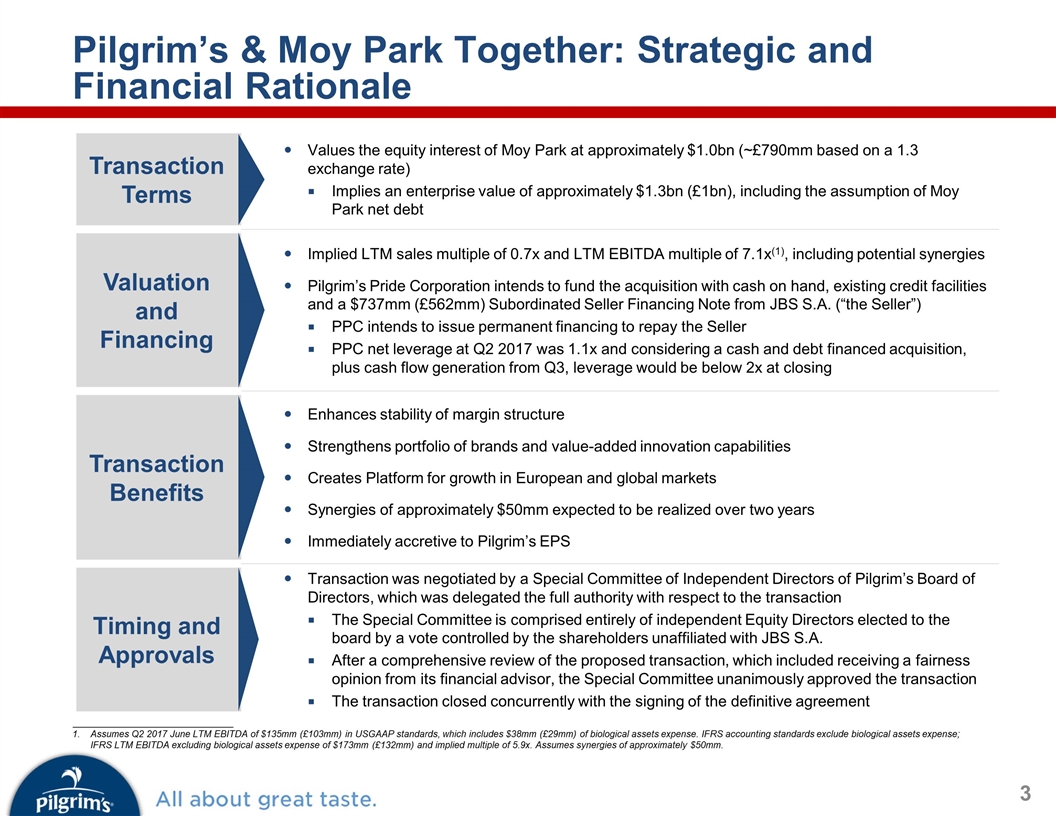

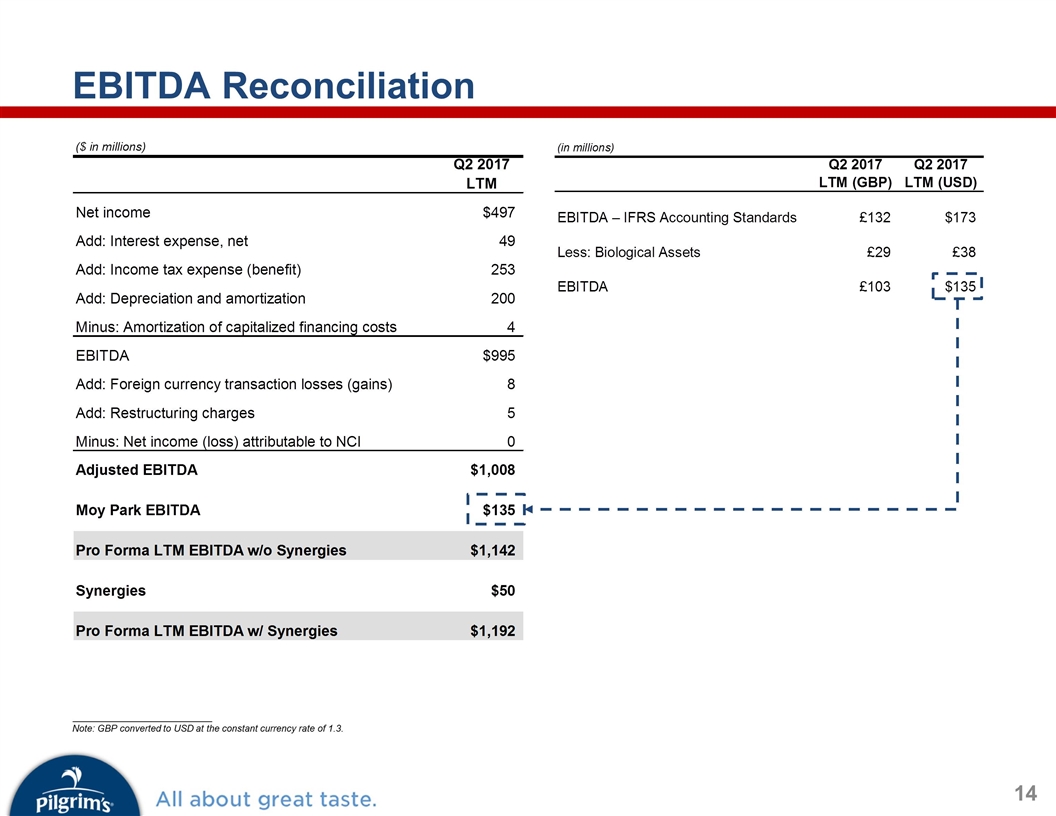

Pilgrim’s & Moy Park Together: Strategic and Financial Rationale ___________________________ Assumes Q2 2017 June LTM EBITDA of $135mm (£103mm) in USGAAP standards, which includes $38mm (£29mm) of biological assets expense. IFRS accounting standards exclude biological assets expense; IFRS LTM EBITDA excluding biological assets expense of $173mm (£132mm) and implied multiple of 5.9x. Assumes synergies of approximately $50mm. Transaction Terms Values the equity interest of Moy Park at approximately $1.0bn (~£790mm based on a 1.3 exchange rate) Implies an enterprise value of approximately $1.3bn (£1bn), including the assumption of Moy Park net debt Valuation and Financing Implied LTM sales multiple of 0.7x and LTM EBITDA multiple of 7.1x(1), including potential synergies Pilgrim’s Pride Corporation intends to fund the acquisition with cash on hand, existing credit facilities and a $737mm (£562mm) Subordinated Seller Financing Note from JBS S.A. (“the Seller”) PPC intends to issue permanent financing to repay the Seller PPC net leverage at Q2 2017 was 1.1x and considering a cash and debt financed acquisition, plus cash flow generation from Q3, leverage would be below 2x at closing Transaction Benefits Enhances stability of margin structure Strengthens portfolio of brands and value-added innovation capabilities Creates Platform for growth in European and global markets Synergies of approximately $50mm expected to be realized over two years Immediately accretive to Pilgrim’s EPS Timing and Approvals Transaction was negotiated by a Special Committee of Independent Directors of Pilgrim’s Board of Directors, which was delegated the full authority with respect to the transaction The Special Committee is comprised entirely of independent Equity Directors elected to the board by a vote controlled by the shareholders unaffiliated with JBS S.A. After a comprehensive review of the proposed transaction, which included receiving a fairness opinion from its financial advisor, the Special Committee unanimously approved the transaction The transaction closed concurrently with the signing of the definitive agreement 3

Moy Park – A Leading Prepared Foods Platform Top 10 UK food company providing fresh, prepared, value-added and locally farmed poultry and complementary convenience food products for more than 70 years Highly regarded and innovative manufacturer of convenience food products Prepared foods represent approximately 50% of revenue Best-in-class and fully vertically integrated market-leading platform 13 plants in the UK, Ireland, France and the Netherlands 5.7mm birds processed per week (approximately 30%(1) of UK production) More than 12,000 team members Stability in margin structure supported by prepared foods business model and long-term partnerships with customers 75% of revenues generated in the UK & Ireland; 25% in Continental Europe Supplies major UK supermarkets and major European Quickservice Restaurant Operators ___________________________ Poultry volume produced based on DEFRA calculations using egg placings and average mortality rates. 4

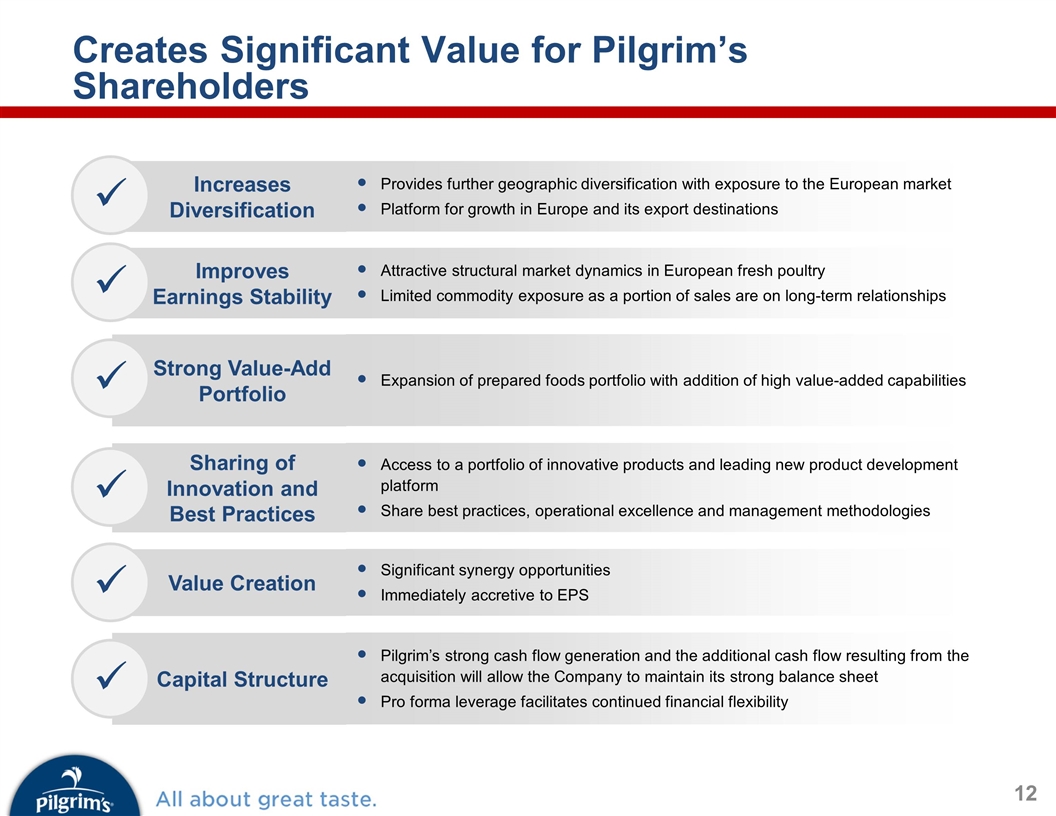

Creates Significant Value for Pilgrim’s Shareholders Increases Diversification Provides further geographic diversification with exposure to the European market Platform for growth in Europe and its export destinations Improves Earnings Stability Attractive structural market dynamics in European fresh poultry Mitigated commodity exposure as a portion of sales are on long-term relationships Strong Value-Add Portfolio Expansion of prepared foods portfolio with addition of high value-added capabilities Sharing of Innovation and Best Practices Access to a portfolio of innovative products and leading new product development platform Share best practices, operational excellence and management expertise Value Creation Significant synergy opportunities Immediately accretive to EPS Capital Structure Pilgrim’s strong cash flow generation and the additional cash flow resulting from the acquisition will allow the Company to maintain its strong balance sheet Pro forma leverage facilitates continued financial flexibility ü ü ü ü ü ü 5

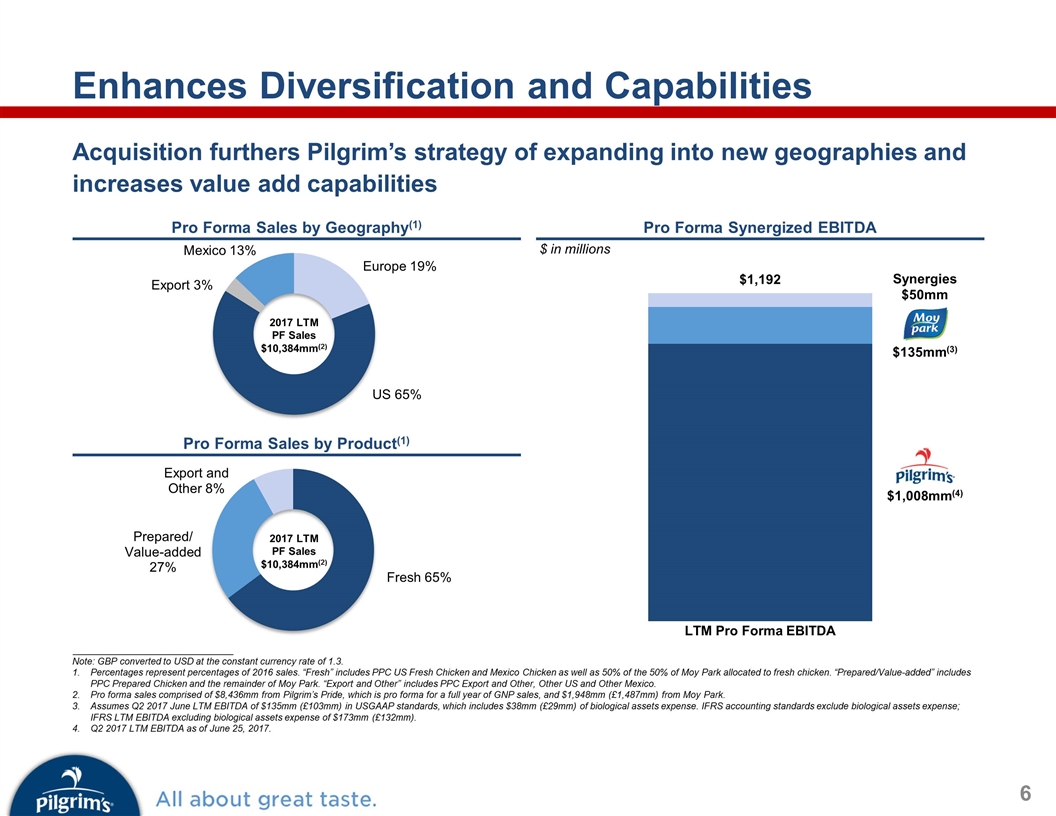

Enhances Diversification and Capabilities Acquisition furthers Pilgrim’s strategy of expanding into new geographies and increases value add capabilities 2017 LTM PF Sales $10,384mm(2) ___________________________ Note: GBP converted to USD at the constant currency rate of 1.3. Percentages represent percentages of 2016 sales. “Fresh” includes PPC US Fresh Chicken and Mexico Chicken as well as 50% of the 50% of Moy Park allocated to fresh chicken. “Prepared/Value-added” includes PPC Prepared Chicken and the remainder of Moy Park. “Export and Other” includes PPC Export and Other, Other US and Other Mexico. Pro forma sales comprised of $8,436mm from Pilgrim’s Pride, which is pro forma for a full year of GNP sales, and $1,948mm (£1,487mm) from Moy Park. Assumes Q2 2017 June LTM EBITDA of $135mm (£103mm) in USGAAP standards, which includes $38mm (£29mm) of biological assets expense. IFRS accounting standards exclude biological assets expense; IFRS LTM EBITDA excluding biological assets expense of $173mm (£132mm). Q2 2017 LTM EBITDA as of June 25, 2017. Pro Forma Sales by Geography(1) Pro Forma Synergized EBITDA Pro Forma Sales by Product(1) Synergies $50mm $135mm(3) $1,008mm(4) 2017 LTM PF Sales $10,384mm(2) 6

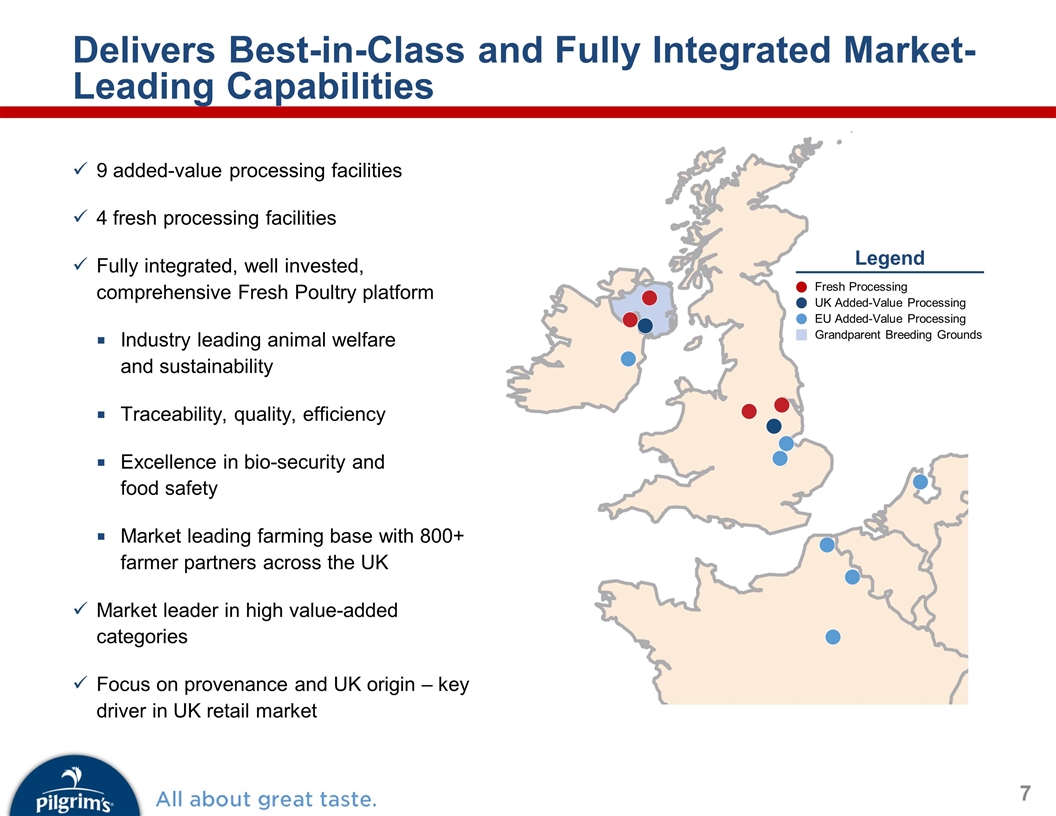

Delivers Best-in-Class and Fully Integrated Market-Leading Capabilities Fresh Processing UK Added-Value Processing EU Added-Value Processing Grandparent Breeding Grounds Legend 9 added-value processing facilities 4 fresh processing facilities Fully integrated, well invested, comprehensive Fresh Poultry platform Industry leading animal welfare and sustainability Traceability, quality, efficiency Excellence in bio-security and food safety Market leading farming base with 800+ farmer partners across the UK Market leader in high value-added categories Focus on provenance and UK origin – key driver in UK retail market 7

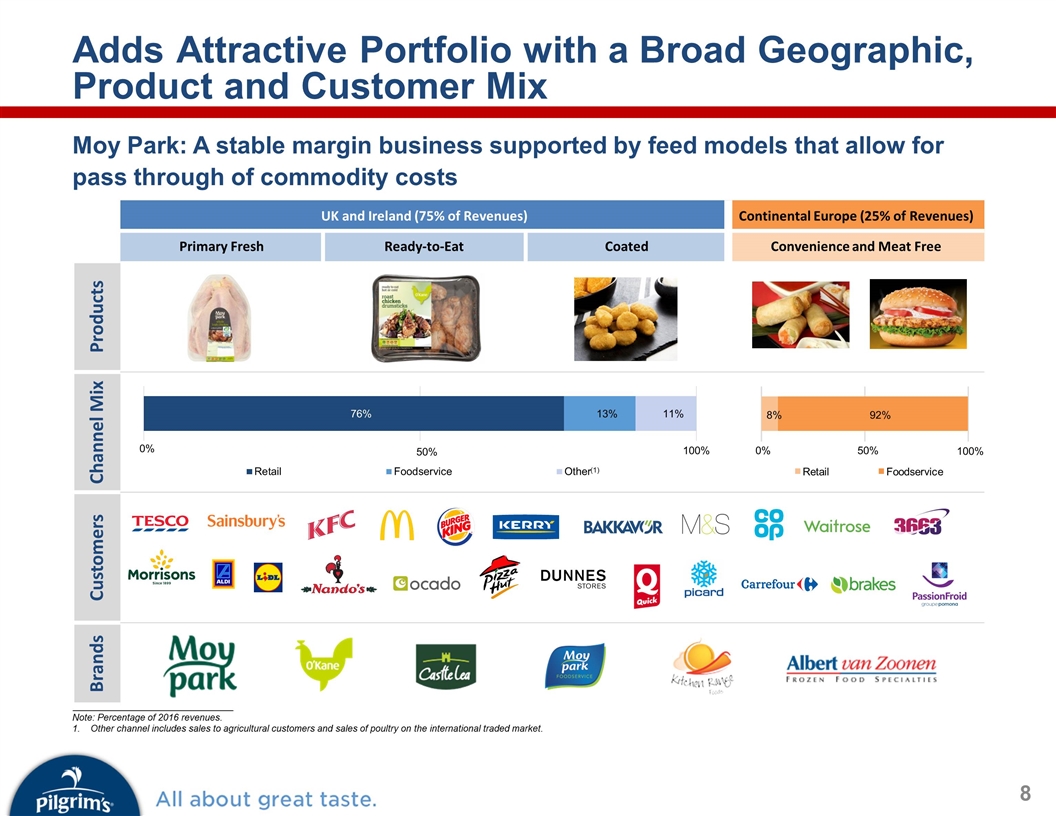

Adds Attractive Portfolio with a Broad Geographic, Product and Customer Mix UK and Ireland (75% of Revenues) Continental Europe (25% of Revenues) Primary Fresh Ready-to-Eat Coated Convenience and Meat Free Products Channel Mix Customers Brands ___________________________ Note: Percentage of 2016 revenues. Other channel includes sales to agricultural customers and sales of poultry on the international traded market. Moy Park: A stable margin business supported by feed models that allow for pass through of commodity costs 8 8 % 92 % Retail Foodservice 100% 0% 50% 100% 50% 0%

Innovative Product Portfolio Market leader in high value-added categories Consumer insights capabilities support innovation and food development, helping deliver a large variety of new products FRESH CHICKEN BREADED CHICKEN SNACKING READY TO COOK ROAST IN THE BAG BBQ & ROAST STARTER MAIN COURSE GLUTEN FREE SENSATIONS 9

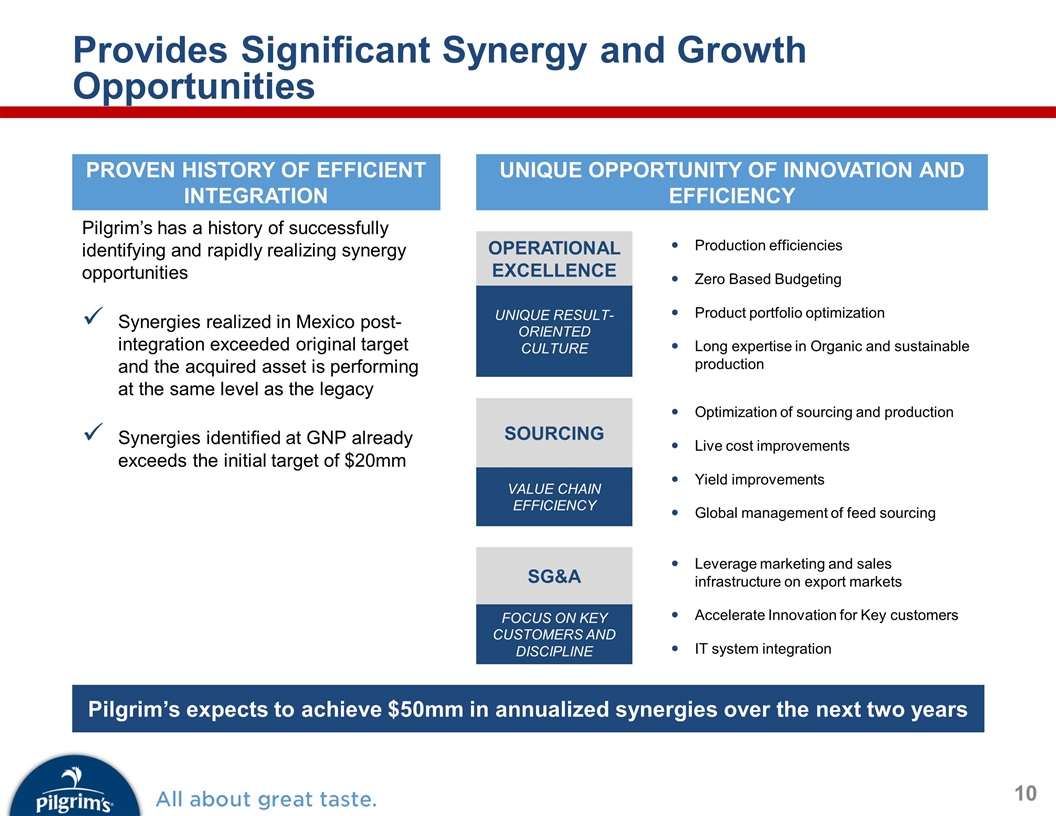

Provides Significant Synergy and Growth Opportunities Pilgrim’s has a history of successfully identifying and rapidly realizing synergy opportunities Synergies realized in Mexico post-integration exceeded original target and the acquired asset is performing at the same level as the legacy Synergies identified at GNP already exceeds the initial target of $20mm PROVEN HISTORY OF EFFICIENT INTEGRATION UNIQUE OPPORTUNITY OF INNOVATION AND EFFICIENCY OPERATIONAL EXCELLENCE Production efficiencies Zero Based Budgeting Product portfolio optimization Long expertise in Organic and sustainable production UNIQUE RESULT-ORIENTED CULTURE SOURCING Optimization of sourcing and production Live cost improvements Yield improvements Global management of feed sourcing VALUE CHAIN EFFICIENCY SG&A Leverage marketing and sales infrastructure on export markets Accelerate Innovation for Key customers IT system integration FOCUS ON KEY CUSTOMERS AND DISCIPLINE Pilgrim’s expects to achieve $50mm in annualized synergies over the next two years 10

Moy Park Squarely Aligns with Pilgrim’s Strategic Priorities Combination creates a stronger, more diverse and safer global leader Enhances existing relationships and opens new relationships with key customers across retail and foodservice channels in Europe P Commitment to innovation, sustainability and growth P Best-in-class operational platform with synergy upside from benchmarking and cross-learning opportunities P Strengthens global portfolio of business P 11

Creates Significant Value for Pilgrim’s Shareholders Increases Diversification Provides further geographic diversification with exposure to the European market Platform for growth in Europe and its export destinations Improves Earnings Stability Attractive structural market dynamics in European fresh poultry Limited commodity exposure as a portion of sales are on long-term relationships Strong Value-Add Portfolio Expansion of prepared foods portfolio with addition of high value-added capabilities Sharing of Innovation and Best Practices Access to a portfolio of innovative products and leading new product development platform Share best practices, operational excellence and management methodologies Value Creation Significant synergy opportunities Immediately accretive to EPS Capital Structure Pilgrim’s strong cash flow generation and the additional cash flow resulting from the acquisition will allow the Company to maintain its strong balance sheet Pro forma leverage facilitates continued financial flexibility ü ü ü ü ü ü 12

Q&A 13

EBITDA Reconciliation ___________________________ Note: GBP converted to USD at the constant currency rate of 1.3. 14

15